UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant ☐

|

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant Rule §240.14a-11(c) or §240.14a-2

|

Ameri Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

|

|

| |

(5)

|

Total fee paid:

|

| |

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount Previously Paid:

|

| |

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

|

|

| |

(3)

|

Filing Party:

|

| |

|

|

| |

(4)

|

Date Filed:

|

AMERI HOLDINGS, INC.

5000 Research Court, Suite 750

Suwanee, Georgia 30024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON [____], 2019

To the Stockholders of Ameri Holdings, Inc.:

You are cordially invited to attend our annual meeting of stockholders on [_______], 2019. We will hold the meeting at 10:00 a.m. Eastern Daylight Time at the offices of Sheppard, Mullin, Richter

& Hampton LLP, 30 Rockefeller Plaza, New York, NY 10112.

In connection with the annual meeting, we have prepared a proxy statement setting out detailed information about the matters that will be covered at the meeting. We will mail our proxy statement,

along with a proxy card, on or about [_______], 2019 to our stockholders of record as of the close of business on [_______], 2019. These materials and our Annual Report on Form 10-K for the year ended December 31, 2018 are also available

electronically at [___________].

Our Board of Directors has fixed the close of business on [_______], 2019 as the record date for the determination of stockholders entitled to notice of and to vote at our annual meeting and at any

adjournment(s), postponement(s) or other delay(s) thereof. Voting on the matters to be considered at the annual meeting can be done (1) by signing and dating the enclosed proxy card and returning it in the enclosed postage-paid envelope (2) by

voting on the internet (the website address for internet voting is on your proxy card) or (3) in person by ballot at the annual meeting. Important information about attending the annual meeting in person is

included in the proxy statement.

The matters that will be considered at the annual meeting are:

|

1. |

To elect four directors, to serve until the Company’s 2019 annual meeting of stockholders and until their successors are duly elected and qualified;

|

|

2. |

To ratify the appointment of our independent auditors;

|

|

3. |

To authorize an amendment to our Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock at a specific ratio, within a range of 1-for-5 and 1-for-25, to be determined by our Board of

Directors in its sole discretion and effected, if at all, within one year of the date the proposal is approved by stockholders (the “Reverse Stock Split Proposal”); and

|

|

4. |

To transact such other business as may properly come before the annual meeting or any adjournment(s), postponement(s) or other delay(s) thereof.

|

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. We are not aware of any other business to come before the annual meeting.

This Notice, the Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2018 are first being mailed to stockholders on or about [_______], 2019. Only stockholders of

record at the close of business on [_______], 2019 and their proxies are entitled to attend and vote at the annual meeting and any and all adjournments, continuations or postponements thereof.

Your vote is important. Regardless of whether you plan to attend the annual meeting, we encourage you to vote your shares promptly by using the internet, or

by signing and returning the proxy card mailed to those who receive paper copies of this proxy statement. You may revoke your proxy at any time before it is voted at the annual meeting by delivering a written statement to the Corporate Secretary

that the proxy is revoked, presenting a later-dated proxy, or attending the annual meeting and voting in person. If you would like to attend and your stock is not registered in your own name, please ask the broker, trust, bank or other nominee

that holds the stock to provide you with evidence of your stock ownership.

If you have any questions, or need assistance in voting your shares, please contact the firm assisting us in the solicitation of proxies:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833) 814-9456

| |

Sincerely,

|

| |

|

| |

/s/ Srinidhi “Dev” Devanur

|

| |

Srinidhi “Dev” Devanur

Chairman of the Board

|

Suwanee, Georgia

[________], 2019

| |

|

|

| |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON [_______], 2019

Whether or not you attend the meeting in person, please vote by internet, or, if you receive a paper copy of the proxy materials, please sign, date and promptly mail the enclosed proxy card or

use the internet voting procedures described on the proxy card. This Notice of Annual Meeting and Proxy Statement along with the Ameri Holdings, Inc. Annual Report on Form 10-K for the year ended December 31, 2018, are available on the

internet at: [__________]

|

|

| |

|

|

AMERI HOLDINGS, INC.

5000 Research Court, Suite 750

Suwanee, Georgia 30024

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON [___], 2019

| |

PAGE

|

|

|

1

|

|

|

1 |

|

|

1 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

10 |

|

|

11 |

|

|

11 |

|

|

11 |

|

|

13 |

|

|

14 |

|

|

14 |

|

|

14 |

|

|

14 |

|

|

16 |

|

|

19

|

|

|

21

|

|

|

28

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

31

|

|

|

|

AMERI HOLDINGS, INC.

5000 Research Court, Suite 750

Suwanee, Georgia 30024

The Board of Directors of Ameri Holdings, Inc., a Delaware corporation (referred to in this Proxy Statement as “Ameri,” “the Company,” “we,” “our” or “us”), is soliciting proxies from our

stockholders in connection with our Annual Meeting of Stockholders to be held on [___], 2019 and at any adjournment(s), postponement(s) or other delay(s) thereof (the “Annual Meeting”). We will hold the meeting at 10:00 a.m. Eastern Daylight Time

at the offices of Sheppard, Mullin, Richter & Hampton LLP, 30 Rockefeller Plaza, New York, New York 10112.

The accompanying proxy is solicited by the Board of Directors and is revocable by the stockholder at any time before it is voted. This Proxy Statement is being mailed to stockholders of the Company

on or about [___], 2019 and is accompanied by the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

Holders of common stock, par value $0.01 per share (“common stock”), outstanding as of the close of business on [___], 2019 (the “Record Date”) are entitled to receive notice of, and to vote at,

the Annual Meeting. As of the Record Date, there were [___] shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on all matters. No class of securities other than our

common stock will be entitled to vote at the Annual Meeting. There are no cumulative voting rights.

The holders of a majority of the stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, constitute a quorum for the transaction of business at the

Annual Meeting. Shares that reflect abstentions and broker non-votes, if any, count as present at the Annual Meeting for the purposes of determining a quorum. A broker non-vote occurs when a bank, broker or other nominee holding shares for a

beneficial owner votes on one proposal but does not vote on another proposal because, with respect to such other proposal, the nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

The vote requirement for each matter is as follows:

|

• |

Proposal 1 (Election of Directors) - Directors are elected by a plurality of the votes cast, and the four nominees who receive the greatest number of favorable votes of the holders of the common stock cast in the election of

directors will be elected directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified.

|

|

• |

Proposal 2 (Ratification of Appointment of Independent Auditors) - The ratification of the appointment of our independent auditors requires the favorable vote of the holders of a majority of the common stock having voting power

present in person or represented by proxy and entitled to vote thereon.

|

|

• |

Proposal 3 (Approval of the Reverse Stock Split) - To be approved, Proposal 3 must receive favorable votes from the holders of a majority of the voting capital outstanding and entitled to vote at the Annual Meeting.

|

In the election of directors (Proposal 1), abstentions and broker non-votes, if any, will be disregarded and have no effect on the outcome of the vote. With respect to the ratification of the

appointment of our independent registered public accounting firm (Proposal 2) abstentions will have the same effect as voting against such proposals, and broker non-votes, if any, will be disregarded and have no effect on the outcome of the vote.

