Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-233260 and 333-252880

PROSPECTUS SUPPLEMENT

(To prospectus dated November 19, 2019)

ENVERIC BIOSCIENCES INC.

3,007,026 Shares of Common Stock

We are offering 3,007,026 shares of our common stock pursuant to this prospectus supplement and accompanying prospectus to certain institutional investors. Each share of common stock is being sold at a price per share equal to $4.27.

In a concurrent private placement, we are also selling to such investors warrants to purchase up to 1,503,513 shares of our common stock (the “Warrants”), exercisable for one share of our common stock at an exercise price of $4.90 per share, and exercisable immediately upon issuance with a term of five (5) years from the date of issuance. The Warrants and the shares of our common stock issuable upon the exercise of the Warrants (the “Warrant Shares”) are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

Palladium Capital Group, LLC (“Palladium”) acted as an advisor in connection with this offering and is entitled to an advisory fee equal to 8.0% of the gross proceeds raised in the offering from the sale of common stock and payment of non-accountable expenses equal to 1.0% of the gross proceeds raised in the offering from the sale of common stock, totaling approximately $1.2 million, and a warrant to purchase 210,492 shares of our common stock (which equals 7% of the aggregate number of shares sold in this offering) at an exercise price of $4.90 per share (the “Palladium Warrant”). The Palladium Warrant will have terms identical in all material respects to the Warrants.

There is no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to list the Warrants on The Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system.

Our common stock is traded on The Nasdaq Capital Market under the symbol “ENVB.” On February 8, 2021, the closing sale price of our common stock on The Nasdaq Capital Market was $4.45 per share.

This investment involves a high degree of risk. See “Risk Factors” on page S-9 of this prospectus supplement and any similar section contained in the accompanying prospectus and in the documents that are incorporated by reference herein and therein.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock to investors is expected to occur on or about February 11, 2021, subject to satisfaction of customary closing conditions.

Effective as of 4:02 pm Eastern Time on December 30, 2020, we filed an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of one share for four shares. The net result of the reverse stock split was a 1-for-4 reverse stock split. All share and per share prices in this prospectus supplement have been adjusted to reflect the reverse stock split.

The date of this prospectus supplement is February 9, 2021.

TABLE OF CONTENTS

| Page | ||

| Prospectus Supplement | ||

| ABOUT THIS PROSPECTUS SUPPLEMENT | S-1 | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | S-2 | |

| PROSPECTUS SUPPLEMENT SUMMARY | S-3 | |

| THE OFFERING | S-8 | |

| RISK FACTORS | S-9 | |

| USE OF PROCEEDS | S-11 | |

| DIVIDEND POLICY | S-11 | |

| DILUTION | S-12 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | S-13 | |

| DESCRIPTION OF SECURITIES WE ARE OFFERING | S-22 | |

| PRIVATE PLACEMENT OF WARRANTS | S-23 | |

| PLAN OF DISTRIBUTION | S-24 | |

| LEGAL MATTERS | S-25 | |

| EXPERTS | S-25 | |

| WHERE YOU CAN FIND MORE INFORMATION | S-25 | |

| INCORPORATION BY REFERENCE | S-25 |

|

Page

|

|

| 6 |

|

| 16 |

|

| 17 | |

| 18 | |

| 19 |

|

| 21 | |

| 29 | |

| 31 | |

| 32 | |

| 36 | |

| 38 | |

| 38 | |

| 39 | |

| 39 |

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of the registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process and consists of two parts. The first part is this prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, gives more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

If information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents we have referred you to in the section of this prospectus supplement and the accompanying prospectus entitled “Incorporation by Reference” and “Where You Can Find More Information” as well as any free writing prospectus provided in connection with this offering.

You should rely only on this prospectus supplement, the accompanying prospectus, and any free writing prospectus provided in connection with this offering and the information incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, and any free writing prospectus provided in connection with this offering. If anyone provides you with different or inconsistent information, you should not rely on it. We are not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering is accurate as of any date other than as of the date of this prospectus supplement, the accompanying prospectus, or such free writing prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

Unless the context otherwise indicates, references in this prospectus to “Enveric”, “we”, “our”, “us” and “the Company” refer, collectively, to Enveric Biosciences, Inc. and its subsidiaries.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering in that jurisdiction. Persons who come into possession of this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering applicable to that jurisdiction. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

| S-1 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents that we incorporate by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions, or the negative of these terms, or similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus supplement and the accompanying prospectus, and in particular those factors referenced in the sections entitled “Risk Factors.”

This prospectus supplement and the accompanying prospectus contain forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Numerous factors could cause our actual results to differ materially from those described in forward-looking statements, including, among other things:

| ● | the impact of the novel coronavirus (COVID-19) on our ongoing and planned clinical trials; | |

| ● | the geographic, social and economic impact of COVID-19 on our ability to conduct our business and raise capital in the future when needed; | |

| ● | delays in planned clinical trials; the ability to establish that potential products are efficacious or safe in preclinical or clinical trials; | |

| ● | the ability to establish or maintain collaborations on the development of therapeutic candidates; | |

| ● | the ability to obtain appropriate or necessary governmental approvals to market potential products; | |

| ● | the ability to obtain future funding for developmental products and working capital and to obtain such funding on commercially reasonable terms; | |

| ● | our ability to manufacture product candidates on a commercial scale or in collaborations with third parties; changes in the size and nature of competitors; | |

| ● | the ability to retain key executives and scientists; and the ability to secure and enforce legal rights related to our products, including patent protection; | |

| ● | our expected use of proceeds from this offering; and | |

| ● | other factors discussed in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein, including those set forth under “Risk Factors” in our Registration Statement on Form S-4 filed with the SEC on May 28, 2020, as amended (the “Form S-4”). |

We have included important factors in the cautionary statements included in this prospectus supplement and the accompanying prospectus and the documents we incorporate by reference herein and therein, including from the Form S-4, particularly in the “Risk Factors” sections of these documents, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. No forward-looking statement is a guarantee of future performance.

You should read this prospectus supplement and the accompanying prospectus and the documents that we incorporate by reference herein and therein completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements in this prospectus supplement and the accompanying prospectus and the documents we incorporate by reference herein and therein represent our views as of the date of this prospectus supplement. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus supplement.

| S-2 |

The following summary of our business highlights some of the information contained elsewhere in, or incorporated by reference into, this prospectus supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, which are described under “Incorporation of Certain Information by Reference” in this prospectus supplement. You should also carefully consider the matters discussed in the section of this prospectus supplement entitled “Risk Factors” and under similar sections of the accompanying prospectus and other periodic reports incorporated herein and therein by reference.

