UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-06660

| Name of Fund: | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock MuniYield Quality Fund II, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 04/30/2022

Date of reporting period: 04/30/2022

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

|

|

APRIL 30, 2022 |

|

|

2022 Annual Report

| |

BlackRock MuniYield Fund, Inc. (MYD)

BlackRock MuniYield Quality Fund, Inc. (MQY)

BlackRock MuniYield Quality Fund II, Inc. (MQT)

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Dear Shareholder,

The 12-month reporting period as of April 30, 2022 saw the emergence of significant challenges that disrupted the economic recovery and strong financial markets which characterized 2021. The U.S. economy shrank in the first quarter of 2022, ending the run of robust growth which followed reopening and the development of the COVID-19 vaccines. Rapid changes in consumer spending led to supply constraints and elevated inflation, which reached a 40-year high. Moreover, while the foremost effect of Russia’s invasion of Ukraine has been a severe humanitarian crisis, the invasion has presented challenges for both investors and policymakers.

Equity prices were mixed but mostly down, as persistently high inflation drove investors’ expectations for higher interest rates, particularly weighing on relatively high valuation growth stocks and economically sensitive small-capitalization stocks. Overall, small-capitalization U.S. stocks declined, while large-capitalization U.S. stocks were nearly flat. Both emerging market stocks and international equities from developed markets fell significantly, pressured by rising interest rates and a strengthening U.S. dollar.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) rose during the reporting period as increasing inflation drove investors’ expectations for higher interest rates. The corporate bond market also faced inflationary headwinds, and increasing uncertainty led to higher corporate bond spreads (the difference in yield between U.S. Treasuries and similarly-dated corporate bonds).

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation is growing faster than expected, raised interest rates in March 2022, the first increase of this business cycle. Furthermore, the Fed wound down its bond-buying programs and raised the prospect of reversing the flow and reducing its balance sheet. Continued high inflation and the Fed’s new tone led many analysts to anticipate that the Fed will continue to raise interest rates multiple times throughout the year.

Looking ahead, however, the horrific war in Ukraine has significantly clouded the outlook for the global economy, leading to major volatility in energy and metal markets. Sanctions on Russia, Europe’s top energy supplier, and general wartime disruption are likely to drive already-high commodity prices even higher. We believe sharp increases in energy prices will exacerbate inflationary pressure while also constraining economic growth. Combating inflation without stifling a recovery, while buffering against ongoing supply and price shocks amid the ebb and flow of the pandemic, will be an especially challenging environment for setting effective monetary policy. Despite the likelihood of more rate increases on the horizon, we believe the Fed will err on the side of protecting employment, even at the expense of higher inflation.

In this environment, we favor an overweight to equities, as valuations have become more attractive and inflation-adjusted interest rates remain low. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and healthcare, are particularly attractive in the long term. We favor U.S. equities due to strong earnings momentum, while Japanese equities should benefit from supportive monetary and fiscal policy. We are underweight credit overall, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities for additional yield. We believe that international diversification and a focus on sustainability and quality can help provide portfolio resilience.

Overall, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of April 30, 2022 | ||||||

| 6-Month | 12-Month | |||||

| U.S. large cap equities (S&P 500® Index) |

(9.65 | )% | 0.21% | |||

| U.S. small cap equities (Russell 2000® Index) |

(18.38 | ) | (16.87) | |||

| International equities (MSCI Europe, Australasia, Far East Index) |

(11.80 | ) | (8.15) | |||

| Emerging market equities |

(14.15 | ) | (18.33) | |||

| 3-month Treasury bills |

0.07 | 0.08 | ||||

| U.S. Treasury securities |

(10.29 | ) | (8.86) | |||

| U.S. investment grade bonds |

(9.47 | ) | (8.51) | |||

| Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) |

(7.90 | ) | (7.88) | |||

| U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

(7.40 | ) | (5.22) | |||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||

| 2 | ||

| Annual Report: |

||

| 4 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| Financial Statements: |

||

| 15 | ||

| 49 | ||

| 50 | ||

| 51 | ||

| 53 | ||

| 54 | ||

| 57 | ||

| 68 | ||

| 69 | ||

| 70 | ||

| 77 | ||

| 78 | ||

| 82 | ||

| 85 |

| 3 |

| Municipal Market Overview For the Reporting Period Ended April 30, 2022 |

Municipal Market Conditions

Municipal bonds posted negative total returns during the period alongside rising interest rates spurred by waning COVID-19 variant fears, a strong domestic economy, surging inflation, the first Fed rate hike since 2018, and heightened expectations for future interest rate raises. Although credit fundamentals remained strong, bolstered by robust revenue growth and elevated fund balances, supply-and-demand technicals became challenged late in the period and drove considerable municipal underperformance versus comparable U.S. Treasuries. Shorter-duration (i.e., less sensitive to interest rates) and lower-rated bonds performed best, though higher-rated bonds outperformed more recently.

| During the 12 months ended April 30, 2022, municipal bond funds experienced net outflows totaling $2 billion (based on data from the Investment Company Institute). The post-pandemic inflow cycle, which spanned 92-weeks and garnered $149 billion, ended abruptly in early 2022 as performance turned starkly negative. As a result, elevated bid-wanted activity weighed on the market as investors raised cash to meet redemptions. At the same time, the market absorbed $446 billion in issuance, slightly below the $448 billion issued during the prior 12-months. New issue oversubscriptions waned late in the period as sentiment turned less constructive. |

|

Bloomberg Municipal Bond Index Total Returns as of April 30, 2022 6 months: (7.90)% 12 months: (7.88)% | ||

|

| ||||

|

|

A Closer Look at Yields

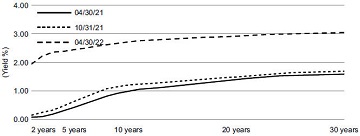

AAA Municipal Yield Curves

Source: Thomson Municipal Market Data.

From April 30, 2021 to April 30, 2022, yields on AAA-rated 30-year municipal bonds increased by 146 basis points (“bps”) from 1.59% to 3.05%, while ten-year rates increased by 173 bps from 0.99% to 2.72% and five-year rates increased by 202 bps from 0.43% to 2.45% (as measured by Thomson Municipal Market Data). As a result, the municipal yield curve flattened over the 12-month period with the spread between two- and 30-year maturities flattening by 66 bps, lagging the 186 bps of flattening experienced in the U.S. Treasury curve.

After maintaining historically tight valuations for most of the reporting period, the selloff experienced in 2022 has restored value to the asset class. Municipal-to-Treasury ratios are through their 5-year averages in the intermediate and long-end of the curve, while yields on municipals exceed yields on both the S&P 500 and investment-grade corporates on an after-tax basis.

