March 2024 Investor Presentation

Disclaimer FORWARD-LOOKING STATEMENTS This presentation includes forward-looking statements within the meaning of the "Safe-Harbor" provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the Securities and Exchange Commission (the "SEC"). You should not place undue reliance on forward-looking statements, and we undertake no obligation to update any such statements. Forward-looking statements can be identified by words such as "anticipates," "intends," "plans," "seeks," "believes," "estimates," "expects," "target," "projects," "outlook," "forecast," "will," "may," "could," "should," "can" and similar references to future periods. In this press release we make forward-looking statements about strategic and growth initiatives and the result of such activity. Risks that could cause results to differ from forward-looking statements we make include, without limitation: current and future economic and market conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, continued inflation and any recession or slowdown in economic growth particularly in the western United States; economic forecast variables that are either materially worse or better than end of quarter projections and deterioration in the economy that could result in increased loan and lease losses, especially those risks associated with concentrations in real estate related loans; our ability to effectively manage problem credits; the impact of bank failures or adverse developments at or news developments concerning other banks on general investor sentiment regarding the liquidity and stability of banks; changes in interest rates that could significantly reduce net interest income and negatively affect asset yields and valuations and funding sources; changes in the scope and cost of FDIC insurance and other coverage; our ability to successfully implement efficiency and operational excellence initiatives; our ability to successfully develop and market new products and technology; changes in laws or regulations; any failure to realize the anticipated benefits of the merger when expected or at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the merger and integration of the companies; the effect of geopolitical instability, including wars, conflicts and terrorist attacks; and natural disasters and other similar unexpected events outside of our control. We also caution that the amount and timing of any future common stock dividends or repurchases will depend on the earnings, cash requirements and financial condition of Columbia, market conditions, capital requirements, applicable law and regulations (including federal securities laws and federal banking regulations), and other factors deemed relevant by Columbia's Board of Directors, and may be subject to regulatory approval or conditions. NON-GAAP FINANCIAL MEASURES In addition to results in accordance with GAAP, this presentation contains certain non-GAAP financial measures. A reconciliation of GAAP to non-GAAP measures is included in the Appendix. We believe presenting certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, our performance trends, and our financial position. We utilize these measures for internal planning and forecasting purposes. We, as well as securities analysts, investors, and other interested parties, also use these measures to compare peer company operating performance. We believe that our presentation and discussion, together with the accompanying reconciliations, provide a complete understanding of factors and trends affecting our business and allows investors to view performance in a manner similar to management. These non-GAAP measures should not be considered a substitution for GAAP basis measures and results, and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. REVERSE ACQUISITION METHOD OF ACCOUNTING On February 28, 2023, Columbia Banking System, Inc. ("Columbia", "we" or "our") completed its merger with Umpqua Holdings Corporation ("UHC"), combining the two premier banks in the Northwest to create one of the largest banks headquartered in the West (the "merger"). Columbia's financial results for any periods ended prior to February 28, 2023 reflect UHC results only on a standalone basis as the merger was treated as a reverse merger with UHC as the accounting acquirer. In addition, Columbia's reported financial results for the first quarter of 2023 reflect UHC financial results only until the closing of the merger after the close of business on February 28, 2023. As a result of these two factors, Columbia's financial results for each of the quarters of 2023 and the year ended December 31, 2023 may not be directly comparable to prior reported periods. The number of shares issued and outstanding, earnings per share, additional paid-in capital, and all references to share quantities or metrics of Columbia have been retrospectively restated to reflect the equivalent number of shares issued in the merger as the merger was treated as a reverse merger with UHC as the accounting acquirer. Under the reverse acquisition method of accounting, the assets and liabilities of Columbia as of February 28, 2023 ("historical Columbia") were recorded at their respective fair values. 2

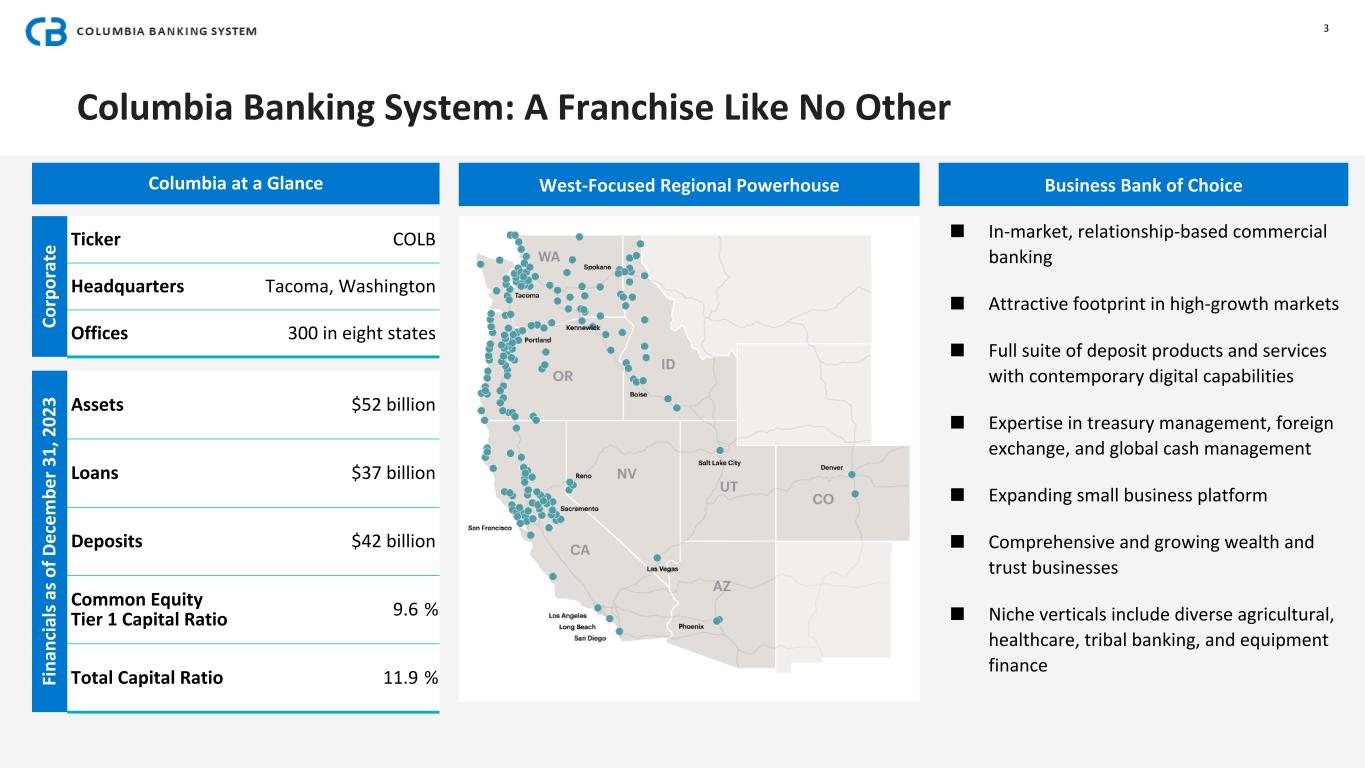

Columbia Banking System: A Franchise Like No Other 3 West-Focused Regional Powerhouse Business Bank of Choice ■ In-market, relationship-based commercial banking ■ Attractive footprint in high-growth markets ■ Full suite of deposit products and services with contemporary digital capabilities ■ Expertise in treasury management, foreign exchange, and global cash management ■ Expanding small business platform ■ Comprehensive and growing wealth and trust businesses ■ Niche verticals include diverse agricultural, healthcare, tribal banking, and equipment finance Columbia at a Glance Co rp or at e Ticker COLB Headquarters Tacoma, Washington Offices 300 in eight states Fi na nc ia ls a s of D ec em be r 31 , 2 02 3 Assets $52 billion Loans $37 billion Deposits $42 billion Common Equity Tier 1 Capital Ratio 9.6 % Total Capital Ratio 11.9 %

Why Columbia? 4 ■ Community banking at scale business model drives granular, low-cost core deposit base ■ Opportunity to gain share in California and growing metros in the West while increasing density in the Northwest ■ Solid capital generation supports long-term organic growth and return to shareholders ■ Strong credit quality supported by diversified, well-structured, and conservatively underwritten loan portfolio ■ Compelling culture with deep community ties that is reflected in our proven ability to attract and retain top banking talent ■ Scaled western franchise that is difficult to replicate provides scarcity value

Operating in Large, Attractive Western Markets 5 Foothold in the West(1) Northwest (population in millions) Seattle, WA Portland, OR California and Nevada Los Angeles, CA Sacramento, CA Other West Phoenix, AZ Denver, CO 4.1mm 2.5mm 12.9mm 2.4mm 5.1mm 3.0mm Top Regional Bank in the NW (WA, OR, ID)(1) Total Northwest Rank Bank (HQ State) Assets ($B) Deposits ($B) Mkt Shr 1 Bank of America (NC) $3,180 $62 17.3 % 2 U.S. Bancorp (MN) 663 51 14.4 % 3 JPMorgan (NY) 3,875 47 13.3 % 4 Wells Fargo (CA) 1,932 42 11.7 % 5 COLB (WA) 52 33 9.3 % 6 KeyCorp (OH) 188 18 5.0 % 7 WaFd (WA) 23 12 3.3 % 8 Banner Corp. (WA) 16 11 3.0 % 5th Largest Bank in our Footprint(1) Total Eight-State Footprint Rank Bank (HQ State) Assets ($B) Deposits ($B) Mkt Shr 1 Wells Fargo (CA) $1,932 $459 16.7 % 2 Zions (UT) 87 61 2.2 % 3 Western Alliance (AZ) 71 51 1.9 % 4 East West (CA) 70 49 1.8 % 5 COLB (WA) 52 41 1.5 % 6 Banc of California (CA) 39 29 1.1 % 7 FirstBank (CO) 28 24 0.9 % 8 Cathay General (CA) 23 15 0.6 % Established Presence in Attractive Markets(1) ■ Our market share in the Northwest stands with large national and super regional banks, at over 9% ■ Our foothold in top western markets and scaled franchise provide us the opportunity to increase share in California, Arizona, Colorado, and Utah ■ Projected population growth of 3.2% over the next five years in our collective footprint exceeds the national average of 2.4% ■ Current household income in our footprint is 109% of the national average, and the five-year growth rate of 10.4% compares favorably to 10.1% nationally Boise, ID Salt Lake City, UT Las Vegas, NV 0.8mm 2.4mm 1.3mm (1) Population, household income, asset, deposit, and market share data sourced from S&P Global Market Intelligence. Assets as of December 31, 2023; deposits and market share as of June 30, 2023 and adjusted by S&P to include acquisitions announced or closed subsequent to that date.

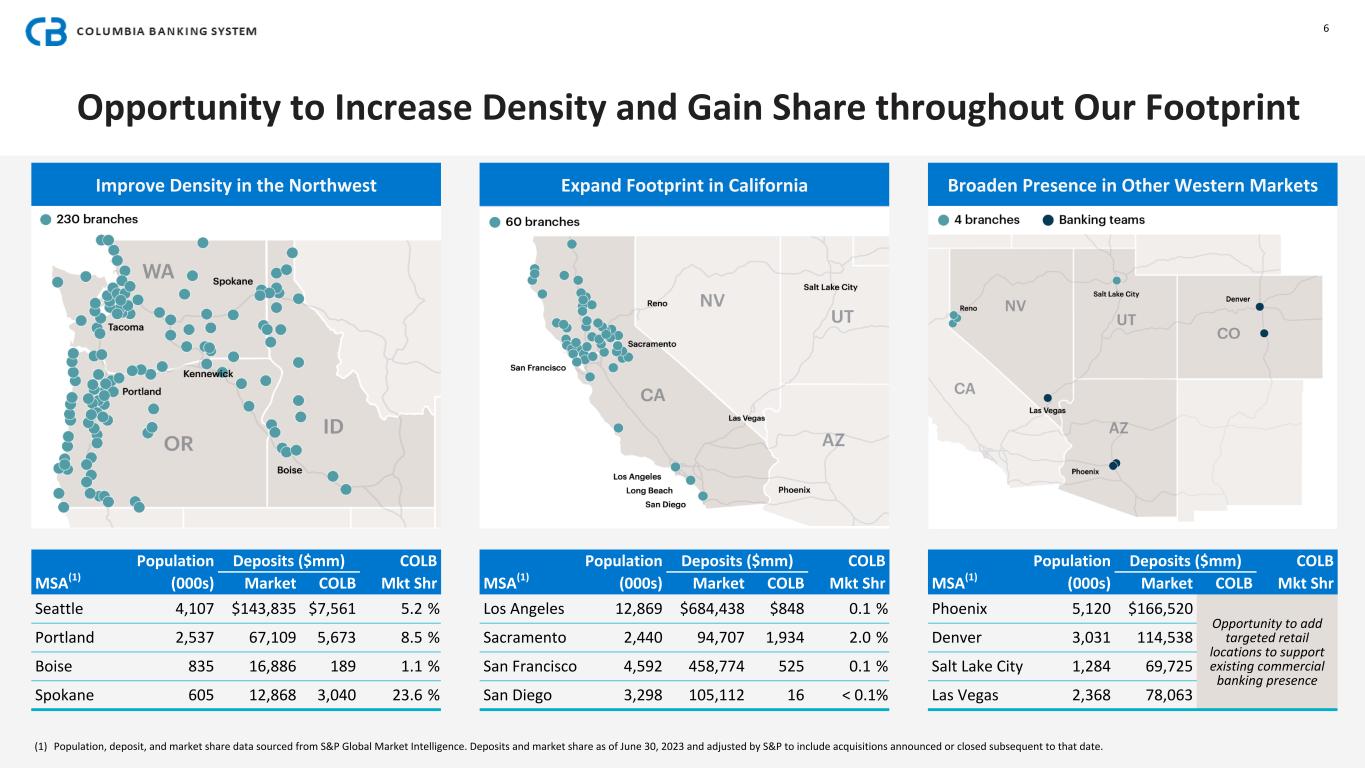

Opportunity to Increase Density and Gain Share throughout Our Footprint 6 Expand Footprint in California Broaden Presence in Other Western MarketsImprove Density in the Northwest Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Seattle 4,107 $143,835 $7,561 5.2 % Portland 2,537 67,109 5,673 8.5 % Boise 835 16,886 189 1.1 % Spokane 605 12,868 3,040 23.6 % Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Phoenix 5,120 $166,520 Opportunity to add targeted retail locations to support existing commercial banking presence Denver 3,031 114,538 Salt Lake City 1,284 69,725 Las Vegas 2,368 78,063 Population Deposits ($mm) COLB MSA(1) (000s) Market COLB Mkt Shr Los Angeles 12,869 $684,438 $848 0.1 % Sacramento 2,440 94,707 1,934 2.0 % San Francisco 4,592 458,774 525 0.1 % San Diego 3,298 105,112 16 < 0.1% (1) Population, deposit, and market share data sourced from S&P Global Market Intelligence. Deposits and market share as of June 30, 2023 and adjusted by S&P to include acquisitions announced or closed subsequent to that date.

Performance Improvement: Near-Term Initiatives 7 1H 2024 Actions to Improve Operational Efficiency ■ Ongoing operational review to improve efficiency throughout the organization is expected to result in a Q4 2024 core expense run rate of $965 million to $985 million annualized(1) ■ Closed five branches in January to fund the opening of new retail locations in existing commercial banking de novo markets ■ Actively managing and selectively reducing deposit offering rates ■ Continued evaluation of wholesale funding options to optimize rate while managing duration risk ■ Additional product bundling and marketing designed to drive higher levels of new customer acquisition ■ Modified underwriting and pricing for FinPac as well as rationalizing its cost structure in light of the current operating environment (1) Excludes CDI amortization and non-operating expense, as detailed in the “Outlook” slide and in “Appendix Non-GAAP Reconciliation” slides later in this presentation.

