Filed Pursuant to Rule 424(b)(3)

Registration No. 333-227011

Prospectus

AMERI Holdings, Inc.

41,115,518 Shares of Common Stock

This prospectus covers the sale or other disposition from time to time of up to 41,115,518 shares of our common stock, $0.01 par value per share, by

the selling stockholders identified in this prospectus, including their transferees, pledgees, donees or successors. The shares offered for resale by this prospectus consist of:

| · |

up to 22,758,621 shares of common stock, of which (a) 3,250,000 shares were issued to the selling stockholders in the Private Placement (as defined

below) and (b) up to 19,508,621 additional shares may be issued to the selling stockholders pursuant to the terms of the Private Placement (which includes 2,250,417 shares of common stock issuable upon the exercise of pre-funded warrants

for shares that could not be issued at the closing of the Private Placement due to share issuance limitations);

|

| · |

up to 18,206,897 shares of common stock issuable upon exercise of warrants to purchase common stock that were issued to the selling stockholders in the

Private Placement, of which (a) 4,400,334 shares are issuable upon the exercise of warrants issued in the Private Placement and (b) up to 13,806,563 additional shares may be issuable upon the exercise of such warrants pursuant to the

terms of the Private Placement; and

|

| · |

150,000 shares of common stock issuable upon exercise of warrants to purchase common stock that were issued to the placement agent (which is also a selling stockholder hereunder) as

compensation for its services in connection with the Private Placement.

|

The selling stockholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their shares of common stock or interests in

shares of common stock on any stock exchange, market, or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the

prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

We are not offering any shares of our common stock for sale under this prospectus. We will not receive any of the proceeds from the sale or other

disposition of the shares of our common stock by the selling stockholders. We will, however, receive a maximum of $7,238,000 from the selling stockholders if all of the warrants issued in connection with the Private Placement are exercised on a cash

basis.

Our common stock is listed on the Nasdaq Capital Market under the symbol “AMRH”. On August 20, 2018, the last reported sale price of our common stock

was $1.53 per share.

An investment in our common stock involves significant risks. You should carefully consider the risk factors beginning on page 11 of

this prospectus before you make your decision to invest in our shares of common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Our securities are not being offered in any jurisdiction where the offer is not permitted under applicable local laws.

The date of this prospectus is October 23, 2018

|

2

|

|

|

11

|

|

|

31

|

|

|

32

|

|

|

32

|

|

|

33

|

|

|

34

|

|

|

38

|

|

|

40

|

|

|

40

|

|

|

40

|

|

|

40

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different

information from that contained in this prospectus. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any

date other than the date on the front cover of this prospectus.

Unless the context requires otherwise, the terms “Ameri”, the “Company”, “we”, “us” and “our” in this prospectus refer to Ameri Holdings, Inc. and its

subsidiaries.

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC. From time to time, we may file one or more prospectus

supplements to add, update or change information included in this prospectus. You should read both this prospectus and any applicable prospectus supplements, together with additional information described below under the caption “Where You Can Find

Additional Information.” You should also carefully consider, among other things, the matters discussed in the section entitled “Risk Factors.”

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information

that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section, as well as our historical financial statements and the notes thereto which are

incorporated by reference in this prospectus.

Our Company

We specialize in delivering SAP cloud, digital and enterprise services to clients worldwide. SAP is a leader in providing enterprise resource planning

(“ERP”) software and technologies to enterprise customers worldwide. We deliver a wide range of solutions and services across multiple domains and industries. Our services center around SAP and include technology consulting, business intelligence,

cloud services, application development/integration and maintenance, implementation services, infrastructure services, and independent validation services, all of which can be delivered as a set of managed services or on an on-demand service basis,

or a combination of both.

Our SAP focus allows us to provide technological solutions to a broad and growing base of clients. We are headquartered in Suwanee, Georgia, and have

offices across the United States, which are supported by offices in India and Canada. Our model inverts the conventional global delivery model wherein offshore information technology (“IT”) service providers are based abroad and maintain a minimal

presence in the United States. With a strong SAP focus, our client partnerships anchor around SAP cloud and digital services. In 2017, we signed a strategic partnership agreement with NEC America to offer SAP S/4 HANA (a next generation enterprise

system) migration services. This partnership will allow us to offer our clients a broader spectrum of services. We pursue an acquisition strategy that seeks to disrupt the established business model of offshore IT service providers.

Our primary business objective is to provide our clients with a competitive advantage by enhancing their business capabilities and technologies with

our expanding consulting services portfolio, which is aided by our business acquisitions. Our strategic acquisitions allow us to bring global service delivery, SAP S/4 HANA, SAP Business Intelligence, SAP Success Factors, SAP Hybris and high-end SAP

consulting capabilities to a broader geographic market and customer base. We continue to leverage our growing geographical footprint and technical expertise to simultaneously expand our service and product offering. With each acquisition, our goal is

to identify business synergies that will allow us to bring new services and products from one subsidiary to customers at our other subsidiaries. While we generate revenues from the consulting businesses of each of our acquired subsidiaries, we

believe that additional revenues will be generated through new business relationships and services developed through our business combinations.

Our Growth Strategy

Our growth strategy is based on customer-driven business expansion and strategic acquisitions of SAP services companies. We introduce specific key

account management strategies to grow organically by cross selling and upselling different services across business units. It is our goal to be a leader in the SAP cloud, digital and enterprise services market. We use strategic acquisitions,

alliances and partnerships to achieve this goal.

We have complementary near-term and longer-term strategies. In the short-term, we continue to focus on high-end consulting and solutions in the SAP

ecosystem. Our medium-term focus will be to make an entry into cloud engagements and SAP HANA. Signing up with NEC America as a strategic partner for the SAP HANA migration will be critical to achieving this objective. Additionally, we plan to gain

market share in high-growth areas within the SAP ecosystem such as Hybris, SuccessFactors and BI/BW/SAP S/4 HANA. In the long-term, we plan to identify and acquire firms in the areas of Artificial Intelligence (AI) and robotics to bolster our AIR (AI

+ Internet of things + robotics) practice. We believe that during each phase of our growth strategy business and market conditions will require our plans to evolve or change, and we plan to be agile in addressing both opportunities and exigencies.

The integration of each of our acquisitions into our business enterprise requires establishing our company’s standard operating procedures at each

acquired entity, seamlessly transitioning each acquired entity’s branding to the “Ameri100” brand and assessing any necessity to transition account management. The integration process also requires us to evaluate any product-line expansions made

possible by the acquired entity and how to bring new product lines to the broader customer base of the entire Company. With the integration of each acquisition, we face challenges of maintaining cross-company visibility and cooperation, creating a

cohesive corporate culture, handling unexpected customer reactions and changes and aligning the interests of the acquired entity’s leadership with the interests of the Company. To date, these challenges have been manageable, and we are becoming more

adept at managing integration issues with each new acquisition.

