UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 , 2023

FOR THE TRANSITION PERIOD FROM _____________ TO _____________

Commission File Number 001-11476

———————

(Exact name of registrant as specified in its charter)

———————

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | ||||

| incorporation or organization) | |||||

| (Address of principal executive offices) | (Zip Code) | ||||

Registrant's telephone number, including area code: 866 -660-8156

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols(s) | Name of each exchange on which registered | ||||||

$0.001 Par Value Per Share | (Nasdaq Capital Market) | |||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | x | |||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $534,959,675 . For purposes of calculating the aggregate market value of shares held by non-affiliates, we have assumed that all outstanding shares are held by non-affiliates, except for shares held by each of our executive officers, directors and 5% or greater stockholders. In the case of 5% or greater stockholders, we have not deemed such stockholders to be affiliates unless there are facts and circumstances which would indicate that such stockholders exercise any control over our company, or unless they hold 10% or more of our outstanding common stock. These assumptions should not be deemed to constitute an admission that all executive officers, directors and 5% or greater stockholders are, in fact, affiliates of our company, or that there are not other persons who may be deemed to be affiliates of our company. Further information concerning shareholdings of our officers, directors and principal stockholders is included or incorporated by reference in Part III, Item 12 of this Annual Report on Form 10-K.

State the number of shares of the issuer’s common stock outstanding, as of the latest practicable date: 93,514,346 shares of common stock issued and outstanding as of March 6, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2024 annual meeting of shareholders (the “2024 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2024 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

1

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| Part I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Item 16. | Form 10-K Summary | |||||||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Report contains forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Report. These factors include:

•our need for additional funding, the availability of, and terms of, such funding, our ability to pay amounts due on such indebtedness, covenants of such indebtedness and security interests in connection therewith;

•risks associated with our outstanding indebtedness, including our outstanding Convertible Senior Notes and term loan, including amounts owed, restrictive covenants and security interests in connection therewith, and our ability to repay such debts and amounts due thereon (including interest) when due, and mandatory and special redemption provisions thereof, and conversion rights associated therewith, including dilution caused thereby (in connection with the Convertible Senior Notes);

•security interests, guarantees and pledges associated with our outstanding Loan and Security Agreement (defined below) and Supply and Offtake Agreements (defined below), and risks associated with such agreements in general;

•risks associated with Phase 2 of the capital project currently in process at our Mobile, Alabama refinery, including costs and cost overruns, timing, delays and unanticipated problems associated therewith;

•health, safety, security and environment risks;

•the level of competition in our industry and our ability to compete and respond to changes in our industry;

•the loss of key personnel or failure to attract, integrate and retain additional personnel;

•our ability to protect our intellectual property and not infringe on others’ intellectual property;

•our ability to scale our business;

•our ability to maintain supplier relationships and obtain adequate supplies of feedstocks;

•our ability to obtain and retain customers;

•our ability to produce our products at competitive rates;

•our ability to execute our business strategy in a very competitive environment;

•trends in, and the market for, the price of oil and gas and alternative energy sources;

•our ability to maintain our relationships with Macquarie Energy North America Trading Inc., and Shell;

•the impact of competitive services and products;

•our ability to complete and integrate future acquisitions;

•our ability to maintain insurance;

•pending and future litigation, potential adverse judgments and settlements in connection therewith, and resources expended in connection therewith;

3

•rules and regulations making our operations more costly or restrictive;

•changes in environmental and other laws and regulations and risks associated with such laws and regulations;

•economic downturns both in the United States and globally;

•risks of increased regulation of our operations and products;

•negative publicity and public opposition to our operations;

•disruptions in the infrastructure that we and our partners rely on;

•an inability to identify attractive acquisition opportunities and successfully negotiate acquisition terms;

•liabilities associated with acquired companies, assets or businesses;

•interruptions at our facilities;

•unexpected changes in our anticipated capital expenditures resulting from unforeseen required maintenance, repairs, or upgrades;

•our ability to acquire and construct new facilities;

•prohibitions on borrowing and other covenants of our debt facilities;

•our ability to effectively manage our growth;

•decreases in global demand for, and the price of, oil;

•repayment of and covenants in our future debt facilities;

•changing rates of inflation and interest rates, the effects of war, and governmental responses thereto and possible recessions caused thereby;

•risks associated with our hedging activities, or our failure to hedge production;

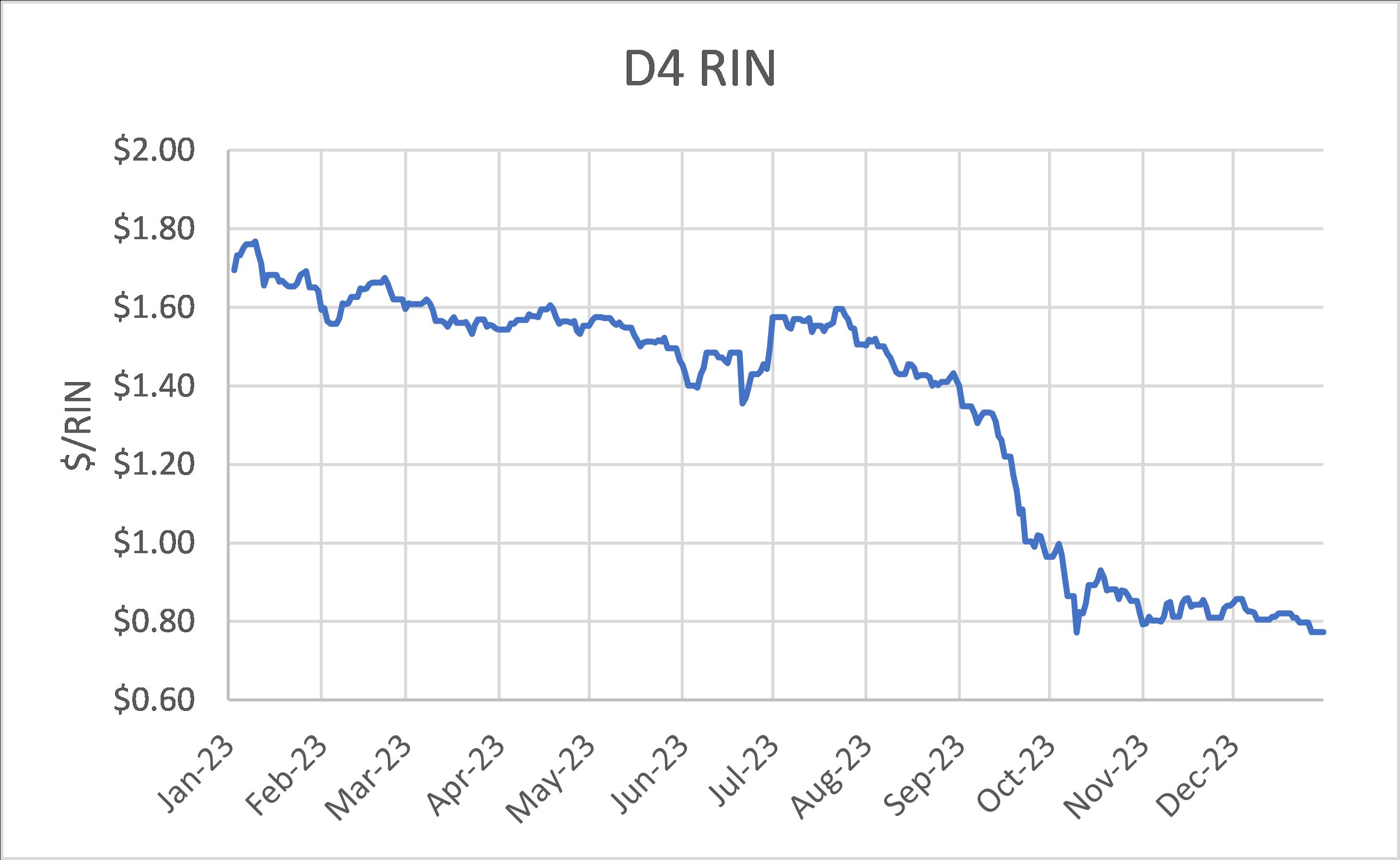

•the volatility in the market price of compliance credits (primarily renewable identification numbers (RINs) needed to comply with the Renewable Fuel Standard (RFS) under Renewable and Low-Carbon Fuel Programs and emission credits needed under other environmental emissions programs, the requirement for us to purchase RINs in the secondary market to the extent we do not generate sufficient RINs internally, and the timing of such required purchases, if any;

•the lack of capital available on acceptable terms to finance our continued growth; and

•other risk factors included under “Risk Factors” in this Report.