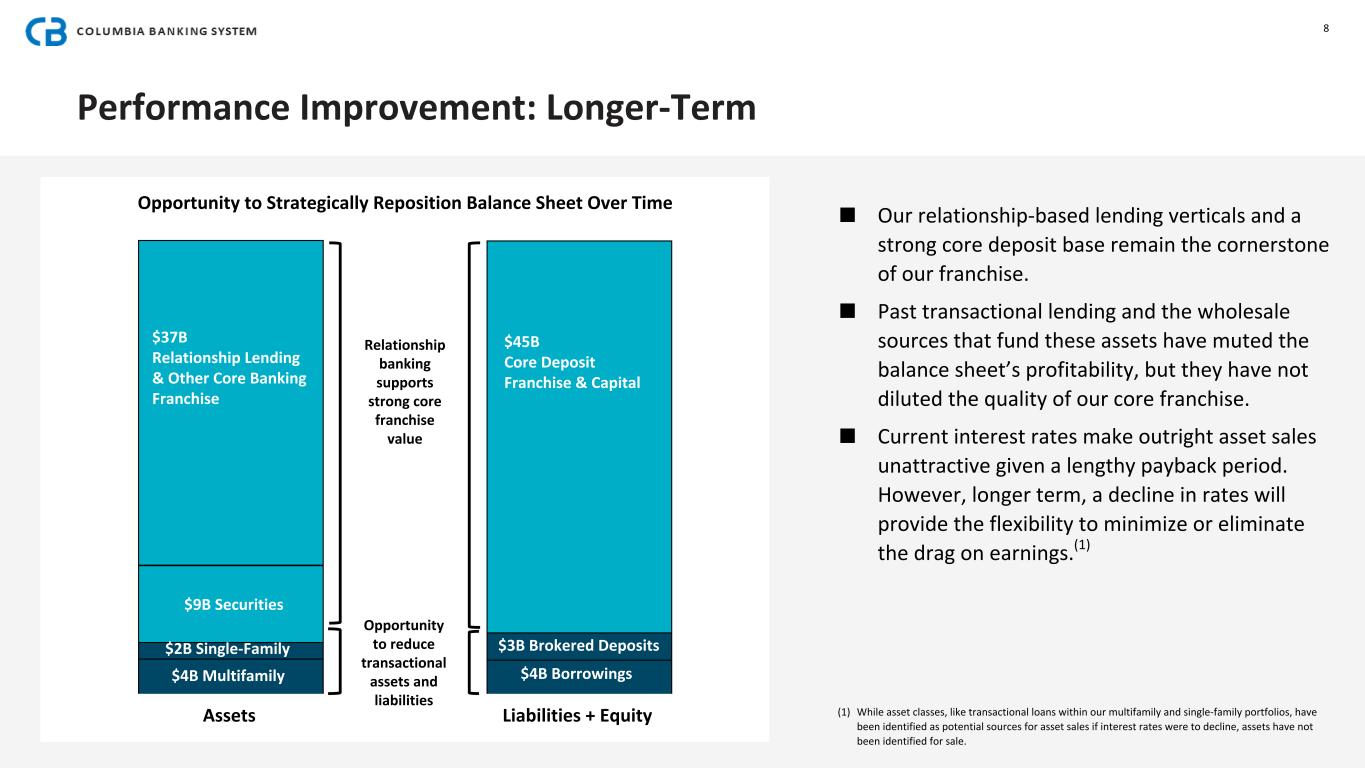

Performance Improvement: Longer-Term 8 ■ Our relationship-based lending verticals and a strong core deposit base remain the cornerstone of our franchise. ■ Past transactional lending and the wholesale sources that fund these assets have muted the balance sheet’s profitability, but they have not diluted the quality of our core franchise. ■ Current interest rates make outright asset sales unattractive given a lengthy payback period. However, longer term, a decline in rates will provide the flexibility to minimize or eliminate the drag on earnings.(1) Opportunity to Strategically Reposition Balance Sheet Over Time Assets Liabilities + Equity $4B Borrowings $3B Brokered Deposits $4B Multifamily $2B Single-Family $9B Securities $37B Relationship Lending & Other Core Banking Franchise $45B Core Deposit Franchise & Capital Opportunity to reduce transactional assets and liabilities Relationship banking supports strong core franchise value (1) While asset classes, like transactional loans within our multifamily and single-family portfolios, have been identified as potential sources for asset sales if interest rates were to decline, assets have not been identified for sale.

FINANCIAL HIGHLIGHTS

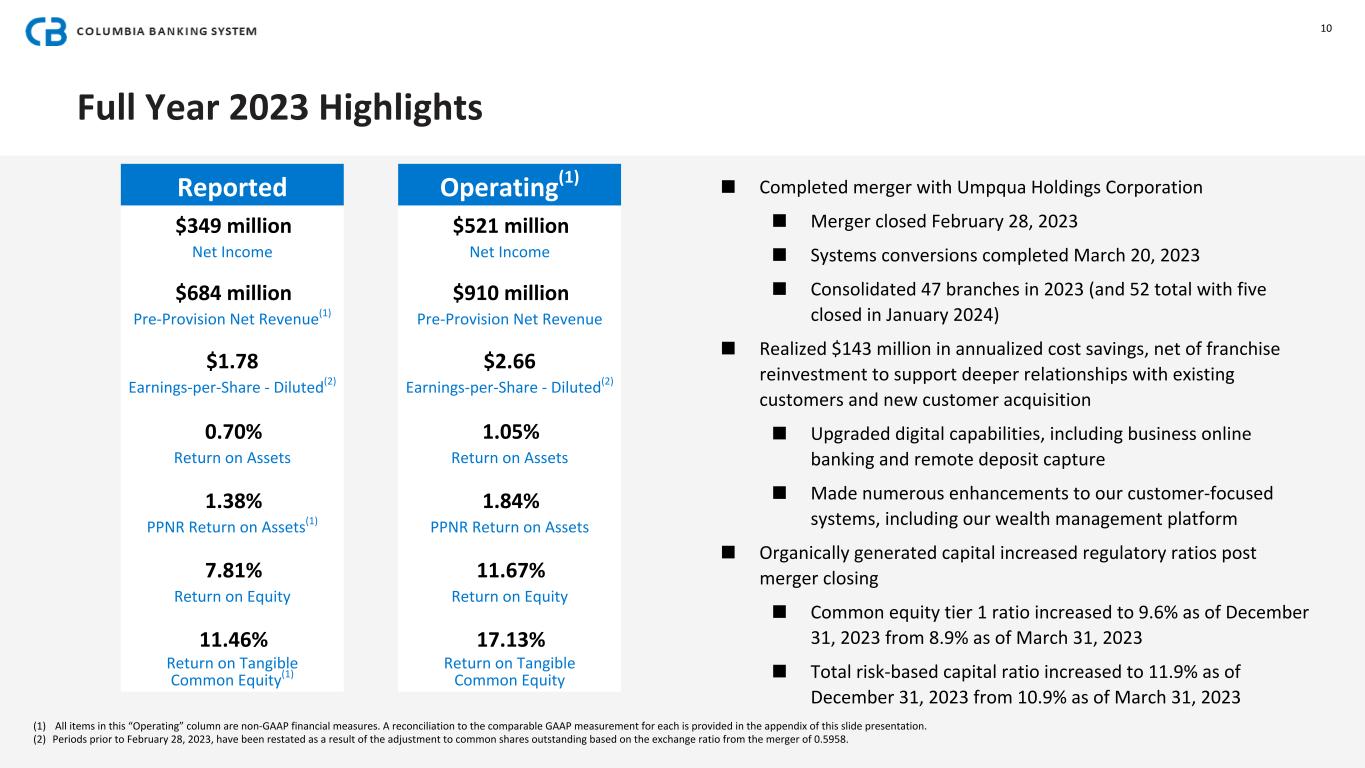

Full Year 2023 Highlights (1) All items in this “Operating” column are non-GAAP financial measures. A reconciliation to the comparable GAAP measurement for each is provided in the appendix of this slide presentation. (2) Periods prior to February 28, 2023, have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. 10 ■ Completed merger with Umpqua Holdings Corporation ■ Merger closed February 28, 2023 ■ Systems conversions completed March 20, 2023 ■ Consolidated 47 branches in 2023 (and 52 total with five closed in January 2024) ■ Realized $143 million in annualized cost savings, net of franchise reinvestment to support deeper relationships with existing customers and new customer acquisition ■ Upgraded digital capabilities, including business online banking and remote deposit capture ■ Made numerous enhancements to our customer-focused systems, including our wealth management platform ■ Organically generated capital increased regulatory ratios post merger closing ■ Common equity tier 1 ratio increased to 9.6% as of December 31, 2023 from 8.9% as of March 31, 2023 ■ Total risk-based capital ratio increased to 11.9% as of December 31, 2023 from 10.9% as of March 31, 2023 Reported Operating(1) $349 million $521 million Net Income Net Income $684 million $910 million Pre-Provision Net Revenue(1) Pre-Provision Net Revenue $1.78 $2.66 Earnings-per-Share - Diluted(2) Earnings-per-Share - Diluted(2) 0.70% 1.05% Return on Assets Return on Assets 1.38% 1.84% PPNR Return on Assets(1) PPNR Return on Assets 7.81% 11.67% Return on Equity Return on Equity 11.46% 17.13% Return on Tangible Common Equity(1) Return on Tangible Common Equity

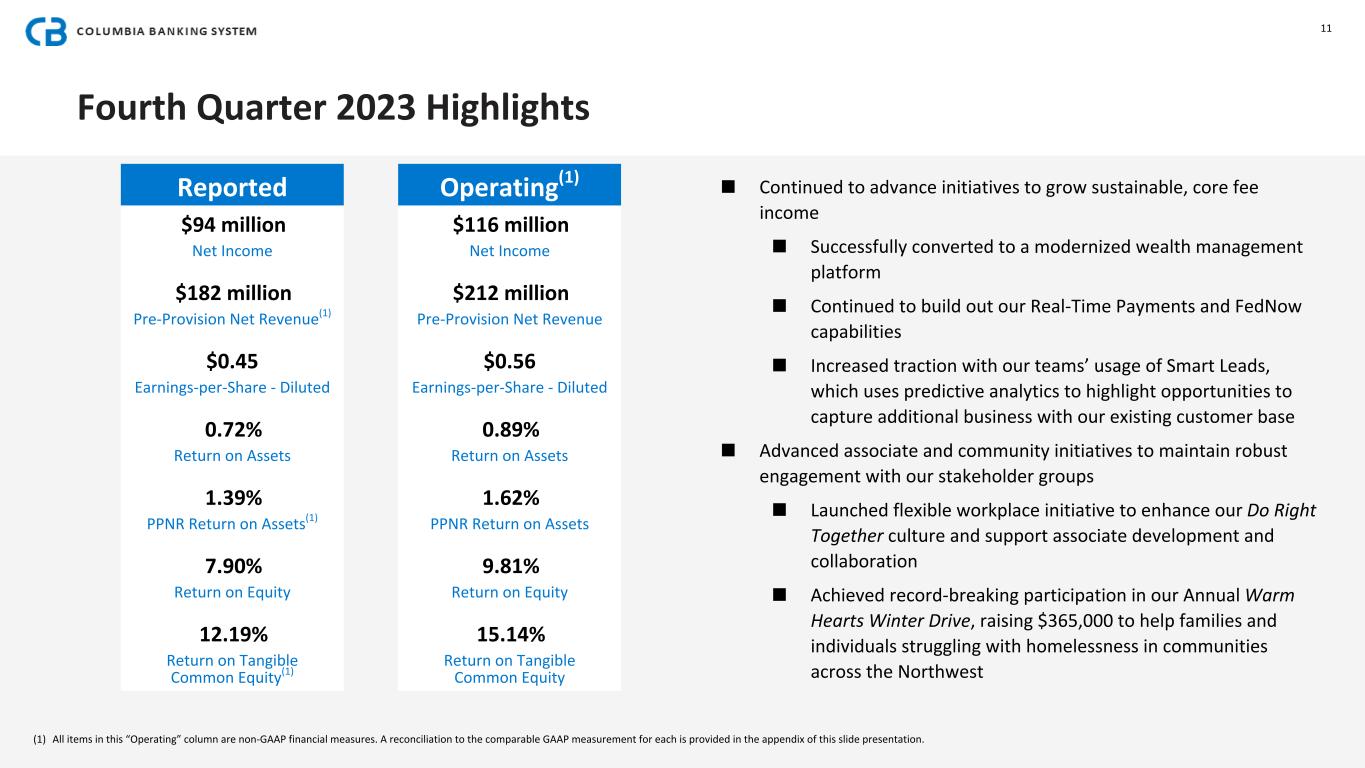

Fourth Quarter 2023 Highlights (1) All items in this “Operating” column are non-GAAP financial measures. A reconciliation to the comparable GAAP measurement for each is provided in the appendix of this slide presentation. 11 ■ Continued to advance initiatives to grow sustainable, core fee income ■ Successfully converted to a modernized wealth management platform ■ Continued to build out our Real-Time Payments and FedNow capabilities ■ Increased traction with our teams’ usage of Smart Leads, which uses predictive analytics to highlight opportunities to capture additional business with our existing customer base ■ Advanced associate and community initiatives to maintain robust engagement with our stakeholder groups ■ Launched flexible workplace initiative to enhance our Do Right Together culture and support associate development and collaboration ■ Achieved record-breaking participation in our Annual Warm Hearts Winter Drive, raising $365,000 to help families and individuals struggling with homelessness in communities across the Northwest Reported Operating(1) $94 million $116 million Net Income Net Income $182 million $212 million Pre-Provision Net Revenue(1) Pre-Provision Net Revenue $0.45 $0.56 Earnings-per-Share - Diluted Earnings-per-Share - Diluted 0.72% 0.89% Return on Assets Return on Assets 1.39% 1.62% PPNR Return on Assets(1) PPNR Return on Assets 7.90% 9.81% Return on Equity Return on Equity 12.19% 15.14% Return on Tangible Common Equity(1) Return on Tangible Common Equity

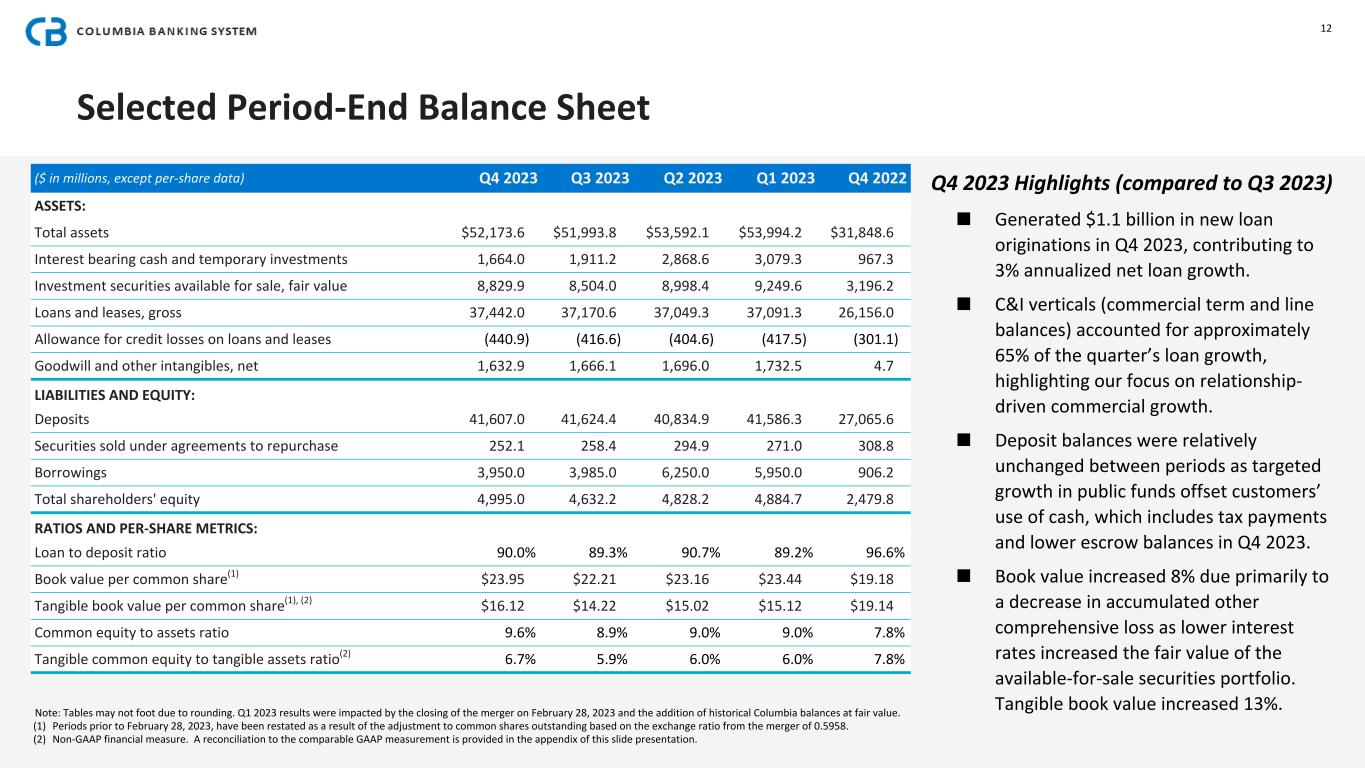

Selected Period-End Balance Sheet Note: Tables may not foot due to rounding. Q1 2023 results were impacted by the closing of the merger on February 28, 2023 and the addition of historical Columbia balances at fair value. (1) Periods prior to February 28, 2023, have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. (2) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. ($ in millions, except per-share data) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 ASSETS: Total assets $52,173.6 $51,993.8 $53,592.1 $53,994.2 $31,848.6 Interest bearing cash and temporary investments 1,664.0 1,911.2 2,868.6 3,079.3 967.3 Investment securities available for sale, fair value 8,829.9 8,504.0 8,998.4 9,249.6 3,196.2 Loans and leases, gross 37,442.0 37,170.6 37,049.3 37,091.3 26,156.0 Allowance for credit losses on loans and leases (440.9) (416.6) (404.6) (417.5) (301.1) Goodwill and other intangibles, net 1,632.9 1,666.1 1,696.0 1,732.5 4.7 LIABILITIES AND EQUITY: Deposits 41,607.0 41,624.4 40,834.9 41,586.3 27,065.6 Securities sold under agreements to repurchase 252.1 258.4 294.9 271.0 308.8 Borrowings 3,950.0 3,985.0 6,250.0 5,950.0 906.2 Total shareholders' equity 4,995.0 4,632.2 4,828.2 4,884.7 2,479.8 RATIOS AND PER-SHARE METRICS: Loan to deposit ratio 90.0% 89.3% 90.7% 89.2% 96.6% Book value per common share(1) $23.95 $22.21 $23.16 $23.44 $19.18 Tangible book value per common share(1), (2) $16.12 $14.22 $15.02 $15.12 $19.14 Common equity to assets ratio 9.6% 8.9% 9.0% 9.0% 7.8% Tangible common equity to tangible assets ratio(2) 6.7% 5.9% 6.0% 6.0% 7.8% 12 Q4 2023 Highlights (compared to Q3 2023) ■ Generated $1.1 billion in new loan originations in Q4 2023, contributing to 3% annualized net loan growth. ■ C&I verticals (commercial term and line balances) accounted for approximately 65% of the quarter’s loan growth, highlighting our focus on relationship- driven commercial growth. ■ Deposit balances were relatively unchanged between periods as targeted growth in public funds offset customers’ use of cash, which includes tax payments and lower escrow balances in Q4 2023. ■ Book value increased 8% due primarily to a decrease in accumulated other comprehensive loss as lower interest rates increased the fair value of the available-for-sale securities portfolio. Tangible book value increased 13%.