The approval of Proposal 2 is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from Proposal 2. With

respect to the approval of the reverse stock split (Proposal 3) abstentions and broker non-votes will have the same effect as voting against such proposals.

The Board of Directors’ Voting Recommendations

The Board of Directors recommends that you vote your shares “FOR” each of the Board of Directors’ four nominees that are standing for election to the Board

of Directors (Proposal 1); “FOR” the ratification of the appointment of our independent auditors (Proposal 2); and “FOR” the approval of the reverse stock split

(Proposal 3).

If you are a stockholder of record as of the Record Date, you may vote using any of the following methods:

|

• |

By the internet. Specific instructions for stockholders of record who wish to use internet voting procedures are set forth on the notice of internet availability of

proxy materials and on the proxy card. If you own shares held in street name, you will receive voting instructions from your broker, bank or nominee and may vote by the internet if they offer that alternative. Please note that

internet voting will close at 11:59 p.m. on [___], 2019.

|

|

• |

Proxy card or voting instruction card. If you received a proxy card or voting instruction card in the mail, complete, sign and date the card and return it in the prepaid envelope.

|

|

• |

In person at the Annual Meeting. All stockholders may vote in person at the Annual Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy

designating that person. If you own shares held in street name, you must obtain a legal proxy from your broker, bank or nominee and present it to the inspector of election with your ballot when you vote at the Annual Meeting.

|

Giving us your proxy means you authorize the Board of Directors’ designated proxy holders (who are identified on the enclosed proxy card) to vote your shares at the Annual Meeting in the manner

that you have indicated and in their best judgment on such other matters that may properly come before the Annual Meeting. If you sign, date and return the enclosed proxy card but do not indicate your vote, the designated proxy holders will vote

your shares “FOR” each of the Board of Directors’ four nominees that are standing for election to the Board of Directors (Proposal 1); “FOR” the ratification of the

appointment of our independent auditors (Proposal 2); and “FOR” the approval of the reverse stock split (Proposal 3).

If You Plan to Attend the Annual Meeting

Attendance at the Annual Meeting will be limited to stockholders and the Company’s invited guests. Each stockholder may be asked to present valid picture identification, such as a driver’s license

or passport. Stockholders holding shares of common stock in brokerage accounts or through a bank or other nominee may be required to show a brokerage statement or account statement reflecting stock ownership. Cameras, recording devices and other

electronic devices will not be permitted at the Annual Meeting. You may contact our Chief Financial Officer, Barry Kostiner, at barry.kostiner@ameri100.com for directions to the Annual Meeting.

If you are a stockholder of record as of the Record Date, you may vote your shares of common stock in person by ballot at the Annual Meeting. If you hold your shares of common stock in a stock

brokerage account or through a bank or other nominee, you will not be able to vote in person at the Annual Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the

Annual Meeting.

You may revoke your proxy by submitting a new proxy with a later date or by notifying our Corporate Secretary in writing at 5000 Research Court, Suite 750, Suwanee, Georgia 30024. If you attend the

Annual Meeting in person and vote by ballot, any previously submitted proxy will be revoked.

We will solicit proxies and will bear the entire cost of our solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement and any additional materials furnished

to our stockholders. We have retained Alliance Advisors, LLC (“Alliance Advisors”) to assist us in the solicitation of proxies, as described in “General-Cost of Solicitation” below. The initial solicitation of proxies by mail may be supplemented

by telephone, fax, e-mail, internet and personal solicitation by our directors, officers or other regular employees. No additional compensation for soliciting proxies will be paid to our directors, officers or other regular employees for their

proxy solicitation efforts. Fees paid to Alliance Advisors are described in “General-Cost of Solicitation” below.

If You Receive More Than One Proxy Card

If you hold your shares of common stock in more than one account, you will receive a proxy card for each account. To ensure that all of your shares of shares of common stock are voted, please vote

using a proxy card for each account that you own. It is important that you vote all of your shares of common stock.

If the shares you own are held in “street name” by a bank, brokerage firm or other nominee, your nominee, as the record holder of your shares, is required to vote your shares according to your

instructions. In order to vote your shares, you will need to follow the directions your nominee provides to you. If you do not give instructions to your nominee, your nominee will determine whether it has discretionary authority to vote your

shares. Applicable regulations prohibit nominees from voting shares on non-routine matters unless the beneficial owners indicate how the shares are to be voted. Therefore, unless you instruct your nominee on how to vote your shares with respect

to the approval of the Certificate of Incorporation amendment or the election of directors, your nominee will be prohibited from voting on such matters on your behalf. Your nominee will, however, continue to have discretionary authority to vote

uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm.

If your nominee returns a valid proxy but is not able to vote your shares, they will constitute “broker non-votes,” which are counted for the purpose of determining the presence of a quorum and

will be counted against the proposal for the amendment of the Company’s Certificate of Incorporation. Broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting other than the amendment of the Company’s

Certificate of Incorporation.

If You Have Any Questions

If you have any questions, or need assistance in voting your shares, please contact the firm assisting us in the solicitation of proxies:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(833) 814-9456

CORPORATE GOVERNANCE AND ETHICS

Composition of the Board of Directors

The current number of directors on our Board of Directors is four. Under our bylaws, the number of directors on our Board of Directors will not be less than three and may be increased or decreased

by resolution of the Board of Directors.

Director Nomination Process

Director Qualifications

In evaluating director nominees, the Nominations and Corporate Governance Committee of our Board of Directors considers the appropriate size of the Board of Directors, as well as the qualities and

skills of individual candidates. Factors considering include the following:

|

• |

A history illustrating personal and professional integrity and ethics;

|

|

• |

Successful business management experience;

|

|

• |

Public company experience, as officer or board member;

|

|

• |

Relevant professional experience; and

|

|

• |

Educational background.

|

The Nominations and Corporate Governance Committee’s goal is to assemble a Board of Directors that brings the Company a diversity of perspectives and skills derived from the factors considered

above. The Nominations and Corporate Governance Committee also considers candidates with relevant non-business experience and training.

Our Board of Directors believes that it is necessary for each of our directors to possess many qualities and skills. When searching for new candidates, the Nominations and Corporate Governance

Committee considers the evolving needs of the Board of Directors and searches for candidates that fill any current or anticipated future gap. Our Board of Directors also believes that all directors must possess a considerable amount of business

management (such as experience as a chief executive or chief financial officer) and educational experience. The Nominations and Corporate Governance Committee first considers a candidate’s management experience and then considers issues of

judgment, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value when considering director candidates. The Nominations and Corporate Governance Committee also focuses on issues of

diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The Nominations and Corporate Governance Committee does not have a formal policy with respect to

diversity; however, our Board of Directors and the Nominations and Corporate Governance Committee believe that it is essential that the directors represent diverse viewpoints. In considering candidates for our Board of Directors, the Nominations

and Corporate Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board of

Directors are also considered.