Financial Conditions of Municipal Issuers

Buoyed by successive federal aid injections, vaccine distribution, and the re-opening of the economy, states and many local governments experienced revenue growth above forecasts in 2021 and continue to do so in 2022. While solid revenue collections, particularly sales and personal income tax receipts, continue to grow in this inflationary environment, higher wages, energy costs, and interest rates in the post-Covid recovery will pressure state and local government costs. While overall credit fundamentals are expected to remain sturdy, prolonged inflation could hurt consumer spending and eventually become a headwind to economic growth and employment expansion. At this point, tax receipts could come under pressure, although states with significant oil and gas production would benefit. While municipal utilities typically benefit from autonomous rate-setting that allows them to adjust for rising fuel costs, rising commodity prices over a prolonged period could test affordability and the political will to raise rates to balance operations. State housing authority bonds, flagship universities, and strong national and regional health systems may also be pressured but are better poised to absorb the impact of the economic shock. Critical providers (safety net hospitals, mass transit systems, airports) with limited resources may still experience fiscal strain from the economic fallout from rising inflation, but aid and the re-opening of the economy will continue to support operating results through 2022. Work-from-home policies remain headwinds for mass transit farebox revenue and commercial real estate values. BlackRock anticipates that a small subset of the market, mainly non-rated stand-alone projects, will remain susceptible to credit deterioration.

The opinions expressed are those of BlackRock as of April 30, 2022 and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of any individual holdings or market sectors. Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to Alternative Minimum Tax (“AMT”). Capital gains distributions, if any, are taxable.

The Bloomberg Municipal Bond Index, a broad, market value-weighted index, seeks to measure the performance of the U.S. municipal bond market. All bonds in the index are exempt from U.S. federal income taxes or subject to the AMT. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

| 4 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume a Fund’s Common Shares capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Fund’s financing cost of leverage is significantly lower than the income earned on a Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit Common Shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Fund had not used leverage. Furthermore, the value of the Funds’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of each Fund’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Funds’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Fund’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Fund’s Common Shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by Common Shareholders and may reduce income to the Common Shares. Moreover, to the extent the calculation of each Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Funds’ investment adviser will be higher than if the Funds did not use leverage.

To obtain leverage, each Fund has issued Variable Rate Demand Preferred Shares (“VRDP Shares”) or Variable Rate Muni Term Preferred Shares (“VMTP Shares”) (collectively, “Preferred Shares”) and/or leveraged its assets through the use of tender option bond trusts (“TOB Trusts”) as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Fund is permitted to issue debt up to 33 1/3% of its total managed assets or equity securities (e.g., Preferred Shares) up to 50% of its total managed assets. A Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by the Preferred Shares’ governing instruments or by agencies rating the Preferred Shares, which may be more stringent than those imposed by the 1940 Act.

If a Fund segregates or designates on its books and records cash or liquid assets having a value not less than the value of a Fund’s obligations under the TOB Trust (including accrued interest), then the TOB Trust is not considered a senior security and is not subject to the foregoing limitations and requirements imposed by the 1940 Act.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S |

5 |

| Fund Summary as of April 30, 2022 | BlackRock MuniYield Fund, Inc. (MYD) |

Investment Objective

BlackRock MuniYield Fund, Inc.’s (MYD) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Fund invests, under normal market conditions, at least 75% of its assets in municipal bonds rated investment grade, or deemed to be of comparable quality by the investment adviser, at the time of investment and invests primarily in long-term municipal bonds with a maturity of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MYD | |

| Initial Offering Date |

November 29, 1991 | |

| Yield on Closing Market Price as of April 30, 2022 ($11.43)(a) |

5.41% | |

| Tax Equivalent Yield(b) |

9.14% | |

| Current Monthly Distribution per Common Share(c) |

$0.0515 | |

| Current Annualized Distribution per Common Share(c) |

$0.6180 | |

| Leverage as of April 30, 2022(d) |

40% | |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

Market Price and Net Asset Value Per Share Summary

| 04/30/22 | 04/30/21 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 11.43 | $ | 14.62 | (21.82 | )% | $ | 15.52 | $ | 11.42 | ||||||||||

| Net Asset Value |

12.62 | 15.26 | (17.30 | ) | 15.69 | 12.62 | ||||||||||||||

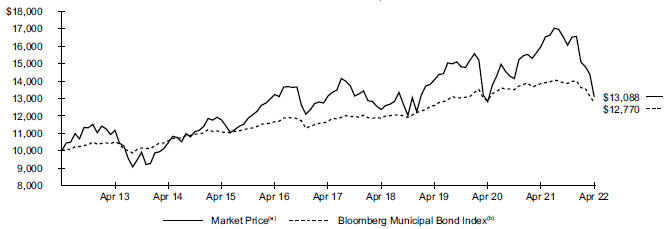

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

| 6 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Fund, Inc. (MYD) |

Performance

Returns for the period ended April 30, 2022 were as follows:

| Average Annual Total Returns | ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| Fund at NAV(a)(b) |

(13.39 | )% | 1.98 | % | 3.95 | % | ||||||

| Fund at Market Price(a)(b) |

(18.13 | ) | (0.08 | ) | 2.73 | |||||||

| National Customized Reference Benchmark(c) |

(7.72 | ) | 2.06 | N/A | ||||||||

| Bloomberg Municipal Bond Index |

(7.88 | ) | 1.80 | 2.47 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at NAV(d) |

(11.81 | ) | 2.10 | 3.76 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at Market Price(d) |

(16.63 | ) | 1.62 | 3.09 | ||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). Effective October 1, 2021, the Fund changed its reporting benchmark from Lipper General & Insured Municipal Debt Funds (Leveraged) to the National Customized Reference Benchmark. The investment adviser believes the new benchmark is a more appropriate reporting benchmark for the Fund. |

The National Customized Reference Benchmark commenced on September 30, 2016.

| (d) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds lost ground in the 12-month period. Rising inflation prompted the Fed to shift toward tighter monetary policy, weighing heavily on the performance of fixed-income assets.

Income contributed to the Fund’s performance, but it was not sufficient to offset the sharp downturn in prices. The Fund’s use of U.S. Treasury futures to manage interest rate risk contributed to results in the rising-rate environment. Holdings in high-quality, short-maturity bonds—while producing negative absolute returns—posted smaller losses than the Fund as a whole. On the other hand, positions in longer-dated issues generally underperformed due to their above-average interest-rate sensitivity.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| F U N D S U M M A R Y |

7 |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Fund, Inc. (MYD) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

| Sector(a)(b) | 04/30/22 | 04/30/21 | ||||||

| Transportation |

22 | % | 22 | % | ||||

| Health |

16 | 14 | ||||||

| State |

15 | 19 | ||||||

| Utilities |

10 | 11 | ||||||

| County/City/Special District/School District |

10 | 10 | ||||||

| Education |

8 | 7 | ||||||

| Tobacco |

7 | 8 | ||||||

| Housing |

7 | 3 | ||||||

| Corporate |

5 | 6 | ||||||

CALL/MATURITY SCHEDULE

| Calendar Year Ended December 31,(a)(c) | Percentage | |||

| 2022 |

9 | % | ||

| 2023 |

7 | |||

| 2024 |

7 | |||

| 2025 |

8 | |||

| 2026 |

3 | |||

CREDIT QUALITY ALLOCATION

| Credit Rating(a)(d) | 04/30/22 | 04/30/21 | ||||||

| AAA/Aaa |

5 | % | 5 | % | ||||

| AA/Aa |

38 | 36 | ||||||

| A |

29 | 25 | ||||||

| BBB/Baa |

10 | 16 | ||||||

| BB/Ba |

6 | 5 | ||||||

| B |

2 | 2 | ||||||

| C |

— | 1 | ||||||

| N/R(e) |

10 | 10 | ||||||

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of April 30, 2022 and April 30, 2021, the market value of unrated securities deemed by the investment adviser to be investment grade represents 3% and 3%, respectively, of the Fund’s total investments. |

| 8 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of April 30, 2022 | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Investment Objective

