Annual Report | The accompanying notes are an integral part of these financial statements. | 23

| The Money Market Portfolios | ||||

| Statement of Investments, June 30, 2011 | ||||

| The Money Market Portfolio | Principal Amount* | Value | ||

| Investments 100.2% | ||||

| Certificates of Deposit 17.4% | ||||

| Bank of Montreal, Chicago Branch, 0.12%, 7/07/11 | $ | 175,000,000 | $ | 175,000,000 |

| Bank of Montreal, Chicago Branch, 0.13%, 7/07/11 | 125,000,000 | 125,000,000 | ||

| Bank of Montreal, Chicago Branch, 0.12%, 7/11/11 | 200,000,000 | 200,000,000 | ||

| Bank of Nova Scotia, Houston Branch, 0.11% - 0.24%, 7/05/11 - 8/24/11 | 475,000,000 | 475,000,000 | ||

| National Australia Bank, New York Branch, 0.18%, 7/18/11 | 150,000,000 | 150,000,000 | ||

| National Australia Bank, New York Branch, 0.09% - 0.16%, 7/11/11 - 9/06/11 | 350,000,000 | 350,000,000 | ||

| Royal Bank of Canada, New York Branch, 0.13%, 9/26/11 | 100,000,000 | 100,001,208 | ||

| The Toronto-Dominion Bank, New York Branch, 0.12%, 7/20/11 | 150,000,000 | 150,000,000 | ||

| The Toronto-Dominion Bank, New York Branch, 0.17% - 0.27%, 7/05/11 - 9/07/11 | 300,000,000 | 300,000,000 | ||

| Westpac Banking Corp., New York Branch, 0.25%, 7/08/11 | 75,000,000 | 75,000,000 | ||

| Total Certificates of Deposit (Cost $2,100,001,208) | 2,100,001,208 | |||

| aCommercial Paper 49.7% | ||||

| Abbott Laboratories, 7/11/11 - 7/26/11 | 306,000,000 | 305,979,631 | ||

| Australia and New Zealand Banking Group Ltd., 7/06/11 (Australia) | 200,000,000 | 199,994,306 | ||

| Australia and New Zealand Banking Group Ltd., 8/26/11 (Australia) | 100,000,000 | 99,975,111 | ||

| Australia and New Zealand Banking Group Ltd., 9/27/11 (Australia) | 200,000,000 | 199,912,000 | ||

| Bank of Nova Scotia, 8/01/11 (Canada) | 21,070,000 | 21,066,553 | ||

| Chevron Texaco Corp., 7/07/11 - 7/13/11 | 250,000,000 | 249,995,820 | ||

| Colgate-Palmolive Co., 7/14/11 - 8/01/11 | 131,500,000 | 131,494,450 | ||

| Commonwealth Bank of Australia, 7/05/11 - 11/28/11 (Australia) | 533,641,000 | 533,462,567 | ||

| Concentrate Manufacturing Co. of Ireland, 7/11/11 (Ireland) | 67,400,000 | 67,398,315 | ||

| Export Development Canada, 7/19/11 (Canada) | 50,000,000 | 49,996,250 | ||

| General Electric Co., 7/01/11 | 500,000,000 | 500,000,000 | ||

| Johnson & Johnson, 7/25/11 | 215,305,000 | 215,279,163 | ||

| Johnson & Johnson, 7/18/11 - 8/30/11 | 36,578,000 | 36,567,116 | ||

| Kingdom of Denmark, 7/27/11 (Denmark) | 100,000,000 | 99,995,306 | ||

| Nestle Capital Corp., 7/05/11 - 8/30/11 (Switzerland) | 161,925,000 | 161,910,647 | ||

| Nestle Finance International Ltd., 8/22/11 (Switzerland) | 196,800,000 | 196,765,888 | ||

| Nestle Finance International Ltd., 9/07/11 - 9/26/11 (Switzerland) | 104,000,000 | 103,975,677 | ||

| Novartis Finance Corp., 7/14/11 (Switzerland) | 20,000,000 | 19,998,303 | ||

| Novartis Finance Corp., 10/17/11 (Switzerland) | 150,000,000 | 149,892,000 | ||

