UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

Sterling Capital Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

James T. Gillespie, President

Sterling Capital Funds

434 Fayetteville Street, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)-228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

STERLING

CAPITAL FUNDS

ANNUAL REPORT

SEPTEMBER 30, 2013

May lose value Not FDIC insured Not insured by any government agency Not guaranteed by the bank Not a deposit

Notice of Privacy Policy & Practices

Sterling Capital Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the Sterling Capital Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| • | Account Applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| • | Account History, including information about the transactions and balances in a customer’s accounts; and |

| • | Correspondence, written, telephonic or electronic between a customer and the Sterling Capital Funds or service providers to the Sterling Capital Funds. |

Disclosure of Customer Information

We may disclose all of the consumer information outlined above to third parties who are not affiliated with the Sterling Capital Funds:

| • | as permitted by law — for example with service providers who maintain or service shareholder accounts for the Sterling Capital Funds or to a shareholder’s broker or agent; and |

| • | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institution. |

Security of Customer Information

We require service providers to the Sterling Capital Funds:

| • | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the Sterling Capital Funds; and |

| • | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the Sterling Capital Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the Sterling Capital Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the Sterling Capital Funds and individuals who provide nonpublic personal information to the Sterling Capital Funds, but do not invest in Sterling Capital Funds shares.

|

Sterling Capital Funds

|

| Management Discussion of Performance |

||||

| 1 | ||||

| Fund Summary |

||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 40 | ||||

| 42 | ||||

| Schedules of Portfolio Investments |

||||

| 46 | ||||

| 48 | ||||

| 49 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 59 | ||||

| 63 | ||||

| 64 | ||||

| 70 | ||||

| 73 | ||||

| 76 | ||||

| 78 | ||||

| 80 | ||||

| 84 | ||||

| 87 | ||||

| 90 | ||||

| 93 | ||||

| 94 | ||||

| 95 | ||||

| 96 | ||||

| 152 | ||||

| 167 | ||||

| 169 | ||||

| 170 | ||||

(This page has been left blank intentionally.)

Letter from the President and the Investment Advisor

| Past performance does not guarantee future results. Mutual fund investing involves risk including the possible loss of principal.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) and is paid a fee for its services. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, LLC. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice. |

|

|

1 |

|

Sterling Capital Large Cap Value Diversified Fund

Portfolio Managers

Sterling Capital Large Cap Value Diversified Fund (formerly known as Sterling Capital Select Equity Fund) (the “Fund”) is managed by Robert W. Bridges and Robert O.Weller, Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

Robert W. Bridges, CFA

Mr. Bridges joined Sterling Capital in 1996. He has investment experience since 1991. He is a graduate of Wake Forest University where he received his BS in Business.

Robert O. Weller, CFA

Mr. Weller joined Sterling Capital in 2012. He has investment experience since 1996. He is a graduate of Loyola University Maryland where he received his BBA in Finance.

Investment Concerns

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. Equity securities (stocks) are more volatile and carry more risk. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. The Fund may invest in foreign securities which involve certain risks such as currency volatility and political, social and economic instability. There is no guarantee that the strategy used by the portfolio manager will produce the desired results.

|

Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

2 |

|

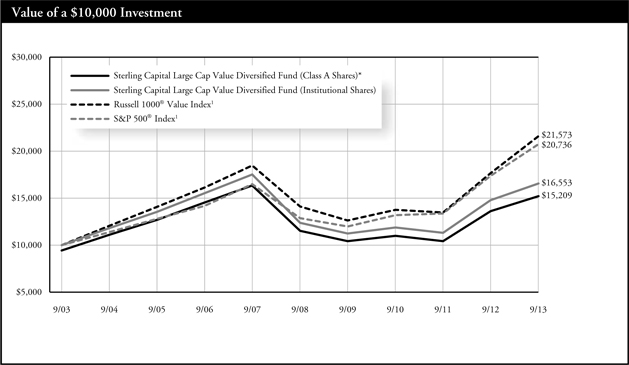

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | As of September 3, 2013, the primary benchmark for the Fund changed from the S&P 500® Index to the Russell 1000® Value Index (the “New Benchmark”), as the New Benchmark was determined to be a more appropriate broad-based index for comparison purposes. The S&P 500® Index will not be shown in the future. |

S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The New Benchmark is a widely recognized index of common stocks that measures the performance of large- and mid-capitalization value sectors of the U.S. equity market. The indexes are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

|

|

3 |

|

Sterling Capital Mid Value Fund

Portfolio Manager

Timothy P. Beyer, CFA

Sterling Capital Mid Value Fund is managed by Timothy P. Beyer, CFA, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Timothy joined Sterling Capital in 2004. He has investment experience since 1989. Timothy is a graduate of East Carolina University where he received his BSBA in Finance.

