UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

| For the fiscal year ended | DECEMBER 31, 2020 | ||||||||||

| OR | |||||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to | |||||||||||

Commission file number 1-6402-1

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) | ||||||||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||||||||

Registrant’s telephone number, including area code: (713) 522-5141

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol (s) | Name of Each Exchange on Which Registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | þ | No | ¨ | |||||||||||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ¨ | þ | |||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | No | ¨ | |||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | þ | No | ¨ | |||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): | |||||||||||||||||||||||||||||

| þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||||||||||

| Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in 12b-2 of the act). | Yes | No | þ | |||||||||||

The aggregate market value of the common stock held by non-affiliates of the registrant (assuming that the registrant’s only affiliates are its executive officers and directors) was $6,690,262,567 based upon a closing market price of $38.89 on June 30, 2020 of a share of common stock as reported on the New York Stock Exchange.

The number of shares outstanding of the registrant’s common stock as of February 12, 2021 was 169,426,435 (net of treasury shares).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement in connection with its 2021 Annual Meeting of Stockholders (Part III).

| |||||||||||

| Page | |||||||||||

2 Service Corporation International

Glossary

The following terms are common to the deathcare industry, are used throughout this report, and have the following meanings:

Atneed — Funeral, including cremation, and cemetery arrangements sold once death has occurred.

Cancellation — Termination of a preneed contract, which relieves us of the obligation to provide the goods and services included in the contract. Cancellations may be requested by the customer or be initiated by us for failure to comply with the contractual terms of payment. State or provincial laws govern the amount of refund, if any, owed to the customer.

Care Trust Corpus — The deposits and net realized capital gains and losses included in a perpetual care trust that cannot be withdrawn. In certain states, some or all of the net realized capital gains can be distributed, so they are not included in the corpus.

Cemetery Merchandise and Services — Stone and bronze memorials, markers, outer burial containers, floral placement, graveside services, merchandise installations, urns, and interments.

Cemetery Perpetual Care Trust or Endowment Care Fund (ECF) — A trust fund established for the purpose of maintaining cemetery grounds and property into perpetuity. For these trusts, the corpus remains in the trust in perpetuity and the investment earnings or elected distributions are withdrawn regularly and are intended to defray our expenses incurred to maintain the cemetery. In certain states, some or all of the net realized capital gains can also be distributed. Additionally, some states allow a total return distribution that may contain elements of income, capital appreciation, and principal.

Cemetery Property — Developed lots, lawn crypts, mausoleum spaces, niches, and cremation memorialization property items (constructed and ready to accept interments) and undeveloped land we intend to develop for the sale of interment rights. Includes the construction-in-progress balance during the pre-construction and construction phases of projects creating new developed property items.

Cemetery Property Amortization or Amortization of Cemetery Property — The non-cash recognized expenses of cemetery property interment rights, which are recorded by specific identification with the cemetery property revenue for each contract.

Cemetery Property Interment Rights — The exclusive right to determine the human remains that will be interred in a specific cemetery property space. See also Cemetery Property Revenue below.

Cemetery Property Revenue — Recognized sales of interment rights in cemetery property when the receivable is deemed collectible and the property is fully constructed and available for interment.

Combination Location (Combos) — Locations where a funeral service location is physically located within or adjoining an SCI-owned cemetery location.

Cremation — The reduction of human remains to bone fragments by intense heat.

Cremation Memorialization — Products specifically designed to commemorate and honor the life of an individual that has been cremated. These products include cemetery property items that provide for the disposition of cremated remains within our cemeteries such as benches, boulders, statues, etc. They also include memorial walls and books where the name of the individual is inscribed but the remains have been scattered or kept by the family.

Funeral Merchandise and Services — Merchandise such as burial caskets and related accessories, outer burial containers, urns and other cremation receptacles, casket and cremation memorialization products, flowers, and professional services relating to funerals including arranging and directing services, use of funeral facilities and motor vehicles, removal, preparation, embalming, cremations, memorialization, visitations, travel protection, and catering.

Funeral Recognized Preneed Revenue — Funeral merchandise and travel protection, net, sold on a preneed contract and delivered before a death has occurred.

Funeral Services Performed — The number of funeral services, including cremations, provided after the date of death, sometimes referred to as funeral volume.

General Agency (GA) Revenue — Commissions we receive from third-party life insurance companies for life insurance policies sold to preneed customers for the purpose of funding preneed funeral arrangements. The commission rate paid is determined based on the product type sold, the length of payment terms, and the age of the insured/annuitant.

Interment — The burial or final placement of human remains in the ground (interment), in mausoleums (entombment), in niches (inurnment), or in cremation memorialization property (inurnment).

Lawn Crypt — Cemetery property in which an underground outer burial receptacle constructed of concrete and reinforced steel has been pre-installed in predetermined designated areas.

Marker — A method of identifying a deceased person in a particular burial space, crypt, niche, or cremation memorialization property. Permanent burial and cremation memorialization markers are usually made of bronze or stone.

FORM 10-K 3

Maturity — When the underlying contracted merchandise is delivered or service is performed, typically at death. This is the point at which preneed funeral contracts are converted to atneed contracts (note — delivery of certain merchandise and services can occur prior to death).

Mausoleum — An above ground structure that is designed to house caskets and/or cremation urns.

Merchandise and Service Trust — A trust account established in accordance with state or provincial law into which we deposit the required percentage of customers’ payments for preneed funeral, cremation, or cemetery merchandise and services to be delivered or performed by us in the future. The amounts deposited can be withdrawn only after we have completed our obligations under the preneed contract or upon the cancellation of the contract. Also referred to as a preneed trust.

Outer Burial Container — A reinforced container intended to inhibit the subsidence of the earth and house the casket after it is placed in the ground, also known as a burial vault.

Preneed — Purchase of cemetery property interment rights or any merchandise and services prior to death occurring.

Preneed Backlog — Future revenue from unfulfilled preneed funeral, cremation, and cemetery contractual arrangements.

Preneed Cemetery Sales Production — Sales of preneed cemetery contracts. These sales are recorded in Deferred revenue, net until the merchandise is delivered, the service is performed, and the property has been constructed and is available for interment.

Preneed Funeral Sales Production — Sales of preneed funeral trust-funded and insurance-funded contracts. Preneed funeral trust-funded contracts are recorded in Deferred revenue, net until the merchandise is delivered or the service is performed. We do not reflect the unfulfilled insurance-funded preneed funeral contract amounts in our Consolidated Balance Sheet. The proceeds of the life insurance policies will be reflected in revenue as these funerals are performed by us in the future.

Preneed Receivables, Net — Amounts due from customers when we have delivered the merchandise, performed the service, or transferred control of the cemetery property interment rights prior to a death occurring or amounts due from customers on irrevocable preneed contracts.

Sales Average — Average revenue per funeral service performed, excluding the impact of funeral recognized preneed revenue, GA revenue, and certain other revenue.

Travel Protection — A product that provides shipment of remains to the servicing funeral home or cemetery of choice if the purchaser passes away outside of a certain radius of their residence, without any additional expense to the family.

Trust Fund Income — Recognized investment earnings from our merchandise and service and perpetual care trust investments.

As used herein, “SCI”, “Company”, “we”, “our”, and “us” refer to Service Corporation International and companies owned directly or indirectly by Service Corporation International, unless the context requires otherwise. Management has published a white paper on the corporate website for further understanding of accounting for preneed sales. You can view the white paper at http://investors.sci-corp.com under Featured Documents. Documents and information on our website are not incorporated by reference herein.

