UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from ____ to ____

Commission file number

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of | (I.R.S. Employer | |||

incorporation or organization) | Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | Non-accelerated filer ◻ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

The number of shares of common stock outstanding on July 22, 2021 was

LTC PROPERTIES, INC.

FORM 10-Q

June 30, 2021

INDEX

PART I -- Financial Information | Page | |

| ||

Item 1. | Financial Statements | |

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 | |

45 | ||

45 | ||

46 | ||

46 | ||

46 | ||

47 | ||

LTC PROPERTIES, INC.

CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except per share)

|

|

| |||||

June 30, 2021 | December 31, 2020 | ||||||

(unaudited) | (audited) | ||||||

ASSETS | |||||||

Investments: | |||||||

Land | $ | | $ | | |||

Buildings and improvements |

| |

| | |||

Accumulated depreciation and amortization |

| ( |

| ( | |||

Operating real estate property, net |

| |

| | |||

Properties held-for-sale, net of accumulated depreciation: 2021—$ |

| |

| — | |||

Real property investments, net |

| |

| | |||

Mortgage loans receivable, net of loan loss reserve: 2021—$ |

| |

| | |||

Real estate investments, net |

| |

| | |||

Notes receivable, net of loan loss reserve: 2021—$ |

| |

| | |||

Investments in unconsolidated joint ventures | | | |||||

Investments, net |

| |

| | |||

Other assets: | |||||||

Cash and cash equivalents |

| |

| | |||

Debt issue costs related to bank borrowings |

| |

| | |||

Interest receivable |

| |

| | |||

Straight-line rent receivable |

| |

| | |||

Lease incentives | | | |||||

Prepaid expenses and other assets |

| |

| | |||

Total assets | $ | | $ | | |||

LIABILITIES | |||||||

Bank borrowings | $ | | $ | | |||

Senior unsecured notes, net of debt issue costs: 2021—$ |

| |

| | |||

Accrued interest |

| |

| | |||

Accrued expenses and other liabilities |

| |

| | |||

Total liabilities |

| |

| | |||

EQUITY | |||||||

Stockholders’ equity: | |||||||

Common stock: $ |

| |

| | |||

Capital in excess of par value |

| |

| | |||

Cumulative net income |

| |

| | |||

Cumulative distributions |

| ( |

| ( | |||

Total LTC Properties, Inc. stockholders’ equity |

| |

| | |||

Non-controlling interests |

| |

| | |||

Total equity |

| |

| | |||

Total liabilities and equity | $ | | $ | | |||

See accompanying notes.

3

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(amounts in thousands, except per share, unaudited)

Three Months Ended | Six Months Ended |

| ||||||||||||

June 30, | June 30, | |||||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 |

|

| |||||

Revenues: | ||||||||||||||

Rental income | $ | | $ | | $ | | $ | | ||||||

Interest income from mortgage loans |

| | |

| |

| | |||||||

Interest and other income |

| |

| |

| |

| | ||||||

Total revenues |

| |

| |

| |

| | ||||||

Expenses: | ||||||||||||||

Interest expense |

| |

| |

| |

| | ||||||

Depreciation and amortization |

| |

| |

| |

| | ||||||

(Recovery) provision for credit losses |

| — |

| — |

| ( |

| | ||||||

Transaction costs | | | | | ||||||||||

Property tax expense | | | | | ||||||||||

General and administrative expenses |

| |

| |

| |

| | ||||||

Total expenses |

| |

| |

| |

| | ||||||

Other operating income: | ||||||||||||||

Gain on sale of real estate, net | | | | | ||||||||||

Operating income |

| |

| |

| |

| | ||||||

Loss on unconsolidated joint ventures | — | ( | — | ( | ||||||||||

Income from unconsolidated joint ventures | | — | | | ||||||||||

Net income | | | | | ||||||||||

Income allocated to non-controlling interests |

| ( |

| ( |

| ( |

| ( | ||||||

Net income attributable to LTC Properties, Inc. |

| |

| | |

| | |||||||

Income allocated to participating securities |

| ( | ( | ( |

| ( | ||||||||

Net income available to common stockholders | $ | | $ | | $ | | $ | | ||||||

Earnings per common share: | ||||||||||||||

Basic | $ | | $ | | $ | | $ | | ||||||

Diluted | $ | | $ | | $ | | $ | | ||||||

Weighted average shares used to calculate earnings per common share: | ||||||||||||||

Basic |

| |

| |

| |

| | ||||||

Diluted |

| |

| |

| |

| | ||||||

Dividends declared and paid per common share | $ | | $ | | $ | | $ | | ||||||

Comprehensive Income: | ||||||||||||||

Net income | $ | | $ | | $ | | $ | | ||||||

Comprehensive income | $ | | $ | | $ | | $ | | ||||||

See accompanying notes.

4

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF EQUITY

(In thousands)

Capital in | Cumulative | Total | Non- | |||||||||||||||||||||

Common Stock | Excess of | Net | Cumulative | Stockholder's | Controlling | Total | ||||||||||||||||||

Shares | Amount | Par Value | Income | Distributions | Equity | Interests | Equity | |||||||||||||||||

Balance—December 31, 2019 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Vesting of performance-based stock units | | — | — | — | ( | ( | — | ( | ||||||||||||||||

Issuance of restricted stock | | | ( | — | — | — | — | — | ||||||||||||||||

Repurchase of common stock | ( | ( | ( | — | — | ( | — | ( | ||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Other | ( | ( | ( | — | — | ( | — | ( | ||||||||||||||||

Balance—March 31, 2020 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Issuance of restricted stock | — | ( | — | — | ( | — | ( | |||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Balance—June 30, 2020 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Other | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||

Balance—September 30, 2020 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Issuance of restricted stock | — | — | ( | — | — | ( | — | ( | ||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Balance—December 31, 2020 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Vesting of performance-based stock units, including the payment of distributions | | | ( | — | ( | ( | — | ( | ||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Cash paid for taxes in lieu of common shares | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||

Other | | | ( | — | — | ( | — | ( | ||||||||||||||||

Balance—March 31, 2021 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

Common Stock cash distributions ($ | — | — | — | — | ( | ( | — | ( | ||||||||||||||||

Stock-based compensation expense | — | — | | — | — | | — | | ||||||||||||||||

Net income | — | — | — | | — | | | | ||||||||||||||||

Non-controlling interest distributions | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Cash paid for taxes in lieu of common shares | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||

Other | | — | ( | — | — | ( | — | ( | ||||||||||||||||

Balance—June 30, 2021 | | $ | | $ | | $ | | $ | ( | $ | | $ | | $ | | |||||||||

5

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands, unaudited)

Six Months Ended June 30, | |||||||

| 2021 |

| 2020 |

| |||

OPERATING ACTIVITIES: |

|

| |||||

Net income | $ | | $ | | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization |

| |

| | |||

Stock-based compensation expense |

| |

| | |||

Gain on sale of real estate, net |

| ( |

| ( | |||

Loss on unconsolidated joint ventures | — | | |||||

Income from unconsolidated joint ventures |

| ( |

| ( | |||

Income distributions from unconsolidated joint ventures | — | | |||||

Straight-line rental income | ( |

| ( | ||||

Adjustment for collectibility of rental income and lease incentives | | | |||||

Lease incentives funded | ( | ( | |||||

Amortization of lease incentives | | | |||||

(Recovery) provision for credit losses |

| ( |

| | |||

Other non-cash items, net |

| |

| | |||

Increase in interest receivable |

| ( |

| ( | |||

Decrease in accrued interest payable |

| ( |

| ( | |||

Net change in other assets and liabilities |

| |

| ( | |||

Net cash provided by operating activities |

| |

| | |||

INVESTING ACTIVITIES: | |||||||

Investment in real estate properties |

| — |

| ( | |||

Investment in real estate developments |

| — |

| ( | |||

Investment in real estate capital improvements |

| ( |

| ( | |||

Capitalized interest | — | ( | |||||

Proceeds from sale of real estate, net |

| |

| | |||

Investment in real estate mortgage loans receivable |

| ( |

| ( | |||

Principal payments received on mortgage loans receivable |

| |

| | |||

Investments in unconsolidated joint ventures |

| ( |

| ( | |||

Proceeds from liquidation of investments in unconsolidated joint ventures | — | | |||||

