Exhibit 99.1

North American Palladium Ltd.

TABLE OF CONTENTS

| Page | |

| Management’s Discussion and Analysis | |

| INTRODUCTION | 2 |

| FORWARD-LOOKING INFORMATION | 2 |

| CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES | 3 |

| OUR BUSINESS | 3 |

| QUARTERLY TRENDS | 4 |

| HIGHLIGHTS | 5 |

| LDI OPERATING & FINANCIAL RESULTS | 6 |

| OTHER EXPENSES | 12 |

| SUMMARY OF QUARTERLY RESULTS | 13 |

| CASH FLOWS, FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES | 14 |

| OUTSTANDING SHARE DATA | 16 |

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES | 16 |

| RISKS AND UNCERTAINTIES | 20 |

| INTERNAL CONTROLS | 21 |

| OTHER INFORMATION | 21 |

| NON-IFRS MEASURES | 22 |

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Management’s Discussion and Analysis

| INTRODUCTION |

Unless the context suggests otherwise, references to “NAP” or the “Company” or similar terms refer to North American Palladium Ltd. and its subsidiaries. “LDI” refers to Lac des Iles Mines Ltd. and “NAP Quebec” refers to its previously held subsidiary, NAP Quebec Mines Ltd.

The following is management’s discussion and analysis of the financial condition and results of operations (“MD&A”) to enable readers of the Company’s condensed interim consolidated financial statements and related notes to assess material changes in financial condition and results of operations for the three and nine months ended September 30, 2014, compared to those of the respective periods in the prior year. This MD&A has been prepared as of November 5, 2014 and is intended to supplement and complement the condensed interim consolidated financial statements and notes thereto for the three and nine months ended September 30, 2014 (collectively, the “Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB. Readers are encouraged to review the Financial Statements in conjunction with their review of this MD&A, the Company’s MD&A for the year ended December 31, 2013, and the most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities, available at www.sec.gov and www.sedar.com, respectively.

All amounts are in Canadian dollars unless otherwise noted and all references to production ounces refer to payable production.

| FORWARD-LOOKING INFORMATION |

Certain information contained in this MD&A constitutes ‘forward-looking statements’ within the meaning of the ‘safe harbor’ provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. The words ‘expect’, ‘believe’, ‘anticipate’, ‘contemplate’, ‘target’, ‘may’, ‘will’, ‘could’, ‘intend’, ‘estimate’ and similar expressions identify forward-looking statements. Forward-looking statements included in this MD&A include, without limitation: information as to our strategy, plans or future financial or operating performance, such as the ramp-up of the Company’s mine, project timelines, production plans, projected cash flows or expenditures, operating cost estimates, mining methods, expected mining rates and other statements that express management's expectations or estimates of future performance. The Company cautions the reader that such forward-looking statements involve known and unknown risk factors that may cause the actual results to be materially different from those expressed or implied by the forward-looking statements. Such risk factors include, but are not limited to: the risk the Company may not be able to continue as a going concern, the possibility that the Company may not be able to obtain sufficient financing, that the Company may not be able to generate sufficient cash to service all its indebtedness and may be forced to take other actions to satisfy its obligations, events of default on its indebtedness, hedging could expose it to losses, competition, the possibility title to its mineral properties will be challenged, dependency on third parties for smelting and refining, the possibility that metal prices and foreign exchange rates may fluctuate, inherent risks associated with development, exploration, mining and processing including risks related to tailings capacity and ground conditions, the mine transition from mining via ramp to mining via shaft, environmental hazards, uncertainty of mineral reserves and resources, the possibility that the mine may not perform as planned, changes in legislation, regulations or political and economic developments in Canada and abroad, risks related to employee relations and to the availability of skilled labour, litigation and the risks associated with obtaining necessary licenses and permits. For more details on these and other risk factors see the Company’s most recent Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The factors and assumptions contained in this MD&A, which may prove to be incorrect, include, but are

2

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

not limited to: that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of business, that metal prices and exchange rates between the Canadian and United States dollar will be consistent with the Company’s expectations, that there will be no material delays affecting operations or the timing of ongoing projects including the mine ramp-up, that prices for key mining and construction supplies, including labour costs, will remain consistent with the Company’s expectations, and that the Company’s current estimates of mineral reserves and resources are accurate. The forward-looking statements are not guarantees of future performance. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as expressly required by law. Readers are cautioned not to put undue reliance on these forward-looking statements.

| CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESERVES AND RESOURCES |

Mineral reserve and mineral resource information contained herein has been calculated in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects, as required by Canadian provincial securities regulatory authorities. Canadian standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained herein is not comparable to similar information disclosed in accordance with the requirements of the SEC. While the terms “measured”, “indicated” and “inferred” mineral resources are required pursuant to National Instrument 43-101, the SEC does not recognize such terms. U.S. investors should understand that “inferred” mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, U.S. investors are cautioned not to assume that any part or all of NAP’s mineral resources constitute or will be converted into reserves. For a more detailed description of the key assumptions, parameters and methods used in calculating NAP’s mineral reserves and mineral resources, see NAP’s most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the SEC.

| OUR BUSINESS |

NAP is an established precious metals producer that has been operating its LDI Mine located in Ontario, Canada since 1993. LDI is one of only two primary producers of palladium in the world, offering investors exposure to the price of palladium.

The Company recently expanded the underground LDI Mine and transitioned from ramp access to shaft access while utilizing long hole open stope mining. Through the utilization of the shaft and bulk mining methods, operations are expected to benefit from increased mining rates and decreased operating costs, transforming LDI into a low cost producer with a rising production profile.

The Company is conducting an exploration program in 2014 targeting the lower portion of the Offset Zone, with the intention to perform a preliminary economic assessment that would entail deepening the shaft and installation of a lower level bulk ore handling system that would increase production and extend the mine life.

The Company has significant exploration potential near the LDI Mine, where a number of growth targets have been identified, and is engaged in an exploration program aimed at increasing its palladium reserves and resources. As an established palladium-platinum group metal (“PGM”) producer with excess mill and shaft capacity on a permitted property, NAP has potential to convert exploration success into production and cash flow on an accelerated timeline.

NAP trades on the TSX under the symbol PDL and on the NYSE MKT under the symbol PAL.

3

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| QUARTERLY TRENDS |

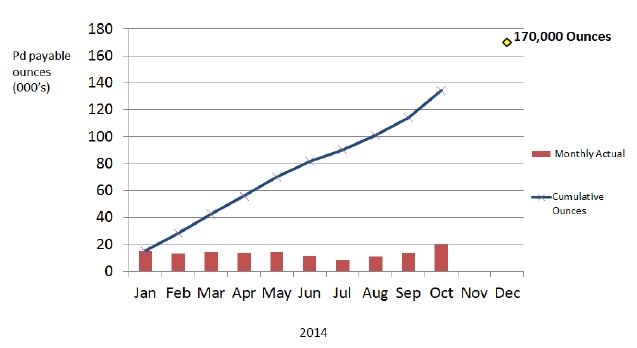

During the first nine months of 2014, upgrades to the ore handling system were completed, transportation of personnel and material via the shaft commenced and mill recoveries remained high; however, production was impacted by repairs to the primary surface crusher, oversized muck, equipment availability and a fatality at the mine site. The fatality in July 2014 impacted the Company’s morale and productivity with the greatest impact on underground operations and the specific shift on site at the time of the tragic accident resulting in the processing of more surface material than planned. The Company continues to ramp-up underground production and for one day in October has exceeded 4,900 tonnes per day.