4 Service Corporation International

| ||

Item 1. Business

General

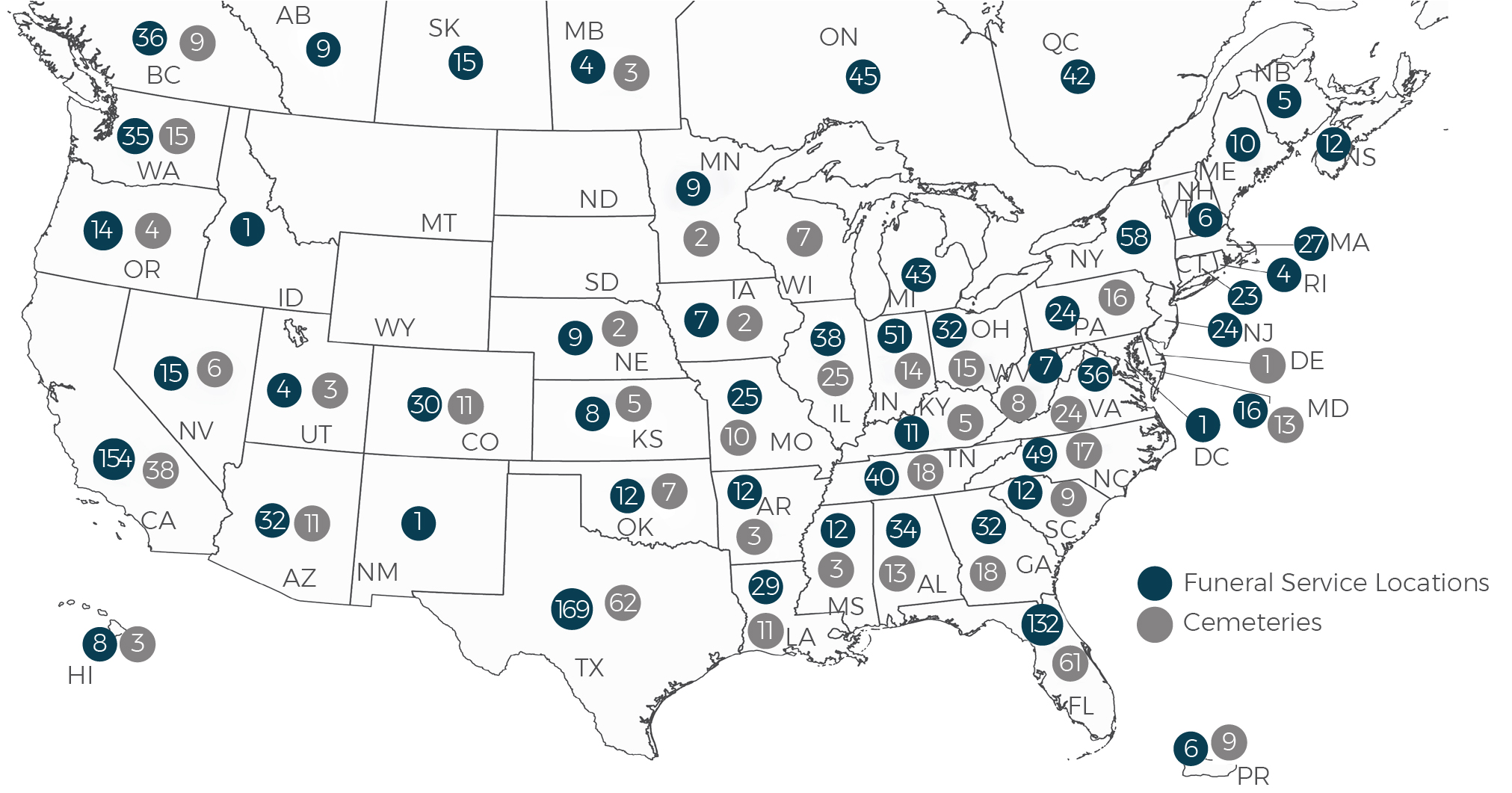

We are North America’s largest provider of deathcare products and services, with a network of funeral service locations and cemeteries unequaled in geographic scale. At December 31, 2020, we operated 1,470 funeral service locations and 483 cemeteries (including 297 funeral service/cemetery combination locations), which are geographically diversified across 44 states, eight Canadian provinces, the District of Columbia, and Puerto Rico.

We are well known for our Dignity Memorial® brand, North America's first transcontinental brand of deathcare products and services. Our other brands include Dignity Planning™, National Cremation Society®, Advantage® Funeral and Cremation Services, Funeraria del Angel™, Making Everlasting Memories®, Neptune Society™ and Trident Society™. Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and other related businesses, which enable us to serve a wide array of customer needs. We sell cemetery property and funeral and cemetery merchandise and services at the time of need and on a preneed basis.

History

We were incorporated in Texas in July of 1962. Our original business plan was based on efficiencies of scale, specifically reducing overhead costs by sharing resources such as preparation services, back office administration support, transportation, and personnel among funeral service locations in a business “cluster.” After proving the plan’s effectiveness in Houston in the early 1960s, we set out to apply this operating strategy through the acquisition of deathcare businesses in other markets over the next three decades. Beginning in 1993, we expanded beyond North America, acquiring major deathcare companies in Australia, the United Kingdom, and France, plus smaller holdings in other European countries, Asia and South America.

During the mid to late 1990s, acquisitions of deathcare facilities became extremely competitive, resulting in increased prices for acquisitions and substantially reduced returns on invested capital. In 1999, we significantly reduced our level of acquisition activity and over the next several years implemented various initiatives to pay down debt, increase cash flow, reduce overhead costs, increase efficiency, and leverage our scale. We divested our international businesses and many North American funeral service locations and cemeteries that were either underperforming or did not fit within our long-term strategy. At the same time, we began to capitalize on the strength of our network by introducing to North America the first transcontinental brand of deathcare services and products — Dignity Memorial® (see www.dignitymemorial.com). Information contained on our website is not part of this report.

In late 2006, having arrived at a position of financial stability and improved operating efficiency, we acquired the then second largest company in the North American deathcare industry, Alderwoods Group. In early 2010, we acquired the then fifth largest company in the North American deathcare industry, Keystone North America. In June of 2011, we acquired 70% of the outstanding shares of The Neptune Society, Inc. (Neptune), which is the nation's largest direct cremation organization, now known as SCI Direct. Subsequently, in 2013 and 2014, we acquired the remaining 30% of the outstanding shares of Neptune. In December 2013, we purchased Stewart Enterprises, Inc. (Stewart), the then second largest operator of funeral service locations and cemeteries in North America. We continue to pursue strategic acquisitions and complete divestitures of non-strategic funeral homes and cemeteries, some of which can be meaningful.

Funeral and Cemetery Operations

Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and other related businesses. See Note 13 in Part II, Item 8. Financial Statements and Supplementary Data, for financial information about our business segments and geographic areas.

We have the largest number of combination locations in North America. Funeral service/cemetery combination locations are businesses in which a funeral service location is physically located within or adjoining a cemetery that we own. Combination locations allow certain facility, personnel, and equipment costs to be shared between the funeral service location and cemetery locations. Such combination facilities typically can be more cost competitive and have higher gross margins than funeral and

FORM 10-K 5

PART I

cemetery operations that are operated separately. Combination locations also create synergies between funeral and cemetery preneed sales force personnel and give families added convenience to purchase both funeral and cemetery merchandise and services at a single location.

Funeral service locations provide all professional services related to funerals and cremations, including the use of funeral home facilities and motor vehicles, arranging and directing services, removal, preparation, embalming, cremations, memorialization, and catering. Funeral merchandise, including burial caskets and related accessories, urns and other cremation receptacles, outer burial containers, flowers, online and video tributes, stationery products, casket and cremation memorialization products, travel protection, and other ancillary merchandise, is sold at funeral service locations.