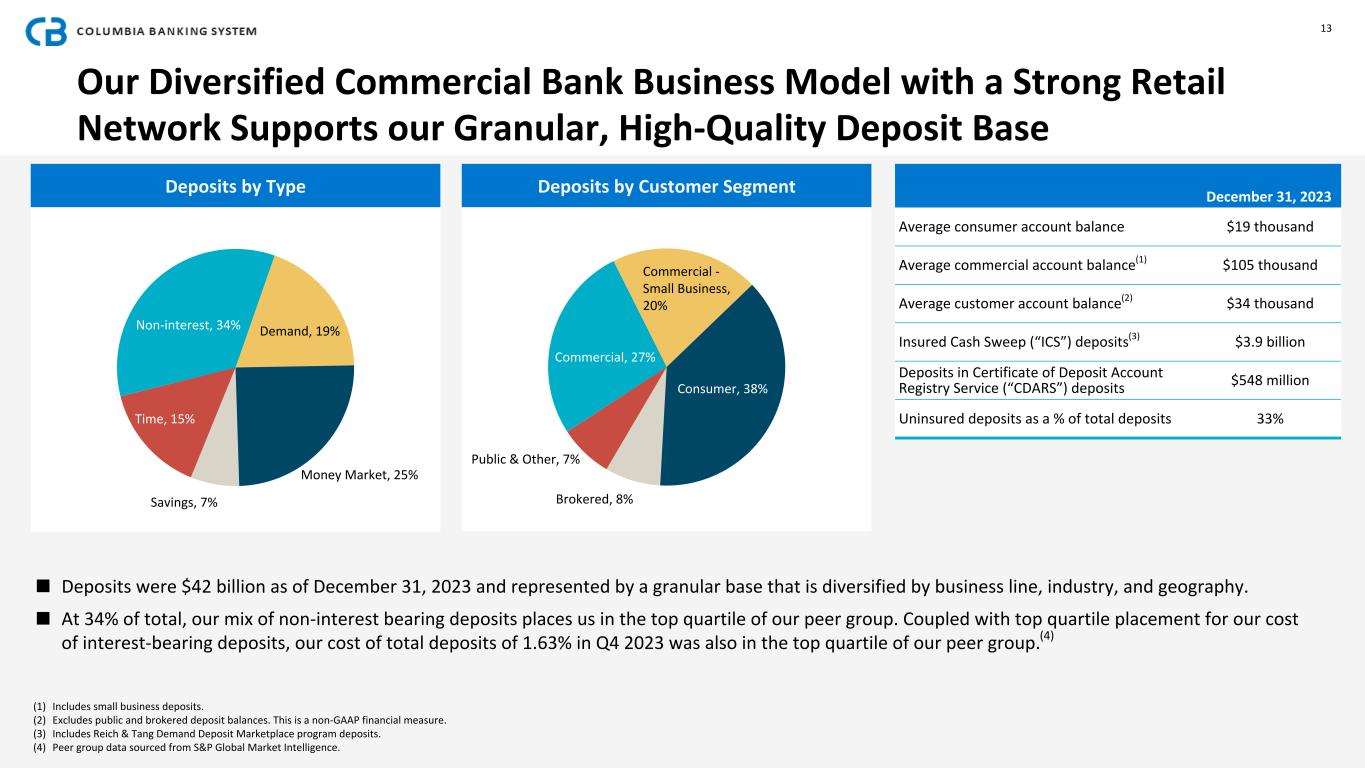

Our Diversified Commercial Bank Business Model with a Strong Retail Network Supports our Granular, High-Quality Deposit Base (1) Includes small business deposits. (2) Excludes public and brokered deposit balances. This is a non-GAAP financial measure. (3) Includes Reich & Tang Demand Deposit Marketplace program deposits. (4) Peer group data sourced from S&P Global Market Intelligence. December 31, 2023 Average consumer account balance $19 thousand Average commercial account balance(1) $105 thousand Average customer account balance(2) $34 thousand Insured Cash Sweep (“ICS”) deposits(3) $3.9 billion Deposits in Certificate of Deposit Account Registry Service (“CDARS”) deposits $548 million Uninsured deposits as a % of total deposits 33% Non-interest, 34% Demand, 19% Money Market, 25% Savings, 7% Time, 15% Deposits by Type 13 ■ Deposits were $42 billion as of December 31, 2023 and represented by a granular base that is diversified by business line, industry, and geography. ■ At 34% of total, our mix of non-interest bearing deposits places us in the top quartile of our peer group. Coupled with top quartile placement for our cost of interest-bearing deposits, our cost of total deposits of 1.63% in Q4 2023 was also in the top quartile of our peer group.(4) Commercial, 27% Commercial - Small Business, 20% Consumer, 38% Brokered, 8% Public & Other, 7% Deposits by Customer Segment

Liquidity Overview Total Available Liquidity at December 31, 2023 ($ in millions) Total off-balance sheet liquidity (available lines of credit): $11,692 Cash and equivalents, less reserve requirement 1,910 Excess bond collateral 5,125 Total available liquidity $18,727 TOTAL AVAILABLE LIQUIDITY AS A PERCENTAGE OF: Assets of $52.2 billion at December 31, 2023 36 % Deposits of $41.6 billion at December 31, 2023 45 % Uninsured deposits of $13.5 billion at December 31, 2023 138 % Total Off-Balance Sheet Liquidity Available at December 31, 2023 ($ in millions) Gross Availability Utilization Net Availability FHLB lines $11,995 $3,770 $8,225 Federal Reserve Discount Window 1,588 — 1,588 Federal Reserve Term Funding Program 1,479 200 1,279 Uncommitted lines of credit 600 — 600 Total off-balance sheet liquidity $15,662 $3,970 $11,692 14 ■ Customer cash usage impacted deposit balances throughout 2023, and customer trends in Q4 2023 include tax payments and lower escrow balances. ■ Growth in public deposits during Q4 2023 offset contraction in small business balances as other deposit categories were relatively stable between December and September. Select Balance Sheet Items Three Months Ended Sequential Quarter Change ($ in millions) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2023 Commercial deposits $11,147 $11,104 $10,790 $11,356 $43 Small business deposits 8,400 8,927 8,835 8,619 (527) Consumer deposits 15,842 15,882 16,199 17,243 (40) Total customer deposits 35,389 35,913 35,824 37,218 (524) Public deposits - non-interest bearing 619 627 643 638 (9) Public deposits - interest bearing 2,285 1,815 1,782 1,918 470 Total public deposits 2,904 2,443 2,425 2,556 462 Administrative deposits 164 146 240 182 18 Brokered deposits 3,150 3,123 2,346 1,631 27 Total deposits $41,607 $41,624 $40,835 $41,586 ($17) Term debt $3,950 $3,985 $6,250 $5,950 ($35) Cash & cash equivalents $2,163 $2,404 $3,407 $3,635 ($241) Available-for-sale securities $8,830 $8,504 $8,998 $9,250 $326 Loans and leases $37,442 $37,171 $37,049 $37,091 $271 Note: Tables may not foot due to rounding.

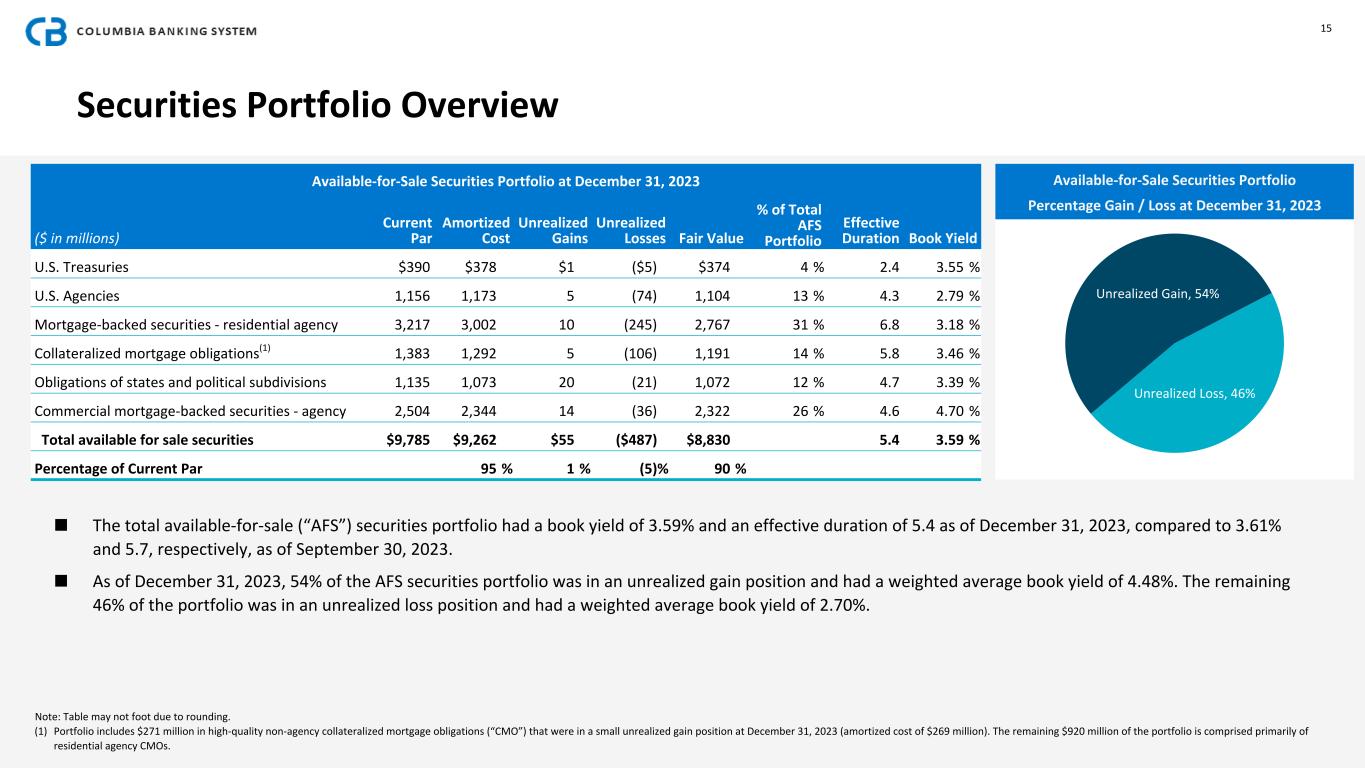

Available-for-Sale Securities Portfolio at December 31, 2023 ($ in millions) Current Par Amortized Cost Unrealized Gains Unrealized Losses Fair Value % of Total AFS Portfolio Effective Duration Book Yield U.S. Treasuries $390 $378 $1 ($5) $374 4 % 2.4 3.55 % U.S. Agencies 1,156 1,173 5 (74) 1,104 13 % 4.3 2.79 % Mortgage-backed securities - residential agency 3,217 3,002 10 (245) 2,767 31 % 6.8 3.18 % Collateralized mortgage obligations(1) 1,383 1,292 5 (106) 1,191 14 % 5.8 3.46 % Obligations of states and political subdivisions 1,135 1,073 20 (21) 1,072 12 % 4.7 3.39 % Commercial mortgage-backed securities - agency 2,504 2,344 14 (36) 2,322 26 % 4.6 4.70 % Total available for sale securities $9,785 $9,262 $55 ($487) $8,830 5.4 3.59 % Percentage of Current Par 95 % 1 % (5) % 90 % 15 Securities Portfolio Overview Note: Table may not foot due to rounding. (1) Portfolio includes $271 million in high-quality non-agency collateralized mortgage obligations (“CMO”) that were in a small unrealized gain position at December 31, 2023 (amortized cost of $269 million). The remaining $920 million of the portfolio is comprised primarily of residential agency CMOs. ■ The total available-for-sale (“AFS”) securities portfolio had a book yield of 3.59% and an effective duration of 5.4 as of December 31, 2023, compared to 3.61% and 5.7, respectively, as of September 30, 2023. ■ As of December 31, 2023, 54% of the AFS securities portfolio was in an unrealized gain position and had a weighted average book yield of 4.48%. The remaining 46% of the portfolio was in an unrealized loss position and had a weighted average book yield of 2.70%. Unrealized Gain, 54% Unrealized Loss, 46% Available-for-Sale Securities Portfolio Percentage Gain / Loss at December 31, 2023

Loan Roll Forward Activity $ in m ill io ns Three Months Ended December 31, 2023 $37,171 $— $1,076 ($119) ($447) ($281) $42 $37,442 Beginning Balance (9/30/23) Merger New Originations Net Advances/ Payments Prepayments Payoffs or Sales Other¹ Ending Balance (12/31/23) 16 (1) Other includes purchase accounting accretion and amortization. $ in m ill io ns Twelve Months Ended December 31, 2023 $26,156 $10,884 $4,058 ($354) ($1,870) ($1,549) $117 $37,442 Beginning Balance (12/31/22) Merger New Originations Net Advances/ Payments Prepayments Payoffs or Sales Other¹ Ending Balance (12/31/23)

