UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07038

The Money Market Portfolios

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_(650) 312-2000

Date of fiscal year end: 6/30

Date of reporting period:_12/31/11

Item 1. Reports to Stockholders.

| The Money Market Portfolios | ||||

| Statement of Investments, December 31, 2011 (unaudited) | ||||

| The Money Market Portfolio | Principal Amount* | Value | ||

| Investments 99.8% | ||||

| Certificates of Deposit 20.5% | ||||

| Bank of Montreal, Chicago Branch, 0.12%, 1/03/12 | $ | 225,000,000 | $ | 225,000,000 |

| Bank of Montreal, Chicago Branch, 0.17%, 1/17/12 | 100,000,000 | 100,000,444 | ||

| Bank of Montreal, Chicago Branch, 0.11% - 0.17%, 1/06/12 - 2/10/12 | 175,000,000 | 175,000,000 | ||

| Bank of Nova Scotia, Houston Branch, 0.29%, 1/04/12 | 125,000,000 | 125,000,000 | ||

| Bank of Nova Scotia, Houston Branch, 0.28%, 1/12/12 | 100,000,000 | 100,000,000 | ||

| Bank of Nova Scotia, Houston Branch, 0.29%, 1/19/12 | 100,000,000 | 100,000,000 | ||

| Bank of Nova Scotia, Houston Branch, 0.26% - 0.29%, 2/27/12 - 3/05/12 | 125,000,000 | 125,000,000 | ||

| Royal Bank of Canada, New York Branch, 0.26%, 1/11/12 | 400,000,000 | 400,000,000 | ||

| Royal Bank of Canada, New York Branch, 0.05% - 0.26%, 1/13/12 - 1/23/12 | 45,525,000 | 45,525,561 | ||

| The Toronto-Dominion Bank, New York Branch, 0.07% - 0.10%, 1/03/12 - 2/21/12 | 175,000,000 | 175,000,028 | ||

| The Toronto-Dominion Bank, New York Branch, 0.30%, 6/25/12 | 200,000,000 | 200,000,000 | ||

| The Toronto-Dominion Bank, New York Branch, 0.31%, 6/29/12 | 125,000,000 | 125,006,240 | ||

| Westpac Banking Corp., New York Branch, 0.46%, 3/30/12 | 50,000,000 | 50,000,000 | ||

| Total Certificates of Deposit (Cost $1,945,532,273) | 1,945,532,273 | |||

| aCommercial Paper 46.8% | ||||

| Australia and New Zealand Banking Group Ltd., 1/05/12 (Australia) | 75,000,000 | 74,997,750 | ||

| Australia and New Zealand Banking Group Ltd., 1/30/12 (Australia) | 150,000,000 | 149,963,750 | ||

| Bank of Nova Scotia, 1/11/12 - 1/13/12 (Canada) | 50,000,000 | 49,999,333 | ||

| Chevron Corp., 1/24/12 - 1/30/12 | 128,800,000 | 128,797,449 | ||

| Commonwealth Bank of Australia, 1/04/12 - 1/20/12 (Australia) | 95,800,000 | 95,794,957 | ||

| Export Development Canada, 2/13/12 (Canada) | 250,000,000 | 249,989,549 | ||

| Export Development Canada, 3/01/12 (Canada) | 100,000,000 | 99,995,000 | ||

| General Electric Co., 1/30/12 | 263,000,000 | 262,985,170 | ||

| Johnson & Johnson, 1/17/12 | 100,000,000 | 99,997,778 | ||

| Johnson & Johnson, 3/19/12 | 100,000,000 | 99,985,917 | ||

| Johnson & Johnson, 1/18/12 - 4/03/12 | 175,500,000 | 175,484,028 | ||

| Johnson & Johnson, 5/01/12 | 125,000,000 | 124,953,785 | ||

| Kingdom of Denmark, 1/04/12 - 1/06/12 (Denmark) | 150,000,000 | 149,999,114 | ||