| PepsiCo Inc., 7/22/11 - 9/02/11 | 375,000,000 | 374,959,460 | ||

| Pfizer Inc., 7/14/11 | 200,000,000 | 199,995,667 | ||

| Procter & Gamble International Funding, 7/08/11 | 150,000,000 | 149,997,958 | ||

| Procter & Gamble International Funding, 7/15/11 | 242,500,000 | 242,493,399 | ||

| Procter & Gamble International Funding, 7/18/11 | 100,000,000 | 99,996,222 | ||

| Province of Ontario, 7/28/11 (Canada) | 275,000,000 | 274,983,500 | ||

| Province of Ontario, 7/07/11 - 8/31/11 (Canada) | 232,375,000 | 232,351,602 | ||

| The Toronto-Dominion Bank, 7/15/11 (Canada) | 50,000,000 | 49,997,083 | ||

| United Parcel Service Inc., 7/19/11 | 175,000,000 | 174,995,625 | ||

| Wal-Mart Stores Inc., 7/08/11 | 179,080,000 | 179,077,263 | ||

| Wal-Mart Stores Inc., 7/01/11 - 7/27/11 | 242,900,000 | 242,891,753 | ||

| Westpac Banking Corp., 9/07/11 (Australia) | 150,000,000 | 149,939,083 | ||

| Westpac Banking Corp., 8/01/11 - 12/08/11 (Australia) | 298,500,000 | 298,327,190 | ||

| Total Commercial Paper (Cost $6,013,664,908) | 6,013,664,908 | |||

24 | Annual Report

The Money Market Portfolios

Statement of Investments, June 30, 2011 (continued)

| The Money Market Portfolio | Principal Amount* | Value | ||

| Investments (continued) | ||||

| U.S. Government and Agency Securities 9.4% | ||||

| a FHLB, 7/06/11 - 7/13/11 | $ | 140,000,000 | $ | 139,998,361 |

| a FHLMC, 7/06/11 | 73,800,000 | 73,799,898 | ||

| a FNMA, 7/06/11 - 7/08/11 | 118,250,000 | 118,249,087 | ||

| a,bInternational Bank for Reconstruction & Development, | ||||

| 7/27/11 (Supranational) | 151,700,000 | 151,692,606 | ||

| 8/08/11 (Supranational) | 150,000,000 | 149,990,500 | ||

| 7/05/11 - 8/22/11 (Supranational) | 247,000,000 | 246,983,013 | ||

| a U.S. Treasury Bill, | ||||

| 4/05/12 | 100,000,000 | 99,794,625 | ||

| 6/28/12 | 150,000,000 | 149,724,473 | ||

| Total U.S. Government and Agency Securities (Cost $1,130,232,563) | 1,130,232,563 | |||

| Municipal Bonds 3.6% | ||||

| c California Infrastructure and Economic Development Bank Revenue, J. Paul Getty Trust, | ||||

| Refunding, Series D, Daily VRDN and Put, 0.02%, 4/01/33 | 21,025,000 | 21,025,000 | ||

| c California State Economic Recovery GO, | ||||

| Series C-2, Daily VRDN and Put, 0.03%, 7/01/23 | 32,400,000 | 32,400,000 | ||

| Series C-4, Daily VRDN and Put, 0.03%, 7/01/23 | 35,790,000 | 35,790,000 | ||

| Durham County Industrial Facilities and PCFA Revenue, Chesterfield Project, Recovery Zone | ||||

| Facility Bonds, Mandatory Put 9/29/11, 0.40%, 1/01/41 | 22,000,000 | 22,000,000 | ||

| c Metropolitan Water District of Southern California Water Revenue, Special, Refunding, | ||||

| Series A, Weekly VRDN and Put, 0.04%, 10/01/29 | 76,030,000 | 76,030,000 | ||

| New York Liberty Development Corp. Liberty Revenue, World Trade Center, Mandatory | ||||

| Put 2/01/12, Series A-1, 0.35%, 12/01/49 | 248,000,000 | 248,000,000 | ||

| Total Municipal Bonds (Cost $435,245,000) | 435,245,000 | |||

| Total Investments before Repurchase Agreements (Cost $9,679,143,679) | 9,679,143,679 | |||

