Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on September 26, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Emergency Medical Services Corporation*

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation) |

4100 (Primary Standard Industrial Classification Code Number) |

20-3738384 (I.R.S. Employer Identification No.) |

6200 S. Syracuse Way, Suite 200

Greenwood Village, Colorado 80111

(303) 495-1200

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices)

Craig A. Wilson, Esq.

Carl Berglind, Esq.

Emergency Medical Services Corporation

6200 S. Syracuse Way, Suite 200

Greenwood Village, Colorado 80111

(303) 495-1200

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With a copy to:

Peter J. Loughran, Esq.

Debevoise & Plimpton LLP

919 Third Avenue

New York, New York 10022

(212) 909-6000

* Information regarding additional registrants is contained in the Table of Additional Registrants on the following page.

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit(1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(2) |

||||

|---|---|---|---|---|---|---|---|---|

8.125% Senior Notes due 2019 of Emergency Medical Services Corporation |

$950,000,000 | 100% | $950,000,000 | $110,295(2) | ||||

Guarantees of 8.125% Senior Notes due 2019(3) |

— | — | — | None(4) | ||||

Total |

$950,000,000 | 100% | $950,000,000 | $110,295 | ||||

|

||||||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(f) promulgated under the Securities Act of 1933, as

amended.

- (2)

- The

registration fee has been calculated under Rule 457(f) of the Securities Act.

- (3)

- See

the following page for a table of guarantor registrants.

- (4)

- Each of the guarantors will fully and unconditionally guarantee the senior notes being registered hereby. Pursuant to Rule 457(n) under the Securities Act, no separate fee for the guarantee is payable.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants*

