UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01976

Sequoia Fund, Inc.

(Exact name of registrant as specified in charter)

9 West 57th Street, Suite 5000

New York, NY 10019

(Address of principal executive offices) (Zip code)

David M. Poppe

Ruane, Cunniff & Goldfarb Inc.

9 West 57th Street

Suite 5000

New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 686-6884

Date of fiscal year end: December 31, 2016

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders.

Report to Shareholders is attached herewith.

Sequoia Fund, Inc.

| Page | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 10 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

Sequoia Fund, Inc.

Illustration of An Assumed Investment of $10,000

(Unaudited)

The table below covers the period from July 15, 1970 (the date Sequoia Fund, Inc. (the “Fund”) shares were first offered to the public) to December 31, 2016.This period was one of widely fluctuating common stock prices. The results shown, which assume reinvestment of distributions, represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance shown. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

|

Please consider the investment objectives, risks and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other information about the Fund. You may obtain year to date performance as of the most recent month end, and a copy of the prospectus by calling 1-800-686-6884, or on the Fund’s website at www.sequoiafund.com. Please read the prospectus carefully before investing.

Shares of the Fund are offered through the Fund’s distributor, Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC is an affiliate of Ruane, Cunniff & Goldfarb Inc. and is a member of FINRA. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

3

Sequoia Fund, Inc.

Annual Fund Operating Expenses

(Unaudited)

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees (fees paid directly from your investment)

The Fund does not impose any sales charges, exchange fees or redemption fees.

Annual Fund Operating Expenses (expenses that are deducted from Fund assets)

| Management Fees |

1.00% | |||||||

| Other Expenses | 0.03% |

|||||||

| Total Annual Fund Operating Expenses* | 1.03% |

|||||||

*Does not reflect Ruane, Cunniff & Goldfarb Inc.’s (‘‘Ruane, Cunniff & Goldfarb’’) contractual reimbursement of a portion of the Fund’s operating expenses. This reimbursement is a provision of Ruane, Cunniff & Goldfarb’s investment advisory agreement with the Fund and the reimbursement will be in effect only so long as that investment advisory agreement is in effect. The expense ratio presented is from the Prospectus dated April 29, 2016. For the year ended December 31, 2016, the Fund’s annual operating expenses and investment advisory fee, net of such reimbursement, were 1.00% and 0.93%, respectively.

4

Sequoia Fund, Inc.

Sequoia Fund, Inc.

Dear Shareholder:

Sequoia Fund’s results for the quarter and year ended December 31, 2016 appear below with comparable results for the S&P 500 Index:

| To December 31, 2016 |

Sequoia Fund |

S&P 500 Index* |

||||||

| Fourth quarter |

3.55% | 3.82% | ||||||

| 1 Year |

-6.90% | 11.96% | ||||||

| 5 Years (Annualized) |

7.64% | 14.66% | ||||||

| 10 Years (Annualized) |

5.96% | 6.95% |

The numbers shown above represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Future performance may be lower or higher than the performance information shown. The performance data quoted represents past performance and assumes reinvestment of distributions.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged capitalization-weighted index of the common stocks of 500 major US corporations.

• • • • • • • • • •

We completed our most difficult year since Bill Ruane and Rick Cunniff nearly closed Ruane Cunniff & Co. in 1974 after four years of severe underperformance following Sequoia Fund’s launch. For the year, Sequoia declined 6.90%, net of fees, vs. an 11.96% gain for the Standard & Poor’s 500 Index. For only the third time in the history of the Fund, we’ve trailed the Index for three consecutive years. The other periods were 1970-1973 and 1988-1990. Even more disappointingly, the Fund’s 10-year annualized return of 5.96% lags the Index return of 6.95%.

Two large investments— one much more widely discussed than the other— account for Sequoia’s underperformance over the past decade:Valeant Pharmaceuticals and cash. Excluding them, the stocks in Sequoia’s portfolio returned 9.70% from 2007 through 2016, versus the aforementioned 6.95% for the Index. While there are no do-overs in our business and actual performance is all that matters, this performance gives us confidence in the Fund’s portfolio and our ability to pick stocks.

It may seem counterintuitive, but we enter 2017 with a great sense of optimism. The passion and perseverance with which every one of our 57 remarkable employees responded to the adversity of the past year was a wonder we sincerely wish Bill and Rick could have been alive to behold. The fact that one of our toughest years was also in many unseen ways one of our best is a testament to the special culture they created. Our administrative team moved mountains to communicate with clients and we began overhauls of our technology and investor relations functions that should yield tangible benefits to Fund shareholders in coming years. Our investment team displayed remarkable stability, with departures limited only to our former CEO Bob Goldfarb and our lead Valeant analyst.

5

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

When our new investment committee structure was implemented last April, it was not in response to a problem portfolio. Rather, we inherited a healthy collection of outstanding companies that we’d helped to construct over many years— along with one large, problematic position. We exited Valeant in the second quarter and subsequently performed roughly in line with a strong stock market. Over the second half of the year, Sequoia returned 7.24% net of fees vs. 7.82% for the Index. Our cash position, which averaged 10% for the year, hurt results in a rising stock market.

We are confident that the principles passed down to us from Bill and Rick, which have served Sequoia so well in the past, will continue to serve us well and differentiate us from competitors. We remain resolutely committed to an intense research process that results in a focused portfolio of businesses we understand, managed by people we respect, and held with a long-term mindset. Despite elevated turnover in 2016, our average holding period remains unusual in the investment business. At year-end, Sequoia consisted of 27 securities, 16 of which we’ve held for at least five years. By value, more than 40% of the Fund’s assets have been held for at least 10 years. Patience allows us to ignore variables we consider unknowable, such as the annual ups and downs of the stock market and the business cycle, and focus our full attention on the questions of competition and competence that determine business performance over time. Concentration ensures that if we answer these questions correctly, our judgments will have a meaningful impact on the Fund’s results.

We have always believed that if you buy excellent companies at attractive prices and hold them for the long term, you will outperform the market averages, come what may on Wall Street or Main Street. The companies we own today have performed admirably against a tepid economic backdrop. Over the past three years, they have, on average, grown their per-share earnings 10.8% annually, while the weighted earnings of the S&P 500 components grew only 2.5% per year. When 2016 results are fully reported, we expect our portfolio will show EPS growth in mid-to-high single digits, versus flattish earnings for the Index. Looking forward, the S&P 500 trades for 17.2x current 2017 earnings estimates. Sequoia trades for 19.8x 2017 earnings estimates. Sequoia trades more dearly than the Index, but has grown much faster and earns a return on equity of 27.8% vs. 14.5% for the Index. We’re confident we have a high quality collection of businesses that is worth its premium to the market multiple.

Another reason for our optimism is that despite elevated market values, we are finding attractive places to invest Sequoia’s money. We made a number of investments in 2016 and one investment in early 2017 that feel promising.

In the second quarter, the Fund bought shares in Carmax, Chipotle Mexican Grill, Charles Schwab and Wells Fargo. In the fall, we increased the position in Carmax after it dipped, making it our largest commitment of capital for the year. At year-end, Carmax amounted to a 5.3% weighting in Sequoia. From our average cost of $51.10, Carmax rose 26% through the end of the year. Charles Schwab, acquired mostly in May 2016, rose 42% from our average cost by the end of the year. Wells Fargo rose about 9% from our basis and, with its dividend, performed in line with the market despite being tarnished by scandal.

