UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended March 31, 2014

Commission File No. 001-32632

UROPLASTY, INC.

(Exact name of registrant as specified in its Charter)

|

Minnesota

|

|

41-1719250

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

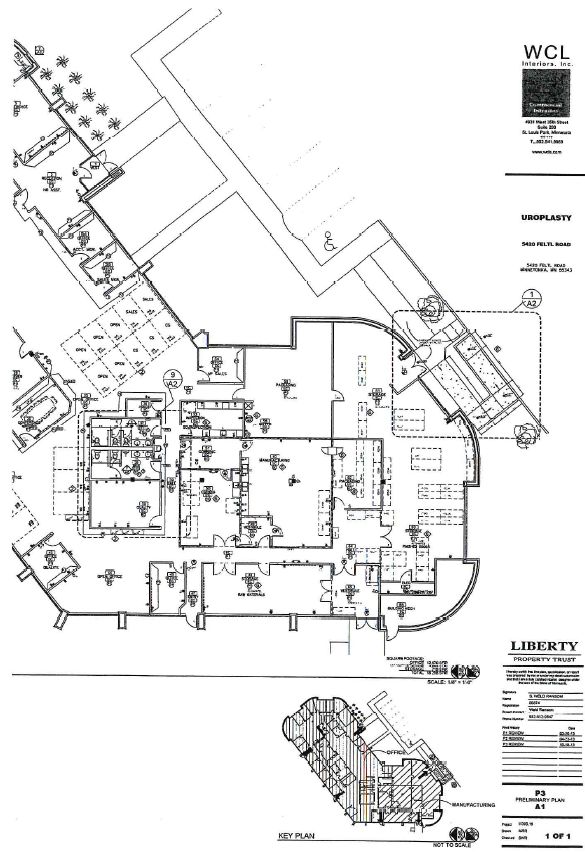

5420 Feltl Road

Minnetonka, Minnesota 55343

(Address of principal executive offices)

(952) 426-6140

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of class

|

|

Name of Exchange on which registered

|

|

Common Stock, $.01 par value

|

|

NASDAQ

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer x

|

Non-Accelerated Filer o

|

Smaller Reporting Company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO x

The aggregate market value of the voting stock and nonvoting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of September 30, 2013 was $64,961,799.

As of May 30, 2014, the registrant had 22,013,835 shares of common stock outstanding.

Documents Incorporated By Reference: Portions of our Proxy Statement for our 2014 Annual Meeting of Shareholders (the “Proxy Statement”), are incorporated by reference in Part III.

|

Item

|

|

Description

|

|

Page

|

|

|

|

|

|

|

|

|

|

PART I

|

|

|

|

1.

|

|

|

|

3

|

|

1A.

|

|

|

|

14

|

|

1B.

|

|

|

|

21

|

|

2.

|

|

|

|

22

|

|

3.

|

|

|

|

22

|

|

4.

|

|

|

|

22

|

|

|

|

PART II

|

|

|

|

5.

|

|

|

|

22

|

|

6.

|

|

|

|

24

|

|

7.

|

|

|

|

24

|

|

7A.

|

|

|

|

32

|

|

8.

|

|

|

|

32

|

|

9.

|

|

|

|

32

|

|

9A.

|

|

|

|

32

|

|

9B.

|

|

|

|

34

|

|

|

|

PART III

|

|

|

|

10.

|

|

|

|

35

|

|

11.

|

|

|

|

35

|

|

12.

|

|

|

|

35

|

|

13.

|

|

|

|

35

|

|

14.

|

|

|

|

35

|

|

|

|

PART IV

|

|

|

|

15.

|

|

|

|

35

|

References to “Uroplasty,” “Company,” “we,” “our” or “us” in this report refer to Uroplasty, Inc. and its subsidiaries.

This report contains references to among others, our trademarks Urgent PC® Neuromodulation System and Urgent® for our neuromodulation product, Macroplastique® Implants for our urological tissue bulking products, VOX® for our otolaryngology tissue bulking products, PTQ® for our colorectal tissue bulking and Uroplasty® for our company. All other trademarks or trade names referred to in this report are the property of their respective owners.

Our fiscal year-end always ends March 31. References in this report to a particular year generally refer to the applicable fiscal year. For example, references to “2014,” “Fiscal 2014” or “the year ended March 31, 2014” mean the fiscal year ended March 31, 2014.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” relating to projections, plans, objectives, estimates, and other statements of future performance. These forward-looking statements are subject to known and unknown risks and uncertainties relating to our future performance that may cause our actual results, performance, achievements, or industry results, to differ materially from those expressed or implied in any such forward-looking statements. Our business operates in highly competitive markets and our operating results and the achievement of the forward-looking statements may be impacted by changes in general economic conditions, competition, reimbursement levels, customer and market preferences, government regulation, tax regulation, foreign exchange rate fluctuations, the degree of market acceptance of products, the uncertainties of potential litigation, and other matters detailed in the “Risk Factors” contained in Item IA of this report.

We do not undertake nor assume any obligation to update any forward-looking statements that we may make from time to time.

We are a medical device company that develops, manufactures and markets innovative, proprietary products for the treatment of voiding dysfunctions. You can access, free of charge, our filings with the Securities and Exchange Commission, including our annual report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K and any other amendments to those reports, at our website

www.uroplasty.com, or at the Commission’s website at

www.sec.gov.

Our primary focus is on two products: the Urgent PC

® Neuromodulation System (“Urgent PC System”), which we believe is the only commercially available Food and Drug Administration (“FDA”) cleared, minimally-invasive, neuromodulation system that delivers

percutaneous tibial nerve stimulation (“PTNS”) for office-based treatment of overactive bladder (“OAB”) and the associated symptoms of urinary urgency, urinary frequency, and urge incontinence; and Macroplastique

® Implants (“Macroplastique”), an injectable, urethral bulking agent for the treatment of adult female stress urinary incontinence primarily due to intrinsic sphincter deficiency (“ISD”). Our Urgent PC System has CE Mark for the treatment of OAB as well as the treatment of fecal incontinence. Macroplastique also has CE Mark for the treatment of adult female stress urinary incontinence as well as male stress incontinence, fecal incontinence, vocal cord rehabilitation and vesicoureteral reflux. While our focus is on commercializing our Urgent PC System and Macroplastique in the United States and Europe, each of these products has market clearance in approximately 15 countries outside of this focus area.

Our primary focus is on growth in the U.S. market, which we entered in 2005 with our Urgent PC System. Prior to that time, essentially all of our business involved the sale of Macroplastique and other products outside of the U.S. We believe the U.S. market presents a significant opportunity for growth in sales of our products.

Our Urgent PC System uses a percutaneous stimulation method to deliver electrical pulses to the tibial nerve which has an effect on the sacral nerve plexus, a control center for bladder function. We have received regulatory clearances for sale of our Urgent PC System in the United States, Canada and Europe. We have intellectual property rights relating to key aspects of our neuromodulation therapy.

We have sold Macroplastique for urological indications in over 40 countries outside the United States since 1991. In October 2006, we received from the FDA pre-market approval for the use of Macroplastique to treat adult female stress urinary incontinence. We began marketing Macroplastique in the United States in 2007.

We believe physicians prefer our products because they offer effective therapies for patients that can be administered in office or outpatient surgical-based settings and, to the extent reimbursement is available, provide the physicians a profitable revenue stream. We believe patients prefer our products because they are minimally invasive treatment alternatives that do not have the side effects associated with pharmaceutical treatment options nor the morbidity associated with surgery.