| dRepurchase Agreements 20.1% | ||||

| Barclays Capital Inc., 0.00%, 7/01/11 (Maturity Value $100,000,000) | ||||

| Collateralized by U.S. Treasury Notes, 0.625%, 1/31/13 (valued at $102,529,154) | 100,000,000 | 100,000,000 | ||

| Deutsche Bank Securities Inc., 0.00%, 7/01/11 (Maturity Value $435,980,000) | ||||

| Collateralized by U.S. Treasury Notes, 0.00% - 10.625%, 7/31/11 - 4/15/18 | ||||

| (valued at $444,699,607) | 435,980,000 | 435,980,000 | ||

| Goldman, Sachs & Co., 0.010%, 7/01/11 (Maturity Value $400,000,111) | ||||

| Collateralized by U.S. Government and Agency Securities, 0.17% - 1.125%, | ||||

| 4/02/12 - 7/30/12 (valued at $408,509,689) | 400,000,000 | 400,000,000 | ||

| HSBC Securities (USA) Inc., 0.005%, 7/01/11 (Maturity Value $325,000,045) | ||||

| Collateralized by U.S. Government and Agency Securities, 0.00% - 6.27%, | ||||

| 8/05/11 - 4/18/16 (valued at $331,503,756) | 325,000,000 | 325,000,000 | ||

| J.P. Morgan Securities LLC, 0.00%, 7/01/11 (Maturity Value $600,000,000) | ||||

| Collateralized by U.S. Government and Agency Securities, 0.00% - 6.125%, | ||||

| 7/18/11 - 5/15/16 (valued at $612,004,767) | 600,000,000 | 600,000,000 | ||

| Merrill Lynch, Pierce, Fenner & Smith Inc., 0.010%, (Maturity Value $300,000,083) | ||||

| Collateralized by U.S. Government and Agency Securities, 0.00% - 5.625%, | ||||

| 7/25/11 - 7/15/37 (valued at $306,000,349) | 300,000,000 | 300,000,000 | ||

| Morgan Stanley & Co. LLC, 0.00%, 7/01/11 (Maturity Value $125,000,000) | ||||

| Collateralized by U.S. Treasury Notes, 0.625% - 1.875%, | ||||

| 4/15/13 - 7/15/15 (valued at $127,500,080) | 125,000,000 | 125,000,000 |

Annual Report | 25

The Money Market Portfolios

Statement of Investments, June 30, 2011 (continued)

26 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 27

28 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 29

The Money Market Portfolios

Notes to Financial Statements

The Money Market Portfolio

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Money Market Portfolios (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of one portfolio, The Money Market Portfolio (Portfolio). The shares of the Portfolio are issued in private placements and are exempt from registration under the Securities Act of 1933.

The following summarizes the Portfolio’s significant accounting policies.

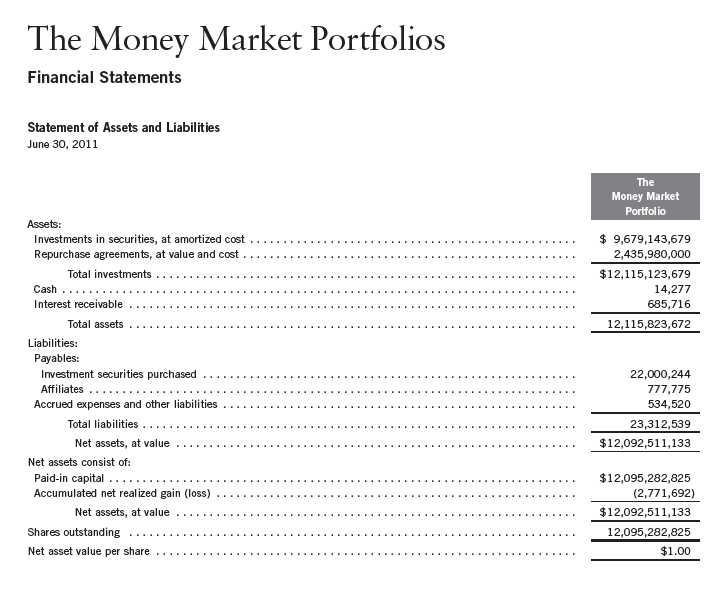

a. Financial Instrument Valuation

Securities are valued at amortized cost, which approximates market value. Amortized cost is an income-based approach which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

b. Repurchase Agreements

The Portfolio enters into repurchase agreements, which are accounted for as a loan by the Portfolio to the seller, collateralized by securities which are delivered to the Portfolio’s custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the Portfolio, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. All repurchase agreements held by the Portfolio at year end had been entered into on June 30, 2011.

