UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Under §240.14a-12 |

|

SENECA FOODS CORPORATION |

|

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

SENECA FOODS CORPORATION

3736 South Main Street

Marion, New York 14505

July 8, 2022

Dear Shareholder:

You are cordially invited to the 2022 Annual Meeting of Shareholders of Seneca Foods Corporation (the “Company”), to be held on Wednesday, August 10, 2022 at 1:00 PM, Central Daylight Time, at the Company’s Offices, 418 East Conde Street, Janesville, WI 53546.

Information about the Annual Meeting is included in the Notice of Annual Meeting of Shareholders and Proxy Statement which follow.

It is important that your shares of Common and Preferred Stock be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, I urge you to give your immediate attention to voting. Please review the enclosed materials, sign and date the enclosed proxy card and return it promptly in the enclosed postage-paid envelope.

| Very truly yours, | ||

| /s/ Paul L. Palmby | ||

| PAUL L. PALMBY | ||

| President and Chief Executive Officer |

SENECA FOODS CORPORATION

3736 South Main Street

Marion, New York 14505

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 10, 2022

To the Shareholders of Seneca Foods Corporation:

You are hereby notified that the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Seneca Foods Corporation (the “Company”) will be held at the Company’s Offices, 418 East Conde Street, Janesville, WI 53546, on Wednesday, August 10, 2022 at 1:00 PM, Central Daylight Time, for the following purposes (which are more fully described in the accompanying proxy statement):

|

1. |

To elect four directors, three of whom to serve until the Annual Meeting of shareholders in 2025, one to serve until the Annual Meeting of shareholders in 2023, and until each of their successors is duly elected and shall qualify; |

|

2. |

To cast a non-binding advisory vote to ratify the appointment of Plante Moran, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023; |

|

3. |

To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Only shareholders of record at the close of business on June 10, 2022 are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

The prompt return of your proxy will avoid delay and save the expense involved in further communication. The proxy may be revoked by you at any time prior to its exercise, and the giving of your proxy will not affect your right to vote in person if you wish to attend the Annual Meeting.

| By Order of the Board of Directors | ||

| /s/ John D. Exner | ||

| JOHN D. EXNER | ||

| Secretary |

DATED: July 8, 2022

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on August 10, 2022. This proxy statement, form of proxy and the Company’s annual report are available at http://www.senecafoods.com/investors.

|

2 |

|

|

5 |

|

|

5 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

9 |

|

|

9 |

|

|

9 |

|

|

10 |

|

|

11 |

|

|

11 |

|

|

15 |

|

|

15 |

|

|

16 |

|

|

16 |

|

|

16 |

|

|

17 |

|

|

18 |

|

|

18 |

|

|

21 |

|

|

22 |

|

|

PROPOSAL TWO: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

23 |

|

24 |

|

|

24 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

26 |

|

|

Compliance with Universal Proxy Rules for Director Nominations |

26 |

PROXY STATEMENT

QUESTIONS AND ANSWERS

ABOUT THE 2022 ANNUAL MEETING

Why did I receive this proxy?

The Board of Directors of Seneca Foods Corporation (the “Company”) is soliciting proxies to be voted at the Annual Meeting of Shareholders. The Annual Meeting will be held Wednesday, August 10, 2022, at 1:00 PM, Central Daylight Time, at the Company’s Offices, 418 East Conde Street, Janesville, WI 53546. This proxy statement summarizes the information you need to know to vote by proxy or in person at the Annual Meeting. You do not need to attend the Annual Meeting in person in order to vote.

Who is entitled to vote?

All record holders of the Company’s voting stock as of the close of business on June 10, 2022 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the Record Date, the following shares of voting stock were issued and outstanding: (i) 6,452,343 shares of Class A common stock, $0.25 par value per share (“Class A Common Stock”); (ii) 1,707,249 shares of Class B common stock, $0.25 par value per share (“Class B Common Stock”, and together with the Class A Common Stock, sometimes collectively referred to as the “Common Stock”); (iii) 200,000 shares of Six Percent (6%) Cumulative Voting Preferred Stock, $0.25 par value per share (“6% Preferred Stock”); (iv) 407,240 shares of 10% Cumulative Convertible Voting Preferred Stock - Series A, $0.25 stated value per share (“10% Series A Preferred Stock”); and (v) 400,000 shares of 10% Cumulative Convertible Voting Preferred Stock - Series B, $0.25 stated value per share (“10% Series B Preferred Stock”).

How many votes do I have?

Each share of Class B Common Stock, 10% Series A Preferred Stock, and 10% Series B Preferred Stock is entitled to one vote on each item submitted to you for consideration. Each share of Class A Common Stock is entitled to one-twentieth (1/20) of one vote on each item submitted to you for consideration. Each share of 6% Preferred Stock is entitled to one vote, but only with respect to the election of directors.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts at the transfer agent or with stockbrokers. Please complete and return all proxy cards to ensure that all your shares are voted.

How do I vote?

|

● |

By Mail: Vote, sign, date your card and mail it in the postage-paid envelope. |

|

● |

In Person: At the Annual Meeting. |

How do I vote my shares that are held by my broker?

If you have shares held by a broker, you may instruct your broker to vote your shares by following the instructions that the broker provides to you.

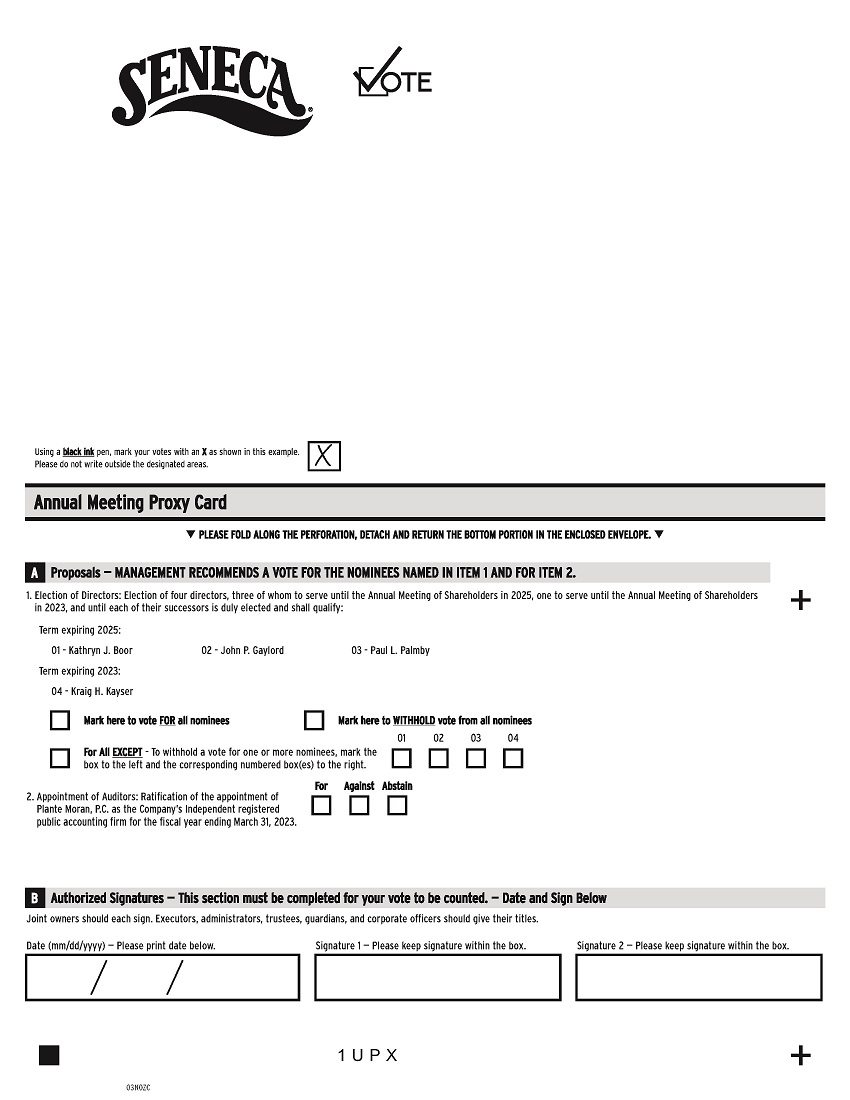

What am I voting on?