Exact Name of Registrant as Specified in its Charter

|

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

||||||

|---|---|---|---|---|---|---|---|---|

A1 Leasing, Inc. |

Subsidiary Guarantor | Florida | 59-3403850 | |||||

Abbott Ambulance, Inc. |

Subsidiary Guarantor | Missouri | 43-1496774 | |||||

Access 2 Care, LLC |

Subsidiary Guarantor | Missouri | 01-0876348 | |||||

Adam Transportation Service, Inc. |

Subsidiary Guarantor | New York | 13-3541209 | |||||

Affilion, Inc. |

Subsidiary Guarantor | Delaware | 27-2937476 | |||||

Air Ambulance Specialists, Inc. |

Subsidiary Guarantor | Colorado | 75-2989736 | |||||

Ambulance Acquisition, Inc. |

Subsidiary Guarantor | Delaware | 51-0352561 | |||||

American Emergency Physicians Management, Inc. |

Subsidiary Guarantor | California | 95-4194045 | |||||

American Investment Enterprises, Inc. |

Subsidiary Guarantor | Nevada | 88-0206998 | |||||

American Medical Pathways, Inc. |

Subsidiary Guarantor | Delaware | 75-2766681 | |||||

American Medical Response Ambulance Service, Inc. |

Subsidiary Guarantor | Delaware | 75-2474011 | |||||

American Medical Response Delaware Valley, LLC |

Subsidiary Guarantor | Delaware | 74-2895618 | |||||

American Medical Response Holdings, Inc. |

Subsidiary Guarantor | Delaware | 84-1370651 | |||||

American Medical Response Management, Inc. |

Subsidiary Guarantor | Delaware | 84-1351841 | |||||

American Medical Response Mid-Atlantic, Inc. |

Subsidiary Guarantor | Pennsylvania | 23-2195702 | |||||

American Medical Response Northwest, Inc. |

Subsidiary Guarantor | Oregon | 93-0567420 | |||||

American Medical Response of Colorado, Inc. |

Subsidiary Guarantor | Delaware | 84-1231591 | |||||

American Medical Response of Connecticut, Incorporated |

Subsidiary Guarantor | Connecticut | 06-1356148 | |||||

American Medical Response of Georgia, Inc. |

Subsidiary Guarantor | Delaware | 58-2193430 | |||||

American Medical Response of Illinois, Inc. |

Subsidiary Guarantor | Delaware | 36-3978701 | |||||

American Medical Response of Inland Empire |

Subsidiary Guarantor | California | 95-2223085 | |||||

American Medical Response of Massachusetts, Inc. |

Subsidiary Guarantor | Massachusetts | 04-2574482 | |||||

American Medical Response of North Carolina, Inc. |

Subsidiary Guarantor | Delaware | 56-1931968 | |||||

American Medical Response of Oklahoma, Inc. |

Subsidiary Guarantor | Delaware | 73-1462014 | |||||

American Medical Response of South Carolina, Inc. |

Subsidiary Guarantor | Delaware | 57-1024333 | |||||

American Medical Response of Southern California |

Subsidiary Guarantor | California | 95-1488421 | |||||

American Medical Response of Tennessee, Inc. |

Subsidiary Guarantor | Delaware | 62-1642499 | |||||

American Medical Response of Texas, Inc. |

Subsidiary Guarantor | Delaware | 76-0487923 | |||||

American Medical Response West |

Subsidiary Guarantor | California | 77-0324739 | |||||

American Medical Response, Inc. |

Subsidiary Guarantor | Delaware | 04-3147881 | |||||

AMR Brockton, L.L.C. |

Subsidiary Guarantor | Delaware | 04-3502200 | |||||

AMR HoldCo, Inc. |

Subsidiary Guarantor | Delaware | 20-2076468 | |||||

Apex Acquisition LLC |

Subsidiary Guarantor | Delaware | 27-1321358 | |||||

Arizona Oasis Acquisition, Inc. |

Subsidiary Guarantor | Delaware | 26-1259367 | |||||

Associated Ambulance Service, Inc. |

Subsidiary Guarantor | New York | 11-2163989 | |||||

Atlantic Ambulance Services Acquisition, Inc. |

Subsidiary Guarantor | Delaware | 33-0506806 | |||||

Atlantic/Key West Ambulance, Inc. |

Subsidiary Guarantor | Delaware | 33-0506809 | |||||

Atlantic/Palm Beach Ambulance, Inc. |

Subsidiary Guarantor | Delaware | 33-0506808 | |||||

BestPractices, Inc. |

Subsidiary Guarantor | Virginia | 54-1489944 | |||||

Blythe Ambulance Service |

Subsidiary Guarantor | California | 95-3433967 | |||||

Broward Ambulance, Inc. |

Subsidiary Guarantor | Delaware | 33-0506810 | |||||

Exact Name of Registrant as Specified in its Charter

|

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

||||||

|---|---|---|---|---|---|---|---|---|

Clinical Partners Management Company, LLC |

Subsidiary Guarantor | Texas | 26-229984 | |||||

Desert Valley Medical Transport, Inc. |

Subsidiary Guarantor | California | 33-0753384 | |||||

EHR Management Co. |

Subsidiary Guarantor | Delaware | 20-3940407 | |||||

EmCare Anesthesia Providers, Inc. |

Subsidiary Guarantor | Delaware | 27-1937828 | |||||

EmCare HoldCo, Inc. |

Subsidiary Guarantor | Delaware | 20-2076495 | |||||

EmCare Holdings, Inc. |

Subsidiary Guarantor | Delaware | 13-3645287 | |||||

EmCare of California, Inc. |

Subsidiary Guarantor | California | 94-2246075 | |||||

EmCare Physician Providers, Inc. |

Subsidiary Guarantor | Missouri | 43-0972570 | |||||

EmCare Physician Services, Inc. |

Subsidiary Guarantor | Delaware | 51-0345538 | |||||

EmCare, Inc. |

Subsidiary Guarantor | Delaware | 75-1732351 | |||||

Emergency Medical Services LP Corporation |

Subsidiary Guarantor | Delaware | 20-2076535 | |||||

Emergency Medicine Education Systems, Inc. |

Subsidiary Guarantor | Texas | 75-2706238 | |||||

EMS Management LLC |

Subsidiary Guarantor | Delaware | 20-2076564 | |||||

EMS Offshore Medical Services, LLC |

Subsidiary Guarantor | Delaware | 26-4733141 | |||||

EverRad, LLC |

Subsidiary Guarantor | Florida | 26-0559257 | |||||

Five Counties Ambulance Service, Inc. |

Subsidiary Guarantor | New York | 11-2127997 | |||||

Florida Emergency Partners, Inc. |

Subsidiary Guarantor | Texas | 59-3383583 | |||||

Fountain Ambulance Service, Inc. |

Subsidiary Guarantor | Alabama | 63-1058995 | |||||

Gold Coast Ambulance Service |

Subsidiary Guarantor | California | 95-2947514 | |||||

Hank's Acquisition Corp. |

Subsidiary Guarantor | Alabama | 33-0569883 | |||||

Healthcare Administrative Services, Inc. |

Subsidiary Guarantor | Delaware | 43-1787964 | |||||

Hemet Valley Ambulance Service, Inc. |

Subsidiary Guarantor | California | 95-2841215 | |||||

Herren Enterprises, Inc. |

Subsidiary Guarantor | California | 95-3327978 | |||||

Holiday Acquisition Company, Inc. |

Subsidiary Guarantor | Colorado | 45-1289504 | |||||

International Life Support, Inc. |

Subsidiary Guarantor | Hawaii | 99-0114256 | |||||

Kutz Ambulance Service, Inc. |

Subsidiary Guarantor | Wisconsin | 39-0827456 | |||||

LifeCare Ambulance Service, Inc. |

Subsidiary Guarantor | Illinois | 36-3799039 | |||||

LifeFleet Southeast, Inc. |

Subsidiary Guarantor | Florida | 59-1395439 | |||||

MedAssociates, LLC |

Subsidiary Guarantor | Texas | 20-5044320 | |||||

Medevac Medical Response, Inc. |

Subsidiary Guarantor | Missouri | 43-1097068 | |||||

Medevac MidAmerica, Inc. |

Subsidiary Guarantor | Missouri | 95-3743718 | |||||

Medic One Ambulance Services, Inc. |

Subsidiary Guarantor | Delaware | 72-1276358 | |||||

Medic One of Cobb, Inc. |

Subsidiary Guarantor | Georgia | 58-1944370 | |||||

Medi-Car Ambulance Service, Inc. |

Subsidiary Guarantor | Florida | 59-1892079 | |||||

Medi-Car Systems, Inc. |

Subsidiary Guarantor | Florida | 59-1996927 | |||||

MedicWest Ambulance, Inc. |

Subsidiary Guarantor | Nevada | 88-0421120 | |||||

MedicWest Holdings, Inc. |

Subsidiary Guarantor | Delaware | 88-0420343 | |||||

MedLife Emergency Medical Service, Inc. |

Subsidiary Guarantor | Alabama | 63-1154514 | |||||

Mercy Ambulance of Evansville, Inc. |

Subsidiary Guarantor | Indiana | 35-1494500 | |||||

Mercy Life Care |

Subsidiary Guarantor | California | 94-2619315 | |||||

Mercy, Inc. |

Subsidiary Guarantor | Nevada | 88-0125707 | |||||

Metro Ambulance Service (Rural), Inc. |

Subsidiary Guarantor | Delaware | 72-1275309 | |||||

Metro Ambulance Service, Inc. |

Subsidiary Guarantor | Delaware | 72-1275308 | |||||

Metro Ambulance Services, Inc. |

Subsidiary Guarantor | Georgia | 58-1036407 | |||||

Metropolitan Ambulance Service |

Subsidiary Guarantor | California | 94-1701773 | |||||

Midwest Ambulance Management Company |

Subsidiary Guarantor | Delaware | 36-3973137 | |||||

Mission Care of Illinois, LLC |

Subsidiary Guarantor | Illinois | 90-0182287 | |||||

Mission Care of Missouri, LLC |

Subsidiary Guarantor | Missouri | 72-1583669 | |||||

Mission Care Services, LLC |

Subsidiary Guarantor | Missouri | 42-1644377 | |||||

Mobile Medic Ambulance Service, Inc. |

Subsidiary Guarantor | Delaware | 04-3171173 | |||||

MSO Newco, LLC |

Subsidiary Guarantor | Delaware | 27-1285928 | |||||

Exact Name of Registrant as Specified in its Charter

|

State or Other Jurisdiction of Incorporation or Organization |

I.R.S. Employer Identification Number |

||||||

|---|---|---|---|---|---|---|---|---|

Nevada Red Rock Ambulance, Inc. |

Subsidiary Guarantor | Delaware | 20-8121800 | |||||

Nevada Red Rock Holdings, Inc. |

Subsidiary Guarantor | Delaware | 20-8846123 | |||||

Northwood Anesthesia Associates, L.L.C. |

Subsidiary Guarantor | Florida | 65-0909229 | |||||

Paramed, Inc. |

Subsidiary Guarantor | Michigan | 38-2142110 | |||||

Park Ambulance Service Inc. |

Subsidiary Guarantor | New York | 13-2508653 | |||||

Physician Account Management, Inc. |

Subsidiary Guarantor | Florida | 03-0373713 | |||||

Physicians & Surgeons Ambulance Service, Inc. |

Subsidiary Guarantor | Ohio | 34-0859642 | |||||

Pinnacle Consultants Mid-Atlantic, L.L.C. |

Subsidiary Guarantor | Delaware | 26-2201105 | |||||

ProvidaCare, L.L.C. |

Subsidiary Guarantor | Texas | 75-2643961 | |||||

Provider Account Management, Inc. |

Subsidiary Guarantor | Delaware | 75-2964700 | |||||

Puckett Ambulance Service, Inc. |

Subsidiary Guarantor | Georgia | 58-1572034 | |||||

Radiology Staffing Solutions, Inc. |

Subsidiary Guarantor | Delaware | 26-2138636 | |||||

Radstaffing Management Solutions, Inc. |

Subsidiary Guarantor | Delaware | 26-2137767 | |||||

Randle Eastern Ambulance Service, Inc. |

Subsidiary Guarantor | Florida | 59-0737717 | |||||

Regional Emergency Services, L.P. |

Subsidiary Guarantor | Delaware | 59-3383586 | |||||

Reimbursement Technologies, Inc. |

Subsidiary Guarantor | Pennsylvania | 23-2634599 | |||||

River Medical Incorporated |

Subsidiary Guarantor | Arizona | 86-0506675 | |||||

Seawall Acquisition, LLC |

Subsidiary Guarantor | Delaware | 27-2494878 | |||||

Seminole County Ambulance, Inc. |

Subsidiary Guarantor | Delaware | 33-0506811 | |||||

Springs Ambulance Service, Inc. |

Subsidiary Guarantor | California | 95-2426613 | |||||

STAT Healthcare, Inc. |

Subsidiary Guarantor | Delaware | 76-0496236 | |||||

Sun Devil Acquisition LLC |

Subsidiary Guarantor | Delaware | 27-2929691 | |||||

Sunrise Handicap Transport Corp. |

Subsidiary Guarantor | New York | 11-2569671 | |||||

TEK Ambulance, Inc. |

Subsidiary Guarantor | Illinois | 36-2915559 | |||||

Templeton Readings, LLC |

Subsidiary Guarantor | Maryland | 04-3731678 | |||||

Tidewater Ambulance Service, Inc. |

Subsidiary Guarantor | Virginia | 54-1244307 | |||||

Troup County Emergency Medical Services, Inc. |

Subsidiary Guarantor | Georgia | 58-1313603 | |||||

V.I.P. Professional Services, Inc. |

Subsidiary Guarantor | California | 95-2539749 | |||||

- *

- The address including zip code and telephone number including area code for each additional registrant is 6200 S. Syracuse Way, Suite 200, Greenwood Village, Colorado 80111, (303) 495-1200.

