UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01976

Sequoia Fund, Inc.

(Exact name of registrant as specified in charter)

9 West 57th Street, Suite 5000

New York, NY 10019

(Address of principal executive offices) (Zip code)

David M. Poppe

Ruane, Cunniff & Goldfarb Inc.

9 West 57th Street

Suite 5000

New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 686-6884

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

Item 1. Reports to Stockholders.

Report to Shareholders.

ANNUAL

REPORT

December 31, 2017

Sequoia Fund, Inc.

| Page | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 14 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

Sequoia Fund, Inc.

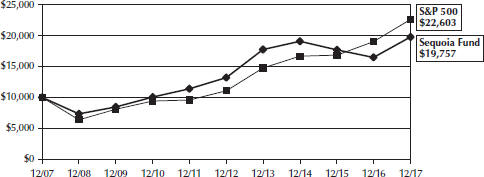

Illustration of an Assumed Investment of $10,000

(Unaudited)

The table below covers the period from July 15, 1970 (the date Sequoia Fund, Inc. (the ”Fund“) shares were first offered to the public) through December 31, 2017. This period was one of widely fluctuating common stock prices.The results shown, which assume reinvestment of distributions, represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance shown. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

|

Please consider the investment objectives, risks and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other information about the Fund.You may obtain year to date performance as of the most recent month end, and a copy of the prospectus by calling 1-800-686-6884, or on the Fund’s website at www.sequoiafund.com. Please read the prospectus carefully before investing.

|

|

Shares of the Fund are offered through the Fund’s distributor, Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC is an affiliate of Ruane, Cunniff & Goldfarb Inc. and is a member of FINRA. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

3

Sequoia Fund, Inc.

Annual Fund Operating Expenses

(Unaudited)

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees (fees paid directly from your investment)

The Fund does not impose any sales charges, exchange fees or redemption fees.

Annual Fund Operating Expenses (expenses that are deducted from Fund assets)

| Management Fees | 1.00 | % | ||||

| Other Expenses | 0.07 | % | ||||

| Total Annual Fund Operating Expenses* | 1.07 | % | ||||

*Does not reflect Ruane, Cunniff & Goldfarb Inc.’s (‘‘Ruane, Cunniff & Goldfarb’’) contractual reimbursement of a portion of the Fund’s operating expenses. This reimbursement is a provision of Ruane, Cunniff & Goldfarb’s investment advisory contract with the Fund and the reimbursement will be in effect only so long as that investment advisory contract is in effect. The expense ratio presented is from the Prospectus dated May 1, 2017. For the year ended December 31, 2017, the Fund’s annual operating expenses and investment advisory fee, net of such reimbursement, were 1.00% and 0.93%, respectively.

4

Sequoia Fund, Inc.

Dear Shareholder:

Sequoia Fund’s results for the quarter and year ended December 31, 2017 appear below with comparable results for the S&P 500 Index:

| Through December 31, 2017 |

Sequoia Fund | S&P 500 Index* | ||

| Fourth quarter |

5.57% | 6.64% | ||

| 1 Year |

20.07% | 21.83% | ||

| 5 Years (Annualized) |

8.44% | 15.79% | ||

| 10 Years (Annualized) |

7.05% | 8.50% | ||

| Since Inception (Annualized)** |

13.65% | 11.00% |

The performance data for the Fund shown above represents past performance and assumes reinvestment of dividends. Past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged capitalization-weighted index of the common stocks of 500 major U.S. corporations.

**Inception Date: July 15, 1970.

• • • • • • • • • •

The team presently managing the Fund took control at the end of the first quarter of 2016 and finished liquidating the Valeant investment by the end of the second quarter of that year. In the eighteen months since, Sequoia has appreciated 29%, versus 31% for the S&P 500 Index. As our historical tendency has been to lag in ebullient environments and outperform in choppier ones, we are generally pleased to have kept pace with a rapidly appreciating stock market.

It won’t last— neither the hot market nor the tight link between our results and those of the Index. Regarding the stock market, while we all asked Santa for a few more 2017s over the next few years, simple math suggests that he won’t deliver. Whether you invest in individual securities or the Index, the same three factors drive your return: earnings growth, dividend yield and valuation. The yield is the easy part— you know that piece of the equation up front (presently 1.9% for the Index). The rate of future earnings growth involves guesswork, but is relatively predictable in the case of the broader stock market because the rate at which S&P 500 earnings grow over the long term is necessarily tied to the pace at which the overall economy expands, and trends in GDP growth don’t change much over time. Consensus Wall Street estimates for 20181 imply that the constituents of the Index will have increased their per-share earnings 5% a year over the 12 years since Index profits peaked back in 2006. They also imply that in real terms— that is, adjusted for inflation— S&P earnings will have grown since 2006 at the same rate they’ve grown for the last fifty years.

1Source: Bloomberg.

5

Sequoia Fund, Inc.

Shareholder Letter (Continued)

While the yield of the Index is a known quantity and its rate of earnings growth typically fluctuates within a narrow band, the wild card for any investor in the broader market is valuation. When price/earnings ratios rise, stock prices can appreciate at a much faster rate than company earnings. But the price that investors will pay for a dollar of earnings can’t rise forever. At roughly 18x the earnings that the Wall Street consensus expects for 2018, the Index trades for a full price by historical standards, and nearly double the P/E ratio that prevailed at the beginning of the bull market back in 2009. With interest rates near fifty-year lows, stocks probably warrant a high valuation. Whether it can climb higher is anyone’s guess, but it’s a good bet that earnings growth and dividend yield will play much greater roles in determining Index returns in the future than they have in the recent past. If the P/E ratio of the market holds steady from here, a 2% dividend yield and 5% likely earnings growth imply long-term stock market returns somewhere in the neighborhood of 7% per year— a far cry from the 30% gain since June 2016 and the blistering 15% annual increase over the nine years since the crash in 2008.

Another good bet is that whatever stocks do over the long-term future, Sequoia’s results will deviate from those of the Index to a much greater degree than they have over the last eighteen months. That’s very much by design. Bill Ruane and Rick Cunniff built our firm on the simple but powerful idea that if you want a different result from the average investor, you should focus on your best ideas and create a portfolio that looks very different from the market averages. It goes without saying that a portfolio of shares in twenty companies is much more likely to stray sharply from the general direction of the stock market than a portfolio of 200. If you pick the right twenty and hold on long enough for their business results to shine through in their stock prices, that divergence should accrue to your benefit.

We believe that Sequoia owns a collection of 22 businesses whose aggregate quality, growth prospects and valuation make them a much more appealing investment than the 500 companies of the S&P Index. Sequoia’s portfolio trades for 21 times the earnings we think our companies will produce in 2018.2 That represents a modest premium to the price/earnings ratio of the Index, but the premium is well deserved, as we expect the per-share earning power of the portfolio to grow 21% in 2018 and 16% in 2019, versus 11% and 10%, respectively, for the Index. By our estimates, the aggregate return on equity of our portfolio substantially exceeds that of the Index, and we believe the earnings of our companies are more resilient to the vagaries of the economic cycle than those of the companies that make up the Index.

2As referenced, this is based on our internal estimates and not the consensus of Wall Street analysts. Our internal estimates reflect how we think a sensible owner would calculate the earnings of a business, and they can deviate significantly from GAAP or “consensus” earnings. Thus when we compare the P/E ratio of our portfolio based on our estimates to the P/E ratio of the Index based on Wall Street consensus, we are to some extent comparing apples and oranges. We consider the comparison a relevant one nonetheless, because while our internal estimates do attribute more earning power than the Wall Street consensus to companies like Amazon that charge many of their growth investments against current earnings (more later), our estimates are often more conservative than Wall Street numbers that exclude costs like stock-based compensation and “extraordinary” restructuring charges, which to us are very real business expenses.