Chipotle has been a weak performer, down 13% since purchase through the end of 2016. We knew Chipotle faced a long road to recovery after several outbreaks of food-borne illnesses frightened customers away, but we were attracted by the enormous potential of the business, which could grow for many years and generate high returns if the executive team manages the recovery adeptly. Chipotle is making changes to management and

6

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

its board of directors, including adding a director who played a key role in the turnaround at McDonald’s a decade ago. Recently reported sales figures for December showed encouraging gains in customer traffic, but we are watching carefully, as the pace of recovery thus far has fallen short of our initial expectations.

In the fall, we exited our small position in Walmart and replaced it with a similarly small position in Amazon. The company’s e-commerce operation (Amazon.com) and its cloud computing platform (Amazon Web Services) are two of the most advantaged businesses we’ve analyzed in quite some time. Both are growing fast and have miles of runway ahead of them. And they are run by arguably the most talented, customer-focused and long term-oriented businessman of his generation.

At a consolidated level, Amazon produces very little in the way of reported profits. Amazon Web Services, whose financials are disclosed separately, earns very rich margins, but the larger e-commerce business reports scant earnings. Our research indicates that the company’s e-commerce business has substantial earnings power that is being masked by a variety of ambitious growth investments. The Fund purchased shares at what we believe to be a reasonable multiple of underlying earnings power excluding those investments. Estimating the long-term potential of Amazon’s many investments is an inherently imprecise exercise, which is why the investment thus far has been a small one.

We do not advocate judging any investment by how it performs in the first six months, but we get a lot of questions about how our new team is gelling. Sequoia’s five new positions, which amounted to nearly 14% of its capital at year-end, outperformed the S&P 500 by 9.6 percentage points on a dollar-weighted basis over an average holding period of six months. We do not draw definitive conclusions from this short-term performance, but for what it’s worth, so far, so good.

As important as the initial performance of these new positions is the fact that we see our research engine functioning at a high level and churning out appealing uses for the Fund’s cash position. While Valeant’s underperformance relative to the S&P 500 over the course of our ownership modestly reduced Sequoia’s annual return since 2010, our outsized cash position since 2008 had a larger impact on results. During a torrid bull market from 2009 through 2014, the Fund kept 15% to 20% of its portfolio in cash, yielding nothing. While we will not change course overnight to become fully invested with the market at all-time highs, our goal is to run the Fund more invested than in the past.

At the very end of the year, we found what we believe will be another good use for our dry powder when we joined a select group of investors in purchasing a stake in Liberty Media Group, a John Malone-affiliated company, as part of Liberty’s acquisition of the Formula One auto racing business. The deal closed on January 23, and Sequoia purchased 4.7 million shares at a discounted price of $25 per share.

Recently, Liberty Media has traded above our cost basis in the public market. Sequoia’s allocation will be restricted for several months, meaning we won’t be able to sell the shares. During that time, accounting rules require us to fair value the stock which will result in a modest discount to its market price to reflect its illiquidity. Undoubtedly, the share price will fluctuate during the lock-up period, but we’re delighted to have acquired shares at what we believe is an attractive price. More importantly, we believe Formula One is a powerful global brand and Liberty will be an excellent manager. Our expectation is to own the shares for years.

7

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

Formula One is the leading global automotive sport with an estimated 400 million fans around the world. While Formula One has grown considerably under the leadership of Bernie Ecclestone over the last three decades, we believe new management has significant opportunities to further improve and grow the sport. Liberty Chairman John Malone and CEO Greg Maffei have exceptional track records as capital allocators and value creators, and we believe they have found a superb manager in Chase Carey to run Formula One. Mr. Carey had successful tenures at Fox Broadcasting, DirecTV, News Corp. and 21st Century Fox and has particular expertise in sports businesses. We believe there is room to improve revenue from broadcast, advertising and sponsorship sources, while also developing a digital business that captures younger fans. Importantly, our return assumptions do not depend on the sport succeeding in immature markets such as the US and China.

• • • • • • • • • •

The Fund realized a large taxable gain in 2016. In an ideal world, the years in which the Fund generated large capital gains distributions would align with years of good performance, mitigating the pain of the tax bite for our taxable shareholders. Alas, this was not the case in 2016. As we adjusted the portfolio in the wake of Bob Goldfarb’s departure, Sequoia’s taxable investors suffered the one-two punch of high capital gains distributions and poor returns. We exited stocks in which we had less conviction and trimmed some of our highly appreciated holdings when they were at attractive prices, bringing the Fund’s total positions down from 39 at the start of the year to 27. We’re happy with this more tightly focused portfolio. It wasn’t fun to realize gains, but economics must trump tax considerations when it comes to selling stocks.

Our goal is always to manage a low-turnover, tax-efficient portfolio with good investment returns. If we succeed, Sequoia will continue to carry a large unrealized capital gain on securities that have appreciated in the portfolio for many years. At year-end 2016, the unrealized gain on appreciated securities amounted to 48% of the value of a Sequoia share. The unrealized gain in Sequoia five years ago was 36%; 10 years ago it was 56% and 15 years ago it was 57%.

A large unrealized capital gain can spook prospective investors, who inherit a potential tax liability associated with the gain when they purchase shares of the Fund. However, if the Fund is run in a consistent manner, investors will leave a large unrealized capital gain and its associated tax liability to the next generation when they exit the Fund. In the meantime, if the Fund’s turnover remains low shareholders should continue to enjoy an unusually high degree of tax efficiency. Many investment firms turn their portfolios over rapidly, accumulating short-term gains, which pay taxes at a higher rate than long-term gains and qualified dividends. Over the past decade, the Fund cumulatively has taken short-term losses far in excess of short-term gains, meaning 100% of our net taxable gains have been long-term.

• • • • • • • • • •

We are very focused on improving all aspects of the Fund’s operation. In November, we welcomed a new head of operations, Wendy Goodrich, who among her many duties is charged with upgrading our client-facing technology – improving our web site so that it offers our clients access to their account information and provides higher quality information about Sequoia. Wendy ran her own consulting business for the past 12 years in which she helped investment firms adopt and adhere to operational best practices. A major focus of her work included selecting, installing and integrating front to back office technology. She’s off to a great start and we are optimistic that Sequoia shareholders will notice significant improvements in 2017.

8

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

In January, we welcomed two new securities analysts to the Sequoia team. Eric Liu spent the past eight years in fundamental research at a respected firm in Boston. He’s a summa cum laude graduate of Yale. Patrick Pierce got an MBA from Columbia’s value investing program in 2014 and spent the past two years at a successful, value-oriented hedge fund in San Francisco. We’re already feeling the positive impact of adding these two talented analysts to our team.

We’re extremely proud of our entire employee team. Our people are working tirelessly to improve all aspects of our business. It’s an honor and a pleasure to work beside such dedicated colleagues. We are also grateful to the Sequoia Fund Board of Directors, which worked very hard in 2016 on behalf of Fund shareholders. And of course, we’re humbled by the loyalty of the many Sequoia shareholders who have stood by us at a difficult time. We do not take your trust in us lightly.