You will be voting on the following proposals:

|

● |

Proposal One: The election of four directors, three of whom to serve until the Annual Meeting of shareholders in 2025, one to serve until the Annual Meeting of shareholders in 2023, and until each of their successors is duly elected and shall qualify; |

|

● |

Proposal Two: The ratification of Plante Moran, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023. |

Will there be any other items of business on the agenda?

Pursuant to SEC rules, shareholder proposals must have been received by June 1, 2022 to be considered at the Annual Meeting. To date, we have received no shareholder proposals and we do not expect any other items of business. Nonetheless, in case there is an unforeseen need, your proxy gives discretionary authority to Paul L. Palmby and Timothy J. Benjamin with respect to any other matters that might be brought before the Annual Meeting. Those persons intend to vote that proxy in accordance with their best judgment.

How many votes are required to act on the proposals?

Pursuant to our Bylaws, provided a quorum is present, directors will be elected by a plurality of all the votes cast at the Annual Meeting with each share of voting stock being voted for as many individuals as there are directors to be elected and for whose election the share is entitled to vote.

The non-binding advisory vote to ratify the appointment of Plante Moran, PC as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023 requires the affirmative vote of a majority of the votes cast on the proposal, provided that a quorum is present at the Annual Meeting.

How are votes counted?

The Annual Meeting will be held if a quorum is represented in person or by proxy. The holders of voting shares entitled to exercise a majority of the voting power of the Company shall constitute a quorum at the Annual Meeting. If you return a signed proxy card, your shares will be counted for the purpose of determining whether there is a quorum. We will treat failures to vote, referred to as abstentions, as shares present and entitled to vote for quorum purposes. A withheld vote is the same as an abstention.

Broker non-votes occur when proxies submitted by a broker, bank or other nominee holding shares in “street name” do not indicate a vote for a proposal because they do not have discretionary voting authority and have not received instructions as to how to vote on the proposal. We will treat broker non-votes as shares that are present and entitled to vote for quorum purposes.

For purposes of each proposal, abstentions and broker non-votes, if any, will not be counted as votes cast on a proposal and will have no effect on the result of the vote on the proposal.

What happens if I return my proxy card without voting on all proposals?

When the proxy is properly executed and returned, the shares it represents will be voted at the Annual Meeting in accordance with your directions. If the signed card is returned with no direction on a proposal, the proxy will be voted FOR the nominees for Director and FOR the ratification of the independent registered public accounting firm.

Who has paid for this proxy solicitation?

The Company has paid the entire expense of this proxy statement and any additional materials furnished to shareholders.

When was this proxy statement mailed?

This proxy statement and the enclosed proxy card were mailed to shareholders beginning on or about July 8, 2022.

How can I obtain a copy of this year’s Annual Report on Form 10-K?

A copy of our 2022 Annual Report to Shareholders, including financial statements for the fiscal year ended March 31, 2022, accompanies this Proxy Statement. The Annual Report, however, is not part of the proxy solicitation material. A copy of our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) may be obtained free of charge by writing to Seneca Foods Corporation, 3736 South Main Street, Marion, New York 14505, Attention: Assistant Secretary or by accessing the “Investor Information” section of the Company’s website at www.senecafoods.com.

Can I find additional information on the Company’s website?

Yes. Our website is located at www.senecafoods.com. Although the information contained on our website is not part of this proxy statement, you can view additional information on the website, such as our code of conduct, corporate governance guidelines, charters of board committees and reports that we file with the SEC. A copy of our code of ethics and each of the charters of our board committees may be obtained free of charge by writing to Seneca Foods Corporation, 418 East Conde Street, Janesville, WI 53546, Attention: Secretary.

PROPOSAL ONE: ELECTION OF DIRECTORS

The Board of Directors unanimously recommends a vote FOR the election of each of the nominees listed below.

In accordance with our Bylaws, the Board of Directors is comprised of nine directors divided into three classes, as equal in number as possible. At this annual meeting four directors will be elected to serve, three of whom until the annual meeting in 2025, one until the annual meeting in 2023, and all until each of their successors is duly elected and shall qualify.

Unless instructed otherwise, proxies will be voted FOR the election of the four nominees listed below. Although the directors do not contemplate that any of the nominees will be unable to serve prior to the Meeting, if such a situation arises, the enclosed proxy will be voted in accordance with the best judgment of the person or persons voting the proxy.

Information Concerning Directors

The following biographies of each of the Director nominees, as well as the Directors whose terms continue beyond the Annual Meeting, contains information regarding that person’s principal occupation, tenure with the Company, business experience, other director positions currently held or held at any time during the past five years, and the specific experience, qualifications, attributes or skills that led to the conclusion by the Board of Directors that such person should serve as a Director of the Company.

Nominee Standing for Election at the 2022 Annual Meeting of Shareholders for a Term Expiring in 2025

Kathryn J. Boor, age 63 – Kathryn J. Boor has been a director since January 2019. Dr. Boor is Dean and Vice Provost of Graduate Education at Cornell University; from 2010-2020, she served as the Ronald P. Lynch Dean of Cornell’s College of Agriculture and Life Sciences. Dr. Boor serves on various boards and councils including the Board of Directors for International Flavors and Fragrance, where she chairs the Innovation and Sustainability Committee (since January 2021), the Southern Tier Regional Economic Development Council, Sarepta Therapeutics, Inc., and the Foundation for Food and Agriculture Research Board of Directors. Dr. Boor earned a B.S. in Food Science from Cornell University, an M.S. in Food Science from the University of Wisconsin and a Ph.D. in Microbiology from the University of California, Davis.

John P. Gaylord, age 61 – John P. Gaylord has been a director since October 2009. Mr. Gaylord has operating and management experience in manufacturing and distribution businesses, including experience as President of Gaylord Interests LLC. He currently serves as a member of the Audit Committee and Compensation Committee, along with being a manager of Comet Signs LLC, a commercial sign manufacturing business in Texas and surrounding states. Mr. Gaylord holds a B.A. from Texas Christian University and an M.B.A. from Southern Methodist University.

Paul L. Palmby, age 59 – Paul L. Palmby has been a director since June 2021. Mr. Palmby is the President and Chief Executive Officer of the Company and has served in that capacity since October 2020. From 2006-2020, Mr. Palmby served as Executive Vice President and Chief Operating Officer of the Company. Prior to that, he served as President of the Vegetable Division of the Company from 2005 to 2006 and Vice President of Operations of the Company from 1999-2004. Mr. Palmby joined the Company in February 1987.

Nominee Standing for Election at the 2022 Annual Meeting of Shareholders for a Term Expiring in 2023

Kraig H. Kayser, age 61 − Kraig H. Kayser previously served as a director from 1985 until his retirement from the Board in 2020. Mr. Kayser was re-appointed to the Board in November 2021, serving as Chairman since this date. Mr. Kayser is the former President and Chief Executive Officer of the Company, serving in this role from 1993 to his retirement from the position in 2020. From 1991 to 1993, he was the Company’s Chief Financial Officer. Mr. Kayser currently serves as the Chair of the Executive Committee of the Board of Trustees of Cornell University. In addition, Mr. Kayser is also a director of Moog Inc. where he serves as Chair of the Audit Committee and a member of the Nominating and Governance Committee. He received a B.A. from Hamilton College and an M.B.A. from Cornell University.

Directors whose Terms Expire in 2023

Peter R. Call, age 65 – Peter R. Call has been a director since 2011. Mr. Call is President of My-T Acres, Inc., a vegetable and grain farm. He was President of Pro-Fac Cooperative, Inc. from 2003-2013 and a member of its board of directors from 2000-2013. Mr. Call also serves as a director of Farm Credit East since 2015 and he has served on the Board of Trustees of Cornell University since 2020 and on the Board of Trustees of Genesee Community College since 2012. Mr. Call also serves on the Board of Directors of Farm Fresh First, LLC, and has done so since 2007. Mr. Call also served on the Board of Directors of Birds Eye Foods from 2002-2009. Mr. Call received his Bachelor of Science (B.S.) degree from Cornell University.