Background

We were incorporated under the laws of the State of Delaware in February 1994 as Spatializer Audio Laboratories, Inc., which was a shell company

immediately prior to our completion of a “reverse merger” transaction on May 26, 2015, in which we caused Ameri100 Acquisition, Inc., a Delaware corporation and our newly created, wholly owned subsidiary, to be merged with and into Ameri and Partners

Inc. (“Ameri and Partners”), a Delaware corporation (the “Merger”). As a result of the Merger, Ameri and Partners became our wholly owned subsidiary with Ameri and Partners’ former stockholders acquiring a majority of the outstanding shares of our

common stock. The Merger was consummated under Delaware law, pursuant to an Agreement of Merger and Plan of Reorganization, dated as of May 26, 2015 (the “Merger Agreement”), and in connection with the Merger we changed our name to AMERI Holdings,

Inc. and do business under the brand name “Ameri100”.

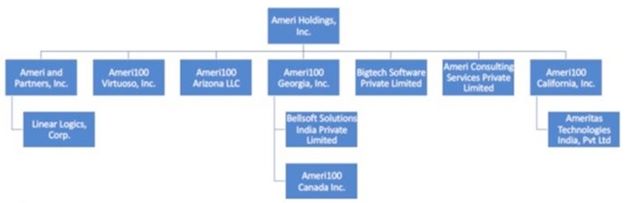

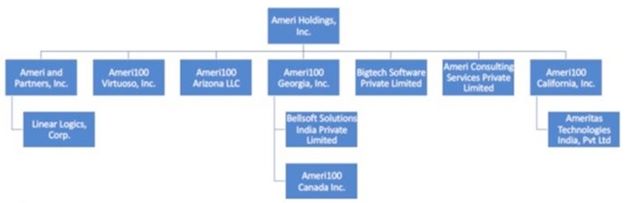

Ameri Holdings, Inc., along with its eleven subsidiaries, Ameri and Partners, Ameri Consulting Service Private Ltd., Ameri100 Georgia Inc. (“Ameri

Georgia”), Bellsoft India Solutions Private Ltd., Ameri100 Canada Inc. (formerly BSI Global IT Solutions Inc.), Linear Logics, Corp., Ameri100 Virtuoso Inc. (“Virtuoso”), Ameri100 Arizona LLC (“Ameri Arizona”), Bigtech Software Private Limited

(“Bigtech”), Ameri100 California Inc. (“Ameri California) and Ameritas Technologies India Private Limited, provides SAP cloud, digital and enterprise services to clients worldwide.

Organizational Chart

Additional Information

Our principal executive offices are located at 5000 Research Court, Suite 750, Suwanee, Georgia 30024, and our telephone number is (770) 935-4152. Our

website is www.ameri100.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this

prospectus or in deciding whether to purchase our common stock.

Private Placement

Securities Purchase Agreements

On July 25, 2018, we entered into a securities purchase agreement (the “Initial Securities Purchase Agreement”) with certain institutional and accredited investors (“Initial Purchasers”) for the

sale of 5,000,000 shares of our common stock (“Initial Shares”) and warrants to purchase a total of 4,000,001 shares (“Initial Warrant Shares”) of our common stock (“Initial Purchaser Warrants”) for total consideration of approximately $6,000,000

(“Initial Investment”). On July 30, 2018, we issued an aggregate of 3,250,000 of the Initial Shares to the Initial Purchasers, with the remaining Initial Shares to be issued pursuant to pre-funded Warrants, subject to adjustment. The $6,000,000

purchase price paid by the Initial Purchasers on July 30, 2018 represents the entire purchase price that will be paid by the Initial Purchasers for the Initial Shares and the Initial Purchaser Warrants (excluding the exercise price to be paid

upon the exercise of Initial Purchaser Warrants), even if additional Shares (through the adjustment of a pre-funded warrant) are issued and additional Warrant Shares become issuable upon the occurrence of certain events described below.

On August 21, 2018, we entered into a second securities purchase agreement (the “Second Securities Purchase Agreement”, and together with the

Initial Securities Purchase Agreement, the “Purchase Agreements”) with an accredited investor (the “Additional Purchaser”, and with the Initial Purchaser, the “Purchasers”) for the sale of 500,417 shares of our common stock, via a pre-funded

warrant due to share issuance limitations (the “Additional Shares”, and with the Initial Shares, the “Common Stock”), and warrants to purchase a total approximately 400,333 shares (the “Additional Warrant Shares”, and with the Initial Warrant

Shares, the “Warrant Shares”) of our common stock (the “Additional Purchaser Warrants”, and with the Initial Purchaser Warrants, the “Purchaser Warrants”) for gross proceeds of approximately $600,000 (the “Additional Investment”). The Additional

Investment was made in connection with, and substantially on the same terms and using the same forms as, the private placement of the Initial Shares and Initial Purchaser Warrants (such private placement and the Additional Investment, the “Private

Placement”). The $600,000 purchase price paid by the Additional Purchaser on August 21, 2018 represents the entire purchase price that will be paid by the Additional Purchaser for the Additional Shares and the Additional Purchaser Warrants

(excluding the exercise price to be paid upon the exercise of Additional Purchaser Warrants), even if additional Shares (through the adjustment of a pre-funded warrant, all pre-funded warrants with the Purchaser Warrants, the “Warrants”) are issued

and additional Warrant Shares become issuable upon the occurrence of certain events described below.

The initial price per share equaled $1.20 and the initial per share exercise price of the Purchaser Warrants equaled $1.60. The per share purchase

price and the exercise price are subject to adjustment as described below. The Initial Purchaser Warrants are immediately exercisable, subject to ownership limitations described below, and expire five years after the date of issuance. The Initial

Purchaser Warrants are exercisable on a cashless basis six months after the issuance date if there is no effective registration statement registering the resale of the shares underlying the Initial Purchaser Warrants. The Additional Purchaser was not

issued any Shares at the closing of the Additional Investment, due to Nasdaq stock issuance limitations, but the Additional Shares will be issued upon the exercise of a pre-funded warrant for no additional consideration to the Company, subject to

stockholder approval. The Additional Purchaser Warrants and the Additional Purchaser’s pre-funded warrant are exercisable following the later of stockholder approval of the Private Placement or the effectiveness of a resale registration statement,

subject to ownership limitations described below, and expire five years after the date of issuance. The Warrants contain provisions for the adjustment of the number of shares issuable upon the exercise of the warrant and of the exercise price in the

event of stock dividends, splits, mergers, asset sales, tender or exchange offers, reclassifications, reorganizations or recapitalizations, combinations, or the like.

