UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-Q

_____________________________

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 1-11356

_______________________________

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | ||||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||||||||

| , | , | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

(215 ) 231-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| New York Stock Exchange | ||||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 191,316,557 shares of common stock, $0.001

Table of Contents

| Page | ||||||||

| PART I—FINANCIAL INFORMATION | ||||||||

| Item 1 | ||||||||

| Item 2 | ||||||||

| Item 3 | ||||||||

| Item 4 | ||||||||

| PART II—OTHER INFORMATION | ||||||||

| Item 1 | ||||||||

| Item 1A | ||||||||

| Item 2 | ||||||||

| Item 6 | ||||||||

2

Glossary of Abbreviations and Acronyms

The following list defines various abbreviations and acronyms used throughout this report, including the Condensed Consolidated Financial Statements, the Notes to Unaudited Condensed Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| Term | Definition | ||||

| 2020 Form 10-K | Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on February 26, 2021 | ||||

| 2014 Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which became effective October 1, 2014 | ||||

| 2020 Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which became effective March 1, 2020 | ||||

| 2016 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in the first quarter of 2016 and subsequently amended in the fourth quarter of 2017 | ||||

| 2018 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in October 2017 to cede a portion of Single Premium NIW beginning January 1, 2018 | ||||

| 2020 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in January 2020 to cede a portion of Single Premium NIW beginning January 1, 2020 | ||||

| ABS | Asset-backed securities | ||||

| All Other | Radian’s non-reportable operating segments and other business activities, including: (i) income (losses) from assets held by our holding company; (ii) related general corporate operating expenses not attributable or allocated to our reportable segments; (iii) for all periods prior to its sale in the first quarter of 2020, income and expenses related to Clayton; (iv) for all periods presented, the income and expenses related to our traditional appraisal services; and (v) certain other immaterial revenue and expense items | ||||

| ASU | Accounting Standards Update, issued by the FASB to communicate changes to GAAP | ||||

| Available Assets | As defined in the PMIERs, assets primarily including the most liquid assets of a mortgage insurer, and reduced by, among other items, premiums received but not yet earned and reinsurance funds withheld | ||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act signed into law on March 27, 2020 | ||||

| Claim Curtailment | Our legal right, under certain conditions, to reduce the amount of a claim, including due to servicer negligence | ||||

| Claim Denial | Our legal right, under certain conditions, to deny a claim | ||||

| Claim Severity | The total claim amount paid divided by the original coverage amount | ||||

| Clayton | Clayton Services LLC, a former indirect subsidiary of Radian Group that was sold on January 21, 2020, through which we provided services related to loan acquisition, RMBS securitization and distressed asset reviews and servicer and loan surveillance | ||||

| CLO | Collateralized loan obligations | ||||

| CMBS | Commercial mortgage-backed securities | ||||

| COVID-19 | The novel coronavirus disease declared a pandemic by the World Health Organization and the Centers for Disease Control and Prevention in March 2020 | ||||

| COVID-19 Amendment | Amendment to the PMIERs effective June 30, 2020, primarily to recognize the COVID-19 pandemic as a nationwide “FEMA Declared Major Disaster” and to set forth guidelines on the application of the Disaster Related Capital Charge to COVID-19 Defaulted Loans | ||||

| COVID-19 Crisis Period | Time period extending from March 1, 2020 to March 31, 2021 | ||||

| COVID-19 Defaulted Loans | All non-performing loans that either: (i) have an Initial Missed Payment occurring during the COVID-19 Crisis Period or (ii) are subject to a forbearance plan granted in response to a financial hardship related to COVID-19 (which is assumed under the COVID-19 Amendment to be the case for any loan that has an Initial Missed Payment occurring during the COVID-19 Crisis Period and is subject to a forbearance plan), the terms of which are materially consistent with the terms of forbearance plans offered by the GSEs | ||||

| Cures | Loans that were in default as of the beginning of a period and are no longer in default because payments were received such that the loan is no longer 60 or more days past due | ||||

| Default to Claim Rate | The percentage of defaulted loans that are assumed to result in a claim | ||||

3

| Term | Definition | ||||

| Demotech | Demotech, Inc. | ||||

| Disaster Related Capital Charge | Under the PMIERs, multiplier of 0.30 applied to the required asset amount factor for each non-performing loan: (i) backed by a property located in a FEMA Designated Area and (ii) either subject to a certain forbearance plan or with an initial default date occurring within a certain timeframe | ||||

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended | ||||

| Eagle Re Issuer(s) | A group of unaffiliated special purpose insurers (VIEs) domiciled in Bermuda, comprising Eagle Re 2018-1 Ltd., Eagle Re 2019-1 Ltd., Eagle Re 2020-1 Ltd., and/or Eagle Re 2020-2 Ltd., which provide reinsurance coverage under Radian Guaranty’s Excess-of-Loss Program. Effective in April 2021, also includes Eagle Re 2021-1 Ltd. | ||||

| Excess-of-Loss Program | The credit risk protection obtained by Radian Guaranty in the form of excess-of-loss reinsurance, which indemnifies the ceding company against loss in excess of a specific agreed limit, up to a specified sum. The program includes reinsurance agreements with the Eagle Re Issuers in connection with various issuances of mortgage insurance-linked notes. The program also includes a separate agreement with a third-party reinsurer, representing a pro rata share of the credit risk alongside the risk assumed by Eagle Re 2018-1 Ltd., an Eagle Re Issuer. | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| Extraordinary Distribution | A dividend or distribution of capital that is required to be approved by an insurance company’s primary regulator that is greater than would be permitted as an ordinary distribution (which does not require regulatory approval) | ||||

| Fannie Mae | Federal National Mortgage Association | ||||

| FASB | Financial Accounting Standards Board | ||||

| FEMA | Federal Emergency Management Agency, an agency of the U.S. Department of Homeland Security | ||||

| FEMA Designated Area | Generally, an area that has been subject to a disaster, designated by FEMA as an individual assistance disaster area for the purpose of determining eligibility for various forms of federal assistance | ||||

| FHA | Federal Housing Administration | ||||

| FHFA | Federal Housing Finance Agency | ||||

| FHLB | Federal Home Loan Bank of Pittsburgh | ||||

| FICO | Fair Isaac Corporation (“FICO”) credit scores, for Radian’s portfolio statistics, represent the borrower’s credit score at origination and, in circumstances where there are multiple borrowers, the lowest of the borrowers’ FICO scores is utilized | ||||

| Fitch | Fitch Ratings, Inc. | ||||

| Foreclosure Stage Default | The stage of default of a loan in which a foreclosure sale has been scheduled or held | ||||

| Freddie Mac | Federal Home Loan Mortgage Corporation | ||||

| GAAP | Generally accepted accounting principles in the U.S., as amended from time to time | ||||

| GSE(s) | Government-Sponsored Enterprises (Fannie Mae and Freddie Mac) | ||||

| HARP | Home Affordable Refinance Program | ||||

| IBNR | Losses incurred but not reported | ||||

| IIF | Insurance in force, equal to the aggregate unpaid principal balances of the underlying loans | ||||

| Initial Missed Payment | The first missed monthly payment, which would be reported to us as delinquent as of the last day of the month for which it was due. (For example, for a loan first reported to the approved insurer in May as having missed its payments due on April 1 and May 1, the Initial Missed Payment shall be deemed to have occurred on April 30. In this example, the loan would become a non-performing primary mortgage guaranty insurance loan in May and, if applicable, the Disaster Related Capital Charge would be applied for May, June, and July.) | ||||

| LAE | Loss adjustment expenses, which include the cost of investigating and adjusting losses and paying claims | ||||

| LIBOR | London Inter-bank Offered Rate | ||||

| Loss Mitigation Activity/Activities | Activities such as Rescissions, Claim Denials, Claim Curtailments and cancellations | ||||

| LTV | Loan-to-value ratio, calculated as the ratio of the original loan amount to the original value of the property, expressed as a percentage | ||||

