• | Net income of $28.9 million, or $0.37 per share, increased 6 percent as compared to the first quarter 2013 as a result of lower provision for loan losses and non-interest expenses. |

• | Operating profit increased to $56.3 million, as compared to $55.3 million for the previous quarter, and included $3.0 million of non-recurring expenses and a $1.9 million positive credit valuation adjustment. |

• | Total loans as of June 30, 2013, were $10.1 billion, an increase of $60.8 million from the previous quarter end, with the majority of growth in commercial and industrial loan balances. |

• | Net interest margin was 3.22 percent, an increase of 3 basis points as compared to the previous quarter from lower deposit costs and higher loan yields. |

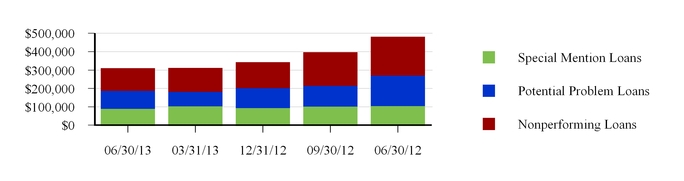

• | Nonperforming assets declined 12 percent to $178.9 million from the prior quarter, benefiting from sales of non-performing loans and other real estate owned. Nonperforming assets to total assets were 1.33 percent at June 30, 2013, compared to 1.51 percent at March 31, 2013, and 2.47 percent at June 30, 2012. |

• | continued uncertainty regarding U.S. and global economic outlook that may impact market conditions and credit quality or prolong weakness in demand for loans or other banking products and services; |

• | unanticipated developments in pending or prospective loan transactions or greater than expected paydowns or payoffs of existing loans; |

• | unanticipated changes in interest rates; |

• | competitive trends in our markets; |

• | unforeseen credit quality problems that could result in charge-offs greater than we have anticipated in our allowance for loan losses; |

• | slower than anticipated dispositions of other real estate owned or declines in real estate values which may negatively impact foreclosed property expense; |

• | lack of sufficient or cost-effective sources of liquidity or funding as and when needed; |

• | loss of key personnel or an inability to recruit and retain appropriate talent; |

• | potential impact of recently adopted capital rules; |

• | greater than anticipated impact on costs, revenues and offered products and services associated with the implementation of other regulatory changes; |

• | changes in monetary or fiscal policies of the U.S. Government; or |

• | failures or disruptions to our data processing or other information or operational systems, including the potential impact of disruptions or breaches at our third party service providers. |

Consolidated Income Statements | |||||||||||||||

(Amounts in thousands, except per share data) | |||||||||||||||

(Unaudited) | |||||||||||||||

Quarters Ended June 30, | Six Months Ended June 30, | ||||||||||||||

2013 | 2012 | 2013 | 2012 | ||||||||||||

Interest Income | |||||||||||||||

Loans, including fees | $ | 107,407 | $ | 105,142 | $ | 214,194 | $ | 208,681 | |||||||

Federal funds sold and interest-bearing deposits in banks | 112 | 133 | 320 | 265 | |||||||||||

Securities: | |||||||||||||||

Taxable | 12,519 | 14,723 | 25,341 | 29,981 | |||||||||||

Exempt from Federal income taxes | 1,532 | 1,336 | 3,034 | 2,636 | |||||||||||

Other interest income | 62 | 131 | 152 | 253 | |||||||||||

Total interest income | 121,632 | 121,465 | 243,041 | 241,816 | |||||||||||

Interest Expense | |||||||||||||||

Interest-bearing demand deposits | 1,034 | 799 | 2,149 | 1,435 | |||||||||||

Savings deposits and money market accounts | 3,887 | 4,265 | 8,286 | 8,867 | |||||||||||

Brokered and time deposits | 4,956 | 5,394 | 10,085 | 10,411 | |||||||||||

Short-term and secured borrowings | 410 | 123 | 528 | 265 | |||||||||||

Long-term debt | 7,613 | 5,538 | 15,221 | 11,116 | |||||||||||

Total interest expense | 17,900 | 16,119 | 36,269 | 32,094 | |||||||||||

Net interest income | 103,732 | 105,346 | 206,772 | 209,722 | |||||||||||

Provision for loan and covered loan losses | 8,843 | 17,038 | 19,200 | 44,739 | |||||||||||

Net interest income after provision for loan and covered loan losses | 94,889 | 88,308 | 187,572 | 164,983 | |||||||||||

Non-interest Income | |||||||||||||||

Trust and Investments | 4,800 | 4,312 | 9,194 | 8,531 | |||||||||||

Mortgage banking | 3,198 | 2,915 | 7,368 | 5,578 | |||||||||||

Capital markets products | 6,048 | 6,033 | 11,087 | 13,382 | |||||||||||

Treasury management | 6,209 | 5,260 | 12,133 | 10,414 | |||||||||||

Loan, letter of credit and commitment fees | 4,282 | 4,359 | 8,359 | 8,723 | |||||||||||

Syndication fees | 3,140 | 2,013 | 6,972 | 4,176 | |||||||||||

Deposit service charges and fees and other income | 1,196 | 1,644 | 3,587 | 3,131 | |||||||||||

Net securities gains (losses) | 136 | (290 | ) | 777 | (185 | ) | |||||||||

Total non-interest income | 29,009 | 26,246 | 59,477 | 53,750 | |||||||||||

Non-interest Expense | |||||||||||||||

Salaries and employee benefits | 39,854 | 42,177 | 82,994 | 84,875 | |||||||||||

Net occupancy expense | 7,387 | 7,653 | 14,921 | 15,332 | |||||||||||

Technology and related costs | 3,476 | 3,273 | 6,940 | 6,569 | |||||||||||

Marketing | 3,695 | 3,058 | 6,012 | 5,218 | |||||||||||

Professional services | 1,782 | 2,247 | 3,681 | 4,204 | |||||||||||

Outsourced servicing costs | 1,964 | 2,093 | 3,598 | 3,803 | |||||||||||

Net foreclosed property expenses | 5,555 | 11,894 | 12,198 | 20,129 | |||||||||||

Postage, telephone, and delivery | 981 | 882 | 1,824 | 1,751 | |||||||||||

Insurance | 2,804 | 4,239 | 5,343 | 8,544 | |||||||||||

Loan and collection expense | 2,280 | 2,918 | 5,057 | 6,075 | |||||||||||

Other expenses | 7,477 | 3,424 | 13,650 | 7,587 | |||||||||||

Total non-interest expense | 77,255 | 83,858 | 156,218 | 164,087 | |||||||||||

Income before income taxes | 46,643 | 30,696 | 90,831 | 54,646 | |||||||||||

Income tax provision | 17,728 | 13,192 | 34,646 | 22,887 | |||||||||||

Net income | 28,915 | 17,504 | 56,185 | 31,759 | |||||||||||

Preferred stock dividends and discount accretion | — | 3,442 | — | 6,878 | |||||||||||

Net income available to common stockholders | $ | 28,915 | $ | 14,062 | $ | 56,185 | $ | 24,881 | |||||||

Per Common Share Data | |||||||||||||||

Basic earnings per share | $ | 0.37 | $ | 0.19 | $ | 0.72 | $ | 0.35 | |||||||

Diluted earnings per share | $ | 0.37 | $ | 0.19 | $ | 0.72 | $ | 0.34 | |||||||

Cash dividends declared | $ | 0.01 | $ | 0.01 | $ | 0.02 | $ | 0.02 | |||||||

Weighted-average common shares outstanding | 76,415 | 70,956 | 76,280 | 70,868 | |||||||||||

Weighted-average diluted common shares outstanding | 76,581 | 71,147 | 76,393 | 71,041 | |||||||||||

Consolidated Income Statements | |||||||||||||||||||

(Amounts in thousands, except per share data) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||||||||||||

Interest Income | |||||||||||||||||||

Loans, including fees | $ | 107,407 | $ | 106,787 | $ | 108,172 | $ | 106,358 | $ | 105,142 | |||||||||

Federal funds sold and interest-bearing deposits in banks | 112 | 208 | 452 | 248 | 133 | ||||||||||||||

Securities: | |||||||||||||||||||

Taxable | 12,519 | 12,822 | 12,938 | 13,907 | 14,723 | ||||||||||||||

Exempt from Federal income taxes | 1,532 | 1,502 | 1,462 | 1,389 | 1,336 | ||||||||||||||

Other interest income | 62 | 90 | 168 | 126 | 131 | ||||||||||||||

Total interest income | 121,632 | 121,409 | 123,192 | 122,028 | 121,465 | ||||||||||||||

Interest Expense | |||||||||||||||||||

Interest-bearing demand deposits | 1,034 | 1,115 | 985 | 958 | 799 | ||||||||||||||

Savings deposits and money market accounts | 3,887 | 4,399 | 4,531 | 4,206 | 4,265 | ||||||||||||||

Brokered and time deposits | 4,956 | 5,129 | 5,561 | 5,860 | 5,394 | ||||||||||||||

Short-term and secured borrowings | 410 | 118 | 77 | 101 | 123 | ||||||||||||||

Long-term debt | 7,613 | 7,608 | 7,235 | 5,495 | 5,538 | ||||||||||||||

Total interest expense | 17,900 | 18,369 | 18,389 | 16,620 | 16,119 | ||||||||||||||

Net interest income | 103,732 | 103,040 | 104,803 | 105,408 | 105,346 | ||||||||||||||

Provision for loan and covered loan losses | 8,843 | 10,357 | 13,177 | 13,509 | 17,038 | ||||||||||||||

Net interest income after provision for loan and covered loan losses | 94,889 | 92,683 | 91,626 | 91,899 | 88,308 | ||||||||||||||

Non-interest Income | |||||||||||||||||||

Trust and Investments | 4,800 | 4,394 | 4,232 | 4,254 | 4,312 | ||||||||||||||

Mortgage banking | 3,198 | 4,170 | 4,197 | 3,685 | 2,915 | ||||||||||||||

Capital markets products | 6,048 | 5,039 | 6,744 | 5,832 | 6,033 | ||||||||||||||

Treasury management | 6,209 | 5,924 | 5,606 | 5,490 | 5,260 | ||||||||||||||

Loan, letter of credit and commitment fees | 4,282 | 4,077 | 4,671 | 4,779 | 4,359 | ||||||||||||||

Syndication fees | 3,140 | 3,832 | 2,231 | 2,700 | 2,013 | ||||||||||||||

Deposit service charges and fees and other income | 1,196 | 2,391 | 1,582 | 1,308 | 1,644 | ||||||||||||||

Net securities gains (losses) | 136 | 641 | 191 | (211 | ) | (290 | ) | ||||||||||||

Total non-interest income | 29,009 | 30,468 | 29,454 | 27,837 | 26,246 | ||||||||||||||

Non-interest Expense | |||||||||||||||||||

Salaries and employee benefits | 39,854 | 43,140 | 45,253 | 44,820 | 42,177 | ||||||||||||||

Net occupancy expense | 7,387 | 7,534 | 7,762 | 7,477 | 7,653 | ||||||||||||||

Technology and related costs | 3,476 | 3,464 | 3,249 | 3,432 | 3,273 | ||||||||||||||

Marketing | 3,695 | 2,317 | 2,448 | 2,645 | 3,058 | ||||||||||||||

Professional services | 1,782 | 1,899 | 1,998 | 2,151 | 2,247 | ||||||||||||||

Outsourced servicing costs | 1,964 | 1,634 | 1,814 | 1,802 | 2,093 | ||||||||||||||

Net foreclosed property expenses | 5,555 | 6,643 | 9,571 | 8,596 | 11,894 | ||||||||||||||

Postage, telephone, and delivery | 981 | 843 | 909 | 837 | 882 | ||||||||||||||

Insurance | 2,804 | 2,539 | 3,290 | 3,352 | 4,239 | ||||||||||||||

Loan and collection expense | 2,280 | 2,777 | 2,227 | 3,329 | 2,918 | ||||||||||||||

Other expenses | 7,477 | 6,173 | 2,794 | 3,289 | 3,424 | ||||||||||||||

Total non-interest expense | 77,255 | 78,963 | 81,315 | 81,730 | 83,858 | ||||||||||||||

