|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Kentucky

|

61-1206757

|

|

|

(State or other jurisdiction of incorporation organization)

|

(I.R.S. Employer Identification No.)

|

|

|

2883 Fifth Avenue

Huntington, West Virginia

|

25702

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant’s telephone number (304) 525-1600

|

||

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

PFBI

|

The Nasdaq Stock Market LLC

|

|

Large accelerated filer

|

Accelerated filer

|

|

|

Non-accelerated filer

|

Smaller reporting company

|

Emerging growth company

|

|

Title of each class

|

Outstanding at March 6, 2020

|

|

|

Common Stock, no par value

|

14,658,132

|

|

Document

|

Parts Into Which Incorporated

|

|

|

Proxy Statement for the Annual Meeting of Shareholders to be held on June 17, 2020.

|

Part III

|

|

PART I

|

||||

|

4

|

||||

|

18

|

||||

|

28

|

||||

|

29

|

||||

|

30

|

||||

|

30

|

||||

|

PART II

|

||||

|

31

|

||||

|

33

|

||||

|

34

|

||||

|

72

|

||||

|

94

|

||||

|

95

|

||||

|

98

|

||||

|

100

|

||||

|

101

|

||||

|

102

|

||||

|

103

|

||||

|

104

|

||||

|

106

|

||||

|

164

|

||||

|

164

|

||||

|

164

|

||||

|

PART III

|

||||

|

165

|

||||

|

165

|

||||

|

165

|

||||

|

165

|

||||

|

165

|

||||

|

PART IV

|

||||

|

166

|

||||

|

170

|

||||

| |

created a new agency to centralize responsibility for consumer financial protection, the Consumer Financial Protection Bureau, which will be responsible for implementing, examining and enforcing

compliance with federal consumer financial laws;

|

| |

applied the same leverage and risk-based capital requirements that apply to insured depository institutions to most bank holding companies;

|

| |

required bank holding companies and banks to be both well capitalized and well managed in order to acquire banks located outside their home state;

|

| |

changed the assessment base for federal deposit insurance from the amount of insured deposits to consolidated assets less tangible capital, eliminated the ceiling on the size of the Deposit

Insurance Fund and increased the floor of the size for the Deposit Insurance Fund;

|

| |

imposed comprehensive regulation of the over-the-counter derivatives market, which would include certain provisions that would effectively prohibit insured depository institutions from conducting

certain derivatives businesses within the institution itself;

|

| |

required large, publicly-traded bank holding companies to create a risk committee responsible for the oversight of enterprise risk management;

|

| |

implemented corporate governance revisions, including with regard to executive compensation and proxy access by shareholders, that apply to all public companies, not just financial institutions;

|

| |

made permanent the $250,000 limit for federal deposit insurance, increased the cash limit of Securities Investor Protection Corporation protection from $100,000 to $250,000 and provided unlimited

federal deposit insurance for non-interest-bearing demand transaction accounts at all insured depository institutions until December 31, 2012;

|

| |

repealed the federal prohibitions on the payment of interest on demand deposits, thereby permitting depository institutions to pay interest on business transaction and other accounts;

|

| |

amended the Electronic Fund Transfer Act (“EFTA”) to, among other things, give the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) the authority to establish rules

regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a

transaction to the issuer; and

|

| |

increased the authority of the Federal Reserve Board to examine financial holding companies and their non-bank subsidiaries.

|

|

•

|

timely and successfully integrate the operations of Premier and each of the acquisitions;

|

|

•

|

maintain the existing relationships with the depositors of each acquisition to minimize the withdrawal of deposits subsequent to the

merger(s);

|

|

•

|

maintain and enhance the existing relationships with the borrowers of each acquisition to limit potential losses from loans made by the them

prior to the acquisition;

|

|

•

|

control the incremental non-interest expense of the integrated operations to maintain overall operating efficiencies;

|

|

•

|

retain and attract qualified personnel at each acquisition; and

|

|

•

|

compete effectively in the communities served by each acquisition and in nearby communities.

|

|

Branch

|

Address

|

Location and Zip Code

|

Leased/

Owned

|

|

Charleston

|

201 Pennsylvania Avenue

|

Charleston, WV 25302

|

Owned

|

|

Madison

|

300 State Street

|

Madison, WV 25130

|

Owned

|

|

Van

|

18854 Pond Fork Road

|

Van, WV 25206

|

Owned

|

|

West Hamlin

|

40 Lincoln Plaza

|

Branchland, WV 25506

|

Leased

|

|

Logan

|

307 Hudgins Street

|

Logan, WV 25601

|

Owned

|

|

Buckhannon

|

14 North Locust Street

|

Buckhannon, WV 26201

|

Owned

|

|

Bridgeport

|

25 Oakmont Lane

|

Bridgeport, WV 26330

|

Owned

|

|

Philippi

|

5 South Main Street

|

Philippi, WV 26416

|

Owned

|

|

Gassaway

|

700 Elk Street

|

Gassaway, WV 26624

|

Owned

|

|

Flatwoods

|

3802 Sutton Lane

|

Sutton, WV 26601

|

Owned

|

|

Sutton

|

373 West Main Street

|

Sutton, WV 26601

|

Owned

|

|

Clay

|

2043 Main Street

|

Clay, WV 25043

|

Owned

|

|

Rock Cave

|

State Routes 4 & 20

|

Rock Cave, WV 26234

|

Leased

|

|

Burnsville

|

316 Walbash Avenue

|

Burnsville, WV 26335

|

Leased

|

|

Ravenswood

|

601 Washington Street

|

Ravenswood, WV 26164

|

Owned

|

|

Ripley South

|

606 South Church Street

|

Ripley, WV 25271

|

Owned

|

|

Ripley East

|

103 Miller Drive

|

Ripley, WV 25271

|

Owned

|

|

Spencer Main

|

303 Main Street

|

Spencer, WV 25276

|

Owned

|

|

Spencer Drive Thru

|

406 Main Street

|

Spencer, WV 25276

|

Owned

|

|

Mineral Wells

|

1397 Elizabeth Pike

|

Mineral Wells, WV 26150

|

Owned

|

|

Connecticut Avenue

|

1130 Connecticut Avenue

|

Washington, DC 20036

|

Leased

|

|

DuPont Circle

|

1604 17th Street, N.W.