Advances and originations under notes receivable |

| ( |

| ( | |||

Principal payments received on notes receivable |

| |

| | |||

Net cash provided by investing activities |

| |

| | |||

FINANCING ACTIVITIES: | |||||||

Bank borrowings |

| |

| | |||

Repayment of bank borrowings |

| ( |

| ( | |||

Principal payments on senior unsecured notes | ( | — | |||||

Stock repurchase plan | — | ( | |||||

Distributions paid to stockholders |

| ( |

| ( | |||

Distributions paid to non-controlling interests |

| ( |

| ( | |||

Financing costs paid |

| ( |

| ( | |||

Cash paid for taxes in lieu of shares upon vesting of restricted stock and performance-based stock units | ( | ( | |||||

Other |

| ( |

| ( | |||

Net cash used in financing activities |

| ( |

| ( | |||

(Decrease) increase in cash, cash equivalents and restricted cash |

| ( |

| | |||

Cash, cash equivalents and restricted cash, beginning of period |

| |

| | |||

Cash, cash equivalents and restricted cash, end of period | $ | | $ | | |||

Supplemental disclosure of cash flow information: | |||||||

Interest paid | $ | | $ | | |||

Non-cash investing and financing transactions: | |||||||

Reclassification of notes receivable to lease incentives | $ | — | $ | | |||

Preferred return reserve related to investments in unconsolidated joint ventures (See Note 3) | $ | | $ | — | |||

See accompanying notes.

6

1. | General |

LTC Properties, Inc., a health care real estate investment trust (“REIT”), was incorporated on May 12, 1992 in the State of Maryland and commenced operations on August 25, 1992. We invest primarily in seniors housing and health care properties primarily through sale-leasebacks, mortgage financing, joint ventures and structured finance solutions including preferred equity and mezzanine lending. We conduct and manage our business as

New Accounting Pronouncements

In March 2020, the Financial Accounting Standards Board (“FASB”) issued guidance which provides temporary optional expedients and exceptions to the U.S. GAAP guidance on contract modifications and hedge accounting to ease the financial reporting burdens of the expected market transition from LIBOR and other interbank offered rates to alternative reference rates. The guidance is effective upon issuance and generally may be elected over time through December 31, 2022. The Company has not adopted any of the optional expedients or exceptions through June 30, 2021 but will continue to evaluate the possible adoption (including potential impact) of any such expedients or exceptions during the effective period as circumstances evolve.

2. | Real Estate Investments |

Assisted living communities, independent living communities, memory care communities and combinations thereof are included in the assisted living property classification (collectively “ALF”).

Any reference to the number of properties or facilities, number of units, number of beds, number

7

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

of operators and yield on investments in real estate are unaudited and outside the scope of our independent registered public accounting firm’s review of our consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board.

Owned Properties. Our owned properties are leased pursuant to non-cancelable operating leases generally with an initial term of

Our leases that contain fixed annual rental escalations and/or have annual rental escalations that are contingent upon changes in the Consumer Price Index, are generally recognized on a straight-line basis over the minimum lease period. Certain leases have annual rental escalations that are contingent upon changes in the gross operating revenues of the property. This revenue is not recognized until the appropriate contingencies have been resolved.

The following table summarizes our investments in owned properties at June 30, 2021 (dollar amounts in thousands):

Average |

| ||||||||||||||

Percentage | Number | Number of | Investment |

| |||||||||||

Gross | of | of | SNF | ALF | per |

| |||||||||

Type of Property | Investment | Investment | Properties (1) | Beds | Units | Bed/Unit |

| ||||||||

Assisted Living | $ | | | % | | — | | $ | | ||||||

Skilled Nursing | | | % | | | | $ | | |||||||

Other (2) | | | % | | | — | — | ||||||||

Total | $ | | | % | | | | ||||||||

| (1) | We own properties in |

| (2) | Includes |

8

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

Future minimum base rents receivable under the remaining non-cancelable terms of operating leases excluding the effects of straight-line rent receivable, amortization of lease incentives and renewal options are as follows (in thousands):

| Cash |

| ||

Rent (1) |

| |||

July-December 2021 | $ | | ||

2022 |

| | ||

2023 |

| | ||

2024 |

| | ||

2025 |

| | ||

Thereafter |

| | ||

| (1) | Represents contractual cash rent, except for certain master leases which are based on estimated cash payments and the Senior Lifestyle Corporation master lease. |

We monitor the collectability of our receivable balances, including deferred rent receivable balances, on an ongoing basis. We write-off uncollectible operator receivable balances, including straight line rent receivable and lease incentives balances, as a reduction to rental income in the period such balances are no longer probable of being collected. Therefore, recognition of rental income is limited to the lesser of the amount of cash collected or rental income reflected on a “straight-line” basis for those customer receivable balances deemed uncollectible. As of June 30, 2021, we have

We continue to take into account the current financial condition of our operators, including consideration of the impact of COVID-19, in our estimation of our uncollectible accounts and deferred rents receivable at June 30, 2021. We are closely monitoring the collectability of such rents and will adjust future estimations as appropriate as further information becomes known.

9

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

The following table summarizes components of our rental income for the three and six months ended June 30, 2021 and 2020 (in thousands):

Three Months Ended | Six Months Ended | ||||||||||||

June 30, | June 30, | ||||||||||||

Rental Income | 2021 | 2020 | 2021 | 2020 | |||||||||

Base cash rental income | $ | | (1) | $ | | $ | | (1) | $ | | |||

Variable cash rental income | | (2) | | (2) | | (2) | | (2) | |||||

Straight-line rent | ( | (3) | | (3) | | (3) | | (3) | |||||

Adjustment for collectability of rental income and lease incentives | — | ( | (4) | ( | (4) | ( | (4) | ||||||

Amortization of lease incentives | ( | ( | ( | ( | |||||||||

Total | $ | | $ | | $ | | $ | | |||||

| (1) | Decreased primarily due to non-payment of rent collected from Senior Lifestyle Corporation (“Senior Lifestyle”), Senior Care Centers, LLC (“Senior Care”) and Abri Health Services, LLC (“Abri Health”) unpaid lease obligations and abated and deferred rent partially offset by increased rent from completion of development projects and contractual rent increases. |

| (2) | The variable rental income for the three and six months ended June 30, 2021, includes reimbursement of real estate taxes by our lessees of $ |

| (3) | Decreased due to more leases accounted for on a cash basis and normal amortization. |

| (4) | Represents straight-line rent receivable and lease incentives write-offs. |

Some of our lease agreements provide purchase options allowing the lessees to purchase the properties they currently lease from us. The following table summarizes information about purchase options included in our lease agreements (dollar amount in thousands):

Type | Number | ||||||||||||

of | of | Gross | Carrying | Option | |||||||||

State | Property | Properties | Investments | Value | Window | ||||||||

California | ALF/MC | $ | | $ | | 2024-2029 | |||||||

California | ALF | | | 2021-TBD | (1) | ||||||||

Colorado | ALF | | | 2022-2026 | |||||||||

Florida | MC | | | 2028-2029 | |||||||||

Kentucky and Ohio | MC | | | 2028-2029 | |||||||||

Texas | MC | | | 2021-2027 | |||||||||

South Carolina | ALF/MC | | | 2028-2029 | |||||||||

Total | $ | | $ | |

| (1) | The option window ending date will be either |

On March 11, 2020, the World Health Organization declared the outbreak of COVID-19 as a pandemic, and on March 13, 2020, the United States declared a national emergency with regard to COVID-19. At June 30, 2021, in conjunction with the continued levels of uncertainty related to the adverse effects of COVID-19, we assessed the probability of collecting substantially all of our lease payments through maturity and concluded that we did not have sufficient information available to evaluate the impact of COVID-19 on the collectibility of our lease payments. The extent to which COVID-19 could impact our operators and the collectibility of our future lease payments will depend on the future developments including the financial impact significance, government support and subsidies and the duration of the pandemic.