The Investment Team supporting the Fund has more than 104 combined years of investment experience and includes:

| • | Eduardo A. Brea, CFA, Managing Director |

| • | Robert W. Bridges, CFA, Director |

| • | Lee D. Houser, CFA, Director |

| • | Patrick W. Rau, CFA, Executive Director |

Investment Concerns

The Fund may invest in undervalued securities that may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability.

|

Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

4 |

|

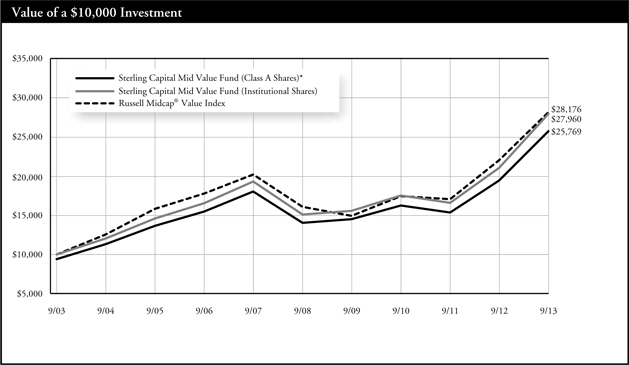

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of the Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index which measures the performance of those securities in the Russell 1000® Index with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

5 |

|

Sterling Capital Small Cap Value Diversified Fund

Portfolio Managers

Sterling Capital Small Cap Value Diversified Fund (formerly known as Sterling Capital Small Value Fund) (the “Fund”) is managed by Robert W. Bridges and Robert O.Weller, Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

Robert W. Bridges, CFA

Mr. Bridges joined Sterling Capital in 1996. He has investment experience since 1991. He is a graduate of Wake Forest University where he received his BS in Business.

Robert O. Weller, CFA

Mr. Weller joined Sterling Capital in 2012. He has investment experience since 1996. He is a graduate of Loyola University Maryland where he received his BBA in Finance.

The Investment Team supporting the Fund has 45 combined years of investment experience and includes:

| • | Rose L. Alexander, Director |

| • | Kenneth L. Willson, Director |

Investment Concerns

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability. There is no guarantee that the strategy used by the portfolio manager will produce the desired results.

|

Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

6 |

|

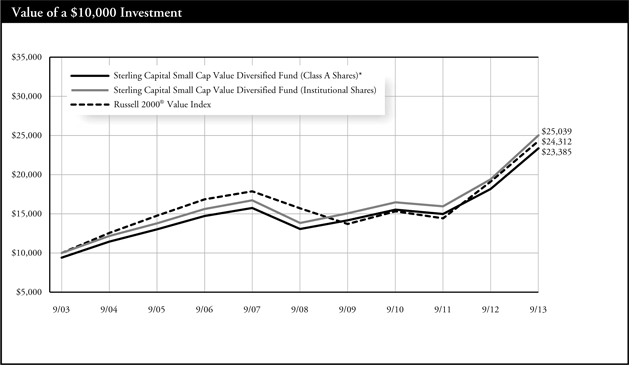

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A, B, C and R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares and have been adjusted for maximum CDSC to the applicable class but does not include 12b-1 fees, which if reflected, would have caused performance of Class A, B C and R Shares to be lower. The performance information for Institutional Shares (formerly known as Sterling Shares) prior to 12/18/06 is based on the performance of the Institutional Shares of the Fund’s Predecessor, Sterling Capital Small Cap Value Fund, a series of The Advisors’ Inner Circle Fund (the “Predecessor Fund”), which transferred all of its assets and liabilities to the Fund pursuant to a reorganization. The performance of the Fund’s Institutional Shares would have been different because the Fund’s Institutional Shares have different expenses than the Predecessor’s Institutional Shares. |

The Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of small- to mid-sized companies. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

7 |

|

Sterling Capital Special Opportunities Fund

Portfolio Manager

George F. Shipp, CFA

Sterling Capital Special Opportunities Fund (the “Fund”) is managed by George F. Shipp, CFA, Director and portfolio manager for Sterling Capital Management LLC. George has been the Fund’s manager since 2003 and also manages the Sterling Capital Equity Income Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business.

