Exhibit 99.1

|

|

Exhibit 99.1

FTI Consulting, Inc.

Toronto Roadshow

February 24th, 2015

|

|

Cautionary Note About Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions relating to acquisitions and other matters, business trends and other information that is not historical, including statements regarding estimates of our medium-term growth targets or other future financial results. When used in this presentation, words such as “anticipates,” “aspirational,” “estimates,” “expects,” “goals,” “intends,” “believes,” “forecasts,” “targets,” “objectives” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our future financial results, are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs, projections and growth targets are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates or growth targets will be achieved, and the Company’s actual results may differ materially from our expectations, beliefs, estimates and growth targets. The Company has experienced fluctuating revenues, operating income and cash flow in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, adverse financial, real estate or other market and general economic conditions, which could impact each of our segments differently, the pace and timing of the consummation and integration of past and future acquisitions, the Company’s ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients and other risks described under the heading “Item 1A Risk Factors” in the Company’s most recent Form 10-K filed with the SEC and in the Company’s other filings with the SEC, including the risks set forth under “Risks Related to Our Reportable Segments” and “Risks Related to Our Operations.” We are under no duty to update any of the forward looking statements to conform such statements to actual results or events and do not intend to do so.

| 2 |

|

|

|

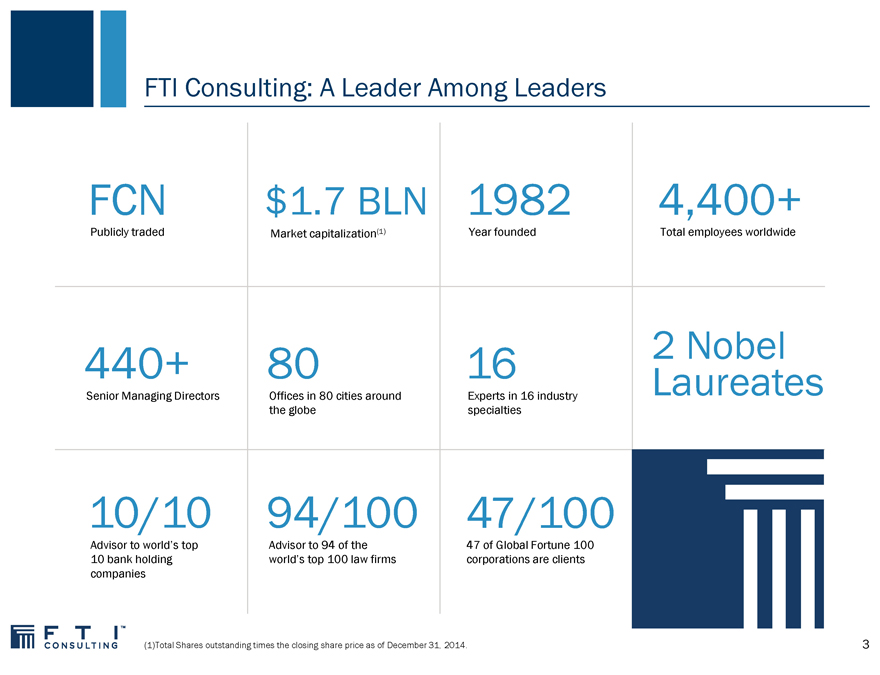

FTI Consulting: A Leader Among Leaders

FCN $1.7 BLN 1982 4,400+

Publicly traded Market capitalization(1) Year founded Total employees worldwide

440+ 80 16 2 Nobel

Senior Managing Directors Offices in 80 cities around Experts in 16 industry Laureates

the globe specialties

10/10 94/100 47/100

Advisor to world’s top Advisor to 94 of the 47 of Global Fortune 100

10 bank holding world’s top 100 law firms corporations are clients

companies

(1)Total Shares outstanding times the closing share price as of December 31, 2014.

| 3 |

|

|

|

Overview

FTI Consulting is a leading professional services company with strong people and strong positions –

corporations and law firms come to FTI Consulting when there is a critical need

New management team (CEO, CFO, CHRO, Chief Strategy, regional leaders) put in place over first nine

months of 2014 – focused on analysis, accountability and discipline

Shifting from a capital driven to an organic growth strategy – with an emphasis on profitable revenue

growth

Committed to building a profitable business with sustainable underlying growth, regardless of economic

conditions

Willingness to invest EBITDA in key growth areas where we have strong people and strong positions

Established medium-term financial target of Adjusted EPS of $2.50+ in 2016

| 4 |

|

|

|

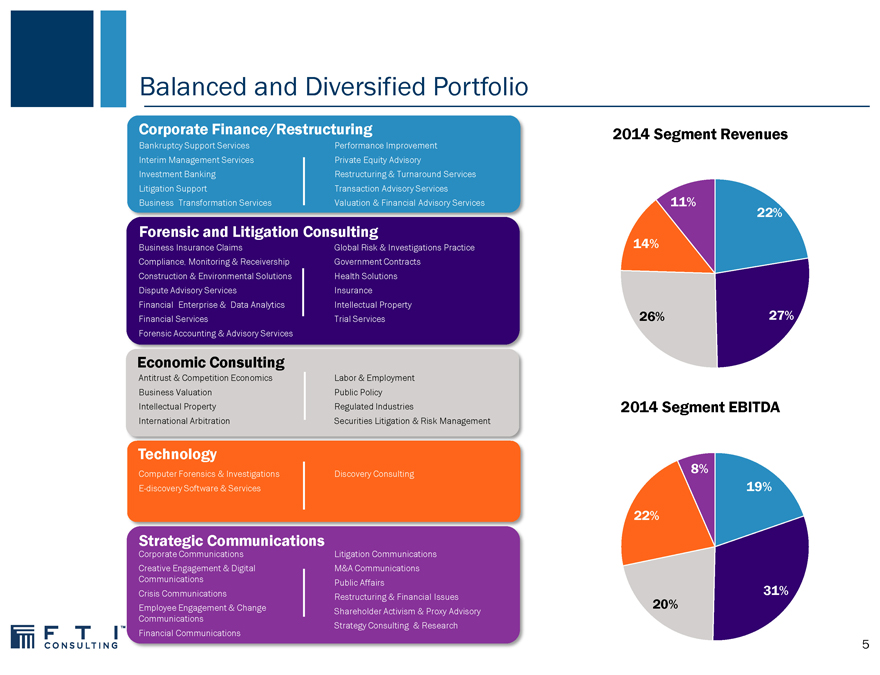

Balanced and Diversified Portfolio

Corporate Finance/Restructuring

Bankruptcy Support Services Performance Improvement

Interim Management Services Private Equity Advisory

Investment Banking Restructuring & Turnaround Services

Litigation Support Transaction Advisory Services

Business Transformation Services Valuation & Financial Advisory Services

Forensic and Litigation Consulting

Business Insurance Claims Global Risk & Investigations Practice

Compliance, Monitoring & Receivership Government Contracts

Construction & Environmental Solutions Health Solutions

Dispute Advisory Services Insurance

Financial Enterprise & Data Analytics Intellectual Property

Financial Services Trial Services

Forensic Accounting & Advisory Services

Economic Consulting

Antitrust & Competition Economics Labor & Employment

Business Valuation Public Policy

Intellectual Property Regulated Industries

International Arbitration Securities Litigation & Risk Management

Technology

Computer Forensics & Investigations Discovery Consulting

E-discovery Software & Services

Strategic Communications

Corporate Communications Litigation Communications

Creative Engagement & Digital M&A Communications

Communications Public Affairs

Crisis Communications Restructuring & Financial Issues

Employee Engagement & Change Shareholder Activism & Proxy Advisory

Communications

Strategy Consulting & Research

Financial Communications

2014 Segment Revenues

11%

22%

14%

26% 27%

2014 Segment EBITDA

8%

19%

22%

31%

20%

| 5 |

|

|

|

Corporate Finance/Restructuring

Services

Bankruptcy Support Services Transaction Advisory Services

Interim Management Valuation & Financial Advisory Services

Investment Banking Clients

Litigation Support Corporations/C-Suite

Business Transformation Services Boards of Directors

Performance Improvement Equity Sponsors

Private Equity Advisory Secured Lenders

Restructuring/Turnaround Services Unsecured Creditors

2010 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014

Segment Revenue $396,216 $364,409 $394,718 $382,586 $93,982 $104,020 $100,041 $93,072 $391,115

Segment Gross Profit

Margin 41.8% 37.4% 39.5% 35.9% 31.9% 35.1% 33.8% 29.3% 32.6%

Segment SG&A $59,629 $60,499 $61,027 $71,966 $19,786 $18,191 $19,047 $18,358 $75,382

Adjusted Segment EBITDA $ 108,152 $75,942 $95,916 $67,183 $10,951 $19,133 $15,534 $9,874 $55,492

Adjusted Segment EBITDA

Margin 27.3% 20.8% 24.3% 17.6% 11.7% 18.4% 15.5% 10.6% 14.2%

Segment Billable Headcount 620 587 697 737 726 713 722 706 706

(in thousands, except percentages and headcount data) (unaudited)

See accompanying financial tables for a reconciliation of Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, which are non-GAAP measures, to the most directly comparable GAAP measures.

| 6 |

|

|

|

Corporate Finance/Restructuring (continued)

Segment Offering

The Corporate Finance/Restructuring segment focuses on strategic, operational, financial and capital needs of businesses by addressing the full spectrum of financial and transactional challenges faced by companies, boards, private equity sponsors, creditor constituencies and other stakeholders.