In this prospectus supplement, unless the context otherwise requires, references to “we,” “us,” “our,” “our company” and “Enveric” refer to Enveric Biosciences, Inc. and its subsidiaries. We were previously known as AMERI Holdings, Inc. (“Ameri”). Following the completion of our offer to purchase all of the issued and outstanding shares of Jay Pharma, Inc. on December 30, 2020, we changed the name of our company from AMERI Holdings, Inc. to Enveric Biosciences, Inc. For more detail on the transaction with Jay Pharma, Inc. and related transactions, see section titled “Recent Development” below.

Company Overview

We are an early-development-stage biosciences company that is seeking to develop innovative, evidence-based prescription products and combination therapies containing cannabinoids to address unmet needs in cancer care. We seek to improve the lives of patients suffering from cancer, initially by developing palliative and supportive care products for persons suffering from certain side effects of cancer and cancer treatment such as pain or skin irritation. We currently intend to offer such palliative and supportive care products in the United States, following approval through established regulatory pathways.

We are also aiming to advance a pipeline of novel cannabinoid combination therapies for hard-to-treat cancers, including glioblastoma multiforme (GBM) and several other indications which are currently being researched.

We intend to bring together leading oncology clinicians and researchers, academic and industry partners so as to develop both external proprietary products and a robust internal pipeline of product candidates aimed at improving quality of life and outcomes for cancer patients. We intend to evaluate options to out-license our proprietary technology as we move along the regulatory pathway instead of building a small targeted selling organization and will potentially utilize a hybrid approach based on the indication and the results.

In developing our product candidates, we intend to focus solely on cannabinoids derived from hemp and synthetic materials containing no tetrahydrocannabinol (THC) in order to comply with U.S. federal regulations. Of the potential cannabinoids to be used in therapeutic formulations, THC, which is responsible for the psychoactive properties of marijuana, can result in undesirable mood effects. Cannabidiol (CBD) and cannabigerol (CBG), on the other hand, are not psychotropic and are therefore more attractive candidates for translation into therapeutic practice. In the future, we may utilize cannabinoids that are derived from cannabis plants, which may contain THC; however, we only intend to do so in jurisdictions where THC is legal. These product candidates will then be studied through a typical FDA drug approval process.

| S-3 |

Product Candidates

Our pipeline of product candidates and key ongoing development programs are shown in the tables below:

| Product Candidate | Targeted Indications | Partner(s) | Status | Expected Next Steps | ||||

| Cannabinoid-Infused Topical Product | Oncology- related skincare conditions (e.g., radiodermatitis) | U.S.-Based Center of Excellence | Research & Development / Discovery | IND submission; Exploratory Phase 1/2 trial with patient enrollment anticipated in the second half of 2020 | ||||

Cannabinoid + Chemotherapy Combination Therapy

Oral synthetic CBD extract given alone or in combination with clomiphene, concurrently with dose-dense Temolozomide chemotherapy |

Glioblastoma Multiforme

Recurrent or progressive |

Dr. Tali Siegal, Rabin Medical Center, Davidoff Institute of Oncology

|

Research & Development / Discovery | IND submission; Exploratory Phase 1/2 trial with patient enrollment anticipated during the second half of 2020 |

| Additional Potential Development Programs | Potential Target Indications | |

Cannabinoid + Chemotherapy Combination Therapy

Clomiphene in combination with CBD in patients with selected locally advanced or metastatic breast cancer treated with standard adjuvant chemotherapy regimens |

Breast Cancer |

Recent Developments

Closing of the Offer

On December 30, 2020, pursuant to the previously announced Tender Offer Support Agreement and Termination of Amalgamation Agreement dated August 12, 2020, as amended by that certain Amendment No. 1 to the Tender Offer Support Agreement and Termination of Amalgamation Agreement dated December 18, 2020 (as amended, the “Tender Agreement”), by and among us, Jay Pharma Inc., a Canada corporation and a wholly owned subsidiary of the Company (“Jay Pharma”), and certain other signatories thereto, we completed a tender offer (the “Offer”) to purchase all of the outstanding common shares of Jay. Following the effective time of the Offer, we changed the name of our company from AMERI Holdings, Inc. to Enveric Biosciences, Inc. and effected a 1-for-4 reverse stock split of the issued and outstanding common stock. Immediately following completion of the Offer and the transactions contemplated in the Tender Agreement, but without giving effect to the issuance of the Series B Warrants (as defined below) (i) the former Jay Pharma equity holders (including certain investors in private placements that closed prior to the completion of the Offer) own approximately 82.3% of the Company; (ii) former Ameri equity holders own approximately 14.5% of the Company; and (iii) a financial advisor to Jay Pharma and Ameri owns approximately 3.2% of the Company.

The holders of approximately 62% of outstanding shares of common stock as of January 11, 2020 are subject to lock-up/leak-out agreements pursuant to which such stockholders have agreed, except in limited circumstances, not to sell or transfer, or engage in swap or similar transactions with respect to, certain shares of common stock, including, as applicable, shares received in the Offer and issuable upon exercise of certain warrants and options. The lock-up period begins at the time of the completion of the Offer and ends on the date that is 180 days after such time. The leak-out period begins on the date that is the end of the lock-up period and ends on a date that is 180 days after such date. During the leak-out period, such holders may only sell up to 15% of the aggregate amount of our securities owned by such holder as of the expiration of the lock-up period per month. Notwithstanding the foregoing, the lock-up and leak-out restrictions are subject to value and trading thresholds set forth in the lock-up/leak-out agreements which, if met, would cause the lock-up and leak-out restrictions to expire. In addition, we may, in our discretion, waive the lock-up and leak-out restrictions with respect to one or more stockholders at any time.

| S-4 |

The common stock on The Nasdaq Capital Market, previously trading through the close of business on December 30, 2020 under the ticker symbol “AMRH,” commenced trading on The Nasdaq Capital Market, on a post-Reverse Stock Split adjusted basis, under the ticker symbol “ENVB” on December 31, 2020.

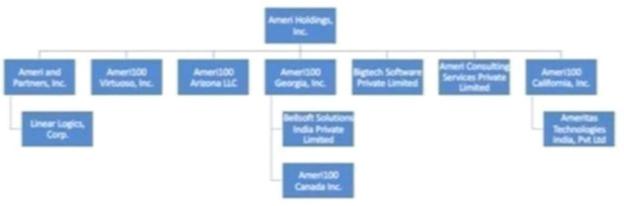

Closing of Spin-Off

As previously reported, on January 10, 2020, Ameri and Ameri100 Inc. (“Private Ameri”) entered into a Share Purchase Agreement (the “Ameri Share Purchase Agreement”) pursuant to which Ameri agreed to contribute, transfer and convey to Private Ameri all of the issued and outstanding equity interests of the existing subsidiaries of Ameri, constituting the entire business and operations of Ameri and its subsidiaries, and wherein Private Ameri agreed to assume the liabilities of such subsidiaries (the “Spin-Off”).