BlackRock MuniYield Quality Fund, Inc.’s (MQY) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Fund invests in municipal bonds which are in the three highest quality rating categories (A or better), or which are deemed to be of comparable quality by the adviser, at the time of investment. The Fund invests primarily in long-term municipal bonds with maturities of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MQY | |

| Initial Offering Date |

June 26, 1992 | |

| Yield on Closing Market Price as of April 30, 2022 ($12.80)(a) |

5.91% | |

| Tax Equivalent Yield(b) |

9.98% | |

| Current Monthly Distribution per Common Share(c) |

$0.0630 | |

| Current Annualized Distribution per Common Share(c) |

$0.7560 | |

| Leverage as of April 30, 2022(d) |

40% | |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The monthly distribution per Common Share, declared on June 1, 2022, was decreased to $0.0560 per share. The yield on closing market price, tax equivalent yield, current monthly distribution per Common Share, and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

| (d) | Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

Market Price and Net Asset Value Per Share Summary

| 04/30/22 | 04/30/21 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 12.80 | $ | 15.92 | (19.60 | )% | $ | 17.08 | $ | 12.72 | ||||||||||

| Net Asset Value |

13.74 | 16.57 | (17.08 | ) | 16.87 | 13.74 | ||||||||||||||

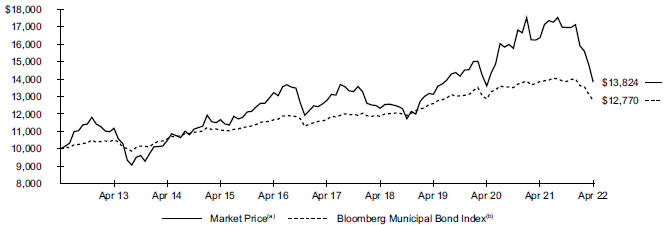

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

| F U N D S U M M A R Y |

9 |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Performance

Returns for the period ended April 30, 2022 were as follows:

| Average Annual Total Returns | ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| Fund at NAV(a)(b) |

(12.93 | )% | 2.47 | % | 3.92 | % | ||||||

| Fund at Market Price(a)(b) |

(15.58 | ) | 1.58 | 3.29 | ||||||||

| National Customized Reference Benchmark(c) |

(7.72 | ) | 2.06 | N/A | ||||||||

| Bloomberg Municipal Bond Index |

(7.88 | ) | 1.80 | 2.47 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at NAV(d) |

(11.81 | ) | 2.10 | 3.76 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at Market Price(d) |

(16.63 | ) | 1.62 | 3.09 | ||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). Effective October 1, 2021, the Fund changed its reporting benchmark from Lipper General & Insured Municipal Debt Funds (Leveraged) to the National Customized Reference Benchmark. The investment adviser believes the new benchmark is a more appropriate reporting benchmark for the Fund. The National Customized Reference Benchmark commenced on September 30, 2016. |

| (d) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds lost ground in the past 12 months. Rising inflation prompted the Fed to shift toward tighter monetary policy, weighing heavily on the performance of fixed-income assets.

Income contributed to the Fund’s performance, but it was not sufficient to offset the sharp downturn in prices. Positions in longer-dated and lower-coupon securities generally experienced the weakest price performance. The Fund’s use of leverage, while augmenting income, amplified the effect of falling prices. While all sectors lost ground in the period, housing and transportation were notable laggards due to their higher interest-rate sensitivity. On the positive side, the Fund’s use of U.S. Treasury futures to manage interest rate risk contributed to results in the rising-rate environment.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Quality Fund, Inc. (MQY) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

| Sector(a)(b) | 04/30/22 | 04/30/21 | ||||||

| Transportation |

25 | % | 23 | % | ||||

| County/City/Special District/School District |

17 | 17 | ||||||

| Health |

14 | 15 | ||||||

| State |

13 | 15 | ||||||

| Utilities |

8 | 9 | ||||||

| Housing |

8 | 7 | ||||||

| Education |

8 | 8 | ||||||

| Tobacco |

4 | 4 | ||||||

| Corporate |

3 | 2 | ||||||

| Other |

— | — | (c) | |||||

CALL/MATURITY SCHEDULE

| Calendar Year Ended December 31,(a)(d) | Percentage | |||

| 2022 |

7 | % | ||

| 2023 |

9 | |||

| 2024 |

9 | |||

| 2025 |

9 | |||

| 2026 |

9 | |||

CREDIT QUALITY ALLOCATION

| Credit Rating(a)(e) | 04/30/22 | 04/30/21 | ||||||

| AAA/Aaa |

5 | % | 5 | % | ||||

| AA/Aa |

42 | 44 | ||||||

| A |

30 | 28 | ||||||

| BBB/Baa |

9 | 11 | ||||||

| BB/Ba |

3 | 3 | ||||||

| B |

1 | — | (c) | |||||

| CCC/Caa |

— | (c) | — | (c) | ||||

| C |

— | (c) | — | (c) | ||||

| N/R(f) |

10 | 9 | ||||||

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| (c) | Rounds to less than 1% of total investments. |

| (d) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (e) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (f) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of April 30, 2022 and April 30, 2021, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2% and 1%, respectively, of the Fund’s total investments. |

| F U N D S U M M A R Y |

11 |

| Fund Summary as of April 30, 2022 | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Investment Objective

BlackRock MuniYield Quality Fund II, Inc.’s (MQT) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S federal income taxes as is consistent with its investment policies and prudent investment management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S federal alternative minimum tax). The Fund invests in municipal bonds which are in the three highest quality rating categories (A or better), or are deemed to be of comparable quality by the investment adviser at the time of investment. The Fund invests primarily in long-term municipal bonds with maturities of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

| Symbol on New York Stock Exchange |

MQT | |

| Initial Offering Date |

August 28, 1992 | |

| Yield on Closing Market Price as of April 30, 2022 ($11.08)(a) |

5.85% | |

| Tax Equivalent Yield(b) |

9.88% | |

| Current Monthly Distribution per Common Share(c) |

$0.0540 | |

| Current Annualized Distribution per Common Share(c) |

$0.6480 | |

| Leverage as of April 30, 2022(d) |

41% | |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

Market Price and Net Asset Value Per Share Summary

| 04/30/22 | 04/30/21 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 11.08 | $ | 13.92 | (20.40 | )% | $ | 15.17 | $ | 11.00 | ||||||||||

| Net Asset Value |

12.17 | 14.58 | (16.53 | ) | 14.85 | 12.17 | ||||||||||||||

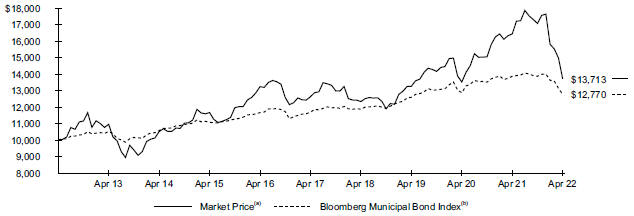

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

| 12 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Performance

Returns for the period ended April 30, 2022 were as follows:

| Average Annual Total Returns | ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| Fund at NAV(a)(b) |

(12.49 | )% | 2.43 | % | 4.05 | % | ||||||

| Fund at Market Price(a)(b) |

(16.55 | ) | 1.66 | 3.21 | ||||||||

| National Customized Reference Benchmark(c) |

(7.72 | ) | 2.06 | N/A | ||||||||

| Bloomberg Municipal Bond Index |

(7.88 | ) | 1.80 | 2.47 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at NAV(d) |

(11.81 | ) | 2.10 | 3.76 | ||||||||

| Lipper General & Insured Municipal Debt Funds (Leveraged) at Market Price(d) |

(16.63 | ) | 1.62 | 3.09 | ||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

| (b) | The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). Effective October 1, 2021, the Fund changed its reporting benchmark from Lipper General & Insured Municipal Debt Funds (Leveraged) to the National Customized Reference Benchmark. The investment adviser believes the new benchmark is a more appropriate reporting benchmark for the Fund. |

The National Customized Reference Benchmark commenced on September 30, 2016.

| (d) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds lost ground in the past 12 months. Rising inflation prompted the Fed to shift toward tighter monetary policy, weighing heavily on the performance of fixed-income assets.