Michael F. Nozzolio, age 71 – Michael F. Nozzolio has been a director since August 2020. Mr. Nozzolio is a Counsel in the law firm Harris Beach PLLC. He was elected and represented the Finger Lakes region in the New York State Legislature, serving ten years in the Assembly, where he became Deputy Minority Leader, and twenty four years in the State Senate. While in the State Senate he served in a number of leadership positions, including Majority Whip. Prior to his elective service, he worked for four years as a Legislative Counsel in the U.S. House of Representatives. Mr. Nozzolio earned a Bachelor of Science degree in labor relations and Master of Science degree in Agricultural Economics from Cornell University. He is a graduate of the Syracuse University College of Law, and served as an officer in the United States Naval Reserve and the New York State Naval Militia. He currently serves as an active member of many advisory boards relating to food and agriculture, including the Cornell College of Agriculture, Cornell AgriTech, The Institute for Food Safety at Cornell and the New York State Center of Excellence for Food and Agriculture at Cornell AgriTech.

Directors whose Terms Expire in 2024

Linda K. Nelson, age 58 – Linda K. Nelson has been a director since February 2021. Ms. Nelson has over 30 years of experience in financial and operational management. Most recently, Ms. Nelson serves as a financial executive consultant, holding a senior leadership position for select organizations and on various acquisition and merger due diligence teams evaluating opportunities for both large-scale private equity firms and local entrepreneurs. From 2011 to 2013, Ms. Nelson held the role of Chief Financial Officer for First American Equipment Finance. Prior to that, Ms. Nelson was with Birds Eye Foods, Inc. for 15 years in increasingly responsible financial roles, reaching the position of Executive Vice President, Chief Financial Officer and Secretary in 2008.

Donald J. Stuart, age 66 – Donald J. Stuart has been a director since November 2020. Mr. Stuart is a Managing Partner / Founder at Cadent Consulting Group. Prior to Cadent, he served as Chief Operating Officer of Kantar Retail. Mr. Stuart was a founding partner of Cannondale Associates in 1992, as well as Managing Director and CEO / President. Before Cannondale, he had a strong finance and marketing background from his management positions at Glendinning Associates and Pillsbury / Green Giant. He has extensive experience in sales and marketing consulting for consumer manufacturers across multiple retail channels. Mr. Stuart received his B.A. in Economics from St. Lawrence University and his M.B.A. from the Amos Tuck School of Business at Dartmouth.

Keith A. Woodward, age 58 – Keith A. Woodward has been a director since July 2018. Mr. Woodward is the former Chief Financial Officer of Tennant Corporation. He is also a former Senior Vice President, Finance for General Mills, Inc. where he worked for 26 years from 1991-2017. From 2006-2009, he was the representative of General Mills appointed to serve as a board advisor to the Company’s Board of Directors pursuant to the Green Giant Alliance Agreement. Mr. Woodward has his M.B.A. in Finance and Marketing, and a B.S. in Accounting both from Indiana University. Mr. Woodward is currently a board member of Phillips Distilling Company in Minneapolis.

The table below provides certain highlights of the composition of our board members. Each of the categories included in the below table has the meaning as it is used in NASDAQ Rule 5605(f).

|

Board Diversity Matrix |

||||

|

Total Number of Directors |

9 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

|

Part I: Gender Identity |

||||

|

Directors |

2 |

6 |

1 |

|

|

Part II: Demographic Background |

||||

|

African American or Black |

||||

|

Alaskan Native or Native American |

||||

|

Asian |

||||

|

Hispanic or Latinx |

||||

|

Native Hawaiian or Pacific Islander |

||||

|

White |

2 |

6 |

||

|

Two or More Races or Ethnicities |

||||

|

LGBTQ+ |

||||

|

Did Not Disclose Demographic Background |

1 |

|||

Under the NASDAQ listing standards, at least a majority of the Company’s directors and all of the members of the Company’s Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee must meet the test of “independence” as defined by NASDAQ. The NASDAQ standards provide that, to qualify as an “independent” director, in addition to satisfying certain criteria, the Board of Directors must affirmatively determine that a director has no relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board of Directors has determined that each director nominee and director whose term will continue beyond the Annual Meeting, other than, Mr. Palmby as the current President and Chief Executive Officer of the Company, Mr. Kayser as the former President and Chief Executive Officer of the Company, Mr. Stuart as the son-in-law of the former Chairman of the Company, and Mr. Call, is “independent” as defined by the NASDAQ listing standards.

In making its determination with respect to Mr. Call, the Board considered his relationship with the Company as fully described in “Certain Transactions and Related Relationships” below on page 20. It concluded that Mr. Call does not satisfy the criteria under NASDAQ standards inasmuch as the Company purchased raw vegetables from My-T Acres, Inc., under an arm's length contract, above the $200,000 threshold permitted under the NASDAQ standards in determining “independence”.

With respect to the five independent directors, there are no transactions, relationships or arrangements not requiring disclosure pursuant to Item 404(a) of Regulation S-K that were considered by the Board in determining that these individuals are independent under the NASDAQ listing standards.

Mr. Kayser serves as the Chairman of the Board of Directors in a non-executive role and has served in that capacity since 2021. Mr. Palmby serves as the Chief Executive Officer and has served in that capacity since 2020. Our Board of Directors has no specific policy regarding separation of the Chairman of the Board and Chief Executive Officer. Although our bylaws permit the Chairman to serve as Chief Executive Officer, our Board has determined that separating these positions is currently in the best interest of the Company and our shareholders. As Chief Executive Officer, Mr. Palmby focuses on the strategy, leadership and day-to-day execution of our business plan while Mr. Kayser provides oversight, direction and leadership to the Board.

Our Board of Directors believes that it is able to effectively provide independent oversight of the Company’s business and affairs, including the risks we face, without an independent Chairman through the composition of our Board of Directors, the strong leadership of the independent Directors and the independent committees of our Board of Directors, and the other corporate governance structures and processes already in place. Five of the nine current Directors are independent under the NASDAQ listing standards. All of our Directors are free to suggest the inclusion of items on the agenda for meetings of our Board of Directors or raise subjects that are not on the agenda for that meeting. In addition, our Board of Directors and each committee have complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. Our Board of Directors also holds regularly scheduled executive sessions of only independent or non-management Directors, as appropriate, in order to promote discussion among such Directors and assure independent oversight of management. Moreover, our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee, all of which are comprised entirely of independent Directors, also perform oversight functions independent of management.

Board Oversight of Risk Management

The Company believes that its leadership structure allows the Directors to provide effective oversight of the Company’s risk management function by receiving and discussing regular reports prepared by the Company’s senior management on areas of material risk to the Company, including market conditions, matters affecting capital allocation, compliance with debt covenants, significant regulatory changes that may affect the Company’s business operations, access to debt and equity capital markets, existing and potential legal claims against the Company and various other matters relating to the Company’s business. Additionally, the Board of Directors administers its risk oversight function through (i) the required approval by the Board of Directors (or a committee thereof) of significant transactions and other decisions, including, among others, major acquisitions and divestitures, new borrowings and the appointment and retention of the Company’s executive management, (ii) the coordination of the direct oversight of specific areas of the Company’s business by the Compensation, Audit and Corporate Governance and Nominating Committees, and (iii) periodic reports from the Company’s auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to the Company’s internal control over financial reporting.

The Board of Directors has a standing Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee. Each member of each of these committees is “independent” as that term is defined in the NASDAQ listing standards. The Board has adopted a written charter for each of these committees, which is available on our website at www.senecafoods.com.

The Audit Committee currently consists of Mr. Woodward (Chair), Ms. Nelson and Mr. Gaylord. The Audit Committee met four times during the fiscal year ended March 31, 2022. The Audit Committee is directly responsible for the engagement of independent auditors, reviews with the auditors the scope and results of the audit, reviews with management or the internal auditor the scope and results of the Company’s internal auditing procedures, reviews the independence of the auditors and any non-audit services provided by the auditors, reviews with the auditors and management the adequacy of the Company’s system of internal accounting controls and makes inquiries into other matters within the scope of its duties. Mr. Woodward and Ms. Nelson have been designated as the Company’s “audit committee financial experts” in accordance with the SEC rules and regulations. Shareholders should understand that this designation is a disclosure requirement of the SEC related to the member’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose any duties, obligations or liability that are greater than are generally imposed on them as members of the Audit Committee and the Board, and this designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any member of the Audit Committee or the Board. See “Report of the Audit Committee” below.