Our annual meeting of Sequoia shareholders and other clients will take place on Friday, May 19 at 10:00 am in the Grand Ballroom of the Plaza Hotel in New York City, the same venue as last year. We look forward to seeing many of you there.

The Ruane, Cunniff & Goldfarb Investment Committee,

|

| |||

| David M. Poppe | John B. Harris | |||

|

|

| ||

| Arman Gokgol-Kline | Trevor Magyar | D. Chase Sheridan | ||

January 31, 2017

9

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance

(Unaudited)

10

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

11

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

12

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

13

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

* * * * *

14

Sequoia Fund, Inc.

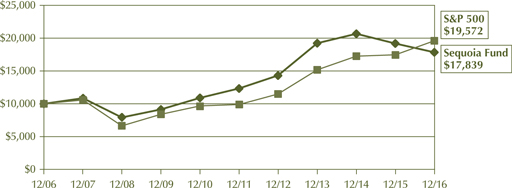

Growth of $10,000 Investment in the Fund

(Unaudited)

Sequoia Fund’s results as of December 31, 2016 appear below with comparable results for the S&P 500 Index:

| To December 31, 2016 |

Sequoia Fund |

S&P 500 Index* |

||||||

| 1 Year |

-6.90% | 11.96% | ||||||

| 5 Years (Annualized) |

7.64% | 14.66% | ||||||

| 10 Years (Annualized) |

5.96% | 6.95% |

The performance shown above represents past performance, assumes reinvestment of distributions, and does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance information shown.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged, capitalization-weighted index of the common stocks of 500 major U.S. corporations.

15

Sequoia Fund, Inc.

(Unaudited)

| As of December 31, 2016 |

%

of net assets | |

| Diversified Companies |

16.9% | |

| U.S. Government Obligations |

9.8% | |

| Retailing |

8.0% | |

| Information Processing |

6.7% | |

| Application Software |

5.9% | |

| Internet Software & Services |

5.7% | |

| Automotive Retail |

5.3% | |

| Auto Parts |

5.1% | |

| Dental Equipment |

4.8% | |

| Aerospace/Defense |

3.5% | |

| Industrial & Construction Supplies |

3.4% | |

| Investment Banking & Brokerage |

3.1% | |

| Construction & Engineering |

2.9% | |

| Flooring Products |

2.6% | |

| Precision Instruments |

2.5% | |

| Diversified Banks |

2.5% | |

| Restaurants |

1.9% | |

| Advertising |

1.8% | |

| Healthcare Equipment |

1.3% | |

| Specialty Chemicals |

1.3% | |

| Electrical & Mechanical Systems |

1.2% | |

| Property and Casualty Insurance |

1.2% | |

| Internet Retail |

1.1% | |

| Healthcare |

0.8% | |

| Other Assets |

0.7% | |

| 100.0% | ||

16

Sequoia Fund, Inc.

(Unaudited)

Shareholder Expense Example

17

Sequoia Fund, Inc.

December 31, 2016

(Percentages are of the Fund’s Net Assets)

Common Stocks (87.9%)

| Shares |

Value (Note 1) | ||||||||

| Advertising (1.8%) |

|||||||||

| 854,302 | Omnicom Group Inc |

$ | 72,709,643 | ||||||

|

|

|

||||||||

| Aerospace/Defense (3.5%) |

|||||||||

| 17,196,077 | Rolls-Royce Holdings plc (United Kingdom) |

141,566,383 | |||||||

|

|

|

||||||||

| Application Software (4.3%) |

|||||||||

| 388,766 | Constellation Software, Inc. (Canada) |

176,661,015 | |||||||

|

|

|

||||||||

| Auto Parts (5.1%) |

|||||||||

| 744,497 | O’Reilly Automotive, Inc. (a) |

207,275,410 | |||||||

|

|

|

||||||||

| Automotive Retail (5.3%) |

|||||||||

| 3,364,893 | Carmax, Inc. (a) |

216,665,460 | |||||||

|

|

|

||||||||

| Construction & Engineering (2.9%) |

|||||||||

| 2,043,163 | Jacobs Engineering Group Inc. (a) |

116,460,291 | |||||||

|

|

|

||||||||

| Dental Equipment (4.8%) |

|||||||||

| 3,435,757 | Dentsply Sirona, Inc. |

198,346,252 | |||||||

|

|

|

||||||||

| Diversified Banks (2.5%) |

|||||||||

| 1,864,956 | Wells Fargo & Co. |

102,777,725 | |||||||

|

|

|

||||||||

| Diversified Companies (16.9%) |

|||||||||

| 1,577 | Berkshire Hathaway, Inc.-Class A (a) |

384,978,817 | |||||||

| 1,878,154 | Berkshire Hathaway, Inc.-Class B (a) |

306,101,539 | |||||||

|

|

|

||||||||

| 691,080,356 | |||||||||

|

|

|

||||||||

| Electrical & Mechanical Systems (1.2%) |

|||||||||

| 710,252 | EMCOR Group, Inc. |

50,257,431 | |||||||

|

|

|

||||||||

| Flooring Products (2.6%) |

|||||||||

| 530,213 | Mohawk Industries, Inc. (a) |

105,872,932 | |||||||

|

|

|

||||||||

| Healthcare (0.8%) |

|||||||||

| 379,211 | Perrigo Company plc (Ireland) |

31,561,732 | |||||||

|

|

|

||||||||

| Healthcare Equipment (1.3%) |

|||||||||

| 699,145 | Danaher Corporation |

54,421,447 | |||||||

|

|

|

||||||||

The accompanying notes form an integral part of these Financial Statements.

18

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2016

|

Shares |

Value (Note 1) | ||||||

| Industrial & Construction Supplies (3.4%) |

|||||||

| 2,994,391 | Fastenal Company |

$ 140,676,489 | |||||

| Information Processing (6.7%) |

|||||||

| 2,673,766 | MasterCard, Inc.-Class A |

276,066,339 | |||||

| Internet Retail (1.1%) |

|||||||

| 57,681 | Amazon.com, Inc. (a) |

43,253,251 | |||||

| Internet Software & Services (5.7%) |

|||||||

| 148,518 | Alphabet, Inc.-Class A (a) |

117,693,089 | |||||

| 148,928 | Alphabet, Inc.-Class C (a) |

114,945,609 | |||||

|

|

|

||||||

| 232,638,698 | |||||||

|

|

|

||||||

| Investment Banking & Brokerage (3.1%) |

|||||||

| 3,246,316 | The Charles Schwab Corp |

128,132,092 | |||||

|

|

|

||||||

| Movies & Entertainment (0.0%) |

|||||||

| 51,019 | Liberty Media Corp-Liberty Media -Class A (a) |

1,599,446 | |||||

| 1,203 | Liberty Media Corp-Liberty Media -Class C (a) |

37,690 | |||||

|

|

|

||||||

| 1,637,136 | |||||||

|

|

|

||||||

| Precision Instruments (2.5%) |

|||||||

| 770,699 | Waters Corp. (a) |

103,574,239 | |||||

|

|

|

||||||

| Property and Casualty Insurance (1.2%) |

|||||||

| 4,001,461 | Hiscox Ltd. (Bermuda) |

50,152,644 | |||||

|

|

|

||||||

| Restaurants (1.9%) |

|||||||

| 209,996 | Chipotle Mexican Grill, Inc. (a) |

79,235,691 | |||||

|

|

|

||||||

| Retailing (8.0%) |

|||||||

| 34,657 | Costco Wholesale Corp |

5,548,932 | |||||

| 781,007 | Tiffany & Co. |

60,473,372 | |||||

| 3,481,803 | TJX Companies, Inc. |

261,587,859 | |||||

|

|

|

||||||

| 327,610,163 | |||||||

|

|

|

||||||

| Specialty Chemicals (1.3%) |

|||||||

| 1,356,950 | Croda International plc (United Kingdom) |

53,447,194 | |||||

|

|

|

||||||

| Total Common Stocks (Cost $1,627,343,417) |

3,602,080,013 | ||||||

|

|

|

||||||

The accompanying notes form an integral part of these Financial Statements.

