UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 31, 2019 | Commission file number 001-38286 |

AMERI Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4484725 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

4080 McGinnis Ferry Road, Suite 1306 Alpharetta, Georgia 30005 |

|

30005 |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (770) 935-4152

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange On Which Registered | ||

| Common Stock $0.01 par value per share | AMRH | The NASDAQ Stock Market LLC | ||

| Warrants to Purchase Common Stock | AMRHW | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] | Smaller reporting company | [X] |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting equity held by non-affiliates of the registrant as of June 28, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $15.76 million based on the closing bid price of the registrant’s common stock of $8.7525 per share on that date. All executive officers and directors of the registrant and all 10% or greater stockholders have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of August 11, 2020, 5,737,001 shares of the registrant’s common stock were issued and outstanding.

EXPLANATORY NOTE

Ameri Holdings, Inc. is filing this Amendment Number 1 to its Annual Report on Form 10-K (“the Amendment”) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 as filed with the Securities and Exchange Commission (the “SEC”) on March 25, 2020 (the “Original Form 10-K”). This Amendment is being filed to update our notes to our audited financial statements and our disclosures under “Management’s Discussion and Analysis” in response to comments the Company received on the Original Form 10-K from the SEC. Specifically, the Company revised the following sections of the Original Form 10-K:

| 1. | Management’s Discussion and Analysis of Financial Condition and Results of Operations; | |

| 2. | Financial Statement Note 1 – Description of Business; | |

| 3. | Financial Statement Note 2 – Summary of Significant Accounting Policies; | |

| 4. | Financial Statement Note 15 – Leases; and | |

| 5. | Financial Statement Note 17 – Revision of Prior Year Financial Statements. |

With respect to Note 17, the Company’s corrections of the financial statements as of December 31, 2019 and the year then ended were a result of the adoption of FASB ASU 2016-02 “Leases” (Topic 842) and the implementation of the guidance for a lease that was executed as of April 1, 2019. In accordance with the guidance provided by the SEC’s Staff Accounting Bulletin 99, Materiality and Staff Accounting Bulletin No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements the Company determined that previously issued financial statements be revised to reflect the correction of these errors.

Except as noted above, the Company has not amended any other aspect of the Original Form 10-K. This Amendment does not reflect events occurring after the filing of our Original Form 10-K or modify or update those disclosures that may be affected by subsequent events. Such subsequent matters are addressed in subsequent reports filed with the SEC. Accordingly, this Amendment should be read in conjunction with our other filings with the SEC.

AMERI Holdings, Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

| PART I |

| ITEM 1. BUSINESS |

This annual report contains forward-looking statements. These statements relate to either future events or our future financial performance. In some cases, you may be able to identify forward-looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms or other synonymous terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Any forward-looking statements made by or on our behalf are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend, and we do undertake any obligation, to revise or update any of the forward-looking statements to match actual results. Readers are urged to carefully review and consider the various disclosures made in this report, which aim to inform interested parties of the risks factors that may affect our business, financial condition, results of operations and prospects.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles (GAAP).

As used in this annual report, the terms the “Company,” “we,” “us,” “our” and similar references refer to AMERI Holdings Inc., and its subsidiaries together, unless the context indicates otherwise.

Our Company

We specialize in delivering SAP cloud, digital and enterprise services to clients worldwide. SAP is a leader in providing enterprise resource planning (“ERP”) software and technologies to enterprise customers worldwide. We deliver a wide range of solutions and services across multiple domains and industries. Our services center around SAP and include technology consulting, business intelligence, cloud services, application development/integration and maintenance, implementation services, infrastructure services, and independent validation services, all of which can be delivered as a set of managed services or on an on-demand service basis, or a combination of both.

Our SAP focus allows us to provide technological solutions to a broad base of clients. We are headquartered in Suwanee, Georgia, and have offices across the United States, which are supported by offices in India and Canada. Our model inverts the conventional global delivery model wherein offshore information technology (“IT”) service providers are based abroad and maintain a minimal presence in the United States. With a strong SAP focus, our client partnerships anchor around SAP cloud and digital services. In 2017, we signed a strategic partnership agreement with NEC America to offer SAP S/4 HANA (a next generation enterprise system) migration services. This partnership will allow us to offer our clients a broader spectrum of services.

Our primary business objective is to provide our clients with a competitive advantage by enhancing their business capabilities and technologies with our expanding consulting services portfolio. Our strategic acquisitions allow us to bring global service delivery, SAP S/4 HANA, SAP Business Intelligence, SAP Success Factors, SAP Hybris and high-end SAP consulting capabilities to a broader geographic market and customer base. We continue to leverage our growing geographical footprint and technical expertise to simultaneously expand our service and product offering. Our goal is to identify business synergies that will allow us to bring new services and products from one subsidiary to customers at our other subsidiaries. While we generate revenues from the consulting businesses of each of our acquired subsidiaries, we believe that additional revenues will be generated through new business relationships and services developed through our business combinations.

Background

We were incorporated under the laws of the State of Delaware in February 1994 as Spatializer Audio Laboratories, Inc., which was a shell company immediately prior to our completion of a “reverse merger” transaction on May 26, 2015, in which we caused Ameri100 Acquisition, Inc., a Delaware corporation and our newly created, wholly owned subsidiary, to be merged with and into Ameri and Partners Inc. (“Ameri and Partners”), a Delaware corporation (the “Merger”). As a result of the Merger, Ameri and Partners became our wholly owned subsidiary with Ameri and Partners’ former stockholders acquiring a majority of the outstanding shares of our common stock. The Merger was consummated under Delaware law, pursuant to an Agreement of Merger and Plan of Reorganization, dated as of May 26, 2015 (the “Merger Agreement”), and in connection with the Merger we changed our name to AMERI Holdings, Inc. and do business under the brand name “Ameri100”.

| 1 |

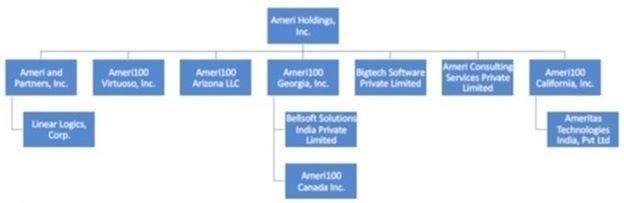

Ameri Holdings, Inc., along with its eleven subsidiaries, Ameri and Partners, Ameri Consulting Service Private Ltd., Ameri100 Georgia Inc. (“Ameri Georgia”), Bellsoft India Solutions Private Ltd., Ameri100 Canada Inc. (formerly BSI Global IT Solutions Inc.), Linear Logics, Corp., Ameri100 Virtuoso Inc. (“Virtuoso”), Ameri100 Arizona LLC (“Ameri Arizona”), Bigtech Software Private Limited (“Bigtech”), Ameri100 California Inc. (“Ameri California) and Ameritas Technologies India Private Limited, provides SAP cloud, digital and enterprise services to clients worldwide.

