UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (the "Act") | |||||

For the fiscal year ended December 31 , 2020

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission File Number 001-35636

(Exact name of registrant as specified in its charter)

| (State of Incorporation) | (I.R.S. Employer Identification No.) | ||||||||||||||||

(Address, including zip code, of Principal Executive Offices)

(888 ) 482-8068

(Registrant’s telephone number, including area code):

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements of the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of June 30, 2020, the aggregate market value of our common stock (based upon the closing price of the stock on the New York Stock Exchange) held by non-affiliates of the registrant was $3.4 billion.

As of February 19, 2021, the registrant had 53.0 million outstanding shares of Common Stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

ASGN INCORPORATED

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

| PART I | |||||||||||

| Item 1. | |||||||||||

| Item 1A. | |||||||||||

| Item 1B. | |||||||||||

| Item 2. | |||||||||||

| Item 3. | |||||||||||

| Item 4. | |||||||||||

| PART II | |||||||||||

| Item 5. | |||||||||||

| Item 6. | |||||||||||

| Item 7. | |||||||||||

| Item 7A. | |||||||||||

| Item 8. | |||||||||||

| Item 9. | |||||||||||

| Item 9A. | |||||||||||

| Item 9B. | |||||||||||

| PART III | |||||||||||

| Item 10. | |||||||||||

| Item 11. | |||||||||||

| Item 12. | |||||||||||

| Item 13. | |||||||||||

| Item 14. | |||||||||||

| PART IV | |||||||||||

| Item 15. | |||||||||||

SPECIAL NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Such statements are based upon current expectations, as well as management’s beliefs and assumptions and involve a high degree of risk and uncertainty. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Statements that include the words "believes," "anticipates," "plans," "expects," "intends," and similar expressions that convey uncertainty of future events or outcomes are forward-looking statements. Forward-looking statements include statements regarding our anticipated financial and operating performance for future periods. Our actual results could differ materially from those discussed or suggested in the forward-looking statements herein. Factors that could cause or contribute to such differences include, but are not limited to, the following: (1) actual demand for our services; (2) the availability of qualified contract professionals and our ability to attract, train and retain them; (3) our ability to remain competitive in obtaining and retaining clients; (4) management of our growth; (5) continued performance and integration of our enterprise-wide information systems; (6) our ability to manage our litigation matters; (7) the successful integration of our acquired subsidiaries; (8) maintenance of our ECS segment contract backlog; and (9) the factors described in Item 1A. Risk Factors of this Annual Report on Form 10-K ("2020 10-K"). Other factors also may contribute to the differences between our forward-looking statements and our actual results. In addition, as a result of these and other factors, our past financial performance should not be relied on as an indication of future performance. All forward-looking statements in this document are based on information available to us as of the date we file this 2020 10-K, and we assume no obligation to update any forward-looking statement or the reasons why our actual results may differ.

1

PART I

Item 1. Business

Overview and History

ASGN Incorporated ("ASGN," "we," or "us") is one of the foremost providers of information technology (IT) and professional services in the technology, digital, creative, engineering and life sciences fields across commercial and government sectors. We operate through three segments: Apex, Oxford and ECS. Our Apex segment provides technology, digital, creative, scientific, engineering staffing and consulting services to Fortune 1000 and mid-market commercial clients across the United States and Canada. Our Oxford segment provides hard-to-find technology, digital, engineering and life sciences staffing and consulting services, in select skill and geographic markets in the United States and Europe. Our ECS segment delivers advanced solutions in cloud, cybersecurity, artificial intelligence, machine learning, application and IT modernization, science and engineering. ECS has built successful customer relationships with some of the world’s leading federal, state and local government agencies.

We have grown through a combination of organic growth and strategic acquisitions. Over the last three years, we acquired ECS Federal, LLC ("ECS") in April 2018 and six "tuck-in" acquisitions that aligned with our strategy to expand our IT consulting and solutions capabilities in the commercial and federal government markets for both our Federal Government business, which is our ECS segment, and our Commercial business, which is comprised of our Apex and Oxford segments.

Commercial Business

Our Commercial business provides a broad spectrum of IT, technology, digital, creative, scientific, engineering staffing and consulting services to Fortune 1000 and mid-market clients across the United States, Canada and Europe. Contracts range from approximately one week to one year in length. Corporate support activities are based in Richmond, Virginia; Beverly, Massachusetts; Los Angeles, California and Irvine, California, with over 120 branch offices across the United States, and certain foreign locations including Mexico, Canada and Europe. Some of the divisions within this business operate under the Apex Systems, Creative Circle, Oxford and CyberCoders trademarks.

Assignment — Our assignment services group provides experienced IT, engineering, regulatory compliance, life sciences, advertising and digital marketing consultants to clients for temporary assignments and project engagements. Our consultants typically have a great deal of knowledge and experience in specialized technical or creative fields, which make them uniquely qualified to fill a given assignment or project.

Consulting — Our IT consulting services group provides workforce mobilization, modern enterprise and digital innovation deliverables-based consulting services. Our consultants and subject matter experts deliver solutions that are customer focused and value driven. From requirements definition to full managed services, we provide a continuum of cloud, data and analytics, and digital transformation solutions to support our clients’ modern enterprise and digital needs, across the full life cycle.

Federal Government Business

Our Federal Government business delivers advanced solutions in cloud, cybersecurity, artificial intelligence, machine learning, application and IT modernization, science and engineering to some of the world's leading agencies in both the public and private sectors. Our team of skilled experts tackle critical and highly complex challenges for customers in the U.S. defense and intelligence communities, federal civilian agencies and state and local government, education and commercial customers. We maintain premier partnerships with leading cloud, cybersecurity and artificial intelligence/machine learning providers and hold specialized certifications in these technologies.

We have a backlog of awarded contracts of $2.6 billion as of December 31, 2020, which represents the estimated amount of future revenues to be recognized under awarded contracts including task orders and options. For a further discussion of contract backlog see Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Contracts range from approximately three to five years in length. Corporate support activities are based in Fairfax, Virginia, with 24 branch offices located across the United States.

Financial information regarding our operating segments and our domestic and international revenues is included in Part II, Item 8. Financial Statements and Supplementary Data.

ASGN was incorporated in 1992. Our principal office is located at 4400 Cox Road, Suite 110, Glen Allen, Virginia 23060, and our telephone number is (888) 482-8068.

Industry and Market Dynamics

ASGN delivers staffing and consulting services in the technology, digital, creative, engineering and life sciences fields across commercial and government sectors. ASGN helps leading corporate enterprises and government organizations develop, implement and operate critical IT and business solutions through its integrated offering of professional staffing and IT consulting services.