19

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2016

|

Principal Amount |

Value (Note 1) | ||||||

| Corporate Bond (1.6%) |

|||||||

| Application Software (1.6%) |

|||||||

| 76,024,100 | Constellation Software, Inc. (Canada) |

||||||

| 7.60%, 3/31/2040 |

$ | 65,328,163 | |||||

|

|

|

||||||

| Total Corporate Bond (Cost $65,283,154) |

65,328,163 | ||||||

|

|

|

||||||

| U.S. Government Obligations (9.8%) |

|||||||

| 400,000,000 | United States Treasury Bill, 0.420% - 0.490% |

||||||

| due 01/19/2017 through 02/09/2017 |

399,878,000 | ||||||

|

|

|

||||||

| Total U.S. Government Obligations |

|||||||

| (Cost $399,878,000) |

399,878,000 | ||||||

|

|

|

||||||

| Total Investments (99.3%) (Cost $2,092,504,571) (b) |

4,067,286,176 | ||||||

| Other Assets Less Liabilities (0.7%) |

29,127,656 | ||||||

|

|

|

||||||

| Net Assets (100.0%) |

$ | 4,096,413,832 | |||||

|

|

|

||||||

| (a) | Non-income producing security. |

| (b) | The cost for federal income tax purposes is identical. |

Generally accepted accounting principles establish a disclosure hierarchy that categorizes the inputs to valuation techniques used to value the investments at measurement date. These inputs are summarized in the three levels listed below:

| Level 1 | – | unadjusted quoted prices in active markets for identical securities | ||||

| Level 2 | – | other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds and credit risk) | ||||

| Level 3 |

– | unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) | ||||

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers between levels are recognized at the end of the reporting period. During the year ended December 31, 2016, there were no transfers into or out of Level 1 or 2 measurements in the fair value hierarchy. There were no Level 3 securities held by the Fund during the year ended December 31, 2016.

The accompanying notes form an integral part of these Financial Statements.

20

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2016

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2016:

|

Common Stocks |

Corporate Bond | U.S. Government Obligations |

Total | |||||||||||||||||

| Level 1 - Quoted Prices |

$ | 3,602,080,013 | $ | — | $ | — | $ | 3,602,080,013 | ||||||||||||

| Level 2 - Other Significant Observable Inputs |

— | 65,328,163 | 399,878,000 | 465,206,163 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 3,602,080,013 | $ | 65,328,163 | $ | 399,878,000 | $ | 4,067,286,176 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes form an integral part of these Financial Statements.

21

Sequoia Fund, Inc.

Statement of Assets and Liabilities

December 31, 2016

| Assets |

||||

| Investments in securities, at value (cost $2,092,504,571) (Note 1) |

$ | 4,067,286,176 | ||

| Cash on deposit |

41,655,634 | |||

| Receivable for investments sold |

1,387,743 | |||

| Receivable for capital stock sold |

490,420 | |||

| Dividends and interest receivable |

3,259,289 | |||

| Other assets |

330,896 | |||

|

|

|

|||

| Total assets |

4,114,410,158 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for capital stock repurchased |

12,120,708 | |||

| Accrued investment advisory fee |

5,157,402 | |||

| Accrued professional fees |

337,503 | |||

| Accrued other expenses |

380,713 | |||

|

|

|

|||

| Total liabilities |

17,996,326 | |||

|

|

|

|||

| Net Assets |

$ | 4,096,413,832 | ||

|

|

|

|||

| Net Assets Consist of |

||||

| Capital (par value and paid in surplus) $.10 par value capital stock, 100,000,000 shares authorized, 25,399,044 shares outstanding |

$ | 2,109,750,368 | ||

| Accumulated net realized gains on investments (Note 4) |

11,928,509 | |||

| Unrealized appreciation on investments and foreign currency transactions |

1,974,734,955 | |||

|

|

|

|||

| Net Assets |

$ | 4,096,413,832 | ||

|

|

|

|||

| Net asset value per share |

$ | 161.28 | ||

|

|

|

|||

The accompanying notes form an integral part of these Financial Statements.

22

Sequoia Fund, Inc.

Year Ended December 31, 2016

| Investment Income |

||||

| Income |

||||

| Dividends, net of $471,689 foreign tax withheld |

$ | 36,798,746 | ||

| Interest |

3,550,543 | |||

|

|

|

|||

| Total investment income |

40,349,289 | |||

|

|

|

|||

| Expenses |

||||

| Investment advisory fee (Note 2) |

51,213,068 | |||

| Professional fees |

2,528,867 | |||

| Transfer agent fees |

899,942 | |||

| Independent Directors fees and expenses |

330,772 | |||

| Custodian fees |

125,000 | |||

| Other |

634,164 | |||

|

|

|

|||

| Total expenses |

55,731,813 | |||

| Less professional fees reimbursed by insurance company (Note 5) |

850,880 | |||

|

|

|

|||

| Expenses before reimbursement by Investment Adviser |

54,880,933 | |||

| Less expenses reimbursed by Investment Adviser (Note 2) |

3,517,864 | |||

|

|

|

|||

| Net expenses |

51,363,069 | |||

|

|

|

|||

| Net investment loss |

(11,013,780 | ) | ||

|

|

|

|||

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions |

||||

| Realized gain (loss) on |

||||

| Investments (Note 3) |

1,223,698,320 | |||

| Foreign currency transactions |

(337,197 | ) | ||

|

|

|

|||

| Net realized gain on investments and foreign currency transactions |

1,223,361,123 | |||

| Net decrease in unrealized appreciation on investments and foreign currency translations |

(1,738,207,180 | ) | ||

|

|

|

|||

| Net realized and unrealized (loss) on investments and foreign currency transactions and translations |

(514,846,057 | ) | ||

|

|

|

|||

| Net decrease in net assets from operations |

$ | (525,859,837 | ) | |

|

|

|

The accompanying notes form an integral part of these Financial Statements.

23

Sequoia Fund, Inc.

