UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-Q

_____________________________

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended September 30, 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 1-11356

_______________________________

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | ||||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||||||||

| , | , | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

(215 ) 231-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| New York Stock Exchange | ||||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 191,556,568 shares of common stock, $0.001 par value per share, outstanding on November 5, 2020.

Table of Contents

| Page Number | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 6. | ||||||||

2

Glossary of Abbreviations and Acronyms

The following list defines various abbreviations and acronyms used throughout this report, including the Condensed Consolidated Financial Statements, the Notes to Unaudited Condensed Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Term | Definition | ||||

| 2014 Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which became effective October 1, 2014 | ||||

| 2016 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in the first quarter of 2016 and subsequently amended in the fourth quarter of 2017 | ||||

| 2018 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in October 2017 to cede a portion of Single Premium NIW beginning January 1, 2018 | ||||

| 2020 Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which became effective March 1, 2020 | ||||

| 2020 Single Premium QSR Agreement | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in January 2020 to cede a portion of Single Premium NIW beginning January 1, 2020 | ||||

| ABS | Asset-backed securities | ||||

| All Other | Radian’s non-reportable operating segments and other business activities, including income (losses) from assets held by our holding company, related general corporate operating expenses not attributable or allocated to our reportable segments and, for all periods through the first quarter of 2020 prior to its sale, income and expenses related to Clayton | ||||

| ASU | Accounting Standards Update, issued by the FASB to communicate changes to GAAP | ||||

| Available Assets | As defined in the PMIERs, assets primarily including the liquid assets of a mortgage insurer, and reduced by premiums received but not yet earned | ||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act signed into law on March 27, 2020 | ||||

| CFPB | Consumer Financial Protection Bureau | ||||

| Claim Curtailment | Our legal right, under certain conditions, to reduce the amount of a claim, including due to servicer negligence | ||||

| Claim Denial | Our legal right, under certain conditions, to deny a claim | ||||

| Claim Severity | The total claim amount paid divided by the original coverage amount | ||||

| Clayton | Clayton Services LLC, an indirect subsidiary of Radian Group, which was sold on January 21, 2020 | ||||

| CMBS | Commercial mortgage-backed securities | ||||

| COVID-19 | The novel coronavirus disease declared a pandemic by the World Health Organization and the Centers for Disease Control and Prevention in March 2020 | ||||

| COVID-19 Amendment | Temporary amendment to the PMIERs effective June 30, 2020, primarily to recognize the COVID-19 pandemic as a nationwide “FEMA Declared Major Disaster” and to set forth guidelines on the application of the Disaster Related Capital Charge to COVID-19 Defaulted Loans | ||||

| COVID-19 Crisis Period | Time period extending from March 1, 2020 to January 1, 2021 | ||||

| COVID-19 Defaulted Loans | All non-performing loans that either: (i) have an Initial Missed Payment occurring during the COVID-19 Crisis Period or (ii) are subject to a forbearance plan granted in response to a financial hardship related to COVID-19 (which is assumed under the COVID-19 Amendment to be the case for any loan that has an Initial Missed Payment occurring during the COVID-19 Crisis Period and is subject to a forbearance plan), the terms of which are materially consistent with the terms of forbearance plans offered by the GSEs | ||||

| Cures | Loans that were in default as of the beginning of a period and are no longer in default because payments were received such that the loan is no longer 60 or more days past due | ||||

| Default to Claim Rate | The percentage of defaulted loans that are assumed to result in a claim | ||||

3

Term | Definition | ||||

| Disaster Related Capital Charge | Under the PMIERs, multiplier of 0.30 applied to the required asset amount factor for each non-performing loan: (i) backed by a property located in a FEMA Designated Area and (ii) either subject to a certain forbearance plan or with an initial default date occurring within a certain timeframe | ||||

| Discrete Item(s) | For tax calculation purposes, certain items that are required to be accounted for in the provision for income taxes as they occur and are not considered components of the estimated annualized effective tax rate for purposes of reporting interim results. Generally, these are items that are: (i) clearly defined (such as changes in tax rate or tax law); (ii) infrequent or unusual in nature; or (iii) gains or losses that are not components of continuing operating income, such as income from discontinued operations or losses reflected as components of other comprehensive income. These items impact the difference between the statutory rate and Radian’s effective tax rate. | ||||

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended | ||||

| Eagle Re Issuer(s) | A group of unaffiliated special purpose reinsurers (VIEs) domiciled in Bermuda, comprising Eagle Re 2018-1 Ltd., Eagle Re 2019-1 Ltd., and/or Eagle Re 2020-1 Ltd., which provide reinsurance coverage under Radian Guaranty’s Excess-of-Loss Program. Effective in October 2020, also includes Eagle Re 2020-2 Ltd. | ||||

| ECF | Enterprise Regulatory Capital Framework proposed by the FHFA on June 30, 2020 | ||||

| Excess-of-Loss Program | The credit risk protection obtained by Radian Guaranty in the form of excess-of-loss reinsurance, which indemnifies the ceding company against loss in excess of a specific agreed limit, up to a specified sum. The program includes reinsurance agreements with the Eagle Re Issuers in connection with various issuances of mortgage insurance-linked notes. The program also includes a separate agreement with a third-party reinsurer, representing a pro rata share of the credit risk alongside the risk assumed by Eagle Re 2018-1 Ltd., an Eagle Re Issuer. | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| Extraordinary Distribution | A dividend or distribution of capital that is required to be approved by an insurance company’s primary regulator that is greater than would be permitted as an ordinary distribution (which does not require regulatory approval) | ||||

| Fannie Mae | Federal National Mortgage Association | ||||

| FASB | Financial Accounting Standards Board | ||||

| FEMA | Federal Emergency Management Agency, an agency of the U.S. Department of Homeland Security | ||||

| FEMA Designated Area | Generally, an area that has been subject to a disaster, designated by FEMA as an individual assistance disaster area for the purpose of determining eligibility for various forms of federal assistance | ||||

| FHA | Federal Housing Administration | ||||

| FHFA | Federal Housing Finance Agency | ||||

| FHLB | Federal Home Loan Bank of Pittsburgh | ||||

| FICO | Fair Isaac Corporation (“FICO”) credit scores, for Radian’s portfolio statistics, represent the borrower’s credit score at origination and, in circumstances where there are multiple borrowers, the lowest of the borrowers’ FICO scores is utilized | ||||

| Fitch | Fitch Ratings, Inc. | ||||

| Foreclosure Stage Default | The stage of default of a loan in which a foreclosure sale has been scheduled or held | ||||

| Freddie Mac | Federal Home Loan Mortgage Corporation | ||||

| GAAP | Generally accepted accounting principles in the U.S., as amended from time to time | ||||

| GSE(s) | Government-Sponsored Enterprises (Fannie Mae and Freddie Mac) | ||||

| HARP | Home Affordable Refinance Program | ||||

| IBNR | Losses incurred but not reported | ||||

| IIF | Insurance in force, equal to the aggregate unpaid principal balances of the underlying loans | ||||

| Initial Missed Payment | The first missed monthly payment, which would be reported to us as delinquent as of the last day of the month for which it was due. (For example, for a loan first reported to the approved insurer in May as having missed its payments due on April 1 and May 1, the Initial Missed Payment shall be deemed to have occurred on April 30. In this example, the loan would become a non-performing primary mortgage guaranty insurance loan in May and the 0.30 multiplier would be applied for May, June, and July.) | ||||