Organizational Chart

Recent Developments

Spin-Off Transaction

Stock Purchase Agreement

On January 10, 2020, we and Ameri100 Inc. (“Buyer”) entered into a Stock Purchase Agreement (the “Agreement”) pursuant to which, among other things and subject to the satisfaction or waiver of specified conditions, the Company will sell to Buyer and Buyer will purchase from the Company one hundred percent (100%) of the outstanding equity interests (the “Purchased Shares”) of Ameri100 Holdco, Inc. (“Holdco”) (the “Spin-Off”).

Prior to the Spin-Off Closing (as defined below), the Company will consummate a reorganization (the “Reorganization”) pursuant to which it will contribute, transfer and convey to Holdco all of the issued and outstanding equity interests of the existing subsidiaries of the Company, constituting the entire business and operations of the Company and its subsidiaries (the “Transferred Legacy Business”). At the Spin-Off Closing, in exchange for the Purchased Shares, all of the issued and outstanding shares of Series A preferred stock of the Company shall be redeemed for a number of shares of Series A preferred stock of Buyer (“Buyer Preferred Stock”) equal to the sum of (a) 431,333 shares of Buyer Preferred Stock plus (b) an additional number of payable-in-kind shares of Buyer Preferred Stock based on a 2% annual interest rate, compounding quarterly, from January 1, 2020 through and including the date of the Spin-Off Closing on the number of shares set forth in clause (a).

Each party’s obligation to consummate the Spin-Off is subject to certain conditions including, but not limited to the consummation of the Reorganization and the consummation of the Amalgamation (as defined below).

Exchange Agreements

In connection with the Agreement, on January 10, 2020, the Company entered into Exchange Agreements (each, an “Exchange Agreement”) with certain creditors of the Company and its subsidiaries (each, a “Converted Debt Holder”), pursuant to which the Company issued in a private offering a total of 599,600 shares of its common stock (the “Exchange Shares”) to such Converted Debt Holders at a price per share of $2.495 in satisfaction of $1,496,000 of the obligations owed by the Company to such Converted Debt Holders, with the remaining $1,000,000 owed to such Converted Debt Holders, plus interest (at an increased rate), due at the closing of the Amalgamation (or the earlier of the termination of the Amalgamation Agreement (as defined below) or 181 days after the date of the Amalgamation Agreement.

| 2 |

Amalgamation Transaction

Amalgamation Agreement

On January 10, 2020, the Company entered into an Amalgamation Agreement (the “Amalgamation Agreement”) with Jay Pharma Merger Sub, Inc. a company organized under the laws of Canada and a wholly-owned subsidiary of the Company (“Merger Sub”), Jay Pharma Inc., a company organized under the laws of Canada (“Jay Pharma”), Jay Pharma ExchangeCo., Inc. a company organized under the laws of British Columbia and a wholly-owned subsidiary of the Company (“ExchangeCo”), and Barry Kostiner, as the Company Representative.

The Amalgamation Agreement provides that, upon the terms and subject to the satisfaction or waiver of the conditions set forth therein, Merger Sub and Jay Pharma will be amalgamated and will continue as one corporation (“AmalCo”) under the terms and conditions prescribed in the Amalgamation Agreement (the “Amalgamation”), AmalCo shall be a direct wholly-owned subsidiary of ExchangeCo and an indirect wholly-owned subsidiary of the Company.

At the effective time of the Amalgamation (the “Effective Time”), all outstanding shares of Jay Pharma (the “Jay Pharma Shares”) will be converted into the right to receive such number of shares of common stock of the Company representing approximately 84% of the post-closing company’s issued and outstanding shares of common stock (calculated prior to the issuance of those new shares of common stock) (“Resulting Issuer Common Stock”). The Jay Pharma Shares will initially be converted into either (a) ExchangeCo Exchangeable Shares (as defined in the Amalgamation Agreement) or (b) ExchangeCo Special Shares (as defined in the Amalgamation Agreement) which in turn will be exchangeable into freely-trading shares of Resulting Issuer Common Stock. Additionally, each outstanding Jay Pharma stock option will be converted into and become an option to purchase the number of shares of Resulting Issuer Common Stock equal to the Exchange Ratio (as defined in the Amalgamation Agreement) and each outstanding Jay Pharma warrant will be converted into and become a warrant to purchase the number of shares of Resulting Issuer Common Stock equal to the Exchange Ratio.

The Amalgamation Agreement also contains covenants regarding the Company and Jay Pharma using their respective reasonable best efforts to obtain all required governmental and regulatory consents and approvals.

Each party’s obligation to consummate the Amalgamation is subject to certain conditions including, but not limited to:

| ● | the approval of each of the Company’s and Jay Pharma’s shareholders; | |

| ● | the consummation of the Spin-Off; | |

| ● | the entering into of certain ancillary agreements by and between the Company and ExchangeCo; | |

| ● | the approval of the NASDAQ to approve for listing the common stock of the resulting company. |

The Amalgamation Agreement contains certain customary termination rights by either the Company or Jay Pharma, including if the Amalgamation is not consummated within 180 days of the date of the Amalgamation Agreement.

If the Amalgamation Agreement is terminated under certain circumstances, the Company may be obligated reimburse Jay Pharma for expenses incurred in an amount not to exceed $500,000.

| 3 |

Ameri Industry

Background

We operate in an intensely competitive IT outsourcing services industry, which competes on quality, service and costs. Though we are able to differentiate our company on all of these axes, our India-based capabilities ensure that labor arbitrage is our fundamental differentiator. Most offshore IT services providers have undertaken a “forward integration” to boost their capabilities and presence in their client geographies (large offshore presence with a small local presence). Conversely, large U.S. system integrators focus on “backward integration” to scale and boost their offshore narrative (offshore being the “back office” for the local operations). Today, the IT services industry is marked by the following characteristics:

| Characteristic | Description | ||

| Mature Market | ● | Most large global companies have already outsourced what they wanted to outsource. | |

| Commoditized Business Model | ● | North America and Europe continue to be the markets with attractive spending potential. However, increased regulations and visa dependencies prove to be a major drawback of the model. | |

| ● | The benefits realized from the business model are largely based on labor arbitrage, productivity benefits and portfolio restructuring. These contours have changed due to commoditization. | ||

| Insourcing | ● | Extremely rapid changes in technology are forcing IT services–traditionally an outsourcing business—to adopt | |

| an insourcing model. | |||

| Rapid Technology Shifts | ● | Cloud services, robotic process automation, artificial intelligence and internet of things are increasingly in demand as part of outsourcing engagements. Smart robots increasingly operate in the cloud, and a ‘labor-as-a- service’ approach has emerged, as clients and providers find that intelligent tools and virtual agents can be easily and flexibly hosted on cloud platforms. | |

| ● | Social media, cloud computing, mobility and big data will continue to be mainstays for any IT ecosystem. | ||

| ● | The convergence of cloud computing, virtualization (applications and infrastructure) and utility computing is around the corner. The ability of a vendor to offer an integrated basket of services on a SaaS model, will be a key differentiator. | ||

| ● | Enterprises are becoming more digital. There is a strong convergence of human and machine intelligence | ||

| thanks to drivers like advanced sensors and machine learning. Operations and technology are converging. | |||

| Contracts & Decision Making | ● | Large multi-year contracts will be renegotiated and broken down into shorter duration contracts and will involve multiple vendors rather than sole sourcing. | |

| ● | The ability to demonstrate value through Proof of Concepts (POCs) and willingness to offer outcome based pricing are becoming critical considerations for decision making, Requests for Proposal (RFP)-driven decisions are increasingly rare. |