c. Income Taxes

It is the Portfolio’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Portfolio intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required. The Portfolio files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Portfolio records a provision for taxes in its financial statements including penalties and interest, if any, for a tax position taken on a tax return (or expected to be taken) when it fails to meet the more likely than not (a greater than 50% probability) threshold and based on the technical merits, the tax position may not be sustained upon examination by the tax authorities. As of June 30, 2011, and for all open tax years, the Portfolio has determined that no provision for income tax is required in the Portfolio’s financial statements. Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are

30 | Annual Report

The Money Market Portfolios

Notes to Financial Statements (continued)

The Money Market Portfolio

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Portfolio, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

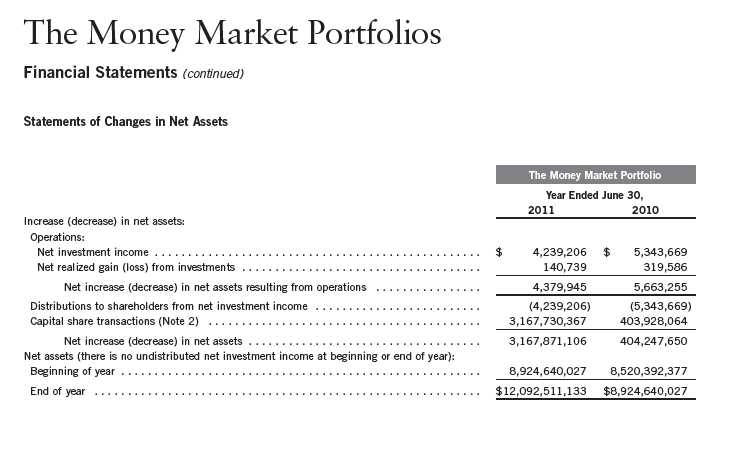

2. SHARES OF BENEFICIAL INTEREST

At June 30, 2011, there were an unlimited number of shares authorized (without par value).

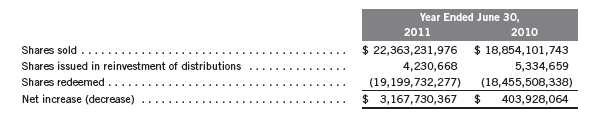

Transactions in the Portfolio’s shares at $1.00 per share were as follows:

Annual Report | 31

The Money Market Portfolios

Notes to Financial Statements (continued)

The Money Market Portfolio

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers, directors, and/or trustees of the Franklin Money Fund, the Franklin Templeton Money Fund Trust, the Institutional Fiduciary Trust, and of the following subsidiaries:

| Subsidiary | Affiliation |

| Franklin Advisers, Inc. (Advisers) | Investment manager |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

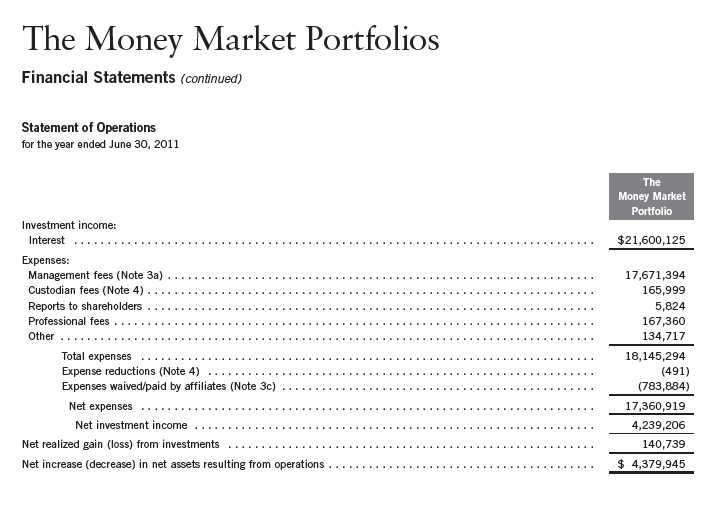

a. Management Fees

The Portfolio pays an investment management fee to Advisers of 0.15% per year of the average daily net assets of the Portfolio.

b. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Portfolio and is not paid by the Portfolio for the services.

c. Waiver and Expense Reimbursements

In efforts to prevent a negative yield, Advisers has voluntarily agreed to waive or limit its fees, assume as its own expense certain expenses otherwise payable by the Portfolio and if necessary, make a capital infusion into the Portfolio. These waivers, expense reimbursements and capital infusions are voluntary and may be modified or discontinued by Advisers at any time, and without further notice. There is no guarantee that the Portfolio will be able to avoid a negative yield.

d. Other Affiliated Transactions

At June 30, 2011, the shares of the Portfolio were owned by the following entities:

4. EXPENSE OFFSET ARRANGEMENT

The Portfolio has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Portfolio’s custodian expenses. During the year ended June 30, 2011, the custodian fees were reduced as noted in the Statement of Operations.

32 | Annual Report

The Money Market Portfolios

Notes to Financial Statements (continued)

The Money Market Portfolio

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At June 30, 2011, the Portfolio had tax basis capital losses of $2,771,692 expiring in 2017. During the year ended June 30, 2011 the Portfolio utilized $140,739 of capital loss carryforwards.

Under the Regulated Investment Company Modernization Act of 2010, the Portfolio will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous law. Any post-enactment capital losses generated in the future will be required to be utilized prior to the losses incurred in pre-enactment tax years.

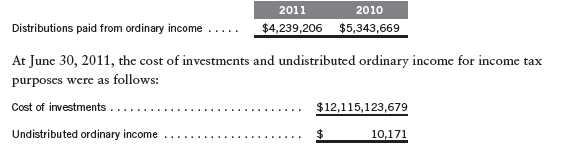

The tax character of distributions paid during the years ended June 30, 2011 and 2010, was as follows:

6. FAIR VALUE MEASUREMENTS

The Portfolio follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Portfolio’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Portfolio’s investments and are summarized in the following fair value hierarchy:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. Money market securities may be valued using amortized cost, in accordance with the 1940 Act. Generally, amortized cost reflects the current fair value of a

Annual Report | 33

The Money Market Portfolios

Notes to Financial Statements (continued)

The Money Market Portfolio

6. FAIR VALUE MEASUREMENTS (continued)

security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as a Level 2.

For movements between the levels within the fair value hierarchy, the Portfolio has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At June 30, 2011, all of the Portfolio’s investments in securities carried at fair value were in Level 2 inputs.

7. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (IFRS). The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP and IFRS and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Portfolio is currently evaluating the impact, if any, of applying this provision.

8. SUBSEQUENT EVENTS

The Portfolio has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

| FHLB | - | Federal Home Loan Bank |

| FHLMC | - | Federal Home Loan Mortgage Corp. |

| FNMA | - | Federal National Mortgage Association |

| GO | - General Obligation | |

| PCFA | - | Pollution Control Financing Authority |

34 | Annual Report

The Money Market Portfolios

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of The Money Market Portfolio

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Money Market Portfolio (the “Fund”) at June 30, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2011 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

August 18, 2011

Annual Report | 35

The Money Market Portfolios

Tax Designation (unaudited)

The Money Market Portfolio

Under Section 871(k)(1)(C) of the Internal Revenue Code (Code), the Fund designates the maximum amount allowable but no less than $2,235,433 as interest related dividends for purposes of the tax imposed under Section 871(a)(1)(A) of the Code for the fiscal year ended June 30, 2011.