After shaft and related infrastructure construction completion in 2013, progress in 2014 has included commissioning, production build up and additional financings. Challenges arising in the third quarter of 2014 included lower grade underground ore (due to mine sequencing), equipment availability and an unfortunate fatality; however, a number of initiatives have been identified and are being implemented. On October 1, 2014, a full-time trial mill run began compared to our previous 16 day batch process resulting in payable palladium production for the month of October of approximately 20,000 ounces. The Company expects to be at or marginally below the lower end of the 2014 guidance of 170,000 payable palladium ounces.

| For the three months ended | |||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | |||||||||||

| 2014 | 2014 | 2014 | 2013 | 2013 | |||||||||||

| Palladium production – payable oz | 32,560 | 39,223 | 42,641 | 30,979 | 30,097 | ||||||||||

| US$ cash cost per palladium oz sold 1 | US$589 | US$510 | US$492 | US$620 | US$581 | ||||||||||

| Surface mining – tonnes | 270,860 | 243,041 | 254,294 | 345,132 | 334,820 | ||||||||||

| Underground mining – tonnes | 304,804 | 263,904 | 275,845 | 231,346 | 208,097 | ||||||||||

| Underground mining – tonnes per day | 3,313 | 2,900 | 3,065 | 2,515 | 2,262 | ||||||||||

| Milling – palladium head grade (g/t) | 2.4 | 3.1 | 3.3 | 2.9 | 2.5 | ||||||||||

| Milling – palladium recovery | 80.7 | % | 83.6 | % | 84.5 | % | 81.5 | % | 80.7 | % | |||||

| Adjusted EBITDA ($000s) | $8,287 | $10,444 | $9,743 | $1,369 | $3,189 | ||||||||||

| 1 Non-IFRS measure. Please refer to Non-IFRS Measures on pages 22-24. | |||||||||||||||

4

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| HIGHLIGHTS |

| Three months ended September 30 | Nine months ended September 30 | |||||||||||

| OPERATIONAL HIGHLIGHTS | 2014 | 2013 | 2014 | 2013 | ||||||||

| Mining | ||||||||||||

|

Tonnes ore mined |

575,664 | 542,917 | 1,612,748 | 1,517,191 | ||||||||

|

Palladium grade (g/t) |

2.6 | 2.5 | 2.9 | 2.8 | ||||||||

| Milling | ||||||||||||

|

Tonnes ore milled |

566,494 | 517,157 | 1,604,483 | 1,504,007 | ||||||||

|

Palladium head grade (g/t) |

2.4 | 2.5 | 2.9 | 2.9 | ||||||||

|

Palladium recovery (%) |

80.7 | 80.7 | 83.1 | 80.4 | ||||||||

| Palladium production – payable oz | 32,560 | 30,097 | 114,423 | 104,180 | ||||||||

| Palladium sales – payable oz | 36,430 | 27,370 | 116,631 | 99,749 | ||||||||

| Realized palladium price per ounce (US$) | $ | 860 | $ | 721 | $ | 806 | $ | 723 | ||||

| Cash cost per ounce palladium sold (US$) 1 | $ | 589 | $ | 581 | $ | 527 | $ | 539 | ||||

| FINANCIAL HIGHLIGHTS | ||||||||||||

| ($000s except per share amounts) | 2014 | 2013 | 2014 | 2013 | ||||||||

| Revenue | $ | 46,441 | $ | 33,348 | $ | 145,674 | $ | 113,651 | ||||

| Production costs | 30,116 | 21,663 | 90,206 | 76,305 | ||||||||

| Income from mining operations | 3,513 | 1,179 | 10,323 | 2,088 | ||||||||

| Loss from continuing operations | $ | (18,790 | ) | $ | (5,324 | ) | $ | (55,413 | ) | $ | (36,949 | ) |

| Loss from continuing operations per share | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.17 | ) | $ | (0.20 | ) |

| Adjusted net loss 1 | $ | (6,991 | ) | $ | (3,904 | ) | $ | (30,557 | ) | $ | (8,951 | ) |

| EBITDA 1 | $ | (4,090 | ) | $ | 3,819 | $ | 12,797 | $ | 369 | |||

| Adjusted EBITDA 1 | $ | 8,287 | $ | 3,189 | $ | 28,474 | $ | 12,039 | ||||

| Capital spending, continuing operations | $ | 5,817 | $ | 26,885 | $ | 14,274 | $ | 92,758 | ||||

| 1Non-IFRS measure. Please refer to Non-IFRS Measures on pages 22-24. | ||||||||||||

In 2014, the Company transitioned from ramp to shaft based underground mining and the sources of ore milled have changed significantly. In the third quarter of 2014:

- 575,664 tonnes at an average grade of 2.6 grams per tonne palladium were mined and processed from the Offset and Roby zones and low grade stockpile.

- The mill processed 566,494 tonnes of ore at an average palladium head grade of 2.4 grams per tonne and a recovery of 80.7% to produce 32,560 ounces of payable palladium.

- Payable palladium production was 32,560 ounces while payable palladium sales were 36,430 ounces.

- Cash interest of $32.2 million was paid including an amount that allowed the Company to revert to a 15% interest rate on its senior secured term loan.

- Revenue increased by $13.1 million compared to 2013 primarily due to more favourable exchange rates, higher palladium ounces sold and higher palladium prices.

- Production costs increased $8.5 million compared to 2013 to $30.1 million primarily due to mining 46% more underground tonnes, milling 10% more tonnes and unfavourable inventory and other cost movements.

- Adjusted EBITDA increased $5.1 million or 160% compared to 2013 to $8.3 million.

- Incurred a net loss of $18.8 million which included non-cash items of $6.9 million of depreciation and amortization, $8.0 million of foreign exchange losses and $6.0 million of interest expense and other costs.

5

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| LDI OPERATING & FINANCIAL RESULTS |

The LDI mine consists of an underground mine, an open pit (currently inactive), a mill with a processing capacity of approximately 15,000 tonnes per day and a shaft with a capacity of approximately 8,000 tonnes per day. The primary underground deposits on the property are the Offset zone and the Roby zone. During the first nine months of 2014, production was impacted by upgrades to the ore handling system, commencement of transportation of men and material via the shaft, repairs to the primary surface crusher, oversized muck, equipment availability and a fatality.

Operating Results

The key operating results are set out in the following table.

| Three months ended September 30 | Nine months ended September 30 | ||||||||

| 2014 | 2013 | 2014 | 2013 | ||||||

| Ore mined (tonnes) | |||||||||

|

Underground |

|||||||||

|

Offset |

232,008 | 208,097 | 721,928 | 442,322 | |||||

|

Roby |

72,796 | - | 122,625 | 143,037 | |||||

| 304,804 | 208,097 | 844,553 | 585,359 | ||||||

|

Surface |

|||||||||

|

Low grade stockpile & reprocessed tailings |

270,860 | - | 768,195 | 4,669 | |||||

|

Open pit |

- | - | - | 538,323 | |||||

|

High grade stockpile |

- | 334,820 | - | 388,840 | |||||

| 270,860 | 334,820 | 768,195 | 931,832 | ||||||

|

Total |

575,664 | 542,917 | 1,612,748 | 1,517,191 | |||||

| Mined ore grade (Pd g/t) | |||||||||

|

Underground |

|||||||||

|

Offset |

4.1 | 4.5 | 4.6 | 4.3 | |||||

|

Roby |

3.7 | - | 4.6 | 4.2 | |||||

| 4.0 | 4.5 | 4.6 | 4.3 | ||||||

|

Surface |

|||||||||

|

Low grade stockpile & reprocessed tailings |

1.1 | - | 1.0 | 1.0 | |||||

|

Open pit |

- | - | - | 2.4 | |||||

|

High grade stockpile |

- | 1.2 | - | 1.3 | |||||

| 1.1 | 1.2 | 1.0 | 1.9 | ||||||

|

Average |

2.6 | 2.5 | 2.9 | 2.8 | |||||

| Milling | |||||||||

|

Tonnes of ore milled |

566,494 | 517,157 | 1,604,483 | 1,504,007 | |||||

|

Palladium head grade (g/t) |

2.4 | 2.5 | 2.9 | 2.9 | |||||

|

Palladium recoveries (%) |

80.7 | 80.7 | 83.1 | 80.4 | |||||

|

Tonnes of concentrate produced |

4,135 | 3,905 | 13,834 | 12,787 | |||||

|

Production cost per tonne milled |

$ | 53 | $ | 42 | $ | 56 | $ | 51 | |

| Payable production | |||||||||

|

Palladium (oz) |

32,560 | 30,097 | 114,423 | 104,180 | |||||

|

Platinum (oz) |

2,506 | 2,227 | 8,227 | 7,849 | |||||

|

Gold (oz) |

2,266 | 2,283 | 7,757 | 8,128 | |||||

|

Nickel (lbs) |

321,761 | 324,361 | 1,096,865 | 1,146,496 | |||||

|

Copper (lbs) |

563,888 | 643,937 | 1,995,914 | 2,144,328 | |||||

| Cash cost per ounce of palladium sold (US$)1 | $ | 589 | $ | 581 | $ | 527 | $ | 539 | |

1 Non-IFRS measure. Please refer to Non-IFRS Measures on pages 22-24.

6

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Mining

In the third quarter of 2014, underground tonnes mined from the Offset and Roby zones were blended with the low grade surface stockpile material for processing in the mill. Underground ore mined at LDI during the three months ended September 30, 2014, consisted of 304,804 tonnes at an average grade of 4.0 g/t palladium compared to 208,097 tonnes at an average palladium grade of 4.5 g/t in the prior year from the Offset zone. LDI processed 270,860 tonnes of the low grade surface stockpile and tailings at an average grade of 1.1 g/t in the third quarter of 2014 compared to 334,820 tonnes an average grade of 1.2 g/t processed from a high grade stockpile in the prior year. On a combined basis, 6% more tonnes at a higher grade were mined and processed in the third quarter of 2014 compared to 2013.