2

In March 2020, COVID-19 was declared a global pandemic by the World Health Organization ("WHO"). As a result of the COVID-19 pandemic, our commercial business began experiencing week-to-week declines in revenues beginning in late March 2020, which continued through the first half of the second quarter. Beginning in mid-May, week-to-week revenues began to improve steadily, which has continued into 2021. Over the same period, our Federal Government business experienced double-digit year-over-year revenue growth.

The Staffing Industry Analysts' ("SIA") U.S. Staffing Industry Forecast (September 2020 Update) found that the COVID-19 pandemic brought an end to a decade of sustained growth in the U.S. staffing industry, with a 17 percent decline in overall revenue in 2020. IT staffing was down nine percent in 2020 but has been one of the most resilient staffing segment through the pandemic due to a high capacity for IT temporary staffing to support remote work; an agile, flexible IT workforce becoming a greater priority and the escalating pace of digital transformations across industries. The SIA projects that IT staffing will increase by seven percent in 2021 and that the staffing industry, as a whole, would recover along with the economy to grow 12 percent to $141.5 billion in 2021. Our ECS acquisition in 2018 expanded our addressable end market as we now compete in the federal government IT services and solutions sector, which was not impacted by the COVID-19 pandemic. Our addressable market is approximately $319.7 billion, which includes $31.7 billion in IT staffing, $120.0 billion in IT consulting and $168.0 billion in government IT services and solutions.

We anticipate that our clients will increase their use of contract labor, professional staffing and consulting services in 2021. By using our contract labor and professional staffing services, our clients benefit from cost structure advantages, flexibility to address fluctuating demand in business and access to greater expertise. Our business model continues to evolve in line with client needs and expectations to focus on higher-end, higher-margin IT consulting services and solutions capabilities, particularly those related to digital transformation. We will continue to grow our diverse client base by focusing on large, stable accounts that are quicker adopters of new technologies. We will invest in our organic growth, and we will look to execute acquisitions in the commercial and federal government end markets that provide us with new solution capabilities, industry expertise or contract vehicles.

Clients

We serve our clients by effectively understanding their IT and consulting services needs and providing them qualified professionals with a unique combination of skills, experience and expertise to meet those needs. We believe effective engagements of contract IT, engineering, digital, creative and scientific professionals require the people involved in making assignments to have significant knowledge of the client’s industry and the ability to assess the specific needs of the client as well as the contract professional’s qualifications. In 2020, revenues from different departments and agencies of the U.S. federal government were approximately 23.5 percent of consolidated revenues and no other client represented more than ten percent of revenues. Approximately 95.6 percent of our revenues are generated in the United States.

Our clients set rigorous requirements for the talent they are seeking, and we use our extensive databases and deep relationships with our contract professionals to quickly identify and pre-screen candidates whose qualifications meet those requirements. We are responsible for recruiting, verifying credentials upon request, hiring, administering pay and benefits, compliance and training, as applicable. Clients select the candidate, provide on-the-job supervision and approve hours worked, as applicable.

Candidates

We recruit candidates with backgrounds in IT, digital, creative, engineering and life sciences who seek contract work opportunities. When we place these candidates on assignments or consulting projects with clients, they become our employees. Many of these contract professionals, and those we place via subcontractors, are paid hourly wage or contract rates based on their specific skills and whether or not the assignment involves travel away from their primary residence. We pay the related costs of employment including social security taxes, federal and state unemployment taxes, workers’ compensation insurance and other similar costs for our employees. After achieving minimum service periods and/or hours worked, our contract professionals are offered access to medical and other voluntary benefit programs (e.g., dental, vision, disability) and the right to participate in our 401(k) retirement savings plan. Each contract professional’s employment relationship with us is terminable at will. We placed approximately 51,000 contract professionals throughout 2020.

Strategy

ASGN's strategy is to identify, enter and be a significant player in the most attractive subsectors of the IT and professional staffing and consulting services markets through both organic and acquisitive growth. We continue to specialize in the large and growing technology, engineering, digital, creative and life sciences markets, reinforce our position as a significant competitor in each, advance our pursuit of the IT services market with our professional staffing services, invest primarily in domestic markets and pursue additional acquisitions that support our differentiated resource deployment model.

Our strategic innovation efforts and technology investments focus on putting the best productivity tools in the hands of our recruiters, our candidates and our clients, making it easy for clients and consultants to work with ASGN. We respond to emerging trends in digitization and candidate sourcing to better position our businesses and improve how we serve clients and consultants.

We consolidate our corporate support services (finance, accounting, human resources, legal, marketing and IT) in centralized locations where we can most effectively and efficiently perform these functions, allowing us to leverage our fixed costs and generate higher incremental earnings as our revenues grow. In addition, we invest in leasehold improvements as we expand, relocate and rationalize our branch facilities to increase the productivity of our consultants.

3

Competition

We compete with other large publicly held and privately owned providers of human capital in the professional staffing and IT consulting services segments on a local, regional, national and international basis across commercial and government sectors.

The principal competitive factors in attracting qualified candidates for contract placements are contract rates, salaries and benefits; availability and variety of opportunities; quality, duration and location of assignments; and responsiveness to requests for placement. Many people seeking contract employment through us are also pursuing employment through other means, including other human capital providers. Therefore, the speed at which we assign prospective professionals and the availability of attractive and appropriate assignments are important factors in our ability to fill open positions. In addition to having high-quality candidates to assign in a timely manner, the principal competitive factors in obtaining and retaining clients are properly assessing the clients’ specific job and project requirements, the appropriateness of the professional assigned to the client, the price of services and monitoring our clients’ satisfaction. Although we believe we compete favorably with respect to these factors, we expect competition to continue to increase.

Human Capital

People are the core of ASGN. Our diverse talent pool helps build a strong workforce and maintain the our competitive advantage. At December 31, 2020, we employed approximately 4,200 internal employees, including staffing consultants, regional sales directors, account managers, recruiters and corporate office employees. We support our employees and consultants through the following initiatives:

Diversity, Equity and Inclusion — As of December 31, 2019, our internal workforce was 48 percent women, 30 percent non-white and 60 percent between the ages of 25 to 54. In 2020, ASGN established new diversity, equity and inclusion training, recruitment, retention and advancement programs, which include mandatory training to raise awareness and eliminate unconscious bias in hiring and promotion practices. Apex Systems has a diversity leadership and a Women@Apex program, which are designed to encourage personal and professional development for employees from all ethnicities, races, religions and backgrounds and to start conversations and empower women at all levels to speak up and be a part of the business. We are working to implement similar programs across the Company.

Work Practices and Employee Well-Being — Our training and development opportunities address, among other things, ethics and integrity; diversity and workplace inclusion; discrimination and harassment; unconscious bias; cybersecurity, privacy and information security; and workplace safety. We reward employees with competitive compensation and benefits packages, including medical, dental and vision plans; short- and long-term disability; life and accident insurance; health savings accounts and flexible spending accounts; and savings plans.