Income contributed to the Fund’s performance, but it was not sufficient to offset the sharp downturn in prices. Positions in longer-dated and lower-coupon securities generally experienced the weakest price performance. The Fund’s use of leverage, while augmenting income, amplified the effect of falling prices. While all sectors lost ground in the period, housing and transportation were notable laggards due to their higher interest-rate sensitivity. On the positive side, the Fund’s use of U.S. Treasury futures to manage interest rate risk contributed to results in the rising-rate environment.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| F U N D S U M M A R Y |

13 |

| Fund Summary as of April 30, 2022 (continued) | BlackRock MuniYield Quality Fund II, Inc. (MQT) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

| Sector(a)(b) | 04/30/22 | 04/30/21 | ||||||

| Transportation |

30 | % | 28 | % | ||||

| County/City/Special District/School District |

17 | 17 | ||||||

| Health |

16 | 16 | ||||||

| State |

11 | 14 | ||||||

| Utilities |

8 | 9 | ||||||

| Housing |

6 | 6 | ||||||

| Education |

6 | 5 | ||||||

| Tobacco |

3 | 3 | ||||||

| Corporate |

3 | 2 | ||||||

| Other |

— | — | (c) | |||||

CALL/MATURITY SCHEDULE

| Calendar Year Ended December 31,(a)(d) | Percentage | |||

| 2022 |

8 | % | ||

| 2023 |

10 | |||

| 2024 |

10 | |||

| 2025 |

9 | |||

| 2026 |

7 | |||

CREDIT QUALITY ALLOCATION

| Credit Rating(a)(e) | 04/30/22 | 04/30/21 | ||||||

| AAA/Aaa |

4 | % | 4 | % | ||||

| AA/Aa |

42 | 42 | ||||||

| A |

32 | 30 | ||||||

| BBB/Baa |

8 | 11 | ||||||

| BB/Ba |

2 | 2 | ||||||

| B |

— | (c) | — | (c) | ||||

| N/R(f) |

12 | 11 | ||||||

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| (c) | Rounds to less than 1% of total investments. |

| (d) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (e) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (f) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of April 30, 2022 and April 30, 2021, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2% and 1%, respectively, of the Fund’s total investments. |

| 14 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

|

April 30, 2022 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Municipal Bonds |

||||||||

| Alabama — 2.2% | ||||||||

| County of Jefferson Alabama Sewer Revenue, Refunding RB |

||||||||

| Series A, Senior Lien, (AGM), 5.00%, 10/01/44 |

$ | 1,665 | $ | 1,728,385 | ||||

| Series A, Senior Lien, (AGM), 5.25%, 10/01/48 |

3,175 | 3,303,756 | ||||||

| Series D, Sub Lien, 6.00%, 10/01/42 |

7,410 | 8,017,709 | ||||||

|

|

|

|||||||

| 13,049,850 | ||||||||

| Arizona — 3.1% | ||||||||

| Glendale Industrial Development Authority, RB |

||||||||

| 5.00%, 05/15/41 |

190 | 199,388 | ||||||

| 5.00%, 05/15/56 |

750 | 782,731 | ||||||

| Industrial Development Authority of the City of Phoenix, RB, Series A, 5.00%, 07/01/46(a) |

3,575 | 3,564,582 | ||||||

| Salt Verde Financial Corp., RB |

||||||||

| 5.00%, 12/01/32 |

7,365 | 8,041,424 | ||||||

| 5.00%, 12/01/37 |

5,000 | 5,532,665 | ||||||

|

|

|

|||||||

| 18,120,790 | ||||||||

| Arkansas — 1.0% | ||||||||

| Arkansas Development Finance Authority, RB |

||||||||

| 5.00%, 12/01/47 |

1,120 | 1,199,404 | ||||||

| Series A, AMT, 4.50%, 09/01/49(a) |

5,230 | 4,822,452 | ||||||

|

|

|

|||||||

| 6,021,856 | ||||||||

| California — 5.1% | ||||||||

| California Educational Facilities Authority, RB, Series V-1, 5.00%, 05/01/49 |

2,010 | 2,440,936 | ||||||

| California Health Facilities Financing Authority, Refunding RB |

||||||||

| Series A, 5.00%, 07/01/23(b) |

2,560 | 2,644,291 | ||||||

| Series A, 4.00%, 04/01/45 |

820 | 795,853 | ||||||

| Series A, 4.00%, 08/15/48 |

1,265 | 1,252,723 | ||||||

| California Municipal Finance Authority, RB, S/F Housing |

||||||||

| Series A, 5.25%, 08/15/39 |

305 | 309,439 | ||||||

| Series A, 5.25%, 08/15/49 |

770 | 780,518 | ||||||

| California Pollution Control Financing Authority, RB, Series A, AMT, 5.00%, 11/21/45(a) |

1,650 | 1,651,546 | ||||||

| California State Public Works Board, RB |

||||||||

| 4.00%, 11/01/41 |

935 | 958,377 | ||||||

| Series I, 5.00%, 11/01/38 |

1,605 | 1,662,912 | ||||||

| California Statewide Financing Authority, RB, Series A, 6.00%, 05/01/43 |

3,285 | 3,290,233 | ||||||

| City of Los Angeles Department of Airports, ARB |

||||||||

| AMT, 5.00%, 05/15/45 |

2,425 | 2,634,707 | ||||||

| Series A, AMT, 4.00%, 05/15/49 |

4,370 | 4,216,718 | ||||||

| City of Los Angeles Department of Airports, Refunding ARB |

||||||||

| Series A, AMT, 5.00%, 05/15/38 |

605 | 664,985 | ||||||

| Series A, AMT, 5.00%, 05/15/39 |

650 | 711,589 | ||||||

| CMFA Special Finance Agency XII, RB, M/F Housing, Series A, 3.25%, 02/01/57(a) |

500 | 375,126 | ||||||

| CSCDA Community Improvement Authority, RB, M/F Housing(a) |

||||||||

| Class 2, 4.00%, 06/01/58 |

1,645 | 1,302,187 | ||||||

| Senior Lien, 3.13%, 06/01/57 |

1,575 | 1,098,094 | ||||||

| Class 2, Senior Lien, 4.00%, 12/01/58 |

715 | 574,314 | ||||||

| San Francisco City & County Airport Comm-San Francisco International Airport, Refunding RB, Series A, AMT, 4.00%, 05/01/52 |