The information in this prospectus is not complete and may be changed. We may not complete this exchange offer or issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 26, 2011

PROSPECTUS

Emergency Medical Services Corporation

Offer to Exchange

$950,000,0000 Outstanding 8.125% Senior Notes due 2019

for

$950,000,0000 Registered 8.125% Senior Notes due 2019

Emergency Medical Services Corporation, is offering to exchange $950,000,000 aggregate principal amount of outstanding 8.125% Senior Notes due 2019 (the "Old Notes"), for a like principal amount of registered 8.125% Senior Notes due 2019 (the "New Notes").

The terms of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered under the Securities Act of 1933, as amended (the "Securities Act"), and will not contain restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP number from the Old Notes and will not entitle their holders to registration rights.

No public market currently exists for the Old Notes or the New Notes.

The exchange offer will expire at p.m., New York City time, on , 2011 (the "Expiration Date") unless we extend the Expiration Date. You should read the section called "The Exchange Offer" for further information on how to exchange your Old Notes for New Notes.

See "Risk Factors" beginning on page 21 for a discussion of risk factors that you should consider prior to tendering your Old Notes in the exchange offer and risk factors related to ownership of the Notes.

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of New Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of up to 90 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus is accurate as of any date other than the date of this prospectus. Also, you should not assume that there has been no change in the affairs of Emergency Medical Services Corporation and its subsidiaries since the date of this prospectus.

i

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our company, the New Notes being issued in the exchange offer and our consolidated financial statements and the related notes included in this prospectus. In this prospectus, unless the context requires otherwise, (i) references to "EMSC" and the "Company" mean Emergency Medical Services Corporation; (ii) references to "we," "us" and "our" mean EMSC and its consolidated subsidiaries; (iii) references to "Parent" mean CDRT Acquisition Corporation; (iv) references to "Merger Sub" mean CDRT Merger Sub, Inc.; and (v) references to "Holding" mean CDRT Holding Corporation. Financial information identified in this prospectus as "pro forma" or "on a pro forma basis" gives effect to the Transactions (as defined below).

Our Company

We are a leading provider of outsourced facility-based physician services and medical transportation services in the United States. We operate our business and market our services under the EmCare and AMR brands, which represent EmCare Holdings Inc. ("EmCare") and American Medical Response, Inc. ("AMR"). EmCare, with more than 35 years of operating history, is a leading provider of physician services in the United States, based on number of contracts with hospitals and affiliated physician groups. Through EmCare, we provide outsourced facility-based physician services for emergency departments, as well as anesthesiology, hospitalist/inpatient, radiology and teleradiology programs. AMR, with more than 50 years of operating history, is a leading provider of medical transportation services to communities, payors and hospitals in the United States based on net revenue and number of transports.

Approximately 86% of our net revenue for the year ended December 31, 2010 was generated under exclusive contracts. We had contract retention rates of 88% at EmCare and 99% at AMR as of December 31, 2010. During 2010, we provided services in approximately 14 million patient encounters in more than 2,000 communities nationwide. For the year ended December 31, 2010, we generated net revenue of approximately $2.9 billion, of which EmCare and AMR represented 52% and 48%, respectively. Our Adjusted EBITDA for the year ended December 31, 2010 was $322.1 million, an increase of $35.1 million, or 12.2%, as compared with 2009. See "Summary Historical Financial Data" for a discussion of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income.

1

We offer a broad range of essential emergency and non-emergency medical services through our two business segments:

| |

EmCare | AMR | ||

|---|---|---|---|---|

Core Services: |

Facility-based physician services • Emergency department staffing and related management services • Anesthesiology, hospitalist/inpatient services, radiology and teleradiology |

Pre- and post-hospital medical transportation • Emergency ("911") and non-emergency ambulance transports • Managed transportation services • Fixed-wing air ambulance services • Disaster response |

||

Customers: |

Hospitals |

Communities |

||

National Market Position: |

8% share of emergency department services market |

7% share of total ambulance market |

||

Number of Contracts: |

569 facility contracts |

168 "911" contracts |

||

Volume for the year ended December 31, 2010: |

Approximately 11.0 million patient encounters |

Approximately 3.2 million patient transports |

EmCare

EmCare is a leading provider of outsourced facility-based physician services to healthcare facilities in the United States, based on number of contracts with hospitals and affiliated physician groups. EmCare has 569 contracts with hospitals and independent physician groups to provide emergency department, anesthesiology, hospitalist/inpatient, radiology and teleradiology staffing, and other management services. We have added 318 net new contracts since 2001. During 2010, EmCare had approximately 11.0 million patient encounters across 40 states and the District of Columbia. As of December 31, 2010, EmCare had an 8% share of the total emergency department ("ED") services market and a 12% share of the outsourced ED services market, the largest share among outsourced providers based on number of ED contracts. EmCare's share of the combined markets for anesthesiology, hospitalist and radiology services was approximately 2% as of such date.

EmCare focuses on providing an environment where physicians can practice quality medicine, while improving operational efficiencies and patient satisfaction and mitigating risk at its customers'

2

hospitals and facilities. We recruit and hire or subcontract with physicians and other healthcare professionals, who then provide services to patients in the facilities with whom we contract. EmCare bills and collects from each patient or the patient's insurance provider for the medical services performed. We also have practice support agreements with independent physician groups and hospitals pursuant to which we provide management services such as billing and collection, recruiting, risk management and certain other administrative services.

American Medical Response

AMR has developed the largest network of ambulance services in the United States. AMR and our predecessor companies have been providing services to some communities for more than 50 years. As of December 31, 2010, we had a 7% share of the total ambulance services market and a 16% share of the outsourced ambulance market, the largest share among outsourced providers based on number of transports and net revenue. During 2010, AMR treated and transported approximately 3.2 million patients in 38 states and the District of Columbia utilizing nearly 4,300 vehicles that operated out of more than 200 sites. AMR has more than 3,500 contracts with communities, government agencies, healthcare providers and insurers to provide ambulance transport services. AMR's broad geographic footprint enables us to contract on a national and regional basis with insurance companies and healthcare facilities.

During 2010, approximately 58% of AMR's net revenue was generated from emergency 911 ambulance services. These services include treating and stabilizing patients, transporting the patient to a hospital or other healthcare facility and providing attendant medical care en-route. Non-emergency ambulance services, including critical care transfer, wheelchair transports and other interfacility transports, accounted for 28% of AMR's net revenue for the same period. The remaining balance of net revenue for 2010 was generated from managed transportation services, fixed-wing air ambulance services, and the provision of training, dispatch and other services to communities and public safety agencies.

AMR also has a national contract with the Federal Emergency Management Agency ("FEMA") to provide ambulance, para-transit and rotary and fixed-wing air ambulance transportation services to supplement federal and military responses to disasters, acts of terrorism and other public health emergencies in the full 48 contiguous states.

Overview of Our Industry

We operate in the outsourced facility-based physician services and medical transportation markets, two large and growing segments of the healthcare market. Emergency medical services are a core component of the range of care a patient could potentially receive in the pre-hospital and hospital-based settings. By law, most communities are required to provide emergency ambulance services and most hospitals are required to provide emergency department services. We believe that the following key factors will continue to drive growth in all our medical services markets:

- •

- Increase in outsourcing. Communities, government agencies

and healthcare facilities are under significant pressure both to improve the quality and to reduce the cost of care. The outsourcing of certain medical services has become a preferred means to

alleviate these pressures.

- •

- Favorable demographics. The growth and aging of the

population will be a significant demand driver for healthcare services, and we believe it will result in an increase in ambulance transports, emergency department visits and demand for our other

services.

- •

- Shortage of primary care physicians. We believe that a portion of the historical and expected growth of emergency department visits is driven by the shortage of primary care physicians in

3

the United States, which causes many patients to utilize the ED as their primary source for healthcare.

For further information on the facility-based physician services and medical transportation markets in which we compete, please see "Business—Description of our Business—Industry Overview."

