UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

Sterling Capital Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

E.G. Purcell, III, President

Sterling Capital Funds

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Notice of Privacy Policy & Practices

Sterling Capital Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the Sterling Capital Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| • | Account Applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| • | Account History, including information about the transactions and balances in a customer’s accounts; and |

| • | Correspondence, written, telephonic or electronic between a customer and the Sterling Capital Funds or service providers to the Sterling Capital Funds. |

Disclosure of Customer Information

We many disclose all of the consumer information outlined above to third parties who are not affiliated with the Sterling Capital Funds:

| • | as permitted by law — for example with service providers who maintain or service shareholder accounts for the Sterling Capital Funds or to a shareholder’s broker or agent; and |

| • | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institution. |

Security of Customer Information

We require service providers to the Sterling Capital Funds:

| • | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the Sterling Capital Funds; and |

| • | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the Sterling Capital Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the Sterling Capital Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the Sterling Capital Funds and individuals who provide nonpublic personal information to the Sterling Capital Funds, but do not invest in Sterling Capital Funds shares.

|

Sterling Capital Funds |

| Table of Contents | ||||

|

Management Discussion of Performance |

||||

| 1 | ||||

| Fund Summary | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| Summary of Portfolio Holdings | 40 | |||

| Expense Example | 43 | |||

| Schedules of Portfolio Investments | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 58 | ||||

| 60 | ||||

| 64 | ||||

| 66 | ||||

| 68 | ||||

| 72 | ||||

| 75 | ||||

| 78 | ||||

| 81 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| Financial Statements | 90 | |||

| Notes to Financial Statements | 148 | |||

| Report of Independent Registered Public Accounting Firm | 169 | |||

| 175 | ||||

| 176 | ||||

(This page has been left blank intentionally.)

|

|

|

|

Letter from the President and the Investment Advisor

Past performance does not guarantee future results.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds and is paid a fee for its services. Shares of the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, Inc. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice.

| 1 | ||||

|

|

|

|

|

|

Sterling Capital Select Equity Fund

Portfolio Manager

Stephen L. Morgan

Sterling Capital Select Equity Fund (formerly known as BB&T Select Equity Fund) (the “Fund”) is managed by Stephen L. Morgan, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Stephen joined Sterling Capital in 1999. He has investment experience since 1980. Stephen is a graduate of American University where he received his BS in Finance and Accounting. He received his MBA from Virginia Tech. The Investment Team supporting the Fund has more than 65 combined years of investment experience and includes:

| • | Greg Towner, CFA, CMT, Director |

| • | J. Blake Guyler, CFA, Director |

| • | James M. Walden, CFA, Director |

Investment Concerns

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. Equity securities (stocks) are more volatile and carry more risk. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. The Fund may invest in foreign securities which involve certain risks such as currency volatility and political, social and economic instability.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 2 | ||||

|

|

|

|

|

|

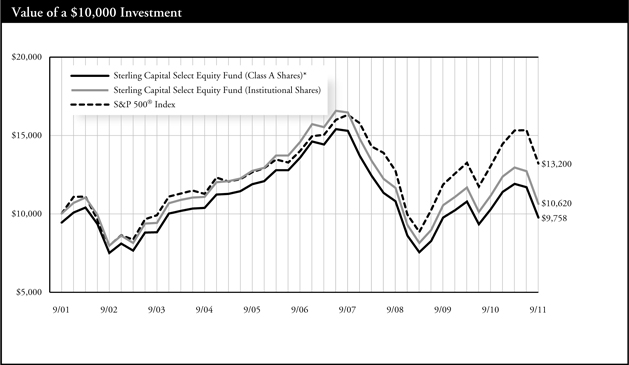

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 3 | ||||

|

|

|

|

|

|

Sterling Capital Mid Value Fund

Portfolio Manager

Timothy P. Beyer, CFA

Sterling Capital Mid Value Fund (formerly known as BB&T Mid Cap Value Fund) (the “Fund”) is managed by Timothy P. Beyer, CFA, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Timothy joined Sterling Capital in 2004. He has investment experience since 1989. Timothy is a graduate of East Carolina University where he received his BSBA in Finance. The Investment Team supporting the Fund has more than 97 combined years of investment experience and includes:

| • | Eduardo A. Brea, CFA, Managing Director |

| • | Robert W. Bridges, CFA, Director |

| • | Lee D. Houser, CFA, Director |

| • | Patrick W. Rau, CFA, Executive Director |

| • | Brian R. Walton, CFA, Managing Director |

Investment Concerns

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 4 | ||||

|

|

|

|

|

|

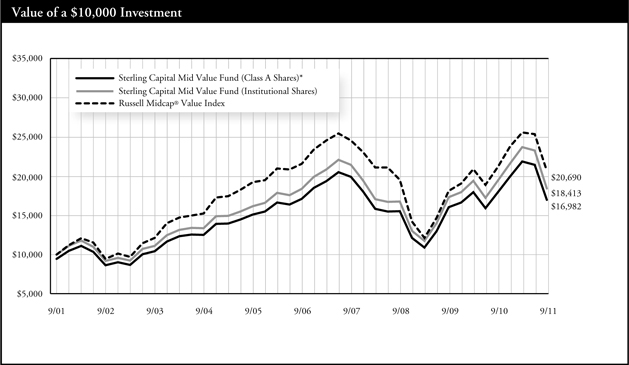

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of the Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against Russell Midcap® Value Index, an unmanaged index which measures the performance of those securities in the Russell 1000 with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If fees had not been waived, the Fund’s total return for the periods would have been lower.

| 5 | ||||

|

|

|

|

|

|

Sterling Capital Small Value Fund

Portfolio Manager

Eduardo Brea, CFA

Sterling Capital Small Value Fund (formerly known as Sterling Capital Small Cap Value Fund) (the “Fund”) is managed by Eduardo Brea, CFA, Managing Director and Equity Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Eduardo joined Sterling Capital in 1995. He has investment experience since 1989. Mr. Brea is a graduate of the University of Florida where he received his BS in Finance. He received his MBA from University of South Florida. The Investment Team supporting the Fund has more than 97 combined years of investment experience and includes:

| • | Timothy P. Beyer, CFA, Managing Director |

| • | Brian R. Walton, CFA, Managing Director |

| • | Patrick W. Rau, CFA, Executive Director |

| • | Robert W. Bridges, CFA, Director |

| • | Lee D. Houser, CFA, Director |

Investment Concerns

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 6 | ||||

|

|

|

|

|

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

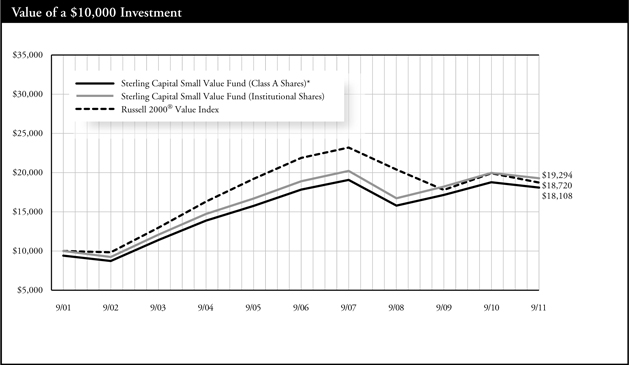

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A, B, C and R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares and has been adjusted for maximum CDSC to the class applicable but does not include 12b-1 fees, which if reflected, would have caused performance of Class A, B C and R Shares to be lower. The performance information for Institutional Shares (formerly known as Sterling Shares) prior to 12/18/06 is based on the performance of the Institutional Shares of the Fund’s Predecessor, Sterling Capital Small Cap Value Fund, a series of The Advisors’ Inner Circle Fund (the “Predecessor Fund”), which transferred all of its assets and liabilities to the Fund pursuant to a reorganization. Information prior to 3/16/01 relates to the UAM Fund Inc.’s Sterling Partners’ Small Cap Value Portfolio, the assets of which were acquired by the Predecessor Fund. The performance of the Fund’s Institutional Shares would have been different because the Fund’s Institutional Shares have different expenses than the Predecessor’s Institutional Shares. |

Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of small- to mid-sized companies. The Index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 7 | ||||

|

|

|

|

|

|

Sterling Capital International Fund

Portfolio Managers

Richard Pell, Chief Investment Officer

Artio Global Management LLC (subadviser)

Sterling Capital International Fund (formerly known as BB&T International Equity Fund) (the “Fund”) is managed by Richard Pell, Chief Investment Officer, at Ario Global Management LLC (“Artio Global”), subadvisor to the Fund. Richard has managed the Fund since 2007. He received his BA from the University of California at Berkeley and an MBA from New York University. Richard has investment experience since 1983.