In the first nine months of 2014, underground tonnes mined from the Offset and Roby zones were blended with the low grade surface stockpile material for processing in the mill. Underground ore mined at LDI from the Offset and Roby zones during the nine months ended September 30, 2014, consisted of 844,553 tonnes at an average grade of 4.6 g/t palladium compared to 585,359 tonnes at an average palladium grade of 4.3 g/t in the prior year. LDI processed 768,195 tonnes of the low grade surface stockpile and tailings at an average grade of 1.0 g/t in the first nine months of 2014 compared to 931,832 tonnes at an average grade of 1.9 g/t processed from the open pit and high and low grade stockpiles in the prior year. On a combined basis, 6% more tonnes of ore were mined and processed in the first nine months of 2014 at similar grades as in 2013.

Milling

During the three months ended September 30, 2014, the LDI mill processed 566,494 tonnes of ore at an average palladium head grade of 2.4 g/t and a recovery of 80.7% to produce 32,560 ounces of payable palladium (2013 – 517,157 tonnes milled, average palladium head grade of 2.5 g/t, recovery of 80.7 %, producing 30,097 ounces of payable palladium).

During the nine months ended September 30, 2014, the LDI mill processed 1,604,483 tonnes of ore at an average palladium head grade of 2.9 g/t and a recovery of 83.1% to produce 114,423 ounces of payable palladium (2013 –1,504,007 tonnes milled, average palladium head grade of 2.9 g/t, recovery of 80.4%, producing 104,180 ounces of payable palladium).

The higher mill recovery for the nine months ended September 30, 2014 compared to 2013 was primarily due to improvements in the mill circuit late in 2013 which increased the percentage of palladium recovered while processing similar ore grades.

Production Costs per Tonne Milled

Production costs per tonne milled were $53 and $56 in the three and nine month periods ended September 30, 2014 respectively compared to $42 and $51 per tonne in the comparable 2013 periods. The increases were primarily due to higher costs associated with mining greater quantities of underground ore (which costs more per tonne to mine) in 2014 compared with 2013 as well as the cost changes noted in the production cost section noted below.

Payable Production

Payable production for the three and nine month periods ended September 30, 2014 were higher for palladium and platinum and lower for all other payable metals compared to their respective 2013 periods.

The changes in payable metal production for the three and nine month periods ended September 30, 2014 compared to the respective periods in 2013 was primarily due to greater tonnes milled and higher recoveries for all metals except nickel being offset by lower head grades for all payable metals except palladium that had similar head grades.

7

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Cash Cost per Ounce of Palladium Sold

Cash cost per ounce of palladium sold is a non-IFRS measure and the calculation is provided in the Non-IFRS Measures section of this MD&A. In 2013, the Company was in transition, sinking a shaft and completing related infrastructure at the same time it was developing and transitioning to mining the Offset zone. In 2014, the development and transitioning to the Offset zone was completed.

The cash cost per ounce of palladium sold increased to US$5891 in the third quarter of 2014 and decreased to US$5271 in the nine month period ended September 30, 2014 compared to US$581 1 and US$539 1 respectively in the comparable periods in the prior year. More payable palladium ounces sold, favourable movements of the Canadian dollar and higher by-product revenues were offset by increased production costs. Please refer to the LDI revenue, production costs, smelting, refining and freight costs and royalty expense sections of this MD&A for additional details.

1 Non-IFRS measure. Please refer to Non-IFRS Measures on pages 22-24.

| Financial Results | ||||||||||

| Income from mining operations for the LDI operations is summarized in the following table. | ||||||||||

| Three months ended September 30 | Nine months ended September 30 | |||||||||

| (expressed in thousands of dollars) | 2014 | 2013 | 2014 | 2013 | ||||||

| Revenue | $ | 46,441 | $ | 33,348 | $ | 145,674 | $ | 113,651 | ||

| Mining operating expenses | ||||||||||

|

Production costs |

||||||||||

|

Mining |

17,041 | 14,551 | 52,909 | 48,943 | ||||||

|

Milling |

7,278 | 6,459 | 22,454 | 19,712 | ||||||

|

General and administration |

4,440 | 4,105 | 14,383 | 12,070 | ||||||

| 28,759 | 25,115 | 89,746 | 80,725 | |||||||

|

Inventory and others |

1,357 | (3,452 | ) | 460 | (4,420 | ) | ||||

| 30,116 | 21,663 | 90,206 | 76,305 | |||||||

|

Smelting, refining and freight costs |

4,007 | 2,922 | 12,320 | 10,130 | ||||||

|

Royalty expense |

1,761 | 1,464 | 6,019 | 4,865 | ||||||

|

Depreciation and amortization |

6,894 | 6,144 | 25,436 | 19,233 | ||||||

|

Loss on disposal of equipment |

150 | (24 | ) | 1,370 | 1,030 | |||||

| Total mining operating expenses | $ | 42,928 | $ | 32,169 | $ | 135,351 | $ | 111,563 | ||

| Income from mining operations | $ | 3,513 | $ | 1,179 | $ | 10,323 | $ | 2,088 | ||

The Company has included income from mining operations as an additional IFRS measure to provide the user with information on the actual results of the LDI operations.

8

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Revenue

Revenue is affected by production and sales volumes, commodity prices, currency exchange rates, mill run timing and shipment schedules. Metal sales for LDI are recognized in revenue at provisional prices when delivered to a smelter for treatment or a designated shipping point. Final pricing is determined in accordance with LDI’s smelter agreements. In most cases, final pricing is determined two months after delivery to the smelter for gold, nickel and copper and four months after delivery for palladium and platinum. These final pricing adjustments can result in additional revenues in a rising commodity price environment and reductions to revenue in a declining commodity price environment. Similarly, a weakening in the Canadian dollar relative to the U.S. dollar would have a positive impact on revenues and a strengthening in the Canadian dollar would have a negative impact on revenues. The Company periodically enters into financial contracts for past production delivered to the smelters to mitigate the smelter agreements’ provisional pricing exposure to rising or declining palladium prices and an appreciating Canadian dollar. As at September 30, 2014, these financial contracts represent 32,500 ounces of palladium (June 30, 2014 – 47,500 palladium ounces) and mature from October 2014 through December 2014 at an average forward price of US$860 (C$950) per ounce (June 30, 2014 –US$799 (C$870) per ounce of palladium). For substantially all of the palladium delivered to the customers under the smelter agreements, the quantities and timing of settlement specified in the financial contracts match final pricing settlement periods. The palladium financial contracts are being recognized on a mark-to-market basis as an adjustment to revenue. The fair value of these contracts at September 30, 2014 was an asset of $2.6 million included in accounts receivable (December 31, 2013 –$0.2 million).

| Revenue for the three months ended September 30, 2014 | |||||||||||||||||||||

| Palladium | Platinum | Gold | Nickel | Copper | Others | Total | |||||||||||||||

| Sales volume(1) | 36,430 | 2,777 | 2,516 | 356,832 | 622,585 | n.a. | n.a. | ||||||||||||||

| Realized price (US$) (1) | $ | 860 | $ | 1,433 | $ | 1,319 | $ | 8.33 | $ | 3.18 | n.a. | n.a. | |||||||||

| Revenue before price adjustment ($000s) | $ | 34,130 | $ | 4,305 | $ | 3,498 | $ | 3,190 | $ | 2,143 | $ | 19 | $ | 47,285 | |||||||

| Price adjustment ($000s): | |||||||||||||||||||||

|

Commodities |

(2,106 | ) | (674 | ) | (162 | ) | (285 | ) | (90 | ) | (1 | ) | (3,318 | ) | |||||||

|

Foreign exchange |

1,906 | 256 | 124 | 111 | 76 | 1 | 2,474 | ||||||||||||||

| Revenue ($000s) | $ | 33,930 | $ | 3,887 | $ | 3,460 | $ | 3,016 | $ | 2,129 | $ | 19 | $ | 46,441 | |||||||