Our cemeteries provide cemetery property interment rights, including developed lots, lawn crypts, mausoleum spaces, niches, and other cremation memorialization and interment options. Cemetery merchandise and services, including memorial markers and bases, outer burial containers, flowers and floral placement, other ancillary merchandise, graveside services, merchandise installation, and interments, are sold at our cemeteries.

We also sell cemetery property interment rights and funeral and cemetery merchandise and services whereby a customer contractually agrees to the terms of certain products and services to be delivered and performed in the future. We define these sales as preneed sales. As a result of such preneed sales, our preneed backlog of unfulfilled funeral and cemetery contracts was $12.7 billion and $12.0 billion at December 31, 2020 and 2019, respectively.

The following table at December 31, 2020 provides the number of our funeral service locations and cemeteries by country, and by state, territory, or province:

| Country, State/Territory/Province | Number of Funeral Service Locations | Number of Cemeteries | Total | |||||||||||||||||

| United States | ||||||||||||||||||||

| Alabama | 34 | 13 | 47 | |||||||||||||||||

| Arizona | 32 | 11 | 43 | |||||||||||||||||

| Arkansas | 12 | 3 | 15 | |||||||||||||||||

| California | 154 | 38 | 192 | |||||||||||||||||

| Colorado | 30 | 11 | 41 | |||||||||||||||||

| Connecticut | 23 | — | 23 | |||||||||||||||||

| Delaware | — | 1 | 1 | |||||||||||||||||

| District of Columbia | 1 | — | 1 | |||||||||||||||||

| Florida | 132 | 61 | 193 | |||||||||||||||||

| Georgia | 32 | 18 | 50 | |||||||||||||||||

| Hawaii | 8 | 3 | 11 | |||||||||||||||||

| Idaho | 1 | — | 1 | |||||||||||||||||

| Illinois | 38 | 25 | 63 | |||||||||||||||||

| Indiana | 51 | 14 | 65 | |||||||||||||||||

| Iowa | 7 | 2 | 9 | |||||||||||||||||

| Kansas | 8 | 5 | 13 | |||||||||||||||||

| Kentucky | 11 | 5 | 16 | |||||||||||||||||

| Louisiana | 29 | 11 | 40 | |||||||||||||||||

| Maine | 10 | — | 10 | |||||||||||||||||

| Maryland | 16 | 13 | 29 | |||||||||||||||||

| Massachusetts | 27 | — | 27 | |||||||||||||||||

| Michigan | 43 | — | 43 | |||||||||||||||||

| Minnesota | 9 | 2 | 11 | |||||||||||||||||

| Mississippi | 12 | 3 | 15 | |||||||||||||||||

| Missouri | 25 | 10 | 35 | |||||||||||||||||

| Nebraska | 9 | 2 | 11 | |||||||||||||||||

6 Service Corporation International

PART I

| Country, State/Territory/Province | Number of Funeral Service Locations | Number of Cemeteries | Total | |||||||||||||||||

| Nevada | 15 | 6 | 21 | |||||||||||||||||

| New Hampshire | 6 | — | 6 | |||||||||||||||||

| New Jersey | 24 | — | 24 | |||||||||||||||||

| New Mexico | 1 | — | 1 | |||||||||||||||||

| New York | 58 | — | 58 | |||||||||||||||||

| North Carolina | 49 | 17 | 66 | |||||||||||||||||

| Ohio | 32 | 15 | 47 | |||||||||||||||||

| Oklahoma | 12 | 7 | 19 | |||||||||||||||||

| Oregon | 14 | 4 | 18 | |||||||||||||||||

| Pennsylvania | 24 | 16 | 40 | |||||||||||||||||

| Puerto Rico | 6 | 9 | 15 | |||||||||||||||||

| Rhode Island | 4 | — | 4 | |||||||||||||||||

| South Carolina | 12 | 9 | 21 | |||||||||||||||||

| Tennessee | 40 | 18 | 58 | |||||||||||||||||

| Texas | 169 | 62 | 231 | |||||||||||||||||

| Utah | 4 | 3 | 7 | |||||||||||||||||

| Virginia | 36 | 24 | 60 | |||||||||||||||||

| Washington | 35 | 15 | 50 | |||||||||||||||||

| West Virginia | 7 | 8 | 15 | |||||||||||||||||

| Wisconsin | — | 7 | 7 | |||||||||||||||||

| Canada | ||||||||||||||||||||

| Alberta | 9 | — | 9 | |||||||||||||||||

| British Columbia | 36 | 9 | 45 | |||||||||||||||||

| Manitoba | 4 | 3 | 7 | |||||||||||||||||

| New Brunswick | 5 | — | 5 | |||||||||||||||||

| Nova Scotia | 12 | — | 12 | |||||||||||||||||

| Ontario | 45 | — | 45 | |||||||||||||||||

| Quebec | 42 | — | 42 | |||||||||||||||||

| Saskatchewan | 15 | — | 15 | |||||||||||||||||

Total (1) | 1,470 | 483 | 1,953 | |||||||||||||||||

(1) Includes businesses held for sale at December 31, 2020

We believe we have satisfactory title to the properties owned and used in our business, subject to various liens, encumbrances, and easements that are incidental to ownership rights and uses and do not materially detract from the value of the property. At December 31, 2020, we owned approximately 90% of the real estate and buildings used at our facilities, and the remainder of the facilities were leased under both finance and operating leases. At December 31, 2020, our 483 cemeteries contained a total of approximately 35,500 acres, of which approximately 66% was developed.

Our corporate headquarters are located at 1929 Allen Parkway, Houston, Texas 77019. The property consists of approximately 160,000 square feet of office space and 185,000 square feet of parking space on approximately seven acres. We also lease approximately 35,000 square feet of office space in Houston, Texas, which we utilize for corporate activities. We own a building in Jefferson, Louisiana with approximately 96,200 square feet of office space that we use, in part, for corporate activities

FORM 10-K 7

PART I

A map of our locations in North America is presented below:

COVID-19 Impact

During 2020, an outbreak of a novel strain of coronavirus (COVID-19) spread worldwide and was declared a global pandemic by the World Health Organization on March 11, 2020. COVID-19 poses a threat to the health and economic well-being of our employees, customers, communities, and vendors. Our dedicated associates are acting as first responders and providing essential services for our client families and communities. The operation of all our facilities is critically dependent on our employees who operate these locations. To ensure the well-being of all our employees and their families, we provided them with detailed health and safety literature on COVID-19, such as the Center for Disease Control (the “CDC”)’s industry-specific guidelines for working with the deceased who were, and may have been, infected with COVID-19. In addition, we provide personal protection equipment to those employees whose positions require such equipment. We continue adding measures to help ensure client families can safely visit our facilities and celebrate the life of their loved ones. We have implemented work from home policies at our corporate offices consistent with CDC and local government guidance to reduce the risks of exposure to COVID-19, while continuing to support our locations and the customers they serve.

Like most businesses world-wide, COVID-19 has impacted various aspects of our business operations. Until the onset of COVID-19, sales growth was continuing to trend in-line and consistent with our forecast for the first quarter of 2020. However, during the last two weeks of the first quarter of 2020, we saw our preneed sales activity and our atneed sales averages precipitously decline as North Americans began to practice social distancing to comply with multiple state and provincial shelter-in-place orders. Since that time, we have experienced periodic increases in services performed in COVID-19 hot spots with accompanying declines in atneed sales averages due to social distancing restrictions.