4

| Term | Definition | ||||

| Master Policies | The Prior Master Policy, the 2014 Master Policy, and the 2020 Master Policy, together | ||||

| Minimum Required Asset(s) | A risk-based minimum required asset amount, as defined in the PMIERs, calculated based on net RIF (RIF, net of credits permitted for reinsurance) and a variety of measures related to expected credit performance and other factors, including the impact of the Disaster Related Capital Charge | ||||

| Model Act | Mortgage Guaranty Insurance Model Act, as issued by the National Association of Insurance Commissioners to establish minimum capital and surplus requirements for mortgage insurers | ||||

| Monthly and Other Recurring Premiums (or Recurring Premium Policies) | Insurance premiums or policies, respectively, where premiums are paid on a monthly or other installment basis, in contrast to Single Premium Policies | ||||

| Monthly Premium Policies | Insurance policies where premiums are paid on a monthly installment basis | ||||

| Moody’s | Moody’s Investors Service | ||||

| Mortgage | Radian’s mortgage insurance and risk services business segment, which provides credit-related insurance coverage, principally through private mortgage insurance on residential first-lien mortgage loans, as well as other credit risk management and contract underwriting solutions to mortgage lending institutions and mortgage credit investors | ||||

| MPP Requirement | Certain states’ statutory or regulatory risk-based capital requirement that the mortgage insurer must maintain a minimum policyholder position, which is calculated based on both risk and surplus levels | ||||

| NIW | New insurance written, representing the aggregate original principal amount of the mortgages underlying the Primary Mortgage Insurance | ||||

| NOL | Net operating loss; for tax purposes, accumulated during years a company reported more tax deductions than taxable income. NOLs may be carried back or carried forward a certain number of years, depending on various factors which can reduce a company’s tax liability. | ||||

| Persistency Rate | The percentage of IIF that remains in force over a period of time | ||||

| PMIERs | Private Mortgage Insurer Eligibility Requirements issued by the GSEs under oversight of the FHFA to set forth requirements an approved insurer must meet and maintain to provide mortgage guaranty insurance on loans acquired by the GSEs. The current PMIERs requirements, sometimes referred to as PMIERs 2.0, incorporate the most recent revisions to the PMIERs that became effective on March 31, 2019. | ||||

| PMIERs Cushion | Under PMIERs, Radian Guaranty's excess of Available Assets over Minimum Required Assets | ||||

| Pool Mortgage Insurance | Insurance that provides a lender or investor protection against default on a group or “pool” of mortgages, rather than on an individual mortgage loan basis, generally subject to an aggregate exposure limit, or “stop loss,” and/or deductible applied to the initial aggregate loan balance of the entire pool, pursuant to the terms of the applicable insurance agreement | ||||

| Primary Mortgage Insurance | Insurance that provides a lender or investor protection against default on an individual mortgage loan basis, at a specified coverage percentage for each loan, pursuant to the terms of the applicable Master Policy | ||||

| Prior Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which was in effect prior to the effective date of the 2014 Master Policy | ||||

| QM | Qualified mortgage; a mortgage that possesses certain low-risk characteristics that enable it to qualify for lender protection under the ability to repay rule instituted by the Dodd-Frank Act | ||||

| QSR Program | The quota share reinsurance agreements entered into with a third-party reinsurance provider in the second and fourth quarters of 2012, collectively | ||||

| Radian | Radian Group Inc. together with its consolidated subsidiaries | ||||

| Radian Group | Radian Group Inc., our insurance holding company | ||||

| Radian Guaranty | Radian Guaranty Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group and our approved insurer under the PMIERs, through which we provide mortgage insurance products and services | ||||

| Radian Reinsurance | Radian Reinsurance Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group, through which we provide mortgage credit risk insurance and reinsurance, including through participation in credit risk transactions issued by the GSEs | ||||

| Radian Title Insurance | Radian Title Insurance Inc., an Ohio domiciled insurance company and an indirect subsidiary of Radian Group, through which we offer title insurance | ||||

5

| Term | Definition | ||||

| RBC States | Risk-based capital states, which are those states that currently impose a statutory or regulatory risk-based capital requirement | ||||

| Real Estate | Radian’s business segment that offers a broad array of title, valuation, asset management and other real estate services to market participants across the real estate value chain | ||||

| Rescission | Our legal right, under certain conditions, to unilaterally rescind coverage on our mortgage insurance policies if we determine that a loan did not qualify for insurance | ||||

| RIF | Risk in force; for Primary Mortgage Insurance, RIF is equal to the underlying loan unpaid principal balance multiplied by the insurance coverage percentage, whereas for Pool Mortgage Insurance, it represents the remaining exposure under the agreements | ||||

| Risk-to-capital | Under certain state regulations, a maximum ratio of net RIF calculated relative to the level of statutory capital | ||||

| RMBS | Residential mortgage-backed securities | ||||

| S&P | Standard & Poor’s Financial Services LLC | ||||

| SAP | Statutory accounting principles and practices, including those required or permitted, if applicable, by the insurance departments of the respective states of domicile of our insurance subsidiaries | ||||

| SEC | United States Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

| Senior Notes due 2024 | Our 4.500% unsecured senior notes due October 2024 ($450 million original principal amount) | ||||

| Senior Notes due 2025 | Our 6.625% unsecured senior notes due March 2025 ($525 million original principal amount) | ||||

| Senior Notes due 2027 | Our 4.875% unsecured senior notes due March 2027 ($450 million original principal amount) | ||||

| Single Premium NIW | NIW on Single Premium Policies | ||||

| Single Premium Policy / Policies | Insurance policies where premiums are paid in a single payment, which includes policies written on an individual basis (as each loan is originated) and on an aggregated basis (in which each individual loan in a group of loans is insured in a single transaction, typically shortly after the loans have been originated) | ||||

| Single Premium QSR Program | The 2016 Single Premium QSR Agreement, the 2018 Single Premium QSR Agreement and the 2020 Single Premium QSR Agreement, collectively | ||||

| Stage of Default | The stage a loan is in relative to the foreclosure process, based on whether a foreclosure sale has been scheduled or held | ||||

| Statutory RBC Requirement | Risk-based capital requirement imposed by the RBC States, requiring a minimum surplus level and, in certain states, a minimum ratio of statutory capital relative to the level of risk | ||||

| Surplus Notes | Collectively: (i) a $100 million 0.0% intercompany surplus note issued by Radian Guaranty to Radian Group, due December 31, 2027 and (ii) a $200 million 3.0% intercompany surplus note issued by Radian Guaranty to Radian Group, due January 31, 2030 | ||||

| Time in Default | The time period from the point a loan reaches default status (based on the month the default occurred) to the current reporting date | ||||