Our sales are and have been significantly influenced by the availability of third-party reimbursement for PTNS treatments.

Effective January 2011, the American Medical Association (“AMA”) granted a Category 1 Current Procedural Terminology (“CPT”) code for PTNS treatments. As a result, we expanded our U.S. field sales and support organization from 15 employed sales representatives and six independent manufacturer’s representatives on April 1, 2010 to 43 employed sales representatives on March 31, 2014, and sales of our Urgent PC System have begun to increase. As of March 31, 2014, we also employed 6 field based clinical support specialists and 5 Regional Sales Directors.

We have focused our efforts on expanding reimbursement coverage with Medicare carriers and private payers by instituting a comprehensive program to educate their medical directors regarding the clinical effectiveness, cost effectiveness and patient benefits of PTNS treatments using our Urgent PC System. As of May 1, 2014, regional Medicare carriers covering 40 states and the District of Columbia, with approximately 40 million covered lives, provide coverage for PTNS treatments. In addition, we estimate that private payers insuring approximately 119 million lives provide coverage for PTNS treatments. As of May 1, 2014, only one regional Medicare carrier representing 10 states, with approximately 10 million covered lives, continued to decline reimbursement coverage for PTNS treatments. Increasing coverage from private payers, as well as obtaining reimbursement from the sole regional Medicare carrier not to provide coverage for PTNS, is a key element of our strategy.

During Fiscal 2014, significant management changes occurred. In April, our Chief Executive Officer resigned, and we appointed Robert Kill as our interim Chief Executive Officer (“CEO”). Mr. Kill became our President and CEO in July 2013. We also have new leaders in sales, marketing, finance, research and development, clinical affairs and healthcare affairs. This team has expertise in medical devices and in urology, as well as experience in growing businesses.

We expect to continue to emphasize sales of our Urgent PC System in the United States and internationally. In fiscal 2014, we implemented new sales strategies and refocused the sales organization. We will continue to emphasize generating greater patient and physician awareness of our Urgent PC system, and on training physicians in the proper use and clinical benefits of our Urgent PC System for overactive bladder. As part of this process, we intend to hire additional clinical support specialists in some of our markets during fiscal 2015 and plan to expand our call point beyond our historical focus on urologists. Specifically, we plan to expand our call point to include gynecologists, urogynecologists and a highly targeted group for primary care physicians who are high prescribers of OAB medications as we look to accelerate the growth of our Urgent PC System. We do not expect to see significant growth in our Macroplastique business, because we believe it is a small, mature market that is more competitively penetrated than the market for OAB treatment using PTNS.

Another key focus in fiscal 2015 will be investments in research and development to build our product pipeline. Our pilot clinical trial for fecal incontinence in the United States using our Urgent PC System is well underway, and we plan to investigate other potential indication expansions in the pelvic health area. We will also seek to expand our product portfolio through business development activities. Our focus will be on capitalizing upon our leverage at the call point created by our strong distribution channel.

Both of our products are targeted at the market for treatment of voiding dysfunctions and address overlapping submarkets. Voiding dysfunctions affect urinary or bowel control and can result in uncontrolled bladder or bowel sensations (overactive bladder or bowel urgency) or unwanted leakage (urinary or fecal incontinence).

We believe that over the next several years a number of key demographic and technological factors will accelerate growth in the market for medical devices to treat OAB symptoms and other urinary and bowel voiding dysfunctions. These factors include the following:

| |

· |

Technology advances and patient awareness. Patients often weigh the clinical benefits, adverse side effects and the level of invasiveness of the procedures, along with other factors, in choosing a treatment alternative. In recent years, with the publicity associated with new technology and treatment alternatives, we believe the number of patients visiting physicians to seek treatment for voiding dysfunctions has increased. |

| |

· |

Emphasis on quality of life. Patients have placed an increased emphasis on quality of life issues and maintaining active lifestyles. Their desire to improve their quality of life is usually an important factor in selecting a treatment for their disorder. We believe patients seeking treatment are increasingly considering alternatives designed to balance the therapeutic effect with any associated side effects. As a result, we believe patients will increasingly choose minimally invasive surgical treatments or other effective treatments such as neuromodulation. |

| |

· |

Aging population. The number of individuals developing voiding dysfunctions with a desire to have a productive and social aging process will increase as the population ages and as life expectancies rise. This group also has greater public awareness and access to healthcare information than past generations to assist in their decision making. |

Symptoms. For individuals with overactive bladder symptoms, the nervous system control for bladder filling and urinary voiding is incompetent. For OAB patients, signals to indicate a full bladder are sent early and frequently, triggers to allow the bladder to relax for filling are ineffective, and nervous controls of the urethral sphincter to keep the bladder closed until an appropriate time are inadequate. An individual with OAB may exhibit one or all of the symptoms that characterize overactive bladder: urinary urgency, urinary frequency and urge incontinence. Urgency is the strong, compelling need to urinate and frequency is a repetitive need to void. For most individuals, normal urinary voiding is approximately eight times per day while individuals with OAB may seek to void over 20 times per day and more than two times during the night. Urge incontinence refers to the involuntary loss of urine associated with an abrupt, strong desire to urinate that typically results in an accident before the individual can reach a restroom.

Treatment of Symptoms. When patients seek treatment for OAB, physicians normally start with conservative therapies such as biofeedback and behavioral modification. When, as is often the case, these therapies are not entirely successful, the next treatment of choice is drug therapy. If, as is the case with a majority of the patients, the drug therapy is ineffective or cannot be tolerated by the patient, the physicians suggest other treatments. For those patients, we believe the minimally invasive Urgent PC treatments offer an alternative to the more invasive treatments such as surgery, implantation of a sacral nerve stimulation device, or injection of OnabotulinumtoxinA into the bladder.

Biofeedback and Behavioral Modification. Bladder training, scheduled voiding techniques and pelvic floor training, often accompanied by the use of voiding diaries, are non-invasive approaches to managing OAB. These techniques are seldom completely effective because they rely on the diligence of and compliance by the individual. In addition, these techniques may not affect the underlying cause of the condition.

Drug Therapy. The most common treatment for OAB is drug therapy using an anticholinergic agent. However, for many patients, drugs are ineffective or the side effects are so bothersome that they discontinue the medications. Common side effects include dry mouth, dry eyes, constipation, cognitive changes and blurred vision.

Neuromodulation. Normal urinary control is dependent upon properly functioning neural pathways and coordination among the central and peripheral nervous systems, the nerve pathways, the bladder and the sphincter. Unwanted, uncoordinated or disrupted signals along these pathways can lead to OAB symptoms. Therapy using neuromodulation incorporates electrical stimulation to target specific neural tissue and modulate the generation of unwanted signals. To alter bladder function, neuromodulation must affect the sacral nerve plexus, which innervates the bladder and pelvic floor. This type of neuromodulation to treat OAB may be provided by a surgically implanted sacral nerve stimulation device by the non-surgical PTNS procedure delivered by our Urgent PC System in a physician’s office.

|

· |

Surgical. Direct sacral nerve stimulation devices consist of a surgically implanted lead near the spine and an implanted stimulator in the buttocks to deliver mild electrical pulses to the sacral nerve plexus. We believe patients may be more inclined to elect a less invasive treatment option for urinary symptoms instead of an invasive surgery that could be associated with complications. |

|

· |

Minimally Invasive. PTNS delivers stimulation to the sacral nerve plexus by temporarily applying electrical pulses to the posterior tibial nerve, accessed through a non-surgical, percutaneous approach on the lower leg. Neuromodulation using PTNS has a therapeutic effect documented in published clinical studies. PTNS has a low risk of complications and is typically performed in a physician’s office because it is a non-surgical treatment. |

OnabotulinumtoxinA. OnabotulinumtoxinA, marketed under the name of BOTOX, is a prescription medicine that is injected into the bladder. One BOTOX treatment can last up to six months before the effects wear off, with the need then to repeat the procedure. However, BOTOX may cause serious side effects that can be life threatening. In addition, due to the risk of urinary retention (not being able to empty the bladder), only patients who are willing and able to initiate self-catheterization post-treatment, if required, are considered for treatment. We believe many patients may be more inclined to elect a treatment for OAB with less significant potential adverse events.