The Compensation Committee consists of Mr. Gaylord (Chair), Mr. Nozzolio and Dr. Boor. The Compensation Committee’s function is to review and recommend to the Board of Directors appropriate executive compensation policy and compensation of the Company’s directors and officers. The Compensation Committee also reviews and makes recommendations with respect to executive and employee benefit plans and programs. The Compensation Committee met two times during the fiscal year ended March 31, 2022.

The Corporate Governance and Nominating Committee currently consists of Dr. Boor (Chair), Mr. Woodward and Mr. Nozzolio. The responsibilities of the Corporate Governance and Nominating Committee include assessing Board membership needs and identifying, screening, recruiting, and presenting director candidates to the Board, implementing policies regarding corporate governance matters, making recommendations regarding committee memberships and sponsoring and overseeing performance evaluations for the Board as a whole and the directors. The Corporate Governance and Nominating Committee met one time during the fiscal year ended March 31, 2022.

The Board has not adopted specific minimum criteria for director nominees and although the Company does not have a formal policy or guidelines regarding diversity, the Company recognizes the value of having a Board that encompasses a broad range of skills, expertise, contacts, industry knowledge and diversity of opinion. The Corporate Governance and Nominating Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service, or if the Corporate Governance and Nominating Committee decides not to nominate a member for re-election, the Corporate Governance and Nominating Committee first considers the appropriateness of the size of the Board. If the Corporate Governance and Nominating Committee determines the Board seat should remain and a vacancy exists, the Corporate Governance and Nominating Committee considers factors that it deems are in the best interests of the Company and its shareholders in identifying and evaluating a new nominee. The Corporate Governance and Nominating Committee will consider nominees suggested by incumbent Board members, management and shareholders.

Shareholder recommendations must be in writing and sent within the time periods set forth under the heading “Shareholder Proposals for the 2023 Annual Meeting” addressed to the Chairman of the Corporate Governance and Nominating Committee, c/o Corporate Secretary, 418 East Conde Street, Janesville, WI 53546 14505, and should include a statement setting forth the qualifications and experience of the proposed candidates and basis for nomination. Any person recommended by shareholders of the Company will be evaluated in the same manner as any other potential nominee for director.

The Board of Directors held four meetings and acted by unanimous written consent one time during the fiscal year ended March 31, 2022. Each director attended every meeting of the Board of Directors, and meetings held by all committees of the Board of Directors on which he or she served, while the director was an active member of the Board. Each director is expected to attend the Annual Meeting of shareholders. In 2021, the Annual Meeting of Shareholders was attended by all nine directors who were serving on the Board at that time.

Shareholder Communication with the Board

The Company provides an informal process for shareholders to send communications to the Board of Directors. Shareholders who wish to contact the Board of Directors or any of its members may do so in writing to Seneca Foods Corporation, 3736 South Main Street, Marion, New York 14505. Correspondence directed to an individual board member will be referred, unopened, to that member. Correspondence not directed to a particular board member will be referred, unopened, to the Chairman of the Audit Committee.

The following provides certain information regarding our executive officers. Each individual’s name and position with the Company is indicated. In addition, the principal occupation and business experience for the past five years is provided for each officer and, unless otherwise stated, each person has held the position indicated for at least the past five years.

Paul L. Palmby, age 59 – Mr. Palmby is the President and Chief Executive Officer of the Company and has served in that capacity since October 2020. From 2006-2020 Mr. Palmby served as Executive Vice President and Chief Operating Officer of the Company. Prior to that, he served as President of the Vegetable Division of the Company from 2005 to 2006 and Vice President of Operations of the Company from 1999-2004. Mr. Palmby joined the Company in February 1987.

Timothy J. Benjamin, age 63 − Mr. Benjamin has served as the Company’s Senior Vice President, Chief Financial Officer and Treasurer since June 2012. Prior to that he served as Corporate Treasurer at North American Breweries in Rochester, New York, since 2011 and was Director of Treasury and Tax Operations at IEC Electronics Corporation in 2010. Prior to that Mr. Benjamin was with Birds Eye Foods, Inc. for 15 years in increasingly responsible financial positions, reaching the position of Vice President and Treasurer in 2008.

Timothy R. Nelson, age 54 – Mr. Nelson has served as the President of Fruit and Snack since 2020 and the Senior Vice President of Operations since December 2018. Prior to that, he held the position of Vice President of Fruit and Snack operations from 2008 to 2018 and he spent time as the Plant Manager of Seneca’s plants in Blue Earth, Montgomery and Glencoe, Minnesota from 1999-2008. Mr. Nelson joined the Company in March 1992.

Dean E. Erstad, age 59 − Mr. Erstad has been Senior Vice President of Sales and Marketing of the Company since 2001 and Vice President of Private Label Sales during 2000.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

Overview

This section discusses our policies and practices relating to executive compensation and presents a review and analysis of the compensation earned during the fiscal year ended March 31, 2022 by our Chief Executive Officer, or CEO, and our two other most-highly compensated executive officers, to whom we refer collectively in this proxy statement as the “named executive officers.” The amounts of compensation earned by these executives are detailed in the Fiscal Year 2022 Summary Compensation Table and the other tables which follow it. The purpose of this section is to provide you with more information about the types of compensation earned by the named executive officers and the philosophy and objectives of our executive compensation programs and practices.

Authority of the Compensation Committee; Role of Executive Officers

The Compensation Committee of the Board of Directors (the “Committee”) consists of Mr. Gaylord (Chair), Dr. Boor, and Mr. Nozzolio. Each member of the Committee qualifies as an independent director under NASDAQ listing standards. The Committee operates under a written charter adopted by the Board. A copy of the charter is available at www.senecafoods.com under “Corporate Governance.” The Committee meets as often as necessary to perform its duties and responsibilities. The Committee held two meetings during fiscal year 2022 and has held one meeting so far during fiscal year 2023. The Committee also regularly meets in executive session without management. The Committee has never engaged a compensation consultant to assist it in developing compensation programs.

The Committee is authorized by our Board of Directors to oversee our compensation and employee benefit practices and plans generally, including our executive compensation, incentive compensation and equity-based plans. The Committee may delegate appropriate responsibilities associated with our benefit and compensation plans to members of management. The Committee has delegated certain responsibilities with regard to our Pension Plan and 401(k) Plan to an investment committee consisting of members of management. The Committee also has delegated authority to our President and CEO to designate those employees who will participate in our Executive Profit Sharing Bonus Plan; provided, however, that the Committee is required to approve participation in such plan by any of our executive officers.

The Committee approves the compensation of our CEO. Our CEO develops and submits to the Committee his recommendation for the compensation of each of the other executive officers in connection with annual merit reviews of their performance. The Committee reviews and discusses the recommendations made by our CEO and approves the compensation for each named executive officer for the coming year. No corporate officer, including our CEO, is present when the Committee determines that officer’s compensation. In addition, our Chief Financial Officer and other members of our finance staff assist the Committee with establishing performance target levels for our Executive Profit Sharing Bonus Plan, as well as with the calculation of actual financial performance and comparison to the performance targets, each of which actions requires the Committee’s approval.

Philosophy and Objectives

Our philosophy for the compensation of all of our employees, including the named executive officers, is to value the contribution of our employees and share profits through broad-based incentive arrangements designed to reward performance and motivate collective achievement of strategic objectives that will contribute to our Company’s success. The primary objectives of the compensation programs for our named executive officers are to:

|

● |

attract and retain highly-qualified executives, |

|

● |

motivate our executives to achieve our business objectives, |

|

● |

reward our executives appropriately for their individual and collective contributions, and |

|

● |

align our executives’ interests with the long-term interests of our shareholders. |

Our compensation principles are designed to complement and support the Company’s business strategy. The packaged fruit and vegetable business is highly competitive, and the principal customers are major food chains and food distributors with strong negotiating power as to price and other terms. Consequently, our success depends on an efficient cost structure (as well as quality products) which enables us to provide favorable prices to the customers and acceptable margins for the Company.

However, an important purpose of our compensation policies is to enable the Company to retain highly valued employees. Our senior management monitors middle and senior management attrition and endeavors to be sufficiently competitive as to salary levels so as to attract and retain highly valued managers. Consequently, the Company has been flexible in awarding compensation, and expects to remain so, to facilitate attracting and retaining quality management personnel.