The per share purchase price (through the pre-funded Warrants) and Warrant exercise price will automatically be adjusted lower (the “Price

Adjustment”), if applicable, to 80% (with respect to the purchase price of the shares) and 110% (with respect to the exercise price of the Warrants) of the lowest of the average daily prices on the 6 trading days after the date that (i) a

registration statement covering the resale of the securities being issued in the transaction is declared effective by the Securities and Exchange Commission (the “SEC”) and (ii) our stockholders approve the Private Placement transaction. If all the

shares issuable pursuant to the Purchase Agreements are not included in the registration statement, another similar adjustment to the per share purchase price and Warrant exercise price will occur on the date that such shares may be sold pursuant to

Rule 144 under the Securities Act. Following any adjustment to the Warrant exercise price, the number of shares that may be issued pursuant to a Warrant will be proportionately increased. In no event will the purchase price or the Warrant exercise

price be less than $0.29 per share. In addition, the Warrants have transaction-specific anti-dilution provisions.

Under the terms of the Warrants, a selling stockholder may not exercise the Warrants to the extent such exercise would cause such selling stockholder,

together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding common stock following such exercise, excluding for purposes of

such determination shares of common stock issuable upon exercise of the Warrants which have not been exercised.

A special meeting of stockholders is scheduled to be held on September 27, 2018 for stockholder approval of the Private Placement. In the event our

stockholders do not approve the Private Placement at such meeting, we are required to seek stockholder approval again by November 15, 2018 and then every four months until the transaction is approved or until the Warrants have terminated.

Placement Agent

A.G.P. / Alliance Global Partners (“AGP”) acted as exclusive placement agent for the issuance and sale of the securities in the Private Placement. We

agreed to pay AGP an aggregate fee equal to 7% of the gross proceeds received by us from the sale of the securities in the transaction, plus expenses. We also agreed to grant to AGP or its designees warrants to purchase up to 150,000 shares of our

common stock (the “Placement Agent Warrants”). The Placement Agent Warrants are exercisable on or after the later of (a) the effective date of the Resale Registration Statement (defined below) and (b) the date that stockholder approval is obtained

and deemed effective. The Placement Agent Warrants terminate on July 27, 2022. The Placement Agent Warrants have an exercise price of $1.32 per share. The terms of the Placement Agent Warrants are otherwise substantially similar to the terms of the

Private Placement Warrants, except the Placement Agent Warrants have customary anti-dilution provisions and do not have the Price Adjustment mechanism.

The maximum number of shares issuable pursuant to the Private Placement transaction documents was calculated using the “floor price” per share of

$0.29 with respect to (i) the total number of shares that were issuable at closing under the Purchase Agreements, not including the pre-funded Warrants and before any adjustments but accounting for the Nasdaq 20% of outstanding shares issuance

limitation, (ii) the pre-funded Warrants which may give effect to the Price Adjustment, and (iii) the total number of Warrant Shares issuable upon exercise of the Purchaser Warrants (taking into consideration the effect of the Price Adjustment)

and the Placement Agent Warrants (which do not get adjusted for any change in the Company’s stock price). Accordingly, (A) the number of shares of common stock issuable under the Purchase Agreements would have been 22,758,621 ($6,600,000 (the

total Private Placement consideration) divided by $0.29 (the floor price)), but due to the Nasdaq 20% limitation only 3,250,000 shares were issued at closing, so (B) the remaining 19,508,621 shares that were paid for at closing (22,758,621 –

3,250,000, assuming the floor price) were accounted for by pre-funded Warrants, (C) the maximum number of shares of common stock issuable under the Warrants and the Placement Agent Warrants is equal to the sum of (i) the warrant coverage of 80%

of the shares purchased (80% x 22,758,621 = 18,206,897) and (ii) 150,000 shares of stock that are issuable under the warrant given to the placement agent as part of its consideration for its services, resulting in an aggregate of 18,356,897, and

thus (D) the aggregate maximum number of shares issuable pursuant to the Private Placement at the floor price is 22,758,621 + 18,356,897 = 41,115,518.

We received aggregate gross proceeds of approximately $6,600,000 for the purchase of the Common Stock and the Warrants. The Company will not receive

any additional consideration in the event the number of Common Stock shares and shares of common stock underlying the Warrants are adjusted. We will, however, receive a maximum of an additional $7,238,000 from the selling stockholders if all of the

warrants issued in connection with the Private Placement are exercised on a cash basis.

Registration Rights Agreement

In connection with the Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”) with the Purchasers,

effective as of the closing of the Private Placement. Pursuant to the Registration Rights Agreement, we agreed to prepare and file the registration statement of which this prospectus forms a part (the “Resale Registration Statement”) with the SEC by

August 24, 2018 for purposes of registering the resale of the shares of Common Stock and the shares of common stock issuable upon exercise of the Warrants. We also agreed to use our reasonable best efforts to cause this registration statement to be

declared effective by the SEC by September 23, 2018 (October 23, 2018 in the event the registration statement is reviewed by the SEC). If we fail to meet the specified filing deadlines or keep the Resale Registration Statement effective, subject to

certain permitted exceptions, we will be required to pay liquidated damages to the Purchasers. We also agreed, among other things, to indemnify the selling holders under the Resale Registration Statement from certain liabilities and to pay all fees

and expenses incident to our performance of or compliance with the Registration Rights Agreement.

Voting Agreement

For the benefit of the Purchasers, certain officers, directors and stockholders of the Company, owning approximately 40% of the outstanding number of

shares of our common stock, entered into voting agreements, pursuant to which such stockholders will agree to vote all shares of our common stock owned by them in favor of the Private Placement.

Risks Relating to Our Business

Our business and our ability to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk

Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In

particular, risks associated with our business include the following:

· We have incurred significant losses since our Reverse

Merger, including an accumulated deficit of approximately $18.5 million as of June 30, 2018, and we may incur significant losses in the future. We will require substantial additional financing to achieve our goals.

· We face significant competition and rapid technological

change and the possibility that our competitors may adopt technologies or develop services that are more effective than ours, which may adversely affect our financial condition.

· We are highly dependent on our key personnel, and if we

are not successful in attracting and retaining highly qualified personnel, we may not be able to successfully implement our business strategy.

· The concentration of our common stock ownership by certain

of our stockholders may limit your ability to influence our corporate matters.

Implications of Being an “Emerging Growth Company”

As a public reporting company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the

Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging

growth company, we:

| ● |

are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial

reporting pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”);

|

| ● |

are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those

elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”);

|

|

●

|

are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as

the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

|

| ● |

are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

|

| ● |

may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition

and Results of Operations, or MD&A; and

|

| ● |

are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act.

|

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of

new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies

that have opted out of the phase-in periods under §107 of the JOBS Act. Please see “Risk Factors,” page 27 (“We are an ‘emerging growth company’. . . .”).