| National Australia Funding, 1/17/12 (Australia) | 11,000,000 | 10,999,315 | ||

| Nestle Capital Corp., 1/20/12 (Switzerland) | 100,000,000 | 99,997,361 | ||

| Nestle Capital Corp., 2/27/12 - 3/08/12 (Switzerland) | 140,750,000 | 140,734,821 | ||

| Nestle Finance International Ltd., 1/05/12 (Switzerland) | 100,000,000 | 99,998,889 | ||

| Nestle Finance International Ltd., 1/18/12 (Switzerland) | 125,000,000 | 124,995,278 | ||

| PepsiCo Inc., 1/19/12 | 100,000,000 | 99,997,500 | ||

| PepsiCo Inc., 1/06/12 - 2/21/12 | 400,000,000 | 399,985,798 | ||

| Pfizer Inc., 1/05/12 | 91,700,000 | 91,699,694 | ||

| Pfizer Inc., 1/12/12 | 254,780,000 | 254,777,360 | ||

| Procter & Gamble Co., 1/09/12 | 50,000,000 | 49,999,555 | ||

| Province of British Columbia, 1/04/12 - 6/20/12 (Canada) | 508,350,000 | 508,135,028 | ||

| Province of Ontario, 1/13/12 - 4/30/12 (Canada) | 237,285,000 | 237,229,285 | ||

| Province of Ontario, 5/31/12 (Canada) | 150,000,000 | 149,905,625 | ||

| Royal Bank of Canada, 1/17/12 (Canada) | 55,000,000 | 54,999,022 | ||

| The Toronto-Dominion Bank, 4/02/12 (Canada) | 4,000,000 | 3,997,956 | ||

| Total Capital Canada Ltd., 1/06/12 (France) | 100,000,000 | 99,999,861 | ||

| Westpac Banking Corp., 2/01/12 (Australia) | 200,000,000 | 199,939,722 | ||

| Westpac Banking Corp., 3/02/12 - 3/27/12 (Australia) | 45,450,000 | 45,411,854 | ||

| Total Commercial Paper (Cost $4,435,747,504) | 4,435,747,504 | |||

18 | Semiannual Report

The Money Market Portfolios

Statement of Investments, December 31, 2011 (unaudited) (continued)

Semiannual Report | 19

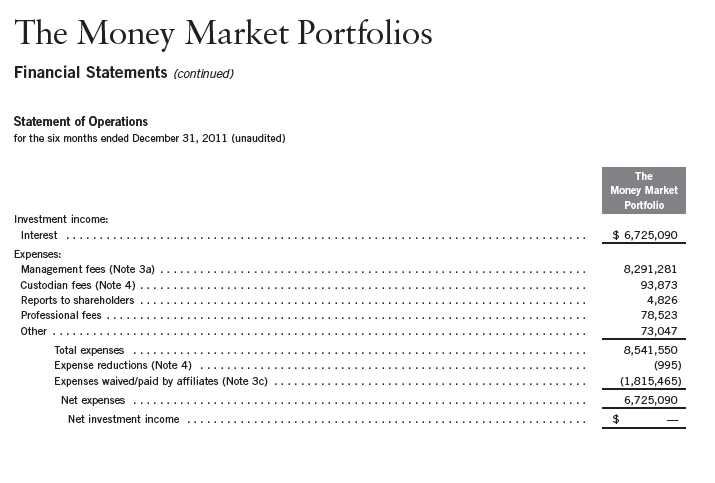

20 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

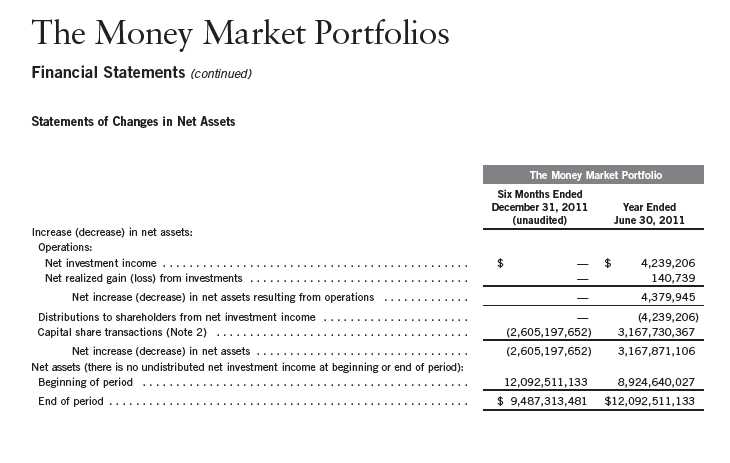

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

The Money Market Portfolios

Notes to Financial Statements (unaudited)

