|

Delaware

|

25-1190717

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

622 Third Avenue, 38th Floor

New York, New York

|

10017-6707

|

|

|

(Address of principal executive office)

|

(Zip Code)

|

|

(212) 878-1800

|

||

|

(Registrant's telephone number, including area code)

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $.10 par value

|

New York Stock Exchange

|

|

Large Accelerated Filer ☒

|

Accelerated Filer ☐

|

|

Non-accelerated Filer ☐

|

Smaller Reporting Company ☐

|

|

Emerging Growth Company ☐

|

|

|

Page No.

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

Mine Safety Disclosures

|

|

|

PART II

|

||

|

Item 5.

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

Signatures

|

| ● |

The Performance Materials segment is a leading supplier of bentonite and bentonite-related products, chromite and leonardite. This segment also provides

products for non-residential construction, environmental and infrastructure projects worldwide, serving customers engaged in a broad range of construction projects.

|

| ● |

The Specialty Minerals segment produces and sells the synthetic mineral product precipitated calcium carbonate ("PCC") and processed mineral product quicklime

("lime"), and mines mineral ores then processes and sells natural mineral products, primarily limestone and talc. This segment is a leading supplier globally of PCC products to the paper industry. This segment's products are used

principally in the paper, building materials, paint and coatings, glass, ceramic, polymer, food, automotive and pharmaceutical industries.

|

| ● |

The Refractories segment produces monolithic and shaped refractory materials and specialty products. It also provides services and sells application and

measurement equipment, calcium metal and metallurgical wire products. Refractories segment products are primarily used in high-temperature applications in the steel, non-ferrous metal and glass industries.

|

| ● |

The Energy Services segment provides services to improve the production, costs, compliance, and environmental impact of activities performed in the oil and

gas industry. This segment offers a range of services for off-shore filtration and well testing to the worldwide oil and gas industry.

|

|

2018

|

2017

|

2016

|

||||||

|

Percentage of Net Sales

|

||||||||

|

Performance Materials

|

46%

|

44%

|

42%

|

|||||

|

Specialty Minerals

|

33%

|

35%

|

36%

|

|||||

|

Refractories

|

17%

|

17%

|

17%

|

|||||

|

Energy Services

|

4%

|

4%

|

5%

|

|||||

|

Total

|

100%

|

100%

|

100%

|

|||||

| ● |

as a filler in the production of coated and uncoated wood-free printing and writing papers, such as office papers;

|

| ● |

as a filler in the production of coated and uncoated groundwood (wood-containing) paper such as magazine and catalog papers; and

|

| ● |

as a coating pigment for both wood-free and groundwood papers.

|

| ● |

HOTCRETE®: High durability shotcrete products for applications at high temperatures in ferrous applications, such as, steel ladles, electric arc

furnaces (EAF) and basic oxygen furnaces (BOF) furnaces.

|

| ● |

FASTFIRE®: High durability castable and shotcrete products in the non-ferrous and ferrous industries with the added benefit of rapid dry-out

capabilities.

|

| ● |

OPTIFORM®: A system of products and equipment for the rapid continuous casting of refractories for applications, such as, steel ladle safety

linings.

|

| ● |

ENDURATEQ®: A high durability refractory shape for glass contact applications, such as, plungers and orifice rings.

|

| ● |

DECTEQ™: A system for the automatic control of electrical power feeding electrodes used in electric arc steel making furnaces.

|

| ● |

LACAM® Torpedo: A laser scanning system that measures the refractory lining thickness inside a Hot Iron (Torpedo) Ladle. The torpedo ladles

transport liquid iron from a blast furnace to the steel plant.

|

| ● |

LACAM® LI Explorer: A laser scanning system that measures the refractory lining thickness from the interior of a Hot Steel Ladle. By entering the

interior, the explorer provides the ability to see all areas of the ladle and identify the smallest flaws in the refractory lining.

|

| ● |

LACAM®: A new, fourth generation Lacam® laser measurement device for use in the worldwide steel industry that is 17 times faster than

the previous version. This new technology provides the fastest and most accurate laser scanning for hot surfaces available today.

|

|

Location

|

Facility

|

Product Line

|

Segment

|

|||

|

United States

|

||||||

|

Alabama, Sandy Ridge

|

Plant; Mine

|

Metalcasting, basic minerals and specialty products

|

Performance Materials

|

|||

|

Arizona, Pima County

|

Plant; Mine (1)

|

Limestone

|

Specialty Minerals

|

|||

|

California, Lucerne Valley

|

Plant; Mine

|

Limestone

|

Specialty Minerals

|

|||

|

Connecticut, Canaan

|

Plant; Mine

|

Limestone, Metallurgical Wire/Calcium

|

Specialty Minerals; Refractories

|

|||

|

Georgia, Cartersville

|

Plant

|

Environmental products and other building materials products

|

Performance Materials

|

|||

|

Illinois, Belvidere

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Illinois, Hoffman Estates

|

Research laboratories; Administrative office (2)

|

All Company Products

|

All Segments

|

|||

|

Indiana, Portage

|

Plant

|

Refractories/Shapes

|

Refractories

|

|||

|

Indiana, Troy

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Iowa, Shell Rock

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Louisiana, Baton Rouge

|

Plant

|

Monolithic Refractories

|

Refractories

|

|||

|

Louisiana, Lafayette

|

Plant

|

Personal Care Products

|

Performance Materials

|

|||

|

Louisiana, New Iberia

|

Operations base (2)

|

Filtration and Well testing services

|

Energy Services

|

|||

|

Massachusetts, Adams

|

Plant; Mine

|

Limestone, Lime, PCC

|

Specialty Minerals

|

|||

|

Michigan, Albion

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Mississippi, Aberdeen

|

Plant

|

Performance additive products

|

Performance Materials

|

|||

|

Montana, Dillon

|

Plant; Mine

|

Talc

|

Specialty Minerals

|

|||

|

Nebraska, Scottsbluff

|

Transportation terminal

|

Performance Materials

|

||||

|

New York, New York

|

Headquarters (2)

|

All Company Products

|

Headquarters

|

|||

|

North Dakota, Gascoyne

|

Plant; Mine

|

Metalcasting, basic minerals and specialty products

|

Performance Materials

|

|||

|

Ohio, Archbold

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Ohio, Bryan

|

Plant

|

Monolithic Refractories

|

Refractories

|

|||

|

Ohio, Dover

|

Plant

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

Pennsylvania, Bethlehem

|

Administrative Office; Research laboratories; Sales Offices

|

All Company Products

|

All Segments

|

|||

|

Pennsylvania, Easton

|

Administrative Office; Research laboratories; Plant; Sales Offices

|

All Company Products

|

All Segments

|

|||

|

Pennsylvania, Slippery Rock

|

Plant; Sales Offices

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

Pennsylvania, York

|

Plant

|

Metalcasting and pet care products

|

Performance Materials

|

|||

|

Tennessee, Chattanooga

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Texas, Bay City

|

Plant

|

Talc

|

Specialty Minerals

|

|||

|

Texas, Houston

|

Research laboratories (2)