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller

reporting company” under the SEC’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting, are not required to

provide a compensation discussion and analysis, are not required to provide a pay-for-performance graph or CEO pay ratio disclosure, and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial

sale of common equity pursuant to a registration statement declared effective under the Securities Act, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would

cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of

non-convertible debt over a three-year period. Under current SEC rules, however, we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e., the market value of common equity held by non-affiliates) of

less than $250 million as of the last business day of our most recently completed second fiscal quarter.

The Offering

This prospectus relates to the resale from time to time by the selling stockholders identified herein of up to 37,391,379 shares of our common stock.

All of the common stock to be registered for resale hereunder was purchased by the selling stockholders in the Private Placement or will potentially be issued to the selling stockholders upon exercise of warrants purchased by the selling stockholders

in the Private Placement and/or as a result of adjustments pursuant to the terms of the Private Placement. We are not offering any shares for sale under the registration statement of which this prospectus is a part.

|

Common stock outstanding immediately prior to the Private Placement:

|

19,063,447 shares

|

|

|

Common stock being offered by the selling stockholders hereunder:

|

Up to 41,115,518 shares, consisting of:

· up to 22,758,621 shares of common

stock, of which (a) 3,250,000 shares were issued to the selling stockholders in the Private Placement (as defined below) and (b) up to 19,508,621 additional shares may be issued to the selling stockholders pursuant to the terms of the

Private Placement (which includes 2,250,417 shares of common stock issuable upon the exercise of pre-funded warrants for shares that could not be issued at the closing of the Private Placement due to share issuance limitations) (the

“Additional Shares”);

· up to 18,206,897 shares of

common stock issuable upon exercise of warrants to purchase common stock that were issued to the selling stockholders in the Private Placement, of which (a) 4,400,334 shares are issuable upon the exercise of warrants issued in the Private

Placement and (b) up to 13,806,563 additional shares may be issuable upon the exercise of such warrants pursuant to the terms of the Private Placement (the “Additional Warrant Shares”); and

· 150,000 shares of common stock

issuable upon exercise of warrants to purchase common stock that were issued to the placement agent (which is also a selling stockholder hereunder) as compensation for its services in connection with the Private Placement.

Pursuant to the terms of the Private Placement, the per share purchase price (through the pre-funded warrants) and Warrant exercise price will

automatically be adjusted lower, if applicable, to 80% (with respect to the purchase price of the shares) and 110% (with respect to the exercise price of the Warrants) of the lowest of the average daily prices on the 6 trading days after the

date that (i) a registration statement covering the resale of the securities being issued in the transaction is declared effective by the SEC and (ii) our stockholders approve the Private Placement transaction. If all the shares issuable

pursuant to the Purchase Agreements are not included in the registration statement, another similar adjustment to the per share purchase price and Warrant exercise price will occur on the date that such shares may be sold pursuant to Rule 144

under the Securities Act. Following any adjustment to the Warrant exercise price, the number of shares that may be issued pursuant to a Warrant will be proportionately increased. In no event will the purchase price or the Warrant exercise

price be less than $0.29 per share.

|

|

The Placement Agent Warrants are exercisable on or after the later of (a) the effective date of the Resale Registration Statement and (b) the

date that stockholder approval is obtained and deemed effective. The Placement Agent Warrants terminate on July 27, 2022. The Placement Agent Warrants have an exercise price of $1.32 per share. The terms of the Placement Agent Warrants are

otherwise substantially similar to the terms of the Private Placement Warrants, except the Placement Agent Warrants have customary anti-dilution provisions and do not have the Price Adjustment mechanism.

|

||

|

Common stock to be outstanding immediately after this offering:

|

29,113,447 shares (assumes all Warrants are exercised on a cash basis and no Additional Shares or Additional Warrant Shares are issued).

60,178,965 shares (assumes all Warrants are exercised on a cash basis and all Additional Shares and Additional Warrant Shares are issued).

|

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of our common stock offered by the selling stockholders under this prospectus. We will, however, receive a maximum

of $7,238,000 from the selling stockholders if all of the warrants issued in connection with the Private Placement are exercised on a cash basis.

|

|

|

Risk Factors:

|

See “Risk Factors” and other information appearing elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding whether

to invest in our common stock.

|

|

|

NASDAQ symbol:

|

AMRH

|

The number of shares of our common stock outstanding immediately before the Private Placement and immediately after this offering excludes:

| · |

2,194,652 shares of common stock reserved for issuance under our 2015 Equity Incentive Plan;

|

| · |

7,471,940 shares of common stock underlying other outstanding warrants and warrants we plan to issue, in each case to purchase shares of our common stock, but which were not issued

in connection with the Private Placement;

|

| · |

741,567 shares of common stock underlying options to purchase shares of our common stock;

|

| · |

446,716 shares of common stock underlying outstanding convertible promissory notes; and

|

| · |

$605,000 worth of common stock to be issued in January 2019 in respect of the 2018 earn-out for our Ameri California acquisition; and

|

Except for the financial statements and the notes thereto, and historical financial information and unless otherwise indicated, all information in this

prospectus reflects or assumes no exercise of outstanding options or warrants after August 20, 2018.

For additional information concerning the offering, see “Plan of Distribution” beginning on page 38.

Risk Factors

Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors” beginning on page 11.

Investing in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described

below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase any of our securities. Any of these risks may have a material adverse effect

on our business, financial condition, results of operations and cash flows and our prospects could be harmed. In that event, the price of our securities could decline and you could lose part or all of your investment.

Risks Relating to Our Business and Industry

We recorded a net loss for the six months ended June 30, 2018 and the twelve months ended December 31, 2017 and there can be no

assurance that our future operations will result in net income.

For the twelve months ended December 31, 2017, we had net revenue of $48,593,712 and comprehensive loss of $11,119,663. For

the six months ended June 30, 2018 and the six months ended June 30, 2017, we generated revenues of $22,138,850 and $24,609,186, respectively, and incurred comprehensive net losses of $3,496,046 and $5,003,010, respectively. At June 30, 2018, we had

stockholders’ equity of $18,303,262. There can be no assurance that our future operations will result in net income. Our failure to increase our revenues or improve our gross margins will harm our business. We may not be able to sustain or increase

profitability on a quarterly or annual basis in the future. If our revenues grow more slowly than we anticipate, our gross margins fail to improve or our operating expenses exceed our expectations, our operating results will suffer. The fee we charge

for our solutions and services may decrease, which would reduce our revenues and harm our business. If we are unable to sell our solutions at acceptable prices relative to our costs, or if we fail to develop and introduce new solutions on a timely

basis and services from which we can derive additional revenues, our financial results will suffer.