Our Competitive Strengths

We believe the following competitive strengths position our company to capitalize on the favorable trends occurring within the healthcare industry and the emergency medical services markets.

Leading Player in Two Large, Growing and Highly Fragmented Markets. We are a leading provider of outsourced facility-based physician services and medical transportation services in the United States. We have significant scale with approximately 14 million patient encounters annually in over 2,000 communities across the United States. The markets in which we compete are highly fragmented with minimal presence from national providers, which we believe results in significant opportunities for continued market share gains as well as strategic "tuck-in" acquisitions. We believe our track record of consistently meeting or exceeding our customers' service expectations across both of our businesses affords us the opportunity to compete effectively in the bidding process for new contracts, as well as to continue to grow complementary service offerings.

Strong, Stable Underlying Industry Volume Trends. We operate within an attractive segment of healthcare services that is supported by strong and stable underlying market volume trends. Based on available data, hospital ED visits have grown at a compound annual growth rate ("CAGR") of 2.5% from 1999 to 2009, and ambulance transports have increased at a CAGR of 3.9% from 2003 to 2009, with no year-over-year declines in market volumes over these periods. These stable, historical market volumes are primarily supported by the critical non-discretionary nature of emergency medical services, as well as aging demographics and a shortage of primary care physicians in the United States.

Broad Spread of Risk with Significant Customer, Geographic and Contract Diversification. Because of our diverse revenue base, we are not reliant on any single facility, community or market. As of December 31, 2010, EmCare had 569 individual facility contracts, with the top 10 ED contracts representing only 9% of EmCare net revenue, and no customer (including all facility contracts under a single hospital system) comprised more than 10% of total net revenue. As of December 31, 2010, AMR had 168 exclusive "911" emergency services contracts and 3,375 non-emergency transport arrangements. AMR's top ten "911" contracts accounted for approximately 24% of AMR net revenue in 2010. We believe that our other services, including anesthesia, hospitalist, radiology, managed transportation and fixed-wing air transport services, also exhibit a broad spread of risk through a diversified customer base and geographic footprint.

Attractive Business Model with Stable Cash Flows and Proven Ability to De-Lever our Balance Sheet. We believe our operating model and the contractual nature of our businesses drive a meaningful amount of recurring revenue which, combined with our relatively low capital expenditure and working capital requirements, lead to strong and predictable cash flows. During 2010, approximately 86% of our net revenue was generated under exclusive contracts. We believe these exclusive contracts and the critical care nature of our services have historically resulted in long-term, stable customer relationships. EmCare and AMR have maintained relationships with their ten largest customers for 15 and 35 years, respectively. We believe our ability to consistently deliver high levels of customer service and continue to improve our customer's key metrics are illustrated by our high contract retention rates of 88% in EmCare and 99% in AMR as of December 31, 2010. Our strong earnings growth and free cash flow generated by our stable customer base have enabled us to reduce our total leverage ratio meaningfully over the last five years.

4

Favorable Pricing Environment with Unique Reimbursement Characteristics. Pricing and reimbursement for EmCare and AMR services have historically been favorable. We believe this trend will remain stable into the future. At EmCare, commercial payor leverage is reduced due to the emergency nature of the services, and physician reimbursement under Medicare has historically been stable. In addition, in many of our hospital contracts, we have the ability to obtain or increase subsidies to offset any reimbursement or payor mix changes. At AMR, communities and municipalities set emergency allowable rates for commercial payors and, with limited exception, do not pay for services out of the tax base. Further, we expect future Medicare reimbursement of ambulance services to be stable given that the phase-in of the Medicare national ambulance fee schedule was completed in 2010, and reimbursement for ambulance services represents a relatively small proportion of total Medicare spending. In addition, at both EmCare and AMR we have visibility into payor mix prior to entering into new contracts, and our payor mix has been stable over time, which allows us to more effectively manage exposure to each payor category.

Opportunities for Continued Cost Reduction and Productivity Improvement. We have a strong track record of profitable growth exhibited by a 16.0% CAGR in our Adjusted EBITDA and our expansion of Adjusted EBITDA margins by approximately 200 basis points from 2006 to 2010. Our consistent earnings growth and margin expansion over the last several years have been driven by our management's continuous focus on cost reductions and productivity improvements as well as benefits realized from information technology investments. We believe there are additional opportunities to continue to drive margin improvements in the future through targeted initiatives and additional technology enhancements.

Increased Outsourcing of Health Services. We believe market conditions are conducive to continued outsourcing of health services. In the EmCare segment, hospitals are increasingly outsourcing physician services due to increased cost pressures, the need to enhance operating efficiency, difficulties in physician recruiting and retention, the future possibility of pay-for-performance models and the desire to improve quality of care while reducing patient care cost. In the AMR segment, communities are increasingly outsourcing emergency medical transportation services due to cost pressures and budget constraints, the need for quality enhancement and improved clinical outcomes, the lack of risk management expertise and the pressure to meet peak demands.

Strong and Experienced Management Team with Demonstrated Track Record of Performance. We have a strong and deep management team with a historical track record of success. Many of our officers have decades of industry experience and significant tenure at EMSC. We are led by William Sanger, CEO, who has 35 years of industry experience, Randy Owen, EVP and CFO, who has 29 years of industry experience, Todd Zimmerman, EmCare President and EVP, who has 20 years of industry experience, and Mark Bruning, AMR President, who has 28 years of industry experience. Our current management team has led us through a series of initiatives focused on driving organic revenue growth and productivity and efficiency gains as well as executing several strategic acquisitions. Together these initiatives have resulted in net revenue and Adjusted EBITDA CAGRs of 10.3% and 16.0%, respectively, over the last four years.

Our Strategy

Our objective is to continue to be a leader in outsourced facility-based physician services and medical transportation services in the United States as we pursue the following strategies and initiatives:

Achieve Organic Growth through Market Share Gains and Continued Outsourcing. We believe we have a unique competency in the treatment, management and billing of episodic and unscheduled patient care. We believe our long operating history, significant scope and scale, and leading market positions provide us with new and expanded opportunities to grow our customer base through market

5

share gains from local and regional competitors as well as through continued outsourcing of physician and medical transportation services by hospitals and communities.

Grow Complementary Service Lines by Cross-Selling to Existing Customers and Adding New Customers. We believe our track record of maintaining successful long-term relationships with customers, combined with the expanded breadth of our service offerings, creates opportunities for us to increase revenue from our existing customer base and add new customers seeking services we previously did not provide. We have entered complementary service lines at both EmCare and AMR that are designed to leverage our core competencies.

Supplement Organic Growth with Opportunistic Acquisitions. The outsourced facility-based physician services and medical transportation services industries are highly fragmented, with only a few large national providers. We believe we have a successful track record of making strategic acquisitions at attractive valuations designed to enhance our market position and improve our value proposition for customers.

Enhance Operational Efficiencies and Productivity to Drive Continued Margin Improvement. We believe there are significant opportunities to build upon our success in improving our productivity and profitability at both EmCare and AMR. At EmCare, we continue to focus on initiatives to improve physician productivity, including more efficient scheduling around peak and off-peak hours, use of mid-level providers as well as improving and realigning physician compensation programs to help accelerate productivity gains. At AMR, we expect to benefit from additional investments in technology, such as the continued roll-out of ePCR (electronic patient care records) to enhance data collection accuracy and billing system automation to reduce our billing costs and days sales outstanding ("DSO").

We describe additional elements of our strategy in "Business—Business Strategy."

Emergency Medical Services Corporation is incorporated under the laws of the state of Delaware. Our corporate headquarters are located at 6200 S. Syracuse Way, Suite 200, Greenwood Village, CO 80111. Our telephone number is (303) 495-1200.