Other than the foregoing background factors that are considered in selecting director candidates, there are no stated minimum qualifications for director nominees, although the Nominations and

Corporate Governance Committee may also consider such other facts as it may deem are in the best interests of Ameri and our stockholders. The Nominations and Corporate Governance Committee does believe it appropriate for at least one, and

preferably several, members of our Board of Directors to meet the criteria for an “Audit Committee financial expert” as defined by the rules of the Securities and Exchange Commission (the “SEC”), and that a majority of the members of our Board of

Directors meet the definition of an “independent director” under the listing standards of the NASDAQ Stock Market.

Identification and Evaluation of Nominees for Directors

The Nominations and Corporate Governance Committee identifies nominees for director by first evaluating the current members of our Board of Directors willing to continue their service on the Board

of Directors. Current members with qualifications and skills that are consistent with the Nominations and Corporate Governance Committee’s criteria for service on the Board of Directors and who are willing to continue their service are considered

for re-nomination, balancing the value of continuity of service by existing members of our Board of Directors with that of obtaining new perspectives. If any member of our Board of Directors does not wish to continue his or her service or if our

Board of Directors decides not to re-nominate a member for re-election, the Nominations and Corporate Governance Committee identifies the desired skills and experience of a new nominee in light of the criteria above. The Nominations and Corporate

Governance Committee generally polls our Board of Directors and members of management for their recommendations regarding potential new nominees. The Nominations and Corporate Governance Committee may also review the composition and qualification

of the boards of directors of our competitors, and may seek input from our stockholders, industry experts or analysts. The Nominations and Corporate Governance Committee reviews the qualifications, experience and background of the candidates.

Final candidates are interviewed by some or all of our independent directors and our Chief Executive Officer. In making its determinations, the Nominations and Corporate Governance Committee

evaluates each individual in the context of our Board of Directors as a whole, with the objective of assembling a group that can best attain success for Ameri and represent stockholder interests through the exercise of sound judgment. After review

and deliberation of all feedback and data, the Nominations and Corporate Governance Committee makes its recommendation to our Board of Directors. Historically, the Nominations and Corporate Governance Committee has not relied on third-party search

firms to identify board candidates. The Nominations and Corporate Governance Committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify and

acquire an appropriate candidate.

The Nominations and Corporate Governance Committee does not have a formal policy regarding consideration of director candidate recommendations from our stockholders. Any recommendations received

from stockholders have been and will continue to be evaluated in the same manner as potential nominees suggested by members of our Board of Directors or management. Stockholders wishing to suggest a candidate for director should write to our

Corporate Secretary at our corporate headquarters. In order for us to effectively consider a recommendation for a nominee for a director position, stockholders must provide the following information in writing: (i) the stockholder’s name and

contact information; (ii) the class and number of shares beneficially owned by the stockholder; (iii) a statement that the stockholder is proposing a candidate for consideration as a director nominee to the Nominations and Corporate Governance

Committee of our Board of Directors; (iv) the name, age, business address and residence address of the candidate and confirmation that the candidate is willing to be considered and serve as a director of the Company if elected; (v) a description of

all arrangements and understandings and the relationship between the stockholder making the recommendation and the candidate being recommended and between the candidate and any customer, supplier, or competitor of the Company; (vi) the principal

occupation and educational background of the candidate; (vii) a statement of the value that the candidate would add to our Board of Directors, including addressing the factors that our Board of Directors normally considers in assessing board

candidates as stated above; and (viii) at least three character references with complete contact information. In order to give the Nominations and Corporate Governance Committee sufficient time to evaluate a recommended candidate, any such

recommendation should be received by our Corporate Secretary at our corporate headquarters not later than the 120th calendar day before the one year anniversary of the date our proxy statement was mailed to stockholders in connection with the

previous year’s annual meeting of stockholders.

Board Leadership Structure

We believe it is beneficial to separate the roles of Chief Executive Officer and Chairman of the Board of Directors to facilitate their differing roles in the leadership of the Company. The role of

the Chairman is to set the agenda for, and preside over, board meetings, as well as providing advice and assistance to the Chief Executive Officer. In contrast, the Chief Executive Officer is responsible for handling the day-to-day management

direction of the Company, serving as a leader to the management team, and formulating corporate strategy.

Srinidhi “Dev” Devanur is currently the Executive Chairman of our Board. The three independent directors are Dimitrios J. Angelis, Thoranath Sukumaran and Carmo Martella.

Following the Annual Meeting, we will continue our philosophy and practice of keeping the Chairman and Chief Executive Officer roles separate. We believe the working relationship between an

independent Chairman and our Chief Executive Officer, on the one hand, and between out Chairman and the other independent directors, on the other, enhances and facilitates the flow of information between management and our Board of Directors as

well as the ability of our independent directors to evaluate and oversee management and its decision-making.

Board Meeting Attendance

Our Board of Directors held [__] in person or telephonic meetings during the year ended December 31, 2018. No director who served as a director during the past year attended fewer than 75% of the

aggregate of the total number of meetings of our Board of Directors.

Director Independence

Our Board of Directors has determined that all director nominees, except for Srinidhi “Dev” Devanur, our Executive Chairman, are independent directors (as currently defined in Rule 5605(a)(2) of

the NASDAQ listing rules). In determining the independence of our directors, the Board of Directors considered all transactions in which the Company and any director had any interest, including those discussed under “Related Transactions and

Section 16(a) Beneficial Ownership Reporting Compliance” below. The independent directors meet as often as necessary to fulfill their responsibilities, including meeting at least twice annually in executive session without the presence of

non-independent directors and management.

Director Attendance at the Annual Meeting

Although we do not have a formal policy regarding attendance by members of our Board of Directors at the Annual Meeting, we encourage all of our directors to attend.

Committees of the Board of Directors

Our Board of Directors currently has three standing committees. The current members of our committees are identified below:

| |

|

Committees

|

|

| |

|

|

|

|

|

|

|

|

|

|

Director

|

|

Audit

|

|

|

Compensation

|

|

|

Nominations and

Corporate

Governance

|

|

|

Dimitrios J. Angelis

|

|

|

X |

|

|

|

X |

|

|

|

X |

|

|

Thoranath Sukumaran

|

|

|

X |

|

|

|

X |

|

|

|

|

|

|

Carmo Martella

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

Srinidhi “Dev” Devanur

|

|

|

|

|

|

|

|

|

|

|

|

|

Srinidhi Devanur, our Executive Chairman, does not serve on any of our standing committees.

Audit Committee. The Audit Committee consists of Messrs. Angelis, Sukumaran

and Martella. The Audit Committee held 4 meetings during the year ended December 31, 2018. All members of the Audit Committee (i) are independent directors (as currently defined in Rule 5605(a)(2) of the NASDAQ listing rules); (ii) meet the

criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); (iii) have not participated in the preparation of the financial statements of the Company or any current subsidiary

of the Company at any time during the past three years; and (iv) are able to read and understand fundamental financial statements. Mr. Angelis qualifies as an “Audit Committee financial expert” as defined in the rules and regulations established by

the SEC. The Audit Committee is governed by a written charter approved by our Board of Directors. The functions of the Audit Committee include, among other things:

|

• |

Meeting with our management periodically to consider the adequacy of our internal controls and the objectivity of our financial reporting;

|

| |

• |

Meeting with our independent registered public accounting firm and with internal financial personnel regarding the adequacy of our internal controls and the objectivity of our financial reporting;

|

|

• |

Recommending to our Board of Directors the engagement of our independent registered public accounting firm;

|

|

• |

Reviewing our quarterly and audited consolidated financial statements and reports and discussing the statements and reports with our management, including any significant adjustments, management judgments and estimates, new

accounting policies and disagreements with management; and

|

|

• |

Reviewing our financial plans and reporting recommendations to our full Board of Directors for approval and to authorize action.

|

Both our independent registered public accounting firm and internal financial personnel regularly meet privately with our Audit Committee and have unrestricted access to the Audit Committee.