6

Sequoia Fund, Inc.

Shareholder Letter (Continued)

Importantly, while we prefer the investment merits of our present portfolio to those of the Index, Sequoia does not stand still. Our job as managers of the Fund is to combine painstaking primary research and thoughtful, disciplined judgment in order to steadily improve our holdings over time. Time will tell if we’re right, but we believe that our purchases and sales during 2017 enhanced the inherent quality and growth rate of the Fund’s underlying earnings stream without increasing the Fund’s aggregate valuation relative to its earnings. Many of the positions that we sold or reduced last year trade for more than twenty times their expected earnings but are not capable of growing much faster than the economy in the absence of acquisitions. By contrast, recent purchases like Alphabet and Priceline trade for similar multiples but grow organically at much faster rates than the average business. Other recent purchases like Credit Acceptance and Hiscox grow more modestly, but trade for roughly half the valuation of the positions they replaced. Importantly, while Alphabet, Priceline, Credit Acceptance and Hiscox are all very different businesses, they have a crucial attribute in common: vast and sustainable competitive advantage.

It’s worth pausing for a moment to look at how Sequoia’s composition has changed over the last eighteen months. The Fund is more concentrated, and the sources of its earnings have shifted away from mature and more asset-intensive manufacturing and retail businesses and toward more rapidly growing and/or more profitable information and service businesses. As already mentioned, we believe that we were able to execute this shift without increasing the Fund’s aggregate price-earnings multiple.

| June | December | |||||

| 2016 | 2017 | |||||

| Internet and Network-Based3 |

10% | 29% | ||||

| Retail4 |

19% | 12% | ||||

| Mature Technology and Services5 |

17% | 25% | ||||

| Cyclical Manufacturing and Finance6 |

40% | 29% | ||||

| Cash & Equivalents |

14% | 5% | ||||

|

|

|

|||||

| Total / NAV |

100% | 100% | ||||

|

|

|

|||||

| Top 10 Holdings / NAV |

60% | 63% | ||||

| Top 15 Holdings / NAV |

70% | 80% | ||||

| # of Positions |

29 | 22 |

To be clear, we make our decisions entirely from the bottom up, and we have no preconceived notions about how the portfolio should look from the top down. So long as we are getting substantially more than we are giving, we are just as happy buying mature metal-benders as we are buying internet innovators. We believe

3Includes Alphabet, Amazon, Formula One, Mastercard and Priceline.

4Includes CarMax, Chipotle, O’Reilly and TJX.

5Includes Charles Schwab, Constellation Software, Dentsply Sirona, Hiscox, Jacobs, Omnicom, and Waters.

6Includes Berkshire, Credit Acceptance, Mohawk, Rolls-Royce, Vopak and Wells Fargo.

7

Sequoia Fund, Inc.

Shareholder Letter (Continued)

that our flexibility in this regard has served the Fund well over time, and has enabled us more recently to uncover interesting opportunities in a strong stock market that many value investors have described as challenging. Even with domestic stock prices at their highest level in years, our pipeline of research projects remains encouragingly full and characteristically quirky, which makes us optimistic that we will be able to further improve the Fund’s risk-adjusted prospects during 2018.

• • • • • • • • • •

Notable drivers of Fund performance in 2017 included Credit Acceptance and Hiscox (up roughly 60%), Mastercard and Waters Corp. (each up roughly 50%), Rolls-Royce and Mohawk (each up roughly 40% in dollars) andAlphabet, Constellation Software and Formula One (each up roughly 35%). Amazon also gained approximately 60% since our first investment and nearly 20% since our subsequent purchases.

Laggards included TJX, CarMax, O’Reilly and Omnicom. All four of these positions have generated strong performance over the time we have owned them, but their prices moved sideways or slightly down for the year.

Though it’s always bittersweet to part with excellent enterprises, we exited longtime investments in Fastenal, Danaher, Emcor, Croda,Tiffany and Costco. We also trimmed our investments in Berkshire Hathaway, Mastercard, O’Reilly, Waters and TJX. Almost all of these sales were driven by opportunities we saw to redeploy capital into either companies with better growth prospects and similar valuations or companies with similar growth prospects and more attractive valuations.The exceptions to this rule were Berkshire and Mastercard, where we felt compelled to reduce large position sizes to better reflect our assessment of future potential.

Purchases that in our estimation served to reduce the price-to-earnings valuation of the Fund without decreasing its growth prospects included our additions to Hiscox, Jacobs, Omnicom and Wells Fargo, as well as our new investments in niche auto lender CreditAcceptance and RoyalVopak, an operator of unique industrial infrastructure assets. Purchases that boosted the growth rate of the Fund’s earning power without increasing its valuation included our new investment in Priceline, the leading online travel agency, and the significant addition to our holding in Alphabet, the parent company of Google.

At 10% of net assets, Alphabet now ranks as the Fund’s second-largest position.Though it produces massive reported profits, Alphabet’s earning power is nevertheless obscured by large growth investments that it must charge against earnings as it incurs them. An asset-intensive business funding refineries rather than research would capitalize these investments and charge them against earnings over years, and often decades. After adjusting for this quirk of the accounting rules, we think one of the best businesses the world has ever seen, with growth prospects far superior to those of the average company, sells for a valuation that is similar to or only slightly higher than that of the overall stock market.

A similar dynamic obscures the earning power of Amazon, the one investment we made during the year at a valuation demonstrably in excess of either the stock market in general or the particular stocks we’ve sold recently. For several reasons, guessing at Amazon’s inherent earning power is more difficult than guessing at Alphabet’s. We think it indisputable, however, that the company’s profits are far larger than they appear. This would be easier to discern if Amazon made its growth investments in stores (“capital” assets that are depreciated over time per the accounting rules) rather than loyalty programs, customer acquisition and cloud software (marketing and R&D costs that must be expensed as incurred). Regardless, our job as investors is to think like owners rather than accountants, and in the case of Amazon, we are pleased to have paid something approximating thirty times

8

Sequoia Fund, Inc.

Shareholder Letter (Continued)

estimated earnings in order to own a business with staggering competitive advantages and the potential to grow at very rapid rates for many years to come. We are also extremely pleased to be partners in business with a founder/CEO who is rightly regarded as one of the greatest business builders in American corporate history.

Though it’s admittedly more difficult to conceptualize, we believe the margin of safety associated with our purchase of Amazon at roughly thirty times our estimate of future earning power was not materially different from the margin of safety associated with our purchases of Wells Fargo at approximately twelve times current earnings. Value comes in many forms, and statistical ratios or simple heuristics often fail to quantify it accurately.

• • • • • • • • • •

For the second consecutive year, the Fund produced a large taxable gain in 2017. In spite of that fact, Sequoia remains one of the lowest-turnover, most tax-efficient vehicles in the mutual fund industry. We had turnover last year equal to 18% of the Fund’s portfolio, and while this level of turnover was slightly higher than our twenty-year average of 12%, it still compares very favorably to that of our peers. According to Morningstar, annual portfolio turnover for Domestic Large Cap Growth Funds has averaged 89% over the last twenty years.