The Uroplasty Solution: The Urgent PC System. Our Urgent PC System is a minimally invasive nerve stimulation device designed for office-based treatment of OAB and the associated symptoms of urge incontinence, urinary urgency and urinary frequency. Using a small-gauge needle electrode inserted above the ankle, our Urgent PC System delivers electrical impulses to the tibial nerve that affect the sacral nerve plexus, a control center for pelvic floor and bladder function.

We believe that our Urgent PC System is the only commercially available FDA-cleared PTNS device in the United States market for treatment of OAB. Components of our Urgent PC System include a hair-width needle electrode, a lead set and an external, handheld, battery-powered stimulator. For each 30-minute office-based therapy session, the physician or other qualified health care provider inserts the needle electrode above the ankle and connects the electrode to the stimulator. Typically, a patient undergoes a course of 12 consecutive weekly treatments, and, subsequently, a personal treatment plan of single treatments at lesser frequency to sustain the therapeutic effect.

Symptoms and Prevalence. Urinary incontinence is defined as the involuntary loss of urine, and is the result of either bladder or urethral dysfunction. In 2007, the US Department of Health and Human Services, Public Health Service, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases reported that, depending on the definition of urinary incontinence used, 5% to 50% of the adult U.S. population suffers from some form of urinary incontinence. The prevalence of urinary incontinence increases with advancing age, and the prevalence of the U.S. population with urinary incontinence is expected to grow over the next decades as the U.S. population ages. Urinary incontinence often results in social isolation, depression, and poor self-rated health and quality of life, and is a significant medical condition with considerable public health impact.

Causes of Urinary Incontinence. The mechanisms of urinary continence are complex and involve the interaction among several anatomical structures. Urinary continence is controlled by the urinary sphincteric mechanism, the pelvic floor support structures and the nervous system. The sphincter muscle surrounds the urethra and provides constrictive pressure to prevent urine from flowing out of the bladder, especially with increased intra-abdominal pressure. In healthy individuals, urination occurs when the nervous system signals the sphincter to relax as the bladder contracts, allowing urine to flow through the urethra. Incontinence may result when one or more parts of this complex mechanism fails to function as intended. Incontinence may be caused by tissue damage during childbirth, pelvic trauma, pelvic surgery, pelvic organ prolapse, spinal cord injuries, neurological diseases (e.g., multiple sclerosis and poliomyelitis), birth defects (e.g., spina bifida) and degenerative changes associated with aging.

Types of Urinary Incontinence. Per the American Urological Association (“AUA”), there are three types of urinary incontinence:

|

· |

Stress Urinary Incontinence — Stress urinary incontinence (“SUI”), refers to the involuntary loss of urine due to an increase in intra-abdominal pressure from ordinary physical activities, such as coughing, sneezing, laughing, straining or lifting. SUI, the most common form of urinary incontinence among women, is estimated to affect almost 30 million women over the age of 18 in the U.S. (Hampel et al., 1997 and 2000 U.S. census data). SUI is caused by urethral hypermobility and/or ISD. Urethral hypermobility – abnormal movement of the bladder neck and urethra – can occur when the anatomic supports for the bladder neck and urethra have weakened. This anatomical change can result from pregnancy, childbirth or age-related tissue deterioration. SUI can also be caused by ISD, or the inability of the urinary sphincteric mechanism to function properly. ISD can be due to congenital or age-related sphincter weakness or can result from damage to the sphincteric mechanism following pelvic trauma, surgery, neurologic diseases or radiation therapy. |

|

· |

Urge Incontinence — Urge incontinence refers to the involuntary loss of urine associated with an abrupt, strong desire to urinate. Urge incontinence often occurs when neurologic problems cause the bladder to contract and empty with little or no warning, and is part of the overactive bladder syndrome. |

|

· |

Overflow Incontinence — Overflow incontinence is associated with an over-distention of the bladder. This can be the result of an under-active bladder or an obstruction in the bladder or urethra. |

Per the AUA, stress and urge incontinence often coexist resulting in mixed incontinence.

Treatments. There are two general approaches to dealing with urinary incontinence. One approach is to manage symptoms, such as through absorbent products, catheters, behavior modification and drug therapy. The other approach is to undergo curative treatments in an attempt to restore continence, such as injection of urethral bulking agents or surgery, or a combination of the two. We believe that patients prefer less invasive treatments that provide the most benefit and have little or no side effects.

Injectable Bulking Agents. Urethral bulking agents (“UBAs”) are injected into the area around the urethra, to augment the surrounding tissue for increased capacity to control the release of urine for patients with SUI. Hence, these materials are often called “bulking agents” or “injectables” and are an attractive alternative to surgery because they are considerably less invasive, offer a quick recovery, and do not require the use of an operating room for placement; UBAs can be implanted in an office or out-patient facility. Additionally, the use of a UBA does not preclude the subsequent use of more invasive treatments if required. Furthermore, UBAs may be used to resolve lingering symptoms for patients who have undergone certain more invasive treatments, such as mid-urethral slings, which failed to completely resolve the stress urinary incontinence conditions.

Surgery. In women, SUI may be corrected through surgery with a mid-urethral sling which provides a hammock-type support for the urethra to prevent its downward movement and the associated leakage of urine.

The Uroplasty Solution: Macroplastique Implants. Macroplastique is used to treat adult female stress urinary incontinence due to ISD. It is designed to restore the patient’s urinary continence immediately following treatment. Macroplastique is a soft-textured, permanent implant injected, under endoscopic visualization, around the urethra distal to the bladder neck. It is a proprietary composition of heat vulcanized, solid, soft, irregularly shaped polydimethylsiloxane (solid silicone elastomer) implants suspended in a biocompatible excretable carrier gel. We believe our compound is better than other commercially available bulking agents because, with its unique composition, shape and size, it does not degrade, is not absorbed into surrounding tissues and does not migrate from the implant site.

We have sold Macroplastique for several urological indications in over 40 countries outside the United States since 1991. In October 2006, we received FDA pre-market approval for the use of Macroplastique to treat adult female SUI due to ISD. We began marketing Macroplastique in the United States in early 2007.

Other Uroplasty Products and Applications

Macroplastique® for Vesicoureteral Reflux. Outside the U.S., we market our Macroplastique products for treatment of vesicoureteral reflux: the abnormal backflow of urine from the bladder into the ureters or kidneys that is most prevalent in infants and children where the ureters did not fully develop. In this application, a bolus of the elastomer implant is injected around the orifice or valve where the ureter enters the bladder.