The Money Market Portfolio

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

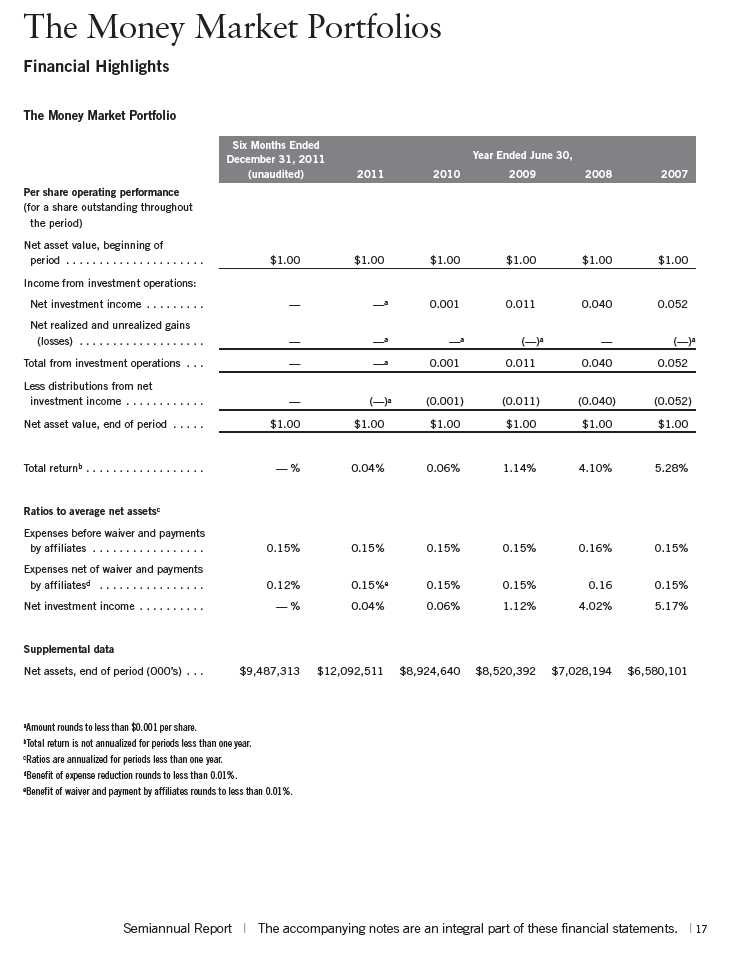

The Money Market Portfolios (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of one portfolio, The Money Market Portfolio (Portfolio). The shares of the Portfolio are issued in private placements and are exempt from registration under the Securities Act of 1933.

The following summarizes the Portfolio’s significant accounting policies.