Investment Concerns

The Fund invests in the securities of foreign and emerging markets which involve certain risks such as currency fluctuation and political, social and economic instability. The Fund may invest in derivatives (futures, options, swaps) and exchange traded funds which may incur additional costs. Derivatives may be more sensitive to changes in market conditions and may amplify risks. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 8 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

MSCI All Country World Index Ex-U.S. (net) is a unmanaged market capitalization-weighted index that is designed to represent the performance of equity markets in the global developed and emerging markets, excluding the United States. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 9 | ||||

|

|

|

|

|

|

Sterling Capital Special Opportunities Fund

Portfolio Manager

George F. Shipp, CFA

Chief Investment Officer

Scott & Stringfellow, LLC (subadviser)

Sterling Capital Special Opportunities Fund (formerly known as BB&T Special Opportunities Fund) (the “Fund”) is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, LLC (“Scott & Stringfellow”), subadvisor to the Fund. George has been the Fund’s manager since 2003 and also manages the Sterling Capital Equity Income Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business. The Investment Team supporting the Fund has more than 123 combined years of investment experience and includes:

| • | Adam B. Bergman, CFA |

| • | Joshua L. Haggerty, CFA |

| • | R. Griffith Jones, Jr. |

| • | Farley C. Shiner, CFA |

| • | Colin R. Ducharme, CFA |

| • | Guy W. Ford, CFA |

| • | Michael S. Peasley, CFA |

Investment Concerns

The Fund is subject to investment style risk which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 10 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 11 | ||||

|

|

|

|

|

|

Sterling Capital Equity Income Fund

Portfolio Manager

George F. Shipp, CFA

Chief Investment Officer

Scott & Stringfellow, LLC (subadviser)

Sterling Capital Equity Income Fund (formerly known as BB&T Equity Income Fund) (the “Fund”) is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, LLC (“Scott & Stringfellow”), subadvisor to the Fund. George has been the Fund’s manager since 2004 and also manages the Sterling Capital Special Opportunities Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business. The Investment Team supporting the Fund has more than 123 combined years of investment experience and includes:

| • | Adam B. Bergman, CFA |

| • | Joshua L. Haggerty, CFA |

| • | R. Griffith Jones, Jr. |

| • | Farley C. Shiner, CFA |

| • | Colin R. Ducharme, CFA |

| • | Guy W. Ford, CFA |

| • | Michael S. Peasley, CFA |

Investment Concerns

The Fund invests primarily in dividend-paying securities but also in convertible securities in search of yield. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 12 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 13 | ||||

|

|

|

|

|

|

Sterling Capital Short-Term Bond Fund

Portfolio Managers

Sterling Capital Short-Term Bond Fund (formerly known as BB&T Short U.S. Government Fund) (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997. He has co-managed the Fund since 2008 and also co-manages the Sterling Capital Total Return Bond Fund. He received his BS from West Chester University and an MBA from Drexel University. Mark has investment experience since 1990.

Richard D. LaCoff

Richard joined Sterling Capital in 2007. He has co-managed the Fund since 2010 and also co-manages the Sterling Capital Total Return Bond Fund. He received his BS from Villanova University and an MBA from Drexel University. Richard has investment experience since 1991.

The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; derivatives (futures and swaps); mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify risks.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 14 | ||||

|

|

|

|

|

|

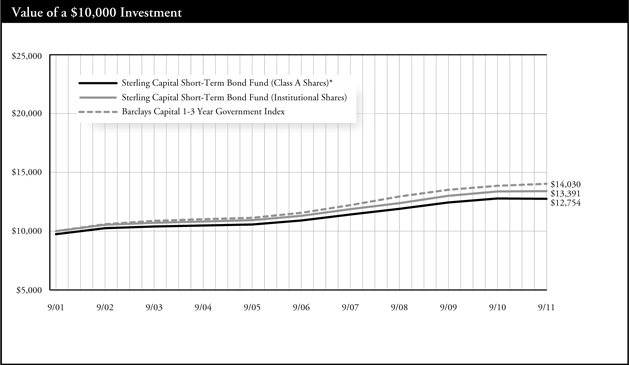

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 1-3 Year Government Index which consists of securities in Barclays Capital U.S. Government Index with a maturity from one up to three years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 15 | ||||