It’s also worth noting that since our team assumed management of the Fund, the specific investments that have driven the overwhelming majority of our realized gains have generated tax deferral benefits that are extraordinary even by Sequoia’s standards. Seven stocks— Berkshire, Idexx, TJX, O’Reilly, Mohawk, Fastenal and Danaher— produced 80% of the taxable gain we have realized since the end of March 2016. We purchased our first shares in five of these seven companies between fifteen and seventeen years ago. Our first purchases of O’Reilly stretch back more than a decade, and our first purchases of Berkshire occurred over 25 years ago. While it’s never fun to settle liabilities that have accrued over decades of compounding, we only hope that we are able to defer all of the Fund’s tax bills for such long periods.

Yet while the benefits of tax deferral are real and significant, they should not be overstated. Because Uncle Sam taxes long-term capital gains at a top rate that is twenty percentage points lower than the top rate for short-term gains, it pays tremendously to hold a profitable investment for more than one year. Beyond that point, however, while there can be meaningful value in delaying the settlement of your tax liability, this deferral benefit pales in comparison to the value of crossing that critical one-year threshold. Put another way, once you accomplish the critical goal of avoiding punitive short-term capital gains, it generally pays to focus more on generating the highest possible pretax return on your capital and less on avoiding taxes altogether.

Consider two investment funds that each produce a 9% annual pretax gain, in line with the total return of American stocks over the very long term. Busy Fund turns its entire portfolio over at the end of every year and pays taxes on all of its profits at the long-term capital gains rate of 23.8%. At the end of ten years, Busy Fund will earn an after-tax return of 6.9% per year. By contrast, Patient Fund defers all of its gains every year, exhibiting zero turnover, and settles its bill with Uncle Sam at the last moment. At the end of ten years, Patient Fund will earn an after-tax return of 7.4% per year.

So clearly there is a cost to turnover...or is there? Imagine a Sensible Fund that turns over 100% of its portfolio every year (paying taxes at the long-term capital gains rate) because it finds new investments that are a little better than the old ones, allowing it to earn 10% a year before taxes instead of 9%. Even bearing the costs of 100% annual turnover— over seven times the average for Sequoia over the last 20 years— Sensible will earn

9

Sequoia Fund, Inc.

Shareholder Letter (Continued)

a ten-year after-tax return of 7.6%. Sensible may be less tax-efficient than Patient, but it’s still the better after-tax investment. In other words, there’s nothing wrong with paying taxes if doing so allows you to make new investments that materially increase your portfolio’s expected rate of return.

If your investment strategy inherently lends itself to significant tax deferral, as ours does, it’s especially beneficial to base your decisions on investment merit rather than taxes because the higher your rate of return, the more benefit you get from tax-deferred compounding. Recall how over ten years, zero-turnover Patient Fund earned 0.50% more per year after taxes than 100%-turnover Busy Fund. That was with both funds earning a 9% annual return before taxes. If they instead earned only 6% before taxes, Patient would only have beaten Busy after taxes by 0.20% per year.

A final comparison is perhaps the most relevant of all. We mentioned earlier that unless price-earnings ratios rise further, it’s probably a decent guess that the S&P 500 will generate a long-term total return of around 7% a year from this point forward. With that as context, imagine a second version of our Patient Fund, like the one just referenced in the paragraph above, which only returns 6% per annum because it obsesses over taxes at the expense of investment results.Then imagine a second version of our Sensible Fund which turns its portfolio over 18% per year, like Sequoia did this past year, and which beats the S&P 500 by 2.65% per annum, in line with Sequoia’s pretax outperformance since inception. Yet again, Sensible is less tax-efficient than Patient, but because it (1) pays its taxes at the long-term capital gains rate, (2) defers its taxes by holding its investments for an average of about six years and (3) sharply outperforms on a pretax basis, Sensible ends up the vastly better investment after taxes, earning 7.7% per annum versus 4.8% for Patient. In case that doesn’t sound like a big difference, consider that over a decade, a $100 initial investment will have turned into $209 for the Sensible investor and only $160 for the Patient investor. If we extend the powerful benefits of compounding over a longer 30-year period, the Sensible investor in our example ends up roughly twice as wealthy as the Patient investor.

With all due respect to the parents of the world, then, patience is not always a virtue. That is what a famous Omaha-based investor had in mind when he wrote the following to the clients of his Buffett Partnership back in 1965:

What is one really trying to do in the investment world? Not pay the least taxes, although that may be a factor to be considered in achieving the end. Means and end should not be confused, however, and the end is to come away with the largest after-tax rate of compound. Quite obviously if two courses of action promise equal rates of pre-tax compound and one involves incurring taxes and the other doesn’t the latter course is superior. However, we find this is rarely the case.

Investment Nirvana is obviously the combination of superior investment performance and high tax efficiency. Though past performance is no guarantee of future results, we are happy to report that over the last twenty years, Sequoia Fund has managed to achieve this exalted condition, earning 7.8% per annum before taxes, as compared to 7.2% for the S&P 500 and 6.3% for our Morningstar peer group, while exhibiting far greater tax-efficiency than the Morningstar peers. As already mentioned, our turnover has been a fraction of that exhibited by the Morningstar peers— and over seven times less than that of our hypothetical Sensible Fund. Far more importantly, virtually 100% of the Fund’s realized gains over the last twenty years have qualified for long-term tax treatment, versus roughly 80% for the Morningstar peers. Though we realize we have much to prove as a

10

Sequoia Fund, Inc.

Shareholder Letter (Continued)

team, we will be disappointed in the extreme if we fail to produce after-tax performance in the future compared to the Index and our peers that is at least on par with what the Fund has accomplished in the past.

While we work toward this goal, rest assured that when we take decisions to realize large gains, we never take them lightly. As we hope to have demonstrated, long-term capital gains taxes can be well worth paying when swapping one investment for another allows you to improve your portfolio’s future rate of return. But as with every investment decision, the tradeoff involves risk: the tax bill you pay today is a fact, whereas the extra future profit you’re hoping for is a forecast. So while the pure mathematics suggest that turnover can make sense even if it nudges your investment return up by a mere 1% per annum, the realities of a humbling world lead us to take a much more conservative approach to what are difficult and often agonizing decisions. In theory, there’s nothing wrong with running the three-foot hurdles if you can leap three feet and an inch on most days. In practice, the activity is a lot more comfortable if you can leap four feet with weights on your ankles. Along these lines, we only take the decision to crystallize a large and certain tax bill when we believe that doing so will result in a very substantial increase to the Fund’s after-tax rate of return.

🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑

As we have discussed in past letters, since the leadership transition at Ruane Cunniff in March of 2016, we have invested substantial time and money in updating and modernizing virtually all of the Firm’s systems, structures and processes. Perhaps the most tangible result of these efforts is the new leadership team we have assembled on the administrative side of our business. Wendy Goodrich, our new Chief Operating Officer, joined us late in 2016. Jennifer Rusk Talia, our new Head of Client Relations, started this past summer. Most recently, we welcomed Patrick Dennis, our new Chief Financial Officer. Pat previously served as CFO for the Gabelli Group, and earlier in his career, he worked with Wendy to help launch and run Eton Park Capital Management, a highly regarded hedge fund. Together with our longtime General Counsel Michael Sloyer, we think Pat, Wendy and Jen form an administrative leadership team as strong as any in our industry. We often find ourselves wondering how we made it nearly fifty years without them.

Over the last eighteen months, we have unveiled a new website, implemented new client relations and fund administration systems and completed a substantial housecleaning of our portfolio accounting system. In addition, the Fund is now open and investable on major mutual fund intermediary platforms such as Charles Schwab, Fidelity/NFS, Pershing, Wells Fargo, TD Ameritrade and Vanguard. During 2018, our administrative team will work to build on these achievements by implementing a new order management system, a new online access portal for separate account clients and a new transfer agency platform that should make it easier for Fund shareholders to interact with DST.