In recognition of the pandemic impact affecting our operators, we have agreed to rent abatements

10

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

totaling $

Acquisitions and Developments: The following table summarizes our acquisitions for the six months ended June 30, 2021 and 2020 (dollar amounts in thousands):

Total | Number | Number | |||||||||||||

Purchase | Transaction | Acquisition | of | of | |||||||||||

Year | Type of Property | Price | Costs | Costs | Properties | Beds/Units | |||||||||

2021 | n/a | $ | — | $ | — | $ | — |

| — | — | |||||

2020 | Skilled Nursing (1) | $ | | $ | | $ | | | | ||||||

| (1) | We acquired a SNF located in Texas. |

During the six months ended June 30, 2021 and 2020, we invested the following in development and improvement projects (in thousands):

Six Months Ended June 30, | ||||||||||||||

2021 | 2020 | |||||||||||||

Type of Property | Developments | Improvements | Developments | Improvements | ||||||||||

Assisted Living Communities | $ | — | $ | | $ | | $ | | ||||||

Skilled Nursing Centers | — | — | | | ||||||||||

Total | $ | — | $ | | $ | | $ | | ||||||

11

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

Completed Developments. We had no completed developments during the six months ended June 30, 2021. The following table summarized our completed developments during the six months ended June 30, 2020 (dollar amounts in thousands):

Number | Type | Number | |||||||||||

of | of | of | Total | ||||||||||

Year | Type of Project | Properties | Property | Beds/Units | State | Investment | |||||||

2020 | Development | ALF/MC | Oregon | $ | | ||||||||

Properties Sold. The following table summarizes property sales during the six months ended June 30, 2021 and 2020 (dollar amounts in thousands):

Type | Number | Number | ||||||||||||||||

of | of | of | Sales | Carrying | Net | |||||||||||||

Year | State (1) | Properties | Properties | Beds/Units | Price | Value | (Loss) gain (2) | |||||||||||

2021 | n/a | n/a | — | — | $ | — | $ | — | $ | | (3) (4) | |||||||

Florida | ALF | | — | | | ( | ||||||||||||

Nebraska | ALF | | | | ( | |||||||||||||

Wisconsin | ALF | | | | | |||||||||||||

Total 2021 | | | $ | | $ | | $ | | ||||||||||

2020 | n/a | n/a | — | — | $ | — | $ | — | $ | | (3) (4) | |||||||

Arizona | SNF | | | | | | ||||||||||||

Colorado | SNF | | | | | | ||||||||||||

Iowa | SNF | (4) | | | | | | |||||||||||

Kansas | SNF | | | | | | ||||||||||||

Texas | SNF | | | | | | ||||||||||||

Total 2020 | | | $ | | $ | | $ | | ||||||||||

(

| (1) | Subsequent to June 30, 2021, we sold a 123-bed SNF in Washington for $ |

| (2) | Calculation of net (loss) gain includes cost of sales. |

| (3) | We recognized additional gain due to the reassessment adjustment of the holdbacks related to properties sold during 2019 and 2020, under the expected value model per ASC Topic 606, Contracts with Customers (“ASC 606”). |

| (4) | One of the transactions includes a holdback of $ |

Properties held-for-sale. The following table summarizes our properties held-for-sale at June 30, 2021 and December 31, 2020 (dollar amounts in thousands):

Type | Number | Number | |||||||||||||

of | of | of | Gross | Accumulated | |||||||||||

State | Property | Properties | Beds/units | Investment | Depreciation | ||||||||||

2021 (1) | WA | SNF | | | $ | | $ | | |||||||

2020 | n/a | n/a | — | — | $ | — | $ | — |

| (1) | Subsequent to June 30, 2021, we sold this SNF for $ |

12

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

Mortgage Loans. The following table summarizes our investments in mortgage loans secured by first mortgages at June 30, 2021 (dollar amounts in thousands):

Type | Percentage | Number of | Investment | |||||||||||||||

Gross | of | of | SNF | per | ||||||||||||||

Interest Rate (1) | Maturity | Investment | Property | Investment | Loans (2) | Properties (3) | Beds | Bed/Unit | ||||||||||

2043 | $ | | SNF | | % | | | | $ | | ||||||||

2045 | | SNF | | % | | | | $ | | |||||||||

2045 |

| | SNF | | % | | | | $ | | ||||||||

2045 | | SNF | | % | | | | $ | | |||||||||

Total | $ | | | % | | | | $ | | |||||||||

| (1) | The majority of the mortgage loans provide for annual increases in the interest rate after a certain time period increasing by |

| (2) | Some loans contain certain guarantees, provide for certain facility fees and the majority of the mortgage loans have a |

| (3) | The properties securing these mortgage loans are located in |

The following table summarizes our mortgage loan activity for the six months ended June 30, 2021 and 2020 (in thousands):

Six Months Ended June 30, | |||||||

2021 | 2020 | ||||||

Originations and funding under mortgage loans receivable | $ | | $ | | |||

Scheduled principal payments received | ( | ( | |||||

Mortgage loan premium amortization | ( | ( | |||||

Provision for loan loss reserve | | ( | |||||

Net (decrease) increase in mortgage loans receivable | $ | ( | $ | | |||

We apply ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”) and the “expected loss” model to estimate our loan losses on our mortgage loans and notes receivable. In determining the expected losses on these receivables, we utilize the probability of default and discounted cash flow methods. Further, we stress-test the results to reflect the impact of unknown adverse future events including recessions.

As of June 30, 2021, the accrued interest receivable of $

13

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

3. | Investment in Unconsolidated Joint Ventures |

We had a preferred equity investment in an unconsolidated joint venture (“JV”) that owned

During 2020, we provided preferred capital contribution commitments to two joint ventures (“JVs”). We determined that each of these JVs meets the accounting criteria to be considered a variable interest entity (“VIE”). We are not the primary beneficiary of the JVs as we do not have the power to direct the activities that most significantly affect the JVs’ economic performance. However, we do have significant influence over the JVs. Therefore, we have accounted for the JVs using the equity method of accounting. The following table provides information regarding these preferred equity investments (dollar amounts in thousands):

Type | Type | Total | Contractual | Number | ||||||||||||

of | of | Preferred | Cash | of | Carrying | |||||||||||

State | Properties | Investment | Return | Portion | Beds/ Units | Value | ||||||||||

Washington | UDP | Preferred Equity | (1) | % | % | — | $ | | (1) | |||||||

Washington | UDP | Preferred Equity | (2) | % | % | — | | (2) | ||||||||

Total | — | $ | |

| (1) | Invested $ |

| (2) | Invested $ |

The following table summarizes our capital contributions, income recognized, and cash interest received related to our investments in unconsolidated joint ventures for the six months ended June 30, 2021 and 2020 (in thousands):

Type | ||||||||||||

of | Capital | Income | Cash Interest | |||||||||

Year | Properties | Contribution | Recognized | Earned | ||||||||

2021 | UDP | (1) | $ | — | $ | | (1) | $ | | (1) | ||

UDP | (2) | | (2) | | (2) | | (2) | |||||

Total | $ | | $ | | $ | | ||||||

2020 | ALF/MC/ILF | (3) | $ | | (3) | $ | | (3) | $ | | (3) | |

Total | $ | | $ | | $ | | ||||||

| (1) | During 2020, we provided a total preferred equity investment of $ |

| (2) | During 2021, we funded the remaining $ |

| (3) | Relates to our preferred equity investment in Arizona discussed above. During 2020, the properties comprising the JV were sold. |

14

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

4. | Notes Receivable |

Notes receivable consists of mezzanine loans and other loan arrangements. The following table is a summary of our notes receivable components as of June 30, 2021 and December 31, 2020 (in thousands):

June 30, 2021 | December 31, 2020 |

| ||||

Mezzanine loans | $ | | $ | | ||

Other loans | | | ||||

Notes receivable loan loss reserve | ( | ( | ||||

Total | $ | | $ | | ||

The following table summarizes our notes receivable activity for the six months ended June 30, 2021 and 2020 (in thousands):