|

|

|

|

|

|

Sterling Capital Intermediate U.S. Government Fund

Portfolio Manager

Brad D. Eppard, CFA

Sterling Capital Intermediate U.S. Government Fund (formerly known as BB&T Intermediate U.S. Government Fund) (the “Fund”) is managed by Brad D. Eppard, CFA, Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Brad joined Sterling Capital in 2003. He has investment experience since 1985. He has been the portfolio manager for the Fund since 2003. Brad is a graduate of Radford University where he received his BS in Business Administration/Accounting. He is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in mortgage-backed securities which tend to be more sensitive to changes in interest rates. The Fund invests in securities issued or guaranteed by the U.S. government or its agencies (such as Fannie Mae or Freddie Mac). Although U.S. government securities issued directly by the U.S. government are guaranteed by the U.S. Treasury, other U.S. government securities issued by an agency or instrumentality of the U.S. government may not be. No assurance can be given that the U.S. government would provide financial support to its agencies and instrumentalities if not required to do so by law.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 16 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured by Barclays Capital Intermediate Government Bond Index, an unmanaged index comprised of all publicly issued non-convertible domestic debt of the U.S. government or any agency there of, or corporate debt guaranteed by the U.S. government all with outstanding principal of $1 million and maturity between one and ten years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 17 | ||||

|

|

|

|

|

|

Sterling Capital Total Return Bond Fund

Portfolio Managers

Sterling Capital Total Return Bond Fund (formerly known as BB&T Total Return Bond Fund) (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997. He has co-managed the Fund since 2008 and also co-manages the Sterling Capital Short-Term Bond Fund. He received his BS from West Chester University and an MBA from Drexel University. Mark has investment experience since 1990.

Richard D. LaCoff

Richard joined Sterling Capital in 2007. He has co-managed the Fund since 2010 and also co-manages the Sterling Capital Short-Term Bond Fund. He received his BS from Villanova University and an MBA from Drexel University. Richard has investment experience since 1991. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; derivatives (futures and swaps); mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify risks.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 18 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against Barclays Capital U.S. Aggregate Bond Index, an unmanaged index which is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 19 | ||||

|

|

|

|

|

|

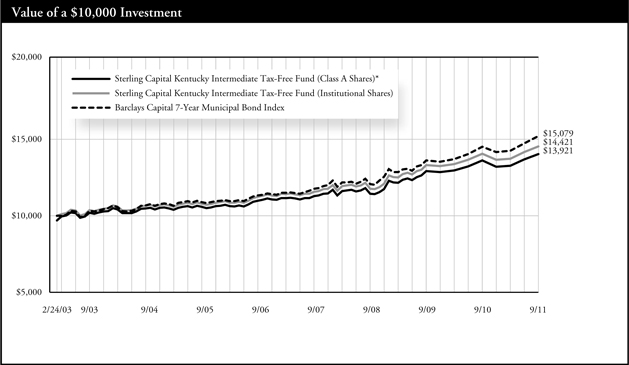

Sterling Capital Kentucky Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Kentucky Intermediate Tax-Free Fund (formerly known as BB&T Kentucky Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Kentucky and its political subdivisions and therefore will be affected by economic, political or other events affecting Kentucky.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 20 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 21 | ||||

|

|

|

|

|

|

Sterling Capital Maryland Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Maryland Intermediate Tax-Free Fund (formerly known as BB&T Maryland Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Maryland and its political subdivisions and therefore will be affected by economic, political or other events affecting Maryland.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 22 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 23 | ||||

|

|

|

|

|

|

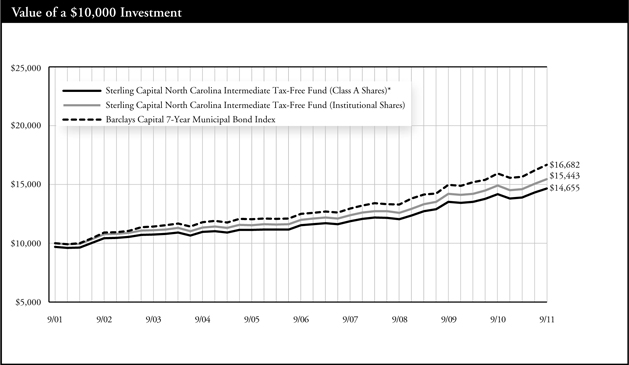

Sterling Capital North Carolina Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital North Carolina Intermediate Tax-Free Fund (formerly known as BB&T North Carolina Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by North Carolina and its political subdivisions and therefore will be affected by economic, political or other events affecting North Carolina.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 24 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 25 | ||||

