Exhibit 25.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

| ☐ | CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b)(2) |

BOKF, NA

(Exact name of trustee specified in its charter)

| 73-0780382 | ||

| (Jurisdiction of incorporation of organization if not a U.S. national bank) |

(I.R.S. Employer Identification Number) | |

| Bank of Oklahoma Tower, P.O. Box 2300, Tulsa, Oklahoma | 74192 | |

| (Address of principal executive offices) | (Zip Code) | |

Frederic Dorwart, Lawyers PLLC, Old City Hall, 124 E 4th St, Tulsa, Oklahoma 74103-5010; (918) 583-9922

(Name, address and telephone number of agent for service)

Service Corporation International

(Exact name of obligor as specified in its charter)

| Texas | 74-1488375 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 1929 Allen Parkway, Houston, Texas | 77019 | |

| (Address of principal executive offices) | (Zip Code) | |

Service Corporation International 4.625% Senior Notes due 2027

(Title of the indenture securities)

Item 1. General Information.

Furnish the following information as to the trustee –

(a) Name and address of each examining or supervising authority to which it is subject.

See Attachment – Item 1

(b) Whether it is authorized to exercise corporate trust powers. Yes

Item 2. Affiliations with the obligor.

If the obligor is an affiliate of the trustee, describe each such affiliation. None

Item 3. Voting securities of the trustee.

Furnish the following information as to each class of voting securities of the trustee:

N/A – See answer to Item 13

Item 4. Trusteeships under other indentures.

If the trustee is a trustee under another indenture under which any other securities, of certificates or interest or participation in any other securities, of the obligor are outstanding, furnish the following information:

N/A – See answer to Item 13

Item 5. Interlocking directorates and similar relationships with the obligor or underwriters.

If the trustee or any of the directors or executive officers of the trustee is a director, officer, partner, employee, appointee, or representative of the obligor or of any underwriter for the obligor, identify each such person having any connection and state the nature of such condition.

N/A – See answer to Item 13

Item 6. Voting securities of the trustee owned by the obligor or its officials.

Furnish the following information as to the voting securities of trustee owned beneficially by the obligor and each director, partner, and executive officer of the obligor:

N/A – See answer to Item 13

Item 7. Voting securities of the trustee owned by underwriters or their officials.

Furnish the following information as to the voting securities of the trustee owned beneficially by each underwriter for the obligor and each director, partner, and executive officer of such underwriter:

N/A – See answer to Item 13

Item 8. Securities of the obligor owned or held by the trustee.

Furnish the following information as to securities of the obligor owned beneficially or held as collateral security for obligations in default by the trustee:

N/A – See answer to Item 13

Item 9. Securities of underwriters owned or held by the trustee.

If the trustee owned beneficially or holds as collateral security for obligations in default any securities on an underwriter for the obligor, furnish the following information as to each class of securities of such underwriter any of which are so owned or held by the trustee:

N/A – See answer to Item 13

Item 10. Ownership or holdings by the trustee of voting securities of certain affiliates or security holders of the obligor.

If the trustee owns beneficially or holds as collateral security for obligations in default voting securities of a person who, to the knowledge of the trustee (1) owns 10 percent or more of the voting securities of the obligor or (2) is an affiliate, other than a subsidiary, of the obligor, furnish the following information as to the voting securities of such person:

N/A – See answer to Item 13

Item 11. Ownership or holdings by the trustee of any securities of a person owning 50 percent or more of the voting securities of the obligor.

If the trustee owns beneficially or holds as collateral security for obligations in default any securities of a person who, to the knowledge of the trustee, owns 50 percent or more of the voting securities of the obligor, furnish the following information as to each class of securities of such person an of which are so owned or held by the trustee:

N/A – See answer to Item 13

Item 12. Indebtedness of the Obligor to the Trustee.

Except as noted in the instructions, if the obligor is indebted to the trustee, furnish the following information:

N/A – See answer to Item 13

Item 13. Defaults by the Obligor.

(a) State whether there is or has been a default with respect to the securities under this indenture. Explain the nature of any such default. None

(b) If the trustee is a trustee under another indenture under which any other securities, or certificates of interest or participation in any other securities, of the obligor are outstanding, or is trustee for more than one outstanding series of securities under the indenture, state whether there has been a default under any such indenture or series, identify the indenture or series affected, and explain the nature of any such default. None

Item 14. Affiliations with the Underwriters.

If any underwriter is an affiliate of the trustee, describe each such affiliation.

N/A – See answer to Item 13

Item 15. Foreign Trustee.

Identify the order or rule pursuant to which the foreign trustee is authorized to act as sole trustee under indentures qualified under the Act.

N/A - Trustee is a National Banking Association organized under the laws of the United States.

Item 16. List of exhibits.

List below all exhibits filed as a part of this statement of eligibility.

1. A copy of the articles of association of the trustee as now in effect. Attached

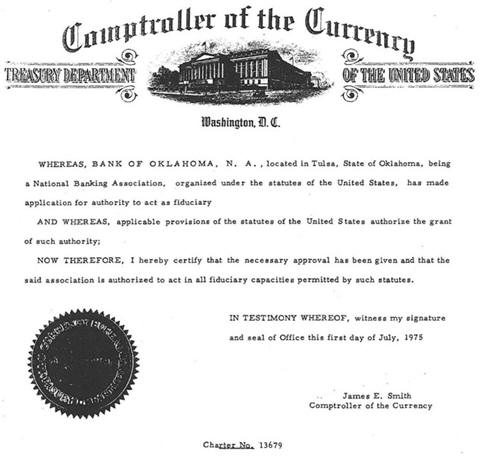

2. A copy of the certificate of authority of the trustee to commence business, if not contained in the articles of association. Attached

3. A copy of the authorization of the trustee to exercise corporate trust powers, if such authorization is not contained in the documents specified in paragraph (1) or (2) above. Attached

4. A copy of the existing bylaws of the trustee, or instruments corresponding thereto. Attached

5. A copy of each indenture referred to in Item 4, if the obligor is in default. N/A

6. The consents of United States institutional trustees required by Section 321(b) of the Act. Attached

7. A copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining authority. Attached

8. A copy of any order pursuant to which the foreign trustee is authorized to act as sole trustee under indentures qualified or to be qualified under the Act.

N/A – See answer to Item 15

9. Foreign trustees are required to file a consent to serve of process of Form F-X [§269.5 of this chapter].

N/A – See answer to Item 15

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939 the trustee, BOKF, NA, a National Banking Association organized and existing under the laws of the United States, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Tulsa, and State of Oklahoma on the 12th day of December, 2017.

| BOKF, NA | ||

| (Trustee) | ||

| By: | /s/ Mary Jo Wagener | |

| Mary Jo Wagener, Vice President | ||

Attachments to SEC Form T- 1

Item 1. General Information

(a) Name and address of each examining or supervising authority to which trustee is subject. Primary Regulator:

Office of the Comptroller of the Currency

Southwestern District

1600 Lincoln Plaza

500 North Akard Street

Suite 1600

Dallas, Texas 75201

Federal Reserve Bank of Kansas City

1 Memorial Drive

Kansas City, MO 64198

Federal Deposit Insurance Corporation

550 17th Street, N.W. Washington, DC 20429

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Item 16. List of exhibits.