We and our subsidiaries have limited operating histories and therefore we cannot ensure the long-term successful operation of our

business or the execution of our business plan.

Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing companies in new and rapidly

evolving markets, such as the technology consulting markets in which we operate. We must meet many challenges including:

| · |

establishing and maintaining broad market acceptance of our solutions and services and converting that acceptance into direct and indirect sources of revenue;

|

| · |

establishing and maintaining adoption of our technology solutions in a wide variety of industries and on multiple enterprise architectures;

|

| · |

timely and successfully developing new solutions and services and increasing the functionality and features of existing solutions and services;

|

| · |

developing solutions and services that result in high degree of enterprise client satisfaction and high levels of end-customer usage;

|

| · |

successfully responding to competition, including competition from emerging technologies and solutions;

|

| · |

developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our solutions and services; and

|

| · |

identifying, attracting and retaining talented personnel at reasonable market compensation rates in the markets in which we employ.

|

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable

to successfully address these risks our business will be harmed.

We face working capital constraints and may not have sufficient working capital in the long term and there is no assurance that

we will be able to obtain additional financing, which could negatively impact our business.

We have incurred significant and recurring operational losses as a result of our

ongoing acquisition strategy. As of August 20, 2018, we had outstanding cash payment obligations related to our past acquisitions of approximately $2.6 million. If our current

cash position does not improve significantly, we will not have sufficient cash on hand to meet these obligations. Due to our working capital constraints, we are not current in all payments to all our unsecured noteholders. We are working with

certain of our unsecured noteholders to negotiate payment terms until we are able to raise more capital.

Operational streamlining that was completed in the second quarter of 2018 is anticipated to provide cash savings of approximately $2.5 million per

year. We believe additional cost-cutting efforts will further reduce cash used in operations. In addition, we believe that we can obtain additional external financing to meet future cash requirements. We raised $1.25 million in March 2017 through

the sale of convertible notes, over $6.7 million in gross proceeds through our public offering of common stock and warrants in November 2017 and $6 million in gross proceeds through our Private Placement in July 2018.

There can be no assurance that we will be able to secure additional sources of capital or that cost savings will provide sufficient working capital.

If we continue to be unable to pay all outstanding payments under our unsecured notes, the unpaid noteholders may take legal action against us, they may accelerate the payment of the principal under the applicable notes, and our senior secured

lender may call a cross-default under our existing credit facility, which could result in the acceleration of the obligations thereunder and have a negative impact on our revenue and financial results. Should we be unable to raise sufficient debt

or equity capital, we could be forced to cease operations. Our plan regarding these matters is to work to raise additional debt and/or equity financing to allow us the ability to cover our current cash flow requirements and meet our obligations as

they become due. There can be no assurances that financing will be available or if available, that such financing will be available under favorable terms.

The economic environment, pricing pressures, and decreased employee utilization rates could negatively impact our revenues and

operating results.

Spending on technology products and services is subject to fluctuations depending on many factors, including the economic environment in the markets

in which our clients operate.

Reduced ERP spending in response to a challenging economic environment leads to increased pricing pressure from our clients, which may adversely

impact our revenue, gross profits, operating margins and results of operations.

In addition to the business challenges and margin pressure resulting from economic slowdown in the markets in which our clients operate and the

response of our clients to such slowdown, there is also a growing trend among consumers of ERP services towards consolidation of technology service providers in order to improve efficiency and reduce costs. Our success in the competitive bidding

process for new projects or in retaining existing projects is dependent on our ability to fulfil client expectations relating to staffing, delivery of services and more stringent service levels. If we fail to meet a client’s expectations in such

projects, this would likely adversely impact our business, revenues and operating margins. In addition, even if we are successful in winning the mandates for such projects, we may experience significant pressure on our operating margins as a result

of the competitive bidding process.

Moreover, our ability to maintain or increase pricing is restricted as clients often expect that as we do more business with them, they will receive

volume discounts or lower rates. In addition, existing and new customers are also increasingly using third-party consultants with broad market knowledge to assist them in negotiating contractual terms. Any inability to maintain or increase pricing

on account of this practice may also adversely impact our revenues, gross profits, operating margins and results of operations.

Uncertain global SAP consulting market conditions may continue to adversely affect demand for our services.

We rely heavily on global demand for ERP services, especially SAP consulting by customers. Any weakness for these ERP

services by global customers will adversely affect our revenue projections and hence our profits. SAP AG is adapting itself to the changes in the market especially towards cloud offerings. These changes may lead to SAP losing its market share to

other competitors like Oracle, Microsoft, Salesforce and Workday among many other newer players. With these setbacks to SAP, we may face uncertain future due to dramatic changes in the market place which in turn will affect our revenues and profits.

Our success depends largely upon our highly-skilled technology professionals and our ability to hire, attract, motivate, retain

and train these personnel.

Our ability to execute projects, maintain our client relationships and acquire new clients depends largely on our ability to attract, hire, train,

motivate and retain highly skilled technology professionals, particularly project managers and other mid-level professionals. If we cannot hire, motivate and retain personnel, our ability to bid for projects, obtain new projects and expand our

business will be impaired and our revenues could decline.

Increasing worldwide competition for skilled technology professionals and increased hiring by technology companies may affect our ability to hire and

retain an adequate number of skilled and experienced technology professionals, which may in turn have an adverse effect on our business, results of operations and financial condition.

In addition, the demands of changes in technology, evolving standards and changing client preferences may require us to redeploy and retrain our

technology professionals. If we are unable to redeploy and retrain our technology professionals to keep pace with continuing changes in technology, evolving standards and changing client preferences, this may adversely affect our ability to bid for

and obtain new projects and may have a material adverse effect on our business, results of operations and financial condition.

Our strategy to increase our growth through acquisitions may be unsuccessful and could adversely affect our business and results.

As part of our growth strategy, we intend to further acquire other businesses; however, there is no assurance that we will be able to identify

appropriate acquisition targets, successfully acquire identified targets or successfully integrate the business of acquired companies to realize the full benefits of the combined businesses.

While we recently acquired Ameri California, Ameri Arizona, Virtuoso and Bigtech in connection with our growth strategy to acquire other businesses,

we can provide no assurance that we will identify appropriate acquisition targets, successfully complete any future acquisitions or successfully integrate the business of companies we do acquire. Even if we successfully acquire a business entity,

there is no assurance that our combined business will become profitable. The process of completing the integration of acquired businesses could cause an interruption of, or loss of momentum in, the activities of our company and the loss of key

personnel. The diversion of management’s attention and any delays or difficulties encountered in connection with the pursuit of business acquisitions and the integration of acquired businesses, and the incurrence of significant, acquisition related

costs in connection with proposed and completed acquisitions, could have an adverse effect on our business, financial condition or results of operations.

