UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K

____________________________________

(Mark One)

| Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

For the fiscal year ended January 30 , 2022

or

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

For the transition period from to

Commission File Number 001-06395

____________________________________

(Exact name of registrant as specified in its charter)

____________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices, Zip Code)

Registrant’s telephone number, including area code: (805 ) 498-2111

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

____________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant (based upon the closing sale price of $61.91 on The Nasdaq Global Select Market) as of August 1, 2021 was approximately $3.1 billion. Stock held by directors, officers and stockholders owning 10% or more of the outstanding common stock (as reported by stockholders on Schedules 13D and 13G) were excluded as they may be deemed affiliates. This determination of affiliate status is not a conclusive determination for any other purpose.

Number of shares of our common stock, $0.01 par value per share, outstanding at March 11, 2022: 64,106,315 .

____________________________________

DOCUMENTS INCORPORATED BY REFERENCE

SEMTECH CORPORATION

INDEX TO FORM 10-K

FOR THE YEAR ENDED JANUARY 30, 2022

| Item 1 | ||||||||

| Item 1A | ||||||||

| Item 1B | ||||||||

| Item 2 | ||||||||

| Item 3 | ||||||||

| Item 4 | ||||||||

| Item 5 | ||||||||

| Item 6 | [Reserved] | |||||||

| Item 7 | ||||||||

| Item 7A | ||||||||

| Item 8 | ||||||||

| Item 9 | ||||||||

| Item 9A | ||||||||

| Item 9B | ||||||||

| Item 9C | ||||||||

| Item 10 | ||||||||

| Item 11 | ||||||||

| Item 12 | ||||||||

| Item 13 | ||||||||

| Item 14 | ||||||||

| Item 15 | ||||||||

| Item 16 | ||||||||

2

Unless the context otherwise requires, the use of the terms "Semtech," "the Company," "we," "us" and "our" in this Annual Report on Form 10-K refers to Semtech Corporation and, as applicable, its consolidated subsidiaries. This Annual Report on Form 10-K may contain references to the Company’s trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies' trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Special Note

Regarding Forward-Looking and Cautionary Statements

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended, based on our current expectations, estimates and projections about our operations, industry, financial condition, performance, operating results, and liquidity. Forward-looking statements are statements other than historical information or statements of current condition and relate to matters such as future financial performance, future operational performance, the anticipated impact of specific items on future earnings, and our plans, objectives and expectations. Statements containing words such as "may," "believe," "anticipate," "expect," "intend," "plan," "project," "estimate," "should," "will," "designed to," "projections," or "business outlook," or other similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that could cause actual results and events to differ materially from those projected. Potential factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to those set forth under "Risk Factors" in Item 1A of this Annual Report on Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission ("SEC"). In light of the significant risks and uncertainties inherent in the forward-looking information included herein that may cause actual performance and results to differ materially from those predicted, any such forward-looking information should not be regarded as representations or guarantees by the Company of future performance or results, or that its objectives or plans will be achieved, or that any of its operating expectations or financial forecasts will be realized. Reported results should not be considered an indication of future performance. Investors are cautioned not to place undue reliance on any forward-looking information contained herein, which reflect management's analysis only as of the date hereof. Except as required by law, the Company assumes no obligation to publicly release the results of any update or revision to any forward-looking statement that may be made to reflect new information, events or circumstances after the date hereof or to reflect the occurrence of unanticipated or future events, or otherwise.

The factors noted above, and the risks included in our SEC filings, may be increased or intensified as a result of the COVID-19 pandemic. The extent to which the COVID-19 pandemic ultimately impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted. In addition to regarding forward-looking statements with caution, you should consider that the preparation of the consolidated financial statements requires us to draw conclusions and make interpretations, judgments, assumptions and estimates with respect to certain factual, legal, and accounting matters. Our consolidated financial statements might have been materially impacted if we had reached different conclusions or made different interpretations, judgments, assumptions or estimates.

3

PART I

Item 1. Business

General

We are a leading global supplier of high-performance analog and mixed-signal semiconductors and advanced algorithms and were incorporated in Delaware in 1960. We design, develop, manufacture and market a wide range of products for commercial applications, the majority of which are sold into the infrastructure, high-end consumer and industrial end markets.

Infrastructure: data centers, passive optical networks ("PON"), base stations, optical networks, servers, carrier networks, switches and routers, cable modems, wireless local area network ("LAN") and other communication infrastructure equipment.

High-End Consumer: smartphones, tablets, wearables, desktops, notebooks, and other handheld products, wireless charging, set-top boxes, digital televisions, monitors and displays, digital video recorders and other consumer equipment.

Industrial: Internet of Things ("IoT") applications, analog and digital video broadcast equipment, video-over-IP solutions, automated meter reading, smart grid, wireless charging, military and aerospace, medical, security systems, automotive, industrial and home automation and other industrial equipment.

Our end customers are primarily original equipment manufacturers ("OEMs") that produce and sell electronics.

Overview of the Semiconductor Industry

The semiconductor industry is broadly divided into analog and digital semiconductor products. Analog semiconductors condition and regulate "real world" functions such as temperature, speed, sound and electrical current. Digital semiconductors process binary information, such as that used by computers. Mixed-signal devices incorporate both analog and digital functions into a single chip and provide the ability for digital electronics to interface with the outside world.

The market for analog and mixed-signal semiconductors differs from the market for digital semiconductors. The analog and mixed-signal industry is typically characterized by longer product life cycles than the digital industry. In addition, analog semiconductor manufacturers tend to have lower capital investment requirements for manufacturing because their facilities tend to be less dependent than digital producers on state-of-the-art production equipment to manufacture leading edge process technologies. The end-product markets for analog and mixed-signal semiconductors are more varied and more specialized than the relatively standardized digital semiconductor product markets.

Another difference between the analog and digital markets is the amount of available talented labor. The analog industry relies more heavily than the digital industry on design and applications talent to distinguish its products from one another. Digital expertise is extensively taught in universities due to its overall market size, while analog and mixed-signal expertise tends to be learned over time based on experience and hands-on training. Consequently, personnel with analog training are scarcer than digital trained engineers. This difference has historically made it more difficult for new suppliers in the analog market to quickly develop products and gain significant market share.

Advancements in digital signal processing technology typically drive the need for corresponding advancements in analog and mixed-signal solutions. We believe that the diversity of our applications allows us to take advantage of areas of relative market strength and reduces our vulnerability to competitive pressure in any one area.

Business Strategy

Our objective is to be a leading supplier of high-performance analog and mixed-signal semiconductors and advanced algorithms to the fastest growing segments of our target markets. We intend to leverage our pool of skilled technical personnel to develop new products or, where appropriate, use strategic acquisitions or small strategic investments to either accelerate our position in the fastest growing areas or to gain entry into these areas. In order to capitalize on our strengths in analog and mixed-signal processing design, development and marketing, we intend to pursue the following strategies:

Leverage our rare analog and mixed-signal design expertise

We invest heavily in the human resources needed to define, design and market high-performance analog and mixed-signal platform products. We have built a team of experienced engineers who combine industry expertise with advanced semiconductor design expertise to meet customer requirements and enable our customers to get their products to market rapidly. We intend to leverage this strength to achieve new levels of integration, power reduction and performance, enabling our customers to achieve differentiation in their end systems.

