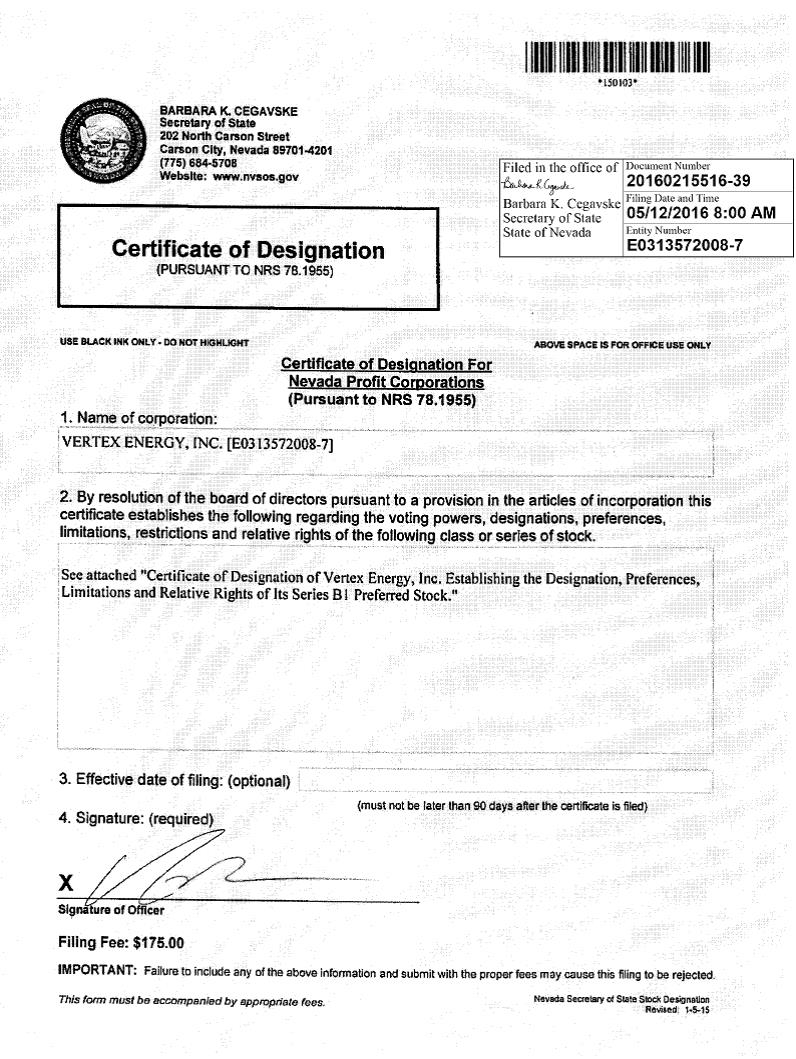

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF DESIGNATION

OF

VERTEX ENERGY, INC.

ESTABLISHING THE DESIGNATION, PREFERENCES,

LIMITATIONS AND RELATIVE RIGHTS OF ITS

SERIES B PREFERRED STOCK

Pursuant to Section 78.1955 of the Nevada Revised Statutes (the “NRS”), Vertex Energy, Inc., a company organized and existing under the State of Nevada (the “Corporation”),

DOES HEREBY CERTIFY that, (a) the Board of Directors, by unanimous written consent of all members of the Board of Directors on May 9, 2016; and (b) stockholders holding shares in the Corporation entitling them to exercise a Majority In Interest (as defined below) of the then aggregate shares of Series B Preferred Stock, voting as a class, on May 9, 2016, duly adopted this amended and restated Certificate of Designation of Vertex Energy, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series B Preferred Stock, by adoption of a resolution which reads as follows, and which shall amend, replace and supersede the Certificate of Designation of Vertex Energy, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series B Preferred Stock, previously filed by the Corporation with the Secretary of State of Nevada on June 23, 2015 (the “Prior Preferred Stock”), which resolution is and reads as follows:

RESOLVED, that pursuant to the authority expressly granted to and invested in the Board of Directors by the provisions of the Articles of Incorporation of the Corporation, as amended and Section 78.1955 of the NRS, a series of the preferred stock, par value $0.001 per share, of the Corporation be, and it hereby is, established; and

FURTHER RESOLVED, that the series of preferred stock of the Corporation be, and it hereby is, given the distinctive designation of “Series B Preferred Stock”; and

FURTHER RESOLVED, that the Series B Preferred Stock shall consist of ten million (10,000,000) shares; and

FURTHER RESOLVED, that the Series B Preferred Stock shall have the powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon set forth in this Certificate of Designation (the “Designation” or the “Certificate of Designation”) below, which shall amend, replace and supersede the Prior Preferred Stock in their entirety:

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 1 |

1.

Ranking. The Series B Preferred Stock shall, with respect to dividend rights, rights of redemption and rights upon liquidation, winding up or dissolution, rank equally with the Corporation’s Series B1 Preferred Stock issued pursuant to that certain Certificate of Designation of Vertex Energy, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series B1 Preferred Stock, filed by the Corporation with the Secretary of State of Nevada on or around May 11, 2016, as may be amended from time to time (the “Series B Preferred Stock”), senior to the Common Stock and the Series C Preferred Stock, each other class or series of shares of the Corporation that the Corporation may issue in the future the terms of which do not expressly provide that such class or series ranks equally with, or senior to, the Series B Preferred Stock, with respect to dividend rights, rights of redemption and/or rights upon liquidation, winding up or dissolution.

The Series B Preferred Stock shall, with respect to dividend rights, rights of redemption and rights upon liquidation, winding up or dissolution, rank equally with each other class or series of shares of the Corporation that the Corporation may issue in the future the terms of which expressly provide that such class or series shall rank equally with the Series B Preferred Stock with respect to dividend rights and rights upon liquidation, winding up or dissolution.

The Series B Preferred Stock shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank junior to each class or series of shares of the Corporation that the Corporation may issue in the future the terms of which expressly provide that such class or series shall rank senior to the Series B Preferred Stock with respect to dividend rights and rights upon liquidation, winding up or dissolution. The Series B Preferred Stock shall also rank junior to the Senior Securities and the Corporation’s existing secured indebtedness as of June 23, 2015.

Dividends.

2.1

Dividends in General. Dividends shall accrue quarterly on the Series B Preferred Stock beginning on the Closing Date, based on the Original Issue Price, at the Dividend Rate, until such Series B Preferred Stock is no longer outstanding either due to conversion, redemption or otherwise as provided herein (“Dividends”).

2.2

Payment of Dividends. The Corporation shall, in accordance with the terms set forth herein, pay the Holder of the Series B Preferred Stock the Accrued Dividends in cash, in shares of Common Stock (as discussed in Section 2.7) or in shares of Series B Preferred Stock (as discussed in Section 2.7), within five Business Days of the end of each fiscal quarter of the Corporation (currently March 31, June 30, September 30 and December 31, each, as applicable a “Dividend Payable Date”), for so long as the Series B Preferred Stock remains outstanding. If the Corporation is prohibited from paying the Accrued Dividends in cash (pursuant to the Senior Credit Agreement), or registered common stock, the Accrued Dividends will be paid in kind in Series B Preferred Stock.