The SAP Industry

SAP as an ERP and Cloud product has become an industry by itself. The core SAP enterprise offering has been reinforced with cloud-based products that make the entire SAP ecosystem extremely attractive from our perspective due to the following attributes:

| ● | The alignment of SAP to enterprises is extremely strong. Given the reliance of enterprises on applications, clients tend to make long-term bets on SAP as an enterprise solution. | |

| ● | According to the September 2014 “HfS Blueprint Report” from by HfS Research Ltd., the SAP market is a multi-billion-dollar market that is very fragmented (there are over 5,000 consulting firms), with the three largest service providers capturing an increasing share of the market. | |

| ● | A significant number of SAP customers must move to S/4 HANA by 2025. |

Our Approach

Our solutions deliver significant business efficiency outcomes through turnkey projects, consulting and offshore services. We believe that our strategic service portfolio, deep industry experience and strong global talent pool offer a compelling proposition to clients. In 2017 we acquired ATCG Technology Solutions, Inc., which has become our wholly-owned subsidiary Ameri California. In 2016, we acquired three companies: Virtuoso, L.L.C. and DC&M Partners, L.L.C.in the U.S. (now Virtuoso and Ameri Arizona, respectively) and Bigtech in India. These strategic acquisitions have brought offshore delivery, SAP S/4 HANA, SAP SuccessFactors, SAP Hybris and high-end SAP consulting capabilities to our service portfolio.

Our Portfolio of Service Offerings

Our portfolio of service offerings expanded significantly since 2016 with our acquisitions of Ameri Georgia, Ameri Arizona, Ameri California, Virtuoso and Bigtech.

| 4 |

Our current portfolio of services is divided into three categories:

Cloud Services

An increasing trend in the IT services market is the adoption of cloud services. Historically, clients have resorted to on-premise software solutions, which required capital investments in infrastructure and data centers. Cloud services enable clients to build and host their applications at much lower costs. Our services offerings leverage the low cost and flexibility of cloud computing.

We have expertise in deploying SAP’s public, private and hybrid cloud services, as well as SAP S/4 HANA, SAP SuccessFactors and SAP Hybris cloud migration services. Our teams are experienced in the rapid delivery of cloud services. We perform SAP application and cloud support and SAP cloud development. Additionally, we provide cloud automation solutions that focus on business objectives and organizational growth.

Digital Services

We have developed several cutting-edge mobile solutions, including Simple Advance Planning and Optimization (“APO”) and SAP IBP/S&OP Mobile Analytics App. The Simple APO mobile application (app) provides sales professionals with real-time collaboration capabilities and customer data, on their mobile devices. It increases the efficiency of the sales process and the accuracy of customer needs forecasting. The SAP IBP mobile app enables the real-time management and analysis of sales and operations planning (S&OP) related data from mobile devices. SAP is an implementation partner for this app. SAP has recognized the app’s value to the ecosystem, as S&OP apps are complex and difficult to design.

We are also active in robotic process automation (“RPA”), which leverages the capability of artificially intelligent software agents for business process automation. We have expertise in automating disparate and redundant data entry tasks by configuring software robots that seamlessly integrate with existing software systems. We also provide RPA solutions for reporting and analysis and deliver insights into business functions by translating large data into structured reports. Lastly, we have a working partnership with Blue Prism, a leading RPA solutions provider, which makes it possible for us to automate up to one-third of all standard back-office operations.

Enterprise Services

We design, implement and manage Business Intelligence (“BI”) and analytics solutions. BI helps our clients navigate the market better by identifying new trends and by targeting top-selling products. We also enable clients to use BI for generating instant financial reports and analytics of customer, product and cost information over time. In addition, we provide solutions for metadata repository, master data management and data quality. Finally, we determine BI demands across various platforms.

Other key enterprise services that we offer include consulting services for global and regional SAP implementations, SAP/IT solution advisory and architectural services, project management services, IT/ERP strategy and vendor selection services. Often clients have relied on us to deliver services in non-SAP packages, as well.

Strategy

The integration of each of our acquisitions into our business enterprise requires establishing our company’s standard operating procedures at each acquired entity, seamlessly transitioning each acquired entity’s branding to the “Ameri100” brand and assessing any necessity to transition account management. The integration process also requires us to evaluate any product-line expansions made possible by the acquired entity and how to bring new product lines to the broader customer base of the entire Company. With the integration of each acquisition, we face challenges of maintaining cross-company visibility and cooperation, creating a cohesive corporate culture, handling unexpected customer reactions and changes and aligning the interests of the acquired entity’s leadership with the interests of the Company.

Sales and Marketing

We combine traditional sales with our strength in industries and technology. Our sales function is composed of direct sales and inside sales professionals. Both work closely with our solutions directors to identify potential opportunities within each account. We currently have over 100+ active clients. Using a consultative selling methodology (working with clients to prescribe a solution that suits their need in terms of efficiency, cost and timelines), target prospects are identified and a pursuit plan is developed for each key account. We utilize a blended sales model that combines consultative selling with traditional sales methods. Once the customer has engaged us, the sales, solutions and marketing teams monitor and manage the relationship with the help of customer relationship management software.

| 5 |

Our marketing strategy is to build a strong, sustainable brand image for our company, position us in the SAP arena and facilitate business opportunities. We use a variety of marketing programs across traditional and social channels to target our prospective and current customers, including webinars, targeted email campaigns, co-sponsoring customer events with SAP to create customer and prospect awareness, search engine marketing and advertising to drive traffic to our web properties, and website development to engage and educate prospects and generate interest through white papers, case studies and marketing collateral.

Revenues and Customers

We generate revenue primarily through consulting services performed in the fulfillment of written service contracts. The service contracts we enter into generally fall into two categories: (1) time-and-materials contracts and (2) fixed-price contracts.

When a customer enters into a time-and-materials or fixed-price, (or a periodic retainer-based) contract, we recognize revenue in accordance with an evaluation of the deliverables in each contract. If the deliverables represent separate units of accounting, we then measure and allocate the consideration from the arrangement to the separate units, based on vendor-specific objective evidence of the value for each deliverable.