On December 30, 2020, pursuant to the Ameri Share Purchase Agreement, Ameri consummated the Spin-Off and all of the issued and outstanding shares of Series A preferred stock of Ameri (the “Series A Preferred Stock”) were redeemed for an equal number of shares of Series A preferred stock of Private Ameri (“Private Ameri Preferred Stock”). Ameri contributed, transferred and conveyed to Private Ameri all of the issued and outstanding equity interests of the existing subsidiaries of Ameri, constituting the entire business and operations of Ameri and its subsidiaries, and Private Ameri assumed the liabilities of such subsidiaries.

Series B Warrants

Pursuant to the Tender Agreement, on December 31, 2020, we issued Series B Warrants (the “Series B Warrants”) to purchase 1,791,923 shares of common stock at an exercise price of $0.01 to Alpha Capital Anstalt (“Alpha”). We are obligated, among other things, to file a registration statement with SEC for purposes of registering the resale of the shares of common stock issuable upon exercise of the Series B Warrants by the investors. The issuance of the Series B Warrants was exempt from the registration requirements of the Securities Act pursuant to an exemption provided by Section 4(a)(2) thereof as a transaction by an issuer not involving a public offering. As described below under “Letter Agreement with Alpha”, on January 12, 2021, we have waived the lock-up restrictions on Alpha with respect to dispositions of the shares of common stock issuable upon exercise of the Series B Warrants (the “Series B Warrant Shares”), and Alpha agreed to limit its sales of shares of our common stock on each trading day to no more than 10% of the daily reported trading volume of common stock on the Nasdaq Stock Market for such trading day, provided, such limitation shall terminate if the closing price of our shares of common stock on the Nasdaq Stock Market exceeds $5.29 per share for five consecutive trading days.

Director and Officer Resignations and Appointments

Effective upon completion of the Offer, Srinidhi “Dev” Devanur, our former Executive Chairman and a former director of the board of directors, Brent Kelton, our former Chief Executive Officer, Barry Kostiner, our former Chief Financial Officer, Carmo Martella, a former director of the board of directors, Thoranath Sukumaran, a former director of the board of directors and Dimitrios Angelis, a former director of the board of directors, all tendered their resignations from their respective positions as officers and directors of our company.

Pursuant to the terms of the Tender Agreement, and as disclosed in the Form S-4, the board of directors appointed David Johnson, George Kegler, Sol Mayer and Marcus Schabacker to the board of directors at the effective time of the Offer.

Effective upon the completion of the Offer, the board of directors appointed David Johnson as our Chief Executive Officer and Chairman, Avani Kanubaddi as our Chief Operating Officer, John Van Buiten as our Chief Financial Officer, and Robert Wilkins as our Chief Medical Officer.

Amended and Restated Certificate of incorporation and Bylaws

In connection with the Tender Agreement, we filed an Amended and Restated Certificate of Incorporation and adopted amended and restated bylaws on December 30, 2020. For additional information regarding our organizational documents, please refer to our Current Report on Form 8-K filed with the SEC on January 6, 2021.

| S-5 |

Delisting of Ameri Warrants

On December 30, 2020, we received a written notice (the “Notice”) from Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that our listed warrants (the “AMRHW Warrants”) would be suspended from listing on the Nasdaq Capital Market. A Form 25-NSE was filed with the SEC on December 30, 2020, which removed the AMRHW Warrants from listing and registration on the Nasdaq Capital Market.

The terms of the AMRHW Warrants are not affected by the delisting, and the AMRHW Warrants may still be exercised in accordance with their terms to purchase common stock of the Company.

The listing of the common stock, which is traded on the Nasdaq Capital Market under the symbol ENVB, is not affected by the delisting of the AMRHW Warrants.

Change in Certifying Accountant

On January 5, 2021, our Audit Committee of the board of directors approved the dismissal of Ram Associates, CPA (“Ram”) as our independent registered public accounting firm, effective December 31, 2020, and engaged Marcum LLP (“Marcum”) as our independent registered public accounting firm for the year ending December 31, 2020. Prior to the completion of the Offer, Marcum served as the independent registered public accounting firm of Jay Pharma, and we believe the change in auditors will be more efficient for reporting purposes.

Letter Agreement with Alpha

On January 12, 2021 we entered into a letter agreement (the “Letter Agreement”) with Alpha. Under the Letter Agreement, (i) we agreed to register 1,791,923 of the Series B Warrant Shares issuable upon the exercise of Series B Warrants, (ii) the Series B Warrant Shares will not be subject to an existing lock-up agreement between us and Alpha, and Alpha will no longer be subject to any limitations on its ability to dispose of the Series B Warrant Shares that are imposed by us to the extent permitted by applicable rules and regulations, (iii) Alpha agreed to limit its sales of common stock on each trading day to no more than 10% of the daily reported trading volume of common stock on the Nasdaq Stock Market for such trading day, provided, such limitation shall terminate if the closing price of our shares of common stock on the Nasdaq Stock Market exceeds $5.29 per share for five consecutive trading days and (iv) we will be free to waive the terms and conditions of any lock-up agreement between us and any of the former shareholders of Jay Pharma Inc. without the consent of, or notice to, Alpha once the registration statement registering the Series B Warrant Shares is declared effective by the SEC.

January 2021 Offering

On January 12, 2021, we entered into a Securities Purchase Agreement (the “January 2021 Purchase Agreement”) with certain institutional and accredited investors, pursuant to which we agreed to issue and sell in a registered direct offering an aggregate of 1,610,679 shares of our common stock and pre-funded warrants to purchase up to 610,679 shares of common stock, at an offering price of $4.5018 per share of common stock and $4.4918 per pre-funded warrant, for gross proceeds of approximately $10 million before the deduction of fees and offering expenses (the “January 2021 Offering”). The pre-funded warrants have an exercise price of $0.01 per share, and are immediately exercisable and may be exercised at any time after their original issuance until such pre-funded warrants are exercised in full, subject to certain beneficial ownership limitations.

Pursuant to the January 2021 Purchase Agreement, in a concurrent private placement, we issued to the purchasers, unregistered warrants to purchase up to 1,666,019 shares of common stock. Such unregistered warrants are exercisable immediately upon issuance and terminate five years following issuance and are exercisable at an exercise price of $4.9519 per share, subject to adjustment as set forth therein and certain beneficial ownership limitations.