1,295 | 1,214,327 | ||||||

| Security | Par (000) |

Value | ||||||

| California (continued) | ||||||||

| State of California, GO, (AMBAC), 5.00%, 04/01/31 |

$ | 10 | $ | 10,021 | ||||

| State of California, Refunding GO, 3.00%, 12/01/46 |

1,045 | 876,807 | ||||||

| Stockton Public Financing Authority, RB, Series A, 6.25%, 10/01/23(b) |

740 | 781,628 | ||||||

|

|

|

|||||||

| 30,247,331 | ||||||||

| Colorado — 2.0% | ||||||||

| Arapahoe County School District No.6 Littleton, GO, Series A, (SAW), 5.50%, 12/01/43 |

2,635 | 2,985,368 | ||||||

| Colorado Health Facilities Authority, Refunding RB, Series A, 4.00%, 08/01/44 |

3,735 | 3,616,709 | ||||||

| Colorado Housing and Finance Authority, Refunding RB, S/F Housing, Series B, (GNMA), 3.25%, 05/01/52 |

1,220 | 1,204,584 | ||||||

| Denver Connection West Metropolitan District, GO, Series A, 5.38%, 12/01/22(b) |

1,250 | 1,313,335 | ||||||

| State of Colorado, COP, Series O, 4.00%, 03/15/44 |

2,695 | 2,718,123 | ||||||

|

|

|

|||||||

| 11,838,119 | ||||||||

| Connecticut — 0.4% | ||||||||

| Connecticut Housing Finance Authority, Refunding RB, M/F Housing, Series A-1, 3.50%, 11/15/51 |

980 | 983,155 | ||||||

| State of Connecticut Special Tax Revenue, RB |

||||||||

| Series A, 4.00%, 05/01/36 |

690 | 714,538 | ||||||

| Series A, 4.00%, 05/01/39 |

440 | 453,636 | ||||||

|

|

|

|||||||

| 2,151,329 | ||||||||

| Delaware — 0.4% | ||||||||

| Delaware Transportation Authority, RB, 5.00%, 06/01/55 |

2,430 | 2,534,500 | ||||||

|

|

|

|||||||

| District of Columbia — 6.9% | ||||||||

| District of Columbia, Refunding RB |

||||||||

| 5.00%, 04/01/35 |

910 | 971,648 | ||||||

| Catholic Health Services, 5.00%, 10/01/48 |

4,875 | 5,294,279 | ||||||

| District of Columbia, TA, 5.13%, 06/01/41 |

4,440 | 4,448,543 | ||||||

| Metropolitan Washington Airports Authority Aviation Revenue, Refunding ARB |

||||||||

| Series A, AMT, 4.00%, 10/01/37 |

715 | 712,054 | ||||||

| Series A, AMT, 4.00%, 10/01/38 |

715 | 706,434 | ||||||

| Series A, AMT, 4.00%, 10/01/40 |

860 | 851,356 | ||||||

| Series A, AMT, 4.00%, 10/01/41 |

1,855 | 1,832,145 | ||||||

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Refunding RB, Series B, Subordinate, 4.00%, 10/01/49 |

1,615 | 1,597,737 | ||||||

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Refunding RB, CAB(c) |

||||||||

| Series B, 2nd Senior Lien, (AGC), 0.00%, 10/01/31 |

8,350 | 5,866,201 | ||||||

| Series B, 2nd Senior Lien, (AGC), 0.00%, 10/01/32 |

15,000 | 10,054,380 | ||||||

| Series B, 2nd Senior Lien, (AGC), 0.00%, 10/01/33 |

13,410 | 8,579,141 | ||||||

|

|

|

|||||||

| 40,913,918 | ||||||||

| Florida — 4.6% | ||||||||

| Alachua County Health Facilities Authority, RB, Series A, 5.00%, 12/01/44 |

4,825 | 4,966,676 | ||||||

| Broward County FL Water & Sewer Utility Revenue, RB, Series A, 4.00%, 10/01/47 |

445 | 451,645 | ||||||

| Capital Projects Finance Authority, Refunding RB |

||||||||

| Series A-1, 5.00%, 10/01/32 |

405 | 442,225 | ||||||

| Series A-1, 5.00%, 10/01/33 |

455 | 494,042 | ||||||

| Series A-1, 5.00%, 10/01/34 |

455 | 492,605 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

15 |

| Schedule of Investments (continued) April 30, 2022 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Florida (continued) | ||||||||

| Capital Projects Finance Authority, Refunding RB (continued) |

||||||||

| Series A-1, 5.00%, 10/01/35 |

$ | 150 | $ | 161,906 | ||||

| Collier County Health Facilities Authority, Refunding RB, Series A, 5.00%, 05/01/45 |

2,790 | 2,893,852 | ||||||

| County of Lee FL Airport Revenue, ARB, Series B, AMT, 5.00%, 10/01/46 |

2,665 | 2,895,893 | ||||||

| County of Miami-Dade Florida Aviation Revenue, Refunding RB |

||||||||

| Series A, 4.00%, 10/01/37 |

680 | 685,587 | ||||||

| Series A, 4.00%, 10/01/38 |

680 | 683,839 | ||||||

| Series A, 4.00%, 10/01/39 |

505 | 506,977 | ||||||

| Florida Development Finance Corp., RB |

||||||||

| Series A, 5.00%, 06/15/40 |

455 | 473,777 | ||||||

| Series A, 5.00%, 06/15/50 |

1,510 | 1,557,840 | ||||||

| Series A, 5.00%, 06/15/55 |

905 | 930,410 | ||||||

| Florida Housing Finance Corp., RB, S/F Housing, |

||||||||

| Series 1, (FHLMC, FNMA, GNMA), 3.50%, 07/01/52 |

2,665 | 2,673,341 | ||||||

| Santa Rosa Bay Bridge Authority, RB, 6.25%, 07/01/28(d)(e) |

2,962 | 2,708,438 | ||||||

| Volusia County Educational Facility Authority, Refunding RB, 5.00%, 10/15/49 |

3,695 | 4,091,954 | ||||||

|

|

|

|||||||

| 27,111,007 | ||||||||

| Georgia — 2.3% | ||||||||

| Georgia Housing & Finance Authority, RB, S/F Housing, Series B, 2.50%, 06/01/50 |

1,485 | 1,088,088 | ||||||

| Georgia Housing & Finance Authority, Refunding RB, S/F Housing, Series A, 4.00%, 06/01/49 |