| VIE | Variable interest entity | ||||

6

Cautionary Note Regarding Forward-Looking Statements

—Safe Harbor Provisions

—Safe Harbor Provisions

All statements in this report that address events, developments or results that we expect or anticipate may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. In most cases, forward-looking statements may be identified by words such as “anticipate,” “may,” “will,” “could,” “should,” “would,” “expect,” “intend,” “plan,” “goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “seek,” “strategy,” “future,” “likely” or the negative or other variations on these words and other similar expressions. These statements, which may include, without limitation, projections regarding our future performance and financial condition, are made on the basis of management’s current views and assumptions with respect to future events, including management’s current views regarding the likely impacts of the COVID-19 pandemic. Any forward-looking statement is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking statement. These statements speak only as of the date they were made, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We operate in a changing environment where new risks emerge from time to time and it is not possible for us to predict all risks that may affect us, particularly those associated with the COVID-19 pandemic, which has had wide-ranging and continually evolving effects. The forward-looking statements, as well as our prospects as a whole, are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in the forward-looking statements. These risks and uncertainties include, without limitation:

■the COVID-19 pandemic, which has caused significant economic disruption, high unemployment, periods of volatility and disruption in financial markets, and required adjustments in the housing finance system and real estate markets. The COVID-19 pandemic has adversely impacted our businesses, and we expect that the COVID-19 pandemic could further impact our business and subject us to certain risks, including those discussed in “Item 1A. Risk Factors—The COVID-19 pandemic has adversely impacted us, and its ultimate impact on our business and financial results will depend on future developments, which are highly uncertain and cannot be predicted, including the scope, severity and duration of the pandemic and actions taken by governmental authorities in response to the pandemic” and the other risk factors in our 2020 Form 10-K;

■changes in economic and political conditions that impact the size of the insurable market, the credit performance of our insured portfolio, and our business prospects;

■changes in the way customers, investors, ratings agencies, regulators or legislators perceive our performance, financial strength and future prospects;

■Radian Guaranty’s ability to remain eligible under the PMIERs and other applicable requirements imposed by the FHFA and by the GSEs to insure loans purchased by the GSEs;

■our ability to maintain an adequate level of capital in our insurance subsidiaries to satisfy existing and future regulatory requirements, including the PMIERs and any changes thereto, such as the application of the COVID-19 Amendment, and potential changes to the Model Act currently under consideration;

■changes in the charters or business practices of, or rules or regulations imposed by or applicable to, the GSEs, which may include changes in response to the COVID-19 pandemic, changes in the requirements for Radian Guaranty to remain an approved insurer to the GSEs, changes in the GSEs’ interpretation and application of the PMIERs, or changes impacting loans purchased by the GSEs;

■the Enterprise Regulatory Capital Framework that was finalized by the FHFA in December 2020 and that, among other things, increases the capital requirements for the GSEs and reduces the credit they receive for risk transfer, which could impact their operations and pricing as well as the size of the insurable mortgage insurance market, and which may form the basis for future versions of the PMIERs;

■changes in the current housing finance system in the United States, including the roles of the FHA, the GSEs and private mortgage insurers in this system;

■our ability to successfully execute and implement our capital plans, including our risk distribution strategy through the capital markets and reinsurance markets, and to maintain sufficient holding company liquidity to meet our liquidity needs;

■our ability to successfully execute and implement our business plans and strategies, including plans and strategies that require GSE and/or regulatory approvals and licenses and that are subject to complex compliance requirements;

■uncertainty from the expected discontinuance of LIBOR and transition to one or more alternative benchmarks that could cause interest rate volatility and, among other things, impact our investment portfolio, cost of debt and cost of reinsurance through mortgage insurance-linked notes transactions;

■any disruption in the servicing of mortgages covered by our insurance policies, as well as poor servicer performance, which could be impacted by the burdens placed on many servicers due to the COVID-19 pandemic;

■a decrease in the Persistency Rates of our mortgage insurance on Monthly Premium Policies;

7

■competition in our mortgage insurance business, including price competition and competition from the FHA and the U.S. Department of Veterans Affairs as well as from other forms of credit enhancement, such as GSE-sponsored alternatives to traditional mortgage insurance;

■the effect of the Dodd-Frank Act on the financial services industry in general, and on our businesses in particular, including the recent changes to the QM loan requirements;

■legislative and regulatory activity (or inactivity), including the adoption of (or failure to adopt) new laws and regulations, or changes in existing laws and regulations, or the way they are interpreted or applied, including potential changes in tax law under the Biden Administration;

■legal and regulatory claims, assertions, actions, reviews, audits, inquiries and investigations that could result in adverse judgments, settlements, fines, injunctions, restitutions or other relief that could require significant expenditures, new or increased reserves or have other effects on our business;

■the amount and timing of potential payments or adjustments associated with federal or other tax examinations;

■the possibility that we may fail to estimate accurately, especially in the event of an extended economic downturn or a period of extreme market volatility and economic uncertainty such as we have been experiencing due to the COVID-19 pandemic, the likelihood, magnitude and timing of losses in establishing loss reserves for our mortgage insurance business or to accurately calculate and/or project our Available Assets and Minimum Required Assets under the PMIERs, which will be impacted by, among other things, the size and mix of our IIF, the level of defaults in our portfolio, the reported status of defaults in our portfolio, including whether they are subject to forbearance, a repayment plan or a loan modification trial period granted in response to a financial hardship related to COVID-19, the level of cash flow generated by our insurance operations and our risk distribution strategies;

■volatility in our financial results caused by changes in the fair value of our assets and liabilities, including our investment portfolio;

■changes in GAAP or SAP rules and guidance, or their interpretation;

■effectiveness and security of our information technology systems and solutions, including our ability to successfully develop, launch and implement new and innovative technologies and digital solutions and the potential disruption in, or failure of, our information technology systems due to computer viruses, unauthorized access, cyber-attack, natural disasters or other similar events;

■our ability to attract and retain key employees; and

■legal and other limitations on amounts we may receive from our subsidiaries, including dividends or ordinary course distributions under our internal tax- and expense-sharing arrangements.

For more information regarding these risks and uncertainties as well as certain additional risks that we face, you should refer to “Item 1A. Risk Factors” in this report and “Item 1A. Risk Factors” in our 2020 Form 10-K, and to subsequent reports and registration statements filed from time to time with the SEC. We caution you not to place undue reliance on these forward-looking statements, which are current only as of the date on which we issued this report. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason.