Income before income taxes | 46,643 | 44,188 | 39,765 | 38,006 | 30,696 | ||||||||||||||

Income tax provision | 17,728 | 16,918 | 16,682 | 14,952 | 13,192 | ||||||||||||||

Net income | 28,915 | 27,270 | 23,083 | 23,054 | 17,504 | ||||||||||||||

Preferred stock dividends and discount accretion | — | — | 3,043 | 3,447 | 3,442 | ||||||||||||||

Net income available to common stockholders | $ | 28,915 | $ | 27,270 | $ | 20,040 | $ | 19,607 | $ | 14,062 | |||||||||

Per Common Share Data | |||||||||||||||||||

Basic earnings per share | $ | 0.37 | $ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | |||||||||

Diluted earnings per share | $ | 0.37 | $ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | |||||||||

Cash dividends declared | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | |||||||||

Weighted-average common shares outstanding | 76,415 | 76,143 | 75,035 | 71,010 | 70,956 | ||||||||||||||

Weighted-average diluted common shares outstanding | 76,581 | 76,203 | 75,374 | 71,274 | 71,147 | ||||||||||||||

Consolidated Balance Sheets | |||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

6/30/13 | 3/31/13 | 12/31/12 | 9/30/12 | 6/30/12 | |||||||||||||||

(Unaudited) | (Unaudited) | (Audited) | (Unaudited) | (Unaudited) | |||||||||||||||

Assets | |||||||||||||||||||

Cash and due from banks | $ | 150,683 | $ | 118,583 | $ | 234,308 | $ | 143,573 | $ | 141,563 | |||||||||

Federal funds sold and interest-bearing deposits in banks | 147,699 | 203,647 | 707,143 | 470,984 | 315,378 | ||||||||||||||

Loans held-for-sale | 34,803 | 38,091 | 49,696 | 49,209 | 35,342 | ||||||||||||||

Securities available-for-sale, at fair value | 1,580,179 | 1,457,433 | 1,451,160 | 1,550,516 | 1,625,649 | ||||||||||||||

Securities held-to-maturity, at amortized cost | 955,688 | 959,994 | 863,727 | 784,930 | 693,277 | ||||||||||||||

Federal Home Loan Bank ("FHLB") stock | 34,063 | 34,288 | 43,387 | 43,387 | 43,467 | ||||||||||||||

Loans – excluding covered assets, net of unearned fees | 10,094,636 | 10,033,803 | 10,139,982 | 9,625,421 | 9,436,235 | ||||||||||||||

Allowance for loan losses | (148,183 | ) | (153,992 | ) | (161,417 | ) | (166,859 | ) | (174,302 | ) | |||||||||

Loans, net of allowance for loan losses and unearned fees | 9,946,453 | 9,879,811 | 9,978,565 | 9,458,562 | 9,261,933 | ||||||||||||||

Covered assets | 158,326 | 176,855 | 194,216 | 208,979 | 244,782 | ||||||||||||||

Allowance for covered loan losses | (24,995 | ) | (24,089 | ) | (24,011 | ) | (21,500 | ) | (21,733 | ) | |||||||||

Covered assets, net of allowance for covered loan losses | 133,331 | 152,766 | 170,205 | 187,479 | 223,049 | ||||||||||||||

Other real estate owned, excluding covered assets | 57,134 | 73,857 | 81,880 | 97,833 | 109,836 | ||||||||||||||

Premises, furniture, and equipment, net | 37,025 | 38,373 | 39,508 | 40,526 | 38,177 | ||||||||||||||

Accrued interest receivable | 38,325 | 39,205 | 34,832 | 36,892 | 37,089 | ||||||||||||||

Investment in bank owned life insurance | 53,216 | 52,873 | 52,513 | 52,134 | 51,751 | ||||||||||||||

Goodwill | 94,496 | 94,509 | 94,521 | 94,534 | 94,546 | ||||||||||||||

Other intangible assets | 11,266 | 12,047 | 12,828 | 13,500 | 14,152 | ||||||||||||||

Derivative assets | 57,361 | 90,303 | 99,261 | 114,777 | 109,539 | ||||||||||||||

Other assets | 144,771 | 126,450 | 143,981 | 139,718 | 147,428 | ||||||||||||||

Total assets | $ | 13,476,493 | $ | 13,372,230 | $ | 14,057,515 | $ | 13,278,554 | $ | 12,942,176 | |||||||||

Liabilities | |||||||||||||||||||

Demand deposits: | |||||||||||||||||||

Noninterest-bearing | $ | 2,736,868 | $ | 2,756,879 | $ | 3,690,340 | $ | 3,295,568 | $ | 2,920,182 | |||||||||

Interest-bearing | 1,234,134 | 1,390,955 | 1,057,390 | 893,194 | 785,879 | ||||||||||||||

Savings deposits and money market accounts | 4,654,930 | 4,741,864 | 4,912,820 | 4,381,595 | 4,146,022 | ||||||||||||||

Brokered time deposits | 1,190,796 | 983,625 | 993,455 | 1,290,796 | 1,484,435 | ||||||||||||||

Time deposits | 1,491,604 | 1,518,980 | 1,519,629 | 1,498,287 | 1,398,012 | ||||||||||||||

Total deposits | 11,308,332 | 11,392,303 | 12,173,634 | 11,359,440 | 10,734,530 | ||||||||||||||

Short-term and secured borrowings | 308,700 | 107,775 | 5,000 | 5,000 | 335,000 | ||||||||||||||

Long-term debt | 499,793 | 499,793 | 499,793 | 374,793 | 374,793 | ||||||||||||||

Accrued interest payable | 5,963 | 6,787 | 7,141 | 5,287 | 5,855 | ||||||||||||||

Derivative liabilities | 62,014 | 84,370 | 93,276 | 108,678 | 106,064 | ||||||||||||||

Other liabilities | 58,651 | 49,137 | 71,505 | 61,916 | 51,780 | ||||||||||||||

Total liabilities | 12,243,453 | 12,140,165 | 12,850,349 | 11,915,114 | 11,608,022 | ||||||||||||||

Equity | |||||||||||||||||||

Preferred stock | — | — | — | 241,585 | 241,185 | ||||||||||||||

Common stock: | |||||||||||||||||||

Voting | 75,238 | 73,144 | 73,479 | 68,348 | 68,307 | ||||||||||||||

Nonvoting | 1,585 | 3,536 | 3,536 | 3,536 | 3,536 | ||||||||||||||

Treasury stock | (9,001 | ) | (9,631 | ) | (24,150 | ) | (22,736 | ) | (22,639 | ) | |||||||||

Additional paid-in capital | 1,016,615 | 1,014,443 | 1,026,438 | 956,356 | 951,127 | ||||||||||||||

Retained earnings | 134,423 | 106,288 | 79,799 | 60,533 | 41,651 | ||||||||||||||

Accumulated other comprehensive income, net of tax | 14,180 | 44,285 | 48,064 | 55,818 | 50,987 | ||||||||||||||

Total equity | 1,233,040 | 1,232,065 | 1,207,166 | 1,363,440 | 1,334,154 | ||||||||||||||

Total liabilities and equity | $ | 13,476,493 | $ | 13,372,230 | $ | 14,057,515 | $ | 13,278,554 | $ | 12,942,176 | |||||||||

Selected Financial Data | ||||||||||||||||||||

(Amounts in thousands, except per share data) | ||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | ||||||||||||||||

Selected Statement of Income Data: | ||||||||||||||||||||

Net interest income | $ | 103,732 | $ | 103,040 | $ | 104,803 | $ | 105,408 | $ | 105,346 | ||||||||||

Net revenue (1)(2) | $ | 133,546 | $ | 134,292 | $ | 135,022 | $ | 133,974 | $ | 132,291 | ||||||||||

Operating profit (1)(2) | $ | 56,291 | $ | 55,329 | $ | 53,707 | $ | 52,244 | $ | 48,433 | ||||||||||

Provision for loan and covered loan losses | $ | 8,843 | $ | 10,357 | $ | 13,177 | $ | 13,509 | $ | 17,038 | ||||||||||

Income before income taxes | $ | 46,643 | $ | 44,188 | $ | 39,765 | $ | 38,006 | $ | 30,696 | ||||||||||

Net income available to common stockholders | $ | 28,915 | $ | 27,270 | $ | 20,040 | $ | 19,607 | $ | 14,062 | ||||||||||

Per Common Share Data: | ||||||||||||||||||||

Basic earnings per share | $ | 0.37 | $ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | ||||||||||

Diluted earnings per share | $ | 0.37 | $ | 0.35 | $ | 0.26 | $ | 0.27 | $ | 0.19 | ||||||||||

Dividends declared | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||||||

Book value (period end) (1) | $ | 15.88 | $ | 15.87 | $ | 15.65 | $ | 15.49 | $ | 15.09 | ||||||||||

Tangible book value (period end) (1)(2) | $ | 14.52 | $ | 14.49 | $ | 14.26 | $ | 14.00 | $ | 13.59 | ||||||||||

Market value (close) | $ | 21.22 | $ | 18.89 | $ | 15.32 | $ | 15.99 | $ | 14.76 | ||||||||||

Book value multiple | 1.34 | x | 1.19 | x | 0.98 | x | 1.03 | x | 0.98 | x | ||||||||||

Share Data: | ||||||||||||||||||||

Weighted-average common shares outstanding | 76,415 | 76,143 | 75,035 | 71,010 | 70,956 | |||||||||||||||

Weighted-average diluted common shares outstanding | 76,581 | 76,203 | 75,374 | 71,274 | 71,147 | |||||||||||||||

Common shares issued (at period end) | 78,015 | 78,050 | 78,062 | 73,291 | 73,273 | |||||||||||||||

Common shares outstanding (at period end) | 77,630 | 77,649 | 77,115 | 72,436 | 72,424 | |||||||||||||||

Performance Ratio: | ||||||||||||||||||||

Return on average assets | 0.86 | % | 0.81 | % | 0.67 | % | 0.70 | % | 0.55 | % | ||||||||||

Return on average common equity | 9.28 | % | 9.01 | % | 6.64 | % | 7.00 | % | 5.18 | % | ||||||||||

Return on average tangible common equity (1)(2) | 10.30 | % | 10.04 | % | 7.45 | % | 7.91 | % | 5.92 | % | ||||||||||

Net interest margin (1)(2) | 3.22 | % | 3.19 | % | 3.16 | % | 3.35 | % | 3.46 | % | ||||||||||

Fee revenue as a percent of total revenue (1) | 21.77 | % | 22.45 | % | 21.83 | % | 21.02 | % | 20.12 | % | ||||||||||

Non-interest income to average assets | 0.87 | % | 0.91 | % | 0.85 | % | 0.85 | % | 0.83 | % | ||||||||||

Non-interest expense to average assets | 2.31 | % | 2.35 | % | 2.35 | % | 2.49 | % | 2.64 | % | ||||||||||

Net overhead ratio (1) | 1.44 | % | 1.44 | % | 1.50 | % | 1.64 | % | 1.81 | % | ||||||||||

Efficiency ratio (1) (2) | 57.85 | % | 58.80 | % | 60.22 | % | 61.00 | % | 63.39 | % | ||||||||||

Balance Sheet Ratios: | ||||||||||||||||||||

Loans to deposits (period end) (3) | 89.27 | % | 88.08 | % | 83.29 | % | 84.73 | % | 87.91 | % | ||||||||||

Average interest-earning assets to average interest-bearing liabilities | 139.76 | % | 141.21 | % | 150.03 | % | 147.76 | % | 146.44 | % | ||||||||||

Capital Ratios (period end): | ||||||||||||||||||||

Total risk-based capital (1) | 13.70 | % | 13.58 | % | 13.17 | % | 13.90 | % | 14.12 | % | ||||||||||

Tier 1 risk-based capital (1) | 11.04 | % | 10.90 | % | 10.51 | % | 12.24 | % | 12.25 | % | ||||||||||

Tier 1 leverage ratio (1) | 10.21 | % | 9.81 | % | 9.50 | % | 11.15 | % | 11.20 | % | ||||||||||