|

Washington, DC 20009

|

Leased

|

|

K Street

|

1501 K Street, N.W.

|

Washington, DC 20006

|

Leased

|

|

NoMa

|

1160 First Street, NE

|

Washington, DC 20002

|

Leased

|

|

Chevy Chase

|

5530 Wisconsin Avenue

|

Chevy Chase, MD 20815

|

Leased

|

|

Richmond

|

320 North First Street

|

Richmond, VA 23219

|

Owned

|

|

Hampton

|

101 N. Armistead Avenue

|

Hampton, VA 23669

|

Owned

|

|

Ronceverte

|

124 Cedar Street

|

Ronceverte, WV 24970

|

Owned

|

|

Lewisburg

|

3371 North Jefferson Street

|

Lewisburg, WV 24901

|

Owned

|

|

Downtown Lewisburg

|

1085 East Washington St.

|

Lewisburg, WV 24901

|

Owned

|

|

White Sulphur Springs

|

42736 Midland Trail East

|

White Sulphur Springs, WV

|

Owned

|

|

Covington

|

151 North Court Avenue

|

Covington, VA 24426

|

Owned

|

|

Loan Production Office

|

Address

|

Location and Zip Code

|

Leased/

Owned

|

|

Beckley

|

300 North Kanawha St, Suite 207

|

Beckley, WV 25801

|

Leased

|

|

Fairmont

|

412 Fairmont Avenue

|

Fairmont, WV 26554

|

Leased

|

|

Branch

|

Address

|

Location and Zip Code

|

Leased/

Owned

|

|

AA Branch

|

67 Commercial Drive, Suite 3

|

Vanceburg, KY 41179

|

Leased

|

|

Brooksville

|

111 Powell Street

|

Brooksville, KY 41004

|

Owned

|

|

Cold Spring

|

136 Plaza Drive

|

Cold Spring, KY 41076

|

Owned

|

|

Eminence

|

5230 South Main Street

|

Eminence, KY 40019

|

Owned

|

|

Florence

|

8542 US 42 Highway

|

Florence KY 41042

|

Owned

|

|

Ft.Wright

|

3425 Valley Plaza Pkway

|

Ft. Wright, KY 41017

|

Owned

|

|

Garrison

|

9234 East KY 8

|

Garrison, KY 41141

|

Owned

|

|

Jackson Highway 15

|

770 Highway 15 North

|

Jackson, KY 41339

|

Owned

|

|

Jackson Main

|

1126 Main Street

|

Jackson, KY 41339

|

Owned

|

|

Maysville

|

1201 US 68

|

Maysville, KY 41056

|

Owned

|

|

Mt. Olivet

|

17 West Walnut Street

|

Mt. Olivet, KY 41064

|

Owned

|

|

Tollesboro

|

2954 West KY 10

|

Tollesboro, KY 41189

|

Owned

|

|

Huntington

|

2600 5th Avenue

|

Huntington, WV 25701

|

Owned

|

|

Ironton

|

221 Railroad Street

|

Ironton, OH 45638

|

Owned

|

|

Proctorville

|

7604 County Road 107 Unit A

|

Proctorville, OH 45669

|

Leased

|

|

Ripley

|

104 Main Street

|

Ripley, OH 45167

|

Owned

|

|

Cash

|

Sales Price

|

|||||||||||

|

Dividends Paid

|

High

|

Low

|

||||||||||

|

2018

|

||||||||||||

|

First Quarter *

|

0.120

|

$

|

16.80

|

$

|

13.43

|

|||||||

|

Second Quarter *

|

0.150

|

21.40

|

14.82

|

|||||||||

|

Third Quarter

|

0.150

|

20.91

|

18.01

|

|||||||||

|

Fourth Quarter

|

0.150

|

19.10

|

14.42

|

|||||||||

|

0.570

|

||||||||||||

|

2019

|

||||||||||||

|

First Quarter

|

0.150

|

$

|

16.99

|

$

|

14.07

|

|||||||

|

Second Quarter

|

0.150

|

17.01

|

14.27

|

|||||||||

|

Third Quarter

|

0.150

|

18.50

|

14.34

|

|||||||||

|

Fourth Quarter

|

0.150

|

20.38

|

16.81

|

|||||||||

|

0.600

|

||||||||||||

|

2020

|

||||||||||||

|

First Quarter (through March 5, 2020)

|

$

|

0.000

|

$

|

18.11

|

$

|

15.08

|

||||||

|

* For comparative purposes, historical per share amounts prior to June 8, 2018 have been adjusted to reflect a 5 for 4 stock split declared on May 16, 2018,

distributed on June 8, 2018 to shareholders of record on June 4, 2018

|

||||||||||||

|

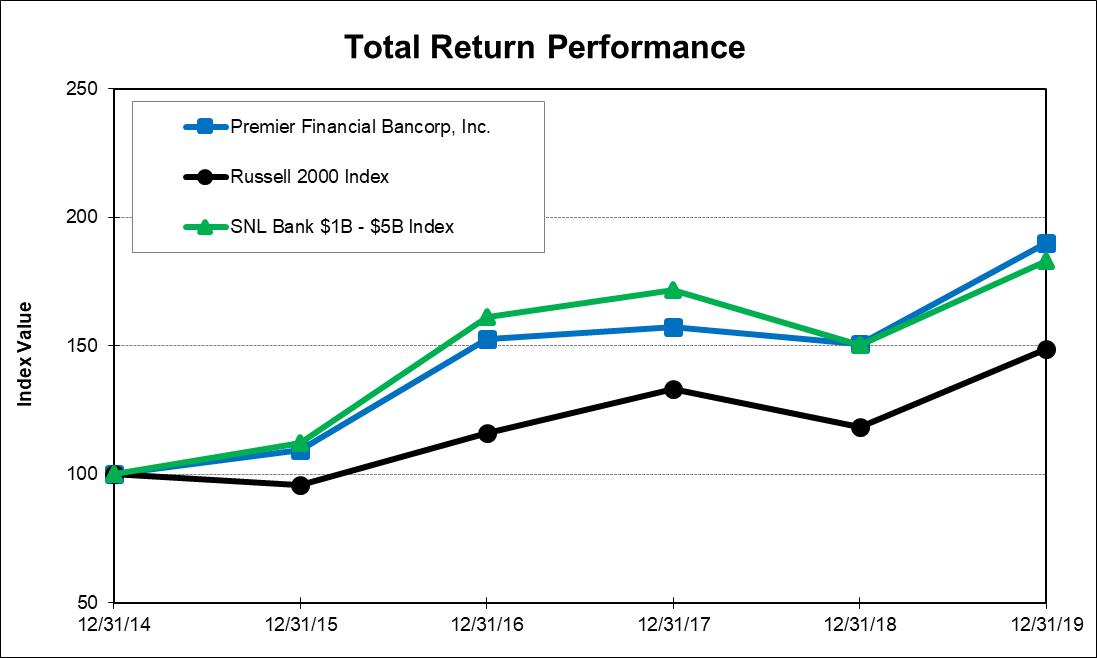

Period Ending

|

||||||

|

Index

|

12/31/14

|

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

12/31/19

|

|

Premier Financial Bancorp, Inc.