Consideration of Most Recent Say on Pay Vote

At the Annual Meeting of Shareholders on August 18, 2020, over 84% of the shares voted were voted in support of the compensation of the Company’s named executive officers. As a result, the Compensation Committee concluded that the compensation paid to executive officers and the Company’s overall pay practices have strong shareholder support and no significant changes have been made since that time.

Also at the Annual Meeting of Shareholders on July 28, 2017, the shareholders expressed a preference that advisory votes on executive compensation occur every three years. Consistent with this preference, the Board of Directors determined to implement an advisory vote on executive compensation every three years, and the next advisory vote on executive compensation will be held in 2023.

Elements of Executive Compensation for Fiscal Year 2022

Base Salary - The base salary of each of our named executive officers is reviewed by the Committee at the beginning of each fiscal year as part of the overall annual review of executive compensation. During the review of base salaries, the Committee considers the executive’s qualifications and experience, scope of responsibilities and future potential, the goals and objectives established for the individual, his or her past performance and competitive salary practices both internally and externally. In addition to the annual reviews, the base salary of a particular executive may be adjusted during the course of a fiscal year, for example, in connection with a promotion or other material change in the executive’s role or responsibilities. During fiscal year 2022, the named executive officers received a range of 4.0% to 7.1% of cost-of-living increases to their base salary in May 2021. The base salary of each of our named executive officers is set forth in the Summary Compensation Table.

As a general rule, base salaries for the named executive officers are set at a level which will allow us to attract and retain highly-qualified executives. Many of our competitors are family-owned businesses operating in rural areas, where compensation rates and salary expectations are below urban levels. However, most of our executive officers also live and work in rural locations, inasmuch as the Company believes that its facilities (some of which include executive offices) should be located in the agricultural areas that produce the crops processed by the Company. Although the compensation level of our executive officers is generally in the upper end of executive compensation in these localities, they are below the compensation levels for comparable positions in most public companies with sales comparable to those of the Company.

Executive Profit Sharing Bonus Plan - The Executive Profit Sharing Bonus Plan is generally available to officers and certain key corporate employees. An annual incentive bonus is payable based upon the Company’s performance, and aligns the interests of executives and employees with those of our shareholders. The Executive Profit Sharing Bonus Plan links performance incentives for management and key employees to increases in shareholder value and promotes a culture of high performance and ownership in which members of management are rewarded for achieving operating efficiencies, reducing costs and improving profitability.

The Executive Profit Sharing Bonus Plan became effective April 1, 2006 and was last amended on February 9, 2022. The most recent amendment did not become effective until April 1, 2022, so the previous amendment on January 25, 2017 remained in effect for fiscal year 2022. Under the Plan, annual incentive bonuses are paid based on achieving the performance criteria set for the Company. The bonuses for officers and certain key corporate employees are distributed at the sole discretion of our CEO upon approval of such bonuses by the Committee. The performance criteria established under each Plan requires the Company's pre-tax profits adjusted to a FIFO basis for a fiscal year to equal or exceed a specific bonus target plus the aggregate bonus amounts calculated under the Plan. The bonus target under each Plan is expressed as a percentage of the consolidated net worth of the Company calculated on a FIFO basis. The bonus targets under the Executive Profit Sharing Bonus Plan range from 5% to 15% increase of consolidated net worth. Additionally, each bonus target corresponds to a potential bonus payment calculated as a percentage of the employee's base salary earned during the fiscal year. The potential bonus payments under the Executive Profit Sharing Bonus Plan range from 10% to 35% of base salary. The Executive Profit Sharing Bonus Plan provides that the Board of Directors or an authorized committee is permitted to make discretionary bonus payments in addition to any bonus payments calculated under the Plan.

The following table sets forth the bonus targets and potential bonus payments established under the Executive Profit Sharing Bonus Plan for fiscal year 2022.

|

Bonus Target as Percent of Consolidated Net Worth |

Potential Bonus Payment |

|

5% |

10% |

|

7.5% |

15% |

|

10% |

20% |

|

12.5% |

25% |

|

15% |

35% |

For fiscal year 2022, the Company’s pre-tax profits on a FIFO basis exceeded the 15% bonus target for a 35% bonus payment. The actual amount earned by each named executive officer in fiscal year 2022 is reported under the Non-Equity Incentive Plan Compensation column in the Summary Compensation Table.

Division Management Bonus Plan - The Division Management Bonus Plan is generally available to the president or other chief executive of each division as well as other officers and certain key corporate employees. The Division Management Bonus Plan uses the performance criteria under the Executive Profit Sharing Bonus Plan, however the performance criteria under the Division Management Bonus Plan is based on the applicable division’s pre-tax profits as a percentage of the division’s net worth, each as calculated on a FIFO basis, rather than the Company on a consolidated basis. The Fruit and Vegetable Division’s pre-tax profits on a FIFO basis exceeded the maximum bonus target for fiscal 2022. The actual amount earned by each named executive officer in fiscal year 2022, if any, is reported under the Non-Equity Incentive Plan Compensation column in the Summary Compensation Table.

Equity Based Incentive Awards - On August 10, 2007, the shareholders approved the 2007 Equity Incentive Plan to align the interests of management and shareholders through the use of stock-based incentives that result in increased stock ownership by management. Executive management’s view of the Plan is that it is important to allow us to continue to attract and retain key talent and to motivate executive and other key employees to achieve the Company’s goals. On July 28, 2017, the shareholders approved the amendment and extension of the 2007 Equity Incentive Plan for an additional ten year term. The Company granted 4,266 shares of restricted Class A common stock awards under the Plan to key employees in fiscal year 2022. Provided that the participant remains employed by the Company, these shares of restricted stock will vest equally over a four-year period. Upon the appointment of Mr. Palmby to President and Chief Executive Officer on October 1, 2020, the compensation committee concurred that Mr. Palmby would no longer receive restricted awards on a prospective basis. Mr. Palmby received a final prorated restricted award in August 2021 covering the time period prior to his appointment as President and Chief Executive Officer.

Retirement Programs - Our executive officers are entitled to participate in the Company’s Pension Plan, which is for the benefit of all employees meeting certain eligibility requirements. Effective August 1, 1989, the Company amended the Pension Plan to provide improved pension benefits under an excess formula. The excess formula for the calculation of the annual retirement benefit is: total years of credited service (not to exceed 35) multiplied by the sum of (i) 0.6% of the participant’s average salary (five highest consecutive years, excluding bonus), and (ii) 0.6% of the participant’s average salary in excess of his or her compensation covered by Social Security.

Participants who were employed by the Company prior to August 1, 1988, are eligible to receive the greater of their benefit determined under the excess formula or their benefit determined under the offset formula as of July 31, 1989. The offset formula is: (i) total years of credited service multiplied by $120, plus (ii) average salary multiplied by 25%, less 74% of the primary Social Security benefit. The maximum permitted annual retirement income that can be paid to a participant under either formula is $245,000. See “Pension Benefits” below for further information regarding the number of years of service credited to each of the named executive officers and the actuarial present value of his accumulated benefit under the Pension Plan.

We also have a 401(k) Plan pursuant to which the Company makes matching and discretionary contributions, however, the named executive officers are not eligible to participate in the Company’s 401(k) match. The Company sponsors an unfunded nonqualified deferred compensation plan to permit certain eligible employees, including the named executive officers, to defer receipt of a portion of their compensation to a future date. This plan was designed to compensate the 401(k) Plan participants for any loss of Company contributions under the 401(k) Plan. None of the named executive officers received a Company match under the deferred compensation plan in excess of $10,000.

Other Compensation - The Company also provides health insurance, term life insurance, and short-term disability benefits that do not discriminate in scope, terms or operation in favor of our executive officers. These benefits are included in the Summary Compensation Table for the named executive officers under “All Other Compensation.”

Other Compensation Policies

Internal Pay Equity - The Committee believes that internal pay equity is an important factor to be considered in establishing compensation for our officers. The Committee has not established a policy regarding the ratio of total compensation of our CEO to that of the other officers, but it does review compensation levels to ensure that appropriate equity exists. The Committee intends to continue to review internal pay equity and may adopt a formal policy in the future if it deems such a policy to be appropriate.