1. A copy of the articles of association of the trustee as now in effect.

2. A copy of the certificate of authority of the trustee to commence business, if not contained in the articles of association.

3. A copy of the authorization of the trustee to exercise corporate trust powers, if authorization is not contained in the document specified in paragraph (1) or (2) above.

4. A copy of the existing bylaws of the trustee, or instruments corresponding thereto.

6. The consents of United States institutional trustees required by Section 321(b) of the Act.

7. A copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining authority.

EXHIBIT 1

BOKF, NATIONAL ASSOCIATION

Charter No. 13679

AMENDED AND RESTATED ARTICLES OF ASSOCIATION

(As of January 1, 2011)

FIRST. The title of this Association shall be “BOKF, National Association”. This Association was first organized in 1910 as The Exchange National Bank of Tulsa. In 1933 this Association was reorganized as The National Bank of Tulsa. In 1975 the name of this Association was changed to Bank of Oklahoma, National Association. In 2011, this Association was merged with other national banks owned by BOK Financial Corporation and its name changed to “BOKF, National Association”.

SECOND . The main office of the Association shall be in the City of Tulsa, County of Tulsa, State of Oklahoma. The general business of the Association shall be conducted at its main office and its branches.

THIRD. The Board of Directors of this Association shall consist of not less than five nor more than twenty-five persons, the exact number to be fixed and determined from time to time by resolution of a majority of the full Board of Directors or by resolution of a majority of the holders of outstanding Common Stock at any annual or special meeting thereof. If required by applicable law, each director shall own common stock of the Association with an aggregate par value of not less than

$1,000, or common stock of a bank holding company owning the Association with an aggregate par, fair market or equity value of not less than $1,000, as of either (i) the date of purchase, (ii) the date the person became a director or (iii) the date of that person’s most recent election to the Board of Directors, whichever is greater.

Any vacancy in the Board of Directors may be filled by action of a majority of the remaining directors between meetings of shareholders. The Board of Directors may not increase the number of directors between meetings of shareholders to a number which: (1) exceeds by more than two the number of directors last elected by shareholders where the number was 15 or less; and (2) exceeds by more than four the number of directors last elected by shareholders where the number was 16 or more, but in no event shall the number of directors exceed 25.

Terms of directors, including directors selected to fill vacancies, shall expire at the next regular meeting of shareholders at which directors are elected, unless the directors resign or are removed from office.

Despite the expiration of a director’s term, the director shall continue to serve until his or her successor is elected and qualifies or until there is a decrease in the number of directors and his or her position is eliminated.

Honorary or advisory members of the Board of Directors, without voting power or power of final decision in matters concerning the business of the Association, may be appointed by resolution of a majority of the full Board of Directors, or by resolution of shareholders at any annual or special meeting. Honorary or advisory directors shall not be counted for purposes of determining the number of directors of the Association or the presence of a quorum in connection with any Board action, and shall not be required to own qualifying shares.

FOURTH. There shall be an annual meeting of the shareholders to elect directors and transact whatever other business may be brought before the meeting. It shall be held at the main office or any other convenient place the Board of Directors may designate, on the day of each year specified therefor in the bylaws, or if that day falls on a legal holiday in the state in which the Association is located, on the next following banking day. If no election is held on the day fixed or in the event of a legal holiday, an election may be held on any subsequent day within 60 days of the day fixed, to be designated by the Board of Directors, or, if the directors fail to fix the day, by shareholders representing two-thirds of the shares issued and outstanding. In all cases at least 10 days advance notice of the meeting shall be given to the shareholders by first class mail.

In all elections of directors, the number of votes each common shareholder may cast will be determined by multiplying the number of shares he or she owns by the number of directors to be elected. Those votes may be cumulated and cast for a single candidate or may be distributed among two or more candidates in the manner selected by the shareholder. On all other questions, each common shareholder shall be entitled to one vote for each share of stock held by him or her.

Nominations for election to the Board of Directors may be made by the Board of Directors or by any stockholder of any outstanding class of capital stock of the Association entitled to vote for election of directors. Nominations other than those made by or on behalf of the existing management shall be made in writing and be delivered or mailed to the President of the Association and to the Comptroller of the Currency, Washington, D.C., not less than 14 days nor more than 50 days prior to any meeting of shareholders called for the election of directors; provided, however, that if less than 21 days’ notice of the meeting is given to shareholders, such nominations shall be mailed or delivered to the President of the Association and to the Comptroller of the Currency not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification shall contain the following information to the extent known to the notifying shareholder:

(1) The name and address of each proposed nominee,

(2) The principal occupation of each proposed nominee,

(3) The total number of shares of capital stock of the Association that will be voted for each proposed nominee,

(4) The name and residence address of the notifying shareholder, and

(5) The number of shares of capital stock of the Association owned by the notifying shareholder.

Nominations not made in accordance herewith may, in his/her discretion, be disregarded by the chairperson of the meeting, and in determining the vote tellers may upon directions by the chairperson disregard all votes cast for each such nominee. No bylaw may unreasonably restrict the nomination of directors by shareholders.

A director may resign at any time by delivering written notice to the Board of Directors, its chairperson, or to the Association, which resignation shall be effective when the notice is delivered unless the notice specifies a later effective date.

A director may be removed with or without cause by shareholders at a meeting called to remove him or her, when notice of the meeting stating that the purpose or one of the purposes is to remove him or her is given; provided, however, that a director may not be removed if the number of votes sufficient to elect him or her under cumulative voting is voted against his or her removal.

FIFTH. The authorized amount of capital stock of this Association shall be 750,000 shares of Common Stock of the par value of $100.00 each; but said capital stock may be increased or decreased from time to time, according to the provisions of the laws of the United States.

No holder of shares of the capital stock of any class of the Association shall have any preemptive or preferential right of subscription to any shares of any class of stock of the Association, whether now or hereafter authorized, or to any obligations convertible into stock of the Association, issued, or sold, nor any right of subscription to any thereof other than such, if any, as the Board of Directors, in its discretion, may from time to time determine and at such price as the Board of Directors, in its discretion, may from time to time fix.

Unless otherwise specified in the Articles of Association or required by law (1) all matters requiring shareholder action including amendments to the Articles of Association must be approved by holders of a majority of the outstanding voting stock, and (2) each shareholder shall be entitled to one vote per share.

Unless otherwise specified in the Articles of Association or required by law, all shares of voting stock shall be voted together as a class, on any matters requiring shareholder approval. If a proposed amendment would affect two or more classes or series in the same or a substantially similar way, all the classes or series so affected must vote together as a single voting group on the proposed amendment.

Shares of the same class or series may be issued as a dividend on a pro rata basis and without consideration. Shares of another class or series may be issued as a share dividend in respect of a class or series of stock if approved by a majority of the votes entitled to be cast by the class or series to be issued unless there are no outstanding shares of the class or series to be issued. Unless otherwise provided by the Board of Directors, the record date for determining shareholders entitled to a share dividend shall be the date the Board of Directors authorizes the share dividend.