Statements of Changes in Net Assets

| Year Ended December 31, |

||||||||

| 2016 | 2015 | |||||||

| Increase (Decrease) in Net Assets |

||||||||

| From operations |

||||||||

| Net investment loss |

$ | (11,013,780 | ) | $ | (35,067,912 | ) | ||

| Net realized gain on investments and foreign currency transactions |

1,223,361,123 | 418,257,275 | ||||||

| Net decrease in unrealized appreciation on investments and foreign currency translations |

(1,738,207,180 | ) | (963,888,313 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in net assets from operations |

(525,859,837 | ) | (580,698,950 | ) | ||||

|

|

|

|

|

|||||

| Distributions to shareholders from: |

||||||||

| Net realized gains |

(824,149,302 | ) | (345,179,339 | ) | ||||

|

|

|

|

|

|||||

| Capital share transactions |

||||||||

| Shares sold |

107,164,394 | 389,567,801 | ||||||

| Shares issued to shareholders on reinvestment of net realized gain distributions |

711,815,195 | 306,531,556 | ||||||

| Shares repurchased |

(2,113,437,940 | ) | (1,097,370,461 | ) | ||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(1,294,458,351 | ) | (401,271,104 | ) | ||||

|

|

|

|

|

|||||

| Total decrease in net assets |

(2,644,467,490 | ) | (1,327,149,393 | ) | ||||

| Net Assets |

||||||||

| Beginning of period |

6,740,881,322 | 8,068,030,715 | ||||||

|

|

|

|

|

|||||

| End of period (including accumulated net investment loss of $0 and $0, respectively) |

$ | 4,096,413,832 | $ | 6,740,881,322 | ||||

|

|

|

|

|

|||||

| Share transactions |

||||||||

| Shares sold |

600,631 | 1,585,069 | ||||||

| Shares issued to shareholders on reinvestment of net realized gain distributions |

4,394,430 | 1,476,907 | ||||||

| Shares repurchased |

(12,119,457 | ) | (4,870,262 | ) | ||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(7,124,396 | ) | (1,808,286 | ) | ||||

|

|

|

|

|

|||||

The accompanying notes form an integral part of these Financial Statements.

24

Sequoia Fund, Inc.

| Year Ended December 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Per Share Operating Performance (for a share outstanding throughout the period) |

||||||||||||||||||||

| Net asset value, beginning of period |

$ | 207.26 | $ | 235.00 | $ | 222.92 | $ | 168.31 | $ | 145.50 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from investment operations |

||||||||||||||||||||

| Net investment (loss) |

(0.43 | ) | (1.08 | ) | (0.61 | ) | (0.72 | ) | (0.41 | ) | ||||||||||

| Net realized and unrealized gains (losses) on investments |

(15.16 | ) | (16.15 | ) | 17.23 | 58.73 | 23.22 | |||||||||||||

| Net increase (decrease) in net asset value from operations |

(15.59 | ) | (17.23 | ) | 16.62 | 58.01 | 22.81 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from |

(30.39 | ) | (10.51 | ) | (4.54 | ) | (3.40 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 161.28 | $ | 207.26 | $ | 235.00 | $ | 222.92 | $ | 168.31 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Return |

(6.90 | )% | (7.31 | )% | 7.56 | % | 34.58 | % | 15.68 | % | ||||||||||

| Ratios/Supplementary data |

||||||||||||||||||||

| Net assets, end of period (in millions) |

$ | 4,096 | $ | 6,741 | $ | 8,068 | $ | 8,039 | $ | 5,837 | ||||||||||

| Ratio of expenses to average net assets |

||||||||||||||||||||

| Before expenses reimbursed by |

1.07 | % (a) | 1.03 | % | 1.03 | % | 1.02 | % | 1.03 | % | ||||||||||

| After expenses reimbursed by |

1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of net investment (loss) to average net assets |

(0.22 | )% | (0.42 | )% | (0.26 | )% | (0.37 | )% | (0.26 | )% | ||||||||||

| Portfolio turnover rate |

16 | % | 10 | % | 8 | % | 2 | % | 5 | % | ||||||||||

(a) Reflects reduction of 0.02% for expenses reimbursed by insurance company.

The accompanying notes form an integral part of these Financial Statements.

25

Sequoia Fund, Inc.

Note 1— Significant Accounting Policies

Sequoia Fund, Inc. (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, open-end management investment company. The investment objective of the Fund is long-term growth of capital. The Fund is an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

| A. | Valuation of investments: Investments are carried at fair value as determined under the supervision of the Fund’s Board of Directors. Securities traded on a national securities exchange are valued at the last reported sales price on the principal exchange on which the security is listed; securities traded in the NASDAQ Stock Market (“NASDAQ”) are valued in accordance with the NASDAQ Official Closing Price. Securities for which there is no sale or Official Closing Price are valued at the mean of the last reported bid and asked prices. |

Securities traded on a foreign exchange are valued at the closing price on the last business day of the period on the principal exchange on which the security is primarily traded. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the New York Stock Exchange on the date of valuation.

U.S. Treasury Bills with remaining maturities of 60 days or less are valued at their amortized cost. U.S. Treasury Bills that when purchased have a remaining maturity in excess of 60 days are valued on the basis of market quotations and estimates until the sixtieth day prior to maturity, at which point they are valued at amortized cost. Fixed-income securities, other than U.S. Treasury Bills, are valued at the last quoted sales price or, if adequate trading volume is not present, at the mean of the last bid and asked prices.

When reliable market quotations are insufficient or not readily available at time of valuation or when Ruane, Cunniff & Goldfarb Inc. (the “Investment Adviser”) determines that the prices or values available do not represent the fair value of a security, such security is valued as determined in good faith by the Investment Adviser, in conformity with guidelines adopted by and subject to review by the Fund’s Board of Directors.

| B. | Foreign currency translations: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of foreign securities are translated into U.S. dollars at the rates of exchange prevailing when such securities are acquired or sold. Income and expenses are translated into U.S. dollars at the rates of exchange prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized gains or losses on foreign currency transactions arise from the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized gains and losses on foreign currency transactions and translations arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

26

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

| C. | Investment transactions and investment income: Investment transactions are accounted for on the trade date and dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Premiums and discounts on fixed income securities are amortized over the life of the respective security. The net realized gain or loss on security transactions is determined for accounting and tax purposes on the specific identification basis. |

| D. | Federal income taxes: The Fund’s policy is to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and distributes all of its taxable income to its stockholders. Therefore, no federal income tax provision is required. |

| E. | Use of estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| F. | Dividends and distributions: Dividends and distributions are recorded by the Fund on the ex-dividend date. |

Note 2— Investment Advisory Agreement and Payments to Affiliates

The Investment Adviser provides the Fund with investment advice and administrative services.

Under the terms of the Advisory Agreement, the Investment Adviser receives an investment advisory fee equal to 1% per annum of the Fund’s average daily net asset value. Under the Advisory Agreement, the Investment Adviser is contractually obligated to reimburse the Fund for the amount, if any, by which the operating expenses of the Fund (including the investment advisory fee) in any year exceed the sum of 1 1⁄2% of the average daily net asset value of the Fund for such year up to a maximum of $30,000,000 of net assets, plus 1% of the average daily net asset value in excess of $30,000,000. The expenses incurred by the Fund exceeded the limitation for the year ended December 31, 2016 and the Investment Adviser reimbursed the Fund $3,517,864. Such reimbursement is not subject to recoupment by the Investment Adviser.