|

Filtration and well testing services

|

Energy Services

|

|||

|

Texas, Houston

|

Administrative Office (2)

|

Filtration and well testing services

|

Energy Services

|

|||

|

Wisconsin, Neenah

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

Wyoming, Colony

|

Plant; Mine

|

Metalcasting, pet litter, personal care, specialty and basic minerals products

|

Performance Materials

|

|||

|

Wyoming, Lovell

|

Plant; Mine

|

Basic minerals, Specialty and pet care products; Environmental and building materials products

|

Performance Materials

|

|

Location

|

Facility

|

Product Line

|

Segment

|

|||

|

International

|

||||||

|

Australia, Brisbane

|

Sales Office/Administrative Office

|

Metalcasting, specialty and pet care products

|

Performance Materials

|

|||

|

Australia, Carlingford

|

Sales Office (2)

|

Monolithic Refractories

|

Refractories

|

|||

|

Australia, Gurulmundi

|

Plant; Mine

|

Metalcasting, specialty and pet care products

|

Performance Materials

|

|||

|

Australia, Perth

|

Operations base (2)

|

Filtration services

|

Energy Services

|

|||

|

Austria, Rottersdorf

|

Plant

|

Pet care products

|

Performance Materials

|

|||

|

Belgium, Brussels

|

Administrative Office

|

Monolithic Refractories

|

Refractories

|

|||

|

Brazil, Macae

|

Operations base (2)

|

Filtration services

|

Energy Services

|

|||

|

Brazil, Sao Jose dos Campos

|

Sales Office (2)/Administrative Office

|

PCC

|

Specialty Minerals

|

|||

|

Canada, Pt. Claire

|

Administrative Office

|

PCC/Monolithic Refractories

|

Specialty Minerals; Refractories

|

|||

|

China, Beijing

|

Sales Office/Administrative Office

|

Metalcasting, specialty, fabric care and pet care products

|

Performance Materials

|

|||

|

China, Chao Yang, Liaoning

|

Plant; Mine

|

Metalcasting and fabric care products

|

Performance Materials

|

|||

|

China, Shanghai

|

Administrative Office/Sales Office

|

PCC/Monolithic Refractories

|

Specialty Minerals; Refractories

|

|||

|

China, Suzhou

|

Plant

|

Environmental and building materials products

|

Performance Materials

|

|||

|

China, Suzhou

|

Plant/Sales Office/Research laboratories

|

PCC/Monolithic Refractories

|

Specialty Minerals; Refractories

|

|||

|

China, Tianjin

|

Plant; Mine; Research laboratories

|

Metalcasting and fabric care products

|

Performance Materials

|

|||

|

Germany, Duisburg

|

Plant/Sales Office/Research laboratories

|

Laser Scanning Instrumentation/ Probes/Monolithic Refractories

|

Refractories

|

|||

|

India, Chennai

|

Plant

|

Metalcasting products

|

Performance Materials

|

|||

|

India, Mumbai

|

Sales Office (2)/Administrative Office

|

PCC/Monolithic Refractories/ Metallurgical Wire

|

Specialty Minerals; Refractories

|

|||

|

Indonesia, Jakarta

|

Operations base (2)

|

Filtration services

|

Energy Services

|

|||

|

Ireland, Cork

|

Plant; Administrative Office (2)/ Research laboratories

|

Monolithic Refractories

|

Refractories

|

|||

|

Italy, Brescia

|

Sales Office

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

Italy, Nave

|

Plant

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

Japan, Gamagori

|

Plant/Research laboratories

|

Monolithic Refractories/Shapes, Calcium

|

Refractories

|

|||

|

Japan, Tokyo

|

Sales/Administrative Office

|

Monolithic Refractories

|

Refractories

|

|||

|

Korea, Pyeongtaek

|

Plant

|

Environmental, building materials and other products

|

Performance Materials

|

|||

|

Malaysia, Kemaman

|

Operations base (2)

|

Filtration and well testing services

|

Energy Services

|

|||

|

Mexico, Villahermosa

|

Operations base (2)

|

Filtration services

|

Energy Services

|

|||

|

Netherlands, Hengelo

|

Plant/Administrative Office

|

Metallurgical Wire

|

Refractories

|

|||

|

Netherlands, Moerdjik

|

Plant/Administrative Office

|

Pet care products

|

Performance Materials

|

|||

|

Nigeria, Port Harcourt

|

Operations base (2)

|

Well Testing services

|

Energy Services

|

|||

|

Poland, Szczytno

|

Plant

|

Environmental products

|

Performance Materials

|

|||

|

Scotland, Aberdeen

|

Operations base (2)

|

Filtration services

|

Energy Services

|

|||

|

South Africa, Johannesburg

|

Sales Office/Administrative Office (2)

|

Monolithic Refractories

|

Refractories

|

|||

|

South Africa, Pietermaritzburg

|

Plant

|

Monolithic Refractories

|

Refractories

|

|||

|

South Korea, Yangbuk-Myeun, Kyeung-buk

|

Plant; Mine

|

Metalcasting products

|

Performance Materials

|

|||

|

Spain, Santander

|

Administrative Office

|

Monolithic Refractories

|

Refractories

|

| Location | Facility |

Product Line |

Segment |

|||

|

Thailand, Laemchabang

|

Plant

|

Metalcasting and fabric care products

|

Performance Materials

|

|||

|

Turkey, Enez

|

Plant; Mine

|

Metalcasting, specialty and basic minerals products

|

Performance Materials

|

|||

|

Turkey, Gebze

|

Plant/Research Laboratories

|

Monolithic Refractories/Shapes/ Application Equipment

|

Refractories

|

|||

|

Turkey, Istanbul

|

Sales Office/Administrative Office

|

Monolithic Refractories

|

Refractories

|

|||

|

Turkey, Kutahya

|

Plant

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

Turkey, Ordu

|

Plant; Mine

|

Pet care Products

|

Performance Materials

|

|||

|

Turkey, Usak

|

Plant; Mine

|

Specialty material products

|

Performance Materials

|

|||

|

United Kingdom, Birkenhead

|

Research laboratories (2)

|

Environmental products

|

Performance Materials

|

|||

|

United Kingdom, Lifford

|

Plant

|

PCC, Lime

|

Specialty Minerals

|

|||

|

United Kingdom, Rotherham

|

Plant/Sales Office

|

Monolithic Refractories/Shapes

|

Refractories

|

|||

|

United Kingdom, Winsford

|

Plant, Research laboratories

|

Fabric care and other products

|

Performance Materials

|

| (1) |

This plant and quarry is leased to another company.

|

| (2) |

Leased by the Company. The facilities in Cork, Ireland, are operated pursuant to a 99-year lease, the term of which commenced in 1963. The Company's

headquarters in New York, New York, are held under a lease which expires in 2021.

|

|

Location

|

Principal Customer

|

|

|

United States

|

||

|

Alabama, Jackson

|

Boise Inc.