Continue to release proprietary new products, achieve new design wins and cross-sell products

We are focused on developing unique, new, and proprietary products that bring value to our target customers in our target markets. These products are typically differentiated in performance but are priced competitively. We also focus on achieving design wins for our products with current and future customers. Design wins are indications by the customer that they intend to

4

incorporate our products into their end product designs. Although we believe that a design win is an indicator of future potential growth, it does not inevitably result in us being awarded business or receiving a purchase commitment. Our technical talent works closely with our customers in securing design wins, defining new products and in implementing and integrating our products into our customers' systems. We also focus on selling our complete portfolio of products to our existing customers, as we believe the technical expertise of our marketing and sales teams allows us to identify and capitalize on cross-selling opportunities.

Focus on fast-growing market segments and regions

We have chosen to target the analog and mixed-signal sub-segments of some of the most exciting and fastest growing end markets. We participate in these markets by focusing on specific product areas within the analog and mixed-signal market, including products for infrastructure, high-end consumer and industrial end markets. All of these markets are characterized by their need for leading-edge, high-performance analog and mixed-signal semiconductor technologies.

The infrastructure, high-end consumer and industrial end markets we supply are characterized by several trends that we believe drive demand for our products. The key trends that we believe are significant for our future growth include:

•Increasing bandwidth over high-speed networks, fueling growth in high speed multimedia transmission, as well as better connectivity;

•Demand for smaller, lighter, more highly integrated and feature-rich mobile devices; and

•Increasing demands for cloud and internet connectivity to low power sensors, enabling a more connected, intelligent and sustainable planet.

Our products address these market trends by providing solutions that are ultra-low power thereby extending battery life, small form factor enabling smaller more mobile devices, highly integrated enabling more functionality within devices, and high-performance enabling product differentiation within our customer base. Additionally, as communications functions are increasingly integrated into a range of systems and devices, these products require analog sensing, processing and control capabilities, which increases the number and size of our targeted end markets.

Leverage outsourced semiconductor fabrication capacity

We outsource most of our manufacturing in order to focus more of our resources on designing, developing and marketing our products. A significant amount of our third-party subcontractors and suppliers, including third-party foundries that supply silicon wafers, are located in the United States ("U.S."), Taiwan and China. We believe that outsourcing our manufacturing provides us numerous benefits, including capital efficiency, the flexibility to adopt and leverage emerging process technologies without significant investment risk, and a more variable cost of goods, all of which provide us with greater operating flexibility.

Products and Technology

We design, develop, manufacture and market high-performance analog and mixed-signal semiconductors and advanced algorithms. We operate and account for results in two reportable segments—the High-Performance Analog Group and the System Protection Group. The High-Performance Analog Group is comprised of our Signal Integrity and Wireless and Sensing product lines, which represent two operating segments. The System Protection Group is comprised of our Protection product line, which represents a separate operating segment (see Note 15 on segment information).

Signal Integrity. We design, develop, manufacture and market a portfolio of optical data communications and video transport products used in a wide variety of infrastructure and industrial applications. Our comprehensive portfolio of integrated circuits ("ICs") for data centers, enterprise networks, PON, and wireless base station optical transceivers and high-speed interfaces ranges from 100Mbps to 400Gbps and supports key industry standards such as Fibre Channel, Infiniband, Ethernet, PON and synchronous optical networks. Our video products offer advanced solutions for next generation high-definition broadcast applications, as well as highly differentiated video-over-IP technology for professional audio video ("Pro AV") applications.

Wireless and Sensing. We design, develop, manufacture and market a portfolio of specialized radio frequency products used in a wide variety of industrial, medical and communications applications, and specialized sensing products used in industrial and consumer applications. Our wireless products, which include our LoRa® devices and wireless radio frequency technology ("LoRa Technology"), feature industry leading and longest range industrial, scientific and medical radio, enabling a lower total cost of ownership and increased reliability in all environments. These features make these products particularly suitable for machine-to-machine and IoT applications. Our unique sensing technology enables proximity sensing and advanced user interface solutions for our mobile and consumer products. Our wireless and sensing products can be found in a broad range of applications in the industrial, medical, and consumer markets. We also design, develop, and market power product devices that control, alter, regulate, and condition the power within electronic systems focused on the LoRa and IoT infrastructure segment. The highest volume product types within this category are switching voltage regulators, combination switching and linear regulators, smart regulators, isolated switches, and wireless charging.

5

Protection. We design, develop, manufacture and market high-performance protection devices, which are often referred to as transient voltage suppressors ("TVS"). TVS devices provide protection for electronic systems where voltage spikes (called transients), such as electrostatic discharge, electrical over stress or secondary lightning surge energy, can permanently damage sensitive ICs. Our portfolio of protection solutions include filter and termination devices that are integrated with the TVS device. Our products provide robust protection while preserving signal integrity in high-speed communications, networking and video interfaces. These products also operate at very low voltage. Our protection products can be found in a broad range of applications including smart phones, LCD and organic light-emitting diode TVs and displays, set-top boxes, monitors and displays, tablets, computers, notebooks, base stations, routers, automobile and industrial systems.

Our net sales by product line were as follows:

| Fiscal Years | |||||||||||||||||

| (in thousands) | 2022 | 2021 | 2020 | ||||||||||||||

| Signal Integrity | $ | 291,114 | $ | 255,640 | $ | 222,846 | |||||||||||

| Wireless and Sensing | 246,174 | 177,534 | 167,454 | ||||||||||||||

| Protection | 203,570 | 161,943 | 157,212 | ||||||||||||||

| Total | $ | 740,858 | $ | 595,117 | $ | 547,512 | |||||||||||

Semtech End Markets

Our products are sold primarily to customers in the infrastructure, high-end consumer and industrial end markets. Our net sales by major end market as a percentage of total net sales are detailed below:

| Fiscal Years | |||||||||||||||||

| (percentage of net sales) | 2022 | 2021 | 2020 | ||||||||||||||

| Infrastructure | 35 | % | 42 | % | 38 | % | |||||||||||

| High-End Consumer | 30 | % | 27 | % | 29 | % | |||||||||||

| Industrial | 35 | % | 31 | % | 33 | % | |||||||||||

| Total | 100 | % | 100 | % | 100 | % | |||||||||||

We believe that our diversity in end markets provides stability to our business and opportunity for growth.