|

100.00

|

109.52

|

152.54

|

157.06

|

150.68

|

189.94

|

|

Russell 2000 Index

|

100.00

|

95.59

|

115.95

|

132.94

|

118.30

|

148.49

|

|

SNL Banks $1B-$5B Index

|

100.00

|

111.94

|

161.04

|

171.69

|

150.42

|

182.85

|

|

(Dollars in thousands, except per share amounts)

|

At or for the Year Ended December 31

|

|||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||

|

Earnings

|

||||||||||||||||||||

|

Net interest income

|

$

|

66,901

|

$

|

59,754

|

$

|

57,488

|

$

|

53,698

|

$

|

48,380

|

||||||||||

|

Provision for loan losses

|

1,250

|

2,315

|

2,499

|

1,748

|

326

|

|||||||||||||||

|

Non-interest income

|

9,334

|

9,098

|

8,655

|

8,187

|

7,099

|

|||||||||||||||

|

Non-interest expense

|

43,764

|

40,471

|

40,218

|

41,193

|

35,804

|

|||||||||||||||

|

Income taxes

|

7,025

|

5,898

|

8,607

|

6,770

|

6,903

|

|||||||||||||||

|

Net income

|

$

|

24,196

|

$

|

20,168

|

$

|

14,819

|

$

|

12,174

|

$

|

12,446

|

||||||||||

|

Financial Position

|

||||||||||||||||||||

|

Total assets

|

$

|

1,781,010

|

$

|

1,690,115

|

$

|

1,493,424

|

$

|

1,496,193

|

$

|

1,244,693

|

||||||||||

|

Loans

|

1,195,295

|

1,149,301

|

1,049,052

|

1,024,823

|

849,746

|

|||||||||||||||

|

Allowance for loan losses

|

13,542

|

13,738

|

12,104

|

10,836

|

9,647

|

|||||||||||||||

|

Goodwill and other intangibles

|

53,016

|

52,908

|

38,746

|

39,720

|

35,976

|

|||||||||||||||

|

Securities

|

390,754

|

365,731

|

278,466

|

288,607

|

255,466

|

|||||||||||||||

|

Deposits

|

1,495,753

|

1,430,127

|

1,272,675

|

1,279,386

|

1,060,196

|

|||||||||||||||

|

Other borrowings

|

26,803

|

33,381

|

28,310

|

32,679

|

32,986

|

|||||||||||||||

|

Subordinated debt

|

5,436

|

5,406

|

5,376

|

5,343

|

-

|

|||||||||||||||

|

Common equity

|

240,241

|

216,729

|

183,355

|

174,184

|

147,232

|

|||||||||||||||

|

Per Common Share Data

|

||||||||||||||||||||

|

Net income – basic

|

1.65

|

1.48

|

1.11

|

0.92

|

1.11

|

|||||||||||||||

|

Net income - diluted

|

1.64

|

1.47

|

1.10

|

0.92

|

1.08

|

|||||||||||||||

|

Book value

|

16.39

|

14.82

|

13.74

|

13.10

|

13.09

|

|||||||||||||||

|

Tangible book value

|

12.77

|

11.20

|

10.84

|

10.11

|

9.89

|

|||||||||||||||

|

Cash dividends

|

0.60

|

0.57

|

0.48

|

0.45

|

0.41

|

|||||||||||||||

|

Financial Ratios

|

||||||||||||||||||||

|

Return on average assets

|

1.40

|

%

|

1.30

|

%

|

0.99

|

%

|

0.82

|

%

|

0.98

|

%

|

||||||||||

|

Return on average common equity

|

10.45

|

%

|

10.46

|

%

|

8.13

|

%

|

6.94

|

%

|

8.41

|

%

|

||||||||||

|

Dividend payout

|

36.36

|

%

|

38.51

|

%

|

43.24

|

%

|

48.62

|

%

|

36.69

|

%

|

||||||||||

|

Stockholders’ equity to total assets at period-end

|

13.49

|

%

|

12.82

|

%

|

12.28

|

%

|

11.64

|

%

|

11.83

|

%

|

||||||||||

|

Average stockholders’ equity to average total assets

|

13.43

|

%

|

12.39

|

%

|

12.18

|

%

|

11.78

|

%

|

11.67

|

%

|

||||||||||

|

ANALYSIS of RETURN ON ASSETS and EQUITY

|

||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||

|

As a percent of average earning assets

|

||||||||||||||||||||

|

Fully taxable-equivalent net interest income

|

4.18

|

%

|

4.13

|

%

|

4.18

|

%

|

3.93

|

%

|

4.15

|

%

|

||||||||||

|

Provision for loan losses

|

(0.08

|

)

|

(0.16

|

)

|

(0.18

|

)

|

(0.13

|

)

|

(0.03

|

)

|

||||||||||

|

Net credit income

|

4.10

|

3.97

|

4.00

|

3.80

|

4.12

|

|||||||||||||||

|

Non-interest income

|

0.58

|

0.63

|

0.62

|

0.59

|

0.61

|

|||||||||||||||

|

Non-interest expense

|

(2.72

|

)

|

(2.79

|

)

|

(2.90

|

)

|

(2.99

|

)

|

(3.05

|

)

|

||||||||||

|

Tax equivalent adjustment

|

(0.01

|

)

|

(0.01

|

)

|

(0.03

|

)

|

(0.03

|

)

|

(0.03

|

)

|

||||||||||

|

Applicable income taxes

|

(0.44

|

)

|

(0.41

|

)

|

(0.62

|

)

|

(0.49

|

)

|

(0.59

|

)

|

||||||||||

|

Return on average earning assets

|

1.51

|

%

|

1.39

|

%

|

1.07

|

%

|

0.88

|

%

|

1.06

|

%

|

||||||||||

|

Multiplied by average earning assets to average total assets

|

93.12

|

93.39

|

92.62

|

92.56

|

92.45

|

|||||||||||||||

|

Return on average assets

|

1.40

|

%

|

1.30

|

%

|

0.99

|

%

|

0.82

|

%

|

0.98

|

%

|

||||||||||

|

Multiplied by average assets to average common stockholders’ equity

|

7.44

|

X

|

8.07

|

X

|

8.21

|

X

|

8.49

|

X

|

8.57

|

X

|

||||||||||

|

Return on average common equity

|

10.45

|

%

|

10.50

|

%

|

8.14

|

%

|

6.94

|

%

|

8.41

|

%

|

||||||||||

|

QUARTERLY FINANCIAL INFORMATION

|

||||||||||||||||||||

|

(Dollars in thousands, except per share amounts)

|

||||||||||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

Full Year

|

||||||||||||||||

|

2019

|

||||||||||||||||||||

|

Interest income

|

$

|

19,064

|

$

|

19,106

|

$

|

19,308

|

$

|

19,100

|

$

|

76,578

|

||||||||||

|

Interest expense

|

2,229

|

2,451

|

2,530

|

2,467

|

9,677

|

|||||||||||||||

|

Net interest income

|

16,835

|

16,655

|

16,778

|

16,633

|

66,901

|

|||||||||||||||

|

Provision for loan losses

|

560

|

330

|

425

|

(65

|

)