The rigorous restrictions placed on gatherings, mandated by state, provincial, and local governments posed a unique challenge for our locations. In mid-March, we quickly implemented technology solutions to allow extended family and friends to virtually participate in the ceremony alongside the immediate family. We also carefully designed outdoor venues to allow guests to be present, while remaining at a safe distance. We also have offered customers the ability to livestream services with the use of Facebook Live and to broadcast cemetery services through radio transmitters at certain locations. Atneed funeral directors are also using virtual meeting platforms to discuss and plan service details with client families. Our preneed sales teams continue overcoming social distancing obstacles in certain areas of the country by leveraging technology with customers who may prefer to purchase cemetery property and merchandise from the safety of their home or setting up outdoor pop-up canopies to discuss pre-planning from a safe distance.

While we implemented creative solutions to meet our client families' needs, we are still periodically experiencing a negative impact to our sales averages due to the continued social distancing impacts across North America. Nevertheless, we continued to experience unprecedented growth in our preneed cemetery sales while continuing to experience an increase in services and burials performed.

As the world continues to experience the fluctuating effects of COVID-19, we remain reliant on the values and capabilities of our organization to meet the needs of our client families while ensuring our associates and customers are safe. The continued

8 Service Corporation International

PART I

demand for services is further evidence that a considerable number of our customers continue to value what our team does best, which is helping our client families gain closure and healing through the process of grieving, remembrance, and celebration. The health, safety, and mental well-being of our associates continues to be a top priority throughout the COVID-19 pandemic. We have been able to avoid layoffs, mandatory furloughs, and any widespread reductions in pay as a result of the impact of COVID-19, while also providing certain associates with bonuses to recognize their incredible efforts and an Employee Assistance Program, which provides access to licensed counseling.

Competition

Although there are several public companies that own funeral service locations and cemeteries, the majority of deathcare businesses in North America are locally-owned, independent operations. We estimate that our funeral and cemetery market share in North America is approximately 15%-16% based on estimated total industry revenue. The success of a single funeral service location or cemetery in any community is a function of the name, reputation, and location of that funeral service location or cemetery. Competitive pricing, professional service and attention, and well-maintained locations are also important.

We have an unparalleled network of funeral service locations and cemeteries that offers high quality products and services at prices that are competitive with local competing funeral service locations, cemeteries, and retail locations. Within this network, the funeral service locations and cemeteries operate under various names as most operations were acquired as existing businesses. We have co-branded the majority of our operations under the name Dignity Memorial®. Our branding strategy gives us a strategic advantage and identity in the industry. While this branding process is intended to emphasize our seamless national network of funeral service locations and cemeteries, the original names associated with acquired operations, and their inherent goodwill and heritage, generally remain the same. For example, Geo. H. Lewis & Sons Funeral Directors is now Geo. H. Lewis & Sons Funeral Directors, a Dignity Memorial® provider.

Strategies for Growth

We are the largest consolidated deathcare company in North America and are well positioned for long-term profitable growth. Like most businesses world-wide, COVID-19 has impacted various aspects of our business operations, however, we believe our fundamental strategy has not changed. Over the next several years, our industry will be largely shaped by the aging of the Baby Boomer generation in the deathcare space and we are poised to benefit from the aging of this North American population. In each stage of life, Baby Boomers have set new trends, transformed society, and redefined norms, and we anticipate the impact will be the same for our industry. We have already begun to see the impact of the Baby Boomers through the growth in our preneed cemetery sales program. We expect seeing a similar impact on our preneed funeral results and ultimately our atneed results as these preneed contracts mature. In every aspect of our business, we are listening and responding to our customer’s changing needs and leveraging our scale to deliver unparalleled experiences - both digitally and in person - to meet those changing needs.

The following strategies remain the core of our foundation: 1) grow revenue, 2) leverage our unparalleled scale, and 3) deploy capital. While these strategies remain unchanged, through the pandemic a shift to a higher use of technology has influenced how we serve our customers and how we invest our capital.

Grow Revenue

We plan to grow revenue by remaining relevant to our customers as their preferences evolve through a combination of price, product, and service differentiation strategies. We also expect that growing our preneed sales will drive future revenue growth.

Remaining Relevant to the Customer

Remaining relevant to our customer is key to generating revenue growth in a changing customer environment. We are constantly evolving to meet the varying preferences and needs of our customers. Whether choosing burial or cremation, the Baby Boomers are redefining the traditional funeral by transitioning away from solemnly mourning a death to a personalized celebration of life ceremony. In certain markets, we are responding to this trend by spending capital to repurpose traditional casket selection rooms to event rooms designed for a celebration. We are offering a customer friendly digital presentation of options that allow the customer to choose merchandise and services including unique celebration, catering, and celebrant services.

In our funeral business, we focus on memorialization merchandise and services that are meaningful to both our burial and cremation customers. The growing trend of cremation requires more flexibility in providing products and services. We have developed cremation service packages, which may or may not include a celebratory memorialization.

In our cemetery business, we continue to grow revenue by responding to the customer’s desire for personalized and unique options by expanding our tiered product and cemetery property options. Over the past several years, we have substantially increased our property options to offer many unique choices. From high-end family estates, which capture incredible views, to nicely landscaped hedge estates, we continue to develop property selections that resonate with our customers. For cemetery

FORM 10-K 9

PART I

merchandise and services, we have developed innovative products such as recurring floral placements, customized cemetery property offerings, and specialized graveside service options. We continue to embrace cremation opportunities for customers in our cemetery segment by offering an increased variety of cremation property options, including niches and scattering gardens.

As we evolve to meet ever-changing customer preferences, we will continue catering to the religious, ethnic, and cultural traditions important to many of our customers. Throughout the COVID-19 pandemic, we have remained flexible to meet the varying needs of customers due to social distancing restrictions placed on our locations across North America. This flexibility has strengthened our resolve to remain relevant to changing customer preferences.

Growing Preneed Sales

Our preneed sales program drives current and future revenue growth. Baby Boomers have been impacting our cemetery preneed sales for several years and are beginning to positively impact the growth of our preneed funeral sales programs. Our sales organization is supported by a highly trained sales force of approximately 3,750 counselors, who provide customers informed guidance about various service and merchandise options tailored for today’s consumers. Utilizing our scale, our counselors are reaching out to consumers through multiple lead channels, driving future revenue growth. We sponsor community events and seminars to educate and provide guidance around preplanning both funeral and cemetery services and merchandise. In 2019, we adopted a more sophisticated direct mail approach and we continue increasing our digital presence through search engine optimization and other marketing channels. We have a unique competitive advantage to continue growing preneed sales benefiting from our size and scale. Our preneed program provides us with an opportunity to develop greater brand awareness, gives consumers peace of mind about their end of life arrangements, and secures future market share. Many of our lead channels shifted away from in person throughout 2020 due to the COVID-19 pandemic. However, we gained efficiencies from generating leads digitally as a result of our website and search engine optimization efforts and leveraged video conferencing for socially distanced interactions with many customers.

Leverage Our Unparalleled Scale

As the largest deathcare company in North America, we leverage our scale by developing our sales organization and optimizing the use of our network using technology and for the benefit of our preneed backlog. Our scale enables cost efficiencies through purchasing power and utilizing economies of scale through our supply chain channel. In 2020 throughout the COVID-19 pandemic, we were able to continue to operate without any major disruptions to our business, which highlights the power of our scale.

Developing Our Sales Organization

Over the last several years, we have continued to invest significantly in the development of our sales organization with best in class tools and technologies. These investments include a customer relationship management system, which drives improvements in productivity and sales production by leveraging data analytics, rigorous lead tracking, and effective follow up campaigns. We continue to diversify our sales force to understand and cater to the religious, ethnic, and cultural traditions important to our customers. Our premier combination locations and other large and recognizable cemeteries and funeral homes attract high-quality sales talent. Our scale allows us to operate and expand our sales organization in a manner that our competitors cannot replicate. During 2020, we were able to train and quickly develop our sales organization to be able to efficiently complete digital sales with the use of various online tools.