The Investment Team supporting the Fund has more than 132 combined years of investment experience and includes:

| • | Adam B. Bergman, CFA |

| • | Joshua L. Haggerty, CFA |

| • | R. Griffith Jones, Jr. |

| • | Farley C. Shiner, CFA |

| • | Colin R. Ducharme, CFA |

| • | Guy W. Ford, CFA |

| • | Michael S. Peasley, CFA |

Investment Concerns

The Fund is subject to investment style risk which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

|

Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

8 |

|

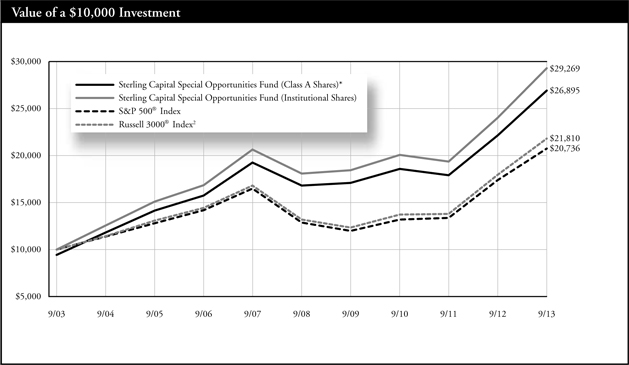

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

| 2 | The Fund now includes the Russell 3000® Index to show how the Fund’s performance compares with the overall performance of the large-cap value segment of the U.S. equity universe. |

The Fund is measured against the S&P 500® Index and the Russell 3000® Index, unmanaged indexes that are generally considered to be representative of the performance of the stock market as a whole. The indexes do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

9 |

|

Sterling Capital Equity Income Fund

Portfolio Manager

George F. Shipp, CFA

Sterling Capital Equity Income Fund (the “Fund”) is managed by George F. Shipp, CFA, Director and portfolio manager for Sterling Capital Management LLC, advisor to the Fund. George has been the Fund’s manager since 2004 and also manages the Sterling Capital Special Opportunities Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business.

The Investment Team supporting the Fund has more than 132 combined years of investment experience and includes:

| • | Adam B. Bergman, CFA |

| • | Joshua L. Haggerty, CFA |

| • | R. Griffith Jones, Jr. |

| • | Farley C. Shiner, CFA |

| • | Colin R. Ducharme, CFA |

| • | Guy W. Ford, CFA |

| • | Michael S. Peasley, CFA |

Investment Concerns

The Fund invests primarily in dividend-paying securities. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

|

Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

10 |

|

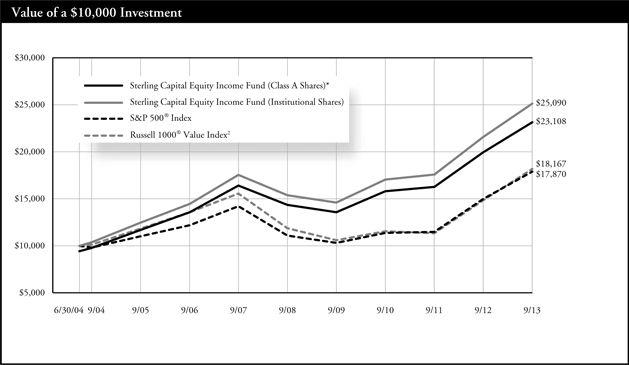

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

| 2 | The Fund now includes the Russell 1000® Value Index to show how the Fund’s performance compares with the overall performance of the large-cap value segment of the U.S. equity universe. |

The Fund is measured against the S&P 500® Index and the Russell 1000® Value Index, unmanaged indexes that are generally considered to be representative of the performance of the stock market as a whole. The indexes do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

11 |

|

Sterling Capital Ultra Short Bond Fund

Portfolio Managers

Sterling Capital Ultra Short Bond Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997 and has co-managed the Fund since 2012. He is head of Sterling’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Richard joined Sterling Capital in 2007 and has co-managed the Fund since 2012. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and a MS in Finance from Drexel University.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