36 | Annual Report

The Money Market Portfolios

Board Members and Officers

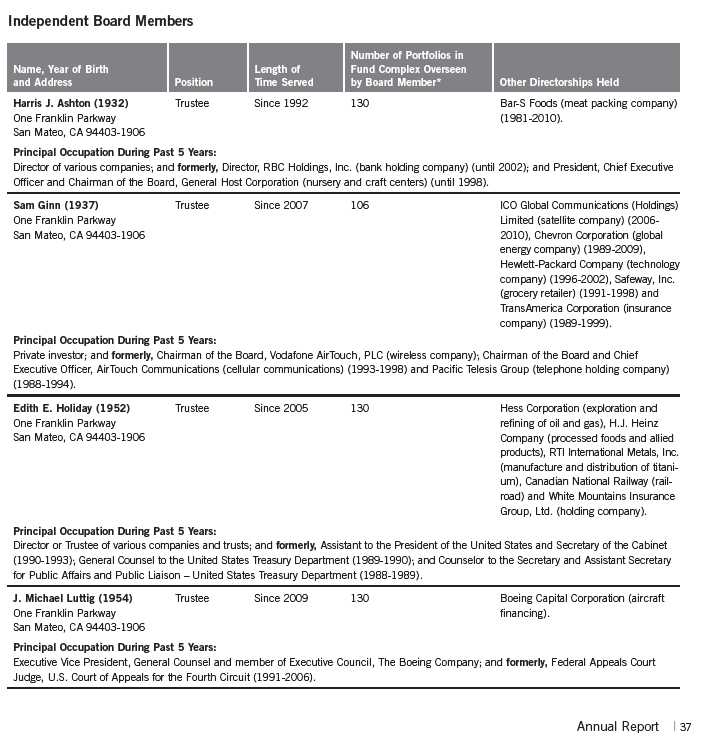

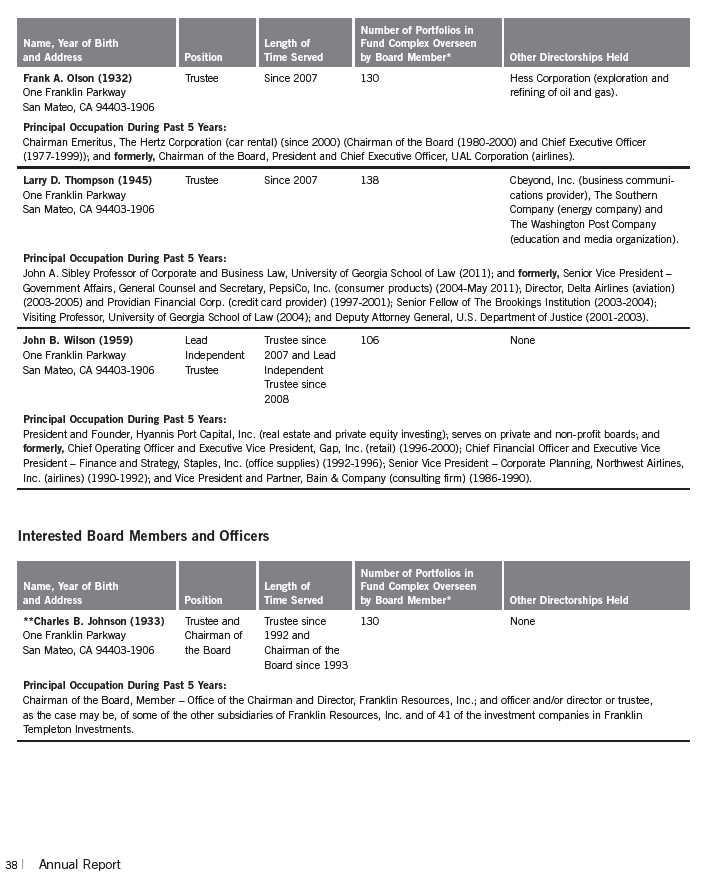

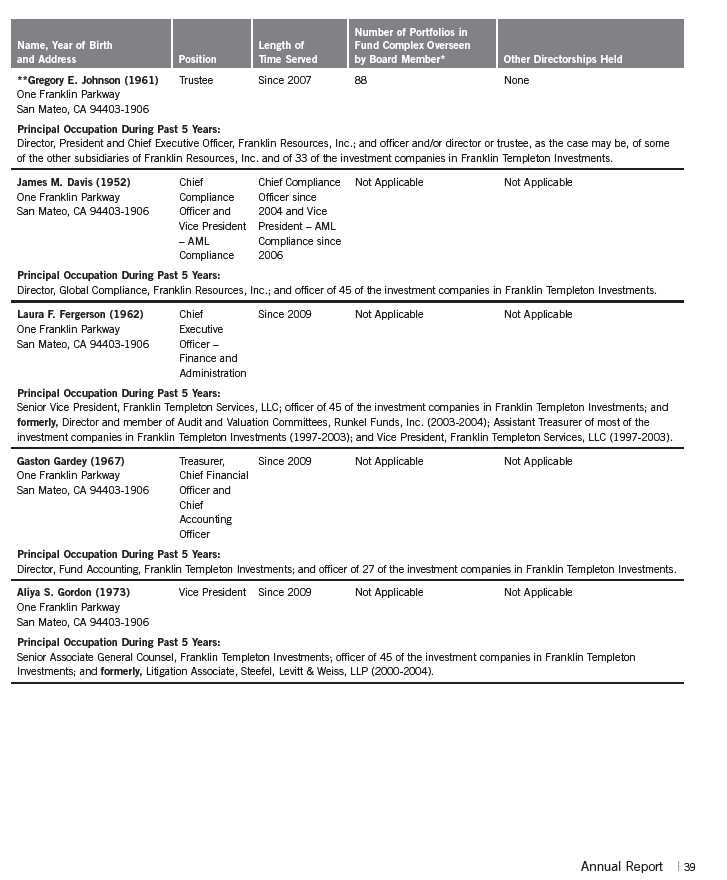

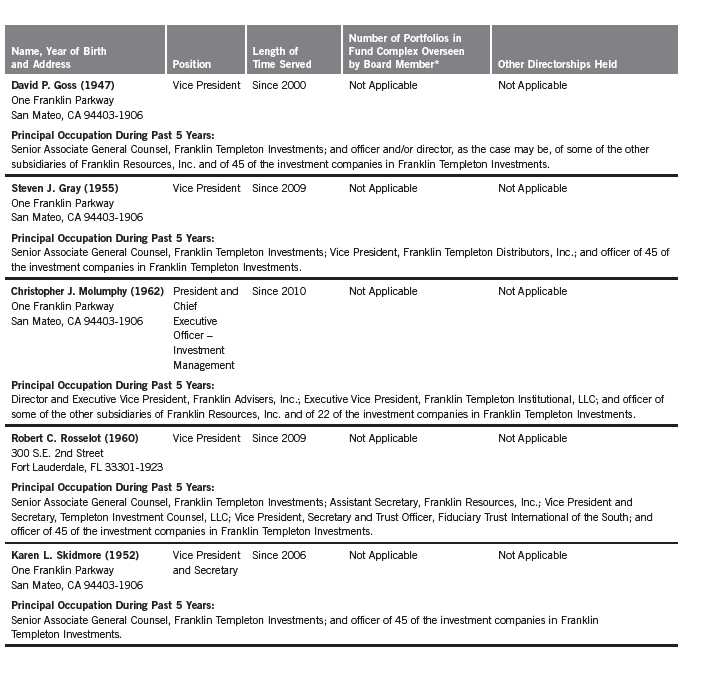