| (1)Quantities and prices are per ounce for palladium, platinum and gold and per pound for nickel and copper. | |||||||||||||||||||||

| Revenue for the three months ended September 30, 2013 | |||||||||||||||||||||

| Palladium | Platinum | Gold | Nickel | Copper | Others | Total | |||||||||||||||

| Sales volume(1) | 27,370 | 2,033 | 2,101 | 314,028 | 586,762 | n.a. | n.a. | ||||||||||||||

| Realized price (US$) (1) | $ | 721 | $ | 1,445 | $ | 1,327 | $ | 6.28 | $ | 3.20 | n.a. | n.a. | |||||||||

| Revenue before price adjustment ($000s) | $ | 20,636 | $ | 3,073 | $ | 2,904 | $ | 2,030 | $ | 1,931 | $ | 49 | $ | 30,623 | |||||||

| Price adjustment ($000s): | |||||||||||||||||||||

|

Commodities |

2,258 | 335 | 299 | 94 | 182 | 3 | 3,171 | ||||||||||||||

|

Foreign exchange |

(249 | ) | (56 | ) | (44 | ) | (61 | ) | (36 | ) | - | (446 | ) | ||||||||

| Revenue ($000s) | $ | 22,645 | $ | 3,352 | $ | 3,159 | $ | 2,063 | $ | 2,077 | $ | 52 | $ | 33,348 | |||||||

| (1)Quantities and prices are per ounce for palladium, platinum and gold and per pound for nickel and copper. | |||||||||||||||||||||

9

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| Revenue for the nine months ended September 30, 2014 | |||||||||||||||||||||

| Palladium | Platinum | Gold | Nickel | Copper | Others | Total | |||||||||||||||

| Sales volume(1) | 116,631 | 8,380 | 7,915 | 1,094,717 | 2,038,907 | n.a. | n.a. | ||||||||||||||

| Realized price (US$) (1) | $ | 806 | $ | 1,432 | $ | 1,296 | $ | 7.61 | $ | 3.15 | n.a. | n.a. | |||||||||

| Revenue before price adjustment | $ | 103,101 | $ | 13,092 | $ | 11,112 | $ | 9,363 | $ | 7,003 | $ | 112 | $ | 143,783 | |||||||

| Price adjustment ($000s): | |||||||||||||||||||||

| Commodities | 592 | (202 | ) | 156 | 214 | (207 | ) | 4 | 557 | ||||||||||||

| Foreign exchange | 729 | 259 | 137 | 95 | 111 | 3 | 1,334 | ||||||||||||||

| Revenue ($000s) | $ | 104,422 | $ | 13,149 | $ | 11,405 | $ | 9,672 | $ | 6,907 | $ | 119 | $ | 145,674 | |||||||

| (1)Quantities and prices are per ounce for palladium, platinum and gold and per pound for nickel and copper. | |||||||||||||||||||||

| Revenue for the nine months ended September 30, 2013 | |||||||||||||||||||||

| Palladium | Platinum | Gold | Nickel | Copper | Others | Total | |||||||||||||||

| Sales volume(1) | 99,749 | 7,499 | 7,803 | 1,099,373 | 2,031,749 | n.a. | n.a. | ||||||||||||||

| Realized price (US$) (1) | $ | 723 | $ | 1,522 | $ | 1,473 | $ | 6.83 | $ | 3.35 | n.a. | n.a. | |||||||||

| Revenue before price adjustment | $ | 74,557 | $ | 11,642 | $ | 11,652 | $ | 7,829 | $ | 6,904 | $ | 170 | $ | 112,754 | |||||||

| Price adjustment ($000s): | |||||||||||||||||||||

| Commodities | 1,305 | (285 | ) | (518 | ) | (308 | ) | (59 | ) | - | 135 | ||||||||||

| Foreign exchange | 68 | 307 | 226 | 69 | 91 | 1 | 762 | ||||||||||||||

| Revenue ($000s) | $ | 75,930 | $ | 11,664 | $ | 11,360 | $ | 7,590 | $ | 6,936 | $ | 171 | $ | 113,651 | |||||||

| (1)Quantities and prices are per ounce for palladium, platinum and gold and per pound for nickel and copper. | |||||||||||||||||||||

During the first nine months of 2013, the Company was sinking a shaft and completing related infrastructure while developing and transitioning to mining the Offset zone. Revenue for the three months ended September 30, 2014 increased $13.1 million or 39% compared to 2013 primarily due to 33% more ounces of palladium sold at 19% higher realized prices, a 6% favourable movement in the exchange rate and greater volumes of platinum (+37%), gold (+20%), nickel (+14%) and copper (+6%).

For the first nine months of 2014, revenues increased $32.0 million or 28% compared to 2013 primarily due to 17% more ounces of palladium sold at 11% higher prices, a 7% favourable exchange rate movement and 12% greater volumes of platinum sold.

Spot Metal Prices* and Exchange Rates

For comparison purposes, the following table sets out spot metal prices and exchange rates.

| Sep-30 | Jun-30 | Mar-31 | Dec-31 | Sep-30 | Jun-30 | Mar-31 | Dec-31 | ||||||||||

| 2014 | 2014 | 2014 | 2013 | 2013 | 2013 | 2013 | 2012 | ||||||||||

| Palladium – US$/oz | $ | 775 | $ | 844 | $ | 778 | $ | 711 | $ | 726 | $ | 643 | $ | 770 | $ | 699 | |

| Platinum – US$/oz | $ | 1,300 | $ | 1,480 | $ | 1,418 | $ | 1,358 | $ | 1,411 | $ | 1,317 | $ | 1,576 | $ | 1,523 | |

| Gold – US$/oz | $ | 1,217 | $ | 1,315 | $ | 1,292 | $ | 1,202 | $ | 1,327 | $ | 1,192 | $ | 1,598 | $ | 1,664 | |

| Nickel – US$/lb | $ | 7.49 | $ | 8.49 | $ | 7.14 | $ | 6.34 | $ | 6.29 | $ | 6.20 | $ | 7.50 | $ | 7.75 | |

| Copper – US$/lb | $ | 3.03 | $ | 3.15 | $ | 3.01 | $ | 3.34 | $ | 3.31 | $ | 3.06 | $ | 3.44 | $ | 3.59 | |

| Exchange rate (Bank of Canada) – CDN$1 = US$ | US$ | 0.89 | US$ | 0.94 | US$ | 0.90 | US$ | 0.94 | US$ | 0.97 | US$ | 0.95 | US$ | 0.98 | US$ | 1.01 |

* Based on the London Metal Exchange

10

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Operating Expenses from Continuing Operations

As of June 30, 2014, the Company had completed modification to the design of the underground ore handling system. Repairs to the primary surface crusher in the second quarter of 2014 and a fatality in the third quarter of 2014 negatively impacted production, payable metal sales and cash cost. Significantly higher propane and power costs as a result of a colder than normal winter negatively impacted the first quarter of 2014 operating costs by approximately $2.7 million.

Production costs

For the three and nine months ended September 30, 2014, production costs were $30.1 million and $90.2 million compared to $21.7 million and $76.3 million in 2013 respectively. Mining costs for the three and nine month periods ended September 30, 2014 increased by $2.5 million (17%) and $4.0 million (8%) respectively compared to the 2013 periods. In 2014, the Company was predominantly mining in the Offset zone, transporting a majority of that material up the shaft and also processing surface stockpiles. In 2013, mining was predominantly in the Offset zone which was transported to surface using the ramp and from the high grade surface stockpile. As such, the 2014 and 2013 mining costs are not comparable as 46% and 44% more tonnes were mined from underground in the third quarter and first nine months of 2014 respectively compared to 2013.

For the three and nine month periods ended September 30, 2014, milling costs increased $0.8 million (13%) and $2.7 million (14%) respectively compared to the respective 2013 periods primarily due to: more tonnes milled; increased depressant usage and grinding media; and, for the nine month period, higher power costs in the first quarter of 2014 related to a colder than normal winter. General and administration costs in the three and nine months ended September 30, 2014 increased $0.3 million and $2.3 million respectively compared to the same periods in 2013 primarily due to amounts charged to the Offset zone capital costs in 2013 that did not recur in 2014; increased consultant costs; and, in the first quarter of 2014, increased propane costs due to a colder than normal winter.

Inventory and other costs increased production costs by $1.4 million and $0.5 million for the three and nine month periods ended September 30, 2014 compared to decreases of $3.5 million and $4.4 million respectively in 2013 periods for net changes of $4.8 million and $4.9 million primarily due to inventory decreases in 2014 compared to increases in 2013 and $1.2 million and $1.3 million of net insurance proceeds received in respective 2013 periods that did not recur in 2014.