Unless otherwise provided in the bylaws, the record date for determining shareholders entitled to notice of and to vote at any meeting is the close of business on the day before the first notice is mailed or otherwise sent to the shareholders, provided that in no event may a record date be more than 70 days before the meeting.

If a shareholder is entitled to fractional shares pursuant to a stock dividend, consolidation or merger, reverse stock split or otherwise, the Association may: (a) issue fractional shares or; (b) in lieu of the issuance of fractional shares, issue script of warrants entitling the holder to receive a full share upon surrendering enough script or warrants to equal a full share; (c) if there is an established and active market in the association’s stock, make reasonable arrangements to provide the shareholder with an opportunity to realize a fair price through sale of the fraction, or purchase of the additional fraction required for a full share; (d) remit the cash equivalent of the fraction to the shareholder; or (e) sell full shares representing all the fractions at public auction or to the highest bidder after having solicited and received sealed bids from at least three licensed stock brokers; and distribute the proceeds pro rata to shareholders who otherwise would be entitled to the fractional shares. The holder of a fractional share is entitled to exercise the rights of a shareholder, including the right to vote, to receive dividends, and to participate in the assets of the Association upon liquidation, in proportion to the fractional interest. The holder of script or warrant is not entitled to any of these rights unless the script or warrants explicitly provide for such rights. The script or warrants may be subject to such additional conditions as: (1) the script or warrants will become void if not exchanged for full shares before a specified date; and (2) that the shares for which the script or warrants are exchangeable may be sold at the option of the Association and the proceeds paid to scriptholders.

The Association, at any time and from time to time, may authorize and issue debt obligations, whether or not subordinated, without the approval of the shareholders. Obligations classified as debt, whether or not subordinated, which may be issued by the Association without the approval of shareholders, do not carry voting rights on any issue, including an increase or decrease in the aggregate number of the securities, or the exchange or reclassification of all or part of securities into securities of another class or series.

SIXTH. The Board of Directors shall appoint one of its members to be Chairman of the Board, who shall perform such duties as may be designated by the Board of Directors. The Board of Directors shall have the power to appoint a President - Tulsa Regional Office, and a President -Oklahoma City Regional Office, each of whom shall perform such duties as may be designated by the Board of Directors or the Chairman of the Board. The Board of Directors shall also have the power to appoint one or more vice presidents, a secretary who shall keep minutes of the directors’ and shareholders’ meetings and be responsible for authenticating the records of the Association, and such other officers and employees as may be required to transact the business of this Association. A duly appointed officer may appoint one or more officers or assistant officers if authorized by the Board of Directors in accordance with the bylaws.

The Board of Directors shall have the power to:

(1) Define the duties of the officers, employees and agents of the Association.

(2) Delegate the performance of its duties, but not the responsibility for its duties, to the officers, employees, and agents of the Association.

(3) Fix the compensation and enter into employment contracts with its officers and employees upon reasonable terms and conditions consistent with applicable law.

(4) Dismiss officers and employees.

(5) Require bonds from officers and employees and to fix the penalty thereof.

(6) Ratify written policies authorized by the Association’s management or committees of the Board.

(7) Regulate the manner in which any increase or decrease of the capital of the Association shall be made, provided that nothing herein shall restrict the power of shareholders to increase or decrease the capital of the Association in accordance with law, and nothing shall raise or lower from two-thirds the percentage required for shareholder approval to increase or reduce the capital.

(8) Manage and administer the business and affairs of the Association.

(9) Adopt bylaws, not inconsistent with law or the Articles of Association, for managing the business and regulating the affairs of the Association. (10) Amend or repeal bylaws, except to the extent that the Articles of Association reserve this power in whole or in part to shareholders.

(11) Make contracts.

(12) Generally to perform all acts that are legal for a Board of Directors to perform.

SEVENTH . The Board of Directors shall have the power to change the location of the main office to any other place within the limits of the City of Tulsa, without the approval of the shareholders, and shall have the power to establish or change the location of any branch or branches of the Association to any other location permitted under applicable law, without the approval of the shareholders, but subject in either event to approval by the Office of the Comptroller of the Currency if required by applicable law.

EIGHTH. The corporate existence of this Association shall continue until terminated according to the laws of the United States.

NINTH. The Board of Directors of this Association, or any three or more shareholders owning, in the aggregate, not less than twenty-five percent (25%) of the outstanding Common Stock of this Association, may call a special meeting of shareholders at any time. Unless otherwise provided by the bylaws or the laws of the United States, or waived by shareholders, a notice of the time, place, and purpose of every annual and special meeting of the shareholders shall be given by first-class mail, postage prepaid, mailed at least 10, and no more than 60 days, prior to the date of the meeting to each shareholder of record at his/her address as shown upon the books of this Association.

TENTH. (A) Directors of the Association shall not be personally liable to the Association or its shareholders for monetary damages for breach of fiduciary duty as a director; provided, however, that the foregoing clause shall not apply to any liability of a Director (1) for breach of the director’s duty of loyalty to the Association or its shareholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, (3) for the payment of unlawful dividends, or (4) for any transaction from which the director derived an improper personal benefit.

(B) The Association shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding whether civil, criminal, administrative or investigative (other than an action by or in the right of the Association) by reason of the fact that he is or was a director, officer, employee or agent of the Association, or is or was serving at the request of the Association as a director, officer, employee or agent of another association, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Association, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Association, and, with respect to any criminal action or proceeding, had reasonable cause to believe that his conduct was unlawful.

(C) The Association shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Association to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the Association, or is or was serving at the request of the Association as a director, officer, employee or agent of another Association, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by him in connection with the defense or settlement of such action or suit if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Association and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Association unless and only to the extent that a court of competent jurisdiction shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the court shall deem proper.

(D) To the extent that a director, officer, employee or agent of the Association has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in paragraphs (B) and (C) of this Article, or in defense of any claim, issue or matter therein, he shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him in connection therewith.

(E) Any indemnification under paragraphs (B) and (C) of this Article (unless ordered by a court) shall be made by the Association only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances because he has met the applicable standard of conduct set forth therein. Such determination shall be made (1) by the Board of Directors by a majority vote of a quorum (as directed in the bylaws of the Association) consisting of directors who were not parties to such action, suit or proceeding, or (2) if such quorum is not obtainable, or even if obtainable a quorum of disinterested directors so elects, by independent legal counsel in a written opinion, or (3) by the shareholders.

(F) Expenses incurred by an officer or director in defending a civil or criminal action, suit or proceeding may be paid by the Association in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the Association as authorized in this Article. Such expenses incurred by other employees and agents may be so paid upon such terms and conditions, if any, as the Board of Directors deems appropriate.

(G) The indemnification and advancement of expenses provided by or granted pursuant to this Article shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any statute, bylaw, agreement, vote of shareholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office.