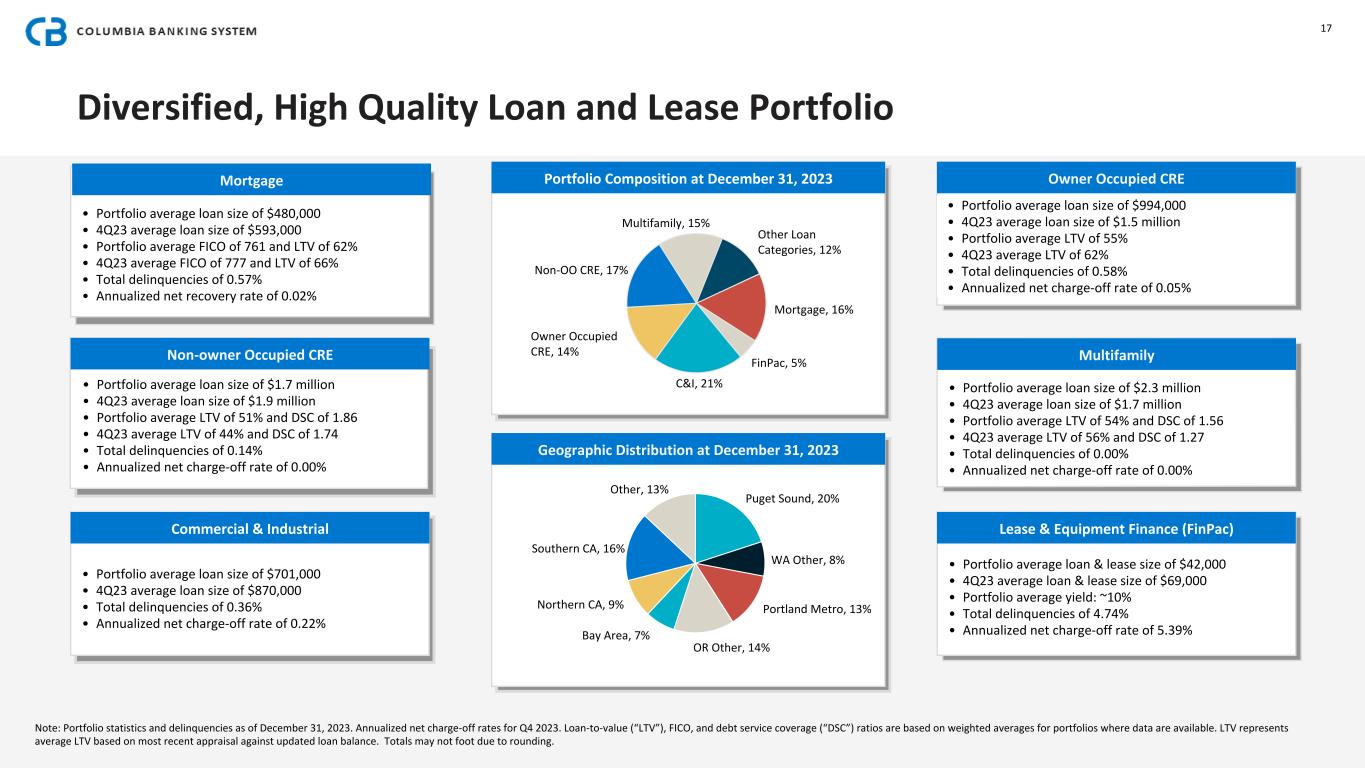

Diversified, High Quality Loan and Lease Portfolio Note: Portfolio statistics and delinquencies as of December 31, 2023. Annualized net charge-off rates for Q4 2023. Loan-to-value (“LTV”), FICO, and debt service coverage (“DSC”) ratios are based on weighted averages for portfolios where data are available. LTV represents average LTV based on most recent appraisal against updated loan balance. Totals may not foot due to rounding. • Portfolio average loan size of $480,000 • 4Q23 average loan size of $593,000 • Portfolio average FICO of 761 and LTV of 62% • 4Q23 average FICO of 777 and LTV of 66% • Total delinquencies of 0.57% • Annualized net recovery rate of 0.02% Non-owner Occupied CRE • Portfolio average loan size of $1.7 million • 4Q23 average loan size of $1.9 million • Portfolio average LTV of 51% and DSC of 1.86 • 4Q23 average LTV of 44% and DSC of 1.74 • Total delinquencies of 0.14% • Annualized net charge-off rate of 0.00% Commercial & Industrial • Portfolio average loan size of $701,000 • 4Q23 average loan size of $870,000 • Total delinquencies of 0.36% • Annualized net charge-off rate of 0.22% Multifamily • Portfolio average loan size of $2.3 million • 4Q23 average loan size of $1.7 million • Portfolio average LTV of 54% and DSC of 1.56 • 4Q23 average LTV of 56% and DSC of 1.27 • Total delinquencies of 0.00% • Annualized net charge-off rate of 0.00% Owner Occupied CRE • Portfolio average loan size of $994,000 • 4Q23 average loan size of $1.5 million • Portfolio average LTV of 55% • 4Q23 average LTV of 62% • Total delinquencies of 0.58% • Annualized net charge-off rate of 0.05% Lease & Equipment Finance (FinPac) • Portfolio average loan & lease size of $42,000 • 4Q23 average loan & lease size of $69,000 • Portfolio average yield: ~10% • Total delinquencies of 4.74% • Annualized net charge-off rate of 5.39% Puget Sound, 20% WA Other, 8% Portland Metro, 13% OR Other, 14% Bay Area, 7% Northern CA, 9% Southern CA, 16% Other, 13% Mortgage, 16% FinPac, 5% C&I, 21% Owner Occupied CRE, 14% Non-OO CRE, 17% Multifamily, 15% Other Loan Categories, 12% Portfolio Composition at December 31, 2023 Geographic Distribution at December 31, 2023 Mortgage 17

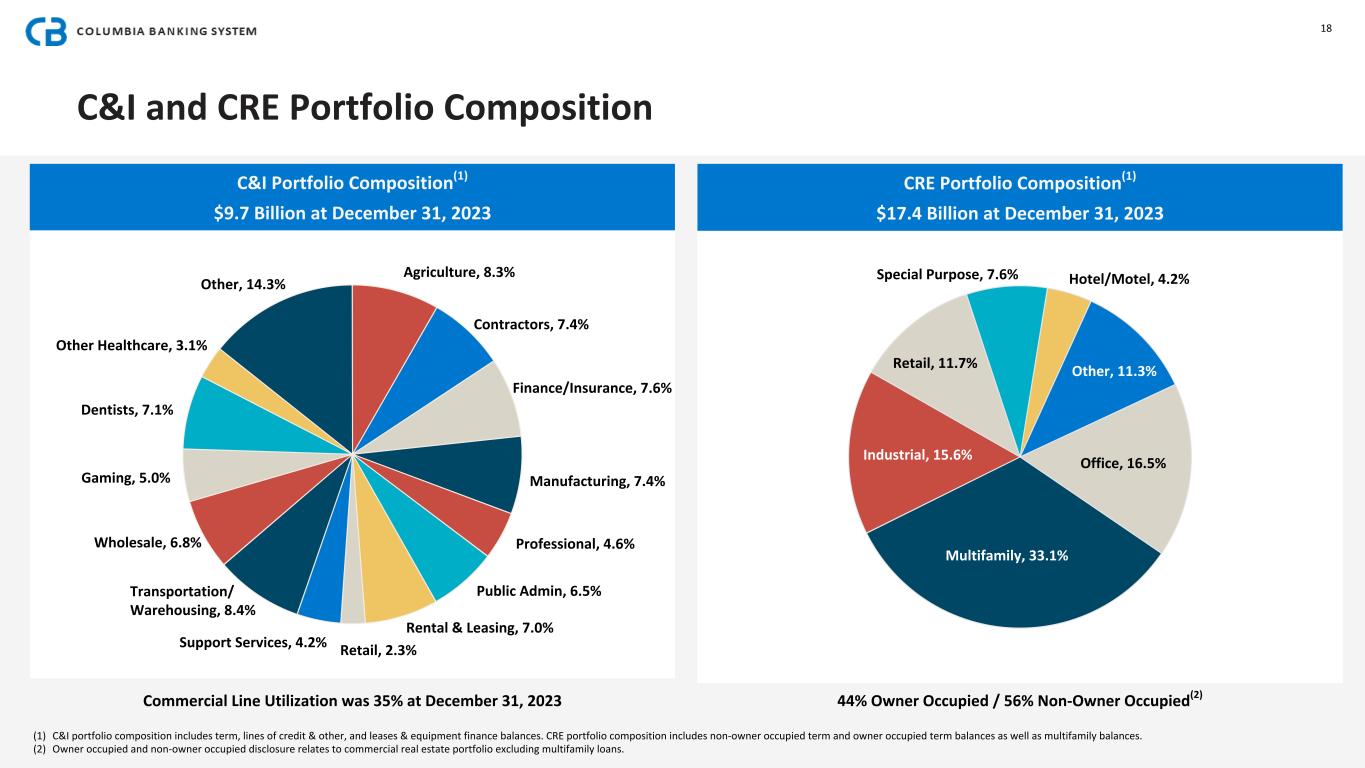

C&I and CRE Portfolio Composition Agriculture, 8.3% Contractors, 7.4% Finance/Insurance, 7.6% Manufacturing, 7.4% Professional, 4.6% Public Admin, 6.5% Rental & Leasing, 7.0% Retail, 2.3%Support Services, 4.2% Transportation/ Warehousing, 8.4% Wholesale, 6.8% Gaming, 5.0% Dentists, 7.1% Other Healthcare, 3.1% Other, 14.3% Office, 16.5% Multifamily, 33.1% Industrial, 15.6% Retail, 11.7% Special Purpose, 7.6% Hotel/Motel, 4.2% Other, 11.3% CRE Portfolio Composition(1) $17.4 Billion at December 31, 2023 C&I Portfolio Composition(1) $9.7 Billion at December 31, 2023 (1) C&I portfolio composition includes term, lines of credit & other, and leases & equipment finance balances. CRE portfolio composition includes non-owner occupied term and owner occupied term balances as well as multifamily balances. (2) Owner occupied and non-owner occupied disclosure relates to commercial real estate portfolio excluding multifamily loans. 44% Owner Occupied / 56% Non-Owner Occupied(2)Commercial Line Utilization was 35% at December 31, 2023 18

Office Portfolio Details Puget Sound, 22% WA Other, 6% Portland Metro, 12% OR Other, 15%Bay Area, 5% N. CA, 11% S. CA, 20% Other, 9% Office Portfolio Metrics at December 31, 2023 Average loan size $1.3 million Average LTV 56% DSC (non-owner occupied) 1.72x % with guaranty (by $ / by #) 85% / 83% Past due 30-89 days $0.9mm / 0.03% of office Nonaccrual $13.3mm / 0.44% of office Special mention $19.2mm / 0.64% of office Classified $57.6mm / 1.91% of office Number of Loans by Balance Geography 19 ■ Loans secured by office properties represented 8% of our total loan portfolio at December 31, 2023. ■ Our office portfolio is 39% owner occupied, 57% non-owner occupied, and 4% construction. Dental and other healthcare loans compose 15% of our office portfolio. ■ The average loan size in our office portfolio is $1.3 million, delinquencies are at a de minimis level, and the majority of our loans contain a guaranty. ■ Excluding floating rate loans, which have already repriced to prevailing rates, only 8% of our office portfolio reprices through 2025. Loans repricing in 2024 and 2025 have average balances of $0.8 million and $1.1 million, respectively. ■ Properties located in suburban markets secure the majority of our office portfolio as only 6% of non-owner occupied office loans are located in downtown core business districts. 1,746 441 71 38 7 6 <$1mm $1-5mm $5-10mm $10-20mm $20-30mm >$30mm 2024, 4% 2025, 4% 2026 & After, 18% Fixed Rate¹, 67% Floating Rate, 7% Repricing Schedule (1) Loans with a swap component are displayed as a fixed rate loan if the swap maturity is equal to the maturity of the loan. If the swap matures prior to the loan, the loan is displayed as adjustable with the rate resetting at the time of the swap maturity. 2024, 5% 2025, 6% 2026 & After, 89% Maturity Schedule , 19 8 9 6 7 1,682 6 3 6

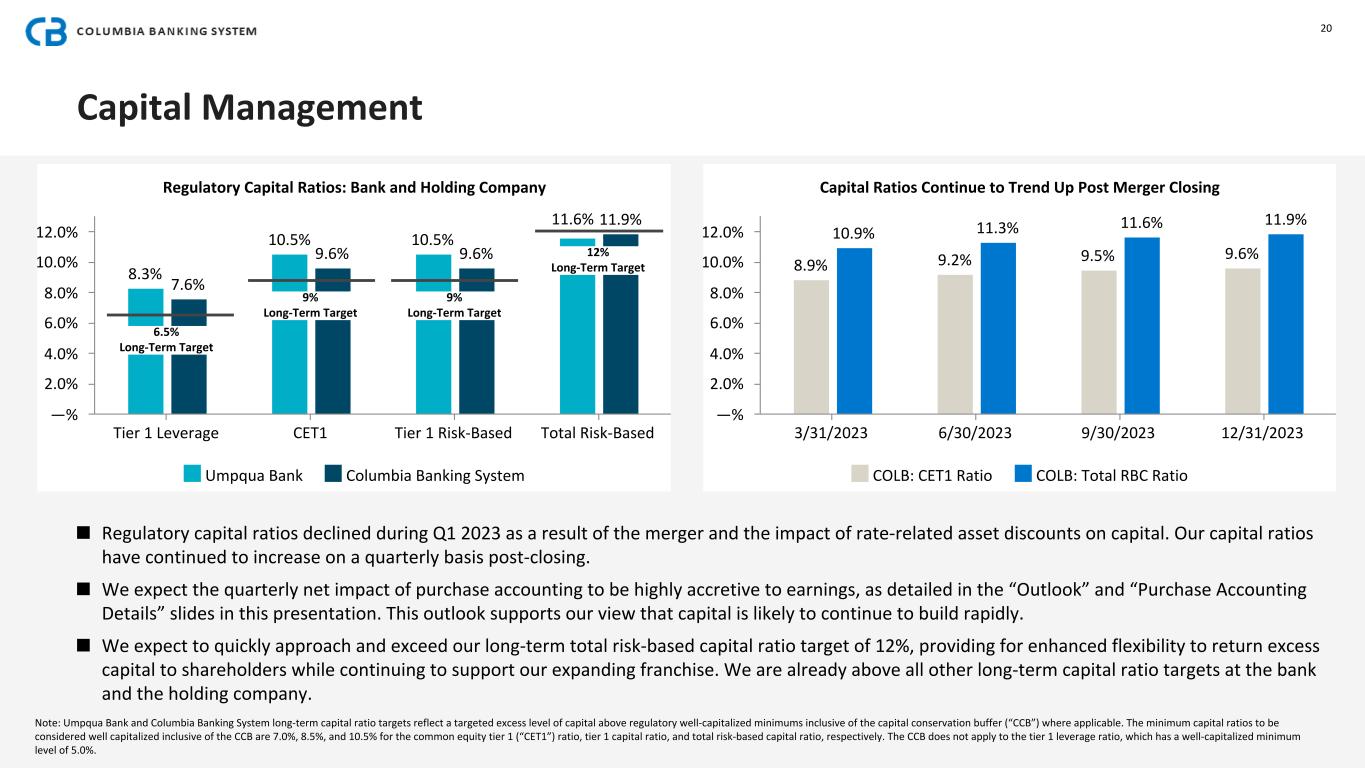

Capital Management 20 Regulatory Capital Ratios: Bank and Holding Company 8.3% 10.5% 10.5% 7.6% 9.6% 9.6% 11.9% Umpqua Bank Columbia Banking System Tier 1 Leverage CET1 Tier 1 Risk-Based Total Risk-Based —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% ■ Regulatory capital ratios declined during Q1 2023 as a result of the merger and the impact of rate-related asset discounts on capital. Our capital ratios have continued to increase on a quarterly basis post-closing. ■ We expect the quarterly net impact of purchase accounting to be highly accretive to earnings, as detailed in the “Outlook” and “Purchase Accounting Details” slides in this presentation. This outlook supports our view that capital is likely to continue to build rapidly. ■ We expect to quickly approach and exceed our long-term total risk-based capital ratio target of 12%, providing for enhanced flexibility to return excess capital to shareholders while continuing to support our expanding franchise. We are already above all other long-term capital ratio targets at the bank and the holding company. Note: Umpqua Bank and Columbia Banking System long-term capital ratio targets reflect a targeted excess level of capital above regulatory well-capitalized minimums inclusive of the capital conservation buffer (“CCB”) where applicable. The minimum capital ratios to be considered well capitalized inclusive of the CCB are 7.0%, 8.5%, and 10.5% for the common equity tier 1 (“CET1”) ratio, tier 1 capital ratio, and total risk-based capital ratio, respectively. The CCB does not apply to the tier 1 leverage ratio, which has a well-capitalized minimum level of 5.0%. Capital Ratios Continue to Trend Up Post Merger Closing 8.9% 9.2% 9.5% 9.6% 10.9% 11.3% 11.6% 11.9% COLB: CET1 Ratio COLB: Total RBC Ratio 3/31/2023 6/30/2023 9/30/2023 12/31/2023 —% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 12% Long-Term Target 9% Long-Term Target 9% Long-Term Target 6.5% Long-Term Target 11.6%

