0000089089DEF 14AFALSE00000890892023-01-012023-12-31iso4217:USD00000890892022-01-012022-12-3100000890892021-01-012021-12-3100000890892020-01-012020-12-310000089089ecd:PeoMembersci:PensionAndEquityValuesReportedInSCTMember2023-01-012023-12-310000089089ecd:PeoMembersci:PensionAndEquityValuesReportedInSCTMember2022-01-012022-12-310000089089ecd:PeoMembersci:PensionAndEquityValuesReportedInSCTMember2021-01-012021-12-310000089089ecd:PeoMembersci:PensionAndEquityValuesReportedInSCTMember2020-01-012020-12-310000089089ecd:PeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2023-01-012023-12-310000089089ecd:PeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2022-01-012022-12-310000089089ecd:PeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2021-01-012021-12-310000089089ecd:PeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2020-01-012020-12-310000089089ecd:PeoMembersci:DividendsPaidOnUnvestedRestrictedShareAwardsMember2023-01-012023-12-310000089089ecd:PeoMembersci:DividendsPaidOnUnvestedRestrictedShareAwardsMember2022-01-012022-12-310000089089ecd:PeoMembersci:DividendsPaidOnUnvestedRestrictedShareAwardsMember2021-01-012021-12-310000089089ecd:PeoMembersci:DividendsPaidOnUnvestedRestrictedShareAwardsMember2020-01-012020-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:PeoMember2023-01-012023-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:PeoMember2022-01-012022-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:PeoMember2021-01-012021-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:PeoMember2020-01-012020-12-310000089089ecd:PeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2023-01-012023-12-310000089089ecd:PeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2022-01-012022-12-310000089089ecd:PeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2021-01-012021-12-310000089089ecd:PeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2020-01-012020-12-310000089089ecd:NonPeoNeoMembersci:PensionAndEquityValuesReportedInSCTMember2023-01-012023-12-310000089089ecd:NonPeoNeoMembersci:PensionAndEquityValuesReportedInSCTMember2022-01-012022-12-310000089089ecd:NonPeoNeoMembersci:PensionAndEquityValuesReportedInSCTMember2021-01-012021-12-310000089089ecd:NonPeoNeoMembersci:PensionAndEquityValuesReportedInSCTMember2020-01-012020-12-310000089089ecd:NonPeoNeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2023-01-012023-12-310000089089ecd:NonPeoNeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2022-01-012022-12-310000089089ecd:NonPeoNeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2021-01-012021-12-310000089089ecd:NonPeoNeoMembersci:FairValueOfEquityCompensationGrantedInCurrentYearValueAtYearEndMember2020-01-012020-12-310000089089sci:DividendsPaidOnUnvestedRestrictedShareAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000089089sci:DividendsPaidOnUnvestedRestrictedShareAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000089089sci:DividendsPaidOnUnvestedRestrictedShareAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000089089sci:DividendsPaidOnUnvestedRestrictedShareAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000089089sci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatWereUnvestedAtEndOfCurrentFiscalYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000089089ecd:NonPeoNeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2023-01-012023-12-310000089089ecd:NonPeoNeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2022-01-012022-12-310000089089ecd:NonPeoNeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2021-01-012021-12-310000089089ecd:NonPeoNeoMembersci:ChangeInTheFairValueOfAwardsMadeInPriorFiscalYearsThatVestedDuringCurrentFiscalYearMember2020-01-012020-12-31000008908912023-01-012023-12-31000008908922023-01-012023-12-31000008908932023-01-012023-12-31000008908942023-01-012023-12-31000008908952023-01-012023-12-31000008908962023-01-012023-12-31000008908972023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Under Rule 14a-12 |

Service Corporation International

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| ☑ | | No fee required. |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| | | |

| | | |

| | | |

| | | |

This page is intentionally left blank.

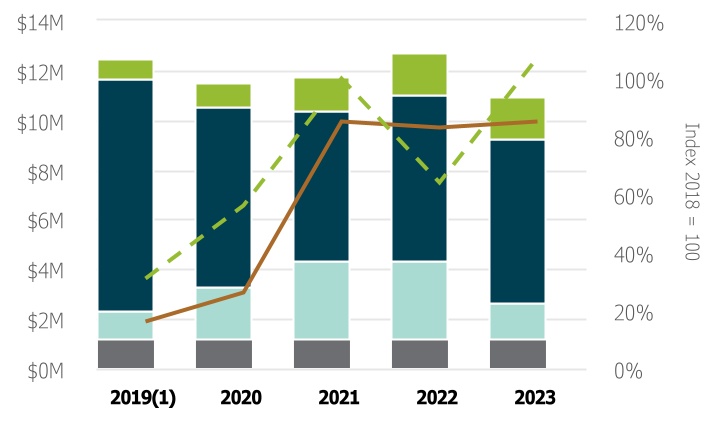

2023: Delivering Shareholder Value

OPERATIONAL HIGHLIGHTS

Revenue (in millions)

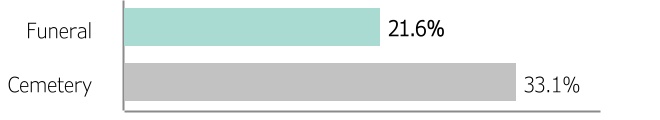

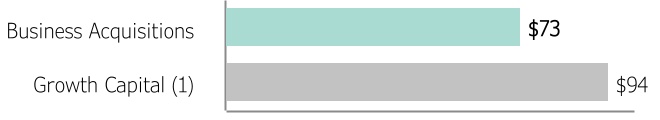

Gross Profit %

Preneed Sales Production (in millions)

INVESTED CAPITAL AND LIQUIDITY

Growth Investments (in millions)

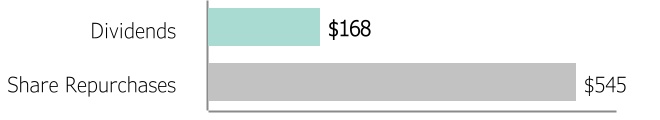

Value Returned to Shareholders (in millions)

Total Liquidity (in millions)

(1)Growth capital includes growth capital expenditures/construction of new facilities and real estate acquisitions

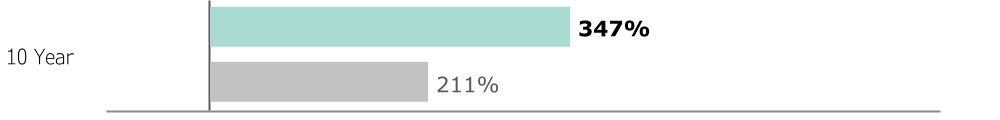

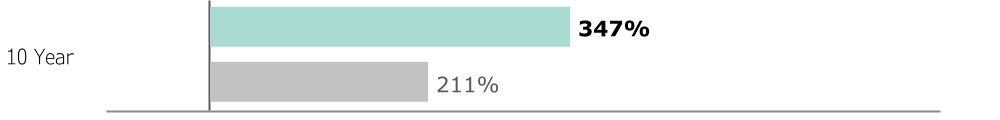

TOTAL SHAREHOLDER RETURN (TSR) COMPARED TO S&P 500(2)

| | |

10-Year Total Shareholder Return +347% 2013-2023 |

(2)As of December 31, 2023 and includes the reinvestment of dividends | Source: S&P Capital IQ

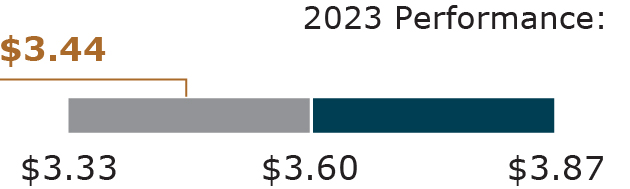

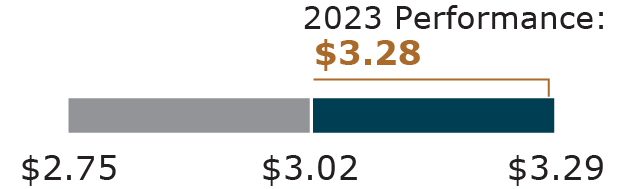

PERFORMANCE MEASURES

Operating Cash Flow (OPCF) (in millions)

GAAP - Generally Accepted Accounting Principles in the United States

Adjusted Earnings Per Share and Adjusted Operating Cash Flow are non-GAAP financial measures. Please see Annex A in this Proxy Statement for disclosures and reconciliations to the appropriate GAAP measure.

| | | | | | | | |

| | |

| | |

| | Tom Ryan's Letter to Shareholders |

| | |

| | |

| | |

Dear Shareholders,

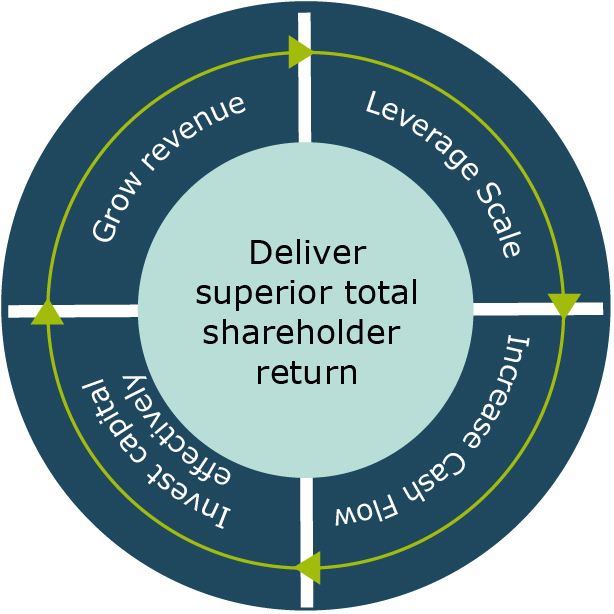

As we look forward to the 2024 Annual Meeting and reflect back on fiscal year 2023, we are excited to continue to build on the lessons learned and new technology deployed during the pandemic, while focusing on our long-term strategy to grow revenue, leverage scale, and allocate capital for optimal returns. In 2023, we followed this strategy and delivered strong financial performance, while maintaining high customer satisfaction scores.

Financial Performance

For the full year, we reported adjusted earnings per share of $3.47, which represents 16% growth on a compounded annual basis since a pre-pandemic 2019 despite navigating a higher interest rate environment. Notably, the number of comparable funeral services performed and the comparable cemetery preneed sales production grew at a compounded annual growth rate of 3% and 10%, respectively, over a pre-pandemic 2019. These operating achievements combined with lower cash taxes enabled us to grow adjusted operating cash flow to $882 million.

These positive results allowed us to continue to invest capital back into our existing businesses through the development of contemporary, high quality cemetery inventory for both the burial and cremation consumer. We also continued to facilitate organic growth with investments into remodeled, refreshed, and modernized facilities. Additionally, we invested $167 million on acquisitions and new construction in high growth markets. Finally, we returned $713 million of capital to you through dividends, and when it made fiscal sense, we repurchased shares. We have maintained a disciplined approach to our balance sheet, debt maturity profile, and liquidity to provide the financial flexibility needed to capitalize on opportunities when presented and to invest capital with the highest relative return. Our strategy has rewarded you, our shareholders, with total shareholder returns over the last 10 years of nearly 350%, significantly outperforming the return of the S&P 500 as well as other market indices.