Smelting, refining and freight costs

Smelting, refining and freight costs for the three and nine months ended September 30, 2014 were $4.0 million and $12.3 million respectively, compared to $2.9 million and $10.1 million in the comparable 2013 periods. The increases over the prior year were primarily due to the impact of a weaker Canadian dollar and more tonnes of concentrate shipped.

Royalty expense

For the three and nine month periods ended September 30, 2014, royalty expenses were $1.8 million and $6.0 million respectively compared to $1.5 million and $4.9 million in the comparable 2013 periods. The increases were primarily due to higher revenues in 2014 compared to 2013.

Depreciation and amortization

Depreciation and amortization for the three and nine months ended September 30, 2014 was $6.9 million and $25.4 million, compared to $6.1 million and $19.2 million respectively in 2013. The increases over the prior year were primarily due to increased production and a significant increase in depreciable assets associated with the LDI mine expansion including the Offset zone and tailings management facilities.

11

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| OTHER EXPENSES |

Exploration

Exploration expenditures for the three and nine month periods ended September 30, 2014 were $2.6 million and $5.2 million respectively (2013 - $3.9 million and $10.9 million respectively). The decreases were primarily due to a more limited exploration program in 2014 compared with 2013 and to a scheduled build-up of underground drilling linked to the completion of an exploration drift in the Offset zone. The 2014 exploration program is focused on: (i) drilling the lower part of the Offset zone below the 1,065 meter level - the known limit of proven and probable reserves; (ii) resource conversion drilling in the upper Offset zone directly north of active and planned mining stopes; and, (iii) delineation of new resources in the upper Offset southeast extension, the shallowest known level of the deposit. The Company is pleased with the results to-date for the areas tested. Please see the Company’s October 16, 2014 news release for a detailed review of the third quarter drilling results.

General and administration

The Company's general and administration expenses for the three and nine month periods ended September 30, 2014 were $2.1 million and $7.3 million respectively compared to $2.9 million and $8.0 million in the prior year periods. The decreases were primarily due to less costs relating to legal fees, consultants, recruiting activities and director fees impacted by restricted stock unit adjustments.

Interest and other income

Interest and other income for the three and nine month periods ended September 30, 2014 were $1.5 million and $3.9 million respectively compared to $0.2 million and $1.7 million in respective 2013 periods. The increases were primarily due to decreases in fair value of convertible debenture warrants in 2014 partially offset by gains on palladium warrants and the renunciation of flow-through expenditures in 2013 that did not recur in 2014.

Interest expense and other costs

Prior to the commencement of commercial production of the shaft on January 1, 2014, the Company had capitalized interest expenses related to the senior secured term loan and the revolving operating line of credit. In 2014, interest related to these loans was expensed. Interest expense and other costs for the three months ended September 30, 2014 were $10.2 million, compared to $2.5 million in the prior year. The increase of $7.7 million was primarily due to an $8.2 million increase in interest expense associated with completion of the Offset zone development project. Interest expense and other costs for the nine months ended September 30, 2014 were $39.2 million, compared to $5.7 million in the prior year. The increase of $33.5 million was primarily due to a $28.8 million increase in interest expense associated with completion of the Offset zone development project and $6.4 million of changes in the fair value of the convertible debentures issued in 2014.

Financing costs

Financing costs for the nine month period ended September 30, 2014 was $7.5 million compared to costs of $3.1 million in the prior year period. The increase over the 2013 comparative costs were primarily due to financing costs in 2014 related to the convertible debentures issued partially offset by 2013 financing costs related to outlays incurred for the initial investigation and negotiation of various potential financing alternatives prior to entering into the final amending agreement for the senior secured term loan in the fourth quarter of 2013.

Foreign exchange loss (gain)

Foreign exchange loss for the three and nine month periods ended September 30, 2014 were $9.8 million and $10.5 million respectively compared to a foreign exchange gain of $3.3 million and a loss of $2.0 million for the three and nine month periods ended September 30, 2013. The gains and losses were primarily due to the impact of exchange rate movements on the US$ denominated senior secured term loan and the US$ denominated credit facility.

12

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| SUMMARY OF QUARTERLY RESULTS |

| (expressed in thousands of Canadian dollars except per | ||||||||||||||||||||||||

| share amounts) | 2014 | 2013 | 2012 | |||||||||||||||||||||

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | |||||||||||||||||

| Revenue | $ | 46,441 | $ | 50,497 | $ | 48,736 | $ | 39,582 | $ | 33,348 | $ | 33,213 | $ | 47,090 | $ | 42,368 | ||||||||

|

Production costs, net of mine restoration costs |

30,116 | 30,355 | 29,735 | 29,890 | 21,663 | 25,701 | 28,941 | 25,421 | ||||||||||||||||

| Exploration expense | 2,566 | 1,891 | 768 | 1,360 | 3,874 | 2,192 | 4,840 | 5,962 | ||||||||||||||||

| Capital expenditures | 5,817 | 5,569 | 2,888 | 16,728 | 26,885 | 27,805 | 38,068 | 41,810 | ||||||||||||||||

| Loss from continuing operations | (18,790 | ) | (9,957 | ) | (26,666 | ) | (11,746 | ) | (5,324 | ) | (26,268 | ) | (5,357 | ) | (3,739 | ) | ||||||||

| Net loss | (18,790 | ) | (9,957 | ) | (26,666 | ) | (11,746 | ) | (5,324 | ) | (26,268 | ) | (2,848 | ) | (54,010 | ) | ||||||||

|

Cash provided by (used in) operations |

8,024 | (3,807 | ) | (16,749 | ) | 4,193 | 2,022 | (2,849 | ) | 3,165 | 37,970 | |||||||||||||

|

Cash provided by (used in) financing activities |

(34,720 | ) | 31,601 | 31,765 | 4,289 | (2,087 | ) | 51,970 | 17,096 | 1,926 | ||||||||||||||

|

Cash used in investing activities |

(5,817 | ) | (5,410 | ) | (2,888 | ) | (16,723 | ) | (26,710 | ) | (27,805 | ) | (37,078 | ) | (41,831 | ) | ||||||||

|

Net loss per share from continuing operations |

||||||||||||||||||||||||

|

– basic |

$ | (0.05 | ) | $ | (0.03 | ) | $ | (0.11 | ) | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.15 | ) | $ | (0.03 | ) | $ | (0.02 | ) |

|

– diluted |

$ | (0.05 | ) | $ | (0.03 | ) | $ | (0.11 | ) | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.16 | ) | $ | (0.03 | ) | $ | (0.02 | ) |

| Net loss per share | ||||||||||||||||||||||||

|

– basic |

$ | (0.05 | ) | $ | (0.03 | ) | $ | (0.11 | ) | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.15 | ) | $ | (0.02 | ) | $ | (0.31 | ) |

|

– diluted |

$ | (0.05 | ) | $ | (0.03 | ) | $ | (0.11 | ) | $ | (0.05 | ) | $ | (0.03 | ) | $ | (0.16 | ) | $ | (0.02 | ) | $ | (0.31 | ) |

| Tonnes milled | 566,494 | 521,478 | 516,511 | 544,074 | 517,157 | 483,266 | 503,585 | 511,226 | ||||||||||||||||

| Palladium ounces sold | 36,430 | 40,716 | 39,485 | 35,205 | 27,370 | 32,620 | 39,760 | 44,394 | ||||||||||||||||

|

Realized palladium price (US$/ounce) |

$ | 860 | $ | 806 | $ | 739 | $ | 725 | $ | 721 | $ | 719 | $ | 730 | $ | 641 | ||||||||

Trends:

- Revenue, production costs, tonnes milled and palladium ounces sold, varied over the last eight quarters as mining has transitioned from the Roby zone underground and the surface open pit to the Offset zone underground and surface stockpiles. Changes in tonnes, grades and sources of ore significantly impacted revenue realized, production costs, ore available for milling and palladium ounces produced. A fatality in July 2014 significantly impacted production in the third quarter of 2014.

- Readily available material in the Roby and open pit zones were largely mined out in the first half of 2013 while the Offset zone production has been ramping up since 2012.

- Realized quarterly average prices for palladium have ranged from US$641 to US$860 per ounce in the last eight quarters while prices for platinum, gold, copper and nickel have generally been flat to declining over the same period. The weakening of the Canadian dollar versus the United States dollar generally results in higher revenues.