Optimizing Our Network and Deploying Customer-Facing Technology

We continue driving operating discipline and leveraging our scale through standardizing processes and capitalizing on new technologies improving the customer experience. Our advancements in technology are changing the way we present our product and service offerings to customers. Our atneed point of sale system, HMIS+, uses a digital platform enabled with high resolution video and photographs to create a seamless presentation of our products and service offerings. Our recently implemented and mobile preneed sales system, provides customers with a full digital presentation experience in their home or other place of their choosing.

In 2018, we completed a redesign of almost 2,000 Dignity Memorial® location websites. Featuring a modern and user-friendly design, these location-specific websites have been designed for mobile use and optimized for better search engine ranking. In addition to the contemporary and sophisticated design, client families now enjoy new features such as a streamlined obituary completion process, social media sharing capabilities, and the ability to create and share personalized content in memory of their loved one. In 2020, our websites grew significantly in number of visits, which reached over 160 million visits.

During 2019, we took significant steps improving the quality of customer feedback and elevating our online reputation. We engaged a third party to increase the response rate from customers for online reviews and we have seen a significant increase in the number of reviews over the past two years. Online reviews provide visibility of customer engagement down to the location level and shorten our response time in addressing customer concerns. We collaborated with a leading technology partner to deliver the J.D. Power surveys digitally, which has increased the quantity and quality of customer feedback and reduced the time it takes to receive customer feedback. We have established a social media presence for a number of our funeral and cemetery businesses, including the ability to livestream services at over 1,000 locations. These digital efforts resulted in favorable customer satisfaction ratings and increased digital sales leads.

10 Service Corporation International

PART I

Although 2020 was difficult in many unexpected ways, we learned valuable lessons around our ability to quickly deploy customer-facing technology. Our associates and client families embraced an increasingly digital world and we utilized various online tools to complete sales and meet families while social distancing during the COVID-19 pandemic. We are encouraged by the increased digitization and we are making great strides with internal projects leveraging technology and simplifying nearly every facet of service delivery.

Growing Our Preneed Backlog

Our preneed backlog, which includes both insurance and trust-funded merchandise and service products, allows us the opportunity to grow future revenue in a more stable and efficient manner than selling at the time of need. The scale of our multi-billion dollar trust portfolios allows us to leverage access to preeminent money managers with favorable fee structures generating above average returns. Our blended funding approach between insurance and trust-funded merchandise and service products allows us to combine the positive cash flow and predictability of the insurance product with the potential upside of higher returns from our trusted merchandise and service products. This blended approach also results in our ability to grow our preneed backlog in a cash flow neutral manner. Additionally, we are experiencing contracts coming out of the backlog today to be serviced with growth rates that are superior to inflationary atneed pricing due to market performance.

Deploy Capital

We continue maximizing capital deployment opportunities in a disciplined and balanced manner to the highest relative return. Our strong liquidity, favorable debt maturity profile, and robust cash flow generation enables us to continue our long-standing commitment to use capital deployment to opportunistically grow our business and enhance shareholder value, even throughout the COVID-19 pandemic. Our priorities for capital deployment remain: 1) investing in acquisitions and building new funeral service locations, 2) paying dividends, 3) repurchasing shares, and 4) managing debt. During 2020, we were able to weather the uncertainty created by the COVID-19 pandemic and strategically deploy capital to the highest relative return opportunities.

Investing in Acquisitions and Building New Funeral Service Locations

We manage our footprint by focusing on strategic acquisitions and building new funeral service locations where the expected returns are attractive and meaningfully exceed our weighted average cost of capital. We target businesses with favorable customer dynamics and locations where we can achieve additional economies of scale. Over the last several years, we have increased our growth capital spend on new funeral service locations growing our footprint into new communities as well as expanding of existing locations to remain relevant to our customers. For our cemetery businesses, we plan to pursue strategic acquisitions to create more opportunities to serve Baby Boomers through our tiered cemetery options. Additionally, we acquire land that will be developed for future cemetery use in some of our largest markets. This investment in our future will allow us to continue creating cemetery offerings that appeal to varying preferences in those markets for many years to come.

Paying Dividends

Our quarterly dividend rate has steadily grown from $0.025 per common share in 2005 to $0.21 per common share at the end of 2020. We target a payout ratio of 30% to 40% of after-tax earnings excluding special items and intend to grow our cash dividend commensurate with the growth in our business.

Repurchasing Shares

Absent opportunities for strategic acquisitions, we expect to continue repurchasing shares of our common stock in the open market or through privately negotiated transactions, subject to market conditions, debt covenants, and normal trading restrictions. The volume and timing of our purchases is determined as we evaluate the opportunity to capture value for our shareholders. Since 2010, we have reduced the number of our shares outstanding by 29%. In August 2020, our Board of Directors increased our repurchase authorization to $500.0 million. The remaining dollar value of shares authorized to be purchased under the share repurchase program was $231.0 million at December 31, 2020. Subsequent to December 31, 2020, we repurchased 802,146 shares for $40.7 million at an average cost per share of $50.74 .

Managing Debt

We continue to focus on maintaining optimal levels of liquidity and financial flexibility. Our flexible capital strategy allows us to manage our debt maturity profile by making open market debt repurchases when it is opportunistic to do so. We generate a relatively consistent annual cash flow stream that is generally resistant to down economic cycles. This cash flow stream and our significant liquidity allow us to substantially reduce our long-term debt maturities should we choose to do so.

Other

We make available free of charge, on or through our website, our annual, quarterly, and current reports and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the Securities and Exchange Commission (SEC). Our website is http://www.sci-corp.com and our telephone number is (713) 522-5141. We also post announcements, updates, events and investor information and presentations on our website in addition to copies of all recent

FORM 10-K 11

PART I

news releases. We may use the Investors section of our website to communicate with investors. It is possible that the financial and other information posted there could be deemed material information. Each of our Board of Directors’ standing committee charters, our Corporate Governance Guidelines, our Code of Ethics for Board Members, and our Code of Conduct for Officers and Employees are available, free of charge, through our website or, upon request, in print. We will post on our internet website all waivers to, or amendments of, our Code of Conduct for Officers and Employees, which are required to be disclosed by applicable law and rules of the New York Stock Exchange listing standards. Information contained on our website is not part of this report. The SEC also maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

Human Capital Management

At December 31, 2020, we employed 16,503 individuals on a full-time basis and 7,632 individuals on a part-time basis. Of the full-time associates, 14,231 were employed in the funeral and cemetery operations and 2,272 were employed in corporate or other overhead areas of our business. Approximately 2.5% of our associates are represented by unions. Although labor disputes occur from time to time, relations with associates are generally considered favorable. We reach out to our associates for feedback throughout their employment at SCI using a variety of voluntary surveys ensuring we are meeting the needs and expectations of our large and diverse workforce.

Associate Benefits

All eligible associates in the United States may elect coverage under our group health and life insurance plans. Associates covered by a collective bargaining agreement are typically covered by union health plans and, therefore, do not participate in our health insurance plan. At December 31, 2020 and 2019, there were 9,620 and 9,528 associates, respectively, who had elected to participate in our group health insurance plans.

Eligible associates in the United States are covered by retirement plans of SCI or various subsidiaries, while international associates are covered by other SCI (or SCI subsidiary) defined contribution or government-mandated benefit plans. We have an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code for the exclusive benefit of our United States employees. We contribute a matching contribution based on the employee's contribution and years of vesting service. For more information about our retirement plans, see Note 12 of Part II, Item 8. Financial Statements and Supplementary Data.

We understand the importance of work-life balance and provide other benefits such as baby bonding time, paid time off, and financial planning support for our associates. Additionally, we offer an employee assistance program that offers 24/7 masters-level counseling services for associates who may be facing challenges outside of the workplace.