12 |

|

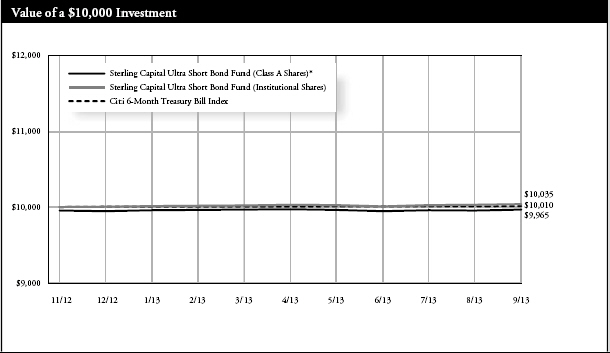

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Citi 6-Month Treasury Bill Index, which measures the performance of Treasury bills with a maturity of six months or less. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

13 |

|

Sterling Capital Short-Term Bond Fund

Portfolio Managers

Sterling Capital Short-Term Bond Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997. He has co-managed the Fund since 2008. He is head of Sterling’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Richard joined Sterling Capital in 2007. He has co-managed the Fund since 2011. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and an MS in Finance from Drexel University.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

14 |

|

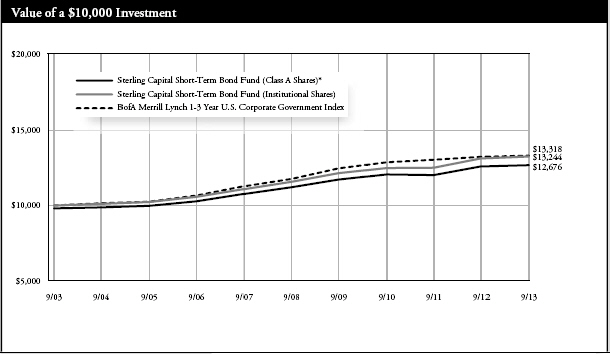

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance could differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 1-3 Year U.S. Corporate Government Index, which consists of securities with a maturity from one to three years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. Fund performance for certain time periods would have been lower without fee waivers in effect.

|

|

15 |

|

Sterling Capital Intermediate U.S. Government Fund

Portfolio Manager

Brad D. Eppard, CFA

Sterling Capital Intermediate U.S. Government Fund (the “Fund”) is managed by Brad D. Eppard, CFA, Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Brad joined Sterling Capital in 2003. He has investment experience since 1985. He has been the portfolio manager for the Fund since 2003. Brad is a graduate of Radford University where he received his BS in Business Administration/Accounting. He is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund may invest in mortgage-backed securities which tend to be more sensitive to changes in interest rates. The Fund invests in securities issued or guaranteed by the U.S. government or its agencies (such as Fannie Mae or Freddie Mac). Although U.S. government securities issued directly by the U.S. government are guaranteed by the U.S. Treasury, other U.S. government securities issued by an agency or instrumentality of the U.S. government may not be. No assurance can be given that the U.S. government would provide financial support to its agencies and instrumentalities if not required to do so by law.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

16 |

|

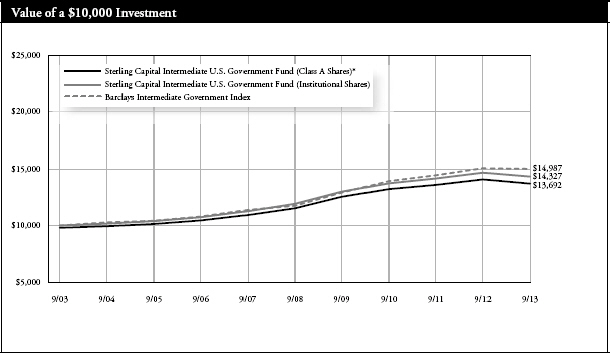

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Barclays Intermediate Government Index, an unmanaged index comprised of all publicly issued non-convertible domestic debt of the U.S. government or any agency there of, or corporate debt guaranteed by the U.S. government all with outstanding principal of $1 million and maturity between one and ten years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

17 |

|

Sterling Capital Total Return Bond Fund

Portfolio Managers

Sterling Capital Total Return Bond Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997 and has co-managed the Fund since 2008. He is head of Sterling Capital’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University, where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Richard joined Sterling Capital in 2007 and has co-managed the Fund since 2011. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and an MS in Finance from Drexel University.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in foreign securities which may expose the fund to currency and exchange rate fluctuations, and mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