The revenue under time-and-materials contracts is recognized as services are rendered and performed at contractually agreed upon rates. Revenue pursuant to fixed-price contracts is recognized under the proportional performance method of accounting. We routinely evaluate whether revenue and profitability should be recognized in the current period. We estimate the proportional performance on our fixed-price contracts on a monthly basis utilizing hours incurred to date as a percentage of total estimated hours to complete the project.

For the twelve months ended December 31, 2019 and December 31, 2018, sales to five major customers accounted for approximately 48% and 39% of our total revenue, respectively.

Technology Research and Development

We regard our services and solutions and related software products as proprietary. We rely primarily on a combination of copyright, trademark and trade secret laws of general applicability, employee confidentiality and invention assignment agreements, distribution and software protection agreements and other intellectual property protection methods to safeguard our technology and software products. We have not applied for patents on any of our technology. We also rely upon our efforts to design and produce new applications and upon improvements to existing software products to maintain a competitive position in the marketplace.

We did not make any material expenditures on research or development activities for the twelve months ended December 31, 2019 and December 31, 2018.

Strategic Alliances

Through our Lean Enterprise Architecture Partnership (“LEAP”) methodology, we have strategic alliances with technology specialists who perform services on an as-needed basis for clients. We partner with niche specialty firms globally to obtain specialized resources to meet client needs. Our business partners include executive recruiters, staffing firms and niche technology companies. The terms of each strategic alliance arrangement depend on the nature of the particular partnership. Such alliance arrangements typically set forth deliverables, scope of the services to be delivered, costs of services and terms and conditions of payment (generally 45 to 90 days for payment to be made). Each alliance arrangement also typically includes terms for indemnification of our company, non-solicitation of each partner’s employees by the other partner and dispute resolution by arbitration.

Alliances and partnerships broaden our offerings and make us a one-stop solution for clients. Our team constantly produces services that complement our portfolio and build strategic partnerships. Our partner companies range from digital marketing strategy consulting firms to large infrastructure players.

On any given project we evaluate a client’s needs and make our best effort to meet them with our full-time specialists. However, in certain circumstances, we may need to go outside the Company, and in this case, we approach our strategic partners to tap into their pools of technology specialists. Project teams are usually composed of a mix of our full-time employees and outside technology specialists. Occasionally, a project team may consist of a Company manager and a few outside technology specialists. While final accountability for any of our projects rests with the Company, the outside technology specialists are incentivized to successfully complete a project with project completion payments that are in addition to hourly billing rates we pay the outside technology specialists.

| 6 |

Competition

The large number of competitors and the speed of technology change make IT services and outsourcing a challenging business. Competitors in this market include systems integration firms, contract programming companies, application software companies, traditional large consulting firms, professional services groups of computer equipment companies and facilities management and outsourcing companies. Examples of our competitors in the IT services industry include Accenture, Cartesian Inc., Cognizant, Hexaware Technologies Limited, Infosys Technologies Limited, Mindtree Limited, RCM Technologies Inc., Tata Consultancy Services Limited, Virtusa, Inc. and Wipro Limited.

We believe that the principal factors for success in the IT services and outsourcing market include performance and reliability; quality of technical support, training and services; responsiveness to customer needs; reputation and experience; financial stability and strong corporate governance; and competitive pricing.

Some of our competitors have significantly greater financial, technical and marketing resources and/or greater name recognition, but we believe we are well positioned to capitalize on the following competitive strengths to achieve future growth:

| ● | well-developed recruiting, training and retention model; | |

| ● | successful service delivery model; | |

| ● | broad referral base; | |

| ● | continual investment in process improvement and knowledge capture; | |

| ● | investment in research and development; | |

| ● | strong corporate governance; and | |

| ● | custom strategic partnerships to provide breadth and depth of services. |

Employees

As of December 31, 2019, our total headcount was 397, which includes employees and billable subcontractors. Our employees are not part of a collective bargaining arrangement and we believe our relations with our employees are good.

Government Regulations

In the United States and India, we are subject to or affected by international, federal, state and local laws, regulations and policies, including anti-bribery rules, trade sanctions, data privacy requirements, labor laws and anti-competition regulations, which are constantly subject to change. The descriptions of the laws, regulations and policies that follow are summaries and should be read in conjunction with the texts of the laws and regulations. The descriptions do not purport to describe all present and proposed laws, regulations and policies that affect our businesses.

We believe that we are in compliance with these laws, regulations and policies. Although we cannot predict the effect of changes to the existing laws, regulations and policies or of the proposed laws, regulations and policies that are described below, we are not aware of proposed changes or proposed new laws, regulations and policies that will have a material adverse effect on our business.

We operate in jurisdictions in which local business practices may be inconsistent with international regulatory requirements, including anti-corruption and anti-bribery regulations prescribed under the U.S. Foreign Corrupt Practices Act (“FCPA”), which, among other things, prohibits giving or offering to give anything of value with the intent to influence the awarding of Government contracts. Also, India’s Prevention of Corruption (Amendment) Bill 2013 (“PCA”) prohibits giving bribe to a public servant. To help ensure compliance with these laws and regulations, we have adopted specific risk management and compliance practices and policies, including a specific policy addressing the FCPA.

| 7 |

Jay Pharma Business Overview

Jay Pharma is an evidence-based pharmaceutical company, dedicated to developing innovative cannabinoid-based products and combination therapies to improve the quality of life for those living with serious and chronic conditions, initially focusing on oncology care. Jay Pharma seeks to improve the lives of persons suffering from cancer, initially by developing cancer care and wellness products for persons suffering from certain side effects of cancer and cancer treatment. Jay Pharma currently intends to offer such palliative cancer care and wellness products, once approved for commercialization in the United States, if ever. Jay Pharma is also aiming to advance a pipeline of novel cannabinoid combination therapies for hard-to-treat cancers, including glioblastoma multiforme (GBM). Jay Pharma intends to bring leading oncology clinicians and researchers, academic and industry partners, proprietary products and data, and eventually a robust pipeline of product candidates, to improve quality of life and provide symptomatic relief to cancer patients.

In developing its product candidates, Jay Pharma intends to focus solely on cannabinoids derived from hemp and synthetic materials containing no tetrahydrocannabinol (THC) in order to comply with U.S. federal regulations. Of the potential cannabinoids to be used in therapeutic formulations, THC, which is responsible for the psychoactive properties of marijuana, can result in undesirable mood effects. Cannabidiol (CBD) and cannabigerol (CBG), on the other hand, are not psychotropic and are therefore more attractive candidates for translation into therapeutic practice. In the future, Jay Pharma may utilize cannabinoids that are derived from cannabis plants, which may contain THC; however, Jay Pharma only intends to do so in jurisdictions where THC is legal.