2.3

Cash Dividend Payments. All Dividends payable in cash hereunder shall be made in lawful money of the United States of America to each Holder in whose name the Series B Preferred Stock is registered as set forth on the books and records of the Corporation. Such payments shall be made by wire transfer of immediately available funds to the account such Holder may from time to time designate by written notice to the Corporation or by Corporation cashier’s check, without any deduction, withholding or offset for any reason whatsoever except to the extent required by law.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 2 |

2.4

Participation. Subject to the rights of the holders, if any, of any shares of the Series A Convertible Preferred Stock or Series B1 Preferred Stock, the Holders shall, as holders of Series B Preferred Stock, be entitled to such dividends paid and Distributions made to the holders of Common Stock to the same extent as if such Holders had converted the Series B Preferred Stock into Common Stock (without regard to any limitations on conversion herein or elsewhere) and had held such shares of Common Stock on the record date for such dividends and Distributions. Payments under the preceding sentence shall be made concurrently with the dividend or Distribution to the holders of Common Stock. Following the occurrence of a Liquidation Event (as hereinafter defined) and the payment in full to a Holder of its applicable Liquidation Preference, such Holder shall cease to have any rights hereunder to participate in any future dividends or distributions made to the holders of Common Stock. No Distributions shall be made with respect to the Common Stock until all past due, if any, and/or declared Dividends on the Series B Preferred Stock have been paid or set aside for payment to the Holders. Notwithstanding the foregoing, the Holders shall have no right of participation in connection with dividends or Distributions made to the Common Stock shareholders consisting solely of shares of Common Stock.

2.5

Non-Cash Distributions. Whenever a Distribution provided for in this Section 2 shall be payable in property other than cash, the value of such Distribution shall be deemed to be the fair market value of such property as determined in good faith by the Board of Directors.

2.6

Other Distributions. Subject to the terms of this Certificate of Designation, and to the fullest extent permitted by the NRS, the Corporation shall be expressly permitted to redeem, repurchase or make distributions on the shares of its capital stock in all circumstances other than where doing so would cause the Corporation to be unable to pay its debts as they become due in the usual course of business or at any time that any amounts are outstanding and claimed under the Senior Credit Agreement (unless consent to such redemption, repurchase or distribution is provided by the lenders thereunder).

Stock Dividend Payments. In lieu of paying the Accrued Dividends in cash, at the option of the Corporation, the Corporation may pay Accrued Dividends in shares of Common Stock of the Corporation (“Dividend Shares”), provided that the Corporation shall not issue Dividend Shares to any Holder if such issuance would cause the Holder to exceed the Maximum Percentage described in Section 4.1(e) below. The total Dividend Shares issuable in connection with the payment by the Corporation of the Accrued Dividends in shares of Common Stock shall be equal to the total amount of Accrued Dividends which the Corporation has decided to pay in shares of Common Stock divided by the Dividend Shares Conversion Price on the applicable Dividend Payable Date. The payment of any Dividends in shares of Common Stock shall be subject in all cases to the Dividend Conversion Limitation. Notwithstanding any other provision of this Section, the Dividend Shares may only be issued in the event the Dividend Shares are covered by a valid and effective registration under the Securities Act that permits the unrestricted resale of the Dividend Shares at the time of receipt and any time thereafter. In the event the Corporation is prohibited from paying the Accrued Dividends in cash or shares of Common Stock, the Accrued Dividends shall be paid in shares of Series B Preferred Stock (“PIK Shares”) equal to the total amount of Accrued Dividends which the Corporation is paying in shares of Series B Preferred Stock divided by the Original Issue Price. At the time any payment of Accrued Dividends is required in the form of additional shares of Series B Preferred Stock, if the number of authorized but unissued shares of Series B Preferred Stock shall not be sufficient to effect such payment in additional shares of Series B Preferred Stock, in addition to such other remedies as shall be available to the holders of Series B Preferred Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Series B Preferred Stock to such number of shares as shall be sufficient for such purpose including, without limitation, engaging in commercially reasonable best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation or this Certificate of Designation.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 3 |

3.

Liquidation Rights.

Liquidation Preference. In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary (each a “Liquidation Event”), the holders of Series B Preferred Stock shall be entitled to receive pari passu with any Distribution of any of the assets of the Corporation to the holders of the Corporation’s Series B1 Preferred Stock and prior and in preference to any Distribution of any of the assets of the Corporation to the holders of the Corporation’s securities other than Senior Securities by reason of their ownership of such stock, but not prior to any holders of the Corporation’s Senior Securities, which holders of the Senior Securities shall have priority to the Distribution of any assets of the Corporation, an amount per share for each share of Series B Preferred Stock held by them equal to the sum of (i) the Liquidation Preference, and (ii) all Accrued Dividends and all declared but unpaid dividends on such share of Series B Preferred Stock. If upon the liquidation, dissolution or winding up of the Corporation, the assets of the Corporation legally available for distribution to the holders of the Series B Preferred Stock (i.e., after payment of the Corporation’s liabilities and payment to any holders of the Corporation’s Senior Securities and pari passu with the holders of the Series B1 Preferred Stock) are insufficient to permit the payment to such holders of the full amounts specified in this Section then the entire assets of the Corporation legally available for distribution shall be distributed with equal priority and pro rata among the holders of the Series B Preferred Stock in proportion to the full amounts they would otherwise be entitled to receive pursuant to this Section and applicable law.

3.2

Remaining Assets. After the payment to the Holders of Series B Preferred Stock and Series B1 Preferred Stock of the full preferential amounts specified above, the entire remaining assets of the Corporation legally available for distribution by the Corporation shall be distributed with equal priority and pro rata among the holders of Common Stock and other junior securities in proportion to the number of shares of Common Stock and other junior securities held by them.

Reorganization. For purposes of this Section 3, a Liquidation Event shall be deemed to occur upon (a) a sale, lease, exclusive license or other conveyance of all or substantially all of the assets of the Corporation or (b) any transaction or series of related transactions (including, without limitation, any reorganization, share exchange, consolidation or merger of the Corporation with or into any other entity but excluding any sale of capital stock by the Corporation for capital raising purposes) (i) in which the holders of the Corporation’s outstanding capital stock immediately before the first such transaction do not, immediately after any other such transaction, retain stock or other equity interests representing at least 50% of the voting power of the surviving entity of such transaction or (ii) in which at least 50% of the Corporation’s outstanding capital stock (calculated on an as-converted to Common Stock basis) is transferred; provided any transaction or event approved by a Majority In Interest shall not be considered a Liquidation Event hereunder.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 4 |

3.4

Valuation of Non-Cash Consideration. If any assets of the Corporation distributed to stockholders in connection with any liquidation, dissolution, or winding up of the Corporation are other than cash, then the value of such assets shall be their fair market value as determined in good faith by the Board of Directors. In the event of a merger or other acquisition of the Corporation by another entity, the Distribution date shall be deemed to be the date such transaction closes.

Conversion. The holders of the Series B Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

Holder Conversion.

(a)

Each share of Series B Preferred Stock and all Accrued Dividends shall be convertible, at the option of the holder thereof (a “Holder Conversion”), at any time following the Closing Date, at the office of the Corporation or any Transfer Agent for the Series B Preferred Stock, into that number of fully-paid, nonassessable shares of Common Stock determined by dividing (i) the Original Issue Price for the Series B Preferred Stock by the Conversion Price and (ii) the total Accrued Dividends desired to be converted divided by the Dividend Shares Conversion Price calculated as of the date of the Notice of Conversion, subject to the Dividend Conversion Limitation (such shares of Common Stock issuable upon a Conversion, the “Holder Conversion Shares”). In order to effectuate the Holder Conversion under this Section 4.1, the Holder must provide the Corporation a written notice of conversion in the form of Exhibit A hereto (the “Notice of Conversion”). The Notice of Conversion must be dated no earlier than three Business Days from the date the Notice of Conversion is actually received by the Corporation.