|

1,250

|

||||||||||||||

|

Net overhead

|

8,417

|

8,694

|

8,279

|

9,040

|

34,430

|

|||||||||||||||

|

Income before income taxes

|

7,858

|

7,631

|

8,074

|

7,658

|

31,221

|

|||||||||||||||

|

Net income

|

6,176

|

5,859

|

6,267

|

5,894

|

24,196

|

|||||||||||||||

|

Basic net income per share

|

0.42

|

0.40

|

0.43

|

0.40

|

1.65

|

|||||||||||||||

|

Diluted net income per share

|

0.42

|

0.40

|

0.43

|

0.40

|

1.64

|

|||||||||||||||

|

Dividends paid per share

|

0.15

|

0.15

|

0.15

|

0.15

|

0.60

|

|||||||||||||||

|

2018

|

||||||||||||||||||||

|

Interest income

|

$

|

15,799

|

$

|

15,753

|

$

|

16,001

|

$

|

18,268

|

$

|

65,821

|

||||||||||

|

Interest expense

|

1,164

|

1,334

|

1,492

|

2,077

|

6,067

|

|||||||||||||||

|

Net interest income

|

14,635

|

14,419

|

14,509

|

16,191

|

59,754

|

|||||||||||||||

|

Provision for loan losses

|

1,115

|

500

|

275

|

425

|

2,315

|

|||||||||||||||

|

Net overhead

|

6,923

|

8,227

|

7,730

|

8,493

|

31,373

|

|||||||||||||||

|

Income before income taxes

|

6,597

|

5,692

|

6,504

|

7,273

|

26,066

|

|||||||||||||||

|

Net income

|

5,133

|

4,375

|

5,021

|

5,639

|

20,168

|

|||||||||||||||

|

Basic net income per share

|

0.38

|

0.33

|

0.38

|

0.39

|

1.48

|

|||||||||||||||

|

Diluted net income per share

|

0.38

|

0.32

|

0.37

|

0.39

|

1.47

|

|||||||||||||||

|

Dividends paid per share

|

0.12

|

0.15

|

0.15

|

0.15

|

0.57

|

|||||||||||||||

|

AVERAGE CONSOLIDATED BALANCE SHEETS AND NET INTEREST INCOME ANALYSIS

|

||||||||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||||||||||||||

|

Average

Balance

|

Interest

|

Yield/

Rate (2)

|

Average

Balance

|

Interest

|

Yield/

Rate (2)

|

Average

Balance

|

Interest

|

Yield/

Rate (2)

|

||||||||||||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||||||||||||||

|

Interest earning assets

|

||||||||||||||||||||||||||||||||||||

|

U.S. Treasury and federal

agency securities

|

$

|

23,836

|

$

|

736

|

3.09

|

%

|

$

|

17,894

|

$

|

309

|

1.73

|

%

|

$

|

21,683

|

$

|

308

|

1.42

|

%

|

||||||||||||||||||

|

States and municipal

obligations (1)

|

13,948

|

481

|

3.45

|

10,291

|

322

|

3.13

|

12,132

|

402

|

3.31

|

|||||||||||||||||||||||||||

|

Mortgage backed securities

|

323,471

|

8,157

|

2.52

|

276,051

|

6,491

|

2.35

|

256,293

|

5,130

|

2.00

|

|||||||||||||||||||||||||||

|

Other securities

|

6,787

|

336

|

4.95

|

4,809

|

222

|

4.62

|

5,595

|

190

|

3.40

|

|||||||||||||||||||||||||||

|

Total investment securities

|

368,042

|

9,710

|

2.64

|

309,045

|

7,344

|

2.38

|

295,703

|

6,030

|

2.04

|

|||||||||||||||||||||||||||

|

Federal funds sold

|

18,385

|

409

|

2.22

|

11,848

|

248

|

2.09

|

7,051

|

73

|

1.04

|

|||||||||||||||||||||||||||

|

Interest-bearing deposits

with banks

|

62,852

|

1,323

|

2.10

|

72,307

|

1,441

|

1.99

|

36,405

|

603

|

1.66

|

|||||||||||||||||||||||||||

|

Loans, net of unearned

income (3)(4)

|

||||||||||||||||||||||||||||||||||||

|

Commercial

|

823,603

|

46,448

|

5.64

|

733,983

|

38,971

|

5.31

|

720,679

|

37,948

|

5.27

|

|||||||||||||||||||||||||||

|

Real estate mortgage

|

303,191

|

16,572

|

5.47

|

294,271

|

15,589

|

5.30

|

292,650

|

15,145

|

5.18

|

|||||||||||||||||||||||||||

|

Installment

|

30,095

|

2,330

|

7.74

|

31,281

|

2,409

|

7.70

|

32,566

|

2,566

|

7.88

|

|||||||||||||||||||||||||||

|

Total loans

|

1,156,889

|

65,350

|

5.65

|

1,059,535

|

56,969

|

5.38

|

1,045,895

|

55,659

|

5.32

|

|||||||||||||||||||||||||||

|

Total interest earning assets

|

1,606,168

|

76,792

|

4.78

|

1,452,735

|

66,002

|

4.54

|

1,385,054

|

62,365

|

4.50

|

|||||||||||||||||||||||||||

|

Allowance for loan losses

|

(13,815

|

)

|

(13,058

|

)

|

(11,461

|

)

|

||||||||||||||||||||||||||||||

|

Cash and due from banks

|

22,856

|

25,478

|

40,915

|

|||||||||||||||||||||||||||||||||

|

Premises and equipment

|

36,864

|

25,784

|

23,775

|

|||||||||||||||||||||||||||||||||

|

Other assets

|

72,704

|

64,600

|

57,170

|

|||||||||||||||||||||||||||||||||

|

Total assets

|

$

|

1,724,777

|

$

|

1,555,539

|

$

|

1,495,453

|

||||||||||||||||||||||||||||||

|

Liabilities and Equity:

|

||||||||||||||||||||||||||||||||||||

|

Interest bearing liabilities

|

||||||||||||||||||||||||||||||||||||

|

NOW and money market

|

$

|

411,717

|

1,324

|

0.32

|

%

|

$

|

378,617

|

958

|

0.25

|

%

|

$

|

368,093

|

619

|

0.17

|

%

|

|||||||||||||||||||||

|

Savings deposits

|

246,954

|

625

|

0.25

|

240,071

|

581

|

0.24

|

238,306

|

478

|

0.20

|

|||||||||||||||||||||||||||

|

Certificates of deposit and other time deposits

|

408,712

|

7,060

|

1.73

|

352,511

|

3,905

|

1.11

|

348,124

|

2,758

|

0.79

|

|||||||||||||||||||||||||||

|

Total interest bearing deposits

|

1,067,383

|

9,009

|

0.84

|

971,199

|

5,444

|

0.56

|

954,523

|

3,855

|

0.40

|

|||||||||||||||||||||||||||

|

Short-term borrowings

|

21,710

|

70

|

0.32

|

22,410

|

34

|

0.15

|

24,965

|

60

|

0.24

|

|||||||||||||||||||||||||||

|

Other borrowings

|

710

|

31

|

4.37

|

3,809

|

156

|

4.10

|

7,074

|

292

|

4.13

|

|||||||||||||||||||||||||||

|

FHLB advances

|

6,718

|

198

|

2.95

|

2,958

|

81

|

2.74

|

-

|

-

|

-

|

|||||||||||||||||||||||||||

|

Subordinated debt

|

5,420

|

369

|

6.81

|

5,390

|

352

|

6.53

|

5,359

|

295

|

5.50

|

|||||||||||||||||||||||||||

|

Total interest-bearing liabilities

|

1,101,941

|

9,677

|

0.88

|

%

|

1,005,766

|

6,067

|

0.60

|

%

|

991,921

|

4,502

|

0.45

|

%

|

||||||||||||||||||||||||

|

Non-interest bearing deposits

|

379,312

|

352,565

|

316,931

|

|||||||||||||||||||||||||||||||||

|

Other liabilities

|

11,601

|

4,451

|

4,411

|

|||||||||||||||||||||||||||||||||

|

Common equity

|

231,923

|

192,757

|

182,190

|

|||||||||||||||||||||||||||||||||

|

Total liabilities and equity

|

$

|

1,724,777

|

$

|

1,555,539

|

$

|

1,495,453

|

||||||||||||||||||||||||||||||

|

Net interest earnings (1)

|

$

|

67,115

|

$

|

59,935

|

$

|

57,863

|

||||||||||||||||||||||||||||||

|

Net interest spread (1)

|

3.90

|

%

|

3.94

|

%

|

4.05

|

%

|

||||||||||||||||||||||||||||||

|

Net interest margin (1)

|

4.18

|

%

|

4.13

|

%

|

4.18

|

%

|

||||||||||||||||||||||||||||||

|

(1) Taxable – equivalent yields are calculated assuming a 21% federal income tax rate for 2019 and 2018 and 35% for 2017