We face intense competition from other service providers.

We are subject to intense competition in the industry in which we operate which may adversely affect our results of

operations, financial condition and cash flows. We operate in a highly competitive industry, which is served by numerous global, national, regional and local firms. Our industry has experienced rapid technological developments, changes in industry

standards and customer requirements. The principal competitive factors in the IT markets include the range of services offered, size and scale of service provider, global reach, technical expertise, responsiveness to client needs, speed in delivery

of IT solutions, quality of service and perceived value. Many companies also choose to perform some or all of their back-office IT and IT-enabled operations internally. Such competitiveness requires us to keep pace with technological developments and

maintains leadership; enhance our service offerings, including the breadth of our services and portfolio, and address increasingly sophisticated customer requirements in a timely and cost-effective manner.

We market our service offerings to large and medium-sized organizations. Generally, the pricing for the projects depends on the type of contract,

which includes time and material contracts, annual maintenance contracts (fixed time frame), fixed price contracts and transaction price based contracts. The intense competition and the changes in the general economic and business conditions can

put pressure on us to change our prices. If our competitors offer deep discounts on certain services or provide services that the marketplace considers more valuable, we may need to lower prices or offer other favorable terms in order to compete

successfully. Any broad-based change to our prices and pricing policies could cause revenues to decline and may reduce margins and could adversely affect results of operations, financial condition and cash flows. Some of our competitors may bundle

software products and services for promotional purposes or as a long-term pricing strategy or provide guarantees of prices and product implementations. These practices could, over time, significantly constrain the prices that we can charge for

certain services. If we do not adapt our pricing models to reflect changes in customer use of our services or changes in customer demand, our revenues and cash flows could decrease.

Our competitors may have significantly greater financial, technical and marketing resources and greater name recognition and, therefore, may be

better able to compete for new work and skilled professionals. Similarly, if our competitors are successful in identifying and implementing newer service enhancements in response to rapid changes in technology and customer preferences, they may be

more successful at selling their services. If we are unable to respond to such changes our results of operations may be harmed. Further, a client may choose to use its own internal resources rather than engage an outside firm to perform the types

of services we provide. We cannot be certain that we will be able to sustain our current levels of profitability or growth in the face of competitive pressures, including competition for skilled technology professionals and pricing pressure from

competitors employing an on-site/offshore business model.

In addition, we may face competition from companies that increase in size or scope as the result of strategic alliances such as mergers or

acquisitions. These transactions may include consolidation activity among hardware manufacturers, software companies and vendors and service providers. The result of any such vertical integration may be greater integration of products and services

that were once offered separately by independent vendors. Our access to such products and services may be reduced as a result of such an industry trend, which could adversely affect our competitive position. These types of events could have a

variety of negative effects on our competitive position and our financial results, such as reducing our revenue, increasing our costs, lowering our gross margin percentage and requiring us to recognize impairments on our assets.

Our business could be adversely affected if we do not anticipate and respond to technology advances in our industry and our

clients’ industries.

The IT and global outsourcing and SAP consulting services industries are characterized by rapid technological change, evolving industry standards,

changing client preferences and new product introductions. Our success will depend in part on our ability to develop IT solutions that keep pace with industry developments. We may not be successful in addressing these developments on a timely basis

or at all. In addition, products or technologies developed by others may not render our services noncompetitive or obsolete. Our failure to address these developments could have a material adverse effect on our business, results of operations,

financial condition and cash flows.

A significant number of organizations are attempting to migrate business applications to advanced technologies. As a result, our ability to remain

competitive will be dependent on several factors, including our ability to develop, train and hire employees with skills in advanced technologies, breadth and depth of process and technology expertise, service quality, knowledge of industry,

marketing and sales capabilities. Our failure to hire, train and retain employees with such skills could have a material adverse impact on our business. Our ability to remain competitive will also be dependent on our ability to design and

implement, in a timely and cost- effective manner, effective transition strategies for clients moving to advanced architectures. Our failure to design and implement such transition strategies in a timely and cost-effective manner could have a

material adverse effect on our business, results of operations, financial condition and cash flows.

Our operations and assets in India expose us to regulatory, economic, political and other uncertainties in India, which could

harm our business.

We have an offshore presence in India where a number of our technical professionals are located. In the past, the Indian economy has experienced many

of the problems confronting the economies of developing countries, including high inflation and varying gross domestic product growth. Salaries and other related benefits constitute a major portion of our total operating costs. Many of our

employees based in India where our wage costs have historically been significantly lower than wage costs in the United States and Europe for comparably skilled professionals, and this has been one of our competitive advantages. However, wage

increases in India or other countries where we have our operations may prevent us from sustaining this competitive advantage if wages increase. We may need to increase the levels of our employee compensation more rapidly than in the past to retain

talent. If such events occur, we may be unable to continue to increase the efficiency and productivity of our employees and wage increases in the long term may reduce our profit margins.

Our clients may seek to reduce their dependence on India for outsourced IT services or take advantage of the services provided in

countries with labor costs similar to or lower than India.

Clients which presently outsource a significant proportion of their IT services requirements to vendors in India may, for various reasons, including

in response to rising labor costs in India and to diversify geographic risk, seek to reduce their dependence on one country. We expect that future competition will increasingly include firms with operations in other countries, especially those

countries with labor costs similar to or lower than India, such as China, the Philippines and countries in Eastern Europe. Since wage costs in our industry in India are increasing, our ability to compete effectively will become increasingly

dependent on our reputation, the quality of our services and our expertise in specific industries. If labor costs in India rise at a rate that is significantly greater than labor costs in other countries, our reliance on the labor in India may

reduce our profit margins and adversely affect our ability to compete, which would, in turn, have a negative impact on our results of operations.

Our business could be materially adversely affected if we do not or are unable to protect our intellectual property or if our

services are found to infringe upon or misappropriate the intellectual property of others.

Our success depends in part upon certain methodologies and tools we use in designing, developing and implementing applications systems in providing

our services. We rely upon a combination of nondisclosure and other contractual arrangements and intellectual property laws to protect confidential information and intellectual property rights of ours and our third parties from whom we license

intellectual property. We enter into confidentiality agreements with our employees and limit distribution of proprietary information. The steps we take in this regard may not be adequate to deter misappropriation of proprietary information and we

may not be able to detect unauthorized use of, protect or enforce our intellectual property rights. At the same time, our competitors may independently develop similar technology or duplicate our products or services. Any significant

misappropriation, infringement or devaluation of such rights could have a material adverse effect upon our business, results of operations, financial condition and cash flows.

Litigation may be required to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others.