The team will also be working behind the scenes to help us convert Ruane Cunniff from an S-Corporation to a limited partnership. This is a technical change that has been on our modernization agenda for a while now, and it should have no discernible impact on clients or Fund shareholders. It will bring our legal entity setup into alignment with standard industry practice and afford us some added administrative flexibility. It will also allow us to codify, in a new set of partnership agreements, the structures we have used to run the Firm since we undertook our leadership transition two years ago. These include the three-person Management Committee that makes our major business decisions and the six-person Investment Committee that makes investment decisions for Sequoia Fund and our separate accounts.

11

Sequoia Fund, Inc.

Shareholder Letter (Continued)

In conjunction with the legal entity change, we plan to “make it official” and designate all five undersigned voting members of the Investment Committee to formally serve as co-managers of Sequoia Fund.The CEO position at Ruane Cunniff will also be replaced by a Managing Partner position, determined by a vote of the Firm’s partners every four years. John Harris will serve as our first Managing Partner. David Poppe will remain a member of the Firm’s Management and Investment Committees and a director of Sequoia Fund, and will thus continue to play a vital role in Ruane Cunniff’s leadership. As is the case with many professional services firms, at the end of John’s four-year term, our partner group will vote to either retain him as Managing Partner or appoint a new one. For his part, John is quite certain that after four years, we will be ready for another colleague’s point of view. He observes that it took his lovely wife much less than four years to stop listening to him.

We see this move to the new partnership structure as the final leg of an important two-year journey that has seen Ruane Cunniff become a partnership not just in letter, but very much in spirit. By establishing the Management and Investment Committees, by recapitalizing the Firm and redistributing ownership more broadly, and now by replacing an appointed CEO position with an elected Managing Partner role, we have created a flatter and more inclusive organization that will be better positioned than ever to serve the interests of our clients and colleagues.

We are in the judgment business, and if the lessons of the recent past and our long careers have taught us anything, it is that a rich debate featuring a variety of opinions produces better decisions and outcomes over time. Thanks in large part to the wonderful culture that we inherited from Bill and Rick, we are all humble enough to know that none of us has all the answers— and that it doesn’t matter who has the right ones, so long as we ultimately identify them. We have learned from two years of experience now that exposure to a diversity of perspectives enables the members of our Management and Investment Committees to make better judgments together than they would on their own. We think that exposing the day-to-day management of the Firm to a more frequent injection of fresh perspective will yield similar benefits.

While we’re going to give it our best effort here, we also think it’s impossible to adequately describe the contribution that David’s leadership has made to our Firm and our clients over the past several years. We have noted previously that by routinely stretching above and beyond the call of duty, our entire team— from the most junior to the most senior— managed to turn the most difficult period in our Firm’s history into what we believe has been Ruane Cunniff’s finest hour. They were merely following the example of their leader. With an elegant combination of humility and quiet resolve that embodies the very best of our culture, David has worked harder than anyone over the last two years to serve our clients and preserve our founders’ legacy. We consider ourselves lucky indeed to call him our partner and our friend.

🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑 🌑

12

Sequoia Fund, Inc.

Shareholder Letter (Continued)

Our annual Investor Day will take place on Friday, May 18, 2018 in the Grand Ballroom of the Plaza Hotel in NewYork City, the same venue as last year. We look forward to seeing many of you there, and in the meantime, we send our warmest wishes for a happy, healthy and successful new year. As ever, we are profoundly grateful for the continued support of our clients, shareholders and Fund directors, and for the remarkable efforts of our team.

Sincerely,

The Ruane, Cunniff & Goldfarb Investment Committee,

|

David M. Poppe |

John B. Harris |

|||

|

Arman Gokgol-Kline

|

Trevor Magyar |

| ||

|

D. Chase Sheridan |

January 22, 2018

13

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance

(Unaudited)

14

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

15

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

16

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

* * * * *

17

Sequoia Fund, Inc.

Growth of $10,000 Investment in the Fund

(Unaudited)

Sequoia Fund’s results as of December 31, 2017 appear below with comparable results for the S&P 500 Index:

| Period ended December 31, 2017 |

Sequoia Fund | S&P 500 Index* | ||

| 1 Year |

20.07% | 21.83% | ||

| 5 Years (Annualized) |

8.44% | 15.79% | ||

| 10 Years (Annualized) |

7.05% | 8.50% |

The performance shown above represents past performance, assumes reinvestment of distributions, and does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance information shown.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged, capitalization-weighted index of the common stocks of 500 major U.S. corporations.

18

Sequoia Fund, Inc.

(Unaudited)

| As of December 31, 2017 |

% of net assets | |

| Diversified Companies |

12.5% | |

| Internet Software & Services |

10.2% | |

| Information Processing |

8.1% | |

| Application Software |

5.6% | |

| Dental Equipment |

5.3% | |

| Retailing |

5.2% | |

| Aerospace/Defense |

4.6% | |

| Investment Banking & Brokerage |

3.9% | |

| Automotive Retail |

3.9% | |

| Movies & Entertainment |

3.8% | |

| Internet Retail |

3.6% | |

| Diversified Banks |

3.6% | |

| U.S. Government Obligations |

3.5% | |

| Flooring Products |

3.5% | |

| Construction & Engineering |

3.4% | |

| Diversified Financial Services |

3.2% | |

| Internet Services |

2.7% | |

| Auto Parts |

2.6% | |

| Advertising |

2.5% | |

| Property & Casualty Insurance |

2.2% | |

| Precision Instruments |

2.0% | |

| Oil & Gas Storage & Transportation |

2.0% | |

| Restaurants |

0.4% | |

| Other Assets |

1.7% | |

| 100.0% | ||

19

Sequoia Fund, Inc.

(Unaudited)

20

Sequoia Fund, Inc.

December 31, 2017

(Percentages are of the Fund’s Net Assets)

Common Stocks (94.8%)