Customer and Associate Priority

In 2024, we will continue to focus on organic revenue growth generated by exceptional customer quality and value through uplifting experiences and personalization as well as a more unique and differentiated cremation experience. As the largest provider of funeral and cemetery services in North America, we are able to leverage our unparalleled scale to drive efficiency and sustained cost savings through investment in digital technologies that offer our client families a more convenient, streamlined and effective buying experience and our associates a more efficient and satisfying service experience. In addition, the scale of our approximately $15 billion preneed backlog allows us to grow future revenue in a stable and efficient manner.

Our success would not be possible without the 25,000 associates that make SCI the great company it is. Their commitment to the families and communities we serve is what sets us apart and helps drive our company’s culture. We are committed to providing a supportive environment in which our associates can thrive through competitive wages, a robust benefits package, career advancement opportunities, and training and development tools.

Conclusion

As a people-oriented business, we will continue to prioritize our client families, associates and communities, utilize our resources responsibly, and maintain our high governance standards all while enhancing shareholder value.

Thank you for your continued support of SCI. As we embark on this exciting journey ahead, I am confident that together, we will make the most of every opportunity to elevate our Company's performance and deliver sustained growth, enriching the value we provide to our shareholders.

| | | | | | | | |

| | "Our strategy has rewarded you, our shareholders, with total shareholder returns over the last 10 years of nearly 350%, significantly outperforming the return of the S&P 500 as well as other market indices." |

2 Service Corporation International

| | | | | | | | |

| | |

| | |

| | Message From Our Board of Directors |

| | |

| | |

| | |

We invite you, our shareholders, to the Service Corporation International 2024 Annual Shareholder Meeting on Tuesday, May 7, 2024 at 9:00 a.m. Central Time, at the Company's Headquarters in Houston, TX.

Shareholders and other interested parties may communicate with any of the independent Directors, including Committee Chairs and the Lead Independent Director, by using the following address:

Service Corporation International

Lead Independent Director c/o Office of Corporate Secretary

1929 Allen Parkway

Houston, TX 77019

Email: leaddirector@sci-us.com

Thank you for the trust you place in us and for your continued investment in Service Corporation International.

Sincerely,

| | | | | | | | | | | |

| | | |

Marcus A. Watts Lead Independent Director | Thomas L. Ryan Chairman and CEO | Alan R. Buckwalter, III | Anthony L. Coelho |

| | | |

| | | |

| Jakki L. Haussler | Victor L. Lund | Ellen Ochoa | C. Park Shaper |

| | | |

| | | |

| Sara Martinez Tucker | W. Blair Waltrip | | |

| | | | | | | | |

| | |

| | |

| | 2024 Annual Meeting of Shareholders |

| | |

| | |

| | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| DATE AND TIME: | PLACE: | RECORD DATE: |

Tuesday, May 7, 2024 at 9:00 a.m. Central Time | Service Corporation International

Conference Center, Heritage I & II

1929 Allen Parkway Houston, Texas 77019 | March 11, 2024 |

| | | | | |

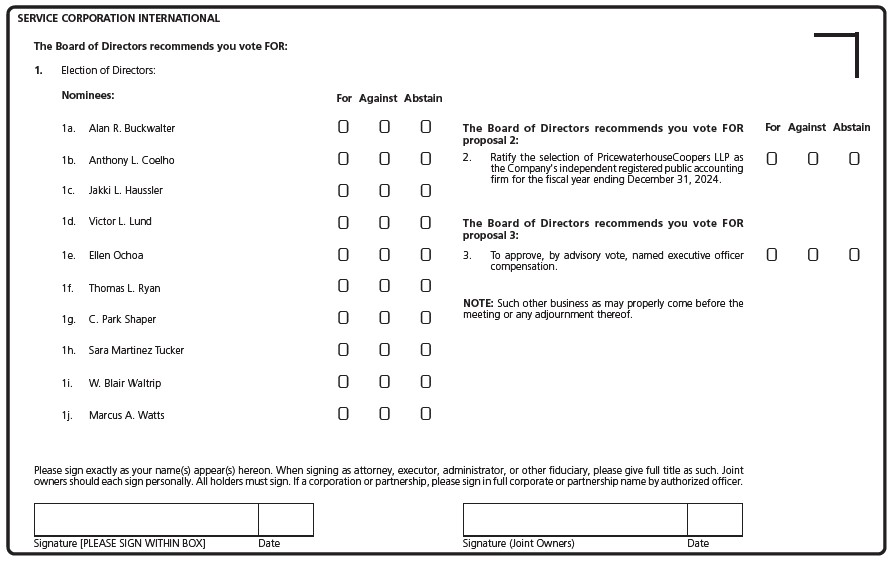

Voting Matters

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| PROPOSAL 1 | | PROPOSAL 2 | | PROPOSAL 3 | | |

| | | | | | | | | | |

| | | | | | | | | | |

Election of 10 Directors | | Ratify the Selection of Pricewaterhouse Coopers LLP, Our Independent Registered Public Accounting Firm | | "Say-on-Pay" Advisory Vote to Approve Named Executive Officer Compensation | | |

| | | | | | | | | | |

| FOR EACH DIRECTOR NOMINEE | | | FOR | | | FOR | | | |

| | | | | | | | | | |

How to Vote

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| BY INTERNET | BY TELEPHONE | BY MAIL | IN PERSON |

Vote your shares at www.proxyvote.com. | Call toll-free number 1-800-690-6903. | Sign, date, and return the enclosed proxy card or voting instruction form. | To attend the meeting in person, you will need proof of your share ownership and valid picture I.D. |

| | | | | | | |

Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number.

| | |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL SHAREHOLDERS MEETING TO BE HELD MAY 7, 2024: For 2024, there is an annual meeting website to provide easy access to our annual meeting materials. At the annual meeting website, you can find an overview of the items for voting, our Proxy Statement and annual report for viewing online or for downloading, and a link to vote your shares. This Proxy Statement, the Notice of Annual Meeting of Shareholders, and the enclosed proxy card are first mailed to shareholders beginning on or about March 27, 2024 and are available at the annual meeting website at: www.sciannualmeeting.com. |

|

4 Service Corporation International

This summary highlights information contained in this Proxy Statement. This summary does not contain all of the information you should consider. Please read this entire Proxy Statement carefully before voting.

| | | | | | | | | | | |

| | | |

| | | |

| PROPOSAL 1 | The Board of Directors recommends that Shareholders vote “FOR” each of the following nominees: |

| | |

| | |

| | |

Director Nominees

| | | | | | | | | | | | | | | | | | |

Name Occupation | Independent | | Director Since | Age | Other Public Boards(1) | Board Committee Composition |

| | | | | | |

| | | | | | |

| | | | | | |

Alan R. Buckwalter Former Chairman and CEO, Chase Bank of Texas | YES | | 2003 | 77 | None | |

Anthony L. Coelho Former Majority Whip of the U. S. House of Representatives Independent business and political consultant | YES | | 1991 | 81 | 3 | |

| | | | | | |

Jakki L. Haussler Founder and Chairwoman of the Board and former CEO, Opus Capital Management | YES | | 2018 | 66 | 3 | |

Victor L. Lund Former CEO and Executive Chairman of the Board, Teradata Corporation | YES | | 2000 | 76 | None | |

| | | | | | |

Ellen Ochoa Former Director, NASA Johnson Space Center Independent Director and Speaker | YES | | 2015 | 65 | None | |

Thomas L. Ryan Chairman and CEO, Service Corporation International | NO | | 2004 | 58 | None | |

C. Park Shaper CEO of Seis Holdings LLC, a private investment holding company | YES | | 2022 | 55 | 2 | |

Sara Martinez Tucker Former CEO, National Math + Science Initiative, a non-profit organization to improve student performance in STEM subjects | YES | | 2018 | 68 | 1 | |

W. Blair Waltrip Independent consultant, family and trust investments, and former Senior Executive of the Company | NO | | 1986 | 69 | None | |

Marcus A. Watts, Lead Independent Director President, The Friedkin Group, an umbrella company overseeing various business interests that include a variety of branded automotive, hospitality, and entertainment companies | YES | | 2012 | 65 | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Audit Committee | | Executive Committee | | Nominating & Corporate Governance Committee |

| Compensation Committee | | Investment Committee | | Member | | Chair |

| | |

| | |

(1)See Director profiles beginning on page 16, which include other public boards for each Director. 6 Service Corporation International

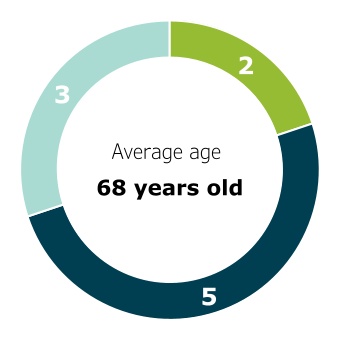

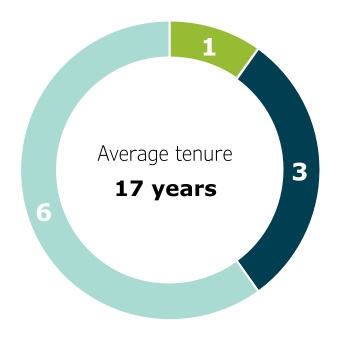

Director Snapshot

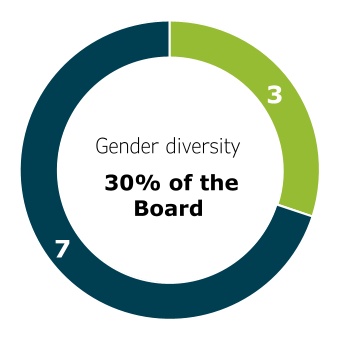

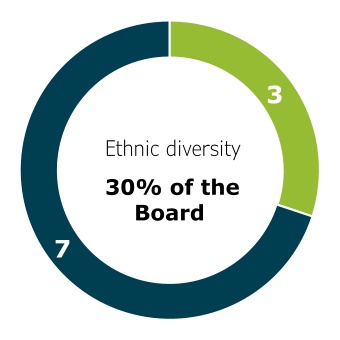

We have added three new Directors since 2018, which has decreased our Board's average age and tenure by two and seven years, respectively. We added a new Director in 2022, appointed a new Lead Director in 2023 and replaced the Chairs of the Audit Committee and Investment Committee in 2023. Of our current Board members, 30% of Directors are ethnically diverse women.