|

|

|

Alabama, Selma

|

International Paper Company

|

|

|

Arkansas, Ashdown

|

Domtar Inc.

|

|

|

Maine, Jay

|

Verso Paper Holdings LLC

|

|

|

Michigan, Quinnesec

|

Verso Paper Holdings LLC

|

|

|

Minnesota, Cloquet

|

Sappi Ltd.

|

|

|

Minnesota, International Falls

|

Boise Inc.

|

|

|

New York, Ticonderoga

|

International Paper Company

|

|

|

Ohio, Chillicothe

|

P.H. Glatfelter Co.

|

|

|

South Carolina, Eastover

|

International Paper Company

|

|

|

Washington, Longview

|

North Pacific Paper Corporation

|

|

|

Wisconsin, Kimberly

|

Appleton Coated

|

|

|

Wisconsin, Park Falls

|

Flambeau River Papers LLC

|

|

|

Wisconsin, Superior

|

New Page Corporation

|

|

|

Wisconsin, Wisconsin Rapids

|

New Page Corporation

|

|

Location

|

Principal Customer

|

|

|

International

|

||

|

Brazil, Guaiba

|

CMPC - Celulose Rio Grandense

|

|

|

Brazil, Jacarei

|

Munksjo Brasil Ind e Com de Papeis Especiais Ltda.

|

|

|

Brazil, Luiz Antonio

|

International Paper do Brasil Ltda.

|

|

|

Brazil, Mucuri

|

Suzano Papel e Celulose S. A.

|

|

|

Brazil, Suzano

|

Suzano Papel e Celulose S. A.

|

|

|

Canada, St. Jerome, Quebec

|

Les Entreprises Rolland Inc

|

|

|

Canada, Windsor, Quebec

|

Domtar Inc.

|

|

|

China, Changshu

|

UPM Changshu

|

|

|

China, Dagang (1)

|

Gold East Paper (Jiangsu) Company Ltd.

|

|

|

China, Zhenjiang (1)

|

Gold East Paper (Jiangsu) Company Ltd.

|

|

|

China, Suzhou (1)

|

Gold HuaSheng Paper Company Ltd.

|

|

|

China, Henan

|

Henan Jianghe Paper Co., Ltd.

|

|

|

China, Shandong

|

Shandong Sun Paper Industry Joint Stock Company Ltd

|

|

|

China, Shouguang (2)

|

Shandong Meilun Paper Corporation

|

|

|

Finland, Äänekoski

|

M-real Corporation

|

|

|

Finland, Tervakoski

|

Trierenberg Holding

|

|

|

France, Alizay

|

Double A Paper Company Ltd.

|

|

|

France, Quimperle

|

PDM Industries

|

|

|

France, Saillat Sur Vienne

|

International Paper Company

|

|

|

Germany, Schongau

|

UPM Corporation

|

|

|

India, Ballarshah (1)

|

Ballarpur Industries Ltd.

|

|

|

India, Dandeli

|

West Coast Paper Mill Ltd.

|

|

|

India, Gaganapur (1)

|

Ballarpur Industries Ltd.

|

|

|

India, Kala Amb (2)

|

Ruchira Papers Limited

|

|

|

India, Saila Khurd

|

Kuantum Papers Ltd.

|

|

|

India, Rayagada (1)

|

JK Paper

|

|

|

Indonesia, Perawang (1)

|

PT Indah Kiat Pulp and Paper Corporation

|

|

|

Indonesia, Perawang 2 (2)

|

PT Indah Kiat Pulp and Paper Corporation

|

|

|

Indonesia, Pindo Deli (2)

|

PT Pindo Deli Pulp and Paper Mills

|

|

|

Japan, Shiraoi (1)

|

Nippon Paper Group Inc.

|

|

|

Malaysia, Sipitang

|

Ballarpur Industries Ltd.

|

|

|

Poland, Kwidzyn

|

International Paper – Kwidzyn, S.A

|

|

|

Portugal, Figueira da Foz (1)

|

Navigator Paper Figueira, S.A.

|

|

|

Slovakia, Ruzomberok

|

Mondi Business Paper SCP

|

|

|

South Africa, Merebank (1)

|

Mondi Paper Company Ltd.

|

|

|

Thailand, Namphong

|

Phoenix Pulp & Paper Public Co. Ltd.

|

|

|

Thailand, Tha Toom (1)

|

Double A Paper Company Ltd.

|

|

|

Thailand, Tha Toom 2 (1)

|

Double A Paper Company Ltd.

|

| (1) |

These plants are owned through joint ventures.

|

|

2018 Tons

Usage

(000s)

|

Total Tons

of Reserves

(000s)

|

Assigned

Reserves

(000s)

|

Unassigned

Reserves**

(000s)