Medium–Term Initiatives

Reinforce core positions e.g., TMT, retail, company-side, interim management

Drive organic growth in new/adjacent businesses where we have the right to win, e.g., Office of the CFO, carve out

Drive overseas bets to fruition e.g., EMEA transaction advisory services, EMEA Tax

Focus on profitability enhancements e.g., geographic rationalization, cost control, engagement profitability improvements

2014 Form 10–K Management’s Discussion & Analysis

Revenues increased $8.6 million, or 2.2%, to $391.1 million for the year ended December 31, 2014, compared to $382.5 million prior year.

Acquisition related revenues contributed $4.4 million, or 1.1%, compared to the same prior year period.

Revenues increased organically $4.2 million, or 1.1%, primarily due higher volume in in our EMEA practice and growth in non-distressed engagements in North America, partially offset by continued slowdown in our global bankruptcy and restructuring practices.

Gross profit decreased $9.9 million, or 7.2%, to $127.5 million for the year ended December 31, 2014 compared to $137.4 million prior year. Gross profit margin decreased to 32.6% for the year ended December 31, 2014 compared to 35.9% for the same prior year period.

The decrease in gross profit margin was due to a shift in the mix of engagements to lower margin non-distressed work, continued investments in our European transaction advisory practice, and higher performance-based compensation expense.

Adjusted Segment EBITDA decreased $11.7 million, or 17.4%, to $55.5 million for the year ended December 31, 2014 compared to $67.2 million for the same prior year period.

| 7 |

|

|

|

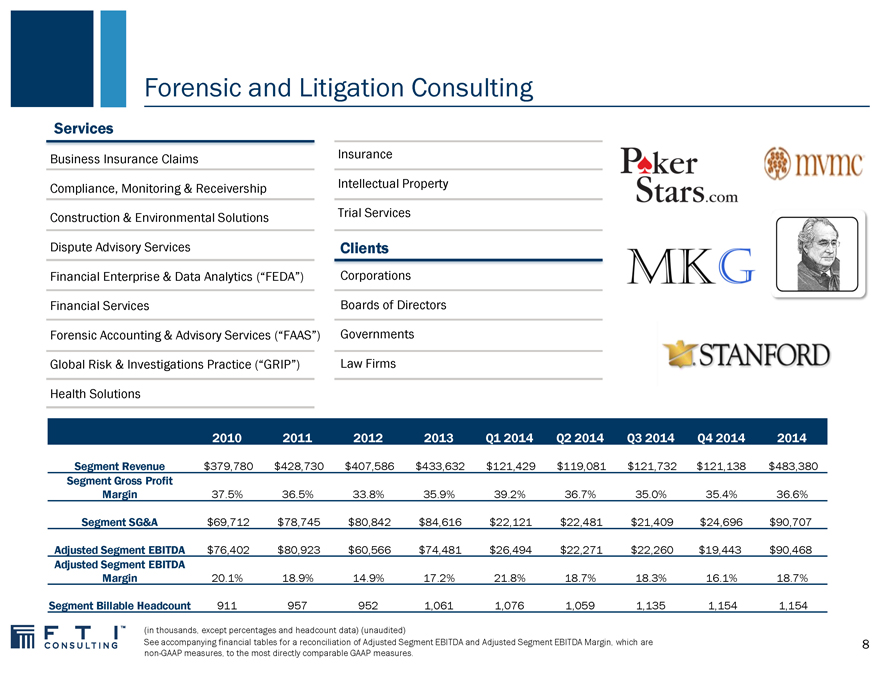

Forensic and Litigation Consulting

Services

Business Insurance Claims Insurance

Compliance, Monitoring & Receivership Intellectual Property

Construction & Environmental Solutions Trial Services

Dispute Advisory Services Clients

Financial Enterprise & Data Analytics (“FEDA”) Corporations

Financial Services Boards of Directors

Forensic Accounting & Advisory Services (“FAAS”) Governments

Global Risk & Investigations Practice (“GRIP”) Law Firms

Health Solutions

2010 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014

Segment Revenue $379,780 $428,730 $407,586 $433,632 $121,429 $119,081 $121,732 $121,138 $483,380

Segment Gross Profit

Margin 37.5% 36.5% 33.8% 35.9% 39.2% 36.7% 35.0% 35.4% 36.6%

Segment SG&A $69,712 $78,745 $80,842 $84,616 $22,121 $22,481 $21,409 $24,696 $90,707

Adjusted Segment EBITDA $76,402 $80,923 $60,566 $74,481 $26,494 $22,271 $22,260 $19,443 $90,468

Adjusted Segment EBITDA

Margin 20.1% 18.9% 14.9% 17.2% 21.8% 18.7% 18.3% 16.1% 18.7%

Segment Billable Headcount 911 957 952 1,061 1,076 1,059 1,135 1,154 1,154

(in thousands, except percentages and headcount data) (unaudited)

See accompanying financial tables for a reconciliation of Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, which are non-GAAP measures, to the most directly comparable GAAP measures.

| 8 |

|

|

|

Forensic and Litigation Consulting (continued)

Segment Offering

The Forensic and Litigation Consulting segment provides a complete range of multidisciplinary, independent dispute advisory, investigative, data acquisition/analysis and forensic accounting services. Our professionals combine end-to-end capabilities with unmatched qualifications when clients face high stakes litigation, arbitration and compliance investigations and regulatory scrutiny.

Medium–Term Initiatives

Reinvest behind core areas of strength e.g., FAAS, FEDA

Grow key regions where we have a right to win e.g., construction & environmental solutions

Invest behind people to expand key businesses e.g., insurance, cyber security

2014 Form 10–K Management’s Discussion & Analysis

Revenues increased $49.7 million, or 11.5%, to $483.4 million for the twelve months ended December 31, 2014 from $433.6 million for the same prior year period.

Acquisition-related revenues contributed $11.1 million, or 2.6% compared to the same prior year period.

Revenues increased organically $38.7 million, or 8.9%, due to higher demand in our global disputes, construction solutions and data analytics practices, and in the North America and Asia Pacific regions of our investigations practice, partially offset by decline in our Health Solutions practice Gross profit increased $21.5 million, or 13.8%, to $176.9 million for the twelve months ended December 31, 2014 from $155.5 million for the same prior year period. Gross profit margin increased 0.8 percentage points to 36.6% for the twelve months ended December 31, 2014 from 35.9% for the same prior year period.

The increase in gross profit margin is related to higher utilization in our construction solutions, data analytics, disputes and investigations practices; partially offset by increased performance based compensation and continued investment in the health solutions practice.

Adjusted Segment EBITDA increased by $16.0 million, or 21.5%, to $90.5 million for the twelve months ended December 31, 2014 from $74.5 million for the same prior year period.