Mechanics of Conversion. In order to effect an Conversion, a holder shall fax or email a copy of the fully executed Notice of Conversion to the Corporation (or in the discretion of the Corporation, with notice to the Holder, the Transfer Agent)(Attention: Chris Carlson, Corporate Secretary, 1331 Gemini Street, Suite 250, Houston, Texas 77058, Fax: (281) 486-0217, Email: chrisc@vertexenergy.com, with a copy to (which shall not constitute notice) The Loev Law Firm, PC, Attn: David M. Loev, Esq., 6300 West Loop South, Suite 280, Bellaire, Texas 77401, Fax: (713) 524-4122, Email: dloev@loevlaw.com). Upon receipt by the Corporation (or the Transfer Agent) of a facsimile or emailed copy of a Notice of Conversion from a Holder, the Corporation (or the Transfer Agent) shall promptly send, via facsimile or email, a confirmation to such Holder stating that the Notice of Conversion has been received, the date upon which the Corporation (or the Transfer Agent) expects to deliver the Common Stock issuable upon such conversion and the name and telephone number of a contact person at the Corporation (or the Transfer Agent) regarding the Conversion. The holder shall surrender, or cause to be surrendered, the Preferred Stock Certificates being converted, duly endorsed, to the Corporation (or the Transfer Agent) at the address listed above within three Business Days of delivering the fully executed Notice of Conversion. The Corporation (or the Transfer Agent) shall not be obligated to issue shares of Common Stock upon a Conversion unless either (x) the Preferred Stock Certificates; or (y) the Lost Certificate Materials described in Section 12, below have been previously received by the Corporation or its Transfer Agent. In the event the Holder has lost or misplaced the certificates evidencing the Preferred Stock, the Holder shall be required to provide the Corporation or the Corporation’s Transfer Agent (as applicable) with whatever documentation and fees each may require to re-issue the Preferred Stock Certificates and shall be required to provide such re-issued Preferred Stock Certificates to the Corporation (or the Transfer Agent) within three Business Days of delivering the Notice of Conversion. Unless the Holder Conversion Shares are covered by a valid and effective registration under the Securities Act or the Notice of Conversion provided by the Holder includes a valid opinion from an attorney stating that such shares of Common Stock issuable in connection with the Notice of Conversion can be issued free of restrictive legend, which shall be determined by the Corporation (or the Transfer Agent) in its sole discretion, such shares shall be issued as Restricted Shares.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 5 |

(c)

Delivery of Common Stock upon Conversion. Upon the receipt of a Notice of Conversion, the Corporation (itself, or through its Transfer Agent) shall, no later than the third Business Day following the date of such receipt (subject to the surrender of the Preferred Stock Certificates by the holder within the period described in Section 4.1(b) or, in the case of lost, stolen or destroyed certificates, after provision of the Lost Certificate Materials) (the “Delivery Period”), issue and deliver (i.e., deposit with a nationally recognized overnight courier service postage prepaid) to the Holder or its nominee (x) a certificate representing the Holder Conversion Shares and (y) a certificate representing the number of shares of Series B Preferred Stock not being converted, if any. Notwithstanding the foregoing, if the Corporation’s Transfer Agent is participating in the Depository Trust Corporation (“DTC”) Fast Automated Securities Transfer program, and so long as the certificates therefor do not bear a legend and the holder thereof is not then required to return such certificate for the placement of a legend thereon, the Corporation shall cause its Transfer Agent to promptly electronically transmit the Common Stock issuable upon conversion to the Holder by crediting the account of the Holder or its nominee with DTC through its Deposit Withdrawal Agent Commission system (“DTC Transfer”). If the aforementioned conditions to a DTC Transfer are not satisfied, the Corporation shall deliver as provided above to the Holder physical certificates representing the Common Stock issuable upon Holder Conversion. Further, a Holder may instruct the Corporation to deliver to the Holder physical certificates representing the Common Stock issuable upon conversion in lieu of delivering such shares by way of DTC Transfer.

(d)

Failure to Provide Preferred Stock Certificates. In the event the Holder provides the Corporation with a Notice of Conversion, but fails to provide the Corporation with the Preferred Stock Certificates or the Lost Certificate Materials (as defined in Section 12 below), by the end of the Delivery Period, the Notice of Conversion shall be considered void and the Corporation shall not be required to comply with such Notice of Conversion. Provided that if the Notice of Conversion only relates to the conversion of Accrued Dividends, the Holder shall not be required to provide the Corporation any Preferred Stock Certificates.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 6 |

(e)

Beneficial Ownership Limitation for Holder Conversions and Voting. No Holder Conversion shall result in the conversion of more than that number of shares of Series B Preferred Stock, if any, such that, upon such Holder Conversion, the aggregate beneficial ownership of the Corporation’s Common Stock (calculated pursuant to Rule 13d-3 of the Exchange Act) of such Holder and all persons affiliated with such Holder as described in Rule 13d-3 is more than 9.999% of the Corporation’s Common Stock then outstanding (the “Maximum Percentage”). In the event any Holder Conversion would result in the issuance of shares of Common Stock to any Holder in excess of the Maximum Percentage, only that number of shares of Series B Convertible Preferred Stock which when Converted would not result in such Holder exceeding the Maximum Percentage shall be subject to such applicable Holder Conversion, if any, and Holder shall continue to hold any remaining shares of Series B Preferred stock, the conversion of which would result in Holder exceeding the Maximum Percentage. The Corporation’s Transfer Agent shall be authorized to promptly disclose the total outstanding shares of Common Stock of the Corporation to the Holder from time to time at the request of the Holder in order for the Holder to determine its compliance with the Maximum Percentage. The provisions of this Section 4.1(e) shall not be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 4.1(e) to correct this Section (or any portion hereof) which may be defective or inconsistent with the intended Maximum Percentage herein contained or to make changes or supplements necessary or desirable to properly give effect to such limitation. The Corporation shall not be required to verify or investigate or confirm whether any Holder Conversion would exceed the Maximum Percentage, and instead the Corporation shall be able to rely on any Notice of Holder Conversion as prima facie evidence of, and as a representation by, the applicable Holder, that such applicable conversion described in the Notice of Holder Conversion would not result in a violation of the Maximum Percentage Additionally, in no event shall any Holder have the right pursuant to Section 6 below, to vote, on any matter presented to the shareholders of the Corporation for their action or consideration at any meeting of shareholders of the Corporation (or by written consent of shareholders in lieu of meeting), a number of voting shares in excess of the Maximum Percentage.

4.2

Automatic Conversion.

(a)

Each share of Series B Preferred Stock, shall automatically and without any required action by any Holder, be converted into that number of fully-paid, non-assessable shares of Common Stock as determined by dividing the Original Issue Price by the Conversion Price, and that the Closing Sales Price of the Corporation’s Common Stock is equal to at least $6.20 per share of Common Stock as adjusted for Recapitalizations (the “Trading Price”) for a period of at least 20 consecutive Trading Days (an “Automatic Conversion” and together with a Holder Conversion, each a “Conversion”), at such time, if ever, following the earlier of (i) six months from the Closing Date or (ii) the effective date of a valid and effective registration statement under the Securities Act covering the resale of the Common Stock issuable upon conversion of the Series B Preferred Stock.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 7 |

(b)