DIRECTOR AGE

| | | | | |

| n | 2 - 50 to 60 years |

| n | 5 - 61 to 70 years |

| n | 3 - 71 and over |

DIRECTOR TENURE

| | | | | |

| n | 1 - 0 to 5 years |

| n | 3 - 6 to 10 years |

| n | 6 - 10 years or more |

ETHNICITY

| | | | | |

| n | 3 - Minority |

| n | 7 - Non-Minority |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

DIRECTOR INDEPENDENCE | | | DIRECTOR NOMINEES EXHIBIT | | | HIGHLY ENGAGED AND ACTIVE BOARD |

| | | | | | |

| | | | | | |

•8 out of 10 Directors are independent •9 out of 10 Directors are non-management •Audit, Compensation, and Nominating and Corporate Governance Committees of SCI are composed entirely of Independent Directors •In 2023, Marcus Watts was named to serve as the Lead Independent Director (see page 31 for list of key duties and responsibilities of Lead Independent Director) | | | •Personal qualities such as self-awareness, respect, integrity, independence, and capacity to function effectively in challenging environments •Experience in various executive/senior leadership roles and proven records of success •Corporate governance knowledge and practices •Appreciation for diversity of people and perspectives •Objectivity and sound judgment | | | •Actively involved with overseeing Company's execution of its strategy and risk management •96% combined meeting attendance record for Board and Board committee meetings in 2023 •8 Board meetings in 2023 •18 committee meetings in 2023 |

| | | | | | |

Our Director nominees possess a diverse mix of backgrounds, experience, and expertise (see page 27 for further information on the skills below): | | | | | | | | | | | | | | | | | |

| FINANCIAL | | MARKETING/BRAND

MANAGEMENT | | GOVERNMENT/

REGULATORY |

| | | | | | | | | | | | | | | | | |

| REAL ESTATE/BUSINESS DEVELOPMENT/M&A | | HUMAN CAPITAL

MANAGEMENT | | RISK MANAGEMENT |

| | | | | | | | | | | | | | | | | |

| INVESTMENTS/FINANCIAL

SERVICES | | TECHNOLOGY OR E-COMMERCE | | INDUSTRY |

Corporate Governance Highlights

Shareholder and Proxy Advisor Outreach

We have a long-standing history of an active shareholder outreach and engagement program. The Board and management continue to place a high priority on listening to and considering the views of our shareholders. Engaging with our shareholders is fundamental to our commitment to good governance practices and has resulted in changes and enhancements to our governance and disclosures over time. Throughout the year, we seek opportunities to connect with our investors to gain and share valuable insights. We also have a formal process of outreach to our top shareholders prior to our annual meeting to solicit feedback on our corporate governance practices, executive compensation programs, environmental and social goals, as well as our long-term business strategy and other issues specific to our industry. In addition, certain of our directors have participated in direct shareholder engagement when requested and deemed appropriate. The results of these conversations are summarized and discussed with both the Board and our management.

| | | | | |

In early 2023, we engaged with shareholders representing approximately 57% of the Company’s common stock prior to our Annual Shareholder Meeting. We have made several governance changes over the years taking into account the feedback and discussions we have with our investors, including adopting proxy access bylaw provisions (see page 37 for further information) in 2023. Through our ongoing shareholder outreach efforts, we better understand the viewpoints of our shareholders as well as gain opportunities to communicate how our decisions align with our strategic goals. Investors continued to indicate support for our overall executive compensation program and viewed it as well-structured and aligned with performance. In response to comments received in prior years, we removed the single-trigger vesting upon change in control for equity awards beginning in 2022. Investors also applauded the change in committee leadership to enhance fresh perspectives as we continue on our journey of Board refreshment. | |

We engaged in 2023 with shareholders representing approximately 57% of the Company's common stock as part of our Proxy Outreach |

|

| |

Investor sentiment is very positive with respect to our enhanced environmental, social, and governance (ESG) disclosures included in our Sustainability Report that is published annually. Most Board meetings involved a discussion on human capital management, diversity and inclusion efforts, and environmental programs. Overall, shareholders are supportive of our focus on our employees and communities we serve and are also appreciative of our enhanced disclosures and metrics around our climate impact.

Please see our 2023 Sustainability Report published in March 2024, which is available on our website at https://investors.sci-corp.com. Using Sustainability Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD), and Task Force on Nature-related Disclosures (TFND) frameworks as guides, we are continuously working to ensure we measure what matters to our Company and drives value for all of our Stakeholders.(1)

(1)These reports, policies and disclosures, as well as those discussed elsewhere in this Proxy Statement, are not part of this Proxy Statement, are not "soliciting material," are not deemed filed with the SEC, and are not to be incorporated by reference into any of our filings with the SEC, whether made before or after the date of this proxy statement and irrespective of any general incorporation language therein, unless specifically identified in such filing as being incorporated by reference in such filing. Furthermore, references to our website URLs are intended to be inactive textual references only.

Board Leadership Refreshment

As we continue to listen and respond to investors, we understand the importance of fresh leadership perspectives within our Board of Directors. In 2023, Marcus Watts was named as our new Lead Independent Director and Jakki Haussler and Sara Martinez Tucker were named as Chairs of the Investment and Audit Committees, respectively. With these new leadership changes, three of our four Board committees are chaired by women that possess six to nine years of tenure with SCI. This affords the Board diverse and new perspectives at the leadership level combined with the highly valued experience and tenure throughout the various committees.

Board Field Visit

Board members periodically perform site visits to SCI facilities individually and as a group. In 2023, Board members visited our funeral home and cemetery combination facility, Funeraria del Angel Palm Valley, in South Texas. During the visit, Board members were able to tour the facility and learn about the customers we serve in our Hispana market. The associates, representing a variety of roles, were able to share impactful stories with the Board members, showcasing their passion and commitment to service excellence.

8 Service Corporation International

Adoption of Best Practices and Board Composition Changes

We have a history of thoughtful consideration of shareholder feedback and monitoring corporate governance best practices. The timeline below demonstrates our governance enhancements with respect to Board structure, shareholder rights, and executive compensation. We also remain continually focused on Board composition and committed to evaluating our disclosures to promote transparency.

| | | | | | | | |

| Best Practices | Board Composition |

| | |

| | |

| | |

| •Board recommended and shareholders approved the de-classification of our Board of Directors •Board recommended and shareholders approved elimination and reduction of certain supermajority voting requirements in our Articles of Incorporation and Bylaws •We eliminated the Umbrella Plan within our executive incentive compensation plan due to certain changes in the Tax Cuts and Jobs Act of 2017 | •Added diverse perspectives and experience with the addition of Sara Martinez Tucker and Jakki Haussler to our Board •To facilitate the recruitment of the next generation of Board leaders, R.L. Waltrip decided not to seek re-election after 56 years of meaningful contributions •Long-time member, Dr. Ed Williams, passed away after faithfully serving on the Board for 27 years |

| | |

| | |

| •Enhanced our disclosures around Environmental, Social, and Governance (ESG) •The Board made changes to the Company's Bylaws to permit the Chair of the Nominating and Corporate Governance Committee of the Board to preside over the Board meetings in the absence of the Board Chair and the Lead Director | •After 36 years of outstanding service on the Board of Directors, John Mecom decided to not seek another term as a Board member |

| | |

| | |

| •Updated the charter of the Nominating and Corporate Governance Committee of the Board reflecting its ESG oversight responsibilities •Strengthened the non-financial modifier, or ESG metric, for the Annual Performance Based incentive plan by increasing the online customer satisfaction rating threshold to 4.25 •Modified ROE threshold for the Performance Unit Plan | •Cliff Morris decided to not seek another term as a Board member in 2021 •Ellen Ochoa was nominated as the Compensation Committee Chair in 2021. Alan Buckwalter transitioned off of the Compensation Committee in 2022 |

| | |

| | |

| •Published our first Sustainability report outlining our ESG initiatives and programs, which is available on our website: https://investors.sci-corp.com/ •Removed automatic single-trigger vesting upon change in control effective for equity awards granted in 2022 | •C. Park Shaper was nominated and elected to the Board in 2022 |

| | |

| | |

| •Adopted bylaw changes that provide shareholders proxy access rights (see page 37 for more information) •Adopted a new claw-back policy in 2023 (see page 52 for details) •Revised our existing insider trading policy (see page 52 for details) | •Sara Martinez Tucker and Jakki L. Haussler were named as Audit Committee and Investment Committee Chair, respectively, in 2023 •Marcus A. Watts was named to serve as the Lead Independent Director in 2023 |

| | |

| | | | | |

| |

| Our best practices include: |

•Majority voting standard in Director elections •Annual Board and Committee evaluation process •Board orientation and education program •No shareholder rights plan or “poison pill” •No single trigger vesting upon change in control | •Shareholders' (10%) ability to call special meetings •Anti-hedging and anti-pledging policies applicable to all Directors and Officers •Stock ownership and retention guidelines for Directors and Officers |

| |

Environmental, Social, and Governance (ESG) Overview

The oversight of environmental and social matters, and the governance of these topics, is the responsibility of our Nominating and Corporate Governance Committee (NCGC). Since 2020, the NCGC reviewed matters presented by our ESG Steering Committee, which is a cross-functional committee of Company management, and addressed other related risks through various committee meetings throughout the year. See page 36 for more details about of the Board's oversight of ESG in our Corporate Governance section in this Proxy Statement. For more information on our ESG initiatives and programs, please refer to our Sustainability Report, which is available on our website at https://investors.sci-corp.com. Our Social Matters

The approximately 25,000 associates we employ and the over 600,000 families we serve guide our purpose and core values, making our Company’s social impact our primary focus. Our associates' compassion, positive outlook, and enthusiasm heighten the level of care for the families we serve and propel our Company’s continued success. We strive for a workplace where ideas are welcomed, efforts are recognized, suggestions are put into practice, and innovative programs are deployed.

Since 2017, we have been certified by Great Place to Work®, a global authority on high-trust, high-performance workplace cultures. We continuously focus on improving associate satisfaction and developing innovative programs.

| | | | | | | | | | | | | | | | | |

| | 91% | | 90% | 89% | 89% | |

| | | | | | |

| of associates feel they are treated fairly regardless of their race. | | of associates feel a sense of pride at what we accomplish. | of associates say they are made to feel welcome when they join the Company. | of associates feel their work has special meaning and this is not "just a job." | |

At SCI, we also believe in supporting causes that enhance and promote the well-being of the communities where we do business. Through strategic partnerships with multiple organizations, we make a difference in the communities where our associates and client families live, work, and play.

We believe in the power of inclusion, and we respect our fellow associates’ work, ideas, beliefs, and lifestyles. Through programs such as our inclusive leadership training and Associate Resource Communities (ARCs), colleagues with similar interests connect with others for networking and opportunities for mentorship. Our leadership team is committed to advancing inclusion and diversity within the workplace by embracing the many backgrounds and perspectives that make each of us unique. Our CEO, Thomas L. Ryan, is a member of CEO Action for Diversity & Inclusion™ and we recently added a senior management position to oversee diversity, equity, and inclusion. This role is critical in supporting the Company’s belief that diversity of talent is a key driver of better business outcomes.

Workforce Demographics

We embrace and value the many backgrounds and perspectives that make our workforce diverse, allowing us to remain relevant to the diverse families we serve.