Employee Engagement, Retention and Development — We are committed to career advancement through training and development that supports both personal and professional growth. Employees are provided with a comprehensive training program of continued education that helps them stay ahead and deliver excellent results, including continued education and professional development. To promote more employee engagement in areas that are most meaningful to our diverse array of employees in 2021, we are supporting the development of Employee Resource Groups ("ERGs") such as the following ERGs: Black Women, Interfaith, Environmental Sustainability, Parents and Caregivers, and Prism (LGBTQ+).

Collaborative Performance Management — We strongly support the belief that our employees should be the primary drivers of their own career growth. Employees are encouraged to seek opportunities that align with their long-term career goals, whether that be lateral job changes, cross-functional training, serving on committees or special projects, or any activity that will help to progress their career. Our performance management process emphasizes clear goals with timely and constructive feedback.

We encourage you to visit our website for more detailed information regarding our Human Capital programs and initiatives. Nothing on our website shall be deemed incorporated by reference into this 2020 10-K.

Government Regulation

We take reasonable steps to ensure that our contract professionals possess all current licenses and certifications required for each placement. We provide state-mandated workers’ compensation insurance, unemployment insurance and professional liability insurance for our internal employees and our contract professionals who are our employees. These expenses have a direct effect on our costs of services, margins and likelihood of achieving or maintaining profitability.

For a further discussion of government regulation associated with our business, see Part I, Item 1A. Risk Factors.

Available Information and Access to Reports

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and all amendments to those reports and statements with the Securities and Exchange Commission ("SEC"). The SEC maintains an internet site sec.gov that contains reports, proxy and information statements and other information technology regarding issuers that file electronically with the SEC. You may also read and copy any of our reports that are filed with the SEC by visiting:

•Our website, asgn.com; or

•By contacting our Investor Relations Department at (818) 878-7900.

4

Our reports are available through any of the foregoing means and are available free of charge on our website as soon as practicable after such material is electronically filed with or furnished to the SEC. Also available on our website are copies of our Code of Ethics for the Principal Executive Officer and Senior Financial Officers, Code of Business Conduct and Ethics, Corporate Governance Guidelines and the charters for the committees of our Board of Directors. We intend to disclose any amendment to, or waiver from, a provision of our Code of Ethics for Principal Executive Officer and Senior Financial Officers on our website promptly after the amendment or waiver has been granted.

5

Item 1A. Risk Factors

Our business is subject to a number of risks including, but not limited to, the following:

Profitability and Operational Risks

The continuing impacts of COVID-19 are highly unpredictable and could be significant, and may have an adverse effect on our business, operations and our future financial performance.

The economic disruptions caused by the global health implications of the COVID-19 pandemic have adversely affected, and may continue to adversely affect, our business, operations and future financial performance. Among other things, our financial performance for 2020 was adversely affected by lower demand in our commercial business. There continues to be uncertainty and unpredictability about the impact of the COVID-19 pandemic on our financial and operating results in future periods.

The impact of the pandemic on our business, operations and future financial performance could include, but are not limited to, adverse impacts to our operating income, operating margin, net income, earnings per share and operating cash flows, as expenses may not decrease at the same rate as revenues decline. In addition, our quarterly and annual revenue growth rates and expenses as a percentage of our revenues may differ significantly from our historical rates, and our future operating results may fall below expectations. The pandemic may also have an effect on our customers' ability to make required payments and, as a result, we may experience an increase in accounts receivable days sales outstanding and credit losses.

If we are not able to remain competitive in obtaining and retaining clients, our future growth will suffer. Many of our agreements may be terminated by clients at will and the termination of a significant number of such agreements would adversely affect our revenues and results of operations.

The professional staffing and consulting services industry is highly competitive and fragmented with limited barriers to entry. We compete in national, regional and local markets with full-service agencies and in regional and local markets with specialized contract staffing agencies and consulting businesses. The success of our business depends upon our ability to continually secure new orders from clients and to fill those orders with our contract professionals.

Most of our agreements with clients do not provide for exclusive use of our services, many of our agreements may be terminated at will and, in some instances, we provide services without entering into contracts. As such, clients are free to place orders with our competitors. If clients terminate a significant number of our staffing and consulting agreements or do not use us for future assignments and we are unable to generate new work to replace lost revenues, the growth of our business could be adversely affected and our revenues and results of operations could be harmed. As a result, it is imperative to our business that we maintain positive relationships with our clients. We are expanding our light deliverables-based professional services model whereby we perform certain project oversight functions. If we are not able to comply with these performance requirements, our revenues and relationships with our clients may be adversely affected.

To the extent that competitors seek to gain or retain market share by reducing prices or increasing marketing expenditures, we could lose revenues and our margins could decline, which could harm our operating results and cause the trading price of our stock to decline. We expect competition for clients to increase in the future, and the success and growth of our business depends on our ability to remain competitive. In addition, we participate in a number of third-party contracts as a subcontractor and that requires us to participate in vendor management contracts, which may subject us to greater risks or lower margins.

If we are unable to attract and retain qualified contract professionals, our business could be adversely affected.

Our business is substantially dependent upon our ability to attract and retain contract professionals who possess the skills, experience and licenses which may be required to meet the specified requirements of our clients. We compete for such contract professionals with other temporary staffing and consulting companies and with our clients and potential clients. There can be no assurance that qualified professionals will be available to us in adequate numbers to staff our temporary assignments. Moreover, our contract professionals are often hired to become regular employees of our clients and their employment is terminable at will. Attracting and retaining contract professionals depends on several factors, including our ability to provide contract professionals with desirable assignments and competitive wages and benefits. The cost of attracting and retaining contract professionals in the future may be higher than we anticipate if there is an increase in competitive wages and benefits and, as a result, if we are unable to pass these costs on to our clients, our likelihood of achieving or maintaining profitability could decline. In periods of low unemployment, there may be a shortage of and significant competition for, the skilled contract professionals sought by our clients. If we are unable to attract and retain a sufficient number of contract professionals to meet client demand, we may be required to forgo revenue opportunities, which may hurt the growth of our business. In periods of high unemployment, contract professionals frequently opt for full-time employment directly with clients and, due to a large pool of available candidates, clients are able to directly hire and recruit qualified candidates without the involvement of staffing agencies.

We utilize several subcontractor firms who employ individuals with the H-1B visa classification. The H-1B visa classification is subject to legislative and administrative changes, as well as changes in the application of standards and enforcement. Immigration laws and regulations can be significantly affected by political developments and levels of economic activity. Current and future restrictions on the availability of such visas could limit our subcontractors’ ability to employ and/or retain the skilled professionals we need to meet our clients’ needs, which could have a material adverse impact on our business.

6

If we are unable to meet our expectations for growth, our future results are likely to be adversely affected.