1,245 | 1,286,066 | ||||||

| Main Street Natural Gas, Inc., RB |

||||||||

| Series A, 5.00%, 05/15/35 |

1,040 | 1,145,411 | ||||||

| Series A, 5.00%, 05/15/36 |

1,040 | 1,149,016 | ||||||

| Series A, 5.00%, 05/15/37 |

1,145 | 1,267,797 | ||||||

| Series A, 5.00%, 05/15/38 |

630 | 698,731 | ||||||

| Series A, 5.00%, 05/15/49 |

2,100 | 2,346,823 | ||||||

| Municipal Electric Authority of Georgia, RB, 4.00%, 01/01/49 |

3,290 | 3,134,567 | ||||||

| Municipal Electric Authority of Georgia, Refunding RB |

||||||||

| Sub-Series A, 4.00%, 01/01/49 |

1,285 | 1,270,973 | ||||||

| Series A, Subordinate, 4.00%, 01/01/51 |

465 | 465,337 | ||||||

|

|

|

|||||||

| 13,852,809 | ||||||||

| Idaho — 1.7% | ||||||||

| Power County Industrial Development Corp., RB, AMT, 6.45%, 08/01/32 |

10,000 | 10,024,600 | ||||||

|

|

|

|||||||

| Illinois — 10.1% | ||||||||

| Chicago Board of Education, GO |

||||||||

| Series C, 5.25%, 12/01/35 |

3,095 | 3,193,712 | ||||||

| Series D, 5.00%, 12/01/46 |

4,040 | 4,116,257 | ||||||

| Series H, 5.00%, 12/01/36 |

460 | 480,769 | ||||||

| Chicago Board of Education, Refunding GO |

||||||||

| Series C, 5.00%, 12/01/25 |

1,365 | 1,441,972 | ||||||

| Series D, 5.00%, 12/01/25 |

1,735 | 1,832,837 | ||||||

| Series D, 5.00%, 12/01/31 |

1,000 | 1,051,791 | ||||||

| Series F, 5.00%, 12/01/22 |

1,305 | 1,325,363 | ||||||

| Series G, 5.00%, 12/01/34 |

455 | 476,322 | ||||||

| Chicago O’Hare International Airport, Refunding ARB |

||||||||

| Series A, Senior Lien, 4.00%, 01/01/36 |

460 | 464,966 | ||||||

| Series A, Senior Lien, 4.00%, 01/01/38 |

1,500 | 1,513,074 | ||||||

| Security | Par (000) |

Value | ||||||

| Illinois (continued) | ||||||||

| Cook County Community College District No. 508, GO, 5.50%, 12/01/38 |

$ | 1,635 | $ | 1,684,392 | ||||

| Illinois Finance Authority, RB |

||||||||

| Series A, 5.00%, 02/15/47 |

500 | 523,441 | ||||||

| Series A, 5.00%, 02/15/50 |

270 | 282,256 | ||||||

| Illinois State Toll Highway Authority, RB |

||||||||

| Series A, 5.00%, 01/01/45 |

2,705 | 2,976,493 | ||||||

| Series A, 4.00%, 01/01/46 |

1,200 | 1,194,025 | ||||||

| Series A, 5.00%, 01/01/46 |

3,135 | 3,472,395 | ||||||

| Series C, 5.00%, 01/01/37 |

5,815 | 6,061,515 | ||||||

| Metropolitan Pier & Exposition Authority, RB, Series A, 5.00%, 06/15/57 |

1,835 | 1,875,768 | ||||||

| Metropolitan Pier & Exposition Authority, Refunding RB, 4.00%, 06/15/50 |

570 | 529,913 | ||||||

| Metropolitan Pier & Exposition Authority, Refunding RB, CAB(c) |

||||||||

| Series B, (AGM), 0.00%, 06/15/43 |

10,925 | 4,103,255 | ||||||

| Series B, (AGM), 0.00%, 06/15/47 |

27,225 | 8,285,248 | ||||||

| State of Illinois, GO |

||||||||

| 5.50%, 07/01/38 |

4,000 | 4,130,472 | ||||||

| 5.00%, 02/01/39 |

3,195 | 3,248,328 | ||||||

| Series A, 5.00%, 04/01/38 |

2,510 | 2,566,716 | ||||||

| State of Illinois, Refunding GO, Series B, 5.00%, 10/01/28 |

1,000 | 1,083,144 | ||||||

| University of Illinois, RB, Series A, 5.00%, 04/01/44 |

2,045 | 2,096,379 | ||||||

|

|

|

|||||||

| 60,010,803 | ||||||||

| Indiana — 2.4% | ||||||||

| City of Valparaiso Indiana, RB |

||||||||

| AMT, 6.75%, 01/01/34 |

1,635 | 1,746,901 | ||||||

| AMT, 7.00%, 01/01/44 |

3,950 | 4,212,861 | ||||||

| Indiana Finance Authority, RB(b) |

||||||||

| Series A, AMT, 5.00%, 07/01/23 |

3,925 | 4,034,288 | ||||||

| Series A, AMT, 5.25%, 07/01/23 |

840 | 863,389 | ||||||

| Indiana Housing & Community Development Authority, RB, S/F Housing, Series A, (FHLMC, FNMA, GNMA), 3.00%, 07/01/52 |

595 | 589,608 | ||||||

| Indianapolis Local Public Improvement Bond Bank, RB, Series A, 5.00%, 01/15/40 |

2,580 | 2,623,669 | ||||||

|

|

|

|||||||

| 14,070,716 | ||||||||

| Iowa — 1.2% | ||||||||

| Iowa Finance Authority, Refunding RB |

||||||||

| 5.25%, 12/01/25 |

940 | 971,901 | ||||||

| Series B, 5.25%, 12/01/50(f) |

5,720 | 5,991,660 | ||||||

|

|

|

|||||||

| 6,963,561 | ||||||||

| Kentucky — 1.3% | ||||||||

| Kentucky Economic Development Finance Authority, RB, Series A, Catholic Health Services, 5.25%, 01/01/23(b) |

2,055 | 2,102,526 | ||||||

| Kentucky Economic Development Finance Authority, Refunding RB, Series A, (AGM), 5.00%, 12/01/45 |

2,625 | 2,967,245 | ||||||

| Kentucky Public Transportation Infrastructure Authority, RB, CAB, Series C, Convertible, 6.75%, 07/01/43 |

2,485 | 2,714,795 | ||||||

|

|

|

|||||||

| 7,784,566 | ||||||||

| Louisiana — 2.0% | ||||||||

| Louisiana Public Facilities Authority, Refunding RB, 5.00%, 04/01/45 |

5,500 | 6,012,039 | ||||||

| 16 | 2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) April 30, 2022 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Louisiana (continued) | ||||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.25%, 05/15/31 |

$ | 635 | $ | 635,780 | ||||

| Series A, 5.25%, 05/15/32 |

2,240 | 2,242,560 | ||||||

| Series A, 5.25%, 05/15/33 |

2,100 | 2,102,381 | ||||||

| Series A, 5.25%, 05/15/35 |

1,025 | 1,048,390 | ||||||

|

|

|

|||||||

| 12,041,150 | ||||||||

| Maryland — 0.8% | ||||||||

| County of Prince George’s Maryland, ARB, 5.20%, 07/01/34 |

1,162 | 1,162,959 | ||||||

| Maryland Health & Higher Educational Facilities Authority, RB, Series 2017, 5.00%, 12/01/46 |

880 | 929,722 | ||||||

| Maryland State Transportation Authority, Refunding RB, Series A, 2.50%, 07/01/47 |

3,650 | 2,548,590 | ||||||

|

|

|

|||||||

| 4,641,271 | ||||||||

| Massachusetts — 1.8% | ||||||||

| Massachusetts Bay Transportation Authority, Refunding RB, Series A-1, 5.25%, 07/01/29 |