Compensation Committee. The Compensation Committee consists of Messrs. Angelis and Sukumaran. The Compensation

Committee held 2 meetings during the year ended December 31, 2018. Messrs. Angelis and Sukumaran are independent, as determined under the various NASDAQ Stock Market, SEC and Internal Revenue Service qualification requirements. The Compensation

Committee is governed by a written charter approved by our Board of Directors. The charter of the Compensation Committee permits the Compensation Committee to engage outside consultants and to consult with our human resources department when

appropriate to assist in carrying out its responsibilities. Compensation consultants have not been engaged by the Company to recommend or assist in determining the amount or form of compensation for any current executive officers or directors of

the Company. The Committee may also obtain advice and assistance from internal or external legal, accounting, or other advisers selected by the Committee. The functions of the Compensation Committee include, among other things:

|

• |

Reviewing and, as it deems appropriate, recommending to our Board of Directors, policies, practices, and procedures relating to the compensation of our directors, officers and other managerial employees and the establishment and

administration of our employee benefit plans;

|

|

• |

Establishing appropriate incentives for officers, including the Chief Executive Officer, to encourage high performance, promote accountability and adherence to company values and further our long-term strategic plan and long-term

value; and

|

|

• |

Exercising authority under our employee benefit plans.

|

Corporate Governance Committee. The Nominations and Corporate Governance Committee consists of Mr. Angelis. The

Nominations and Corporate Governance Committee held 2 meetings during the year ended December 31, 2018. Mr. Angelis is an independent director (as currently defined in Rule 5605(a)(2) of the NASDAQ listing rules). The Nominations and Corporate

Governance Committee is governed by a written charter approved by our Board of Directors. The functions of the Nominations and Corporate Governance Committee include, among other things:

|

• |

Reviewing and recommending nominees for election as directors;

|

|

• |

Assessing the performance of our board of directors;

|

|

• |

Developing guidelines for the composition of our board of directors;

|

|

• |

Reviewing and administering our corporate governance guidelines and considering other issues relating to corporate governance; and

|

|

• |

Oversight of the Company compliance officer and compliance with the Company’s Code of Ethics and Business Conduct and Code of Ethics for our Chief Executive Officer and Senior Financial Officers.

|

The Board of Directors’ Role in Risk Oversight

Our Board of Directors, as a whole and also at the committee level, has an active role in managing enterprise risk. The members of our Board of Directors participate in our

risk oversight assessment by receiving regular reports from members of senior management and the Company compliance officer appointed by our Board of Directors on areas of material risk to us, including operational, financial, legal and regulatory,

and strategic and reputational risks. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee oversees management of financial risks, as

well as our policies with respect to risk assessment and risk management. The Nominations and Corporate Governance Committee manages risks associated with the independence of our Board of Directors and potential conflicts of interest. Members of

the management team report directly to our Board of Directors or the appropriate committee. The directors then use this information to understand, identify, manage, and mitigate risk. Once a committee has considered the reports from management, the

chairperson will report on the matter to our full Board of Directors at the next meeting of the Board of Directors, or sooner if deemed necessary. This enables our Board of Directors and its committees to effectively carry out its risk oversight

role.

Communications with our Board of Directors

Any stockholder may send correspondence to our Board of Directors c/o Corporate Secretary, Ameri Holdings, Inc., 5000 Research Court, Suite 750, Suwanee, Georgia, 30024. Our

Corporate Secretary will review all correspondence addressed to our Board of Directors, or any individual director, and forward all such communications to our Board of Directors or the appropriate director prior to the next regularly scheduled

meeting of our Board of Directors following the receipt of the communication, unless the corporate secretary decides the communication is more suitably directed to Company management and forwards the communication to Company management. Our

Corporate Secretary will summarize all stockholder correspondence directed to our Board of Directors that is not forwarded to our Board of Directors and will make such correspondence available to our Board of Directors for its review at the request

of any member of our Board of Directors.

Code of Business Conduct and Ethics

We have established a Code of Ethics and Business Conduct and a Code of Ethics for our Chief Executive Officer and Senior Financial Officers (the “Ethics Codes”) that apply to our officers, directors, employees and

contractors. The Ethics Codes contain general guidelines for conducting our business consistent with the highest standards of business ethics and compliance with applicable law, and is intended to qualify as “codes of ethics” within the meaning of

Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K. Day-to-day compliance with the Ethics Codes is overseen by the Company compliance officer appointed by our Board of Directors. If we make any amendments to the Ethics

Codes or grant any waiver from a provision of the Ethics Codes to any director or executive officer, we will promptly disclose the nature of the amendment or waiver on the “Investors” section of the Company’s website (www.ameri100.com) under the

tab “Corporate Governance”.

Corporate Governance Documents Available Online

Our corporate governance documents, including the Audit Committee charter, Compensation Committee charter, Nominations and Corporate Governance Committee charter and Ethics Codes, are available

free of charge on the “Investors” section of our website (www.ameri100.com) under the tab “Corporate Governance”. Information contained on our website is not incorporated by reference in, or considered part of, this Proxy Statement. Stockholders

may also request paper copies of these documents free of charge upon written request to Investor Relations, Ameri Holdings, Inc., 5000 Research Court, Suite 750, Suwanee, Georgia 30024.

Director Term Limits

Our Board of Directors does not currently have a term limit policy limiting the number of years a director may serve on the Board of Directors.

Executive Officers

The names of our executive officers, their ages, their positions with Ameri, and other biographical information as of [______], 2019, are set forth below. There are no family relationships among

our directors and executive officers.

|

Name

|

Age

|

Position

|

| |

|

|

|

Srinidhi “Dev” Devanur

|

53

|

Executive Chairman of the Board

|

|

Brent Kelton

|

48

|

Chief Executive Officer

|

|

Barry Kostiner

|

48

|

Chief Financial Officer

|

Srinidhi “Dev” Devanur became our Executive Vice Chairman and a member of our Board in May 2015. He became our Executive Chairman in December 2018. Srinidhi

“Dev” Devanur is the founder of Ameri and Partners on the representative on the Board. He is a seasoned technology entrepreneur who has more than 20 years of experience in the IT services industry with a specialization in sales and resource

management. He has built businesses from ground up and has successfully executed acquisitions, mergers and corporate investments. He has managed the sales function by working closely with various Fortune 500 customers in the United States and India

to sell software solutions, support and staff augmentation related services. Srinidhi “Dev” Devanur co-founded Ivega Company in 1997, an international niche IT consulting company with special focus on financial services which merged with TCG in

2004, creating a 1,000+ person focused differentiator in the IT consulting space. Following this, he founded SaintLife Bio-pharma Pvt. Ltd., which was acquired by a Nasdaq listed company. Srinidhi “Dev” Devanur has a bachelor’s degree in electrical

engineering from the University of Bangalore, India and has also attended a Certificate program in Strategic Sales Management at the University of Chicago Booth School of Business.