Tier 1 common equity to risk-weighted assets (1)(2)(4) | 9.05 | % | 8.89 | % | 8.52 | % | 8.12 | % | 8.05 | % | ||||||||||

Tangible common equity to tangible assets (1)(2) | 8.43 | % | 8.48 | % | 7.88 | % | 7.70 | % | 7.67 | % | ||||||||||

Total equity to total assets | 9.15 | % | 9.21 | % | 8.59 | % | 10.27 | % | 10.31 | % | ||||||||||

(1) | Refer to Glossary of Terms for definition. |

(2) | This is a non-U.S. GAAP financial measure. Refer to "Non-U.S. GAAP Financial Measures" for a reconciliation from non-U.S. GAAP to U.S. GAAP. |

(3) | Excludes covered assets. Refer to Glossary of Terms for definition. |

(4) | Does not give effect to the final Basel III capital rules adopted and issued by the Federal Reserve Board on July 2, 2013. |

Selected Financial Data (continued) | |||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||||||||||||

Additional Selected Information: | |||||||||||||||||||

Credit valuation adjustment on capital markets derivatives (1) | $ | 1,882 | $ | 246 | $ | 854 | $ | 5 | $ | (830 | ) | ||||||||

Salaries and employee benefits: | |||||||||||||||||||

Salaries and wages | $ | 23,397 | $ | 24,015 | $ | 24,333 | $ | 24,373 | $ | 23,728 | |||||||||

Share-based costs | 3,236 | 2,863 | 5,665 | 5,181 | 5,239 | ||||||||||||||

Incentive compensation, retirement costs and other employee benefits | 13,221 | 16,262 | 15,255 | 15,266 | 13,210 | ||||||||||||||

Total salaries and employee benefits | $ | 39,854 | $ | 43,140 | $ | 45,253 | $ | 44,820 | $ | 42,177 | |||||||||

Provision for unfunded commitments | $ | 467 | $ | 1,723 | $ | (867 | ) | $ | — | $ | — | ||||||||

Assets under management and administration (AUMA) (1) | $ | 5,427,498 | $ | 5,515,199 | $ | 5,196,094 | $ | 5,007,235 | $ | 4,738,973 | |||||||||

Custody assets included in AUMA | $ | 2,351,163 | $ | 2,438,600 | $ | 2,345,410 | $ | 2,192,530 | $ | 2,073,777 | |||||||||

Loan Composition (excluding covered assets (1)) | ||||||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

6/30/13 | % of Total | 3/31/13 | % of Total | 12/31/12 | % of Total | 9/30/12 | % of Total | 6/30/12 | % of Total | |||||||||||||||||||||||||

(Unaudited) | (Unaudited) | (Audited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||||||

Commercial and industrial | $ | 5,019,494 | 50 | % | $ | 4,951,951 | 49 | % | $ | 4,901,210 | 48 | % | $ | 4,666,375 | 48 | % | $ | 4,523,780 | 48 | % | ||||||||||||||

Commercial - owner-occupied CRE | 1,641,973 | 16 | % | 1,640,064 | 16 | % | 1,595,574 | 16 | % | 1,437,935 | 15 | % | 1,384,831 | 15 | % | |||||||||||||||||||

Total commercial | 6,661,467 | 66 | % | 6,592,015 | 65 | % | 6,496,784 | 64 | % | 6,104,310 | 63 | % | 5,908,611 | 63 | % | |||||||||||||||||||

Commercial real estate | 1,981,541 | 20 | % | 2,002,833 | 20 | % | 2,132,063 | 21 | % | 2,069,423 | 21 | % | 2,124,492 | 23 | % | |||||||||||||||||||

Commercial real estate - multi-family | 520,160 | 5 | % | 517,418 | 5 | % | 543,622 | 5 | % | 544,775 | 6 | % | 499,250 | 5 | % | |||||||||||||||||||

Total commercial real estate | 2,501,701 | 25 | % | 2,520,251 | 25 | % | 2,675,685 | 26 | % | 2,614,198 | 27 | % | 2,623,742 | 28 | % | |||||||||||||||||||

Construction | 211,976 | 2 | % | 174,077 | 2 | % | 190,496 | 2 | % | 162,724 | 2 | % | 171,014 | 2 | % | |||||||||||||||||||

Residential real estate | 347,629 | 3 | % | 368,569 | 4 | % | 373,580 | 4 | % | 360,094 | 4 | % | 330,254 | 3 | % | |||||||||||||||||||

Home equity | 159,958 | 2 | % | 162,035 | 2 | % | 167,760 | 2 | % | 170,068 | 2 | % | 174,131 | 2 | % | |||||||||||||||||||

Personal | 211,905 | 2 | % | 216,856 | 2 | % | 235,677 | 2 | % | 214,027 | 2 | % | 228,483 | 2 | % | |||||||||||||||||||

Total loans | $ | 10,094,636 | 100 | % | $ | 10,033,803 | 100 | % | $ | 10,139,982 | 100 | % | $ | 9,625,421 | 100 | % | $ | 9,436,235 | 100 | % | ||||||||||||||

Loan Composition (excluding covered assets (1)) | ||||||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||||||

Commercial Loans Composition by Industry Segment | ||||||||||||||||||||||||||||||||||

(Classified pursuant to the North American Industrial Classification System standard industry descriptions and represents our client's primary business activity) | ||||||||||||||||||||||||||||||||||

June 30, 2013 | March 31, 2013 | December 31, 2012 | ||||||||||||||||||||||||||||||||

Amount | % of Total | Amount Non-performing | % Non-perform-ing(2) | Amount | % of Total | Amount Non-performing | % Non-perform-ing(2) | Amount | % of Total | |||||||||||||||||||||||||

Manufacturing | $ | 1,523,128 | 23 | % | $ | 2,710 | * | $ | 1,599,688 | 24 | % | $ | — | — | % | $ | 1,496,719 | 23 | % | |||||||||||||||

Healthcare | 1,562,779 | 23 | % | 309 | * | 1,565,431 | 24 | % | 314 | * | 1,514,496 | 23 | % | |||||||||||||||||||||

Wholesale trade | 700,064 | 11 | % | 133 | * | 684,791 | 10 | % | — | — | % | 635,477 | 10 | % | ||||||||||||||||||||

Finance and insurance | 555,911 | 8 | % | 529 | * | 504,311 | 8 | % | 186 | * | 584,763 | 9 | % | |||||||||||||||||||||

Real estate, rental and leasing | 347,961 | 6 | % | 1,793 | 1 | % | 362,060 | 6 | % | 512 | * | 359,947 | 6 | % | ||||||||||||||||||||

Professional, scientific and technical services | 471,099 | 7 | % | 3,392 | 1 | % | 434,650 | 7 | % | 5,525 | 1 | % | 391,976 | 6 | % | |||||||||||||||||||

Administrative, support, waste management and remediation services | 420,386 | 6 | % | 11,461 | 3 | % | 398,024 | 6 | % | — | — | % | 426,960 | 7 | % | |||||||||||||||||||

Architecture, engineering and construction | 255,808 | 4 | % | 10,749 | 4 | % | 229,797 | 3 | % | 9,415 | 4 | % | 225,199 | 3 | % | |||||||||||||||||||

All other (3) | 824,331 | 12 | % | 16,706 | 2 | % | 813,263 | 12 | % | 15,371 | 2 | % | 861,247 | 13 | % | |||||||||||||||||||

Total commercial (4) | $ | 6,661,467 | 100 | % | $ | 47,782 | 1 | % | $ | 6,592,015 | 100 | % | $ | 31,323 | * | $ | 6,496,784 | 100 | % | |||||||||||||||

Commercial Real Estate and Construction Loan Portfolio by Collateral Type | ||||||||||||||||||||||||||||||||||

June 30, 2013 | March 31, 2013 | December 31, 2012 | ||||||||||||||||||||||||||||||||

Amount | % of Total | Amount Non-performing | % Non-perform-ing(2) | Amount | % of Total | Amount Non-performing | % Non-perform-ing(2) | Amount | % of Total | |||||||||||||||||||||||||

Commercial Real Estate Portfolio | ||||||||||||||||||||||||||||||||||

Land | $ | 196,839 | 8 | % | $ | 18,349 | 9 | % | $ | 223,880 | 9 | % | $ | 23,335 | 10 | % | 240,503 | 9 | % | |||||||||||||||

Residential 1-4 family | 40,589 | 2 | % | 3,433 | 8 | % | 48,100 | 2 | % | 6,148 | 13 | % | 58,704 | 2 | % | |||||||||||||||||||

Multi-family | 520,160 | 21 | % | 2,654 | 1 | % | 517,418 | 20 | % | 9,704 | 2 | % | 543,622 | 20 | % | |||||||||||||||||||

Industrial/warehouse | 273,044 | 11 | % | 6,955 | 3 | % | 273,017 | 11 | % | 7,674 | 3 | % | 272,535 | 10 | % | |||||||||||||||||||

Office | 538,892 | 21 | % | 6,088 | 1 | % | 542,737 | 22 | % | 2,715 | 1 | % | 566,834 | 21 | % | |||||||||||||||||||

Retail | 473,709 | 19 | % | 2,902 | 1 | % | 463,915 | 18 | % | 7,452 | 2 | % | 472,024 | 18 | % | |||||||||||||||||||

Healthcare | 198,548 | 8 | % | — | — | % | 183,359 | 7 | % | — | — | % | 205,318 | 8 | % | |||||||||||||||||||

Mixed use/other | 259,920 | 10 | % | 5,378 | 2 | % | 267,825 | 11 | % | 6,615 | 2 | % | 316,145 | 12 | % | |||||||||||||||||||

Total commercial real estate | $ | 2,501,701 | 100 | % | $ | 45,759 | 2 | % | $ | 2,520,251 | 100 | % | $ | 63,643 | 3 | % | $ | 2,675,685 | 100 | % | ||||||||||||||

Construction Portfolio | ||||||||||||||||||||||||||||||||||

Residential 1-4 family | $ | 13,868 | 7 | % | $ | — | — | % | $ | 11,796 | 7 | % | $ | — | — | % | 14,160 | 7 | % | |||||||||||||||

Multi-family | 42,409 | 20 | % | — | — | % | 22,230 | 13 | % | — | — | % | 36,129 | 19 | % | |||||||||||||||||||

Industrial/warehouse | 8,395 | 4 | % | — | — | % | 2,800 | 1 | % | — | — | % | 29,633 | 16 | % | |||||||||||||||||||

Office | 19,487 | 9 | % | — | — | % | 14,212 | 8 | % | 402 | 3 | % | 8,863 | 5 | % | |||||||||||||||||||

Retail | 63,957 | 30 | % | — | — | % | 51,846 | 30 | % | — | — | % | 37,457 | 20 | % | |||||||||||||||||||

Healthcare | 24,362 | 11 | % | — | — | % | 27,005 | 16 | % | — | — | % | 14,196 | 7 | % | |||||||||||||||||||

Mixed use/other | 39,498 | 19 | % | — | — | % | 44,188 | 25 | % | — | — | % | 50,058 | 26 | % | |||||||||||||||||||

Total construction | $ | 211,976 | 100 | % | $ | — | — | % | $ | 174,077 | 100 | % | $ | 402 | * | $ | 190,496 | 100 | % | |||||||||||||||

(1) | Refer to Glossary of Terms for definition. |

(2) | Calculated as nonperforming loans in the respective industry segment or collateral type divided by total loans of the corresponding industry segment or collateral type presented above. |

(3) | All other consists of numerous smaller balances across a variety of industries with no category greater than 3%. |

(4) | Includes owner-occupied commercial real estate of $1.6 billion at June 30, 2013 and March 31, 2013. |

* | Less than 1%. |

Asset Quality (excluding covered assets (1)) | |||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||||||||||||

Credit Quality Key Ratios | |||||||||||||||||||

Net charge-offs (annualized) to average loans | 0.56 | % | 0.70 | % | 0.73 | % | 0.87 | % | 1.16 | % | |||||||||