(H) The indemnification and advancement of expenses provided by or granted pursuant to this Article shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

(I) By action of its Board of Directors, notwithstanding any interest of the directors in the action, the Association may purchase and maintain insurance, in such amounts as the Board of Directors deems appropriate, on behalf of any person who is or was a director, officer, employee or agent of the Association, or of any association a majority of the voting stock of which is owned by the Association, or is or was serving at the request of the Association as a director, officer, employee or agent of another association, partnership, joint venture, trust or other enterprise, against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the Association would have the power or would be required to indemnify him against such liability under the provisions of this Article or any other applicable law; provided, however, that such insurance shall exclude coverage for a formal order assessing civil money penalties against a director, officer, employee or agent of the Association.

(J) The term director as used herein shall include persons serving as advisory directors, senior directors or directors emeritus or any other similar advisory capacity to the Board of Directors of the Association.

(K) Notwithstanding any provision to the contrary contained herein, the Association shall not indemnify directors, officers or employees against expenses, penalties or other payments incurred in an administrative proceeding or action instituted by an appropriate Bank regulatory agency, which proceeding or action results in a final order assessing civil money penalties or requiring affirmative action by an individual or individuals in the form of payments to the Association; provided, however that the Association shall advance expenses to a director, officer or employee incurred in connection with the defense of any such action if:

(1) The indemnitee enters into an agreement satisfactory to the Association pursuant to which the indemnitee shall reimburse any expenses advanced if (a) a final order is entered in the action assessing civil money penalties or requiring payments to the Association, or (b) if the Board of Directors of the Association finds that the indemnitee willfully misrepresented factors relevant to the Board’s determination of conditions described in (2)(a) or (b) below;

(2) Prior to making any advances, the Board of the Association, in good faith, determines in writing that all of the following conditions are met: (a) the indemnitee has a substantial likelihood of prevailing on the merits; (b) in the event that the indemnitee does not prevail, he or she will have the financial capability to reimburse the Association; and (c) payment of expenses by the Association will not adversely affect Bank safety and soundness; and

(3) If at any time the Board of the Association believes, or should reasonably believe, that the conditions described in (2)(a), (2)(b) or (2)(c) are no longer met, the Association shall cease paying any such expenses.

ELEVENTH. These Articles of Association may be amended at any regular or special meeting of the shareholders by the affirmative vote of the holders of a majority of the outstanding Common Stock of this Association, unless the vote of the holders of a greater amount of stock is required by law, and in that case by the vote of the holders of such greater amount. The Association’s Board of Directors may propose one or more amendments to the Articles of Association for submission to the shareholders.

/s/ Frederic Dorwart

Frederic Dorwart

EXHIBIT 2

EXHIBIT 3

Comptroller of the Currency

Administrator of National Banks

Washington, DC 20219

CERTIFICATE OF CORPORATE EXISTENCE

AND FIDUCIARY POWERS

I, Thomas J. Curry, Comptroller of the Currency, do hereby certify that:

1. The Comptroller of the Currency, pursuant to Revised Statutes 324, et seq, as amended, and 12 USC 1, et seq, as amended, has possession, custody, and control of all records pertaining to the chartering, regulation, and supervision of all national banking associations.

2. “BOKF, National Association,” Tulsa, Oklahoma (Charter No. 13679), is a national banking association formed under the laws of the United States and is authorized thereunder to transact the business of banking and exercise fiduciary powers on the date of this certificate.

| IN TESTIMONY WHEREOF, today, June 2, 2016, I have hereunto subscribed my name and caused my seal of office to be affixed to these presents at the U.S. Department of the Treasury, in the City of Washington, District of Columbia.

|

| /s/ Thomas J. Curry |

| Comptroller of the Currency |

EXHIBIT 4

BOKF, NATIONAL ASSOCIATION

AMENDED AND RESTATED

BYLAWS

(Adopted December 21, 1993)

(With Amendment dated May 28, 1996)

(With Amendment dated January 1, 2011)

INDEX

ARTICLE I - Main Office

ARTICLE II - Meetings of Shareholders

| Section 1. | Annual Meeting |

| Section 2. | Special Meetings |

| Section 3. | Place of Meeting |

| Section 4. | Notice of Meeting |

| Section 5. | Voting Lists |

| Section 6. | Quorum |

| Section 7. | Proxies |

| Section 8. | Voting of Shares |

| Section 9. | Voting of Shares by Certain Holders |

| Section 10. | Inspectors of Election |

| Section 11. | Informal Action by Shareholders |

ARTICLE III - Directors

| Section 1. | Number, Tenure and Qualifications |

| Section 2. | Resignation; Removal |

| Section 3. | Vacancies |

| Section 4. | Quorum |

| Section 5. | Compensation |

| Section 6. | General Powers |

| Section 7. | Advisory Directors |

| Section 8. | Nomination of Directors |

ARTICLE IV - Meetings of the Board of Directors

| Section 1. | Regular Meetings |

| Section 2. | Special Meetings |

| Section 3. | Notice |

| Section 4. | Quorum |

| Section 5. | Special Meetings By Conference Telephone |

ARTICLE V - Committees of the Board

| Section 1. | Executive Committee |

| Section 2. | Audit Committee |

| Section 3. | Credit and Investment Committee |

| Section 4. | CRA Committee |

| Section 5. | Other Committees |

| Section 6. | Committee Meeting by Conference Telephone |

ARTICLE VI - Officers

| Section 1. | Number |

| Section 2. | Election and Term of Office |

| Section 3. | Qualification |

| Section 4. | Removal |

| Section 5. | Vacancies |

| Section 6. | Compensation |

| Section 7. | Chairman of the Board |

| Section 8. | President |

| Section 9. | President – Tulsa Branch |

| Section 10. | President – Oklahoma City |

| Section 11. | Vice Presidents |

| Section 12. | The Secretary |

| Section 13. | The Treasurer |

| Section 14. | Assistant Secretaries and Assistant Treasurers |

ARTICLE VII Trust Division

| Section 1. | Trust Division |

| Section 2. | Trust Investment Committee |

| Section 3. | Trust Audit Committee |

| Section 4. | Fiduciary Files |

| Section 5. | Trust Investments |

ARTICLE VIII Shares of Stock

| Section 1. | Certificates for Shares |

| Section 2. | Transfer of Shares |

ARTICLE IX - Closing of Transfer Books and Fixing of Record Date

ARTICLE X - Fiscal Year

ARTICLE XI - Annual Report

ARTICLE XII - Dividends

ARTICLE XIII - Seal

ARTICLE XIV - Indemnification

ARTICLE XV - Miscellaneous Provisions

| Section 1. | Execution of Instruments |

| Section 2. | Records |

| Section 3. | Banking Hours |

ARTICLE XVI - Amendments

BOKF, NATIONAL ASSOCIATION

AMENDED AND RESTATED

BYLAWS

(Adopted December 21, 1993)

(With Amendment dated May 28, 1996)

(With Amendment dated January 1, 2011)

ARTICLE I

Main Office

The main office of the association shall be located in the City of Tulsa, County of Tulsa, State of Oklahoma. The general business of the association shall be conducted at its main office, its branches and such other offices as are permitted by the rules and regulations of the office of the Comptroller of the Currency.

ARTICLE II

Meetings of Shareholders

Section 1. Annual Meeting.