Compensation Deductibility Policy - Under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”), a publicly held corporation may not deduct compensation of more than $1 million paid to any “covered employee” in any year. Although certain qualifying “performance-based compensation” was previously exempt from this deduction limit, the Tax Cuts and Jobs Act that was signed into law on December 22, 2017 made certain changes to Section 162(m). Pursuant to such changes, “performance-based compensation” is no longer exempt under Section 162(m). None of our executive officers received more than $1,000,000 in compensation during fiscal year 2022 or any prior year, so Section 162(m) has not been applicable to the Company.

No Stock Options - The Company has never awarded stock options to any officer or employee, and it does not presently contemplate initiating any plan or practice to award stock options.

Timing of Grants - The Committee anticipates that stock awards to the Company’s officers under the 2007 Equity Incentive Plan will typically be granted annually in conjunction with the review of the individual performance of each officer. This review will take place at a regularly scheduled meeting of the Compensation Committee.

The following table summarizes, for the fiscal years ended March 31, 2022 and 2021, the amount of compensation earned by the named executive officers:

|

Name and Principal Position |

Year |

Salary |

Non-Equity Incentive Plan Compensation |

(1) Stock Awards |

(2) All Other Compensation |

Total | ||||||||||||||||

|

Paul L. Palmby |

2022 |

$ | 687,588 | $ | 275,656 | $ | 25,000 | $ | 9,665 | $ | 997,908 | |||||||||||

|

President and |

2021 |

$ | 512,328 | $ | 214,315 | $ | 50,000 | $ | 10,898 | $ | 787,541 | |||||||||||

|

Chief Executive Officer |

||||||||||||||||||||||

|

Timothy J. Benjamin |

2022 |

$ | 327,778 | $ | 114,722 | $ | 25,000 | $ | 4,460 | $ | 471,961 | |||||||||||

|

Senior Vice President and |

2021 |

$ | 307,371 | $ | 107,943 | $ | 12,500 | $ | 4,679 |

$ |

432,493 | |||||||||||

| Chief Financial Officer | ||||||||||||||||||||||

|

Timothy R. Nelson |

2022 |

$ | 299,956 | $ | 118,985 | $ | 25,000 | $ | 647 | $ | 444,588 | |||||||||||

|

Senior Vice President of Operations |

||||||||||||||||||||||

|

(1) |

Represents the total grant date fair value of stock awards on the date of the award. The fair values of these awards were based on the closing price of the Company’s Class A common stock as reported on the NASDAQ Global Select Market on the date of grant. |

|

(2) |

This includes the Company’s matching contribution to its deferred compensation plan for each named executive officer, if any, and the amount of premium paid by the Company for group term life insurance on the named executive officer’s life. The value of perquisites and other personal benefits are not shown in the table individually because the aggregate amount of such compensation, if any, is less than $10,000 for each named executive officer. |

Outstanding Equity Awards at 2022 Fiscal Year-End

| Unvested Restricted Stock Awards | ||||||||

| Shares | Market Value (1) | |||||||

| Name | ||||||||

| Paul L. Palmby | 2,742 | (2) | $ | 141,323 | ||||

| President and Chief Executive Officer | ||||||||

| Timothy J. Benjamin | 1,040 | (3) | $ | 53,602 | ||||

| Senior Vice President and Chief Financial Officer | ||||||||

| Timothy R. Nelson | 474 | (4) | $ | 24,430 | ||||

| Senior Vice President of Operations | ||||||||

|

(1) |

Determined based on the closing price of the Company’s Class A Common Stock ($51.54) on March 31, 2022. |

|

(2) |

Mr. Palmby’s restricted stock holdings as of March 31, 2022 vest as follows, provided that he remains employed by the Company on such dates: 1,304 shares on August 10, 2022, 914 shares on August 10, 2023, 407 shares on August 10, 2024 and 117 shares on August 10, 2025. |

|

(3) |

Mr. Benjamin's restricted stock holdings as of March 31, 2022 vest as follows, provided that he remains employed by the Company on such dates: 415 shares on August 10, 2022, 318 shares on August 10, 2023, 190 shares on August 10, 2024 and 117 shares on August 10, 2025. |

|

(4) |

Mr. Nelson's restricted stock holdings as of March 31, 2022 vest as follows, provided that he remains employed by the Company on such dates: 119 shares on August 10, 2022, 119 shares on August 10, 2023, 119 shares on August 10, 2024 and 117 shares on August 10, 2025. |

The Company’s Pension Plan is a funded, tax-qualified, noncontributory defined-benefit pension plan that covers certain employees, including the named executive officers. Effective August 1, 1989, the Company amended the Pension Plan to provide improved pension benefits under an excess formula. The excess formula for the calculation of the annual retirement benefit is: total years of credited service (not to exceed 35) multiplied by the sum of (i) 0.6% of the participant’s average salary (five highest consecutive years, excluding bonus), and (ii) 0.6% of the participant’s average salary in excess of his compensation covered by Social Security. The amount of annual earnings that may be considered in calculating benefits under the Pension Plan is limited by law. For 2022, the annual limitation is $305,000.

Participants who were employed by the Company prior to August 1, 1988, are eligible to receive the greater of their benefit determined under the excess formula or their benefit determined under the offset formula as of July 31, 1989. The offset formula is: (i) total years of credited service multiplied by $120, plus (ii) average salary multiplied by 25%, less 74% of the primary Social Security benefit. The maximum permitted annual retirement income that can be paid to a participant under either formula is $245,000.

Under the director compensation program, which became effective September 1, 2012 and amended as of August 13, 2020, each non-employee director is paid a monthly cash retainer of $2,500. Mr. Palmby, as a current officer of the Company, did not receive any compensation for serving the Company as members of the Board of Directors. The Company’s non-employee directors received the following aggregate amounts of compensation for the fiscal year ended March 31, 2022:

|

Name |

Fees Earned or Paid in Cash |

|||

|

Kraig H. Kayser |

$ | 12,500 | ||

|

Kathryn J. Boor |

$ | 30,000 | ||

|

Peter R. Call |

$ | 30,000 | ||

|

John P. Gaylord |

$ | 30,000 | ||

|

Linda K. Nelson |

$ | 30,000 | ||

|

Michael F. Nozzolio |

$ | 30,000 | ||

|

Donald J. Stuart |

$ | 30,000 | ||

|

Keith A. Woodward |

$ | 30,000 | ||

|

(1) |

Compensation Committee Interlocks |

As noted above, the Compensation Committee is comprised of Mr. Gaylord (Chair), Dr. Boor, and Mr. Nozzolio. No member of the Compensation Committee is or was formerly an officer or an employee of the Company. No executive officer of the Company serves as a member of the board of directors and compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors, nor has such interlocking relationship existed in the past three years.

Certain Transactions and Relationships

According to written policy of the Audit Committee, any related party transactions, excluding compensation, which is delegated to the Compensation Committee, involving one of the Company’s directors or executive officers, must be reviewed and approved by the Audit Committee. Any member of the Audit Committee who is a related party with respect to a transaction under review may not participate in the deliberations or vote on the approval or ratification of the transaction. Related parties include any of the Company’s directors or executive officers, certain of the Company’s stockholders and their immediate family members. To identify any related party transactions, each year, the Company submits and requires each director and officer to complete director and officer questionnaires identifying any transactions with the Company in which the executive officer or director or their family members has an interest. In addition, the Board of Directors determines, on an annual basis, which members of the Board meet the definition of independent director as defined in the NASDAQ listing standards and reviews and discusses any relationships with a director that would potentially interfere with his or her exercise of independent judgment in carrying out the responsibilities of a director.

A small percentage (less than 1% in fiscal years 2022 and 2021) of vegetables supplied to the Company are grown by My-T Acres, Inc. Peter R. Call, a Director, is the President of My-T Acres, Inc., which supplied the Company approximately $2.9 million and $2.2 million pursuant to a raw vegetable grower contract in fiscal years 2022 and 2021, respectively. The Chairman of the Audit Committee reviewed the relationship and determined that the My-T Acres contract was negotiated at arm's length and on no more favorable terms than to other growers in the marketplace.

The Company made charitable contributions to the Seneca Foods Foundation in the amount of $1.0 million for each of fiscal years 2022 and 2021. The Foundation is a nonprofit entity that supports charitable activities by making grants to unrelated organizations or institutions, and is managed by current employees of the Company.