Inclusion and Diversity

We believe in the power of inclusion and respecting our fellow associates’ work, ideas, beliefs, and lifestyles. Our Inclusion and Diversity Committee, which is a cross-functional team of associates, has been key to the development of programs such as our Women’s Leadership Conference and Associate Resource Communities (ARCs). The ARCs allow colleagues with similar interests to connect for networking, provide opportunities for growth, and support the communities and customers we serve. Our leadership team is committed to advancing inclusion and diversity within the workplace, by embracing the many backgrounds and perspectives that make each of us so unique, allowing us to remain relevant to the families we serve.

Training and Development

We provide opportunities for career growth, as we believe supporting the personal and professional goals of our associates is a priority for us. In addition to development programs and a robust online training portal offering more than 2,000 courses, associates can participate in mentoring programs and take advantage of discounts and tuition reimbursement through our many university partnerships. We are also proud to offer scholarship and apprentice programs to those interested in joining our profession.

Regulation

Our funeral operations are regulated by the Federal Trade Commission (the “FTC”) under the FTC’s Trade Regulation Rule on Funeral Industry Practices (the “Funeral Rule”), which went into effect in 1984. The Funeral Rule defines certain acts or practices as unfair or deceptive and contains certain requirements to prevent these acts or practices. The preventive measures require a funeral provider to give consumers accurate, itemized price information and various other disclosures about funeral merchandise and services and prohibit a funeral provider from: 1) misrepresenting legal, crematory, and cemetery requirements; 2) embalming for a fee without permission; 3) requiring the purchase of a casket for direct cremation; and 4) requiring consumers to buy certain funeral merchandise or services as a condition for furnishing other funeral merchandise or services.

12 Service Corporation International

PART I

Our operations are also subject to regulation, supervision, and licensing under numerous federal, state, and local laws and regulations as well as Canadian provincial laws and regulations. For example, state laws impose licensing requirements for funeral service locations and funeral directors and regulate preneed sales including our preneed trust activities. Our facilities are subject to environmental, health, and safety regulations. We take various measures to comply with the Funeral Rule and all laws and regulations. For example, we have established and maintain policies and procedures around our business practices; we provide training of our personnel; and we perform ongoing reviews of our compliance efforts. We are currently in substantial compliance with the Funeral Rule and all laws and regulations.

Federal, state, and local legislative bodies and regulatory agencies (including Canadian legislative bodies and agencies) frequently propose new laws and regulations, some of which could have a material effect on our operations and on the deathcare industry in general. We cannot accurately predict the outcome of any proposed legislation or regulation or the effect that any such legislation or regulation might have on us.

Executive Officers of the Company

The following table sets forth, as of February 16, 2021, the name and age of each executive officer of the Company, the office held, and the year first elected an officer.

| Officer Name | Age | Position | Year First Became Officer | |||||||||||||||||

| Thomas L. Ryan | 55 | Chairman of the Board, Chief Executive Officer and President | 1999 | |||||||||||||||||

| Sumner J. Waring, III | 52 | Senior Vice President, Chief Operating Officer | 2002 | |||||||||||||||||

| Eric D. Tanzberger | 52 | Senior Vice President, Chief Financial Officer | 2000 | |||||||||||||||||

| Gregory T. Sangalis | 65 | Senior Vice President, General Counsel and Secretary | 2007 | |||||||||||||||||

| Elisabeth G. Nash | 59 | Senior Vice President, Operations Services | 2004 | |||||||||||||||||

| John H. Faulk | 45 | Senior Vice President, Revenue and Business Development | 2010 | |||||||||||||||||

| Steven A. Tidwell | 59 | Senior Vice President, Sales and Marketing | 2010 | |||||||||||||||||

| Tammy R. Moore | 53 | Vice President and Corporate Controller | 2010 | |||||||||||||||||

Mr. Ryan was elected Chairman of the Board of SCI effective in January 2016, appointed Chief Executive Officer in February 2005, and President in 2019. He joined the Company in 1996 and served in a variety of financial management roles until November 2000, when he was asked to serve as Chief Executive Officer of European Operations based in Paris, France. In July 2002, Mr. Ryan returned to the United States where he was appointed President and Chief Operating Officer of SCI. Before joining SCI, Mr. Ryan was a certified public accountant with Coopers & Lybrand LLP for eight years. He holds a bachelor's degree in business administration from the University of Texas at Austin. Mr. Ryan serves as a member of the University of Texas McCombs Business School Advisory Council and is a member of the Board of Trust Managers of Weingarten Realty Investors (NYSE: WRI).

Mr. Waring, Senior Vice President and Chief Operating Officer, is responsible for North American Operations. He joined SCI in 1996 as Area Vice President of Operations when SCI acquired his family's funeral business. He was appointed President of the Northeast Region in 1999 and President of the Pacific Region in September 2001. In September 2002, Mr. Waring was appointed Vice President, Western Operations, a position he held until May 2004 when he was appointed Vice President, Major Market Operations. He was promoted to Senior Vice President in 2006. In May 2015, Mr. Waring's responsibilities were expanded to include all operations in North America. Mr. Waring holds a bachelor's degree in business administration from Stetson University, a degree in mortuary science from Mount Ida College, and a master's degree in business administration from the University of Massachusetts Dartmouth. Mr. Waring serves on the Board of Directors of BankFive and the Board of Trustees of Tabor Academy.

Mr. Tanzberger was appointed Senior Vice President and Chief Financial Officer in June 2006 and also served as Treasurer from July 2007 to February 2017. Mr. Tanzberger joined the Company in August 1996 and held various management positions prior to being promoted to Corporate Controller in August 2002. Before joining SCI, Mr. Tanzberger served as Assistant Corporate Controller at Kirby Marine Transportation Corp., an inland waterway barge and tanker company. He was also a certified public accountant with Coopers and Lybrand LLP. Mr. Tanzberger holds a bachelor's degree in business administration from the University of Notre Dame. Mr. Tanzberger is the Audit Committee Chair for United Way of Houston and the Treasurer of the National Funeral Directors Association Funeral Service Foundation. He also serves on the Board of Directors for Junior Achievement of Southeast Texas.

Mr. Sangalis joined the Company in 2007 as Senior Vice President, General Counsel and Secretary. In 2012, his responsibilities were expanded to include Human Resources. He previously served as Senior Vice President, Law and Administration for Team Inc., a leading provider of specialty industrial maintenance and construction services. Prior to that, Mr. Sangalis served as Managing Director and General Counsel of Main Street Equity Ventures II, a private equity investment firm, and as Senior Vice President, General Counsel and Secretary for Waste Management, Inc., the leading provider of waste management services in North America. Mr. Sangalis holds a bachelor's degree in finance from Indiana University and a

FORM 10-K 13

PART I

master's degree in business administration from the University of Minnesota. He earned his juris doctorate from the University of Minnesota Law School.

Ms. Nash was named Senior Vice President of Operations Services in 2010 and is currently responsible for a variety of support functions, including information technology, supply chain, and program management. Prior to that she was Vice President of Process Improvement and Technology, where she led the redefinition of our field and home office processes and systems. Before joining SCI, Ms. Nash served in various senior management accounting and financial positions with Pennzoil Corp. She holds a bachelor's degree in business administration in accounting from Texas A&M University. Ms. Nash serves on the Board of Directors of Genesys Works.

Mr. Faulk was named Senior Vice President of Revenue and Business Development in 2018. He joined SCI in March 2010 as Vice President, Business Development, to oversee the Company's strategic growth, including mergers and acquisitions, real estate and construction. His promotion in 2018 expanded his role to include setting direction for the company’s pricing and cemetery development functions. Prior to joining the Company, Mr. Faulk worked for Bain & Company, Inc. where he helped Fortune 500 Companies and specialty retailers identify profit growth opportunities and achieve strong operating results. He holds a master's degree in business administration from the Darden Graduate School of Business at the University of Virginia and a bachelor's degree in electrical engineering from the University of Virginia.