Any such litigation could be time consuming and costly. Although we believe that our services do not infringe or misappropriate on the intellectual property rights of others and that we have all rights necessary to utilize the intellectual property

employed in our business, defense against these claims, even if not meritorious, could be expensive and divert our attention and resources from operating our company. A successful claim of intellectual property infringement against us could require

us to pay a substantial damage award, develop non-infringing technology, obtain a license or cease selling the products or services that contain the infringing technology. Such events could have a material adverse effect on our business, financial

condition, results of operations and cash flows.

Any disruption in the supply of power, IT infrastructure and telecommunications lines to our facilities could disrupt our

business process or subject us to additional costs.

Any disruption in basic infrastructure, including the supply of power, could negatively impact our ability to provide timely or adequate services to

our clients. We rely on a number of telecommunications service and other infrastructure providers to maintain communications between our various facilities and clients in India, the United States and elsewhere. Telecommunications networks are

subject to failures and periods of service disruption, which can adversely affect our ability to maintain active voice and data communications among our facilities and with our clients. Such disruptions may cause harm to our clients’ business. We

do not maintain business interruption insurance and may not be covered for any claims or damages if the supply of power, IT infrastructure or telecommunications lines is disrupted. This could disrupt our business process or subject us to additional

costs, materially adversely affecting our business, results of operations, financial condition and cash flows.

System security risks and cyber-attacks could disrupt our information technology services provided to customers, and any such

disruption could reduce our expected revenue, increase our expenses, damage our reputation and adversely affect our stock price and the value of our warrants.

Security and availability of IT infrastructure is of the utmost concern for our business, and the security of critical

information and infrastructure necessary for rendering services is also one of the top priorities of our customers.

System security risks and cyber-attacks could breach the security and disrupt the availability of our IT services provided to customers. Any such

breach or disruption could allow the misuse of our information systems, resulting in litigation and potential liability for us, the loss of existing or potential clients, damage to our reputation and diminished brand value and could have a material

adverse effect on our financial condition.

Our network and our deployed security controls could also be penetrated by a skilled computer hacker or intruder. Further, a hacker or intruder could

compromise the confidentiality and integrity of our protected information, including personally identifiable information; deploy malicious software or code like computer viruses, worms or Trojan horses, etc. may exploit any security

vulnerabilities, known or unknown, of our information system; cause disruption in the availability of our information and services; and attack our information system through various other mediums.

We also procure software or hardware products from third party vendors that provide, manage and monitor our services. Such products may contain known

or unfamiliar manufacturing, design or other defects which may allow a security breach or cyber-attack, if exploited by a computer hacker or intruder, or may be capable of disrupting performance of our IT services and prevent us from providing

services to our clients.

In addition, we manage, store, process, transmit and have access to significant amounts of data and information that may include our proprietary and

confidential information and that of our clients. This data may include personal information, sensitive personal information, personally identifiable information or other critical data and information, of our employees, contractors, officials,

directors, end customers of our clients or others, by which any individual may be identified or likely to be identified. Our data security and privacy systems and procedures meet applicable regulatory standards and undergo periodic compliance

audits by independent third parties and customers. However, if our compliance with these standards is inadequate, we may be subject to regulatory penalties and litigation, resulting in potential liability for us and an adverse impact on our

business.

We are still susceptible to data security or privacy breaches, including accidental or deliberate loss and unauthorized disclosure or dissemination

of such data or information. Any breach of such data or information may lead to identity theft, impersonation, deception, fraud, misappropriation or other offenses in which such information may be used to cause harm to our business and have a

material adverse effect on our financial condition, business, results of operations and cash flows.

We must effectively manage the growth of our operations, or our company will suffer.

Our ability to successfully implement our business plan requires an effective planning and management process. If funding is available, we intend to

increase the scope of our operations and acquire complimentary businesses. Implementing our business plan will require significant additional funding and resources. If we grow our operations, we will need to hire additional employees and make

significant capital investments. If we grow our operations, it will place a significant strain on our existing management and resources. If we grow, we will need to improve our financial and managerial controls and reporting systems and procedures,

and we will need to expand, train and manage our workforce. Any failure to manage any of the foregoing areas efficiently and effectively would cause our business to suffer.

Our revenues are concentrated in a limited number of clients and our revenues may be significantly reduced if these clients

decrease their IT spending.

Our client contracts are based on time and materials expenses. We do not have long-term client contracts. Our client contracts contain standard

payment terms, and our clients only pay us for services rendered. We have limited exposure for non-payment by our clients and do not have any unresolved client debts. While our client contracts can be terminated with little or no notice, it is

uncommon for our clients to terminate an engagement in the middle of the implementation of services.

For the twelve-month period ended December 31, 2017 and the six months ended June 30, 2018, sales to five major customers accounted for approximately

43% and 40%, respectively, of our total revenue. Consequently, if our top clients reduce or postpone their IT spending significantly, this may lower the demand

for our services and negatively affect our revenues and profitability. Further, any significant decrease in the growth of the financial services or other industry segments on which we focus may reduce the demand for our services and negatively

affect our revenues, profitability and cash flows.

Our client contracts can typically be terminated without cause and with little or no notice or penalty, which could negatively

impact our revenues and profitability.

Our clients typically retain us on a non-exclusive, project-by-project basis. Many of our client contracts can be terminated

with or without cause. Our business is dependent on the decisions and actions of our clients, and there are a number of factors relating to our clients that are outside of our control which might lead to termination of a project or the loss of a

client, including:

| · |

financial difficulties for a client;

|

| · |

a change in strategic priorities, resulting in a reduced level of technology spending;

|

| · |

a demand for price reductions; or an unwillingness to accept higher pricing due to various factors such as higher wage costs, higher cost of doing business;

|

| · |

a change in outsourcing strategy by moving more work to the client’s in-house technology departments or to our competitors;

|

| · |

the replacement by our clients of existing software with packaged software supported by licensors;

|

| · |

mergers and acquisitions;

|

| · |

consolidation of technology spending by a client, whether arising out of mergers and acquisitions, or otherwise; and

|

| · |

sudden ramp-downs in projects due to an uncertain economic environment.

|

Our inability to control the termination of client contracts could have a negative impact on our financial condition and results of operations.

Our engagements with customers are typically singular in nature and do not necessarily provide for subsequent engagements.

Our clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific projects, rather than on a recurring

basis under long-term contracts. Although a substantial majority of our revenues are generated from repeat business, which we define as revenues from a client who also contributed to our revenues during the prior fiscal year, our engagements with

our clients are typically for projects that are singular in nature. Therefore, we must seek out new engagements when our current engagements are successfully completed or terminated, and we are constantly seeking to expand our business with

existing clients and secure new clients for our services. In addition, in order to continue expanding our business, we may need to significantly expand our sales and marketing group, which would increase our expenses and may not necessarily result

in a substantial increase in business. If we are unable to generate a substantial number of new engagements for projects on a continual basis, our business and results of operations would likely be adversely affected.