(2) Yields are calculated on historical cost except for yields on marketable equity securities that are calculated used fair value

(3) Includes loan fees, immaterial in amount, in both interest income and the calculation of yield on loans

(4) Includes loans on non-accrual status

|

||||||||||||||||||||||||||||||||||||

|

LOAN SUMMARY

|

||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||

|

As of December 31

|

||||||||||||||||||||||||||||||

|

2019

|

%

|

2018

|

%

|

2017

|

%

|

2016

|

%

|

2015

|

%

|

|||||||||||||||||||||

|

Summary of Loans by Type

|

||||||||||||||||||||||||||||||

|

Commercial, secured by real estate

|

$

|

523,958

|

43.8

|

%

|

$

|

493,937

|

43.0

|

%

|

$

|

451,433

|

43.0

|

%

|

$

|

443,832

|

43.3

|

%

|

$

|

374,558

|

44.1

|

%

|

||||||||||

|

Commercial, other

|

105,079

|

8.8

|

103,624

|

9.0

|

78,259

|

7.5

|

76,736

|

7.5

|

68,339

|

8.0

|

||||||||||||||||||||

|

Real estate construction and land development

|

136,138

|

11.4

|

128,926

|

11.2

|

139,012

|

13.2

|

117,828

|

11.5

|

78,695

|

9.3

|

||||||||||||||||||||

|

Real estate mortgage

|

389,985

|

32.6

|

381,027

|

33.2

|

338,829

|

32.3

|

342,294

|

33.4

|

285,826

|

33.6

|

||||||||||||||||||||

|

Agricultural

|

1,860

|

0.2

|

2,233

|

0.2

|

1,631

|

0.2

|

1,383

|

0.1

|

1,728

|

0.2

|

||||||||||||||||||||

|

Consumer

|

29,007

|

2.4

|

27,688

|

2.4

|

28,293

|

2.7

|

30,916

|

3.0

|

31,445

|

3.7

|

||||||||||||||||||||

|

Other

|

9,268

|

0.8

|

11,866

|

1.0

|

11,595

|

1.1

|

11,834

|

1.2

|

9,155

|

1.1

|

||||||||||||||||||||

|

Total loans

|

$

|

1,195,295

|

100.0

|

%

|

$

|

1,149,301

|

100.0

|

%

|

$

|

1,049,052

|

100.0

|

%

|

$

|

1,024,823

|

100.0

|

%

|

$

|

849,746

|

100.0

|

%

|

||||||||||

|

Non-performing Assets

|

||||||||||||||||||||||||||||||

|

Non-accrual loans

|

$

|

14,437

|

$

|

17,448

|

$

|

15,246

|

$

|

25,747

|

$

|

7,141

|

||||||||||||||||||||

|

Accruing loans which are contractually past due 90 days or more

|

2,228

|

1,086

|

3,391

|

1,999

|

3,032

|

|||||||||||||||||||||||||

|

Accruing troubled debt restructurings

|

3,020

|

6,283

|

12,584

|

8,268

|

3,996

|

|||||||||||||||||||||||||

|

Total non-performing and restructured loans

|

19,685

|

24,817

|

31,221

|

36,014

|

14,169

|

|||||||||||||||||||||||||

|

Other real estate acquired through foreclosures

|

12,242

|

14,024

|

19,966

|

12,665

|

13,040

|

|||||||||||||||||||||||||

|

Total non-performing and restructured loans and other real estate

|

$

|

31,927

|

$

|

38,841

|

$

|

51,187

|

$

|

48,679

|

$

|

27,209

|

||||||||||||||||||||

|

Non-performing and restructured loans as a % of total loans

|

1.65

|

%

|

2.16

|

%

|

2.98

|

%

|

3.51

|

%

|

1.67

|

%

|

||||||||||||||||||||

|

Non-performing and restructured loans and other real estate as a % of total assets

|

1.79

|

%

|

2.30

|

%

|

3.43

|

%

|

3.25

|

%

|

2.19

|

%

|

||||||||||||||||||||

|

Allocation of Allowance forLoan Losses

|

||||||||||||||||||||||||||||||

|

Commercial, other

|

$

|

1,946

|

9.8

|

%

|

$

|

2,152

|

10.2

|

%

|

$

|

1,226

|

8.8

|

%

|

$

|

1,243

|

8.8

|

%

|

$

|

1,166

|

9.3

|

%

|

||||||||||

|

Real estate, construction

|

1,724

|

11.4

|

2,255

|

11.2

|

2,408

|

13.2

|

1,397

|

11.5

|

1,061

|

9.3

|

||||||||||||||||||||

|

Real estate, other

|

9,591

|

76.4

|

8,980

|

76.2

|

8,142

|

75.3

|

7,849

|

76.7

|

7,113

|

77.7

|

||||||||||||||||||||

|

Consumer installment

|

281

|

2.4

|

351

|

2.4

|

328

|

2.7

|

347

|

3.0

|

307

|

3.7

|

||||||||||||||||||||

|

Total

|

$

|

13,542

|

100.0

|

%

|

$

|

13,738

|

100.0

|

%

|

$

|

12,104

|

100.0

|

%

|

$

|

10,836

|

100.0

|

%

|

$

|

9,647

|

100.0

|

%

|

||||||||||

|

SUMMARY OF LOAN LOSS EXPERIENCE

|

||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

For the Year Ended December 31

|

||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||

|

Allowance for loan losses beginning of period

|

$

|

13,738

|

$

|

12,104

|

$

|

10,836

|

$

|

9,647

|

$

|

10,347

|

||||||||||

|

Amounts charged off:

|

||||||||||||||||||||

|

Commercial, financial and agricultural loans

|

680

|

794

|

496

|

347

|

611

|

|||||||||||||||

|

Real estate construction loans

|

14

|

20

|

129

|

-

|

900

|

|||||||||||||||

|

Real estate loans – other

|

829

|

398

|

1,000

|

323

|

376

|

|||||||||||||||

|

Consumer installment loans

|

193

|

156

|

278

|

340

|

209

|

|||||||||||||||

|

Total charge-offs

|

1,716

|

1,368

|

1,903

|

1,010

|

2,096

|

|||||||||||||||

|

Recoveries on amounts previously charged-off:

|

||||||||||||||||||||

|

Commercial, financial and agricultural loans

|

163

|

169

|

236

|

172

|

121

|

|||||||||||||||

|

Real estate construction loans

|

-

|

400

|

10

|

143

|

99

|

|||||||||||||||

|

Real estate loans – other

|

65

|

60

|

299

|

50

|

753

|

|||||||||||||||

|

Consumer installment loans

|

42

|

58

|

127

|

86

|

97

|

|||||||||||||||

|

Total recoveries

|

270

|

687

|

672

|

451

|

1,070

|

|||||||||||||||

|

Net charge-offs

|

1,446

|

681

|

1,231

|

559

|

1,026

|

|||||||||||||||

|

Provision for loan losses

|

1,250

|

2,315

|

2,499

|

1,748

|

326

|

|||||||||||||||

|

Allowance for loan losses, end of period

|

$

|

13,542

|

$

|

13,738

|

$

|

12,104

|

$

|

10,836

|

$

|

9,647

|

||||||||||

|

Average total loans

|

$

|

1,156,889

|

$

|

1,059,535

|

$

|

1,045,894

|

$

|

1,003,528

|

$

|

866,556

|

||||||||||

|

Total loans at year-end

|

1,195,295

|

1,149,301

|

1,049,052

|

1,024,823

|

849,746

|

|||||||||||||||

|

As a percent of average loans

|

||||||||||||||||||||

|

Net charge-offs

|

0.12

|

%

|

0.06

|

%

|

0.12

|

%

|

0.06

|

%

|

0.12

|

%

|

||||||||||

|

Provision for loan losses

|

0.11

|

%

|

0.22

|

%

|

0.24

|

%

|

0.17

|

%

|

0.04

|

%

|

||||||||||

|

Allowance for loan losses

|

1.17

|

%

|

1.30

|

%

|

1.16

|

%

|

1.08

|

%

|

1.11

|

%

|

||||||||||

|

As a percent of total loans at year-end

|

||||||||||||||||||||

|

Allowance for loan losses

|

1.13

|

%

|

1.20

|

%

|

1.15

|

%

|

1.06

|

%

|

1.14

|

%

|

||||||||||

|

As a multiple of net charge-offs

|

||||||||||||||||||||

|

Allowance for loan losses

|

9.37

|

X

|

20.17

|

X

|

9.83

|

X

|

19.38

|

X

|

9.40

|

X

|

||||||||||

|

Income before tax and provision for loan losses

|

22.46

|

X

|

41.68

|

X

|

21.06

|

X

|

37.02

|

X

|

19.18

|

X

|

||||||||||

|

LOAN MATURITIES and INTEREST SENSITIVITY

|

||||||||||||||||

|

December 31, 2019

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||

|

Projected Maturities*

|

||||||||||||||||

|

One Year or Less

|

One Through Five Years

|

Over

Five Years

|

Total

|

|||||||||||||

|

Commercial, secured by real estate

|

$

|

115,699

|

$

|

385,358

|

$

|

22,957

|

$

|

524,014

|

||||||||

|

Commercial, other

|

57,304

|

43,067

|

4,756

|

105,127

|

||||||||||||

|

Real estate construction

|

69,194

|

61,213

|

5,791

|

136,198

|

||||||||||||

|

Agricultural

|

186

|

1,501

|

173

|

1,860

|

||||||||||||

|

Total

|

$

|

242,383

|

$

|

491,139

|

$

|

33,677

|

$

|

767,199

|

||||||||

|

Fixed rate loans

|

$

|

57,647

|

$

|

169,475

|

$

|

16,642

|

$

|

243,764

|

||||||||

|

Floating rate loans

|

184,736

|

321,664

|

17,035

|

523,435

|

||||||||||||

|

Total

|

$

|

242,383

|

$

|

491,139

|

$

|

33,677

|

$

|

767,199

|

||||||||

|

Fixed rate loans projected to mature after one year

|

$

|

186,117

|

||||||||||||||

|

Floating rate loans projected to mature after one year

|

338,699

|

|||||||||||||||

|

Total

|

$

|

524,816

|

||||||||||||||

|

(*) Based on scheduled or approximate repayments

|

||||||||||||||||

|

FAIR VALUE OF SECURITIES AVAILABLE FOR SALE

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

As of December 31

|

||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

U.S. government sponsored entity securities

|

$

|

30,730

|

$

|

24,170

|

$

|

19,134

|

||||||

|

States and political subdivisions

|

16,017

|

14,327

|

11,634

|

|||||||||

|

Mortgage-backed securities issued by government sponsored entities

|

341,953

|

323,785

|

247,698

|

|||||||||

|

Other securities

|

2,054

|

3,449

|

-

|

|||||||||

|

Total securities

|

$

|

390,754

|

$

|

365,731

|

$

|

278,466

|

||||||

|

SECURITIES MATURITY AND YIELD ANALYSIS

|

||||||||||||

|

December 31, 2019

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Fair Value

|

Average Maturity (yrs/mos)

|

Taxable Equivalent Yield*

|

||||||||||

|

U.S. government sponsored entity securities

|

||||||||||||

|

Within one year

|

$

|

7,633

|

1.95

|

%

|

||||||||

|

After one but within five years

|

12,105

|

2.68

|

||||||||||

|

After five but within ten years

|

10,450

|

2.51

|

||||||||||

|

After ten years

|

542

|

2.24

|

||||||||||

|

Total U.S. government sponsored entity securities

|

$

|

30,730

|

4/1

|

2.43

|

||||||||

|

States and political subdivisions

|

||||||||||||

|

Within one year

|

1,822

|

3.15

|

||||||||||

|

After one but within five years

|

3,238

|

2.61

|

||||||||||

|

After five but within ten years

|

5,534

|

3.08

|

||||||||||

|

After ten years

|

5,423

|

3.78

|

||||||||||

|

Total states and political subdivisions securities

|

$

|

16,017

|

7/3

|

3.28

|

||||||||

|

Mortgage-backed securities**

|

||||||||||||

|

Within one year

|

2,225

|

3.10

|

||||||||||

|

After one but within five years

|

325,558

|

2.67

|

||||||||||

|

After five but within ten years

|

14,170

|

2.54

|

||||||||||

|

Total mortgage-backed securities

|

$

|

341,953

|

3/8

|

2.67

|

||||||||

|

Other securities

|

||||||||||||

|

After one but within five years

|

$

|

1,527

|

3.89

|

%

|

||||||||

|

After five but within ten years

|

527

|

3.67

|

||||||||||

|

Total other securities

|

$

|

2,054

|

3/3

|

3.84

|

||||||||

|

Total securities available-for-sale

|

$

|

390,754

|

3/10

|

2.68

|

||||||||

|

(*) Fully tax-equivalent using the rate of 21%

|

||||||||||||

|

(**) Maturities for mortgage-backed securities are based on expected average life

|

||||||||||||

|

MATURITY OF TIME DEPOSITS $100,000 OR MORE

|

||||

|

December 31, 2019

|

||||

|

(Dollars in thousands)