Following an Automatic Conversion, the Corporation shall within two Business Days, deliver notice to each Holder that an Automatic Conversion has occurred, at the address of each Holder which the Corporation then has on record (an “Automatic Conversion Notice”); provided, that the Corporation is not required to receive any confirmation that such Automatic Conversion Notice was received by a Holder, but instead assuming such Automatic Conversion Notice was sent to the address which the Corporation then has on record for such Holder, the Automatic Conversion Notice shall be treated as received by the Holder for all purposes on the third Business Day following the date such notice was sent by the Corporation (the “Automatic Conversion Notice Receipt Date”). Within three Business Days following the Automatic Conversion Notice Receipt Date, the Corporation shall pay each Holder the total amount of Accrued Dividends owed on such Series B Preferred Stock, if any (the “Automatic Conversion Dividends”) in cash (subject to the terms of the Senior Credit Agreement) or at the option of the Corporation, in shares of Common Stock equal to the total Accrued Dividends divided by the Dividend Shares Conversion Price calculated on the applicable Automatic Conversion Notice Receipt Date, subject to the Dividend Conversion Limitation, and issue to each Holder all shares of Common Stock which such Holder is due in connection with the Automatic Conversion (the “Automatic Conversion Shares”, and together with the Holder Conversion Shares, the “Shares”) and promptly deliver such Automatic Conversion Shares (and if applicable, cash in an amount equal to the Accrued Dividends) to the address of Holder which the Corporation then has on record (a “Delivery”). The Automatic Conversion Shares issuable in connection with an Automatic Conversion shall be fully-paid, non-assessable shares of Common Stock. Unless the Automatic Conversion Shares are covered by a valid and effective registration under the Securities Act or the Holder provides a valid opinion from an attorney stating that such Automatic Conversion Shares can be issued free of restrictive legend, which shall be determined by the Corporation in its sole discretion, prior to the issuance date of such Automatic Conversion Shares, such Automatic Conversion Shares shall be issued as Restricted Shares.

(c)

The issuance and Delivery by the Corporation of the Automatic Conversion Shares (and if applicable, the cash Accrued Dividends) shall fully discharge the Corporation from any and all further obligations under or in connection with the Series B Preferred Stock and shall automatically, and without any required action by the Corporation or the Holder, result in the cancellation, termination and invalidation of any outstanding Series B Preferred Stock and Preferred Stock Certificates held by Holder or his, her or its assigns and shall upon the payment of the Automatic Conversion Dividends, fully discharge any and all requirement for the Corporation to pay Dividends on such Series B Preferred Stock shares converted, which Series B Preferred Stock converted shall cease accruing Dividends upon an Automatic Conversion.

(d)

Without limiting the obligation of each Holder set forth herein (including in the subsequent clause (e)), the Corporation and/or the Corporation’s Transfer Agent shall be authorized to take whatever action necessary, if any, following the issuance and Delivery of the Automatic Conversion Shares to reflect the cancellation of the Series B Preferred Stock subject to the Automatic Conversion, which shall not require the approval and/or consent of any Holder (a “Cancellation”).

(e)

Notwithstanding the above, each Holder, by accepting such Preferred Stock Certificates hereby covenants that it will, whenever and as reasonably requested by the Corporation and the Transfer Agent, at the Corporation’s sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as the Corporation or the Transfer Agent may reasonably require in order to complete, insure and perfect the Cancellation, if such may be reasonably required by the Corporation and/or the Corporation’s Transfer Agent.

(f)

In the event that the Delivery of any Automatic Conversion Shares (or any cash Accrued Dividends) is unsuccessful and/or any Holder fails to accept such Automatic Conversion Shares (or applicable cash Accrued Dividends), such Automatic Conversion Shares (and if applicable, cash Accrued Dividends) shall be held by the Corporation and/or the Transfer Agent in trust (without accruing interest) and shall be released to such Holder upon reasonable evidence to the Corporation or the Transfer Agent that such Holder is the legal owner of such Automatic Conversion Shares, provided that the Holder’s failure to accept such Automatic Conversion Shares, cash Accrued Dividends and/or the Corporation’s inability to Deliver such shares or dividends shall in no event effect the validity of the Cancellation.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 8 |

(g)

The Automatic Conversion Right shall supersede and take priority over the Holder’s Optional Conversion Right in the event that there are any conflicts between such rights.

(h)

The Maximum Percentage ownership limitation described in Section 4.1(e) above shall not apply to an Automatic Conversion, provided that the Automatic Conversion Shares, including any shares issuable in consideration for Accrued Dividends shall be subject to the Share Cap. In the event any Automatic Conversion would result, if Converted in full, in the Corporation exceeding the Share Cap, the maximum number of shares of Common Stock allowable under the Share Cap shall be issued pro rata to each Holder and, and subject to the terms of the Senior Credit Agreement, the remaining Series B Preferred Stock shares and/or Accrued Dividends shall be immediately redeemed by the Corporation as if such remaining portion of Series B Preferred Stock and/or Accrued Dividends was subject to a Mandatory Redemption on such Automatic Conversion Notice Receipt Date (as provided in Section 8 hereof, substituting the Automatic Conversion Notice Receipt Date for the Required Redemption Date in Section 8).

4.3

Fractional Shares. If any Conversion of Series B Preferred Stock would result in the issuance of a fractional share of Common Stock (aggregating all shares of Series B Preferred Stock being converted pursuant to a given Notice of Conversion), then subject to the terms of the Senior Credit Agreement, such fractional share shall be payable in cash based upon the market value of the Common Stock on the trading day immediately prior to the date of conversion (as determined in good faith by the Board of Directors) and the number of shares of Common Stock issuable upon conversion of the Series B Preferred Stock shall be the next lower whole number of shares. If the Corporation elects not to, or is unable to, make such a cash payment, the Holder shall be entitled to receive, in lieu of the final fraction of a share, one whole share of Common Stock.

4.4

Taxes. The Corporation shall not be required to pay any tax which may be payable in respect to any transfer involved in the issue and delivery of shares of Common Stock upon Conversion in a name other than that in which the shares of the Series B Preferred Stock so converted were registered, and no such issue or delivery shall be made unless and until the person requesting such issue or delivery has paid to the Corporation the amount of any such tax, or has established, to the satisfaction of the Corporation, that such tax has been paid. The Corporation shall withhold from any payment due whatsoever in connection with the Series B Preferred Stock any and all required withholdings and/or taxes the Corporation, in its sole discretion deems reasonable or necessary, absent an opinion from Holder’s accountant or legal counsel, acceptable to the Corporation in its sole determination, that such withholdings and/or taxes are not required to be withheld by the Corporation.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 9 |

4.5

No Impairment. The Corporation will not through any reorganization, transfer of assets, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation but will at all times in good faith assist in the carrying out of all the provisions of this Section 4 and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the holders of Series B Preferred Stock against impairment. Notwithstanding the foregoing, nothing in this Section shall prohibit the Corporation from amending its Articles of Incorporation with the requisite consent of its stockholders and the Board of Directors, provided that such amendment will not prohibit the Corporation from having sufficient authorized shares of Common Stock to permit conversion hereunder.

4.6

Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock solely for the purpose of effecting the conversion of the shares of the Series B Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding shares of the Series B Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series B Preferred Stock, the Corporation will use its commercially reasonable efforts to take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

4.7

Cap on Shares of Common Stock. Notwithstanding anything herein to the contrary, the maximum number of shares of Common Stock to be issued in connection with the Conversion of all of the outstanding shares of Series B Preferred Stock shares (and upon conversion or exercise of any other securities required to be aggregated with the Series B Preferred Stock pursuant to the applicable rules and requirements of the NASDAQ Capital Market), or otherwise as provided herein, shall not exceed such number of shares of Common Stock that would violate applicable listing rules of the NASDAQ Capital Market in the event the Corporation’s stockholders do not approve the issuance of the Common Stock issuable in connection with a Conversion (and upon conversion or exercise of any other securities required to be aggregated with the Series B Preferred Stock pursuant to the applicable rules and requirements of the NASDAQ Capital Market), or otherwise as provided herein (the “Share Cap”). In the event the number of shares of Common Stock to be issued hereunder (and upon conversion or exercise of any other securities required to be aggregated with the Series B Preferred Stock pursuant to the applicable rules and requirements of the NASDAQ Capital Market) in connection with a Conversion or otherwise, exceeds the Share Cap, then subject to the terms of the Senior Credit Agreement, the Corporation shall instead (i) immediately redeem such portion of Series B Preferred Stock, the conversion of which would exceed the Share Cap, in cash as if such applicable Series B Preferred Stock shares were subject to a Mandatory Redemption (as provided in Section 8 hereof); and (ii) pay any Accrued Dividends and future Dividends in cash, or shall otherwise first obtain the approval of the stockholders of the Corporation under applicable rules and requirements of the NASDAQ Capital Market prior to issuing such shares of Common Stock in excess of the Share Cap.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 10 |

5.