9

|

|

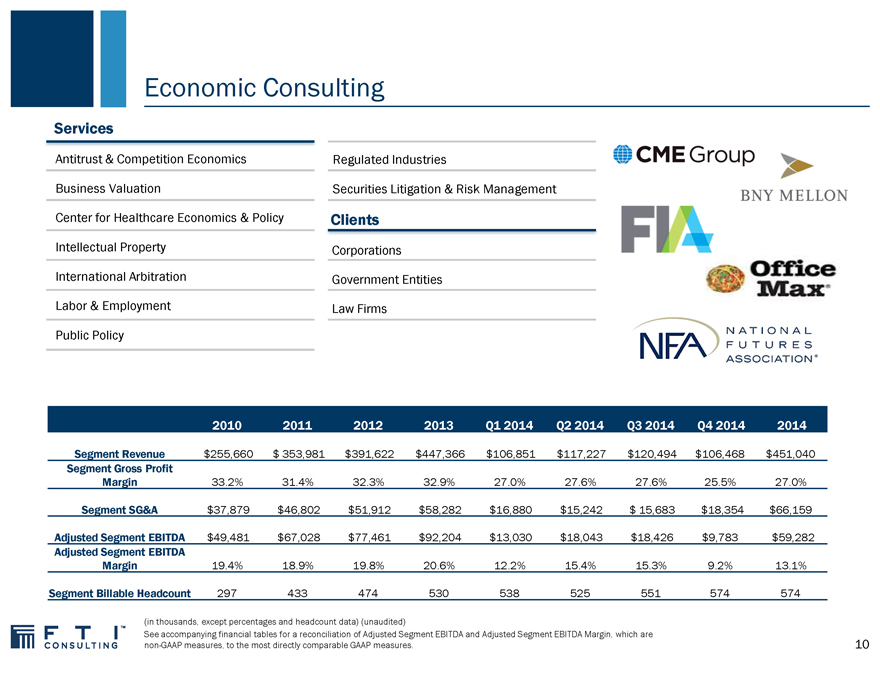

Economic Consulting

Services

Antitrust & Competition Economics Regulated Industries

Business Valuation Securities Litigation & Risk Management

Center for Healthcare Economics & Policy Clients

Intellectual Property Corporations

International Arbitration Government Entities

Labor & Employment Law Firms

Public Policy

2010 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014

Segment Revenue $255,660 $ 353,981 $391,622 $447,366 $106,851 $117,227 $120,494 $106,468 $451,040

Segment Gross Profit

Margin 33.2% 31.4% 32.3% 32.9% 27.0% 27.6% 27.6% 25.5% 27.0%

Segment SG&A $37,879 $46,802 $51,912 $58,282 $16,880 $15,242 $ 15,683 $18,354 $66,159

Adjusted Segment EBITDA $49,481 $67,028 $77,461 $92,204 $13,030 $18,043 $18,426 $9,783 $59,282

Adjusted Segment EBITDA

Margin 19.4% 18.9% 19.8% 20.6% 12.2% 15.4% 15.3% 9.2% 13.1%

Segment Billable Headcount 297 433 474 530 538 525 551 574 574

(in thousands, except percentages and headcount data) (unaudited)

See accompanying financial tables for a reconciliation of Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, which are non-GAAP measures, to the most directly comparable GAAP measures.

10

|

|

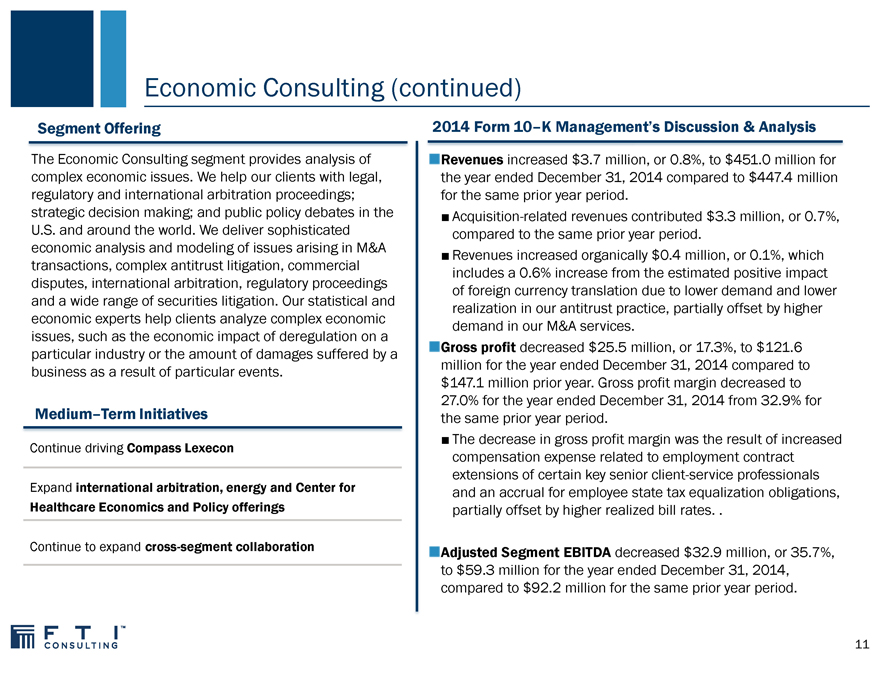

Economic Consulting (continued)

Segment Offering

The Economic Consulting segment provides analysis of complex economic issues. We help our clients with legal, regulatory and international arbitration proceedings; strategic decision making; and public policy debates in the U.S. and around the world. We deliver sophisticated economic analysis and modeling of issues arising in M&A transactions, complex antitrust litigation, commercial disputes, international arbitration, regulatory proceedings and a wide range of securities litigation. Our statistical and economic experts help clients analyze complex economic issues, such as the economic impact of deregulation on a particular industry or the amount of damages suffered by a business as a result of particular events.

Medium–Term Initiatives

Continue driving Compass Lexecon

Expand international arbitration, energy and Center for Healthcare Economics and Policy offerings

Continue to expand cross-segment collaboration

2014 Form 10–K Management’s Discussion & Analysis

Revenues increased $3.7 million, or 0.8%, to $451.0 million for the year ended December 31, 2014 compared to $447.4 million for the same prior year period.

Acquisition-related revenues contributed $3.3 million, or 0.7%, compared to the same prior year period.

Revenues increased organically $0.4 million, or 0.1%, which includes a 0.6% increase from the estimated positive impact of foreign currency translation due to lower demand and lower realization in our antitrust practice, partially offset by higher demand in our M&A services.

Gross profit decreased $25.5 million, or 17.3%, to $121.6 million for the year ended December 31, 2014 compared to $147.1 million prior year. Gross profit margin decreased to

27.0% for the year ended December 31, 2014 from 32.9% for the same prior year period.

The decrease in gross profit margin was the result of increased compensation expense related to employment contract extensions of certain key senior client-service professionals and an accrual for employee state tax equalization obligations, partially offset by higher realized bill rates. .

Adjusted Segment EBITDA decreased $32.9 million, or 35.7%, to $59.3 million for the year ended December 31, 2014, compared to $92.2 million for the same prior year period.

11

|

|

Technology

Software & Services Clients

Computer Forensics & Investigations Corporations

Discovery Consulting Government Agencies

E-discovery Software & Services Law Firms

2010 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014

Segment Revenue $176,607 $218,738 $195,194 $202,663 $60,063 $60,720 $62,359 $58,168 $241,310

Segment Gross Profit

Margin 62.7% 60.0% 54.9% 52.2% 48.9% 45.7% 49.7% 47.8% 48.0%

Segment SG&A $ 59,721 $65,322 $62,436 $59,890 $16,079 $16,648 $17,017 $18,418 $68,162

Adjusted Segment EBITDA $64,358 $77,011 $57,203 $60,655 $17,348 $15,104 $17,835 $13,258 $63,545

Adjusted Segment EBITDA

Margin 36.4% 35.2% 29.3% 29.9% 28.9% 24.9% 28.6% 22.8% 26.3%

Segment Billable Headcount 257 290 277 306 321 328 335 344 344

(in thousands, except percentages and headcount data) (unaudited)

See accompanying financial tables for a reconciliation of Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, which are non-GAAP measures, to the most directly comparable GAAP measures.