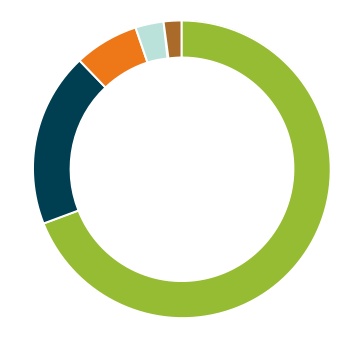

ETHNIC DIVERSITY

MANAGEMENT

| | | | | | | | |

| n | 69% | White |

| n | 19% | Hispanic |

| n | 7% | Black / African American |

| n | 3% | Asian |

| n | 2% | Other Ethnicities |

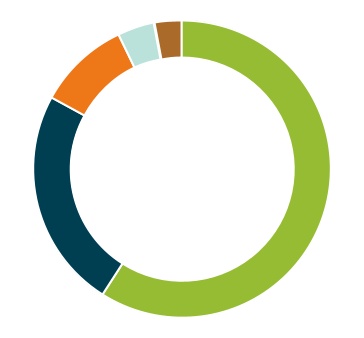

NON-MANAGEMENT

| | | | | | | | |

| n | 58% | White |

| n | 25% | Hispanic |

| n | 10% | Black / African American |

| n | 4% | Asian |

| n | 3% | Other Ethnicities |

TOTAL

| | | | | | | | |

| n | 59% | White |

| n | 24% | Hispanic |

| n | 10% | Black / African American |

| n | 4% | Asian |

| n | 3% | Other Ethnicities |

10 Service Corporation International

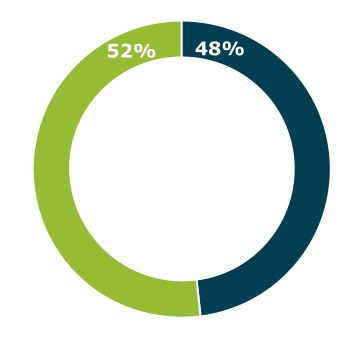

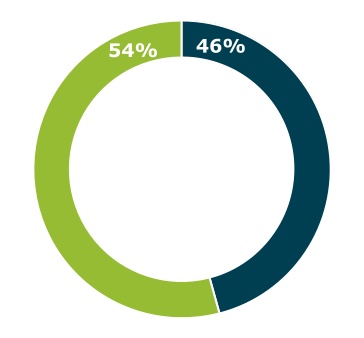

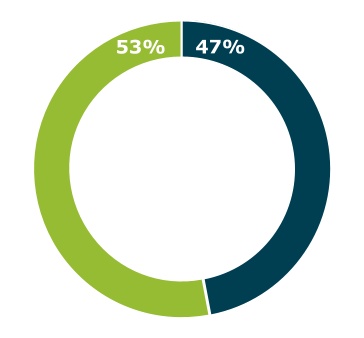

GENDER DIVERSITY

TURNOVER

| | | | | |

| n | Voluntary Turnover |

| n | Involuntary Turnover |

| n | Total Company Turnover |

Our workforce of 25,000 associates includes approximately 18,000 full-time and 7,000 part-time individuals. Due to the seasonality of our business, we appreciate the flexibility of our part-time associates. Of our 25,000 associates, the sales team of approximately 3,800 associates has higher attrition than other roles due to the highly competitive nature of sales positions.

Our Corporate Governance Highlights

| | | | | | | | |

| 3 NEW DIRECTORS | 30% OF CURRENT BOARD MEMBERS | 8 OUT OF 10 DIRECTORS |

Have been added since 2018, which has decreased our Board's tenure by seven years | Are women | Are independent |

| | |

| | |

30% OF CURRENT BOARD MEMBERS | 3 OF OUR COMMITTEE CHAIRS | 9 OUT OF 10 DIRECTORS |

Self-identify as a member of an underrepresented group | Are ethnically diverse women | Are non-management |

Our Environmental Initiatives

We believe in the responsible use of natural resources to reduce adverse impacts on the communities in which we live and operate. We continue to look for opportunities to improve our end-to-end supply chain processes and reduce our environmental impact.

As North America’s leading provider of funeral, cremation, and cemetery services, we are making efforts to understand our impact and approach to environmental matters. To support our sustainability journey, we have piloted initiatives that begin to measure factors that impact the environment including carbon emission outputs and energy consumption metrics. Our commitment to environmental stewardship continues to include assessing our water usage, exploring environmentally innovative technology, recycling of waste materials, providing eco-friendly alternatives for families and protecting our 35,500 acres of green space. We support these efforts by collaborating with suppliers to align with our code of conduct and enhance our supply chain practices and policies.

Our Company is committed to monitor and evaluate our use of natural resources and its potential impact on the environment. To accurately track and measure our energy usage, we implemented a utility usage reporting solution in 2023 to capture consumption across our almost 2,000 funeral homes, cemeteries and crematory locations. This new system and process helps us to understand our energy consumption and focus on our natural gas and electricity use.

These new reporting methods support our efforts in capturing the data needed to monitor our carbon emissions footprint as well as purchased grid electricity for the applicable data coverage areas. Along with this, SCI has been converting energy contracts to renewable sources since 2019 and 20% of our electricity usage is from renewable sources. With these new metrics, we are able to capture the percentage of renewable energy being consumed by our locations. We will continue to gain insights and help identify additional opportunities for improvement.

Water is an important natural resource that we are dedicated to tracking at our funeral homes and cemeteries. We have developed methods to understand and report on our water usage from metered utilities and freshwater sources and how much is recycled for irrigation purposes. As we grow to better understand our climate impact, we have initiated water reduction pilots through implementation of new irrigation systems at select cemeteries with advanced water monitors and controls that create more efficient water usage.

We have included our greenhouse gas, electricity and water consumption metrics in our 2023 Sustainability Report, which is available on our website at https://investors.sci-corp.com.

We are currently exploring several opportunities regarding reducing water consumption and greenhouse gas emissions and improving energy conservation through the following initiatives:

| | | | | |

| |

•Piloting enhanced irrigation methods at select cemeteries. •Replacing older cremation units with newer, efficient models and installation of a water cremation unit that utilizes a water-based process to reduce our carbon emissions. •Continuous protective maintenance of 35,500 acres of green space. | •Exploring solar panel opportunities at additional locations. •Continued conversion of electricity contracts to renewable sources since 2019. •Recycling waste byproduct to aid in conserving natural resources and prevent unnecessary emissions. |

| |

For more information on our ESG initiatives and programs, please refer to our 2023 Sustainability Report, which is available on our website at https://investors.sci-corp.com.

Our Cybersecurity Risk Management and Strategy

We have invested in building a cybersecurity infrastructure to protect our information systems and secure our data from cyberattacks. Our information security program features risk management strategies, security awareness training, security operations, incident response, security governance, third-party risk management, IT security risk management, security architecture, and vulnerability management. As part of our broader enterprise risk management system, cybersecurity risk is strategically reviewed, monitored, and managed alongside other enterprise risks on a regular basis.

Certain members of the Board of Directors have experience conducting oversight of cybersecurity risk management across different industries, including technology and finance. For more information on Board cybersecurity experience and risk oversight responsibilities, please see page 27 and page 36. 12 Service Corporation International

| | | | | | | | | | | |

| | | |

| | | |

| PROPOSAL 2 | The Board of Directors recommends that Shareholders vote “FOR” ratification of the selection of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm of the Company. |

| | |

| | |

| | |

Auditor Selection

Why we believe you should vote "FOR" PwC as our independent auditors:

| | | | |

| | |

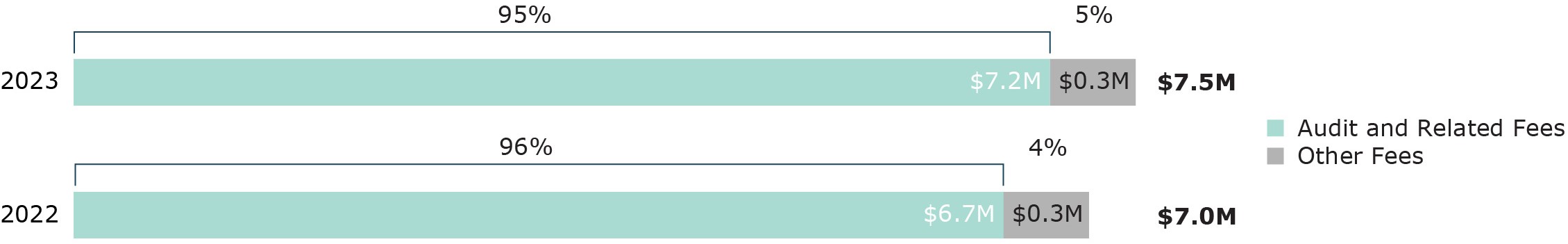

PwC engagement: •PwC has extensive knowledge of our unique industry and has demonstrated its capability and expertise as an Independent Registered Public Accounting Firm. •PwC maintains independence and objectivity through 5-year audit partner engagement rotations, strong internal control procedures, and regulatory oversight from PCAOB and SEC in addition to industry peer-reviewed audits. •Our Audit Committee and PwC regularly meet to discuss audit matters and provide updates outside the presence of management. •Our Audit Committee reviews SCI's engagement letter and approves PwC's annual audit and non-audit fees. •Approximately 95% of the fees incurred are audit-related. | | |

| | |

YEAR-OVER-YEAR COMPARISON OF OUR AUDIT TO NON-AUDIT FEES

For more information in regard to the audit and non-audit fees, please see section titled “Audit Fees and All Other Fees” under Audit Committee Matters on page 39.

| | | | | | | | | | | |

| | | |

| | | |

| PROPOSAL 3 | The Board of Directors recommends a vote “FOR” advisory approval of the resolution regarding compensation of our Named Executive Officers (as set forth in this Proxy Statement). |

| | |

| | |

| | |

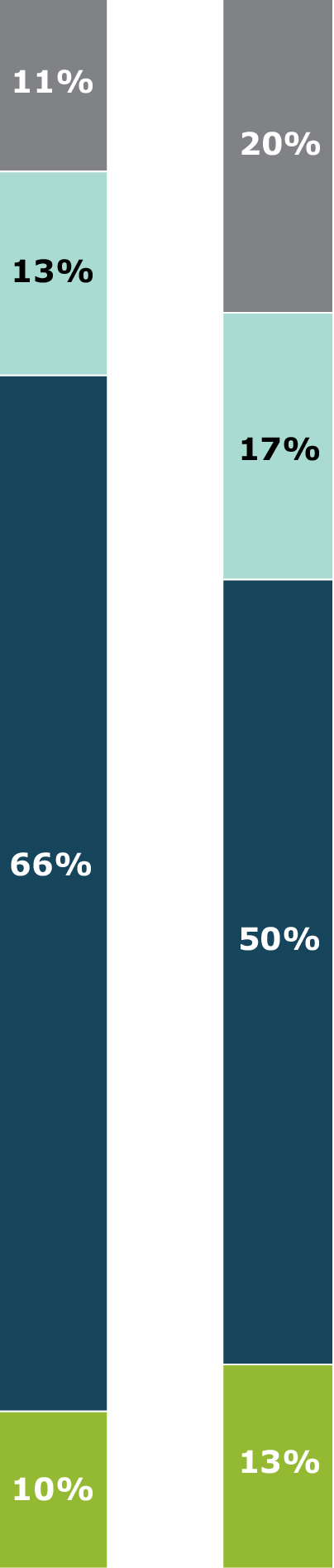

2023 Named Executive Officers' Compensation

Over the past several years, the Compensation Committee in conjunction with management has worked to improve the alignment of our compensation programs with the interests of our shareholders. In 2023, almost 80% of our CEO’s compensation and over 65% of the compensation of our other Named Executive Officers' (NEOs) was performance-based or stock-based compensation.