The Transactions

On February 13, 2011, EMSC entered into an Agreement and Plan of Merger (the "Merger Agreement") with Parent and Merger Sub, formerly a wholly owned subsidiary of Parent. Pursuant to the Merger Agreement, Merger Sub merged with and into EMSC, with EMSC as the surviving corporation and a wholly owned subsidiary of Parent (the "Merger"). Immediately following the Merger, all of the outstanding common stock of Parent was owned by Holding, which is owned by Clayton, Dubilier & Rice Fund VIII, L.P. ("CD&R Fund VIII"), CD&R Friends & Family Fund VIII, L.P. ("CD&R F&F Fund"), CD&R Advisor Fund VIII Co-Investor, L.P. ("CD&R Advisor Co-Investor") and CD&R EMS Co-Investor, L.P. (together with CD&R Fund VIII, CD&R F&F Fund and CD&R Advisor Co-Investor, the "CD&R Affiliates").

6

On May 25, 2011, the following transactions occurred in connection with the Merger (collectively, the "Transactions"):

- •

- LP units of the entity formerly known as Emergency Medical Services L.P., a wholly owned subsidiary of EMSC, were

exchanged for EMSC common stock;

- •

- outstanding shares of EMSC common stock were converted into the right to receive $64.00 per share in cash,

without interest and less any applicable withholding taxes;

- •

- options to purchase shares of EMSC common stock (other than options that were rolled over by certain members of management

as described below), vested or unvested, were cancelled and each option was converted into the right to receive a cash payment equal to the excess (if any) of $64.00 per share over the exercise price

per share of the option times the number of shares subject to the option, without interest and less any applicable withholding taxes;

- •

- restricted shares, vested or unvested, were fully vested at the effective time and canceled and extinguished and each

restricted share was converted into the right to receive $64.00 per share in cash, without interest and less any applicable withholding taxes;

- •

- restricted stock units, vested or unvested, were cancelled and extinguished, and each restricted stock unit was converted

into the right to receive a cash payment equal to $64.00 per share times the number of shares of EMSC common stock subject to such restricted stock units, without interest and less any applicable

withholding taxes;

- •

- the CD&R Affiliates invested $887.1 million in the common stock of Holding, the proceeds of which were contributed

to Parent (the "CD&R Equity Investment");

- •

- certain members of our management rolled over existing options to purchase EMSC common stock with an aggregate value of

$28.3 million, based on the Merger consideration price, into options to purchase common stock of Holding (the "Management Rollover Investment" and, together with the CD&R Equity Investment, the

"Equity Contributions");

- •

- Merger Sub entered into new senior secured credit facilities, comprising (i) a seven-year senior

secured term loan facility of up to $1,440 million (as further described in "Description of Other Indebtedness—Term Loan Facility," the "Term Loan Facility") and (ii) a

five-year senior secured asset-based loan facility of up to $350 million (as further described in "Description of Other Indebtedness—ABL Facility," the "ABL Facility"

and, together with the Term Loan Facility, the "Senior Secured Credit Facilities");

- •

- Merger Sub issued the Old Notes;

- •

- the net proceeds of the Equity Contributions, the Old Notes and the borrowings under the Term Loan Facility were used to

fund the cash consideration payable to our former stockholders and other equity holders, repay outstanding borrowings under our prior senior secured credit facility and pay related transaction fees

and expenses;

- •

- Merger Sub merged with and into EMSC, with EMSC as the surviving corporation; and

- •

- upon consummation of the Merger, the rights and obligations of Merger Sub under the Old Notes and the Indenture, dated as of May 25, 2011, governing the Notes (the "Indenture") and under the Senior Secured Credit Facilities were assumed by the Company.

Our Sponsor

Founded in 1978, Clayton, Dubilier & Rice, LLC is a private equity firm with an integrated operational and financial approach to investing. CD&R has 40 investment professionals with offices in New York and London. Over the firm's 33-year history, CD&R has invested over $12 billion in capital

7

in 51 businesses and is currently investing out of its $5 billion eighth fund. CD&R has a disciplined and clearly defined investment strategy with a special focus on multi-location services and distribution businesses.

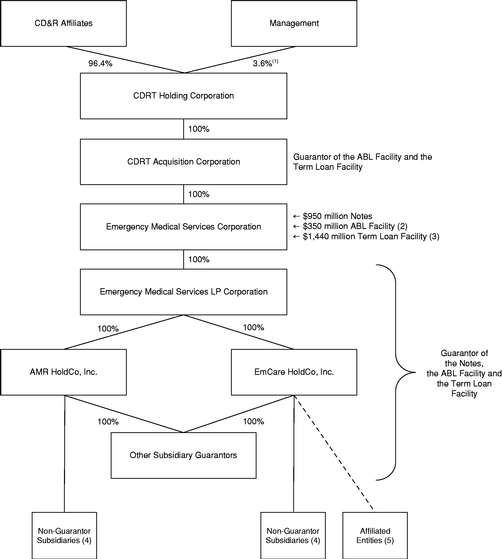

Ownership and Organizational Structure

The following chart illustrates our ownership and organizational structure:

- (1)

- Represents

options to purchase Holding common stock held by EMSC management as well as shares of Holding common stock to be issued to EMSC management in

connection with a management equity offering completed in September 2011. See "Security Ownership of Certain Beneficial Owners and Management."

- (2)

- In connection with the Transactions, we entered into the ABL Facility, which provides for a five-year senior secured revolving credit facility of up to $350 million, subject to a borrowing base of approximately $356 million and approximately $47 million of letters of credit issued under the ABL Facility as of June 30, 2011. As of June 30, 2011, we were able to borrow approximately $303 million under the ABL Facility. See "Description of Other Indebtedness—ABL Facility." We have not drawn on the ABL Facility.

8

- (3)

- In

connection with the Transactions, we entered into the Term Loan Facility which provides for a seven-year senior secured term loan facility of

up to $1,440 million. See "Description of Other Indebtedness—Term Loan Facility."

- (4)

- The

Old Notes are not guaranteed by any of our foreign subsidiaries or any of our subsidiaries subject to regulation as an insurance company, including our

captive insurance subsidiary. The Old Notes are structurally subordinated to the indebtedness and other liabilities of our non-guarantor subsidiaries, including their insurance

liabilities. As of June 30, 2011, the non-guarantor subsidiaries had no indebtedness and approximately $155.9 million of primarily insurance-related liabilities. Our

non-guarantor subsidiaries generated approximately $2.1 million of our net revenue for the year ended December 31, 2010 and held approximately $162.0 million of our

assets as of June 30, 2011.

- (5)

- Due to the corporate practice of medicine restrictions of certain states, we maintain long-term management contracts with affiliated physician groups, which employ or contract with physicians to provide physician services. These entities are not subsidiaries of our company but their operations are typically consolidated in accordance with generally accepted accounting principles. See "Business—EmCare—Contracts—Affiliated Physician Group Contracts."

Market and Industry Data

The market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry publications used in this prospectus were prepared on our behalf and none of the sources cited in this prospectus consented to the inclusion of any data from its reports, nor have we sought their consent.

Trademarks and Service Marks

EMSC®, AMR® and EmCare® are three of our brand names, trademarks or service marks. Information contained in this prospectus may also refer to brand names, trademarks or service marks of other companies. All such brand names, trademarks or service marks are the property of their respective owners.