Adjustments for Recapitalizations.

Equitable Adjustments for Recapitalizations. (a) The Liquidation Preference and the Original Issue Price (each, as and if applicable) (the “Preferred Stock Adjustable Provisions”); (b) the Conversion Price, Dividend Shares Conversion Price and Trading Price (as and if applicable) (the “Common Stock Adjustable Provisions”), and (c) any and all other terms, conditions, amounts and provisions of this Designation which (i) pursuant to the terms of this Designation provide for equitable adjustment in the event of a Recapitalization (the “Other Equitable Adjustable Provisions”); or (ii) the Board of Directors of the Corporation determines in their reasonable good faith judgment is required to be equitably adjusted in connection with any Recapitalizations, shall each be subject to equitable adjustment as provided in Sections 5.2 through 5.3, below, as determined by the Board of Directors in their sole and reasonable discretion.

Adjustments for Subdivisions or Combinations of Common Stock. In the event the outstanding shares of Common Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Common Stock, without a corresponding subdivision of the Series B Preferred Stock, the applicable Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately and equitably adjusted. In the event the outstanding shares of Common Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Common Stock, without a corresponding combination of the Series B Preferred Stock, the Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately and equitably adjusted.

Adjustments for Subdivisions or Combinations of Series B Preferred Stock. In the event the outstanding shares of Series B Preferred Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Series B Preferred Stock, the applicable Preferred Stock Adjustable Provisions, Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately adjusted. In the event the outstanding shares of Series B Preferred Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Series B Preferred Stock, the applicable Preferred Stock Adjustable Provisions, Common Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately adjusted.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 11 |

5.4

Adjustments for Reclassification, Exchange and Substitution.

(a)

Except to the extent such Recapitalization Event is subject to Sections 5.1 through 5.3, above (the “Recapitalization and Adjustment Rights”), and/or Section 3 (“Liquidation Rights”), if at any time or from time to time after the Closing Date there shall occur any capital reorganization, recapitalization, reclassification, share exchange, restructuring, consolidation, combination or merger involving the Corporation in which the Common Stock (but not the Series B Preferred Stock) is converted into or exchanged for shares of stock or other securities or property (including cash) of the Corporation or otherwise (other than a transaction covered by the Recapitalization and Adjustment Rights or Liquidation Rights) (each a “Recapitalization Event”), provision shall be made so that each Series B Preferred Holder shall thereafter be entitled to receive upon conversion of the shares of Series B Preferred Stock held by such Series B Preferred Holder the kind and number of shares of stock or other securities or property (including cash or any combination thereof) of the Corporation or otherwise, to which a Common Stock shareholder holding the number of shares of Common Stock into which the shares of Series B Preferred Stock held by such Series B Preferred Holder are convertible immediately prior to such reorganization, recapitalization, reclassification, consolidation or merger (without regard for the Maximum Percentage) would have been entitled upon such event.

(b)

In the event that the holders of Common Stock have the opportunity to elect the form of consideration to be received in the business combination, then the Corporation shall make adequate provision whereby the holders of Series B Preferred Stock shall have the opportunity to determine the form of consideration into which all of the Series B Preferred Stock, treated as a single class, shall be convertible from and after the effective date of such business combination. If such opportunity is granted, such determination shall be based on the determination at a meeting duly called or via a written consent to action of a Majority In Interest, shall be subject to any limitations to which all holders of Common Stock are subject, such as pro rata reductions applicable to any portion of the consideration payable in such business combination, and shall be conducted in such a manner as to be completed by the date which is the earliest of (1) the deadline for elections to be made by holders of Common Stock and (2) two Business Days prior to the anticipated effective date of the business combination. Further, the Corporation shall not effect any such consolidation, merger or sale, unless prior to the consummation thereof, the successor entity (if other than the Corporation) resulting from consolidation or merger or the entity purchasing such assets assumes by written instrument, the obligation to deliver to each such holder such shares of stock, securities or assets as, in accordance with the foregoing provisions, such holder may be entitled to acquire.

(c)

If a conversion of Series B Preferred Stock is to be made in connection with a transaction contemplated by this Section 5.3 or a similar transaction affecting the Corporation (other than a tender or exchange offer), the conversion of any shares of Series B Preferred Stock may, at the election of the Holder thereof, be conditioned upon the consummation of such transaction, in which case such conversion shall not be deemed to be effective until such transaction has been consummated. In connection with any tender or exchange offer for shares of Common Stock, Holders of Series B Preferred Stock shall have the right to tender (or submit for exchange) shares of Series B Preferred Stock in such a manner so as to preserve the status of such shares as Series B Preferred Stock until immediately prior to such time as shares of Common Stock are to be purchased (or exchanged) pursuant to such offer, at which time that portion of the shares of Series B Preferred Stock so tendered which is convertible into the number of shares of Common Stock to be purchased (or exchanged) pursuant to such offer shall be deemed converted into the appropriate number of shares of Common Stock. Any shares of Series B Preferred Stock not so converted shall be returned to the Holder as Series B Preferred Stock.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 12 |

(d)

None of the foregoing provisions shall affect the right of a Holder of shares of Series B Preferred Stock to convert such Holder’s shares of Series B Preferred Stock into shares of Common Stock prior to the effective date of such business combination, subject to the terms of this Designation.

(e)

In the event of any Recapitalization Event falling under this Section 5.3, in such case, appropriate adjustment shall be made in the application of the provisions of this Section 5.3 with respect to the rights and interests of the Series B Preferred Holders after such events to the end that the provisions of this Section 5.3 (including, but not limited to, adjustment of the Conversion Price in respect of any shares of Series B Preferred Stock then in effect and the number of shares issuable upon conversion of all such shares of Series B Preferred Stock) shall be applicable after that event as nearly reasonably as may be. The Corporation may not become a party to any such transaction unless its terms are consistent with the preceding requirements and such transaction is otherwise effected in accordance with this Designation.

5.5

Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment pursuant to this Section 5, the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Series B Preferred Stock a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the reasonable written request at any time of any holder of Series B Preferred Stock, furnish or cause to be furnished to such holder a like certificate setting forth (i) such adjustments and readjustments, (ii) the Conversion Price at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of the Series B Preferred Stock.

Voting.