You should read the matters described in “Risk Factors” and the other cautionary statements made in this Report as being applicable to all related forward-looking statements wherever they appear in this Report. We cannot assure you that the forward-looking statements in this Report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. All forward-looking statements included herein speak only as of the date of the filing of this Report. All subsequent written and oral forward-looking statements attributable to the Company, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements above. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

In this Annual Report on Form 10-K, we may rely on and refer to information regarding the refining, re-refining, used oil and oil and gas industries in general from market research reports, analyst reports and other publicly available information.

4

Although we believe that this information is reliable, we have not commissioned any of such information, we cannot guarantee the accuracy and completeness of this information, and we have not independently verified any of it.

Our fiscal year ends on December 31st. Interim results are presented on a quarterly basis for the quarters ended March 31st, June 30th, and September 30th, the first quarter, second quarter and third quarter, respectively, with the quarter ending December 31st being referenced herein as our fourth quarter. Fiscal 2023 means the year ended December 31, 2023, whereas fiscal 2022 means the year ended December 31, 2022. Fiscal 2021 means the year ended December 31, 2021.

In addition to the items included in the Glossary below, unless the context requires otherwise, references to:

•the “Company,” “we,” “us,” “our,” “Vertex,” “Vertex Energy” and “Vertex Energy, Inc.” refer specifically to Vertex Energy, Inc. and its consolidated subsidiaries;

•“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

•“Securities Act” refers to the Securities Act of 1933, as amended; and

•“SEC” or the “Commission” refers to the United States Securities and Exchange Commission.

5

GLOSSARY

The following are abbreviations and definitions of certain terms used in this Report, which are commonly used in the refining and oil and gas industry:

No. 2 Oil – A high sulfur diesel oil, which is used in off-road equipment and in the marine industry such as tug boats and ships. It is also used to blend fuel oil and has multiple applications to fuel furnaces (“boilers”). It is a low viscosity, flammable liquid petroleum product.

No. 6 Oil – A lesser grade of oil than No. 2 oil, it is used only in certain applications.

Adjusted Gross Margin – Adjusted gross margin is gross profit (loss) plus or minus unrealized gain or losses on hedging activities and inventory adjustments.

Adjusted Gross Margin Per Barrel of Throughput – Adjusted gross margin per throughput barrel is calculated as adjusted gross margin divided by total throughput barrels for the period presented.

Adjusted EBITDA – Adjusted EBITDA represents net income (loss) from operations plus or minus unrealized gains or losses on hedging activities, RFS costs (mainly RINs), and inventory adjustments, depreciation and amortization, interest expense, taxes and certain other unusual or non-recurring charges included in selling, general, and administrative expenses.

Aggregators – Specialized businesses that purchase used oil and petroleum by-products from multiple collectors and sell and deliver it as feedstock to processors.

Asphalt Flux – Also called asphalt extender or blowdown, asphalt flux is a by-product of re-refining used oil suitable for blending with bitumen (the geological term for naturally occurring deposits of solid or semi-solid petroleum) or asphalt to form a product of greater fluidity or softer consistency. It is a thick, relatively nonvolatile fraction of petroleum used as flux (i.e., a substance used to promote fusion). It is a derivative, nearly or completely solid at room temperature, of certain crude oils. This black, tarry material usually comes from vacuum residue (i.e., the residue left over from vacuum distillation (see below)). It has several industrial applications. Pavers heat it to liquid form and mix it in gravel to make road surface materials called “blacktop,” “madcadam,” “tarmac,” or “asphalt.” Builders use it to make and join bricks, to coat roofs, and to form shingles. It also glues together various manufactured goods.

Base Oil – A lubricant grade oil initially produced from refining crude oil or through chemical synthesis used in manufacturing lubricant products such as lubricating greases, motor oil, and metal processing fluids.

BBL, bbl or Bbl – The abbreviated form for one barrel, 42 U.S. gallons of liquid volume.

BCD, bcd or b/cd – The abbreviated form of barrels per calendar day; meaning the total number of barrels of actual throughput processed within 24 hours under typical operating conditions.

Black Oil – A term used to describe used lubricating oils, which may be visually characterized as dark in color due to carbon and other residual elements and compounds which accumulate through use. This term can also refer to the business segment within the Company, which manages used motor oil related operations and processes such as purchase, sales, aggregation, processing, and re-refining.

Blender – An entity that combines various petroleum distillates to make a finished product that meets the applicable customer’s specification. In this combining process, each hydrocarbon stream is analyzed through a distillation cure as well as other testing to help ensure the quality of product is met. Through this process, each stream is blended into a specific product, including gasoline, No. 2 oil, marine diesel and fuel oils.

Blendstock – A bulk liquid component combined with other materials to produce a finished petroleum product.

BPD or bpd – The abbreviated form for barrels per day. This can refer to designed or actual capacity/throughput.

Bunker Fuel – Any type of fuel oil used aboard ships, and includes heavy oil and No. 6 Oil.

6

Catalytic Reforming - A process that uses heat, pressure, and a catalyst to convert low-octane naphthas into high-octane gasoline blending components.

Collectors – Typically local businesses that purchase used oil from generators and provide on-site collection services.

Crack – Crack means breaking apart crude oil into its component products, including gases like propane, heating fuel, gasoline, light distillates like jet fuel, intermediate distillates like diesel fuel and heavy distillates like grease.

Cracking – Refers to the process of breaking down larger, heavier, and more complex hydrocarbon molecules into simpler and lighter molecules through the use of heat, pressure, and sometimes a catalyst.

Crack Spread - The crack spread is a measure of the difference between market prices for refined products and crude oil, commonly used by the refining industry. We use crack spreads as a performance benchmark for our fuel gross margin and as a comparison with other industry participants. Crack spreads can fluctuate significantly, particularly when prices of refined products do not move in the same direction as the cost of crude oil.

Crack Spread USGC 2-1-1 - To calculate the crack spread that we believe most closely relates to the crude intakes and products at the Mobile Refinery, we use two barrels of Louisiana Light Sweet crude oil, producing one barrel of USGC CBOB gasoline and one barrel of USGC ULSD.

Crude oil distillation - The process of distilling vapor from liquid crudes, usually by heating and condensing the vapor slightly above atmospheric pressure turning it back to liquid in order to purify, fractionate or form the desired products.

Cutterstock – Any stream that is blended to adjust various properties of the resulting blend.

Distillates or Distillate Fuel – Finished fuel products such as diesel fuels, jet fuel and kerosene.

Feedstock – A product or a combination of products derived from crude oil and destined for further processing in the refining or re-refining industries. It is transformed into one or more components and/or finished products.

Fuel Gross Margin – Fuel gross margin is defined as gross profit (loss) plus or minus operating expenses and depreciation attributable to cost of revenues and other non-fuel items included in cost of revenues including realized and unrealized gains or losses on hedging activities, Renewable Fuel Standard (RFS) costs (mainly related to Renewable Identification Numbers (RINs)), inventory adjustments, fuel financing costs and other revenues and cost of sales items.

Fuel Gross Margin Per Barrel of Throughput – Is calculated as fuel gross margin divided by total throughput barrels for the period presented.

Gasoline Blendstock – Naphthas and various distillate products used for blending or compounding into finished motor gasoline. These components can include reformulated gasoline blendstock for oxygenate blending (RBOB) but exclude oxygenates (alcohols and ethers), butane, and pentanes (an organic compound with properties similar to a butane).