Palladium served as an advisor in connection with the January 2021 Offering and received an advisory fee of $900,000 and an unregistered warrant to purchase up to 155,493 shares of common stock. The terms of such warrant are identical in all material respects to the terms of the unregistered warrants issued in such concurrent private placement.

| S-6 |

Reverse Stock Split

Effective as of 4:02 pm Eastern Time on December 30, 2020, we filed an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of one share for four shares. The net result of the reverse stock split was a 1-for-4 reverse stock split. We made proportionate adjustments to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all stock options, restricted stock units (if any) and warrants outstanding as of the effective times of the reverse stock split in accordance with the terms of each security based on the split ratio. Also, we reduced the number of shares reserved for issuance under our equity compensation plans proportionately based on the split ratios. Except for adjustments that resulted from the rounding up of fractional shares to the next whole share, the reverse stock split affected all stockholders uniformly and did not change any stockholder’s percentage ownership interest in our company. All share and related option and warrant information presented in this prospectus supplement have been retroactively adjusted to reflect the reduced number of shares outstanding and the increase in share price which resulted from these actions; however, common stock share and per share amounts in the accompanying prospectus and certain of the documents incorporated by reference herein have not been adjusted to give effect to the reverse stock split.

Company Information

We were incorporated under the laws of the State of Delaware in February 1994 as Spatializer Audio Laboratories, Inc., which was a shell company immediately prior to the completion of a “reverse merger” transaction on May 26, 2015, whereby Ameri100 Acquisition, Inc., a Delaware corporation and newly created, wholly owned subsidiary, was merged with and into Ameri and Partners Inc. (“Ameri and Partners”), a Delaware corporation (the “2015 Merger”). As a result of the 2015 Merger, Ameri and Partners became Ameri’s wholly owned subsidiary with Ameri and Partners’ former stockholders acquiring a majority of the outstanding shares of Ameri common stock. The 2015 Merger was consummated under Delaware law pursuant to an Agreement of Merger and Plan of Reorganization, dated as of May 26, 2015 (the “2015 Merger Agreement”), and in connection with the 2015 Merger, Ameri changed its name to AMERI Holdings, Inc. Ameri does business under the brand name “Ameri100”. Ameri Holdings, Inc., along with its eleven operating subsidiaries, provides SAP cloud, digital and enterprise services to clients worldwide. On December 30, 2020, we completed the Offer and changed our name to “Enveric Biosciences, Inc.” Our principal corporate office is located at Enveric Biosciences, Inc., 4851 Tamiami Trail N, Suite 200, telephone (239) 302-1707. Our internet address is https://www.enveric.com/, and the information included in, or linked to our website is not part of this prospectus. We have included our website address in this prospectus solely as a textual reference.

| S-7 |

| Issuer | Enveric Biosciences, Inc. | |

| Common Stock offered by us | 3,007,026 shares | |

| Shares of common stock to be outstanding after this offering | 18,336,376 shares (excluding shares issuable upon the exercise of the Warrants to be issued in the concurrent private placement). | |

| Offering price per share | $4.27 per share of common stock. | |

| Use of proceeds | We intend to use the net proceeds from this offering for working capital purposes. See “Use of Proceeds” on page S-11.

| |

| Concurrent private placement of Warrants | In a concurrent private placement, we are selling to investors in this offering Warrants to purchase up to an additional 1,503,513 shares of our common stock. Each Warrant will be exercisable for one share of our common stock at an exercise price of $4.90 per share, will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The Warrants and the Warrant Shares are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to list the Warrants on the Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system. | |

| Risk factors | See the “Risk Factors” section of this prospectus supplement, the Form S-4 and in the other documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our securities. | |

| Nasdaq Capital Market symbol | “ENVB” |

The number of shares of our common stock that will be outstanding immediately after this offering as shown above is based on 15,329,350 shares outstanding as of February 9, 2021. The number of shares outstanding as of February 9, 2021, as used throughout this prospectus supplement, unless otherwise indicated, excludes:

| ● | 262,500 shares of common stock issuable upon the conversion of outstanding shares of Series B Convertible Preferred Stock;

| |

| ● | 1,791,923 shares of common stock issuable upon the exercise of Series B Warrants; | |

| ● | 806,563 shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $1.37 per share; | |

| ● | 3,770,762 shares of common stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $9.25 per share; | |

| ● | 2,695,893 shares of common stock reserved for future issuance under our Long-Term Incentive Plan; | |

| ● | 1,503,513 shares of common stock issuable upon the exercise of the Warrants to be issued to the purchasers in a concurrent private placement with this offering at an exercise price of $4.90 per share; and | |

| ● | 210,492 shares of common stock issuable upon the exercise of the Palladium Warrant at an exercise price of $4.90 per share. |

Except as otherwise indicated, the information in this prospectus supplement is as of February 9, 2021 and assumes (i) no exercise of the Warrants, (ii) no exercise of the Palladium Warrant and (iii) no exercise of options, vesting of restricted stock units or exercise of warrants described above.

| S-8 |

Investing in our securities involves a high degree of risk. In addition to the other information contained in this prospectus supplement to the accompanying prospectus and in the documents we incorporate by reference, you should carefully consider the risks discussed below and under the heading “Risk Factors” in the Form S-4 before making a decision about investing in our securities. The risks and uncertainties discussed below and in the Form S-4 are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of these risks occur, our business, financial condition and operating results could be harmed, the trading price of our common stock could decline and you could lose part or all of your investment.

If you purchase our common stock in this offering, you will suffer immediate dilution of your investment.

The offering price of our common stock in this offering is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase our common stock in this offering, you will pay a price per share of our common stock that substantially exceeds our net tangible book value per share after giving effect to this offering. Based on an offering price of $4.27 per share of our common stock, if you purchase our common stock in this offering, you will experience immediate dilution of $2.83per share, representing the difference between the offering price per share of our common stock and our pro forma as adjusted net tangible book value per share after giving effect to this offering. Furthermore, if any of our outstanding options or warrants are exercised at prices below the offering price, or if we grant additional options or other awards under our equity incentive plans or issue additional warrants, you may experience further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

Because we will have broad discretion and flexibility in how the net proceeds from this offering are used, we may use the net proceeds in ways in which you disagree.

We intend to use the net proceeds from this offering for working capital purposes. See “Use of Proceeds” on page S-11. We have not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

You may experience future dilution as a result of future equity offerings and other issuances of our securities. In addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect the price of our common stock.

In order to raise additional capital, we may in the future offer additional shares of common stock or other securities convertible into or exchangeable for our common stock prices that may not be the same as the price per share in this offering. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of common stock or securities convertible into shares of common stock in future transactions may be higher or lower than the price per share in this offering. You will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of common stock under our stock incentive programs. In addition, the sale of shares of common stock in this offering and any future sales of a substantial number of shares of common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares for sale will have on the market price of our common stock.

We expect to require additional capital in the future in order to develop our product candidates, which are in early stages of development. If we do not obtain any such additional financing, it may be difficult to effectively realize our long-term strategic goals and objectives.

| S-9 |

Our current cash resources will not be sufficient to fund the development of our product candidates through all of the required clinical trials to receive regulatory approval and commercialization. If we cannot secure this additional funding when such funds are required, we may fail to develop our product candidates or be forced to forego certain strategic opportunities.