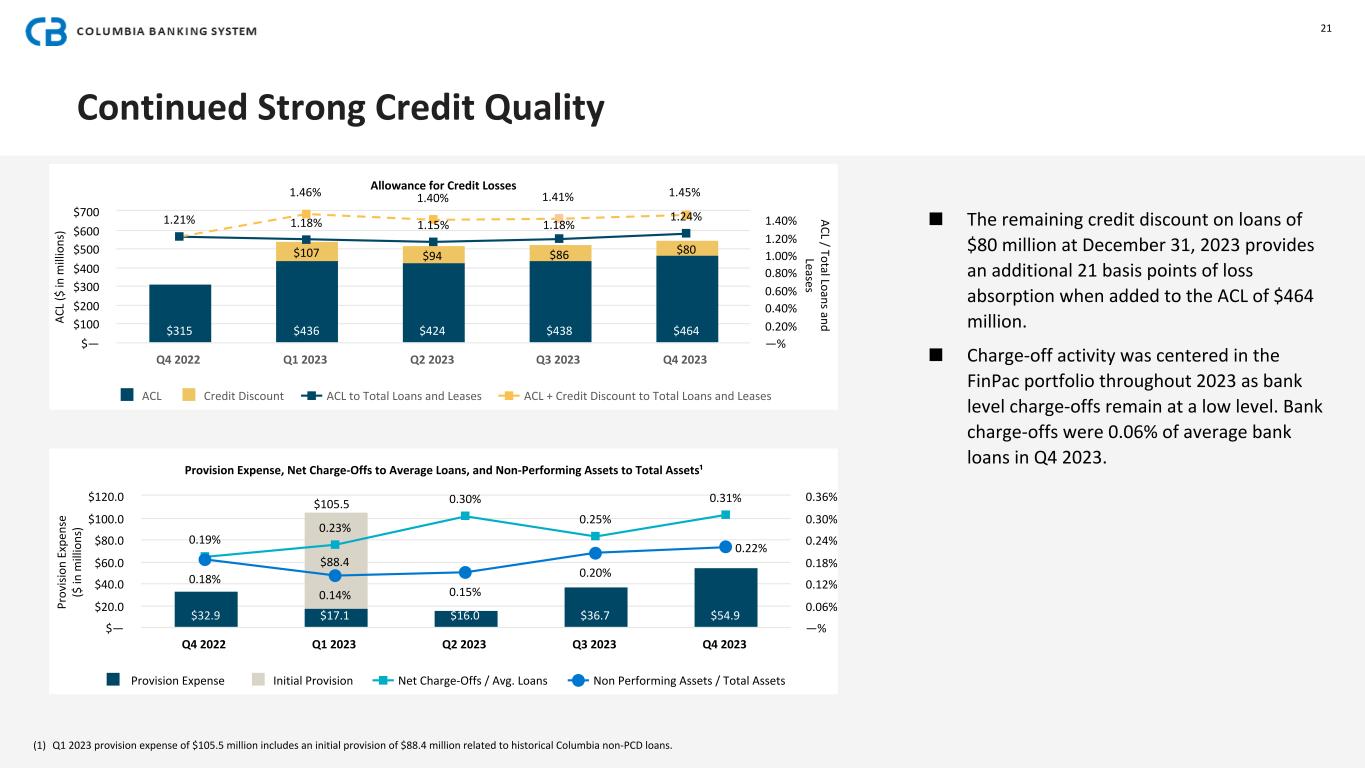

Continued Strong Credit Quality Pr ov is io n Ex pe ns e ($ in m ill io ns ) Provision Expense, Net Charge-Offs to Average Loans, and Non-Performing Assets to Total Assets¹ $32.9 $17.1 $16.0 $36.7 $54.9 $88.4 0.19% 0.23% 0.30% 0.25% 0.31% 0.18% 0.14% 0.15% 0.20% 0.22% Provision Expense Initial Provision Net Charge-Offs / Avg. Loans Non Performing Assets / Total Assets Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $— $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 —% 0.06% 0.12% 0.18% 0.24% 0.30% 0.36% 21 A CL ($ in m ill io ns ) A CL / Total Loans and Leases Allowance for Credit Losses $315 $436 $424 $438 $464 $107 $94 $86 $80 1.21% 1.18% 1.15% 1.24% ACL Credit Discount ACL to Total Loans and Leases ACL + Credit Discount to Total Loans and Leases Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $— $100 $200 $300 $400 $500 $600 $700 —% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% $105.5 (1) Q1 2023 provision expense of $105.5 million includes an initial provision of $88.4 million related to historical Columbia non-PCD loans. 1.41% 1.18% 1.45%1.40%1.46% ■ The remaining credit discount on loans of $80 million at December 31, 2023 provides an additional 21 basis points of loss absorption when added to the ACL of $464 million. ■ Charge-off activity was centered in the FinPac portfolio throughout 2023 as bank level charge-offs remain at a low level. Bank charge-offs were 0.06% of average bank loans in Q4 2023.

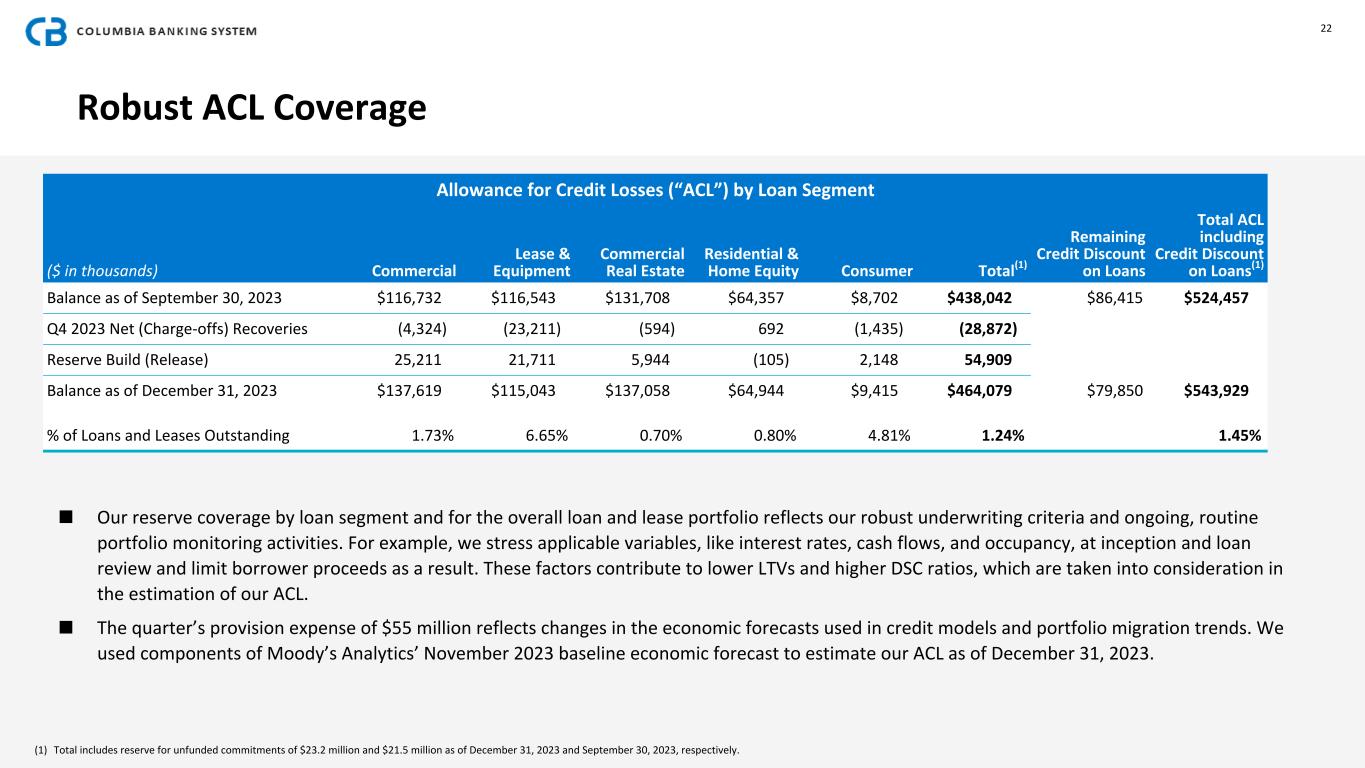

Robust ACL Coverage (1) Total includes reserve for unfunded commitments of $23.2 million and $21.5 million as of December 31, 2023 and September 30, 2023, respectively. 22 ■ Our reserve coverage by loan segment and for the overall loan and lease portfolio reflects our robust underwriting criteria and ongoing, routine portfolio monitoring activities. For example, we stress applicable variables, like interest rates, cash flows, and occupancy, at inception and loan review and limit borrower proceeds as a result. These factors contribute to lower LTVs and higher DSC ratios, which are taken into consideration in the estimation of our ACL. ■ The quarter’s provision expense of $55 million reflects changes in the economic forecasts used in credit models and portfolio migration trends. We used components of Moody’s Analytics’ November 2023 baseline economic forecast to estimate our ACL as of December 31, 2023. Allowance for Credit Losses (“ACL”) by Loan Segment ($ in thousands) Commercial Lease & Equipment Commercial Real Estate Residential & Home Equity Consumer Total(1) Remaining Credit Discount on Loans Total ACL including Credit Discount on Loans(1) Balance as of September 30, 2023 $116,732 $116,543 $131,708 $64,357 $8,702 $438,042 $86,415 $524,457 Q4 2023 Net (Charge-offs) Recoveries (4,324) (23,211) (594) 692 (1,435) (28,872) Reserve Build (Release) 25,211 21,711 5,944 (105) 2,148 54,909 Balance as of December 31, 2023 $137,619 $115,043 $137,058 $64,944 $9,415 $464,079 $79,850 $543,929 % of Loans and Leases Outstanding 1.73% 6.65% 0.70% 0.80% 4.81% 1.24% 1.45%

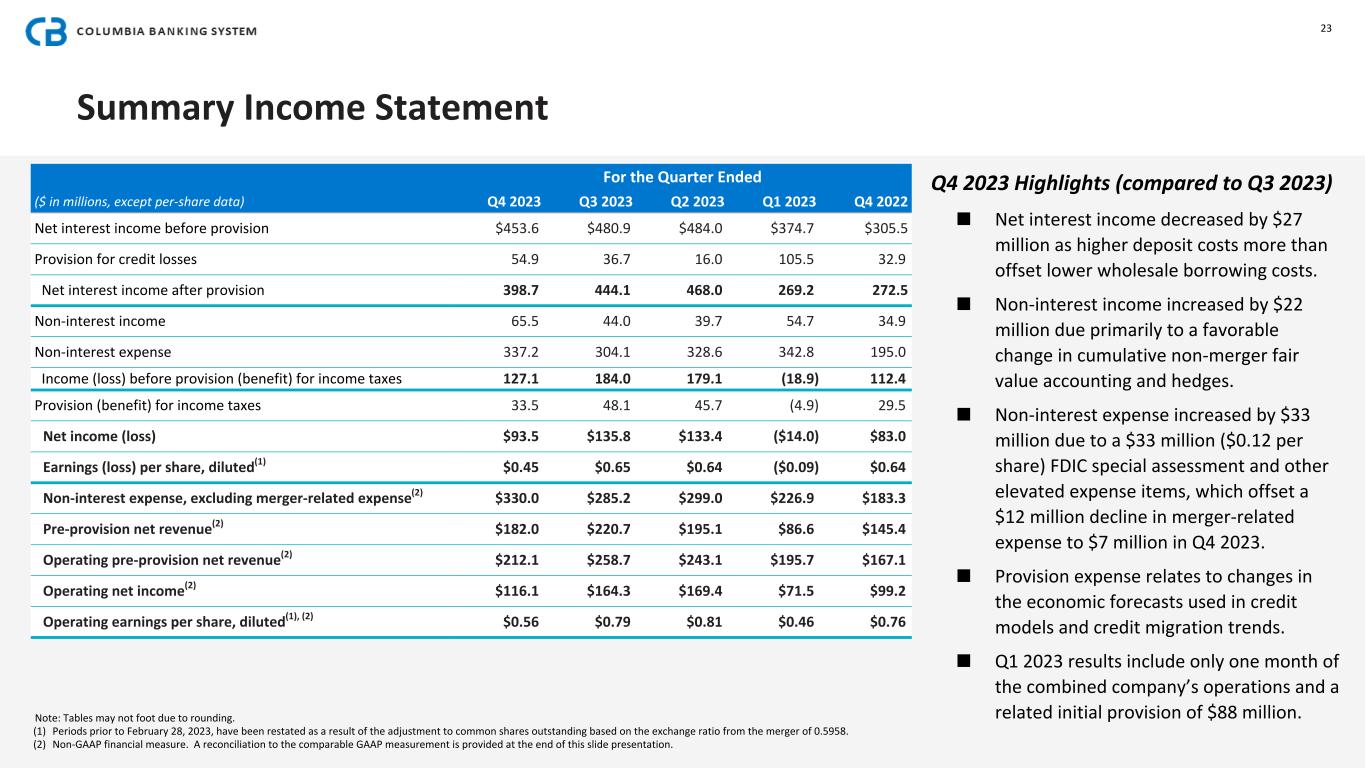

Summary Income Statement Note: Tables may not foot due to rounding. (1) Periods prior to February 28, 2023, have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. (2) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. For the Quarter Ended ($ in millions, except per-share data) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Net interest income before provision $453.6 $480.9 $484.0 $374.7 $305.5 Provision for credit losses 54.9 36.7 16.0 105.5 32.9 Net interest income after provision 398.7 444.1 468.0 269.2 272.5 Non-interest income 65.5 44.0 39.7 54.7 34.9 Non-interest expense 337.2 304.1 328.6 342.8 195.0 Income (loss) before provision (benefit) for income taxes 127.1 184.0 179.1 (18.9) 112.4 Provision (benefit) for income taxes 33.5 48.1 45.7 (4.9) 29.5 Net income (loss) $93.5 $135.8 $133.4 ($14.0) $83.0 Earnings (loss) per share, diluted(1) $0.45 $0.65 $0.64 ($0.09) $0.64 Non-interest expense, excluding merger-related expense(2) $330.0 $285.2 $299.0 $226.9 $183.3 Pre-provision net revenue(2) $182.0 $220.7 $195.1 $86.6 $145.4 Operating pre-provision net revenue(2) $212.1 $258.7 $243.1 $195.7 $167.1 Operating net income(2) $116.1 $164.3 $169.4 $71.5 $99.2 Operating earnings per share, diluted(1), (2) $0.56 $0.79 $0.81 $0.46 $0.76 23 Q4 2023 Highlights (compared to Q3 2023) ■ Net interest income decreased by $27 million as higher deposit costs more than offset lower wholesale borrowing costs. ■ Non-interest income increased by $22 million due primarily to a favorable change in cumulative non-merger fair value accounting and hedges. ■ Non-interest expense increased by $33 million due to a $33 million ($0.12 per share) FDIC special assessment and other elevated expense items, which offset a $12 million decline in merger-related expense to $7 million in Q4 2023. ■ Provision expense relates to changes in the economic forecasts used in credit models and credit migration trends. ■ Q1 2023 results include only one month of the combined company’s operations and a related initial provision of $88 million.

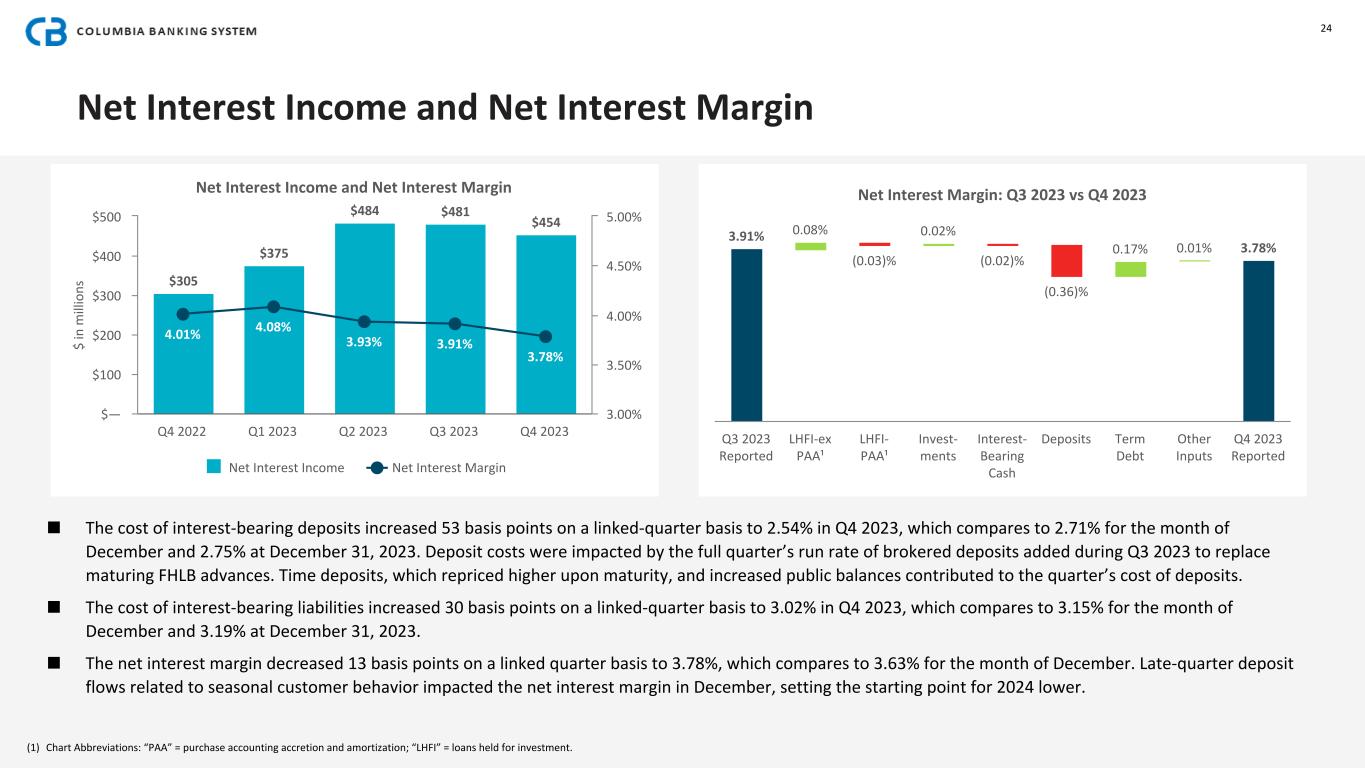

Net Interest Income and Net Interest Margin (1) Chart Abbreviations: “PAA” = purchase accounting accretion and amortization; “LHFI” = loans held for investment. $ in m ill io ns Net Interest Income and Net Interest Margin $305 $375 $484 $481 $454 4.01% 4.08% 3.93% 3.91% 3.78% Net Interest Income Net Interest Margin Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $— $100 $200 $300 $400 $500 3.00% 3.50% 4.00% 4.50% 5.00% Net Interest Margin: Q3 2023 vs Q4 2023 3.91% 0.08% (0.03)% 0.02% (0.02)% (0.36)% 0.17% 0.01% 3.78% Q3 2023 Reported LHFI-ex PAA¹ LHFI- PAA¹ Invest- ments Interest- Bearing Cash Deposits Term Debt Other Inputs Q4 2023 Reported 24 ■ The cost of interest-bearing deposits increased 53 basis points on a linked-quarter basis to 2.54% in Q4 2023, which compares to 2.71% for the month of December and 2.75% at December 31, 2023. Deposit costs were impacted by the full quarter’s run rate of brokered deposits added during Q3 2023 to replace maturing FHLB advances. Time deposits, which repriced higher upon maturity, and increased public balances contributed to the quarter’s cost of deposits. ■ The cost of interest-bearing liabilities increased 30 basis points on a linked-quarter basis to 3.02% in Q4 2023, which compares to 3.15% for the month of December and 3.19% at December 31, 2023. ■ The net interest margin decreased 13 basis points on a linked quarter basis to 3.78%, which compares to 3.63% for the month of December. Late-quarter deposit flows related to seasonal customer behavior impacted the net interest margin in December, setting the starting point for 2024 lower.