18 |

|

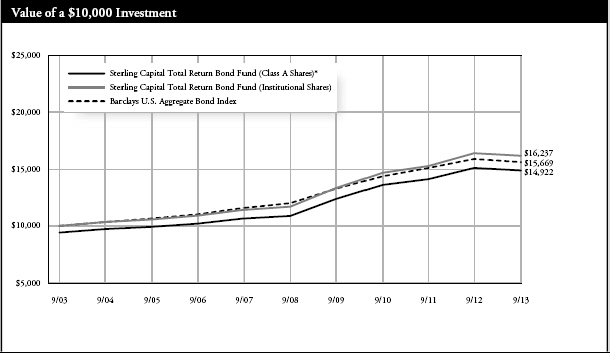

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the Barclays U.S. Aggregate Bond Index, an unmanaged index which is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. Fund performance for certain time periods would have been lower without fee waivers in effect.

|

|

19 |

|

Sterling Capital Corporate Fund

Portfolio Managers

Sterling Capital Corporate Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997 and has co-managed the Fund since 2011. He is head of Sterling Capital’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Richard joined Sterling Capital in 2007 and has co-managed the Fund since 2011. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and an MS in Finance from Drexel University.

The investment team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

20 |

|

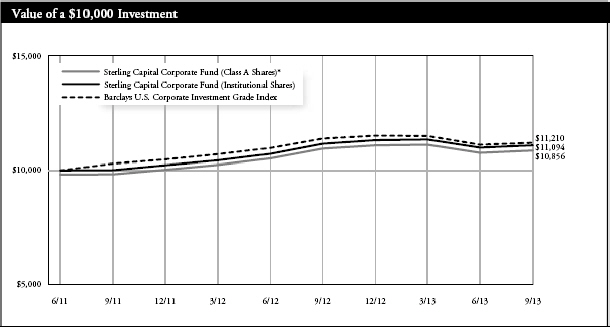

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-888-228-1872.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A and C Shares were not in existence prior to 2/1/13. Performance for periods prior to 2/1/13 is based on the performance of Institutional Shares and has been adjusted for maximum CDSC to the class applicable but does not include 12b-1 fees, which if reflected, would have caused performance of Class A and C Shares to be lower. |

| 2 | The Fund converted Class S Shares into Institutional Shares effective 2/1/13. |

The Fund is measured against the Barclays U.S. Corporate Investment Grade Index, an unmanaged index consisting of publicly issued U.S. Corporate and specified foreign debentures and secured notes, all which have at least one year to final maturity. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been waived prior to 2/1/13. Fund performance for certain time periods would have been lower without fee waivers in effect. There are currently no waiver agreements in effect.

|

|

21 |

|

Sterling Capital Securitized Opportunities Fund

Portfolio Managers

Sterling Capital Securitized Opportunities Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997 and has co-managed the Fund since 2011. He is head of Sterling Capital’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Richard joined Sterling Capital in 2007 and has co-managed the Fund since 2011. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and an MS in Finance from Drexel University.

The investment team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity.

| Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

22 |

|

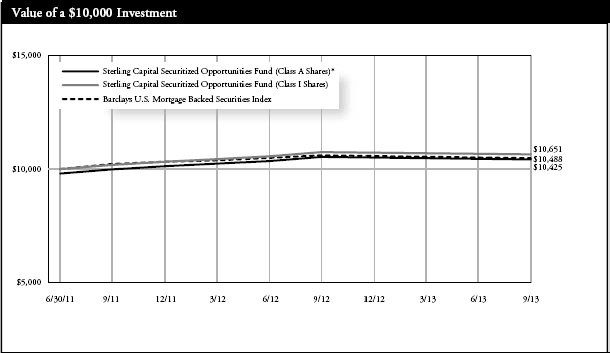

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-888-228-1872.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A and C Shares were not in existence prior to 2/1/13. Performance for periods prior to 2/1/13 is based on the performance of Institutional Shares and has been adjusted for maximum CDSC to the class applicable but does not include 12b-1 fees, which if reflected, would have caused performance of Class A and C Shares to be lower. |

| 2 | The Fund converted Class S Shares into Institutional Shares effective 2/1/13. |