Any additional capital raised through the sale of equity or equity-backed securities may dilute our stockholders’ ownership percentages and could also result in a decrease in the market value of our equity securities.

The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding.

In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

| S-10 |

We estimate that the net proceeds from the sale of our common stock offered under this prospectus supplement, after deducting estimated offering expenses payable by us, will be approximately $11.5 million, excluding the proceeds we may receive form the exercise of the Warrants issued in the concurrent private placement.

We intend to use the net proceeds from the sale of the shares for working capital purposes. The amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used by our operations. As a result, we will retain broad discretion in the allocation of the net proceeds of this offering.

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay dividends will be made at the discretion of our board of directors. Investors should not purchase our common stock with the expectation of receiving cash dividends.

| S-11 |

If you invest in our common stock in this offering, your ownership interest will be diluted by the difference between the price per share you pay and the net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value as of September 30, 2020, was approximately $(3,589,158), or $(0.63) per share of our common stock, based upon 5,737,001 shares of our common stock outstanding as of that date. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of September 30, 2020. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

Our pro forma net tangible book value as of September 30, 2020, was approximately $14,884,217, or $0.97 per share, after giving effect to (i) the Spin-Off; (ii) the Offer, whereby the Company issued 7,621,052 shares of common stock and 262,500 shares of Series B Preferred Stock that are convertible into 262,500 shares of common stock in exchange for 35,635,807 common shares of Jay Pharma (excluding the issuance of an aggregate of 3,262,907 shares of Series B Preferred Stock that are convertible into 3,262,907 shares of common stock issued in transactions related to the Offer); (iii) the conversion of indebtedness and the securities issued upon closing of a private placement made in connection with the Offer; (iv) the acquisition of intellectual property by Jay Pharma in exchange for 10,360,007 common shares of Jay Pharma; and (v) the issuance of 1,610,679 shares of our common stock in the January 2021 Offering at the price of $4.5018 per share and the exercise of pre-funded warrants to purchase 610,679 shares of common stock sold in the January 2021 Offering; and (vi) the conversion of 3,262,907 shares of Series B Preferred Stock into 3,262,907 shares of common stock.

After giving further effect to the sale of 3,007,026 shares of our common stock in this offering at the price of $4.27 per share, and after deducting the estimated offering expenses payable by us in this offering, our pro forma as adjusted net tangible book value as of September 30, 2020, would have been approximately $26.4 million, or $1.44 per share. This represents an immediate increase in pro forma net tangible book value of $0.47 per share to existing stockholders and immediate dilution in net tangible book value of $2.83 per share to new investors. The following table illustrates this dilution on a per share basis:

| Offering price per share | $ | 4.27 | ||||||

| Historical net tangible book value per share as of September 30, 2020 | $ | (0.63 | ) | |||||

| Pro forma increase in net tangible book value per share | $ | 1.60 | ||||||

| Pro forma net tangible book value per share as of September 30, 2020 | $ | 0.97 | ||||||

| Increase in net tangible book value per share attributable to this offering | $ | 0.47 | ||||||

| Pro forma as adjusted net tangible book value per share as of September 30, 2020, after giving effect to this offering | $ | 1.44 | ||||||

| Dilution in net tangible book value per share to new investors | $ | 2.83 |

The foregoing discussion and table assumes no exercise of the Warrants to be issued in a concurrent private placement or the Palladium Warrant. To the extent that outstanding options or warrants are exercised, you may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

The above discussion and table as of September 30, 2020 are based upon, after giving effect to the adjustments set forth above, and excludes:

| ● | 262,500 shares of common stock issuable upon the conversion of outstanding shares of Series B Convertible Preferred Stock; | |

| ● | 1,791,923 shares of common stock issuable upon the exercise of Series B Warrants; | |

| ● | 806,563 shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $1.37 per share; | |

| ● | 3,615,268 shares of common stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $9.25 per share; | |

| ● | 2,695,893 shares of common stock reserved for future issuance under our Long-Term Incentive Plan; | |

| ● | 1,503,513 shares of common stock issuable upon the exercise of the Warrants to be issued to the purchasers in a concurrent private placement with this offering at an exercise price of $4.90 per share; and | |

| ● | 210,492 shares of common stock issuable upon the exercise of the Palladium Warrant at an exercise price of $4.90 per share. |

| S-12 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and operating results together with our financial statements and related notes incorporated by reference into this prospectus. This discussion and analysis and other parts of this prospectus contain forward-looking statements based upon current beliefs, plans and expectations that involve risks, uncertainties and assumptions. See “Special Note Regarding Forward-Looking Statements.” Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Risk Factors” or in other parts of this prospectus or the documents incorporated by reference into this prospectus. Unless stated otherwise, references in this discussion and analysis to “us,” “we,” “our,” “Enveric” or our “Company” and similar terms refer to Enveric Biosciences, Inc., a Delaware corporation. References to “Ameri” refer to our Company prior to the Offer.

Overview

Merger

On December 30, 2020, pursuant to the previously announced the Tender Agreement, we completed the Offer to purchase all of the outstanding common shares of Jay Pharma for the number of shares of common stock of the Company, par value $0.01 per share or Series B Preferred Stock, as applicable, equal to the exchange ratio of 0.8849, and Jay Pharma became a wholly-owned subsidiary of the Company, on the terms and conditions set forth in the Tender Agreement. Following the effective time of the Offer, the Company changed the name of the Company from AMERI Holdings, Inc. to Enveric Biosciences, Inc. and effected a 1-for-4 reverse stock split of the issued and outstanding common stock. Immediately following completion of the Offer and the transactions contemplated in the Tender Agreement, but without giving effect to the issuance of the Series B Warrants to purchase 1,791,923 shares of common stock, (i) the former Jay Pharma equity holders (including certain investors in private placements that closed prior to the completion of the Offer) own approximately 82.3% of the Company; (ii) former Ameri equity holders own approximately 14.5% of the Company; and (iii) a financial advisor to Jay Pharma and Ameri owns approximately 3.2% of the Company.

On December 30, 2020, pursuant to the Ameri Share Purchase Agreement, Ameri consummated the Spin-Off and all of the issued and outstanding shares of Series A Preferred Stock were redeemed for an equal number of shares of Private Ameri Preferred Stock. Ameri contributed, transferred and conveyed to Private Ameri all of the issued and outstanding equity interests of the existing subsidiaries of Ameri, constituting the entire business and operations of Ameri and its subsidiaries, and Private Ameri assumed the liabilities of such subsidiaries.