Nonperforming loans to total loans | 1.21 | % | 1.28 | % | 1.37 | % | 1.87 | % | 2.22 | % | |||||||||

Nonperforming loans to total assets | 0.90 | % | 0.96 | % | 0.99 | % | 1.35 | % | 1.62 | % | |||||||||

Nonperforming assets to total assets | 1.33 | % | 1.51 | % | 1.57 | % | 2.09 | % | 2.47 | % | |||||||||

Allowance for loan losses to: | |||||||||||||||||||

Total loans | 1.47 | % | 1.53 | % | 1.59 | % | 1.73 | % | 1.85 | % | |||||||||

Nonperforming loans | 122 | % | 120 | % | 116 | % | 93 | % | 83 | % | |||||||||

Nonperforming assets | |||||||||||||||||||

Loans past due 90 days and accruing | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||

Nonaccrual loans | 121,759 | 128,657 | 138,780 | 179,895 | 209,339 | ||||||||||||||

OREO | 57,134 | 73,857 | 81,880 | 97,833 | 109,836 | ||||||||||||||

Total nonperforming assets | $ | 178,893 | $ | 202,514 | $ | 220,660 | $ | 277,728 | $ | 319,175 | |||||||||

Restructured loans accruing interest | $ | 48,281 | $ | 46,591 | $ | 60,980 | $ | 58,431 | $ | 97,690 | |||||||||

Special mention loans | $ | 92,880 | $ | 106,446 | $ | 96,794 | $ | 104,706 | $ | 108,052 | |||||||||

Potential problem loans | $ | 97,196 | $ | 78,185 | $ | 107,876 | $ | 112,929 | $ | 164,077 | |||||||||

Nonperforming Loans Rollforward | |||||||||||||||||||

Beginning balance | $ | 128,657 | $ | 138,780 | $ | 179,895 | $ | 209,339 | $ | 233,222 | |||||||||

Additions: | |||||||||||||||||||

New nonaccrual loans | 26,190 | 31,331 | 28,527 | 38,948 | 57,717 | ||||||||||||||

Reductions: | |||||||||||||||||||

Return to performing status | (2,288 | ) | — | (3,824 | ) | (236 | ) | (1,953 | ) | ||||||||||

Paydowns and payoffs, net of advances | (246 | ) | (885 | ) | (21,454 | ) | (11,094 | ) | (9,961 | ) | |||||||||

Net sales | (12,601 | ) | (12,809 | ) | (20,544 | ) | (21,351 | ) | (25,954 | ) | |||||||||

Transfer to OREO | (3,366 | ) | (6,266 | ) | (2,826 | ) | (3,250 | ) | (9,968 | ) | |||||||||

Transfer to loans held for sale | — | (2,240 | ) | — | (9,200 | ) | — | ||||||||||||

Charge-offs | (14,587 | ) | (19,254 | ) | (20,994 | ) | (23,261 | ) | (33,764 | ) | |||||||||

Total reductions | (33,088 | ) | (41,454 | ) | (69,642 | ) | (68,392 | ) | (81,600 | ) | |||||||||

Balance at end of period | $ | 121,759 | $ | 128,657 | $ | 138,780 | $ | 179,895 | $ | 209,339 | |||||||||

OREO Rollforward | |||||||||||||||||||

Beginning balance | $ | 73,857 | $ | 81,880 | $ | 97,833 | $ | 109,836 | $ | 123,498 | |||||||||

New foreclosed properties | 3,366 | 6,266 | 2,826 | 3,250 | 9,968 | ||||||||||||||

Valuation adjustments | (6,128 | ) | (4,458 | ) | (5,274 | ) | (6,245 | ) | (9,207 | ) | |||||||||

Disposals: | |||||||||||||||||||

Sales proceeds | (14,677 | ) | (9,067 | ) | (11,526 | ) | (8,041 | ) | (13,517 | ) | |||||||||

Net gain (loss) on sale | 716 | (764 | ) | (1,979 | ) | (967 | ) | (906 | ) | ||||||||||

Balance at end of period | $ | 57,134 | $ | 73,857 | $ | 81,880 | $ | 97,833 | $ | 109,836 | |||||||||

Restructured Loans Accruing Interest Rollforward | |||||||||||||||||||

Beginning balance | $ | 46,591 | $ | 60,980 | $ | 58,431 | $ | 97,690 | $ | 136,521 | |||||||||

Additions: | |||||||||||||||||||

New restructured loans accruing interest | 4,219 | 458 | 6,552 | 2,001 | 1,864 | ||||||||||||||

Restructured loans returned to accruing status | — | — | 3,823 | — | 157 | ||||||||||||||

Reductions: | |||||||||||||||||||

Paydowns and payoffs, net of advances | (2,347 | ) | 36 | (3,995 | ) | (3,935 | ) | (14,593 | ) | ||||||||||

Transfers to nonperforming loans | — | (14,883 | ) | (2,988 | ) | (15,464 | ) | (25,688 | ) | ||||||||||

Net sales | — | — | — | — | (170 | ) | |||||||||||||

Removal of restructured loan status | (182 | ) | — | (843 | ) | (21,861 | ) | (401 | ) | ||||||||||

Balance at end of period | $ | 48,281 | $ | 46,591 | $ | 60,980 | $ | 58,431 | $ | 97,690 | |||||||||

(1) | Refer to Glossary of Terms for definition. |

Asset Quality (excluding covered assets (1)) | |||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||

Credit Quality Indicators (1) | |||||||||||||||||||||||||||

Special Mention Loans | % of Portfolio Loan Type | Potential Problem Loans | % of Portfolio Loan Type | Non-Performing Loans | % of Portfolio Loan Type | Total Loans | |||||||||||||||||||||

June 30, 2013 | |||||||||||||||||||||||||||

Commercial | $ | 83,485 | 1.3 | % | $ | 59,748 | 0.9 | % | $ | 47,782 | 0.7 | % | $ | 6,661,467 | |||||||||||||

Commercial real estate | 1,072 | * | 27,489 | 1.1 | % | 45,759 | 1.8 | % | 2,501,701 | ||||||||||||||||||

Construction | — | — | % | — | — | % | — | — | % | 211,976 | |||||||||||||||||

Residential real estate | 6,187 | 1.8 | % | 6,755 | 1.9 | % | 12,812 | 3.7 | % | 347,629 | |||||||||||||||||

Home equity | 2,001 | 1.3 | % | 3,106 | 1.9 | % | 13,655 | 8.5 | % | 159,958 | |||||||||||||||||

Personal | 135 | 0.1 | % | 98 | * | 1,751 | 0.8 | % | 211,905 | ||||||||||||||||||

Total | $ | 92,880 | 0.9 | % | $ | 97,196 | 1.0 | % | $ | 121,759 | 1.2 | % | $ | 10,094,636 | |||||||||||||

March 31, 2013 | |||||||||||||||||||||||||||

Commercial | $ | 87,966 | 1.3 | % | $ | 31,198 | 0.5 | % | $ | 31,323 | 0.5 | % | $ | 6,592,015 | |||||||||||||

Commercial real estate | 11,412 | 0.5 | % | 33,462 | 1.3 | % | 63,643 | 2.5 | % | 2,520,251 | |||||||||||||||||

Construction | — | — | % | — | — | % | 402 | 0.2 | % | 174,077 | |||||||||||||||||

Residential real estate | 5,739 | 1.6 | % | 9,109 | 2.5 | % | 14,966 | 4.1 | % | 368,569 | |||||||||||||||||

Home equity | 1,325 | 0.8 | % | 4,312 | 2.7 | % | 13,615 | 8.4 | % | 162,035 | |||||||||||||||||

Personal | 4 | * | 104 | * | 4,708 | 2.2 | % | 216,856 | |||||||||||||||||||

Total | $ | 106,446 | 1.1 | % | $ | 78,185 | 0.8 | % | $ | 128,657 | 1.3 | % | $ | 10,033,803 | |||||||||||||

(1) | Refer to Glossary of Terms for definition. |

* | Less than 0.1%. |

Loan Portfolio Aging | |||||||||||||||||||||||

Current | 30-59 Days Past Due | 60-89 Days Past Due | 90 Days Past Due and Accruing | Nonaccrual | Total Loans | ||||||||||||||||||

June 30, 2013 | |||||||||||||||||||||||

Loan balances: | |||||||||||||||||||||||

Commercial | $ | 6,613,146 | $ | 539 | $ | — | $ | — | $ | 47,782 | $ | 6,661,467 | |||||||||||

Commercial real estate | 2,446,365 | 6,690 | 2,887 | — | 45,759 | 2,501,701 | |||||||||||||||||

Construction | 211,976 | — | — | — | — | 211,976 | |||||||||||||||||

Residential real estate | 334,423 | 265 | 129 | — | 12,812 | 347,629 | |||||||||||||||||

Personal and home equity | 356,201 | 256 | — | — | 15,406 | 371,863 | |||||||||||||||||

Total loans | $ | 9,962,111 | $ | 7,750 | $ | 3,016 | $ | — | $ | 121,759 | $ | 10,094,636 | |||||||||||

% of loan balance: | |||||||||||||||||||||||

Commercial | 99.27 | % | 0.01 | % | — | % | — | % | 0.72 | % | 100.00 | % | |||||||||||

Commercial real estate | 97.78 | % | 0.27 | % | 0.12 | % | — | % | 1.83 | % | 100.00 | % | |||||||||||

Construction | 100.00 | % | — | % | — | % | — | % | — | % | 100.00 | % | |||||||||||

Residential real estate | 96.19 | % | 0.08 | % | 0.04 | % | — | % | 3.69 | % | 100.00 | % | |||||||||||

Personal and home equity | 95.79 | % | 0.07 | % | — | % | — | % | 4.14 | % | 100.00 | % | |||||||||||

Total loans | 98.69 | % | 0.08 | % | 0.03 | % | — | % | 1.20 | % | 100.00 | % | |||||||||||

Asset Quality (excluding covered assets (1)) | |||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||||||||||||

Nonaccrual loans | |||||||||||||||||||

Commercial | $ | 47,782 | $ | 31,323 | $ | 41,913 | $ | 61,182 | $ | 59,841 | |||||||||

Commercial real estate | 45,759 | 63,643 | 68,554 | 88,057 | 119,444 | ||||||||||||||

Construction | — | 402 | 557 | 557 | 555 | ||||||||||||||

Residential real estate | 12,812 | 14,966 | 11,224 | 12,502 | 11,028 | ||||||||||||||

Personal and home equity | 15,406 | 18,323 | 16,532 | 17,597 | 18,471 | ||||||||||||||

Total | $ | 121,759 | $ | 128,657 | $ | 138,780 | $ | 179,895 | $ | 209,339 | |||||||||

Nonaccrual loans as a percent of total loan type: | |||||||||||||||||||

Commercial | 0.72 | % | 0.48 | % | 0.65 | % | 1.00 | % | 1.01 | % | |||||||||

Commercial real estate | 1.83 | % | 2.53 | % | 2.56 | % | 3.37 | % | 4.55 | % | |||||||||

Construction | — | % | 0.23 | % | 0.29 | % | 0.34 | % | 0.32 | % | |||||||||

Residential real estate | 3.69 | % | 4.06 | % | 3.00 | % | 3.47 | % | 3.34 | % | |||||||||

Personal and home equity | 4.14 | % | 4.84 | % | 4.10 | % | 4.58 | % | 4.59 | % | |||||||||

Total | 1.20 | % | 1.28 | % | 1.37 | % | 1.87 | % | 2.22 | % | |||||||||

Loans past due 60-89 days and still accruing: | |||||||||||||||||||

Commercial | $ | — | $ | 3,725 | $ | 1,365 | $ | 1,129 | $ | 5,064 | |||||||||

Commercial real estate | 2,887 | 2,365 | 5,278 | 3,588 | 2,543 | ||||||||||||||

Construction | — | — | — | — | — | ||||||||||||||

Residential real estate | 129 | 485 | — | 655 | 21 | ||||||||||||||

Personal and home equity | — | 461 | 462 | 1,569 | 1,017 | ||||||||||||||

Total | $ | 3,016 | $ | 7,036 | $ | 7,105 | $ | 6,941 | $ | 8,645 | |||||||||

Loans past due 60-89 days and still accruing as a percent of total loan type: | |||||||||||||||||||