There shall be an annual meeting of the shareholders to elect directors and transact whatever other business may be brought before the meeting. It shall be held at the main office or any other convenient place the Board of Directors may designate, on the second Wednesday of April of each year, or if that day falls on a legal holiday in the state of Oklahoma, on the next following banking day. If no election is held on the day fixed or in the event of a legal holiday, an election may be held on any subsequent day within 60 days of the day fixed, to be designated by the Board of Directors, or, if the Board of Directors fail to fix the day, by shareholders representing two- thirds of the shares issued and outstanding. In all cases at least 10 days advance notice of the meeting shall be given to the shareholders by first class mail.

Section 2. Special Meetings.

The Board of Directors of this Association, or any three or more shareholders owning, in the aggregate, not less than twenty-five percent (25%) of the outstanding Common Stock of this Association, may call a special meeting of shareholders at any time. Unless waived by shareholders, a notice of the time, place, and purpose of every annual and special meeting of the shareholders shall be given by first-class mail, postage prepaid, mailed at least 10, and no more than 60 days, prior to the date of the meeting to each shareholder of record at his/her address as shown upon the books of this Association.

Section 3. Place of Meeting.

Any annual, regular or special meeting of the shareholders of the association may be held at any convenient place, either within or without the State of Oklahoma, if such place be designated by the Board of Directors in a written notice of the meeting sent to all shareholders or in a waiver of notice signed by all shareholders entitled to vote at a meeting. If no specific designation is made, the place of meeting shall be the main office of the association.

Section 4. Notice of Meeting.

Written or printed notice stating the place, day and hour of the meeting and, in case of a special meeting, the purpose or purposes for which the meeting is called, shall be delivered not less than ten nor more than forty days before the date of the meeting, either personally or by mail, by or at the direction of the President, or the Secretary, or the officer or persons calling the meeting, to each shareholder of record entitled to vote at such meeting. If mailed, such notice shall be deemed to be delivered when deposited in the United States mail, addressed to the shareholder at his address as it appears on the stock transfer books of the association, with postage thereon prepaid. If any annual or special meeting of the shareholders be adjourned to another time or place, no notice as to such adjourned meeting need be given other than by announcement at the meeting at which such adjournment is taken; provided, however, that in the event such meeting be adjourned for thirty days or more, notice of the adjourned meeting shall be given as in the case of an original meeting. Notice of the place, day, hour and purpose of any annual or special meeting of the shareholders of the association may be waived in writing by any shareholder or by his attendance at such meeting. Such waiver may be given before or after the meeting, and shall be filed with the Secretary or entered upon the records of the meeting.

Section 5. Voting Lists.

The officer or agent having charge of the stock transfer books for shares of the association shall make, at least 48 hours before each meeting of shareholders, a complete list of the shareholders entitled to vote at such meeting, or any adjournment thereof, arranged in alphabetical order, with the address of, and the number of shares held by, each, which list, for a period of 24 hours prior to such meeting, shall be kept on file at the principal office of the association and shall be subject to inspection by any shareholder or person representing shares at any time during usual business hours. Such list shall also be produced and kept open at the time and place of the meeting and shall be subject to the inspection of any shareholder during the whole time of the meeting. Either such list, when certified by the officer or agent preparing the same, or the original stock transfer books shall be prima facie evidence as to who are the shareholders entitled to examine such list or transfer books or to vote at any meeting of shareholders. Provided, however, it shall not be necessary to prepare and produce a list of shareholders if the share ledger reasonably shows in alphabetical order by classes of shares all persons entitled to represent shares at such meeting with the number of shares entitled to be voted by each shareholder.

Section 6. Quorum.

A majority of the outstanding shares of the association entitled to vote, represented in person or by proxy, shall constitute a quorum at a meeting of shareholders. If less than a majority of the outstanding shares are represented at a meeting, a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. The shareholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough shareholders to leave less than a quorum.

Section 7. Proxies.

Shareholders may vote at any meeting of the shareholders by proxies duly authorized in writing, but no officer or employee of this association shall act as proxy. Proxies shall be valid only for one meeting, to be specified therein, and any adjournments of such meeting. Proxies shall be dated and filed with the records of the meeting. Proxies with rubber stamped facsimile signatures may be used and unexecuted proxies may be counted upon receipt of a confirming telegram from the shareholder. Proxies meeting the above requirements submitted at any time during a meeting shall be accepted.

Section 8. Voting of Shares.

When a quorum is present or represented at any meeting, the vote of the holders of a majority of the shares entitled to vote, present in person or represented by proxy, shall decide any question brought before such meeting, unless the question is one upon which, by express provisions of the statutes or of the certificate of incorporation or of these bylaws, a different vote is required, in which case such express provision shall govern and control the decision of such question. Voting at any annual, regular or special shareholders’ meeting need not be by ballot unless demand therefor is made by a shareholder, proxy or other person present at and entitled to vote at such meeting. In all elections of directors, the number of votes each common shareholder may cast will be determined by multiplying the number of shares he or she owns by the number of directors to be elected. Those votes may be cumulated and cast for a single candidate or may be distributed among two or more candidates in the manner selected by the shareholder. On all other questions, each common shareholder shall be entitled to one vote for each share of stock held by him or her. Every fractional share of stock, if any, shall entitle its owner to the corresponding fractional vote.

Section 9. Voting of Shares by Certain Holders .

Shares standing in the name of another association shall be voted by the President of such association, or by proxy appointed by him, unless some other person, by resolution of such other association’s Board of Directors, shall be appointed to vote such shares, in which case such person shall be entitled to vote the shares upon the production of a certified copy of such resolution.

Shares held by an administrator, executor, guardian or conservator may be voted by him, either in person or by proxy, without a transfer of such shares into his name. Shares standing in the name of a trustee may be voted by him either in person or by proxy, but no trustee shall be entitled to vote shares held by him without a transfer of such shares into his name.

Shares standing in the name of a receiver may be voted by such receiver, and shares held by or under the control of a receiver may be voted by such receiver without the transfer thereof into his name if authority so to do be contained in an appropriate order of the court by which such receiver was appointed.

A shareholder whose shares are pledged shall be entitled to vote such shares until the shares have been transferred into the name of the pledgee, and thereafter the pledgee shall be entitled to vote the shares so transferred. Provided, however, that if the instrument of transfer discloses the pledge, the transferor shall be entitled to vote such pledged shares unless, in the instrument of transfer, the pledgor shall have expressly empowered the pledgee to represent the shares. If the pledgee is thus empowered, he or his proxy shall be exclusively entitled to represent such shares. Shares of its own stock belonging to the association shall not be voted, directly or indirectly, at any meeting, and shall not be counted in determining the total number of outstanding shares at any given time, but shares of its own stock held by the association in a fiduciary capacity may be voted and shall be counted in determining the total number of outstanding shares and the actual voting power of the shareholders at any given time.

Section 10. Inspectors of Election.

In advance of any meeting of shareholders, the Board of Directors may appoint inspectors of the election to act at such meeting or any adjournment thereof. If the inspectors of the election be not so appointed, the Chairman of any such meeting may, and on the request of any shareholder or his proxy shall, make such appointment at the meeting. The number of such inspectors shall be one or three. If appointed at a meeting on the request of one or more shareholders or proxies, the majority of shares present and entitled to vote shall determine whether one or three inspectors are to be appointed. An inspector need not be a shareholder, but no person who is a candidate for an office of the association shall act as an inspector.