Available Information

Our executive office is located at 5000 Research Court, Suite 750, Suwanee, Georgia 30024. Our telephone number is (770) 935-4152 and our website is www.ameri100.com. We provide free access to various reports that we file with or furnish to the U.S. Securities and Exchange Commission through our website, as soon as reasonably practicable after they have been filed or furnished.

| 8 |

| ITEM 1A. RISK FACTORS |

In addition to the information set forth at the beginning of Management’s Discussion and Analysis entitled “Special Note Regarding Forward-Looking Information”, investors should consider that there are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially and adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Relating to Our Business and Industry

If the requirements of our indebtedness are not satisfied, a default could be deemed to occur and our lenders or the holders of our notes could accelerate the payment of the outstanding indebtedness.

As of December 31, 2019, we had an outstanding aggregate of $1 million in 8% Convertible Unsecured Promissory Notes (the “2017 Notes”), which were issued to one of our accredited investor, including one of the Company’s then-directors, Dhruwa N. Rai, and David Luci, who became a director of the Company in February 2018. The 2017 Notes bear interest at 8% per annum and matured in March 2020. We have not repaid the 2017 Notes and do not currently have sufficient funds available to meet these obligations.

We recorded a net loss for the twelve months ended December 31, 2019 and December 31, 2018 and there can be no assurance that our future operations will result in net income.

For the twelve months ended December 31, 2019, and December 31, 2018, we had net revenue of $40 million and $43 million, respectively, and we had comprehensive net loss of $6.1 million and $19.4 million, respectively. At December 31, 2019, we had stockholders’ equity of approximately $10.6 million and an accumulated deficit of approximately $40.5 million. There can be no assurance that our future operations will result in net income. Our failure to increase our revenues or improve our gross margins will harm our business. We may not be able to sustain or increase profitability on a quarterly or annual basis in the future. If our revenues grow more slowly than we anticipate, our gross margins fail to improve or our operating expenses exceed our expectations, our operating results will suffer. The fee we charge for our solutions and services may decrease, which would reduce our revenues and harm our business. If we are unable to sell our solutions at acceptable prices relative to our costs, or if we fail to develop and introduce new solutions on a timely basis and services from which we can derive additional revenues, our financial results will suffer.

We and our subsidiaries have limited operating histories and therefore we cannot ensure the long-term successful operation of our business or the execution of our business plan.

Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing companies in new and rapidly evolving markets, such as the technology consulting markets in which we operate. We must meet many challenges including:

| ● | establishing and maintaining broad market acceptance of our solutions and services and converting that acceptance into direct and indirect sources of revenue; | |

| ● | establishing and maintaining adoption of our technology solutions in a wide variety of industries and on multiple enterprise architectures; | |

| ● | timely and successfully developing new solutions and services and increasing the functionality and features of existing solutions and services; | |

| ● | developing solutions and services that result in high degree of enterprise client satisfaction and high levels of end-customer usage; | |

| ● | successfully responding to competition, including competition from emerging technologies and solutions; | |

| ● | developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our solutions and services; and | |

| ● | identifying, attracting and retaining talented personnel at reasonable market compensation rates in the markets in which we employ. |

| 9 |

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully address these risks our business will be harmed.

We face working capital constraints and may not have sufficient working capital in the long term and there is no assurance that we will be able to obtain additional financing, which could negatively impact our business.

We have incurred significant and recurring operational losses as a result of our ongoing acquisition strategy. As of December 31, 2019, we had outstanding cash payment obligations related to our past acquisitions of approximately $2.5 million and which amount is currently reduced to $1 Million. If our current cash position does not improve significantly, we will not have sufficient cash on hand to meet these obligations. Due to our working capital constraints, we are not current in all payments to all our unsecured noteholders. We are working with certain of our unsecured noteholders to negotiate payment terms until we are able to raise more capital.

There can be no assurance that we will be able to secure additional sources of capital or that cost savings will provide sufficient working capital. If we continue to be unable to pay all outstanding payments under our unsecured notes, the unpaid noteholders may take legal action against us, they may accelerate the payment of the principal under the applicable notes, and our senior secured lender may call a cross-default under our existing credit facility, which could result in the acceleration of the obligations thereunder and have a negative impact on our revenue and financial results. Should we be unable to raise sufficient debt or equity capital, we could be forced to cease operations. Our plan regarding these matters is to work to raise additional debt and/or equity financing to allow us the ability to cover our current cash flow requirements and meet our obligations as they become due. There can be no assurances that financing will be available or if available, that such financing will be available under favorable terms.

The economic environment, pricing pressures, and decreased employee utilization rates could negatively impact our revenues and operating results.

Spending on technology products and services is subject to fluctuations depending on many factors, including the economic environment in the markets in which our clients operate.

Reduced ERP spending in response to a challenging economic environment leads to increased pricing pressure from our clients, which may adversely impact our revenue, gross profits, operating margins and results of operations.

In addition to the business challenges and margin pressure resulting from economic slowdown in the markets in which our clients operate and the response of our clients to such slowdown, there is also a growing trend among consumers of ERP services towards consolidation of technology service providers in order to improve efficiency and reduce costs. Our success in the competitive bidding process for new projects or in retaining existing projects is dependent on our ability to fulfil client expectations relating to staffing, delivery of services and more stringent service levels. If we fail to meet a client’s expectations in such projects, this would likely adversely impact our business, revenues and operating margins. In addition, even if we are successful in winning the mandates for such projects, we may experience significant pressure on our operating margins as a result of the competitive bidding process.

Moreover, our ability to maintain or increase pricing is restricted as clients often expect that as we do more business with them, they will receive volume discounts or lower rates. In addition, existing and new customers are also increasingly using third-party consultants with broad market knowledge to assist them in negotiating contractual terms. Any inability to maintain or increase pricing on account of this practice may also adversely impact our revenues, gross profits, operating margins and results of operations.

Uncertain global SAP consulting market conditions may continue to adversely affect demand for our services.

We rely heavily on global demand for ERP services, especially SAP consulting by customers. Any weakness for these ERP services by global customers will adversely affect our revenue projections and hence our profits. SAP AG is adapting itself to the changes in the market especially towards cloud offerings. These changes may lead to SAP losing its market share to other competitors like Oracle, Microsoft, Salesforce and Workday among many other newer players. With these setbacks to SAP, we may face uncertain future due to dramatic changes in the market place which in turn will affect our revenues and profits.

Our success depends largely upon our highly-skilled technology professionals and our ability to hire, attract, motivate, retain and train these personnel.

Our ability to execute projects, maintain our client relationships and acquire new clients depends largely on our ability to attract, hire, train, motivate and retain highly skilled technology professionals, particularly project managers and other mid-level professionals. If we cannot hire, motivate and retain personnel, our ability to bid for projects, obtain new projects and expand our business will be impaired and our revenues could decline.

| 10 |

Increasing worldwide competition for skilled technology professionals and increased hiring by technology companies may affect our ability to hire and retain an adequate number of skilled and experienced technology professionals, which may in turn have an adverse effect on our business, results of operations and financial condition.