Commercial | — | % | 0.06 | % | 0.02 | % | 0.02 | % | 0.09 | % | |||||||||

Commercial real estate | 0.12 | % | 0.09 | % | 0.20 | % | 0.14 | % | 0.10 | % | |||||||||

Construction | — | % | — | % | — | % | — | % | — | % | |||||||||

Residential real estate | 0.04 | % | 0.13 | % | — | % | 0.18 | % | 0.01 | % | |||||||||

Personal and home equity | — | % | 0.12 | % | 0.11 | % | 0.41 | % | 0.25 | % | |||||||||

Total | 0.03 | % | 0.07 | % | 0.07 | % | 0.07 | % | 0.09 | % | |||||||||

Loans past due 30-59 days and still accruing: | |||||||||||||||||||

Commercial | $ | 539 | $ | 5,647 | $ | 2,195 | $ | 6,141 | $ | 901 | |||||||||

Commercial real estate | 6,690 | 5,666 | 4,073 | 5,232 | 1,314 | ||||||||||||||

Construction | — | — | — | — | — | ||||||||||||||

Residential real estate | 265 | 2,175 | 3,260 | 240 | 341 | ||||||||||||||

Personal and home equity | 256 | 647 | 1,837 | 2,072 | 1,983 | ||||||||||||||

Total | $ | 7,750 | $ | 14,135 | $ | 11,365 | $ | 13,685 | $ | 4,539 | |||||||||

Loans past due 30-59 days and still accruing as a percent of total loan type: | |||||||||||||||||||

Commercial | 0.01 | % | 0.09 | % | 0.03 | % | 0.10 | % | 0.01 | % | |||||||||

Commercial real estate | 0.27 | % | 0.22 | % | 0.15 | % | 0.20 | % | 0.05 | % | |||||||||

Construction | — | % | — | % | — | % | — | % | — | % | |||||||||

Residential real estate | 0.08 | % | 0.59 | % | 0.87 | % | 0.07 | % | 0.10 | % | |||||||||

Personal and home equity | 0.07 | % | 0.17 | % | 0.46 | % | 0.54 | % | 0.49 | % | |||||||||

Total | 0.08 | % | 0.14 | % | 0.11 | % | 0.14 | % | 0.05 | % | |||||||||

(1) | Refer to Glossary of Terms for definition. |

* | Less than 0.01%. |

Asset Quality (excluding covered assets (1)) | |||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||

Nonaccrual Loan Stratification | |||||||||||||||||||||||

$10.0 Million or More | $5.0 to $9.9 Million | $3.0 to $4.9 Million | $1.5 to $2.9 Million | Under $1.5 Million | Total | ||||||||||||||||||

June 30, 2013 | |||||||||||||||||||||||

Amount: | |||||||||||||||||||||||

Commercial | $ | 33,593 | $ | — | $ | 3,107 | $ | 5,010 | $ | 6,072 | $ | 47,782 | |||||||||||

Commercial real estate | 11,306 | 5,864 | 3,932 | 3,859 | 20,798 | 45,759 | |||||||||||||||||

Residential real estate | — | — | 4,789 | — | 8,023 | 12,812 | |||||||||||||||||

Personal and home equity | — | — | — | — | 15,406 | 15,406 | |||||||||||||||||

Total | $ | 44,899 | $ | 5,864 | $ | 11,828 | $ | 8,869 | $ | 50,299 | $ | 121,759 | |||||||||||

Number of borrowers: | |||||||||||||||||||||||

Commercial | 3 | — | 1 | 2 | 29 | 35 | |||||||||||||||||

Commercial real estate | 1 | 1 | 1 | 2 | 35 | 40 | |||||||||||||||||

Residential real estate | — | — | 1 | — | 33 | 34 | |||||||||||||||||

Personal and home equity | — | — | — | — | 47 | 47 | |||||||||||||||||

Total | 4 | 1 | 3 | 4 | 144 | 156 | |||||||||||||||||

March 31, 2013 | |||||||||||||||||||||||

Amount: | |||||||||||||||||||||||

Commercial | $ | 12,074 | $ | 8,769 | $ | 3,082 | $ | 4,733 | $ | 2,665 | $ | 31,323 | |||||||||||

Commercial real estate | 15,890 | 5,915 | 8,313 | 14,977 | 18,548 | 63,643 | |||||||||||||||||

Construction | — | — | — | — | 402 | 402 | |||||||||||||||||

Residential real estate | — | — | 4,789 | 2,417 | 7,760 | 14,966 | |||||||||||||||||

Personal and home equity | — | — | 3,760 | — | 14,563 | 18,323 | |||||||||||||||||

Total | $ | 27,964 | $ | 14,684 | $ | 19,944 | $ | 22,127 | $ | 43,938 | $ | 128,657 | |||||||||||

Number of borrowers: | |||||||||||||||||||||||

Commercial | 1 | 1 | 1 | 2 | 22 | 27 | |||||||||||||||||

Commercial real estate | 1 | 1 | 2 | 7 | 37 | 48 | |||||||||||||||||

Construction | — | — | — | — | 1 | 1 | |||||||||||||||||

Residential real estate | — | — | 1 | 1 | 29 | 31 | |||||||||||||||||

Personal and home equity | — | — | 1 | — | 44 | 45 | |||||||||||||||||

Total | 2 | 2 | 5 | 10 | 133 | 152 | |||||||||||||||||

(1) | Refer to Glossary of Terms for definition. |

Asset Quality (excluding covered assets (1)) | |||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||

Restructured Loan Accruing Interest Stratification | |||||||||||||||||||||||

$10.0 Million or More | $5.0 to $9.9 Million | $3.0 to $4.9 Million | $1.5 to $2.9 Million | Under $1.5 Million | Total | ||||||||||||||||||

June 30, 2013 | |||||||||||||||||||||||

Amount: | |||||||||||||||||||||||

Commercial | $ | 25,412 | $ | 14,067 | $ | 3,969 | $ | — | $ | 425 | $ | 43,873 | |||||||||||

Commercial real estate | — | — | — | 2,126 | 677 | 2,803 | |||||||||||||||||

Personal and home equity | — | — | — | — | 1,605 | 1,605 | |||||||||||||||||

Total | $ | 25,412 | $ | 14,067 | $ | 3,969 | $ | 2,126 | $ | 2,707 | $ | 48,281 | |||||||||||

Number of borrowers: | |||||||||||||||||||||||

Commercial | 2 | 2 | 1 | — | 2 | 7 | |||||||||||||||||

Commercial real estate | — | — | — | 1 | 2 | 3 | |||||||||||||||||

Personal and home equity | — | — | — | — | 2 | 2 | |||||||||||||||||

Total | 2 | 2 | 1 | 1 | 6 | 12 | |||||||||||||||||

March 31, 2013 | |||||||||||||||||||||||

Amount: | |||||||||||||||||||||||

Commercial | $ | 22,145 | $ | 13,919 | $ | — | $ | — | $ | 783 | $ | 36,847 | |||||||||||

Commercial real estate | — | 5,090 | — | 2,159 | 877 | 8,126 | |||||||||||||||||

Personal and home equity | — | — | — | — | 1,618 | 1,618 | |||||||||||||||||

Total | $ | 22,145 | $ | 19,009 | $ | — | $ | 2,159 | $ | 3,278 | $ | 46,591 | |||||||||||

Number of borrowers: | |||||||||||||||||||||||

Commercial | 2 | 2 | — | — | 3 | 7 | |||||||||||||||||

Commercial real estate | — | 1 | — | 1 | 3 | 5 | |||||||||||||||||

Personal and home equity | — | — | — | — | 2 | 2 | |||||||||||||||||

Total | 2 | 3 | — | 1 | 8 | 14 | |||||||||||||||||

(1) | Refer to Glossary of Terms for definition. |

Foreclosed Real Estate (OREO), excluding covered assets (1) | ||||||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||||||

OREO Properties by Type | ||||||||||||||||||||||||||||||||||

June 30, 2013 | March 31, 2013 | December 31, 2012 | ||||||||||||||||||||||||||||||||

Number of Properties | Amount | % of Total | Number of Properties | Amount | % of Total | Number of Properties | Amount | % of Total | ||||||||||||||||||||||||||

Single-family homes | 17 | $ | 3,677 | 6 | % | 21 | $ | 1,861 | 2 | % | 50 | $ | 6,337 | 8 | % | |||||||||||||||||||

Land parcels | 143 | 24,907 | 44 | % | 151 | 30,875 | 42 | % | 170 | 33,072 | 40 | % | ||||||||||||||||||||||

Multi-family | 5 | 8,014 | 14 | % | 6 | 8,089 | 11 | % | 6 | 8,111 | 10 | % | ||||||||||||||||||||||

Office/industrial | 23 | 15,144 | 27 | % | 31 | 21,263 | 29 | % | 40 | 27,585 | 34 | % | ||||||||||||||||||||||

Retail | 7 | 5,392 | 9 | % | 8 | 6,709 | 9 | % | 8 | 6,775 | 8 | % | ||||||||||||||||||||||

Mixed use | — | — | — | % | 2 | 5,060 | 7 | % | — | — | — | % | ||||||||||||||||||||||

Total | 195 | $ | 57,134 | 100 | % | 219 | $ | 73,857 | 100 | % | 274 | $ | 81,880 | 100 | % | |||||||||||||||||||

OREO Property Type by Location | ||||||||||||||||||||||||||||||||||

Illinois | Colorado | Wisconsin | South Eastern(2) | Mid Western(3) | Other | Total | ||||||||||||||||||||||||||||

June 30, 2013 | ||||||||||||||||||||||||||||||||||

Single-family homes | $ | 1,121 | $ | — | $ | 322 | $ | — | $ | 2,234 | $ | — | $ | 3,677 | ||||||||||||||||||||

Land parcels | 14,359 | — | — | 7,904 | 2,644 | — | 24,907 | |||||||||||||||||||||||||||

Multi-family | 774 | 7,240 | — | — | — | — | 8,014 | |||||||||||||||||||||||||||

Office/industrial | 11,462 | — | 1,633 | — | 2,049 | — | 15,144 | |||||||||||||||||||||||||||

Retail | 4,743 | — | — | 580 | 69 | — | 5,392 | |||||||||||||||||||||||||||

Total | $ | 32,459 | $ | 7,240 | $ | 1,955 | $ | 8,484 | $ | 6,996 | $ | — | $ | 57,134 | ||||||||||||||||||||

% of Total | 57 | % | 13 | % | 3 | % | 15 | % | 12 | % | — | % | 100 | % | ||||||||||||||||||||

March 31, 2013 | ||||||||||||||||||||||||||||||||||

Single-family homes | $ | 1,642 | $ | — | $ | — | $ | — | $ | 219 | $ | — | $ | 1,861 | ||||||||||||||||||||

Land parcels | 18,700 | — | — | 9,250 | 2,925 | — | 30,875 | |||||||||||||||||||||||||||

Multi-family | 939 | 7,150 | — | — | — | — | 8,089 | |||||||||||||||||||||||||||

Office/industrial | 15,152 | — | 2,070 | 501 | 3,540 | — | 21,263 | |||||||||||||||||||||||||||

Retail | 5,583 | — | — | 1,126 | — | — | 6,709 | |||||||||||||||||||||||||||

Mixed use | — | — | 5,060 | — | — | — | 5,060 | |||||||||||||||||||||||||||

Total | $ | 42,016 | $ | 7,150 | $ | 7,130 | $ | 10,877 | $ | 6,684 | $ | — | $ | 73,857 | ||||||||||||||||||||

% of Total | 56 | % | 10 | % | 10 | % | 15 | % | 9 | % | — | % | 100 | % | ||||||||||||||||||||

December 31, 2012 | ||||||||||||||||||||||||||||||||||

Single-family homes | $ | 4,301 | $ | — | $ | — | $ | — | $ | 1,866 | $ | 170 | $ | 6,337 | ||||||||||||||||||||