6

The following table depicts our main product lines and their end market and product applications:

| Typical End Product Applications | ||||||||||||||||||||

| Product Groups | Infrastructure | High-End Consumer | Industrial | |||||||||||||||||

| Signal Integrity | Optical module ICs supporting up to 400Gb/s for Ethernet, Fibre Channel protocols in data center and access applications, and 4G/5G/LTE wireless applications | Serial Digital Interconnect interface ICs for Broadcast Video, Video over IP technology for Pro AV applications | ||||||||||||||||||

| Wireless and Sensing | Smartphones, media players, tablets, wearables, hearing aids and high end audio | IoT, Industrial Asset Monitoring, Tracking & Logistics, Smart Metering, Smart Home, Smart Building / City, Smart Agriculture, Power Management and Aviation & Aerospace | ||||||||||||||||||

| Protection | Servers, workstations, desktop PC/notebooks, ultrabooks, optical modules, printers, copiers, 4G/5G/LTE base stations, 1/10 Gb/s Ethernet | Smartphones, tablets, wearables, cameras, TVs, set top boxes | Industrial automation, measurement & instrumentation, automotive, IoT | |||||||||||||||||

Seasonality

Seasonality has not historically had a material impact on our business segments or results of operations.

Sales and Marketing

Net sales made directly to customers during fiscal years 2022, 2021 and 2020, were approximately 13%, 18% and 28% of total net sales, respectively. The remaining 87%, 82% and 72% of net sales, respectively, were made through independent distributors. The decline in direct sales is due to customers electing to leverage the value of distribution to better manage their supply chain. We have direct sales personnel located throughout the U.S., Europe, and Asia who manage the sales activities of independent sales representative firms and independent distributors. We expense our advertising costs as they are incurred.

We operate internationally through our foreign subsidiaries. Semtech (International) AG serves the European and Asian markets from its headquarters in Rapperswil, Switzerland, and through its wholly-owned subsidiaries based in the United Kingdom ("U.K.") and Japan. Semtech (International) AG also maintains branch offices, either directly or through one of its wholly-owned subsidiaries, in multiple countries or territories including China, Taiwan and South Korea. Semtech Canada Corporation serves the Canadian market for most of the products from our Signal Integrity Products Group from its headquarters in Burlington, Ontario. Independent representatives and distributors are also used to serve customers throughout the world. Some of our distributors and sales representatives also offer products from our competitors, as is customary in the industry.

7

Customers, Sales Data and Backlog

As a result of the breadth of our products and markets, we have a broad and balanced range of customers.

Representative Customers by End Markets:

| Infrastructure | High-End Consumer | Industrial | |||||||||||||||

| Alibaba Group Holding, Ltd. | LG Electronics Inc. | Helium | |||||||||||||||

| Alphabet Inc. | Quanta Computer | Honeywell Inc. | |||||||||||||||

| Cisco Systems, Inc. | Samsung Electronics Co., Ltd. | Itron, Inc. | |||||||||||||||

| Ericsson | Sharp Corporation | Panasonic Corp | |||||||||||||||

| Hewlett-Packard | Vivo Technology Co., Ltd. | Raytheon Company | |||||||||||||||

| Lumentum Holdings Inc. | Rockwell Automation | ||||||||||||||||

| Nokia Corporation | Sharp Corporation | ||||||||||||||||

| Samsung Electronics Co., Ltd. | Sonova International | ||||||||||||||||

| Sumitomo Electric | Sony Corp | ||||||||||||||||

| ZTE Corporation | |||||||||||||||||

Our customers include major OEMs and their subcontractors in the infrastructure, high-end consumer and industrial end markets. Our products are typically purchased by these customers for their performance, price and/or technical support, as compared to our competitors.

In fiscal years 2022, 2021 and 2020, sales in the U.S. represented 10%, 10% and 9% of our sales, respectively, while foreign sales represented 90%, 90% and 91% of our sales, respectively. Sales to customers located in China (including Hong Kong) and South Korea comprised 60% and 6% of our sales, respectively, in fiscal year 2022. No other foreign country comprised more than 5% of our sales in fiscal year 2022.

Concentration of Net Sales - Significant Customers

The following table sets forth the concentration of sales among the customers that accounted for more than 10% of our net sales in at least one of the fiscal years 2022, 2021 and 2020:

| Fiscal Years | |||||||||||||||||

| (percentage of net sales) | 2022 | 2021 | 2020 | ||||||||||||||

| Frontek Technology Corporation (and affiliates) | 18 | % | 16 | % | 11 | % | |||||||||||

| Trend-tek Technology Ltd. (and affiliates) | 17 | % | 17 | % | 13 | % | |||||||||||

| CEAC International Ltd. (and affiliates) | 11 | % | 11 | % | 8 | % | |||||||||||

| Arrow Electronics (and affiliates) | 10 | % | 9 | % | 9 | % | |||||||||||

Premier Technical Sales Korea, Inc. (and affiliates) (1) | 6 | % | 6 | % | 7 | % | |||||||||||

| Samsung Electronics (and affiliates) | 2 | % | 2 | % | 4 | % | |||||||||||

(1) Premier is a distributor with a concentration of sales to Samsung Electronics (and affiliates). The above percentages represent our estimate of the sales activity related to Samsung Electronics (and affiliates) that is passing through this distributor.

Concentration of Accounts Receivable - Significant Customers

The following table shows customers that had an outstanding receivable balance that represented at least 10% of our total net receivables as of one or more of the dates indicated:

| (percentage of net receivables) | January 30, 2022 | January 31, 2021 | |||||||||

| Frontek Technology Corporation (and affiliates) | 17 | % | 10 | % | |||||||

| CEAC International Ltd. (and affiliates) | 10 | % | 14 | % | |||||||

| Trend-tek Technology Ltd. (and affiliates) | 7 | % | 14 | % | |||||||

8

Backlog

Our backlog of orders as of the end of fiscal years 2022, 2021 and 2020 was approximately $250.1 million, $161.4 million and $93.0 million, respectively. The majority of our backlog is typically requested for delivery within six months. In markets where the end system life cycles are relatively short, customers typically request delivery in four to eight weeks. A backlog analysis at any given time gives little indication of our future business except on a short-term basis, principally within the next 45 days. We do not have any significant backlog with deliveries beyond 18 months.

Manufacturing Capabilities

Our strategy is to outsource most of our manufacturing functions to third-party foundries and assembly and test contractors. The third-party foundries fabricate silicon wafers, while the assembly and test contractors package and test our products. We believe this outsourcing permits us to take advantage of the best available technology, leverage the capital investment of others and reduce our operating costs associated with manufacturing assets.