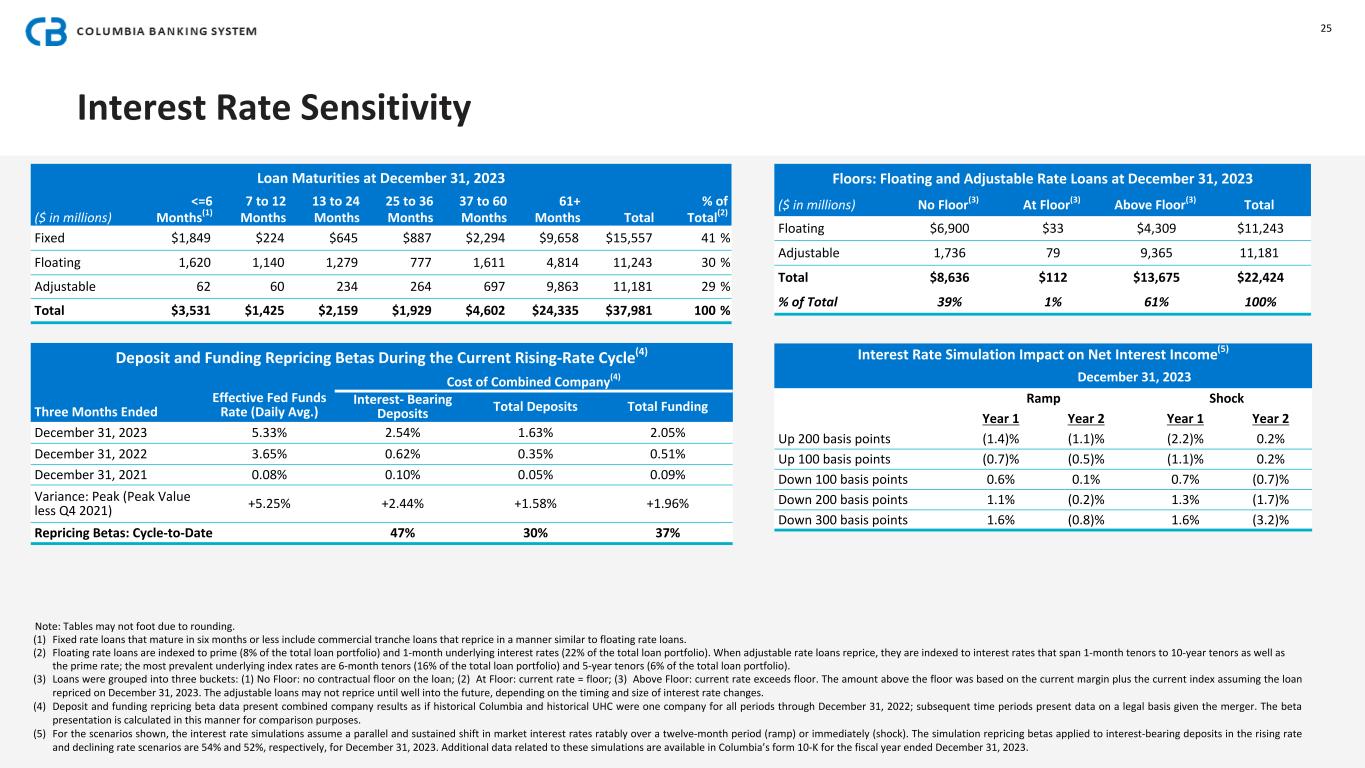

Loan Maturities at December 31, 2023 <=6 7 to 12 13 to 24 25 to 36 37 to 60 61+ % of ($ in millions) Months(1) Months Months Months Months Months Total Total(2) Fixed $1,849 $224 $645 $887 $2,294 $9,658 $15,557 41 % Floating 1,620 1,140 1,279 777 1,611 4,814 11,243 30 % Adjustable 62 60 234 264 697 9,863 11,181 29 % Total $3,531 $1,425 $2,159 $1,929 $4,602 $24,335 $37,981 100 % Interest Rate Sensitivity Floors: Floating and Adjustable Rate Loans at December 31, 2023 ($ in millions) No Floor(3) At Floor(3) Above Floor(3) Total Floating $6,900 $33 $4,309 $11,243 Adjustable 1,736 79 9,365 11,181 Total $8,636 $112 $13,675 $22,424 % of Total 39% 1% 61% 100% 25 Note: Tables may not foot due to rounding. (1) Fixed rate loans that mature in six months or less include commercial tranche loans that reprice in a manner similar to floating rate loans. (2) Floating rate loans are indexed to prime (8% of the total loan portfolio) and 1-month underlying interest rates (22% of the total loan portfolio). When adjustable rate loans reprice, they are indexed to interest rates that span 1-month tenors to 10-year tenors as well as the prime rate; the most prevalent underlying index rates are 6-month tenors (16% of the total loan portfolio) and 5-year tenors (6% of the total loan portfolio). (3) Loans were grouped into three buckets: (1) No Floor: no contractual floor on the loan; (2) At Floor: current rate = floor; (3) Above Floor: current rate exceeds floor. The amount above the floor was based on the current margin plus the current index assuming the loan repriced on December 31, 2023. The adjustable loans may not reprice until well into the future, depending on the timing and size of interest rate changes. (4) Deposit and funding repricing beta data present combined company results as if historical Columbia and historical UHC were one company for all periods through December 31, 2022; subsequent time periods present data on a legal basis given the merger. The beta presentation is calculated in this manner for comparison purposes. (5) For the scenarios shown, the interest rate simulations assume a parallel and sustained shift in market interest rates ratably over a twelve-month period (ramp) or immediately (shock). The simulation repricing betas applied to interest-bearing deposits in the rising rate and declining rate scenarios are 54% and 52%, respectively, for December 31, 2023. Additional data related to these simulations are available in Columbia’s form 10-K for the fiscal year ended December 31, 2023. Deposit and Funding Repricing Betas During the Current Rising-Rate Cycle(4) Effective Fed Funds Rate (Daily Avg.) Cost of Combined Company(4) Three Months Ended Interest- Bearing Deposits Total Deposits Total Funding December 31, 2023 5.33% 2.54% 1.63% 2.05% December 31, 2022 3.65% 0.62% 0.35% 0.51% December 31, 2021 0.08% 0.10% 0.05% 0.09% Variance: Peak (Peak Value less Q4 2021) +5.25% +2.44% +1.58% +1.96% Repricing Betas: Cycle-to-Date 47% 30% 37% Interest Rate Simulation Impact on Net Interest Income(5) December 31, 2023 Ramp Shock Year 1 Year 2 Year 1 Year 2 Up 200 basis points (1.4)% (1.1)% (2.2)% 0.2% Up 100 basis points (0.7)% (0.5)% (1.1)% 0.2% Down 100 basis points 0.6% 0.1% 0.7% (0.7)% Down 200 basis points 1.1% (0.2)% 1.3% (1.7)% Down 300 basis points 1.6% (0.8)% 1.6% (3.2)%

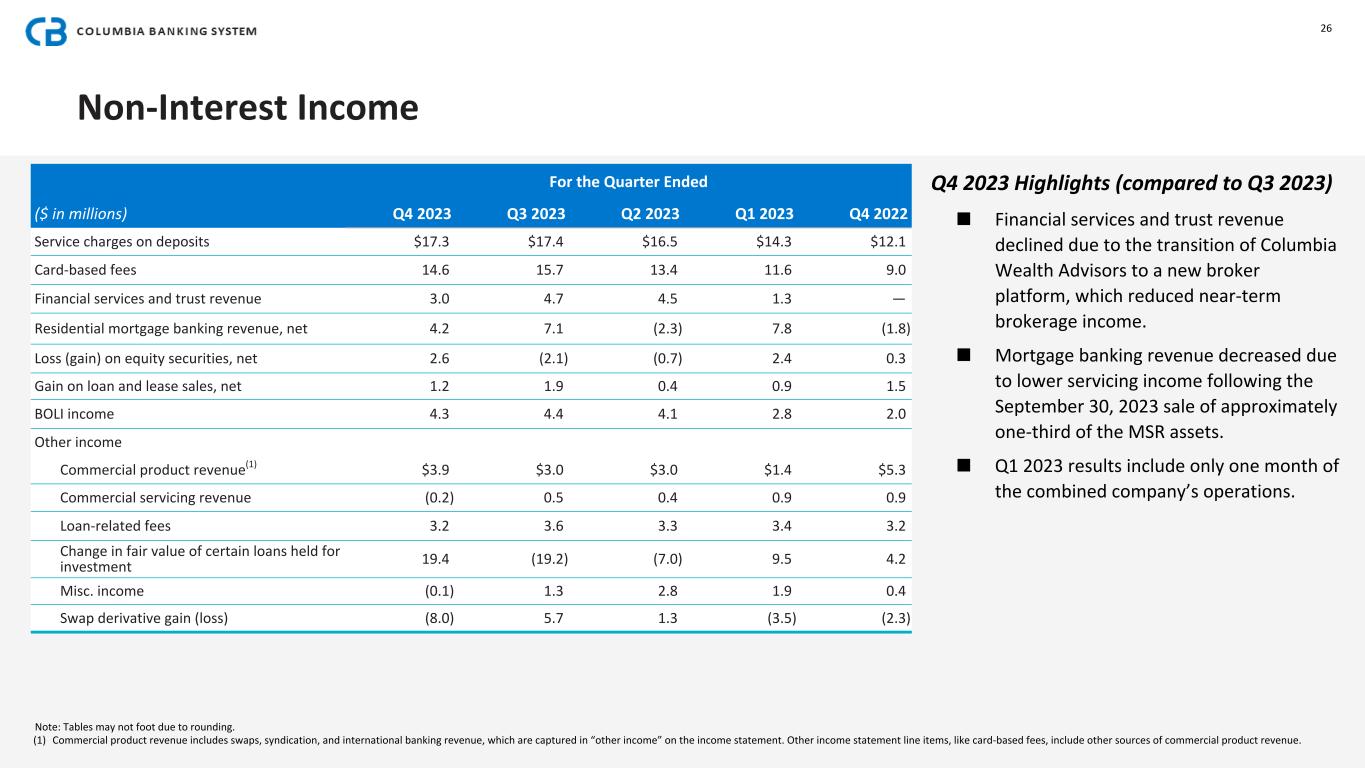

Non-Interest Income Note: Tables may not foot due to rounding. (1) Commercial product revenue includes swaps, syndication, and international banking revenue, which are captured in “other income” on the income statement. Other income statement line items, like card-based fees, include other sources of commercial product revenue. For the Quarter Ended ($ in millions) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Service charges on deposits $17.3 $17.4 $16.5 $14.3 $12.1 Card-based fees 14.6 15.7 13.4 11.6 9.0 Financial services and trust revenue 3.0 4.7 4.5 1.3 — Residential mortgage banking revenue, net 4.2 7.1 (2.3) 7.8 (1.8) Loss (gain) on equity securities, net 2.6 (2.1) (0.7) 2.4 0.3 Gain on loan and lease sales, net 1.2 1.9 0.4 0.9 1.5 BOLI income 4.3 4.4 4.1 2.8 2.0 Other income Commercial product revenue(1) $3.9 $3.0 $3.0 $1.4 $5.3 Commercial servicing revenue (0.2) 0.5 0.4 0.9 0.9 Loan-related fees 3.2 3.6 3.3 3.4 3.2 Change in fair value of certain loans held for investment 19.4 (19.2) (7.0) 9.5 4.2 Misc. income (0.1) 1.3 2.8 1.9 0.4 Swap derivative gain (loss) (8.0) 5.7 1.3 (3.5) (2.3) 26 Q4 2023 Highlights (compared to Q3 2023) ■ Financial services and trust revenue declined due to the transition of Columbia Wealth Advisors to a new broker platform, which reduced near-term brokerage income. ■ Mortgage banking revenue decreased due to lower servicing income following the September 30, 2023 sale of approximately one-third of the MSR assets. ■ Q1 2023 results include only one month of the combined company’s operations.

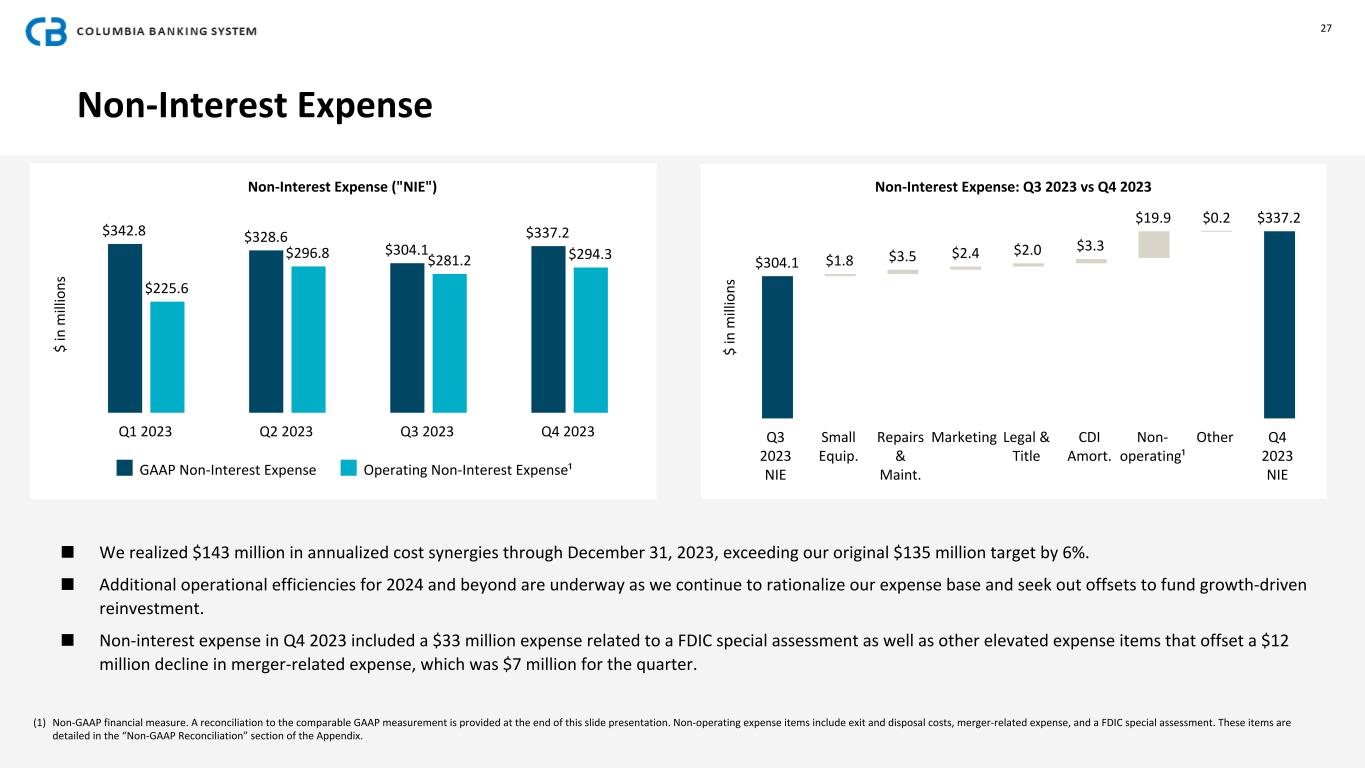

Non-Interest Expense 27 $ in m ill io ns Non-Interest Expense ("NIE") $342.8 $328.6 $304.1 $337.2 $225.6 $296.8 $281.2 $294.3 GAAP Non-Interest Expense Operating Non-Interest Expense¹ Q1 2023 Q2 2023 Q3 2023 Q4 2023 ■ We realized $143 million in annualized cost synergies through December 31, 2023, exceeding our original $135 million target by 6%. ■ Additional operational efficiencies for 2024 and beyond are underway as we continue to rationalize our expense base and seek out offsets to fund growth-driven reinvestment. ■ Non-interest expense in Q4 2023 included a $33 million expense related to a FDIC special assessment as well as other elevated expense items that offset a $12 million decline in merger-related expense, which was $7 million for the quarter. $ in m ill io ns Non-Interest Expense: Q3 2023 vs Q4 2023 $304.1 $1.8 $3.5 $2.4 $2.0 $3.3 $19.9 $0.2 $337.2 Q3 2023 NIE Small Equip. Repairs & Maint. Marketing Legal & Title CDI Amort. Non- operating¹ Other Q4 2023 NIE (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. Non-operating expense items include exit and disposal costs, merger-related expense, and a FDIC special assessment. These items are detailed in the “Non-GAAP Reconciliation” section of the Appendix.