|

Conversion

Factor

|

Mining Claims

|

||||||||||||||||||

|

Owned

|

Unpatented *

|

Leased

|

|||||||||||||||||||||

|

Limestone

|

|||||||||||||||||||||||

|

Adams, MA

|

714

|

23,028

|

23,028

|

—

|

80%

|

23,028

|

—

|

—

|

|||||||||||||||

|

Canaan, CT

|

578

|

17,734

|

17,734

|

—

|

90%

|

17,734

|

—

|

—

|

|||||||||||||||

|

Lucerne Valley, CA

|

997

|

40,762

|

40,762

|

95%

|

40,762

|

—

|

—

|

||||||||||||||||

|

Pima County, AZ

|

170

|

7,869

|

7,869

|

—

|

90%

|

7,869

|

—

|

—

|

|||||||||||||||

|

Total Limestone

|

2,459

|

89,393

|

89,393

|

—

|

89,393

|

—

|

—

|

||||||||||||||||

|

100%

|

0%

|

100%

|

0%

|

0%

|

|||||||||||||||||||

|

Talc

|

|||||||||||||||||||||||

|

Dillon, MT

|

189

|

2,728

|

2,728

|

—

|

85%

|

2,728

|

—

|

—

|

|||||||||||||||

|

100%

|

0%

|

100%

|

0%

|

0%

|

|||||||||||||||||||

|

Sodium Bentonite

|

|||||||||||||||||||||||

|

Australia

|

67

|

1,007

|

1,007

|

—

|

80%

|

1,007

|

|||||||||||||||||

|

Belle/Colony, WY/SD

|

1,263

|

64,560

|

64,560

|

—

|

77%

|

3,595

|

12,214

|

48,751

|

|||||||||||||||

|

Lovell, WY

|

751

|

36,462

|

36,462

|

—

|

86%

|

16,753

|

14,971

|

4,738

|

|||||||||||||||

|

Other SD, WY, MT

|

72,831

|

—

|

72,831

|

79%

|

54,815

|

15,048

|

2,968

|

||||||||||||||||

|

Total Sodium Bentonite

|

2,081

|

174,860

|

102,029

|

72,831

|

75,163

|

42,233

|

57,464

|

||||||||||||||||

|

58%

|

42%

|

43%

|

24%

|

33%

|

|||||||||||||||||||

|

Calcium Bentonite

|

|||||||||||||||||||||||

|

Chao Yang, Liaoning, China

|

89

|

1,650

|

1,650

|

—

|

78%

|

1,650

|

|||||||||||||||||

|

Nevada

|

1

|

1,560

|

1,560

|

—

|

76%

|

1,016

|

44

|

500

|

|||||||||||||||

|

Sandy Ridge, AL

|

93

|

6,525

|

6,525

|

—

|

75%

|

1,966

|

4,559

|

||||||||||||||||

|

Turkey, Enez//Usak

|

236

|

3,608

|

3,608

|

—

|

77%

|

3,608

|

|||||||||||||||||

|

Turkey, Unye

|

187

|

4,750

|

4,750

|

—

|

80%

|

4,750

|

|||||||||||||||||

|

Total Calcium Bentonite

|

606

|

18,093

|

18,093

|

—

|

2,982

|

44

|

15,067

|

||||||||||||||||

|

100%

|

0%

|

16%

|

0%

|

83%

|

|||||||||||||||||||

|

Leonardite

|

|||||||||||||||||||||||

|

Gascoyne, ND

|

89

|

2,652

|

2,652

|

—

|

72%

|

—

|

2,019

|

633

|

|||||||||||||||

|

100%

|

0%

|

76%

|

24%

|

||||||||||||||||||||

|

Chromite

|

|||||||||||||||||||||||

|

South Africa

|

—

|

3,494

|

3,494

|

—

|

75%

|

—

|

—

|

3,494

|

|||||||||||||||

|

100%

|

0%

|

0%

|

0%

|

100%

|

|||||||||||||||||||

|

Other

|

|||||||||||||||||||||||

|

Nevada**

|

—

|

2,997

|

0%

|

2,997

|

80%

|

2,997

|

—

|

||||||||||||||||

|

—

|

100%

|

0%

|

100%

|

0%

|

|||||||||||||||||||

|

GRAND TOTALS

|

5,424

|

294,217

|

218,389

|

75,828

|

170,266

|

47,293

|

76,658

|

||||||||||||||||

|

74%

|

26%

|

58%

|

16%

|

26%

|

|||||||||||||||||||

| * |

Quantity of reserves that would be owned if patent was granted.

|

| ** |

Unassigned reserves are reserves which we expect will require additional expenditures for processing facilities.

|

|

Name

|

Age

|

Position

|

||

|

Douglas T. Dietrich

|

49

|

Chief Executive Officer

|

||

|

Brett Argirakis

|

54

|

Vice President and Managing Director, Minteq International Inc.

|

||

|

Michael A. Cipolla

|

61

|

Vice President, Corporate Controller and Chief Accounting Officer

|

||

|

Matthew E. Garth

|

44

|

Senior Vice President, Finance and Treasury, Chief Financial Officer

|

||

|

Jonathan J. Hastings

|

56

|

Group President, Performance Materials

|

||

|

Andrew M. Jones

|

60

|

Vice President and Managing Director, Energy Services

|

||

|

Douglas W. Mayger

|

61

|

Senior Vice President and Director – MTI Supply Chain

|

||

|

Thomas J. Meek

|

61

|

Senior Vice President, General Counsel, Human Resources, Secretary and Chief

|

||

|

Compliance Officer

|

||||

|

D.J. Monagle, III

|

56

|

Group President, Specialty Minerals and Refractories

|

|

Period

|

Total Number of

Shares Purchased

|

Average Price

Paid Per Share

|

Total Number of

Shares Purchased as

Part of the Publicly

Announced Program

|

Dollar Value of

Shares that May

Yet be Purchased

Under the Program

|

||||||||||||

|

October 1 - October 28

|

—

|

$

|

—

|

230,650

|

$

|

133,645,212

|

||||||||||

|

October 29 - November 25

|

—

|

$

|

—

|

230,650

|

$

|

133,645,212

|

||||||||||

|

November 26 - December 26

|

102,534

|

$

|

52.07

|

333,184

|

$

|

128,306,742

|

||||||||||

|

Total

|

102,534

|

$

|

52.07

|

|||||||||||||

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

||||||||||||||||||||

|

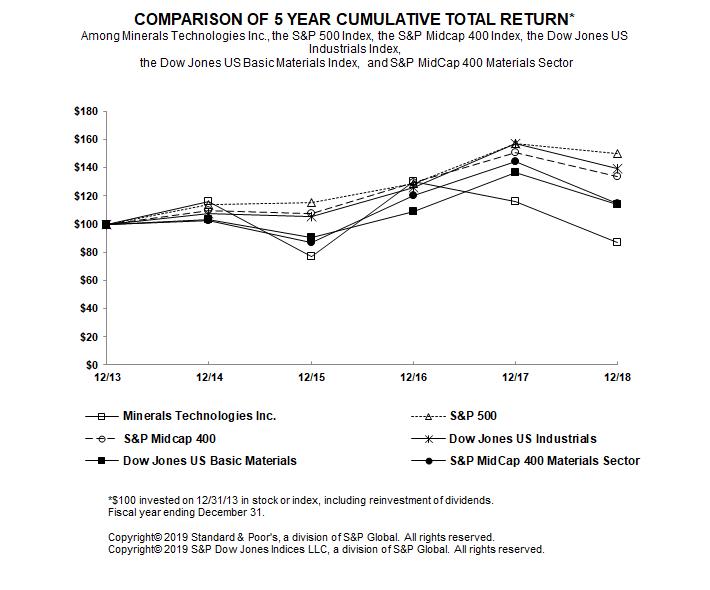

Minerals Technologies Inc.

|

$

|

100.00

|

$

|

115.99

|

$

|

76.85

|

$

|

129.87

|

$

|

116.07

|

$

|

86.81

|

|||||||||||||

|

S&P 500

|

100.00

|

113.69

|

115.26

|

129.05

|

157.22

|

150.33

|

|||||||||||||||||||

|

S&P Midcap 400

|

100.00

|

109.77

|

107.38

|

129.65

|

150.71

|

134.01

|

|||||||||||||||||||

|

Dow Jones US Industrials

|

100.00

|

170.30

|

105.49

|

126.09

|

157.03

|

139.35

|

|||||||||||||||||||

|

Dow Jones US Basic Materials

|

100.00

|

103.39

|

90.54

|

108.90

|

136.22

|

114.19

|

|||||||||||||||||||

|

S&P MidCap 400 Materials Sector

|

100.00

|

102.28

|

87.23

|

120.37

|

144.08

|

114.64

|

|||||||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(in

millions, except per share data)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Net sales