The Fund is measured against the Barclays U.S. Mortgage Backed Securities Index. The index measures the performance of investment grade fixed-rate mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae, and Freddie Mac. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been waived prior to 2/1/13. Fund performance for certain time periods would have been lower without fee waivers in effect. There are currently no waiver agreements in effect.

|

|

23 |

|

Sterling Capital Kentucky Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Kentucky Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Kentucky and its political subdivisions and therefore will be affected by economic, political or other events affecting Kentucky.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

24 |

|

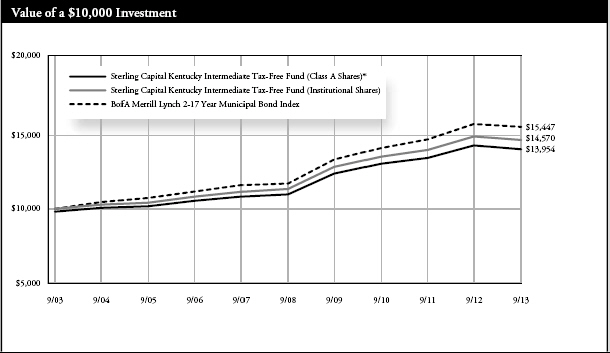

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index that is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

25 |

|

Sterling Capital Maryland Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Maryland Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Maryland and its political subdivisions and therefore will be affected by economic, political or other events affecting Maryland.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

26 |

|

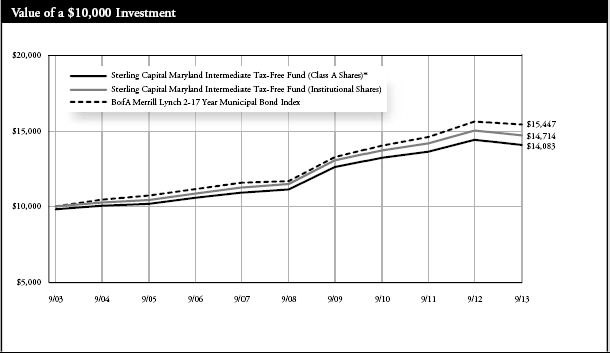

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

27 |

|

Sterling Capital North Carolina Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital North Carolina Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by North Carolina and its political subdivisions and therefore will be affected by economic, political or other events affecting North Carolina.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

28 |

|

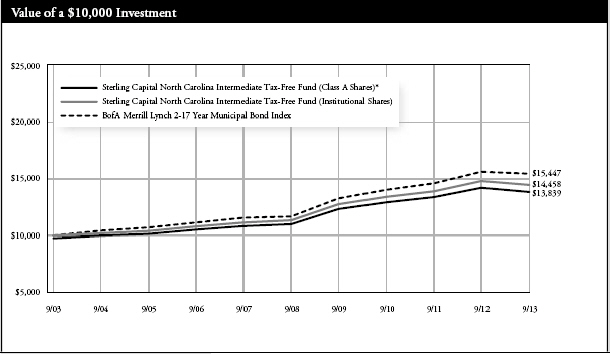

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

29 |

|

Sterling Capital South Carolina Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital South Carolina Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by South Carolina and its political subdivisions and therefore will be affected by economic, political or other events affecting South Carolina.

| Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

30 |

|

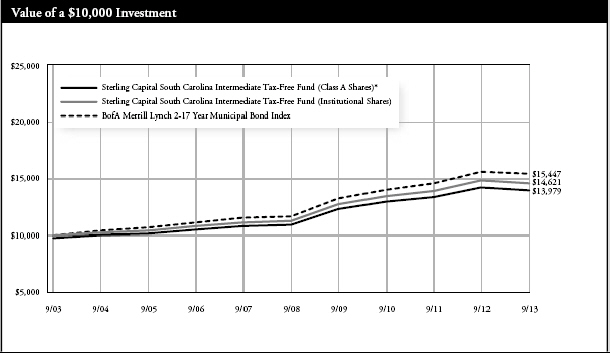

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

1 Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses.

The Fund is measured against the BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

31 |

|

Sterling Capital Virginia Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Virginia Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Virginia and its political subdivisions and therefore will be affected by economic, political or other events affecting Virginia.

| Portfolio composition is as of September 30, 2013 and is subject to change and risk. |

|

|

32 |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

33 |

|

Sterling Capital West Virginia Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital West Virginia Intermediate Tax-Free Fund (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Robert is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder.