Restricted Class Voting. In addition to any class or series voting rights provided to the holders of Series B Preferred Stock herein or required by law, on any matter presented to the shareholders of the Corporation for their action or consideration at any meeting of shareholders of the Corporation (or by written consent of shareholders in lieu of meeting), each holder of outstanding shares of Series B Preferred Stock shall be entitled to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of Series B Preferred Stock held by such holder are convertible as of the record date for determining shareholders entitled to vote on such matter, subject in all cases to the Maximum Percentage (i.e., in no event shall any Holder have the right to vote more voting shares in connection with the terms of this Section 6.1 than as equals its individual Maximum Percentage (when aggregated with all other voting shares beneficially owned by such Holder as of such applicable record date)), and shall be entitled, notwithstanding any provision hereof, to notice of any shareholders’ meeting in accordance with the bylaws of the Corporation. Fractional votes shall not, however, be permitted and any fractional voting rights available on an as-converted to Common Stock basis (after aggregating all fractional shares into which shares of Series B Preferred Stock held by each holder could be converted) shall be rounded to the nearest whole share (with one-half being rounded upward). Except as provided by law or by the other provisions of the Articles of Incorporation or this Designation, holders of Series B Preferred Stock shall vote together with the holders of Common Stock as a single class. In the event any Holder’s voting rights under this Section 6.1 are limited by the Maximum Percentage, the total number of voting shares eligible to be voted on the applicable matter shall similarly be decreased. For the sake of clarity, the purpose of this Section 6 is to limit the maximum voting rights of the Series B Preferred Stock shares held by any individual Holder, to the lesser of (a) 9.99% of the Corporation’s Common Stock then outstanding; and (b) such number of voting shares of the Corporation, if any, that, when added together with the other voting securities of the Corporation beneficially owned (as calculated pursuant to Rule 13d-3 of the Exchange Act) by such Holder, totals 9.99% of the Corporation’s then outstanding Common Stock.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 13 |

6.2

No Series Voting. Other than as provided herein or required by law, there shall be no series voting.

Protective Provisions.

Subject to the rights of series of preferred stock which may from time to time come into existence, so long as any shares of Series B Preferred Stock are outstanding, the Corporation shall not, without first obtaining the approval (at a meeting duly called or by written consent, as provided by law) of the holders of a Majority In Interest:

(a)

Increase or decrease (other than by redemption or conversion) the total number of authorized shares of Series B Preferred Stock (except to the extent required to issue PIK Shares if required by the terms set forth herein, which for the sake of clarity, and without otherwise limiting this provision, shall not require approval of the Holders);

(b)

Re-issue any shares of Series B Preferred Stock converted or redeemed pursuant to the terms of this Designation (except to the extent required to issue PIK Shares if required by the terms set forth herein, which for the sake of clarity, and without otherwise limiting this provision, shall not require approval of the Holders);

(c)

Create, or authorize the creation of, or issue or obligate itself to issue shares of, any class or series of capital stock unless the same ranks junior to (and not pari passu with) the Series B Preferred Stock with respect to the distribution of assets on the liquidation, dissolution or winding up of the Corporation, the payment of dividends and rights of redemption, or increase the authorized number of shares of any additional class or series of capital stock unless the same ranks junior to (and not pari passu with) the Series B Preferred Stock with respect to the distribution of assets on the liquidation, dissolution or winding up of the Corporation, the payment of dividends and rights of redemption, in each such case, other than issuances of (or in connection with issuances of) shares of Series B Preferred Stock pursuant to the Purchase Agreement and PIK Shares;

(d)

Effect an exchange, reclassification, or cancellation of all or a part of the Series B Preferred Stock (except pursuant to Section 5.3 hereof, which shall not require any approval or consent of the Holders);

(e)

Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series B Preferred Stock (except pursuant to Section 5.3 hereof, which shall not require any approval or consent of the Holders);

(f)

Issue any shares of Series B Preferred Stock other than pursuant to the Purchase Agreement or as PIK Shares;

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 14 |

(g)

Alter or change the rights, preferences or privileges of the shares of Series B Preferred Stock so as to affect adversely the shares of such series; or

(h)

Amend or waive any provision of the Corporation’s Articles of Incorporation or Bylaws relative to the Series B Preferred Stock so as to affect adversely the shares of Series B Preferred Stock in any material respect as compared to holders of other series of shares.

Redemption Rights.

Optional Corporation Redemption. Subject to the terms of the Senior Credit Agreement, the Corporation shall have the option, exercisable from time to time after the Corporation Redemption Triggering Date, to redeem all or any portion of the outstanding shares of Series B Preferred Stock (a “Corporation Redemption”) which have not been previously Converted into Common Stock (as provided above in Section 4) (the “Corporation Redemption Rights”), by paying each applicable Holder, an amount equal to (a) the Original Issue Price multiplied by the number of Series B Preferred Stock shares held by each applicable Holder, subject to the Corporation Redemption; plus (b) the Accrued Dividends (the “Corporation Redemption Amount”).

In the event the Corporation exercises its Corporation Redemption Rights, it shall redeem and repurchase Series B Preferred Stock pari passu with the Series B1 Preferred Stock and pro rata between all Holders based on the Pro Rata Amount, provided that the Corporation shall have the option in its sole discretion, without the required approval of any Holders, to redeem and repurchase up to 100% of the outstanding shares of Series B Preferred Stock held by any Holder pursuant to Section 8.1 above, with the proceeds raised from such Holder in connection with the Holder’s investment in the Corporation’s Series B1 Offering, without requiring the Corporation to redeem or repurchase any other Holder’s Series B Preferred Stock or make a pro rata redemption or repurchase of any shares of Series B Preferred Stock.

(b)

To exercise the Corporation Redemption Right, the Corporation shall deliver to each Holder an irrevocable written notice (a “Corporation Redemption Notice”), indicating the date the Corporation intends to pay the Corporation Redemption Amount (as applicable, the “Corporation Redemption Date”), which date may not be less than ten days nor more than 20 days from the date the Corporation Redemption Notice is delivered to a Holder. In the event the applicable aggregate Corporation Redemption Amount is not paid to the Holders on the applicable Corporation Redemption Date, the Corporation Redemption Notice shall be considered void and of no force or effect.

(c)

Notwithstanding the foregoing, the Series B Preferred Stock may not be redeemed unless and until all amounts outstanding and claimed under the Senior Credit Agreement have been paid in full in cash.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 15 |

8.2

Mandatory Corporation Redemption. Notwithstanding the Corporation Redemption Rights set forth in Section 8.1, above, the Corporation shall, subject to the terms of the Senior Credit Agreement, be required to redeem all then outstanding shares of Series B Preferred Stock within two Business Days of the Required Redemption Date (“Mandatory Redemption” and together with a Corporation Redemption, a “Redemption”). A Mandatory Redemption shall be effected by the Corporation, within two Business Days of the Required Redemption Date (the “Post-Redemption Triggering Period”), by paying each Holder an amount in cash equal to (a) the Original Issue Price multiplied by the number of Series B Preferred Stock shares held by each applicable Holder, subject to the Mandatory Redemption; plus (b) the Accrued Dividends (the “Mandatory Redemption Amount” and together with the Corporation Redemption Amount, each as applicable, a “Redemption Amount”) and promptly delivering such Mandatory Redemption Amount to the address of Holder which the Corporation then has on record. The date of such Redemption Delivery (as defined below) shall be defined herein as the “Mandatory Redemption Date”). The Holders shall be prohibited from Converting the Series B Preferred Stock during the Post-Redemption Triggering Period, unless the Corporation shall allow such Conversion, at the Corporation’s sole option and its sole discretion.

8.3

Effect of Redemption. The payment by the Corporation to each Holder (at each such Holder’s address of record) (or if the Holder fails to deliver the Preferred Stock Certificates and/or Lost Certificate Materials required to be delivered as discussed below in connection with such Redemption, upon the Corporation setting aside such Redemption Amount in trust for the benefit of the Holder) of the Corporation Redemption Amount or Mandatory Redemption Amount (as applicable, a “Redemption Delivery”) in connection with a Corporation Redemption or Mandatory Redemption, as applicable, and effective as of the Corporation Redemption Date or the Mandatory Redemption Date, as applicable, shall fully discharge the Corporation from any and all further obligations under the Series B Preferred Stock shares redeemed and shall automatically, and without any required action by the Corporation or the Holder or his, her or its assigns (including the requirement that the Holder provide the Corporation or the Corporation’s Transfer Agent the Preferred Stock Certificates relating to such Corporation Redemption), result in the cancellation, termination and invalidation of any outstanding Series B Preferred Stock and related Preferred Stock Certificates held by a Holder which are subject to a Corporation Redemption or Mandatory Redemption, as applicable and shall upon the payment of the applicable Redemption Amount, fully discharge any and all requirement for the Corporation to pay further Dividends, and which Series B Preferred Stock shall cease accruing Dividends upon a Redemption.