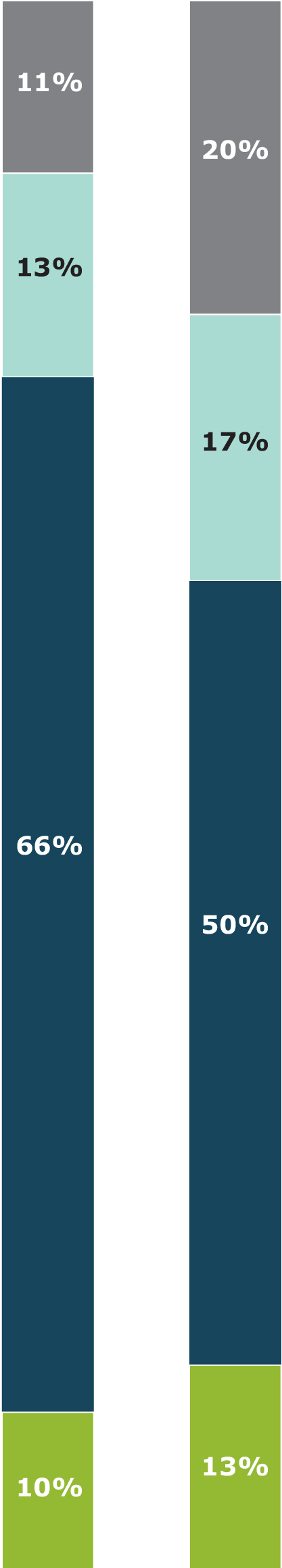

| | | | | | | | | | | | | | |

% of 2023 Compensation for CEO and Other NEOs | Component | Description | Highlights and Recent Changes |

| | | | |

| Annual Base Salary | •Fixed cash •Established based on a competitive range of benchmark pay levels |

|

| | |

| | |

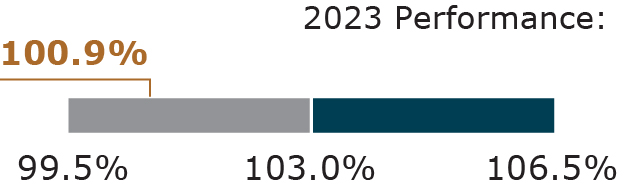

| Annual Performance-Based Incentive Compensation | •Performance-Based cash •Tied to the attainment of performance measures: •Normalized EPS •Normalized Free Cash Flow per Share •Comparable Preneed Production •Established based on a competitive range of benchmark pay levels | •92% payout percentage for 2023 performance •2020 plan introduced an ESG metric, which is tied to Google star (customer satisfaction) ratings |

| | |

| | |

| Long-Term Incentive Compensation | (1/3) Stock Options •Vest at a rate of 1/3 per year | |

| |

(1/3) Restricted Stock: •Vest at a rate of 1/3 per year | |

| |

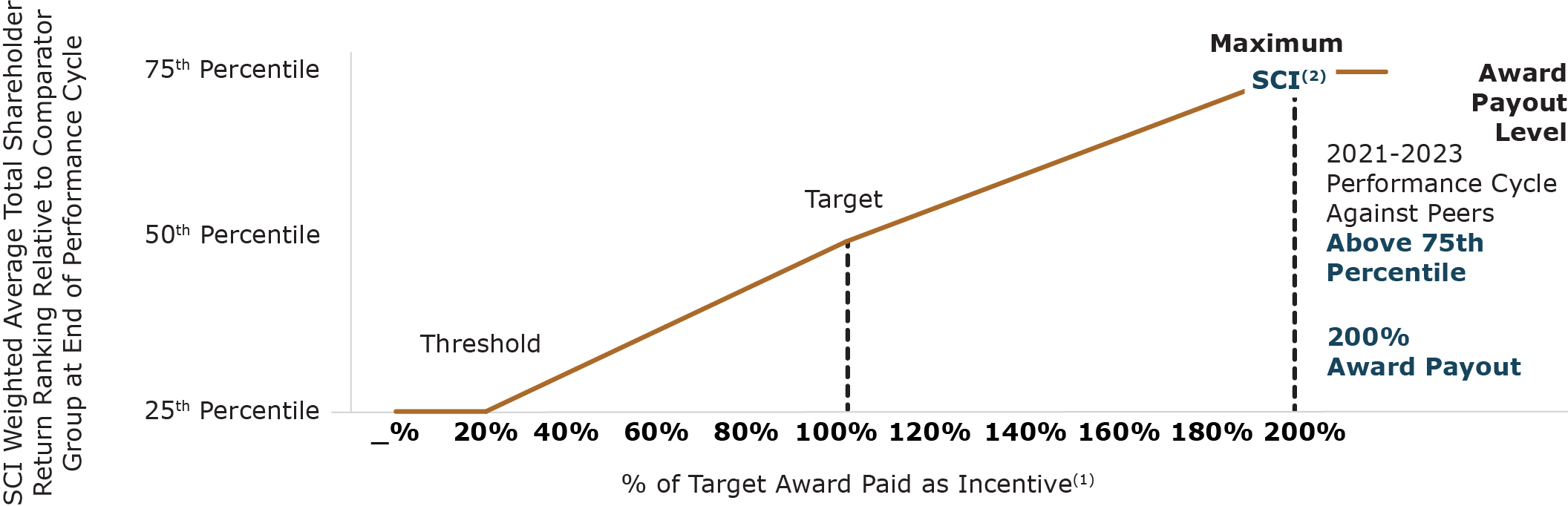

(1/3) Performance-Based Units (“PUP”): •Tied to measurement of three-year total shareholder return (“TSR”) relative to the constituents of the S&P MidCap 400 index that is governed by a normalized return on equity (ROE) benchmark floor tied to the S&P MidCap 400® index | •200% payout percentage for 2021-2023 performance cycle •Units are denominated in shares instead of dollars |

| |

•Long-term incentive compensation is established based on a competitive range of benchmark pay levels | •Removed automatic single-trigger vesting upon change in control effective for equity awards granted in 2022 |

| | |

| | |

| Other Compensation | Retirement Plans: •Executive Deferred Compensation Plan •401(k) Plan | |