The Offer has been accounted for as a “reverse merger” under the acquisition method of accounting for business combinations with Jay Pharma treated as the accounting acquirer of Ameri. As such, the historical financial statements of Jay Pharma have become the historical financial statements of Ameri, or the combined company, and are incorporated into this report labeled “Jay Pharma, Inc.” No historical common stock, stock options and additional paid-in capital, including share and per share amounts presented in this Management’s Discussion and Analysis of Financial Condition and Results of Operations has been adjusted to reflect the equity structure of the resulting issuer as a result of the Offer and the related transactions, including the effect of the Exchange Ratio and the common stock.

Reverse Stock Split

On December 30, 2020, we affected a 1-for-4 reverse stock split. We made proportionate adjustments to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all stock options, restricted stock units (if any) and warrants outstanding as of the effective times of the reverse stock split in accordance with the terms of each security based on the split ratio. Also, we reduced the number of shares reserved for issuance under our equity compensation plans proportionately based on the split ratios. Except for adjustments that resulted from the rounding up of fractional shares to the next whole share, the reverse stock split affected all stockholders uniformly and did not change any stockholder’s percentage ownership interest in our company. All share and related option and warrant information presented in this prospectus supplement (other than this Management’s Discussion and Analysis of Financial Condition and Results of Operations as noted below) have been retroactively adjusted to reflect the reduced number of shares outstanding and the increase in share price which resulted from these actions; however, common stock share and per share amounts in the accompanying prospectus and certain of the documents incorporated by reference herein have not been adjusted to give effect to the reverse stock split. No share or related option or warrant information presented in this Management’s Discussion and Analysis of Financial Condition and Results of Operations has been adjusted to reflect the reduced number of shares outstanding, the increase in share price which resulted from these actions or otherwise give effect to the reverse stock split.

| S-13 |

Business Overview

We are a biopharmaceutical and wellness company that is seeking to develop innovative, evidence-based cannabinoid product candidates and combination therapies to address unmet needs in cancer care. We seek to improve the lives of persons suffering from cancer, initially by developing over-the-counter palliative cancer care and wellness cosmetic product candidates for persons suffering from the side effects of cancer and cancer treatment. We are also aiming to advance a pipeline of novel cannabinoid combination therapies for hard-to-treat cancers, including glioblastoma multiforme (GBM). We are to bring leading oncology clinicians and researchers, academic and industry partners, proprietary products and data, and eventually a robust pipeline of product candidates, to improve quality of life and provide symptomatic relief to cancer patients.

Key Components of Our Results of Operations

Operating Expenses

Our operating expenses include financial statement preparation services, tax compliance, various consulting and director fees, legal services, auditing fees, and stock-based compensation. These expenses have increased in connection with the Company’s product development and the Company’s management expects these expenses to continue to increase as the Company continues to develop its potential product candidates.

Results of Operations

Comparison of the Nine Months Ended September 30, 2020 and 2019

The following table sets forth information comparing the components of net loss for the nine months ended September 30, 2020 and the comparable period in 2019:

| Nine Months Ended September 30, | ||||||||

| 2020 | 2019 | |||||||

| Expenses | ||||||||

| Operating expenses | $ | 2,094,044 | $ | 1,895,355 | ||||

| Loss from operations | (2,094,044 | ) | (1,895,355 | ) | ||||

| Other expense | ||||||||

| Extinguishment of notes payable | - | 32,257 | ||||||

| Interest expense | 388,143 | 47,858 | ||||||

| Total other expense | 312,642 | 80,115 | ||||||

| Net Loss | $ | (2,482,187 | ) | $ | (1,975,470 | ) | ||

| Other comprehensive income | ||||||||

| Foreign exchange (loss) gain | (30,077 | ) | (5,204 | ) | ||||

| Comprehensive loss | $ | (2,512,264 | ) | $ | (1,970,266 | ) | ||

| Net loss per share - basic and diluted | $ | (0.10 | ) | $ | (0.08 | ) | ||

| Weighted average shares outstanding, basic and diluted | 25,916,419 | 25,060,193 | ||||||

| S-14 |

Operating Expenses

Our operating expenses increased to $2,094,044, for the nine months ended September 30, 2020 from $1,895,355 for the nine months ended September 30, 2019, for an increase of $198,689, or 10.5%. This change was primarily driven by an increase in legal fees of $677,646 and consulting fees of $259,773, offset by a decrease in stock-based compensation of $535,587, marketing costs of $180,354, and research and development of $156,911.

Interest Expense

Our interest expense for the nine months ended September 30, 2020 was $388,143 compared to $47,858 for the nine months ended September 30, 2019. This increase was primarily driven by the Company’s promissory notes that were entered into during 2019, with an aggregate principal amount of $2,077,925, which it did not have during the nine months ended September 30, 2019.

Foreign Exchange

Our foreign exchange (loss) gain was $(30,077) for the nine months ended September 30, 2020 as compared to $5,204 for the nine months ended September 30, 2019. The increase in foreign exchange loss is primarily due to the U.S. Dollar weakening against the Canadian Dollar and the conversion of the Canadian Dollars into United States Dollars for payment of United States Dollar denominated expenses.

Comparison of the Year Ended December 30, 2019 and 2018

The following table sets forth information comparing the components of net loss for the year ended December 31, 2019 and the comparable year in 2018:

| Year Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Expenses | ||||||||

| Operating expenses | $ | 2,296,534 | $ | 1,919,577 | ||||

| Operating loss | (2,296,534 | ) | (1,919,577 | ) | ||||

| Other expense | ||||||||

| Extinguishment of notes payable | 32,316 | - | ||||||

| Accretion and interest | 81,823 | - | ||||||

| Total other expense | 114,139 | - | ||||||

| Net Loss | $ | (2,410,673 | ) | $ | (1,919,577 | ) | ||

| Other comprehensive loss | ||||||||

| Foreign exchange loss | (6,667 | ) | (3,877 | ) | ||||

| Comprehensive loss | $ | (2,417,340 | ) | $ | (1,923,454 | ) | ||

| Loss per share - basic and diluted | $ | (0.10 | ) | $ | (0.08 | ) | ||

| Weighted average shares outstanding, basic and diluted | 25,085,980 | 22,607,147 | ||||||

| S-15 |

Operating Expenses

Our operating expenses increased to $2,296,534, for the year ended December 31, 2019 from $1,919,577 for the year ended December 31, 2018, for an increase of $376,957, or 19.6%. This change was primarily driven by an increase in payroll and consulting fees of approximately $409,000, an increase in stock-based compensation of $117,896, offset by a decrease in patent costs of $652,624.

Extinguishment of Notes Payable

Our loss on extinguishment of notes payable increased to $32,316, for year ended December 31, 2019 was due to the Company entering into an amendment to the July 2019 Note on September 20, 2019, which extended the maturity date for such note to until the earlier of (a) the completion of a bridge financing of greater than or equal to $1.5 million, or (b) November 7, 2019.