During fiscal year 2022, the Company recorded a liability for retirement arrangements to beneficiaries of certain former employees of the Company that have family relationships to two of the Company’s current Directors. As of March 31, 2022, the liability for these benefits totaled $1.9 million. Payments are made monthly over the beneficiary’s lifetime.

During fiscal year 2022, the Company had the following four employment relationships. Aaron Wadell, brother-in-law of Donald J. Stuart a Director of the Company, was employed as Vice President of e-Business for the Company. Bruce Wolcott, brother-in-law of Donald J. Stuart a Director of the Company, was employed as Vice President of Marketing for the Company. Jesse Hayes, son of Paul L. Palmby an Executive Officer of the Company, was employed as Director of Foodservice for the Company. Patrick Nelson, son of Timothy R. Nelson an Executive Officer of the Company, was employed as Regional Senior Manager of Technical Services for the Company. For each of the aforementioned employees the total fiscal year 2022 compensation (base salary, bonus, and benefits) exceeded the reporting threshold of $120,000 but did not exceed $270,000. The Chairman of the Audit Committee reviewed and approved each of these relationships and determined that each compensation arrangement was at arm’s length and structured the same for what would be a similarly situated employee.

Security Ownership of Certain Beneficial Owners

To the best of the Company’s knowledge, no person or group (as those terms are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange of 1934, as amended (the “Exchange Act”)) beneficially owned, as of June 10, 2022, more than five percent of the shares of any class of the Company’s voting securities except as set forth in the following table. Beneficial ownership for these purposes is determined in accordance with applicable SEC rules and includes shares over which a person has sole or shared voting power investment power. The holdings of Common Stock listed in the table do not include the shares obtainable upon conversion of the 10% Series A Preferred Stock and the 10% Series B Preferred Stock, which currently are convertible into one share of Class A Common Stock and one share of Class B Common Stock for every 20 shares of 10% Series A Preferred Stock and 30 shares of 10% Series B Preferred Stock.

| Amount of Shares and Nature of Beneficial Ownership | ||||||||||||||||||

|

Title of Class |

Name and Address of Beneficial Owner |

Sole Voting/ Investment Power |

Shared Voting/ Investment Power |

Total |

(1) Percent of Class |

|||||||||||||

| 6% Preferred Stock |

Michael Wolcott Pittsford, New York |

40,844 | - | 40,844 | 20.42 | % | ||||||||||||

|

Kurt C. Kayser Bradenton, Florida |

27,536 | - | 27,536 | 13.77 | % | |||||||||||||

|

Susan W. Stuart Fairfield, Connecticut |

25,296 | - | 25,296 | 12.65 | % | |||||||||||||

|

Bruce S. Wolcott Canandaigua, New York |

25,296 | - | 25,296 | 12.65 | % | |||||||||||||

|

Grace W. Wadell Lake Oswego, Oregon |

25,292 | - | 25,292 | 12.65 | % | |||||||||||||

|

Mark S. Wolcott Pittsford, New York |

25,292 | - | 25,292 | 12.65 | % | |||||||||||||

|

Estate of L. Jerome Wolcott, Jr. Costa Mesa, California |

15,222 | - | 15,222 | 7.61 | % | |||||||||||||

|

Peter B. Wolcott Torrington, Connecticut |

15,222 | - | 15,222 | 7.61 | % | |||||||||||||

| Amount of Shares and Nature of Beneficial Ownership (Continued) | ||||||||||||||||||

|

Title of Class |

Name and Address of Beneficial Owner |

Sole Voting/ Investment Power |

Shared Voting/ Investment Power |

Total |

(1) Percent of Class |

|||||||||||||

|

10% Series A Preferred Stock |

Marilyn W. Kayser Rochester, New York |

141,644 | - | 141,644 | 34.78 | % | ||||||||||||

|

Bruce S. Wolcott |

26,605 | 26,605 | 53,210 | 13.07 | % | |||||||||||||

|

Susan W. Stuart |

26,605 | 26,605 | 53,210 | 13.07 | % | |||||||||||||

|

Mark S. Wolcott |

26,605 | 26,605 | 53,210 | 13.07 | % | |||||||||||||

|

Grace W. Wadell |

26,605 | 26,605 | 53,210 | 13.07 | % | |||||||||||||

|

Kraig H. Kayser Lakewood Ranch, Florida |

32,168 | - | 32,168 | 7.90 | % | |||||||||||||

|

Hannelore Wolcott-Bailey Penn Yan, New York |

20,588 | - | 20,588 | 5.06 | % | |||||||||||||

|

10% Series B Preferred Stock |

Marilyn W. Kayser |

165,080 | - | 165,080 | 41.27 | % | ||||||||||||

|

Kraig H. Kayser |

91,400 | - | 91,400 | 22.85 | % | |||||||||||||

|

Bruce S. Wolcott |

15,100 | 15,100 | 30,200 | 7.55 | % | |||||||||||||

|

Susan W. Stuart |

15,100 | 15,100 | 30,200 | 7.55 | % | |||||||||||||

|

Mark S. Wolcott |

15,100 | 15,100 | 30,200 | 7.55 | % | |||||||||||||

|

Grace W. Wadell |

15,100 | 15,100 | 30,200 | 7.55 | % | |||||||||||||

|

Hannelore Wolcott-Bailey |

22,720 | - | 22,720 | 5.68 | % | |||||||||||||

|

Class A Common Stock |

BlackRock Inc. 55 East 52nd Street New York, New York |

1,160,893 | - | 1,160,893 | (2) | 17.99 | % | |||||||||||

|

Dimensional Fund Advisors LP 6300 Bee Cave Road Building One Austin, Texas |

583,248 | - | 583,248 | (3) | 9.04 | % | ||||||||||||

|

Seneca Foods 401(k) Plan |

439,845 | - | 439,845 | 6.82 | % | |||||||||||||

|

The Vanguard Group 100 Vanguard Blvd. Malvern, Pennsylvania |

397,866 | 7,187 | 405,053 | (4) | 6.28 | % | ||||||||||||

|

Royce & Associates, LP 745 Fifth Avenue New York, New York |

371,403 | - | 371,403 | (5) | 5.76 | % | ||||||||||||

| Amount of Shares and Nature of Beneficial Ownership (Continued) | ||||||||||||||||||

|

Title of Class |

Name and Address of Beneficial Owner |

Sole Voting/ Investment Power |

Shared Voting/ Investment Power |

Total |

(1) Percent of Class |

|||||||||||||

|

Class B Common Stock |

Seneca Foods Pension Plan |

471,000 | - | 471,000 | 27.59 | % | ||||||||||||

|

Kraig H. Kayser |

112,983 | 76,824 | 189,807 | (6) | 11.12 | % | ||||||||||||

|

Susan W. Stuart |

63,492 | 104,030 | 167,522 | (7) | 9.81 | % | ||||||||||||

|

Seneca Foods 401(k) Plan |

106,816 | - | 106,816 | 6.26 | % | |||||||||||||

|

Marilyn Kayser |

94,547 | - | 94,547 | 5.54 | % | |||||||||||||

|

(1) |

The applicable percentage of beneficial ownership is based on the number of shares of each class of voting stock outstanding as of June 10, 2022. |

|

(2) |

Based solely upon an amended Statement on Schedule 13G filed with the SEC on January 27, 2022 by BlackRock, Inc. (“BlackRock”) reporting (i) sole power to vote or direct the vote of 1,124,239 shares, (ii) shared power to vote or direct the vote of zero shares, (iii) sole power to dispose or direct the disposition of 1,160,893 shares, and (iv) shared power to dispose or direct the disposition of zero shares, of the Company’s Class A Common Stock. Blackrock reports that iShares Core S&P Small-Cap ETF and BlackRock Fund Advisors each beneficially owns more than five percent of the total outstanding shares of Class A Common Stock. |