|

$

|

1,807.6

|

$

|

1,675.7

|

$

|

1,638.0

|

$

|

1,797.6

|

$

|

1,725.0

|

||||||||||

|

Cost of sales

|

1,346.2

|

1,208.5

|

1,177.6

|

1,326.6

|

1,289.6

|

|||||||||||||||

|

Production margin

|

461.4

|

467.2

|

460.4

|

471.0

|

435.4

|

|||||||||||||||

|

Marketing and administrative expenses

|

178.6

|

180.7

|

176.4

|

184.4

|

181.2

|

|||||||||||||||

|

Research and development expenses

|

22.7

|

23.7

|

23.8

|

23.6

|

24.4

|

|||||||||||||||

|

Insurance / litigation gain

|

—

|

—

|

—

|

—

|

(2.3

|

)

|

||||||||||||||

|

Acquisition related transaction and integration costs

|

1.7

|

3.4

|

8.0

|

11.8

|

19.1

|

|||||||||||||||

|

Restructuring and other items, net

|

2.5

|

15.0

|

28.3

|

45.2

|

43.2

|

|||||||||||||||

|

Income from operations

|

255.9

|

244.4

|

223.9

|

206.0

|

169.8

|

|||||||||||||||

|

Interest expense, net

|

(45.9

|

)

|

(43.4

|

)

|

(54.4

|

)

|

(60.9

|

)

|

(41.8

|

)

|

||||||||||

|

Debt modification costs and fees

|

—

|

(3.9

|

)

|

—

|

(4.5

|

)

|

(5.8

|

)

|

||||||||||||

|

Non-cash pension settlement costs

|

(4.4

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||

|

Other non-operating income (deductions), net

|

(1.5

|

)

|

(6.2

|

)

|

0.8

|

(8.0

|

)

|

0.8

|

||||||||||||

|

Total non-operating deductions, net

|

(51.8

|

)

|

(53.5

|

)

|

(53.6

|

)

|

(73.4

|

)

|

(46.8

|

)

|

||||||||||

|

Income from continuing operations before tax and equity in earnings

|

204.1

|

190.9

|

170.3

|

132.6

|

123.0

|

|||||||||||||||

|

Provision (benefit) for taxes on income*

|

34.4

|

(6.6

|

)

|

35.3

|

22.8

|

30.8

|

||||||||||||||

|

Equity in earnings of affiliates, net of tax

|

3.5

|

1.5

|

2.1

|

1.8

|

1.2

|

|||||||||||||||

|

Income from continuing operations, net of tax

|

173.2

|

199.0

|

137.1

|

111.6

|

93.4

|

|||||||||||||||

|

Income from discontinued operations, net of tax

|

—

|

—

|

—

|

—

|

2.1

|

|||||||||||||||

|

Consolidated net income

|

173.2

|

199.0

|

137.1

|

111.6

|

95.5

|

|||||||||||||||

|

Less:

|

||||||||||||||||||||

|

Net income attributable to non-controlling interests

|

4.2

|

3.9

|

3.7

|

3.7

|

3.1

|

|||||||||||||||

|

Net income attributable to Minerals Technologies Inc. (MTI)

|

$

|

169.0

|

$

|

195.1

|

$

|

133.4

|

$

|

107.9

|

$

|

92.4

|

||||||||||

|

Earnings per share attributable to MTI:

|

||||||||||||||||||||

|

Basic:

|

||||||||||||||||||||

|

Income from continuing operations

|

$

|

4.79

|

$

|

5.54

|

$

|

3.82

|

$

|

3.11

|

$

|

2.62

|

||||||||||

|

Income from discontinued operations

|

—

|

—

|

—

|

—

|

0.06

|

|||||||||||||||

|

Basic earnings per share

|

$

|

4.79

|

$

|

5.54

|

$

|

3.82

|

$

|

3.11

|

$

|

2.68

|

||||||||||

|

Diluted:

|

||||||||||||||||||||

|

Income from continuing operations

|

$

|

4.75

|

$

|

5.48

|

$

|

3.79

|

$

|

3.08

|

$

|

2.59

|

||||||||||

|

Income from discontinued operations

|

—

|

—

|

—

|

—

|

0.06

|

|||||||||||||||

|

Diluted earnings per share

|

$

|

4.75

|

$

|

5.48

|

$

|

3.79

|

$

|

3.08

|

$

|

2.65

|

||||||||||

|

Cash dividends declared per common share

|

$

|

0.20

|

$

|

0.20

|

$

|

0.20

|

$

|

0.20

|

$

|

0.20

|

||||||||||

|

Shares used in computation of earnings per share:

|

||||||||||||||||||||

|

Basic

|

35.3

|

35.2

|

34.9

|

34.7

|

34.5

|

|||||||||||||||

|

Diluted

|

35.6

|

35.6

|

35.2

|

35.0

|

34.8

|

|||||||||||||||

| * |

During the fourth quarter of 2017, the Company recorded a provisional $47 million income tax benefit from the U.S. Tax Cuts and Job Acts legislation. This

benefit is comprised of an $82 million benefit which related primarily to the remeasurement of the Company’s U.S. deferred tax liabilities at a lower U.S. tax rate of 21%, partially offset by tax expense of $35 million for the deemed

repatriation of unremitted earnings of foreign subsidiaries. During 2018, the Company recorded a benefit of $4.4 million as a measurement period adjustment to the deemed repatriation of unremitted earnings of foreign subsidiaries.

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

(in

millions)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Working capital

|

$

|

494.4

|

$

|

542.2

|

$

|

455.6

|

$

|

485.0

|

$

|

552.0

|

||||||||||

|

Total assets

|

3,087.1

|

2,970.4

|

2,863.4

|

2,980.0

|

3,157.5

|

|||||||||||||||

|

Long-term debt, net of unamortized discount and deferred financing costs

|

907.8

|

959.8

|

1,069.9

|

1,255.3

|

1,429.4

|

|||||||||||||||

|

Total debt

|

1,016.3

|

969.9

|

1,082.8

|

1,264.9

|

1,435.3

|

|||||||||||||||

|

Total shareholders' equity

|

1,385.3

|

1,279.1

|

1,030.9

|

937.7

|

888.9

|

|||||||||||||||

| ● |

Develop multiple high-filler technologies under the FulFill® platform of products, to increase the fill rate in freesheet paper and continue to progress with

commercial discussions and full-scale paper machine trials.

|

| ● |

Develop products and processes for waste management and recycling opportunities to reduce the environmental impact of the paper mill, reduce energy

consumption and improve the sustainability of the papermaking process, including our NewYield® and ENVIROFIL® products.

|

| ● |

Further penetration into the packaging segment of the paper industry.

|

| ● |

Increase our sales of PCC for paper by further penetration of the markets for paper filling at both freesheet and groundwood mills, particularly in emerging

markets.

|

| ● |

Expand the Company's PCC coating product line using the satellite model.

|

| ● |

Increase our presence and gain penetration of our bentonite-based foundry customers for the Metalcasting industry in emerging markets, such as China and

India.

|

| ● |

Increase our presence and market share in global pet care products, particularly in emerging markets.

|

| ● |

Deploy new products in pet care such as lightweight litter.

|

| ● |

Promote the Company's expertise in crystal engineering, especially in helping papermakers customize PCC morphologies for specific paper applications.