8

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

Index to Condensed Consolidated Financial Statements

| Page | |||||

| Quarterly Financial Statements | |||||

| Notes to Unaudited Condensed Consolidated Financial Statements | |||||

9

Radian Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

Condensed Consolidated Balance Sheets (Unaudited)

| (In thousands, except per-share amounts) | March 31, 2021 | December 31, 2020 | ||||||||||||

| Assets | ||||||||||||||

Investments (Notes 5 and 6) | ||||||||||||||

Fixed-maturities available for sale—at fair value, net of allowance for credit losses of $ | $ | $ | ||||||||||||

Trading securities—at fair value (amortized cost of $ | ||||||||||||||

Equity securities—at fair value (cost of $ | ||||||||||||||

Short-term investments—at fair value (includes $ | ||||||||||||||

| Other invested assets—at fair value | ||||||||||||||

| Total investments | ||||||||||||||

| Cash | ||||||||||||||

| Restricted cash | ||||||||||||||

| Accrued investment income | ||||||||||||||

| Accounts and notes receivable | ||||||||||||||

Reinsurance recoverables (includes $ | ||||||||||||||

| Deferred policy acquisition costs | ||||||||||||||

| Property and equipment, net | ||||||||||||||

Goodwill and other acquired intangible assets, net (Note 7) | ||||||||||||||

Other assets (Note 9) | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||

| Liabilities | ||||||||||||||

| Unearned premiums | $ | $ | ||||||||||||

Reserve for losses and LAE (Note 11) | ||||||||||||||

Senior notes (Note 12) | ||||||||||||||

FHLB advances (Note 12) | ||||||||||||||

| Reinsurance funds withheld | ||||||||||||||

Net deferred tax liability (Note 10) | ||||||||||||||

| Other liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

Commitments and contingencies (Note 13) | ||||||||||||||

| Stockholders’ equity | ||||||||||||||

Common stock: par value $ | ||||||||||||||

Treasury stock, at cost: | ( | ( | ||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

Accumulated other comprehensive income (loss) (Note 15) | ||||||||||||||

| Total stockholders’ equity | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

10

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Operations (Unaudited)

Condensed Consolidated Statements of Operations (Unaudited)

| Three Months Ended March 31, | ||||||||||||||

| (In thousands, except per-share amounts) | 2021 | 2020 | ||||||||||||

| Revenues | ||||||||||||||

Net premiums earned (Note 8) | $ | $ | ||||||||||||

Services revenue (Note 4) | ||||||||||||||

| Net investment income | ||||||||||||||

| Net gains (losses) on investments and other financial instruments | ( | ( | ||||||||||||

| Other income | ||||||||||||||

| Total revenues | ||||||||||||||

| Expenses | ||||||||||||||

| Provision for losses | ||||||||||||||

| Policy acquisition costs | ||||||||||||||

| Cost of services | ||||||||||||||

| Other operating expenses | ||||||||||||||

| Interest expense | ||||||||||||||

| Amortization and impairment of other acquired intangible assets | ||||||||||||||

| Total expenses | ||||||||||||||

| Pretax income | ||||||||||||||

| Income tax provision | ||||||||||||||

| Net income | $ | $ | ||||||||||||

| Net Income Per Share | ||||||||||||||

| Basic | $ | $ | ||||||||||||

| Diluted | $ | $ | ||||||||||||

| Weighted-average number of common shares outstanding—basic | ||||||||||||||

| Weighted-average number of common and common equivalent shares outstanding—diluted | ||||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

11

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Net income | $ | $ | ||||||||||||

Other comprehensive income (loss), net of tax (Note 15): | ||||||||||||||

| Unrealized holding gains (losses) on investments arising during the period for which an allowance for expected losses has not been recognized | ( | ( | ||||||||||||

| Less: Reclassification adjustment for net gains (losses) on investments included in net income (loss): | ||||||||||||||

| Net realized gains (losses) on disposals and non-credit related impairment losses | ( | |||||||||||||

| Net decrease (increase) in expected credit losses | ||||||||||||||

| Other comprehensive income (loss), net of tax | ( | ( | ||||||||||||

| Comprehensive income (loss) | $ | ( | $ | |||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

12

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Common Stockholders’ Equity (Unaudited)

Condensed Consolidated Statements of Changes in Common Stockholders’ Equity (Unaudited)

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Common Stock | ||||||||||||||

| Balance, beginning of period | $ | $ | ||||||||||||

Shares repurchased under share repurchase program (Note 14) | ( | |||||||||||||

| Balance, end of period | ||||||||||||||

| Treasury Stock | ||||||||||||||

| Balance, beginning of period | ( | ( | ||||||||||||

| Repurchases of common stock under incentive plans | ( | ( | ||||||||||||

| Balance, end of period | ( | ( | ||||||||||||

| Additional Paid-in Capital | ||||||||||||||

| Balance, beginning of period | ||||||||||||||

| Issuance of common stock under incentive and benefit plans | ||||||||||||||

| Share-based compensation | ||||||||||||||

Shares repurchased under share repurchase program (Note 14) | ( | ( | ||||||||||||

| Balance, end of period | ||||||||||||||

| Retained Earnings | ||||||||||||||

| Balance, beginning of period | ||||||||||||||

| Net income | ||||||||||||||

| Dividends and dividend equivalents declared | ( | ( | ||||||||||||

| Balance, end of period | ||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | ||||||||||||||

| Balance, beginning of period | ||||||||||||||

| Net unrealized gains (losses) on investments, net of tax | ( | ( | ||||||||||||

| Balance, end of period | ||||||||||||||

| Total Stockholders’ Equity | $ | $ | ||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

13

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

Condensed Consolidated Statements of Cash Flows (Unaudited)

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Cash Flows from Operating Activities | ||||||||||||||

| Net cash provided by (used in) operating activities | $ | $ | ||||||||||||

| Cash Flows from Investing Activities | ||||||||||||||

| Proceeds from sales of: | ||||||||||||||

| Fixed-maturities available for sale | ||||||||||||||

| Trading securities | ||||||||||||||

| Equity securities | ||||||||||||||

| Proceeds from redemptions of: | ||||||||||||||

| Fixed-maturities available for sale | ||||||||||||||

| Trading securities | ||||||||||||||

| Purchases of: | ||||||||||||||

| Fixed-maturities available for sale | ( | ( | ||||||||||||

| Equity securities | ( | ( | ||||||||||||

| Sales, redemptions and (purchases) of: | ||||||||||||||

| Short-term investments, net | ( | ( | ||||||||||||

| Other assets and other invested assets, net | ||||||||||||||

| Proceeds from sale of subsidiary, net of cash sold | ||||||||||||||

| Purchases of property and equipment | ( | ( | ||||||||||||

| Net cash provided by (used in) investing activities | ( | |||||||||||||

| Cash Flows from Financing Activities | ||||||||||||||

| Dividends and dividend equivalents paid | ( | ( | ||||||||||||

| Issuance of common stock | ||||||||||||||

| Repurchases of common shares | ( | ( | ||||||||||||

| Credit facility commitment fees paid | ( | ( | ||||||||||||

| Change in secured borrowings, net (with terms three months or less) | ( | |||||||||||||

| Proceeds from secured borrowings (with terms greater than three months) | ||||||||||||||

| Repayments of secured borrowings (with terms greater than three months) | ( | ( | ||||||||||||

| Repayments of other borrowings | ( | |||||||||||||

| Net cash provided by (used in) financing activities | ( | ( | ||||||||||||

| Increase (decrease) in cash and restricted cash | ( | |||||||||||||

| Cash and restricted cash, beginning of period | ||||||||||||||

| Cash and restricted cash, end of period | $ | $ | ||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

14

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

1. Description of Business

We are a diversified mortgage and real estate business, providing both credit-related mortgage insurance coverage and a broad array of other mortgage, risk, title, valuation, asset management and other real estate services. We have two reportable business segments—Mortgage and Real Estate.