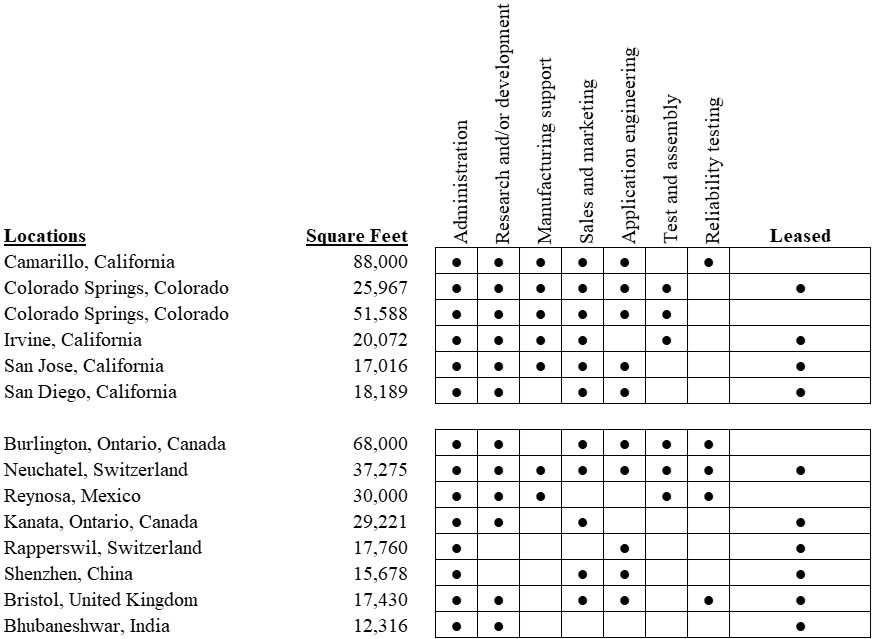

We perform a limited amount of internal probe and final test activities at our facilities in Camarillo, Irvine and San Diego in California, Neuchâtel in Switzerland, and Reynosa in Mexico. These activities accommodate situations in which tight coupling with product design is desirable or where there are unique requirements. A majority of our very small form factor protection devices are packaged at our facilities in Colorado Springs, Colorado. Our packaged discrete rectifier products are packaged and tested in-house in Reynosa, Mexico. Almost all of our other products are packaged and tested by outside subcontractors.

In keeping with our mostly "fabless" business model, we have no wafer fabrication facilities except for our operation in Reynosa, Mexico. In fiscal year 2022, the Reynosa facility provided approximately 14% of the silicon for our packaged discrete rectifier products, which were approximately 2% of our end product net sales in fiscal year 2022. The remaining end products representing 98% of our net sales were supported with finished silicon wafers purchased from third-party wafer foundries primarily located in the U.S., Taiwan and China. We anticipate that substantially all of the silicon wafers we require will come from third-party foundries in fiscal year 2023.

Despite our use of third-party wafer foundries for sourcing a majority of our silicon needs, we do maintain internal process development capabilities. Our process engineers work closely with our third-party foundries on the improvement and development of process capabilities. In fiscal year 2022, we used various manufacturing processes, including Bipolar, CMOS, RF-CMOS and Silicon Germanium ("SiGe") BiCMOS processes.

While we do have some redundancy of fabrication processes by using multiple third-party foundries, any interruption of supply by one or more of these foundries could materially impact us. As a result, we maintain some amount of business interruption insurance in part to help reduce the financial risk associated with a wafer supply interruption, but we are not fully insured against this risk.

Although our products are made from basic materials (principally silicon, metals and plastics), all of which are available from a number of suppliers, capacity at wafer foundries sometimes becomes constrained. The limited availability of certain materials, such as silicon wafer substrates, may impact our suppliers’ ability to meet our demand needs or impact the price we are charged. The prices of certain other basic materials, such as metals, gases and chemicals used in the production of ICs, can exhibit price volatility depending on the changes in demand for these basic commodities. In most cases, we do not procure these materials ourselves, but we are nevertheless reliant on these materials for producing our products because our third-party foundry and package and test subcontractors must procure them. To help minimize risks associated with constrained capacity, we use multiple foundries and have taken other steps to prevent supply interruptions at certain foundries and subcontractors.

In addition to our development and production facilities in Colorado Springs, Colorado, which provide assembly services for a majority of our very small form factor protection devices, we use third-party subcontractors to perform almost all of our other assembly and test operations. A majority of our offshore assembly and test activity is conducted by third-party subcontractors based in China, Taiwan and Malaysia. We have operations offices located in the Philippines, Malaysia and China that support and coordinate some of the worldwide shipment of products. We have installed our own test equipment at some of our packaging and testing subcontractors in order to ensure a certain level of capacity, assuming the subcontractor has ample employees to operate the equipment. We are monitoring the impact of the COVID-19 pandemic on our suppliers and third-party subcontractors and cannot determine the extent of the impact it may continue to have on our operations. See “Item 1A. Risk Factors - Risks Relating to Production Operations - We rely on a limited number of suppliers and subcontractors, many of which are foreign-based entities, for many essential components and materials and certain critical manufacturing services and any interruption or loss of supplies or services from these entities could significantly interrupt our business operations and the production of our products.”

Our arrangements with both third-party wafer foundries and package and test subcontractors are designed to provide some assurance of capacity but are not expected to assure access to all the manufacturing capacity we may need in the future.

9

Competition

The analog and mixed-signal semiconductor and advanced algorithms industries are highly competitive, and we expect competitive pressures to continue. Our ability to compete effectively and to expand our business will depend on our ability to continue to recruit and retain key engineering talent, our ability to execute on new product developments, and our ability to persuade customers to design these new products into their applications.

Our industry is characterized by decreasing average unit selling prices over the life of a product as the volumes typically increase. However, price decreases can sometimes be quite rapid and faster than the rate of increase of the associated product volumes. We believe we compete effectively based upon our ability to capitalize on efficiencies and economies of scale in production and sales, and our ability to maintain or improve our productivity and product yields to reduce manufacturing costs. Our industry is also characterized by rapid technological change, and design and other technological obsolescence. We believe we compete effectively based on our success in developing new products that implement new technologies, protection of our trade secrets and know-how and maintaining high product quality and reliability.

We are in direct and active competition, with respect to one or more of our product lines, with numerous manufacturers of varying size, technical capability and financial strength. A number of these competitors are dependent on semiconductor products as their principal source of income, and some are much larger and better resourced than we are. The number of competitors continues to grow due to expansion of the market segments in which we participate. Additionally, there has been a trend toward consolidation in our industry as companies attempt to strengthen or hold their market positions in an evolving industry. Such consolidations may make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, channel coverage, technology or product functionality. We also expect that the trend among large OEMs to seek to develop their own semiconductor solutions will continue and expand. As we move into new markets, we may face competition from larger competitors with longer histories in these markets. Certain of our customers and suppliers also have divisions that produce products competitive with ours, and other customers may seek to vertically integrate competitive solutions in the future.

Intellectual Property and Licenses

We have been granted 199 U.S. patents and 239 foreign patents and have numerous patent applications pending with respect to our products and to technologies associated with our business. The expiration dates of issued patents range from 2022 to 2040. Although we consider patents to be helpful in maintaining a competitive advantage, we do not believe they create definitive competitive barriers to entry. There can be no assurance that our patent applications will lead to issued patents, that others will not develop or patent similar or superior products or technologies, or that our patents will not be challenged, invalidated, or circumvented by others. While our various intellectual property ("IP") rights are important to our success, we do not believe any individual patent, group of patents, or the expiration thereof would materially affect our business operations.