Outlook (1) Twelve months ended December 31, 2023 impacted by the February 28, 2023 merger close. (2) The cumulative fair value discount on historical Columbia loans was established as of February 28, 2023, and the allocation between the credit-related discount and the rate-related discount was established at that time. Our disclosure of credit-related and rate-related discount accretion is an estimate based on the relative allocation of these two items to the discount at closing. (3) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. 2023 Results(1) Three Months Ended Twelve Months Ended ($ in millions) December 31, 2023 December 31, 2023 Full-Year 2024 Outlook Notes Average earning assets $47,838 million $45,868 million $48,000 - $49,000 million Assumes balance sheet growth in the 0-3% range from year-end 2023. Net interest margin - GAAP 3.78% 3.91% 3.45% - 3.60% Forward outlook includes 75 bps of rate cuts by the Federal Reserve in the latter part of 2024. Anticipates contraction in 1H24 and stabilization and potential improvement in 2H24. Non-interest bearing deposits declined in January 2024 and were stable in February 2024. Incorporates purchase accounting income. PAA - securities; rate related(2) $37 million $131 million $130 - $140 million Assumes very low prepayment activity; an increase in payoff or paydown speeds would increase income.PAA - loans; rate related(2) $27 million $98 million $90 - $100 million PAA - loans; credit related(2) $5 million $23 million $15 - $20 million Non-interest expense, excluding CDI amortization, merger-related expense, exit and disposal costs, and FDIC special assessment(3) $261 million $987 million $995 - $1,035 million Ongoing operational review to improve efficiency throughout the organization is expected to result in a Q4 2024 core expense run rate of $965 - $985 million annualized. CDI amortization $33 million $111 million ~$120 million Not included in non-interest expense detailed above. Incorporates CDI amortization of $32 million for Q1 2024 and $29 million for each of the remaining three quarters of 2024. Merger-related expense $7 million $172 million $10 - $15 million Not included in non-interest expense detailed above; driven by vesting of prior merger-related items. Effective income tax rate 26.4% 26.0% 26.5% 28

APPENDIX Non-GAAP Reconciliation

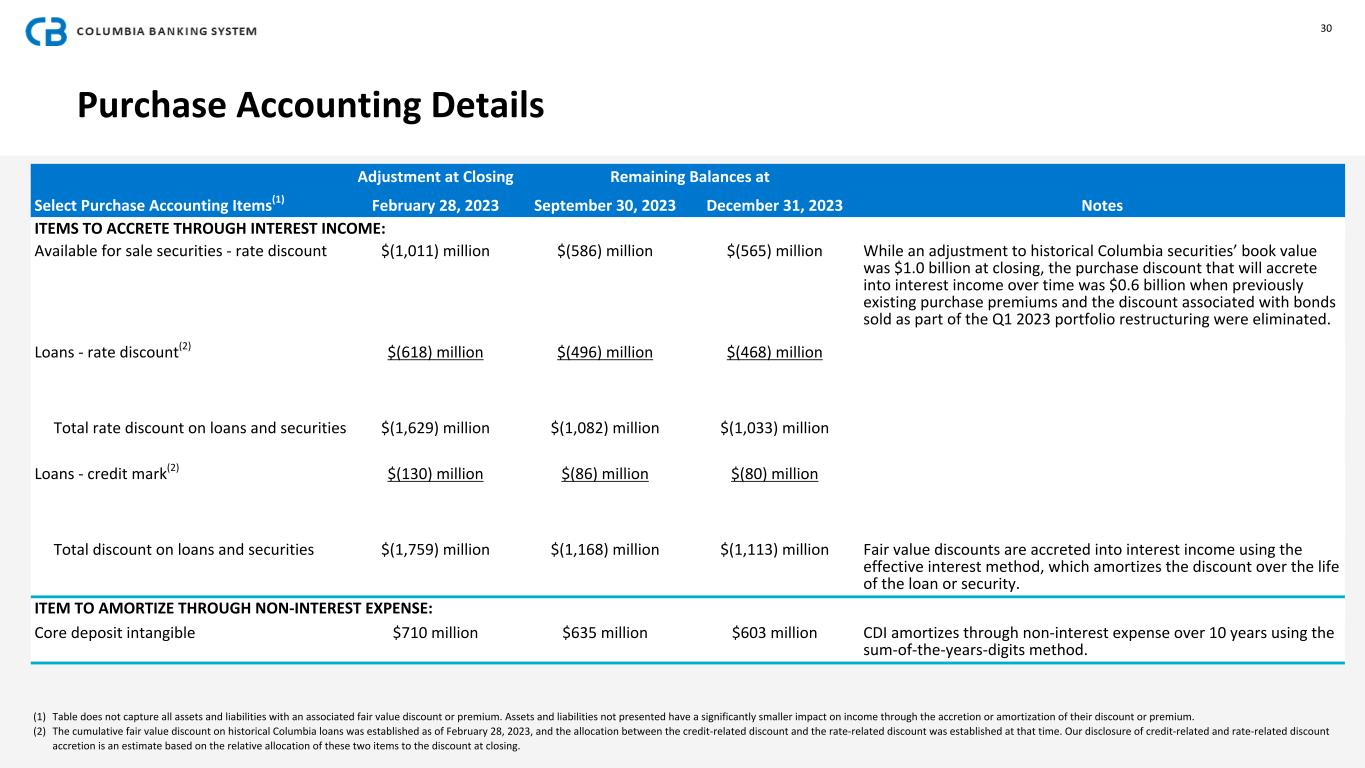

Purchase Accounting Details (1) Table does not capture all assets and liabilities with an associated fair value discount or premium. Assets and liabilities not presented have a significantly smaller impact on income through the accretion or amortization of their discount or premium. (2) The cumulative fair value discount on historical Columbia loans was established as of February 28, 2023, and the allocation between the credit-related discount and the rate-related discount was established at that time. Our disclosure of credit-related and rate-related discount accretion is an estimate based on the relative allocation of these two items to the discount at closing. Adjustment at Closing Remaining Balances at Select Purchase Accounting Items(1) February 28, 2023 September 30, 2023 December 31, 2023 Notes ITEMS TO ACCRETE THROUGH INTEREST INCOME: Available for sale securities - rate discount $(1,011) million $(586) million $(565) million While an adjustment to historical Columbia securities’ book value was $1.0 billion at closing, the purchase discount that will accrete into interest income over time was $0.6 billion when previously existing purchase premiums and the discount associated with bonds sold as part of the Q1 2023 portfolio restructuring were eliminated. Loans - rate discount(2) $(618) million $(496) million $(468) million Total rate discount on loans and securities $(1,629) million $(1,082) million $(1,033) million Loans - credit mark(2) $(130) million $(86) million $(80) million Total discount on loans and securities $(1,759) million $(1,168) million $(1,113) million Fair value discounts are accreted into interest income using the effective interest method, which amortizes the discount over the life of the loan or security. ITEM TO AMORTIZE THROUGH NON-INTEREST EXPENSE: Core deposit intangible $710 million $635 million $603 million CDI amortizes through non-interest expense over 10 years using the sum-of-the-years-digits method. 30

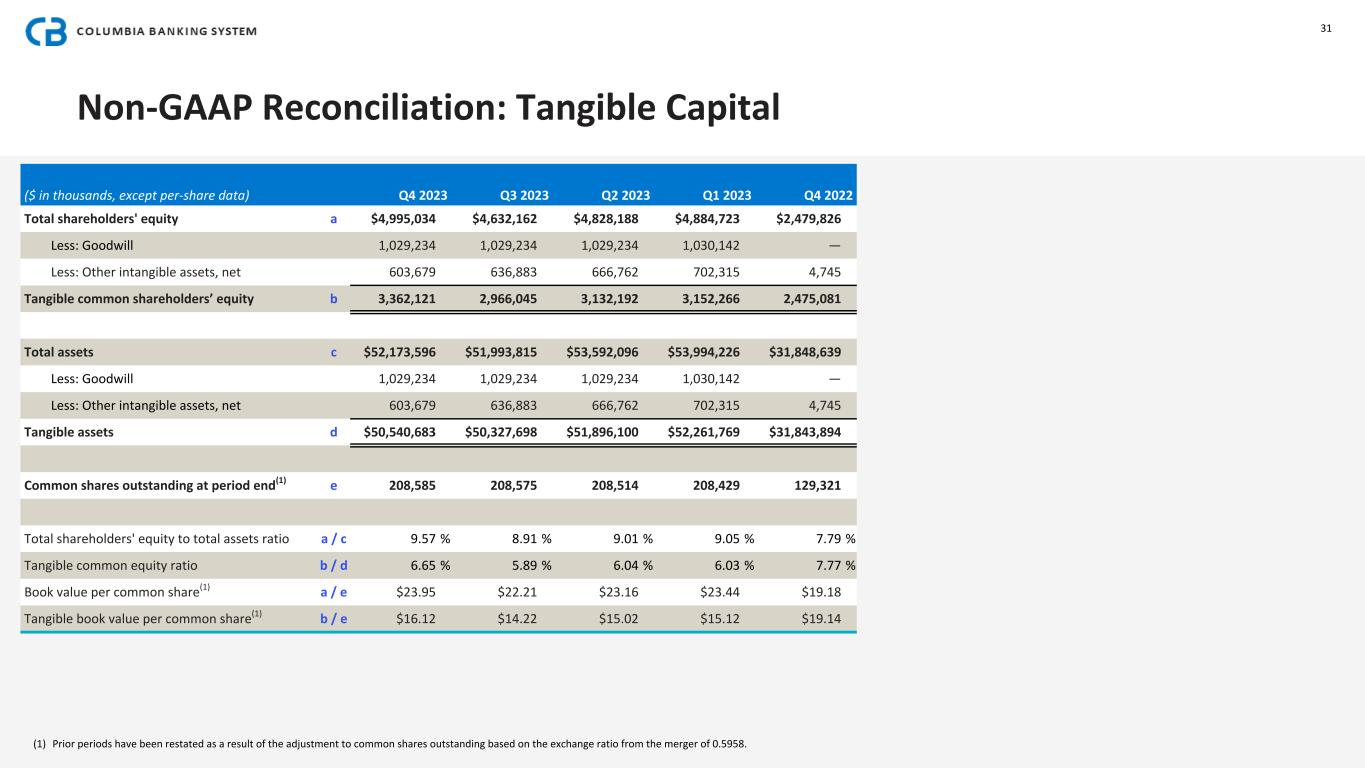

Non-GAAP Reconciliation: Tangible Capital ($ in thousands, except per-share data) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Total shareholders' equity a $4,995,034 $4,632,162 $4,828,188 $4,884,723 $2,479,826 Less: Goodwill 1,029,234 1,029,234 1,029,234 1,030,142 — Less: Other intangible assets, net 603,679 636,883 666,762 702,315 4,745 Tangible common shareholders’ equity b 3,362,121 2,966,045 3,132,192 3,152,266 2,475,081 Total assets c $52,173,596 $51,993,815 $53,592,096 $53,994,226 $31,848,639 Less: Goodwill 1,029,234 1,029,234 1,029,234 1,030,142 — Less: Other intangible assets, net 603,679 636,883 666,762 702,315 4,745 Tangible assets d $50,540,683 $50,327,698 $51,896,100 $52,261,769 $31,843,894 Common shares outstanding at period end(1) e 208,585 208,575 208,514 208,429 129,321 Total shareholders' equity to total assets ratio a / c 9.57 % 8.91 % 9.01 % 9.05 % 7.79 % Tangible common equity ratio b / d 6.65 % 5.89 % 6.04 % 6.03 % 7.77 % Book value per common share(1) a / e $23.95 $22.21 $23.16 $23.44 $19.18 Tangible book value per common share(1) b / e $16.12 $14.22 $15.02 $15.12 $19.14 (1) Prior periods have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. 31