4

Term | Definition | ||||

| IRS | Internal Revenue Service | ||||

| LAE | Loss adjustment expenses, which include the cost of investigating and adjusting losses and paying claims | ||||

| LIBOR | London Inter-bank Offered Rate | ||||

| Loss Mitigation Activity/Activities | Activities such as Rescissions, Claim Denials, Claim Curtailments and cancellations | ||||

| LTV | Loan-to-value ratio, calculated as the percentage of the original loan amount to the original value of the property | ||||

| Master Policies | The Prior Master Policy, the 2014 Master Policy, and the 2020 Master Policy, together | ||||

| Minimum Required Asset(s) | A risk-based minimum required asset amount, as defined in the PMIERs, calculated based on net RIF (RIF, net of credits permitted for reinsurance) and a variety of measures related to expected credit performance and other factors, including the impact of the Disaster Related Capital Charge | ||||

| Model Act | Mortgage Guaranty Insurance Model Act, as issued by the NAIC to establish minimum capital and surplus requirements for mortgage insurers | ||||

| Monthly and Other Recurring Premiums (or Recurring Premium Policies) | Insurance premiums or policies, respectively, where premiums are paid on a monthly or other installment basis, in contrast to Single Premium Policies | ||||

| Moody’s | Moody’s Investors Service | ||||

| Mortgage | Radian’s mortgage insurance and risk services business segment, which provides credit-related insurance coverage, principally through private mortgage insurance on residential first-lien mortgage loans, as well as other credit risk management solutions to mortgage lending institutions and mortgage credit investors | ||||

| MPP Requirement | Certain states’ statutory or regulatory risk-based capital requirement that the mortgage insurer must maintain a minimum policyholder position, which is calculated based on both risk and surplus levels | ||||

| NAIC | National Association of Insurance Commissioners | ||||

| NIW | New insurance written | ||||

| NOL | Net operating loss; for tax purposes, accumulated during years a company reported more tax deductions than taxable income. NOLs may be carried back or carried forward a certain number of years, depending on various factors which can reduce a company’s tax liability. | ||||

| Persistency Rate | The percentage of IIF that remains in force over a period of time | ||||

| PMIERs | Private Mortgage Insurer Eligibility Requirements issued by the GSEs under oversight of the FHFA to set forth requirements an approved insurer must meet and maintain to provide mortgage guaranty insurance on loans acquired by the GSEs. The current PMIERs requirements, sometimes referred to as PMIERs 2.0, incorporate the most recent revisions to the PMIERs that became effective on March 31, 2019. | ||||

| Pool Insurance | Pool Insurance differs from primary insurance in that our maximum liability is not limited to a specific coverage percentage on an individual mortgage loan. Instead, an aggregate exposure limit, or “stop loss,” and/or deductible is applied to the initial aggregate loan balance on a group or “pool” of mortgages. | ||||

| Prior Master Policy | Radian Guaranty’s master insurance policy, setting forth the terms and conditions of our mortgage insurance coverage, which was in effect prior to the effective date of the 2014 Master Policy | ||||

| QM | Qualified mortgage; a mortgage that possesses certain low-risk characteristics that enable it to qualify for lender protection under the ability to repay rule instituted by the Dodd-Frank Act | ||||

| QSR Program | The quota share reinsurance agreements entered into with a third-party reinsurance provider in the second and fourth quarters of 2012, collectively | ||||

| Radian | Radian Group Inc. together with its consolidated subsidiaries | ||||

| Radian Group | Radian Group Inc. | ||||

| Radian Guaranty | Radian Guaranty Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group | ||||

| Radian Reinsurance | Radian Reinsurance Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group | ||||

5

Term | Definition | ||||

| Radian Title Insurance | Radian Title Insurance Inc., formerly known as EnTitle Insurance Company, an Ohio domiciled insurance company and an indirect subsidiary of Radian Group | ||||

| RBC States | Risk-based capital states, which are those states that currently impose a statutory or regulatory risk-based capital requirement | ||||

| Real Estate | Radian’s business segment that is primarily a fee-for-service business that offers a broad array of title, valuation, asset management and other real estate services to market participants across the real estate value chain | ||||

| Reinstatements | Reversals of previous Rescissions, Claim Denials and Claim Curtailments | ||||

| Rescission | Our legal right, under certain conditions, to unilaterally rescind coverage on our mortgage insurance policies if we determine that a loan did not qualify for insurance | ||||

| RIF | Risk in force; for primary insurance, RIF is equal to the underlying loan unpaid principal balance multiplied by the insurance coverage percentage, whereas for Pool Insurance, it represents the remaining exposure under the agreements | ||||

| Risk-to-capital | Under certain state regulations, a maximum ratio of net RIF calculated relative to the level of statutory capital | ||||

| RMBS | Residential mortgage-backed securities | ||||

| S&P | Standard & Poor’s Financial Services LLC | ||||

| SAP | Statutory accounting principles and practices, including those required or permitted, if applicable, by the insurance departments of the respective states of domicile of our insurance subsidiaries | ||||

| SEC | United States Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

| Senior Notes due 2024 | Our 4.500% unsecured senior notes due October 2024 ($450 million original principal amount) | ||||

| Senior Notes due 2025 | Our 6.625% unsecured senior notes due March 2025 ($525 million original principal amount) | ||||

| Senior Notes due 2027 | Our 4.875% unsecured senior notes due March 2027 ($450 million original principal amount) | ||||

| Single Premium NIW / IIF | NIW or IIF, respectively, on Single Premium Policies | ||||

| Single Premium Policy / Policies | Insurance policies where premiums are paid in a single payment, which includes policies written on an individual basis (as each loan is originated) and on an aggregated basis (in which each individual loan in a group of loans is insured in a single transaction, typically shortly after the loans have been originated) | ||||

| Single Premium QSR Program | The 2016 Single Premium QSR Agreement, the 2018 Single Premium QSR Agreement and the 2020 Single Premium QSR Agreement, together | ||||

| Stage of Default | The stage a loan is in relative to the foreclosure process, based on whether a foreclosure sale has been scheduled or held | ||||

| Statutory RBC Requirement | Risk-based capital requirement imposed by the RBC States, requiring a minimum surplus level and, in certain states, a minimum ratio of statutory capital relative to the level of risk | ||||

| Surplus Notes | Collectively: (i) a $100 million 0.0% intercompany surplus note issued by Radian Guaranty to Radian Group, due December 31, 2027 and (ii) a $200 million 3.0% intercompany surplus note issued by Radian Guaranty to Radian Group, due January 31, 2030 | ||||

| VIE | Variable interest entity | ||||

6

Cautionary Note Regarding Forward-Looking Statements—Safe Harbor Provisions

All statements in this report that address events, developments or results that we expect or anticipate may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. In most cases, forward-looking statements may be identified by words such as “anticipate,” “may,” “will,” “could,” “should,” “would,” “expect,” “intend,” “plan,” “goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “seek,” “strategy,” “future,” “likely” or the negative or other variations on these words and other similar expressions. These statements, which may include, without limitation, projections regarding our future performance and financial condition, are made on the basis of management’s current views and assumptions with respect to future events, including management’s current views regarding the likely impacts of the COVID-19 pandemic. Any forward-looking statement is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking statement. These statements speak only as of the date they were made, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We operate in a changing environment where new risks emerge from time to time and it is not possible for us to predict all risks that may affect us, particularly those associated with the COVID-19 pandemic, which has had wide-ranging and continually evolving effects. The forward-looking statements, as well as our prospects as a whole, are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in the forward-looking statements. These risks and uncertainties include, without limitation:

■the COVID-19 pandemic, which has significantly impacted the global economy, disrupted global supply chains, lowered certain equity market valuations, created periods of significant volatility and disruption in financial markets, required adjustments in the housing finance system and real estate markets and increased unemployment levels. In addition, the pandemic has resulted in travel restrictions, stay-at-home, quarantine and similar orders, which have resulted in the closures of many businesses and, for those permitted to open, numerous operating limitations such as social distancing and other extensive health and safety measures. As a result, the demand for certain of our products and services has been impacted, and this impact may continue for an unknown period and could expand in scope. We expect that the COVID-19 pandemic and measures taken to reduce its spread will pervasively impact our business and subject us to certain risks, including those discussed in “Item 1A. Risk Factors—The COVID-19 pandemic has adversely impacted our business, and its ultimate impact on our business and financial results will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and actions taken by governmental authorities in response to the pandemic” and the other risk factors in this report;