|

|

|

|

|

|

Sterling Capital South Carolina Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital South Carolina Intermediate Tax-Free Fund (formerly known as BB&T South Carolina Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by South Carolina and its political subdivisions and therefore will be affected by economic, political or other events affecting South Carolina.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 26 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 27 | ||||

|

|

|

|

|

|

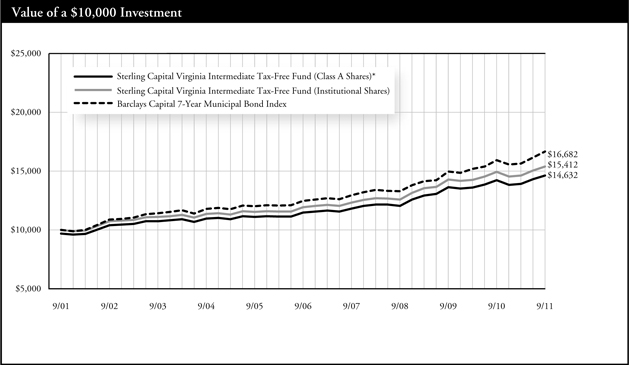

Sterling Capital Virginia Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Virginia Intermediate Tax-Free Fund (formerly known as BB&T Virginia Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Virginia and its political subdivisions and therefore will be affected by economic, political or other events affecting Virginia.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 28 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 29 | ||||

|

|

|

|

|

|

Sterling Capital West Virginia Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital West Virginia Intermediate Tax-Free Fund (formerly known as BB&T West Virginia Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by West Virginia and its political subdivisions and therefore will be affected by economic, political or other events affecting West Virginia.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| 30 | ||||

|

|

|

|

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 31 | ||||

|

|

|

|

|

|

Sterling Capital National Tax-Free Money Market Fund

Portfolio Manager

Michael Sirianni, CFA

Federated Investment Management Company (subadviser)

Sterling Capital National Tax-Free Money Market Fund (formerly known as BB&T National Tax-Free Money Market Fund) (the “Fund”) was managed during the 12-month period by Michael Sirianni, portfolio manager for Federated Investment Management Company (“Federated IMC”), subadvisor to the Fund. Michael managed the Fund since 2006. He received his BA from Pennsylvania State University and an MBA from the University of Pittsburgh. Michael has investment experience since 1987. The Investment Team at Federated IMC supporting the Fund has an average of more than 11 years of investment management experience:

| • | Gregg Purinton |

| • | Hanan Callas, CFA |

| • | Kyle D. Stewart, CFA |

Investment Concerns

Distributions of the Fund net interest income from tax-exempt securities generally are not subject to federal income tax, but for some may be subject to the federal alternative minimum tax and to state and local taxes. A portion of the Fund distributions may be taxable as ordinary income or capital gains.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in a money market fund.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 32 | ||||

|

|

|

|

|

|

Sterling Capital Prime Money Market Fund

Portfolio Manager

Paige Wilhelm, CFA

Federated Investment Management Company (subadviser)

Sterling Capital Prime Money Market Fund (formerly known as BB&T Prime Money Market Fund) (the “Fund”) was managed during the 12-month period by Paige Wilhelm, portfolio manager for Federated Investment Management Company (“Federated IMC”), subadvisor to the Fund. Paige managed the Fund since 2006. She received her BS from Indiana University and an MBA from Duquesne University. Paige has investment experience since 1991. The Investment Team at Federated IMC supporting the Fund has an average of more than 11 years of investment management experience:

| • | Jason DeVito |

| • | William Jamison |

| • | Natalie F. Metz |

| • | Mary Ellen Tesla |

| • | Mark F. Weiss, CFA |

Investment Concerns

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in a money market fund.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 33 | ||||