The Fund has contractually agreed to pay an asset-based fee to a financial intermediary for providing recordkeeping and other administrative services for sub-accounts maintained by the intermediary. The Investment Adviser has contractually agreed to pay such fees on behalf of the Fund as long as the Advisory Agreement remains in effect. Total fees paid by the Investment Adviser to the intermediary on behalf of the Fund for the year ended December 31, 2016 were approximately $97,000.

For the year ended December 31, 2016, advisory fees of $51,213,068 were earned by the Investment Adviser and brokerage commissions of $1,272,509 were earned by Ruane, Cunniff & Goldfarb LLC, the Fund’s distributor and a wholly-owned subsidiary of the Investment Adviser. Certain officers of the Fund are also officers of the Investment Adviser and Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC received no compensation from the Fund on the sale of the Fund’s capital shares for the year ended December 31, 2016. There were no other amounts accrued or paid to interested persons, including officers and directors.

27

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 3— Investment Transactions

The aggregate cost of purchases and the proceeds from the sales of securities, excluding short-term securities, for the year ended December 31, 2016 were $744,007,896 and $2,950,748,907, respectively. Included in proceeds of sales is $558,522,209 representing the value of securities disposed of in payment of redemptions in-kind, resulting in realized gains of $426,279,050.

Note 4— Federal Income Tax Information

Distributions to shareholders are determined in accordance with federal income tax regulations and may differ from those determined for financial statement purposes. To the extent these differences are permanent such amounts are reclassified within the capital accounts. During the year ended December 31, 2016, permanent differences primarily due to realized gains on redemptions in-kind not recognized for tax purposes, net operating loss and different book and tax treatment of net realized gains on foreign currency transactions resulted in a net decrease in accumulated net realized gains of $425,900,621 with a corresponding increase in capital of $414,886,841, and a decrease to accumulated net investment loss of $11,013,780. These reclassifications had no effect on net assets.

At December 31, 2016 the aggregate gross unrealized appreciation and depreciation of securities for federal income tax purposes were $2,033,363,082 and $58,581,477, respectively.

The tax character of distributions paid for the years ended December 31, 2016 and 2015 was as follows:

| 2016 | 2015 | |||||||

| Distributions paid from |

||||||||

| Long-term capital gains |

$ | 824,149,302 | $ | 345,179,339 | ||||

|

|

|

|

|

|||||

As of December 31, 2016 and December 31, 2015 the components of distributable earnings on a tax basis were as follows:

|

2016 |

2015 |

|||||||

| Undistributed long-term gains |

$ | 11,928,509 | $ | 38,617,309 | ||||

| Unrealized appreciation |

$ | 1,974,734,955 | 3,712,942,135 | |||||

|

|

|

|

|

|||||

| $ | 1,986,663,464 | $ | 3,751,559,444 | |||||

|

|

|

|

|

|||||

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the positions are ‘‘more likely than not’’ to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open years (tax years ended December 31, 2013 through December 31, 2016) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

28

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 5— Indemnification

The Fund’s officers, directors and agents are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, except as noted in the following paragraph, the Fund has not had prior claims or losses pursuant to these arrangements and expects the risk of loss thereunder to be remote.

During 2016, the Fund indemnified the independent directors for $1,284,000 in legal fees incurred by the independent directors in connection with the Epstein suit discussed in Note 6. Such legal fees are included in professional fees in the Statement of Operations. A portion of these legal fees, $850,000, was paid directly to counsel for the independent directors pursuant to the Fund’s directors and officers insurance policy. The remainder of the legal fees was included as a fund expense subject to the expense reimbursement provision of the Investment Advisory Agreement. As set forth in Note 2, the Investment Adviser reimbursed the Fund $3,517,864 for the year-ended December 31, 2016 under such provision.

Note 6— Legal Proceedings

On January 8, 2016, Stanley H. Epstein, Harriet P. Epstein, and SEP IRAA/C Peter Christopher Gardener, derivatively and on behalf of the Fund, filed a suit against Ruane, Cunniff & Goldfarb Inc., Robert D. Goldfarb, David Poppe, Robert L. Swiggett and Roger Lowenstein (collectively, the “Defendants”) in the Supreme Court of the State of New York, County of New York. The Fund is also named in the suit as a Nominal Defendant. On May 9, 2016, the plaintiffs filed an amended complaint, adding Edward Lazarus as an additional Defendant. The amended complaint asserts derivative claims in connection with certain of the Fund’s investments against the Defendants for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, breach of contract and gross negligence. The case is Epstein v. Ruane, Cunniff & Goldfarb Inc. et al., 650100/2016, Supreme Court of the State of New York, County of New York (Manhattan). In February 2017, the court granted the defendants’ motion to dismiss all claims in the action.

On March 14, 2016, Clive Cooper, individually and as a representative of a class, on behalf of DST Systems, Inc. 401(k) Profit Sharing Plan, filed a suit in the Southern District of NewYork against Ruane, Cunniff & Goldfarb Inc., DST Systems, Inc., The Advisory Committee of the DST Systems, Inc. 401(K) Profit Sharing Plan, the Compensation Committee of the Board of Directors of DST Systems, Inc., Jerome H. Bailey, Lynn Dorsey Bleil, Lowell L. Bryan, Gary D. Forsee, Gregg Wm. Givens, Charles Haldeman, Jr., Samuel G. Liss and John Does 1-20. The complaint asserts claims for breach of fiduciary duty and violation of ERISA’s prohibited transaction rules, co-fiduciary breach, and breach of trust in connection with certain investments made on behalf of the Plan. The case is Cooper v. DST Systems, Inc. et al., 1:16cv1900, U.S. District Court for the Southern District of New York. The plaintiffs in the action have dismissed without prejudice all claims against all of the defendants other than Ruane, Cunniff & Goldfarb Inc., which is now the only defendant in the case. The Fund is not a defendant in this lawsuit.

29

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Ruane, Cunniff & Goldfarb Inc. believes that the foregoing lawsuits are without merit and intends to defend itself vigorously against the allegations in them. The outcomes of these lawsuits are not expected to have a material impact on the Fund’s financial statements.

Note 7— Subsequent Events

Accounting principles generally accepted in the United States of America require the Fund to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements.

During the year ended December 31, 2016, the Investment Adviser entered into an agreement to purchase securities as part of a private placement offering on behalf of its clients, including the Fund. Subsequent to December 31, 2016, the Investment Adviser allocated to the Fund, and the Fund purchased, approximately $117,000,000 in shares of these securities. As part of the purchase agreement, the Fund is restricted from selling the acquired shares for a maximum of six months following the date of acquisition.

There were no other subsequent events noted through the date of issuance of these financial statements.

Note 8— New Accounting Pronouncements

On October 13, 2016, the Securities and Exchange Commission (the “SEC”) adopted new rules and forms and amended existing rules and forms which are intended to modernize and enhance the reporting and disclosure of information by registered investment companies and to improve the quality of information that funds provide to investors. In an effort to enhance monitoring and regulation, the new rules and forms will allow the SEC to more effectively collect and use data reported by funds. The new rules also promote effective liquidity risk management across the open-end fund industry and enhance disclosure regarding fund liquidity and redemption practices. Also under the new rules, the SEC will permit open-end funds, with the exception of money market funds, to offer swing pricing, subject to board approval and review. The effective dates of these rules are generally December 1, 2018. Management is currently evaluating the impacts and implications of the updates, which have not yet been determined.