■further changes in economic and political conditions, including those resulting from the November 2020 elections and COVID-19, that impact the size of the insurable market, the credit performance of our insured portfolio, and our business prospects;

■changes in the way customers, investors, ratings agencies, regulators or legislators perceive our performance, financial strength and future prospects;

■Radian Guaranty’s ability to remain eligible under the PMIERs, including potential future changes to the PMIERs, and other applicable requirements imposed by the FHFA and by the GSEs to insure loans purchased by the GSEs;

■the proposed ECF that would, among other items, establish significant capital requirements for the GSEs once finalized, which could impact the GSEs’ operations and the size of the insurable mortgage insurance market, and which may form the basis for future versions of the PMIERs;

■our ability to successfully execute and implement our capital plans, including our risk distribution strategy through the capital markets and reinsurance markets, and to maintain sufficient holding company liquidity to meet our liquidity needs;

■our ability to successfully execute and implement our business plans and strategies, including plans and strategies that require GSE and/or regulatory approvals and various licenses and complex compliance requirements;

■our ability to maintain an adequate level of capital in our insurance subsidiaries to satisfy existing and future regulatory requirements, including the PMIERs and any changes thereto, such as the application of the COVID-19 Amendment, and potential changes to the Model Act currently under consideration;

■changes in the charters or business practices of, or rules or regulations imposed by or applicable to, the GSEs, which may include changes in the requirements to remain an approved insurer to the GSEs, the GSEs’ interpretation and application of the PMIERs, as well as changes impacting loans purchased by the GSEs, including changes to the GSEs’ business practices in response to the COVID-19 pandemic;

■changes in the current housing finance system in the United States, including the role of the FHA, the GSEs and private mortgage insurers in this system;

■uncertainty from the expected discontinuance of LIBOR and transition to one or more alternative benchmarks that could cause interest rate volatility and, among other things, impact our investment portfolio, cost of debt and cost of reinsurance through mortgage insurance-linked notes transactions;

7

■any disruption in the servicing of mortgages covered by our insurance policies, as well as poor servicer performance, which could result from the burdens placed on many servicers due to the impact of the COVID-19 pandemic;

■a decrease in the Persistency Rates of our mortgage insurance on monthly premium products;

■competition in our mortgage insurance business, including price competition and competition from the FHA and U.S. Department of Veterans Affairs as well as from other forms of credit enhancement, including GSE-sponsored alternatives to traditional mortgage insurance;

■the effect of the Dodd-Frank Act on the financial services industry in general, and on our businesses in particular, including the proposed changes to the QM loan requirements which currently are being considered by the CFPB;

■legislative and regulatory activity (or inactivity), including the adoption of (or failure to adopt) new laws and regulations, or changes in existing laws and regulations, or the way they are interpreted or applied, including the enactment of the CARES Act and the adoption, interpretation or application of laws and regulations in response to COVID-19;

■legal and regulatory claims, assertions, actions, reviews, audits, inquiries and investigations that could result in adverse judgments, settlements, fines, injunctions, restitutions or other relief that could require significant expenditures, new or increased reserves or have other effects on our business;

■the amount and timing of potential settlements, payments or adjustments associated with federal or other tax examinations;

■the possibility that we may fail to estimate accurately, especially in the event of an extended economic downturn or a period of extreme market volatility and uncertainty such as we are currently experiencing due to the COVID-19 pandemic, the likelihood, magnitude and timing of losses in establishing loss reserves for our mortgage insurance business or to accurately calculate and/or project our Available Assets and Minimum Required Assets under the PMIERs, which will be impacted by, among other things, the size and mix of our IIF, the level of defaults in our portfolio, the reported status of defaults in our portfolio, including whether they are subject to forbearance, a repayment plan or a loan modification trial period under a loan modification in response to COVID-19, the level of cash flow generated by our insurance operations and our risk distribution strategies;

■volatility in our financial results caused by changes in the fair value of our assets and liabilities, including our investment portfolio;

■changes in GAAP or SAP rules and guidance, or their interpretation;

■our ability to attract and retain key employees; and

■legal and other limitations on amounts we may receive from our subsidiaries, including dividends or ordinary course distributions under our internal tax- and expense-sharing arrangements.

For more information regarding these risks and uncertainties as well as certain additional risks that we face, you should refer to “Item 1A. Risk Factors” in this report and “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, and to subsequent reports and registration statements filed from time to time with the SEC. We caution you not to place undue reliance on these forward-looking statements, which are current only as of the date on which we issued this report. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason.

8

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

Radian Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

| (In thousands, except per-share amounts) | September 30, 2020 | December 31, 2019 | |||||||||

| Assets | |||||||||||

Investments (Notes 5 and 6) | |||||||||||

Fixed-maturities available for sale—at fair value, net of allowance for credit losses of $ | $ | $ | |||||||||

Trading securities—at fair value (amortized cost of $ | |||||||||||

Equity securities—at fair value (cost of $ | |||||||||||

Short-term investments—at fair value (includes $ | |||||||||||

| Other invested assets—at fair value | |||||||||||

| Total investments | |||||||||||

| Cash | |||||||||||

| Restricted cash | |||||||||||

| Accounts and notes receivable | |||||||||||

Goodwill and other acquired intangible assets, net (Note 7) | |||||||||||

| Prepaid reinsurance premium | |||||||||||

Other assets (Note 9) | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Unearned premiums | $ | $ | |||||||||

Reserve for losses and loss adjustment expense (Note 11) | |||||||||||

Senior notes (Note 12) | |||||||||||

FHLB advances (Note 12) | |||||||||||

| Reinsurance funds withheld | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (Note 13) | |||||||||||

| Stockholders’ equity | |||||||||||

Common stock: par value $ | |||||||||||

Treasury stock, at cost: | ( | ( | |||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

Accumulated other comprehensive income (loss) (Note 15) | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

9

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands, except per-share amounts) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

Net premiums earned (Note 8) | $ | $ | $ | $ | |||||||||||||||||||

Services revenue (Note 4) | |||||||||||||||||||||||

| Net investment income | |||||||||||||||||||||||

Net gains (losses) on investments and other financial instruments | |||||||||||||||||||||||

| Other income | |||||||||||||||||||||||

| Total revenues | |||||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Provision for losses | |||||||||||||||||||||||

| Policy acquisition costs | |||||||||||||||||||||||

| Cost of services | |||||||||||||||||||||||

| Other operating expenses | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Loss on extinguishment of debt | |||||||||||||||||||||||

Amortization and impairment of other acquired intangible assets | |||||||||||||||||||||||

| Total expenses | |||||||||||||||||||||||

| Pretax income | |||||||||||||||||||||||

| Income tax provision | |||||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Net Income Per Share: | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | $ | $ | $ | $ | |||||||||||||||||||

Weighted-average number of common shares outstanding—basic | |||||||||||||||||||||||

Weighted-average number of common and common equivalent shares outstanding—diluted | |||||||||||||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

10

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

Other comprehensive income (loss), net of tax (Note 15): | |||||||||||||||||||||||

| Unrealized gains (losses) on investments: | |||||||||||||||||||||||

Unrealized holding gains (losses) arising during the period for which an allowance for expected losses has not been recognized | |||||||||||||||||||||||

Less: Reclassification adjustment for net gains (losses) included in net income (loss): | |||||||||||||||||||||||

Net realized gains (losses) on disposals and non-credit related impairment losses | |||||||||||||||||||||||

Net decrease (increase) in expected credit losses | ( | ||||||||||||||||||||||

Net unrealized gains (losses) on investments | |||||||||||||||||||||||

Net foreign currency translation adjustments | ( | ||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | |||||||||||||||||||||||

| Comprehensive income | $ | $ | $ | $ | |||||||||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