12

|

|

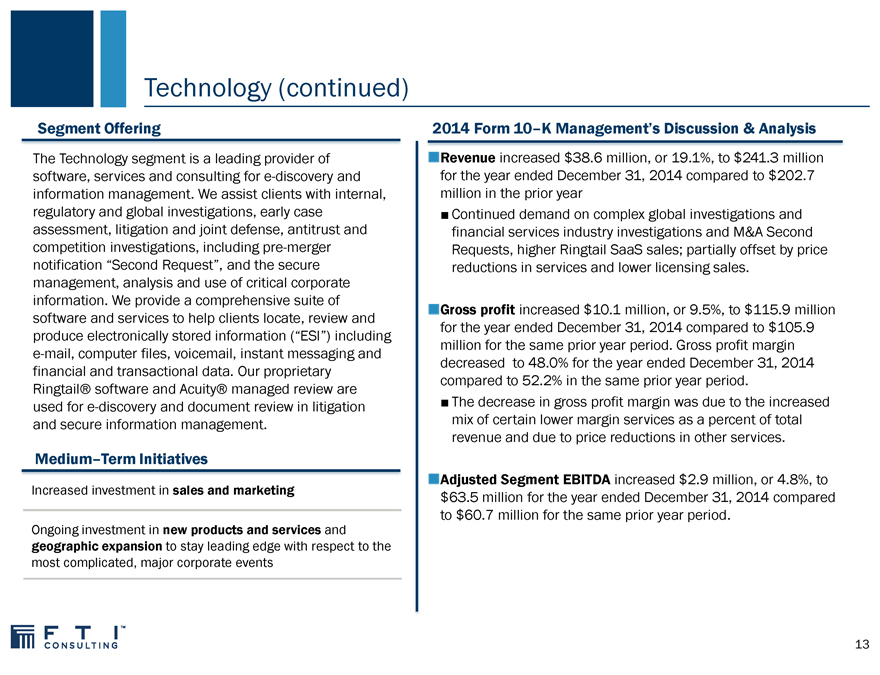

Technology (continued)

Segment Offering

The Technology segment is a leading provider of software, services and consulting for e-discovery and information management. We assist clients with internal, regulatory and global investigations, early case assessment, litigation and joint defense, antitrust and competition investigations, including pre-merger notification “Second Request”, and the secure management, analysis and use of critical corporate information. We provide a comprehensive suite of software and services to help clients locate, review and produce electronically stored information (“ESI”) including e-mail, computer files, voicemail, instant messaging and financial and transactional data. Our proprietary Ringtail® software and Acuity® managed review are used for e-discovery and document review in litigation and secure information management.

Medium–Term Initiatives

Increased investment in sales and marketing

Ongoing investment in new products and services and geographic expansion to stay leading edge with respect to the most complicated, major corporate events

2014 Form 10–K Management’s Discussion & Analysis

Revenue increased $38.6 million, or 19.1%, to $241.3 million for the year ended December 31, 2014 compared to $202.7 million in the prior year

Continued demand on complex global investigations and financial services industry investigations and M&A Second Requests, higher Ringtail SaaS sales; partially offset by price reductions in services and lower licensing sales.

Gross profit increased $10.1 million, or 9.5%, to $115.9 million for the year ended December 31, 2014 compared to $105.9 million for the same prior year period. Gross profit margin decreased to 48.0% for the year ended December 31, 2014 compared to 52.2% in the same prior year period.

The decrease in gross profit margin was due to the increased mix of certain lower margin services as a percent of total revenue and due to price reductions in other services.

Adjusted Segment EBITDA increased $2.9 million, or 4.8%, to $63.5 million for the year ended December 31, 2014 compared to $60.7 million for the same prior year period.

13

|

|

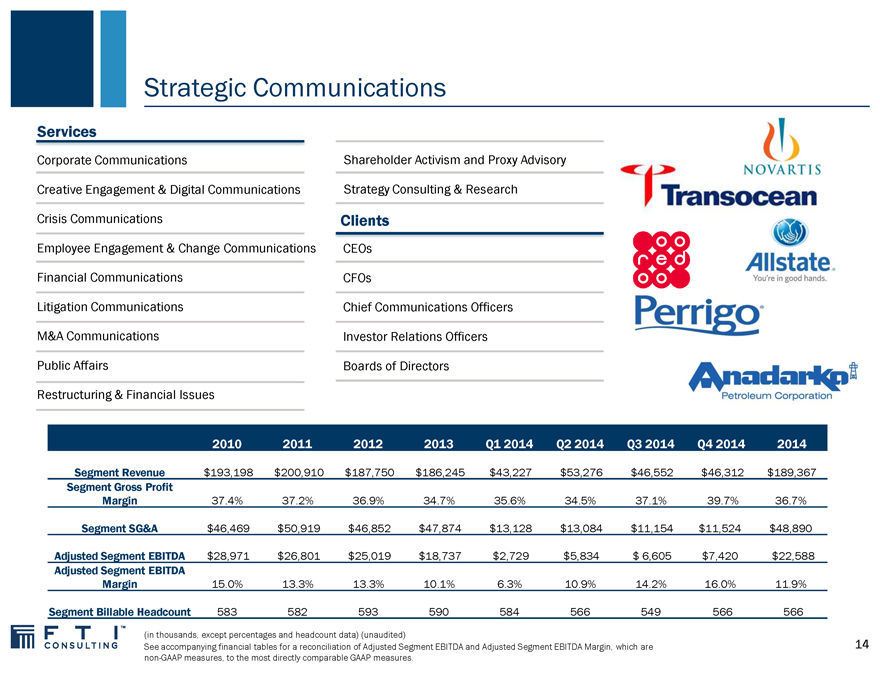

Strategic Communications

Services

Corporate Communications Shareholder Activism and Proxy Advisory

Creative Engagement & Digital Communications Strategy Consulting & Research

Crisis Communications Clients

Employee Engagement & Change Communications CEOs

Financial Communications CFOs

Litigation Communications Chief Communications Officers

M&A Communications Investor Relations Officers

Public Affairs Boards of Directors

Restructuring & Financial Issues

2010 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 2014

Segment Revenue $193,198 $200,910 $187,750 $186,245 $43,227 $53,276 $46,552 $46,312 $189,367

Segment Gross Profit

Margin 37.4% 37.2% 36.9% 34.7% 35.6% 34.5% 37.1% 39.7% 36.7%

Segment SG&A $46,469 $50,919 $46,852 $47,874 $13,128 $13,084 $11,154 $11,524 $48,890

Adjusted Segment EBITDA $28,971 $26,801 $25,019 $18,737 $2,729 $5,834 $ 6,605 $7,420 $22,588

Adjusted Segment EBITDA

Margin 15.0% 13.3% 13.3% 10.1% 6.3% 10.9% 14.2% 16.0% 11.9%

Segment Billable Headcount 583 582 593 590 584 566 549 566 566

(in thousands, except percentages and headcount data) (unaudited)

See accompanying financial tables for a reconciliation of Adjusted Segment EBITDA and Adjusted Segment EBITDA Margin, which are non-GAAP measures, to the most directly comparable GAAP measures.

14

|

|

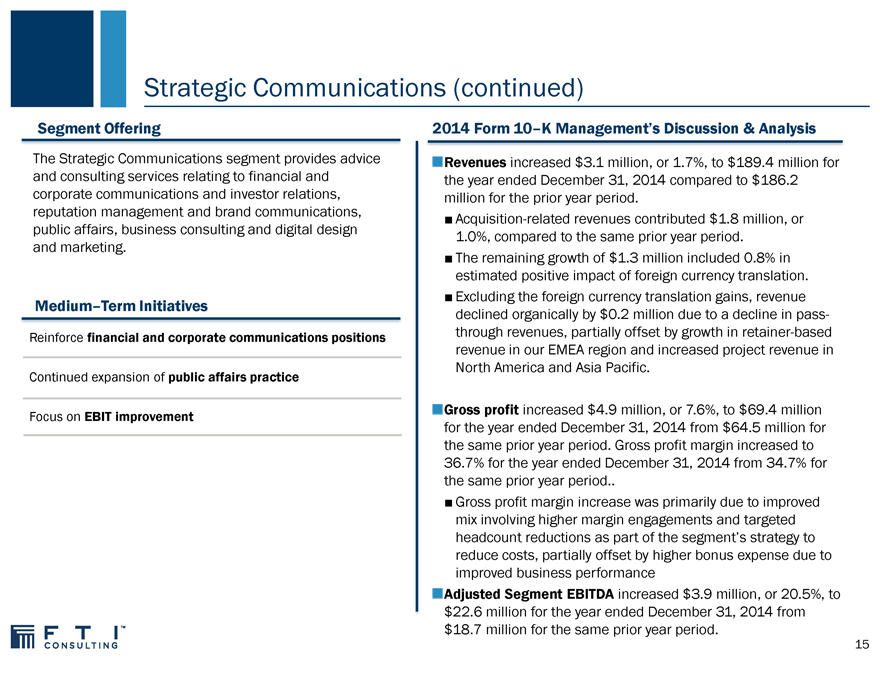

Strategic Communications (continued)

Segment Offering

The Strategic Communications segment provides advice and consulting services relating to financial and corporate communications and investor relations, reputation management and brand communications, public affairs, business consulting and digital design and marketing.