Brent Kelton became our Chief Executive Officer in December 2017. Mr. Kelton previously joined the Company in March 2017 through its

acquisition of Ameri100 California Inc. (formerly ATCG Technology Solutions, Inc. (ATCG)) as a wholly-owned operating subsidiary of the Company, which Mr. Kelton led. Prior to joining Ameri, he previously led Fujitsu’s North American SAP business

unit and KPIT Technologies Limited’s SAP strategic business unit, at which he grew KPIT to over 1,600 employees globally with annual revenues of $125 million. Mr. Kelton has also held leadership positions at several technology service providers

focused on implementation services and support of SAP solutions. Mr. Kelton holds a bachelor of science degree in business analysis and management information systems from Texas A&M University and has completed executive education courses at

the Stanford Graduate School of Business.

Barry Kostiner became our Chief Financial Officer in October 2018. Prior to joining Ameri, Mr. Kostiner served as an advisor on capital markets and business development to LinKay

Technologies, Inc. a company specializing in artificial intelligence technologies, which Mr. Kostiner joined in April 2017. From November 2017 to October 2018, Mr. Kostiner also served as a consultant on data analytics and mergers and acquisition

strategy to Cypress Skilled Nursing, a skilled nursing services company. From January 2011 to October 2018, Mr. Kostiner served as a principal at Three Pillars Energy, a consulting company. From June 2013 to March 2015, he was a portfolio manager

with Platinum Management, a multi-strategy hedge fund. Mr. Kostiner holds a bachelor of science degree in electrical engineering and a master of science degree in operations research from the Massachusetts Institute of Technology.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of [August 22], 2019 regarding the beneficial ownership of our common stock by (i) each person we know to be the beneficial owner of 5% or more of our

common stock, (ii) each of our current executive officers, (iii) each of our directors, and (iv) all of our current executive officers and directors as a group. Information with respect to beneficial ownership has been furnished by each director,

executive officer or 5% or more stockholder, as the case may be. The address for all executive officers and directors is c/o Ameri Holdings, Inc., 5000 Research Court, Suite 750, Suwanee, Georgia, 30024.

Percentage of beneficial ownership in the table below is calculated based on [52,417,688] shares of common stock outstanding as of [August 22], 2019. Beneficial ownership is determined in

accordance with the rules of the SEC, which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common stock

issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of [August 22], 2019. Unless otherwise indicated, the persons or entities

identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them.

|

Name(1)

|

|

Number of Shares

Beneficially

Owned

|

|

|

Percentage of

Shares

Beneficially

Owned

|

|

| |

|

|

|

|

|

|

|

Executive Officers, Present Directors and Proposed Directors:

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Srinidhi “Dev” Devanur

|

|

|

6,276,375 |

|

|

|

11.94

|

%

|

|

Brent Kelton (2)

|

|

|

1,430,053

|

|

|

|

2.72

|

%

|

|

Barry Kostiner

|

|

|

-

|

|

|

|

-

|

|

|

Dimitrios J. Angelis (3)

|

|

|

40,990

|

|

|

|

*

|

|

|

Thoranath Sukumaran

|

|

|

-

|

|

|

|

-

|

|

|

Carmo Martella

|

|

|

-

|

|

|

|

-

|

|

|

All executive officers and directors as a group (6 persons)

|

|

|

7,747,418

|

|

|

|

14.78

|

%

|

| |

|

|

|

|

|

|

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Anson Funds Management LP(4)

|

|

|

4,877,350

|

|

|

|

9.30

|

%

|

|

Hudson Bay Capital Management (5)

|

|

|

4,395,951

|

|

|

|

8.39

|

%

|

| * |

Less than one percent of outstanding shares.

|

| (1) |

Unless otherwise indicated, the address of each person or entity is c/o AMERI Holdings, Inc., 5000 Research Court, Suite 750, Suwanee, Georgia, 30024.

|

| (2) |

Consists of 1,080,053 shares of common stock and 350,000 options which are currently exercisable..

|

| (3) |

Consists of 40,990 shares of common stock and 25,000 shares of common stock issuable upon exercise of options exercisable within 60 days.

|

| (4) |

Based on information provided in the Schedule 13G/A filed on February 14, 2019. Anson Advisors Inc. and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive

power over the securities held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr.

Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these shares of common stock except to the extent of their pecuniary interest therein. The principal business address of Anson is 5950 Berkshire Lane, Suite 210,

Dallas, Texas 75225. Anson Funds Management LP and Anson Advisors Inc. serve as co-investment advisors to Anson and may direct the vote and disposition of the 4,877,350 shares of Common Stock held by the Fund. As the general partner of

Anson Funds Management LP, Anson Management GP LLC may direct the vote and disposition of the 4,877,350 shares of Common Stock held by Anson. As the principal of Anson Fund Management LP and Anson Management GP LLC, Mr. Winson may

direct the vote and disposition of the 4,877,350 shares of Common Stock held by Anson. As directors of Anson Advisors Inc., Mr. Nathoo and Mr. Kassam may each direct the vote and disposition of the 4,877,350 shares of Common Stock held

by Anson.

|

| (5) |

Based on information provided in the Schedule 13G filed on February 1, 2019. Includes 4,395,951 shares of Common Stock issuable upon exercise of warrants, which warrants are subject to a 9.99% beneficial ownership blocker. Hudson Bay

Capital Management, L.P. (“Hudson Bay”), which serves as the investment manager to Hudson Bay Master Fund Ltd., in whose name the securities reported are held, may be deemed to be the beneficial owner of all shares of common stock of

the Company held by Hudson Bay Master Fund Ltd. Mr. Sander Gerber serves as the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay. Mr. Gerber disclaims beneficial ownership of these securities. The

address for Hudson Bay and Mr. Gerber is 777 Third Avenue, 30th Floor, New York, New York 10017.