Mortgage

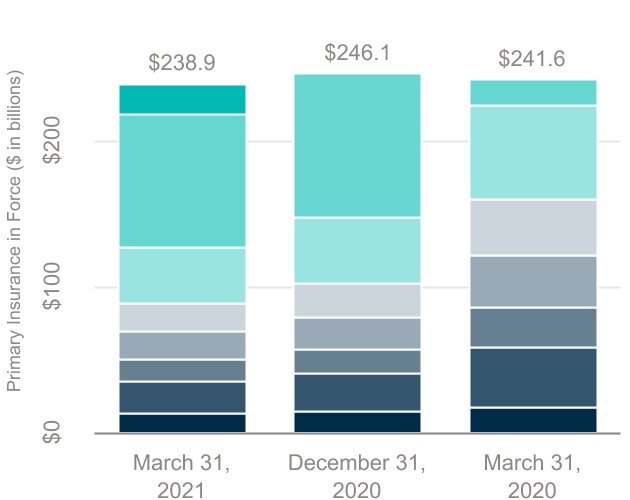

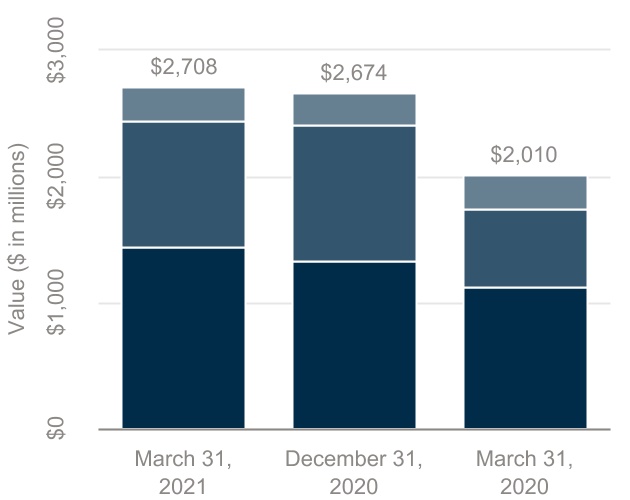

Our Mortgage segment provides credit-related insurance coverage, principally through private mortgage insurance on residential first-lien mortgage loans, as well as other credit risk management and contract underwriting solutions, to mortgage lending institutions and mortgage credit investors. We provide our mortgage insurance products and services mainly through our wholly-owned subsidiary, Radian Guaranty. Private mortgage insurance plays an important role in the U.S. housing finance system because it promotes affordable home ownership and helps protect mortgage lenders and investors, as well as other beneficiaries, by mitigating default-related losses on residential mortgage loans. Generally, these loans are made to homebuyers who make down payments of less than 20 % of the purchase price for their home or, in the case of refinancings, have less than 20 % equity in their home. Private mortgage insurance also facilitates the sale of these low down payment loans in the secondary mortgage market, most of which are currently sold to the GSEs. Our total direct primary mortgage IIF and RIF were $238.9 billion and $58.5 billion, respectively, as of March 31, 2021, compared to $246.1 billion and $60.7 billion, respectively, as of December 31, 2020. In addition to providing private mortgage insurance, we participate in credit risk transfer programs developed by the GSEs as part of their initiative to distribute mortgage credit risk and increase the role of private capital in the mortgage market. Our additional RIF under credit risk transfer transactions, resulting from our participation in these programs with the GSEs, totaled $428.8 million as of March 31, 2021 compared to $392.0 million as of December 31, 2020.

The GSEs and state insurance regulators impose various capital and financial requirements on our mortgage insurance subsidiaries. These include Risk-to-capital, other risk-based capital measures and surplus requirements, as well as the PMIERs financial requirements. Failure to comply with these capital and financial requirements may limit the amount of insurance that our mortgage insurance subsidiaries write or may prohibit them from writing insurance altogether. The GSEs and state insurance regulators possess significant discretion with respect to our mortgage insurance subsidiaries and all aspects of their business. See Note 16 for additional information on PMIERs and other regulatory information, and “—Recent Developments” below for a discussion of the elevated risks posed by the COVID-19 pandemic, which has led to an increase in mortgage defaults in our insured portfolio and a resulting increase in our Minimum Required Assets.

Real Estate

Our Real Estate segment is primarily a fee-for-service business that offers a broad array of services to market participants across the real estate value chain. Our real estate services include title, valuation, asset management and other real estate services offered primarily to mortgage lenders, mortgage and real estate investors, GSEs, real estate brokers and agents. These services help lenders, investors, consumers and real estate agents evaluate, manage, monitor, acquire and sell properties. These services include software as a service solutions and platforms, as well as managed services, such as real estate owned asset management, single family rental services and real estate valuation services. In addition, we provide title insurance and non-insurance title, closing and settlement services to mortgage lenders, GSEs and mortgage investors, as well as directly to consumers for residential mortgage loans.

See Note 4 for additional information about our reportable segments and All Other business activities.

Recent Developments

As a seller of mortgage credit protection, our results are subject to macroeconomic conditions and specific events that impact the housing finance and real estate markets, including events that impact mortgage originations and the credit performance of our RIF. Many of these conditions are beyond our control, including housing prices, unemployment, interest rate changes, the availability of credit and other factors that may be derived from national and regional economic conditions. In general, a deterioration in economic conditions increases the likelihood that borrowers will be unable to satisfy their mortgage obligations. A deteriorating economy can adversely affect housing values, which in turn can influence the willingness of borrowers to continue to make mortgage payments regardless of whether they have the financial resources to do so. Mortgage defaults can also occur due to a variety of specific events affecting borrowers, including death or illness, divorce or other family problems, unemployment, or other events. In addition, factors impacting regional economic conditions, acts of terrorism, war or other severe conflicts, event-specific economic depressions or other catastrophic events such as natural disasters and pandemics could result in increased defaults due to the impact of such events on the ability of borrowers to satisfy their mortgage obligations and on the value of affected homes.

Beginning in March 2020, the unprecedented and continually evolving social and economic impacts associated with the COVID-19 pandemic on the U.S. and global economies generally, and in particular on the U.S. housing, real estate and housing finance markets, had a negative effect on our business and our financial results for the second quarter of 2020, and to

15

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

a lesser extent, since then, and are expected to adversely impact certain aspects of our business and results of operations in future periods. Specifically, and primarily as a result of an increase in the number of new defaults since the start of the pandemic, our financial results have included: (i) an increase in provision for losses and (ii) an increase in our Minimum Required Assets under the PMIERs. While the number of new defaults increased significantly during the second quarter of 2020, they have subsequently trended down, but remain elevated compared to levels before the pandemic. See Note 11 for additional information on our reserve for losses.

The long-term impact of the COVID-19 pandemic on our businesses will depend on, among other things: the extent and duration of the pandemic, the severity of illness and number of people infected with the virus and the acceptance and long-term effectiveness of anti-viral treatments and vaccines, especially as new strains of COVID-19 have been discovered; the wider economic effects of the pandemic and the scope and duration of governmental and other third-party measures restricting day-to-day life and business operations; the impact of economic stimulus efforts to support the economy through the pandemic; and governmental and GSE programs implemented to assist borrowers experiencing a COVID-19-related hardship, including forbearance programs and suspensions of foreclosures and evictions. Although we are uncertain of the potential magnitude or duration of the business and economic impacts of the COVID-19 pandemic, these and other factors, including those discussed in our 2020 Form 10-K, could continue to have a material negative effect on the Company’s business, liquidity, results of operations and financial condition.