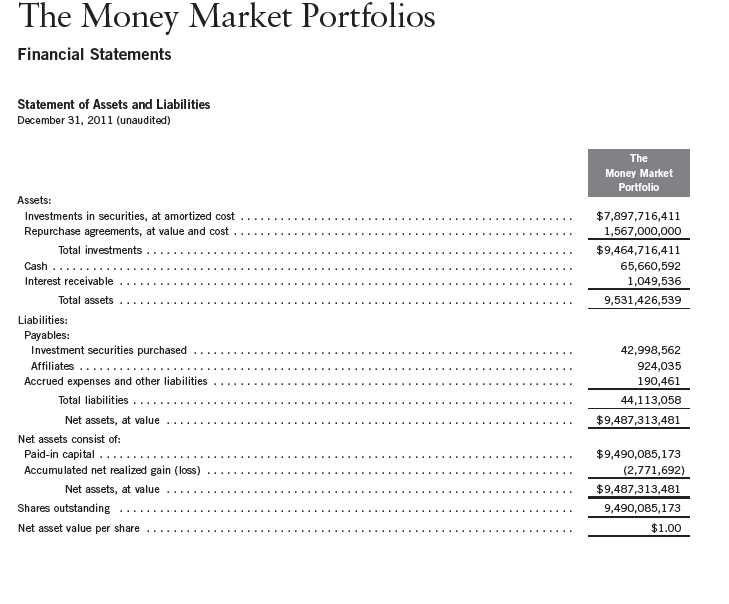

a. Financial Instrument Valuation

Securities are valued at amortized cost, which approximates market value. Amortized cost is an income-based approach which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

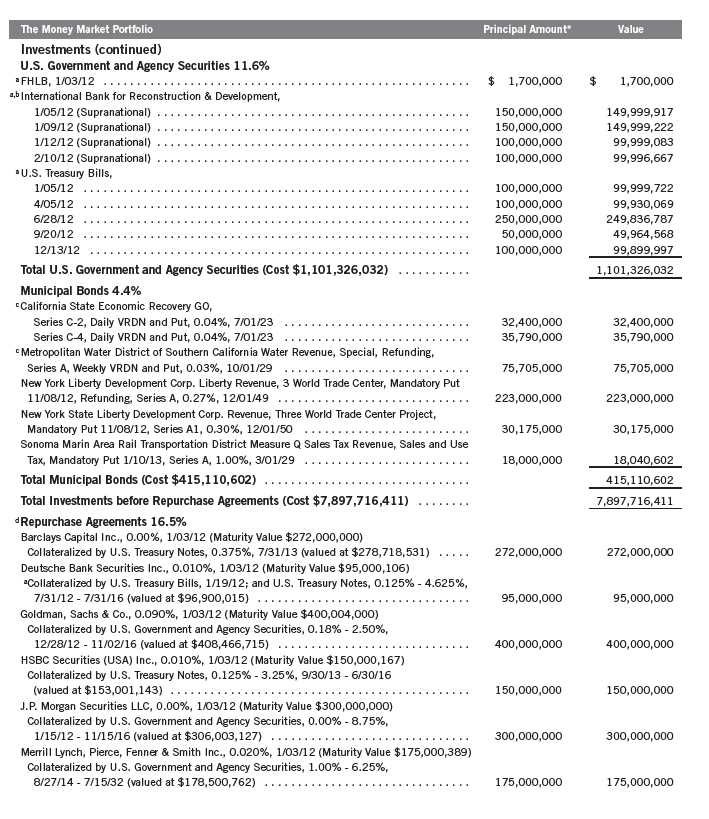

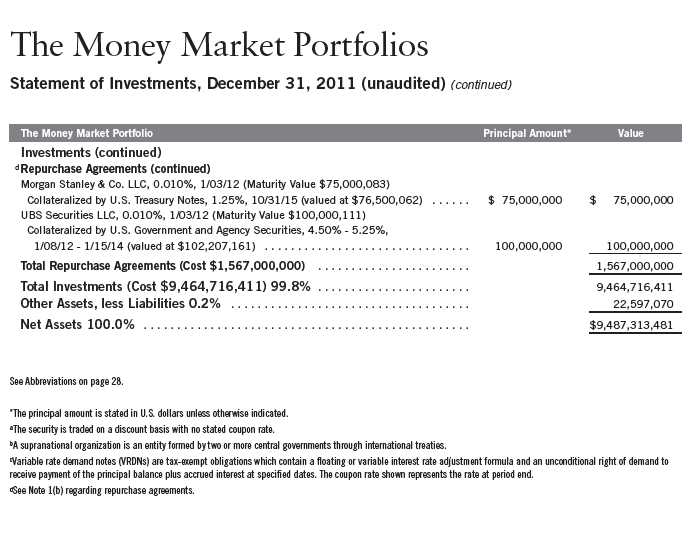

b. Repurchase Agreements

The Portfolio enters into repurchase agreements, which are accounted for as a loan by the Portfolio to the seller, collateralized by securities which are delivered to the Portfolio’s custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the Portfolio, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. All repurchase agreements held by the Portfolio at period end had been entered into on December 30, 2011.