In case any person appointed as inspector fails to appear or fails or refuses to act, the vacancy may be filled by appointment made by the Board of Directors in advance of the convening of the meeting, or at the meeting by the person or officer acting as Chairman.

The inspectors shall first take and subscribe an oath or affirmation faithfully to execute the duties of inspectors at such meeting with strict impartiality and according to the best of their ability.

The inspectors of the election shall determine the number of shares outstanding and the voting power of each, the shares represented at the meeting, the existence of a quorum, the authenticity, validity and effect of proxies, receive votes or ballots, take charge of the polls, hear and determine all challenges and questions in any way arising in connection with the right to vote, count and tabulate all votes, determine the result, and do such other acts as may be proper to conduct the election or voting with fairness to all shareholders. The inspectors of the election shall perform their duties impartially, in good faith, to the best of their ability, and as expeditiously as is practical. If there be three inspectors, the decision, act or certificate of a majority shall be effective in all respects as the decision, act or certificate of all.

On request of the Chairman of the meeting, or of any shareholder or his proxy, the inspectors shall make a report in writing of any challenge or question or matter determined by them, and execute a certificate of any fact found by them. Any report or certificate made by them shall be prima facie evidence of the facts stated therein; provided, however, that any ruling by such inspectors may, upon being disputed by any shareholder, proxy or other person, present at and entitled to vote at such meeting, be appealed to the floor of the shareholders’ meeting.

Section 11. Informal Action by Shareholders.

Any action required to be taken at a meeting of the shareholders, or any other action which may be taken at a meeting of the shareholders, may be taken without a meeting if a consent in writing, setting forth the action so taken, shall be signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Prompt notice of the taking of any such corporate action without a meeting by less than unanimous written consent shall be given to those shareholders who have not consented in writing.

ARTICLE III

Directors

Section 1. Number, Tenure and Qualifications.

The number of Directors of the association shall be not less than five and not more than twenty-five, as determined from time to time by resolution of a majority of the full Board of Directors or by resolution of a majority of the holders of outstanding common stock at the annual meeting, or at a special meeting called for such purpose. Directors need not be residents of the State of Oklahoma. A Director to be qualified to take office shall be legally competent to enter into contracts. Directors, other than the initial Board of Directors, shall be elected at the annual meeting of the shareholders. Terms of directors, including directors selected to fill vacancies, shall expire at the next regular meeting of shareholders at which directors are elected, unless the directors resign or are removed from office. Despite the expiration of a director’s term, the director shall continue to serve until his or her successor is elected and qualifies or until there is a decrease in the number of directors and his or her position is eliminated.

Section 2. Resignation; Removal.

A director may resign at any time by delivering written notice to the Board of Directors, its chairperson, or to the Association, which resignation shall be effective when the notice is delivered unless the notice specifies a later effective date. A director may be removed with or without cause by shareholders at a meeting called to remove him or her, when notice of the meeting stating that the purpose or one of the purposes is to remove him or her is given; provided, however, that a director may not be removed if the number of votes sufficient to elect him or her under cumulative voting is voted against his or her removal.

Section 3. Vacancies.

Any vacancy in the Board of Directors may be filled by action of a majority of the remaining directors between meetings of shareholders. The Board of Directors may not increase the number of directors between meetings of shareholders to a number which: (1) exceeds by more than two the number of directors last elected by shareholders where the number was 15 or less; and (2) exceeds by more than four the number of directors last elected by shareholders where the number was 16 or more, but in no event shall the number of directors exceed 25.

Section 4. Quorum.

A majority of the director positions on the board shall constitute a quorum at any meeting, except when otherwise provided by law, or the bylaws, provided that a quorum may not be reduced to below one-third of the number of director positions, but at a lesser number may adjourn any meeting, from time to time, and the meeting may be held, as adjourned, without further notice. If the number of directors is reduced below the number that would constitute a quorum, no business may be transacted, except selecting directors to fill vacancies in conformance with Section 2.17.

If a quorum is present, the board of directors may take action through the vote of a majority of the directors who are in attendance.

Section 5. Compensation .

By resolution of the Board of Directors, the Directors may be paid their expenses, if any, of attendance at each meeting of the Board of Directors, and may be paid a fixed sum for attendance at each meeting of the Board of Directors or a stated salary as Director. No such payment shall preclude any Director from serving the association in any other capacity and receiving compensation therefor. Members of any committee appointed by the Board of Directors may be allowed like compensation for attending committee meetings.

Section 6. General Powers.

The business and affairs of the association shall be managed and conducted and all corporate powers shall be exercised by its Board of Directors, which may exercise all such powers of the association and do all such lawful acts and things as are not by statute or by the certificate of incorporation or by these bylaws directed or required to be exercised and done by the shareholders. The Board of Directors shall elect all officers of the association and may impose upon them such additional duties and give them such additional powers not defined in these bylaws, and not inconsistent herewith, as they may determine.

Section 7. Advisory Directors.

The Board of Directors may, by resolution adopted by a majority of the entire Board, appoint one or more advisory directors who shall have no vote or authority to act and who shall provide only general policy advice to the Board. Advisory directors shall have no voting rights and shall not be counted or included as a director for quorum or any other purposes and shall not be required to own qualifying shares.

Section 8. Nomination of Directors.

Nominations for election to the Board of Directors may be made by the Board of Directors or by any stockholder of any outstanding class of capital stock of the Association entitled to vote for election of directors. Nominations other than those made by or on behalf of the existing management shall be made in writing and be delivered or mailed to the President of the Association and to the Comptroller of the Currency, Washington, D.C., not less than 14 days nor more than 50 days prior to any meeting of shareholders called for the election of directors; provided, however, that if less than 21 days notice of the meeting is given to shareholders, such nominations shall be mailed or delivered to the President of the Association and to the Comptroller of the Currency not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification shall contain the following information to the extent known to the notifying shareholder:

(1) The name and address of each proposed nominee,

(2) The principal occupation of each proposed nominee,

(3) The total number of shares of capital stock of the Association that will be voted for each proposed nominee,

(4) The name and residence address of the notifying shareholder, and

(5) The number of shares of capital stock of the Association owned by the notifying shareholder.

Nominations not made in accordance herewith may, in his/her discretion, be disregarded by the chairperson of the meeting, and in determining the vote tellers may upon directions by the chairperson disregard all votes cast for each such nominee. No bylaw may unreasonably restrict the nomination of directors by shareholders.

ARTICLE IV

Meetings of the Board of Directors

Section 1. Regular Meetings.

A regular meeting of the Board of Directors shall be held without notice, at 12:00 noon on the last Tuesday of each month at the main office of the association unless the Board shall designate another date and/or place. The Board of Directors may provide, by resolution, the time and place, either within or without the State of Oklahoma, for the holding of additional regular meetings without other notice than such resolution.

Section 2. Special Meetings.