Mr. Tidwell joined SCI as Vice President, Main Street Market Operations, in March 2010 and was promoted to Senior Vice President of Sales and Merchandising in 2012. As a co-founder of Keystone North America, Inc., Mr. Tidwell served as its President and Chief Executive Officer from May 2007 until it was acquired by SCI in March 2010. In his role, Mr. Tidwell worked closely with Keystone's Senior Leadership Team to develop and implement organic growth strategies as well as external growth and acquisition strategies. He began his career as a licensed funeral director and embalmer in Nashville, Tennessee, and has been actively involved in the funeral and cemetery profession for over thirty-seven years. He holds an associate of arts degree from John A. Gupton College and has attended Executive Management and Leadership programs at the Harvard Business School, Vanderbilt University Owen Graduate School of Management, and the Center for Creative Leadership.

Mrs. Moore joined the Company in August 2002 as Manager of Financial Reporting. She was promoted to Director of Financial Reporting in 2004 and Managing Director and Assistant Controller in June 2006. In February 2010, she was promoted to Vice President and Corporate Controller and oversees trust accounting and compliance, general accounting, internal and external reporting, customer service, and strategic planning and analysis. Prior to joining the Company, Mrs. Moore was a certified public accountant with PricewaterhouseCoopers LLP. She holds a bachelor's degree in business administration in accounting from the University of Texas at San Antonio.

Item 1A. Risk Factors

Cautionary Statement on Forward-Looking Statements

The statements in this Form 10-K that are not historical facts are forward-looking statements made in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. These statements may be accompanied by words such as “believe”, “estimate”, “project”, “expect”, “anticipate”, or “predict” that convey the uncertainty of future events or outcomes. These statements are based on assumptions that we believe are reasonable; however, many important factors could cause our actual consolidated results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. These factors are discussed below. We assume no obligation and make no undertaking to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by the Company, whether as a result of new information, future events, or otherwise.

Risks Related to Our Business

The COVID-19 pandemic has impacted the global economy and has had an adverse effect on certain aspects of our business and results of operations while having a positive effect on others as described in Part II, Item 7, "Management Discussion and Analysis of Financial Condition and Results of Operations." Future public health threats could have material adverse consequences for our business and results of operations.

As a result of the COVID-19 pandemic and the related adverse economic and health consequences, we have experienced and may continue to be subject to any of the following risks:

•our preneed funeral sales have decreased and our preneed cemetery sales temporarily decreased;

•the value of our preneed trust investments and related net investment income temporarily diminished due to the disruption in the financial markets; and

•our funeral sales average has decreased.

We may also experience the following COVID-19 related risks:

14 Service Corporation International

PART I

•our funeral and cemetery revenues may decrease due to reduced and deferred services, actual or perceived consumer financial constraints, government restrictions on gathering sizes, and voluntary social distancing;

•illness may disrupt our workforce;

•our supply chain could be disrupted; and

•our operating costs may increase due to increased overtime, health insurance claims, worker’s compensation claims, supply costs, or other effects related to COVID-19.

Any of the foregoing risks could have a material, adverse effect on our business, financial condition, and results of operations. Given the ongoing and dynamic nature of the spread of COVID-19, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain and largely outside of our control.

Our affiliated trust funds own investments in securities, which are affected by market conditions that are beyond our control.

In connection with our preneed merchandise and service sales and our cemetery property sales, most affiliated trust funds own investments in equity securities, fixed income securities, commingled funds, money market funds, and mutual funds. The fair value of these investments and our earnings and investment gains and losses on these securities and funds are affected by financial market conditions that are beyond our control. Additionally, we may not choose the optimal mix of securities for any particular market condition.

The following table summarizes our investment returns (realized and unrealized), excluding certain fees, on our trust funds:

| Years Ended December 31, | |||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||

| Preneed funeral merchandise and service trust funds | 16.5 | % | 20.0 | % | (4.9) | % | |||||||||||

| Preneed cemetery merchandise and service trust funds | 16.7 | % | 20.5 | % | (5.2) | % | |||||||||||

| Cemetery perpetual care trust funds | 13.4 | % | 17.0 | % | (3.0) | % | |||||||||||

| Combined trust funds | 15.6 | % | 19.2 | % | (4.4) | % | |||||||||||

Generally, earnings or gains and losses on our trust investments are recognized and we withdraw cash when the underlying merchandise is delivered, service is performed, or upon contract cancellation. Our cemetery perpetual care trusts recognize earnings, and in certain states, capital gains and losses or fixed percentage distributions. We withdraw allowable cash when we incur qualifying cemetery maintenance costs.

If the investments in our trust funds experience significant declines in 2021 or subsequent years, there could be insufficient funds in the trusts to cover the costs of delivering merchandise and services or maintaining our cemeteries in the future. We may be required to cover any such shortfall with cash flows from operations, which could have a material adverse effect on our financial condition, results of operations, and cash flows. For more information related to our trust investments, see Note 3 in Part II, Item 8. Financial Statements and Supplementary Data.

If the fair value of these trusts, plus any other amount due to us upon delivery of the associated contracts, were to decline below the estimated costs to deliver the underlying products and services, we would record a charge to earnings to record a liability for the expected losses on the delivery of the associated contracts. As of December 31, 2020, no such charge was required in any reported period.

We may be required to replenish our affiliated funeral and cemetery trust funds to meet minimum funding requirements, which would have a negative effect on our earnings and cash flow.

In certain states and provinces, we have withdrawn allowable distributable earnings, including unrealized gains, prior to the maturity or cancellation of the related contract. Additionally, some states have laws that either require replenishment of investment losses under certain circumstances or impose various restrictions on withdrawals of future earnings when trust fund values drop below certain prescribed amounts. In the event of market declines that result in a severe decrease in trust fund value, we may be required to replenish amounts in the respective trusts in some future period. As of December 31, 2020, we had unrealized losses of $6.9 million in the various trusts within these states. See Off-Balance Sheet Arrangements, Contractual Obligations, and Commercial and Contingent Commitments in Part II, Item 7.

Our ability to execute our strategic plan depends on many factors, some of which are beyond our control.

Our strategic plan is focused on growing our revenue, leveraging our scale, and deploying our capital. Many of the factors that impact our ability to execute our strategic plan, such as the number of deaths and general economic conditions, are beyond our control. Changes in operating conditions, such as supply disruptions and labor disputes, could negatively impact our operations. Our inability to leverage scale to drive cost savings, productivity improvements, preneed production, or earnings growth anticipated by management could affect our financial performance. Our inability to identify acquisition candidates and to complete acquisitions, divestitures, or strategic alliances as planned or to successfully integrate acquired businesses and realize expected synergies and strategic benefits could impact our financial performance. Our inability to deploy capital to maximize shareholder value could impact our financial performance. We cannot give assurance that we will be able to execute any or all of our strategic plan. Failure to execute any or all of our strategic plan could have a material adverse effect on our financial condition, results of operations, and cash flows.

FORM 10-K 15

PART I

Our credit agreements contain covenants that may prevent us from engaging in certain transactions.

Our Bank Credit Facility contains, among other things, various affirmative and negative covenants that may prevent us from engaging in certain transactions that might otherwise be considered beneficial to us. The covenants limit, among other things, our and our subsidiaries’ ability to:

•Incur additional indebtedness (including guarantee obligations);

•Create liens on assets;

•Engage in certain transactions with affiliates;

•Enter into sale-leaseback transactions;

•Engage in mergers, liquidations, and dissolutions;

•Sell assets;

•Pay dividends, distributions, and other payments in respect of our capital stock;

•Purchase our capital stock in the open market;

•Make investments, loans, or advances;

•Repay indebtedness or amend the agreements relating thereto;

•Create restrictions on our ability to receive distributions from subsidiaries; and

•Change our lines of business.