Accretion and Interest

Our accretion and interest expense for the year ended December 31, 2019 was $81,823 compared to $0 for the year ended December 31, 2018. This increase was primarily driven by the Company’s promissory notes that were entered into during 2019, with an aggregate principal amount of $740,336, which it did not have during the year ended December 31, 2018.

Foreign Exchange

Our foreign exchange loss was $6,667 for the year ended December 31, 2019 as compared to $3,877 for the year ended December 31, 2018, for an increase of $2,790. The increase in foreign exchange loss is primarily due to the U.S. Dollar strengthening against the Canadian Dollar and the conversion of the Canadian Dollars into United States Dollars for payment of United States Dollar denominated expenses.

Liquidity and Capital Resources

The Company has incurred continuing losses from its operations and as of September 30, 2020, the Company had an accumulated deficit of $7,377,068 and working capital deficiency of $3,589,158.

Since inception, the Company has met its liquidity requirements principally through the issuance of notes payable and the sale of its shares of common stock.

The Company has no present revenue and the Company’s ability to continue its operations and to pay its obligations when they become due is contingent upon the Company obtaining additional financing. Management’s plans include seeking to procure additional funds through debt and equity financings and to continue to develop its technologies under its sublicense agreement (see Note 4 to the financial statements for the year ended December 31, 2019). Without further funding, the sublicense agreement will have no commercial value.

There are no assurances that the Company will be able to raise capital on terms acceptable to the Company or at all, or that cash flows generated from its operations will be sufficient to meet its current operating costs and required debt service. Our ability to obtain additional capital may depend on prevailing economic conditions and financial, business and other factors beyond our control. The COVID-19 pandemic has caused an unstable economic environment globally. Disruptions in the global financial markets may adversely impact the availability and cost of credit, as well as our ability to raise money in the capital markets. Current economic conditions have been and continue to be volatile. Continued instability in these market conditions may limit our ability to access the capital necessary to fund and grow our business. If the Company is unable to obtain sufficient amounts of additional capital, it may be required to reduce the scope of its planned product development, which could harm its financial condition and operating results, or it may not be able to continue to fund its ongoing operations. These conditions raise substantial doubt about the Company’s ability to continue as a going concern to sustain operations for at least one year from the issuance date of these financial statements. The accompanying financial statements do not include any adjustments that might result from the outcome of these uncertainties.

| S-16 |

On January 12, 2018, the Company entered into a sublicense agreement (which formalized the sublicense terms as agreed to in 2017) with TO Pharmaceuticals USA LLC (“TOP”). This agreement requires TOP to sublicense to the Company certain patent and other intellectual property rights for the exclusive use by the Company in cancer-related applications. These rights include intellectual property consisting of patents regarding cannabis pharmaceutical products. The sublicense does not provide for any ability for the Company to sublicense these rights to third parties without the express written consent of TOP. In exchange for the sublicensed patents, the Company issued to TOP 7,280,000 shares of its common stock along with an obligation to issue to TOP 40% of shares of common stock issued to investors during future financings up to $1.25 million. In connection with the additional rounds of financing, the Company issued to TOP an additional 2,157,162 common shares during the year ended December 31, 2018.

In January 2018, the Company closed a private placement for 1,900,000 shares of common stock for CAD $0.25 (USD $0.20) per common share for gross proceeds of CAD $475,000 (USD $376,203).

In October 2018, the Company closed a private placement for 992,244 shares of common stock and warrants to purchase 992,244 shares of common stock for CAD $0.87 (USD $0.68) per common share for gross proceeds of CAD $579,044 (USD $446,462). The warrants are exercisable immediately and expire on October 31, 2020.

On February 7, 2019, the Company received $60,000 in exchange for a promissory note to David Stefansky with an aggregate face value of $66,000, including an original issue discount of $6,000 (the “February 2019 Note”). The February 2019 Note bears no stated interest rate and was due on May 8, 2019. Given that the Company was unable to pay its obligation under the note, the February 2019 Note is currently in default. The Company amortized the full $6,000 original issue discount in the statement of operations and comprehensive loss through December 31, 2019. On December 30, 2020, the February 2019 Note was converted into the Company’s common stock in connection with the consummation of the Offer.

On February 1, 2019, the Company entered into a consulting agreement with David Stefansky. In connection with the consulting agreement, on March 5, 2019, the Company issued a note payable to its executive director for $150,000 (the “March 2019 Note”). The note bears no interest and is due and payable on March 4, 2020. The agreement expired on February 1, 2020. On December 30, 2020, the March 2019 Note was converted into common stock of the Company in connection with the consummation of the Offer. During April 2019, the Company received $300,000 in exchange for convertible notes in an aggregate principal amount of $300,000 (the “April 2019 Convertible Notes”) and warrants to purchase 250,000 shares of the Company’s common stock. The April 2019 Convertible Notes payable bear interest at a rate of 6% per annum and are due and payable one year from the date of issuance. The notes are convertible at any time by the holder into shares of the Company’s common stock at a price of $0.60 per share. If the Company sells or issues common stock at a price lower than the conversion price of the notes, the conversion price shall be reduced to that price. The notes payable will automatically convert into shares of the Company’s common stock in the event that the Company consummates a reverse merger with a publicly traded company. On December 30, 2020, the April 2019 Convertible Notes converted into shares of the Company’s common stock in connection with the consummation of the Offer.

On July 8, 2019, the Company entered into a note agreement (the “July 2019 Note”) with a limited liability company (the “Lender”). The July 2019 Note’s face value was $157,714.29 and the original issue discount was $19,714.29 for total gross proceeds of $138,000. The maturity date of the July 2019 Note was September 8, 2019. As there remained an outstanding balance on the July 2019 Note at its maturity date, the Company was in default. Per the July 2019 Note, the Lender may at its option (a) declare the entire principal amount of the July 2019 Note, together with all accrued interest thereon and all other amounts payable hereunder, immediately due and payable; and/or (b) exercise any or all of its rights, powers or remedies under applicable law. In connection with the July 2019 Note, the Company issued warrants to purchase 131,429 shares of the Company’s common stock at an exercise price of $0.71 per share. The warrants are exercisable for a period of five years.

| S-17 |

On September 20, 2019, the Company entered into the first amendment to the July 2019 Note. The amendment extended the maturity date for the July 2019 Note until the earlier of (a) the completion of a bridge financing of greater than or equal to $1,500,000, or (b) November 7, 2019. In consideration for the amendment, the Company agreed to pay an extension fee of $18,926, which was added to the outstanding balance of the July 2019 Note. In addition to the extension fee, the Company agreed to grant warrants to purchase 50,000 shares of the Company’s common stock, subject to approval by the Company’s board of directors. If the Company’s board of directors did not approve the grant of the warrants prior to October 18, 2019, the Company agreed to pay an additional extension fee of $15,000 in lieu of issuing the warrants. On October 19, 2019, given that the Company did not grant the warrants, $15,000 was added to the face value of the July 2019 Note.