Special meetings of the Board of Directors may be called by or at the request of the Chairman of the Board, the President or any three Directors. The person or persons authorized to call special meetings of the Board of Directors may fix any place, either within or without the State of Oklahoma, as the place for holding any special meeting of the Board of Directors called by them. Meetings may be held at any time and any place without notice, if all the Directors are present or if those not present waive notice of the meeting in writing.

Section 3. Notice.

Notice of any special meeting shall be given at least three days prior thereto by written notice delivered personally or mailed to each Director at his business address, or by telegram, telecopy or telex. If mailed, such notice shall be deemed to be delivered when deposited in the United States mail so addressed, with postage prepaid thereon. If notice be given by telegram, such notice shall be deemed to be delivered when the telegram is delivered to the telegraph company. Any Director may, in writing, waive notice of any meeting, either before or after such meeting. The attendance of a Director at a meeting shall constitute a waiver of notice of such meeting, except where a Director attends a meeting for the express purpose of objecting to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special meeting of the Board of Directors need be specified in the notice or waiver of notice of such meeting, except as required by statute or specifically provided for herein.

Section 4. Quorum.

In all meetings of the Board of Directors a majority of the director positions on the Board shall be necessary to constitute a quorum for the transaction of business, unless otherwise provided by law, by the Articles of Association or by these bylaws. The act of the majority of the Directors present at a meeting at which a quorum is present shall be the act of the Board of Directors, unless the act of a greater number is expressly required by statute, the certificate of incorporation or by these bylaws. If a quorum shall not be present at any meeting of Directors, the Directors present thereat may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present.

Section 5. Special Meetings By Conference Telephone.

Members of the Board of Directors may participate in special meetings through use of conference telephone or similar communications equipment so long as all members participating in such meetings can hear one another.

ARTICLE V

Committees of the Board

Section 1. Executive Committee.

The Board may appoint from among its members an Executive Committee of such number as the Board shall deem proper. The Chairman of the Board shall be a member ex officio, but all other members shall serve during the pleasure of the Board. The Executive Committee shall have and may exercise, so far as may be permitted by law, all the authority and all the powers of the Board during intervals between meetings thereof. The Executive Committee shall keep minutes of its meetings and such minutes shall be submitted at the next regular meeting of the Board at which a quorum is present, at which time any action taken by the Board with respect thereto shall be entered in the minutes of the Board. All acts done and powers conferred by the Executive Committee from time to time shall be deemed to be, and may be certified as being done or conferred, under the authority of the Board.

The Executive Committee may determine at any time in its discretion to hold regular meetings, in which event such meetings shall be held at the time, place, and date so designated, without any notice thereof required to be given to its members. Notice of any meetings of the Executive Committee other than regular meetings shall be given to its members in a manner deemed most likely to provide them actual notice thereof, as far in advance of the time of the meeting as practicable. A majority of all members of the Executive Committee, at least two of whom shall be non-ex officio members, shall constitute a quorum for all purposes.

The Executive Committee may adopt its own rules of procedure.

Section 2. Audit Committee.

The Board shall appoint an Audit Committee, consisting of not less than three members other than active officers of the association. The Audit Committee shall, at least once every twelve months, examine the affairs of the Association, count its cash, compare its assets and liabilities with the accounts of the general ledger, and ascertain whether the accounts are correctly kept and the condition of the association corresponds therewith.

All audits and examinations described in this section may be performed by the members of the Audit Committee directly or through certified public accountants selected by the Audit Committee for such purpose and responsible solely to the Audit Committee and the Board for the results of their audits and examinations. The expenses of audits and examinations made by persons other than the Audit Committee shall be paid by the Association. The Audit Committee shall report the results of all audits and examinations in writing to the Board at its next regular meeting thereafter, and shall recommend to the Board such changes in the manner of doing business as shall seem desirable on the basis thereof. [Such report and all actions taken thereon shall be noted in the minutes of the Board.] [Note: all bracketed material is the procedure for trust examinations required by 12 C.F.R. §9.9.]

Section 3. Credit and Investment Committee.

The Board shall appoint a Credit & Investment Committee. At least three members of the Credit & Investment Committee shall be persons other than active officers of the Association. The Credit & Investment Committee shall (i) review, supervise, and recommend action to the Board in procedures for, the lending activities of the Association, (ii) review, supervise, and recommend action to the Board for, the investment activities of the Association, and (iii) review, supervise and recommend action respecting assets, asset quality, loan reviews, and regulatory examinations. The Credit and Investment Committee shall, subject to approval by the Board, adopt a charter detailing the authority, duties, memberships, quorum, and meeting schedules of the Committee. The Credit & Investment Committee shall keep minutes of its meetings, and such minutes shall be submitted at the next regular meeting of the Board at which a quorum is present, at which time any action taken by the Board with respect thereto shall be entered in the minutes of the Board.

Section 4. CRA Committee

The Board shall appoint a CRA Committee. At least three members of the CRA Committee shall be persons other than active officers of the Association. The CRA Committee shall review, supervise, and recommend action to the Board regarding the performance by the Association of its obligations under the Community Reinvestment Act. The CRA Committee shall, subject to approval by the Board, adopt a charter detailing the authority, duties, memberships, quorum, and meeting schedules of the Committee. The CRA Committee shall keep minutes of its meetings, and such minutes shall be submitted at the next regular meeting of the Board at which a quorum is present, at which time any action taken by the Board with respect thereto shall be entered in the minutes of the Board.

Section 5. Other Committees.

The Board of Directors may appoint, from time to time, from its own members, other committees of one or more persons, for such purposes and with such powers as the Board may determine. The Chairman of the Board may appoint non-director officers to such committees for the purpose of counseling with and providing information to the committee, and may remove such members at any time at his pleasure. Non-director members so appointed may be voting members of such committees, but all official actions of such committees must be approved by a majority of their director members. Meetings of such committees may be held in the absence of non- director members whenever the director members so choose. All such committees shall keep minutes of its meetings and such minutes shall be submitted at the next regular meeting of the Board at which a quorum is present, at which time any action of the Board with respect thereto shall be entered in the minutes of the Board.

Section 6. Committee Meeting by Conference Telephone.

Members of each Committee (other than the Audit Committee) may participate in meetings of those committees through use of conference telephone or similar communications equipment, so long as all members participating in such meeting can hear one another.

ARTICLE VI

Officers

Section 1. Number.

The officers of the association shall be a Chairman of the Board, a President and Chief Executive Officer, a President - Oklahoma City, a Secretary and a Treasurer, each of whom shall be elected by the Board of Directors. The Board of Directors may elect or appoint one or more Vice Presidents, and any other officers, assistant officers, managers and assistant managers of branches and agents as it shall deem necessary or desirable, who shall hold their offices for such terms as shall be determined from time to time by the Board, and shall have such authority and perform such duties as shall be determined from time to time by the Board, the Chairman of the Board or a President. Any two or more corporate offices, except those of President and Vice President, or President and Secretary, may be held by the same person; but no officer shall execute, acknowledge or verify any instrument in more than one capacity if such instrument be required by law or by these bylaws to be executed, acknowledged or verified by any two or more officers.