11

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Common Stockholders’ Equity

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Common Stock | |||||||||||||||||||||||

Balance, beginning of period | $ | $ | $ | $ | |||||||||||||||||||

Issuance of common stock under incentive and benefit plans | |||||||||||||||||||||||

Shares repurchased under share repurchase program (Note 14) | ( | ( | ( | ||||||||||||||||||||

| Balance, end of period | |||||||||||||||||||||||

| Treasury Stock | |||||||||||||||||||||||

| Balance, beginning of period | ( | ( | ( | ( | |||||||||||||||||||

Repurchases of common stock under incentive plans | ( | ( | ( | ( | |||||||||||||||||||

| Balance, end of period | ( | ( | ( | ( | |||||||||||||||||||

| Additional Paid-in Capital | |||||||||||||||||||||||

| Balance, beginning of period | |||||||||||||||||||||||

Issuance of common stock under incentive and benefit plans | |||||||||||||||||||||||

Share-based compensation | |||||||||||||||||||||||

Shares repurchased under share repurchase program (Note 14) | ( | ( | ( | ||||||||||||||||||||

| Balance, end of period | |||||||||||||||||||||||

| Retained Earnings | |||||||||||||||||||||||

| Balance, beginning of period | |||||||||||||||||||||||

| Net income | |||||||||||||||||||||||

Dividends and dividend equivalents declared | ( | ( | ( | ( | |||||||||||||||||||

| Balance, end of period | |||||||||||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | |||||||||||||||||||||||

| Balance, beginning of period | ( | ||||||||||||||||||||||

Net unrealized gains (losses) on investments, net of tax | |||||||||||||||||||||||

Net foreign currency translation adjustment, net of tax | ( | ||||||||||||||||||||||

| Balance, end of period | |||||||||||||||||||||||

| Total Stockholders’ Equity | $ | $ | $ | $ | |||||||||||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

12

Radian Group Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| (In thousands) | Nine Months Ended September 30, | ||||||||||

| 2020 | 2019 | ||||||||||

| Cash Flows from Operating Activities: | |||||||||||

| Net cash provided by (used in) operating activities | $ | $ | |||||||||

| Cash Flows from Investing Activities: | |||||||||||

Proceeds from sales of: | |||||||||||

Fixed-maturities available for sale | |||||||||||

Trading securities | |||||||||||

Equity securities | |||||||||||

Proceeds from redemptions of: | |||||||||||

Fixed-maturities available for sale | |||||||||||

Trading securities | |||||||||||

Purchases of: | |||||||||||

Fixed-maturities available for sale | ( | ( | |||||||||

Equity securities | ( | ( | |||||||||

Sales, redemptions and (purchases) of: | |||||||||||

Short-term investments, net | ( | ( | |||||||||

Other assets and other invested assets, net | |||||||||||

Proceeds from sale of a subsidiary, net of cash sold | |||||||||||

Purchases of property and equipment, net | ( | ( | |||||||||

| Net cash provided by (used in) investing activities | ( | ( | |||||||||

| Cash Flows from Financing Activities: | |||||||||||

Dividends and dividend equivalents paid | ( | ( | |||||||||

Issuance of senior notes, net | |||||||||||

Repayments and repurchases of senior notes | ( | ||||||||||

Issuance of common stock | |||||||||||

Repurchases of common shares | ( | ( | |||||||||

Credit facility commitment fees paid | ( | ( | |||||||||

Change in secured borrowings, net (with terms three months or less) | ( | ||||||||||

Proceeds from secured borrowings (with terms greater than three months) | |||||||||||

Repayments of secured borrowings (with terms greater than three months) | ( | ( | |||||||||

Repayments of other borrowings | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Effect of exchange rate changes on cash and restricted cash | ( | ||||||||||

| Increase (decrease) in cash and restricted cash | ( | ( | |||||||||

| Cash and restricted cash, beginning of period | |||||||||||

| Cash and restricted cash, end of period | $ | $ | |||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements.

13

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

__________________________________________________________________________________________________

1. Business Overview and Recent Developments

Business Overview

We are a diversified mortgage and real estate business, providing both credit-related mortgage insurance coverage and a broad array of other mortgage, risk, title, valuation, asset management and other real estate services. We have two reportable business segments—Mortgage and Real Estate.