Six Months Ended June 30, | ||||||

2021 | 2020 | |||||

Advances under notes receivable | $ | | (1) | $ | | |

Principal payments received under notes receivable | ( | ( | ||||

Reclassified to lease incentives | — | ( | (2) | |||

Notes receivable reserve | | | ||||

Net decrease | $ | ( | $ | ( | ||

| (1) | Funding under working capital notes and mezzanine loans with interest ranging between |

| (2) | Represents interim working capital loans related to development projects which matured upon completion of the development projects and commencement of the master leases. |

5. | Lease Incentives |

Our lease incentive balances at June 30, 2021 and December 31, 2020 are as follows (in thousands):

June 30, 2021 | December 31, 2020 | |||||

Non-contingent lease incentives | $ | | $ | |

The following table summarizes our lease incentives activity for the six months ended June 30, 2021 and 2020 (in thousands):

Six Months Ended June 30, | ||||||||||||||||

2021 | 2020 |

| ||||||||||||||

Funding |

| Amortization |

| Funding |

| Amortization |

| Reclassification |

| |||||||

Non-contingent lease incentives | $ | |

| $ | ( |

| $ | |

| $ | ( |

| $ | | (1) | |

| (1) | We reclassified a $ |

Non-contingent lease incentives represent payments made to our lessees for various reasons including entering into a new lease or lease amendments and extensions. Contingent lease incentives represent potential contingent earn-out payments that may be made to our lessees in the future, as part of

15

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

our lease agreements. From time to time, we may commit to provide contingent payments to our lessees, upon our properties achieving certain rent coverage ratios. Once the contingent payment becomes probable and estimable, the contingent payment is recorded as a lease incentive. Lease incentives are amortized as a yield adjustment to rental income over the remaining life of the lease.

6. | Debt Obligations |

Bank Borrowings. We have an unsecured credit agreement that provides for a revolving aggregate commitment of the lenders of up to $

Senior Unsecured Notes. We have senior unsecured notes held by institutional investors with interest rates ranging from

The debt obligations by component as of June 30, 2021 and December 31, 2020 are as follows (dollar amounts in thousands):

At June 30, 2021 | At December 31, 2020 | ||||||||||||||

Applicable | Available | Available | |||||||||||||

Interest | Outstanding | for | Outstanding | for | |||||||||||

Debt Obligations | Rate (1) | Balance | Borrowing | Balance | Borrowing | ||||||||||

Bank borrowings (2) | $ | | $ | | $ | | $ | | |||||||

Senior unsecured notes, net of debt issue costs (3) | | — | | — | |||||||||||

Total | $ | | $ | | $ | | $ | | |||||||

| (1) | Represents weighted average of interest rate as of June 30, 2021. |

| (2) | Subsequent to June 30, 2021, we had a net borrowing of $ |

| (3) | Subsequent to June 30, 2021, we paid $ |

Our borrowings and repayments are as follows (in thousands):

Six Months Ended June 30, | |||||||||||||

2021 | 2020 | ||||||||||||

Debt Obligations | Borrowings | Repayments | Borrowings | Repayments | |||||||||

Bank borrowings | $ | | (1) | $ | ( | $ | | $ | ( | ||||

Senior unsecured notes | — | ( | (2) | — | — | ||||||||

Total | $ | | $ | ( | $ | | $ | ( | |||||

| (1) | Subsequent to June 30, 2021, we had a net borrowing of $ |

| (2) | Subsequent to June 30, 2021, we paid $ |

16

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

7. | Equity |

Non-controlling Interests. We have entered into partnerships to develop and/or own real estate. Given that our limited members do not have the substantive kick-out rights, liquidation rights, or participation rights, we have concluded that the partnerships are VIEs. As we exercise power over and receive benefits from the VIEs, we are considered the primary beneficiary. Accordingly, we consolidate the VIEs and record the non-controlling interests on the consolidated financial statements.

As of June 30, 2021, we have the following consolidated VIEs (in thousands):

Gross | |||||||||||||

Investment | Property | Consolidated | Non-Controlling | ||||||||||

Year | Purpose | Type | State | Assets | Interests | ||||||||

2019 | Owned real estate | ALF/MC | VA | $ | | $ | | ||||||

2018 | Owned real estate | ILF | OR | | | ||||||||

2018 | Owned real estate and development | ALF/MC | OR | | | ||||||||

2017 | Owned real estate and development | ILF/ALF/MC | WI | | | ||||||||

2017 | Owned real estate | ALF/MC | SC | | | ||||||||

Total | $ | | $ | |

Common Stock. We have separate equity distribution agreements (collectively, “Equity Distribution Agreements”) to offer and sell, from time to time, up to $

During the six months ended June 30, 2021 and 2020, we acquired

Stock Repurchase Plan. On March 12, 2020, our Board of Directors authorized the repurchase of up to

Available Shelf Registration. We have an automatic shelf registration statement on file with the SEC, and currently have the ability to file additional automatic shelf registration statements, to provide us with capacity to publicly offer an indeterminate amount of common stock, preferred stock, warrants, debt, depositary shares, or units. We may from time to time raise capital under our automatic shelf registration statement in amounts, at prices, and on terms to be announced when and if the securities are offered. The specifics of any future offerings, along with the use of proceeds of any securities offered, will be described in detail in a prospectus supplement, or other offering materials, at the time of the offering. Our shelf registration statement expires on February 28, 2022.

17

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

Distributions. We declared and paid the following cash dividends (in thousands):

Six Months Ended June 30, | ||||||||||||||

2021 | 2020 | |||||||||||||

Declared | Paid | Declared | Paid | |||||||||||

Common Stock (1) | $ | | (2) | $ | | (2) | $ | | (3) | $ | | (3) | ||

| (1) | Represents $ |

| (2) | Includes $ |

| (3) | Includes $ |

In July 2021, we declared a monthly dividend of $

Stock-Based Compensation. During the second quarter of 2021, we adopted and our shareholders approved the 2021 Equity Participation Plan (“the 2021 Plan”) which replaces the 2015 Equity Participation Plan (“the 2015 Plan”). Under the 2021 Plan,

At June 30, 2021, we had

The following table summarizes our restricted stock activity for the six months ended June 30, 2021 and 2020:

Six Months Ended June 30, | |||||||

2021 | 2020 | ||||||

Outstanding, January 1 | | | |||||

Granted | | | |||||

Vested | ( | ( | |||||

Outstanding, June 30 | | | |||||

18

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

During the six months ended June 30, 2021 and 2020, we granted

During the six months ended June 30, 2021 and 2020, we granted restricted stock and performance-based stock units as follows:

No. of | Price per | |||||||

Year | Shares/Units | Share | Vesting Period | |||||

2021 | $ | ratably over | ||||||

| $ | | TSR targets (1) | |||||

| $ | | May 26, 2022 | |||||

| $ | | April 1, 2022 | |||||

2020 | $ | | ratably over | |||||

| $ | | TSR targets (1) | |||||

| $ | | May 27, 2021 | |||||

| $ | | ratably over | |||||

| (1) | Vesting is based on achieving certain total shareholder return (“TSR”) targets in with acceleration opportunity in . |

Compensation expense recognized related to the vesting of restricted common stock and performance-based stock units for the six months ended June 30, 2021 and 2020 were $

Remaining | |||

Compensation | |||

Vesting Date | Expense | ||

2021 | $ | | |

2022 | | ||

2023 | | ||

2024 | | ||

Total | $ | | |

19

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

8. | Commitments and Contingencies |

At June 30, 2021, we had commitments as follows (in thousands):

Total | ||||||||||||

Investment | 2021 | Commitment | Remaining | |||||||||

Commitment | Funding | Funded | Commitment | |||||||||

Real estate properties (Note 2. Real Estate Investments) | $ | | (1) | $ | | $ | | $ | | |||

Accrued incentives and earn-out liabilities (Note 5. Lease Incentives) | | | | | ||||||||

Mortgage loans (Note 2. Real Estate Investments) | | (2) | | | | |||||||

Notes receivable (Note 4. Notes Receivable) | | | | | ||||||||

Total | $ | | $ | | $ | | $ | | ||||

| (1) | Represents commitments to purchase land and improvements, if applicable, and to develop, re-develop, renovate or expand seniors housing and health care properties. |

| (2) | Represents $ |

Also, some of our lease agreements provide purchase options allowing the lessee to purchase the properties they currently lease from us. See Note 2. Real Estate Investments for a table summarizing information about our purchase options.