9

Summary of the Terms of the Exchange Offer

The Notes |

On May 25, 2011 (the "Issuance Date"), Merger Sub issued $950 million aggregate principal amount of 8.125% Senior Notes due 2019 pursuant to exemptions from the registration requirements of the Securities Act. On such date, upon the consummation of the Merger of Merger Sub with and into the Company, the Company assumed all the rights and obligations under the Old Notes and the Indenture. The initial purchasers for the Old Notes were Barclays Capital Inc., Deutsche Bank Securities Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. Incorporated, RBC Capital Markets, LLC, UBS Securities LLC, Citigroup Global Markets Inc., Natixis Securities North America Inc. (the "Initial Purchasers"). When we use the term "Old Notes" in this prospectus, we mean the 8.125% Senior Notes due 2019 that were privately placed with the Initial Purchasers on May 25, 2011, and were not registered with the SEC. | |

|

When we use the term "New Notes" in this prospectus, we mean the 8.125% Senior Notes due 2019 registered with the SEC and offered hereby in exchange for the Old Notes. When we use the term "Notes" in this prospectus, the related discussion applies to both the Old Notes and the New Notes. |

|

|

The terms of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered under the Securities Act and will not be subject to restrictions on transfer, will bear a different CUSIP and ISIN number than the Old Notes, will not entitle their holders to registration rights and will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the Old Notes. |

|

|

The CUSIP numbers for the Old Notes are 12513P AA7 (Rule 144A) and U1251T AA5 (Regulation S). The ISIN numbers for the Old Notes are US12513PAA75 (Rule 144A), and USU1251TAA52 (Regulation S). The CUSIP number for the New Notes is and the ISIN number for the New Notes is . |

|

The Exchange Offer |

You may exchange Old Notes for a like principal amount of New Notes. The consummation of the exchange offer is not conditioned upon any minimum or maximum aggregate principal amount of Old Notes being tendered for exchange. |

|

Resale of New Notes |

We believe the New Notes that will be issued in the exchange offer may be resold by most investors without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to certain conditions. You should read the discussion under the heading "The Exchange Offer" for further information regarding the exchange offer and resale of the New Notes. |

10

Registration Rights Agreement |

We have undertaken the exchange offer pursuant to the terms of the Exchange and Registration Rights Agreement we entered into with the Initial Purchasers on May 25, 2011 (the "Registration Rights Agreement"). Pursuant to the Registration Rights Agreement, we agreed to use our commercially reasonable efforts to consummate an exchange offer for the Old Notes pursuant to an effective registration statement or to cause resales of the Old Notes to be registered. The Registration Rights Agreement provides that if a Registration Default occurs, the interest rate on the Registrable Securities will be increased by (i) 0.25% per annum for the first 90-day period beginning on the day immediately following such Registration Default and (ii) an additional 0.25% per annum with respect to each subsequent 90-day period, in each case until and including the date such Registration Default ends, up to a maximum increase of 0.50% per annum. See "Exchange Offer; Registration Rights." |

|

Consequences of Failure to Exchange the Old Notes |

You will continue to hold Old Notes that remain subject to their existing transfer restrictions if: |

|

|

• you do not tender your Old Notes; or |

|

|

• you tender your Old Notes and they are not accepted for exchange. |

|

|

We will have no obligation to register the Old Notes after we consummate the exchange offer. See "The Exchange Offer—Terms of the Exchange Offer; Period for Tendering Old Notes." |

|

Expiration Date |

The exchange offer will expire at p.m., New York City time, on , 2011 (the "Expiration Date"), unless we extend it, in which case Expiration Date means the latest date and time to which the exchange offer is extended. |

|

Interest on the New Notes |

The New Notes will accrue interest from the most recent date to which interest has been paid or provided for on the Old Notes or, if no interest has been paid on the Old Notes, from the Issuance Date. |

11

Conditions to the Exchange Offer |

The exchange offer is subject to several customary conditions. We will not be required to accept for exchange, or to issue New Notes in exchange for, any Old Notes, and we may terminate or amend the exchange offer if we determine in our reasonable judgment at any time before the Expiration Date that the exchange offer would violate applicable law or any applicable interpretation of the staff of the SEC. The foregoing conditions are for our sole benefit and may be waived by us at any time. In addition, we will not accept for exchange any Old Notes tendered, and no New Notes will be issued in exchange for any such Old Notes, if at any time any stop order is threatened or in effect with respect to: |

|

|

• the registration statement of which this prospectus constitutes a part; or |

|

|

• the qualification of the Indenture under the Trust Indenture Act of 1939, as amended (the "Trust Indenture Act"). |

|

|

See "The Exchange Offer—Conditions to the Exchange Offer." We reserve the right to terminate or amend the exchange offer at any time prior to the Expiration Date upon the occurrence of any of the foregoing events. |

|

Procedures for Tendering Old Notes |

If you wish to accept the exchange offer, you must tender your Old Notes and do the following on or prior to the Expiration Date, unless you follow the procedures described under "The Exchange Offer—Guaranteed Delivery Procedures." |

|

|

• if Old Notes are tendered in accordance with the book-entry procedures described under "The Exchange Offer—Book-Entry Transfer," transmit an Agent's Message to the Exchange Agent through the Automated Tender Offer Program ("ATOP") of The Depository Trust Company ("DTC"), or |

|

|

• transmit a properly completed and duly executed letter of transmittal, or a facsimile copy thereof, to the Exchange Agent, including all other documents required by the letter of transmittal. |

|

|

See "The Exchange Offer—Procedures for Tendering Old Notes." |

|

Guaranteed Delivery Procedures |

If you wish to tender your Old Notes, but cannot properly do so prior to the Expiration Date, you may tender your Old Notes according to the guaranteed delivery procedures set forth under "The Exchange Offer—Guaranteed Delivery Procedures." |

12

Withdrawal Rights |

Tenders of Old Notes may be withdrawn at any time prior to p.m., New York City time, on the Expiration Date. To withdraw a tender of Old Notes, a notice of withdrawal must be actually received by the Exchange Agent at its address set forth in "The Exchange Offer—Exchange Agent" prior to p.m., New York City time, on the Expiration Date. See "The Exchange Offer—Withdrawal Rights." |

|

Acceptance of Old Notes and Delivery of New Notes |

Except in some circumstances, any and all Old Notes that are validly tendered in the exchange offer prior to p.m., New York City time, on the Expiration Date will be accepted for exchange. The New Notes issued pursuant to the exchange offer will be delivered promptly after the Expiration Date. See "The Exchange Offer—Acceptance of Old Notes for Exchange; Delivery of New Notes." |

|

Material United States Federal Income Tax Considerations |

We believe that the exchange of an Old Note for a New Note pursuant to the exchange offer will not be treated as a sale or exchange for U.S. federal income tax purposes. See "Material United States Federal Income Tax Considerations." |

|

Exchange Agent |

Wilmington Trust, National Association is serving as the Exchange Agent (the "Exchange Agent"). |

13

Summary of the Terms of the Notes

The terms of the New Notes offered in the exchange offer are identical in all material respects to the Old Notes, except that the New Notes:

- •

- are registered under the Securities Act and therefore will not be subject to restrictions on transfer;

- •

- will not be subject to provisions relating to additional interest;

- •

- will bear a different CUSIP and ISIN number;

- •

- will not entitle their holders to registration rights; and

- •

- will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the Old Notes.

The following summary contains basic information about the New Notes and the guarantees thereof and is not intended to be complete. For a more complete understanding of the New Notes and the guarantees, please refer to the section entitled "Description of Notes" in this prospectus.