Medium–Term Initiatives

Reinforce financial and corporate communications positions

Continued expansion of public affairs practice

Focus on EBIT improvement

2014 Form 10–K Management’s Discussion & Analysis

Revenues increased $3.1 million, or 1.7%, to $189.4 million for the year ended December 31, 2014 compared to $186.2 million for the prior year period.

Acquisition-related revenues contributed $1.8 million, or 1.0%, compared to the same prior year period.

The remaining growth of $1.3 million included 0.8% in estimated positive impact of foreign currency translation.

Excluding the foreign currency translation gains, revenue declined organically by $0.2 million due to a decline in pass-through revenues, partially offset by growth in retainer-based revenue in our EMEA region and increased project revenue in North America and Asia Pacific.

Gross profit increased $4.9 million, or 7.6%, to $69.4 million for the year ended December 31, 2014 from $64.5 million for the same prior year period. Gross profit margin increased to 36.7% for the year ended December 31, 2014 from 34.7% for the same prior year period

Gross profit margin increase was primarily due to improved mix involving higher margin engagements and targeted headcount reductions as part of the segment’s strategy to reduce costs, partially offset by higher bonus expense due to improved business performance Adjusted Segment EBITDA increased $3.9 million, or 20.5%, to $22.6 million for the year ended December 31, 2014 from $18.7 million for the same prior year period.

15

|

|

Financial Overview

16

|

|

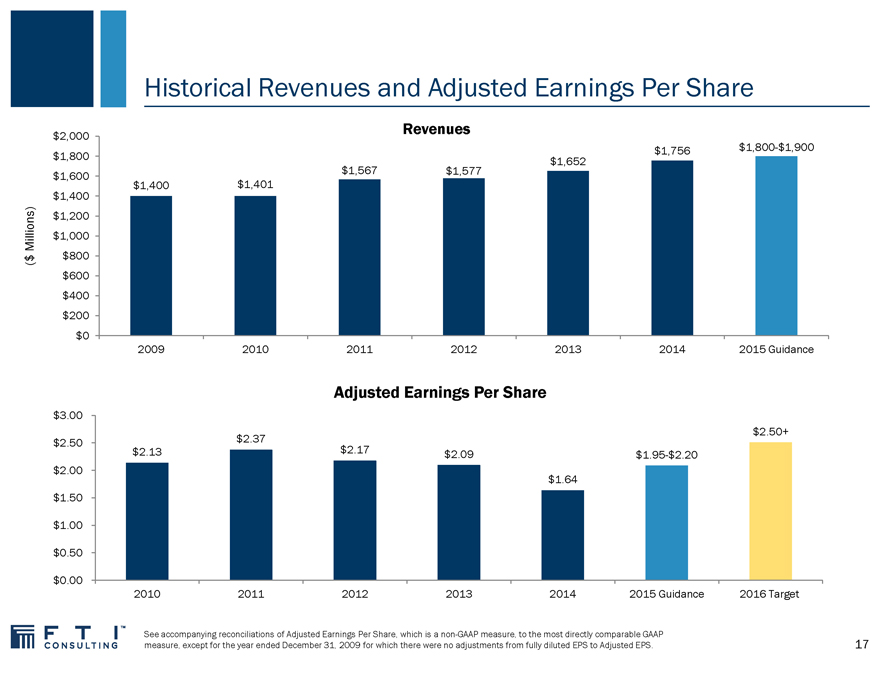

Historical Revenues and Adjusted Earnings Per Share

$2,000

$1,756 $1,800-$1,900

$1,800 $1,652

$1,600 $1,567 $1,577

$1,400 $1,401

$1,400

$1,200

Millions) $1,000

$ $800

(

$600

$400

$200

$0

2009 2010 2011 2012 2013 2014 2015 Guidance

Adjusted Earnings Per Share

$3.00

$ 2.50+

$2.50 $2.37

$ 2.13 $ 2.17 $2.09 $ 1.95-$ 2.20

$2.00

$1.64

$1.50

$1.00

$0.50

$0.00

2010 2011 2012 2013 2014 2015 Guidance 2016 Target

See accompanying reconciliations of Adjusted Earnings Per Share, which is a non-GAAP measure, to the most directly comparable GAAP measure, except for the year ended December 31, 2009 for which there were no adjustments from fully diluted EPS to Adjusted EPS.

17

|

|

Financial Profile

Q4 2014 Q4 2013 Q3 2014 FY 2014 FY 2013

Cash and cash equivalents $ 283,680 $ 205,833 $ 178,778 $ 283,680 $ 283,833

Accounts receivable, net $ 485,101 $ 476,445 $ 565,657 $ 485,101 $ 476,445

Days sales outstanding (“DSO”)1 97 107 97 97 97

Net cash provided by operating

activities $ 114,922 $ 89,465 $ 97,583 $ 135,401 $ 193,271

Purchases of property and $ 7,459 $ 19,550 $ 10,019 $ 39,256 $ 42,544

equipment

Payments for acquisition of $ 7,783 $ 14,732 $ 73 $ 23,467 $ 55,498

businesses, net of cash received

Purchase and retirement of common — $ 17,994 — $ 4,367 $ 66,763

stock

Total debt $ 711,000 $ 711,014 $ 711,000 $ 711,000 $ 717,014

(1) DSO is a performance measure used to assess how quickly revenues are collected by the Company. We calculate DSO at the end of each reporting period by dividing net accounts receivable reduced by billings in excess of services provided, by revenue for the quarter, adjusted for changes in foreign exchange rates. We multiply the result by the number of days in the quarter.

18

|

|

Appendix

19

|

|

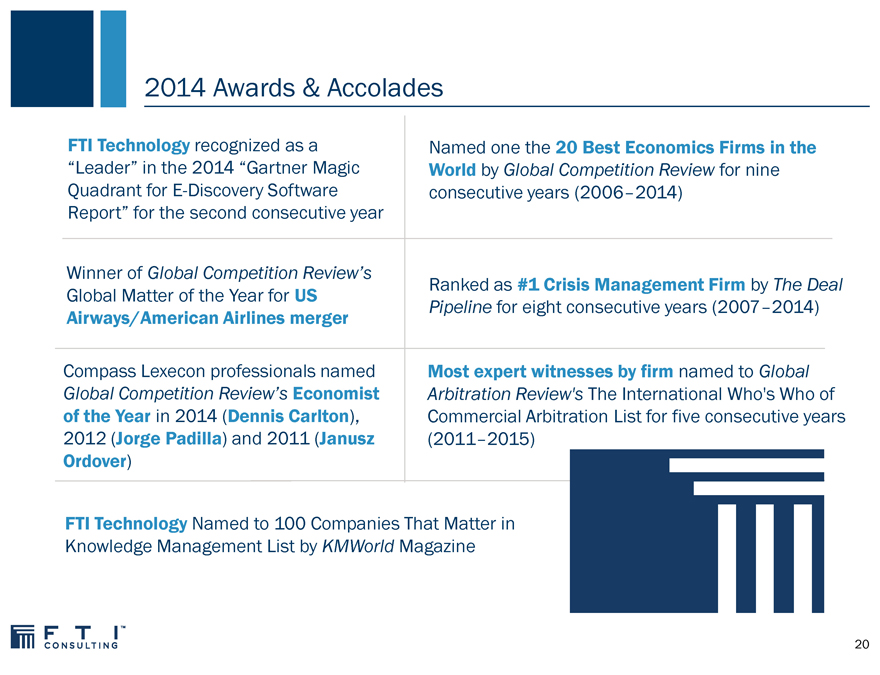

2014 Awards & Accolades

FTI Technology recognized as a

“Leader” in the 2014 “Gartner Magic

Quadrant for E-Discovery Software

Report” for the second consecutive year

Winner of Global Competition Review’s

Global Matter of the Year for US Airways/American Airlines merger

Compass Lexecon professionals named

Global Competition Review’s Economist of the Year in 2014 (Dennis Carlton),

2012 (Jorge Padilla) and 2011 (Janusz

Ordover)

Named one the 20 Best Economics Firms in the World by Global Competition Review for nine consecutive years (2006–2014)

Ranked as #1 Crisis Management Firm by The Deal

Pipeline for eight consecutive years (2007–2014)