c. Income Taxes

It is the Portfolio’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Portfolio intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Portfolio recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of December 31, 2011, and for all open tax years, the Portfolio has determined that no liability for unrecognized tax benefits is required in the Portfolio’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are

24 | Semiannual Report

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Portfolio, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

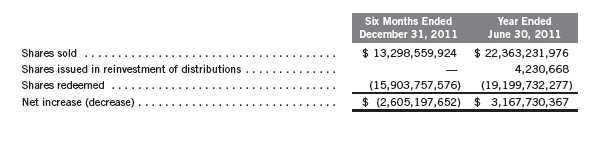

2. SHARES OF BENEFICIAL INTEREST

At December 31, 2011, there were an unlimited number of shares authorized (without par value). Transactions in the Portfolio’s shares at $1.00 per share were as follows:

Semiannual Report | 25

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers, directors, and/or trustees of the Franklin Money Fund, the Franklin Templeton Money Fund Trust, the Institutional Fiduciary Trust, and of the following subsidiaries:

| Subsidiary | Affiliation |

| Franklin Advisers, Inc. (Advisers) | Investment manager |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Portfolio pays an investment management fee to Advisers of 0.15% per year of the average daily net assets of the Portfolio.

b. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Portfolio and is not paid by the Portfolio for the services.

c. Waiver and Expense Reimbursements

In efforts to prevent a negative yield, Advisers has voluntarily agreed to waive or limit its fees, assume as its own expense certain expenses otherwise payable by the Portfolio and if necessary, make a capital infusion into the Portfolio. These waivers, expense reimbursements and capital infusions are voluntary and may be modified or discontinued by Advisers at any time, and without further notice. There is no guarantee that the Portfolio will be able to avoid a negative yield.

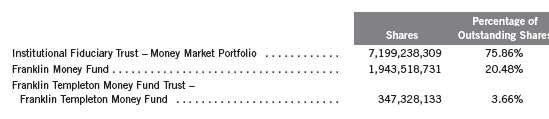

d. Other Affiliated Transactions

At December 31, 2011, the shares of the Portfolio were owned by the following entities:

4. EXPENSE OFFSET ARRANGEMENT

The Portfolio has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Portfolio’s custodian expenses. During the period ended December 31, 2011, the custodian fees were reduced as noted in the Statement of Operations.

26 | Semiannual Report

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At June 30, 2011, the Portfolio had capital loss carryforwards of $2,771,692 expiring in 2017.

Under the Regulated Investment Company Modernization Act of 2010, the Portfolio will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous law. Any post-enactment capital losses generated will be required to be utilized prior to the losses incurred in pre-enactment tax years.

At December 31, 2011, the cost of investments for book and income tax purposes was the same.

6. FAIR VALUE MEASUREMENTS

The Portfolio follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Portfolio’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Portfolio’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. Money market securities may be valued using amortized cost, in accordance with the 1940 Act. Generally, amortized cost reflects the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2 inputs.

For movements between the levels within the fair value hierarchy, the Portfolio has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At December 31, 2011, all of the Portfolio’s investments in securities carried at fair value were valued using Level 2 inputs.

Semiannual Report | 27

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

7. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Portfolio believes the adoption of this ASU will not have a material impact on its financial statements.

8. SUBSEQUENT EVENTS

The Portfolio has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

FHLB - Federal Home Loan Bank

GO - General Obligation

28 | Semiannual Report

Shareholder Information

Proxy Voting Policies and Procedures

The Trust’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Trust’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Semiannual Report | 29

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson, and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

THE MONEY MARKET PORTFOLIOS

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date February 24 2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date February 24 2012

By /s/GASTON GARDEY

Gaston Gardey

Chief Financial Officer and Chief Accounting Officer

Date February 24 2012