- Underground mining operations has transitioned to a shaft based ore handling system from a ramp based one in the most recent quarters. The Company is currently moving material to surface using both the ramp and the shaft and therefore costs are somewhat higher than those expected once operations fully utilize the ore handling system modification completed in July.

- Capital expenditures have been generally declining for the last eight quarters as activities associated with the construction of the shaft and related infrastructure to process the upper Offset zone ore were completed.

13

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| CASH FLOWS, FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES |

Sources and Uses of Cash

| Nine months ended | ||||||||||||

| Three months ended September 30 | September 30 | |||||||||||

| (expressed in thousands of dollars) | 2014 | 2013 | 2014 | 2013 | ||||||||

| Cash provided by operations prior to changes in non-cash working capital | $ | 4,505 | $ | 2,455 | $ | 23,165 | $ | 2,253 | ||||

| Changes in non-cash working capital | 3,519 | (433 | ) | (35,697 | ) | 85 | ||||||

| Cash provided by (used in) operations | 8,024 | 2,022 | (12,532 | ) | 2,338 | |||||||

| Cash provided by (used in) financing | (34,720 | ) | (2,087 | ) | 28,646 | 66,979 | ||||||

| Cash used in investing | (5,817 | ) | (26,710 | ) | (14,115 | ) | (91,593 | ) | ||||

| Increase (decrease) in cash from continuing operations | (32,513 | ) | (26,775 | ) | 1,999 | (22,276 | ) | |||||

| Net cash provided by discontinued operations | - | - | - | 20,142 | ||||||||

| Increase (decrease) in cash and cash equivalents | $ | (32,513 | ) | $ | (26,775 | ) | $ | 1,999 | $ | (2,134 | ) | |

Operating Activities

For the three months ended September 30, 2014, cash provided by operations prior to changes in non-cash working capital was $4.5 million, compared to $2.5 million in the prior year. The increase of $2.0 million was primarily due to a $13.1 million increase in revenues partially offset by an $8.5 million increase in production costs and a $3.3 million increase in realized foreign exchange loss. For the nine months ended September 30, 2014, cash provided by operations prior to changes in non-cash working capital was $23.2 million, compared to $2.3 million in the prior year. The increase of $20.9 million was primarily due to a $32.0 million increase in revenue, a $5.7 million decrease in exploration expenses and a $3.1 million decrease in financing costs partially offset by a $13.9 million increase in production costs.

For the three months ended September 30, 2014, changes in non-cash working capital resulted in a source of cash of $3.5 million, compared to a use of cash of $0.4 million in the prior year. The increased source of $3.9 million was primarily due to a reduction in cash-settlements of accounts payable and accrued liabilities of $4.4 million and a reduction in inventories of $3.8 million partially offset by a reduction in cash collections of $4.1 million in accounts receivable.

For the nine months ended September 30, 2014, changes in non-cash working capital resulted in a use of cash of $35.7 million, compared to a source of cash of $0.1 million in the prior year. The increased use of $35.8 million was primarily due to increases in accounts receivable of $28.4 million and an increase in cash settlements of accounts payable and accrued liabilities of $13.7 million partially offset by an increase of other assets of $4.1 million and a decrease in the change in inventory of $2.4 million.

Financing Activities

For the three months ended September 30, 2014, financing activities resulted in a use of cash of $34.7 million compared to a use of $2.1 million in 2013. The $36.8 million increase was primarily due to $30.2 million higher interest payments (including the payment of interest accrued from January 1, 2014 to June 30, 2014 and associated prepayment fee) partially offset by $6.7 million lower credit facility repayment in 2014 and $9.5 million of common shares issued in 2013 that did not recur in 2014.

For the nine month ended September 30, 2014, financing activities resulted in a source of cash of $28.6 million compared to $67.0 million in 2013. The $38.4 million decrease was primarily due to $61.2 million of net proceeds from convertible debentures issued (that have largely been converted into equity) and $33.8 million of interest expenses paid in 2014 compared to $131.9 million of net proceeds of a senior secured term loan issued in 2013 offset by the repayment of $79.2 million senior secured notes in 2013.

14

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Investing Activities

For the three and nine month periods ended September 30, 2014, investing activities used cash of $5.8 million and $14.1 million (2013 - $26.7 million and $91.6 million respectively) primarily due to additions to mining interests of $5.8 million and $14.3 million respectively (2013 - $14.3 million and $92.8 million respectively).

Liquidity and Capital Resources

| As at September 30 | As at December 31 | ||||

| (expressed in thousands of dollars) | 2014 | 2013 | |||

| Cash balance | $ | 11,792 | $ | 9,793 | |

| Net working capital | $ | 24,781 | $ | (174,211 | ) |

| Shareholders’ equity | $ | 235,206 | $ | 222,496 | |

| Total debt | $ | 256,923 | $ | 239,086 |

As at September 30, 2014, the Company had cash and cash equivalents of $11.8 million compared to $9.8 million as at December 31, 2013. The increase is due primarily to the sources and uses of cash as noted above. The funds are deposited with major Canadian chartered banks.

The Company has, subject to a borrowing base cap, a US$60.0 million credit facility that is secured by certain of the Company's accounts receivables and inventory and may be used for working capital liquidity and general corporate purposes. In July 2014, the Company extended its US$60 million credit facility to July 3, 2015 and as at September 30, 2014, the borrowing base calculation limited the credit facility to a maximum of US$37.1 million of which US$36.1 million was utilized.

In July 2014, the Company paid US$23.4 million to its senior secured term loan lender representing US$16.2 million of accrued interest and US$7.2 million of associated pre-payment fee. Effective June 30, 2014, the Company reverted to a 15% annual interest rate on the senior secured term loan and made a US$6.5 million interest payment on September 30, 2014.

The Company has $11.6 million of finance leases funding equipment for operations. Please also see the contractual obligations below for additional commitments.

The Company’s liquidity may be adversely affected by operating performance, a downturn in capital market conditions impacting access to capital markets or entity specific conditions. The achievement of profitable operations is dependent on a number of variables including, but not limited to, metal prices, operational costs, capital expenditures, timely transition to mining by shaft, and meeting production targets. Adverse changes in any of these variables may require the Company to seek additional financing.

The Company’s senior secured term loan and credit facility contain several financial covenants which, if not met, would result in an event of default. This debt also includes certain other covenants, including limits on liens, material adverse change provisions and cross-default provisions. Certain events of default result in this debt becoming immediately due. Other events of default entitle the lender to demand repayment. As at September 30, 2014, the Company was in compliance with all covenants.

15

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Contractual Obligations

Contractual obligations are comprised as follows:

| As at September 30, 2014 | Payments Due by Period | ||||||||

| ($000s) | Total | 1-3 Years | 3-5 Years | 5+ Years | |||||

| Finance lease obligations | $ | 12,659 | $ | 3,750 | $ | 8,334 | $ | 575 | |

| Operating leases | 3,458 | 3,285 | 173 | - | |||||

| Purchase obligations | 10,773 | 10,773 | - | - | |||||

| $ | 26,890 | $ | 17,808 | $ | 8,507 | $ | 575 | ||

In addition to the above, the Company also has asset retirement obligations at September 30, 2014 in the amount of $15.3 million for the LDI Mine. The Company also has contractual obligations reflected in accounts payable and has obligations related to its credit facility and long-term debt. The Company obtained letters of credit of $14.4 million as financial surety for these future outlays.

Contingencies and Commitments

Please refer to notes 14, 17 and 20 of the Company’s Financial Statements. On July 2, 2014, the Company settled the B.R. Davidson claim for $1.0 million, payable on or before December 1, 2014.

Related Party Transactions

There were no related party transactions for the nine month period ended September 30, 2014.

| OUTSTANDING SHARE DATA |

As of November 5, 2014, there were 386,514,777 common shares of the Company outstanding. In addition, there were options outstanding pursuant to the Amended and Restated 2013 Corporate Stock Option Plan entitling holders thereof to acquire 3,492,442 common shares of the Company at a weighted average exercise price of $1.45 per share.

At November 5, 2014, $1.8 million and $43.0 million of 2014 and 2012 convertible debentures were outstanding and were convertible into approximately 7.1 million and 14.8 million common shares respectively.