In addition, the demands of changes in technology, evolving standards and changing client preferences may require us to redeploy and retrain our technology professionals. If we are unable to redeploy and retrain our technology professionals to keep pace with continuing changes in technology, evolving standards and changing client preferences, this may adversely affect our ability to bid for and obtain new projects and may have a material adverse effect on our business, results of operations and financial condition.

We face intense competition from other service providers.

We are subject to intense competition in the industry in which we operate which may adversely affect our results of operations, financial condition and cash flows. We operate in a highly competitive industry, which is served by numerous global, national, regional and local firms. Our industry has experienced rapid technological developments, changes in industry standards and customer requirements. The principal competitive factors in the IT markets include the range of services offered, size and scale of service provider, global reach, technical expertise, responsiveness to client needs, speed in delivery of IT solutions, quality of service and perceived value. Many companies also choose to perform some or all of their back-office IT and IT-enabled operations internally. Such competitiveness requires us to keep pace with technological developments and maintains leadership; enhance our service offerings, including the breadth of our services and portfolio, and address increasingly sophisticated customer requirements in a timely and cost-effective manner.

We market our service offerings to large and medium-sized organizations. Generally, the pricing for the projects depends on the type of contract, which includes time and material contracts, annual maintenance contracts (fixed time frame), fixed price contracts and transaction price-based contracts. The intense competition and the changes in the general economic and business conditions can put pressure on us to change our prices. If our competitors offer deep discounts on certain services or provide services that the marketplace considers more valuable, we may need to lower prices or offer other favorable terms in order to compete successfully. Any broad-based change to our prices and pricing policies could cause revenues to decline and may reduce margins and could adversely affect results of operations, financial condition and cash flows. Some of our competitors may bundle software products and services for promotional purposes or as a long-term pricing strategy or provide guarantees of prices and product implementations. These practices could, over time, significantly constrain the prices that we can charge for certain services. If we do not adapt our pricing models to reflect changes in customer use of our services or changes in customer demand, our revenues and cash flows could decrease.

Our competitors may have significantly greater financial, technical and marketing resources and greater name recognition and, therefore, may be better able to compete for new work and skilled professionals. Similarly, if our competitors are successful in identifying and implementing newer service enhancements in response to rapid changes in technology and customer preferences, they may be more successful at selling their services. If we are unable to respond to such changes our results of operations may be harmed. Further, a client may choose to use its own internal resources rather than engage an outside firm to perform the types of services we provide. We cannot be certain that we will be able to sustain our current levels of profitability or growth in the face of competitive pressures, including competition for skilled technology professionals and pricing pressure from competitors employing an on-site/offshore business model.

In addition, we may face competition from companies that increase in size or scope as the result of strategic alliances such as mergers or acquisitions. These transactions may include consolidation activity among hardware manufacturers, software companies and vendors and service providers. The result of any such vertical integration may be greater integration of products and services that were once offered separately by independent vendors. Our access to such products and services may be reduced as a result of such an industry trend, which could adversely affect our competitive position. These types of events could have a variety of negative effects on our competitive position and our financial results, such as reducing our revenue, increasing our costs, lowering our gross margin percentage and requiring us to recognize impairments on our assets.

Our business could be adversely affected if we do not anticipate and respond to technology advances in our industry and our clients’ industries.

The IT and global outsourcing and SAP consulting services industries are characterized by rapid technological change, evolving industry standards, changing client preferences and new product introductions. Our success will depend in part on our ability to develop IT solutions that keep pace with industry developments. We may not be successful in addressing these developments on a timely basis or at all. In addition, products or technologies developed by others may not render our services noncompetitive or obsolete. Our failure to address these developments could have a material adverse effect on our business, results of operations, financial condition and cash flows.

A significant number of organizations are attempting to migrate business applications to advanced technologies. As a result, our ability to remain competitive will be dependent on several factors, including our ability to develop, train and hire employees with skills in advanced technologies, breadth and depth of process and technology expertise, service quality, knowledge of industry, marketing and sales capabilities. Our failure to hire, train and retain employees with such skills could have a material adverse impact on our business. Our ability to remain competitive will also be dependent on our ability to design and implement, in a timely and cost- effective manner, effective transition strategies for clients moving to advanced architectures. Our failure to design and implement such transition strategies in a timely and cost-effective manner could have a material adverse effect on our business, results of operations, financial condition and cash flows.

| 11 |

Our operations and assets in India expose us to regulatory, economic, political and other uncertainties in India, which could harm our business.

We have an offshore presence in India where a number of our technical professionals are located. In the past, the Indian economy has experienced many of the problems confronting the economies of developing countries, including high inflation and varying gross domestic product growth. Salaries and other related benefits constitute a major portion of our total operating costs. Many of our employees based in India where our wage costs have historically been significantly lower than wage costs in the United States and Europe for comparably skilled professionals, and this has been one of our competitive advantages. However, wage increases in India or other countries where we have our operations may prevent us from sustaining this competitive advantage if wages increase. We may need to increase the levels of our employee compensation more rapidly than in the past to retain talent. If such events occur, we may be unable to continue to increase the efficiency and productivity of our employees and wage increases in the long term may reduce our profit margins.

Our clients may seek to reduce their dependence on India for outsourced IT services or take advantage of the services provided in countries with labor costs similar to or lower than India.

Clients which presently outsource a significant proportion of their IT services requirements to vendors in India may, for various reasons, including in response to rising labor costs in India and to diversify geographic risk, seek to reduce their dependence on one country. We expect that future competition will increasingly include firms with operations in other countries, especially those countries with labor costs similar to or lower than India, such as China, the Philippines and countries in Eastern Europe. Since wage costs in our industry in India are increasing, our ability to compete effectively will become increasingly dependent on our reputation, the quality of our services and our expertise in specific industries. If labor costs in India rise at a rate that is significantly greater than labor costs in other countries, our reliance on the labor in India may reduce our profit margins and adversely affect our ability to compete, which would, in turn, have a negative impact on our results of operations.

Our business could be materially adversely affected if we do not or are unable to protect our intellectual property or if our services are found to infringe upon or misappropriate the intellectual property of others.

Our success depends in part upon certain methodologies and tools we use in designing, developing and implementing applications systems in providing our services. We rely upon a combination of nondisclosure and other contractual arrangements and intellectual property laws to protect confidential information and intellectual property rights of ours and our third parties from whom we license intellectual property. We enter into confidentiality agreements with our employees and limit distribution of proprietary information. The steps we take in this regard may not be adequate to deter misappropriation of proprietary information and we may not be able to detect unauthorized use of, protect or enforce our intellectual property rights. At the same time, our competitors may independently develop similar technology or duplicate our products or services. Any significant misappropriation, infringement or devaluation of such rights could have a material adverse effect upon our business, results of operations, financial condition and cash flows.