|

||||

|

Maturing 3 months or less

|

$

|

38,130

|

||

|

Maturing over 3 months

|

60,399

|

|||

|

Maturing over 6 months

|

63,889

|

|||

|

Maturing over 12 months

|

78,933

|

|||

|

Total

|

$

|

241,351

|

||

|

PAYMENTS DUE ON CONTRACTUAL OBLIGATIONS

|

||||||||||||||||||||

|

December 31, 2019

|

||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Total

|

Less than one year

|

1-3

years

|

3-5

years

|

More than five years

|

||||||||||||||||

|

Total deposits

|

$

|

1,495,753

|

$

|

1,357,823

|

$

|

116,463

|

$

|

21,459

|

$

|

8

|

||||||||||

|

Repurchase agreements

|

20,428

|

20,428

|

-

|

-

|

-

|

|||||||||||||||

|

Federal Home Loan Bank advances(1)

|

6,400

|

6,400

|

-

|

-

|

-

|

|||||||||||||||

|

Subordinated debentures (2)

|

6,186

|

-

|

-

|

-

|

6,186

|

|||||||||||||||

|

Operating lease obligations(3)

|

8,018

|

1,059

|

2,008

|

1,456

|

3,495

|

|||||||||||||||

|

Data and item processing contracts(4)

|

12,969

|

4,716

|

8,253

|

-

|

-

|

|||||||||||||||

|

Total

|

$

|

1,549,754

|

$

|

1,390,426

|

$

|

126,724

|

$

|

22,915

|

$

|

9,689

|

||||||||||

|

(1) The contractual obligation of the Federal Home Loan Bank advances differs from the carrying value on the balance sheet at Dec.31, 2019 due to the

remaining unamortized fair value adjustment recorded as a result of the acquisition of First Bank on Oct. 12, 2018.

(2) The contractual obligation of the subordinated debenture differs from the carrying value on the balance sheet at December 31, 2019 due to the

remaining unamortized fair value adjustment recorded as a result of the acquisition of Bankshares on January 15, 2016.

(3) The operating lease obligations include extension options that may be exercised by the Company.

(4) Data and item processing contractual obligations are estimated using the average billing for the last three months of 2019.

|

||||||||||||||||||||

|

Year-end

2019

|

Year-end

2018

|

ALCO Guidelines

|

||||||||||

|

Projected 1-year net interest income

|

||||||||||||

|

-100 bp change vs. base rate

|

-4.5

|

%

|

-4.2

|

%

|

5

|

%

|

||||||

|

+100 bp change vs. base rate

|

3.5

|

%

|

0.4

|

%

|

5

|

%

|

||||||

|

Projected 1-year net interest income

|

||||||||||||

|

-200 bp change vs. base rate

|

-6.7

|

%

|

-9.1

|

%

|

10

|

%

|

||||||

|

+200 bp change vs. base rate

|

6.0

|

%

|

-0.1

|

%

|

10

|

%

|

||||||

|

SELECTED CAPITAL INFORMATION

|

||||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

As of December 31

|

||||||||||||

|

2019

|

2018

|

Change

|

||||||||||

|

Stockholders’ Equity

|

$

|

240,241

|

$

|

216,729

|

$

|

23,512

|

||||||

|

Disallowed amounts of goodwill and other intangibles

|

(49,290

|

)

|

(49,263

|

)

|

(27

|

)

|

||||||

|

Deferred tax assets from NOL and tax credit carryforwards

|

(298

|

)

|

(286

|

)

|

(12

|

)

|

||||||

|

Unrealized (gain) loss on securities available for sale

|

(3,703

|

)

|

3,852

|

(7,555

|

)

|

|||||||

|

Common Equity Tier 1 capital

|

$

|

186,950

|

$

|

171,032

|

$

|

15,918

|

||||||

|

Qualifying subordinated debt

|

6,000

|

6,000

|

-

|

|||||||||

|

Tier 1 capital

|

$

|

192,950

|

$

|

177,032

|

$

|

15,918

|

||||||

|

Tier 2 capital adjustments

|

||||||||||||

|

Allowable amount of the allowance for loan losses

|

13,542

|

13,738

|

||||||||||

|

Total capital

|

$

|

206,492

|

$

|

190,770

|

||||||||

|

Total risk-weighted assets

|

$

|

1,253,472

|

$

|

1,201,379

|

||||||||

|

Ratios

|

||||||||||||

|

CET1 capital to risk-weighted assets

|

14.92

|

%

|

14.24

|

%

|

||||||||

|

Tier 1 capital to risk-weighted assets

|

15.39

|

%

|

14.74

|

%

|

||||||||

|

Total capital to risk-weighted assets

|

16.47

|

%

|

15.88

|

%

|

||||||||

|

Leverage

|

11.28

|

%

|

10.72

|

%

|

||||||||

|

Capital conservation buffer

|

8.47

|

%

|

7.88

|

%

|

||||||||

Net Interest Income

|

RATE VOLUME ANALYSIS OF CHANGES IN NET INTEREST INCOME

|

||||||||||||||||||||||||

|

(Dollars in thousands on a tax equivalent basis)

|

||||||||||||||||||||||||

|

2019 vs 2018

|

2018 vs 2017

|

|||||||||||||||||||||||

|

Increase (decrease) due to change in

|

Increase (decrease) due to change in

|

|||||||||||||||||||||||

|

Volume

|

Rate

|

Net Change

|

Volume

|

Rate

|

Net Change

|

|||||||||||||||||||

|

Interest income*:

|

||||||||||||||||||||||||

|

Loans

|

$

|

5,405

|

$

|

2,976

|

$

|

8,381

|

$

|

730

|

$

|

580

|

$

|

1,310

|

||||||||||||

|

Investment securities

|

1,500

|

866

|

2,366

|

282

|

1,032

|

1,314

|

||||||||||||||||||

|

Federal funds sold

|

145

|

16

|

161

|

70

|

105

|

175

|

||||||||||||||||||

|

Deposits with banks

|

(196

|

)

|

78

|

(118

|

)

|

695

|

143

|

838

|

||||||||||||||||

|

Total interest income

|

$

|

6,854

|

$

|

3,936

|

$

|

10,790

|

$

|

1,777

|

$

|

1,860

|

$

|

3,637

|

||||||||||||

|

Interest expense:

|

||||||||||||||||||||||||

|

Deposits

|

||||||||||||||||||||||||

|

NOW and money market

|

$

|

89

|

$

|

277

|

$

|

366

|

$

|

18

|

$

|

321

|

$

|

339

|

||||||||||||

|

Savings

|

17

|

27

|

44

|

4

|

99

|

103

|

||||||||||||||||||

|

Certificates of deposit

|

700

|

2,455

|

3,155

|

35

|

1,112

|

1,147

|

||||||||||||||||||

|

Short-term borrowings

|

(1

|

)

|

37

|

36

|

(6

|

)

|

(20

|

)

|

(26

|

)

|

||||||||||||||

|

Other borrowings

|

(135

|

)

|

10

|

(125

|

)

|

(134

|

)

|

(2

|

)

|

(136

|

)

|

|||||||||||||

|

FHLB borrowings

|

113

|

4

|

117

|

81

|

-

|

81

|

||||||||||||||||||

|

Subordinated debt

|

2

|

15

|

17

|

2

|

55

|

57

|

||||||||||||||||||

|

Total interest expense

|

$

|

785

|

$

|

2,825

|

$

|

3,610

|

$

|

-

|

$

|

1,565

|

$

|

1,565

|

||||||||||||

|

Net interest income*

|

$

|

6,069

|

$

|

1,111

|

$

|

7,180

|

$

|

1,777

|

$

|

295

|

$

|

2,072

|

||||||||||||

|

(*) Fully taxable equivalent using the rate of 21% for 2019 and 2018, and 35% for 2017.