Land parcels | 18,913 | — | — | 10,446 | 3,713 | — | 33,072 | |||||||||||||||||||||||||||

Multi-family | 1,178 | 6,933 | — | — | — | — | 8,111 | |||||||||||||||||||||||||||

Office/industrial | 17,960 | — | 2,300 | 3,450 | 3,875 | — | 27,585 | |||||||||||||||||||||||||||

Retail | 5,584 | — | — | 1,191 | — | — | 6,775 | |||||||||||||||||||||||||||

Total | $ | 47,936 | $ | 6,933 | $ | 2,300 | $ | 15,087 | $ | 9,454 | $ | 170 | $ | 81,880 | ||||||||||||||||||||

% of Total | 59 | % | 8 | % | 3 | % | 18 | % | 12 | % | * | 100 | % | |||||||||||||||||||||

(1) | Refer to Glossary of Terms for definition. |

(2) | Represents the southeastern states of Arkansas, Florida and Georgia. |

(3) | Represents the midwestern states of Kansas, Michigan, Missouri, Indiana, and Ohio. |

* | Less than 1%. |

Allowance for Loan Losses (excluding covered assets (1)) | |||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

2Q13 | 1Q13 | 4Q12 | 3Q12 | 2Q12 | |||||||||||||||

Change in allowance for loan losses: | |||||||||||||||||||

Balance at beginning of period | $ | 153,992 | $ | 161,417 | $ | 166,859 | $ | 174,302 | $ | 183,844 | |||||||||

Loans charged-off: | |||||||||||||||||||

Commercial | (2,372 | ) | (11,146 | ) | (10,388 | ) | (4,062 | ) | (7,769 | ) | |||||||||

Commercial real estate | (8,725 | ) | (7,566 | ) | (8,105 | ) | (16,790 | ) | (17,924 | ) | |||||||||

Construction | — | 70 | 30 | 64 | (828 | ) | |||||||||||||

Residential real estate | (783 | ) | (436 | ) | (621 | ) | (299 | ) | (1,006 | ) | |||||||||

Home equity | (334 | ) | (374 | ) | (1,640 | ) | (1,001 | ) | (4 | ) | |||||||||

Personal | (2,776 | ) | (5 | ) | (612 | ) | (1,006 | ) | (6,341 | ) | |||||||||

Total charge-offs | (14,990 | ) | (19,457 | ) | (21,336 | ) | (23,094 | ) | (33,872 | ) | |||||||||

Recoveries on loans previously charged-off: | |||||||||||||||||||

Commercial | 459 | 396 | 947 | 919 | 634 | ||||||||||||||

Commercial real estate | 141 | 1,364 | 2,133 | 544 | 4,150 | ||||||||||||||

Construction | 25 | 9 | 16 | 594 | 1,664 | ||||||||||||||

Residential real estate | 2 | 2 | 106 | 7 | 2 | ||||||||||||||

Home equity | 199 | 61 | 52 | 117 | 314 | ||||||||||||||

Personal | 46 | 52 | 43 | 229 | 163 | ||||||||||||||

Total recoveries | 872 | 1,884 | 3,297 | 2,410 | 6,927 | ||||||||||||||

Net charge-offs | (14,118 | ) | (17,573 | ) | (18,039 | ) | (20,684 | ) | (26,945 | ) | |||||||||

Provisions charged to operating expenses | 8,309 | 10,148 | 12,597 | 13,241 | 17,403 | ||||||||||||||

Balance at end of period | $ | 148,183 | $ | 153,992 | $ | 161,417 | $ | 166,859 | $ | 174,302 | |||||||||

Allocation of allowance for loan losses: | |||||||||||||||||||

General allocated reserve: | |||||||||||||||||||

Commercial | $ | 64,868 | $ | 57,280 | $ | 50,450 | $ | 49,115 | $ | 47,210 | |||||||||

Commercial real estate | 36,820 | 45,030 | 52,700 | 54,500 | 53,700 | ||||||||||||||

Construction | 2,626 | 2,011 | 2,317 | 2,200 | 2,635 | ||||||||||||||

Residential real estate | 4,945 | 5,800 | 5,700 | 5,100 | 5,200 | ||||||||||||||

Home equity | 3,070 | 3,700 | 4,000 | 3,980 | 4,200 | ||||||||||||||

Personal | 3,130 | 2,900 | 2,860 | 2,800 | 3,260 | ||||||||||||||

Total allocated | 115,459 | 116,721 | 118,027 | 117,695 | 116,205 | ||||||||||||||

Specific reserve | 32,724 | 37,271 | 43,390 | 49,164 | 58,097 | ||||||||||||||

Total | $ | 148,183 | $ | 153,992 | $ | 161,417 | $ | 166,859 | $ | 174,302 | |||||||||

Allocation of reserve by a percent of total allowance for loan losses: | |||||||||||||||||||

General allocated reserve: | |||||||||||||||||||

Commercial | 44 | % | 37 | % | 31 | % | 29 | % | 27 | % | |||||||||

Commercial real estate | 25 | % | 29 | % | 33 | % | 33 | % | 31 | % | |||||||||

Construction | 2 | % | 1 | % | 1 | % | 1 | % | 2 | % | |||||||||

Residential real estate | 3 | % | 4 | % | 4 | % | 3 | % | 3 | % | |||||||||

Home equity | 2 | % | 3 | % | 2 | % | 2 | % | 2 | % | |||||||||

Personal | 2 | % | 2 | % | 2 | % | 2 | % | 2 | % | |||||||||

Total allocated | 78 | % | 76 | % | 73 | % | 70 | % | 67 | % | |||||||||

Specific reserve | 22 | % | 24 | % | 27 | % | 30 | % | 33 | % | |||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | |||||||||

Allowance for loan losses to: | |||||||||||||||||||

Total loans | 1.47 | % | 1.53 | % | 1.59 | % | 1.73 | % | 1.85 | % | |||||||||

Nonperforming loans | 122 | % | 120 | % | 116 | % | 93 | % | 83 | % | |||||||||

(1) | Refer to Glossary of Terms for definition. |

Deposits | ||||||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||

6/30/13 | % of Total | 3/31/13 | % of Total | 12/31/12 | % of Total | 9/30/12 | % of Total | 6/30/12 | % of Total | |||||||||||||||||||||||||

(Unaudited) | (Unaudited) | (Audited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||||||||||

Noninterest-bearing deposits | $ | 2,736,868 | 24 | % | $ | 2,756,879 | 24 | % | $ | 3,690,340 | 30 | % | $ | 3,295,568 | 29 | % | $ | 2,920,182 | 27 | % | ||||||||||||||

Interest-bearing demand deposits | 1,234,134 | 11 | % | 1,390,955 | 12 | % | 1,057,390 | 9 | % | 893,194 | 8 | % | 785,879 | 7 | % | |||||||||||||||||||

Savings deposits | 245,133 | 2 | % | 245,762 | 2 | % | 310,188 | 3 | % | 245,906 | 2 | % | 221,816 | 2 | % | |||||||||||||||||||

Money market accounts | 4,409,797 | 39 | % | 4,496,102 | 40 | % | 4,602,632 | 38 | % | 4,135,689 | 37 | % | 3,924,206 | 37 | % | |||||||||||||||||||

Brokered time deposits: | ||||||||||||||||||||||||||||||||||

Traditional | 445,666 | 4 | % | 330,851 | 3 | % | 382,833 | 3 | % | 562,717 | 5 | % | 667,454 | 6 | % | |||||||||||||||||||

Client CDARS(1) | 695,130 | 6 | % | 652,774 | 6 | % | 610,622 | 5 | % | 728,079 | 6 | % | 762,231 | 7 | % | |||||||||||||||||||

Non-client CDARS(1) | 50,000 | 1 | % | — | — | % | — | — | % | — | — | % | 54,750 | 1 | % | |||||||||||||||||||

Total brokered time deposits | 1,190,796 | 11 | % | 983,625 | 9 | % | 993,455 | 8 | % | 1,290,796 | 11 | % | 1,484,435 | 14 | % | |||||||||||||||||||

Time deposits | 1,491,604 | 13 | % | 1,518,980 | 13 | % | 1,519,629 | 12 | % | 1,498,287 | 13 | % | 1,398,012 | 13 | % | |||||||||||||||||||

Total deposits | $ | 11,308,332 | 100 | % | $ | 11,392,303 | 100 | % | $ | 12,173,634 | 100 | % | $ | 11,359,440 | 100 | % | $ | 10,734,530 | 100 | % | ||||||||||||||

Client deposits(1) | $ | 10,812,666 | 95 | % | $ | 11,061,452 | 97 | % | $ | 11,790,801 | 97 | % | $ | 10,796,723 | 95 | % | $ | 10,012,326 | 93 | % | ||||||||||||||

(1) | Refer to Glossary of Terms for definition. |

Net Interest Margin | |||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Quarters Ended June 30, | |||||||||||||||||||||

2013 | 2012 | ||||||||||||||||||||

Average Balance | Interest (1) | Yield / Rate | Average Balance | Interest (1) | Yield / Rate | ||||||||||||||||

Assets: | |||||||||||||||||||||

Federal funds sold and interest-bearing deposits in banks | $ | 181,823 | $ | 112 | 0.24 | % | $ | 210,756 | $ | 133 | 0.25 | % | |||||||||

Securities: | |||||||||||||||||||||

Taxable | 2,149,465 | 12,519 | 2.33 | % | 2,083,002 | 14,723 | 2.83 | % | |||||||||||||

Tax-exempt (2) | 239,851 | 2,337 | 3.90 | % | 171,426 | 2,035 | 4.75 | % | |||||||||||||

Total securities | 2,389,316 | 14,856 | 2.49 | % | 2,254,428 | 16,758 | 2.97 | % | |||||||||||||

FHLB stock | 34,270 | 62 | 0.72 | % | 43,444 | 131 | 1.19 | % | |||||||||||||

Loans, excluding covered assets: | |||||||||||||||||||||

Commercial | 6,635,679 | 74,150 | 4.42 | % | 5,704,843 | 65,535 | 4.54 | % | |||||||||||||

Commercial real estate | 2,502,503 | 23,920 | 3.78 | % | 2,778,787 | 28,586 | 4.07 | % | |||||||||||||

Construction | 194,958 | 2,051 | 4.16 | % | 152,891 | 1,536 | 3.97 | % | |||||||||||||

Residential | 395,196 | 3,633 | 3.68 | % | 347,922 | 3,630 | 4.17 | % | |||||||||||||

Personal and home equity | 376,955 | 3,031 | 3.22 | % | 417,427 | 3,666 | 3.53 | % | |||||||||||||

Total loans, excluding covered assets (3) | 10,105,291 | 106,785 | 4.18 | % | 9,401,870 | 102,953 | 4.34 | % | |||||||||||||

Total interest-earning assets before covered assets (2) | 12,710,700 | 121,815 | 3.80 | % | 11,910,498 | 119,975 | 3.99 | % | |||||||||||||

Covered assets (4) | 148,242 | 621 | 1.66 | % | 237,781 | 2,189 | 3.66 | % | |||||||||||||

Total interest-earning assets (2) | 12,858,942 | $ | 122,436 | 3.77 | % | 12,148,279 | $ | 122,164 | 3.99 | % | |||||||||||

Cash and due from banks | 143,973 | 148,174 | |||||||||||||||||||

Allowance for loan and covered loan losses | (181,235 | ) | (218,798 | ) | |||||||||||||||||

Other assets | 588,082 | 702,533 | |||||||||||||||||||

Total assets | $ | 13,409,762 | $ | 12,780,188 | |||||||||||||||||

Liabilities and Equity: | |||||||||||||||||||||

Interest-bearing demand deposits | $ | 1,250,305 | $ | 1,034 | 0.33 | % | $ | 795,833 | $ | 799 | 0.40 | % | |||||||||

Savings deposits | 246,928 | 126 | 0.21 | % | 225,335 | 161 | 0.29 | % | |||||||||||||

Money market accounts | 4,383,915 | 3,760 | 0.34 | % | 3,920,627 | 4,104 | 0.42 | % | |||||||||||||