Most expert witnesses by firm named to Global

Arbitration Review’s The International Who’s Who of

Commercial Arbitration List for five consecutive years

(2011–2015)

FTI Technology Named to 100 Companies That Matter in Knowledge Management List by KMWorld Magazine

20

|

|

FTI Consulting Executive Leadership Team

Steven H. Gunby David M. Johnson Heather Klink

President & Chief Chief Financial Acting General

Executive Officer Officer Counsel

Paul Linton Holly Paul Adam S. Bendell

Chief Strategy & Chief Human Chief Innovation

Transformation

Officer Resources Officer Officer

Jeffrey S. Amling

Catherine Freeman Senior Managing

Senior Vice Mollie Hawkes

Director,

President, Senior Director,

Business

Controller & Chief Investor Relations

Accounting Officer Development &

Marketing

21

|

|

FTI Consulting Business Leadership Team

Robert Duffy

Neal Hochberg John Klick

Global Segment

Leader, Corporate Global Segment Global Segment

Finance/ Leader, Forensic & Leader, Economic

Litigation Consulting Consulting

Restructuring

Ken Barker Seth Rierson Ed Reilly

Global Practice Global Segment Global Segment

Leader, Health Leader, Leader, Strategic

Solutions Technology Communications

Carlyn Taylor Frank Holder Rod Sutton

Global Industries Latin America Asia Pacific

Leader Chairman Chairman

22

|

|

Financial Tables

23

|

|

Full-Year 2014 Results: Condensed Consolidated Statements of Comprehensive Income (Loss)

All numbers in $000s, except for per share data

Year Ended December 31,

2014 2013

Revenues $1,756,212 $1,652,432

Operating expenses

Direct cost of revenues 1,144,757 1,042,061

Selling, general & administrative expense 433,845 394,681

Special charges 16,339 38,414

Acquisition-related contingent consideration (1,676) (10,869)

Amortization of other intangible assets 15,521 22,954

Goodwill impairment charge — 83,752

1,608,786 1,570,993

Operating income 147,426 81,439

Other income (expense)

Interest income & other 4,670 1,748

Interest expense (50,685) (51,376)

(46,015) (49,628)

Income before income tax provision 101,411 31,811

Income tax provision 42,604 42,405

Net income (loss) $58,807 ($10,594)

Earnings (loss) per common share – basic $1.48 ($0.27)

Earnings (loss) per common share – diluted $1.44 ($0.27)

Weighted average common shares outstanding – basic 39,726 39,188

Weighted average common shares outstanding – diluted 40,729 39,188

Other Comprehensive loss, net of tax: ($29,179) ($9,720)

Foreign currency translation adjustments, net of tax $0

Total other comprehensive loss, net of tax (29,179) (9,720)

Comprehensive income (loss) $29,628 ($20,314)

24

|

|

Fourth Quarter 2014 Results: Operating Results by Business Segment

All numbers in $000s, except for bill rate per hour and headcount data

Adjusted Segment Average Billable

Three Months Ended December 31, 2014 Revenues Adjusted EBITDA (1) Utilization Revenue-Generating Headcount (at period end)

EBITDA Margin (1) Rate

Corporate Finance/Restructuring $93,072 $9,874 10.6% 61% $368 706

Forensic and Litigation Consulting 121,138 19,443 16.1% 64% $313 1,154

Economic Consulting 106,468 9,783 9.2% 69% $503 574

Technology (2) 58,168 13,258 22.8% N/M N/M 344

Strategic Communications (2) 46,312 7,420 16.0% N/M N/M 566

Total $425,158 $59,778 14.1% 3,344

Unallocated Corporate (23,720)

Adjusted EBITDA(1) $36,058 8.5%

Adjusted Segment Average Billable

Three Months Ended December 31, 2013 Revenues Adjusted EBITDA (1) Utilization Revenue-Generating Headcount (at period end)

EBITDA Margin (1) Rate

Corporate Finance/Restructuring $92,751 $10,848 11.7% 62% $421 737

Forensic and Litigation Consulting 114,720 17,556 15.3% 71% $322 1,061

Economic Consulting 108,089 21,982 20.3% 74% $506 530

Technology (2) 53,562 14,670 27.4% N/M N/M 306

Strategic Communications (2) 46,876 5,928 12.6% N/M N/M 590

Total $415,998 $70,984 17.1% 3,224

Unallocated Corporate (23,321)

Adjusted EBITDA(1) $47,663 11.5%

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Adjusted EBITDA, Adjusted Segment EBITDA, and Adjusted Segment EBITDA Margin.

(2) The majority of the Technology and Strategic Communications segments’ revenues are not generated based on billable hours. Accordingly, utilization and average billable rate metrics are not presented as they are not meaningful as a segment-wide metric.

25

|

|

2014: Reconciliation of Non-GAAP Financial Measures

26

|

|

2014: Reconciliation of Net Income (Loss) and Operating Income (Loss) to Adjusted EBITDA

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income (Loss) and Adjusted EBITDA.

27

|

|

Q1 2014: Reconciliation of Net Income And Operating Income to Adjusted EBITDA

All numbers in $000s

Corporate Forensic and Economic Strategic

Three Months Ended March 31, 2014 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net income $18,117

Interest income and other ($1,003)

Interest expense $12,655

Income tax provision $10,348

Operating income(1) $8,607 $25,402 $12,430 $13,066 $ 1,005 ($20,393) $40,117

Depreciation and amortization of intangible $3,006 $1,765 $1,387 $4,282 $ 1,724 $1,037 $13,201

assets

Remeasurement of acquisition-related ($662) ($673) ($787) — —— ($2,122)

contingent consideration

Adjusted EBITDA (1) $10,951 $26,494 $13,030 $17,348 $ 2,729 ($19,356) $51,196

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income and Adjusted EBITDA.

28

|

|

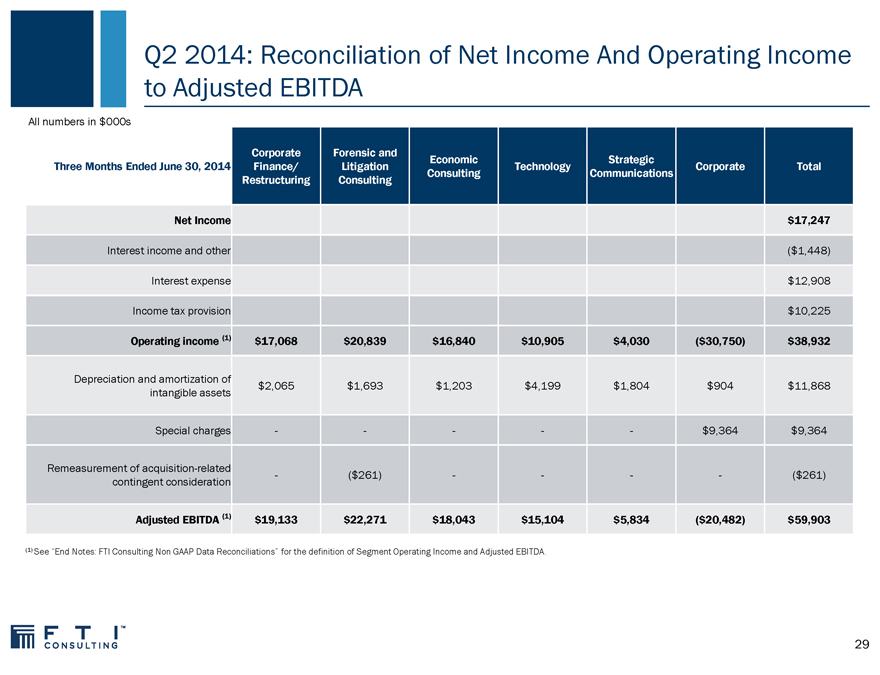

Q2 2014: Reconciliation of Net Income And Operating Income to Adjusted EBITDA

All numbers in $000s

Corporate Forensic and Economic Strategic

Three Months Ended June 30, 2014 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net Income $17,247

Interest income and other ($1,448)

Interest expense $12,908

Income tax provision $10,225

Operating income (1) $17,068 $20,839 $16,840 $10,905 $ 4,030 ($30,750) $38,932

Depreciation and amortization of $2,065 $1,693 $1,203 $4,199 $ 1,804 $904 $11,868

intangible assets

Special charges ———— — $9,364 $9,364

Remeasurement of acquisition-related — ($261) —— —— ($261)

contingent consideration

Adjusted EBITDA (1) $19,133 $22,271 $18,043 $15,104 $ 5,834 ($20,482) $59,903

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income and Adjusted EBITDA.