|

|

|

|

|

|

Sterling Capital U.S. Treasury Money Market Fund

Portfolio Manager

Kevin E. McNair, CFA

Sterling Capital U.S. Treasury Money Market Fund (formerly known as BB&T U.S. Treasury Money Market Fund) (the “Fund”) is managed by Kevin E. McNair, CFA, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Mr. McNair joined Sterling Capital in 1994. He has investment experience since 1994. Kevin is a graduate of the University of North Carolina at Chapel Hill where he received his BA in Economics. He received his MA in Economics from North Carolina State University. The Investment Team supporting the Fund has more than 65 combined years of investment experience:

| • | Robert F. Millikan, CFA, Executive Director |

| • | Brad D. Eppard, CFA, Director |

| • | David T. Johnson, Associate Director |

Investment Concerns

U.S. government guarantees apply only to the underlying securities of the Fund that are issued by the U.S. government or its agencies or instrumentalities and not the Fund shares.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in a money market fund.

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 34 | ||||

|

|

|

|

|

|

Sterling Capital Strategic Allocation Funds

Portfolio Managers

Team Managed

Sterling Capital Strategic Allocation Funds (formerly known as BB&T Capital Manager Funds) (the “Funds”) are managed by Asset Allocation and ARC Teams of Sterling Capital Management LLC led by Jeffrey J. Schappe, CFA, Managing Director and Chief Investment Officer & James C. Willis, CFA, Managing Director. The Investment Team supporting the Funds includes 10 investment professionals with an average of more than 15 years industry experience.

Investment Concerns

The Funds are primarily concentrated in underlying funds and are therefore subject to the same risks the funds are invested in bear a portion of the expenses of the underlying funds. The underlying funds may be invested in equity securities and are subject to market risk. Investments in bonds are subject to credit risk, call risk and interest rate risk (as interest rates rise the value of bond prices will decline). The underlying funds may invest in more aggressive investments such as foreign securities, which involve certain risks such as currency volatility, political and social instability and reduced market liquidity; small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines and more sensitive to economic factors; and high-yield (junk) debt securities which involve greater risks than investment grade bonds. The underlying funds may also be money market funds.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in them.

| 35 | ||||

|

|

|

|

|

|

Sterling Capital Strategic Allocation Conservative Fund

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

The Fund is measured against S&P 500® Index, which is generally considered to be representative of the performance of the stock market as a whole, and against Barclays Capital Intermediate Government Bond Index, which is widely used as a broad measure of the performance of U.S. Government Bonds with maturities of less than 10 years. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees have been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 36 | ||||

|

|

|

|

|

|

Sterling Capital Strategic Allocation Balanced Fund

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

The Fund is measured against S&P 500® Index, which is generally considered to be representative of the performance of the stock market as a whole, and against Barclays Capital Intermediate Government Bond Index, which is widely used as a broad measure of the performance of U.S. Government Bonds with maturities of less than 10 years. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees have been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 37 | ||||

|

|

|

|

|

|

Sterling Capital Strategic Allocation Growth Fund

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

The Fund is measured against S&P 500® Index, which is generally considered to be representative of the performance of the stock market as a whole, and against Barclays Capital Intermediate Government Bond Index, which is widely used as a broad measure of the performance of U.S. Government Bonds with maturities of less than 10 years. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and, fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees have been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 38 | ||||

|

|

|

|

|

|

Sterling Capital Strategic Allocation Equity Fund

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against S&P 500® Index, an unmanaged index generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees have been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 39 | ||||

| Sterling Capital Funds |

Sterling Capital Funds invested, as a percentage of net assets, in the following industry sectors, countries, states, funds or security types, as of September 30, 2011.

40

| Sterling Capital Funds |

| Summary of Portfolio Holdings (Unaudited)

|

41

| Sterling Capital Funds |

| Summary of Portfolio Holdings (Unaudited) |

42

| Sterling Capital Funds |

As a shareholder of the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2011 through September 30, 2011.