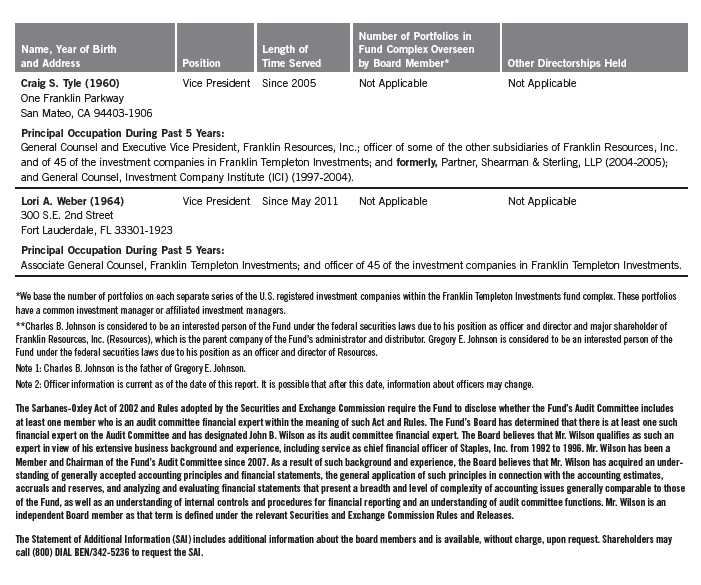

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, principal occupations during the past five years and number of portfolios overseen in the Franklin Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