In December 2016, the FASB released an Accounting Standards Update (“ASU”) that makes technical changes to various sections of the Accounting Standards Codification (“ASC”), including Topic 820, Fair Value Measurement. The changes to Topic 820 are intended to clarify the difference between a valuation approach and a valuation technique. The changes to ASC 820-10-50-2 require a reporting entity to disclose, for Level 2 and Level 3 fair value measurements, a change in either or both a valuation approach and a valuation technique and the reason(s) for the change. The changes to Topic 820 are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. At this time, management is evaluating the implications of the ASU and its impact on the financial statements and disclosures has not yet been determined.

30

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

The Board of Directors and Shareholders of Sequoia Fund, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Sequoia Fund, Inc. (the “Fund”), as of December 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets and the financial highlights for each of the years in the two-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The financial highlights for years ending prior to January 1, 2015 were audited by other auditors, whose report thereon dated February 19, 2015, expressed an unqualified opinion on those statements.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets and the financial highlights for each of the years in the two-year period then ended in conformity with U.S. generally accepted accounting principles.

New York, New York

February 24, 2017

|

31

Sequoia Fund, Inc.

Approval of Advisory Agreement

(Unaudited)

At a meeting held on December 5, 2016, the Board of Directors of Sequoia Fund, Inc. (the “Fund”), including a majority of the independent Directors, evaluated and approved the renewal of the advisory contract (the “Advisory Agreement”) between the Fund and Ruane, Cunniff & Goldfarb Inc. (the “Investment Adviser”). In approving the renewal of the Advisory Agreement, the Directors considered all information they deemed reasonably necessary to evaluate the terms of the Advisory Agreement.

Nature, Extent and Quality of Services. The Directors considered information concerning the nature, extent and quality of the services provided by the Investment Adviser to the Fund under the Advisory Agreement. They considered information about members of the Investment Committee and the Investment Adviser’s existing and planned staffing levels and changes to the staffing levels that had occurred since the last contract renewal. The Directors also considered information about the Investment Adviser’s investment and research process and the number of individuals devoted to investment research and portfolio management. They considered information regarding the compensation arrangements of the portfolio manager and members of the Investment Committee and information about investments in the Fund by the portfolio manager and members of the Investment Committee. Based on these factors and other factors concerning advisory services provided by the Investment Adviser, the Directors concluded that they were satisfied with the nature, extent and quality of services provided to the Fund by the Investment Adviser under the Advisory Agreement.

Investment Performance. The Directors reviewed information regarding the Fund’s performance under the Investment Adviser’s management. They considered information reflecting the Fund’s performance and the performance of the S&P 500 Index for the 1-year, 3-year, 5-year and 10-year periods ended September 30, 2016. They reviewed information concerning those portfolio holdings that contributed to the Fund’s performance during those periods, as well as holdings that detracted from such performance during those periods. They considered information about the Fund’s purchases and sales during the period. They also considered the Fund’s annualized performance compared to the performance of peer-group funds for the 1-year, 3-year, 5-year and 10-year periods ended September 30, 2016. They considered the source of the information and discussed the performance of the S&P 500 Index relative to the Fund’s performance. The Directors considered the Fund’s performance in light of information provided by the Investment Adviser concerning the performance of other advisory clients managed by the Fund’s portfolio manager for various periods through September 30, 2016. The Directors considered how the Investment Adviser evaluates the performance of the Fund and its rationale for the causes of the Fund’s performance during recent periods. The Directors also considered the Fund’s performance since inception and that of the S&P 500 Index for that period.

Fees. The Directors considered the fee paid to the Investment Adviser under the Advisory Agreement and the Fund’s overall expense ratio. They reviewed information provided by the Investment Adviser comparing the Fund’s advisory fee and expense ratio to the advisory fees charged by, and the expense ratios of, the peer-group funds. They reviewed information showing that the Fund’s expense ratio was 1.00% (after expense reimbursements) and that the average expense ratio for the peer-group funds was 1.21%. They considered the Investment Adviser’s obligation under the Advisory Agreement to reimburse the Fund for the excess, if any, in any year of the Fund’s operating expenses over 1 1⁄2% of the Fund’s average daily net asset values up to a maximum of $30 million, plus 1% of the Fund’s average daily net asset values in excess of $30 million and the amount reimbursed by the Investment Adviser for the most recent year end. They considered information concerning the Investment Adviser’s view of the advisory fee and the Fund’s recent and historical performance. The Directors also considered information regarding the fees charged by the Investment Adviser to its other advisory clients. Based on these

32

Sequoia Fund, Inc.

Approval of Advisory Agreement (Continued)

(Unaudited)

and other factors, the Directors determined that the fee charged by the Investment Adviser to the Fund under the Advisory Agreement was reasonable in light of the services provided by the Investment Adviser and the fees charged by other advisers to similar funds.

Profitability and Other Benefits to the Investment Adviser. The Directors considered information concerning the profitability of the Fund to the Investment Adviser. They also considered other benefits to the Investment Adviser and its affiliates as a result of their relationship with the Fund, including a written analysis of the amounts and rates of brokerage commissions paid by the Fund to Ruane, Cunniff & Goldfarb LLC, a registered broker-dealer that is an affiliate of the Investment Adviser. Based on these factors, the Directors concluded that the Investment Adviser’s profitability would not prevent them from approving the renewal of the Advisory Agreement.

Economies of Scale. The Directors considered information concerning economies of scale and whether the existing advisory fee paid by the Fund to the Investment Adviser might require adjustment in light of any economies of scale. The Directors determined that no modification of the existing advisory fee was necessary.

In light of the Fund’s performance, the Investment Adviser’s provision of advisory and other services, the reasonableness of the Fund’s advisory fee compared to the advisory fees of peer-group funds and other factors, the Directors concluded that the renewal of the Advisory Agreement and retention of the Investment Adviser under the terms of the Advisory Agreement (including at the advisory fee rate set forth in the Advisory Agreement) were in the best interests of the Fund and its stockholders. This conclusion was not based on any single factor, but on an evaluation of the totality of factors and information reviewed and evaluated by the Directors. Based upon such conclusions, the Directors, including a majority of the independent Directors, approved the renewal of the Advisory Agreement.