The Investment Team supporting the Fund includes 21 investment professionals with an average of more than 18 years of industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by West Virginia and its political subdivisions and therefore will be affected by economic, political or other events affecting West Virginia.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

34 |

|

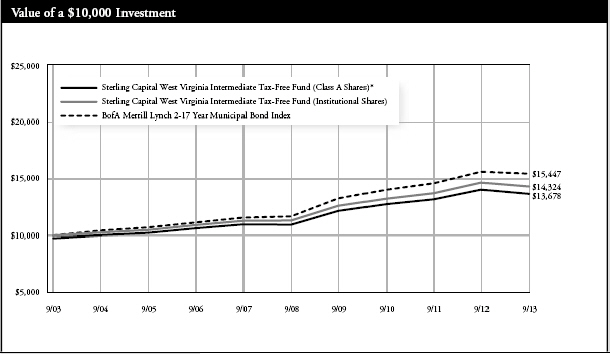

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 2-17 Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

|

|

35 |

|

Sterling Capital Strategic Allocation Funds

Portfolio Managers

Team Managed

Sterling Capital Strategic Allocation Funds (the “Funds”) are managed by the Sterling Capital Advisory Solutions Team which is led by James C. Willis, CFA and Jeffrey J. Schappe, CFA & Chief Market Strategist.

The Investment Team supporting the Funds includes 8 investment professionals with an average of more than 14 years of industry experience.

Investment Concerns

The Funds are primarily concentrated in underlying funds and are therefore subject to the same risks as the underlying funds and bear a portion of the expenses of the underlying funds. The underlying funds may be invested in equity securities and are subject to market risk. Investments in bonds are subject to credit risk, call risk and interest rate risk (as interest rates rise the value of bond prices will decline). The underlying funds may invest in foreign securities, which involve certain risks such as currency volatility, political and social instability and reduced market liquidity; small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines and more sensitive to economic factors; and high-yield (junk) debt securities, which involve greater risks than investment grade bonds. The underlying funds may also be money market funds.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in them.

Portfolio composition is as of September 30, 2013 and is subject to change and risk.

|

|

36 |

|

Sterling Capital Strategic Allocation Conservative Fund

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

| 1 | As of March 1, 2013, the Russell 3000® Index is included to show how the Fund’s performance compares with the returns of the U.S. equity markets generally. The Russell 3000® Index represents approximately 98% of the U.S. equity market and comprises the 3,000 largest companies in the United States. |

The Fund is measured against the Russell Global Index, the Russell 3000® Index and the Barclays U.S. Aggregate Bond Index. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been waived. Fund performance for certain time periods would have been lower without fee waivers in effect. Currently all management fees are being waived.

|

|

37 |

|

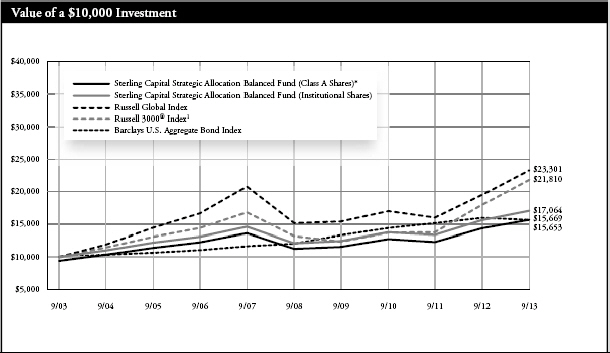

Sterling Capital Strategic Allocation Balanced Fund

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

| 1 | As of March 1, 2013, the Russell 3000® Index is included to show how the Fund’s performance compares with the returns of the U.S. equity markets generally. The Russell 3000® Index represents approximately 98% of the U.S. equity market and comprises the 3,000 largest companies in the United States. |

The Fund is measured against the Russell Global Index, the Russell 3000® Index and the Barclays U.S. Aggregate Bond Index. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been waived. Fund performance for certain time periods would have been lower without fee waivers in effect. Currently all management fees are being waived.