3,250 | 3,784,137 | ||||||

| Massachusetts Housing Finance Agency, RB, M/F Housing |

||||||||

| Series C-1, 3.15%, 12/01/49 |

1,165 | 967,372 | ||||||

| Series C-1, 3.25%, 12/01/54 |

4,280 | 3,523,724 | ||||||

| Massachusetts Port Authority, ARB, Series E, AMT, 5.00%, 07/01/51 |

2,325 | 2,497,343 | ||||||

|

|

|

|||||||

| 10,772,576 | ||||||||

| Michigan — 1.3% | ||||||||

| Michigan Finance Authority, Refunding RB, Series A, 4.00%, 12/01/49 |

1,710 | 1,665,661 | ||||||

| Michigan State Housing Development Authority, RB, M/F Housing, Series A, 2.70%, 10/01/56 |

1,995 | 1,469,559 | ||||||

| Michigan State University, Refunding RB, Series B, 5.00%, 02/15/48 |

2,105 | 2,311,760 | ||||||

| Michigan Strategic Fund, RB, AMT, 5.00%, 06/30/48 |

2,255 | 2,305,203 | ||||||

|

|

|

|||||||

| 7,752,183 | ||||||||

| Minnesota — 2.1% | ||||||||

| Duluth Economic Development Authority, Refunding RB |

||||||||

| Series A, 4.25%, 02/15/48 |

2,160 | 2,198,988 | ||||||

| Series A, 5.25%, 02/15/53 |

4,315 | 4,655,738 | ||||||

| Minnesota Housing Finance Agency, RB (FHLMC, FNMA, GNMA), 3.50%, 07/01/52 |

3,735 | 3,760,861 | ||||||

| Series A, (FHLMC, FNMA, GNMA), 2.75%, 07/01/42 |

715 | 589,364 | ||||||

| Series A, (FHLMC, FNMA, GNMA), 3.00%, 07/01/52 |

1,335 | 1,317,213 | ||||||

|

|

|

|||||||

| 12,522,164 | ||||||||

| Missouri — 3.1% | ||||||||

| Health & Educational Facilities Authority of the State of Missouri, RB, 4.00%, 06/01/53 |

6,030 | 5,869,065 | ||||||

| Health & Educational Facilities Authority of the State of Missouri, Refunding RB |

||||||||

| 5.50%, 05/01/43 |

510 | 524,052 | ||||||

| Series A, 4.00%, 07/01/46 |

1,250 | 1,209,945 | ||||||

| Series C, 5.00%, 11/15/47 |

5,470 | 5,800,361 | ||||||

| Missouri Housing Development Commission, RB, S/F Housing, (FHLMC, FNMA, GNMA), 3.50%, 05/01/52 |

4,835 | 4,870,015 | ||||||

|

|

|

|||||||

| 18,273,438 | ||||||||

| Security | Par (000) |

Value | ||||||

| Nebraska — 0.7% | ||||||||

| Central Plains Energy Project, RB |

||||||||

| 5.25%, 09/01/37 |

$ | 1,670 | $ | 1,687,086 | ||||

| 5.00%, 09/01/42 |

925 | 934,221 | ||||||

| Nebraska Investment Finance Authority, RB, (FHLMC, FNMA, GNMA), 3.00%, 03/01/52 |

1,335 | 1,310,304 | ||||||

|

|

|

|||||||

| 3,931,611 | ||||||||

| New Hampshire(a) — 0.8% | ||||||||

| New Hampshire Business Finance Authority, Refunding RB |

||||||||

| Series B, 4.63%, 11/01/42 |

3,205 | 3,255,806 | ||||||

| Series C, AMT, 4.88%, 11/01/42 |

1,665 | 1,696,077 | ||||||

|

|

|

|||||||

| 4,951,883 | ||||||||

| New Jersey — 15.5% | ||||||||

| Casino Reinvestment Development Authority, Inc., Refunding RB |

||||||||

| 5.25%, 11/01/39 |

3,490 | 3,604,388 | ||||||

| 5.25%, 11/01/44 |

3,180 | 3,277,454 | ||||||

| Hudson County Improvement Authority, RB, 4.00%, 10/01/46 |

3,470 | 3,458,858 | ||||||

| New Jersey Economic Development Authority, RB |

||||||||

| 4.00%, 11/01/38 |

1,075 | 1,044,982 | ||||||

| 4.00%, 11/01/39 |

860 | 832,091 | ||||||

| 5.00%, 06/15/49 |

4,850 | 5,134,288 | ||||||

| Series EEE, 5.00%, 06/15/48 |

7,780 | 8,189,415 | ||||||

| Series B, AMT, 6.50%, 04/01/31 |

2,005 | 2,132,919 | ||||||

| New Jersey Economic Development Authority, Refunding ARB, AMT, 5.00%, 10/01/47 |

3,040 | 3,258,077 | ||||||

| New Jersey Health Care Facilities Financing Authority, RB, 4.00%, 07/01/51 |

6,540 | 6,441,540 | ||||||

| New Jersey Higher Education Student Assistance Authority, Refunding RB |

||||||||

| Series B, AMT, 4.00%, 12/01/41 |

2,570 | 2,509,322 | ||||||

| Series C, AMT, Subordinate, 5.00%, 12/01/52 |

2,595 | 2,680,804 | ||||||

| New Jersey Transportation Trust Fund Authority, RB |

||||||||

| Series AA, 5.00%, 06/15/44 |

3,875 | 3,928,281 | ||||||

| Series BB, 5.00%, 06/15/50 |

10,800 | 11,360,693 | ||||||

| New Jersey Transportation Trust Fund Authority, RB, CAB, Series C, (AMBAC), 0.00%, 12/15/35(c) |

7,395 | 4,065,372 | ||||||

| New Jersey Turnpike Authority, RB |

||||||||

| Series A, 4.00%, 01/01/42 |

1,530 | 1,551,151 | ||||||

| Series E, 5.00%, 01/01/45 |

5,425 | 5,608,935 | ||||||

| State of New Jersey, GO, Series A, 4.00%, 06/01/31 |

1,180 | 1,234,081 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.25%, 06/01/46 |

5,120 | 5,424,783 | ||||||

| Sub-Series B, 5.00%, 06/01/46 |

14,860 | 15,774,068 | ||||||

|

|

|

|||||||

| 91,511,502 | ||||||||

| New Mexico — 0.5% | ||||||||

| New Mexico Mortgage Finance Authority, RB, S/F Housing |

||||||||

| Class A, (FHLMC, FNMA, GNMA), 3.00%, 03/01/53 |

1,000 | 992,534 | ||||||

| Series C, (FHLMC, FNMA, GNMA), 4.25%, 03/01/53 |

1,600 | 1,682,360 | ||||||

|

|

|

|||||||

| 2,674,894 | ||||||||

| New York — 12.6% | ||||||||

| City of New York, GO, Series C, 5.00%, 08/01/42 |

2,330 | 2,570,463 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

17 |

| Schedule of Investments (continued) April 30, 2022 |

BlackRock MuniYield Fund, Inc. (MYD) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| New York (continued) | ||||||||

| Erie Tobacco Asset Securitization Corp., Refunding RB, Series A, 5.00%, 06/01/45 |