| Shares | Value (Note 1) |

|||||||

| Advertising (2.5%) |

||||||||

| 1,476,000 | Omnicom Group Inc. |

$ | 107,497,080 | |||||

|

|

|

|||||||

| Aerospace/Defense (4.6%) |

||||||||

| 17,196,077 | Rolls-Royce Holdings plc (United Kingdom) |

196,649,977 | ||||||

|

|

|

|||||||

| Application Software (5.6%) |

||||||||

| 388,766 | Constellation Software, Inc. (Canada) |

235,678,176 | ||||||

|

|

|

|||||||

| Auto Parts (2.6%) |

||||||||

| 454,080 | O’Reilly Automotive, Inc. (a) |

109,224,403 | ||||||

|

|

|

|||||||

| Automotive Retail (3.9%) |

||||||||

| 2,547,513 | CarMax, Inc. (a) |

163,372,009 | ||||||

|

|

|

|||||||

| Construction & Engineering (3.4%) |

||||||||

| 2,199,307 | Jacobs Engineering Group Inc. |

145,066,290 | ||||||

|

|

|

|||||||

| Dental Equipment (5.3%) |

||||||||

| 3,435,757 | DENTSPLY SIRONA, Inc. |

226,175,883 | ||||||

|

|

|

|||||||

| Diversified Banks (3.6%) |

||||||||

| 2,512,818 | Wells Fargo & Co. |

152,452,668 | ||||||

|

|

|

|||||||

| Diversified Companies (12.5%) |

||||||||

| 1,407 | Berkshire Hathaway, Inc.-Class A (a) |

418,723,214 | ||||||

| 554,454 | Berkshire Hathaway, Inc.-Class B (a) |

109,903,872 | ||||||

|

|

|

|||||||

| 528,627,086 | ||||||||

|

|

|

|||||||

| Diversified Financial Services (3.2%) |

||||||||

| 424,594 | Credit Acceptance Corp. (a) |

137,347,667 | ||||||

|

|

|

|||||||

| Flooring Products (3.5%) |

||||||||

| 530,213 | Mohawk Industries, Inc. (a) |

146,285,767 | ||||||

|

|

|

|||||||

| Information Processing (8.1%) |

||||||||

| 2,274,491 | Mastercard, Inc.-Class A |

344,266,958 | ||||||

|

|

|

|||||||

| Internet Retail (3.6%) |

||||||||

| 131,211 | Amazon.com, Inc. (a) |

153,447,328 | ||||||

|

|

|

|||||||

| Internet Services (2.7%) |

||||||||

| 66,868 | The Priceline Group, Inc. (a) |

116,199,198 | ||||||

|

|

|

|||||||

| Internet Software & Services (10.2%) |

||||||||

| 148,518 | Alphabet, Inc.-Class A (a) |

156,448,861 | ||||||

| 265,296 | Alphabet, Inc.-Class C (a) |

277,605,734 | ||||||

|

|

|

|||||||

| 434,054,595 | ||||||||

|

|

|

|||||||

The accompanying notes form an integral part of these Financial Statements.

21

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2017

| Shares | Value (Note 1) |

|||||||

| Investment Banking & Brokerage (3.9%) |

||||||||

| 3,246,316 | The Charles Schwab Corp. |

$ | 166,763,253 | |||||

|

|

|

|||||||

| Movies & Entertainment (3.8%) |

||||||||

| 51,019 | Liberty Media Corporation-Liberty Formula One - Series A (a) |

1,669,342 | ||||||

| 4,693,543 | Liberty Media Corporation-Liberty Formula One - Series C (a) |

160,331,429 | ||||||

|

|

|

|||||||

| 162,000,771 | ||||||||

|

|

|

|||||||

| Oil & Gas Storage & Transportation (2.0%) |

||||||||

| 1,892,737 | Koninklijke Vopak NV (Netherlands) |

83,050,240 | ||||||

|

|

|

|||||||

| Precision Instruments (2.0%) |

||||||||

| 438,546 | Waters Corp. (a) |

84,722,702 | ||||||

|

|

|

|||||||

| Property & Casualty Insurance (2.2%) |

||||||||

| 4,635,727 | Hiscox Ltd. (Bermuda) |

91,630,496 | ||||||

|

|

|

|||||||

| Restaurants (0.4%) |

||||||||

| 58,824 | Chipotle Mexican Grill, Inc. (a) |

17,001,901 | ||||||

|

|

|

|||||||

| Retailing (5.2%) |

||||||||

| 2,886,775 | TJX Companies, Inc |

220,722,817 | ||||||

|

|

|

|||||||

| Total Common Stocks (Cost $1,869,694,882) |

4,022,237,265 | |||||||

|

|

|

|||||||

| Principal Amount |

||||||||

| U.S. Government Obligations (3.5%) |

||||||||

| 150,000,000 | United States Treasury Bill, 1.24% due 02/15/2018 | 149,773,125 | ||||||

|

|

|

|||||||

| Total U.S. Government Obligations (Cost $149,773,125) |

149,773,125 | |||||||

|

|

|

|||||||

| Total Investments (98.3%) (Cost $2,019,468,007) (b) |

4,172,010,390 | |||||||

| Other Assets Less Liabilities (1.7%) |

73,801,937 | |||||||

|

|

|

|||||||

| Net Assets (100.0%) |

$ | 4,245,812,327 | ||||||

|

|

|

|||||||

(a) Non-income producing security.

(b) The cost for federal income tax purposes is identical.

The accompanying notes form an integral part of these Financial Statements.

22

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2017

Generally accepted accounting principles establish a disclosure hierarchy that categorizes the inputs to valuation techniques used to value the investments at measurement date. These inputs are summarized in the three levels listed below:

| Level 1 – | unadjusted quoted prices in active markets for identical securities |

| Level 2 – | other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds and credit risk) |

| Level 3 – | unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers between levels are recognized at the end of the reporting period. During the year ended December 31, 2017, there were no transfers into or out of Level 1 or 2 measurements in the fair value hierarchy except for the transaction disclosed in Note 3. There were no Level 3 securities held by the Fund during the year ended December 31, 2017.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2017:

| Common Stocks | U.S. Government Obligations |

Total | ||||||||||

| Level 1 - Quoted Prices |

$ | 4,022,237,265 | $ | — | $ | 4,022,237,265 | ||||||

| Level 2 - Other Significant Observable Inputs |

— | 149,773,125 | 149,773,125 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 4,022,237,265 | $ | 149,773,125 | $ | 4,172,010,390 | ||||||

|

|

|

|

|

|

|

|||||||

The accompanying notes form an integral part of these Financial Statements.

23

Sequoia Fund, Inc.

Statement of Assets and Liabilities

December 31, 2017

| Assets |

||||

| Investments in securities, at value (cost $2,019,468,007) (Note 1) |

$ | 4,172,010,390 | ||

| Cash on deposit |

76,975,257 | |||

| Receivable for investments sold |

1,037,659 | |||

| Receivable for capital stock sold |

187,380 | |||

| Dividends and interest receivable |

1,985,833 | |||

| Other assets |

125,201 | |||

|

|

|

|||

| Total assets |

4,252,321,720 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for capital stock repurchased |

2,414,226 | |||

| Accrued investment advisory fee |

3,481,066 | |||

| Accrued professional fees |

474,058 | |||

| Accrued other expenses |

140,043 | |||

|

|

|

|||

| Total liabilities |

6,509,393 | |||

|

|

|

|||

| Net Assets |

$ | 4,245,812,327 | ||

|

|

|

|||

| Net Assets Consist of |

||||

| Capital (par value and paid in surplus) $.10 par value capital stock, |

$ | 2,070,021,532 | ||

| Accumulated net realized gains on investments (Note 4) |

23,203,435 | |||

| Unrealized appreciation on investments and foreign currency transactions |

2,152,587,360 | |||

|

|

|

|||

| Net Assets |

$ | 4,245,812,327 | ||

|

|

|

|||

| Net asset value per share |

$ | 169.55 | ||

|

|

|

|||

The accompanying notes form an integral part of these Financial Statements.

24

Sequoia Fund, Inc.