|

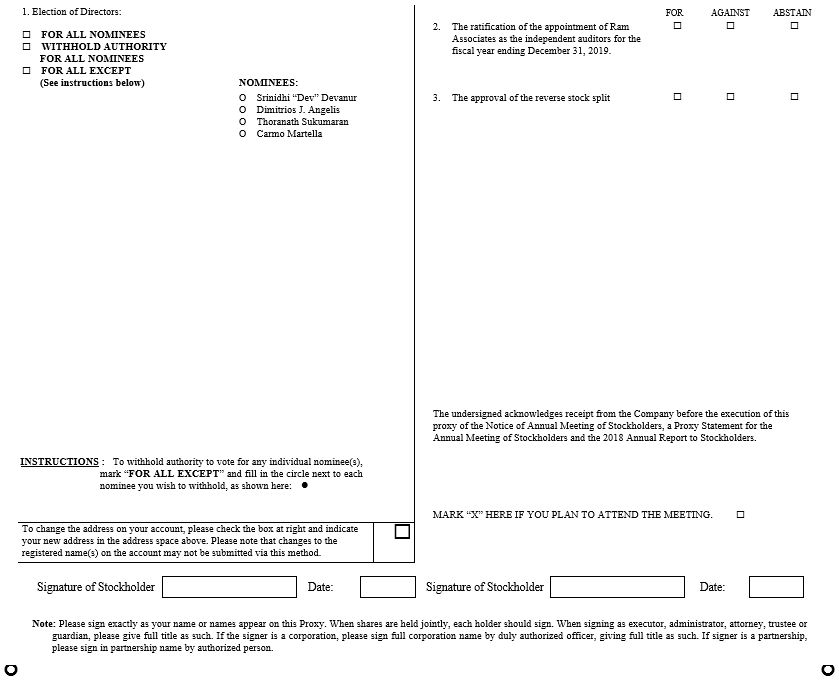

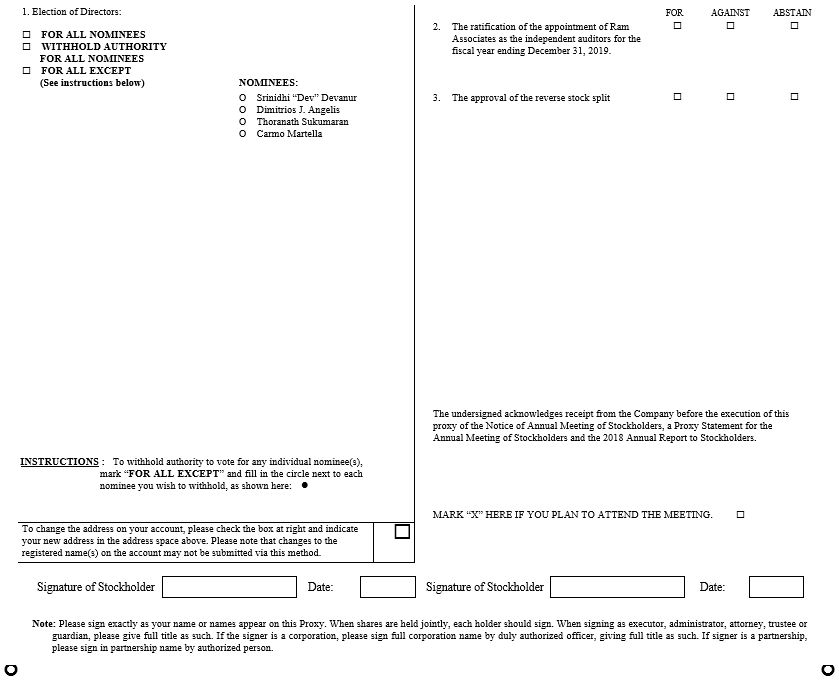

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of four members. Each nominated director elected at the Annual Meeting will serve until the next annual meeting of stockholders and until their successors

are duly elected and qualified.

Upon the recommendation of the Nominations and Corporate Governance Committee, our Board of Directors has nominated each of the following four persons to be elected to serve until the next annual

meeting of stockholders and until their successors are duly elected and qualified. Each of the nominees (i) currently serves on our Board of Directors (ii) has consented to being named in this Proxy Statement and (iii) has agreed to serve as a

director if elected. As of the date of this Proxy Statement, our Board of Directors is not aware of any nominee who is unable or will decline to serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS USING THE ENCLOSED PROXY CARD TO VOTE FOR

THE FOUR NOMINEES LISTED BELOW

Nominees for Election to the Board of Directors

|

Name

|

|

Position

|

|

Srinidhi “Dev” Devanur

|

|

Executive Chairman of the Board and Director

|

|

Dimitrios J. Angelis

|

|

Director

|

|

Thoranath Sukumaran

|

|

Director

|

|

Carmo Martella

|

|

Director

|

The four nominees standing for election who receive the greatest number of votes cast at the 2019 annual meeting will be elected as directors.

Information about the Company’s Director Nominees

Set forth below are descriptions of the backgrounds of each nominee and their principal occupations for at least the past five years and their public-company directorships as of the Record Date.

There are no family relationships among our directors and executive officers. All ages are as of [___], 2019.

In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board of Directors to the conclusion that he should

serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well

as a commitment of service to Ameri and our Board of Directors.

|

Srinidhi “Dev” Devanur

|

Age 53

|

Director since 2015

|

|

Executive Chairman of the Board and Director

|

Mr. Devanur’s biographical information is provided above under the heading “CORPORATE GOVERNANCE AND ETHICS- Executive Officers.”

|

Dimitrios J. Angelis

|

Age 49

|

Director since 2015

|

|

Executive Counsel at Life Sciences Law Group

|

Mr. Angelis became a member of our Board in May 2015. Mr. Angelis currently works with the Life Sciences Law Group, providing outside General Counsel advice to pharmaceutical, medical device and

biologics companies. He is also a director of Digirad Inc. (NASDAQ: DRAD) a leader in the field of nuclear gamma cameras for use in cardiology, women’s health, pediatric and other imaging and neuropathy diagnostics applications. Previously, he has

served as the Chief Executive Officer of OTI America Inc., the U.S.-based subsidiary of publicly-held On Track Innovations Ltd., a pioneer of cashless payment technology, since December 2013. His role was to oversee and monetize the extensive

patent portfolio of over 100 U.S. and international patents. Mr. Angelis has served as a director of On Track Innovations since December 2012, and served as its Chairman of the Board from April 2013 until February 2015. From October 2012 until

December 2013, Mr. Angelis served as the General Counsel of Wockhardt Pharmaceuticals Inc., an international biologics and pharmaceutical company. From October 2008 to October 2012, Mr. Angelis was a senior counsel at Dr. Reddy’s Laboratories,

Ltd., a publicly-traded pharmaceutical company, and during 2008 he was the Chief Legal Officer and Corporate Secretary of Osteotech, Inc., a publicly-traded medical device company, with responsibility for managing the patent portfolio of

approximately 42 patents. Prior to that, Mr. Angelis worked in the pharmaceutical industry in various corporate, strategic and legal roles. In addition, he worked for McKinsey & Company, Merrill Lynch and the Japanese government more than five

years ago. He began his legal career as a transactional associate with the New York office of the law firm Mayer Brown. Mr. Angelis holds a B.A. degree in Philosophy and English from Boston College, an M.A. in Behavioral Science and Negotiation

from California State University and a J.D. from New York University School of Law. The Board believes that Mr. Angelis’ substantial experience as an accomplished attorney, negotiator and general counsel to public and private companies in the

healthcare field will enable him to bring a wealth of strategic, legal and business acumen to the Board, well qualifying him to serve as a director.

|

Thoranath Sukumaran

|

Age 67

|

Director Since 2018

|

|

President of Oakwood Strategy Consulting, Inc.