Mortgage

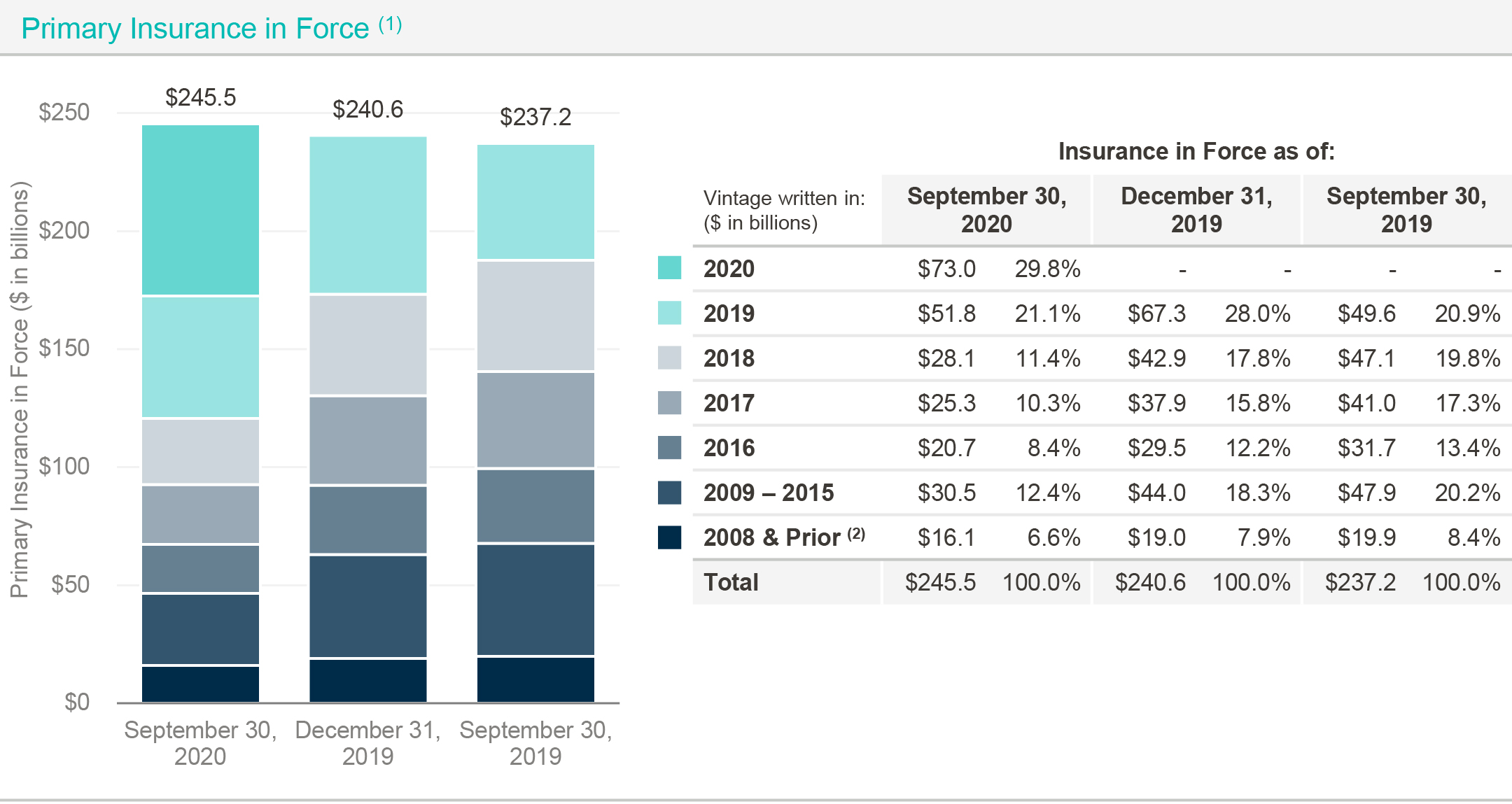

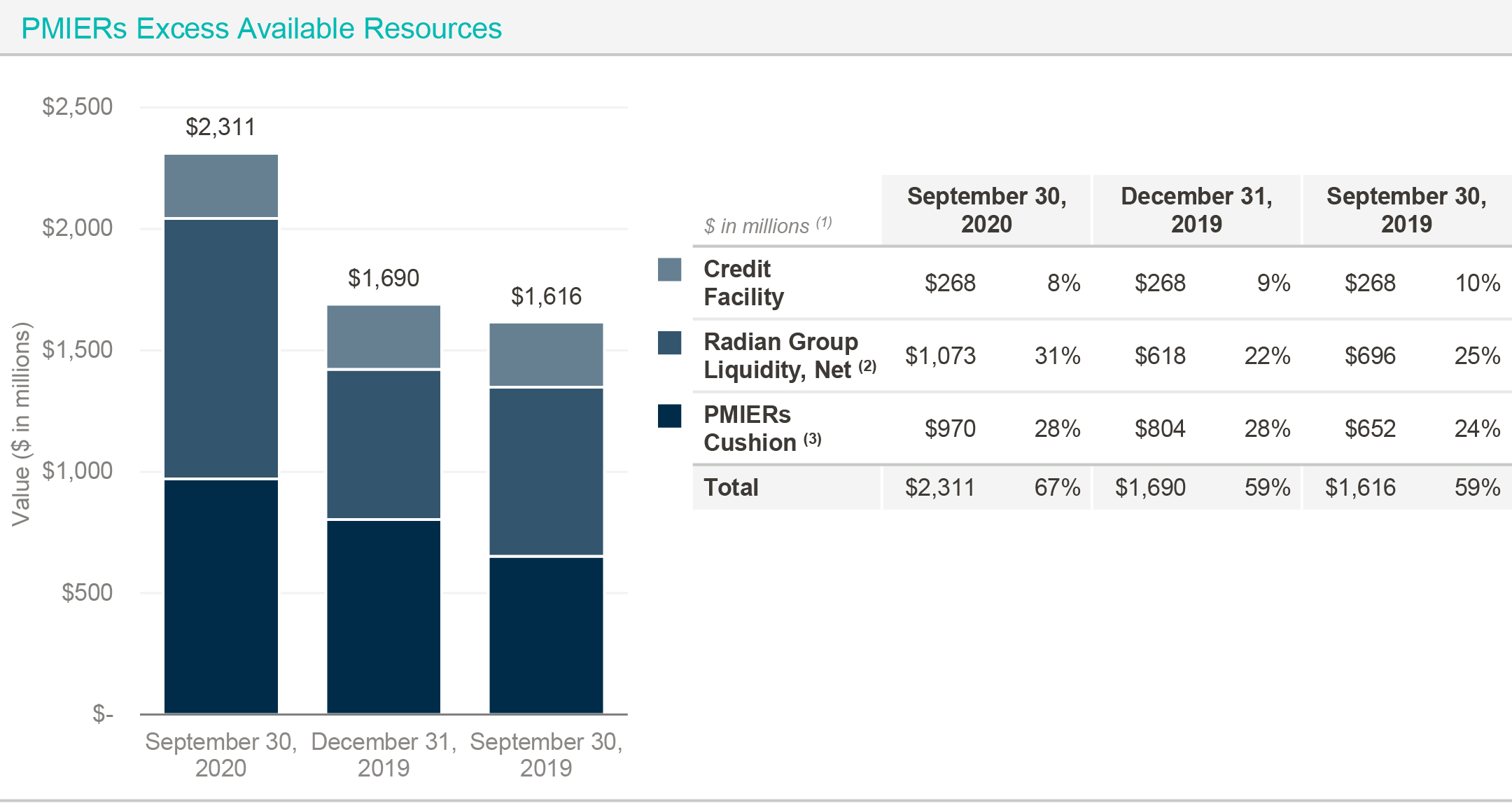

Our Mortgage segment provides credit-related insurance coverage, principally through private mortgage insurance on residential first-lien mortgage loans, as well as other credit risk management and contract underwriting solutions, to mortgage lending institutions and mortgage credit investors. We provide our mortgage insurance products and services mainly through our wholly-owned subsidiary, Radian Guaranty. Private mortgage insurance plays an important role in the U.S. housing finance system because it promotes affordable home ownership and helps protect mortgage lenders, investors and other beneficiaries by mitigating default-related losses on residential mortgage loans. Generally, these loans are made to homebuyers who make down payments of less than 20 % of the purchase price for their home or, in the case of refinancings, have less than 20 % equity in their home. Private mortgage insurance also facilitates the sale of these low down payment loans in the secondary mortgage market, most of which are currently sold to the GSEs. Our total direct primary mortgage IIF and RIF were $245.5 billion and $61.0 billion, respectively, as of September 30, 2020, compared to $240.6 billion and $60.9 billion, respectively, as of December 31, 2019. In addition to providing private mortgage insurance, we participate in credit risk transfer programs developed by the GSEs as part of their initiative to distribute mortgage credit risk and increase the role of private capital in the mortgage market. Our additional RIF under credit risk transfer transactions, resulting from our participation in these programs with the GSEs, totaled $389.1 million as of September 30, 2020 compared to $275.2 million as of December 31, 2019.

The GSEs and state insurance regulators impose various capital and financial requirements on our insurance subsidiaries. These include Risk-to-capital, other risk-based capital measures and surplus requirements, as well as the PMIERs financial requirements. Failure to comply with these capital and financial requirements may limit the amount of insurance that our mortgage insurance subsidiaries write or may prohibit them from writing insurance altogether. The GSEs and state insurance regulators possess significant discretion with respect to our mortgage insurance subsidiaries and all aspects of their business. See Note 16 for additional information on PMIERs and other regulatory information, and “—Recent Developments” below for a discussion of the elevated risks posed by the COVID-19 pandemic, which has led to an increase in mortgage defaults in our insured portfolio and a resulting increase in our Minimum Required Assets during 2020.

Real Estate

Our Real Estate segment is primarily a fee-for-service business that offers a broad array of services to market participants across the real estate value chain. Our Real Estate services include title, valuation, asset management and other real estate services offered primarily to financial institutions, investors, GSEs, real estate brokers and agents. Our Real Estate services help lenders, investors, consumers and real estate agents evaluate, manage, monitor, acquire and sell properties. These services include software as a service solutions and platforms, as well as managed services, such as real estate owned asset management, single family rental services, real estate valuation services and real estate brokerage services. In addition, we provide title insurance and non-insurance title, closing and settlement services to mortgage lenders as well as directly to consumers for residential mortgage loans.

See Note 4 for additional information about our reportable segments and All Other business activities, including the sale of Clayton and the impact of organizational changes in the first quarter of 2020.

Recent Developments

As a seller of mortgage credit protection, our results are subject to macroeconomic conditions and specific events that impact the housing finance and real estate markets, including events that impact mortgage originations and the credit performance of our RIF. Many of these conditions are beyond our control, including housing prices, unemployment levels, interest rate changes, the availability of credit and other factors that may be derived from national and regional economic conditions. In general, a deterioration in economic conditions increases the likelihood that borrowers will be unable to satisfy their mortgage obligations. A deteriorating economy can adversely affect housing values, which in turn can influence the willingness of borrowers to continue to make mortgage payments regardless of whether they have the financial resources to do so. Mortgage defaults can also occur due to a variety of specific events affecting borrowers, including death or illness, divorce or other family problems, unemployment, or other events. In addition, factors impacting regional economic conditions, acts of terrorism, war or other severe conflicts, event-specific economic depressions or other catastrophic events such as natural disasters and

14

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

pandemics could result in increased defaults due to the impact of such events on the ability of borrowers to satisfy their mortgage obligations and on the value of affected homes.