Litigation may be required to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others. Any such litigation could be time consuming and costly. Although we believe that our services do not infringe or misappropriate on the intellectual property rights of others and that we have all rights necessary to utilize the intellectual property employed in our business, defense against these claims, even if not meritorious, could be expensive and divert our attention and resources from operating our company. A successful claim of intellectual property infringement against us could require us to pay a substantial damage award, develop non-infringing technology, obtain a license or cease selling the products or services that contain the infringing technology. Such events could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Any disruption in the supply of power, IT infrastructure and telecommunications lines to our facilities could disrupt our business process or subject us to additional costs.

Any disruption in basic infrastructure, including the supply of power, could negatively impact our ability to provide timely or adequate services to our clients. We rely on a number of telecommunications service and other infrastructure providers to maintain communications between our various facilities and clients in India, the United States and elsewhere. Telecommunications networks are subject to failures and periods of service disruption, which can adversely affect our ability to maintain active voice and data communications among our facilities and with our clients. Such disruptions may cause harm to our clients’ business. We do not maintain business interruption insurance and may not be covered for any claims or damages if the supply of power, IT infrastructure or telecommunications lines is disrupted. This could disrupt our business process or subject us to additional costs, materially adversely affecting our business, results of operations, financial condition and cash flows.

| 12 |

System security risks and cyber-attacks could disrupt our information technology services provided to customers, and any such disruption could reduce our expected revenue, increase our expenses, damage our reputation and adversely affect our stock price and the value of our warrants.

Security and availability of IT infrastructure is of the utmost concern for our business, and the security of critical information and infrastructure necessary for rendering services is also one of the top priorities of our customers.

System security risks and cyber-attacks could breach the security and disrupt the availability of our IT services provided to customers. Any such breach or disruption could allow the misuse of our information systems, resulting in litigation and potential liability for us, the loss of existing or potential clients, damage to our reputation and diminished brand value and could have a material adverse effect on our financial condition.

Our network and our deployed security controls could also be penetrated by a skilled computer hacker or intruder. Further, a hacker or intruder could compromise the confidentiality and integrity of our protected information, including personally identifiable information; deploy malicious software or code like computer viruses, worms or Trojan horses, etc. may exploit any security vulnerabilities, known or unknown, of our information system; cause disruption in the availability of our information and services; and attack our information system through various other mediums.

We also procure software or hardware products from third party vendors that provide, manage and monitor our services. Such products may contain known or unfamiliar manufacturing, design or other defects which may allow a security breach or cyber-attack, if exploited by a computer hacker or intruder, or may be capable of disrupting performance of our IT services and prevent us from providing services to our clients.

In addition, we manage, store, process, transmit and have access to significant amounts of data and information that may include our proprietary and confidential information and that of our clients. This data may include personal information, sensitive personal information, personally identifiable information or other critical data and information, of our employees, contractors, officials, directors, end customers of our clients or others, by which any individual may be identified or likely to be identified. Our data security and privacy systems and procedures meet applicable regulatory standards and undergo periodic compliance audits by independent third parties and customers. However, if our compliance with these standards is inadequate, we may be subject to regulatory penalties and litigation, resulting in potential liability for us and an adverse impact on our business.

We are still susceptible to data security or privacy breaches, including accidental or deliberate loss and unauthorized disclosure or dissemination of such data or information. Any breach of such data or information may lead to identity theft, impersonation, deception, fraud, misappropriation or other offenses in which such information may be used to cause harm to our business and have a material adverse effect on our financial condition, business, results of operations and cash flows.

We must effectively manage the growth of our operations, or our company will suffer.

Our ability to successfully implement our business plan requires an effective planning and management process. If funding is available, we intend to increase the scope of our operations and acquire complimentary businesses. Implementing our business plan will require significant additional funding and resources. If we grow our operations, we will need to hire additional employees and make significant capital investments. If we grow our operations, it will place a significant strain on our existing management and resources. If we grow, we will need to improve our financial and managerial controls and reporting systems and procedures, and we will need to expand, train and manage our workforce. Any failure to manage any of the foregoing areas efficiently and effectively would cause our business to suffer.

Our revenues are concentrated in a limited number of clients and our revenues may be significantly reduced if these clients decrease their IT spending.

Our client contracts are based on time and materials expenses. We do not have long-term client contracts. Our client contracts contain standard payment terms, and our clients only pay us for services rendered. We have limited exposure for non-payment by our clients and do not have any unresolved client debts. While our client contracts can be terminated with little or no notice, it is uncommon for our clients to terminate an engagement in the middle of the implementation of services.

For the twelve-month period ended December 31, 2019 and December 31, 2018, sales to five major customers accounted for approximately 48% and 39%, respectively, of our total revenue. Consequently, if our top clients reduce or postpone their IT spending significantly, this may lower the demand for our services and negatively affect our revenues and profitability. Further, any significant decrease in the growth of the financial services or other industry segments on which we focus may reduce the demand for our services and negatively affect our revenues, profitability and cash flows.

| 13 |

Our client contracts can typically be terminated without cause and with little or no notice or penalty, which could negatively impact our revenues and profitability.

Our clients typically retain us on a non-exclusive, project-by-project basis. Many of our client contracts can be terminated with or without cause. Our business is dependent on the decisions and actions of our clients, and there are a number of factors relating to our clients that are outside of our control which might lead to termination of a project or the loss of a client, including:

| ● | financial difficulties for a client; | |

| ● | a change in strategic priorities, resulting in a reduced level of technology spending; | |

| ● | a demand for price reductions; or an unwillingness to accept higher pricing due to various factors such as higher wage costs, higher cost of doing business; | |

| ● | a change in outsourcing strategy by moving more work to the client’s in-house technology departments or to our competitors; | |

| ● | the replacement by our clients of existing software with packaged software supported by licensors; | |

| ● | mergers and acquisitions; | |

| ● | consolidation of technology spending by a client, whether arising out of mergers and acquisitions, or otherwise; and | |

| ● | sudden ramp-downs in projects due to an uncertain economic environment. |

Our inability to control the termination of client contracts could have a negative impact on our financial condition and results of operations.

Our engagements with customers are typically singular in nature and do not necessarily provide for subsequent engagements.

Our clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific projects, rather than on a recurring basis under long-term contracts. Although a substantial majority of our revenues are generated from repeat business, which we define as revenues from a client who also contributed to our revenues during the prior fiscal year, our engagements with our clients are typically for projects that are singular in nature. Therefore, we must seek out new engagements when our current engagements are successfully completed or terminated, and we are constantly seeking to expand our business with existing clients and secure new clients for our services. In addition, in order to continue expanding our business, we may need to significantly expand our sales and marketing group, which would increase our expenses and may not necessarily result in a substantial increase in business. If we are unable to generate a substantial number of new engagements for projects on a continual basis, our business and results of operations would likely be adversely affected.