PTQ® Implants. We also market our silicone elastomer implants under the name PTQ

® Implants outside of the U.S. as a minimally invasive product to address fecal incontinence (sometimes referred to as bowel incontinence). Our PTQ Implants offer minimally-invasive, soft-textured permanent implant for treatment of fecal incontinence. PTQ is implanted circumferentially into the submucosa of the anal canal, creating a “bulking” and supportive effect around the anal sphincter. PTQ is CE marked and currently sold outside the United States in various international markets.

Urgent PC for Fecal Incontinence. Our Urgent PC System is CE marked and sold outside of the United States for the treatment of fecal incontinence. We also intend to explore the commercialization of our Urgent PC System for this application in the U.S. and started on a multiyear pilot clinical trial in fiscal 2013 as a prelude to a full clinical study for FDA clearance.

VOX® Implants. In addition to urological applications, we market our silicone elastomer bulking material outside the United States to help improve speech and swallowing function in patients with unilateral vocal cord paralysis. The implants are sold for vocal cord rehabilitation applications under the trade name VOX

® Implants.

Distributed Products. In The Netherlands and United Kingdom only, we distribute certain wound care products in accordance with a distributor agreement. Under the terms of the distributor agreement, we are not obligated to purchase any minimum level of wound care products.

Our goal is to become the leading provider of minimally invasive, office and outpatient surgical-based solutions to treat and improve the quality of life for patients suffering from the physical and emotional stress resulting from voiding dysfunction problems. We believe that with our Urgent PC System and Macroplastique products we can increasingly garner the attention of key physicians and distributors to grow our revenue. The key elements of our strategy are to:

|

· |

Increase market coverage in the United States. We believe the United States presents a significant opportunity for growth in sales of our products. In order to grow our business in the United States, we anticipate further investment in our sales and marketing organization, as needed, to support our sales growth. |

|

· |

Elevate the clinical and competitive selling skills of our sales team. We believe that enhanced training of our sales force will improve the effectiveness and efficiency of both implementing and expanding our Urgent PC System within a physician office as well as improve sales force productivity. We will continue to invest in training of our sales force. |

|

· |

Educate physicians and third-party insurance carriers about the benefits of our Urgent PC System. We believe education of physicians and third-party insurance carriers regarding the benefits of our Urgent PC System is critical to the successful adoption of this System, and to reimbursement for treatments by third-party carriers. To this end, we have conducted clinical studies which we believe will help us with our sales and marketing efforts. |

|

· |

Build patient awareness of office and outpatient surgical-based solutions. Patients often weigh the quality of life benefits of electing to undergo a surgical procedure against the invasiveness of the procedure. We intend to continue to expand our marketing efforts to build patient awareness of the treatment alternatives and encourage patients to see physicians. Increasing patient awareness of our treatment alternatives will help physicians build their practices and simultaneously increase sales of our products. |

|

· |

Focus on office and outpatient surgical-based solutions for physicians. We believe our company is uniquely positioned to provide a broad product offering of office and outpatient surgical-based solutions for physicians. By expanding our United States presence, we intend to develop long-standing relationships with leading physicians treating voiding dysfunctions. These relationships will provide us with a source of new product ideas and a conduit through which to introduce new products. Building these relationships is an important part of our growth strategy, particularly for the development and introduction of new products. |

|

· |

Obtain FDA clearance to expand use of our Urgent PC System for other indications. Our Urgent PC System is CE marked and sold outside of the United States for the treatment of fecal incontinence. We intend to explore the commercialization in the U.S. of our Urgent PC System for the treatment of fecal incontinence. To commercialize the product in the U.S. for the treatment of fecal incontinence, we will need to conduct clinical trials for FDA clearance and for seeking reimbursement coverage from third-party payers. We started on a multiyear pilot clinical trial in fiscal 2013 and plan to start a pivotal clinical study needed for FDA clearance in fiscal 2015. |

|

· |

Develop, license or acquire new products. We believe that our office and outpatient surgical-based solutions are an important competitive advantage because they allow us to address the preferences of doctors and patients, as well as the quality of life issues presented by voiding dysfunctions. An important part of our long term growth strategy is to broaden our product lines further to meet customer needs by developing, licensing and acquiring new products to be sold by our sales team. |

Sales, Distribution and Marketing

We are focusing our sales and marketing efforts primarily on urologists, urogynecologists and gynecologists with significant office-based and outpatient surgery-based patient volume.

To support our business in the United States, we have a sales organization, consisting primarily of 43 direct field sales representatives, 5 Regional Sales Directors, 6 clinical specialists, a marketing organization to market our products directly to our customers and a reimbursement department. We anticipate further increasing our sales and marketing organization in the United States, as needed, to support our sales growth.

Outside of the United States, we sell our products primarily through a direct sales organization in the United Kingdom, The Netherlands, Switzerland and the Nordic countries, and in all other markets primarily through distributors. Each of our distributors has a territory-specific distribution agreement, including requirements indicating they may not sell products that compete directly with ours. Collectively, distributors accounted for approximately 13%, 14% and 17% of our total net sales for fiscal 2014, 2013 and 2012, respectively.

We use clinical studies and worldwide scientific community awareness programs to demonstrate the safety and efficacy of our products. This data is important to obtain regulatory approval and to support our sales staff and distributors in securing product reimbursement in their territories. Publications of clinical data in peer-reviewed journals and presentations at professional society meetings by clinical researchers add to the scientific community awareness of our products, including patient indications, treatment technique and expected outcomes. We provide a range of activities designed to support physicians in their clinical research.

Third-Party Reimbursement

In the United States as well as in foreign countries, sales of our products depend in significant part on the availability of reimbursement from third-party payers. In the United States, third-party payers consist of government programs such as Medicare, private health insurance plans, managed care organizations and other similar programs. For any product, three factors are critical to reimbursement:

|

• |

coding, which ensures uniform descriptions of procedures, diagnoses and medical products; |

|

• |

coverage, which is the payer’s policy describing the clinical circumstances under which it will pay for a given treatment; and |

|

• |

payment processes and amounts. |

We believe the availability of a Category 1 CPT code for PTNS treatments has encouraged, and will continue to encourage, broader coverage and subsequent use of our Urgent PC System in the U.S. However, each governmental and private payer makes its own coverage decision.

We have focused our efforts on expanding reimbursement coverage with Medicare carriers and private payers by instituting a comprehensive program to educate their medical directors regarding the clinical effectiveness, cost effectiveness and patient benefits of PTNS treatments using our Urgent PC System. As of May 1, 2014, regional Medicare carriers (“MACs”) covering 40 states and the District of Columbia, with approximately 40 million covered lives, provide coverage for PTNS treatments. In addition, we estimate that private payers insuring approximately 119 million lives provide coverage for PTNS treatments. As of May 1, 2014, only one regional Medicare carrier representing 10 states with approximately 10 million covered lives, continued to decline reimbursement coverage for PTNS treatments. This regional Medicare carrier

had jurisdiction over two states at April 1, 2013, but due to consolidation of certain MACs, now has jurisdiction over ten states. In May 2014, National Government Services (“NGS”) re-affirmed its non-coverage policy for PTNS. We plan to continue to educate NGS Medical Directors about the benefits and positive outcomes of PTNS therapy.