Our results of operations may fluctuate from quarter to quarter, which could affect our business, financial condition and results

of operations.

Our results of operations may fluctuate from quarter to quarter depending upon several factors, some of which are beyond our control. These factors

include the timing and number of client projects commenced and completed during the quarter, the number of working days in a quarter, employee hiring, attrition and utilization rates and the mix of time-and-material projects versus fixed price

deliverable projects and maintenance projects during the quarter. Additionally, periodically our cost increases due to both the hiring of new employees and strategic investments in infrastructure in anticipation of future opportunities for revenue

growth.

These and other factors could affect our business, financial condition and results of operations, and this makes the prediction of our financial

results on a quarterly basis difficult. Also, it is possible that our quarterly financial results may be below the expectations of public market analysts.

We are heavily dependent on our senior management, and a loss of a member of our senior management team could cause our stock

price and the value of our warrants to suffer.

If we lose members of our senior management, we may not be able to find appropriate replacements on a timely basis, and our business could be

adversely affected. Our existing operations and continued future development depend to a significant extent upon the performance and active participation of certain key individuals. We do not currently maintain key man insurance. If we were to lose

any of our key personnel, we may not be able to find appropriate replacements on a timely basis and our financial condition and results of operations could be materially adversely affected.

Our international sales and operations are subject to applicable laws relating to trade, export controls

and foreign corrupt practices, the violation of which could adversely affect its operations.

We must comply with all applicable international trade, customs, export controls and economic sanctions laws and regulations of the United States and

other countries. We are also subject to the Foreign Corrupt Practices Act and other anti-bribery laws that generally bar bribes or unreasonable gifts to foreign governments or officials. Changes in trade sanctions laws may restrict our business

practices, including cessation of business activities in sanctioned countries or with sanctioned entities, and may result in modifications to compliance programs. Violation of these laws or regulations could result in sanctions or fines and could

have a material adverse effect on our financial condition, results of operations and cash flows.

Our income tax returns are subject to review by taxing authorities, and the final determination of our tax liability with respect

to tax audits and any related litigation could adversely affect our financial results.

Although we believe that our tax estimates are reasonable and that we prepare and submit our tax filings on a timely basis and in accordance with all

applicable tax laws, the final determination with respect to any tax audits, and any related litigation, could be materially different from our estimates or from our historical income tax provisions and accruals. The results of an audit or

litigation could have a material effect on operating results and/or cash flows in the periods for which that determination is made. In addition, future period earnings may be adversely impacted by litigation costs, settlements, penalties and/or

interest assessments.

Failure of our customers to pay the amounts owed to us in a timely manner may adversely affect our financial condition and

operating results.

We generally provide payment terms ranging from 30 to 60 days. As a result, we generate significant accounts receivable from sales to our customers,

representing approximately 60% of current assets as of December 31, 2017 and approximately 83% of current assets as of June 30, 2018. Accounts receivable from sales to customers were $8.8 million as of December 31, 2017 and $7.9 million as of June

30, 2018. As of June 30, 2018, the largest amount owed by a single customer was approximately 9% of total accounts receivable. As of June 30, 2018, we had no allowance for doubtful accounts. If any of our significant customers have insufficient

liquidity, we could encounter significant delays or defaults in payments owed to us by such customers, and we may need to extend our payment terms or restructure the receivables owed to us, which could have a significant adverse effect on our

financial condition. Any deterioration in the financial condition of our customers will increase the risk of uncollectible receivables. Global economic uncertainty could also affect our customers’ ability to pay our receivables in a timely manner

or at all or result in customers going into bankruptcy or reorganization proceedings, which could also affect our ability to collect our receivables.

If we are unable to collect our dues or receivables from or invoice our unbilled services to our clients, our results of

operations and cash flows could be adversely affected.

Our business depends on our ability to successfully obtain payments from our clients of the amounts they owe us for work performed. We evaluate the

financial condition of our clients and usually bill and collect on relatively short cycles. Macroeconomic conditions, such as a potential credit crisis in the global financial system, could result in financial difficulties for our clients,

including limited access to the credit markets, insolvency or bankruptcy. Such conditions could cause clients to delay payment, request modifications of their payment terms, or default on their payment obligations to us, all of which could increase

our receivables. If we experience delays in the collection of, or are unable to collect, our client balances, our results of operations and cash flows could be adversely affected. In addition, if we experience delays in billing and collection for

our services, our cash flows could be adversely affected.

Goodwill that we carry on our balance sheet could give rise to significant impairment charges in the future.

Goodwill is subject to impairment review at least annually. Impairment testing under standards as issued by the Financial Accounting Standards Board

may lead to impairment charges in the future. Any significant impairment charges could have a material adverse effect on our results of operations.

Our revenue and operating results may be affected by the rate of growth in the use of technology in business and the type and

level of technology spending by our clients.

Our business depends, in part, upon continued reliance on the use of technology in business by our clients and prospective

clients as well as their customers and suppliers. In particular, the success of our new service offerings requires continued demand for such services and our ability to meet this demand in a cost-effective manner. In challenging economic

environments, our clients may reduce or defer their spending on new technologies in order to focus on other priorities and prospective clients may decide not to engage our services. Also, many companies have already invested substantial resources in

their current means of conducting commerce and exchanging information, and they may be reluctant or slow to adopt new approaches that could disrupt existing personnel, processes and infrastructures. If the growth of technology usage in business, or

our clients’ spending on such technology, declines, or if we cannot convince our clients or potential clients to embrace new technological solutions, our revenue and operating results could be adversely affected.

Our business will suffer if we fail to anticipate and develop new services and enhance existing services in order to keep pace

with rapid changes in technology and the industries on which we focus.

The ERP services market is characterized by rapid technological changes, evolving industry standards, changing client preferences and new product and

service introductions. Our future success will depend on our ability to anticipate these advances and enhance our existing offerings or develop new product and service offerings to meet client needs. We may not be successful in anticipating or

responding to these advances on a timely basis, or, if we do respond, the services or technologies we develop may not be successful in the marketplace. We may also be unsuccessful in stimulating customer demand for new and upgraded products, or

seamlessly managing new product introductions or transitions. Further, products, services or technologies that are developed by our competitors may render our services non-competitive or obsolete. Our failure to address the demands of the rapidly

evolving information technology environment, particularly with respect to digital technology, the internet of things, artificial intelligence, cloud computing and storage, mobility and applications and analytics, could have a material adverse

effect on our business, results of operations and financial condition.

Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business,

investments and results of operations.

We are subject to laws and regulations enacted by national, regional and local governments, including non-U.S. governments. In particular, we are