|

Mr. Sukumaran became a member of our Board in December 2018. Mr. Sukumaran has been the President of Oakwood Strategy Consulting, Inc, a consulting firm

based in New Jersey, focusing on providing strategy and advisory services to middle market companies since 2012. He has held no directorships over the past five years. Prior to Oakwood, Mr. Sukumaran was a Senior Vice President at Morgan Stanley in

New York. Prior to that, he had held senior positions in wealth management and corporate banking with Smith Barney and American Express Bank. Mr. Sukumaran has a Master’s Degree in Economics from Kerala University in India. Mr. Sukumaran is active

in numerous Indo-US trade associations and is the past President of the US-India American Chamber of Commerce, a trade group focusing on Indo-US cross border trade and investment activities of middle market companies.

|

Carmo Martella

|

Age 52

|

Director Since 2019

|

|

Former Chief Technology Officer of MedData

|

Mr. Martella became a member of our Board in April 2019. Mr. Martella previously served as Chief Technology Officer of MedData from January 2017 through January 2019. Prior to MedData, he was a

Senior Director for Amtrak from August 2014 through January 2017. Prior to that he held positions at Broto Legal (2013-2014) and IBM (1999-2013). He received his B.A. in education from Illinois College and his MA-ABD from the University of Illinois

at Springfield.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION AS DIRECTOR OF EACH NOMINEE LISTED ON THE PROXY CARD.

REPORT OF THE AUDIT COMMITTEE

The following is the report of the Audit Committee with respect to Ameri’s audited financial statements for the year ended December 31, 2018.

The purpose of the Audit Committee is to assist the Board of Directors in its general oversight of Ameri’s financial reporting, internal controls and audit functions. The Audit Committee does not

itself prepare financial statements or perform audits, and its members are not auditors or certifiers of the Company’s financial statements. In fulfilling its oversight responsibility of appointing and reviewing the services performed by the

Company’s independent registered public accounting firm, the Audit Committee carefully reviews the policies and procedures for the engagement of the independent registered public accounting firm, including the scope of the audit, audit fees,

auditor independence matters and the extent to which the independent registered public accounting firm may be retained to perform non-audit related services.

The Company maintains an auditor independence policy that bans its auditors from performing non-financial consulting services, such as information technology consulting and internal audit services.

This policy mandates that the Audit Committee approve the audit and non-audit services and related budget in advance, and that the Audit Committee be provided with quarterly reporting on actual spending. This policy also mandates that the Company

may not enter into auditor engagements for non-audit services without the Audit Committee’s express approval. The Audit Committee charter describes in greater detail the full responsibilities of the Audit Committee and is available on our website

at www.ameri100.com. The Audit Committee is comprised solely of independent directors as defined by Rule 5605(a)(2) of the NASDAQ listing standards.

The Audit Committee met on five occasions during the year ended December 31, 2018. The Audit Committee met privately in executive session with Ram Associates as part of each regular meeting and

held private meetings with the Chief Financial Officer and other officers of Ameri throughout the year.

In accordance with the Audit Committee charter and the requirements of law, the Audit Committee pre-approves all services to be provided by Ameri’s independent auditors, Ram Associates.

Pre-approval is required for audit services, audit-related services, tax services and other services.

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2018 with the Company’s management and Ram Associates, the Company’s independent

registered public accounting firm. The Audit Committee has also discussed with Ram Associates the matters required to be discussed by Auditing Standard No. 16, “Communications with Audit Committees” issued by the Public Company Accounting Oversight

Board (“PCAOB”). The Audit Committee also has received and reviewed the written disclosures and the letter from Ram Associates required by applicable requirements of the PCAOB regarding Ram Associates’ communications with the Audit Committee

concerning independence, and has discussed with Ram Associates its independence from the Company.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the financial statements referred to above be included in the Annual Report.

|

AUDIT COMMITTEE

|

| |

|

Dimitrios J. Angelis

|

|

Thoranath Sukumaran

|

|

Carmo Martella

|

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of our Board of Directors is responsible for the appointment, compensation, retention and oversight of the work of our independent registered public accounting firm. The Audit

Committee is considering Ram Associates to serve as the Company’s independent registered public accounting firm. Ram Associates has audited our financial statements since the year ended December 31, 2017. While it is not required to do so, the

Audit Committee is submitting to stockholders for ratification the selection of Ram Associates as the Company’s independent registered public accounting firm for the year ending December 31, 2019. Notwithstanding ratification of the selection of

Ram Associates to serve as the Company’s independent registered public accounting firm, the Audit Committee will be under no obligation to select Ram Associates as the Company’s independent registered public accounting firm.

We expect that representatives of Ram Associates will be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to

appropriate questions.

Principal Accounting Fees

In May 2015, the Board selected Ram Associates as its independent accountant to audit the registrant’s financial statements. Since they were retained, there have been (1) no disagreements between

us and Ram Associates on any matters of accounting principle or practices, financial statement disclosure, or auditing scope or procedures and (2) no reportable events within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K. Ram

Associates has not issued any reports on our financial statements during the previous two fiscal years that contained any adverse opinion or a disclaimer of opinion or were qualified or modified as to uncertainty, audit scope or accounting

principle. In connection with the audit of the 2015 financial statements, we entered into an engagement agreement with Ram Associates which sets forth the terms by which Ram Associates has performed audit and related professional services for us.

The following table sets forth the aggregate accounting fees paid by us for the year ended December 31, 2018 and the year ended December 31, 2017. The below fees were paid to the firm Ram

Associates. All non-audit related services in the table were pre-approved and/or ratified by the Audit Committee of our Board of Directors.

|

Type of Fees

|

|

Year Ended

December 31,

2018

|

|

|

Year Ended

December 31,

2017

|

|

|

Audit Fees

|

|

$

|

80,000

|

|

|

$

|

75,000

|

|

|

Audit Related Fees

|

|

|

-

|

|

|

|

—

|

|

|

Tax Fees

|

|

|

-

|

|

|

|

—

|

|

|

All Other Fees

|

|

|

-

|

|

|

|

29,500

|

|

|

Total

|

|

$

|

80,000

|

|

|

$

|

104,500

|

|

Types of Fees Explanation

Audit Fees. Audit fees were incurred for accounting services rendered for the audit of our consolidated financial statements for the year

ended December 31, 2018 and 2017 and reviews of quarterly consolidated financial statements.

Audit Committee Pre-Approval of Services by Independent Registered Public Accounting Firm

The Audit Committee is granted the authority and responsibility under its charter to pre-approve all audit and non-audit services provided to the Company by its independent registered public

accounting firm, including specific approval of internal control and tax-related services. In exercising this responsibility, the Audit Committee considers whether the provision of each professional accounting service is compatible with maintaining

the audit firm’s independence.

Pre-approvals are detailed as to the category or professional service and when appropriate are subject to budgetary limits. Company management and the independent registered public accounting

firm periodically report to the Audit Committee regarding the scope and fees for professional services provided under the pre-approval.