We have registered many of our trademarks in the U.S. and in various foreign jurisdictions. Registration generally provides rights in addition to basic trademark protections and is typically renewable upon proof of continued use. We have registered, or are in the process of registering, our SEMTECH trademark in many jurisdictions. In one location use of this trademark is prohibited, but we are permitted to use our Semtech International trade name. This restriction has not had a material impact on our business to date and we do not anticipate it will have a material impact in the future.

We also have registered certain materials in which we have copyright ownership, which provides additional protection for this intellectual property.

Intellectual Capital and Product Development

The development of IP and the resulting proprietary products is a critical success factor for us. Recruiting and retaining key technical talent is the foundation for designing, developing, and marketing our IP in the form of new proprietary products in the global marketplace. Our ability to recruit and retain our engineering talent is one of the keys to maintaining our competitive advantage. Historically, we have been successful in retaining our key engineering staff and recruiting new talent. One of our strategies to recruit talent is the establishment of multiple design center locations. As a result, we have design centers throughout the world.

Circuit design engineers, layout engineers, product and test engineers, application engineers, and field application engineers are our most valuable employees. Together they perform the critical tasks of design and layout of ICs, turning these circuits into silicon devices, and conferring with customers about designing these devices into their applications. The majority of our engineers fit into one of these categories. Most of these engineers have many years of experience in the design, development, and layout of circuits targeted for use in protection, advanced communications and power management, multimedia and data communications, and wireless and sensing applications. We also employ a number of software engineers and systems engineers that specialize in the development of software and systems architecture, who enable us to develop systems oriented products in select markets.

10

We occasionally enter into agreements with customers that allow us to recover certain costs associated with product design and engineering services. Recovery for these services could potentially lag behind the period in which we recognize the related expense, causing a difference in recognition timing that could potentially create volatility in our reported product development and engineering expenses.

Human Capital

As of January 30, 2022, our year-over-year headcount increased from 1,394 to 1,439 full-time employees worldwide, of whom 1,043 employees were based outside of the U.S. There were 577 employees in research and development, 291 employees in sales, marketing and field services, and 190 employees in general and administrative functions. The remaining employees support operational activities, including product and test engineering, assembly, manufacturing, distribution and quality functions. Our focus on innovation gives us a unique appreciation to the importance of recruitment, retention and the professional development of our employees. In fiscal year 2022, we enhanced our talent acquisition processes and capabilities, recruiting additional talent acquisition specialists to focus on the increasingly complex talent market and building our pipeline for an even more diverse and inclusive workforce. The health and wellbeing of our employees and their families remains our highest priority, and supporting and improving the local communities in which our employees are located is an important part of our culture. We continue to benchmark and enhance our total compensation and benefits packages across the 19 countries in which we are located.

Talent

Our talent strategy involves our efforts to achieve an optimal balance of internal development, supplemented by external hires. This approach contributes to and enhances our employee loyalty and commitment. As of the end of fiscal year 2022, our average employee tenure is 8.6 years, reflecting the strong engagement of our employees. As new employees continue to join Semtech, we expect their contributions to bring fresh ideas to help drive innovation and continuous improvement.

Our recruiting efforts leverage both internal and external resources to recruit and attract highly skilled and talented workers across the globe, and we encourage our employees to provide referrals for open positions. We enhanced our performance management framework, strengthening our goal setting and calibration processes. This framework ensures that feedback provided in these performance discussions supports leadership growth and long-term development. Our development programs include a library suite of professional third party trainings spanning more than 16,000 courses. In addition, Semtech offers a comprehensive annual and new hire compliance training that focuses on diversity, anti-harassment and code of conduct, among others.

Compensation

Our pay-for-performance philosophy incentivizes individual and team performance that directly contributes to the achievement of company objectives. We provide compensation packages that include a competitive base salary, annual incentive bonuses, and long-term equity awards, as appropriate. Our compensation program is designed to attract, reward and retain those highly-talented individuals who possess the critical skills necessary to support our business objectives, contribute to the achievement of our annual strategic goals and create long-term value for our stockholders. We believe that a compensation program that rewards employees both for short-term and long-term performance aligns employees' and our stockholders' interests.

Health and Wellbeing

We provide access to a variety of flexible and convenient health and welfare programs, including benefits that support their physical and mental health through tools and resources to help them maintain and improve their health status. We believe our offerings provide flexible choices to meet the diverse needs of our employees and their families globally. Each year, we review our benefits programs to ensure they are appropriately resourced and deliver value. In fiscal year 2022, we introduced a new financial wellbeing program for our U.S. based employees and in fiscal year 2023 we will seek to expand this and other elements globally.

In light of the protracted timeframes related to the COVID-19 pandemic, we continued to operate our business, while ensuring the safety of our employees and compliance with local or regional governmental regulations, which included having the vast majority of our employees work from home, as well as providing additional safety measures for employees continuing critical, on-site work.

Diversity and Inclusion

We are committed in our efforts to increase diversity and foster an inclusive work environment that supports our global workforce and helps us provide innovative solutions for our customers. In fiscal year 2022, we launched the Semtech Women's Leadership Council that elevates and empowers our female employees through collaboration, education, inspiration and peer support. We continue our focus on improving our hiring, development, advancement and retention of diverse talent and our overall diversity representation.

We continuously promote inclusion through our stated core values and principles. We provide training to all employees to

11

improve their understanding of behaviors that can be perceived as discriminatory, exclusionary, and/or harassing. Employees are encouraged to report such behaviors to management or via an anonymous hotline.

Community Involvement

As good corporate citizens, we aim to contribute to the communities where we live and work, and believe that this commitment helps in our efforts to attract and retain employees. We offer our employees the opportunity to give back to their local communities, contribute to charities and participate in corporate-sponsored initiatives.

Government Regulations

We are required to comply, and it is our policy to comply, with numerous government regulations that are normal and customary to businesses in our industry and that operate in our markets and operating locations.

Our sales that serve the military and aerospace markets primarily consist of high-reliability products that are offered within our Wireless and Sensing product line that have been qualified to be sold in these markets by the U.S. Department of Defense ("DOD"). In order to maintain these qualifications, we must comply with certain specifications promulgated by the DOD. As part of maintaining these qualifications, we are routinely audited by the DOD. Based on current specifications, we believe we can maintain our qualifications for the foreseeable future. However, these specifications could be modified by the DOD in the future or we could become subject to other government requirements, which could make the manufacturing of these products more difficult and thus could adversely impact our profitability in the Wireless and Sensing operating segment. In fiscal year 2022, our sales that serve military and aerospace markets comprised approximately 2% of our sales. A small number of special assemblies from the Wireless and Sensing product line are subject to the International Traffic in Arms Regulations ("ITAR"). We have a Technical Assistance Agreement in place that permits us to assemble certain of these products in Mexico. International shipments of products subject to ITAR require a State Department license.