The code under which PTNS is reimbursed was one of several hundred codes that the Centers for Medicare and Medicaid Services (“CMS”) noted as a potentially misvalued code earlier this year. In November 2013, CMS indicated further review of PTNS is warranted, and as a result, CMS will be gathering additional feedback before a final decision is made. The final decision could result in an increase, a decrease or no change in the reimbursement rate for PTNS. Any change to the reimbursement rate due to this review is not expected to be published until November 2014 and will become effective beginning in January 2015.

In December 2013, the Blue Cross and Blue Shield (“BCBS”)Association Medical Advisory Panel concluded that use of PTNS for the treatment of voiding dysfunction meets their Technology Evaluation Center criteria. This panel is responsible for assessing medical technologies through a comprehensive review of clinical evidence. This positive assessment concluded that PTNS improves net health outcomes as much as, or more than, other established therapies and is strong validation of the acceptance of Urgent PC as an important treatment option for OAB. Currently, there are approximately 100 million lives covered by the 37 BCBS companies across the United States, with approximately 30 million lives as of May 1, 2014 having access to PTNS through positive coverage from their local plan. This decision can now be used by the remaining BCBS companies as an important tool in assessing positive coverage for PTNS for the treatment of overactive bladder.

Outside of the U.S., our Urgent PC System treatments are reimbursed under an available reimbursement code in the Netherlands. In other countries in Europe there are no specific reimbursement codes for Urgent PC System treatments and generally reimbursement is from fund-holder trusts or global hospital budgets.

We believe there are appropriate CPT codes available to describe the use of Macroplastique to treat adult female SUI due to ISD in the United States. Outside of the United States, government managed health care systems and private insurance control reimbursement for devices and procedures. Reimbursement systems in international markets vary significantly by country. In the European Union, reimbursement decision-making is neither regulated nor integrated at the European Union level. Each country has its own system, often closely protected by its corresponding national government. Reimbursement for Macroplastique has been successful in multiple international markets where hospitals and physicians have budgets approved by fund-holder trusts or global hospital budgets.

Manufacturing and Suppliers

We subcontract the manufacturing of our Urgent PC System and its related components, and have a U.S. FDA-registered manufacturing facility in Minnetonka, Minnesota, where we manufacture all of our tissue bulking products. Our facility uses dedicated heating, cooling, ventilation and high efficiency particulate air filtration systems to provide cleanroom and other controlled working environments. Our trained technicians perform all critical manufacturing processes in qualified environments according to validated written procedures. We use qualified vendors to sterilize our products using validated methods.

Our U.S. manufacturing facility and systems are periodically audited by regulatory agencies and other authorities to ensure compliance with ISO 13485 (medical device quality management systems), applicable European and Canadian medical device requirements, as well as FDA’s Quality Systems Regulations. We also are subject to additional state, local, and federal government regulations applicable to the manufacture of our products. While we believe we are compliant with all applicable regulations, we cannot guarantee that we will pass each regulatory audit.

We purchase several medical grade materials and other components for use in our finished products from single source suppliers meeting our quality and other requirements. Although we believe our sources of supply could be replaced if necessary without undue disruption, it is possible that the process of qualifying new suppliers could cause an interruption in our ability to manufacture our products, which could have a negative impact on sales.

The market for voiding dysfunction products is intensely competitive. Competitors offer management and curative treatments, pharmaceutical products such as anticholinergic drugs, injectable drugs, implantables including neuromodulation devices, urethral injectables and urethral sling products. We believe the principal decision factors among treatment methods include severity of patient symptoms and procedure risk, physician and patient acceptance of the treatment method, cost, availability of third-party reimbursement, and marketing and sales coverage. In addition to adequately addressing the decision factors, our ability to compete in this market will also depend on the consistency of our product quality as well as delivery and product pricing. Other factors affecting our success include our product development and innovation capabilities, clinical study results, ability to obtain required regulatory approvals, ability to protect our proprietary technology, manufacturing and marketing capabilities and ability to attract and retain skilled employees.

PTNS. We believe our Urgent PC System offers a minimally invasive, office-based treatment alternative in the continuum of care for OAB patients. Conservative therapies such as dietary restrictions, pelvic floor exercises, bladder retraining, biofeedback, and anticholinergic drugs usually precede our Urgent PC System treatments. Anticholinergic medications that could be seen as competing with PTNS include Detrol

® and Toviaz

® (both by Pfizer Inc.); Ditropan

® (Johnson & Johnson); Enablex

® (Novartis AG); Sanctura

® (Allergan, Inc.) and Vesicare

® (GlaxoSmithKline plc). These medications treat symptoms of OAB, some by preventing unwanted bladder contractions and others by tightening the bladder or urethra muscles or by relaxing bladder muscles. We believe our Urgent PC System normally is prescribed after these drugs are used but discontinued because they were ineffective or had unwanted side effects. In the case of anticholinergic medications, the side effects often include dry eyes, dry mouth, constipation, cognitive changes and blurred vision.

Allergan, Inc. recently began to commercialize Botulinum toxin A (Botox

®) for OAB treatments, and this treatment is a direct competitor for our Urgent PC System following unsuccessful drug therapy. In this procedure, Botox is injected in and around the urethra, often with approximately twenty individual injection sites, to numb and mask the symptoms of urgency and frequency. Nevertheless, although we believe that marketing campaigns by Allergan, Inc. will increase awareness of OAB, we also believe that the side effects of Botox injections for this application, which can include urinary retention and urinary tract infection, will lead many patients to choose our less invasive solution.

The Medtronic InterStim neuromodulation device, which stimulates the sacral nerve, requires surgical implantation of a lead near the patient’s spine in addition to a battery powered stimulator in the buttocks. In contrast, our Urgent PC System allows minimally invasive stimulation of the sacral nerve plexus in an office-based setting without any surgical intervention. Other companies may also enter the U.S. market with neuromodulation or other products for the treatment of OAB.

Bulking. Injectable urethral bulking agents for SUI competing directly with Macroplastique in the United States include: Durasphere

® manufactured by Carbon Medical Technologies, Inc. and distributed by Coloplast Corp; and Coaptite

® manufactured by Merz Aesthetics, Inc. and distributed by Boston Scientific Corporation. We believe Macroplastique competes favorably against these products because it will not degrade, resorb or migrate, has no special preparation or storage requirements, and is safe and effective for treating adult female stress urinary incontinence.

Outside of the United States, Deflux

® (manufactured by Q-Med AB, a wholly owned subsidiary of Galderma S.A., and distributed by Salix Pharmaceuticals, Ltd.) and Bulkamid

® (manufactured by Contura, Inc., Denmark and distributed by Johnson & Johnson) compete with Macroplastique for vesicoureteral reflux and SUI, respectively.

Many of our competitors and potential competitors have significantly greater financial, manufacturing, marketing and distribution resources than us. In addition, many of our competitors offer broader product lines within the urology market, which may give these competitors the ability to negotiate exclusive, long-term supply contracts and to offer comprehensive pricing for their products. It is possible other large health care and consumer products companies may enter this industry in the

future. Furthermore, smaller companies, academic institutions, governmental agencies and other public and private research organizations will continue to conduct research, seek patent protection and establish arrangements for commercializing products. These products may compete directly with any products that we may offer in the future.

The testing, manufacturing, promotion, marketing and distribution of our products in the United States, Europe and other parts of the world are subject to regulation by numerous governmental authorities, including the FDA, the European Union and other analogous agencies.