2. Significant Accounting Policies

We refer to Radian Group Inc. together with its consolidated subsidiaries as “Radian,” the “Company,” “we,” “us” or “our,” unless the context requires otherwise. We generally refer to Radian Group Inc. alone, without its consolidated subsidiaries, as “Radian Group.” Unless otherwise defined in this report, certain terms and acronyms used throughout this report are defined in the Glossary of Abbreviations and Acronyms included as part of this report.

The financial information presented for interim periods is unaudited; however, such information reflects all adjustments that are, in the opinion of management, necessary for the fair statement of the financial position, results of operations, comprehensive income (loss) and cash flows for the interim periods presented. Such adjustments are of a normal recurring nature. The year-end condensed balance sheet data was derived from our audited financial statements, but does not include all disclosures required by GAAP.

To fully understand the basis of presentation, these interim financial statements and related notes contained herein should be read in conjunction with the audited financial statements and notes thereto included in our 2020 Form 10-K. The results of operations for interim periods are not necessarily indicative of results to be expected for the full year or for any other period. See Note 1 for discussion of the elevated risks to our future business, liquidity, results of operations and financial condition due to the COVID-19 pandemic.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of our contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. While the amounts included in our condensed consolidated financial statements include our best estimates and assumptions, actual results may vary materially.

Other Significant Accounting Policies

See Note 2 of Notes to Consolidated Financial Statements in our 2020 Form 10-K for information regarding other significant accounting policies. There have been no significant changes in our significant accounting policies from those discussed in our 2020 Form 10-K, other than described below in “—Recent Accounting Pronouncements—Accounting Standards Adopted During 2021.”

16

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

Recent Accounting Pronouncements

Accounting Standards Adopted During 2021

In December 2019, the FASB issued ASU 2019-12, Income Taxes—Simplifying the Accounting for Income Taxes. This update simplifies the accounting for income taxes by removing certain exceptions to the general principles of ASC Topic 740 in GAAP and clarifies certain aspects to promote consistency among reporting entities. We adopted this update effective January 1, 2021. The adoption of this update did not have an impact on our financial statements and disclosures.

In October 2020, the FASB issued ASU 2020-08, Codification Improvements to Subtopic 310-20, Receivables—Nonrefundable Fees and Other Costs. This update clarifies that, for each reporting period, to the extent the amortized cost basis of an individual callable debt security exceeds the amount repayable by the issuer at the next call date, the excess (i.e., the premium) should be amortized to the next call date. We adopted ASU 2020-08 on January 1, 2021 on a prospective basis. The adoption of this update did not have a material impact on our financial statements and disclosures.

Accounting Standards Not Yet Adopted

In August 2018, the FASB issued ASU 2018-12, Financial Services—Insurance. The new standard: (i) requires that assumptions used to measure the liability for future policy benefits be reviewed at least annually; (ii) defines and simplifies the measurement of market risk benefits; (iii) simplifies the amortization of deferred acquisition costs; and (iv) enhances the required disclosures about long-duration contracts. This update is effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the impact on our financial statements and future disclosures as a result of this update.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform—Facilitation of the Effects of Reference Reform on Financial Reporting. This update provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform. The amendments in this update are optional and may be elected from the date of issuance through December 31, 2022, as reference rate reform activities occur. We are currently evaluating the impact of the guidance and our options related to the practical expedients.

3. Net Income Per Share

Basic net income per share is computed by dividing net income by the weighted-average number of common shares outstanding, while diluted net income per share is computed by dividing net income attributable to common stockholders by the sum of the weighted-average number of common shares outstanding and the weighted-average number of dilutive potential common shares. Dilutive potential common shares relate to our share-based compensation arrangements.

The calculation of basic and diluted net income per share is as follows.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands, except per-share amounts) | 2021 | 2020 | ||||||||||||

| Net income—basic and diluted | $ | $ | ||||||||||||

| Average common shares outstanding—basic | ||||||||||||||

Dilutive effect of share-based compensation arrangements (1) | ||||||||||||||

| Adjusted average common shares outstanding—diluted | ||||||||||||||

| Net income per share: | ||||||||||||||

| Basic | $ | $ | ||||||||||||

| Diluted | $ | $ | ||||||||||||

(1)The following number of shares of our common stock equivalents issued under our share-based compensation arrangements are not included in the calculation of diluted net income per share because they are anti-dilutive.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Shares of common stock equivalents | ||||||||||||||

17

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

4. Segment Reporting

We have two strategic business units that we manage separately—Mortgage and Real Estate. Our Mortgage segment derives its revenue from mortgage insurance and other mortgage and risk services, including contract underwriting services provided to lenders. Our Real Estate segment offers a broad array of title, valuation, asset management and other real estate services to market participants across the real estate value chain. In addition, we report as All Other activities that include: (i) income (losses) from assets held by our holding company; (ii) related general corporate operating expenses not attributable or allocated to our reportable segments; (iii) for all periods through its sale in January 2020, income and expenses related to Clayton; (iv) for all periods presented, the income and expenses related to our traditional appraisal services, which we wound down beginning in the fourth quarter of 2020; and (v) certain other immaterial revenue and expense items.

As described in Note 4 of Notes to Consolidated Financial Statements in our 2020 Form 10-K, we implemented several changes to our segment reporting in 2020, including related to the wind down of our traditional appraisal business announced in the fourth quarter of 2020. All changes to the composition of our segment reporting have been reflected in our segment operating results for all periods presented. See Note 1 for additional details about our Mortgage and Real Estate businesses.

With the exception of goodwill and other acquired intangible assets that relate to our Real Estate segment, which are reviewed as part of our annual goodwill impairment assessment, we do not manage assets by segment.

Adjusted Pretax Operating Income (Loss)

Our senior management, including our Chief Executive Officer (Radian’s chief operating decision maker), uses adjusted pretax operating income (loss) as our primary measure to evaluate the fundamental financial performance of each of Radian’s business segments and to allocate resources to the segments. Adjusted pretax operating income (loss) is defined as pretax income (loss) excluding the effects of: (i) net gains (losses) on investments and other financial instruments; (ii) loss on extinguishment of debt; (iii) amortization and impairment of goodwill and other acquired intangible assets; and (iv) impairment of other long-lived assets and other non-operating items, such as gains (losses) from the sale of lines of business and acquisition-related income and expenses. See Note 4 of Notes to Consolidated Financial Statements in our 2020 Form 10-K for detailed information regarding items excluded from adjusted pretax operating income (loss), including the reasons for their treatment.

Although adjusted pretax operating income (loss) excludes certain items that have occurred in the past and are expected to occur in the future, the excluded items represent those that are: (i) not viewed as part of the operating performance of our primary activities or (ii) not expected to result in an economic impact equal to the amount reflected in pretax income (loss).