Over the past several years, we have experienced revenue and earnings growth both organically and through acquisitions, though this growth was dampened in 2020 due to the global pandemic. There is no assurance that we will be able to continue this pace of growth in the future or meet our strategic objectives for growth. Our growth could be adversely affected by many factors, including future technology industry conditions, macroeconomic events such as the recent global pandemic, competition and labor market trends or regulations. If our growth rate slows, or if it fails to grow at the pace anticipated and we are unable to be successful in our growth initiatives and strategies, our financial results could be less than our expectations or those of investors or analysts and our stock price could be adversely affected.

Our business strategy also includes continuing efforts to integrate and optimize our organization, programs, technology and delivery of services to make us a more agile and effective competitor, to reduce the cost of operating our business and to increase our operating profit and operating profit margin. We may not be successful in our continuing integration and optimization efforts, and they may fail to achieve the cost savings we anticipate or limit our ability to scale growth. Further, we may fail to prevent the return of costs eliminated in these efforts. If we are not successful in implementing our integration and optimization efforts, our business, financial condition and results of operations could be adversely affected.

A loss or reduction in revenues from one or more large client accounts could have a material adverse impact on our business.

During 2020, revenue from various organizations within the U.S. federal government were approximately 23.5 percent of consolidated revenues, and no other client represented more than 10 percent of revenues. All of our government contracts can be terminated by the U.S. government either for its convenience or if we default by failing to perform under the contract. Further, our large commercial clients may enter into non-exclusive arrangements with several staffing firms and the client is generally able to terminate our contracts on short notice without penalty. The deterioration of the financial condition or business prospects of these large clients, or a change in their strategy around the use of our services, could reduce their need for our services and result in a significant decrease in the revenues and earnings we derive from them. The loss of one or more of our large national or multinational clients, or a significant decrease in their demand for our services, could have a material adverse impact on our results of operations.

We may not successfully make or integrate acquisitions, which could harm our business and growth.

As part of our growth strategy, we have made numerous acquisitions, and we intend to continue to pursue selected acquisitions in the future. We compete with other companies in the professional staffing and consulting industries for acquisition opportunities and there can be no assurance that we will be able to successfully identify suitable acquisition candidates or be able to complete future acquisitions on favorable terms, if at all. There also can be no assurance that we will realize the benefits expected from any transaction or receive a favorable return on investment from our acquisitions.

We may pay substantial amounts of cash or incur debt to finance our acquisitions, which could adversely affect our liquidity and capital resources. The incurrence of indebtedness would also result in increased interest expense and could include additional covenants or other restrictions that would impede our ability to manage our operations. We may also issue equity securities to pay for acquisitions, which could result in dilution to our stockholders. In addition, any acquisitions we announce could be viewed negatively by investors, which may adversely affect the price of our common stock.

The integration of an acquisition involves a number of factors that may affect our operations. These factors include diversion of management’s attention from other business concerns, difficulties or delay in the integration of acquired operations, retention of key personnel, entry into unfamiliar markets, significant unanticipated costs or legal liabilities and tax and accounting issues. If we fail to accurately forecast the financial impact of an acquisition transaction, we may incur tax and accounting changes. Furthermore, once we have integrated an acquired business, the business may not achieve anticipated levels of revenue, profitability or productivity, or otherwise perform as expected. Any of these factors may have a material adverse effect on our results of operations and financial condition.

Failure to comply with the terms of our debt agreements could affect our operating flexibility.

Our outstanding debt at December 31, 2020 included a term loan of $490.8 million under our senior secured credit facility and $550.0 million of 4.625 percent unsecured senior notes due 2028. Our term loan has a variable interest rate, making us more vulnerable to increases in interest rates. Additionally, we use a portion of our cash flow from operations for interest payments on our debt rather than for our operations.

Our failure to comply with restrictive covenants under our debt instruments could result in an event of default, which, if not cured or waived, could result in the requirement to repay such borrowings before their due date. Some covenants are tied to our operating results and thus may be breached if we do not perform as expected. Further, the terms of our senior credit facility permit additional borrowings, subject to certain conditions. If new debt is added to our current debt levels, the related risks we now face could intensify.

7

We expect to use cash on hand and cash flows from operations to pay our expenses and repay our debt. Our ability to pay our expenses thus depends on our future performance, which will be affected by financial, business, economic and other factors. If we do not have enough money, we may be required to refinance all or part of our existing debt, sell assets or borrow additional funds. We may not be able to take such actions on terms that are favorable to us, if at all. The lenders may require fees and expenses to be paid or other changes to terms in connection with waivers or amendments. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by increased costs and/or rates.

We derive significant revenues from contracts and task orders awarded through a competitive bidding process. Our revenues and profitability may be adversely impacted if we fail to compete effectively in such processes.

Our contracts and task orders with the federal government are typically awarded through a competitive bidding process, which creates significant competition and pricing pressure. We spend time and resources to prepare bids and proposals for contracts. Some of these contracts may not be awarded to us or, if awarded, we may not receive meaningful task orders under these contracts. We may encounter delays and additional expenses if our competitors protest or challenge contracts awarded to us in competitive bidding, and any such protest or challenge could result in the resubmission of bids on modified specifications, or in the termination, reduction or modification of the awarded contract. If we are unable to win particular contracts, we may be prevented from providing to customers services that are purchased under those contracts for a number of years. In addition, upon the expiration of a contract, if the customer requires further services of the type provided by the contract, there is frequently a competitive rebidding process. There can be no assurance that we will win any particular bid, or that we will be able to replace business lost upon expiration or completion of a contract, and the termination or non-renewal of any of our significant contracts could cause our actual results to differ materially and adversely from those anticipated.

Our earnings and profitability may vary based on the mix of our contracts and may be adversely affected by our failure to accurately estimate and manage costs, time and resources.

Our ECS segment generates revenues under various types of contracts: firm-fixed-price, cost reimbursable and time and materials. Our earnings and profitability may vary materially depending on changes in the proportionate amount of revenues derived from each type of contract, the costs incurred in their performance and the nature of services or solutions provided. Under firm-fixed-price contracts, we perform specific tasks and services for a fixed price. Compared with cost reimbursable, firm-fixed-price contracts generally offer higher margin opportunities, but involve greater financial risk because we bear the impact of cost overruns. When making proposals on firm-fixed-price contracts, we rely heavily on our estimates of costs and timing for completing the associated projects. Failure to accurately estimate costs, resources and technology needed to perform our contracts or to effectively manage and control our costs during the performance of work could result in reduced profits or in losses. Under cost reimbursable contracts, we are reimbursed for allowable costs plus a profit margin or fee. These contracts generally have lower profitability and less financial risk. Under time and materials contracts, we are reimbursed for labor at negotiated hourly billing rates and for certain expenses. We assume financial risk on time and materials contracts because we assume the risk of performing those contracts at negotiated hourly rates.