Perquisites and Personal Benefits: •Reasonable benefits provided | |

| CEO | Other NEO | | |

| | | | |

14 Service Corporation International

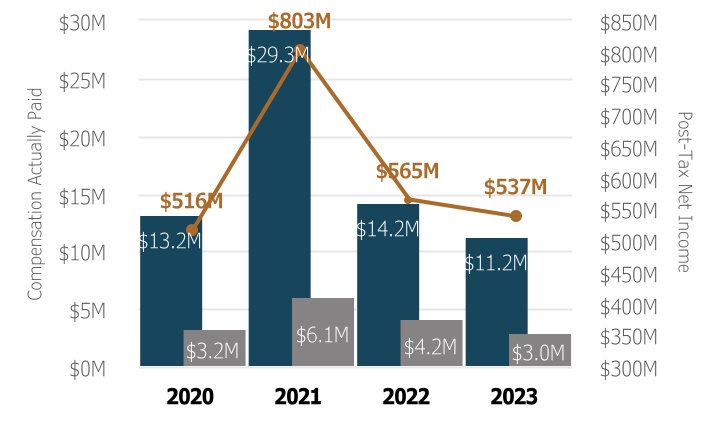

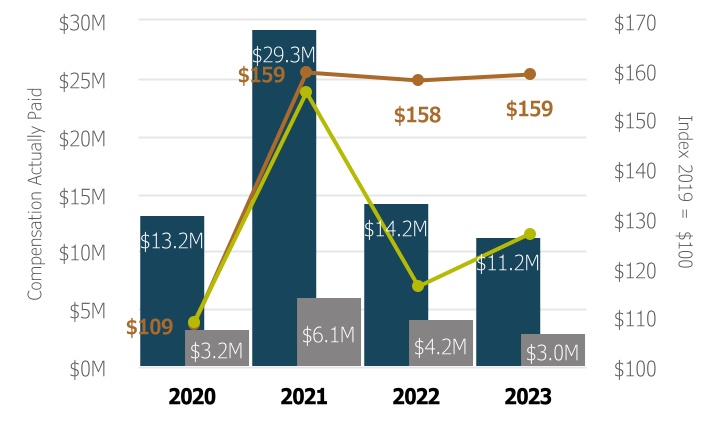

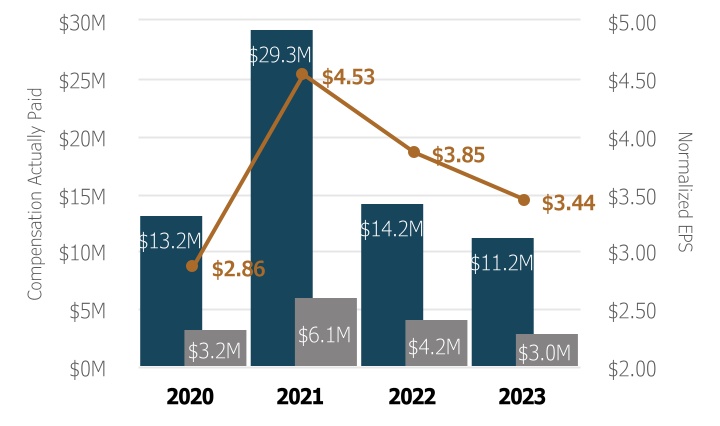

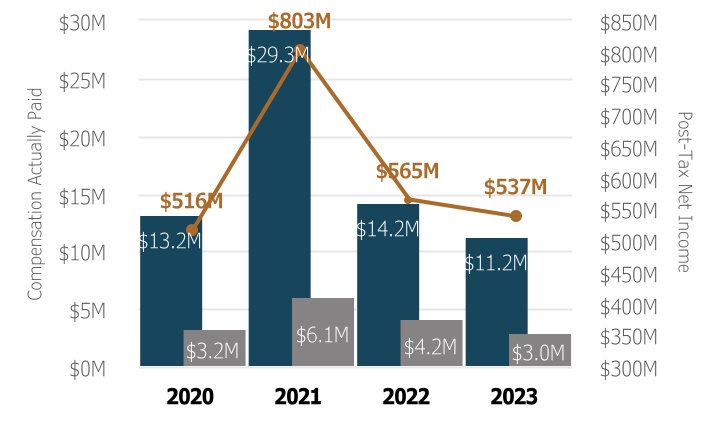

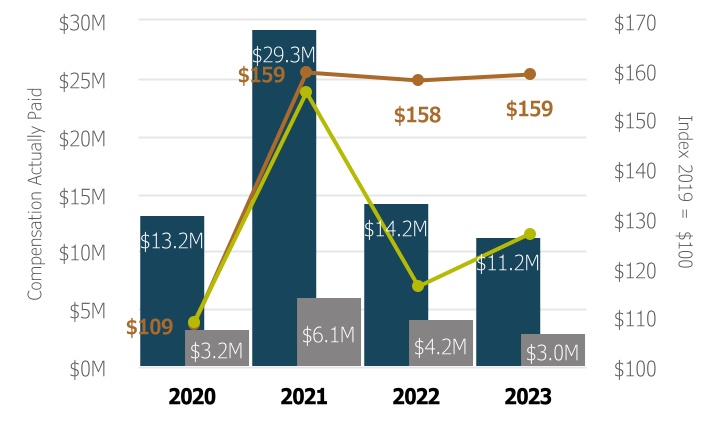

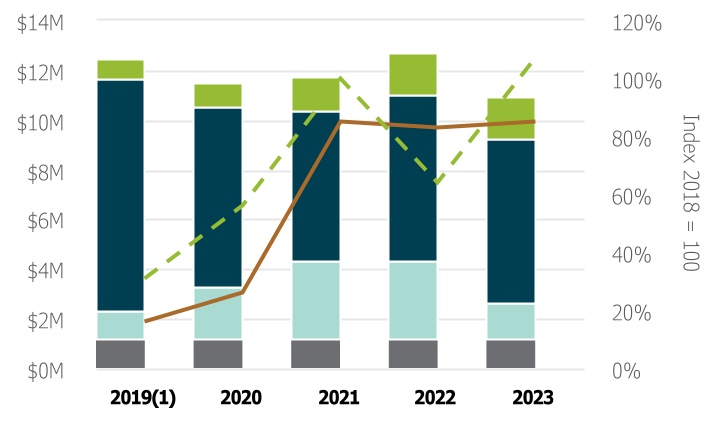

Pay for Performance Alignment

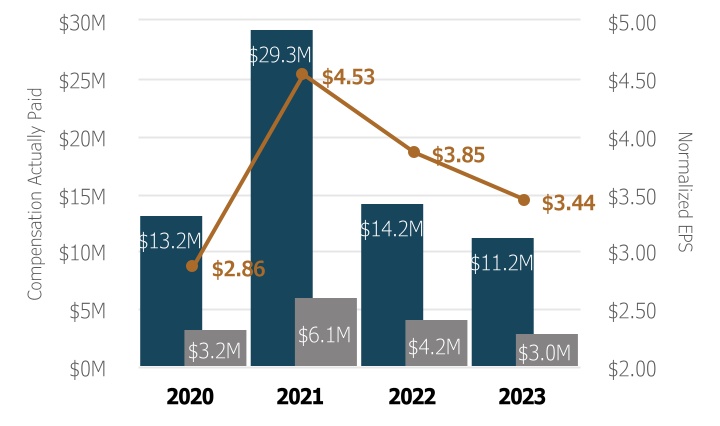

A significant portion of the compensation of our Named Executive Officers is directly linked to the Company’s performance, as demonstrated in the historical payouts related to our annual and long-term incentive plans. Below is a graph aligning CEO pay and performance, using the five-year total shareholder return. The Company realized total shareholder return (TSR) of 85% over the last five fiscal years.

| | | | | |

| |

| ¢ | Other Compensation |

| ¢ | Long-Term Incentive Compensation |

| ¢ | Annual Performance-Based Incentive Compensation |

| ¢ | Annual Base Salary |

| — | SCI TSR |

| -- | S&P 500 TSR |

| |

(1)A change in the denomination of the performance unit plan created a temporary distortion in the disclosure of 2019 total compensation by "doubling up" previous performance plan grants, which were disclosed when paid, with the initial inclusion of the 2019 performance plan grant values.

| | | | | | | | |

| | |

| | |

| | Corporate Governance at

Service Corporation International |

| | |

| | |

| | |

| | | | | | | | | | | |

| | | |

| | | |

| PROPOSAL 1 | Election of Directors The Board of Directors recommends that Shareholders vote “FOR” each of the following nominees: |

| | |

| | |

| | |

Set forth below are profiles for each of the ten candidates nominated by the Nominating and Corporate Governance Committee of the Board of Directors for election by shareholders at this year’s Annual Meeting each with one-year terms expiring at the 2025 annual meeting. Directors are elected by a majority of votes cast at the meeting.

Director Nominees

| | | | | | | | |

| | |

| Alan R. Buckwalter

INDEPENDENT Director Since: 2003 Age: 77 Committees: Executive, Investment, Nominating and Corporate Governance | Occupation: Former Chairman and CEO, Chase Bank of Texas Education: Fairleigh Dickinson University |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Human Capital Management •Investments/Financial Services •Real Estate/Business Development/M&A •Risk Management PRIOR BUSINESS EXPERIENCE •Chairman and CEO, Chase Bank of Texas (1998-2003) •President of Texas Commerce Bank (1990-1998) •Held various positions at Chemical Bank in corporate division (1970-1990) | OTHER POSITIONS •Board Member, Texas Medical Center •Chairman Emeritus and Board Member, Central Houston, Inc. PAST PUBLIC COMPANY BOARDS •Freeport-McMoRan, Inc. (2013-2015) •Plains Exploration and Production (2003-2013); subsequently acquired by Freeport-McMoRan Inc. FORMER POSITIONS •Former Board of Directors, Federal Reserve Bank of Dallas (Houston Branch) | DIRECTOR SUMMARY: Alan Buckwalter’s extensive corporate finance and banking experience provides the Board with valuable financial and investment management insights. He is a strong resource for relevant strategy and risk management gained from his many years in senior executive roles. His tenure on the Board has allowed him to develop a robust understanding of our unique industry. Furthermore, he possesses significant corporate governance knowledge developed by past service on the boards of other publicly traded companies. |

| | |

16 Service Corporation International

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Anthony L. Coelho

INDEPENDENT Director Since: 1991 Age: 81 Committees: Compensation, Executive, Nominating and Corporate Governance | Occupation: Former Majority Whip of the U.S. House of Representatives Independent business and political consultant Education: Loyola University Los Angeles |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Government/Regulatory •Human Capital Management •Investments/Financial Services •Marketing/Brand Management PRIOR POLITICAL EXPERIENCE •Chairman of the President’s Committee on Employment of People with Disabilities (1994-2001) •General Chairman of Al Gore’s Presidential campaign (1999-2000) •Majority Whip (1987-1989) •Member of U.S. House of Representatives (1978-1989); original sponsor/author of the Americans With Disabilities Act | PRIOR BUSINESS EXPERIENCE •President/CEO of Wertheim Schroder Financial Services, grew $800 million firm to $4.5 billion over 6 years (1990-1995) CURRENT PUBLIC COMPANY BOARDS •Board Chairman, Esquire Financial Holdings, Inc. •AudioEye, Inc. •EVO Transportation & Energy Services, Inc. SELECT PAST PUBLIC COMPANY BOARDS •Chairman, Cyberonics •Chairman, Circus Circus Enterprises (now MGM Mirage) •Chairman, ICF Kaiser International, Inc. •Warren Resources, Inc. FORMER POSITIONS •Former Chairman and current Board Member of the Epilepsy Foundation | DIRECTOR SUMMARY: Tony Coelho’s successful role as President and CEO of a multi-billion financial services company provides the Board with financial, investing, and senior leadership expertise. His experience on the Board has allowed him to develop a robust understanding of our unique industry. His political experience and expertise provide unique insights into government, public policy matters, and regulatory issues. Additionally, he has significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies. |

| | |

Corporate Governance at Service Corporation International

| | | | | | | | | | | |

| | | |

| Jakki L. Haussler

INDEPENDENT Director Since: 2018 Age: 66 Committees: Audit, Investment (Chair) | Occupation: Founder and Chairwoman of the Board, Opus Capital Management (since 1996), an independent registered investment advisor, providing investment solutions to institutions and high-net worth individuals Education: University of Cincinnati Salmon P. Chase College of Law, Northern Kentucky University |

| | | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Government/Regulatory •Investments/Financial Services •Marketing/Brand Management •Real Estate/Business Development/M&A PRIOR BUSINESS EXPERIENCE •CEO Opus Capital Management (1996-2019) •Managing Director, Capvest Venture Fund, LP (2000-2011) a private equity fund for growth and expansion stage companies •Partner, Adena Ventures, LP (1999-2010) a private equity fund targeting underserved markets | CURRENT PUBLIC BOARD POSITIONS •Barnes Group Inc. •Morgan Stanley Funds •Vertiv Holding Co. OTHER POSITIONS •Member, Board of Directors, The Victory Funds •Member/Founder, Chase College of Law, Transaction Law Practice Center •Board of Visitors, Chase College of Law •Member, Northern Kentucky University Foundation Investment Committee PAST PUBLIC COMPANY BOARDS •Cincinnati Bell, Inc. •Best Transport, Inc. (now Descartes Systems Group, Inc.) | DIRECTOR SUMMARY: Jakki Haussler has expertise in finance, portfolio management, and senior leadership experience as founder and Chairwoman of Opus Capital Management. Her expertise and experience provides background in investments and equity funds. Her experience as Partner in Adena Ventures provides insight into business development and M&A activity. Her other board positions have given her exposure to different industries and varying approaches to governance and issue resolution. |

| | |

18 Service Corporation International

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Victor L. Lund

INDEPENDENT Director Since: 2000 Age: 76 Committees: Audit, Executive, Nominating and Corporate Governance | Occupation: Former President, CEO, and Executive Chairman of the Board, Teradata Corporation Education: The University of Utah MBA, The University of Utah |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Human Capital Management •Marketing/Brand Management •Real Estate/Business Development/M&A •Technology or e-Commerce PRIOR BUSINESS EXPERIENCE •Executive Chairman (2019-2020) & President and CEO (2016-2018), Interim CEO (2019-2020), Teradata Corporation •Chairman, DemandTec, a software company (2006-2012) •Chairman, Mariner Healthcare, Inc. (2002-2004) •Vice Chairman, Albertsons, Inc. (1999-2002) •22-year career with American Stores Company in various positions including Chairman, CEO, CFO and Corporate Controller (1977-1999) •Audit CPA, Ernst & Ernst (1972-1977) | PAST PUBLIC COMPANY BOARDS •Teradata Corporation •DemandTec •Delta Airlines •Del Monte Foods, Inc. •Mariner Healthcare, Inc. •Albertsons, Inc. •American Stores Company •NCR Corporation | DIRECTOR SUMMARY: Victor Lund’s years of senior executive experience and leadership such as his former position of CEO and Executive Chairman of Teradata provide the Board with invaluable experience in technology and technological processes. His tenure on the Board has allowed him to develop a robust understanding of our unique industry. As a former auditor who also worked in various corporate finance positions, he possesses an extensive understanding of financial reporting and auditing practices. Furthermore, his service on other boards provide SCI with valuable corporate governance expertise. |

| | |

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Ellen Ochoa

INDEPENDENT Director Since: 2015 Age: 65 Committees: Compensation (Chair), Investment | Occupation: Former Director of NASA and Independent Director and Speaker Education: San Diego State University MS, PhD (Electrical Engineering), Stanford University |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Government/Regulatory •Human Capital Management •Risk Management •Technology or e-Commerce PRIOR BUSINESS EXPERIENCE •Director of NASA Johnson Space Center (2013-2018); Astronaut at NASA Johnson Space Center (1990-2012), first Hispanic female astronaut with nearly 1,000 hours in space •Branch Chief and Research Engineer, NASA Ames Research Center (1988-1990) •Researcher, Sandia National Laboratories (1985-1988) | OTHER POSITIONS •Member, Board of Directors, SRI International •Member, National Academy of Engineering •Member, Board of Directors, Mutual of America •Member, Board of Directors, Gordon and Betty Moore Foundation •Fellow, American Institute of Aeronautics and Astronautics •Fellow, American Association for the Advancement of Science •Director Emerita (former Vice Chair) Manned Space Flight Education Foundation FORMER POSITIONS •Former Chair Board Governance, National Science Board (Special Government Employee) •Former Chair, Nomination Evaluation Committee, National Medal of Technology & Innovation •Former Member, Board of Directors, Federal Reserve Bank of Dallas •Former Member Board of Trustees, Stanford University | DIRECTOR SUMMARY: Ellen Ochoa’s background with NASA and other governmental entities provides the Board with extensive technology and government/regulatory experience and insight. The senior leadership experience gained through her role as Director of NASA’s Johnson Space Center provides the Board with strategic planning, management of large projects, personnel development, and capital allocation expertise. Her many other positions include oversight activities such as financial stewardship and organizational governance. |