We are a party from time to time to various general and professional liability claims and lawsuits asserted against the lessees or borrowers of our properties, which in our opinion are not singularly or in the aggregate material to our results of operations or financial condition. These types of claims and lawsuits may include matters involving general or professional liability, which we believe under applicable legal principles are not our responsibility as a non-possessory landlord or mortgage holder. We believe that these matters are the responsibility of our lessees and borrowers pursuant to general legal principles and pursuant to insurance and indemnification provisions in the applicable leases or mortgages. We intend to continue to vigorously defend such claims.

20

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

9. | Major Operators |

We have

Number of | Number of | Percentage of | |||||||||||||

SNF | ALF | Total | Total | ||||||||||||

Operator | SNF | ALF | Beds | Units | Revenue (1) | Assets (2) | |||||||||

Prestige Healthcare (3) | | — | | | | % | | % | |||||||

| (1) | Includes rental income from owned properties and interest income from mortgage loans as of June 30, 2021 and excludes variable rental income from lessee reimbursement and sold properties. |

| (2) | Represents the net carrying value of the properties divided by the Total assets on the Consolidated Balance Sheets. |

| (3) | The majority of the revenue derived from this operator relates to interest income from mortgage loans. |

Our financial position and ability to make distributions may be adversely affected if Prestige Healthcare or any of our lessees and borrowers face financial difficulties, including any bankruptcies, inability to emerge from bankruptcy, insolvency or general downturn in business of any such operator, impact upon services or occupancy levels due to COVID-19, or in the event any such operator does not renew and/or extend its relationship with us.

21

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

10. | Earnings per Share |

The following table sets forth the computation of basic and diluted net income per share (in thousands, except per share amounts):

Three Months Ended | Six Months Ended |

| ||||||||||||

June 30, | June 30, |

| ||||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||||

Net income | $ | | $ | | $ | | $ | | ||||||

Less income allocated to non-controlling interests |

| ( |

| ( |

| ( |

| ( | ||||||

Less income allocated to participating securities: | ||||||||||||||

Non-forfeitable dividends on participating securities | ( | ( | ( | ( | ||||||||||

Income allocated to participating securities | — | — | — | ( | ||||||||||

Total net income allocated to participating securities | ( | ( | ( | ( | ||||||||||

Net income available to common stockholders | | | | | ||||||||||

Effect of dilutive securities: | ||||||||||||||

Participating securities (1) | — | — | — | — | ||||||||||

Net income for diluted net income per share | $ | | $ | | $ | | $ | | ||||||

Shares for basic net income per share | | | | | ||||||||||

Effect of dilutive securities: | ||||||||||||||

Stock options | | — | | — | ||||||||||

Performance-based stock units | — | (2) | | — | (2) | | ||||||||

Participating securities (1) | — | — | — | — | ||||||||||

Total effect of dilutive securities | | | | | ||||||||||

Shares for diluted net income per share | | | | | ||||||||||

Basic net income per share | $ | | $ | | $ | | $ | | ||||||

Diluted net income per share | $ | | $ | | $ | | $ | | ||||||

| (1) | For the three and six months ended June 30, 2021, and 2020, the participating securities have been excluded from the computation of diluted net income per share as such inclusion would be anti-dilutive. |

| (2) | For the three and six months ended June 30, 2021, |

11. | Fair Value Measurements |

In accordance with the accounting guidance regarding the fair value option for financial assets and financial liabilities, entities are permitted to choose to measure certain financial assets and liabilities at fair value, with the change in unrealized gains and losses reported in earnings. We did not elect the fair value option for any of our financial assets and financial liabilities.

22

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

The carrying amount of cash and cash equivalents, prepaid expenses and other assets, accrued interest, accrued expenses and other liabilities approximates fair value because of the short-term maturity of these instruments. We do not invest our cash in auction rate securities.

At June 30, 2021 | At December 31, 2020 | ||||||||||||

Carrying | Fair | Carrying | Fair | ||||||||||

Value | Value | Value | Value | ||||||||||

Mortgage loans receivable, net of loan loss reserve | $ | | $ | | (1) | $ | | $ | | (1) | |||

Notes receivable, net of loan loss reserve |

| |

| | (2) |

| |

| | (2) | |||

Bank borrowings |

| | | (3) | | | (3) | ||||||

Senior unsecured notes, net of debt issue costs |

| | | (4) | | | (4) | ||||||

| (1) | Our investment in mortgage loans receivable is classified as Level 3. The fair value is determined using a widely accepted valuation technique, discounted cash flow analysis on the expected cash flows. The discount rate is determined using our assumption on market conditions adjusted for market and credit risk and current returns on our investments. The discount rate used to value our future cash inflows of the mortgage loans receivable at June 30, 2021 and December 31, 2020 was |

| (2) | Our investments in notes receivable are classified as Level 3. The discount rate is determined using our assumption on market conditions adjusted for market and credit risk and current returns on our investments. The discount rate used to value our future cash flows of the notes receivable at June 30, 2021 and December 31, 2020, were |

| (3) | Our bank borrowings bear interest at a variable interest rate. The estimated fair value of our bank borrowings approximated their carrying values at June 30, 2021 and December 31, 2020 based upon prevailing market interest rates for similar debt arrangements. |

| (4) | Our obligation under our senior unsecured notes is classified as Level 3 and thus the fair value is determined using a widely accepted valuation technique, discounted cash flow analysis on the expected cash flows. The discount rate is measured based upon management’s estimates of rates currently prevailing for comparable loans available to us, and instruments of comparable maturities. At June 30, 2021, the discount rate used to value our future cash outflow of our senior unsecured notes was |

12. | Subsequent Events |

Subsequent to June 30, 2021 the following events occurred:

Real Estate Investments: We sold a skilled nursing center in Washington for $

| ● | three assisted living communities to an existing operator. |

| ● | three assisted living communities in Nebraska to an existing operator. The lease has a -year term with |

23

LTC PROPERTIES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CONTINUED

(Unaudited)

Debt: We had a net borrowing of $

Equity: We declared a monthly of $

24

Item 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

This quarterly report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, adopted pursuant to the Private Securities Litigation Reform Act of 1995. Statements that are not purely historical may be forward-looking. You can identify some of the forward-looking statements by their use of forward-looking words, such as “believes,” “expects,” “may,” “will,” “could,” “would,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates,” or the negative of those words or similar words. Forward-looking statements involve inherent risks and uncertainties regarding events, conditions and financial trends that may affect our future plans of operation, business strategy, results of operations and financial position. A number of important factors could cause actual results to differ materially from those included within or contemplated by such forward-looking statements, including, but not limited to, our dependence on our operators for revenue and cash flow; the duration and extent of the effects of the COVID-19 pandemic; government regulation of the health care industry; federal and state health care cost containment measures including reductions in reimbursement from third-party payors such as Medicare and Medicaid; required regulatory approvals for operation of health care facilities; a failure to comply with federal, state, or local regulations for the operation of health care facilities; the adequacy of insurance coverage maintained by our operators; our reliance on a few major operators; our ability to renew leases or enter into favorable terms of renewals or new leases; operator financial or legal difficulties; the sufficiency of collateral securing mortgage loans; an impairment of our real estate investments; the relative illiquidity of our real estate investments; our ability to develop and complete construction projects; our ability to invest cash proceeds for health care properties; a failure to qualify as a REIT; our ability to grow if access to capital is limited; and a failure to maintain or increase our dividend. For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking statements, please see the discussion under “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and in our publicly available filings with the Securities and Exchange Commission. We do not undertake any responsibility to update or revise any of these factors or to announce publicly any revisions to forward-looking statements, whether as a result of new information, future events or otherwise.