We may not realize the full value of our ECS segment contract backlog, which may result in lower revenues than anticipated.

Contract backlog, which was $2.6 billion at December 31, 2020, is a useful measure of potential future revenues for our ECS segment. Our ECS segment contract backlog consists of contracts for which funding has been formally awarded (funded backlog) and unfunded backlog, which represents the estimated future revenues to be earned from negotiated contract awards for which funding has not been awarded and from unexercised contract options.

The U.S. government's ability to elect to not exercise contract options or to modify, curtail or terminate our contracts makes the calculation of our ECS segment contract backlog subject to numerous uncertainties. Due to the uncertain nature of our contracts with the U.S. government, we may never realize revenue from some of the engagements that are included in our contract backlog. Our unfunded backlog, in particular, contains amounts that we may never realize as revenue because the maximum contract value specified under a U.S. government contract or task order awarded to us is not necessarily indicative of the revenue that we will realize under that contract.

An impairment in the carrying amount of goodwill and other intangible assets could require a write down that materially and adversely affects our results of operations and net worth.

As of December 31, 2020, we had $1.6 billion of goodwill and $487.9 million of net acquired intangible assets. We review goodwill and indefinite-lived intangible assets (consisting entirely of trademarks) for impairment at least annually and when events or changes in circumstances indicate that the carrying amount may not be recoverable. Intangible assets having finite lives are amortized over their useful lives and are tested for recoverability whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. We may be required to record a charge, which could be material, in our financial statements during the period in which we determine an impairment has occurred. Impairment charges could materially and adversely affect our results of operations in the periods that such charges are recorded.

8

Risks Related to Government Contracts

A significant loss or suspension of our facility security clearances with the federal government could lead to a reduction in our revenues, cash flows and operating results.

We act as a contractor and a subcontractor to the U.S. federal government and many of its agencies. Some government contracts require us to maintain facility security clearances and require some of our employees to maintain individual security clearances. If our employees lose or are unable to timely obtain security clearances, or we lose a facility clearance, a government agency client may terminate the contract or decide not to renew it upon its expiration. In addition, a security breach by us could cause serious harm to our business, damage our reputation and prevent us from being eligible for further work on sensitive or classified systems for federal government clients.

We are required to comply with numerous laws and regulations related to government contracts, some of which are complex, and our failure to comply could result in fines or civil or criminal penalties, or suspension or debarment, which could materially and adversely affect our results of operations.

We must comply with laws and regulations relating to the formation, administration and performance of federal government contracts. These laws and regulations affect how we conduct business with our federal government customers. Such laws and regulations may potentially impose added costs on our business and our failure to comply with them may lead to civil or criminal penalties, termination of our U.S. government contracts and/or suspension or debarment from contracting with U.S. government agencies. All of our U.S. government contracts can be terminated by the U.S. government either for its convenience or if we default by failing to perform under the contract. Termination for convenience provisions provide only for our recovery of costs incurred or committed settlement expenses and profit on the work completed prior to termination. Termination for default provisions provide for the contractor to be liable for excess costs incurred by the U.S. government in procuring undelivered items from another source and could damage our reputation and impair our ability to compete for future contracts. Failure to comply with regulations and required practices and procedures could harm our reputation or influence the award of new contracts.

Changes in U.S. government spending or budgetary priorities, the failure of government budgets to be approved on a timely basis, or delays in contract awards and other procurement activity may significantly and adversely affect our future financial results.

Our business depends upon continued U.S. government expenditures on intelligence, defense, homeland security, federal health IT and other programs that we support. The U.S. government conducts periodic reviews of U.S. defense strategies and priorities which may shift Department of Defense budgetary priorities, reduce overall spending, or delay contract or task order awards for defense-related programs from which we would otherwise expect to derive a significant portion of our future revenues. Any of these changes could impair our ability to obtain new contracts or contract renewals. Any new contracting requirements or procurement methods could be costly or administratively difficult for us to implement. Our revenues, cash flows and operating results could be adversely affected by spending caps or changes in budgetary priorities, as well as by delays in the government budget process, program starts or the award of contracts or task orders under contracts.

Audits by U.S. government agencies for contracts with federal government clients could result in unfavorable audit results that could subject us to a variety of penalties and sanctions and could harm our reputation and relationships with our customers and adversely impact results of operations.

Federal government agencies, including the Defense Contract Audit Agency and the Defense Contract Management Agency, routinely audit and investigate government contracts and government contractors’ administrative processes and systems. These agencies review our performance on contracts, pricing practices, cost structure and compliance with applicable laws, regulations and standards. Any costs found to be improperly allocated to a specific contract will not be reimbursed, while such costs already reimbursed must be refunded. If a government audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or debarment from doing business with federal government agencies.

Cybersecurity and Technology Risks

The failure to prevent a cybersecurity incident affecting our systems could result in the disruption of our services or the disclosure or misuse of sensitive information, which could harm our reputation, decrease demand for our services and products, expose us to liability, penalties and remedial costs, or otherwise adversely affect our financial performance.

Our daily business operations depend on our information technology systems for a wide variety of functions, including, among other things, identifying staffing resources, matching personnel with client assignments and managing our accounting and financial reporting functions. In conducting our business, we routinely collect and retain personal information on these systems about our employees and contract professionals and their dependents including, without limitation, full names, social security numbers, addresses, birth dates and payroll-related information.

Any information-technology systems are at risk of being compromised, whether through malicious activity or human or technological error. Although we devote significant resources to maintain and regularly upgrade our information security technologies, and we have implemented security controls to help protect the security and privacy of our business information, our information technology systems are subject to potential security breaches through third-party service providers, employee negligence, fraud or misappropriation, business email compromise

9

and cybersecurity threats, including denial of service attacks, viruses, ransomware or other malicious software programs, and third parties gaining unauthorized access to our information technology systems for purposes of misappropriating assets or confidential information, corrupting data or causing operational disruption. We are continuously exposed to unauthorized attempts to compromise such sensitive information through cyber-attacks, insider threats and other information security threats, including physical break-ins and malicious insiders, and we have, from time to time, experienced security incidents. For example, in November 2020, one of our divisions experienced a network intrusion resulting in the compromise of former employee information for that division. We incurred costs relating to this event, including costs to retain third-party consultants and forensic experts to investigate the attack and assist with remediation. We also invested in tightening security of our information technology infrastructure, systems and network. The incident did not have a material impact on our business, operations or financial results.

Any security incident that results in the compromise of personal information we collect and retain, or that otherwise disrupts or negatively impacts our operations, could harm our reputation, lead to customer attrition, and expose us to regulatory enforcement action or litigation. Because the techniques used in cyber attacks change frequently and may be difficult to detect for periods of time, we may face difficulties in anticipating and implementing adequate security measures to prevent security breaches. In addition, our information technology systems are vulnerable to fire, storm, flood, power loss, computer and network failures, problems with transitioning to upgraded or replacement systems or platforms, flaws in third-party software or services, terrorist attacks and similar events. All of these risks are also applicable wherever we rely on outside vendors to provide services.