Generators – Entities that generate used oil through their daily operations such as automotive businesses conducting oil changes on consumer and commercial vehicles and industrial users changing lubricants on machinery and heavy equipment. Generators can be service stations, governments or other businesses that produce or receive used oil.

Group III base oils – Greater than 90 percent saturates, with less than 0.03 percent sulfur and with a viscosity index above 120. Although made from crude oil, Group III base oils are sometimes described as synthesized hydrocarbons.

Hydrocarbons – An organic compound consisting entirely of hydrogen and carbon. When used in the Company’s filings the term generally refers to crude oil and its derivatives.

HSFO – High Sulphur Fuel Oil or HSFO, means fuel oil with a high sulphur content.

Hydrotreating – Processing feedstock with hydrogen to remove impurities such as sulfur, chlorine, and oxygen and to stabilize the end product.

7

IMO 2020 – Refers to the International Maritime Organization’s rule, effective January 1, 2020, which limited sulfur content in fuels used on board ships operating outside designated emission control areas to 0.50% mass by mass.

Industrial Burners – Entities which burn combustible waste products (when used in the Company’s filings, generally used motor oil and re-refined hydrocarbon feedstocks) to generate power, heat or for other industrial purposes.

Industrial fuel - A distillate fuel oil, typically a blend of lower-quality fuel oils. It can include diesel fuels and fuel oils such as No. 1, No. 2, and No. 4 diesel fuels that are historically used for space heating and power generation. Industrial fuel is typically a fuel with low viscosity, as well as low sulfur, ash, and heavy metal content, making it an ideal blending agent.

Light Fuels – Fuels such as gasoline and kerosene.

LLS - Louisiana Light Sweet Crude and is a grade of crude oil classified by its low sulfur content.

LPG - Liquefied petroleum gases.

Lubricant or lube - Means a solvent-neutral paraffinic product used in commercial heavy-duty engine oils, passenger car oils, and specialty products for industrial applications such as heat transfer, metalworking, rubber, and other general process oil.

Lubricating Base Oil – A crude oil derivative used for lubrication.

Marine Diesel Oil – A blend of petroleum products that is used as a fuel in the marine industry.

MBL – means one thousand barrels.

Metals – Consist of recoverable ferrous and non-ferrous recyclable metals from manufacturing and consumption. Scrap metal can be recovered from pipes, barges, boats, building supplies, surplus equipment, tanks, and other items consisting of metal composition. These materials are segregated, processed, cut up, and sent back to a steel mill for re-purposing.

MDO – Means marine diesel oil, which is a type of fuel oil and is a blend of gasoil and heavy fuel oil, with less gasoil than intermediate fuel oil used in the maritime field.

Naphthas – Refers to any of various volatile, highly flammable liquid hydrocarbon mixtures used chiefly as solvents and diluents and as raw materials for conversion to gasoline.

Oil collection services – Includes the collection, handling, treatment, and transacting of used motor oil and related products which contain used motor oil (such as oil filters and absorbents) acquired from customers.

Olefins – Hydrotreated VGO.

Other refinery products – Includes the sales of asphalt, condensate, recovered products, and other petroleum products.

Processors – Entities (usually re-refineries) which utilize a processing technology to convert used oil or petroleum by-products into a higher-value feedstock or end-product.

Pygas (pyrolysis gasoline) – A product that can be blended with gasoline as an octane booster or distilled and separated into its components, including benzene and other hydrocarbons.

Re-Refined Base Oil – The end product of used oil that is first cleansed of its contaminants, such as dirt, water, fuel, and used additives through vacuum distillation. The oil is also generally hydrotreated to remove any remaining chemicals. This process is very similar to what traditional oil refineries do to remove base oil from crude oil. Finally, the re-refined oil is combined with a fresh additive package by blenders to bring it up to industry performance levels.

Re-Refining – Refers to the process or industry which uses refining processes and technology with used oil as a feedstock to produce high-quality base stocks and intermediate feedstocks for lubricants, fuels, and other petroleum products.

8

Refining – The process of purification of a substance. The refining of liquids is often accomplished by distillation or fractionation. Gases can be refined in this way as well, by being cooled and/or compressed until they liquefy. Gases and liquids can also be refined by extraction with a selective solvent that dissolves away either the substance of interest, or the unwanted impurities.

Refining adjusted EBITDA – Represents income (loss) from operations plus or minus unrealized gain or losses on hedging activities, RFS costs (mainly RINs), and inventory adjustments, depreciation and amortization, interest expense, taxes, acquisition costs, environmental reserves and certain other unusual or non-recurring charges included in selling, general, and administrative expenses.

Reformate – A gasoline blending stock produced by catalytic reforming.

Renewable Diesel or RD – Means a diesel fuel derived from vegetable oils or animal fats that is produced through various processes, most commonly through hydrotreating, reacting the feedstock with hydrogen under temperatures and pressure in the presence of a catalyst.

RINs – Means renewable identification numbers and refers to serial numbers assigned to credits generated from renewable fuel production under the Environmental Protection Agency’s Renewable Fuel Standard (RFS) regulations, which require blending renewable fuels into the nation’s fuel supply. In lieu of blending, refiners may purchase these transferable credits to comply with the regulations.

Sour Crude Oil – Refers to crude oil containing quantities of sulfur greater than 0.4 percent by weight.

Sweet Crude Oil – Refers to crude oil containing quantities of sulfur equal to or less than 0.4 percent by weight.

Toll Processing/Third Party Processing – Refining or petrochemicals production done on a fee basis. A plant owner puts another party’s feedstock through his equipment and charges for this service. A portion of the product retained by the processor may constitute payment. This form of compensation occurs frequently in refining because the feedstock supplier often is interested in retaining only one part of the output slate.

Transmix – A mix of transportation fuels, usually gasoline and diesel, created by mixing different specification products during pipeline transportation, stripping fuels from barges and bulk fuel terminals. Transmix processing plants distill the transmix back into specification products, such as unleaded gasoline and diesel fuel.

UMO – The abbreviation for used motor oil.

USGC CBOB – U.S. Gulf Coast Conventional Blendstock for Oxygenate Blending, which means conventional gasoline blendstock intended for blending with oxygenates downstream of the refinery where it was produced.

USGC ULSD – U.S. Gulf Coast Ultra-low sulfur diesel (ULSD), which is diesel fuel containing a maximum of 15 parts per million (ppm) of sulfur.

Used Oil – Any oil that has been refined from crude oil, or any synthetic oil that has been used, and as a result of use or as a consequence of extended storage or spillage has been contaminated with physical or chemical impurities. Examples of used oil include used motor oil, hydraulic oil, transmission fluid, and diesel and transformer oil.

Virgin Base Oil – Base oil which has not previously been recycled or re-refined.

Vacuum Distillation – The process of distilling vapor from liquid crudes, usually by heating and condensing the vapor below atmospheric pressure turning it back to a liquid in order to purify, fractionate or form the desired products.

Vacuum Gas Oil or VGO – A product produced from a vacuum distillation column which is predominately used as an intermediate feedstock to produce transportation fuels and other by-products such as gasoline, diesel and marine fuels.

VTB – Refers to vacuum tower bottoms, the leftover bottom product of distillation, which can be processed in cokers and used for upgrading into gasoline, diesel, and gas oil.

9

PART I

Item 1. Business

Corporate History

We were formed as a Nevada corporation on May 14, 2008. Pursuant to an Amended and Restated Agreement and Plan of Merger dated May 19, 2008, by and between Vertex Holdings, L.P. (formerly Vertex Energy, L.P.), a Texas limited partnership (“Holdings”), us, World Waste Technologies, Inc., a California corporation (“WWT” or “World Waste”), Vertex Merger Sub, LLC, a California limited liability company and our wholly-owned subsidiary (“Merger Subsidiary”), and Benjamin P. Cowart, our Chief Executive Officer, as agent for our shareholders (as amended from time to time, the “Merger Agreement”), effective on April 16, 2009, World Waste merged with and into Merger Subsidiary, with Merger Subsidiary continuing as the surviving corporation and becoming our wholly-owned subsidiary (the “Merger”). In connection with the Merger, (i) each outstanding share of World Waste common stock was cancelled and exchanged for 0.10 shares of our common stock; (ii) each outstanding share of World Waste Series A preferred stock was cancelled and exchanged for 0.4062 shares of our Series A preferred stock; and (iii) each outstanding share of World Waste Series B preferred stock was cancelled and exchanged for 11.651 shares of our Series A preferred stock.