Beginning in March 2020, the unprecedented and continually evolving social and economic impacts associated with the COVID-19 pandemic on the U.S. and global economies generally, and in particular on the U.S. housing, real estate and housing finance markets had a negative effect on our business and our financial results for the second quarter of 2020, and to a lesser extent the third quarter of 2020, and are expected to adversely impact our business and results of operations in future periods. Specifically, and primarily as a result of an increase in the number of new defaults for the nine months ended September 30, 2020, our financial results include: (i) an increase in provision for losses and (ii) an increase in our Minimum Required Assets required under the PMIERs. The number of new defaults increased significantly during the second quarter of 2020, and while the new defaults during the third quarter remain elevated compared to levels before the pandemic, they decreased by 67.5 % from the prior quarter. See Note 11 for additional information on our reserve for losses. In response to the uncertainties associated with COVID-19, during the second quarter of 2020 we strengthened our capital and liquidity positions by extending our existing credit facility and issuing $525 million aggregate principal amount of Senior Notes due 2025. See Note 12 for additional information on our borrowings and financing activities. The ultimate significance of the COVID-19 pandemic on our businesses will depend on, among other things: the extent and duration of the pandemic, the severity of and number of people infected with the virus and whether an effective anti-viral treatment or vaccine is developed and made widely available; the wider economic effects of the pandemic and the scope and duration of governmental and other third party measures restricting day-to-day life and business operations; the impact of economic stimulus efforts to support the economy through the pandemic; and governmental and GSE programs implemented to assist borrowers experiencing a COVID-19-related hardship, including forbearance programs and suspensions of foreclosures and evictions. Although we are uncertain of the potential magnitude or duration of the business and economic impacts of the COVID-19 pandemic, these and other factors, including those discussed in our 2019 Form 10-K, could have a material negative effect on the Company’s business, liquidity, results of operations and financial condition.

2. Significant Accounting Policies

We refer to Radian Group Inc. together with its consolidated subsidiaries as “Radian,” the “Company,” “we,” “us” or “our,” unless the context requires otherwise. We generally refer to Radian Group Inc. alone, without its consolidated subsidiaries, as “Radian Group.” Unless otherwise defined in this report, certain terms and acronyms used throughout this report are defined in the Glossary of Abbreviations and Acronyms included as part of this report.

The financial information presented for interim periods is unaudited; however, such information reflects all adjustments that are, in the opinion of management, necessary for the fair statement of the financial position, results of operations, comprehensive income (loss) and cash flows for the interim periods presented. Such adjustments are of a normal recurring nature. The year-end condensed balance sheet data was derived from our audited financial statements, but does not include all disclosures required by GAAP.

To fully understand the basis of presentation, these interim financial statements and related notes contained herein should be read in conjunction with the audited financial statements and notes thereto included in our 2019 Form 10-K. The results of operations for interim periods are not necessarily indicative of results to be expected for the full year or for any other period. See Note 1 for discussion of the elevated risks to our future business, liquidity, results of operations and financial condition due to the COVID-19 pandemic.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of our contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. While the amounts included in our condensed consolidated financial statements include our best estimates and assumptions, actual results may vary materially.

15

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

Other Significant Accounting Policies

See Note 2 of Notes to Consolidated Financial Statements in our 2019 Form 10-K for information regarding other significant accounting policies. There have been no significant changes in our significant accounting policies from those discussed in our 2019 Form 10-K, other than described below in “—Investments” and “—Recent Accounting Pronouncements—Accounting Standards Adopted During 2020.”

Investments

Investments in fixed-maturity securities not classified as held to maturity or trading securities are classified as available for sale and are reported at fair value, with unrealized gains and losses (net of tax) reported as a separate component of stockholders’ equity as accumulated other comprehensive income (loss), unless: (i) we intend to sell the impaired security; (ii) it is more likely than not that we will be required to sell the impaired security prior to recovery of its amortized cost basis; or (iii) the present value of cash flows we expect to collect is less than the amortized cost basis of a security. In those instances, we record an impairment loss through earnings that varies depending on specific circumstances, as described below.

If a sale is likely, the full amount of the impairment is recognized as a loss in the statement of operations. Otherwise, unrealized losses on securities are separated into: (i) the portion of loss that represents the credit loss and (ii) the portion that is due to other factors. As a result of the adoption, effective January 2020, of ASU 2016-13, Financial Instruments—Credit Losses (“ASU 2016-13”), described below, in evaluating whether a decline in value for other securities relates to an existing credit loss, we consider several factors, including, but not limited to, the following:

■the extent to which the amortized cost basis is greater than fair value;

■reasons for the decline in value (e.g., adverse conditions related to industry or geographic area, changes in financial condition to the issuers or underlying loan obligors);

■any changes to the rating of the security by a rating agency;

■the failure of the issuer to make a scheduled payment;

■the financial position, access to capital and near-term prospects of the issuer, including the current and future impact of any specific events; and

■our best estimate of the present value of cash flows expected to be collected.

In addition, we no longer consider the duration of the decline in value in assessing whether our fixed income securities available for sale have a credit loss impairment.

On initial recognition and at each reporting date after a credit loss is identified, we recognize an allowance for remaining lifetime expected credit losses. This amount is calculated as the difference between the amortized cost and the present value of future expected cash flows, limited to the difference between the carrying amount (i.e., fair value) and amortized cost. If a credit loss is determined to exist, the credit loss impairment is included in net gains (losses) on investments and other financial instruments in the statement of operations, with an offset to an allowance for credit losses. Subsequent changes (favorable and unfavorable) in expected credit losses are recognized immediately in net income (loss) as a credit loss impairment or a reversal of credit loss impairment.

Recent Accounting Pronouncements

Accounting Standards Adopted During 2020

We adopted ASU 2016-13 on January 1, 2020 using the modified retrospective adoption approach. This ASU and the associated subsequent amendments require that financial assets measured at their amortized cost basis be presented at the net amount expected to be collected. Credit losses relating to our available-for-sale debt securities are recorded through an allowance for credit losses, rather than a write-down of the asset, with the amount of the allowance limited to the amount by which fair value is less than amortized cost. This allowance method will allow reversals of credit losses if the estimate of credit losses declines. This ASU affected certain of our accounts and notes receivable, including premiums receivable, and certain of our other assets, including reinsurance recoverables; however, the update did not have a material effect on our financial statements and disclosures. See Note 6 for additional information.

16

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

Accounting Standards Not Yet Adopted

In August 2018, the FASB issued ASU 2018-12, Financial Services—Insurance. The new standard: (i) requires that assumptions used to measure the liability for future policy benefits be reviewed at least annually; (ii) defines and simplifies the measurement of market risk benefits; (iii) simplifies the amortization of deferred acquisition costs; and (iv) enhances the required disclosures about long-duration contracts. This update is effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the impact on our financial statements and future disclosures as a result of this update.

In December 2019, the FASB issued ASU 2019-12, Income Taxes—Simplifying the Accounting for Income Taxes. This update simplifies the accounting for income taxes by removing certain exceptions to the general principals of ASC Topic 740 in GAAP. This update is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the impact on our financial statements and future disclosures as a result of this update.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform—Facilitation of the Effects of Reference Reform on Financial Reporting. This update provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform. The amendments in this update are optional and may be elected from the date of issuance through December 31, 2022, as reference rate reform activities occur. We are currently evaluating the impact of the guidance and our options related to the practical expedients.