|

|

38 |

|

Sterling Capital Strategic Allocation Growth Fund

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

| 1 | As of March 1, 2013, the Russell 3000® Index is included to show how the Fund’s performance compares with the returns of the U.S. equity markets generally. The Russell 3000® Index represents approximately 98% of the U.S. equity market and comprises the 3,000 largest companies in the United States. |

The Fund is measured against the Russell Global Index, the Russell 3000® Index and the Barclays U.S. Aggregate Bond Index. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been waived. Fund performance for certain time periods would have been lower without fee waivers in effect. Currently all management fees are being waived.

|

|

39 |

|

| Sterling Capital Funds |

Sterling Capital Funds invested, as a percentage of net assets, in the following industry sectors, countries, states, funds or security types, as of September 30, 2013:

40

| Sterling Capital Funds |

| Summary of Portfolio Holdings (Unaudited) |

41

| Sterling Capital Funds |

As a shareholder of the Sterling Capital Funds (each “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2013 through September 30, 2013.

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| Beginning Account Value 4/1/13 |

Ending Account Value 9/30/13 |

Expenses Paid During Period* 4/1/13 - 9/30/13 |

Annualized Expense Ratio During Period 4/1/13 - 9/30/13 | |||||||||||||||||

| Sterling Capital Large Cap Value Diversified Fund |

||||||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,064.79 | $ | 5.69 | 1.10 | % | ||||||||||||

| Class B Shares |

1,000.00 | 1,060.22 | 9.50 | 1.84 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,060.10 | 9.55 | 1.85 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,065.84 | 4.40 | 0.85 | % | |||||||||||||||

| Sterling Capital Mid Value Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 1,137.07 | 6.27 | 1.17 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,132.66 | 10.26 | 1.92 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,133.09 | 10.27 | 1.92 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,139.16 | 4.93 | 0.92 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,124.84 | 7.56 | 1.42 | % | |||||||||||||||

| Sterling Capital Small Cap Value Diversified Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 1,110.78 | 6.72 | 1.27 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,106.24 | 10.67 | 2.02 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,106.31 | 10.67 | 2.02 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,112.20 | 5.40 | 1.02 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,107.59 | 8.24 | 1.56 | % | |||||||||||||||

| Sterling Capital Special Opportunities Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 1,094.16 | 6.40 | 1.22 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,089.85 | 10.27 | 1.96 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,090.34 | 10.32 | 1.97 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,095.80 | 5.10 | 0.97 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,093.10 | 7.66 | 1.46 | % | |||||||||||||||

| Sterling Capital Equity Income Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 1,041.54 | 6.19 | 1.21 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,037.76 | 10.01 | 1.96 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,037.29 | 10.01 | 1.96 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,042.70 | 4.92 | 0.96 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,039.90 | 7.47 | 1.46 | % | |||||||||||||||

| Sterling Capital Ultra Short Bond Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 1,000.16 | 3.71 | 0.74 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,001.42 | 2.46 | 0.49 | % | |||||||||||||||

| Sterling Capital Short-Term Bond Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 999.75 | 3.81 | 0.76 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 996.02 | 7.56 | 1.51 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,001.01 | 2.56 | 0.51 | % | |||||||||||||||

| Sterling Capital Intermediate U.S. Government Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 978.26 | 4.46 | 0.90 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 973.52 | 8.16 | 1.65 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 973.60 | 8.16 | 1.65 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 978.59 | 3.22 | 0.65 | % | |||||||||||||||

| Sterling Capital Total Return Bond Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 979.21 | 4.02 | 0.81 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 975.54 | 7.73 | 1.56 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 975.58 | 7.73 | 1.56 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 980.48 | 2.78 | 0.56 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 977.68 | 5.21 | 1.05 | % | |||||||||||||||

| Sterling Capital Corporate Fund |

|

|||||||||||||||||||

| Class A Shares |

1,000.00 | 976.76 | 4.21 | 0.85 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 973.08 | 7.91 | 1.60 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 978.18 | 2.98 | 0.60 | % | |||||||||||||||

42

| Sterling Capital Funds |

| Expense Example (Unaudited) |

| Beginning Account Value 4/1/13 |

Ending Account Value 9/30/13 |

Expenses Paid During Period* 4/1/13 - 9/30/13 |

Annualized Expense Ratio During Period 4/1/13 - 9/30/13 | |||||||||||||||||

| Sterling Capital Securitized Opportunities Fund |

||||||||||||||||||||

| Class A Shares |