Our Bank Credit Facility requires us to maintain certain leverage and interest coverage ratios. These covenants and coverage ratios may require us to take actions to reduce our indebtedness or act in a manner contrary to our strategic plan and business objectives. In addition, events beyond our control, including changes in general economic and business conditions, may affect our ability to satisfy these covenants. A breach of any of these covenants could result in a default of our indebtedness. If we breach certain affirmative covenants or any negative covenants contained in our Bank Credit Facility, then, immediately upon notice from the administrative agent, an event of default will have occurred and the lenders could elect to declare all amounts outstanding thereunder, together with accrued interest, immediately due and payable. If we breach any of the other affirmative covenants contained in our Bank Credit Facility, and such breach continues unremedied for 30 days after receipt of notice thereof, then an event of default will have occurred and the lenders party thereto could elect to declare all amounts outstanding thereunder, together with accrued interest, immediately due and payable. Any such declaration would also result in an event of default under our Senior Indenture governing our various senior notes. For additional information, see Financial Condition, Liquidity and Capital Resources in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 6 in Part II, Item 8. Financial Statements and Supplementary Data.

If we lost the ability to use surety bonding to support our preneed activities, we may be required to make material cash payments to fund certain trust funds.

We have entered into arrangements with certain surety companies whereby such companies agree to issue surety bonds on our behalf as financial assurance or as required by existing state and local regulations. The surety bonds are used for various business purposes; however, the majority of the surety bonds issued and outstanding have been issued to support our preneed funeral and cemetery activities. In the event all of the surety companies canceled or did not renew our surety bonds, which generally have twelve-month renewal periods, we would be required to either obtain replacement coverage or fund approximately $145.3 million into state-mandated trust accounts as of December 31, 2020. There can be no assurance that we would be able to obtain replacement coverage at a similar cost or at all.

Increasing death benefits related to preneed contracts funded through life insurance or annuity contracts may not cover future increases in the cost of providing a price-guaranteed service.

We sell price-guaranteed preneed contracts through various programs providing for future services at prices prevailing when the agreements are signed. For preneed contracts funded through life insurance or annuity contracts, we receive in cash a general agency commission from a third-party insurance company that typically averages approximately 25% of the total sale. Additionally, we receive an increasing death benefit associated with the contract of approximately 1% per year in cash at the time the service is performed. There is no guarantee that the increasing death benefit will cover future increases in the cost of providing a price-guaranteed service, and any such excess cost could be materially adverse to our financial condition, results of operations, and cash flows.

16 Service Corporation International

PART I

The financial condition of third-party insurance companies that fund our preneed contracts may impact our future revenue.

Where permitted by state law, customers may arrange their preneed contract by purchasing a life insurance or annuity policy from third-party insurance companies. The customer/policy holder assigns the policy benefits to us as payment for their preneed contract at the time of need. If the financial condition of the third-party insurance companies were to deteriorate materially because of market conditions, strategic transactions, or otherwise, there could be an adverse effect on our ability to collect all or part of the proceeds of the life insurance policy, including the annual increase in the death benefit, if we fulfill the preneed contract at the time of need. Failure to collect such proceeds could have a material adverse effect on our financial condition, results of operations, and cash flows.

Unfavorable publicity could affect our reputation and business.

Since our operations relate to life events involving emotional stress for our client families, our business is dependent on customer trust and confidence. Unfavorable publicity about our business generally or in relation to any specific location could affect our reputation and customers’ trust and confidence in our products and services, thereby having an adverse impact upon our sales and financial results.

We use a combination of insurance, self-insurance, and large deductibles in managing our exposure to certain inherent risks; therefore, we could be exposed to unexpected costs that could negatively affect our financial performance.

Our insurance coverage is subject to deductibles, self-insured retentions, limits of liability, and similar provisions that we believe are prudent based on our operations. Because we self-insure a significant portion of expected losses under our workers' compensation, auto, and general and professional liability insurance programs, unanticipated changes in any applicable actuarial assumptions, trends and interpretations, or management estimates underlying our recorded liabilities for these losses, including potential increases in costs, could result in materially different amounts of expense than expected under these programs. These unanticipated changes could have a material adverse effect on our financial condition, results of operations, and cash flows.

Declines in overall economic conditions beyond our control could reduce future potential earnings and cash flows and could result in future impairments to goodwill and/or other intangible assets.

In addition to an annual review, we assess the impairment of goodwill and/or other intangible assets whenever events or changes in circumstances indicate that the carrying value may be greater than fair value. Factors that could trigger an interim impairment review include, but are not limited to, a significant decline in our stock price, significant underperformance relative to historical or projected future operating results, and significant negative industry or economic trends. If any of these factors occur, we may have a triggering event, which could result in an impairment of our goodwill and/or other intangible assets. If economic conditions worsen causing deterioration in our operating revenue, operating margins, and cash flows, we may have a triggering event that could result in an impairment of our goodwill and/or other intangible assets. Our cemetery segment, which has a goodwill balance of $328.9 million as of December 31, 2020, is more sensitive to market conditions and goodwill impairments because it is more reliant on preneed sales, which are impacted by customer discretionary spending. For additional information, see Critical Accounting Policies, Recent Accounting Pronouncements, and Accounting Changes in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Any failure to maintain the security of the information relating to our customers, their loved ones, our associates, and our vendors could damage our reputation, could cause us to incur substantial additional costs and to become subject to litigation, and could adversely affect our operating results, financial condition, or cash flow.

In the ordinary course of our business, we and our vendors receive and retain certain personal information, in both physical and electronic formats, about our customers, their loved ones, our associates, and our vendors, and there is an expectation that we will adequately protect that information. In addition, our online operations at our websites depend upon the secure transmission of confidential information over public networks, including information permitting electronic payments. The U.S. regulatory environment surrounding information security and privacy is increasingly demanding. New laws and regulations governing data privacy, security, cybersecurity, and the unauthorized disclosure of confidential information, including recent California legislation, pose increasingly complex compliance challenges and potentially elevate our costs. Any failure by us to comply with these laws and regulations, including as a result of a security or privacy breach, could result in significant penalties and liabilities for us. A significant theft, loss, or fraudulent use of the personally identifiable information we maintain or failure of our vendors to use or maintain such data in accordance with contractual provisions could result in significant costs, fines, and litigation. Additionally, if we acquire a company that has violated or is not in compliance with applicable data protection laws, we may incur significant liabilities and penalties as a result.

FORM 10-K 17

PART I

We maintain substantial security measures and data backup systems to protect, store, and prevent unauthorized access to such information. Nevertheless, it is possible that computer hackers and others (through cyberattacks, which are rapidly evolving and becoming increasingly sophisticated, or by other means) might defeat our security measures in the future and obtain the personal information of customers, their loved ones, our associates, and our vendors that we hold. Further, our associates, contractors, or third parties with whom we do business may attempt to circumvent our security measures to misappropriate such information and may purposefully or inadvertently cause a breach, corruption, or data loss involving such information. A breach of our security measures or failure in our backup systems could adversely affect our reputation with our customers and their loved ones, our associates, and our vendors; as well as our operations, results of operations, financial condition, and cash flows; and could result in litigation against us or the imposition of penalties. Moreover, a security breach could require that we expend significant additional resources to upgrade further the security measures that we employ to guard such important personal information against cyberattacks and other attempts to access such information and could result in a disruption of our operations.

Our Canadian business exposes us to operational, economic, and currency risks.