As a global company, we are required to comply with various governmental trade law and export restrictions imposed by the U.S. and certain foreign jurisdictions. For example, the U.S. Department of Commerce has placed Huawei Technologies Co., Ltd. ("Huawei") and certain of its affiliates on the "Entity List" for actions contrary to the national security and foreign policy interests of the U.S. On August 17, 2020, the Department of Commerce issued a final rule that amended the Export Administration Regulations ("EAR") to expand the controls on foreign-produced direct products based on certain U.S. software and technology and sold to or for Huawei, which has further impacted our ability to ship to Huawei, as well as to certain other customers who we believe incorporate our products into their products sold to Huawei. To mitigate the adverse impact of these restrictions, we have filed for several export licenses, some of which have already been granted. Sales of our products to Huawei accounted for less than 10% of our net sales during fiscal years 2022, 2021 and 2020.

For discussion related to environmental matters, see Note 13 to the Consolidated Financial Statements.

Available Information

General information about us can be found on our website at www.semtech.com. The information on our website is for informational purposes only and should not be relied on for investment purposes. The information on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the SEC.

We make available free of charge, either by direct access on our website or a link to the SEC website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Our reports filed with, or furnished to, the SEC are also available directly at the SEC’s website at www.sec.gov.

12

Item 1A. Risk Factors

You should carefully consider and evaluate all of the information in this Annual Report on Form 10-K, including the risk factors listed below. If any of these risks actually occur, our business could be materially harmed. If our business is harmed, the trading price of our common stock could decline. See also “Special Note Regarding Forward Looking and Cautionary Statements” at the beginning of this Annual Report on Form 10-K.

Risks Relating to Macroeconomic and Industry Conditions

The COVID-19 pandemic has adversely affected and may in the future adversely affect, our operations, and those of our customers, distributors, suppliers, third-party foundries and subcontractors thereby adversely affecting our business, financial condition and results of operations.

The COVID-19 pandemic negatively impacted our financial results by decreasing sales, driven by supply chain interruptions, which primarily impacted the first half of fiscal year 2021. For example, in the first quarter of fiscal year 2021, some shipments of our products were delayed due to COVID-19 related shutdowns of our plant in Reynosa, Mexico, as well as some subcontractors in Malaysia. In addition, some of our suppliers have experienced temporary reductions or closures, which resulted in limited disruptions in our ability and the ability of our subcontractors to receive certain raw materials, including silicon wafers, which are essential to the manufacturing of our products. In some cases, the disruption resulted, and may in the future result, in reduced production of our products and delays for delivery of our products to our customers. We believe the general supply chain constraints in the industry may be motivating certain customers to increase their inventory to protect against the supply risk. To the extent that this is occurring, we could experience a decrease in future demand as potential excess inventory in the supply chain is worked down.

While we cannot predict the ultimate impact of the COVID-19 virus on our business at this time, the pandemic and related efforts to mitigate the pandemic have impacted and could in the future impact our business in a number of ways, including but not limited to the following: decreasing demand and pricing for our products as a result of any negative economic impact of the pandemic; disrupting our manufacturing processes, as has already occurred with the temporary reductions or closures of our facilities, third-party foundries and contractors, and the delay of supplies being received; disrupting freight infrastructure, thereby delaying shipments from vendors to assembly and test sites and shipments of our final product to customers; disrupting the manufacturing process of our customers that use our components in their products, thereby impacting demand for our products; adversely impacting the business of our suppliers, which have resulted in, among other things, price increases and delays for delivery of raw materials and components needed for the production of our products; impacting our ability to maintain our workforce during this uncertain time; increasing employee absenteeism due to infection or the fear of infection; possible lawsuits or additional regulatory actions due to the spread of COVID-19 in the workplace and potential increases in costs to implement health safety measures; suffering from reputational risk if we experience a COVID-19 outbreak in our workplace; and adversely impacting the productivity of management and our employees that are working remotely. Additionally, there is an increased risk that we may experience cybersecurity-related events such as COVID-19 themed phishing attacks and other security challenges as a result of most of our employees and our service providers working remotely from non-corporate managed networks during the ongoing COVID-19 pandemic and potentially continuing working remotely even after the COVID-19 pandemic has subsided.

Further, any COVID-19 vaccine or testing mandate imposed on our employees, whether due to regulations enacted by the U.S. Department of Labor’s Occupational Safety and Health Administration or otherwise, could result in increased costs, labor disruptions or employee attrition. If we lose employees, it may be difficult in the current competitive labor market to find replacement employees, which could have an adverse effect on future revenues and costs.

In addition, the pandemic has impacted the operations of our distributors and direct customers. Because a significant majority of our net sales is through authorized distributors, the financial health of our distributors is critical to our success. Some of our distributors are small organizations with limited working capital. Our distributors have experienced, and may continue to experience from time to time, disruptions to their operations due to the pandemic, including temporary reductions or closures during which they have diminished ability or are unable to sell our products. If our distributors suffer material economic harm during the pandemic, the distributors may no longer be able to continue in business or may continue in a reduced capacity. Our direct customers have also experienced, and may continue to or again experience, reductions or closures of their manufacturing facilities or an inability to obtain other components, either of which could negatively impact demand for our products that are incorporated into our customers' devices and solutions.

The ultimate magnitude of the COVID-19 pandemic, including the extent of its impact on our financial condition and results of operations, which could be material, will depend on all of the factors noted above, including other factors that we may not be able to foresee at this time.

13

Our future results may fluctuate, fail to match past performance or fail to meet expectations as a result of conditions beyond our control, such as general economic conditions in the markets we compete, cyclical and other conditions unique to our industry and the financial health and viability of our suppliers and customers.

Our results may fluctuate in the future, may fail to match our past performance or fail to meet our expectations and the expectations of analysts and investors as a result of conditions beyond our control. Our results and related ratios, such as gross margin, operating income percentage and effective tax rate may fluctuate for a variety of reasons beyond our control, including: general economic conditions in the countries where we sell our products, including recessions or inflationary pressures; geopolitical turmoil, such as the conflict between Russia and Ukraine and any sanctions, export controls or other retaliatory actions against, or restrictions on doing business with Russia, as well as any resulting disruption, instability or volatility in the global markets and industries resulting from such conflict; the availability of adequate supply commitments from our outside suppliers; the timing of new product introductions by us, our customers and our competitors; seasonality and variability in the computer market and our other end markets; product obsolescence; the scheduling, rescheduling or cancellation of orders by our customers; the cyclical nature of demand for our customers’ products; our ability to predict and meet evolving industry standards and consumer preferences; our ability to develop new process technologies and achieve volume production; changes in manufacturing yields; capacity utilization; product mix and pricing; movements in exchange rates, interest rates or tax rates; our ability to integrate and realize synergies from acquisitions; the manufacturing and delivery capabilities of our subcontractors and litigation and regulatory matters.