In conjunction with the 2014 convertible debentures, approximately 35.7 million common share purchase warrants at an exercise price of $0.5786 per share were issued. As at November 5, 2014, none of the common share purchase warrants had been exercised.

| CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

Critical accounting policies generally include estimates that are highly uncertain and for which changes in those estimates could materially impact the Company’s financial statements. The following accounting policies are considered critical:

| a. | Use of estimates |

The preparation of the condensed interim consolidated financial statements in conformity with IFRS requires management to make judgments, estimates, and assumptions that affect the application of accounting policies and the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Significant estimates and assumptions relate to recoverability of mining operations and mineral exploration properties. While management believes that these estimates and assumptions are reasonable, actual results could vary significantly.

16

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Certain assumptions are dependent upon reserves, which represent the estimated amount of ore that can be economically and legally extracted from the Company’s properties. In order to estimate reserves, assumptions are required about a range of geological, technical and economic factors, including quantities, grades, production techniques, recovery rates, production costs, transportation costs, commodity prices and exchange rates. Estimating the quantity and/or grade of reserves requires the size, shape and depth of ore bodies to be determined by analyzing geological data such as drilling samples. This process may require complex and difficult geological judgments to interpret the data. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Because the economic assumptions used to estimate reserves change from period to period, and because additional geological data is generated during the course of operations, estimates of reserves may change from period to period. Changes in reported reserves may affect the Company’s financial results and financial position in a number of ways, including the following:

-

Asset carrying values including mining interests may be affected due to changes in estimated future cash flows;

-

Depreciation and amortization expensed in the statement of operations may change or be impacted where such expenses are determined by the units of production basis, or where the useful economic lives of assets change;

-

Decommissioning, site restoration and environmental provisions may change where changes in estimated reserves affect expectations about the timing or cost of these activities; and

-

The carrying value of deferred tax assets may change due to changes in estimates of the likely recovery of the tax benefits.

| b. | Impairment assessments of long-lived assets |

The carrying amounts of the Company’s non-financial assets, excluding inventories and deferred tax assets, are reviewed at each reporting date to determine whether there is any indication of impairment. Impairment is assessed at the level of cash-generating units (“CGUs”). An impairment loss is recognized in the Consolidated Statements of Operations and Comprehensive Loss for any excess of carrying amount over the recoverable amount.

Impairment is determined for an individual asset unless the asset does not generate cash inflows that are independent of those generated from other assets or groups of assets, in which case, the individual assets are grouped together into CGUs for impairment purposes.

The recoverable amount of an asset or cash-generating unit is the greater of its “value in use”, defined as the discounted present value of the future cash flows expected to arise from its continuing use and its ultimate disposal, and its “fair value less costs to sell”, defined as the best estimate of the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date, less costs of disposal. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset.

An impairment loss is recognized in the Consolidated Statements of Operations and Comprehensive Loss if the carrying amount of an asset or a CGU exceeds its estimated recoverable amount.

Impairment losses recognized in prior periods are assessed at each reporting date for any indications that the loss has decreased or no longer exists. An impairment loss on non-financial assets other than goodwill is reversed if there has been a change in the estimates used to determine the recoverable amount, only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of amortization, if no impairment loss had been recognized.

17

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| c. | Depreciation and amortization of mining interests |

Mining interests relating to plant and equipment, mining leases and claims, royalty interests, and other development costs are recorded at cost with depreciation and amortization provided on the unit-of-production method over the estimated remaining ounces of palladium to be produced based on the proven and probable reserves or, in the event that the Company is mining resources, an appropriate estimate of the resources mined or expected to be mined.

Mining interests relating to small vehicles and certain machinery with a determinable expected life are recorded at cost with depreciation provided on a straight-line basis over their estimated useful lives, ranging from three to seven years, which most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset. Straight-line depreciation is calculated over the depreciable amount, which is the cost of an asset, less its residual value.

Significant components of individual assets are assessed and, if a component has a useful life that is different from the remainder of that asset, that component is depreciated separately using the unit-of-production or straight-line method as appropriate. Costs relating to land are not amortized.

Leased assets are depreciated over the shorter of the lease term and their useful lives unless it is reasonably certain that the Company will obtain ownership by the end of the lease term.

Depreciation methods, useful lives and residual values are reviewed at each financial year-end and adjusted if appropriate.

| d. | Revenue recognition |

Revenue from the sale of metals in the course of ordinary activities is measured at the fair value of the consideration received or receivable, net of volume adjustments. Revenue is recognized when persuasive evidence exists, usually in the form of an executed sales agreement, that the significant risks and rewards of ownership have been transferred to the buyer, recovery of the consideration is probable, the associated costs and possible return of goods can be estimated reliably, there is no continuing management involvement with the goods, and the amount of revenue can be measured reliably. The timing of the transfers of risks and rewards varies depending on the individual terms of the contract of sale.

Revenue from the sale of palladium and by-product metals from the LDI Mine is provisionally recognized based on quoted market prices upon the delivery of concentrate to the smelter or designated shipping point, which is when title transfers and significant rights and obligations of ownership pass. The Company’s smelter contract provides for final prices to be determined by quoted market prices in a period subsequent to the date of concentrate delivery. Variations from the provisionally priced sales are recognized as revenue adjustments until final pricing is determined. Accounts receivable are recorded net of estimated treatment and refining costs, which are subject to final assay adjustments. Subsequent adjustments to provisional pricing amounts due to changes in metal prices and foreign exchange are disclosed separately from initial revenues in the notes to the financial statements.

| e. | Asset retirement obligations |

In accordance with Company policies, asset retirement obligations relating to legal and constructive obligations for future site reclamation and closure of the Company’s mine sites are recognized when incurred and a liability and corresponding asset are recorded at management’s best estimate. Estimated closure and restoration costs are provided for in the accounting period when the obligation arising from the related disturbance occurs.

The amount of any liability recognized is estimated based on the risk-adjusted costs required to settle present obligations, discounted using a pre-tax risk-free discount rate consistent with the time period of expected cash flows. When the liability is initially recorded, a corresponding asset retirement cost is recognized as an addition to mining interests and amortized using the unit of production method.

18

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

The liability for each mine site is accreted over time and the accretion charges are recognized as a finance cost in the Consolidated Statements of Operations and Comprehensive Loss. The liability is subject to re-measurement at each reporting date based on changes in discount rates and timing or amounts of the costs to be incurred. Changes in the liability, other than accretion charges, relating to mine rehabilitation and restoration obligations, which are not the result of current production of inventory, are added to or deducted from the carrying value of the related asset retirement cost in the reporting period recognized. If the change results in a reduction of the obligation in excess of the carrying value of the related asset retirement cost, the excess balance is recognized as a recovery through profit or loss in the period.

Adoption of New Accounting Standards

The following new accounting standards have been adopted by the Company.

IAS 32 Financial Instruments: Presentation

This standard is amended to clarify requirements for offsetting of financial assets and financial liabilities. The amendment is effective for annual periods beginning on or after January 1, 2014. This amendment did not have a material impact on the condensed interim consolidated financial statements of the Company.

IAS 36 Recoverable Amounts

This standard was amended in May 2013 to change the disclosure required when an impairment loss is recognized or reversed. The amendments require the disclosure of the recoverable amount of an asset or cash generating unit at the time an impairment loss has been recognized or reversed and detailed disclosure of how the associated fair value less costs of disposal has been determined. The amendments are effective for annual periods beginning on or after January 1, 2014 with earlier adoption permitted. This amendment did not have a material impact on the condensed interim consolidated financial statements of the Company.

IFRIC 21 Accounting for Levies Imposed by Governments

This interpretation provides guidance on the obligating event giving rise to a liability in connection with a levy imposed by a government, and clarifies that the obligating event is the activity that triggers the payment of the levy as identified by the legislation. The interpretation is effective for annual periods beginning on or after January 1, 2014. This amendment did not have a material impact on the condensed interim consolidated financial statements of the Company.

New standards and interpretations not yet adopted

In addition to the new standards disclosed in the Company’s annual financial statements for the year ended December 31, 2013, the following new standards and amendments to standards are not yet effective as of the September 30, 2014 reporting date or have otherwise not yet been adopted by the Company. The Company is evaluating the impact, if any, adoption of the standards will have on the disclosures in the Company’s condensed interim consolidated financial statements:

IAS 16 and IAS 38 Clarification of acceptable methods of depreciation and amortization

This pronouncement amends IAS 16 Property Plant and Equipment and IAS 38 Intangible Assets to (i) clarify that the use of a revenue-based depreciation method is not appropriate for property, plant and equipment, and (ii) provide a rebuttal presumption for intangible assets. The amendment is effective for years beginning on or after January 1, 2016. This amendment is not expected to have a material impact on the condensed interim consolidated financial statements of the Company.