Year Ended December 31, 2017

| Investment Income |

||||

| Income |

||||

| Dividends, net of $233,710 foreign tax withheld |

$ | 23,935,153 | ||

| Interest |

3,324,192 | |||

|

|

|

|||

| Total investment income |

27,259,345 | |||

|

|

|

|||

| Expenses |

||||

| Investment advisory fee (Note 2) |

41,991,661 | |||

| Professional fees |

1,499,196 | |||

| Transfer agent fees |

830,618 | |||

| Independent Directors fees and expenses |

465,141 | |||

| Custodian fees. |

125,000 | |||

| Other |

770,925 | |||

|

|

|

|||

| Total expenses |

45,682,541 | |||

| Less professional fees reimbursed by insurance company (Note 5) |

650,000 | |||

|

|

|

|||

| Expenses before reimbursement by Investment Adviser |

45,032,541 | |||

| Less expenses reimbursed by Investment Adviser (Note 2) |

2,890,879 | |||

|

|

|

|||

| Net expenses |

42,141,662 | |||

|

|

|

|||

| Net investment loss |

(14,882,317 | ) | ||

|

|

|

|||

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions |

||||

| Realized gain (loss) on |

||||

| Investments (Note 3) |

604,410,179 | |||

| Foreign currency transactions |

(14,072 | ) | ||

|

|

|

|||

| Net realized gain on investments and foreign currency transactions |

604,396,107 | |||

| Net increase in unrealized appreciation on investments and foreign currency translations . |

177,852,405 | |||

|

|

|

|||

| Net realized and unrealized gain on investments and foreign currency transactions and translations |

782,248,512 | |||

|

|

|

|||

| Net increase in net assets from operations |

$ | 767,366,195 | ||

|

|

|

The accompanying notes form an integral part of these Financial Statements.

25

Sequoia Fund, Inc.

Statements of Changes in Net Assets

| |

Year Ended December 31, |

| ||||||

| 2017 | 2016 | |||||||

| Increase (Decrease) in Net Assets |

||||||||

| From operations |

||||||||

| Net investment loss |

$ | (14,882,317 | ) | $ | (11,013,780 | ) | ||

| Net realized gain on investments and foreign currency transactions |

604,396,107 | 1,223,361,123 | ||||||

| Net increase (decrease) in unrealized appreciation on investments and foreign currency translations |

177,852,405 | (1,738,207,180 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from operations |

767,366,195 | (525,859,837 | ) | |||||

|

|

|

|

|

|||||

| Distributions to shareholders from: |

||||||||

| Net realized gains |

(537,585,896 | ) | (824,149,302 | ) | ||||

|

|

|

|

|

|||||

| Capital share transactions |

||||||||

| Shares sold |

117,034,879 | 107,164,394 | ||||||

| Shares issued to shareholders on reinvestment of net realized gain distributions |

451,584,683 | 711,815,195 | ||||||

| Shares repurchased |

(649,001,366 | ) | (2,113,437,940 | ) | ||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(80,381,804 | ) | (1,294,458,351 | ) | ||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

149,398,495 | (2,644,467,490 | ) | |||||

| Net Assets |

||||||||

| Beginning of period |

4,096,413,832 | 6,740,881,322 | ||||||

|

|

|

|

|

|||||

| End of period (including accumulated net investment loss of $0 and $0, respectively) |

$ | 4,245,812,327 | $ | 4,096,413,832 | ||||

|

|

|

|

|

|||||

| Share transactions |

||||||||

| Shares sold |

679,161 | 600,631 | ||||||

| Shares issued to shareholders on reinvestment of net realized gain distributions |

2,749,684 | 4,394,430 | ||||||

| Shares repurchased |

(3,786,278 | ) | (12,119,457 | ) | ||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(357,433 | ) | (7,124,396 | ) | ||||

|

|

|

|

|

|||||

The accompanying notes form an integral part of these Financial Statements.

26

Sequoia Fund, Inc.

|

|

Year Ended December 31, |

| ||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Per Share Operating Performance (for a share outstanding throughout the period) |

||||||||||||||||||||

| Net asset value, beginning of period |

$ | 161.28 | $ | 207.26 | $ | 235.00 | $ | 222.92 | $ | 168.31 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from investment operations |

||||||||||||||||||||

| Net investment (loss) |

(0.59 | ) | (0.43 | ) | (1.08 | ) | (0.61 | ) | (0.72 | ) | ||||||||||

| Net realized and unrealized gains (losses) on investments |

32.12 | (15.16 | ) | (16.15 | ) | 17.23 | 58.73 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net increase (decrease) in net asset value from operations |

31.53 | (15.59 | ) | (17.23 | ) | 16.62 | 58.01 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from |

||||||||||||||||||||

| Net realized gains |

(23.26 | ) | (30.39 | ) | (10.51 | ) | (4.54 | ) | (3.40 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 169.55 | $ | 161.28 | $ | 207.26 | $ | 235.00 | $ | 222.92 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Return |

20.07 | %(a) | (6.90 | )% | (7.31 | )% | 7.56 | % | 34.58 | % | ||||||||||

| Ratios/Supplementary data |

||||||||||||||||||||

| Net assets, end of period (in millions) |

$ | 4,246 | $ | 4,096 | $ | 6,741 | $ | 8,068 | $ | 8,039 | ||||||||||

| Ratio of expenses to average net assets |

||||||||||||||||||||

| Before expenses reimbursed by Investment Adviser |

1.07 | %(b) | 1.07 | %(b) | 1.03 | % | 1.03 | % | 1.02 | % | ||||||||||

| After expenses reimbursed by Investment Adviser |

1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of net investment (loss) to average net assets |

(0.35 | )% | (0.22 | )% | (0.42 | )% | (0.26 | )% | (0.37 | )% | ||||||||||

| Portfolio turnover rate |

18 | % | 16 | % | 10 | % | 8 | % | 2 | % | ||||||||||

| (a) | Includes the impact of proceeds received and credited to the Fund resulting from a class action settlement, which enhanced the Fund’s performance for the year ended December 31, 2017 by 0.05%. |

| (b) | Reflects reductions of 0.02% and 0.02% for expenses reimbursed by insurance company for the periods ended December 31, 2017 and 2016, respectively. |

The accompanying notes form an integral part of these Financial Statements.

27

Sequoia Fund, Inc.

Note 1— Significant Accounting Policies

Sequoia Fund, Inc. (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, open-end management investment company. The investment objective of the Fund is long-term growth of capital. The Fund follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”)Accounting Standard CodificationTopic 946 Financial Services— Investment Companies.The following accounting policies conform to U.S. generally accepted accounting principles (”GAAP“). The Fund consistently follows such policies in the preparation of its financial statements.

| A. | Valuation of investments: Investments are carried at fair value as determined under the supervision of the Fund’s Board of Directors. Securities traded on a national securities exchange are valued at the last reported sales price on the principal exchange on which the security is listed; securities traded in the NASDAQ Stock Market (”NASDAQ“) are valued in accordance with the NASDAQ Official Closing Price. Securities for which there is no sale or Official Closing Price are valued at the mean of the last reported bid and asked prices. |

Securities traded on a foreign exchange are valued at the closing price on the last business day of the period on the principal exchange on which the security is primarily traded. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the New York Stock Exchange on the date of valuation.

U.S. Treasury Bills with remaining maturities of 60 days or less are valued at their amortized cost. U.S. Treasury Bills that when purchased have a remaining maturity in excess of 60 days are valued on the basis of market quotations and estimates until the sixtieth day prior to maturity, at which point they are valued at amortized cost. Fixed-income securities, other than U.S.Treasury Bills, are valued at the last quoted sales price or, if adequate trading volume is not present, at the mean of the last bid and asked prices.