Issuer |

Emergency Medical Services Corporation | |

Notes offered |

$950 million aggregate principal amount of 8.125% Senior Notes due 2019. |

|

Maturity |

The Notes will mature on June 1, 2019 |

|

Interest payment dates |

June 1 and December 1, commencing on December 1, 2011. |

|

Ranking |

The Notes are our unsecured senior indebtedness and rank: |

|

|

• equal in right of payment with all of our existing and future senior indebtedness; |

|

|

• senior in right of payment to all of our existing and future subordinated obligations; |

|

|

• effectively subordinated to all of our secured indebtedness, including indebtedness under our new $1,440 million senior secured term loan facility and our new senior secured asset-based loan facility of up to $350 million, to the extent of the value of the assets securing such indebtedness; and |

|

|

• structurally subordinated to all existing and future indebtedness and other liabilities of our non-guarantor subsidiaries, including all of our foreign subsidiaries. |

|

Guarantors |

The Notes are guaranteed, on an unsecured senior basis, by each of our domestic subsidiaries that is a borrower under or that guarantees our obligations under our senior secured credit facilities. These guarantees are subject to release under specified circumstances. See "Description of Notes—Subsidiary Guarantees." The guarantee of each Guarantor will be an unsecured senior obligation of that Guarantor and ranks: |

|

|

• equal in right of payment with all existing and future senior indebtedness of that guarantor; |

14

|

• senior in right of payment with all existing and future guarantor subordinated obligations; |

|

|

• effectively subordinated to all secured indebtedness of that guarantor to the extent of the value of the assets securing such indebtedness, including any such guarantor's guarantee of indebtedness under our new $1,440 million senior secured term loan facility and our new senior secured asset-based loan facility of up to $350 million; and |

|

|

• structurally subordinated to all existing and future indebtedness and other liabilities of our non-guarantor subsidiaries, including all of our foreign subsidiaries. |

|

|

The Notes are not guaranteed by any of our foreign subsidiaries or any of our subsidiaries subject to regulation as an insurance company, including our captive insurance subsidiary. The Notes are structurally subordinated to the indebtedness and other liabilities of our non-guarantor subsidiaries, including their insurance liabilities. As of June 30, 2011, the non-guarantor subsidiaries had no indebtedness and approximately $155.9 million of primarily insurance-related liabilities. Our non-guarantor subsidiaries generated approximately $2.1 million of our net revenue for the year ended December 31, 2010 and held approximately $162.0 million of our assets as of June 30, 2011. |

|

Optional redemption |

We may redeem the Notes, in whole or in part, at any time (1) prior to June 1, 2014, at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, plus the make-whole premium described under "Description of Notes—Optional Redemption," and (2) on and after June 1, 2014, at the redemption prices described under "Description of Notes—Optional Redemption." |

|

Optional redemption after certain equity offerings |

Prior to June 1, 2014, we may redeem on one or more occasions up to 35% of the original aggregate principal amount of the Notes in an amount not exceeding the net proceeds of one or more equity offerings at a redemption price equal to 108.125% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, as described under "Description of Notes—Optional Redemption." |

|

Offer to repurchase |

If we experience a change of control, we must offer to repurchase all of the Notes (unless otherwise redeemed) at a price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. See "Description of Notes—Change of Control." |

15

|

If we sell assets under certain circumstances, we must use the proceeds to make an offer to purchase Notes at a price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, to the date of purchase. See "Description of Notes—Certain Covenants—Limitation on Sales of Assets and Subsidiary Stock." |

|

Certain covenants |

The Indenture contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

|

|

• incur more indebtedness or issue certain preferred shares; |

|

|

• pay dividends, redeem stock or make other distributions; |

|

|

• make investments; |

|

|

• create restrictions on the ability of our restricted subsidiaries to pay dividends to us or make other intercompany transfers; |

|

|

• create liens; |

|

|

• transfer or sell assets; |

|

|

• merge or consolidate; |

|

|

• enter into certain transactions with our affiliates; and |

|

|

• designate subsidiaries as unrestricted subsidiaries. |

|

|

Most of these covenants will cease to apply for so long as the Notes have investment grade ratings from both Moody's and S&P. These covenants are subject to important exceptions and qualifications, which are described under "Description of Notes—Certain Covenants" and "Description of Notes—Merger and Consolidation." |

|

Risk factors |

Investing in the Notes involves risks. For a description of risks you should consider before making your investment decision, see "Risk Factors." |

16

Ratio of Earnings to Fixed Charges

| |

Predecessor | Successor | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

|

Period from January 1 through May 24, 2011 |

Period from May 25, through June 30, 2011 |

|||||||||||||||

| |

Year ended December 31, | |||||||||||||||||||||

| |

2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||

Ratio of earnings to fixed charges(1) |

0.46 | 0.37 | 0.27 | 0.22 | 0.14 | 0.23 | 0.66 | |||||||||||||||

- (1)

- For the purposes of calculating the ratio of earnings to fixed charges, earnings consist of income before taxes plus fixed charges. Fixed charges consist of interest expense, amortization of debt issuance costs and the portion of rental expense that we believe is representative of the interest component of rental expense.

17

Summary Historical Financial Data

The following table presents summary consolidated historical financial data for EMSC and its consolidated subsidiaries.

The consolidated financial statements included in this prospectus are presented for two periods: the period prior to and including May 24, 2011 ("Predecessor") and the period including and after May 25, 2011 ("Successor"), the date of the Merger. As a result of the Transactions, our consolidated financial statements after the Merger are not comparable to our consolidated financial statements prior to the date of the Merger. The historical data presented below are not necessarily indicative of the results to be expected for any future period.

The summary historical financial data for EMSC and its consolidated subsidiaries as of December 31, 2009 and 2010 (Predecessor) and for the years ended December 31, 2008, 2009 and 2010 (Predecessor) are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical financial data for EMSC and its consolidated subsidiaries as of and for the six months ended June 30, 2010 (Predecessor), the period from January 1 through May 24, 2011 (Predecessor), the period from May 25 through June 30, 2011 and as of June 30, 2011 (Successor) are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary historical balance sheet data for EMSC and its consolidated subsidiaries as of December 31, 2008 were derived from our audited consolidated financial statements not included in this prospectus.

This information should be read in conjunction with "Risk Factors," "Unaudited Pro Forma Consolidated Financial Statements," "Selected Historical Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| |

Predecessor | Successor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, | Six months ended June 30, |

Period from January 1 through May 24 |

Period from May 25 through June 30, |

||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | ||||||||||||||

| |

(in thousands of dollars) |

|

||||||||||||||||||

Statement of Operations Data: |

||||||||||||||||||||

Net revenue |

$ | 2,409,864 | $ | 2,569,685 | $ | 2,859,322 | $ | 1,388,158 | $ | 1,221,790 | $ | 319,543 | ||||||||

Compensation and benefits |

1,637,425 | 1,796,779 | 2,023,503 | 976,760 | 874,633 | 221,804 | ||||||||||||||

Operating expenses |

383,359 | 334,328 | 359,262 | 177,115 | 156,740 | 41,856 | ||||||||||||||

Insurance expense |

82,221 | 97,610 | 97,330 | 48,012 | 47,229 | 10,089 | ||||||||||||||

Selling, general and administrative expenses |

69,658 | 63,481 | 67,912 | 35,156 | 29,241 | 6,861 | ||||||||||||||

Depreciation and amortization expense |

68,980 | 64,351 | 65,332 | 31,872 | 28,467 | 11,061 | ||||||||||||||

Income from operations |

168,221 | 213,136 | 245,983 | 119,243 | 85,480 | 27,872 | ||||||||||||||

Interest income from restricted assets |

6,407 | 4,516 | 3,105 | 1,714 | 1,124 | 162 | ||||||||||||||

Interest expense |

(42,087 | ) | (40,996 | ) | (22,912 | ) | (13,326 | ) | (7,886 | ) | (17,950 | ) | ||||||||

Realized gain (loss) on investments |

2,722 | 2,105 | 2,450 | 149 | (9 | ) | 7 | |||||||||||||

Interest and other (expense) income |

2,055 | 1,816 | 968 | 471 | (28,873 | ) | (140 | ) | ||||||||||||

Loss on early debt extinguishment |

(241 | ) | — | (19,091 | ) | (19,091 | ) | (10,069 | ) | — | ||||||||||

Income before income taxes and equity in earnings of unconsolidated subsidiary |

137,077 | 180,577 | 210,503 | 89,160 | 39,767 | 9,951 | ||||||||||||||

Income tax expense |

(52,530 | ) | (65,685 | ) | (79,126 | ) | (34,365 | ) | (19,242 | ) | (4,158 | ) | ||||||||