|

(3) |

Based solely upon an amended Statement on Schedule 13G filed with the SEC on February 8, 2022 by Dimensional Fund Advisors LP (“Dimensional”) reporting (i) sole power to vote or direct the vote of 569,727 shares, (ii) shared power to vote or direct the vote of zero shares, (iii) sole power to dispose or direct the disposition of 583,248 shares, and (iv) shared power to dispose or direct the disposition of zero shares, of the Company’s Class A Common Stock. Dimensional reports that these securities are owned by various investment funds to which Dimensional acts as an investment advisor or serves as investment manager or sub-advisor, which have the right to receive or the power to direct the receipt of dividends or the proceeds from the sale of the Company’s Class A Common Stock, and to its knowledge no one fund’s interest is more than five percent of the total outstanding shares of Class A Common Stock. Dimensional disclaims beneficial ownership of these shares. |

|

(4) |

Based solely upon an amended Statement on Schedule 13G filed with the SEC on February 10, 2022 by The Vanguard Group (“Vanguard”) reporting (i) sole power to vote or direct the vote of zero shares, (ii) shared power to vote or direct the vote of 3,986 shares, (iii) sole power to dispose or direct the disposition of 397,866 shares, and (iv) shared power to dispose or direct the disposition of 7,187 shares, of the Company’s Class A Common Stock. Vanguard reports that its clients, including investment companies registered under the Investment Company Act of 1940 and other managed accounts, have the right to receive or the power to direct the receipt of dividends or the proceeds from the sale of the Company’s Class A Common Stock and no one other person’s interest is more than five percent of the total outstanding shares of Class A Common Stock. |

|

(5) |

Based solely upon an amended Statement on Schedule 13G filed with the SEC on January 25, 2022 by Royce and Associates, LP (“RALP”) reporting (i) sole power to vote or direct the vote of 371,403 shares, (ii) shared power to vote or direct the vote of zero shares, (iii) sole power to dispose or direct the disposition of 371,403 shares, and (iv) shared power to dispose or direct the disposition of zero shares, of the Company’s Class A Common Stock. RALP reports that these securities are beneficially owned by one or more registered investment companies or other managed accounts that are investment management clients of RALP and no one other person’s interest is more than five percent of the total outstanding shares of Class A Common Stock. RALP disclaims beneficial ownership of these shares. |

|

(6) |

Mr. Kayser has sole voting and investment power over 112,983 shares of Class B Common Stock he owns. The shares in the table include personal 401(k) holdings of 832 shares. Mr. Kayser has shared voting and investment power with respect to (i) 74,924 shares held by the Seneca Foods Foundation (the “Foundation”), of which Mr. Kayser is a director and (ii) 1,900 shares held in a trust, for which Mr. Kayser is the custodian. |

|

(7) |

The shares reported in the table include (i) 18,894 shares of Class B Common Stock held by Ms. Stuart’s husband, (ii) 10,212 shares held in a trust, for which Ms. Stuart is the trustee and (iii) 74,924 shares held by the Foundation, of which Ms. Stuart is a director. The shares in the table do not include 471,000 shares held by the Pension Plan, of which Ms. Stuart’s husband is a trustee. Ms. Stuart has shared voting and investment power with respect to the shares held by the Foundation and the shares held in trust. She disclaims beneficial ownership of the shares held by her husband. |

Security Ownership of Management and Directors

The following table sets forth certain information available to the Company with respect to shares of all classes of the Company’s voting securities owned by each director, by each named executive officer (as defined on page 15) and by all directors and executive officers as a group, as of June 10, 2022. Beneficial ownership for these purposes is determined in accordance with applicable SEC rules and includes shares over which a person has sole or shared voting power or investment power. The holdings of Common Stock listed in the table do not include the shares obtainable upon conversion of the 10% Series A Preferred Stock and the 10% Series B Preferred Stock, which currently are convertible into one share of Class A Common Stock and one share of Class B Common Stock for every 20 shares of 10% Series A Preferred Stock and 30 shares of 10% Series B Preferred Stock.

| Name of Beneficial Owner | Title of Class |

Shares Beneficially Owned |

(1) Percent of Class |

||||||

|

Kraig H. Kayser |

Class A Common Stock (2) |

153,990 | 2.39 | % | |||||

|

Class B Common Stock (3) |

189,807 | 11.12 | % | ||||||

|

10% Series A Preferred Stock (2) |

32,168 | 7.90 | % | ||||||

|

10% Series B Preferred Stock (2) |

91,400 | 22.85 | % | ||||||

|

Kathryn J. Boor |

- | * | |||||||

|

Peter R. Call |

Class A Common Stock |

5,097 | * | ||||||

|

John P. Gaylord |

Class A Common Stock |

1,000 | * | ||||||

|

Linda K. Nelson |

- | * | |||||||

|

Michael F. Nozzolio |

- | * | |||||||

|

Donald J. Stuart |

Class A Common Stock (4) |

69,830 | 1.08 | % | |||||

|

Class B Common Stock (4) |

82,386 | 4.83 | % | ||||||

|

6% Preferred Stock (4) |

25,296 | 12.65 | % | ||||||

|

10% Series A Preferred Stock (4) |

53,210 | 13.07 | % | ||||||

|

10% Series B Preferred Stock (4) |

30,200 | 7.55 | % | ||||||

|

Keith A. Woodward |

Class A Common Stock |

500 | * | ||||||

|

Paul L. Palmby |

Class A Common Stock (5) |

102,601 | 1.59 | % | |||||

|

Class B Common Stock (5) |

77,338 | 4.53 | % | ||||||

|

Timothy J. Benjamin |

Class A Common Stock (6) |

5,403 | * | ||||||

|

Class B Common Stock (6) |

512 | * | |||||||

|

Timothy R. Nelson |

Class A Common Stock (7) |

2,008 | * | ||||||

|

Class B Common Stock (7) |

372 | * | |||||||

|

All directors and executive officers as a group |

Class A Common Stock |

266,110 | 4.12 | % | |||||

|

Class B Common Stock |

276,011 | 16.17 | % | ||||||

|

6% Preferred Stock |

25,296 | 12.65 | % | ||||||

|

10% Series A Preferred Stock |

85,378 | 20.97 | % | ||||||

|

10% Series B Preferred Stock |

121,600 | 30.40 | % |

|

* |

Less than 1.0%. |

|

(1) |

The applicable percentage of beneficial ownership is based on the number of shares of each class of voting stock outstanding as of June 10, 2022. |

|

(2) |

All shares in the table reflect shares owned directly by Mr. Kayser with the exception of 76,936 shares of Class A Common Stock held by the Foundation, of which Mr. Kayser is a director and 1,400 shares of Class A Common Stock held in a trust, for which Mr. Kayser is the custodian. The shares in the table include personal 401(k) holdings of 3,426 and 832 shares of Class A and Class B Common Stock, respectively. |

|

(3) |

See note 6 to the table under the heading “Security Ownership of Certain Beneficial Owners” |

|

(4) |

The shares in the table include the following shares held directly by Mr. Stuart: (i) 12,616 shares of Class A Common Stock, (ii) 18,894 shares of Class B Common Stock, (iii) 26,605 shares of 10% Series A Preferred Stock, and (iv) 15,100 shares of Series B Preferred Stock. The shares in the table also include the following shares held directly by Mr. Stuart’s wife: (i) 57,214 shares of Class A Common Stock, (ii) 63,492 shares of Class B Common Stock, (iii) 25,296 shares of 6% Preferred Stock, (iv) 26,605 shares of 10% Series A Preferred Stock, and (v) 15,100 shares of 10% Series B Preferred Stock. Mr. Stuart disclaims beneficial ownership of the shares held by his wife. |

|

(5) |

The shares in the table include 25,665 and 2,414 shares of Class A and Class B Common Stock, respectively, held directly by Mr. Palmby, which includes 1,567 and 381 shares of Class A and Class B Common Stock, respectively, as personal 401(k) holdings. Mr. Palmby also has shared voting and investment power with respect to the Class A and Class B Common stock held by the Foundation, which totaled 76,936 and 74,924, respectively in the table above. |

|

(6) |

Mr. Benjamin has sole voting and investment power over 5,403 and 512 shares of Class A and Class B Common Stock owned by him, including personal 401(k) holdings of 559 and 136 shares of Class A and Class B Common Stock, respectively. |

|

(7) |

Mr. Nelson has sole voting and investment power over 2,008 and 372 shares of Class A and Class B Common Stock owned by him, including personal 401(k) holdings of 1,534 and 372 shares of Class A and Class B Common Stock, respectively. |

Delinquent Section 16(a) Reports