In October 2020, the FASB issued ASU 2020-08, Codification Improvements to Subtopic 310-20, Receivables—Nonrefundable Fees and Other Costs. This update clarifies that an entity should reevaluate whether a callable debt security is within the scope of ASC paragraph 310-20-35-33 for each reporting period. This update is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Early adoption is not permitted. Entities are required to apply ASU 2020-08 on a prospective basis as of the beginning of the period of adoption for existing or newly purchased callable debt securities. We are currently evaluating the impact on our financial statements and future disclosures as a result of this update.

3. Net Income Per Share

Basic net income per share is computed by dividing net income by the weighted-average number of common shares outstanding, while diluted net income per share is computed by dividing net income attributable to common stockholders by the sum of the weighted-average number of common shares outstanding and the weighted-average number of dilutive potential common shares. Dilutive potential common shares relate to our share-based compensation arrangements.

The calculation of basic and diluted net income per share is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands, except per-share amounts) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Net income —basic and diluted | $ | $ | $ | $ | |||||||||||||||||||

Average common shares outstanding—basic (1) | |||||||||||||||||||||||

Dilutive effect of share-based compensation arrangements (2) | |||||||||||||||||||||||

Adjusted average common shares outstanding—diluted | |||||||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||

Basic | $ | $ | $ | $ | |||||||||||||||||||

Diluted | $ | $ | $ | $ | |||||||||||||||||||

______________________

(1)Includes the impact of fully vested shares under our share-based compensation programs.

(2)The following number of shares of our common stock equivalents issued under our share-based compensation arrangements are not included in the calculation of diluted net income per share because they are anti-dilutive:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Shares of common stock equivalents | |||||||||||||||||||||||

17

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

4. Segment Reporting

We have two strategic business units that we manage separately—Mortgage and Real Estate. Our Mortgage segment derives its revenue from mortgage insurance and other mortgage and risk services, including contract underwriting services provided to lenders. Our Real Estate segment offers a broad array of title, valuation, asset management and other real estate services to market participants across the real estate value chain. In addition, we report as All Other activities that include income (losses) from assets held by our holding company, related general corporate operating expenses not attributable or allocated to our reportable segments and, for all periods through the first quarter of 2020, income and expenses related to Clayton prior to its sale in January 2020.

Subsequent to the sale of Clayton, our Chief Executive Officer (Radian’s chief operating decision maker) implemented certain organizational changes that caused the composition of our reportable segments to change. As revised, the Company’s Mortgage and Real Estate segments are managed by our President of Mortgage and Co-Heads of Real Estate, respectively, who are responsible for the overall profitability of their respective segments and who are directly accountable to our chief operating decision maker.

The differences in the basis of segmentation compared to our 2019 Form 10-K are as follows:

| Business Activity | Current Segmentation | Prior Segmentation | ||||||

Mortgage insurance and risk services | Mortgage | Mortgage Insurance | ||||||

Contract underwriting services | Mortgage | Services | ||||||

Title and real estate services (1) | Real Estate | Services | ||||||

Clayton | All Other | Services | ||||||

Income (loss) from holding company assets (and related corporate expenses) | All Other | Mortgage Insurance | ||||||

______________________

(1)Includes single family rental services.

These segment reporting changes align with the changes in personnel reporting lines, management oversight and branding following the sale of Clayton, and are consistent with the way our chief operating decision maker began assessing the performance of our reportable segments and other business activities effective in the first quarter of 2020. These changes to our reportable segments have been reflected in our segment operating results for all periods presented. See Note 1 for additional details about our Mortgage and Real Estate businesses.

With the exception of goodwill and other acquired intangible assets that relate to our Real Estate segment, which are reviewed as part of our annual goodwill impairment assessment, we do not manage assets by segment.

Adjusted Pretax Operating Income (Loss)

Our senior management, including our chief operating decision maker, uses adjusted pretax operating income (loss) as our primary measure to evaluate the fundamental financial performance of each of Radian’s business segments and to allocate resources to the segments. Adjusted pretax operating income (loss) is defined as pretax income (loss) excluding the effects of: (i) net gains (losses) on investments and other financial instruments; (ii) loss on extinguishment of debt; (iii) amortization and impairment of goodwill and other acquired intangible assets; and (iv) impairment of other long-lived assets and other non-operating items, such as gains (losses) from the sale of lines of business and acquisition-related income and expenses. See Note 4 of Notes to Consolidated Financial Statements in our 2019 Form 10-K for detailed information regarding items excluded from adjusted pretax operating income (loss), including the reasons for their treatment.

Although adjusted pretax operating income (loss) excludes certain items that have occurred in the past and are expected to occur in the future, the excluded items represent those that are: (i) not viewed as part of the operating performance of our primary activities or (ii) not expected to result in an economic impact equal to the amount reflected in pretax income (loss).

Adjusted pretax operating income (loss) for each segment represents segment results on a standalone basis; therefore, inter-segment eliminations and reclassifications required for consolidated GAAP presentation have not been reflected. Inter-segment activities are recorded at market rates for segment reporting and eliminated in consolidation.

18

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

The reconciliation of adjusted pretax operating income (loss) for our reportable segments to consolidated pretax income is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||

| Adjusted pretax operating income (loss): | ||||||||||||||||||||||||||

Mortgage (1) | $ | $ | $ | $ | (2) | |||||||||||||||||||||

Real Estate (3) | ( | ( | ( | ( | ||||||||||||||||||||||

Total adjusted pretax operating income (loss) for reportable segments | ||||||||||||||||||||||||||

All Other adjusted pretax operating income (loss) | ||||||||||||||||||||||||||

Net gains (losses) on investments and other financial instruments | ||||||||||||||||||||||||||

Loss on extinguishment of debt | ( | ( | ||||||||||||||||||||||||

Amortization and impairment of other acquired intangible assets | ( | ( | ( | ( | ||||||||||||||||||||||

Impairment of other long-lived assets and other non-operating items | ( | ( | ( | |||||||||||||||||||||||

| Consolidated pretax income | $ | $ | $ | $ | ||||||||||||||||||||||

______________________

(1)Includes allocated corporate operating expenses and depreciation expense as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||

| Allocated corporate operating expenses | $ | $ | $ | $ | ||||||||||||||||||||||

| Depreciation expense | ||||||||||||||||||||||||||

(2)Includes a cumulative adjustment to unearned premiums recorded in the second quarter of 2019, as further described below.

(3)Includes allocated corporate operating expenses and depreciation expense as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||

| Allocated corporate operating expenses | $ | $ | $ | $ | ||||||||||||||||||||||

| Depreciation expense | ||||||||||||||||||||||||||

Our results for the nine months ended September 30, 2019 include a $32.9 million increase in net premiums earned and a $0.12 increase in net income per share due to a reduction in our unearned premiums, resulting from a cumulative adjustment in the second quarter of 2019 related to an update to the amortization rates used to recognize revenue for Single Premium Policies. See Note 2 of Notes to Consolidated Financial Statements in our 2019 Form 10-K for additional information regarding this adjustment and our accounting policies for insurance premiums revenue recognition.

19

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

Revenue

The reconciliation of revenue for our reportable segments to consolidated revenues is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

Mortgage (1) | $ | $ | $ | $ | (2) | |||||||||||||||||||||

Real Estate (1) | ||||||||||||||||||||||||||

Total revenues for reportable segments | ||||||||||||||||||||||||||

All Other revenues (3) | ||||||||||||||||||||||||||

Net gains (losses) on investments and other financial instruments | ||||||||||||||||||||||||||

| Other non-operating revenue | ||||||||||||||||||||||||||

Elimination of inter-segment revenues (3) | ( | ( | ( | ( | ||||||||||||||||||||||

| Total revenues | $ | $ | $ | $ | ||||||||||||||||||||||

______________________

(1)Includes immaterial inter-segment revenues for the three and nine months ended September 30, 2020 and 2019.