8.4

Further Actions Following Redemption. Without limiting the obligation of each Holder set forth herein (including in the subsequent Section 8.5), the Corporation and/or the Corporation’s Transfer Agent shall be authorized to take whatever action necessary, if any, following the payment of the Corporation Redemption Amount or Mandatory Redemption Amount, to reflect the cancellation of the Series B Preferred Stock subject to the applicable Redemption, which shall not require the approval and/or consent of any Holder, and provided that by agreeing to the terms and conditions of this Designation and the acceptance of the Series B Preferred Stock, each Holder hereby agrees to release the Corporation and the Corporation’s Transfer Agent from any and all liability whatsoever in connection with the cancellation of the Series B Preferred Stock subject to and following a Corporation Redemption and/or a Mandatory Redemption, regardless of the return to the Corporation or the Transfer Agent of any Preferred Stock Certificates evidencing such Series B Preferred Stock subject to the Corporation Redemption and/or Mandatory Redemption, as applicable, which as stated above, shall be automatically cancelled upon the payment of the Corporation Redemption Amount and Mandatory Redemption Amount, as applicable to the Holder, or if the provisions of Section 8.6 apply and the Holder fails to deliver the Preferred Stock Certificates and/or Lost Certificate Materials, upon the Corporation setting aside such Redemption Amount in trust for the benefit of the Holder (a “Redemption Cancellation”).

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 16 |

8.5

Further Redemption Assurances. Notwithstanding the above, each Holder, by accepting such Preferred Stock Certificates hereby covenants that it will (a) deliver to the Corporation or the Corporation’s Transfer Agent, promptly upon the receipt of any Corporation Redemption Notice, but in any case prior to the applicable Corporation Redemption Date, and/or promptly upon the occurrence of the Required Redemption Date, the applicable Preferred Stock Certificates relating to the Corporation Redemption and Mandatory Redemption, as applicable (or Lost Certificate Materials associated therewith); and (b) whenever and as reasonably requested by the Corporation and the Corporation’s Transfer Agent, at the Corporation’s sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as the Corporation or the Transfer Agent may reasonably require in order to complete, insure and perfect a Redemption Cancellation, if such may be reasonably required by the Corporation and/or the Corporation’s Transfer Agent.

Additional Redemption Procedures. In the event that (a) Redemption Delivery is unsuccessful notwithstanding the fact that the Corporation has mailed such applicable Corporation Redemption Amount and/or Mandatory Redemption Amount to the correct address of the Holder as set forth in the records of the Corporation; or (b) any Holder fails to timely deliver to the Corporation for cancellation the Preferred Stock Certificates evidencing the Series B Preferred Stock subject to such Corporation Redemption and/or Mandatory Redemption, or Lost Certificate Materials associated therewith, and the Corporation therefore refrains from completing a Redemption Delivery, such Corporation Redemption Amount and/or Mandatory Redemption Amount shall be held by the Corporation in trust and such Redemption Amount shall be released to such Holder upon reasonable evidence to the Corporation or the Transfer Agent that such Holder is (y) the legal owner of such Corporation Redemption Amount and/or Mandatory Redemption Amount and/or (z) the delivery to the Corporation or its Transfer Agent of the applicable Preferred Stock Certificates, as applicable, or Lost Certificate Materials, provided that the Holder’s failure to accept such Corporation Redemption Amount and/or Mandatory Redemption Amount, the Corporation’s inability to pay any Holder its applicable Redemption Amount, and/or the Holder’s failure to deliver the Preferred Stock Certificates or Lost Certificate Materials, under either of such circumstances shall in no event effect the validity of the Corporation Redemption Cancellation, Redemption Cancellation, or the consequences of a Corporation Redemption Delivery or Mandatory Redemption Delivery as described in Section 8.1 and Section 8.2 hereof. Furthermore, the Holder shall be due no interest on the Corporation Redemption Amount and/or Mandatory Redemption Amount while being held by the Corporation in trust and any and all interest, if any, which shall accrue on such amount shall be the sole property of the Corporation.

8.7

Further Holder Redemption Assurances. Notwithstanding the above, each Holder, by accepting such Preferred Stock Certificates will whenever and as reasonably requested by the Corporation and the Corporation’s Transfer Agent, at its sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as the Corporation or the Transfer Agent may reasonably require in order to complete, insure and perfect the cancellation of such Holder’s shares in the event of a Corporation Redemption and/or Mandatory Redemption, if such may be reasonably required by the Corporation and/or the Corporation’s Transfer Agent.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 17 |

8.8

Effect of All Redemptions. The Series B Preferred Stock subject to a Corporation Redemption and/or Mandatory Redemption shall cease accruing any Dividends and shall have all Conversion rights immediately terminate effective as of the Corporation Redemption Date or the Mandatory Redemption Date, unless otherwise agreed in the sole discretion of the Corporation.

8.9

Redemption Failure. In the event the Corporation is prohibited from completing a Mandatory Redemption by the Senior Credit Agreement, the Series B Preferred Stock shall remain outstanding until such time as the Corporation is no longer prohibited by the Senior Credit Agreement from completing a Mandatory Redemption and at that time the Corporation shall immediately redeem the Series B Preferred Stock pursuant to this Section 8. During the period the Corporation is prohibited from completing a Mandatory Redemption by the Senior Credit Agreement, the term “Dividend Rate” shall mean 10%.

9.

Notices.

9.1

In General. Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile or email transmission, and shall be effective, unless otherwise provided herein, three days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party. The addresses for such communications are (i) if to the Corporation to, Chris Carlson, Corporate Secretary, 1331 Gemini Street, Suite 250, Houston, Texas 77058, Fax: (281) 486-0217, Telephone: (866) 660-8156, Email: chrisc@vertexenergy.com, with a copy to (which shall not constitute notice) The Loev Law Firm, PC, Attn: David M. Loev, 6300 West Loop South, Suite 280, Bellaire, Texas 77401, Fax: (713) 524-4122, Email: dloev@loevlaw.com, and (ii) if to any Holder to the address set forth in the records of the Corporation or its Transfer Agent, as applicable, or such other address as may be designated in writing hereafter, in the same manner, by such person.

9.2

Notices of Record Date. In the event that the Corporation shall propose at any time:

(a)

to declare any Distribution upon its Common Stock, whether in cash, property, stock or other securities, whether or not a regular cash dividend and whether or not out of earnings or earned surplus;

(b)

to effect any reclassification or recapitalization of its Common Stock outstanding involving a change in the Common Stock; or

(c)

to voluntarily liquidate or dissolve or undertake a Liquidation Event;

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 18 |

then, in connection with each such event, the Corporation shall send to the Holders of the Series B Preferred Stock at least ten Business Days’ prior written notice of the date on which a record shall be taken for such Distribution (and specifying the date on which the holders of Common Stock shall be entitled thereto and, if applicable, the amount and character of such Distribution) or for determining rights to vote in respect of the matters referred to in (b) and (c) above.

Such written notice shall be given by first class mail (or express courier), postage prepaid, addressed to the holders of Series B Preferred Stock at the address for each such holder as shown on the books of the Corporation and shall be deemed given on the date such notice is mailed.