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this year.

| Beginning Account Value 4/1/11 |

Ending Account Value 9/30/11 |

Expenses Paid During Period* 4/1/11 - 9/30/11 |

Annualized Expense Ratio During Period 4/1/11 - 9/30/11 | |||||||||||||||||

| Sterling Capital Select Equity Fund |

||||||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 819.80 | $ | 4.97 | 1.09 | % | ||||||||||||

| Class B Shares |

1,000.00 | 816.50 | 8.38 | 1.84 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 816.70 | 8.38 | 1.84 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 821.00 | 3.83 | 0.84 | % | |||||||||||||||

| Sterling Capital Mid Value Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 776.40 | 5.30 | 1.19 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 773.10 | 8.62 | 1.94 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 773.30 | 8.62 | 1.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 777.30 | 4.19 | 0.94 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 775.90 | 6.37 | 1.43 | % | |||||||||||||||

| Sterling Capital Small Value Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 760.40 | 5.87 | 1.33 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 757.60 | 9.16 | 2.08 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 757.60 | 9.16 | 2.08 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 761.40 | 4.77 | 1.08 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 762.50 | 6.80 | 1.54 | % | |||||||||||||||

| Sterling Capital International Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 755.10 | 6.20 | 1.41 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 753.70 | 9.54 | 2.17 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 754.80 | 9.50 | 2.16 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 756.70 | 5.11 | 1.16 | % | |||||||||||||||

| Sterling Capital Special Opportunities Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 835.20 | 5.93 | 1.29 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 832.10 | 9.37 | 2.04 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 832.20 | 9.37 | 2.04 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 836.50 | 4.79 | 1.04 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 834.10 | 7.08 | 1.54 | % | |||||||||||||||

| Sterling Capital Equity Income Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 922.80 | 5.74 | 1.19 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 919.30 | 9.33 | 1.94 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 919.50 | 9.34 | 1.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 924.00 | 4.53 | 0.94 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 921.80 | 6.89 | 1.43 | % | |||||||||||||||

| Sterling Capital Short-Term Bond Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,002.20 | 3.97 | 0.79 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,002.40 | 2.71 | 0.54 | % | |||||||||||||||

| Sterling Capital Intermediate U.S. Government Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,047.00 | 4.87 | 0.95 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,043.20 | 8.71 | 1.70 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,042.20 | 8.70 | 1.70 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,048.30 | 3.59 | 0.70 | % | |||||||||||||||

| Sterling Capital Total Return Bond Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,038.80 | 4.86 | 0.95 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,034.90 | 8.67 | 1.70 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,035.80 | 8.68 | 1.70 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,041.00 | 3.58 | 0.70 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,037.90 | 6.13 | 1.20 | % | |||||||||||||||

| Sterling Capital Kentucky Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,055.70 | 4.84 | 0.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,057.10 | 3.56 | 0.69 | % | |||||||||||||||

43

| Sterling Capital Funds |

| Expense Example (Unaudited) |

| Beginning Account Value 4/1/11 |

Ending Account Value 9/30/11 |

Expenses Paid During Period* 4/1/11 - 9/30/11 |

Annualized Expense Ratio During Period 4/1/11 - 9/30/11 | |||||||||||||||||

| Sterling Capital Maryland Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,053.80 | $ | 4.74 | 0.92 | % | ||||||||||||

| Institutional Shares |

1,000.00 | 1,055.10 | 3.45 | 0.67 | % | |||||||||||||||

| Sterling Capital North Carolina Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,055.40 | 4.74 | 0.92 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,056.70 | 3.45 | 0.67 | % | |||||||||||||||

| Sterling Capital South Carolina Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,055.40 | 4.95 | 0.96 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,057.00 | 3.66 | 0.71 | % | |||||||||||||||

| Sterling Capital Virginia Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,051.30 | 4.78 | 0.93 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,053.60 | 3.50 | 0.68 | % | |||||||||||||||

| Sterling Capital West Virginia Intermediate Tax-Free Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,052.90 | 4.84 | 0.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,054.20 | 3.55 | 0.69 | % | |||||||||||||||

| Sterling Capital National Tax-Free Money Market Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,000.10 | 1.40 | 0.28 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,000.10 | 1.40 | 0.28 | % | |||||||||||||||

| Sterling Capital Prime Money Market Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,000.10 | 1.00 | 0.20 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,000.10 | 1.00 | 0.20 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,000.10 | 1.00 | 0.20 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,000.10 | 1.00 | 0.20 | % | |||||||||||||||

| Sterling Capital U.S. Treasury Money Market Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,000.10 | 0.25 | 0.05 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,000.10 | 0.25 | 0.05 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,000.10 | 0.25 | 0.05 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,000.10 | 0.25 | 0.05 | % | |||||||||||||||