(2)Includes a cumulative adjustment to unearned premiums recorded in the second quarter of 2019 as further described above.

The accounting standard on revenue from contracts with customers is primarily applicable to our services revenue and is not applicable to our investments and insurance products, which represent the majority of our revenue. See Note 2 of Notes to Consolidated Financial Statements in our 2019 Form 10-K for additional information regarding our accounting policies and the services we offer.

The table below, which represents total services revenue on our condensed consolidated statements of operations for the periods indicated, represents the disaggregation of services revenues from external customers, by type:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Services revenue | |||||||||||||||||||||||

| Real Estate services: | |||||||||||||||||||||||

| Valuation services | $ | $ | $ | $ | |||||||||||||||||||

| Title services | |||||||||||||||||||||||

| Asset management services | |||||||||||||||||||||||

| Other real estate services | |||||||||||||||||||||||

| Mortgage services | |||||||||||||||||||||||

All Other services (1) | |||||||||||||||||||||||

| Total services revenue | $ | $ | $ | $ | |||||||||||||||||||

______________________

(1)Includes services revenue from Clayton prior to its sale in January 2020.

Our services revenues are recognized over time and measured each period based on the progress to date as services are performed and made available to customers. Our contracts with customers, including payment terms, are generally short-term in nature; therefore, any impact related to timing is immaterial. Revenue expected to be recognized in any future period related to remaining performance obligations, such as contracts where revenue is recognized as invoiced and contracts with variable consideration related to undelivered performance obligations, is not material.

Revenue recognized related to services made available to customers and billed is reflected in accounts and notes receivable. Accounts and notes receivable includes $28.9 million and $10.8 million as of September 30, 2020 and December 31, 2019, respectively, related to services revenue contracts. Revenue recognized related to services performed and not yet billed is recorded in unbilled receivables and reflected in other assets. See Note 9 for additional information. Deferred revenue, which

20

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

5. Fair Value of Financial Instruments

For discussion of our valuation methodologies for assets and liabilities measured at fair value and the fair value hierarchy, see Note 5 of Notes to Consolidated Financial Statements in our 2019 Form 10-K.

The following is a list of assets that are measured at fair value by hierarchy level as of September 30, 2020:

| (In thousands) | Level I | Level II | Total | ||||||||||||||

| Assets at fair value | |||||||||||||||||

| Investments: | |||||||||||||||||

| Fixed-maturities available for sale: | |||||||||||||||||

U.S. government and agency securities | $ | $ | $ | ||||||||||||||

State and municipal obligations | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

RMBS | |||||||||||||||||

CMBS | |||||||||||||||||

Other ABS | |||||||||||||||||

Foreign government and agency securities | |||||||||||||||||

| Total fixed-maturities available for sale | |||||||||||||||||

| Trading securities: | |||||||||||||||||

State and municipal obligations | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

RMBS | |||||||||||||||||

CMBS | |||||||||||||||||

| Total trading securities | |||||||||||||||||

Equity securities | |||||||||||||||||

| Short-term investments: | |||||||||||||||||

U.S. government and agency securities | |||||||||||||||||

State and municipal obligations | |||||||||||||||||

Money market instruments | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

Other investments (1) | |||||||||||||||||

| Total short-term investments | |||||||||||||||||

Total investments at fair value (2) | |||||||||||||||||

| Other: | |||||||||||||||||

Loaned securities: (3) | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

Equity securities | |||||||||||||||||

Total assets at fair value (2) | $ | $ | $ | ||||||||||||||

______________________

(1)Comprising short-term certificates of deposit and commercial paper.

(2)Does not include other invested assets of $2.5 million that are primarily invested in limited partnership investments valued using the net asset value as a practical expedient and $3.0 million invested in a private convertible promissory note.

21

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

(3)Securities loaned to third-party borrowers under securities lending agreements are classified as other assets in our condensed consolidated balance sheets. See Note 6 for more information.

The following is a list of assets that are measured at fair value by hierarchy level as of December 31, 2019:

| (In thousands) | Level I | Level II | Total | ||||||||||||||

| Assets at fair value | |||||||||||||||||

| Investments: | |||||||||||||||||

| Fixed-maturities available for sale: | |||||||||||||||||

U.S. government and agency securities | $ | $ | $ | ||||||||||||||

State and municipal obligations | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

RMBS | |||||||||||||||||

CMBS | |||||||||||||||||

Other ABS | |||||||||||||||||

Foreign government and agency securities | |||||||||||||||||

| Total fixed-maturities available for sale | |||||||||||||||||

| Trading securities: | |||||||||||||||||

State and municipal obligations | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

RMBS | |||||||||||||||||

CMBS | |||||||||||||||||

| Total trading securities | |||||||||||||||||

Equity securities | |||||||||||||||||

| Short-term investments: | |||||||||||||||||

U.S. government and agency securities | |||||||||||||||||

State and municipal obligations | |||||||||||||||||

Money market instruments | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

Other investments (1) | |||||||||||||||||

| Total short-term investments | |||||||||||||||||

Total investments at fair value (2) | |||||||||||||||||

| Other: | |||||||||||||||||

Loaned securities: (3) | |||||||||||||||||

U.S. government and agency securities | |||||||||||||||||

Corporate bonds and notes | |||||||||||||||||

Equity securities | |||||||||||||||||

Total assets at fair value (2) | $ | $ | $ | ||||||||||||||

______________________

(1)Comprising short-term certificates of deposit and commercial paper.

(2)Does not include other invested assets of $2.6 million that are primarily invested in limited partnership investments valued using the net asset value as a practical expedient and $1.5 million invested in a private convertible promissory note.

(3)Securities loaned to third-party borrowers under securities lending agreements are classified as other assets in our condensed consolidated balance sheets. See Note 6 for more information.

At September 30, 2020 and December 31, 2019, we had a Level III asset of $5.5 million and $0.4 million, respectively, measured at fair value, included in other assets in our condensed consolidated balance sheets. The Level III asset represents the embedded derivatives associated with mortgage insurance-linked notes transactions in connection with our Excess-of-Loss

22

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements (Continued)

______________________________________________________________________________________________________

Program, as described in Note 8. The total fair value of the embedded derivatives at September 30, 2020 and December 31, 2019 consists of impacts related to the fair value accounting for derivatives associated with our reinsurance contracts and the related fluctuations from period to period. The estimated fair value related to our embedded derivatives reflects the present value impact of the future variation in premiums we will pay, and includes significant unobservable inputs associated with LIBOR rates and the yield on investments held by trust.

There were no

Other Fair Value Disclosure

The carrying value and estimated fair value of other selected liabilities not carried at fair value in our condensed consolidated balance sheets were as follows as of the dates indicated:

| September 30, 2020 | December 31, 2019 | ||||||||||||||||||||||

| (In thousands) | Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Senior notes | $ | $ | $ | $ | |||||||||||||||||||

| FHLB advances | |||||||||||||||||||||||

The fair value of our senior notes is estimated based on their quoted market prices. The fair value of our FHLB advances is estimated based on expected cash flows for similar borrowings. These liabilities are categorized in Level II of the fair value hierarchy. See Note 12 for further information on our senior notes and FHLB advances.

6. Investments

Available for Sale Securities

Our available for sale securities within our investment portfolio consisted of the following as of the dates indicated:

| September 30, 2020 | |||||||||||||||||||||||||||||

| (In thousands) | Amortized Cost | Allowance for Credit Losses | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||||

| Fixed-maturities available for sale: | |||||||||||||||||||||||||||||

U.S. government and agency securities | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

State and municipal obligations | ( | ||||||||||||||||||||||||||||

Corporate bonds and notes | ( | ( | |||||||||||||||||||||||||||

RMBS | ( | ||||||||||||||||||||||||||||

CMBS | ( | ||||||||||||||||||||||||||||