Time deposits | 1,494,380 | 3,772 | 1.01 | % | 1,341,312 | 3,862 | 1.16 | % | |||||||||||||

Brokered time deposits | 1,152,635 | 1,184 | 0.41 | % | 1,382,207 | 1,532 | 0.45 | % | |||||||||||||

Total interest-bearing deposits | 8,528,163 | 9,876 | 0.46 | % | 7,665,314 | 10,458 | 0.55 | % | |||||||||||||

Short-term and secured borrowings | 173,089 | 410 | 0.94 | % | 250,774 | 123 | 0.19 | % | |||||||||||||

Long-term debt | 499,793 | 7,613 | 6.08 | % | 379,463 | 5,538 | 5.82 | % | |||||||||||||

Total interest-bearing liabilities | 9,201,045 | $ | 17,899 | 0.78 | % | 8,295,551 | $ | 16,119 | 0.78 | % | |||||||||||

Noninterest-bearing demand deposits | 2,816,783 | 2,995,802 | |||||||||||||||||||

Other liabilities | 141,793 | 156,656 | |||||||||||||||||||

Equity | 1,250,141 | 1,332,179 | |||||||||||||||||||

Total liabilities and equity | $ | 13,409,762 | $ | 12,780,188 | |||||||||||||||||

Net interest spread (2)(5) | 2.99 | % | 3.21 | % | |||||||||||||||||

Effect of noninterest-bearing funds | 0.23 | % | 0.25 | % | |||||||||||||||||

Net interest income/margin (2)(5) | $ | 104,537 | 3.22 | % | $ | 106,045 | 3.46 | % | |||||||||||||

(1) | Interest income included $6.3 million in loan fees for the quarters ended June 30, 2013 and 2012. |

(2) | Interest income and yields are presented on a tax-equivalent basis, assuming a federal income tax rate of 35%. This is a non-U.S. GAAP measure. Refer to Non-U.S. GAAP Measures for a reconciliation of the effect of the tax-equivalent adjustment. |

(3) | Average loans on a nonaccrual basis for the recognition of interest income totaled $125.3 million and $222.1 million for the quarters ended June 30, 2013 and 2012, respectively, and are included in loans for purposes of this analysis. Interest foregone on nonperforming loans was estimated to be approximately $1.2 million and $2.3 million for the quarters ended June 30, 2013 and 2012, respectively, based on the average loan portfolio yield for the respective period. |

(4) | Covered interest-earning assets consist of loans acquired through an FDIC-assisted transaction that are subject to a loss share agreement and the related indemnification asset. |

(5) | Refer to Glossary of Terms for definition. |

Net Interest Margin | |||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Quarter Ended June 30, | Quarter Ended March 31, | ||||||||||||||||||||

2013 | 2013 | ||||||||||||||||||||

Average Balance | Interest (1) | Yield / Rate | Average Balance | Interest (1) | Yield / Rate | ||||||||||||||||

Assets: | |||||||||||||||||||||

Federal funds sold and interest-bearing deposits in banks | $ | 181,823 | $ | 112 | 0.24 | % | $ | 335,916 | $ | 208 | 0.25 | % | |||||||||

Securities: | |||||||||||||||||||||

Taxable | 2,149,465 | 12,519 | 2.33 | % | 2,106,304 | 12,822 | 2.44 | % | |||||||||||||

Tax-exempt (2) | 239,851 | 2,337 | 3.90 | % | 220,522 | 2,286 | 4.15 | % | |||||||||||||

Total securities | 2,389,316 | 14,856 | 2.49 | % | 2,326,826 | 15,108 | 2.60 | % | |||||||||||||

FHLB stock | 34,270 | 62 | 0.72 | % | 38,129 | 90 | 0.94 | % | |||||||||||||

Loans, excluding covered assets: | |||||||||||||||||||||

Commercial | 6,635,679 | 74,150 | 4.42 | % | 6,529,029 | 71,256 | 4.37 | % | |||||||||||||

Commercial real estate | 2,502,503 | 23,920 | 3.78 | % | 2,651,132 | 25,392 | 3.83 | % | |||||||||||||

Construction | 194,958 | 2,051 | 4.16 | % | 188,211 | 1,953 | 4.15 | % | |||||||||||||

Residential | 395,196 | 3,633 | 3.68 | % | 406,091 | 3,762 | 3.71 | % | |||||||||||||

Personal and home equity | 376,955 | 3,031 | 3.22 | % | 389,395 | 3,206 | 3.34 | % | |||||||||||||

Total loans, excluding covered assets (3) | 10,105,291 | 106,785 | 4.18 | % | 10,163,858 | 105,569 | 4.16 | % | |||||||||||||

Total interest-earning assets before covered assets (2) | 12,710,700 | 121,815 | 3.80 | % | 12,864,729 | 120,975 | 3.76 | % | |||||||||||||

Covered assets (4) | 148,242 | 621 | 1.66 | % | 161,842 | 1,218 | 3.02 | % | |||||||||||||

Total interest-earning assets (2) | 12,858,942 | $ | 122,436 | 3.77 | % | 13,026,571 | $ | 122,193 | 3.75 | % | |||||||||||

Cash and due from banks | 143,973 | 142,925 | |||||||||||||||||||

Allowance for loan and covered loan losses | (181,235 | ) | (188,894 | ) | |||||||||||||||||

Other assets | 588,082 | 636,726 | |||||||||||||||||||

Total assets | $ | 13,409,762 | $ | 13,617,328 | |||||||||||||||||

Liabilities and Equity: | |||||||||||||||||||||

Interest-bearing demand deposits | $ | 1,250,305 | $ | 1,034 | 0.33 | % | $ | 1,264,740 | $ | 1,115 | 0.36 | % | |||||||||

Savings deposits | 246,928 | 126 | 0.21 | % | 274,310 | 164 | 0.24 | % | |||||||||||||

Money market accounts | 4,383,915 | 3,760 | 0.34 | % | 4,566,766 | 4,235 | 0.38 | % | |||||||||||||

Time deposits | 1,494,380 | 3,772 | 1.01 | % | 1,525,931 | 3,936 | 1.05 | % | |||||||||||||

Brokered time deposits | 1,152,635 | 1,184 | 0.41 | % | 1,000,613 | 1,193 | 0.48 | % | |||||||||||||

Total interest-bearing deposits | 8,528,163 | 9,876 | 0.46 | % | 8,632,360 | 10,643 | 0.50 | % | |||||||||||||

Short-term and secured borrowings | 173,089 | 410 | 0.94 | % | 92,906 | 118 | 0.51 | % | |||||||||||||

Long-term debt | 499,793 | 7,613 | 6.08 | % | 499,793 | 7,608 | 6.09 | % | |||||||||||||

Total interest-bearing liabilities | 9,201,045 | $ | 17,899 | 0.78 | % | 9,225,059 | $ | 18,369 | 0.80 | % | |||||||||||

Noninterest-bearing demand deposits | 2,816,783 | 3,005,007 | |||||||||||||||||||

Other liabilities | 141,793 | 159,634 | |||||||||||||||||||

Equity | 1,250,141 | 1,227,628 | |||||||||||||||||||

Total liabilities and equity | $ | 13,409,762 | $ | 13,617,328 | |||||||||||||||||

Net interest spread (2)(5) | 2.99 | % | 2.95 | % | |||||||||||||||||

Effect of noninterest-bearing funds | 0.23 | % | 0.24 | % | |||||||||||||||||

Net interest income/margin (2)(5) | $ | 104,537 | 3.22 | % | $ | 103,824 | 3.19 | % | |||||||||||||

(1) | Interest income included $6.3 million and $5.1 million in loan fees for the quarters ended June 30, 2013 and March 31, 2013, respectively. |

(2) | Interest income and yields are presented on a tax-equivalent basis, assuming a federal income tax rate of 35%. This is a non-U.S. GAAP measure. Refer to Non-U.S. GAAP Measures for a reconciliation of the effect of the tax-equivalent adjustment. |

(3) | Average loans on a nonaccrual basis for the recognition of interest income totaled $125.3 million and $137.0 million for the quarters ended June 30, 2013 and March 31, 2013, respectively, and are included in loans for purposes of this analysis. Interest foregone on nonperforming loans was estimated to be approximately $1.2 million and $1.4 million for the quarters ended June 30, 2013 and March 31, 2013, respectively, based on the average loan portfolio yield for the respective period. |

(4) | Covered interest-earning assets consist of loans acquired through an FDIC-assisted transaction that are subject to a loss share agreement and the related indemnification asset. |

(5) | Refer to Glossary of Terms for definition. |

Net Interest Margin | |||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Six Months Ended June 30, | |||||||||||||||||||||

2013 | 2012 | ||||||||||||||||||||

Average Balance | Interest (1) | Yield / Rate | Average Balance | Interest (1) | Yield / Rate | ||||||||||||||||

Assets: | |||||||||||||||||||||

Federal funds sold and interest-bearing deposits in banks | $ | 258,444 | $ | 320 | 0.25 | % | $ | 211,050 | $ | 265 | 0.25 | % | |||||||||

Securities: | |||||||||||||||||||||

Taxable | 2,128,004 | 25,341 | 2.38 | % | 2,069,864 | 29,981 | 2.90 | % | |||||||||||||

Tax-exempt (2) | 230,240 | 4,623 | 4.02 | % | 161,919 | 4,015 | 4.96 | % | |||||||||||||

Total securities | 2,358,244 | 29,964 | 2.54 | % | 2,231,783 | 33,996 | 3.05 | % | |||||||||||||

FHLB stock | 36,189 | 152 | 0.83 | % | 42,070 | 253 | 1.19 | % | |||||||||||||

Loans, excluding covered assets: | |||||||||||||||||||||

Commercial | 6,582,441 | 145,406 | 4.39 | % | 5,573,826 | 129,444 | 4.59 | % | |||||||||||||

Commercial real estate | 2,576,407 | 49,312 | 3.81 | % | 2,688,545 | 56,301 | 4.14 | % | |||||||||||||

Construction | 191,604 | 4,004 | 4.16 | % | 228,601 | 4,147 | 3.59 | % | |||||||||||||

Residential | 400,805 | 7,395 | 3.69 | % | 333,940 | 7,249 | 4.34 | % | |||||||||||||

Personal and home equity | 383,155 | 6,237 | 3.28 | % | 412,269 | 7,398 | 3.61 | % | |||||||||||||

Total loans, excluding covered assets (3) | 10,134,412 | 212,354 | 4.17 | % | 9,237,181 | 204,539 | 4.38 | % | |||||||||||||

Total interest-earning assets before covered assets (2) | 12,787,289 | 242,790 | 3.78 | % | 11,722,084 | 239,053 | 4.04 | % | |||||||||||||

Covered assets (4) | 155,004 | 1,839 | 2.37 | % | 251,200 | 4,142 | 3.28 | % | |||||||||||||

Total interest-earning assets (2) | 12,942,293 | $ | 244,629 | 3.76 | % | 11,973,284 | $ | 243,195 | 4.03 | % | |||||||||||

Cash and due from banks | 143,443 | 144,741 | |||||||||||||||||||

Allowance for loan and covered loan losses | (185,043 | ) | (221,434 | ) | |||||||||||||||||

Other assets | 612,269 | 705,779 | |||||||||||||||||||

Total assets | $ | 13,512,962 | $ | 12,602,370 | |||||||||||||||||

Liabilities and Equity: | |||||||||||||||||||||

Interest-bearing demand deposits | $ | 1,257,482 | $ | 2,149 | 0.34 | % | $ | 725,312 | $ | 1,435 | 0.40 | % | |||||||||

Savings deposits | 260,543 | 291 | 0.23 | % | 221,740 | 317 | 0.29 | % | |||||||||||||

Money market accounts | 4,474,835 | 7,995 | 0.36 | % | 4,060,241 | 8,550 | 0.42 | % | |||||||||||||

Time deposits | 1,510,069 | 7,708 | 1.03 | % | 1,346,836 | 7,795 | 1.16 | % | |||||||||||||