Additionally, as a result of the Merger, as the successor entity of World Waste, we assumed World Waste’s filing obligations with the Securities and Exchange Commission and our common stock began trading on the Over-The-Counter Bulletin Board under the symbol “VTNR.OB” effective May 4, 2009. Subsequently, effective February 13, 2013, our common stock began trading on The NASDAQ Capital Market under the symbol “VTNR”, where it has continued to trade.

Prior Material Acquisitions and Transactions

Vertex Holdings Acquisition

Effective as of August 31, 2012, we acquired 100% of the outstanding equity interests of Vertex Acquisition Sub, LLC (“Acquisition Sub”), a special purpose entity consisting of substantially all of the assets of Holdings and real-estate properties of B & S Cowart Family L.P. (“B&S LP” and the “Acquisition”). Prior to closing the Acquisition, Holdings contributed to Acquisition Sub substantially all of its assets and liabilities relating to the business of transporting, storing, processing and re-refining petroleum products, crudes and used lubricants, including all of the outstanding equity interests in Holdings’ wholly-owned operating subsidiaries, Cedar Marine Terminals, L.P. (“CMT” or “Cedar Marine Terminals”), which operates a 19-acre bulk liquid storage facility and terminal on the Houston Ship Channel, which serves as a truck-in, barge-out facility and provides throughput terminal operations and which terminal is also the site of our proprietary, patented, Thermal Chemical Extraction Process (“TCEP”) (described below); Crossroad Carriers, L.P. (“Crossroad”) is a common carrier that provides transportation and logistical services for liquid petroleum products, as well as other hazardous materials and product streams; Vertex Recovery, L.P. (“Vertex Recovery”), is a generator solutions company for the recycling and collection of used oil and oil-related residual materials from large regional and national customers throughout the U.S. and Canada, which it facilitates through a network of independent recyclers and franchise collectors; and H&H Oil, L.P. (“H&H Oil”), which collects and recycles used oil and residual materials from customers based in Austin, Baytown, Dallas, San Antonio and Corpus Christi, Texas and B&S LP contributed real estate associated with the operations of H&H Oil.

Omega Refining Acquisition

In May 2014, we acquired certain of the assets of Omega Refining, LLC (“Omega Refining”), Bango Refining NV, LLC (“Bango Refining”) and Omega Holdings Company LLC (“Omega Holdings” and collectively with Omega Refining and Bango Refining, “Omega” or the “sellers”) related to (1) the operation of oil re-refineries and, in connection therewith, purchasing used lubricating oils and re-refining such oils into processed oils and other products for the distribution, supply and sale to end-customers and (2) the provision of related products and support services. The assets included Omega’s Marrero, Louisiana plant which produces vacuum gas oil (VGO) and a Bango, Nevada plant which produces base lubricating oils. We acquired the assets in the name of our indirect wholly-owned subsidiary, Vertex Refining LA, LLC (“Vertex LA”). The assets and operations acquired from Omega fall under our Black Oil segment. The Bango Refining operations were sold in January 2016.

10

Heartland Acquisition

In December 2014, we acquired substantially all of the assets of Warren Ohio Holdings Co., LLC, f/k/a Heartland Group Holdings, LLC (“Heartland”) related to and used in an oil re-refinery and, in connection with the collecting, aggregating and purchasing of used lubricating oils and the re-refining of such oils into processed oils and other products for the distribution, supply and sale to end-customers, including raw materials, finished products and work-in-process, equipment and other fixed assets, customer lists and marketing information, the name ‘Heartland’ and other related trade names, Heartland’s real property relating to its used oil refining facility located in Columbus, Ohio, used oil storage and transfer facilities located in Columbus, Zanesville and Norwalk, Ohio, and leases related to storage and transfer facilities located in Zanesville, Ohio, Mount Sterling, Kentucky, and Ravenswood, West Virginia (collectively, the “Heartland Assets”). The Heartland Assets were acquired by our indirect wholly-owned subsidiary, Vertex Refining OH, LLC (“Vertex OH”). The assets and operations acquired from Heartland (the “Heartland Assets and Operations”) fall under our Black Oil segment and are included under discontinued operations in the accompanying financial statements, refer to “Part II” – “Item 8. Financial Statements and Supplementary Data”, Note 24, “Discontinued Operations” for additional information. The Heartland assets and operations were sold in February 2023, as discussed below under “Recent Transactions” – “Sale and Purchase Agreement”.

Crystal Energy, LLC

On June 1, 2020 (the “Crystal Energy Closing Date”), the Company, through Vertex Operating, entered into and closed a Member Interest Purchase Agreement with Crystal Energy, LLC (“Crystal Energy”). Upon the closing of the acquisition, Crystal Energy became a wholly-owned subsidiary of Vertex Operating.

Crystal Energy is an Alabama limited liability company that was organized on September 7, 2016, for the purpose of purchasing, storing, selling, and distributing refined motor fuels. These activities include the wholesale distribution of gasoline, blended gasoline, and diesel for use as engine fuel to operate automobiles, trucks, locomotives, and construction equipment. Crystal Energy markets its products to third-party customers, and customers will typically resell these products to retailers, end-use consumers, and others. These assets are used in our Refining segment. Crystal Energy substantially ceased its operations in December 2023.

Penthol Agreement Termination

On June 5, 2016, the Company and Penthol LLC reached an agreement for the Company to act as Penthol’s exclusive agent to market and promote Group III base oil from the United Arab Emirates to the United States. The Company also agreed to provide logistical support. The start-up date was July 25, 2016, with a 5-year term through 2021. Over the Company’s objection, Penthol terminated the Agreement effective January 19, 2021. The Company and Penthol are currently involved in litigation involving such termination and related matters as described in greater detail in “Part II”–- “Item 8. Financial Statements and Supplementary Data” in the Notes to Consolidated Financial Statements in “Note 4. Commitments and Contingencies”, under the heading “Litigation”.

Prior Material Transactions

Mobile Refinery Acquisition

Effective April 1, 2022, we completed the acquisition of a 75,000 bpd crude oil refinery ten miles north of Mobile, in Saraland, Alabama (the “Mobile Refinery”) and related logistics assets, which include a deep-water draft, bulk loading terminal facility with 600,000 Bbls of storage capacity for crude oil and associated refined petroleum products located in Mobile, Alabama (the “Blakeley Island Terminal”) from Equilon Enterprises LLC d/b/a Shell Oil Products US and/or Shell Oil Company and/or Shell Chemical LP, subsidiaries of Shell plc (“Shell”). The terminal includes a dock for loading and unloading vessels with a pipeline tie-in, as well as the related logistics infrastructure of a high-capacity truck rack with 3-4 loading heads per truck, each rated at 600 gallons per minute (the “Mobile Truck Rack”). The Mobile Refinery currently processes heavy and sour crude to produce heavy olefin feed, regular gasoline, premium gasoline, jet fuel, and diesel fuel.

The Company paid a total of $75.0 million in consideration for the acquisition of the Mobile Refinery. In addition, we paid $16.4 million for previously agreed upon capital expenditures, miscellaneous prepaids and reimbursable items and an $8.7 million technology solution comprising the ecosystem required for the Company to run the Mobile Refinery after the acquisition. The Company also purchased certain crude oil and finished products inventories for $130.2 million owned by Shell at the Mobile Refinery.