| | |

20 Service Corporation International

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Thomas L. Ryan

NON-INDEPENDENT Director Since: 2004 Age: 58 Committees: Executive (Chair) | Occupation: Chairman (since 2016) and CEO (since 2005) of SCI Education: The University of Texas at Austin |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Human Capital Management •Industry •Investments/Financial Services •Risk Management PRIOR BUSINESS EXPERIENCE •CEO European Operations, SCI (2000-2002) •Variety of financial management roles, SCI (1996-2000) | OTHER POSITIONS •Board Member, University of Texas McCombs Business School Advisory Council •Senior Member, University of Texas MD Anderson Cancer Center Board of Visitors PAST PUBLIC COMPANY BOARDS •Texas Industries •Chesapeake Energy •Weingarten Realty Investors FORMER POSITIONS •Former Chairman and Member of the Board of Trustees, United Way of Greater Houston •Former Board Member, Genesys Works | DIRECTOR SUMMARY: Thomas L. Ryan’s 28-year career with SCI has instilled a deep understanding of our industry and strategic insights as well as strong leadership skills. He has demonstrated operational execution and long-term strategic direction, including leadership of significant acquisitions and capital allocation decision-making, as well as risk management. His service with other publicly traded company boards has given him valuable insight into corporate governance and diverse approaches to key issues. |

| | |

| | |

| | |

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| C. Park Shaper

INDEPENDENT Director Since: 2022 Age: 55 Committees: Audit, Compensation | Occupation: CEO of Seis Holdings LLC, a private investment holding company (2013‑present) Education: Stanford University MBA, J.L. Kellogg Graduate School of Management, Northwestern University |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Government/Regulatory •Investments/Financial Services •Real Estate/Business Development/M&A •Risk Management PRIOR BUSINESS EXPERIENCE •President, Kinder Morgan, Inc. (2005-2013) •Variety of financial management roles, Kinder Morgan, Inc. (2000-2005) •President and Director, Altair Corporation (1999) •VP and CFO First Data Analytics (1997-1999) | CURRENT PUBLIC COMPANY BOARDS •Sunnova Energy International, Inc. •Kinder Morgan, Inc. OTHER BOARD POSITIONS •Chair, Texas Children's Board of Trustees •Member, Board of Overseers of the Hoover Institution at Stanford University •Member, Board of Advisors of the Baker Institute at Rice University PAST PUBLIC COMPANY BOARDS •Weingarten Realty •Star Peak Energy Transition Corp. •Star Peak Corp. II | DIRECTOR SUMMARY: C. Park Shaper’s extensive leadership background includes his role as CEO of Seis Holdings LLC, a private investment holding company, a position he has held since 2013; as well as positions of increasing responsibility at Kinder Morgan from 2000-2013, including Vice President and CFO in 2000, a member of the Office of the Chairman in 2003, Executive Vice President in 2004, and President from 2005 to 2013. Prior to Kinder Morgan, Mr. Shaper held positions as President of Altair Corporation and Vice President and CFO of First Data Analytics. His broad experience provides the Board with invaluable leadership and financial experience, as well as strategy and management expertise. He has also served on the board of directors of various public companies with service on audit, compensation, and nominating and corporate governance committees. |

| | |

22 Service Corporation International

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Sara Martinez Tucker

INDEPENDENT Director Since: 2018 Age: 68 Committees: Audit (Chair), Nominating and Corporate Governance | Occupation: Former CEO, National Math & Science Initiative, a non-profit organization to improve student performance in STEM (Science, Technology, Engineering, and Math) subjects Education: The University of Texas at Austin MBA, McCombs School of Business, The University of Texas at Austin |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Government/Regulatory •Human Capital Management •Risk Management •Technology or e-Commerce PRIOR BUSINESS EXPERIENCE •Vice President, AT&T (1997-2006) CURRENT PUBLIC COMPANY BOARDS •American Electric Power

| OTHER POSITIONS •Member, University of Notre Dame’s Board of Fellows and Board of Trustees •Board Member, Nationwide Mutual Insurance Company •PAST PUBLIC COMPANY BOARDS •Cornerstone OnDemand, Inc. •Xerox Corporation •Sprint Corporation FORMER POSITIONS •CEO, National Math & Science Initiative (2013-2015) •Former Chair (2017-2018), University of Texas System Board of Regents (2015-2019) •Under Secretary of Education in the U.S. Department of Education (2006-2008) | DIRECTOR SUMMARY: Sara Martinez Tucker has extensive knowledge and experience gained through her various executive leadership roles. Her most recent executive experience and her role as the chair of a board business and technology committee provides the Board with invaluable experience and expertise in technology. She also provides strong leadership and executive experience through her previous role as Vice President with AT&T. Her background serving as the Department of Education’s undersecretary has given her specific insight into governmental processes and human capital management, as well as exposure to a variety of regulatory issues. Further, she possesses significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies. |

| | |

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| W. Blair Waltrip

NON-INDEPENDENT Director Since: 1986 Age: 69 Committees: Investment | Occupation: Independent Consultant, Family and Trust Investments, and Former Senior Executive of SCI Education: Sam Houston State University |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Financial •Industry •Investments/Financial Services •Real Estate/Business Development/M&A •Risk Management PRIOR BUSINESS EXPERIENCE •Various positions at SCI including VP of Corporate Development, SVP of Funeral Operations, EVP of SCI’s real estate division, Chairman and CEO of SCI Canada, and EVP of SCI (1977-2000) | OTHER POSITIONS •Treasurer, National Museum of Funeral History •Active real estate broker PAST PUBLIC COMPANY BOARDS •Sanders Morris Harris Group, Inc. (Edelman Financial) | DIRECTOR SUMMARY: Blair Waltrip's experience includes various corporate finance roles at SCI, demonstrating a solid understanding of mergers and acquisitions, real estate, and investment management. His tenure as EVP/COO at SCI allowed him to develop a robust understanding of our unique industry. Further, he possesses corporate governance knowledge developed by past service on the board of another publicly traded company. |

| | |

24 Service Corporation International

Corporate Governance at Service Corporation International

| | | | | | | | |

| | |

| Marcus A. Watts

LEAD INDEPENDENT Director Since: 2012 Age: 65 Committees: Compensation, Executive, Nominating and Corporate Governance (Chair) | Occupation: President, The Friedkin Group (since 2011), which includes a variety of branded automotive, hospitality, and entertainment companies Education: Texas A&M University Harvard Law School |

| | |

| | | | | | | | |

SKILLS & QUALIFICATIONS: •Government/Regulatory •Human Capital Management •Industry •Marketing/Brand Management •Risk Management PRIOR BUSINESS EXPERIENCE •Vice Chair and Managing Partner-Houston, Locke Lord LLP (1984-2010) with a focus on corporate and securities law, governance, and related matters | CURRENT PUBLIC COMPANY BOARDS •Coterra Energy, Inc. CURRENT OTHER BOARD POSITIONS •Board Member, Highland Resources, Inc. (private real estate company) PAST OTHER BOARD POSITIONS •Former Chairman, Greater Houston Partnership •Former Chairman, Board of Trustees, United Way of Greater Houston •Former Board Chair, Federal Reserve Bank of Dallas (Houston Branch) PAST PUBLIC COMPANY BOARDS •Complete Production Services, Inc. (2007-2012), acquired by Superior Energy Services •Cornell Companies (2001-2005) | DIRECTOR SUMMARY: Marcus Watts’ executive role as President of The Friedkin Group provides the Board with senior leadership expertise and experience from oversight of various branded business interests. His previous role as Vice Chair and Managing Partner-Houston of Locke Lord LLP, provides the Board with extensive regulatory and government experience. Additionally, he possesses significant marketing, brand management, and corporate governance knowledge developed by current and past service on the boards of other private and publicly traded companies. Uniquely, Mr. Watts also possesses rare and valuable industry experience through his extensive prior service as independent counsel to the Company as well as other entities engaged in the deathcare industry. |

| | |

Corporate Governance at Service Corporation International

Consideration of Director Nominees

The Nominating and Corporate Governance Committee understands the Board member recruitment process is critical to providing strategic perspective while also bringing specific experience and expertise to a broad range of issues. A diverse Board, with members who embrace inclusive behaviors, provides keen insights and creates a decision-making environment that is more likely to take into account the various risks, consequences, and implications of potential solutions.

In discharging its responsibilities, the Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. In the past, the Committee has also retained a third-party executive search firm to identify candidates.

The Committee considers many factors when evaluating a potential candidate including the current composition of the Board, the balance of independent Directors, the diversity of its Directors, and the need for particular areas of expertise. The Committee considers how a candidate's personal factors such as gender, ethnicity, and age; professional characteristics such as education, areas of expertise, and professional experience; and core competencies align with the corporate strategy of SCI and the needs of the Board as a whole.

Currently the collective competencies include:

| | | | | |

| |

•Accounting and finance •Industry knowledge •Strategic insight | •Understanding and fostering leadership •Business judgment and executive/senior management expertise •Diverse experiences and backgrounds |

| |

Once the Nominating and Corporate Governance Committee has identified a prospective nominee, the Committee will consider the available information concerning the nominee, including the Committee’s own knowledge of the prospective nominee, and may seek additional information or an interview. If the Committee determines that further consideration is warranted, the Committee will evaluate the prospective nominee against the standards and qualifications set out in the Company’s Corporate Governance Guidelines. The Company’s Corporate Governance Guidelines include personal characteristics and collective core competencies.

The personal characteristics sought in prospective candidates include the following:

| | |

|

•Integrity, character, and accountability •Ability to provide wise and thoughtful counsel on a broad range of issues •Financial literacy and ability to read and understand financial statements and other indices of financial performance •Ability to work effectively with mature confidence as part of a team •Ability to provide counsel to management in developing creative solutions and in identifying innovative opportunities •Commitment to prepare for and attend meetings and to be accessible to management and other Directors |

|

After completing this evaluation process, the Committee makes nomination recommendations to the full Board. The Board determines the nominees after considering the recommendation and report of the Committee.

In 2023, the Service Corporation International Board of Directors adopted a bylaw change that provides shareholders a proxy access right (see page 37 for more information). 26 Service Corporation International

Corporate Governance at Service Corporation International

Director Qualifications, Skills, and Experience

The Nominating and Corporate Governance Committee of the Board of Directors requires that certain general qualifications are met to serve on the Board. The Board believes that each of the nominees presented possess these general qualifications. In addition to the general qualifications, there are other unique qualifications important to serving on our Board, which are outlined in the table below. The mix of general and unique qualifications combined with each nominee's background, experience, and expertise allows us to have an effectively functioning Board that is well-equipped in its oversight capacity as stewards of the Company.