$ | 4,070 | $ | 4,086,020 | ||||

| Metropolitan Transportation Authority, RB |

||||||||

| Series B, 5.25%, 11/15/38 |

4,960 | 5,095,215 | ||||||

| Series B, 5.25%, 11/15/39 |

1,765 | 1,812,353 | ||||||

| Metropolitan Transportation Authority, Refunding RB |

||||||||

| Series C-1, 4.75%, 11/15/45 |

3,335 | 3,499,055 | ||||||

| Series C-1, 5.00%, 11/15/50 |

1,085 | 1,128,706 | ||||||

| Series C-1, 5.25%, 11/15/55 |

1,605 | 1,736,928 | ||||||

| Monroe County Industrial Development Corp., Refunding RB |

||||||||

| 4.00%, 12/01/46 |

1,090 | 1,029,109 | ||||||

| Series A, 4.00%, 07/01/50 |

2,240 | 2,210,947 | ||||||

| New York City Housing Development Corp., RB, M/F Housing |

||||||||

| Series A, 3.00%, 11/01/55 |

2,220 | 1,707,837 | ||||||

| Series F-1, (FHA), 2.40%, 11/01/46 |

5,310 | 3,887,233 | ||||||

| Series F-1, (FHA), 2.50%, 11/01/51 |

3,660 | 2,590,581 | ||||||

| New York City Industrial Development Agency, Refunding RB |

||||||||

| Series A, Class A, (AGM), 3.00%, 01/01/37 |

455 | 405,204 | ||||||

| Series A, Class A, (AGM), 3.00%, 01/01/39 |

455 | 400,489 | ||||||

| Series A, Class A, (AGM), 3.00%, 01/01/40 |

320 | 280,127 | ||||||

| New York City Transitional Finance Authority Future Tax Secured Revenue, RB |

||||||||

| Sub-Series E-1, 5.00%, 02/01/42 |

1,135 | 1,136,765 | ||||||

| Series C, Subordinate, 4.00%, 05/01/45 |

2,275 | 2,258,797 | ||||||

| Series F-1, Subordinate, 4.00%, 02/01/51 |

840 | 825,534 | ||||||

| Sub-Series C-1, Subordinate, 4.00%, 05/01/40 |

905 | 915,020 | ||||||

| New York Counties Tobacco Trust IV, Refunding RB, Series A, 6.25%, 06/01/41(a) |

3,500 | 3,547,646 | ||||||

| New York Liberty Development Corp., Refunding RB |

||||||||

| Series 1, Class 1, 5.00%, 11/15/44(a) |

8,145 | 8,224,283 | ||||||

| Series 2, Class 2, 5.15%, 11/15/34(a) |

705 | 724,933 | ||||||

| Series 2, Class 2, 5.38%, 11/15/40(a) |

1,760 | 1,816,227 | ||||||

| Series A, 2.88%, 11/15/46 |

7,060 | 5,446,430 | ||||||

| New York State Environmental Facilities Corp., RB, Series B, Subordinate, 5.00%, 06/15/48 |

3,750 | 4,077,259 | ||||||

| New York State Urban Development Corp., RB, Series A, 3.00%, 03/15/50 |

2,695 | 2,224,833 | ||||||

| New York Transportation Development Corp., ARB, Series A, AMT, 5.25%, 01/01/50 |

1,525 | 1,579,900 | ||||||

| New York Transportation Development Corp., RB |

||||||||

| AMT, 5.00%, 10/01/35 |

750 | 796,473 | ||||||

| AMT, 5.00%, 10/01/40 |

2,120 | 2,216,538 | ||||||

| Triborough Bridge & Tunnel Authority, RB |

||||||||

| Series A, 5.00%, 11/15/49 |

1,790 | 1,949,144 | ||||||

| Series A, 4.00%, 11/15/54 |

2,065 | 2,037,366 | ||||||

| Series A, 5.00%, 11/15/56 |

1,850 | 2,016,855 | ||||||

| Westchester County Healthcare Corp., RB, Series A, Senior Lien, 5.00%, 11/01/44 |

421 | 433,640 | ||||||

|

|

|

|||||||

| 74,667,910 | ||||||||

| North Carolina — 1.5% | ||||||||

| County of Union North Carolina Enterprise System Revenue, RB, 3.00%, 06/01/51 |

4,300 | 3,528,223 | ||||||

| North Carolina Housing Finance Agency, RB, S/F Housing, (FHLMC, FNMA, GNMA), 3.75%, 07/01/52 |

1,315 | 1,336,164 | ||||||

| North Carolina Medical Care Commission, RB |

||||||||

| Series A, 4.00%, 10/01/40 |

240 | 225,564 | ||||||

| Series A, 5.00%, 10/01/40 |

360 | 380,527 | ||||||

| Security | Par (000) |

Value | ||||||

| North Carolina (continued) | ||||||||

| North Carolina Medical Care Commission, RB (continued) |

||||||||

| Series A, 4.00%, 10/01/45 |

$ | 220 | $ | 200,607 | ||||

| Series A, 5.00%, 10/01/45 |

640 | 671,656 | ||||||

| Series A, 4.00%, 10/01/50 |

270 | 242,319 | ||||||

| Series A, 5.00%, 10/01/50 |

720 | 754,162 | ||||||

| University of North Carolina at Chapel Hill, RB, 5.00%, 02/01/49 |

1,130 | 1,299,076 | ||||||

|

|

|

|||||||

| 8,638,298 | ||||||||

| North Dakota — 0.5% | ||||||||

| County of Cass North Dakota, Refunding RB, Series B, 5.25%, 02/15/58 |

2,000 | 2,138,776 | ||||||

| North Dakota Housing Finance Agency, RB, M/F Housing, Series A, 4.00%, 01/01/53 |

985 | 1,004,624 | ||||||

|

|

|

|||||||

| 3,143,400 | ||||||||

| Ohio — 5.5% | ||||||||

| Buckeye Tobacco Settlement Financing Authority, Refunding RB |

||||||||

| Series A-2, Class 1, 4.00%, 06/01/37 |

610 | 596,178 | ||||||

| Series A-2, Class 1, 4.00%, 06/01/38 |

610 | 595,643 | ||||||

| Series A-2, Class 1, 4.00%, 06/01/39 |

610 | 595,147 | ||||||

| Series A-2, Class 1, 4.00%, 06/01/48 |

1,605 | 1,500,875 | ||||||

| Series B-2, Class 2, 5.00%, 06/01/55 |

7,005 | 6,810,884 | ||||||

| County of Allen Ohio Hospital Facilities Revenue, Refunding RB, Series A, 4.00%, 11/01/44 |

4,160 | 4,165,009 | ||||||

| County of Franklin Ohio, RB |

||||||||

| Series 2017, 5.00%, 12/01/46 |

840 | 887,394 | ||||||

| Series A, 6.13%, 07/01/22(b) |

1,380 | 1,389,890 | ||||||

| Series A, 4.00%, 12/01/49 |

1,060 | 1,046,026 | ||||||

| County of Hamilton Ohio, Refunding RB |

||||||||

| 4.00%, 08/15/50 |

1,245 | 1,151,779 | ||||||

| Series A, 3.75%, 08/15/50 |

2,190 | 1,902,825 | ||||||

| County of Montgomery Ohio, Refunding RB, 4.00%, 08/01/46 |

1,915 | 1,885,176 | ||||||

| Ohio Air Quality Development Authority, RB, AMT, 5.00%, 07/01/49(a) |

645 | 630,811 | ||||||

| Ohio Housing Finance Agency, Refunding RB, (FHLMC, FNMA, GNMA), 3.25%, 09/01/52 |