18

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

The reconciliation of adjusted pretax operating income (loss) for our reportable segments to consolidated pretax income is as follows.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Adjusted pretax operating income (loss): | ||||||||||||||

| Mortgage | $ | $ | ||||||||||||

| Real Estate | ( | ( | ||||||||||||

Total adjusted pretax operating income (loss) for reportable segments (1) | ||||||||||||||

| All Other adjusted pretax operating income (loss) | ||||||||||||||

| Net gains (losses) on investments and other financial instruments | ( | ( | ||||||||||||

| Amortization and impairment of other acquired intangible assets | ( | ( | ||||||||||||

| Impairment of other long-lived assets and other non-operating items | ( | ( | ||||||||||||

| Consolidated pretax income | $ | $ | ||||||||||||

(1)Includes allocated corporate operating expenses and depreciation expense as follows.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Mortgage: | ||||||||||||||

| Allocated corporate operating expenses | $ | $ | ||||||||||||

| Depreciation expense | ||||||||||||||

| Real Estate: | ||||||||||||||

| Allocated corporate operating expenses | $ | $ | ||||||||||||

| Depreciation expense | ||||||||||||||

19

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

Revenue

The reconciliation of revenue for our reportable segments to consolidated revenues is as follows.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Revenues: | ||||||||||||||

Mortgage (1) | $ | $ | ||||||||||||

Real Estate (2) | ||||||||||||||

| Total revenues for reportable segments | ||||||||||||||

All Other revenues (1) | ||||||||||||||

| Net gains (losses) on investments and other financial instruments | ( | ( | ||||||||||||

| Elimination of inter-segment revenues | ( | ( | ||||||||||||

| Total revenues | $ | $ | ||||||||||||

(1)Includes immaterial inter-segment revenues for the three months ended March 31, 2020.

(2)Includes immaterial inter-segment revenues for the three months ended March 31, 2021 and 2020.

The table below, which represents total services revenue on our condensed consolidated statements of operations for the periods indicated, represents the disaggregation of services revenues from external customers, by type.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Real Estate services: | ||||||||||||||

| Title services | $ | $ | ||||||||||||

| Asset management services | ||||||||||||||

| Valuation services | ||||||||||||||

| Other real estate services | ||||||||||||||

| Mortgage services | ||||||||||||||

All Other services (1) | ||||||||||||||

| Total services revenue | $ | $ | ||||||||||||

(1)Includes services revenue from Clayton prior to its sale in January 2020 and amounts related to our traditional appraisal business, which we wound down beginning in the fourth quarter of 2020.

5. Fair Value of Financial Instruments

For discussion of our valuation methodologies for assets and liabilities measured at fair value and the fair value hierarchy, see Note 5 of Notes to Consolidated Financial Statements in our 2020 Form 10-K.

20

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

| (In thousands) | Level I | Level II | Level III | Total | ||||||||||||||||||||||

Assets at fair value as of March 31, 2021 | ||||||||||||||||||||||||||

| Investments: | ||||||||||||||||||||||||||

| Fixed-maturities available for sale: | ||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | $ | ||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| RMBS | ||||||||||||||||||||||||||

| CMBS | ||||||||||||||||||||||||||

| CLO | ||||||||||||||||||||||||||

| Other ABS | ||||||||||||||||||||||||||

| Foreign government and agency securities | ||||||||||||||||||||||||||

| Total fixed-maturities available for sale | ||||||||||||||||||||||||||

| Trading securities: | ||||||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| RMBS | ||||||||||||||||||||||||||

| CMBS | ||||||||||||||||||||||||||

| Total trading securities | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

| Short-term investments: | ||||||||||||||||||||||||||

| U.S. government and agency securities | ||||||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Money market instruments | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| CMBS | ||||||||||||||||||||||||||

| Other ABS | ||||||||||||||||||||||||||

Other investments (1) | ||||||||||||||||||||||||||

| Total short-term investments | ||||||||||||||||||||||||||

Other invested assets (2) | ||||||||||||||||||||||||||

Total investments at fair value (2) | ||||||||||||||||||||||||||

| Other: | ||||||||||||||||||||||||||

Embedded derivatives (3) | ||||||||||||||||||||||||||

Loaned securities: (4) | ||||||||||||||||||||||||||

| U.S. government and agency securities | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

Total assets at fair value (2) | $ | $ | $ | $ | ||||||||||||||||||||||

(1)Comprising short-term certificates of deposit and commercial paper.

(2)Does not include other invested assets of $2.8 million that are primarily invested in limited partnership investments valued using the net asset value as a practical expedient.

(3)Embedded derivatives related to our Excess-of-Loss Program are classified as other assets in our consolidated balance sheets. See Note 8 for more information about our reinsurance programs.

(4)Securities loaned to third-party borrowers under securities lending agreements are classified as other assets in our condensed consolidated balance sheets. See Note 6 for more information.

21

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

| (In thousands) | Level I | Level II | Level III | Total | ||||||||||||||||||||||

Assets at fair value as of December 31, 2020 | ||||||||||||||||||||||||||

| Investments: | ||||||||||||||||||||||||||

| Fixed-maturities available for sale: | ||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | $ | ||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| RMBS | ||||||||||||||||||||||||||

| CMBS | ||||||||||||||||||||||||||

| CLO | ||||||||||||||||||||||||||

| Other ABS | ||||||||||||||||||||||||||

| Foreign government and agency securities | ||||||||||||||||||||||||||

| Total fixed-maturities available for sale | ||||||||||||||||||||||||||

| Trading securities: | ||||||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| RMBS | ||||||||||||||||||||||||||

| CMBS | ||||||||||||||||||||||||||

| Total trading securities | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

| Short-term investments: | ||||||||||||||||||||||||||

| State and municipal obligations | ||||||||||||||||||||||||||

| Money market instruments | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| Other ABS | ||||||||||||||||||||||||||

Other investments (1) | ||||||||||||||||||||||||||

| Total short-term investments | ||||||||||||||||||||||||||

Other invested assets (2) | ||||||||||||||||||||||||||

Total investments at fair value (2) | ||||||||||||||||||||||||||

| Other: | ||||||||||||||||||||||||||

Embedded derivatives (3) | ||||||||||||||||||||||||||

Loaned securities: (4) | ||||||||||||||||||||||||||

| U.S. government and agency securities | ||||||||||||||||||||||||||

| Corporate bonds and notes | ||||||||||||||||||||||||||

| Equity securities | ||||||||||||||||||||||||||

Total assets at fair value (2) | $ | $ | $ | $ | ||||||||||||||||||||||

(1)Comprising short-term certificates of deposit and commercial paper.

(2)Does not include other invested assets of $2.0 million that are primarily invested in limited partnership investments valued using the net asset value as a practical expedient.

(3)Embedded derivatives related to our Excess-of-Loss Program are classified as other assets in our consolidated balance sheets. See Note 8 for more information about our reinsurance programs.

(4)Securities loaned to third-party borrowers under securities lending agreements are classified as other assets in our condensed consolidated balance sheets. See Note 6 for more information.

22

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

There were no

Other Fair Value Disclosure

The carrying value and estimated fair value of other selected liabilities not carried at fair value in our condensed consolidated balance sheets were as follows as of the dates indicated.

| March 31, 2021 | December 31, 2020 | |||||||||||||||||||||||||

| (In thousands) | Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | ||||||||||||||||||||||

| Senior notes | $ | $ | $ | $ | ||||||||||||||||||||||

| FHLB advances | ||||||||||||||||||||||||||

The fair value of our senior notes is estimated based on quoted market prices. The fair value of our FHLB advances is estimated based on expected cash flows for similar borrowings. These liabilities are categorized in Level II of the fair value hierarchy. See Note 12 for further information about these borrowings.