| Sterling Capital Strategic Allocation Conservative Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 934.40 | 3.54 | 0.73 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 931.50 | 7.17 | 1.48 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 931.40 | 7.17 | 1.48 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 936.10 | 2.33 | 0.48 | % | |||||||||||||||

| Sterling Capital Strategic Allocation Balanced Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 872.10 | 3.14 | 0.67 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 869.10 | 6.65 | 1.42 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 870.10 | 6.66 | 1.42 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 874.00 | 1.97 | 0.42 | % | |||||||||||||||

| Sterling Capital Strategic Allocation Growth Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 837.00 | 3.18 | 0.69 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 834.80 | 6.62 | 1.44 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 834.60 | 6.62 | 1.44 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 838.30 | 2.03 | 0.44 | % | |||||||||||||||

| Sterling Capital Strategic Allocation Equity Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 811.00 | 3.72 | 0.82 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 807.00 | 7.11 | 1.57 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 807.50 | 7.11 | 1.57 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 812.00 | 2.59 | 0.57 | % | |||||||||||||||

| * | Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio, multiplied by 183 days divided by 365 (to reflect the six month period). |

44

| Sterling Capital Funds |

| Expense Example (Unaudited) |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the year. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value 4/1/11 |

Ending Account Value 9/30/11 |

Expenses Paid During Period* 4/1/11 - 9/30/11 |

Annualized Expense Ratio During Period 4/1/11 - 9/30/11 | |||||||||||||||||

| Sterling Capital Select Equity Fund |

||||||||||||||||||||

| Class A Shares |

$ | 1,000.00 | $ | 1,019.60 | $ | 5.52 | 1.09 | % | ||||||||||||

| Class B Shares |

1,000.00 | 1,015.84 | 9.30 | 1.84 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,015.84 | 9.30 | 1.84 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,020.86 | 4.26 | 0.84 | % | |||||||||||||||

| Sterling Capital Mid Value Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,019.10 | 6.02 | 1.19 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,015.34 | 9.80 | 1.94 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,015.34 | 9.80 | 1.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,020.36 | 4.76 | 0.94 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,017.90 | 7.23 | 1.43 | % | |||||||||||||||

| Sterling Capital Small Value Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,018.40 | 6.73 | 1.33 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,014.64 | 10.50 | 2.08 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,014.64 | 10.50 | 2.08 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,019.65 | 5.47 | 1.08 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,017.35 | 7.79 | 1.54 | % | |||||||||||||||

| Sterling Capital International Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,018.00 | 7.13 | 1.41 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,014.19 | 10.96 | 2.17 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,014.24 | 10.91 | 2.16 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,019.25 | 5.87 | 1.16 | % | |||||||||||||||

| Sterling Capital Special Opportunities Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,018.60 | 6.53 | 1.29 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,014.84 | 10.30 | 2.04 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,014.84 | 10.30 | 2.04 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,019.85 | 5.27 | 1.04 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,017.35 | 7.79 | 1.54 | % | |||||||||||||||

| Sterling Capital Equity Income Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,019.10 | 6.02 | 1.19 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,015.34 | 9.80 | 1.94 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,015.34 | 9.80 | 1.94 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,020.36 | 4.76 | 0.94 | % | |||||||||||||||

| Class R Shares |

1,000.00 | 1,017.90 | 7.23 | 1.43 | % | |||||||||||||||

| Sterling Capital Short-Term Bond Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,021.11 | 4.00 | 0.79 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,022.36 | 2.74 | 0.54 | % | |||||||||||||||

| Sterling Capital Intermediate U.S. Government Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,020.31 | 4.81 | 0.95 | % | |||||||||||||||

| Class B Shares |

1,000.00 | 1,016.55 | 8.59 | 1.70 | % | |||||||||||||||

| Class C Shares |

1,000.00 | 1,016.55 | 8.59 | 1.70 | % | |||||||||||||||

| Institutional Shares |

1,000.00 | 1,021.56 | 3.55 | 0.70 | % | |||||||||||||||

| Sterling Capital Total Return Bond Fund |

||||||||||||||||||||

| Class A Shares |

1,000.00 | 1,020.31 | 4.81 | 0.95 | % | |||||||||||||||

| Class B Shares |