Our products are regulated in the United States as medical devices by the FDA under the Food, Drug and Cosmetic Act (FDC Act). Noncompliance with applicable requirements can result in, among other things:

|

· |

fines, injunctions, and civil penalties; |

|

· |

recall or seizure of products; |

|

· |

operating restrictions, or total or partial suspension of production; |

|

· |

denial of requests for 510(k) clearance or pre-market approval of new products; |

|

· |

withdrawal of existing approvals; and |

Depending on the degree of risk posed by the medical device and the extent of controls needed to ensure safety and effectiveness, there are two pathways for FDA marketing clearance of medical devices. For devices deemed by FDA to pose relatively less risk (Class I or Class II devices), manufacturers, in most instances, must submit a pre-market notification requesting permission for commercial distribution, known as 510(k) clearance. Devices deemed by FDA to pose the greatest risk (Class III devices), such as life-sustaining, life-supporting or implantable devices, or a device deemed not to be substantially equivalent to a previously cleared 510(k) device, require the submission of a pre-market approval (PMA) application. The FDA can also impose restrictions on the sale, distribution or use of devices at the time of their clearance or approval, or subsequent to marketing.

In October 2005, our initial version of the Urgent PC System received 510(k) clearance for sale within the United States. In July 2006, our second generation Urgent PC System received 510(k) clearance for sale within the United States.

In October 2006, we received FDA pre-market approval for the use of Macroplastique to treat female stress urinary incontinence in the United States. As part of the FDA-approval process, we are conducting a customary post-market study.

After a device is placed on the market, numerous regulatory requirements apply. These include:

|

· |

Quality System Regulations, which require manufacturers to follow design, testing, control, documentation and other quality assurance procedures during the manufacturing process; |

|

· |

labeling regulations, which govern product labels and labeling, prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling and promotional activities; |

|

· |

medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; and |

|

· |

notices of correction or removal, and recall regulations. |

The FDC Act requires that medical devices be manufactured in accordance with FDA’s current Quality System Regulations, which require, among other things, that we:

|

· |

regulate our design and manufacturing processes and control them by the use of written procedures; |

|

· |

investigate any deficiencies in our manufacturing process or in the products we produce; |

|

· |

keep detailed records and maintain a corrective and preventative action plan; and |

|

· |

allow the FDA to inspect our manufacturing facilities on a periodic basis to monitor our compliance with Quality System Regulations. |

Our U.S. manufacturing facility and processes have been inspected and certified in compliance with ISO 13485, applicable European medical device directives and Canadian Medical Device Requirements.

European Union and Other Regions

The European Union has adopted rules that require that medical products receive the right to affix the CE mark, which stands for Conformité Européenne. The CE mark demonstrates adherence to quality standards and compliance with relevant European medical device directives. Products that bear the CE mark can be imported to, sold or distributed within the European Union.

Our initial version of the Urgent PC System received CE marking in November 2005. Our second generation Urgent PC System received CE mark approval and approval from the Canadian Therapeutic Products Directorate of Health in June 2006.

We received the CE mark approval for Macroplastique in 1996 for the treatment of male and female stress urinary incontinence and vesicoureteral reflux; for VOX in 2000 for vocal cord rehabilitation and; for PTQ in 2002 for the treatment of fecal incontinence. Our manufacturing facilities and processes have been inspected and certified by AMTAC Certification Services, a recognized Notified Body, a testing and certification firm based in the United Kingdom.

We currently sell our products in approximately 40 foreign countries, including those within the European Union. Requirements pertaining to medical devices vary widely from country to country, ranging from no health regulations to detailed submissions such as those required by the FDA. We have obtained regulatory approvals in countries where required of us to sell our products. We believe the extent and complexity of regulations for medical devices such as those produced by us are increasing worldwide. We anticipate that this trend will continue and that the cost and time required to obtain approval to market in any given country will increase.

Patents, Trademarks and Licenses

We seek to establish and protect our proprietary technology using a combination of patents, trademarks, copyrights, trade secrets, and nondisclosure and non-competition agreements. We file patent applications for patentable technologies we consider important to the development of our business based on an analysis of the cost of obtaining a patent, the likely scope of protection, and the relative benefits of patent protection compared to trade secret protection, among other considerations.

We have obtained, by filing and by acquisition, various issued U.S. and foreign patents and pending patent applications related to electro-nerve stimulation.

In addition, we hold U.S. and foreign patents covering soft-tissue bulking materials, processes and applications. While we believe that our patents adequately protect our technologies, there can be no assurance that any of our issued patents are of sufficient scope or strength to provide meaningful protection and that any of our pending patent applications will result in patents being issued to us. In addition, there can be no assurance that any of our current or future patents will not be challenged, narrowed, invalidated or circumvented by others, or that our patents will provide us with any competitive advantage. Any legal proceedings to maintain, defend or enforce our patent rights could be lengthy and costly, with no guarantee of success. Third parties could also hold patents that may require us to negotiate licenses to conduct our business, and there can be no assurance that the required licenses would be available on reasonable terms, or at all.

We also seek to protect our trade secrets by requiring employees, consultants, and other parties to sign confidentiality agreements and noncompetition agreements, and by limiting access by outside parties to confidential information. There can be no assurance that these measures will prevent the unauthorized disclosure or use of this information or that others will not be able to independently develop this information.

In the U.S. and throughout the European Union, we have registered “Uroplasty” as our Company name, “Urgent” for our neuromodulation product, “Macroplastique” for our urological tissue bulking products, “VOX” for our otolaryngology tissue bulking products, and “PTQ” for our colorectal tissue bulking products.

We have certain royalty agreements under which we pay royalties on sales of Macroplastique and the Macroplastique implantation needle-positioning device.

We have research and development projects and activities to develop, enhance and evaluate potential new products for which we incur costs for regulatory submissions, regulatory compliance and clinical research. Our expenditures for clinical research include studies for new applications or indications for existing products, post-approval regulatory compliance and marketing and reimbursement approval by third-party payers. Our expenditures for research and development totaled approximately $2.2 million, $2.4 million and $1.9 million for fiscal 2014, 2013 and 2012, respectively.

The medical device industry is subject to substantial litigation. We face an inherent risk of liability for claims alleging adverse effects to the patient. We currently carry $10 million of worldwide product liability insurance. However, we cannot assure you that our existing insurance coverage limits are adequate to protect us from liabilities we might incur. Product liability insurance is expensive and in the future may not be available to us on acceptable terms, or at all. Furthermore, we do not expect to be able to obtain insurance covering our costs and losses as a result of any product recall. A successful claim in excess of our insurance coverage could materially deplete our assets. Moreover, any claim against us could generate negative publicity, which could decrease the demand for our products and our ability to generate revenues.

Compliance with Environmental Laws

Compliance by us with applicable environmental requirements during fiscal 2014, 2013 and 2012, respectively has not had a material effect upon our capital expenditures, earnings or competitive position.

Dependence on Major Customers

During fiscal 2014, 2013 and 2012, none of our customers individually accounted for 10% or more of our net sales.

We did not have significant backlog at fiscal year-end 2014, 2013 or 2012. We process customer orders generally within one or two days of receipt of the order.

As of March 31, 2014, we had 118 employees, of which 113 were full-time and 5 were part-time. No employee was subject to a collective bargaining agreement. We believe we maintain good relations with our employees.