19

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

IFRS 15 Revenue from contracts with customers

This new standard on revenue recognition supercedes IAS 18 Revenue, IAS 11 Construction Contracts, and related interpretations. The amendment is effective for years beginning on or after January 1, 2017. The Company is presently evaluating the potential impact of this new standard on the condensed interim consolidated financial statements of the Company.

IFRS 9 Financial Instruments: Classification and Measurement

On July 24, 2014 the IASB issued the complete IFRS 9 (IFRS 9 (2014)) which will replace IAS 39, Financial Instruments: Recognition and Measurement. In November 2009 the IASB issued the first version of IFRS 9, Financial Instruments (IFRS 9 (2009)) and subsequently issued various amendments in October 2010, (IFRS 9 Financial Instruments (2010)) and November 2013 (IFRS 9 Financial Instruments (2013)).

IFRS 9 (2009) introduces new requirements for the classification and measurement of financial assets. Under IFRS 9 (2009), financial assets are classified and measured based on the business model in which they are held and the characteristics of their contractual cash flows. This includes the introduction of a third measurement category for financial assets – fair value through other comprehensive income.

IFRS 9 (2010) introduces additional changes relating to financial liabilities.

IFRS 9 (2013) includes a new general hedge accounting standard which will align hedge accounting more closely with risk management. This new standard does not fundamentally change the types of hedging relationships or the requirement to measure and recognize ineffectiveness, however it will provide more hedging strategies that are used for risk management to qualify for hedge accounting and introduce more judgment to assess the effectiveness of a hedging relationship.

Special transitional requirements have been set for the application of the new general hedging model.

IFRS 9 (2014) includes finalized guidance on the classification and measurement of financial assets. The final standard also amends the impairment model by introducing a new ‘expected credit loss’ model for calculating impairment, and new general hedge accounting requirements.

The mandatory effective date of IFRS 9 is for annual periods beginning on or after January 1, 2018 and must be applied retrospectively with some exemptions. Early adoption is permitted. The restatement of prior periods is not required and is only permitted if information is available without the use of hindsight. The Company is presently evaluating the impact of adopting this standard and does not intend to early adopt IFRS 9 (2009), IFRS 9 (2010) or IFRS 9 (2013) and/or IFRS 9 (2014) in its financial statements for the annual period beginning on January 1, 2015.

| RISKS AND UNCERTAINTIES |

The risks and uncertainties are discussed within the Company’s most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities, the Company’s Short Form Base Shelf Prospectus filed on February 12, 2013, and the Company’s Prospectus Supplement filed on April 8, 2014.

20

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| INTERNAL CONTROLS |

Disclosure Controls and Procedures

Management is responsible for the information disclosed in this MD&A and has in place the appropriate information systems, procedures and controls to ensure that information used internally by management and disclosed externally is, in all material respects, complete and reliable.

For the nine months ended September 30, 2014, the Chief Executive Officer and Chief Financial Officer certify that they have designed, or caused to be designed under their supervision, disclosure controls and procedures to provide reasonable assurance that material information relating to the Company and its consolidated subsidiaries would be made known to them by others within those entities.

The disclosure controls and procedures are evaluated annually through regular internal reviews which are carried out under the supervision of, and with the participation of, the Company’s management, including the Chief Executive Officer and Chief Financial Officer.

Internal Control over Financial Reporting

For the nine months ended September 30, 2014, the Chief Executive Officer and Chief Financial Officer certify that they have designed, or caused to be designed under their supervision, internal controls over financial reporting to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the financial statements for external purposes in accordance with IFRS.

There have been no changes in the Company’s internal controls over the financial reporting that occurred during the nine month period ended September 30, 2014 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

Management is responsible for establishing and maintaining adequate internal controls over financial reporting. Internal control over financial reporting, no matter how well designed, has inherent limitations and can only provide reasonable assurance, not absolute assurance, with respect to the preparation and fair presentation of published financial statements and management does not expect such controls will prevent or detect all misstatements due to error or fraud. The Company is continually evolving and enhancing its systems of controls and procedures.

Under the supervision and with the participation of the Chief Executive Officer and the Chief Financial Officer, management performs regular internal reviews and conducts an annual evaluation of the effectiveness of its internal control over financial reporting based on the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (1992).

| OTHER INFORMATION |

Additional information regarding the Company is included in the Company’s Annual Information Form and Annual Report on Form 40-F, which are filed with the SEC and the provincial securities regulatory authorities, respectively. A copy of the Company’s Annual Information Form is posted on the SEDAR website at www.sedar.com. A copy of the Annual Report or Form 40-F can be obtained from the SEC’s website at www.sec.gov.

21

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

| NON-IFRS MEASURES |

This MD&A refers to cash cost per ounce, adjusted net loss, EBITDA and adjusted EBITDA which are not recognized measures under IFRS. Such Non-IFRS financial measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Management uses these measures internally. The use of these measures enables management to better assess performance trends. Management understands that a number of investors, and others who follow the Company’s performance, assess performance in this way. Management believes that these measures better reflect the Company’s performance and are better indications of its expected performance in future periods. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

2013 was a transition year for the Company as it was sinking the shaft and completing related infrastructure at the same time it was developing and transitioning to mining the Offset zone. As a result, the 2013 financial results would not be directly comparable to the prior or future years.

The following tables reconcile these non-IFRS measures to the most directly comparable IFRS measures:

Cash Cost Per Ounce of Palladium

The Company uses this measure internally to evaluate the underlying operating performance of the Company for the reporting periods presented. The Company believes that providing cash cost per ounce allows the ability to better evaluate the results of the underlying business of the Company.

Cash cost per ounce include mine site operating costs such as mining, processing, administration and royalties, but are exclusive of depreciation, amortization, reclamation, capital and exploration costs. Cash cost per ounce calculation is reduced by any by-product revenue and is then divided by ounces sold to arrive at the by-product cash cost per ounce of sales. This measure, along with revenues, is considered to be a key indicator of a Company’s ability to generate operating earnings and cash flow from its mining operations.

The Company’s primary operation relates to the extraction of palladium metal. Therefore, all other metals extracted in conjunction with the palladium metal are considered to be a by-product credit for the purposes of the cash cost calculation.

Reconciliation of Palladium Cash Cost per Ounce

| For the nine months | |||||||||||||||

| For the three months ended | ended September 30 | ||||||||||||||

| (expressed in thousands of dollars except | Sep 30 | June 30 | Mar 31 | Dec 31 | Sep 30 | ||||||||||

| ounce and per ounce amounts) | 2014 | 2014 | 2014 | 2013 | 2013 | 2014 | 2013 | ||||||||

| Production costs including overhead | $ | 30,116 | $ | 30,355 | $ | 29,735 | $ | 31,153 | $ | 21,663 | $ | 90,206 | $ | 76,305 | |

| Smelting, refining and freight costs | 4,007 | 4,130 | 4,183 | 3,864 | 2,922 | 12,320 | 10,130 | ||||||||

| Royalty expense | 1,761 | 2,184 | 2,074 | 1,669 | 1,464 | 6,019 | 4,865 | ||||||||

| Mine restoration costs, net of insurance recoveries | - | - | - | - | 1,214 | - | 1,263 | ||||||||

| Operational expenses | 35,884 | 36,669 | 35,992 | 36,686 | 27,263 | 108,545 | 92,563 | ||||||||

| Less by-product metal revenue | 12,511 | 14,103 | 14,639 | 12,425 | 10,703 | 41,252 | 37,721 | ||||||||

| $ | 23,373 | $ | 22,566 | $ | 21,353 | $ | 24,261 | $ | 16,560 | $ | 67,293 | $ | 54,842 | ||

| Divided by ounces of palladium sold | 36,430 | 40,716 | 39,485 | 35,206 | 27,370 | 116,631 | 99,749 | ||||||||

| Cash cost per ounce (CDN$) | $ | 642 | $ | 554 | $ | 541 | $ | 689 | $ | 605 | $ | 577 | $ | 550 | |

| Average exchange rate (CDN$1 – US$) | 0.92 | 0.92 | 0.91 | 0.90 | 0.96 | 0.91 | 0.98 | ||||||||

| Cash cost per ounce (US$), net of by-product credits | $ | 589 | $ | 510 | $ | 492 | $ | 620 | $ | 581 | $ | 527 | $ | 539 | |

22

THIRD QUARTER REPORT 2014

North American Palladium Ltd.

Adjusted EBITDA