The following table describes the specific qualifications of our Board and desired skills and experience:

| | | | | | | | | |

| Element & Qualification | Description | |

| | | |

| Financial | SCI uses a broad set of financial metrics to measure its performance. Accurate financial reporting and robust auditing are critical to our success. We expect all of our Directors to have an understanding of finance, financial reporting processes, and internal controls. | |

| Government/Regulatory | We operate in a heavily regulated industry. Directors with backgrounds in law or in government positions provide experience and insights that assist us in legal and regulatory compliance matters and in working constructively with governmental and regulatory organizations. | |

| Human Capital Management | SCI has a large workforce, which is an important asset and key resource for the Company. Therefore, we seek individuals with experience in employee development, recruitment of key talent/personnel, succession planning, and oversight of Company culture. | |

| Industry | The funeral and cemetery industry is unique and industry experience is rare. Directors with prior industry experience can help shape and develop the Company’s strategy. | |

| Investments/

Financial

Services | Knowledge of financial markets, investment activities, and trust and insurance operations assists our Directors in understanding, advising on, and overseeing our investment strategies. Our trust investments as of December 31, 2023 include $8.1 billion in preneed funeral and cemetery trusts and related receivables that are part of our $14.8 billion backlog of future revenue. | |

| Marketing/

Brand Management | We employ a multi-brand strategy and also rely heavily on marketing our products and services on a preneed basis. Directors with marketing experience and/or brand management experience provide expertise and guidance as we seek to expand brand awareness, enhance our reputation, and increase preneed sales. | |

| Real Estate/Business Development/ Mergers and Acquisitions (M&A) | We own a significant amount of real estate. Directors with experience in real estate provide insight into our tiered product/pricing strategy for our cemeteries as well as advice on best uses of our real estate. We seek to grow through acquisitions and development of new business operations. Directors with backgrounds in business development and M&A provide insight into developing and implementing strategies for growing our business. | |

| Risk

Management | As a large corporation, we must effectively manage our enterprise risks to ensure long-term value. We seek Directors with experience in assessing and managing financial, operational, social, and other risks significant to the Company. | |

| | | |

| Technology or

e-Commerce | Directors with education or experience in relevant technology are helpful in understanding our efforts to enhance the customer experience as well as improve our internal processes and operations. | |

Corporate Governance at Service Corporation International

Although the members of our Board each embody a broad range of backgrounds, experience, and expertise, the table below is intended to highlight only the top five qualifications for each Board member. These same skills/qualifications are also included in the Director's profiles as set forth in Proposal 1: Election of Directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill/Qualification | Buckwalter | Coelho | | | Haussler | Lund+ | | | | Ochoa+ | Ryan | Shaper | | Tucker+ | W. B. Waltrip | Watts*+ | | |

| | | | | | | | | | | | | | | | | | |

| Financial | l | l | | | l | l | | | | l | l | l | | l | l | | | |

| Government/Regulatory | | l | | | l | | | | | l | | l | | l | | l | | |

| Human Capital Management | l | l | | | | l | | | | l | l | | | l | | l | | |

| Industry | | | | | | | | | | | l | | | | l | l | | |

| Investments/Financial Services | l | l | | | l | | | | | | l | l | | | l | | | |

| Marketing/Brand Management | | l | | | l | l | | | | | | | | | | l | | |

| Real Estate/Business Development/M&A | l | | | | l | l | | | | | | l | | | l | | | |

| Risk Management | l | | | | | | | | | l | l | l | | l | l | l | | |

| Technology or e-Commerce | | | | | | l | | | | l | | | | l | | | | |

| | | | | | | | | | | | | | | | | | |

| Board Diversity | | | | | | | | | | | | | | | | | | |

| Gender Identity | | | | | | | | | | | | | | | | | | |

| Male | l | l | | | | l | | | | | l | l | | | l | l | | |

| Female | | | | | l | | | | | l | | | | l | | | | |

| Race/Ethnicity | | | | | | | | | | | | | | | | | | |

| White | l | l | | | | l | | | | | l | l | | | l | l | | |

| African American or Black | | | | | l | | | | | | | | | | | | | |

| Hispanic | | | | | | | | | | l | | | | l | | | | |

* Lead Independent Director

+ Director has experience conducting oversight of cybersecurity risk management across different industries.

Director Independence

The Board conducts an annual review and affirmatively determined 8 of the current 10 Directors are “independent” as defined by the standards of the NYSE and SCI’s Corporate Governance Guidelines. Thomas L. Ryan and W. Blair Waltrip are considered non-independent Directors.

Director Compensation

Our Corporate Governance Guidelines provide for compensation for our non-employee Directors’ services. Thomas L. Ryan, who is also a paid executive Officer of the Company, does not receive additional compensation for serving on the Board. Annual compensation for our non-employee Directors includes cash and stock-based equity compensation.

Maintaining a market-based compensation program for our non-employee Directors enables the Company to attract and retain qualified members to serve on the Board. With the assistance of Meridian Compensation Partners, LLC (“Meridian”), the Nominating and Corporate Governance Committee periodically reviews our non-employee Director compensation levels and practices and compares them to comparable general industry companies in a revenue size range similar to SCI to ensure they are aligned with market practices. Specifically, comparisons are made to the companies included in the Peer Comparator Group used for benchmarking the compensation of our executives, as well as to data presented in the annual NACD Director Compensation Report.

Components of Board Compensation:

•The annual Board cash retainer is $90,000.

•Additional cash retainers for leadership positions on the Board are as follows:

•Lead Independent Director - $30,000

•Audit Committee Chair - $25,000

•Compensation Committee Chair - $20,000

•Investment Committee Chair - $15,000

•Nominating and Corporate Governance Committee (NCGC) Chair - $15,000

•Annual stock grants are based on a target value of $180,000 per Director.

28 Service Corporation International

Corporate Governance at Service Corporation International

The Compensation Committee believes our total Director compensation package is competitive with market practices and is fair and appropriate in light of the responsibilities and obligations of our non-employee Directors. The following table sets forth non-employee Director compensation for 2023, which was approved by the Nominating and Corporate Governance Committee.

2023 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned

or Paid in Cash | Stock Awards(1) | | | | Total |

| Alan R. Buckwalter | | | $ | 90,000 | | | $ | 180,043 | | | | | | | $ | 270,043 | |

| Anthony L. Coelho | | | 105,000 | | | 180,043 | | | | | | | 285,043 | |

Jakki L. Haussler(2), Investment Committee Chair | | | 101,250 | | | 180,043 | | | | | | | 281,293 | |

| Victor L. Lund | | | 102,500 | | | 180,043 | | | | | | | 282,543 | |

| | | | | | | | | | | |

Ellen Ochoa, Compensation Committee Chair | | | 110,000 | | | 180,043 | | | | | | | 290,043 | |

| C. Park Shaper | | | 90,000 | | | 180,043 | | | | | | | 270,043 | |

Sara Martinez Tucker(2), Audit Committee Chair | | | 108,750 | | | 180,043 | | | | | | | 288,793 | |

| W. Blair Waltrip | | | 97,500 | | | 180,043 | | | | | | | 277,543 | |

Marcus A. Watts(2), NCGC Committee Chair and Lead Independent Director | | | 127,500 | | | 180,043 | | | | | | | 307,543 | |

(1)Amounts in the Stock Awards column represent the annual stock grants based on a target value of $180,000 per Director.

(2)In 2023, Marcus A. Watts was named as Lead Independent Director, Sara Martinez Tucker was named as the Audit Committee Chair, and Jakki L. Haussler was named as Investment Committee Chair.

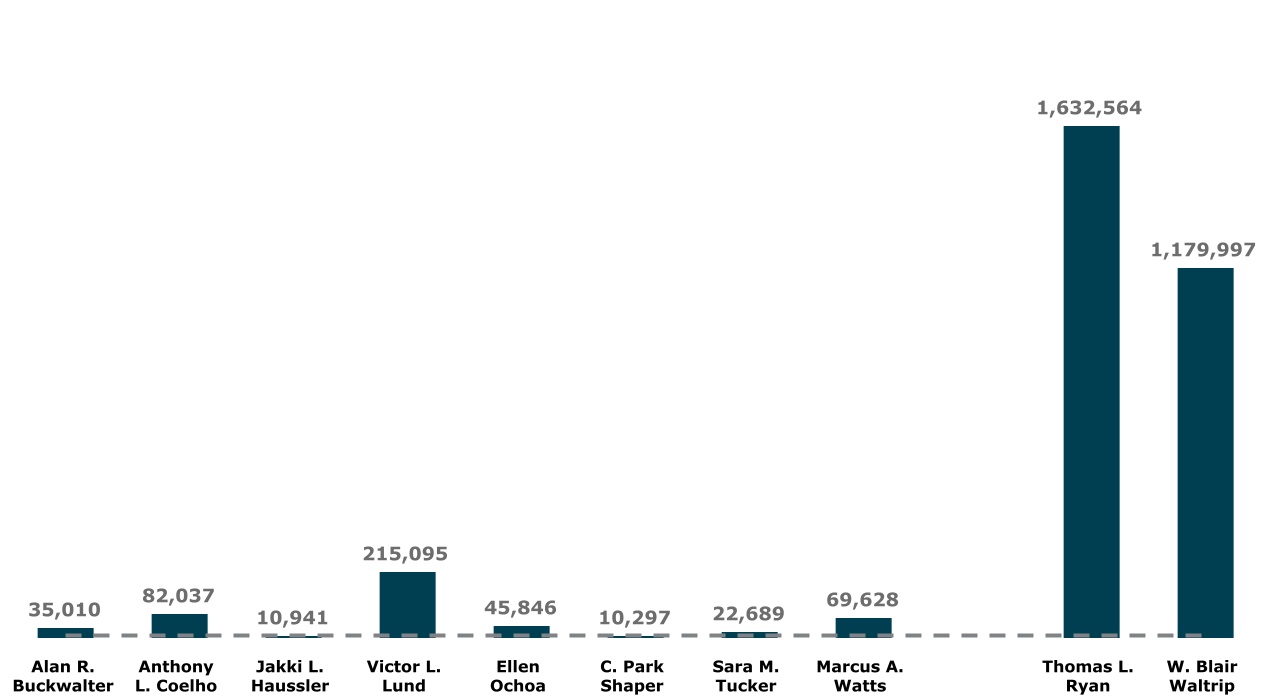

Director Ownership of SCI Stock

Stock ownership has a critical role in aligning the interests of Directors with those of our shareholders. The Company's Corporate Governance Guidelines contain a policy to encourage the Directors to own SCI stock. Under the guidelines each Director is encouraged to hold SCI common stock with a fair market value of at least $500,000 within five years of the Director’s initial election to the Board. Measurement of stock ownership against the guidelines will be calculated once a year based on the valuation of the shares held at year end utilizing the closing price of SCI common stock on the last trading day of the previous year ($68.45 per share at December 31, 2023 or a minimum shareholding of 7,305 shares for 2024). The following graphic presents the current holdings for our Directors as of March 11, 2024. Further details are provided in the tables of Director and Officer shareholdings listed under “Voting Securities and Principal Holders”.

Corporate Governance at Service Corporation International

SCI COMMON SHARES BENEFICIALLY OWNED

| | | | | | | | | | | | | | |

| | | | |

| Independent Directors | | Non-Independent Directors | |

| | |

|

AT MARCH 11, 2024, 100% OF DIRECTORS HAVE EXCEEDED THEIR OWNERSHIP GUIDELINE LEVELS FOR 2024. |

|

Board Structure and Operations

Leadership Structure

Over the past several years, there have been significant changes in our leadership and Board of Directors. In 2016, the Board appointed the current CEO, Thomas L. Ryan, as Chairman as this structure allows the Chief Executive Officer to effectively and efficiently guide the Board utilizing the insight and perspective he has gained by leading the Company. In addition, our Chief Executive Officer has the necessary experience, commitment, and support of the other Board members to carry out the role of Chairman effectively. His in-depth knowledge of our Company, our growth, and historical development, coupled with his extensive industry expertise and significant leadership experience, make him particularly qualified to lead discussions at the Board level on important matters affecting the Company.