When reliable market quotations are insufficient or not readily available at the time of valuation or when Ruane, Cunniff & Goldfarb Inc. (the ”Investment Adviser“) determines that the prices or values available do not represent the fair value of a security, such security is valued as determined in good faith by the Investment Adviser, in conformity with procedures adopted by and subject to review by the Fund’s Board of Directors.

| B. | Foreign currency translations: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of foreign securities are translated into U.S. dollars at the rates of exchange prevailing when such securities are acquired or sold. Income and expenses are translated into U.S. dollars at the rates of exchange prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized gains or losses on foreign currency transactions arise from the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized gains and losses on foreign currency transactions |

28

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

and translations arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

| C. | Investment transactions and investment income: Investment transactions are accounted for on the trade date and dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Premiums and discounts on fixed income securities are amortized over the life of the respective security.The net realized gain or loss on security transactions is determined for accounting and tax purposes on the specific identification basis. |

| D. | Federal income taxes: The Fund’s policy is to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, and it intends to distribute all of its taxable income to its stockholders. Therefore, no federal income tax provision is required. |

| E. | Use of estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| F. | Dividends and distributions: Dividends and distributions are recorded by the Fund on the ex-dividend date. |

Note 2— Investment Advisory Contract and Payments to Affiliates

The Investment Adviser provides the Fund with investment advice and administrative services.

Under the terms of the Advisory Contract, the Investment Adviser receives an investment advisory fee equal to 1% per annum of the Fund’s average daily net asset value. Under the Advisory Contract, the Investment Adviser is contractually obligated to reimburse the Fund for the amount, if any, by which the operating expenses of the Fund (including the investment advisory fee) in any year exceed the sum of 1 1⁄2% of the average daily net asset value of the Fund for such year up to a maximum of $30,000,000 of net assets, plus 1% of the average daily net asset value in excess of $30,000,000.The expenses incurred by the Fund exceeded the limitation for the year ended December 31, 2017 and the Investment Adviser reimbursed the Fund $2,574,879. Such reimbursement is not subject to recoupment by the Investment Adviser.

The Fund has contractually agreed to pay an asset-based fee to a financial intermediary for providing recordkeeping and other administrative services for sub-accounts maintained by the intermediary. The Investment Adviser has contractually agreed to pay such fees on behalf of the Fund as long as the Advisory Contract remains in effect. Total fees paid by the Investment Adviser to the intermediary on behalf of the Fund for the year ended December 31, 2017 were approximately $316,000, which is included in expenses reimbursed by Investment Adviser in the Statement of Operations.

29

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

For the year ended December 31, 2017, advisory fees of $41,991,661 were earned by the Investment Adviser and brokerage commissions of $302,674 were earned by Ruane, Cunniff & Goldfarb LLC, the Fund’s distributor and a wholly-owned subsidiary of the Investment Adviser. Certain officers of the Fund are also officers of the Investment Adviser and Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC received no compensation from the Fund on the sale of the Fund’s capital shares for the year ended December 31, 2017. There were no other amounts accrued or paid to interested persons, including officers and directors.

Note 3— Investment Transactions

The aggregate cost of purchases and the proceeds from the sales of securities, excluding short-term securities, for the year ended December 31, 2017 were $689,251,404 and $1,113,606,955, respectively. Included in proceeds of sales is $56,626,367 representing the value of securities disposed of in payment of redemptions in-kind, resulting in realized gains of $54,439,731.

During the year ended December 31, 2016, the InvestmentAdviser entered into an agreement to purchase securities as part of a private placement offering on behalf of its clients, including the Fund. Subsequent to December 31, 2016, the Investment Adviser allocated to the Fund, and the Fund purchased, approximately $117,000,000 of these securities. As part of the purchase agreement, the Fund was restricted from selling the acquired shares for a maximum of six months following the date of acquisition. As the restriction was lifted in June, 2017, the securities were tradable under a shelf registration and transferred from Level 2 to Level 1 during the year ended December 31, 2017.

Note 4— Federal Income Tax Information

Distributions to shareholders are determined in accordance with federal income tax regulations and may differ from those determined for financial statement purposes. To the extent these differences are permanent such amounts are reclassified within the capital accounts. During the year ended December 31, 2017, permanent differences primarily due to realized gains on redemptions in-kind not recognized for tax purposes, net operating loss and different book and tax treatment of net realized gains on foreign currency transactions resulted in a net decrease in accumulated net realized gains of $55,535,285 with a corresponding increase in capital of $40,652,968, and an increase to accumulated net investment loss of $14,882,317. These reclassifications had no effect on net assets.

At December 31, 2017 the federal tax cost, aggregate gross unrealized appreciation and depreciation of securities for federal income tax purposes were $2,019,468,007, $2,163,076,325 and $10,533,942, respectively.

30

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

The tax character of distributions paid for the years ended December 31, 2017 and 2016 was as follows:

| 2017 | 2016 | |||||||

| Distributions paid from Long-term capital gains |

$ | 537,585,896 | $ | 824,149,302 | ||||

|

|

|

|

|

|||||

As of December 31, 2017 and December 31, 2016 the components of distributable earnings on a tax basis were as follows:

| 2017 | 2016 | |||||||

| Undistributed long-term gains |

$ | 23,203,435 | $ | 11,928,509 | ||||

| Unrealized appreciation |

2,152,587,360 | 1,974,734,955 | ||||||

|

|

|

|

|

|||||

| $ | 2,175,790,795 | $ | 1,986,663,464 | |||||

|

|

|

|

|

|||||

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the positions are ‘‘more likely than not’’ to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open years (tax years ended December 31, 2014 through December 31, 2017) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

Note 5— Indemnification

The Fund’s officers, directors and agents are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, except as noted in the following paragraph, the Fund has not had prior claims or losses pursuant to these arrangements and expects the risk of loss thereunder to be remote.

During the year ended December 31, 2017, the Fund indemnified the independent directors for approximately $650,000 in legal fees incurred by the independent directors in connection with legal matters. Such legal fees are included in professional fees in the Statement of Operations. These legal fees were paid directly to counsel for the independent directors pursuant to the Fund’s directors and officers insurance policy.

31

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 6— Legal Proceedings

On January 8, 2016, Stanley H. Epstein, Harriet P. Epstein, and SEP IRAA/C Peter Christopher Gardner, derivatively and on behalf of the Fund, filed a suit against Ruane, Cunniff & Goldfarb Inc., Robert D. Goldfarb, David Poppe, Robert L. Swiggett and Roger Lowenstein (collectively, the “Defendants”) in the Supreme Court of the State of New York, County of New York. The Fund is also named in the suit as a Nominal Defendant. On May 9, 2016, the plaintiffs filed an amended complaint, adding Edward Lazarus as an additional Defendant. The amended complaint asserts derivative claims in connection with certain of the Fund’s investments against the Defendants for alleged breach of fiduciary duty, aiding and abetting breach of fiduciary duty, breach of contract and gross negligence. The case is Epstein v. Ruane, Cunniff & Goldfarb Inc. et al., 650100/2016, Supreme Court of the State of New York, County of New York (Manhattan). In February 2017, the court granted the Defendants’ motion to dismiss all claims in the action. On March 22, 2017, the plaintiffs filed a notice of appeal from the court’s dismissal. On November 21, 2017, plaintiffs Stanley Epstein and Harriet Epstein filed a Stipulation of Voluntary Discontinuance of their claims. On December 21, 2017, SEP IRAA/C Peter Christopher Gardner, derivatively and on behalf of the Fund, filed a brief in the Appellate Division – First Department appealing the Supreme Court’s Order dismissing all claims.

On November 14, 2017, Donald Tapert, derivatively and on behalf of the Fund, filed a suit against David M. Poppe, Edward Lazarus, Robert L. Swiggett, Roger Lowenstein, Tim Medley, John B. Harris, Peter Atkins, Melissa Crandall, Robert D. Goldfarb, and Ruane, Cunniff & Goldfarb Inc., in the Baltimore City Circuit Court, Maryland. The Fund is also named in the suit as a Nominal Defendant. The complaint asserts derivative claims for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, waste of corporate assets, and unjust enrichment. The case is Donald Tapert v. David M. Poppe et al., Case No. 24-C-17-005430 Baltimore City Circuit Court, Maryland.