Income before equity in earnings of unconsolidated subsidiary |

84,547 | 114,892 | 131,377 | 54,795 | 20,525 | 5,793 | ||||||||||||||

Equity in earnings of unconsolidated subsidiary |

300 | 347 | 347 | 199 | 143 | 33 | ||||||||||||||

Net income |

$ | 84,847 | $ | 115,239 | $ | 131,724 | $ | 54,994 | $ | 20,668 | $ | 5,826 | ||||||||

18

| |

Predecessor | Successor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, | Six months ended June 30, |

Period from January 1 through May 24 |

Period from May 25 through June 30, |

||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | ||||||||||||||

| |

(in thousands of dollars) |

|

||||||||||||||||||

Balance Sheet Data (at end of period): |

||||||||||||||||||||

Cash and cash equivalents |

$ | 146,173 | $ | 332,888 | $ | 287,361 | $ | 313,033 | $ | 186,811 | ||||||||||

Working capital(1) |

495,033 | 516,078 | 531,477 | 524,777 | 385,188 | |||||||||||||||

Property, plant and equipment, net |

124,869 | 125,855 | 133,731 | 121,324 | 135,479 | |||||||||||||||

Total assets |

1,541,219 | 1,654,707 | 1,748,552 | 1,704,795 | 4,072,796 | |||||||||||||||

Total debt(2) |

458,505 | 453,930 | 421,276 | 427,535 | 2,379,335 | |||||||||||||||

Stockholders' equity |

539,039 | 686,087 | 847,205 | 764,775 | 891,301 | |||||||||||||||

Cash Flow Data: |

||||||||||||||||||||

Cash flows provided by (used in): |

||||||||||||||||||||

Operating activities |

$ | 211,457 | $ | 272,553 | $ | 185,544 | $ | 84,742 | $ | 67,975 | $ | 37,721 | ||||||||

Investing activities |

(74,945 | ) | (116,629 | ) | (158,865 | ) | (60,358 | ) | (89,459 | ) | (2,847,446 | ) | ||||||||

Financing activities |

(19,253 | ) | 30,791 | (72,206 | ) | (44,239 | ) | 20,671 | 2,709,988 | |||||||||||

Purchases of property, plant and equipment |

(32,088 | ) | (44,728 | ) | (49,121 | ) | (15,168 | ) | (18,496 | ) | (2,892 | ) | ||||||||

Other Financial Data: |

||||||||||||||||||||

Adjusted EBITDA(3) |

$ | 247,084 | $ | 286,982 | $ | 322,119 | $ | 155,874 | $ | 130,582 | $ | 40,039 | ||||||||

Cash interest expense |

39,983 | 39,165 | 20,428 | 12,190 | 6,556 | 16,046 | ||||||||||||||

- (1)

- Working

capital is defined as current assets less current liabilities.

- (2)

- Total

debt is defined as long-term debt and capital lease obligations, including current maturities, and excludes adjustments resulting from

loan fees, which are accounted for as a reduction to outstanding debt.

- (3)

- Adjusted

EBITDA is defined as net income before equity in earnings of unconsolidated subsidiary, income tax expense, loss on early debt extinguishment,

interest and other (expense) income, realized gain (loss) on investments, interest expense, depreciation and amortization expense, equity-based compensation expenses and related party management fees.

Adjusted EBITDA, as reported historically, has been adjusted to reflect equity-based compensation expenses and related party management fees. See the reconciliation table below.

Adjusted EBITDA is commonly used by management and investors as a performance measure. Adjusted EBITDA is not considered a measure of financial performance under GAAP, and the items excluded from Adjusted EBITDA are significant components in understanding and assessing our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as an alternative to GAAP measures such as net income, cash flows provided by or used in operating, investing or financing activities or other financial statement data presented in our consolidated financial statements as an indicator of financial performance or liquidity. Some of these limitations are:

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- Adjusted EBITDA does not reflect our interest expense, or the requirements necessary to service interest or principal

payments on our debt;

- •

- Adjusted EBITDA does not reflect our income tax expenses or the cash requirements to pay our taxes;

- •

- Adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or

contractual commitments; and

- •

- although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

Because Adjusted EBITDA is not a measure determined in accordance with GAAP and is susceptible to varying calculations, this measure, as presented, may not be comparable to other similarly titled measures of other companies.

19

The following tables set forth a reconciliation to net income of Adjusted EBITDA for the periods presented:

| |

Predecessor | Successor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, | Six Months ended June 30, |

Period from January 1, through May 24, |

Period from May 25 through June 30, |

||||||||||||||||

| |

2008 | 2009 | 2010 | 2010 | 2011 | 2011 | ||||||||||||||

| |

(in thousands of dollars) |

|

||||||||||||||||||

Consolidated/Combined |

||||||||||||||||||||

Net income |

$ | 84,847 | $ | 115,239 | $ | 131,724 | $ | 54,994 | $ | 20,668 | $ | 5,826 | ||||||||

Income tax expense |

52,530 | 65,685 | 79,126 | 34,365 | 19,242 | 4,158 | ||||||||||||||

Equity in earnings of unconsolidated subsidiary(a) |

(300 | ) | (347 | ) | (347 | ) | (199 | ) | (143 | ) | (33 | ) | ||||||||

Loss on early debt extinguishment(b) |

241 | — | 19,091 | 19,091 | 10,069 | — | ||||||||||||||

Interest and other (income) expense(c) |

(2,055 | ) | (1,816 | ) | (968 | ) | (471 | ) | 28,873 | 140 | ||||||||||

Realized (gain) loss on investments(d) |

(2,722 | ) | (2,105 | ) | (2,450 | ) | (149 | ) | 9 | (7 | ) | |||||||||

Interest expense |

42,087 | 40,996 | 22,912 | 13,326 | 7,886 | 17,950 | ||||||||||||||

Interest income from restricted assets |

(6,407 | ) | (4,516 | ) | (3,105 | ) | (1,714 | ) | (1,124 | ) | (162 | ) | ||||||||

Income from operations |

168,221 | 213,136 | 245,983 | 119,243 | 85,480 | 27,872 | ||||||||||||||

Interest income from restricted assets |

6,407 | 4,516 | 3,105 | 1,714 | 1,124 | 162 | ||||||||||||||

Depreciation and amortization expense |

68,980 | 64,351 | 65,332 | 31,872 | 28,467 | 11,061 | ||||||||||||||

Equity-based compensation expense(e) |

2,476 | 3,979 | 6,699 | 2,545 | 15,112 | 430 | ||||||||||||||

Related party management fees(f) |

1,000 | 1,000 | 1,000 | 500 | 399 | 514 | ||||||||||||||

Adjusted EBITDA |

$ | 247,084 | $ | 286,982 | $ | 322,119 | $ | 155,874 | $ | 130,582 | $ | 40,039 | ||||||||

- (a)

- Represents

the equity in earnings recognized in the 2008, 2009, 2010 and 2011 periods relating to the minority interest held by AMR in a joint venture in

Trinidad. AMR recognizes equity in earnings of the unconsolidated subsidiary in the income statement, but not in Adjusted EBITDA.

- (b)

- Represents

a loss on early debt extinguishment of $241,000 recorded during 2008, no effect on early debt extinguishment in 2009, a loss on early debt

extinguishment of $19.1 million recorded during 2010, and a loss on early debt extinguishment of $10.1 million during the Predecessor period of January 1 through May 24,

2011.

- (c)

- Represents

interest and other (income) expense. During the Predecessor period of January 1 through May 24, 2011 and the Successor period of

May 25 through June 30, 2011, this included $29.5 million and $0.3 million, respectively, of expenses incurred with the Transactions.

- (d)

- Represents

realized gains or losses on investments held at EMCA Insurance Company, Ltd. ("EMCA") associated with insurance related assets. These

gains or losses are recorded only upon a sale or maturity of such investments.

- (e)

- Represents

the non-cash equity based compensation expense related to equity based awards under our prior and existing equity-based incentive

plans.

- (f)

- Represents the management fees paid to our prior sponsor and payable to CD&R as part of the consulting agreement entered into at the closing of the Transactions.

20