Our results of operations could be adversely affected if we cannot successfully keep pace with technological changes in the development and implementation of our services.

Our success depends on our ability to keep pace with rapid technological changes in the development and implementation of our services. We rely on a variety of technologies to support important functions in our business, including the recruitment, placement and monitoring of our contract professionals, our billings, and candidate and client data analytics. If we do not sufficiently invest in new technology and industry developments, such as emerging job and resume posting services, appropriately implement new technologies, or evolve our business at sufficient speed and scale in response to such developments, or if we do not make the right strategic investments to respond to these developments, our services, results of operations and ability to develop and maintain our business could be adversely affected.

Legal and Regulatory Risks

Significant legal actions and claims could subject us to substantial uninsured liabilities, result in damage to our business reputation, result in the discontinuation of our client relationships and adversely affect our recruitment and retention efforts.

We employ people internally and in the workplaces of other businesses. Our ability to control or influence the workplace environment of our clients is limited. Further, many of the individuals that we place with our clients have access to client information systems and confidential information. As the employer of record of our contract professionals, we incur a risk of liability to our contract professionals for various workplace events, including claims of physical injury, discrimination, harassment or failure to protect confidential personal information. Other inherent risks include possible claims of errors and omissions; intentional misconduct; release, misuse or misappropriation of client intellectual property; criminal activity; torts; or other claims. We also have been subject to legal actions alleging vicarious liability, negligent hiring, discrimination, sexual harassment, retroactive entitlement to employee benefits, violation of wage and hour requirements, retaliation and related legal theories. These types of actions could involve large claims and significant defense costs. We may be subject to liability in such cases even if the contribution to the alleged injury was minimal. Moreover, in most instances, we are required to indemnify clients against some or all of these risks and we could be required to pay substantial sums to fulfill our indemnification obligations. In addition, we may need to indemnify our clients against losses in the event that the client is determined to be non-compliant with the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the "ACA") due to a joint employer claim.

A failure of any of our employees internally, or contract professionals in client's workplaces, to observe our policies and guidelines intended to reduce these risks could result in negative publicity, injunctive relief, criminal investigations and/or charges, payment of monetary damages or fines, or other material adverse impacts on our business. Claims raised by clients stemming from the improper actions of our contract professionals, even if without merit, could cause us to incur significant expense associated with the costs or damages related to such claims. Further, such claims by clients could damage our business reputation and result in the discontinuation of client relationships. Any associated negative publicity could adversely affect our ability to attract and retain qualified contract professionals in the future.

We proactively address many of these issues with our robust compliance program. Further, to protect ourselves from the costs and damages of significant legal actions and claims, we maintain workers’ compensation, errors and omissions, employment practices and general liability insurance coverage in amounts and with deductibles that we believe are appropriate for our operations. Our insurance policies include a retention amount and may not cover all claims against us or continue to be available to us at a reasonable cost. In addition, we face various employment-related risks not covered by insurance, such as wage and hour laws and employment tax responsibility. If we do not maintain adequate insurance coverage or are made party to significant uninsured claims, we may be exposed to substantial liabilities that could have a material adverse impact on our results of operations and financial condition.

10

Our business is subject to government regulation, which in the future could restrict the types of employment services we are permitted to offer or result in additional or increased costs that reduce our revenues and earnings.

The professional staffing and IT services industry is regulated in the United States and other countries in which we operate. We are subject to federal, state and local laws and regulations governing the employer/employee relationship, such as those related to payment of federal, state and local payroll and unemployment taxes for our corporate employees and contractor professional employees, tax withholding, social security or retirement benefits, licensing, wage and hour requirements, paid sick leave, paid family leave and other leaves, employee benefits, pay equity, non-discrimination, sexual harassment and workers’ compensation; and we must further comply with immigration laws and a wide variety of notice and administrative requirements, such as record keeping, written contracts and reporting. We are also subject to U.S. laws and regulations relating to government contracts with federal agencies, as well as the requirements of the ACA. In certain other countries, we may not be considered the legal employers of our temporary personnel, however we are still responsible for collecting taxes and social security deductions and transmitting these amounts to the taxing authorities.

In addition, we are subject to data privacy, protection and security laws and regulations, the most significant of which is the European General Data Protection Act ("GDPR") that governs the personal information of European persons, which we may collect, use and retain in the ordinary course of our business. This law impacts our U.S. operations as well as our European operations as it applies not only to third-party transactions, but also to transfers of information among the Company and its subsidiaries. The GDPR imposes more stringent compliance and operational requirements for entities processing personal information that is potentially confidential and/or personally identifiable and sensitive, such as stronger safeguards for data transfers to countries outside the European Union and stronger enforcement authorities and mechanisms. Certain U.S. states have also enacted laws requiring security measures that are broadly similar to GDPR requirements, including the California Consumer Privacy Act, and we expect that other states will continue to do so. Any inadvertent non-compliance of the GDPR or other data privacy laws could result in governmental enforcement actions, fines and other penalties that could potentially have an adverse effect our operations and reputation.

Future changes in the laws or governmental regulations affecting our business may result in the prohibition or restriction of certain types of employment services that we are permitted to offer, or the imposition of new or additional compliance requirements that could increase our costs and reduce our revenues and earnings. Due to the substantial number of state and local jurisdictions in which we operate, there also is a risk that we may be unable to adequately monitor actual or proposed changes in, or the interpretation of, the laws or governmental regulations of such states and localities. Any delay in our compliance with changes in such laws or governmental regulations could result in potential fines, penalties, or other sanctions for non-compliance. In addition, although we may elect to bill some or all of any additional costs to our customers, there can be no assurances that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to fully cover any increased costs as a result of future changes in laws or government regulations.

Our business may be materially affected by changes to fiscal and tax policies that could adversely affect our results of operations and cash flows.

Our business is subject to taxation in the United States and the foreign jurisdictions where we operate. Due to economic and political conditions, tax rates in various jurisdictions may be subject to significant change. Our future effective tax rates could be affected by changes made by the current administration in the United States and in the mix of earnings in countries with differing statutory tax rates or by changes in the tax laws or their interpretation.

Various levels of government also are increasingly focused on tax reform and other legislative action to increase tax revenue. Further changes in tax laws in the United States or foreign jurisdictions where we operate, or in the interpretation of such laws, could have a material adverse effect on our business, results of operations, financial condition or cash flows.

We are subject to various business, regulatory and currency risks associated with international operations, which could increase our costs, cause our results of operations to fluctuate and adversely affect our business.