11

As a result of the Mobile Refinery purchase, Vertex Refining and Shell Trading (US) Company (“STUSCO”) entered into a Crude Oil & Hydrocarbon Feedstock Supply Agreement (the “Crude Supply Agreement”) pursuant to which STUSCO agreed to sell to Vertex Refining, NV, LLC (“Vertex Refining”), and Vertex Refining agreed to buy from STUSCO, all of the crude oil and hydrocarbon feedstock requirements of the Mobile Refinery, subject to certain exceptions set forth therein. The agreement provides that STUSCO is the exclusive supplier for the Mobile Refinery’s requirement for crude oil and hydrocarbon feedstock.

Additionally, as a result of the Mobile Refinery purchase, we entered into several agreements with Macquarie Energy North America Trading Inc (“Macquarie”). Under these agreements (together, the “Inventory Financing Agreement”), Macquarie agreed to finance the Mobile Refinery’s crude supply and inventories, and Vertex agreed to provide storage and terminalling services to Macquarie. At the time of the acquisition, Macquarie agreed to finance $124.3 million of the $130.2 million of opening inventories.

Macquarie Transactions

On April 1, 2022 (the “Commencement Date”), Vertex Refining entered into a Supply and Offtake Agreement (the “Crude Oil Supply and Offtake Agreement”) with Macquarie, pertaining to crude oil supply and offtake of finished products located at the Mobile Refinery acquired on April 1, 2022. On the Commencement Date, pursuant to an Inventory Sales Agreement and in connection with the Crude Oil Supply and Offtake Agreement, Macquarie purchased from Vertex Refining all crude oil and finished products within the categories covered by the Crude Oil Supply and Offtake Agreement and the Inventory Sales Agreement, which were held at the Mobile Refinery and a certain specified third party storage terminal, which were previously purchased by Vertex Refining as part of the acquisition of the Mobile Refinery.

Pursuant to the Crude Oil Supply and Offtake Agreement, beginning on the Commencement Date and subject to certain exceptions, substantially all of the crude oil located at the Mobile Refinery and at a specified third-party storage terminal from time to time will be owned by Macquarie prior to its sale to Vertex Refining for consumption within the Mobile Refinery processing units. Also pursuant to the Crude Oil Supply and Offtake Agreement, and subject to the terms and conditions and certain exceptions set forth therein, Macquarie will purchase from Vertex Refining substantially all of the Mobile Refinery’s output of certain refined products and will own such refined products while they are located within certain specified locations at the Mobile Refinery. Macquarie takes title to the refined products stored in our storage tanks until they are sold to our retail locations or to third parties. We record the inventory owned by Macquarie on our behalf as inventory with a corresponding accrued liability on our balance sheet because we maintain the risk of loss until the refined products are sold to third parties and we have an obligation to repurchase it.

Pursuant to the Crude Oil Supply and Offtake Agreement and subject to the terms and conditions therein, Macquarie may during the term of the Crude Oil Supply and Offtake Agreement procure crude oil and refined products from certain third parties which may be sold to Vertex Refining or third parties pursuant to the Crude Oil Supply and Offtake Agreement and may sell Refined Products to Vertex Refining or third parties (including customers of Vertex Refining).

The obligations of Vertex Refining and any of its subsidiaries under the Crude Oil Supply and Offtake Agreement and related transaction documents are guaranteed by the Company. The obligations of Vertex Refining and any of its subsidiaries under the Crude Oil Supply and Offtake Agreement and related transaction documents are also secured by a Pledge and Security Agreement in favor of Macquarie, discussed below, executed by Vertex Refining. In addition, the Crude Oil Supply and Offtake Agreement also requires that Vertex Refining post and maintain cash collateral (in the form of an independent amount) as security for Vertex Refining’s obligations under the Crude Oil Supply and Offtake Agreement and the related transaction documents. The amount of cash collateral is subject to adjustments during the term.

The Crude Oil Supply and Offtake Agreement has a 24 month term following the Commencement Date, subject to the performance of customary covenants, and certain events of default and termination events provided therein (certain of which are discussed in greater detail below), for a facility of this size and type. Additionally, either party may terminate the agreement at any time, for any reason, with no less than 180 days prior notice to the other. The agreement automatically extends for another 12 months after the end of the initial term, unless terminated prior to such date by either party with 180 days prior written notice.

The price for crude oil purchased by the Company from Macquarie and for products sold by the Company to Macquarie within each agreed product group, in each case, is equal to a pre-determined benchmark, plus a pre-agreed upon differential, subject to adjustments and monthly true-ups.

12

In connection with the entry into the Crude Oil Supply and Offtake Agreement, Vertex Refining entered into various ancillary agreements which relate to supply, storage, marketing and sales of crude oil and refined products including, but not limited to the following: Inventory Sales Agreement, Master Crude Oil and Products Agreement, Storage and Services Agreement, and a Pledge and Security Agreement (collectively with the Supply and Offtake Agreement, the “Supply Transaction Documents”).

Vertex Refining’s obligations under the Crude Oil Supply and Offtake Agreement and related transaction documents (other than the hedges which are secured and guaranteed on a pari passu basis under the Loan and Security Agreement (defined and discussed below)) were unconditionally guaranteed by the Company pursuant to the terms of a Guaranty entered into on April 1, 2022, by the Company in favor of Macquarie (the “Guaranty”).

Term Loan

On April 1, 2022 (the “Closing Date”), Vertex Refining; the Company, as a guarantor; substantially all of the Company’s direct and indirect subsidiaries, as guarantors (together with the Company, the “Initial Guarantors”); certain funds and accounts under management by BlackRock Financial Management, Inc. or its affiliates, as lenders (“BlackRock”), certain funds managed or advised by Whitebox Advisors, LLC, as lenders (“Whitebox”), certain funds managed by Highbridge Capital Management, LLC, as lenders (“Highbridge”), Chambers Energy Capital IV, LP, as a lender (“Chambers”), CrowdOut Capital LLC, as a lender (“CrowdOut Capital”), CrowdOut Credit Opportunities Fund LLC, as a lender (collectively with BlackRock, Whitebox, Highbridge, Chambers and CrowdOut Capital, the “Lenders”); and Cantor Fitzgerald Securities, in its capacity as administrative agent and collateral agent for the Lenders (the “Agent”), entered into a Loan and Security Agreement (the Loan and Security Agreement as amended to date, the “Loan and Security Agreement”).

Pursuant to the Loan and Security Agreement, the Lenders agreed to provide a $125 million term loan to Vertex Refining (the “Initial Term Loan”), the proceeds of which, less agreed upon fees and discounts, were held in escrow prior to the Closing Date, pursuant to an Escrow Agreement. On the Closing Date, net proceeds from the term loans, less the agreed upon fees and discounts, as well as certain transaction expenses, were released from escrow to Vertex Refining in an aggregate amount of $94 million.

On May 26, 2022, each of the Initial Guarantors (including the Company), Vertex Refining OH, LLC, which is indirectly wholly-owned by the Company (“Vertex OH”), HPRM LLC, and Tensile-Heartland Acquisition Corporation, a Delaware corporation (“Tensile-Heartland”, and together with Vertex Ohio and HPRM, the “Additional Guarantors”, and the Additional Guarantors, together with the Initial Guarantors and such other subsidiaries of the Company who from time to time have guaranteed the obligations of Vertex Refining under the Loan and Security Agreement, the “Guarantors”, and the Guarantors, together with Vertex Refining, the “Loan Parties”), entered into an Amendment Number One to Loan and Security Agreement (“Amendment No. One to Loan Agreement”), with certain of the Lenders and CrowdOut Warehouse LLC, as a lender (the “Additional Lenders” and together with the Initial Lenders, the “Lenders”) and the Agent, pursuant to which, the amount of the Term Loan (as defined below) was increased from $125 million to $165 million, with the Additional Lenders providing an additional term loan in the amount of $40 million (the “First Additional Term Loan”).