Note – Changes to rate/volume are allocated to both rate and volume on a proportional dollar basis

|

||||||||||||||||||||||||

|

NON-INTEREST INCOME AND EXPENSE

|

||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||

|

Increase (Decrease) Over Prior Year

|

||||||||||||||||||||||||||||

|

2019

|

2018

|

|||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

Amount

|

Percent

|

Amount

|

Percent

|

||||||||||||||||||||||

|

Non-interest income:

|

||||||||||||||||||||||||||||

|

Service charges on deposit accounts

|

$

|

4,661

|

$

|

4,562

|

$

|

4,357

|

$

|

99

|

2.17

|

$

|

205

|

4.71

|

||||||||||||||||

|

Electronic banking income

|

3,488

|

3,530

|

3,260

|

(42

|

)

|

(1.19

|

)

|

270

|

8.28

|

|||||||||||||||||||

|

Secondary market mortgage income

|

214

|

180

|

201

|

34

|

18.89

|

(21

|

)

|

(10.45

|

)

|

|||||||||||||||||||

|

Other

|

971

|

826

|

837

|

145

|

17.55

|

(11

|

)

|

(1.31

|

)

|

|||||||||||||||||||

|

Total non-interest income

|

$

|

9,334

|

$

|

9,098

|

$

|

8,655

|

$

|

236

|

2.59

|

$

|

443

|

5.12

|

||||||||||||||||

|

Non-interest expense:

|

||||||||||||||||||||||||||||

|

Salaries and wages

|

$

|

17,502

|

$

|

16,118

|

$

|

15,595

|

$

|

1,384

|

8.59

|

$

|

523

|

3.35

|

||||||||||||||||

|

Employee benefits

|

3,983

|

3,685

|

3,760

|

298

|

8.09

|

(75

|

)

|

(1.99

|

)

|

|||||||||||||||||||

|

Total staff costs

|

21,485

|

19,803

|

19,355

|

1,682

|

8.49

|

448

|

2.31

|

|||||||||||||||||||||

|

Occupancy and equipment

|

6,909

|

6,294

|

5,999

|

615

|

9.77

|

295

|

4.92

|

|||||||||||||||||||||

|

Outside data processing

|

5,782

|

5,199

|

5,173

|

583

|

11.21

|

26

|

0.50

|

|||||||||||||||||||||

|

Professional fees

|

1,131

|

1,506

|

975

|

(375

|

)

|

(24.90

|

)

|

531

|

54.46

|

|||||||||||||||||||

|

Taxes, other than payroll, property and income

|

973

|

888

|

780

|

85

|

9.57

|

108

|

13.85

|

|||||||||||||||||||||

|

Amortization of intangibles

|

885

|

778

|

974

|

107

|

13.75

|

(196

|

)

|

(20.12

|

)

|

|||||||||||||||||||

|

OREO gains, losses and expenses, net

|

1,550

|

244

|

1,601

|

1,306

|

535.25

|

(1,357

|

)

|

(84.76

|

)

|

|||||||||||||||||||

|

Loan collection expenses

|

342

|

746

|

627

|

(404

|

)

|

(54.16

|

)

|

119

|

18.98

|

|||||||||||||||||||

|

FDIC insurance

|

223

|

564

|

675

|

(341

|

)

|

(60.46

|

)

|

(111

|

)

|

(16.44

|

)

|

|||||||||||||||||

|

Other expenses

|

4,484

|

4,449

|

4,059

|

35

|

0.79

|

390

|

9.61

|

|||||||||||||||||||||

|

Total non-interest expenses

|

$

|

43,764

|

$

|

40,471

|

$

|

40,218

|

$

|

3,293

|

8.14

|

$

|

253

|

0.63

|

||||||||||||||||

|

A.

|

Management’s Report on Internal Control Over Financial Reporting

|

|

/s/ Robert W. Walker

|

/s/ Brien M. Chase

|

|

|

Robert W. Walker, President and

|

Brien M. Chase, Senior Vice President

|

|

|

Chief Executive Officer

|

and Chief Financial Officer

|

|

|

Date: March 12, 2020

|

Date: March 12, 2020

|

|

2019

|

2018

|

|||||||

|

ASSETS

|

||||||||

|

Cash and due from banks

|

$

|

23,091

|

$

|

22,992

|

||||

|

Interest bearing bank balances

|

65,465

|

39,911

|

||||||

|

Federal funds sold

|

5,902

|

17,872

|

||||||

|

Cash and cash equivalents

|

94,458

|

80,775

|

||||||

|

Time deposits with other banks

|

598

|

1,094

|

||||||

|

Securities available for sale

|

390,754

|

365,731

|

||||||

|

Loans

|

1,195,295

|

1,149,301

|

||||||

|

Allowance for loan losses

|

(13,542

|

)

|

(13,738

|

)

|

||||

|

Net loans

|

1,181,753

|

1,135,563

|

||||||

|

Federal Home Loan Bank stock, at cost

|

4,450

|

3,628

|

||||||

|

Premises and equipment, net

|

37,257

|

29,385

|

||||||

|

Other real estate owned, net

|

12,242

|

14,024

|

||||||

|

Interest receivable

|

4,699

|

4,295

|

||||||

|

Goodwill

|

47,640

|

47,640

|

||||||

|

Other intangible assets

|

5,376

|

5,268

|

||||||

|

Deferred taxes

|

-

|

1,541

|

||||||

|

Other assets

|

1,783

|

1,171

|

||||||

|

Total assets

|

$

|

1,781,010

|

$

|

1,690,115

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Deposits

|

||||||||

|

Non-interest bearing

|

$

|

367,870

|

$

|

391,763

|

||||

|

Time deposits, $250,000 and over

|

100,638

|

74,161

|

||||||

|

Other interest bearing

|

1,027,245

|

964,203

|

||||||

|

Total deposits

|

1,495,753

|

1,430,127

|

||||||

|

Securities sold under agreements to repurchase

|

20,428

|

22,062

|

||||||

|

Other borrowed funds

|

-

|

2,500

|

||||||

|

FHLB advances

|

6,375

|

8,819

|

||||||

|

Subordinated debt

|

5,436

|

5,406

|

||||||

|

Interest payable

|

912

|

733

|

||||||

|

Deferred taxes

|

811

|

-

|

||||||

|

Other liabilities

|

11,054

|

3,739

|

||||||

|

Total liabilities

|

1,540,769

|

1,473,386

|

||||||

|

Stockholders' equity

|

||||||||

|