Incorporation and Current Subsidiaries

We were incorporated in January 1992 as a Minnesota corporation and a wholly owned subsidiary of our original parent. In February 1995, we became a stand-alone, privately held company pursuant to a Plan of Reorganization confirmed by the U.S. Bankruptcy Court. We became a reporting company pursuant to a registration statement filed with the Securities and Exchange Commission in July 1996.

Our wholly owned foreign subsidiaries and their respective principal functions are as follows:

|

Uroplasty BV |

Incorporated in The Netherlands, distributes the Urgent PC Neuromodulation System, Macroplastique Implants, VOX Implants, PTQ Implants, all of their accessories, and wound care products. Products are sold primarily through our direct sales force in the United Kingdom, the Netherlands, Switzerland and the Nordic countries, and through distributors in all other markets. |

|

Uroplasty LTD |

Incorporated in the United Kingdom and acts as the sole distributor of the Urgent PC Neuromodulation System, Macroplastique Implants, PTQ Implants, all of their accessories, and wound care products in the United Kingdom and Ireland. Products are sold primarily through a direct sales organization. |

Available Information

Our principal executive offices are located at 5420 Feltl Road, Minnetonka, Minnesota 55343. Our telephone number at this address is (952) 426-6140. Our website is located at www.uroplasty.com. The information contained on our website or connected to our website is not incorporated by reference into and should not be considered part of this report.

We make available, free of charge and through our Internet web site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to any such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Our operations are subject to a number of risks and uncertainties that may affect our financial results, our accounting, and the accuracy of the statements we make in this Form 10-K. For example, we make statements about our belief in the efficacy of our product, the impact of regulatory and reimbursement approvals on our products and revenues, trends in international regulation, the attributes of our products versus those of our competitors, the adequacy of our resources, including cash, available to us, and other matters all of which represent our expectations or beliefs about future events. Our actual results may vary from these expectations because of a number of factors that affect our business, the most important of which include the following:

We continue to incur losses and may never reach profitability

We have incurred net losses in each of the last five fiscal years. As of March 31, 2014, we had an accumulated deficit of approximately $44 million primarily

because of costs relating to the development, including seeking regulatory approvals, and commercialization of our products. We expect our operating expenses relating to sales and marketing activities, product development and clinical trials, including an FDA-mandated post-market clinical study for our Macroplastique product, will continue during the foreseeable future. To achieve profitability, we must generate substantially more revenue than we have in prior years. Our ability to achieve significant revenue growth will depend, in large part, on our ability to achieve widespread market acceptance and third-party reimbursement for our products and successfully expand our business in the U.S. We may never achieve substantial market acceptance, realize significant revenue from the sale of our products or be profitable.

The use and acceptance of our products is heavily dependent upon the availability of third-party reimbursement for the procedures in which our products are used.

In the United States, healthcare providers that purchase medical devices, including our products, generally rely on third-party payers, including Medicare, Medicaid, private health insurance carriers and managed care organizations, to reimburse all or part of the cost and fees associated with the procedures performed using these devices. The commercial success of our products will depend on the ability of healthcare providers to obtain adequate reimbursement from third-party payers for the procedures in which our products are used. Third-party payers are increasingly challenging the coverage and pricing of medical products and procedures.

Even if a procedure is eligible for reimbursement, the level of reimbursement may not be adequate to justify the use of our products. In addition, third-party payers may deny reimbursement if they determine that the device used in the treatment was not cost-effective or was used for a non-approved indication, particularly if there is not a published CPT code for reimbursement. For example, in 2009, the AMA advised the medical community that the previously recommended Category 1 CPT code for PTNS treatments should be replaced with an unlisted code. As a result, many third-party insurers delayed or denied reimbursement for PTNS treatments, significantly impacting the sales of our Urgent PC System, until a new code was effective in January 2011.

The availability of the Category 1 CPT code for PTNS treatments has encouraged broader use of our Urgent PC System, but it has not resulted in universal coverage and there can be no assurance that additional payers will agree to create coverage policies or that the policies, if they are created, will provide adequate reimbursement, that existing coverage will not again be challenged (as it was in fiscal 2009), or that government actions will not decrease the level of reimbursement.

Reimbursement and healthcare payment systems in international markets vary significantly by country, with some countries offering government-sponsored healthcare or private insurance, or both. In many countries where there is government-sponsored healthcare reimbursement, decisions are made by individual hospitals with the government setting an upper limit of reimbursement. In most foreign countries, there are also insurance systems that may offer payments for alternative procedures. We cannot be certain that we, or in countries in which we work with our distributors, will successfully and cost-effectively manage all of these payment systems.

All third-party reimbursement programs, whether government-funded or insured commercially, inside the United States or outside, are developing increasingly sophisticated methods of controlling health care costs through prospective reimbursement and capitation programs, group purchasing, redesign of benefits, second opinions, careful review of bills, encouragement of healthier lifestyles and exploration of more cost-effective methods of delivering healthcare. These types of programs can potentially limit the amount that healthcare providers may be willing to pay for medical devices and could

have a material adverse effect on our financial position and results of operations.

We cannot predict how quickly or how broadly the market will accept our products.

In addition to the availability of third-party reimbursement, market acceptance of our products will depend on our ability to demonstrate the safety, clinical efficacy, perceived benefits, and cost-effectiveness of our products compared to products or treatment options of our competitors. We cannot assure you that we will be successful in educating the marketplace about the benefits of our products. Our Urgent PC System requires a new treatment protocol for the physicians and their staff to implement repeatedly. Even if customers accept our products, this acceptance may not translate into repeat sales if our customers do not fully adopt the new treatment protocol in their practice.

We are subject to changing federal and state regulations that could increase the cost of doing business or impose requirements with which we cannot comply

In response to perceived increases in health care costs in recent years, there have been and continue to be proposals by the federal government, state governments, regulators and third-party payers to control these costs and, more generally, to reform the U.S. healthcare system. Certain of these proposals could limit the prices we are able to charge for our products or the amounts of reimbursement available for our products and could limit the acceptance and availability of our products, adversely affecting our financial position and results of operations.

The 2010 Healthcare Reform Legislation imposes an excise tax on us that we may be unable to recoup, and requires cost controls that may impact the rate of reimbursement for our products.

Significant U.S. healthcare reform legislation, the Patient Protection and Affordable Care Act, as reconciled by the Health Care and Education Reconciliation Act of 2010 (collectively, the “PPACA”), was enacted into law in March 2010. Commencing January 1, 2013, the PPACA imposed on manufacturers or producers making sales of medical devices in the U.S., other than sales at retail for individual use, an excise tax. Our U.S. net sales, all subject to the excise tax, represented approximately 73% of our worldwide consolidated net sales in fiscal 2014 and we expect U.S. sales to continue to grow and become a greater proportion of our worldwide consolidated net sales. To the extent the clinics and physicians will not absorb increased costs represented by the tax because of reimbursement limitations, we likely will not be able to offset the tax with increased revenue. Accordingly, the new tax will adversely affect our business, cash flows and results of operations. Although several bills have been proposed in U.S. Congress to eliminate the tax, including a bill passed by the U.S. Senate, most of these bills are tied to corresponding increases in taxes from other sources, and therefore face substantial opposition.