6. Investments

Available for Sale Securities

Our available for sale securities within our investment portfolio consisted of the following as of the dates indicated.

| March 31, 2021 | ||||||||||||||||||||||||||||||||

| (In thousands) | Amortized Cost | Allowance for Credit Losses | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||||||||||||||||||

| Fixed-maturities available for sale: | ||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||

| State and municipal obligations | ( | |||||||||||||||||||||||||||||||

| Corporate bonds and notes | ( | ( | ||||||||||||||||||||||||||||||

| RMBS | ( | |||||||||||||||||||||||||||||||

| CMBS | ( | |||||||||||||||||||||||||||||||

| CLO | ( | |||||||||||||||||||||||||||||||

| Other ABS | ( | |||||||||||||||||||||||||||||||

| Foreign government and agency securities | ||||||||||||||||||||||||||||||||

| Total securities available for sale, including loaned securities | $ | ( | $ | $ | ( | |||||||||||||||||||||||||||

Less: loaned securities (1) | ||||||||||||||||||||||||||||||||

| Total fixed-maturities available for sale | $ | $ | ||||||||||||||||||||||||||||||

(1)Included in other assets in our consolidated balance sheet as further described below. See below for a discussion of our securities lending agreements.

23

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

| December 31, 2020 | ||||||||||||||||||||||||||||||||

| (In thousands) | Amortized Cost | Allowance for Credit Losses | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||||||||||||||||||

| Fixed-maturities available for sale: | ||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||

| State and municipal obligations | ( | |||||||||||||||||||||||||||||||

| Corporate bonds and notes | ( | ( | ||||||||||||||||||||||||||||||

| RMBS | ( | |||||||||||||||||||||||||||||||

| CMBS | ( | |||||||||||||||||||||||||||||||

| CLO | ( | |||||||||||||||||||||||||||||||

| Other ABS | ( | |||||||||||||||||||||||||||||||

| Foreign government and agency securities | ||||||||||||||||||||||||||||||||

| Total securities available for sale, including loaned securities | $ | ( | $ | $ | ( | |||||||||||||||||||||||||||

Less: loaned securities (1) | ||||||||||||||||||||||||||||||||

| Total fixed-maturities available for sale | $ | $ | ||||||||||||||||||||||||||||||

(1)Included in other assets in our consolidated balance sheet as further described below. See below for a discussion of our securities lending agreements.

The following table provides a rollforward of the allowance for credit losses on fixed-maturities available for sale, which relates entirely to corporate bonds and notes for the periods indicated. There was no allowance for the three months ended March 31, 2020.

| (In thousands) | Three Months Ended March 31, 2021 | |||||||

| Beginning balance | $ | |||||||

| Net increases (decreases) in allowance on previously impaired securities | ( | |||||||

| Ending balance | $ | |||||||

Gross Unrealized Losses and Related Fair Value of Available for Sale Securities

For securities deemed “available for sale” that are in an unrealized loss position and for which an allowance for credit loss has not been established, the following tables show the gross unrealized losses and fair value, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, as of the dates indicated. Included in the amounts as of March 31, 2021 and December 31, 2020 are loaned securities under securities lending agreements that are classified as other assets in our condensed consolidated balance sheets, as further described below.

24

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

| March 31, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Less Than 12 Months | 12 Months or Greater | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description of Securities | # of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | ( | $ | $ | $ | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| State and municipal obligations | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds and notes | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| RMBS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

CLO | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other ABS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | ( | $ | $ | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Less Than 12 Months | 12 Months or Greater | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description of Securities | # of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | |||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | ( | $ | $ | $ | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| State and municipal obligations | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds and notes | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RMBS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CMBS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLO | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other ABS | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | ( | $ | $ | ( | |||||||||||||||||||||||||||||||||||||||||||||||

See “Net Gains (Losses) on Investments” below for additional details on our net gains (losses) on investments, including the changes in the allowance for credit losses on fixed maturities available for sale and other impairments due to our intent to sell securities in an unrealized loss position. See Note 2 of Notes to Consolidated Financial Statements in our 2020 Form 10-K for information regarding our accounting policy for impairments.

Securities Lending Agreements

We participate in a securities lending program whereby we loan certain securities in our investment portfolio to third-party borrowers for short periods of time. Although we report such securities at fair value within other assets in our condensed consolidated balance sheets, rather than within investments, the detailed information we provide in this Note 6 includes these securities. See Note 5 for additional detail on the loaned securities, and see Note 6 of Notes to Consolidated Financial Statements in our 2020 Form 10-K for additional information about our accounting policies with respect to our securities lending agreements and the collateral requirements thereunder.

All of our securities lending agreements are classified as overnight and revolving. Securities collateral on deposit with us from third-party borrowers totaling $93.8 million and $43.3 million as of March 31, 2021 and December 31, 2020, respectively,

25

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

may not be transferred or re-pledged unless the third-party borrower is in default, and is therefore not reflected in our condensed consolidated financial statements.

Net Gains (Losses) on Investments

Net gains (losses) on investments consisted of the following.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Net realized gains (losses): | ||||||||||||||

Fixed-maturities available for sale (1) | $ | ( | $ | |||||||||||

| Trading securities | ||||||||||||||

| Equity securities | ||||||||||||||

| Other investments | ||||||||||||||

| Net realized gains (losses) on investments | ( | |||||||||||||

| Impairment losses due to intent to sell | ( | |||||||||||||

| Net decrease (increase) in expected credit losses | ||||||||||||||

| Net unrealized gains (losses) on investments | ( | ( | ||||||||||||

| Total net gains (losses) on investments | $ | ( | $ | ( | ||||||||||

(1)Components of net realized gains (losses) on fixed-maturities available for sale include the following.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Gross investment gains from sales and redemptions | $ | $ | ||||||||||||

| Gross investment losses from sales and redemptions | ( | ( | ||||||||||||

The net changes in unrealized gains (losses) recognized in earnings on investments that were still held at each period-end were as follows.

| Three Months Ended March 31, | ||||||||||||||

| (In thousands) | 2021 | 2020 | ||||||||||||

| Net unrealized gains (losses) on investments still held: | ||||||||||||||

| Trading securities | $ | ( | $ | ( | ||||||||||

| Equity securities | ( | |||||||||||||

| Other investments | ||||||||||||||

| Net unrealized gains (losses) on investments still held | $ | ( | $ | ( | ||||||||||

26

| Radian Group Inc. Notes to Unaudited Condensed Consolidated Financial Statements | |||||

Contractual Maturities

The contractual maturities of fixed-maturities available for sale were as follows.

| March 31, 2021 | ||||||||||||||

| Available for Sale | ||||||||||||||

| (In thousands) | Amortized Cost | Fair Value | ||||||||||||

| Due in one year or less | $ | $ | ||||||||||||

Due after one year through five years (1) | ||||||||||||||

Due after five years through 10 years (1) | ||||||||||||||

Due after 10 years (1) | ||||||||||||||

Asset-backed and mortgage-backed securities (2) | ||||||||||||||

| Total | ||||||||||||||

| Less: loaned securities | ||||||||||||||

| Total fixed-maturities available for sale | $ | $ | ||||||||||||

(1)Actual maturities may differ as a result of calls before scheduled maturity.

Other

For the three months ended March 31, 2021, we did not transfer any securities to or from the available for sale or trading categories.