|

| ● |

Expand PCC produced for paper filling applications by working with industry partners to develop new methods to increase the ratio of PCC for fiber

substitutions.

|

| ● |

Develop unique calcium carbonate and talc products used in the manufacture of novel biopolymers, a new market opportunity.

|

| ● |

Deploy new talc and GCC products in paint, coating and packaging applications.

|

| ● |

Deploy value-added formulations of refractory materials that not only reduce costs but improve performance.

|

| ● |

Deploy our laser measurement technologies into new applications.

|

| ● |

Expand our refractory maintenance model to other steel makers globally.

|

| ● |

Increase our presence and market share in Asia and in the global powdered detergent market.

|

| ● |

Continue the development of our proprietary Enersol® products for agricultural applications worldwide.

|

| ● |

Pursue opportunities for our products in environmental and building and construction markets in the Middle East, Asia Pacific and South America regions.

|

| ● |

Increase our presence and market share for geosynthetic clay liners within the Environmental Products product line.

|

| ● |

Increase our presence and market penetration in offshore produced water and offshore filtration and well testing within the Energy Services segment.

|

| ● |

Deploy operational excellence principles into all aspects of the organization, including system infrastructure and lean principles.

|

| ● |

Continue to explore selective acquisitions to fit our core competencies in minerals and fine particle technology.

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

Net sales

|

$

|

1,807.6

|

$

|

1,675.7

|

$

|

1,638.0

|

7.9

|

%

|

2.3

|

%

|

||||||||||

|

Cost of sales

|

1,346.2

|

1,208.5

|

1,177.6

|

11.4

|

%

|

2.6

|

%

|

|||||||||||||

|

Production margin

|

461.4

|

467.2

|

460.4

|

(1.2

|

)%

|

1.5

|

%

|

|||||||||||||

|

Production margin %

|

25.5

|

%

|

27.9

|

%

|

28.1

|

%

|

||||||||||||||

|

Marketing and administrative expenses

|

178.6

|

180.7

|

176.4

|

(1.2

|

)%

|

2.4

|

%

|

|||||||||||||

|

Research and development expenses

|

22.7

|

23.7

|

23.8

|

(4.2

|

)%

|

(0.4

|

)%

|

|||||||||||||

|

Acquisition related transaction and integration costs

|

1.7

|

3.4

|

8.0

|

(50.0

|

)%

|

(57.5

|

)%

|

|||||||||||||

|

Restructuring and other items, net

|

2.5

|

15.0

|

28.3

|

(83.3

|

)%

|

(47.0

|

)%

|

|||||||||||||

|

Income from operations

|

255.9

|

244.4

|

223.9

|

4.7

|

%

|

9.2

|

%

|

|||||||||||||

|

Operating margin %

|

14.2

|

%

|

14.6

|

%

|

13.7

|

%

|

||||||||||||||

|

Interest expense, net

|

(45.9

|

)

|

(43.4

|

)

|

(54.4

|

)

|

5.8

|

%

|

(20.2

|

)%

|

||||||||||

|

Debt modification costs and fees

|

—

|

(3.9

|

)

|

—

|

*

|

*

|

||||||||||||||

|

Non-cash pension settlement costs

|

(4.4

|

)

|

—

|

—

|

*

|

*

|

||||||||||||||

|

Other non-operating income (deductions), net

|

(1.5

|

)

|

(6.2

|

)

|

0.8

|

(75.8

|

)%

|

*

|

||||||||||||

|

Total non-operating deductions, net

|

(51.8

|

)

|

(53.5

|

)

|

(53.6

|

)

|

(3.2

|

)%

|

(0.2

|

)%

|

||||||||||

|

Income from operations before tax and equity in earnings

|

204.1

|

190.9

|

170.3

|

6.9

|

%

|

12.1

|

%

|

|||||||||||||

|

Provision (benefit) for taxes on income

|

34.4

|

(6.6

|

)

|

35.3

|

*

|

(118.7

|

)%

|

|||||||||||||

|

Effective tax rate

|

16.9

|

%

|

(3.5

|

)%

|

20.7

|

%

|

||||||||||||||

|

Equity in earnings of affiliates, net of tax

|

3.5

|

1.5

|

2.1

|

133.3

|

%

|

(28.6

|

)%

|

|||||||||||||

|

Income from operations, net of tax

|

173.2

|

199.0

|

137.1

|

(13.0

|

)%

|

45.1

|

%

|

|||||||||||||

|

Less: Net income attributable to non-controlling interests

|

4.2

|

3.9

|

3.7

|

7.7

|

%

|

5.4

|

%

|

|||||||||||||

|

Net income attributable to Minerals Technologies Inc. (MTI)

|

$

|

169.0

|

$

|

195.1

|

$

|

133.4

|

(13.4

|

)%

|

46.3

|

%

|

||||||||||

| * |

Not meaningful

|

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

U.S.

|

$

|

961.6

|

$

|

939.3

|

$

|

936.2

|

2.4

|

%

|

0.3

|

%

|

||||||||||

|

International

|

846.0

|

736.4

|

701.8

|

14.9

|

%

|

4.9

|

%

|

|||||||||||||

|

Total sales

|

$

|

1,807.6

|

$

|

1,675.7

|

$

|

1,638.0

|

7.9

|

%

|

2.3

|

%

|

||||||||||

|

Performance Materials Segment

|

$

|

828.1

|

$

|

734.8

|

$

|

686.1

|

12.7

|

%

|

7.1

|

%

|

||||||||||

|

Specialty Minerals Segment

|

589.3

|

584.8

|

591.5

|

0.8

|

%

|

(1.1

|

)%

|

|||||||||||||

|

Refractories Segment

|

311.9

|

279.4

|

274.5

|

11.6

|

%

|

1.8

|

%

|

|||||||||||||

|

Energy Services Segment

|

78.3

|

76.7

|

85.9

|

2.1

|

%

|

(10.7

|

)%

|

|||||||||||||

|

Total sales

|

$

|

1,807.6

|

$

|

1,675.7

|

$

|

1,638.0

|

7.9

|

%

|

2.3

|

%

|

||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

Net Sales

|

||||||||||||||||||||

|

Metalcasting

|

$

|

328.9

|

$

|

294.3

|

$

|

258.0

|

$

|

34.6

|

$

|

36.3

|

||||||||||

|

Household, Personal Care & Specialty Products

|

248.8

|

169.6

|

171.2

|

79.2

|

(1.6

|

)

|

||||||||||||||

|

Environmental Products

|

80.3

|

67.7

|

78.9

|

12.6

|

(11.2

|

)

|

||||||||||||||

|

Building Materials

|

70.4

|

78.2

|

74.1

|

(7.8

|

)

|

4.1

|

||||||||||||||

|

Basic Minerals

|

99.7

|

125.0

|

103.9

|

(25.3

|

)

|

21.1

|

||||||||||||||

|

Total net sales

|

$

|

828.1

|

$

|

734.8

|

$

|

686.1

|

$

|

93.3

|

$

|

48.7

|

||||||||||

|

Income from operations

|

$

|

116.8

|

$

|

119.7

|

$

|

121.1

|

$

|

(2.9

|

)