29

|

|

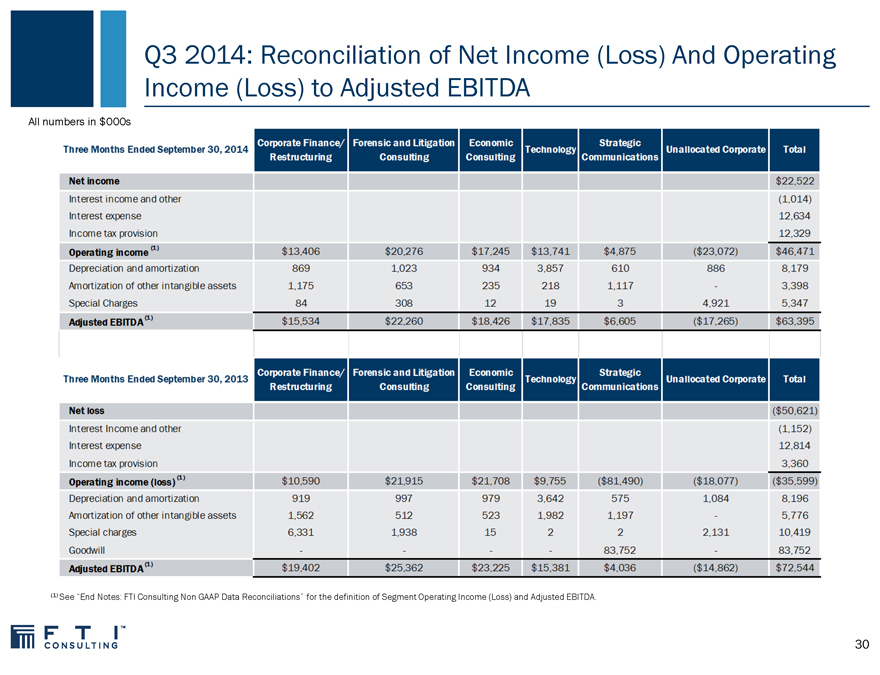

Q3 2014: Reconciliation of Net Income (Loss) And Operating Income (Loss) to Adjusted EBITDA

All numbers in $000s

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income (Loss) and Adjusted EBITDA.

30

|

|

Q4 2014: Reconciliation of Net Income (Loss) And Operating Income to Adjusted EBITDA

All numbers in $000s

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income (Loss) and Adjusted EBITDA.

31

|

|

2010 – 2014 Reconciliation of Net Income (Loss) to Adjusted EPS and Adjusted EBITDA

32

|

|

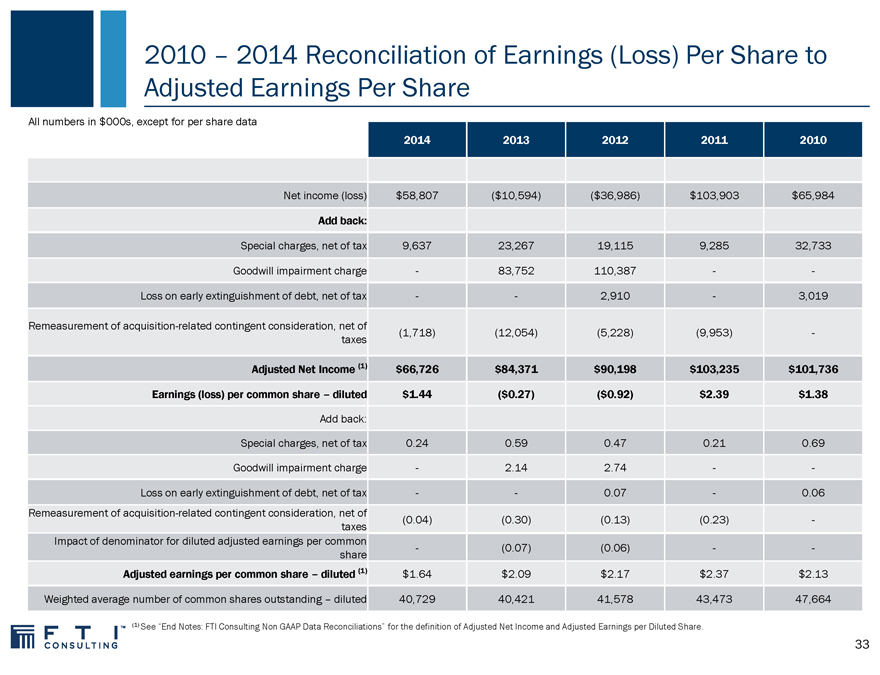

2010 – 2014 Reconciliation of Earnings (Loss) Per Share to Adjusted Earnings Per Share

All numbers in $000s, except for per share data

2014 2013 2012 2011 2010

Net income (loss) $58,807 ($10,594) ($36,986) $103,903 $65,984

Add back:

Special charges, net of tax 9,637 23,267 19,115 9,285 32,733

Goodwill impairment charge — 83,752 110,387 — -

Loss on early extinguishment of debt, net of tax —— 2,910 — 3,019

Remeasurement of acquisition-related contingent consideration, net of (1,718) (12,054) (5,228) (9,953) -

taxes

Adjusted Net Income (1) $66,726 $84,371 $90,198 $103,235 $101,736

Earnings (loss) per common share – diluted $1.44 ($0.27) ($0.92) $2.39 $1.38

Add back:

Special charges, net of tax 0.24 0.59 0.47 0.21 0.69

Goodwill impairment charge — 2.14 2.74 — -

Loss on early extinguishment of debt, net of tax —— 0.07 — 0.06

Remeasurement of acquisition-related contingent consideration, net of (0.04) (0.30) (0.13) (0.23) -

taxes

Impact of denominator for diluted adjusted earnings per common — (0.07) (0.06) — -

share

Adjusted earnings per common share – diluted (1) $1.64 $2.09 $2.17 $2.37 $2.13

Weighted average number of common shares outstanding – diluted 40,729 40,421 41,578 43,473 47,664

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Adjusted Net Income and Adjusted Earnings per Diluted Share.

33

|

|

Reconciliation of 2014 Net Income And Operating Income to Adjusted EBITDA

All numbers in $000s

Corporate Forensic and Economic Strategic

Year Ended December 31, 2014 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net income $58,807

Interest income and other ($4,670)

Interest expense $50,685

Income tax provision $42,604

Operating income (1) $46,913 $83,180 $55,282 $46,906 $15,603 ($100,458) $147,426

Depreciation and amortization of intangible $3,568 $4,301 $4,068 $15,768 $2,562 $3,722 $33,989

assets

Amortization of other intangible assets $5,589 $3,613 $1,047 $852 $4,420 — $15,521

Special charges $84 $308 $12 $19 $3 $15,913 $16,339

Remeasurement of acquisition-related ($662) ($934) ($1,127) ——— ($2,723)

contingent consideration

Adjusted EBITDA (1) $55,492 $90,468 $59,282 $63,545 $22,588 ($80,823) $210,552

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income and Adjusted EBITDA.