The Company used a portion of the proceeds from the Term Loan borrowing to pay a portion of the purchase price associated with the acquisition of the Mobile Refinery (defined above) acquired by Vertex Refining on April 1, 2022, as discussed in greater detail above, and to pay certain fees and expenses associated with the closing of the Loan and Security Agreement and was required to use the remainder of the funds for (i) the planned renewable diesel conversion of the Mobile Refinery, and (ii) working capital and liquidity needs.

In connection with the entry into the initial Loan and Security Agreement, and as additional consideration for the Lenders agreeing to loan funds to the Company thereunder, the Company granted warrants to purchase 2.75 million shares of common stock of the Company to the Lenders (and/or their affiliates) on the Closing Date (the “April 2022 Warrants”). The terms of the warrants are set forth in a Warrant Agreement (the “April 2022 Warrant Agreement”) entered into on April 1, 2022, between the Company and Continental Stock Transfer & Trust Company as warrant agent.

In connection with the entry into the Amendment No. One to Loan Agreement, and as a required term and condition thereof, on May 26, 2022, the Company granted warrants (the “May 2022 Warrants”) to purchase 250 thousand shares of the Company’s common stock to the Additional Lenders and their affiliates. The terms of the Additional Warrants are set forth in a Warrant Agreement (the “May 2022 Warrant Agreement”) entered into on May 26, 2022, between the Company and Continental Stock Transfer & Trust Company as warrant agent.

13

On December 28, 2023, each of the Guarantors (including the Company), together with Vertex Refining (the “Loan Parties”), entered into an amendment to the Loan and Security Agreement with the Lenders and the Agent (“Amendment No. Five to Loan Agreement”), pursuant to which certain of the Lenders agreed to provide an additional term loan in the amount of $50 million (the “Second Additional Term Loan”, and together with the First Additional Term Loan and the Initial Term Loan, the “Term Loan”).

In connection with the Second Additional Term Loan, and as additional consideration to the Lenders providing the Additional Term Loan for loaning funds to the Company in connection therewith, the Company granted warrants to purchase 1 million shares of common stock of the Company to the Lenders, or affiliates thereof (the “December 2023 Warrants” and together with the May 2022 Warrants and April 2022 Warrants, the “Warrants”). The terms of the New Warrants are set forth in a Warrant Agreement (the “December 2023 Warrant Agreement” and together with the April 2022 Warrant Agreement and May 2022 Warrant Agreement, the “Warrant Agreements”) entered into on December 28, 2023, between the Company and Continental Stock Transfer & Trust Company as warrant agent.

Finally, as additional consideration for the Lenders agreeing to Amendment No. Five to the Loan Agreement, the Company agreed to reprice the April 2022 Warrants and May 2022 Warrants to have an exercise price of $3.00 per share (the “Warrant Repricing”), pursuant to the entry by the Company and Continental Stock Transfer & Trust Company, as warrant agent, into (i) an amendment, dated as of December 28, 2023, to the warrant agreement governing the April 2022 Warrants (the “April 2022 Warrant Amendment”) and an (ii) an amendment to the warrant agreement governing the May 2022 Warrants (the “May 2022 Warrant Amendment”).

Myrtle Grove Facility Purchase

On April 1, 2022, the Company, through Vertex Splitter Corporation (“Vertex Splitter”), a wholly-owned subsidiary of the Company, acquired the 15% noncontrolling interest of Vertex Refining Myrtle Grove LLC (“MG SPV”) held by Tensile-Myrtle Grove Acquisition Corporation (“Tensile-MG”), an affiliate of Tensile Capital Partners Master Fund LP, an investment fund based in San Francisco, California (“Tensile”) from Tensile-Vertex Holdings LLC (“Tensile-Vertex”), an affiliate of Tensile for $7.2 million, which was based on the value of the Class B Unit preference of MG SPV held by Tensile-MG, plus capital invested by Tensile-MG in MG SPV (which had not been returned as of the date of payment), plus cash and cash equivalents held by Tensile-MG as of the closing date. As a result, the Company acquired 100% of MG SPV, which in turn owns the Company’s Belle Chasse, Louisiana, re-refining complex.

Sale and Purchase Agreement

On February 1, 2023, HPRM LLC (“HPRM”), which is indirectly wholly-owned by the Company, entered into a Sale and Purchase Agreement (the “Sale Agreement”) with GFL Environmental Services USA, Inc. (“GFL”) whereby HPRM agreed to sell to GFL, and GFL agreed to purchase from HPRM, all of HPRM’s equity interest in Vertex OH. Vertex Operating and GFL Environmental Inc. (“GFL Environmental”), an affiliate of GFL, were also parties to the Sale Agreement.

Pursuant to the Sale Agreement, HPRM agreed to sell GFL all of its equity interests in Vertex OH, which owns the Heartland refinery located in Columbus, Ohio (the “Heartland Refinery”). The sale also includes all property and assets owned by Vertex OH, including inventory associated with the Heartland Refinery, and all real and leased property and permits owned by Vertex OH, and all used motor oil collection and recycling assets and operations owned by Vertex OH (collectively with the Heartland Refinery, the “Heartland Assets and Operations”).

The transactions contemplated by the Sale Agreement closed on February 1, 2023.

The purchase price for the transaction was $90 million, subject to certain customary adjustments for net working capital, taxes and assumed liabilities. We also entered into a transition services agreement, restrictive covenant agreement and, through our subsidiary Vertex LA, a used motor oil supply agreement with GFL in connection with the sale.

Paydown of Term Loan

On February 5, 2023, the Company used $11 million of the proceeds from the Sale Agreement to paydown the then principal amount of the Term Loan.

Amendment No. 1 to Supply and Offtake Agreement

14

In connection with the entry into the RD Supply and Offtake Agreement, discussed below, Macquarie, Vertex Refining and the Company, entered into Amendment Agreement No. 1 to the Supply and Offtake Agreement (“Amendment 1”). Pursuant to Amendment 1, the Crude Oil Supply and Offtake Agreement was amended to include certain additional documents relating to the RD Supply and Offtake Agreement as transaction documents, and to update such Crude Oil Supply and Offtake Agreement in connection therewith, to amend the unwind procedures associated with the Crude Oil Supply and Offtake Agreement, and to update or revise certain other covenants set forth in the Crude Oil Supply and Offtake Agreement relating to cross defaults, finance agreements, minimum liquidity, and guarantor requirements, to be conformed with changes made to analogous provisions in, or to otherwise account for, the RD Supply and Offtake Agreement terms. Amendment 1 also made conforming amendments to certain other agreements relating to the Crude Oil Supply and Offtake Agreement.

Renewables RD Supply and Offtake Agreement

On May 26, 2023 (the “Commencement Date”), Vertex Renewables Alabama, LLC, an affiliate indirectly wholly-owned by the Company (“Vertex Renewables”), entered into a Supply and Offtake Agreement (the “RD Supply and Offtake Agreement” and together with the Crude Oil Supply and Offtake Agreement, the “Supply and Offtake Agreements”) with Macquarie, pertaining to the supply and financing of renewable biomass feedstocks used for the production of renewable fuels, the offtake and financing of renewable diesel, and the provision of certain financing accommodations with respect to certain agreed environmental attributes associated with the operation of such renewable diesel unit (including Renewable Identification Numbers (RINs), tax credits, and low carbon fuel credits) at the Mobile Refinery.

The RD Supply and Offtake Agreement has a 24 month term following the Commencement Date, which was May 26, 2023, subject to the performance of customary covenants, and may be terminated earlier following the occurrence of certain events of default and termination events provided therein that are customary for a facility of this size and type and subject to applicable cure periods in certain events. Additionally, either party may terminate the agreement at any time, for any reason, with not less than 180 days prior notice to the other. In the event Vertex Renewables is the terminating party, Vertex Refining must also at the same time, terminate that certain Crude Oil Supply and Offtake Agreement entered into with Macquarie dated April 1, 2022.

Pursuant to the RD Supply and Offtake Agreement, we pay or receive certain fees from Macquarie based on changes in market prices over time.