|

$

|

(1.4

|

)

|

||||||||

|

% of net sales

|

14.1

|

%

|

16.3

|

%

|

17.7

|

%

|

||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

Net

Sales

|

||||||||||||||||||||

|

Paper PCC

|

$

|

378.5

|

$

|

377.7

|

$

|

387.9

|

$

|

0.8

|

$

|

(10.2

|

)

|

|||||||||

|

Specialty PCC

|

66.9

|

66.0

|

64.3

|

0.9

|

1.7

|

|||||||||||||||

|

PCC Products

|

$

|

445.4

|

$

|

443.7

|

$

|

452.2

|

$

|

1.7

|

$

|

(8.5

|

)

|

|||||||||

|

Ground Calcium Carbonate

|

$

|

91.0

|

$

|

87.3

|

$

|

83.6

|

$

|

3.7

|

$

|

3.7

|

||||||||||

|

Talc

|

52.9

|

53.8

|

55.7

|

(0.9

|

)

|

(1.9

|

)

|

|||||||||||||

|

Processed Minerals Products

|

$

|

143.9

|

$

|

141.1

|

$

|

139.3

|

$

|

2.8

|

$

|

1.8

|

||||||||||

|

Total net sales

|

$

|

589.3

|

$

|

584.8

|

$

|

591.5

|

$

|

4.5

|

$

|

(6.7

|

)

|

|||||||||

|

Income from operations

|

$

|

95.4

|

$

|

88.9

|

$

|

102.7

|

$

|

6.5

|

$

|

(13.8

|

)

|

|||||||||

|

% of net sales

|

16.2

|

%

|

15.2

|

%

|

17.4

|

%

|

||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

Net Sales

|

||||||||||||||||||||

|

Refractory Products

|

$

|

261.1

|

$

|

226.9

|

$

|

219.0

|

$

|

34.2

|

$

|

7.9

|

||||||||||

|

Metallurgical Products

|

50.8

|

52.5

|

55.5

|

(1.7

|

)

|

(3.0

|

)

|

|||||||||||||

|

Total net sales

|

$

|

311.9

|

$

|

279.4

|

$

|

274.5

|

$

|

32.5

|

$

|

4.9

|

||||||||||

|

Income from operations

|

$

|

45.4

|

$

|

39.8

|

$

|

37.0

|

$

|

5.6

|

$

|

2.8

|

||||||||||

|

% of net sales

|

14.6

|

%

|

14.2

|

%

|

13.5

|

%

|

||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

(millions of dollars)

|

2018

|

2017

|

2016

|

2018 vs. 2017

|

2017 vs. 2016

|

|||||||||||||||

|

Net Sales

|

$

|

78.3

|

$

|

76.7

|

$

|

85.9

|

$

|

1.6

|

$

|

(9.2

|

)

|

|||||||||

|

Income (Loss) from operations

|

$

|

4.5

|

$

|

6.1

|

$

|

(25.9

|

)

|

$

|

(1.6

|

)

|

$

|

32.0

|

||||||||

|

% of net sales

|

5.7

|

%

|

8.0

|

%

|

*

|

|||||||||||||||

| * |

Not meaningful

|

|

Payments Due by Period

|

||||||||||||||||||||

|

(millions of dollars)

|

Total

|

2019

|

2020 – 2021

|

2022 – 2023

|

After 2023

|

|||||||||||||||

|

Long-term debt

|

$

|

930.9

|

$

|

3.3

|

$

|

269.4

|

$

|

0.2

|

$

|

658.0

|

||||||||||

|

Interest related to long term debt

|

200.6

|

45.6

|

83.7

|

65.8

|

5.5

|

|||||||||||||||

|

Estimated pension and post retirement plan funding

|

20.0

|

10.0

|

10.0

|

—

|

—

|

|||||||||||||||

|

Operating lease obligations

|

79.8

|

17.3

|

22.5

|

15.2

|

24.8

|

|||||||||||||||

|

Repatriation tax liability

|

16.4

|

—

|

—

|

—

|

16.4

|

|||||||||||||||

|

Other long term liabilities

|

23.4

|

0.4

|

—

|

—

|

23.0

|

|||||||||||||||

|

Total contractual obligations

|

$

|

1,271.1

|

$

|

76.6

|

$

|

385.6

|

$

|

81.2

|

$

|

727.7

|

||||||||||

| ● |

Significant under-performance relative to historical or projected future operating results;

|

| ● |

Significant changes in the manner of use of the acquired assets or the strategy for the overall business;

|

| ● |

Significant negative industry or economic trends;

|

| ● |

Market capitalization below invested capital.

|

|

(millions of dollars)

|

Discount Rate

|

Salary Scale

|

Return on Asset

|

|||||||||

|

1% increase

|

$

|

(3.8

|

)

|

$

|

0.8

|

$

|

(2.0

|

)

|

||||

|

1% decrease

|

$

|

6.6

|

$

|

(0.7

|

)

|

$

|

2.7

|

|||||

|

(millions of dollars)

|

Discount Rate

|

Salary Scale

|

||||||

|

1% increase

|

$

|

(31.4

|

)

|

$

|

4.0

|

|||

|

1% decrease

|

$

|

54.0

|

$

|

(3.5

|

)

|

|||

|

Plan Category

|

Number of Securities to

be Issued Upon Exercise

of Outstanding Options

|

Weighted Average

Exercise Price of

Outstanding Options

|

Number of Securities

Remaining Available

for Future Issuance

|

|||||||||

|

Equity compensation plans approved by security holders

|

1,054,259

|

$

|

54.04

|

866,023

|

||||||||

|

Total

|

1,054,259

|

$

|

54.04

|

866,023

|

||||||||

| (a) |

The following documents are filed as part of this report:

|

| 1. |

Financial Statements. The following Consolidated Financial Statements of Mineral Technologies Inc. and subsidiary companies and Reports of Independent

Registered Public Accounting Firm are set forth on pages F-2 to F-38.

|

| 2. |

Financial Statement Schedule. The following financial statement schedule is filed as part of this report:

|

| 3. |

Exhibits. The following exhibits are filed as part of, or incorporated by reference into, this report.

|

|

Exhibit No.

|

Exhibit Title

|

|

|

Restated Certificate of Incorporation of the Company (Incorporated by reference to exhibit 3.1 filed with the Company's Annual Report

on Form 10-K (file no. 001-11430) for the year ended December 31, 2003)

|

||

|

By-Laws of the Company as amended and restated effective March 13, 2018 (Incorporated by reference to exhibit 3.1 filed with the

Company's Current Report on Form 8-K (file no. 001-11430) filed on March 19, 2018)

|

||

|

Specimen Certificate of Common Stock (Incorporated by reference to exhibit 4.1 filed with the Company's Annual Report on Form 10-K

(file no. 001-11430) for the year ended December 31, 2003)

|

||

|

10.1

|

Asset Purchase Agreement, dated as of September 28, 1992, by and between Specialty Refractories Inc. and Quigley Company Inc.