34

|

|

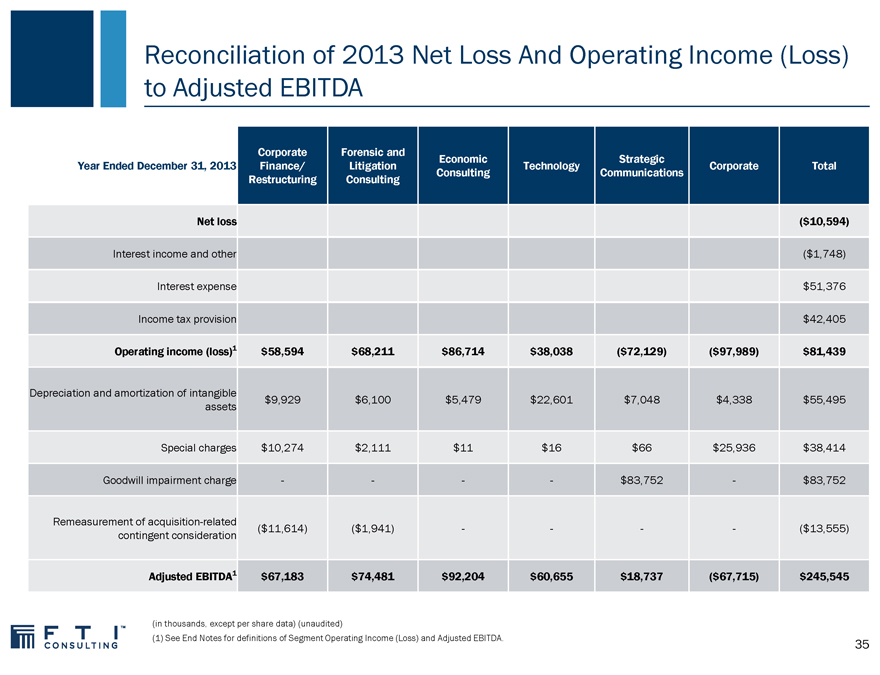

Reconciliation of 2013 Net Loss And Operating Income (Loss) to Adjusted EBITDA

Corporate Forensic and Economic Strategic

Year Ended December 31, 2013 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net loss ($10,594)

Interest income and other ($1,748)

Interest expense $51,376

Income tax provision $42,405

Operating income (loss)1 $58,594 $68,211 $86,714 $38,038 ($72,129) ($97,989) $81,439

Depreciation and amortization of intangible $9,929 $6,100 $5,479 $22,601 $7,048 $4,338 $55,495

assets

Special charges $10,274 $2,111 $11 $16 $66 $25,936 $38,414

Goodwill impairment charge ———— $83,752 — $83,752

Remeasurement of acquisition-related ($11,614) ($1,941) ———— ($13,555)

contingent consideration

Adjusted EBITDA1 $67,183 $74,481 $92,204 $60,655 $18,737 ($67,715) $245,545

(in thousands, except per share data) (unaudited)

| (1) |

|

See End Notes for definitions of Segment Operating Income (Loss) and Adjusted EBITDA. |

35

|

|

Reconciliation of 2012 Net Loss And Operating Income (Loss) to Adjusted EBITDA

All numbers in $000s

Corporate Forensic and Economic Strategic

Year Ended December 31, 2012 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net loss ($36,986)

Interest income and other ($5,659)

Interest expense $56,731

Income tax provision $40,100

Loss on early extinguishment of debt $4,850

Operating income (loss) (1) $80,970 $45,809 $71,992 $33,642 ($97,298) ($76,079) $59,036

Depreciation and amortization of $8,835 $6,487 $4,478 $20,447 $7,218 $4,546 $52,011

intangible assets

Special charges $11,332 $8,276 $991 $3,114 $4,712 $1,132 $29,557

Goodwill impairment charge ———— $110,387 — $110,387

Remeasurement of acquisition-related ($5,222) ($6) ———— ($5,228)

contingent consideration

Adjusted EBITDA(1) $95,915 $60,566 $77,461 $57,203 $25,019 ($70,401) $245,763

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income (Loss) and Adjusted EBITDA.

36

|

|

Reconciliation of 2011 Net Income And Operating Income to Adjusted EBITDA

All numbers in $000s

Forensic and

Corporate Finance/ Economic Strategic

Year Ended December 31, 2011 Litigation Technology Corporate Total

Restructuring Consulting Communications

Consulting

Net income $103,903

Interest income and other ($6,304)

Interest expense $58,624

Income tax provision $49,224

Operating income (1) $66,591 $74,831 $60,890 $ 57,917 $19,066 ($73,848) $205,447

Depreciation and amortization of intangible $8,902 $6,215 $4,045 $ 19,094 $7,735 $4,962 $50,953

assets

Special charges $9,440 $839 $2,093 —— $2,840 $15,212

Remeasurement of acquisition-related ($8,991) ($962) — ——— ($9,953)

contingent consideration

Adjusted EBITDA (1) $75,942 $80,923 $67,028 $ 77,011 $26,801 ($66,046) $261,659

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income and Adjusted EBITDA.

37

|

|

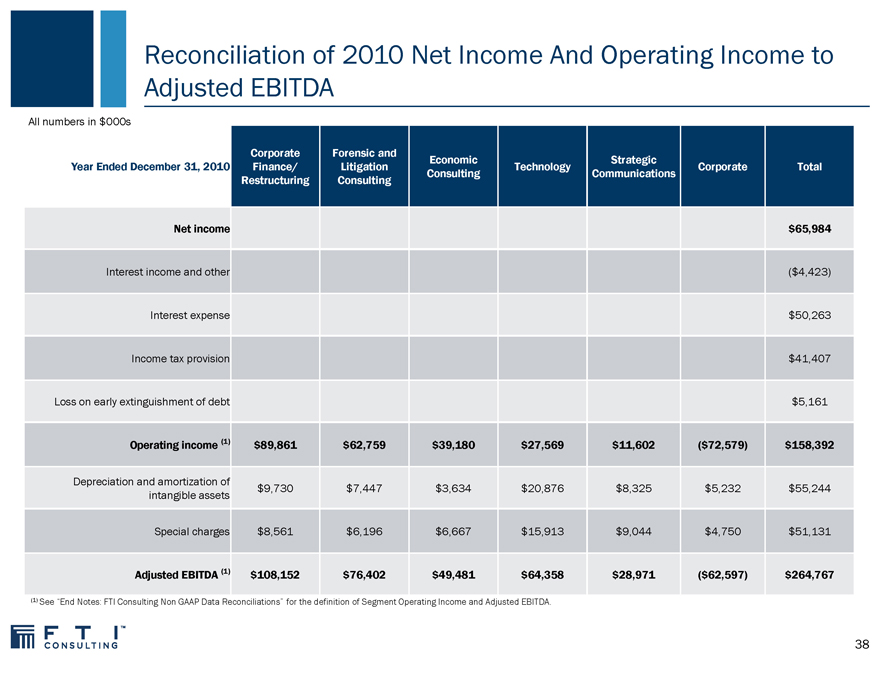

Reconciliation of 2010 Net Income And Operating Income to Adjusted EBITDA

All numbers in $000s

Corporate Forensic and Economic Strategic

Year Ended December 31, 2010 Finance/ Litigation Technology Corporate Total

Restructuring Consulting Consulting Communications

Net income $65,984

Interest income and other ($4,423)

Interest expense $50,263

Income tax provision $41,407

Loss on early extinguishment of debt $5,161

Operating income (1) $89,861 $62,759 $39,180 $ 27,569 $11,602 ($72,579) $158,392

Depreciation and amortization of $9,730 $7,447 $3,634 $ 20,876 $8,325 $5,232 $55,244

intangible assets

Special charges $8,561 $6,196 $6,667 $ 15,913 $9,044 $4,750 $51,131

Adjusted EBITDA (1) $108,152 $76,402 $49,481 $ 64,358 $28,971 ($62,597) $264,767

(1) See “End Notes: FTI Consulting Non GAAP Data Reconciliations” for the definition of Segment Operating Income and Adjusted EBITDA.

38

|

|

End Notes: FTI Consulting Non-GAAP Data Reconciliations

Beginning with the quarter ended March 31, 2014, the definitions of each of these non-GAAP measures have been updated to exclude the impact of changes in the fair value of acquisition-related contingent consideration liabilities. Prior period amounts included herein have been reclassified to conform to the current period’s presentation.

We define Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”) as Net Income and Earnings Per Diluted Share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. We use Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total Company operating performance on a consistent basis. We believe that this measure, when considered together with our GAAP financial results, provides management and investors with a more complete understanding of our business operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt.

We define Segment Operating Income (loss) as a segment’s share of consolidated operating income (loss). We define Total Segment Operating Income (loss) as the total of Segment Operating Income (loss) for all segments, which excludes unallocated corporate expenses. We use Segment Operating Income (loss) for the purpose of calculating Adjusted Segment EBITDA (loss). We define Adjusted EBITDA as consolidated net income (loss) before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income (loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We define Total Adjusted Segment EBITDA as the total of Adjusted Segment EBITDA for all segments, which excludes unallocated corporate expenses. We define Adjusted Segment EBITDA Margin as Adjusted Segment EBITDA as a percentage of a segment’s share of revenue. We use Adjusted Segment EBITDA to internally evaluate the financial performance of our segments because we believe it is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and investors with a more complete understanding of our operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges, and goodwill impairment charges. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of our operating results to the operating results of other companies.

Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Consolidated Statements of Comprehensive Income (loss).

39

|

|

Critical Thinking at the Critical Time ™

40