On February 9, 2018, Charles Wilfong & Ann R. Wilfong JTWROS, derivatively on behalf of the Fund, filed a suit against Ruane, Cunniff & Goldfarb Inc., Robert D. Goldfarb, David Poppe and Roger Lowenstein, in the Supreme Court of the State of NewYork.The Fund is also named in the suit as a Nominal Defendant. The complaint asserts derivative claims for breach of duty of loyalty, breach of duty of care, and wrongful refusal to take action. The case is Charles Wilfong v. Ruane, Cunniff & Goldfarb Inc. et al., 650699/2018, Supreme Court of the State of New York, County of New York (Manhattan).

On March 14, 2016, Clive Cooper, individually and as a representative of a class, on behalf of DST Systems, Inc. 401(k) Profit Sharing Plan, filed a suit in the Southern District of NewYork against Ruane, Cunniff & Goldfarb Inc., DST Systems, Inc.,TheAdvisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., Jerome H. Bailey, Lynn Dorsey Bleil, Lowell L. Bryan, Gary D. Forsee, Gregg Wm. Givens, Charles E. Haldeman, Jr., Samuel G. Liss and John Does 1-20.The complaint asserts claims for alleged breach of fiduciary duty and violation of ERISA’s prohibited transaction rules, co-fiduciary breach, and breach of trust in connection with certain investments made on behalf of the Plan. The case is Cooper v. DST Systems, Inc. et al., Case No. 1:16-cv-01900-WHP, U.S. District Court for the Southern District of New York. The plaintiffs in the action dismissed without prejudice all claims against all of the defendants other than Ruane, Cunniff & Goldfarb Inc., which was thereby the only defendant in the case. On August 15,

32

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

2017, the court granted Ruane, Cunniff & Goldfarb Inc.’s motion to compel arbitration and the case was dismissed on August 17, 2017. On September 8, 2017, the plaintiffs filed a notice of appeal from the Court’s Order granting the motion to compel arbitration and dismissing the case. The Fund is not a defendant in this lawsuit.

On September 1, 2017, plaintiffs Michael L. Ferguson, Myrl C. Jeffcoat and Deborah Smith, on behalf of the DST Systems, Inc. 401(k) Profit Sharing Plan, filed a suit in the Southern District of New York against Ruane, Cunniff & Goldfarb Inc., DST Systems, Inc., The Advisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., George L. Argyros, Tim Bahr, Jerome H. Bailey, Lynn Dorsey Bleil, Lowell L. Bryan, Ned Burke, John W. Clark, Michael G. Fitt, Gary D. Forsee, Steven Gebben, Gregg Wm. Givens, Kenneth Hager, Charles E. Haldeman, Jr., Lawrence M. Higby, Joan Horan, Stephen Hooley, Robert T. Jackson, Gerard M. Lavin, Brent L. Law, Samuel G. Liss, Thomas McDonnell, Jude C. Metcalfe,Travis. E. Reed, M. Jeannine Strandjord, Beth Sweetman, DouglasTapp and Randall Young. The complaint asserts claims for alleged breach of fiduciary duty under ERISA, breach of trust, and other claims. The case is Ferguson, et al. v. Ruane, Cunniff & Goldfarb Inc., Case No. 1:17-cv-06685 (S.D.N.Y.). The Fund is not a defendant in this lawsuit.

On September 7, 2017, plaintiff Stephanie Ostrander, as representative of a class of similarly situated persons, and on behalf of the DST Systems, Inc. 401(k) Profit Sharing Plan, filed a suit in the Western District of Missouri against DST Systems, Inc., The Advisory Committee of the DST Systems, Inc., 401(k) Profit Sharing Plan, The Compensation Committee of The Board of Directors of DST Systems, Inc., Ruane, Cunniff & Goldfarb, Inc. and John Does 1-20. The complaint asserts claims for alleged breach of fiduciary duty, breach of trust, and other claims.The case is Ostrander v. DST Systems, Inc. et al., Case No. 4:17-cv-00747-GAF.The Fund is not a defendant in this lawsuit. On February 2, 2018, the court granted the defendants’ motion to dismiss all claims.

Ruane, Cunniff & Goldfarb Inc. believes that the foregoing lawsuits are without merit and intends to defend itself vigorously against the allegations in them. The outcomes of these lawsuits are not expected to have a material impact on the Fund’s financial statements.

Note 7— Subsequent Events

Accounting principles generally accepted in the United States of America require the Fund to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

33

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

Sequoia Fund, Inc.:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Sequoia Fund, Inc. (the “Fund”), including the schedule of investments, as of December 31, 2017, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in the three-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the three-year period then ended, in conformity with U.S. generally accepted accounting principles. The financial highlights for the years ending prior to January 1, 2015 were audited by other auditors, whose report thereon dated February 19, 2015, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public CompanyAccounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of December 31, 2017, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of Sequoia Fund, Inc. since 2015.

New York, New York

February 16, 2018

34

Sequoia Fund, Inc.

(Unaudited)

The Statement of Additional Information (”SAI“) includes additional information about Fund Directors and is available, without charge, upon request. You may call toll-free 1-800-686-6884 to request the SAI.

| Name, Age, and Address |

Position Held with Fund(1) |

Length of Time Served(2) |

Principal Occupation during Past 5 Years |

Other | ||||

| Interested Directors and Officer(3) |

||||||||

| David M. Poppe, 53 |

President, CEO & |

14 Years |

President & Director |

None | ||||

| 9 West 57th Street |

Director |

of the Investment |

||||||

| New York, NY 10019 |

Adviser. |

|||||||

| John B. Harris, 41 |

Director |

1 Year |

Analyst of the |

None | ||||

| 9 West 57th Street |

Investment Adviser. |

|||||||

| New York, NY 10019 |

||||||||

| Independent Directors |

||||||||

| Peter Atkins, 54 |

Director |

1 Year |

Managing Director, |

None | ||||

| 9 West 57th Street |

Permian Partners. |

|||||||

| New York, NY 10019 |

||||||||

| Melissa Crandall, 38 |

Director |

Since September |

Principal, Braddock- |

None | ||||

| 9 West 57th Street |

12, 2017 |

Matthews, LLC |

||||||

| New York, NY 10019 |

(Executive |

|||||||

| Recruiting). |

||||||||

| Edward Lazarus, 58 9 West 57th Street New York, NY 10019 |

Chairman of the Board and Director | 3 Years | Executive Vice President and General Counsel of Tribune Media Co., and former Chief of Staff to the Chairman of the Federal Communications Commission. | None | ||||

| Roger Lowenstein, 64 |

Director |

19 Years |

Writer for Major |

None | ||||

| 9 West 57th Street |

Financial and News |

|||||||

| New York, NY 10019 |

Publications. |

|||||||

| Tim Medley, 74 |

Director |

1 Year |

President, Medley & |

None | ||||

| 9 West 57th Street |

Brown, LLC |

|||||||

| New York, NY 10019 |

(SEC-registered |

|||||||

| investment adviser). |

||||||||

35

Sequoia Fund, Inc.

Directors and Officers (Continued)

(Unaudited)

| Name, Age, and Address |

Position Held |

Length of

Time |

Principal Past 5 Years |

Other | ||||

| Robert L. Swiggett, 96 9 West 57th Street New York, NY 10019 |

Director | 47 Years | Retired. | None | ||||

| Additional Officers | ||||||||