Description of Business Activities:

We are an energy transition company specializing in refining and marketing high-value conventional and lower-carbon alternative transportation fuels. We are engaged in operations across the petroleum value chain, including refining, collection, aggregation, transportation, storage and sales of aggregated feedstock and refined products to end-users. All of these products are commodities that are subject to various degrees of product quality and performance specifications.

We operate in two segments:

(1) Refining and Marketing, and

(2) Black Oil and Recovery.

Our Refining and Marketing segment manages the refining of crude oil and renewable feedstocks, and distributes finished products across the southeastern United States through a high-capacity truck rack, together with deep and shallow water distribution points capable of supplying waterborne vessels.

Our Black Oil and Recovery segment aggregates and manages the re-refinement of used motor oil and other petroleum by-products and sells the re-refined products to end customers.

Refining and Marketing Segment

Our Refining and Marketing segment is engaged in the refining and distribution of petroleum products and includes the Mobile Refinery and related operations. As described above, effective April 1, 2022, we completed the acquisition of the Mobile Refinery, a 75,000 bpd crude oil refinery ten miles north of Mobile, in Saraland, Alabama and related logistics assets, which include a deep-water draft, bulk loading terminal facility with 600,000 Bbls of storage capacity for crude oil and associated refined petroleum products located in Mobile, Alabama. The terminal includes a dock for loading and unloading vessels with a pipeline tie-in, as well as the related logistics infrastructure of a high-capacity truck rack with 3-4 loading heads

15

per truck, each rated at 600 gallons per minute. The Mobile Refinery currently processes heavy and sour crude to produce heavy olefin feed, regular gasoline, premium gasoline, jet fuel, and diesel fuel.

On May 27, 2023, the Mobile Refinery began processing soybean oil into renewable diesel (“RD”). The RD facility located in Mobile, Alabama, specializes in the advanced refining of organic feedstocks, including crop oils and waste oils, into high-quality renewable diesel. With a proven background in feedstock and supply-chain logistics, coupled with strong transport infrastructure and tankage, Vertex’s commercial operations provide critical support by establishing pathways to supply feedstock necessary for ratable production. We currently sell our finished renewable diesel product in the western half of North America.

In addition, we aggregate a diverse mix of feedstocks petroleum distillates, transmix and other off-specification chemical products. These feedstock streams are purchased from pipeline operators, refineries, chemical processing facilities and third-party providers. We have a toll-based processing agreement in place with Monument Chemical Port Arthur, LLC (formerly with KMTEX) (“Monument Chemical”) to re-refine feedstock streams, under our direction, into various end products that we specify. Monument Chemical uses industry standard processing technologies to re-refine our feedstocks into pygas, gasoline blendstock and marine fuel cutterstock. We sell all of our re-refined products directly to end-customers or to processing facilities for further refinement. In addition, we are distributing refined motor fuels such as gasoline, blended gasoline products and diesel used as engine fuels, to third party customers who typically resell these products to retailers and end consumers.

Black Oil and Recovery Segment

Discontinued operations of Vertex include our Heartland Assets and Operations, which is part of our Black Oil business, Refer to “Part II” – “Item 8. Financial Statements and Supplementary Data”, Note 24, “Discontinued Operations” for additional information.

Our Black Oil business is engaged in operations across the entire used motor oil recycling value chain including collection, aggregation, transportation, storage, refinement, and sales of aggregated feedstock and re-refined products to end users. We collect and purchase used oil directly from generators such as oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries, and petrochemical manufacturing operations. We own a fleet of 68 collection vehicles, which routinely visit generators to collect and purchase used motor oil and perform other collection services. We also aggregate used oil from a diverse network of approximately 30 suppliers who operate similar collection businesses to ours.

We manage the logistics of transport, storage and delivery of used oil to our customers. We own a fleet of 30 transportation trucks and more than 80 above ground storage tanks with over 8.0 million gallons of storage capacity. These assets are primarily used by the Black Oil segment. In addition, we also utilize third parties for the transportation and storage of used oil feedstocks. Typically, we sell used oil to our customers in bulk to ensure efficient delivery by truck, rail, or barge. In many cases, we have contractual purchase and sale agreements with our suppliers and customers, respectively. We believe these contracts are beneficial to all parties involved because it ensures that a minimum volume is sold from collectors and generators, a minimum volume is purchased by our customers, and we are able to minimize our inventory risk by a spread between the costs to acquire used oil and the revenues received from the sale and delivery of used oil. The majority of our contracts are treated as normal purchase and normal sale transactions. In addition, at our Marrero, Louisiana facility, we produce a Vacuum Gas Oil (VGO) product that is sold to refineries as well as to the marine fuels market. At our Columbus, Ohio facility (Heartland Petroleum), divested on February 1, 2023, we produced a base oil product that is sold to lubricant packagers and distributors.

We currently provide our services in 5 states, primarily in the Gulf Coast, Midwest and Mid-Atlantic regions of the United States. For the rolling twelve-month period ending December 31, 2023, we aggregated approximately 67.9 million gallons of used motor oil and other petroleum by-product feedstocks and managed the re-refining of approximately 59.7 million gallons of used motor oil with our proprietary VGO and Base Oil processes.

Our Black Oil and Recovery segments include two business lines. The Black Oil business collects and purchases used motor oil directly from third-party generators, aggregates used motor oil from an established network of local and regional collectors, and sells used motor oil to our customers for use as a feedstock or replacement fuel for industrial burners. We operate a refining facility and we also utilize third-party processing facilities. Our Recovery business includes a generator solutions company for the proper recovery and management of hydrocarbon streams as well as metals which includes transportation and marine salvage services throughout the Gulf Coast.

16

We also operate a facility in Marrero, Louisiana, which facility re-refines used motor oil and also produces VGO and a re-refining complex in Belle Chasse, Louisiana, which we call our Myrtle Grove facility.

The Company’s Recovery business includes a generator solutions company for the proper recovery and management of hydrocarbon streams, the sales and marketing of Group III base oils through January 2021, and other petroleum-based products, together with the recovery and processing of metals.

Organizational Structure

The following chart reflects our current organization structure, including significant subsidiaries (all of which are wholly-owned, except as discussed below):

Our Industry

Conventional Refining

The petroleum refining industry is a competitive landscape comprising an array of fully integrated national and multinational oil companies that engage in diverse activities within the refining sector. These activities include exploration, production, transportation, refining, marketing, retail fuel and convenience stores, and independent refiners. Within the industry, our principal competitors are the petroleum refiners based in the Gulf Coast Region.

Given the nature of the industry, the cost of crude oil and other feedstocks is a crucial competitive factor that must be continually monitored. We analyze our refinery complexity, efficiency, and product mix to make informed decisions on allocating resources and maximizing our profitability. Distribution and transportation costs are also essential competitive factors that we actively manage in an attempt to minimize our expenses while maintaining the quality of our products. Additionally, regulatory compliance costs such as Renewable Fuel Standards are closely monitored to ensure we remain compliant while working towards minimizing the associated costs.

Used Oil Re-Refining

17

The used oil recycling industry comprises generators, collectors, aggregators, processors, re-refiners, and end-users. Generators produce used oil through oil changes on vehicles, machinery, and heavy equipment. Collectors are intermediaries who collect used oil from generators and transport it to aggregators, processors, and re-refiners. Aggregators purchase used oil and petroleum by-products from multiple collectors and deliver those as feedstock to processors and re-refiners. Processors and re-refiners convert used oil or petroleum by-products into higher-value feedstock or end-products using vacuum distillation and hydrotreating processes. Re-refined lubricating base oil is of equal quality and lasts as long as virgin base oil, while intermediate products are used as industrial fuels or transportation fuel blend stocks.

The market value of recycled oil is based on its end-use, while the financial and environmental benefits of recycling used oil are dependent on the extent to which the used oil is re-refined, and the price spread between natural gas and crude oil. Environmental regulations prohibit the disposal of used oil in sewers or landfills due to the heavy metals and other contaminants that make it detrimental to the environment if improperly disposed. Re-refined oil significantly reduces the amount of toxic heavy metals, greenhouse gases, and other pollutants introduced into the environment, conserves petroleum that would have otherwise been refined into virgin base stock oil, and is a more environmentally responsible option than burning used oil as an industrial fuel. With the increasing demand for high-quality, environmentally responsible products, we believe that the used oil recycling market has significant growth potential through increasing the percentage of recycled oil that is re-refined rather than burned as a low-cost industrial fuel.