With respect to the professional services rendered, the Audit Committee had determined that the rendering of all non-audit services by Ram Associates was compatible with maintaining the auditor’s

independence and had pre-approved all such services.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF RAM ASSOCIATES AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019, ON THE

PROXY CARD.

Role and Authority of Compensation Committee

The Compensation Committee currently consists of Messrs. Angelis and Sukumaran. Messrs. Angelis and Sukumaran are each a “non-employee director” within the meaning of Rule

16b-3 under the Securities and Exchange Act of 1934 and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code. Messrs. Angelis and Sukumaran and satisfy the independence requirements imposed by the NASDAQ Stock

Market.

The Compensation Committee is responsible for discharging the responsibilities of the Board of Directors with respect to the compensation of our executive officers. The

Compensation Committee recommends overall compensation of our executive officers to the Board of Directors. The Board of Directors approves all compensation of our executive officers. The Compensation Committee also periodically reviews director

compensation.

The charter of the Compensation Committee permits the Compensation Committee to engage outside consultants and to consult with our human resources department when appropriate

to assist in carrying out its responsibilities. Compensation consultants have not been engaged by the Company to recommend or assist in determining the amount or form of compensation for any current executive officers or directors of the Company.

The Committee may also obtain advice and assistance from internal or external legal, accounting, or other advisers selected by the Committee.

Elements of Executive Compensation

Our executive compensation consists of the following elements:

| |

•

|

Annual Incentive Bonus;

|

| |

•

|

Long-Term Incentives; and

|

| |

•

|

Retirement benefits under a 401(k) plan and generally available benefit programs.

|

Base Salary. The base salary for each executive is initially established

through negotiation at the time the executive is hired, taking into account his or her scope of responsibilities, qualifications, experience, prior salary, and competitive salary information within our industry. Year-to-year adjustments to each

executive officer’s base salary are determined by an assessment of his or her sustained performance against individual goals, including leadership skills and the achievement of high ethical standards, the individual’s impact on our business and

financial results, current salary in relation to the salary range designated for the job, experience, demonstrated potential for advancement, and an assessment against base salaries paid to executives for comparable jobs in the marketplace..

Annual Bonus. Annual bonus payments under our executive employment agreements are based on the discretion of our

Board of Directors. We believe that such bonuses provide our executives with an incentive to achieve goals that are aligned with our stockholders’ interests, with the achievement of such goals being measurable in terms of revenue and income or

other financial objectives. An executive officer’s failure to achieve measurable performance goals can affect his or her bonus amount. We believe that offering significant potential income in the form of bonuses allows us to attract and retain

executives and to align their interests with those of our stockholders.

Long-Term Incentives. The Compensation Committee has the ability to grant equity instruments to our executives under

our 2015 Equity Incentive Award Plan. The Compensation Committee has the ability to issue a variety of instruments, but equity grants will typically be in the form of stock options and restricted stock units. We believe that our executive

compensation program must include long-term incentives such as stock options and restricted stock units if we wish to hire and retain high-level executive talent. We also believe that stock options and restricted stock units help to provide a

balance to the overall executive compensation program as base salary and bonus awards focus only on short-term compensation. In addition, the vesting period of stock options and restricted stock units encourages executive retention and the

preservation of stockholder value. Finally, we believe that aligning at least a portion of restricted stock units vesting provisions to financial performance measures further aligns executive compensation to stockholder value; if performance

targets are not achieved, then the awards do not vest. We base the number of equity units granted on the type and responsibility level of the executive’s position, the executive’s performance in the prior year and the executive’s potential for

continued sustained contributions to our long-term success and the long-term interests of our stockholders.

401(k) and Other Benefits. During 2018, our executive officers were eligible to receive certain benefits generally

available to all our employees on the same terms, including medical, dental and vision insurance, long-term and short-term disability insurance, life and accidental death and dismemberment insurance, health and dependent care flexible spending

accounts, educational and employee assistance, paid-time-off, and certain other benefits. During 2015, we also maintained a tax-qualified 401(k) Plan, which provides for broad-based employee participation. During 2018, under the 401(k) Plan, at the

Company’s discretion, all employees were eligible to receive matching contributions from Ameri of (i) 100% of their first 3% of employee contributions and (ii) 50% of the next 2% of employee contributions up to an aggregate maximum of $10,600 per

employee, per year, subject to vesting provisions.

Compensation Risk Assessment. In establishing and reviewing our overall compensation program, the Compensation

Committee considers whether the program and its various elements encourage or motivate our executives or other employees to take excessive risks. We believe that our compensation program and its elements are designed to encourage our employees to

act in the long-term best interests of the Company and are not reasonably likely to have a material adverse effect on our business.

The Impact of Tax and Accounting Treatments on Elements of Compensation

We have elected to award non-qualified stock options instead of incentive stock options to all our employees, directors and consultants to allow the corporation to take

advantage of the more favorable tax advantages associated with non-qualified stock options.

Internal Revenue Code Section 162(m) precludes us from deducting compensation in excess of $1.0 million for certain employees. To date, we have not exceeded the $1.0 million

limit for those employees, and the Compensation Committee has not defined a policy that all compensation must be deductible. However, since stock-based awards comprise a significant portion of total compensation, the Compensation Committee has

taken appropriate steps to preserve deductibility for such awards in the future, when appropriate.

Summary Compensation Table

The following table provides information regarding the compensation earned during the years ended December 31, 2018 and December 31, 2017 by our Chief Executive Officer and our

two other most highly compensated executive officers (our “Named Executive Officers”) who were employed by us during such years.

|

Name & Principal

Position

|

Transition

Period or

Fiscal Year

Ended

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

|

Non-Qualified

Deferred

Compensation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Brent Kelton(1)

Chief Executive Officer

|

12/31/2018

12/31/2017

|

|

|

250,000

121,500

|

|

|

|

100,000

50,000

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

350,000

171,500

|

|

|

Viraj Patel(2)

Chief Financial Officer

|

12/31/2018

12/31/2017

|

|

|

204,621

137,222

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

204,621

137,222

|

|

|

Giri Devanur(3)

Former President and Chief Executive Officer

|

12/31/2018

12/31/2017

|

|

|

220,000

220,000

|

|

|

|

25,000

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

220,000

245,500

|

|

|

Srinidhi (Dev) Devanur

Executive Vice Chairman

|

12/31/2018

12/31/2017

|

|

|

250,000

100,000

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

—

—

|

|

|

|

250,000

100,000

|

|

|

(1)

|

Brent Kelton was appointed as our Chief Executive Officer effective December 26, 2017.

|

|

(2)

|

Viraj Patel was appointed as our Chief Financial Officer effective April 24, 2017 and he has served as CFO until December 15, 2018.

|

|

(3)

|

Giri Devanur’s employment with the Company terminated on December 26, 2017. The Company agreed to pay Mr. Devanur severance of $220,000, his annual salary at the time of departure

in accordance with the terms of his employment agreement, over a period of one year and a lump sum of $25,000 in exchange for his release of the Company from all claims he or his heirs, executors and assigns ever had or may have against

the Company, its officers, directors, employees, stockholders or any of one of them by reason of any actual or alleged act, omission, transaction, practice, conduct, occurrence, or other matter.

|