(Incorporated by reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-51292), originally filed on August 25, 1992)

|

|

|

10.1(a)

|

Agreement dated October 22, 1992 between Specialty Refractories Inc. and Quigley Company Inc., amending Exhibit 10.1 (Incorporated by

reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-59510), originally filed on March 15, 1993)

|

|

|

10.1(b)

|

Letter Agreement dated October 29, 1992 between Specialty Refractories Inc. and Quigley Company Inc., amending Exhibit 10.1

(Incorporated by reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-59510), originally filed on March 15, 1993)

|

|

|

10.2

|

Reorganization Agreement, dated as of September 28, 1992, by and between the Company and Pfizer Inc. (Incorporated by reference to

the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-51292), originally filed on August 25, 1992)

|

|

|

10.3

|

Asset Contribution Agreement, dated as of September 28, 1992, by and between Pfizer Inc. and Specialty Minerals Inc. (Incorporated by

reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-51292), originally filed on August 25, 1992)

|

|

|

10.4

|

Asset Contribution Agreement, dated as of September 28, 1992, by and between Pfizer Inc. and Barretts Minerals Inc. (Incorporated by

reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-51292), originally filed on August 25, 1992)

|

|

|

10.4(a)

|

Agreement dated October 22, 1992 between Pfizer Inc, Barretts Minerals Inc. and Specialty Minerals Inc., amending Exhibits 10.3 and

10.4 (Incorporated by reference to the exhibit so designated filed with the Company's Registration Statement on Form S-1 (Registration No. 33-59510), originally filed on March 15, 1993)

|

|

|

Employment Agreement, dated December 13, 2016, between the Company and Douglas T. Dietrich (Incorporated by reference to exhibit 10.1

filed with the Company's Current Report on Form 8-K (file no. 001-11430) filed on December 16, 2016) (+)

|

||

|

Form of Employment Agreement between the Company and each of Brett Argirakis, Michael A. Cipolla, Matthew E. Garth, Jonathan J.,

Hastings, Andrew Jones, Douglas W. Mayger, Thomas J. Meek, and D.J. Monagle, III (Incorporated by reference to exhibit 10.6 filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2016) (+)

|

||

|

Severance Agreement between the Company and Douglas T. Dietrich (Incorporated by reference to the exhibit 10.2 filed with the

Company’s Current Report on form 8-K (file no. 001-11430) filed on December 16, 2016) (+)

|

||

|

Form of Severance Agreement between the Company and each of Brett Argirakis, Michael A. Cipolla, Matthew E. Garth, Jonathan J.

Hastings, Andrew Jones, Douglas W. Mayger, Thomas J. Meek, and D.J. Monagle, III (Incorporated by reference to exhibit 10.8 filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2016) (+)

|

||

|

Form of Indemnification Agreement between the Company and each of Brett Argirakis, Michael A. Cipolla, Douglas T. Dietrich, Matthew

E. Garth, Jonathan J. Hastings, Andrew Jones, Douglas W. Mayger, Thomas J. Meek, D.J. Monagle III and each of the Company’s non-employee directors (Incorporated by reference to exhibit 10.1 filed with the Company's Current Report on Form

8-K (file no. 001-11430) filed on May 8, 2009) (+)

|

||

|

Company Employee Protection Plan, as amended August 27, 1999 (Incorporated by reference to exhibit 10.7 filed with the Company's

Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2004) (+)

|

||

|

Company Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors, as amended and restated effective January 1,

2008 (Incorporated by reference to exhibit 10.8 filed with the Company's Quarterly Report on Form 10-Q (file no. 001-11430) for the quarter ended March 30, 2008) (+)

|

||

|

First Amendment to the Company Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors, dated January 18, 2012

(Incorporated by reference to exhibit 10.11(a) filed with the Company’s Annual Report on Form 10-K (file no. 001-11430)for the year ended December 31, 2011) (+)

|

||

|

2015 Stock Award and Incentive Plan of the Company (Incorporated by reference to Appendix B to the Company’s 2015 Proxy Statement

(file no. 001-11430) filed on April 2, 2015) (+)

|

||

|

Company Retirement Plan, as amended and restated, dated December 21, 2012 (Incorporated by reference to exhibit 10.12 filed with the

Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2012) (+)

|

|

Second Amendment to Company Retirement Plan, as amended and restated, dated December 22, 2014 (Incorporated by reference to exhibit

10.13(a) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2014)(+)

|

||

|

Third Amendment to Company Retirement Plan, as amended and restated, dated June 12, 2015 (Incorporated by reference to exhibit 10.2

filed with the Company's Quarterly Report on Form 10-Q (file no. 001-11430) for the quarter ended June 28, 2015)(+)

|

||

|

Fourth Amendment to Company Retirement Plan, as amended and restated, dated December 16, 2016 (Incorporated by reference to exhibit

10.13(c) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2016)(+)

|

||

|

Fifth Amendment to Company Retirement Plan, as amended and restated, dated December 6, 2017 (Incorporated by reference to exhibit

10.13(d) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2017)(+)

|

||

|

Company Supplemental Retirement Plan, amended and restated effective December 31, 2009 (Incorporated by reference to exhibit 10.13

filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2009) (+)

|

||

|

First Amendment to Company Supplemental Retirement Plan, as amended and restated, dated December 22, 2014 (Incorporated by reference

to exhibit 10.14(a) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2014)(+)

|

||

|

Company Savings and Investment Plan, as amended and restated, dated December 21, 2012 (Incorporated by reference to exhibit 10.14

filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2012) (+)

|

||

|

Amendment to the Company Savings and Investment Plan, as amended and restated, dated December 5, 2013 (Incorporated by reference to

exhibit 10.15(a) filed with the Company’s Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2013) (+)

|

||

|

Amendment to the Company Savings and Investment Plan, as amended and restated, dated December 5, 2013 (Incorporated by reference to

exhibit 10.15(b) filed with the Company’s Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2013) (+)

|

||

|

Third Amendment to the Company Savings and Investment Plan, as amended and restated, dated December 22, 2014 (Incorporated by

reference to exhibit 10.15(c) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2014)(+)

|

||

|

Amendment to the Company Savings and Investment Plan, as amended and restated, dated December 31, 2015 (Incorporated by reference to

exhibit 10.15(d) filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2015)(+)

|

||

|

Company Supplemental Savings Plan, amended and restated effective December 31, 2009 (Incorporated by reference to exhibit 10.15 filed

with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2009) (+)

|

||

|

Amendment to the Company Supplemental Savings Plan, dated December 28, 2011 (Incorporated by reference to exhibit 10.16(a) filed with

the Company’s Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2011)(+)

|

||

|

First Amendment to the Company Supplemental Savings Plan, dated December 22, 2014 (Incorporated by reference to exhibit 10.16(b)

filed with the Company's Annual Report on Form 10-K (file no. 001-11430) for the year ended December 31, 2014)(+)

|

||

|