On November 21, 2019, the Company entered into the second amendment to the July 2019 Note (the “November 21 Amendment”). The November 21 Amendment extended the maturity date for the Note until the earlier of (a) the completion of a bridge financing of greater than or equal to $1,500,000, or (b) December 9, 2019. In consideration for the November 21 Amendment, the Company agreed to grant 25,440 shares of the Company’s common stock, subject to approval by the Company’s board of directors.

On December 9, 2019, the Company entered into the third amendment to the July 2019 Note (the “December 9 Amendment”). The December 9 Amendment extended the maturity date for the Note until the earlier of (a) the completion of a bridge financing of greater than or equal to $1,500,000, or (b) January 7, 2020. In consideration for the December 9 Amendment, the Company agreed to pay the previously outstanding extension fees of $33,926 on or before March 1, 2020.

On January 8, 2020 the Company entered into the fourth amendment to the July 2019 Note (the “January 8 Amendment”). The January 8 Amendment extended the maturity date for the July 2019 Note until the (a) the completion of a bridge financing of greater than or equal to $1,500,000, or (b) April 1, 2020. In consideration for the January 8 Amendment, the Company agreed to grant 50,000 shares of the Company’s common stock, subject to approval by the Company’s board of directors. On December 30, 2020, the July 2019 Notes were repaid in connection with the consummation of the Offer

On January 10, 2020, the Company issued a convertible note payable for $1,500,000 to Alpha in exchange for cash. On December 30, 2020, the convertible note issued to Alpha converted into shares of the Company’s common stock and shares of Series B Preferred Stock in connection with the consummation of the Offer.

The Company has no present revenue and the Company’s ability to continue its operations and to pay its obligations when they become due is contingent upon the Company obtaining additional financing. Management’s plans include seeking to procure additional funds through debt and equity financings and to continue to develop the Company’s technologies under the series of assignment and assumption agreements with Tikkun.

Based on the Company’s current development plans, the Company believes that existing cash, the cash it received from the Alpha Investment and this offering will be sufficient to satisfy its anticipated cash requirements for the next twelve months, but that the Company will be required to seek additional equity or debt financing in the next twelve months. In the event that additional financing is required from outside sources, the Company may not be able to raise monies on terms acceptable to it or at all. If we are unable to obtain sufficient amounts of additional capital, it may be required to reduce the scope of its planned product development, which could harm its financial condition and operating results, or it may not be able to continue to fund its ongoing operations.

Cash Flows

Since inception, we have primarily used its available cash to fund its product development expenditures.

| S-18 |

Cash Flows for the Nine Months Ended September 30, 2020 and 2019

The following table sets forth a summary of cash flows for the periods presented:

| Nine Months Ended September 30, | ||||||||

| 2020 | 2019 | |||||||

| Net cash used in operating activities | $ | (1,638,798 | ) | $ | (632,590 | ) | ||

| Net cash provided by financing activities | 1,932,196 | 520,000 | ||||||

| Effect of foreign exchange rate on cash | 3,786 | 7,802 | ||||||

| Net (decrease) increase in cash | $ | 297,184 | $ | (104,788 | ) | |||

Operating Activities

Net cash used in operating activities was $1,638,798 during the nine months ended September 30, 2020, which consisted primarily of a net loss of $2,482,187, offset by amortization of note discount of $285,858, increases in prepaid expenses and other current assets for $1,841, and increases in accounts payable and accrued liabilities of $522,162.

Net cash used in operating activities was $632,590 during the nine months ended September 30, 2019, which consisted primarily of a net loss of $1,975,470, offset by amortization of note discount of $38,985, increases in stock based compensation of $624,052, decreases in prepaid expenses and other current assets of $67,591, an extinguishment of notes payable of $32,257, and increases in accounts payable and accrued liabilities of $571,121.

Financing Activities

Net cash provided by financing activities was $1,932,196 during the nine months ended September 30, 2020, which consisted primarily of $50,000 in proceeds from convertible notes payable, $1,812,410 in proceeds from note payable, $227,500 in proceeds from the sale of common stock, and a decrease of $157,714 in repayment of note payable.

Net cash provided by financing activities was $520,000 during the nine months ended September 30, 2019, which consisted of $300,000 in proceeds from convertible notes payable, $198,000 in proceeds from note payable, and $22,000 in advances from related parties.

Cash Flows for the year ended December 31, 2019 and 2018

The following table sets forth a summary of cash flows for the periods presented:

| Year Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Net cash used in operating activities | $ | (647,860 | ) | $ | (711,165 | ) | ||

| Net cash provided by financing activities | 560,000 | 822,665 | ||||||

| Effect of foreign exchange rate on cash | 17,903 | (3,744 | ) | |||||

| Net (decrease) increase in cash | $ | (69,957 | ) | $ | 107,756 | |||

Operating Activities

Net cash used in operating activities was $647,860 during the year ended December 31, 2019, which consisted primarily of a net loss of $2,410,673, offset by extinguishment of note payable of $32,316, amortization of note discount of 68,453, stock-based compensation of $624,052, increases in prepaid expenses and other current assets for $104,340, and increases in accounts payable and accrued liabilities of $933,652.

Net cash used in operating activities was $711,165 during the year ended December 31, 2018, which consisted primarily of a net loss of $1,919,577, offset by stock-based compensation of $53,294, stock issued for sublicense in the amount of $644,006, decreases in prepaid expenses and other current assets of $5,938, and increases in accounts payable and accrued liabilities of $151,668.

| S-19 |

Financing Activities

Net cash provided by financing activities was $560,000 during the year ended December 31, 2019, which consisted primarily of $238,000 in proceeds from notes payable, $300,000 in proceeds from convertible notes payable, and $22,000 in advances from related party.

Net cash provided by financing activities was $822,665 during the year ended December 31, 2018, which consisted of $822,665 in proceeds from common stock.

Off-Balance Sheet Arrangements

The Company did not have any off-balance sheet financing arrangements or liabilities, guarantee contracts, retained or contingent interests in transferred assets, or any obligation arising out of a material variable interest in an unconsolidated entity. Additionally, the Company does not have interests in, nor relationships with, any special purpose entities.

Critical Accounting Policies and Significant Judgments and Estimates

The Company’s accounting policies are fundamental to understanding its management’s discussion and analysis. The Company’s significant accounting policies are presented in Note 3 to its financial statements for the year ended December 31, 2019, which are incorporated by reference into this prospectus supplement. The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and notes required by U.S. GAAP. However, in the opinion of the management of the Company, all adjustments necessary for a fair presentation of the financial position and operating results have been included in the Company’s condensed financial statements.

Recent Accounting Standards

Management does not believe that any recently issued, but not yet effective accounting standards, when adopted, will have a material effect on the accompanying financial statements, other than those disclosed below.