We conduct business outside the United States primarily in Canada and Europe, and we have a nearshore delivery center in Mexico. Our international operations, which in the aggregate represented less than five percent of our consolidated revenues in 2020, expose us to, among other things operational, regulatory, political and currency risks in the countries in which we operate.

General Risks

U.S. and global market and economic developments could adversely affect our business, financial condition and results of operations.

Demand for the professional staffing and consulting services that we provide is significantly affected by global market and economic conditions. As economic activity slows, many clients or potential clients reduce their use of and reliance upon contract professionals. During periods of reduced economic activity, we may also be subject to increased competition for market share and pricing pressure. As a result, a recession or periods of reduced economic activity could harm our business and results of operations.

11

The loss of key members of our senior management team could adversely affect the execution of our business strategy and our financial results.

We believe that the successful execution of our business strategy and our ability to build upon our business and acquisitions of new businesses depends on the continued employment of key members of our senior management team. We have provided short-term and long-term incentive compensation to our key management in an effort to retain them. However, if members of our senior management team become unable or unwilling to continue in their present positions, we could incur significant costs and experience business disruption related to time spent on efforts to replace them, and our financial results and our business could be adversely affected.

Failure of internal controls may leave us susceptible to errors and fraud.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls and internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable assurance that the objectives of the control system are met. Furthermore, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, would be detected, particularly in our newly acquired companies and international operations. If our internal controls are unsuccessful, our business and results of operations could be adversely affected.

The trading price of our common stock has experienced significant volatility, which may result in losses for investors.

In 2020, the trading price of our common stock experienced significant fluctuations, ranging from a high of $86.66 to a low of $31.26. The closing price of our common stock on the NYSE was $94.16 on February 19, 2021. Our common stock may continue to fluctuate widely as a result of a large number of factors, many of which are beyond our control, including but not limited to:

•general economic conditions, slow or negative growth of unrelated markets and other external factors;

•failure to meet previously announced guidance or analysts’ expectations of our quarterly results;

•announcements by us or our competitors of acquisitions, significant contracts, commercial relationships or capital commitments;

•commencement of, or involvement in, any significant litigation matter;

•any major change in our management or Board of Directors ("Board");

•changes in government regulations;

•recommendations by securities analysts or changes in earnings estimates;

•announcements by our competitors of their earnings that are not in line with analyst expectations;

•sale or purchase of stock by us or by our stockholders; and

•short sales, hedging and other derivative transactions in shares of our common stock.

Among other things, stock-price volatility could mean that investors are not able to sell their shares at or above the prices they paid for the stock. We may encounter difficulty should we desire to access the public markets for financing or use our common stock as consideration in a strategic transaction. Additionally, securities class action litigation can occur following periods of stock-price volatility, which could result in substantial costs, potential liabilities and the diversion of our management’s attention and resources.

Our business is subject to disruptions and other risks of health crises, earthquakes, fire, floods and other catastrophic events.

Our business relies heavily on the health and safety of our employees, contract professionals and customers and the continuity of our business systems. Adverse events, such as harm to our offices, the inability to travel and other matters affecting the regions or economies in which we operate could harm our business. In the event of a major disruption caused by a natural disaster or man-made problem, or outbreaks of pandemic diseases such as COVID-19, we may be unable to continue our operations and may experience system interruptions and reputational harm. Acts of terrorism and other geopolitical unrest could also cause disruptions in our business or the business of our clients, vendors, or the economy as a whole. All of the aforementioned risks may be further increased if our disaster recovery plans prove to be inadequate. Similarly, if our clients are harmed by any of these events, their demand for our services may decrease, which would decrease our revenues and harm our business. A significant disaster or disruption, whether man-made or natural, could materially adversely affect our business, results of operations, financial condition and prospects.

Provisions in our corporate documents and Delaware law may delay or prevent a change in control that our stockholders consider favorable.

Provisions in our certificate of incorporation and bylaws could have the impact of delaying or preventing a change of control or changes in our management. These provisions include the following:

•Our Board has the right to elect directors to fill a vacancy in the Board upon the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our Board until the next applicable annual meeting of stockholders.

•Stockholders must provide advance notice to nominate individuals for election to the Board or to propose matters that can be acted upon at a stockholders’ meeting. Further, our Board is divided into three classes and only one class is up for election each year. These provisions may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of us.

12

•Our Board may issue, without stockholder approval, up to one million shares of undesignated or "blank check" preferred stock. The ability to issue undesignated or "blank check" preferred stock makes it possible for our Board to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt by, or make it more difficult for, a third- party to acquire us.

As a Delaware corporation, we are also subject to certain Delaware anti-takeover provisions, including Section 203 of the Delaware General Corporation Law. Under these provisions, a corporation may not engage in a business combination with any large stockholders who hold 15 percent or more of our outstanding voting capital stock in a merger or business combination unless the holder has held the stock for three years, the Board has expressly approved the merger or business transaction, or at least two-thirds of the outstanding voting capital stock not owned by such large stockholder approves the merger or the transaction. These provisions of Delaware law may have the impact of delaying, deferring, or preventing a change of control and may discourage bids for our common stock at a premium over its market price. In addition, our Board could rely on these provisions of Delaware law to discourage, prevent, or delay an acquisition of us.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

As of December 31, 2020, we leased office space in the following locations. We believe that our facilities are suitable and adequate for our current operations.

| Location | Square Feet | Lease Expiration | |||||||||||||||

| ASGN and Apex Headquarters | Richmond, Virginia | 105,100 | October 2024 | ||||||||||||||

| Oxford Headquarters | Beverly, Massachusetts | 67,600 | December 2025 | ||||||||||||||

| ECS Headquarters | Fairfax, Virginia | 53,400 | June 2024 | ||||||||||||||

Branch Offices(1) | United States, Canada, Netherlands, Belgium, Ireland, Switzerland, Germany and Spain | 981,600 | June 2021 through October 2027 | ||||||||||||||

| Delivery Center | Mexico | 14,500 | July 2021 | ||||||||||||||

___________________

(1) We have approximately 170 branch office locations that occupy spaces ranging from approximately 1,000 to 41,000 square feet with lease terms that range from six months to 11.0 years.

Item 3. Legal Proceedings

We are involved in various legal proceedings, claims and litigation arising in the ordinary course of business. However, based on the facts currently available, we do not believe that the disposition of matters that are pending or asserted will have a material effect on our financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

13

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock — Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol ASGN. At February 19, 2021 we had 53.0 million shares outstanding, 23 holders of record and an indeterminate number of beneficial owners of our common stock held through brokers and other intermediaries.

Dividend Information — Since inception, we have not declared or paid any cash dividends on our common stock, and we have no present intention of paying any dividends on our common stock in the foreseeable future. Our Board periodically reviews our dividend policy to determine whether the declaration of dividends is appropriate. The terms of our credit facility restrict our ability to pay dividends. The restriction is variable based upon our leverage ratio and certain other circumstances, as outlined in the agreement.