The notice provisions set forth in this section may be shortened or waived prospectively or retrospectively by the vote or written consent of the holders of a Majority In Interest, voting together as a single class.

10.

No Preemptive Rights. No Holder shall have the right to repurchase shares of capital stock of the Corporation sold or issued by the Corporation except to the extent that such right may from time to time be set forth in a written agreement between the Corporation and such stockholder.

11.

Reports. The Corporation shall mail to all holders of Series B Preferred Stock those reports, proxy statements and other materials that it mails to all of its holders of Common Stock.

Replacement Preferred Stock Certificates. In the event that any Holder notifies the Corporation that a Preferred Stock Certificate evidencing shares of Series B Preferred Stock has been lost, stolen, destroyed or mutilated, the Corporation shall issue a replacement stock certificate evidencing the Series B Preferred Stock identical in tenor and date (or if such certificate is being issued for shares not covered in a redemption or conversion, in the applicable tenor and date) to the original Preferred Stock Certificate evidencing the Series B Preferred Stock, provided that the Holder executes and delivers to the Corporation and/or its Transfer Agent, as applicable, an affidavit of lost stock certificate and an agreement reasonably satisfactory to the Corporation and its Transfer Agent to indemnify the Corporation from any loss incurred by it in connection with such Series B Preferred Stock certificate, and provides the Corporation and/or its Transfer Agent such other information, documents and if applicable, bonds and indemnities as the Corporation or its Transfer Agent customarily requires for reissuances of stock certificates (collectively the “Lost Certificate Materials”); provided, however, the Corporation shall not be obligated to re-issue replacement stock certificates if the Holder contemporaneously requests the Corporation to convert or redeem the full number of shares evidenced by such lost, stolen, destroyed or mutilated certificate.

13.

No Other Rights or Privileges. Except as specifically set forth herein, the Holders of the Series B Preferred Stock shall have no other rights, privileges or preferences with respect to the Series B Preferred Stock.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 19 |

14.

Construction. When used in this Designation, unless a contrary intention appears: (i) a term has the meaning assigned to it; (ii) “or” is not exclusive; (iii) “including” means including without limitation; (iv) words in the singular include the plural and words in the plural include the singular, and words importing the masculine gender include the feminine and neuter genders; (v) any agreement, instrument or statute defined or referred to herein or in any instrument or certificate delivered in connection herewith means such agreement, instrument or statute as from time to time amended, modified or supplemented and includes (in the case of agreements or instruments) references to all attachments thereto and instruments incorporated therein; (vi) the words “hereof”, “herein” and “hereunder” and words of similar import when used in this Designation shall refer to this Designation as a whole and not to any particular provision hereof; (vii) references contained herein to Article, Section, Schedule and Exhibit, as applicable, are references to Articles, Sections, Schedules and Exhibits in this Designation unless otherwise specified; (viii) references to “dollars”, “Dollars” or “$” in this Designation shall mean United States dollars; (ix) reference to a particular statute, regulation or law means such statute, regulation or law as amended or otherwise modified from time to time; (x) any definition of or reference to any agreement, instrument or other document herein shall be construed as referring to such agreement, instrument or other document as from time to time amended, supplemented or otherwise modified (subject to any restrictions on such amendments, supplements or modifications set forth herein); (xi) unless otherwise stated in this Designation, in the computation of a period of time from a specified date to a later specified date, the word “from” means “from and including” and the words “to” and “until” each mean “to but excluding”; (xii) references to “days” shall mean calendar days; and (xiii) the paragraph and section headings contained in this Designation are for convenience only, and shall in no manner affect the interpretation of any of the provisions of this Designation.

15.

Miscellaneous.

15.1

Cancellation of Series B Preferred Stock. If any shares of Series B Preferred Stock are converted pursuant to Section 4 or redeemed or repurchased by the Corporation pursuant to Section 8, the shares so converted or redeemed shall be canceled and shall return to the status of designated, but unissued Series B Preferred Stock.

15.2

Further Assurances. Each Holder hereby covenants that, in consideration for receiving shares of Series B Preferred Stock, that he, she or it will, whenever and as reasonably requested by the Corporation, do, execute, acknowledge and deliver any and all such other and further acts, deeds, confirmations, agreements and documents as the Corporation or its Transfer Agent may reasonably require in order to complete, insure and perfect any of the terms, conditions or provisions of this Designation, including, but not limited to, (a) any Automatic Conversion; and/or (b) any Redemption.

15.3

Technical, Corrective, Administrative or Similar Changes. The Corporation may, by any means authorized by law and without any vote of the Holders of shares of the Series B Preferred Stock, make technical, corrective, administrative or similar changes in this Designation that do not, individually or in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Series B Preferred Stock.

15.4

Waiver/Amendment. Notwithstanding any provision in this Designation to the contrary, any provision contained herein and any right of the holders of Series B Preferred Stock granted hereunder may be waived and/or amended as to all shares of Series B Preferred Stock (and the Holders thereof) upon the written consent of a Majority In Interest, unless a higher percentage is required by applicable law, in which case the written consent of the Holders of not less than such higher percentage of shares of Series B Preferred Stock shall be required.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 20 |

15.5

Interpretation. Whenever possible, each provision of this Designation shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Designation. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

15.6

No Other Rights. Except as may otherwise be required by law, the shares of the Series B Preferred Stock shall not have any powers, Designation, preferences or other special rights, other than those specifically set forth in this Designation.

16.

Definitions. In addition to other terms defined throughout this Designation, the following terms have the following meanings when used herein:

16.1

“Accrued Dividends” means Dividends which have accrued and are unpaid on the Series B Preferred Stock as of the applicable date of determination.

16.2

“Business Day” means any day except Saturday, Sunday or any day on which banks are authorized by law to be closed in the City of Houston, Texas.

16.3

“Closing Book Value/Market Price” means the greater of (a) the book value of the Corporation’s Common Stock; and (b) the market price of the Corporation’s Common Stock, each as calculated pursuant to the applicable rules and regulations of the NASDAQ Capital Market on the Closing Date.

16.4

“Closing Date” means the first closing date of the transactions contemplated by the Purchase Agreement.

16.5

“Closing Sales Price” means the last sales price of the Common Stock on the Principal Market as reported by NASDAQ.com (or a comparable reporting service of national reputation selected by the Corporation and reasonably acceptable to a Majority In Interest of the Holders if NASDAQ.com is not then reporting closing sales prices of the Common Stock) (collectively, “NASDAQ.com”), or if the foregoing does not apply, the last reported sales price of such security on a national exchange or in the over-the-counter market on the electronic bulletin board for such security as reported by NASDAQ.com, or, if no such price is reported for such security by NASDAQ.com, the average of the bid prices of all market makers for such security as reported in the “pink sheets” market maintained by OTC Market Group, in each case for such date or, if such date was not a Trading Day for such security, on the next preceding date that was a Trading Day. If the Closing Sales Price cannot be calculated for such security as of either of such dates as provided above, the Closing Sales Price of such security on such date shall be the fair market value as reasonably determined by an investment banking firm selected by the Corporation and reasonably acceptable to a Majority In Interest of the Holders, with the costs of such appraisal to be borne by the Corporation.

| Vertex Energy: Amended and Restated Certificate of Designation of Series B Preferred Stock | Page 21 |

16.6

“Common Stock” shall mean the common stock, $0.001 par value per share of the Corporation.

16.7

“Conversion Price” shall equal $3.10 per share, subject to adjustment in connection with any Recapitalization.

16.8

“Corporation Redemption Triggering Date” means the two year anniversary of the Closing Date.

16.9