40 | Annual Report

Annual Report | 41

SHAREHOLDER INFORMATION

BOARD REVIEW OF INVESTMENT MANAGEMENT AGREEMENT

At a meeting held March 1, 2011, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for the Fund. In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings. Information furnished and discussed throughout the year included investment performance reports and related financial information for the Fund, as well as periodic reports on shareholder services, legal compliance, pricing, and other services provided by the Investment Manager (Manager) and its affiliates. In addition, information specifically furnished to the Board in connection with the contract renewals being considered at the meeting included a Fund Profitability Analysis Report and additional information. Additionally, a report prepared by Lipper compared the Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund Profitability Analysis Report discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Included with such Profitability Analysis Report was information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates, including management’s explanation of differences where relevant, as well as a three-year expense analysis with an explanation for any increase in expense ratios. Additional information accompanying such report were a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Fund by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and a comparative analysis concerning transfer agent fees charged the Fund.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. The Fund Profitability Analysis Report and other additional material prepared by Management, along with the Lipper Report for the Fund, were sent to each of the Trustees on January 28, 2011. Such material was reviewed and discussed by the independent Trustees among themselves and with Management in a telephonic conference call that took place February 11, 2011. Questions raised in such telephonic conference call were responded to by Management and were discussed at a meeting of independent Trustees held prior to the Board meeting. It was noted that all of the independent Trustees also served as independent Trustees on the Boards of each of the feeder funds and in considering such materials, emphasis was placed on various factors, including those taken into account by such Trustees in approving the investment advisory arrangements for the feeder funds.

PROXY VOTING POLICIES AND PROCEDURES

The Fund has established Proxy Voting Policies and Procedures ("Policies") that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund's complete Policies online at franklintempleton.com. Alternatively,

shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923, Attention: Proxy Group. Copies of the Fund's proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission's website at sec.gov and reflect the most recent 12-month period ended June 30.

QUARTERLY STATEMENT OF INVESTMENTS

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission's website at sec.gov. The filed form may also be viewed and copied at the Commission's Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-800/SEC-0330.

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $82,524 for the fiscal year ended June 30, 2011 and $68,844 for the fiscal year ended June 30, 2010.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant's investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $85,000 for the fiscal year ended June 30, 2011 and $0 for the fiscal year ended June 30, 2010. The services for which these fees were paid included technical tax consultation for capital gain tax reporting to foreign governments and the application of the local country tax laws to investments made by various Franklin Templeton funds.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $4,037 for the fiscal year ended June 30, 2011 and $0 for the fiscal year ended June 30, 2010. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant other than services reported in paragraphs (a)-(c) of Item 4 were $140,763 for the fiscal year ended June 30, 2011 and $0 for the fiscal year ended June 30, 2010. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

(e) (1) The registrant’s audit committee is directly responsible for approving the services to be provided by the auditors, including:

| (i) | pre-approval of all audit and audit related services; |

| (ii) | pre-approval of all non-audit related services to be provided to the Fund by the auditors; |

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit

committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for services rendered by the principal accountant to the registrant and the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $229,800 for the fiscal year ended June 30, 2011 and $0 for the fiscal year ended June 30, 2010.

(h) The registrant’s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

THE MONEY MARKET PORTFOLIOS

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date August 25, 2011

Pursuant to the requirements of the Securities Exchange Act of 1934 and

the Investment Company Act of 1940, this report has been signed below

by the following persons on behalf of the registrant and in the

capacities and on the dates indicated.

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date August 25, 2011

By /s/GASTON GARDEY

Gaston Gardey

Chief Financial Officer and Chief Accounting Officer

Date August 25, 2011