Securities Authorized for Issuance Under Equity Compensation Plan — Information responsive to this item will be set forth in the 2021 Proxy Statement to be filed with the SEC within 120 days after the end of the Company’s fiscal year and is incorporated herein by reference.

Recent Sales of Unregistered Securities — None.

Common Stock Repurchases — On May 31, 2019, the Board approved a stock repurchase program under which we may repurchase up to $250.0 million of our common stock through May 30, 2021. Under this program, we have repurchased $27.9 million of our common stock, see Note 10. Stockholders' Equity in Part II, Item 8. Financial Statements and Supplementary Data.

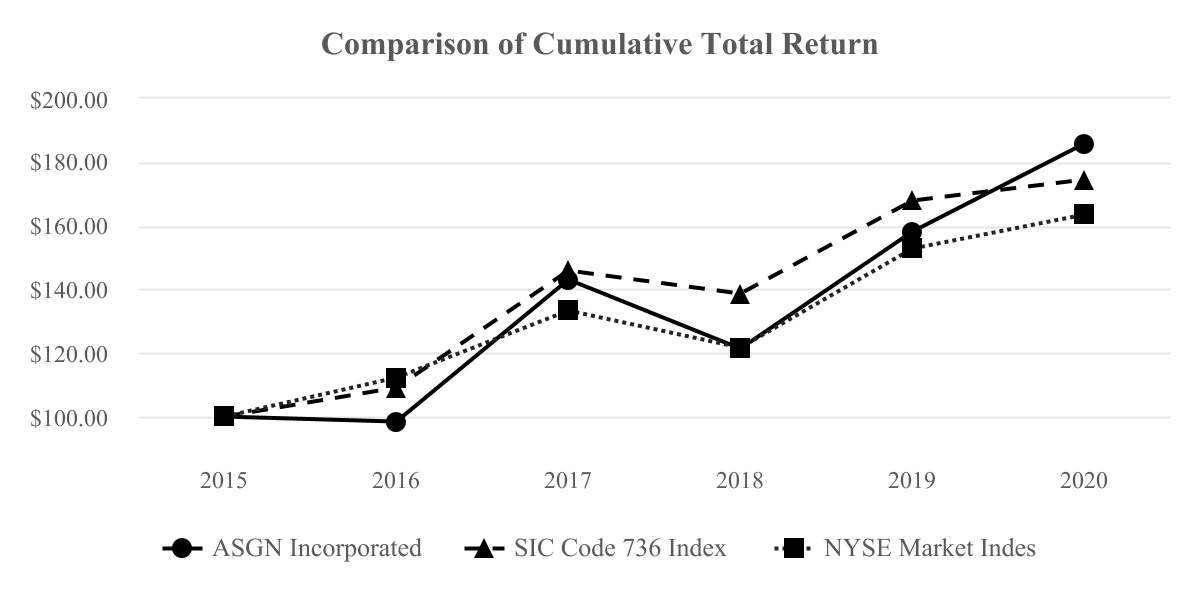

Stock Performance Graph — The following graph compares the performance of ASGN’s common stock price during the period from December 31, 2015 to December 31, 2020 with the composite prices of companies listed on the NYSE and of companies included in the SIC Code No. 736—Personnel Supply Services Companies Index. The companies listed in the SIC Code No. 736 include peer companies in the same industry or line of business as ASGN. The graph depicts the results of investing $100 in our common stock, the NYSE market index, and an index of the companies listed in the SIC Code No. 736 on December 31, 2015, and assumes that dividends were reinvested, where applicable, during the period.

The comparisons shown in the graph below are based upon historical data, and we caution stockholders that the stock price performance shown in the graph below is not indicative of, nor intended to forecast, potential future performance.

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||||||||||

| ASGN | $ | 100.00 | $ | 98.24 | $ | 142.98 | $ | 121.25 | $ | 157.89 | $ | 185.83 | ||||||||||||||||||||||||||

| SIC Code No. 736 Index | $ | 100.00 | $ | 108.98 | $ | 145.64 | $ | 138.70 | $ | 167.69 | $ | 174.27 | ||||||||||||||||||||||||||

| NYSE Market Index | $ | 100.00 | $ | 112.08 | $ | 133.26 | $ | 121.54 | $ | 152.83 | $ | 163.51 | ||||||||||||||||||||||||||

Item 6. Selected Financial Data

Not applicable.

14

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the other sections of this 2020 10-K, including the Special Note on Forward-Looking Statements and Part I, Item 1A. Risk Factors.

OVERVIEW

ASGN provides professional staffing and IT consulting services in the technology, digital, creative, engineering and life sciences fields across commercial and government sectors. Our Commercial business is comprised of the Apex and Oxford segments, and the Federal Government business is the ECS segment.

Our Apex segment provides technology, digital, creative, scientific, engineering staffing and consulting services to Fortune 1000 and mid-market clients across the United States and Canada. Our Oxford segment provides hard-to-find technology, digital, engineering and life sciences staffing and consulting services, in select skill and geographic markets in the United States and Europe. Our ECS segment delivers advanced solutions in cloud, cybersecurity, artificial intelligence, machine learning, application and IT modernization, science and engineering to departments and agencies in the federal government.

The Impact of COVID-19 on our Results and Operations

As a result of the COVID-19 pandemic, our Commercial business was down 5.7 percent from 2019 related to lower demand in certain industry verticals. During 2020, we experienced week-to-week declines in revenues beginning in March 2020 through mid-May. Thereafter, revenues have steadily improved, which has continued into 2021. Our Commercial business reported sequential quarterly revenue growth in the second half of 2020 and for the fourth quarter both commercial segments and all five industry verticals were up sequentially. Over the same period, our Federal Government business experienced double-digit year-over-year revenue growth.

Critical Accounting Policies and Estimates

Our financial statements are prepared in conformity with accounting principles generally accepted in the United States ("GAAP"), which require us to make certain assumptions and related estimates affecting the amounts reported in the consolidated financial statements. Actual results could differ from those estimates.

Critical accounting policies are those we believe are both most important to the portrayal of our financial condition and results and require our most difficult, subjective or complex judgments, often because we must make estimates about matters that are inherently uncertain. Judgments and uncertainties affecting the application of those policies may result in materially different amounts being reported under different conditions or using different assumptions. We believe the accounting policies and estimates most critical in understanding the judgments involved in preparing our financial statements are goodwill and acquired intangible assets.

Recognition of Goodwill and Acquired Intangible Assets — Determining the fair value of goodwill and intangible assets requires management's judgment, the use of significant estimates and assumptions and, in some cases, the utilization of independent valuation experts. The most critical assumptions utilized in this determination are the future cash flow estimates associated with the acquired businesses and the discount rates applied to those cash flow estimates.