33

Directors and Officers

(Unaudited)

The Statement of Additional Information (“SAI”) includes additional information about Fund Directors and is available, without charge, upon request. You may call toll-free 1-800-686-6884 to request the SAI.

| Name, Age, and Address |

Position Held with Fund(1) |

Length of Time Served(2) | Principal Occupation during Past 5 Years |

Other | ||||||

| Interested Directors and Officer(3) |

|

|||||||||

| David M. Poppe, 52 9 West 57th Street New York, NY 10019 |

President, CEO & Director | 13 Years | President & Director of Ruane, Cunniff & Goldfarb Inc. | None | ||||||

| John B. Harris, 40 9 West 57th Street New York, NY 10019 |

Director | |

Since May 20, 2016 |

|

Analyst of Ruane, Cunniff & Goldfarb Inc. | None | ||||

| Independent Directors |

||||||||||

| Peter Atkins, 53 9 West 57th Street New York, NY 10019 |

Director | |

Since September 12, 2016 |

|

Managing Director, Permian Partners. | None | ||||

| Edward Lazarus, 57 9 West 57th Street New York, NY 10019 |

Director(4) | 2 Years | Executive Vice President and General Counsel of Tribune Media Co., and former Chief of Staff to the Chairman of the Federal Communications Commission. | None | ||||||

| Roger Lowenstein, 63 9 West 57th Street New York, NY 10019 |

Director | 18 Years | Writer for Major Financial and News Publications. | None | ||||||

| Tim Medley, 73 9 West 57th Street New York, NY 10019 |

Director | |

Since March 14, 2016 |

|

President, Medley & Brown, LLC (SEC-registered investment adviser). | None | ||||

| Robert L. Swiggett, 95 9 West 57th Street New York, NY 10019 |

Director | 46 Years | Retired. | None | ||||||

34

Sequoia Fund, Inc.

Directors and Officers (Continued)

(Unaudited)

| Name, Age, and Address |

Position Held with Fund(1) |

Length of Time Served(2) |

Principal Occupation during Past 5 Years |

Other | ||||||

| Additional Officers |

||||||||||

| Paul J. Greenberg, 54 9 West 57th Street New York, NY 10019 |

Treasurer | 3 Years | Managing Director of BlackRock, Inc. | None | ||||||

| Michael Sloyer, 55 9 West 57th Street New York, NY 10019 |

General Counsel & Chief Compliance Officer | 3 Years | General Counsel of Ruane, Cunniff & Goldfarb Inc. | None | ||||||

| Michael Valenti, 47 9 West 57th Street New York, NY 10019 |

Assistant Secretary | 10 Years | Administrator of Ruane, Cunniff & Goldfarb Inc. | None | ||||||

| (1) | There are no other funds in the complex. |

| (2) | Directors serve until their resignation, removal or death. |

| (3) | Mr. Harris and Mr. Poppe are “interested persons” of the Fund, as defined by the 1940 Act, based on their positions with Ruane, Cunniff & Goldfarb Inc. |

| (4) | Effective January 1, 2017, Mr. Lazarus became the Chairperson of the Board. |

35

Other Information

(Unaudited)

Results of Stockholder Meeting

A Special Meeting of the Stockholders of Sequoia Fund, Inc. was held on September 12, 2016. At the meeting, the stockholders were asked to consider and vote upon the election of three Directors of the Fund, each such Director to serve a term of indefinite duration and until his successor is duly elected and qualified. A majority of the votes cast at the Meeting (at which a quorum was present), voted in favor of electing each of the three Directors. The results were as follows:

| Voted For | Voted Against | Abstained | ||||||||||

| John B. Harris |

13,347,879 | 985,540 | 276,352 | |||||||||

| Peter Atkins |

13,705,552 | 617,170 | 287,055 | |||||||||

| Tim Medley |

13,654,568 | 667,404 | 287,805 | |||||||||

Other Information

Shares of the Fund may be offered only to persons in the United States and by way of a prospectus. This should not be considered a solicitation or offering of any product or service to investors residing outside of the United States.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s web site at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information regarding the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. For a complete list of the Fund’s portfolio holdings, view the most recent semi-annual or annual report on Sequoia Fund’s web site at http://www.sequoiafund.com/fund-reports.htm.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Visit Sequoia Fund’s web site at www.sequoiafund.com and use the ‘‘Shareholder Information’’ link to obtain all proxy information. This information may also be obtained from the SEC’s web site at www.sec.gov or by calling DST Systems, Inc. at 1-800-686-6884.

36

[THIS PAGE INTENTIONALLY LEFT BLANK.]

[THIS PAGE INTENTIONALLY LEFT BLANK.]

[THIS PAGE INTENTIONALLY LEFT BLANK.]

Sequoia Fund, Inc.

9 West 57th Street, Suite 5000

New York, New York 10019-2701

1-800-686-6884

Website: www.sequoiafund.com

Interested Directors

David M. Poppe

John B. Harris

Independent Directors

Edward Lazarus, Chairperson of the Board

Peter Atkins

Roger Lowenstein

Tim Medley

Robert L. Swiggett

Officers

| David M. Poppe | — | President & CEO | ||

| Paul J. Greenberg | — | Treasurer | ||

| Michael Sloyer | — | General Counsel & Chief Compliance Officer | ||

| Michael Valenti | — | Assistant Secretary |

| Investment Adviser | Registrar and Transfer Agent | |

| Ruane, Cunniff & Goldfarb Inc. | DST Systems, Inc. | |

| 9 West 57th Street, Suite 5000 | P.O. Box 219477 | |

| New York, New York 10019-2701 | Kansas City, Missouri 64121 | |

| Distributor | Accounting Agent | |

| Ruane, Cunniff & Goldfarb LLC | BNY Mellon Investment | |

| 9 West 57th Street, Suite 5000 | Servicing (US) Inc. | |

| New York, New York 10019-2701 | 4400 Computer Drive | |

| Westborough, MA 01581 | ||

| Custodian | ||

| The Bank of New York Mellon | Legal Counsel | |

| MF Custody Administration Department | Seward & Kissel LLP | |

| 225 Liberty Street, 25th Floor | One Battery Park Plaza | |

| New York, New York 10286 | New York, New York 10004 | |

| Item 2. Code of Ethics. | ||

| (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. A copy of this code of ethics is attached as an exhibit to this Form N-CSR and also made available on the registrant’s website at www.sequoiafund.com. | |

| (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics definition. | |

| (d) | The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. | |

| Item 3. Audit Committee Financial Expert. | ||

| The registrant’s Board of Directors has determined that the registrant does not have an audit committee financial expert serving on its audit committee. The registrant’s Board of Directors has determined that, based on the background and extensive experience of each of the members of the audit committee in the financial services industry, a designated audit committee financial expert is unnecessary. The members of the audit committee are well-known and respected members of the investment management industry and the registrant is satisfied that their collective knowledge and experience is sufficient for them to perform their duties as audit committee members. | ||

| Item 4. Principal Accountant Fees and Services. | ||

| Audit Fees | ||

| (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $60,500 for 2015 and $52,500 for 2016. | |

| Audit-Related Fees | ||

| (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $0 for 2015 and $0 for 2016. | |

| Tax Fees | ||

| (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $4,000 for 2015 and $5,000 for 2016. | |

| All Other Fees | ||

| (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2015 and $0 for 2016. | |

| (e)(1) | The registrant’s audit committee has the responsibility to pre-approve all audit and non-audit services provided to the registrant by its independent auditor in advance at regularly scheduled audit committee meetings. The registrant’s audit committee also has the responsibility to pre-approve all non-audit services provided by the registrant’s independent auditor to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial reporting of the registrant, in advance at regularly scheduled audit committee meetings. | |

| (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: | |

| (b) None | ||

| (c) None | ||

| (d) None | ||

| (f) | Not Applicable. | |