Executive Overview

Business and Investment Strategy

We are a real estate investment trust (“REIT”) that invests in seniors housing and health care properties through sale-leaseback transactions, mortgage financing, joint ventures, construction financing and structured finance solutions including mezzanine lending. Our primary objectives are to create, sustain and enhance stockholder equity value and provide current income for distribution to stockholders through real estate investments in seniors housing and health care properties managed by experienced operators.

25

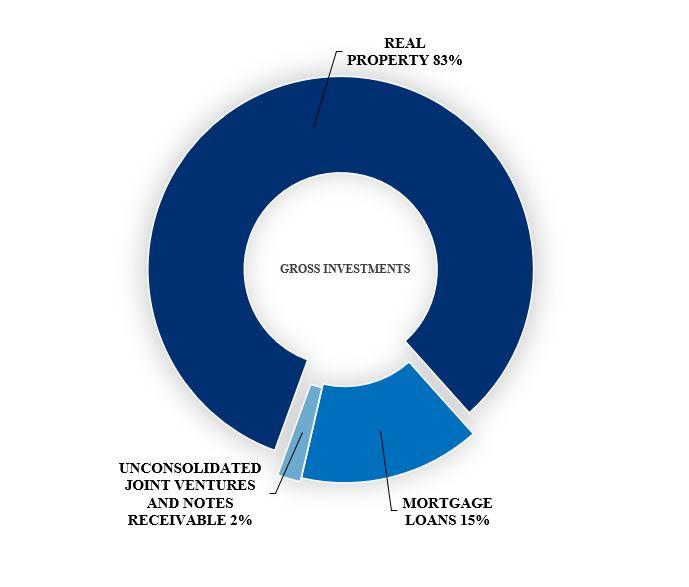

The following graph summarizes our gross investments as of June 30, 2021:

Our primary seniors housing and health care property classifications include skilled nursing centers (“SNF”), assisted living communities (“ALF”), independent living communities (“ILF”), memory care communities (“MC”) and combinations thereof. We conduct and manage our business as one operating segment, rather than multiple operating segments, for internal reporting and internal decision-making purposes. For purposes of this quarterly report and other presentations, we generally include ALF, ILF, MC, and combinations thereof in the ALF classification. As of June 30, 2021, seniors housing and long-term health care properties comprised approximately 99.3% of our real estate investment portfolio. We have been operating since August 1992.

Substantially all of our revenues and sources of cash flows from operations are derived from operating lease rentals, interest earned on outstanding loans receivable and income from investments in unconsolidated joint ventures. Income from our investments in owned properties and mortgage loans represent our primary source of liquidity to fund distributions and are dependent upon the performance of the operators on their lease and loan obligations and the rates earned thereon. To the extent that the operators experience operating difficulties and are unable to generate sufficient cash to make payments to us, there could be a material adverse impact on our consolidated results of operations, liquidity and/or financial condition. To mitigate this risk, we monitor our investments through a variety of methods determined by property type and operator. Our monitoring process includes periodic review of financial statements for each facility, periodic review of operator credit, scheduled property inspections and review of covenant compliance.

In addition to our monitoring and research efforts, we also structure our investments to help mitigate payment risk. Some operating leases and loans are credit enhanced by guaranties and/or letters of credit. In addition, operating leases are typically structured as master leases and loans are generally cross-

26

defaulted and cross-collateralized with other loans, operating leases or agreements between us and the operator and its affiliates.

Depending upon the availability and cost of external capital, we anticipate making additional investments in health care related properties. New investments are generally funded from cash on hand, proceeds from periodic asset sales, temporary borrowings under our unsecured revolving line of credit and internally generated cash flows. Our investments generate internal cash from rent and interest receipts and principal payments on mortgage loans receivable. Permanent financing for future investments, which replaces funds drawn under our unsecured revolving line of credit, is expected to be provided through a combination of public and private offerings of debt and equity securities and secured and unsecured debt financing. The timing, source and amount of cash flows provided by financing activities and used in investing activities are sensitive to the capital markets’ environment, especially to changes in interest rates. Changes in the capital markets’ environment may impact the availability of cost-effective capital.

We believe our business model has enabled and will continue to enable us to maintain the integrity of our property investments, including in response to financial difficulties that may be experienced by operators. Traditionally, we have taken a conservative approach to managing our business, choosing to maintain liquidity and exercise patience until favorable investment opportunities arise.

COVID-19

On March 11, 2020, the World Health Organization declared the outbreak of coronavirus (“COVID-19”) as a pandemic, and on March 13, 2020, the United States declared a national emergency with regard to COVID-19. The COVID-19 pandemic has had repercussions across regional and global economies and financial markets. The outbreak of COVID-19 in many countries, including the United States, has significantly and adversely impacted public health and economic activity, and has contributed to significant volatility, dislocations and liquidity disruptions in financial markets.

The operations and occupancy levels at our properties have been adversely affected by COVID-19 and could be further adversely affected by COVID-19 or another pandemic especially if there are infections on a large scale at our properties. The impact of COVID-19 has included, and another pandemic could include, early resident move-outs, our operators delaying accepting new residents due to quarantines, potential occupants postponing moves to our operators’ facilities, and/or hospitals cancelling or significantly reducing elective surgeries thereby there were fewer people in need of skilled nursing care. Additionally, as our operators have responded to the pandemic, operating costs have begun to rise. A decrease in occupancy, ability to collect rents from residents and/or increase in operating costs could have a material adverse effect on the ability of our operators to meet their financial and other contractual obligations to us, including the payment of rent. In recognition of the pandemic impact affecting our operators, we have agreed to rent abatements totaling $2.8 million and rent deferrals for certain operators totaling $4.8 million between April 2020 and June 2021, of which $1.5 million subsequently has been repaid. The $6.1 million in rent abatements and deferrals, net of repayments, represented approximately 2% of our April 2020 through June 2021 contractual rent and interest. The remaining balance of deferred rent is due to us over the next 24 months or upon receipt of government funds from the U.S. Coronavirus Aid, Relief, and Economic Security (the “CARES Act”).

During the six months ended June 30, 2021, we proactively provided additional financial support to the majority of our operators by reducing 2021 rent and interest escalations by 50%. The rent and interest escalation reduction were given in the form of a rent and interest credit in recognition of operators’ increased costs due to COVID-19. During six months ended June 30, 2021, we recognized a decrease of $0.5 million of GAAP revenue and a decrease of $1.3 million of cash revenue. We expect the

27

escalation reductions to have a de minimis effect on GAAP revenue during the third and fourth quarters of 2021.

Real Estate Portfolio Overview

The following tables summarize our real estate investment portfolio by owned properties and mortgage loans and by type, as of June 30, 2021 (dollar amounts in thousands):

Six Months Ended | ||||||||||||||||||||

Percentage | June 30, 2021 | Percentage | Number | Number of | ||||||||||||||||

Gross | of | Rental | Interest | of | of | SNF | ALF | |||||||||||||

Owned Properties | Investments | Investments | Income (1) | Income | Revenues | Properties (2) | Beds (3) | Units (3) | ||||||||||||

Assisted Living | $ | 840,502 | 50.2 | % | $ | 26,586 | $ | — | 37.3 | % | 102 | — | 5,799 | |||||||

Skilled Nursing | 560,467 | 33.5 | % | 28,399 | — | 39.8 | % | 51 | 6,277 | 212 | ||||||||||

Other (4) | 11,360 | 0.7 | % | 483 | — | 0.7 | % | 1 | 118 | — | ||||||||||

Total Owned Properties | 1,412,329 | 84.4 | % | 55,468 | — | 77.8 | % | 154 | 6,395 | 6,011 | ||||||||||

Mortgage Loans | ||||||||||||||||||||

Skilled Nursing | 259,641 | 15.6 | % | — | 15,855 | 22.2 | % | 22 | 2,739 | — | ||||||||||

Total Mortgage Loans | 259,641 | 15.6 | % | — | 15,855 | 22.2 | % | 22 | 2,739 | — | ||||||||||