The PPACA also contains provisions aimed at improving the quality and decreasing the costs of healthcare. The Medicare provisions include value-based payment programs, increased funding of comparative effectiveness research, reduced hospital payments for avoidable readmissions and hospital acquired conditions, and pilot programs to evaluate alternative payment methodologies that promote care coordination (such as bundled physician and hospital payments). Additionally, the PPACA includes a reduction in the annual rate of reimbursement growth for hospitals that began in 2011 and provides for the establishment of an independent payment advisory board to recommend ways of reducing the rate of growth in Medicare spending beginning in 2014. Many of these provisions will not be effective for a number of years and there are many programs and requirements for which the details have not yet been fully established. Accordingly, although it remains impossible to predict the extent of the regulation and the full impact of the PPACA, any changes that lower reimbursement for our products or reduce medical procedure volumes could adversely affect our business and results of operations.

Changes in regulatory policy, particularly at the FDA, might adversely affect our operations.

The FDA has increased significantly the scrutiny applied to 510(k) submissions, and it may also focus more scrutiny on other regulation within its purview. Both the FDA and the United States Congress are influenced by high profile events, injuries and cases that generate publicity and public attention, and new legislation is often generated as a result of those events. There can be no assurance that new products we introduce will not be delayed by the current level of scrutiny applied to applications at the FDA or that new laws and regulations will not be adopted that impact the cost of production and marketing of our existing products.

If we are not able to attract, retain and motivate our sales force and expand our distribution channels, our sales and revenues will suffer.

In the U.S., we have a sales organization consisting primarily of direct sales representatives, and a marketing organization to market our products directly and support our distributor organizations. We expect to expand our sales and marketing organization, as needed, to support our growth. We have and will continue to incur significant additional expenses to support this organization. We cannot be certain that our sales organization will be able to generate sales of our Urgent PC System at levels that justify its expense, or even if it can, that we will be able to recruit, train, motivate or retain qualified sales and marketing personnel. Except for our direct sales organization in the United States, United Kingdom, The Netherlands, Switzerland and the Nordic countries, for other countries we sell our products through a network of independent distributors.

Our ability to increase product sales in foreign markets will largely depend on our ability to develop and maintain relationships with our distributors and on their ability to successfully market and sell our products. We may not be able to retain distributors who are willing to commit the necessary resources to market and sell our products to the level of our expectations. Failure to maintain or expand our distribution channels or to recruit, retain and motivate qualified personnel could have a material adverse effect on our product sales and revenues.

The size and resources of our competitors may render it difficult for us to successfully compete in the marketplace.

Our products compete against similar medical devices and other treatment methods, including drugs, for treating voiding dysfunctions. Many of our competitors, which include some of the largest medical products and pharmaceutical companies in the world, have significantly greater financial, research and development, manufacturing and marketing resources than we have. Our competitors could use these resources to develop or acquire products that are safer, more effective, less invasive, less expensive or more readily accepted than our products. Their products could make our technology and products obsolete or noncompetitive. Our competitors could also devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can.

We are primarily dependent on sales of two product lines and our business would suffer if sales of either of these product lines decline.

Currently, we are dependent on sales of our Urgent PC System and Macroplastique products. In fiscal 2014, net sales of our Urgent PC System and Macroplastique accounted for

approximately 61% and 34%, respectively, of our total net sales. If demand for any or both of the product lines declines, our revenues and business prospects may suffer.

We may require additional financing and may find it difficult to obtain the financing on favorable terms, or at all.

Our future liquidity and capital requirements will depend on numerous factors, including: the timing and cost required to expand our sales, marketing and distribution capabilities in the United States markets; the cost and effectiveness of our marketing and sales efforts of our products in international markets; the effect of competing technologies and market, reimbursement and regulatory developments; the cost of research and development programs; and the cost involved in protecting our proprietary rights. Although we currently have an adequate cash balance, we may need to raise additional financing to support our operations and planned growth activities in the future because we have yet to achieve profitability and generate positive cash flows. Any equity financing could substantially dilute your equity interests in our company and any debt financing could impose significant financial and operational restrictions on us. We cannot assure you that we will obtain additional financing on acceptable terms, or at all.

We could be subject to fines and penalties, or required to temporarily or permanently cease offering products, if we fail to comply with the extensive regulations applicable to the sale and manufacture of medical products.

The production and marketing of our products and our ongoing research and development, preclinical testing and clinical trial activities are subject to extensive regulation and review by numerous governmental authorities both in the United States and abroad. U.S. and foreign regulations applicable to medical devices are wide-ranging and govern, among other things, the testing, marketing and pre-market review of new medical devices, and the manufacturing practices, reporting, advertising, exporting, labeling and record keeping procedures. We are required to obtain regulatory approval or clearance before we can market our products in the United States and certain foreign countries. The regulatory process requires significant time, effort and expenditures to bring our products to market, and we cannot assure you that the regulatory authority we currently possess to market our products will remain available, or that we will be able to obtain authority to sell new or existing products in new markets. Further, the manufacture and manufacturing facilities of medical products are subject to periodic reviews and inspection by the FDA and foreign regulatory authorities. Our failure to comply with regulatory requirements could result in governmental agencies:

|

· |

imposing fines and penalties on us; |

|

· |

preventing us from manufacturing or selling our products; |

|

· |

bringing civil or criminal charges against us; |

|

· |

delaying the introduction of our new products into the market; |

|

· |

enforcing operating restrictions on us; |

|

· |

recalling or seizing our products; or |

|

· |

withdrawing or denying approvals or clearances for our products. |

Even if we receive regulatory approval or clearance of a product, the approval or clearance could limit the uses for which we may label and promote the product, which may limit the market for our products.

Our distributors may not obtain regulatory approvals in a timely basis, or at all.

We often rely on our distributors in countries outside the United States in seeking regulatory approval to market our products in particular countries. To the extent we do so, we are dependent on persons outside of our direct control to make regulatory submissions and secure approvals, and we do or will not have direct access to health care agencies in those markets to ensure timely regulatory approvals or prompt resolution of regulatory or compliance matters. If our distributors fail to obtain the required approvals or do not do so in a timely manner, our sales from our international operations and our results of operations may be adversely affected.

We may not have the resources to successfully market our products, which would adversely affect our business and results of operations.

The marketing of our products requires a significant amount of time and expense in order to identify the physicians who would use our products and to train a sales force that is large enough to interact with the targeted physicians. The ease and predictability of third-party reimbursement significantly impacts the success of our marketing activities. We may not have adequate resources to market our products successfully against larger competitors who have more resources than we do. If we cannot market our products successfully, our business and results of operations would be adversely affected.

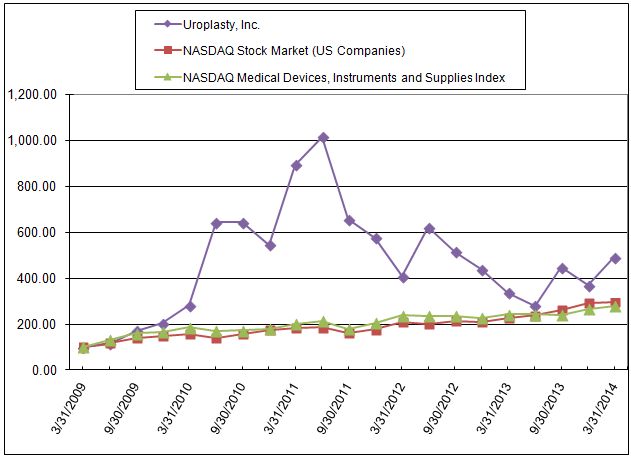

If we cannot attract and retain our key personnel and management team, we may not be able to manage and operate successfully, and we may not be able to meet our strategic objectives.