Our results of operations may fluctuate from quarter to quarter, which could affect our business, financial condition and results of operations.

Our results of operations may fluctuate from quarter to quarter depending upon several factors, some of which are beyond our control. These factors include the timing and number of client projects commenced and completed during the quarter, the number of working days in a quarter, employee hiring, attrition and utilization rates and the mix of time-and-material projects versus fixed price deliverable projects and maintenance projects during the quarter. Additionally, periodically our cost increases due to both the hiring of new employees and strategic investments in infrastructure in anticipation of future opportunities for revenue growth.

| 14 |

These and other factors could affect our business, financial condition and results of operations, and this makes the prediction of our financial results on a quarterly basis difficult. Also, it is possible that our quarterly financial results may be below the expectations of public market analysts.

We are heavily dependent on our senior management, and a loss of a member of our senior management team could cause our stock price and the value of our warrants to suffer.

If we lose members of our senior management, we may not be able to find appropriate replacements on a timely basis, and our business could be adversely affected. Our existing operations and continued future development depend to a significant extent upon the performance and active participation of certain key individuals. We do not currently maintain key man insurance. If we were to lose any of our key personnel, we may not be able to find appropriate replacements on a timely basis and our financial condition and results of operations could be materially adversely affected.

Our international sales and operations are subject to applicable laws relating to trade, export controls and foreign corrupt practices, the violation of which could adversely affect its operations.

We must comply with all applicable international trade, customs, export controls and economic sanctions laws and regulations of the United States and other countries. We are also subject to the Foreign Corrupt Practices Act and other anti-bribery laws that generally bar bribes or unreasonable gifts to foreign governments or officials. Changes in trade sanctions laws may restrict our business practices, including cessation of business activities in sanctioned countries or with sanctioned entities, and may result in modifications to compliance programs. Violation of these laws or regulations could result in sanctions or fines and could have a material adverse effect on our financial condition, results of operations and cash flows.

Our income tax returns are subject to review by taxing authorities, and the final determination of our tax liability with respect to tax audits and any related litigation could adversely affect our financial results.

Although we believe that our tax estimates are reasonable and that we prepare and submit our tax filings on a timely basis and in accordance with all applicable tax laws, the final determination with respect to any tax audits, and any related litigation, could be materially different from our estimates or from our historical income tax provisions and accruals. The results of an audit or litigation could have a material effect on operating results and/or cash flows in the periods for which that determination is made. In addition, future period earnings may be adversely impacted by litigation costs, settlements, penalties and/or interest assessments.

Failure of our customers to pay the amounts owed to us in a timely manner may adversely affect our financial condition and operating results.

We generally provide payment terms ranging from 30 to 60 days. As a result, we generate significant accounts receivable from sales to our customers, representing approximately 84% of current assets as of December 31, 2019 and approximately 78% of current assets as of December 31, 2018. Accounts receivable from sales to customers were $6.4 million as of December 31, 2019 and $7.9 million as of December,31 2018. As of December 31, 2019, the largest amount owed by a single customer was approximately 11% of total accounts receivable. As of December 31, 2019, we had an allowance of $85,430 for doubtful accounts. If any of our significant customers have insufficient liquidity, we could encounter significant delays or defaults in payments owed to us by such customers, and we may need to extend our payment terms or restructure the receivables owed to us, which could have a significant adverse effect on our financial condition. Any deterioration in the financial condition of our customers will increase the risk of uncollectible receivables. Global economic uncertainty could also affect our customers’ ability to pay our receivables in a timely manner or at all or result in customers going into bankruptcy or reorganization proceedings, which could also affect our ability to collect our receivables.

If we are unable to collect our dues or receivables from or invoice our unbilled services to our clients, our results of operations and cash flows could be adversely affected.

Our business depends on our ability to successfully obtain payments from our clients of the amounts they owe us for work performed. We evaluate the financial condition of our clients and usually bill and collect on relatively short cycles. Macroeconomic conditions, such as a potential credit crisis in the global financial system, could result in financial difficulties for our clients, including limited access to the credit markets, insolvency or bankruptcy. Such conditions could cause clients to delay payment, request modifications of their payment terms, or default on their payment obligations to us, all of which could increase our receivables. If we experience delays in the collection of, or are unable to collect, our client balances, our results of operations and cash flows could be adversely affected. In addition, if we experience delays in billing and collection for our services, our cash flows could be adversely affected.

| 15 |

Goodwill that we carry on our balance sheet could give rise to significant impairment charges in the future.

Goodwill is subject to impairment review at least annually. Impairment testing under standards as issued by the Financial Accounting Standards Board may lead to impairment charges in the future. Any significant impairment charges could have a material adverse effect on our results of operations.

Our revenue and operating results may be affected by the rate of growth in the use of technology in business and the type and level of technology spending by our clients.

Our business depends, in part, upon continued reliance on the use of technology in business by our clients and prospective clients as well as their customers and suppliers. In particular, the success of our new service offerings requires continued demand for such services and our ability to meet this demand in a cost-effective manner. In challenging economic environments, our clients may reduce or defer their spending on new technologies in order to focus on other priorities and prospective clients may decide not to engage our services. Also, many companies have already invested substantial resources in their current means of conducting commerce and exchanging information, and they may be reluctant or slow to adopt new approaches that could disrupt existing personnel, processes and infrastructures. If the growth of technology usage in business, or our clients’ spending on such technology, declines, or if we cannot convince our clients or potential clients to embrace new technological solutions, our revenue and operating results could be adversely affected.

Our business will suffer if we fail to anticipate and develop new services and enhance existing services in order to keep pace with rapid changes in technology and the industries on which we focus.

The ERP services market is characterized by rapid technological changes, evolving industry standards, changing client preferences and new product and service introductions. Our future success will depend on our ability to anticipate these advances and enhance our existing offerings or develop new product and service offerings to meet client needs. We may not be successful in anticipating or responding to these advances on a timely basis, or, if we do respond, the services or technologies we develop may not be successful in the marketplace. We may also be unsuccessful in stimulating customer demand for new and upgraded products, or seamlessly managing new product introductions or transitions. Further, products, services or technologies that are developed by our competitors may render our services non-competitive or obsolete. Our failure to address the demands of the rapidly evolving information technology environment, particularly with respect to digital technology, the internet of things, artificial intelligence, cloud computing and storage, mobility and applications and analytics, could have a material adverse effect on our business, results of operations and financial condition.

Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations.

We are subject to laws and regulations enacted by national, regional and local governments, including non-U.S. governments. In particular, we are required to comply with certain SEC and other legal requirements. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied, could have a material adverse effect on our business and results of operations.

Our international operations subject us to exposure to foreign currency fluctuations.