Uncertainty about global economic conditions can pose a risk to the overall economy by causing fluctuations to and reductions in consumer and commercial spending. Demand for our products could be different from our expectations due to many factors including: changes in business and economic conditions; conditions in the credit market that affect consumer confidence; customer acceptance of our products; changes in customer order patterns; including order cancellations; and changes in the level of inventory held by vendors.

The semiconductor industry is also highly cyclical and has experienced significant downturns, which are characterized by reduced product demand, production overcapacity, increased levels of inventory, industry-wide fluctuations in the demand for semiconductors and the significant erosion of average selling prices. The cyclical nature of the semiconductor industry may cause us to experience substantial period-to-period fluctuations in our operating results.

The average selling prices of products in our markets have historically decreased rapidly and will likely do so in the future, which could harm our revenue and gross margins.

As is typical in the semiconductor industry, the average selling price of a particular product has historically declined significantly over the life of the product. In the past, we have reduced the average selling prices of our products in anticipation of future competitive pricing pressures, new product introductions by us or our competitors and other factors. We expect that we will have to similarly reduce prices in the future for older generations of products. Reductions in our average selling prices to one customer could also impact our average selling prices to all customers. A decline in average selling prices would harm our gross margins for a particular product. If not offset by sales of other products with higher gross margins, our overall gross margins may be adversely affected. Our business, results of operations, financial condition and prospects will suffer if we are unable to offset any reductions in our average selling prices by increasing our sales volumes, reducing our costs and/or developing new or enhanced products with higher selling prices or gross margins on a timely basis.

Risks Relating to Production Operations

We rely on a limited number of suppliers and subcontractors, many of which are foreign-based entities, for many essential components and materials and certain critical manufacturing services and any interruption or loss of supplies or services from these entities could significantly interrupt our business operations and the production of our products.

Our reliance on a limited number of subcontractors and suppliers for wafers, packaging, testing and certain other processes involves several risks, including potential inability to obtain an adequate supply of required components and reduced control over the price, timely delivery, reliability and quality of components. These risks are attributable to several factors, including limitations on resources, labor problems, equipment failures or the occurrence of natural disasters. The good working relationships we have established with our suppliers and subcontractors could be disrupted, and our supply chain could suffer, if a supplier or subcontractor were to experience a change in control. There can be no assurance that problems will not occur in the future with suppliers or subcontractors. Disruption or termination of our supply sources or subcontractors could significantly delay our shipments to customers, which could damage relationships with current and prospective customers and harm our business. Any prolonged inability to obtain timely deliveries or quality manufacturing or any other circumstances that would require us to seek alternative sources of supply or to manufacture or package certain components internally could limit our growth and harm our business.

Many of our third-party subcontractors and suppliers, including third-party foundries that supply silicon wafers, are located in foreign countries or territories including Taiwan and China. While our utilization of multiple third-party foundries does create

14

some redundancy of fabrication processes, any interruption of supply by one or more of these foundries could materially impact us.

A majority of our package and test operations are performed by third-party contractors based in the U.S., Taiwan and China. Our international business activities, in general, are subject to a variety of potential risks resulting from political and economic uncertainties. Any political turmoil or trade restrictions in these countries, particularly China, could limit our ability to obtain goods and services from these suppliers and subcontractors. The effect of an economic crisis or political turmoil impacting our suppliers located in these countries may impact our ability to meet the demands of our customers. For example, the COVID-19 pandemic resulted in extended shutdowns of certain of our businesses. This public health crisis or any further political developments or health concerns in markets in which our third-party contractors and suppliers are based could result in social, economic and labor instability, adversely affecting the supply of our products and, in turn, our business, financial condition and results of operations. If we find it necessary to transition the goods and services received from our existing suppliers or subcontractors to other firms, we would likely experience an increase in production costs and a delay in production associated with such a transition, both of which could have a significant negative effect on our operating results, as these risks are substantially uninsured.

Our ability to increase product sales and revenue may be constrained by the manufacturing capacity of our suppliers.

Although we provide our suppliers with rolling forecasts of our production requirements, their ability to provide wafers to us is limited by their available capacity. For example, we believe the strong increase in industry-wide demand for electronic equipment for remote work arrangements as a result of the COVID-19 pandemic has resulted, and will continue to result, in capacity shortages of our suppliers. This lack of capacity has at times constrained our product sales and revenue growth and may do so again in the future. In addition, an increased need for capacity to meet internal demands or demands of other customers could cause our suppliers to reduce capacity available to us. Our suppliers may also require us to pay amounts in excess of contracted or anticipated amounts for wafer deliveries or require us to make other concessions in order to acquire the wafer supply necessary to meet our customer requirements. If our suppliers extend lead times, limit supplies or the manufacturing capacity we require, or increase prices due to capacity constraints or other factors, we may, in turn, have to increase the prices of our products in order to remain profitable, and our customers may reduce their purchase levels with us and/or seek alternative solutions to meet their demand. If any of the foregoing occurs, our revenue and gross margin may materially decline, which could materially and adversely impact our business and results of operations. Delays in increasing third-party manufacturing capacity may also limit our ability to meet customer demand.

Our products may be found to be defective, product liability claims may be asserted against us and we may not have sufficient liability insurance.

Manufacturing semiconductors is a highly complex and precise process, requiring production in a tightly controlled, clean environment. Minute impurities in our manufacturing materials, contaminants in the manufacturing environment, manufacturing equipment failures, and other defects can cause our products to be non-compliant with customer requirements or otherwise nonfunctional. We face an inherent business risk of exposure to warranty and product liability claims in the event that our products fail to perform as expected or such failure of our products results, or is alleged to result, in bodily injury or property damage (or both). Since a defect or failure in our product could give rise to failures in the goods that incorporate them (and consequential claims for damages against our customers from their customers), we may face claims for damages that are disproportionate to the revenues and profits we receive from the products involved.

Our general warranty policy provides for repair or replacement of defective parts. In some cases, a refund of the purchase price is offered. In certain instances, we have agreed to other warranty terms, including some indemnification provisions, which could prove to be significantly more costly than repair, replacement or refund. We attempt to limit our liability through our standard terms and conditions and negotiation of sale and other customer contracts, but there is no assurance that such limitations will be accepted or effective. While we maintain some insurance for such events, a successful warranty or product liability claim against us in excess of our available insurance coverage, if any, and established reserves, or a requirement that we participate in a product recall, would have adverse effects (that could be material) on our business, operating results and financial condition. Additionally, in the event that our products fail to perform as expected, our reputation may be damaged, which could make it more difficult for us to sell our products to existing and prospective customers and could adversely affect our business, operating results and financial condition.

Obsolete inventories as a result of changes in demand for our products and changes in the life cycles of our products could adversely affect our business, operating results and financial condition.