Total Portfolio | $ | 1,671,970 | 100.0 | % | $ | 55,468 | $ | 15,855 | 100.0 | % | 176 | 9,134 | 6,011 | |||||||

Six Months Ended | ||||||||||||||||||||

Percentage | June 30, 2021 | Percentage | Number | Number of | ||||||||||||||||

Gross | of | Rental | Interest | of | of | SNF | ALF | |||||||||||||

Summary of Properties by Type | Investments | Investments | Income (1) | Income | Revenues | Properties (2) | Beds (3) | Units (3) | ||||||||||||

Assisted Living | $ | 840,502 | 50.2 | % | $ | 26,586 | $ | — | 37.3 | % | 102 | — | 5,799 | |||||||

Skilled Nursing | 820,108 | 49.1 | % | 28,399 | 15,855 | 62.0 | % | 73 | 9,016 | 212 | ||||||||||

Other (4) | 11,360 | 0.7 | % | 483 | — | 0.7 | % | 1 | 118 | — | ||||||||||

Total Portfolio | $ | 1,671,970 | 100.0 | % | $ | 55,468 | $ | 15,855 | 100.0 | % | 176 | 9,134 | 6,011 | |||||||

| (1) | Excludes variable rental income from lessee reimbursement and rental income from sold properties. |

| (2) | We have investments in owned properties and mortgage loans in 27 states leased or mortgaged to 31 different operators. |

| (3) | See Item 1. Financial Statements – Note 2. Real Estate Investments for discussion of bed/unit count. |

| (4) | Includes three parcels of land held-for-use and one behavioral health care hospital. |

As of June 30, 2021, we had $1.3 billion in net carrying value of real estate investments, consisting of $1.1 billion or 80.4% invested in owned and leased properties and $0.3 billion or 19.6% invested in mortgage loans secured by first mortgages. Our investment in mortgage loans mature in 2043 and beyond and contain interest rates between 9.3% and 10.1%.

For the six months ended June 30, 2021, rental income represented 78.8% of total gross revenues, interest income represented 20.2% of total gross revenues and other investments represented 1.0% of total gross revenues. In most instances, our lease structure contains fixed annual rental escalations and/or annual rental escalations that are contingent upon changes in the Consumer Price Index, which are generally recognized on a straight-line basis over the minimum lease period. Certain leases have annual rental escalations that are contingent upon changes in the gross operating revenues of the property. This revenue is not recognized until the appropriate contingencies have been resolved.

For the six months ended June 30, 2021, we recorded $0.7 million in straight-line rental income and amortization of lease incentive cost of $0.2 million. During the six months ended June 30, 2021, we received $62.1 million of cash rental income, which includes $7.1 million of operator reimbursements for our real estate taxes. At June 30, 2021, the straight-line rent receivable balance, net of write-offs for uncollectible amounts, on the balance sheet was $24.4 million.

28

Update on Certain Operators

Senior Care Centers, LLC

Senior Care Centers, LLC and affiliates and subsidiaries (“Senior Care”) filed for Chapter 11 bankruptcy in December 2018. During 2019, while in bankruptcy, Senior Care assumed LTC’s master lease and, in March 2020, Senior Care emerged from bankruptcy. Concurrent with their emergence from bankruptcy, in accordance with the order confirming Senior Care’s plan of reorganization, Abri Health Services, LLC (“Abri Health”) was formed as the parent company of reorganized Senior Care and became co-tenant and co-obligor with reorganized Senior Care under our master lease. In March 2021, as a result of Senior Care’s and Abri Health’s (collectively, the “Lessee”) unpaid lease obligations under the master lease, we sent a notice of default and applied proceeds from letters of credit to certain obligations owed under the master lease. Furthermore, on April 7, 2021, we sent the Lessee a notice of termination of the master lease to be effective April 17, 2021. On April 16, 2021, the Lessee filed for Chapter 11 bankruptcy, which bankruptcy proceeding(s) remain pending.

Brookdale Senior Living Communities, Inc

During the third quarter of 2020, we consolidated our four leases with Brookdale Senior Living Communities, Inc (“Brookdale”) into one master lease and extended the term by one year to December 31, 2021. The master lease provides three renewal options consisting of a four-year renewal option, a five-year renewal option and a 10-year renewal option. The economic terms of rent remain the same as the consolidated rent terms under the previous four separate lease agreements. During the first quarter of 2021, the Brookdale master lease was amended to extend the current term by one year to December 31, 2022. The notice period for this renewal option is January 1, 2022 to April 30, 2022. Brookdale is current on rent payments through July 2021.

Senior Lifestyle Corporation

An affiliate of Senior Lifestyle Corporation (“Senior Lifestyle”) operated 23 of our properties under a master lease with a combination of independent living, assisted living and memory care units. Senior Lifestyle failed to pay full rent to us during the second quarter of 2020. Accordingly, we wrote-off a total $17.7 million of straight-line rent receivable and lease incentives related to this master lease and transitioned rental revenue recognition to cash basis effective July 2020. During 2020, Senior Lifestyle paid us $13.8 million of their $18.4 million contractual rent and we applied their letter of credit and deposits totaling $3.7 million to past due rent of $3.6 million and to their outstanding notes receivable of $0.1 million. Accordingly, we recognized $17.4 million of rental revenue from Senior Lifestyle in 2020. To date in 2021, Senior Lifestyle has not paid rent or its other obligations under the master lease.

During the six months ended June 30, 2021, we transitioned 12 assisted living communities previously leased to Senior Lifestyle to three operators. These communities are located in Illinois, Ohio, Colorado and Wisconsin. Total cash rent expected under these three master lease agreements is $5.3 million for the first lease year, $7.3 million for the second lease year and $7.6 million for the third lease year, escalating 2% annually thereafter. Additionally, we sold three assisted living communities located in Wisconsin and a closed community located in Nebraska previously leased to Senior Lifestyle for a total sales price of $35.9 million. We received total combined proceeds of $34.8 million and recorded a net gain on sale of $5.4 million.

29

Subsequent to June 30, 2021, we transitioned an assisted living community in Wisconsin, previously leased to Senior Lifestyle, to a regionally based operator new to us. The lease has a 10-year term with three 5-year renewal terms. Cash rent under the new lease is $0.9 million in the first lease year, $1.2 million in the second lease year, $1.3 million in the third lease year, and escalating 2% annually thereafter. Also, we entered into the following two lease agreements covering a total of six communities in the Senior Lifestyle portfolio:

| ● | three assisted living communities to an existing operator. Two properties are located in Pennsylvania, and one in New Jersey. The lease has a 2-year term with zero cash rent for the first three months then cash rent will be based on mutually agreed fair market rent. |

| ● | three assisted living communities in Nebraska to an existing operator. The lease has a 2-year term with zero cash rent for the first three months then cash rent will be based on mutually agreed fair market rent. |

Genesis Healthcare, Inc

On August 10, 2020, in the Quarterly Report on Form 10-Q, Genesis Healthcare, Inc. (“Genesis”) reported doubt regarding its ability to continue as a going concern. As a result, we wrote-off $4.3 million of straight-line rent receivable related to this master lease during the third quarter of 2020 and transitioned rental revenue recognition to cash basis effective September 2020. On March 3, 2021, Genesis announced its three-part strategic restructuring plan to strengthen its liquidity position and capital structure. As part of its plan, Genesis delisted its Class A common stock from the New York Stock Exchange and deregistered its Class A Common Stock under the Securities Exchange Act of 1934, during the first quarter of 2021. Genesis is current on rent payments through July 2021.