Brokered time deposits | 1,077,044 | 2,376 | 0.44 | % | 1,096,638 | 2,616 | 0.48 | % | |||||||||||||

Total interest-bearing deposits | 8,579,973 | 20,519 | 0.48 | % | 7,450,767 | 20,713 | 0.56 | % | |||||||||||||

Short-term and secured borrowings | 133,219 | 528 | 0.79 | % | 257,990 | 265 | 0.20 | % | |||||||||||||

Long-term debt | 499,793 | 15,221 | 6.08 | % | 379,628 | 11,116 | 5.81 | % | |||||||||||||

Total interest-bearing liabilities | 9,212,985 | $ | 36,268 | 0.79 | % | 8,088,385 | $ | 32,094 | 0.79 | % | |||||||||||

Noninterest-bearing demand deposits | 2,910,375 | 3,025,241 | |||||||||||||||||||

Other liabilities | 150,654 | 164,977 | |||||||||||||||||||

Equity | 1,238,948 | 1,323,767 | |||||||||||||||||||

Total liabilities and equity | $ | 13,512,962 | $ | 12,602,370 | |||||||||||||||||

Net interest spread (2)(5) | 2.97 | % | 3.24 | % | |||||||||||||||||

Effect of noninterest-bearing funds | 0.23 | % | 0.25 | % | |||||||||||||||||

Net interest income/margin (2)(5) | $ | 208,361 | 3.20 | % | $ | 211,101 | 3.49 | % | |||||||||||||

(1) | Interest income included $11.5 million and $13.6 million in loan fees for the six months ended June 30, 2013 and 2012, respectively. |

(2) | Interest income and yields are presented on a tax-equivalent basis, assuming a federal income tax rate of 35%. This is a non-U.S. GAAP measure. Refer to Non-U.S. GAAP Measures for a reconciliation of the effect of the tax-equivalent adjustment. |

(3) | Average loans on a nonaccrual basis for the recognition of interest income totaled $131.5 million and $240.3 million for the six months ended June 30, 2013 and 2012, respectively, and are included in loans for purposes of this analysis. Interest foregone on nonperforming loans was estimated to be approximately $2.6 million and $5.1 million for the six months ended June 30, 2013 and 2012, respectively, based on the average loan portfolio yield for the respective period. |

(4) | Covered interest-earning assets consist of loans acquired through an FDIC-assisted transaction that are subject to a loss share agreement and the related indemnification asset. |

(5) | Refer to Glossary of Terms for definition. |

Quarters Ended | |||||||||||||||||||

2013 | 2012 | ||||||||||||||||||

June 30 | March 31 | December 31 | September 30 | June 30 | |||||||||||||||

Taxable-equivalent net interest income | |||||||||||||||||||

U.S. GAAP net interest income | $ | 103,732 | $ | 103,040 | $ | 104,803 | $ | 105,408 | $ | 105,346 | |||||||||

Taxable-equivalent adjustment | 805 | 784 | 765 | 729 | 699 | ||||||||||||||

Taxable-equivalent net interest income (a) | $ | 104,537 | $ | 103,824 | $ | 105,568 | $ | 106,137 | $ | 106,045 | |||||||||

Average Earning Assets (b) | $ | 12,858,942 | $ | 13,026,571 | $ | 13,115,687 | $ | 12,420,769 | $ | 12,148,279 | |||||||||

Net Interest Margin ((a) annualized) / (b) | 3.22 | % | 3.19 | % | 3.16 | % | 3.35 | % | 3.46 | % | |||||||||

Net Revenue | |||||||||||||||||||

Taxable-equivalent net interest income (a) | $ | 104,537 | $ | 103,824 | $ | 105,568 | $ | 106,137 | $ | 106,045 | |||||||||

U.S. GAAP non-interest income | 29,009 | 30,468 | 29,454 | 27,837 | 26,246 | ||||||||||||||

Net revenue (c) | $ | 133,546 | $ | 134,292 | $ | 135,022 | $ | 133,974 | $ | 132,291 | |||||||||

Operating Profit | |||||||||||||||||||

U.S. GAAP income before income taxes | $ | 46,643 | $ | 44,188 | $ | 39,765 | $ | 38,006 | $ | 30,696 | |||||||||

Provision for loan and covered loan losses | 8,843 | 10,357 | 13,177 | 13,509 | 17,038 | ||||||||||||||

Taxable-equivalent adjustment | 805 | 784 | 765 | 729 | 699 | ||||||||||||||

Operating profit | $ | 56,291 | $ | 55,329 | $ | 53,707 | $ | 52,244 | $ | 48,433 | |||||||||

Efficiency Ratio | |||||||||||||||||||

U.S. GAAP non-interest expense (d) | $ | 77,255 | $ | 78,963 | $ | 81,315 | $ | 81,730 | $ | 83,858 | |||||||||

Net revenue | $ | 133,546 | $ | 134,292 | $ | 135,022 | $ | 133,974 | $ | 132,291 | |||||||||

Efficiency ratio (c) / (d) | 57.85 | % | 58.80 | % | 60.22 | % | 61.00 | % | 63.39 | % | |||||||||

Adjusted Net Income | |||||||||||||||||||

U.S. GAAP net income available to common stockholders | $ | 28,915 | $ | 27,270 | $ | 20,040 | $ | 19,607 | $ | 14,062 | |||||||||

Amortization of intangibles, net of tax | 473 | 473 | 411 | 407 | 404 | ||||||||||||||

Adjusted net income (e) | $ | 29,388 | $ | 27,743 | $ | 20,451 | $ | 20,014 | $ | 14,466 | |||||||||

Average Tangible Common Equity | |||||||||||||||||||

U.S. GAAP average total equity | $ | 1,250,141 | $ | 1,227,628 | $ | 1,260,875 | $ | 1,356,244 | $ | 1,332,178 | |||||||||

Less: average goodwill | 94,506 | 94,519 | 94,531 | 94,544 | 94,556 | ||||||||||||||

Less: average other intangibles | 11,644 | 12,426 | 13,152 | 13,820 | 14,341 | ||||||||||||||

Less: average preferred stock | — | — | 60,409 | 241,389 | 240,993 | ||||||||||||||

Average tangible common equity (f) | $ | 1,143,991 | $ | 1,120,683 | $ | 1,092,783 | $ | 1,006,491 | $ | 982,288 | |||||||||

Return on average tangible common equity ((e) annualized) / (f) | 10.30 | % | 10.04 | % | 7.45 | % | 7.91 | % | 5.92 | % | |||||||||

Six Months Ended June 30, | |||||||

2013 | 2012 | ||||||

Taxable-equivalent net interest income | |||||||

U.S. GAAP net interest income | $ | 206,772 | $ | 209,722 | |||

Taxable-equivalent adjustment | 1,589 | 1,379 | |||||

Taxable-equivalent net interest income (a) | $ | 208,361 | $ | 211,101 | |||

Average Earning Assets (b) | $ | 12,942,293 | $ | 11,973,284 | |||

Net Interest Margin ((a) annualized) / (b) | 3.20 | % | 3.49 | % | |||

Net Revenue | |||||||

Taxable-equivalent net interest income (a) | $ | 208,361 | $ | 211,101 | |||

U.S. GAAP non-interest income | 59,477 | 53,750 | |||||

Net revenue (c) | $ | 267,838 | $ | 264,851 | |||

Operating Profit | |||||||

U.S. GAAP income before income taxes | $ | 90,831 | $ | 54,646 | |||

Provision for loan and covered loan losses | 19,200 | 44,739 | |||||

Taxable-equivalent adjustment | 1,589 | 1,379 | |||||

Operating profit | $ | 111,620 | $ | 100,764 | |||

Efficiency Ratio | |||||||

U.S. GAAP non-interest expense (d) | $ | 156,218 | $ | 164,087 | |||

Net revenue | $ | 267,838 | $ | 264,851 | |||

Efficiency ratio (c) / (d) | 58.33 | % | 61.95 | % | |||

Adjusted Net Income | |||||||

U.S. GAAP net income available to common stockholders | $ | 56,185 | $ | 24,881 | |||

Amortization of intangibles, net of tax | 946 | 808 | |||||

Adjusted net income (e) | $ | 57,131 | $ | 25,689 | |||

Average Tangible Common Equity | |||||||

U.S. GAAP average total equity | $ | 1,238,948 | $ | 1,323,767 | |||

Less: average goodwill | 94,513 | 94,562 | |||||

Less: average other intangibles | 12,033 | 14,674 | |||||

Less: average preferred stock | — | 240,797 | |||||

Average tangible common equity (f) | $ | 1,132,402 | $ | 973,734 | |||

Return on average tangible common equity ((e) annualized) / (f) | 10.19 | % | 5.31 | % | |||

2013 | 2012 | ||||||||||||||||||

June 30 | March 31 | December 31 | September 30 | June 30 | |||||||||||||||

Tier 1 Common Capital | |||||||||||||||||||

U.S. GAAP total equity | $ | 1,233,040 | $ | 1,232,065 | $ | 1,207,166 | $ | 1,363,440 | $ | 1,334,154 | |||||||||

Trust preferred securities | 244,793 | 244,793 | 244,793 | 244,793 | 244,793 | ||||||||||||||

Less: accumulated other comprehensive income, net of tax | 14,180 | 44,285 | 48,064 | 55,818 | 50,987 | ||||||||||||||

Less: goodwill | 94,496 | 94,509 | 94,521 | 94,534 | 94,546 | ||||||||||||||

Less: other intangibles | 11,266 | 12,047 | 12,828 | 13,500 | 14,152 | ||||||||||||||

Tier 1 risk-based capital | 1,357,891 | 1,326,017 | 1,296,546 | 1,444,381 | 1,419,262 | ||||||||||||||

Less: preferred stock | — | — | — | 241,585 | 241,185 | ||||||||||||||

Less: trust preferred securities | 244,793 | 244,793 | 244,793 | 244,793 | 244,793 | ||||||||||||||

Tier 1 common capital (e) | $ | 1,113,098 | $ | 1,081,224 | $ | 1,051,753 | $ | 958,003 | $ | 933,284 | |||||||||

Tangible Common Equity | |||||||||||||||||||

U.S. GAAP total equity | $ | 1,233,040 | $ | 1,232,065 | $ | 1,207,166 | $ | 1,363,440 | $ | 1,334,154 | |||||||||

Less: goodwill | 94,496 | 94,509 | 94,521 | 94,534 | 94,546 | ||||||||||||||

Less: other intangibles | 11,266 | 12,047 | 12,828 | 13,500 | 14,152 | ||||||||||||||

Tangible equity (f) | 1,127,278 | 1,125,509 | 1,099,817 | 1,255,406 | 1,225,456 | ||||||||||||||

Less: preferred stock | — | — | — | 241,585 | 241,185 | ||||||||||||||

Tangible common equity (g) | $ | 1,127,278 | $ | 1,125,509 | $ | 1,099,817 | $ | 1,013,821 | $ | 984,271 | |||||||||

Tangible Assets | |||||||||||||||||||

U.S. GAAP total assets | $ | 13,476,493 | $ | 13,372,230 | $ | 14,057,515 | $ | 13,278,554 | $ | 12,942,176 | |||||||||

Less: goodwill | 94,496 | 94,509 | 94,521 | 94,534 | 94,546 | ||||||||||||||

Less: other intangibles | 11,266 | 12,047 | 12,828 | 13,500 | 14,152 | ||||||||||||||

Tangible assets (h) | $ | 13,370,731 | $ | 13,265,674 | $ | 13,950,166 | $ | 13,170,520 | $ | 12,833,478 | |||||||||

Risk-weighted Assets (i) | $ | 12,296,092 | $ | 12,164,677 | $ | 12,337,398 | $ | 11,804,578 | $ | 11,588,371 | |||||||||

Period-end Common Shares Outstanding (j) | 77,630 | 77,649 | 77,115 | 72,436 | 72,424 | ||||||||||||||

Ratios: | |||||||||||||||||||

Tier 1 common equity to risk-weighted assets (e) / (i) | 9.05 | % | 8.89 | % | 8.52 | % | 8.12 | % | 8.05 | % | |||||||||