The life cycles of some of our products depend heavily upon the life cycles of the end-products into which our products are designed. End-market products with short life cycles require us to manage closely our production and inventory levels. Inventory may also become obsolete because of adverse changes in end-market demand. We may in the future be adversely affected by obsolete or excess inventories, which may result from unanticipated changes in the estimated total demand for our products or the estimated life cycles of the end-products into which our products are designed. In addition, some customers

15

restrict how far back the date of manufacture for our products can be, which can render our products obsolete. In addition, certain customers may stop ordering products from us and go out of business due to adverse economic conditions or otherwise, thereby causing some of our product inventory to become obsolete. As a result, our inventory may become obsolete for reasons beyond our control, which may adversely affect our business, operating results and financial condition.

Business interruptions, such as natural disasters, acts of violence and the outbreak of contagious diseases, could harm our business and have a material adverse effect on our operations.

Earthquakes and other natural disasters, terrorist attacks, armed conflicts, wars and other acts of violence, and other national or international crisis, calamity or emergency, including the outbreak of pandemic or contagious disease, such as COVID-19, may result in interruption to the business activities of us, our suppliers and our customers and overall disruption of the economy at many levels. These events may directly impact our physical facilities or those of our customers and suppliers. Additionally, these events, which are generally unforeseeable and difficult to predict, may cause some of our customers or potential customers to reduce their level of expenditures on certain services and products, which could ultimately reduce our revenue.

Our corporate headquarters, a portion of our assembly and research and development activities, and certain other critical business operations are located near major earthquake fault lines. We do not maintain earthquake insurance and our business could be harmed in the event of a major earthquake. We generally do not maintain flood coverage, including for our Asian locations where certain of our operations support and sales offices are located. Such flood coverage has become very expensive; as a result we have elected not to purchase this coverage. If one of these locations were to experience a major flood, our business may be harmed.

We operate a manufacturing facility in Reynosa, Mexico. Historically, certain regions in Mexico have experienced high levels of violence. Any significant disruption of our operations at this facility could materially affect our ability to generate revenues for certain products within our Wireless and Sensing operating segment. Some of the products that we produce at this facility require certification by the Defense Contract Audit Agency ("DCAA"). Failure to secure or maintain the required certification, either directly through the DCAA or through a qualifying third party would materially affect our authorization to manufacture applicable products at this facility, and our revenue for certain products within our Wireless and Sensing products line could materially decline.

Our business could also be harmed if natural disasters, acts of violence, national or international crises or other calamities or emergencies interrupt the production of wafers by our suppliers, the assembly and testing of products by our subcontractors, or the operations of our distributors and direct customers. We rely on third-party freight firms for nearly all of our shipments from vendors to assembly and test sites, primarily in Asia, and for shipments of our final product to customers. This includes ground and air transportation. Any significant disruption of such freight business globally or in certain parts of the world, particularly where our operations are concentrated, whether due to COVID-19 or otherwise, could materially and adversely affect our ability to generate revenues.

The ultimate impact of business interruption events, both in terms of direct impact on us and our supply chain, as well as on our end customers (to include their own supply chain issues as well as end-market issues), may not be known for a considerable period of time following the event. We maintain some business interruption insurance to help reduce the effect of business interruptions, but we are not fully insured against such risks. Also as a result of these events, insurance premiums for businesses may increase and the scope of coverage may be decreased. Consequently, we may not be able to obtain adequate insurance coverage for our business and properties. Further, any loss of revenue due to a slowdown or cessation of end customer demand is uninsured. Accordingly, any of these disruptions could significantly harm our business.

Risks Relating to Research and Development, Engineering, Intellectual Property and New Technologies

We may be unsuccessful in developing and selling new products, which is central to our objective of maintaining and expanding our business.

We operate in a dynamic environment characterized by price erosion, rapid technological change, and design and other technological obsolescence. Our competitiveness and future success depend on our ability to predict and adapt to these changes in a timely and cost-effective manner by designing, developing, manufacturing, marketing and providing support for our own new products and technologies. A failure to achieve design wins, to introduce these new products in a timely manner, or to achieve market acceptance for these products on commercially reasonable terms could harm our business.

The introduction of new products presents significant business challenges because product development commitments and expenditures must be made well in advance of product sales. The success of a new product depends on accurate forecasts of long-term market demand and future technological developments, as well as on a variety of specific implementation factors, including: timely and efficient completion of technology, product and process design and development; timely and efficient implementation of manufacturing, assembly, and test processes; the ability to secure and effectively utilize fabrication capacity in different geometries; product performance; product quality and reliability; and effective marketing, sales and service.

16

The efforts to achieve design wins typically are lengthy and can require us to both incur design and development costs and dedicate scarce engineering resources in pursuit of a single customer opportunity. We may not prevail in the competitive selection process. If a customer initially chooses a competitor's product during the selection process, it becomes significantly more difficult for us to sell our products for use in that customer's system because changing suppliers can involve significant cost, time, effort and risk for our customers. Thus, our failure to win a competitive bid can result in our foregoing revenues from a given customer's product line for the life of that product. Even if we are able to develop products and achieve design wins, the design wins may never generate revenues if end-customer projects are unsuccessful in the marketplace or the end-customer terminates the project, which may occur for a variety of reasons. In addition, mergers and consolidations among customers may lead to termination of certain projects before the associated design win generates revenue. If design wins do generate revenue, the time lag between the design win and meaningful revenue can be uncertain and could be significant. If we fail to develop products with required features or performance standards or experience even a short delay in bringing a new product to market, or if our customers fail to achieve market acceptance of their products, our business, financial condition and operating results could be materially and adversely impacted.

Our customers require our products to undergo a lengthy and expensive qualification process without any assurance of product sales.

Prior to purchasing our products, many of our customers require that our products undergo an extensive qualification process, which involves testing of the products in the customer's system as well as rigorous reliability testing. This qualification process may continue for six months or longer. However, qualification of a product by a customer does not ensure any sales of the product to that customer. Even after successful qualification and sales of a product to a customer, a subsequent revision to the product or software, changes in the manufacturing process or the selection of a new supplier by us may require a new qualification process, which may result in delays and in us holding excess or obsolete inventory. After our products are qualified, it can take an additional six months or more before the customer commences volume production of components or devices that incorporate our products. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, toward qualifying our products with customers in anticipation of sales. If we are unsuccessful or delayed in qualifying any of our products with a customer, such failure or delay would preclude or delay sales of such product to the customer, which may impede our growth and cause our business to suffer.

Our products may fail to meet new industry standards or requirements and the efforts to meet such industry standards or requirements could be costly.

Many of our products are based on industry standards that are continually evolving. Our ability to compete in the future will depend in part on our ability to anticipate, identify and ensure compatibility or compliance with these evolving industry standards. The emergence of new industry standards could render our products incompatible with products developed by our customers and potential customers. As a result, we could be required to invest significant time and effort and to incur significant expense to redesign our products to ensure compliance with relevant standards. If our products are not in compliance with prevailing industry standards or requirements, we could miss opportunities to achieve crucial design wins which in turn could have a material adverse effect on our business, operating results and financial conditions.

Unfavorable or uncertain conditions in the 5G infrastructure market may cause fluctuations in our rate of revenue growth or financial results.