Other Operators

During the third quarter of 2020, an operator failed to pay its full contractual rent. Accordingly, we wrote-off $1.2 million of straight-line rent receivable related to this master lease. Effective September 1, 2020, we consolidated our two master leases with the operator into one combined master lease. Under the new combined master lease, we agreed to abate $0.7 million of rent and allow the operator to defer rent as needed through March 31, 2021. During the first quarter of 2021, the new combined master lease was amended to extend the deferral period another three months starting April 1, 2021. During the second quarter of 2021, the combined master lease was further amended to extend the deferral period through September 30, 2021. During the six months ended June 30, 2021, the operator deferred $2.1 million of rent and, at June 30, 2021, the remaining deferred rent balance due from the operator was $2.5 million. In July 2021, the operator deferred $0.4 million and has a total deferred rent balance of $2.9 million. The operator can defer rent up to $0.4 million for each of August and September 2021. During 2020, we recorded an impairment charge of $1.0 million related to an assisted living community that was operated by the operator. The community was closed in October 2020 and sold during the first quarter of 2021. As a result of this transaction, we recognized a net loss on sale of $0.9 million during the first quarter of 2021.

30

2021 Rent deferrals, net of repayments, and abatements (in thousands):

Three Months Ended | Three Months Ended | |||||||||

March 31, 2021 | June 30, 2021 | July 2021 | ||||||||

Rent deferrals, net of repayments | $ | 1,122 | $ | 1,121 | $ | 366 | ||||

Rent abatements | 600 | 1,069 | 323 | |||||||

50% reduction of 2021 rent & interest escalations | 1,204 | 133 | - | |||||||

$ | 2,926 | $ | 2,323 | $ | 689 |

We have agreed to provide rent deferrals up to $0.5 million and abatements up to $0.3 million for each of August and September 2021.

31

2021 Activities Overview

The following tables summarize our transactions during the six months ended June 30, 2021 (dollar amounts in thousands):

Investment in Development and Improvement projects

Developments | Improvements | |||||

Assisted Living Communities | $ | — | $ | 2,046 | ||

Properties Sold

Type | Number | Number | ||||||||||||||

of | of | of | Sales | Carrying | Net | |||||||||||

State (1) | Properties | Properties | Beds/Units | Price | Value | (Loss) gain (2) | ||||||||||

n/a | n/a | — | — | $ | — | $ | — | $ | 159 | (3) | ||||||

Florida | ALF | 1 | — | 2,000 | 2,625 | (858) | ||||||||||

Nebraska | ALF | 1 | 40 | 900 | 1,079 | (205) | ||||||||||

Wisconsin | ALF | 3 | 263 | 35,000 | 28,295 | 5,594 | ||||||||||

5 | 303 | $ | 37,900 | $ | 31,999 | $ | 4,690 |

| (1) | Subsequent to June 30, 2021, we sold a 123-bed SNF in Washington for $7,700. We received proceeds of $7,200 and expect to recognize a gain on sale of $2,600. |

| (2) | Calculation of net (loss) gain includes cost of sales. |

| (3) | We recognized additional gain due to the reassessment adjustment of the holdbacks related to properties sold in 2019 and 2020 under the expected value model per ASC Topic 606, Contracts with Customers (“ASC 606”). |

Investment in Mortgage Loans

Originations and funding under mortgage loans receivable | $ | 426 | ||

Scheduled principal payments received | (625) | |||

Mortgage loan premium amortization | (3) | |||

Recovery of loan loss reserve | 2 | |||

Net decrease in mortgage loans receivable | $ | (200) |

Investment in Unconsolidated Joint Ventures

Type | Type | Total | Contractual | Number | 2021 | Cash | |||||||||||||||||||

of | of | Preferred | Cash | of | Carrying | Capital | Income | Interest | |||||||||||||||||

State | Properties | Investment | Return | Portion | Beds/ Units | Value | Contribution | Recognized | Received | ||||||||||||||||

Washington (1) |

| UDP |

| Preferred Equity | (1) | 12 | % |

| 7 | % |

| — | $ | 6,340 | $ | — | $ | 225 | $ | 187 | |||||

Washington (2) |

| UDP |

| Preferred Equity | (2) | 12 | % |

| 8 | % |

| — | 13,000 | 8,000 | 440 | 353 | |||||||||

— | $ | 19,340 | $ | 8,000 | $ | 665 | $ | 540 |

| (1) | Invested $6,340 of preferred equity in an entity that will develop and own a 95-unit ALF/MC in Washington. Our investment represents 15.5% of the estimated total investment. The preferred equity investment earns an initial cash rate of 7% increasing to 9% in year four until the internal rate of return (“IRR”) is 8%. After achieving an 8% IRR, the cash rate drops to 8% until achieving an IRR ranging between 12% to 14%. |

| (2) | Invested $13,000 of preferred equity in an entity that will develop and own a 267-unit ILF/ALF in Washington. Our investment represents 11.6% of the estimated total investment. The preferred equity investment earns an initial cash rate of 8% until achieving an IRR ranging between 12% and 14%. |

Notes Receivable

Advances under notes receivable |

| $ | 1,811 | (1) |

|

Principal payments received under notes receivable | (2,553) | ||||

Notes receivable loan loss reserve | 7 | ||||

Net increase in notes receivable | $ | (735) |

| (1) | Funding under working capital notes and mezzanine loans with interest ranging between 5% and 8% and maturities between 2022 and 2030. |

32

Health Care Regulatory Climate

The Centers for Medicare & Medicaid Services (“CMS”) annually updates Medicare skilled nursing facility (“SNF”) prospective payment system rates and other policies. On July 30, 2019, CMS issued its final fiscal year 2020 Medicare skilled nursing facility update. Under the final rule, CMS projected aggregate payments to SNFs would increase by $851 million, or 2.4%, for fiscal year 2020 compared with fiscal year 2019. The final rule also addressed implementation of the new Patient-Driven Payment Model case mix classification system that became effective on October 1, 2019, changes to the group therapy definition in the skilled nursing facility setting, and various SNF Value-Based Purchasing and quality reporting program policies. On April 10, 2020, CMS issued a proposed rule to update SNF rates and policies for fiscal year 2021, which started October 1, 2020, and issued the final rule on July 31, 2020. CMS estimated that payments to SNFs would increase by $750 million, or 2.2%, for fiscal year 2021 compared to fiscal year 2020. CMS also adopted revised geographic delineations to identify a provider’s status as an urban or rural facility and to calculate the wage index, applying a 5% cap on any decreases in a provider’s wage index from fiscal year 2020 to fiscal year 2021. Finally, CMS also finalized updates to the SNF value-based purchasing program to reflect previously finalized policies, updated the 30-day phase one review and correction deadline for the baseline period quality measure quarterly report, and announced performance periods and performance standards for the fiscal year 2023 program year. On April 8, 2021, CMS issued a proposed rule to update SNF rates and policies for fiscal year 2022, which starts October 1, 2021. CMS estimates that under the proposed rule, overall payments to SNFs under the SNF prospective payment system in fiscal year 2022 are projected to increase by approximately $444 million, or 1.3%, compared with those in fiscal year 2021. The proposed rule also includes proposals for the SNF Quality Reporting Program, and the SNF Value-Based Program for fiscal year 2022.

Since the announcement of the COVID-19 pandemic and beginning as of March 13, 2020, CMS has issued numerous temporary regulatory waivers and new rules to assist health care providers, including SNFs, respond to the COVID-19 pandemic. These include waiving the SNF 3-day qualifying inpatient hospital stay requirement, flexibility in calculating a new Medicare benefit period, waiving timing for completing functional assessments, waiving requirements for health care professional licensure, survey and certification, provider enrollment, and reimbursement for services performed by telehealth, among many others. CMS also announced a temporary expansion of its Accelerated and Advance Payment Program to allow SNFs and certain other Medicare providers to request accelerated or advance payments in an amount up to 100% of the Medicare Part A payments they received from October–December 2019; this expansion was suspended April 26, 2020 in light of other CARES Act funding relief. The Continuing Appropriations Acts, 2021 and Other Extensions Act, enacted on October 1, 2020, amended the repayment terms for all providers and suppliers that requested and received accelerated and advance payments during the COVID-19 public health emergency. Specifically, Congress gave providers and suppliers that received Medicare accelerated and advance payment(s) one year from when the first loan payment was made to begin making repayments. In addition, CMS has also enhanced requirements for nursing facilities to report COVID-19 infections to local, state and federal authorities. On July 19, 2021, HHS Secretary Becerra announced that he had renewed, effective July 20, 2021, the declared public health emergency for an additional 90-day period.