Our Competitive Strengths

Large, Diversified Feedstock Supply Network

We obtain our feedstock supply through a combination of direct collection activities and purchases from third-party suppliers. We believe our balanced direct and indirect approach to obtaining feedstock is highly advantageous because it enables us to maximize total supply and reduce our reliance on any single supplier and the risk of not fulfilling our minimum feedstock sale quotas. We collect feedstock directly from over 4,500 generators including oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries and petrochemical manufacturing operations, as well as brokers. We aggregate used oil from a diverse network of approximately 30 suppliers who operate similar collection businesses to ours.

Strategic Relationships

We have established relationships with key feedstock suppliers, storage and transportation providers, oil re-refineries, and end-user customers. We believe our relationships with these parties are strong, in part due to our high level of customer service, competitive prices, and our ability to contract (for purchase or sale) long-term, minimum monthly feedstock commitments. We believe that our strategic relationships could lead to contract extensions and expanded feedstock supply or purchase agreements.

Logistics Capabilities

We have extensive expertise and experience managing and operating feedstock supply chain logistics and multimodal transportation services for customers who purchase our feedstock or higher-value, re-refined products. We believe that our scale, infrastructure, expertise, and contracts enable us to cost effectively transport product and consistently meet our customers’ volume, quality and delivery schedule requirements.

Diversified End Product Sales

We believe that the diversity of the products we sell reduces our overall risk and exposure to price fluctuations. Prices for petroleum-based products can be impacted significantly by supply and demand fluctuations which are not correlated with general commodity price changes.

Management Team

We are led by a management team with expertise in petroleum refining, recycling, finance, operations, and re-refinement technology. Each member of our senior management team has more than 25 years of industry experience. We believe the strength of our management team will help our success in the marketplace.

Products and Services

18

We generate substantially all of our revenue from the sale of twelve categories of products and certain services discussed below. All of these products are commodities that are subject to various degrees of product quality and performance specifications.

Distillates

Distillates are finished fuel products such as gasoline, jet fuel and diesel fuels.

Base Oil

Base oil is an oil to which other oils or substances are added to produce a lubricant. Typically, the main substance in lubricants, base oils, are refined from crude oil.

Pygas

Pygas, or pyrolysis gasoline, is a product that can be blended with gasoline as an octane booster or that can be distilled and separated into its components, including benzene and other hydrocarbons.

Industrial Fuel

Industrial fuel is a distillate fuel oil which is typically a blend of lower quality fuel oils. It can include diesel fuels and fuel oils such as No. 1, No. 2 and No. 4 diesel fuels that are historically used for space heating and power generation. Industrial fuel is typically a fuel with low viscosity, as well as low sulfur, ash, and heavy metal content, making it an ideal blending agent.

Oil Collection Services

Oil collection services include the collection, handling, treatment and sales of used motor oil and products which include used motor oil (such as oil filters) which are collected from our customers.

Metals

Metals consist of recoverable ferrous and non-ferrous recyclable metals from manufacturing and consumption. Scrap metal can be recovered from pipes, barges, boats, building supplies, surplus equipment, tanks, and other items consisting of metal composition. These materials are segregated, processed, cut-up and sent back to a steel mill for re-purposing.

Other re-refinery products

Other re-refinery products include the sales of asphalt, condensate, recovered products, and other petroleum products.

VGO/Marine fuel sales

VGO/Marine fuel sales relate to the sale of low sulfur fuel meeting the criteria for IMO 2020 compliant marine fuels.

The way that the product categories above and our services fit into our two operating segments are described below. For further description of individual products, please refer to the Glossary of terms at the beginning of this document.

19

Refining and Marketing(1) | Black Oil and Recovery (2) | |||||||

Gasolines | X | |||||||

Jet Fuel | X | |||||||

Distillates | X | |||||||

| Renewable diesel | X | |||||||

Base oil | X | |||||||

VGO/Marine fuel | X | X | ||||||

Other refined products (3) | X | X | ||||||

Pygas | X | |||||||

Metals (4) | X | |||||||

Other re-refined products (5) | X | X | ||||||

Terminalling | X | |||||||

Oil collection services | X | |||||||

(1) The Refining and Marketing segment consists primarily of the sale of refined hydrocarbon products such as gasoline, distillates, jet fuel, intermediates refined at the Mobile Refinery and pygas; and industrial fuels, which are produced at a third-party facility (Monument Chemical).

(2) The Black Oil segment continued operations consist primary of the sale of (a) other re-refinery products, recovered products, and used motor oil; (b) specialty blending and packaging of lubricants; (c) transportation revenues; (d) the sale of VGO (vacuum gas oil)/marine fuel; (e) petroleum products which include base oil and industrial fuels—which consist of used motor oils, cutterstock and fuel oil generated by our facilities; (f) oil collection services—which consist of used oil sales, burner fuel sales, antifreeze sales and service charges; (g) the sale of other re-refinery products including asphalt, condensate, recovered products, and used motor oil; (h) sale of ferrous and non-ferrous recyclable Metal(s) products that are recovered from manufacturing and consumption; and (i) revenues generated from trading/marketing of Group III Base Oils. On February 1, 2023, the Company sold its Heartland Assets and Operations (which forms a part of the Black Oil segment), and as such, has determined to present the Company’s Heartland Assets and Operations as discontinued operations.

(3) Other refinery products include the sales of base oil, cutterstock and hydrotreated VGO, LPGs, sulfur and vacuum tower bottoms (VTB).

(4) Metals consist of recoverable ferrous and non-ferrous recyclable metals from manufacturing and consumption. Scrap metal can be recovered from pipes, barges, boats, building supplies, surplus equipment, tanks, and other items consisting of metal composition. These materials are segregated, processed, cut-up and sent back to a steel mill for re-purposing.

(5) Other re-refinery products include the sales of asphalt, condensate, recovered products, and other petroleum products.

Suppliers

In our Refining and Marketing segment we purchase crude oil and renewable feedstock from third party suppliers and compete for these products in the open market.

In our Black Oil segment, we conduct business with a number of used oil generators, as well as a large network of suppliers that collect used oil from used oil generators. In our capacity as a collector of used oil, we purchase feedstock from approximately 10,000 businesses, such as oil change service stations, automotive repair shops, manufacturing facilities, petroleum refineries, and petrochemical manufacturing operations, which generate used oil through their operations.

Customers

The Black Oil segment sells used oil, VGO, base oil and other petroleum feedstocks to numerous customers in the Gulf Coast and Midwest regions of the United States. The primary customers of its products are packagers, distributers, blenders and industrial burners, as described above as well as re-refiners of the feedstock. The Black Oil segment is party to various feedstock sale agreements whereby we sell used oil feedstock to third parties. The agreements provide for customers to purchase certain minimum gallons of used oil feedstock per month at a price per barrel equal to our direct costs, plus certain commissions, based on the quality and quantity of the used oil we supply.

20

The Recovery segment does not rely solely on contracts, but mainly on the spot market as well as a strategic network of customers and vendors to support the purchase and sale of its products which are commodities. It also relies on project-based work which it bids on from time to time, of which there is no guarantee or assurance of repeat business.

Competition

All aspects of the energy refining industry are very competitive. We compete with various other refining companies on the Gulf Coast. Our competitors include major integrated, national, and independent energy companies. Many of these competitors have greater financial and technical resources and staff which may allow them to better withstand and react to changing and adverse market conditions. Our profitability is dependent on refined product margins which can fluctuate significantly based on conditions out of our control. In addition, crude supply can have a large impact on profitability. Our refining business sources and obtains all of our crude oil from third-party sources and competes globally for crude oil and feedstocks.