Section 2. Election and Term of Office.

The officers of the association to be elected by the Board of Directors shall be elected annually by the Board of Directors at the first meeting of the Board of Directors held after each annual meeting of the shareholders. If the election of officers shall not be held at such meeting, such election shall be held as soon thereafter as conveniently may be. Additional officers and assistant officers may be elected or appointed by the Board of Directors during the year. Each officer shall hold office for the current year for which the board was elected and until his successor shall have been duly elected and shall have qualified, or until his death or until he shall resign or shall have been removed in the manner hereinafter provided. Any vacancy occurring in the office of president shall be filled promptly by the Board of Directors.

Section 3. Qualification.

To be qualified to take office, an officer shall be legally competent to enter into contracts. Officers need not be residents of Oklahoma or of the United States. Officers need not be shareholders of the association, and only the Chairman of the Board, the President - Tulsa Regional Office and the President - Oklahoma City Regional Office need be a Director of this association.

Section 4. Removal.

Any officer or agent elected or appointed by the Board of Directors may be removed at any time by the Board of Directors whenever in its judgment the best interests of the association would be served thereby.

Section 5. Vacancies.

A vacancy in any office because of death, resignation, removal, disqualification or otherwise, may be filled by the Board of Directors for the unexpired portion of the term.

Section 6. Compensation .

The compensation of all officers, assistant officers and agents of the association shall be fixed by the Board of Directors.

Section 7. Chairman of the Board.

The Board of Directors shall from its members appoint a Chairman of the Board. The Chairman of the Board of Directors shall, when present, preside at all meetings of the stockholders and Board of Directors, either annual or special. He shall be an ex officio member of any committee of Directors. He shall assist the Board of Directors in the formulation of policies to be pursued by the executive management of the association. He may sign with the Secretary or any other proper officer of the association, thereunto authorized by the Board of Directors, and deliver on behalf of the association any deeds, mortgages, bonds, contracts, powers of attorney, or other instruments which the Board of Directors have authorized to be executed, except in cases where the signing and execution thereof shall be expressly delegated by the Board of Directors or by these Bylaws to some other officer or agent of the association or shall be required by law to be otherwise signed or executed. He shall perform all such other duties as are incident to his office or are properly required of him by the Board of Directors.

Section 8. President.

The President-Tulsa Regional Office shall be the President of the Association and also the chief operating officer of the Association. The President shall be the chief administrative officer of the Association. He shall, when present, and in the absence of the Chairman of the Board preside at all meetings of the Board of Directors and stockholders. He shall be ex officio a member of any committee of Directors. He shall have general and active management of the business of the association, and shall see that all orders and resolutions of the Board of Directors are carried into effect. He shall have the power to execute bonds, mortgages and other contracts requiring a seal, under the seal of the association, except where required by law to be otherwise signed and executed and except where the signing and execution thereof shall be expressly delegated by the Board of Directors to some other officer or agent of the association. He shall vote any stock which may stand in the name of the association on the books of any other company. He shall have power to superintend any officers or heads of departments and to dismiss any of the subordinate employees when he shall deem proper. He shall perform such other duties and exercise such other powers as are provided in these bylaws and, in addition thereto, as are incident to his office or are properly required of him by the Board of Directors.

In the absence of the Chairman of the Board or in the event of his inability or refusal to act, the President shall perform the duties of the Chairman of the Board, and when so acting shall have all the powers of and be subject to all the restrictions upon the Chairman of the Board.

In the absence of the President, or in the event of his death, or inability or refusal to act, the President – Oklahoma City Regional Office shall perform the duties of the President, and when so acting, shall have all the power of and be subject to all the restrictions upon the President.

Section 9. President – Tulsa Regional Office.

The Board of Directors shall appoint from its members a President-Tulsa Regional Office who shall also be the chief operating officer of the Tulsa Regional Office. The President-Tulsa Regional Office shall be the chief administrative officer of the association in the area designated by the Board as covered by the Tulsa Regional Office. He shall have general and active management of the business of the Tulsa Regional Office, and shall see that all orders and resolutions of the Board of Directors with respect to such office are carried into effect. He shall have power to superintend any officers or heads of departments of the Tulsa Regional Office and to dismiss any of the subordinate employees of such office when he shall deem proper. He shall perform such other duties and exercise such other powers as are provided in these bylaws and, in addition thereto, as are incident to his office or are properly required of him by the Board of Directors.

Section 10. President – Oklahoma City Regional Office.

The Board of Directors shall appoint from its members a President-Oklahoma City Regional Office who shall also be the chief operating officer of the Oklahoma City Regional Office. The President-Oklahoma City Regional Office shall be the chief administrative officer of the association in the area designated by the Board as covered by the Oklahoma City Regional Office. He shall have general and active management of the business of the Oklahoma City Regional Office, and shall see that all matters with respect to such office are carried into effect as requested by the chief executive officer and chief operating officer of the Association. He shall perform such other duties and exercise such other powers as are provided in these bylaws and, in addition thereto, as are incident to his office or are properly assigned to him by the Board of Directors, the chief executive officer or the chief operating officer of the Association.

Section 11. Vice Presidents.

The Board may appoint one or more Vice Presidents, one or more of whom may be Executive or Senior Vice Presidents. In the absence of the President of both Regional Offices, or in the event of their deaths, or inability or refusal to act, the Vice President (or in the event there be more than one Vice President, the Vice Presidents in the order designated at the time of their election or in the absence of any designation, then in the order of their election) shall perform the duties of the President, and when so acting, shall have all the powers of and be subject to all the restrictions upon the President. Any Vice President may sign, with the Secretary or an Assistant Secretary, certificates for shares of the association, and shall perform such other duties as from time to time may be assigned to him by the President or by the Board of Directors. Each Vice-President shall perform such other duties and exercise such other powers as are properly assigned to him by the Board of Directors or the President of the Association.

Section 12. The Secretary .

The Secretary shall: (a) Keep the minutes of the shareholders’ meetings and of the Board of Directors’ meetings in one or more books provided for that purpose; (b) see that all notices are duly given in accordance with the provisions of these bylaws and as required by law; (c) be custodian of the corporate records and of the seal of the association and see that the seal of the association is affixed to all documents, the execution of which on behalf of the association under its seal is duly authorized; (d) keep a register of the post office address of each shareholder; (e) sign, with the President or a Vice-President, certificates for shares of the association, the allotment of which shall have been authorized by resolution of the Board of Directors; (f) have general charge of the stock transfer books of the association; (g) in general, perform all duties incident to the office of Secretary and such other duties as from time to time may be assigned to him by the President or by the Board of Directors.

Section 13. The Treasurer.

If required by the Board of Directors, the Treasurer shall give a bond for the faithful discharge of his duties in such sum and with such surety or sureties as the Board of Directors shall determine. He shall: (a) have charge and custody of and be responsible for all funds and securities of the association, receive and give receipts for moneys due and payable to the association from any source whatsoever, and deposit all such moneys in the name of the association in such banks, trust companies or other depositories as shall be selected; and (b) in general, perform all the duties as from time to time may be assigned to him by the President or by the Board of Directors.