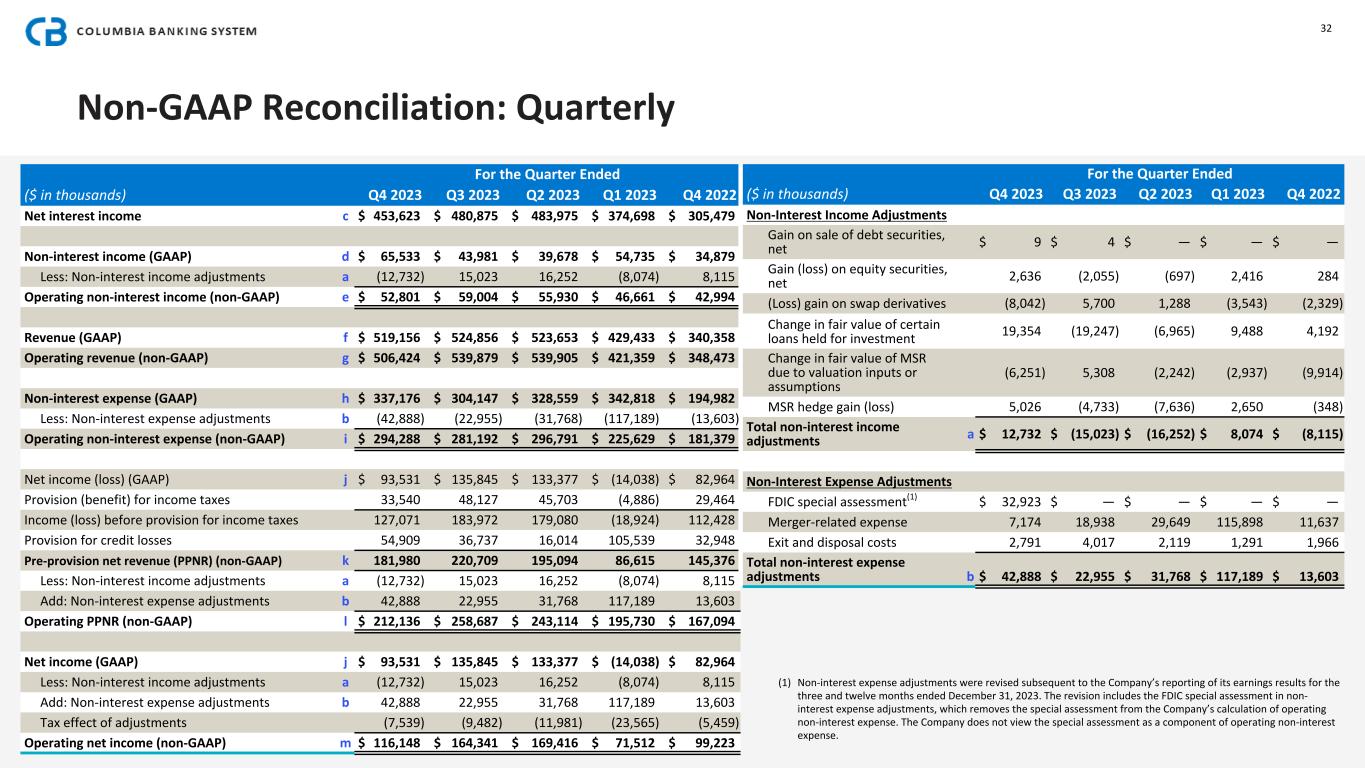

Non-GAAP Reconciliation: Quarterly For the Quarter Ended ($ in thousands) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Net interest income c $ 453,623 $ 480,875 $ 483,975 $ 374,698 $ 305,479 Non-interest income (GAAP) d $ 65,533 $ 43,981 $ 39,678 $ 54,735 $ 34,879 Less: Non-interest income adjustments a (12,732) 15,023 16,252 (8,074) 8,115 Operating non-interest income (non-GAAP) e $ 52,801 $ 59,004 $ 55,930 $ 46,661 $ 42,994 Revenue (GAAP) f $ 519,156 $ 524,856 $ 523,653 $ 429,433 $ 340,358 Operating revenue (non-GAAP) g $ 506,424 $ 539,879 $ 539,905 $ 421,359 $ 348,473 Non-interest expense (GAAP) h $ 337,176 $ 304,147 $ 328,559 $ 342,818 $ 194,982 Less: Non-interest expense adjustments b (42,888) (22,955) (31,768) (117,189) (13,603) Operating non-interest expense (non-GAAP) i $ 294,288 $ 281,192 $ 296,791 $ 225,629 $ 181,379 Net income (loss) (GAAP) j $ 93,531 $ 135,845 $ 133,377 $ (14,038) $ 82,964 Provision (benefit) for income taxes 33,540 48,127 45,703 (4,886) 29,464 Income (loss) before provision for income taxes 127,071 183,972 179,080 (18,924) 112,428 Provision for credit losses 54,909 36,737 16,014 105,539 32,948 Pre-provision net revenue (PPNR) (non-GAAP) k 181,980 220,709 195,094 86,615 145,376 Less: Non-interest income adjustments a (12,732) 15,023 16,252 (8,074) 8,115 Add: Non-interest expense adjustments b 42,888 22,955 31,768 117,189 13,603 Operating PPNR (non-GAAP) l $ 212,136 $ 258,687 $ 243,114 $ 195,730 $ 167,094 Net income (GAAP) j $ 93,531 $ 135,845 $ 133,377 $ (14,038) $ 82,964 Less: Non-interest income adjustments a (12,732) 15,023 16,252 (8,074) 8,115 Add: Non-interest expense adjustments b 42,888 22,955 31,768 117,189 13,603 Tax effect of adjustments (7,539) (9,482) (11,981) (23,565) (5,459) Operating net income (non-GAAP) m $ 116,148 $ 164,341 $ 169,416 $ 71,512 $ 99,223 For the Quarter Ended ($ in thousands) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Non-Interest Income Adjustments Gain on sale of debt securities, net $ 9 $ 4 $ — $ — $ — Gain (loss) on equity securities, net 2,636 (2,055) (697) 2,416 284 (Loss) gain on swap derivatives (8,042) 5,700 1,288 (3,543) (2,329) Change in fair value of certain loans held for investment 19,354 (19,247) (6,965) 9,488 4,192 Change in fair value of MSR due to valuation inputs or assumptions (6,251) 5,308 (2,242) (2,937) (9,914) MSR hedge gain (loss) 5,026 (4,733) (7,636) 2,650 (348) Total non-interest income adjustments a $ 12,732 $ (15,023) $ (16,252) $ 8,074 $ (8,115) Non-Interest Expense Adjustments FDIC special assessment(1) $ 32,923 $ — $ — $ — $ — Merger-related expense 7,174 18,938 29,649 115,898 11,637 Exit and disposal costs 2,791 4,017 2,119 1,291 1,966 Total non-interest expense adjustments b $ 42,888 $ 22,955 $ 31,768 $ 117,189 $ 13,603 32 (1) Non-interest expense adjustments were revised subsequent to the Company’s reporting of its earnings results for the three and twelve months ended December 31, 2023. The revision includes the FDIC special assessment in non- interest expense adjustments, which removes the special assessment from the Company’s calculation of operating non-interest expense. The Company does not view the special assessment as a component of operating non-interest expense.

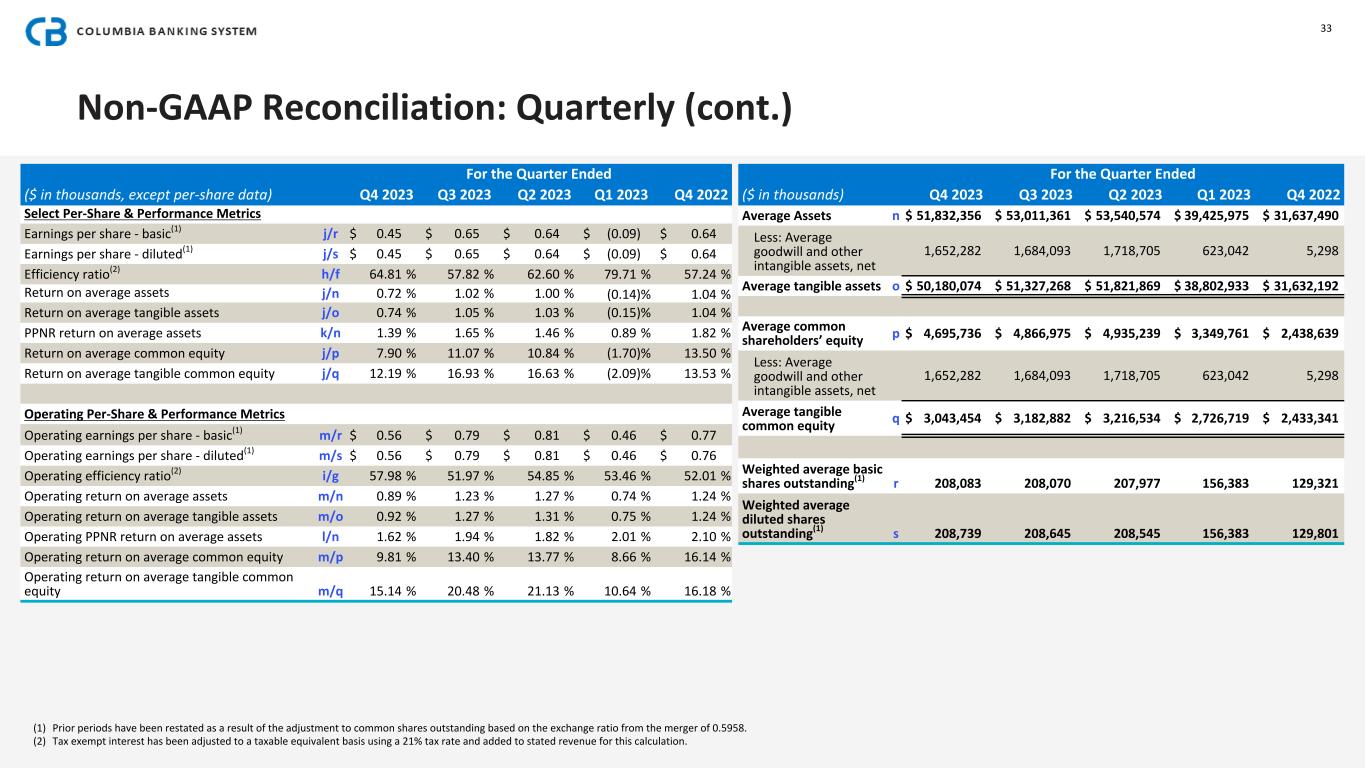

Non-GAAP Reconciliation: Quarterly (cont.) For the Quarter Ended ($ in thousands, except per-share data) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Select Per-Share & Performance Metrics Earnings per share - basic(1) j/r $ 0.45 $ 0.65 $ 0.64 $ (0.09) $ 0.64 Earnings per share - diluted(1) j/s $ 0.45 $ 0.65 $ 0.64 $ (0.09) $ 0.64 Efficiency ratio(2) h/f 64.81 % 57.82 % 62.60 % 79.71 % 57.24 % Return on average assets j/n 0.72 % 1.02 % 1.00 % (0.14) % 1.04 % Return on average tangible assets j/o 0.74 % 1.05 % 1.03 % (0.15) % 1.04 % PPNR return on average assets k/n 1.39 % 1.65 % 1.46 % 0.89 % 1.82 % Return on average common equity j/p 7.90 % 11.07 % 10.84 % (1.70) % 13.50 % Return on average tangible common equity j/q 12.19 % 16.93 % 16.63 % (2.09) % 13.53 % Operating Per-Share & Performance Metrics Operating earnings per share - basic(1) m/r $ 0.56 $ 0.79 $ 0.81 $ 0.46 $ 0.77 Operating earnings per share - diluted(1) m/s $ 0.56 $ 0.79 $ 0.81 $ 0.46 $ 0.76 Operating efficiency ratio(2) i/g 57.98 % 51.97 % 54.85 % 53.46 % 52.01 % Operating return on average assets m/n 0.89 % 1.23 % 1.27 % 0.74 % 1.24 % Operating return on average tangible assets m/o 0.92 % 1.27 % 1.31 % 0.75 % 1.24 % Operating PPNR return on average assets l/n 1.62 % 1.94 % 1.82 % 2.01 % 2.10 % Operating return on average common equity m/p 9.81 % 13.40 % 13.77 % 8.66 % 16.14 % Operating return on average tangible common equity m/q 15.14 % 20.48 % 21.13 % 10.64 % 16.18 % For the Quarter Ended ($ in thousands) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Average Assets n $ 51,832,356 $ 53,011,361 $ 53,540,574 $ 39,425,975 $ 31,637,490 Less: Average goodwill and other intangible assets, net 1,652,282 1,684,093 1,718,705 623,042 5,298 Average tangible assets o $ 50,180,074 $ 51,327,268 $ 51,821,869 $ 38,802,933 $ 31,632,192 Average common shareholders’ equity p $ 4,695,736 $ 4,866,975 $ 4,935,239 $ 3,349,761 $ 2,438,639 Less: Average goodwill and other intangible assets, net 1,652,282 1,684,093 1,718,705 623,042 5,298 Average tangible common equity q $ 3,043,454 $ 3,182,882 $ 3,216,534 $ 2,726,719 $ 2,433,341 Weighted average basic shares outstanding(1) r 208,083 208,070 207,977 156,383 129,321 Weighted average diluted shares outstanding(1) s 208,739 208,645 208,545 156,383 129,801 (1) Prior periods have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. (2) Tax exempt interest has been adjusted to a taxable equivalent basis using a 21% tax rate and added to stated revenue for this calculation. 33

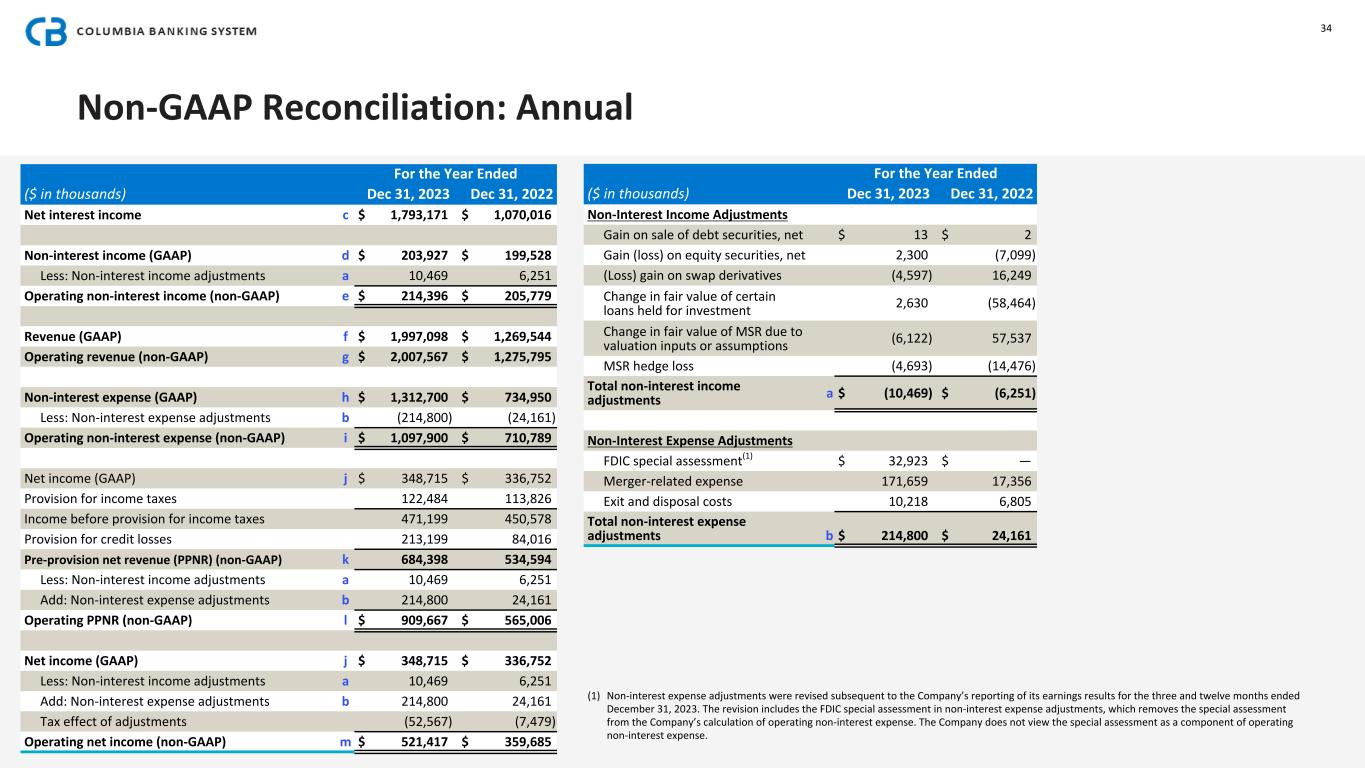

Non-GAAP Reconciliation: Annual For the Year Ended ($ in thousands) Dec 31, 2023 Dec 31, 2022 Net interest income c $ 1,793,171 $ 1,070,016 Non-interest income (GAAP) d $ 203,927 $ 199,528 Less: Non-interest income adjustments a 10,469 6,251 Operating non-interest income (non-GAAP) e $ 214,396 $ 205,779 Revenue (GAAP) f $ 1,997,098 $ 1,269,544 Operating revenue (non-GAAP) g $ 2,007,567 $ 1,275,795 Non-interest expense (GAAP) h $ 1,312,700 $ 734,950 Less: Non-interest expense adjustments b (214,800) (24,161) Operating non-interest expense (non-GAAP) i $ 1,097,900 $ 710,789 Net income (GAAP) j $ 348,715 $ 336,752 Provision for income taxes 122,484 113,826 Income before provision for income taxes 471,199 450,578 Provision for credit losses 213,199 84,016 Pre-provision net revenue (PPNR) (non-GAAP) k 684,398 534,594 Less: Non-interest income adjustments a 10,469 6,251 Add: Non-interest expense adjustments b 214,800 24,161 Operating PPNR (non-GAAP) l $ 909,667 $ 565,006 Net income (GAAP) j $ 348,715 $ 336,752 Less: Non-interest income adjustments a 10,469 6,251 Add: Non-interest expense adjustments b 214,800 24,161 Tax effect of adjustments (52,567) (7,479) Operating net income (non-GAAP) m $ 521,417 $ 359,685 For the Year Ended ($ in thousands) Dec 31, 2023 Dec 31, 2022 Non-Interest Income Adjustments Gain on sale of debt securities, net $ 13 $ 2 Gain (loss) on equity securities, net 2,300 (7,099) (Loss) gain on swap derivatives (4,597) 16,249 Change in fair value of certain loans held for investment 2,630 (58,464) Change in fair value of MSR due to valuation inputs or assumptions (6,122) 57,537 MSR hedge loss (4,693) (14,476) Total non-interest income adjustments a $ (10,469) $ (6,251) Non-Interest Expense Adjustments FDIC special assessment(1) $ 32,923 $ — Merger-related expense 171,659 17,356 Exit and disposal costs 10,218 6,805 Total non-interest expense adjustments b $ 214,800 $ 24,161 34 (1) Non-interest expense adjustments were revised subsequent to the Company’s reporting of its earnings results for the three and twelve months ended December 31, 2023. The revision includes the FDIC special assessment in non-interest expense adjustments, which removes the special assessment from the Company’s calculation of operating non-interest expense. The Company does not view the special assessment as a component of operating non-interest expense.

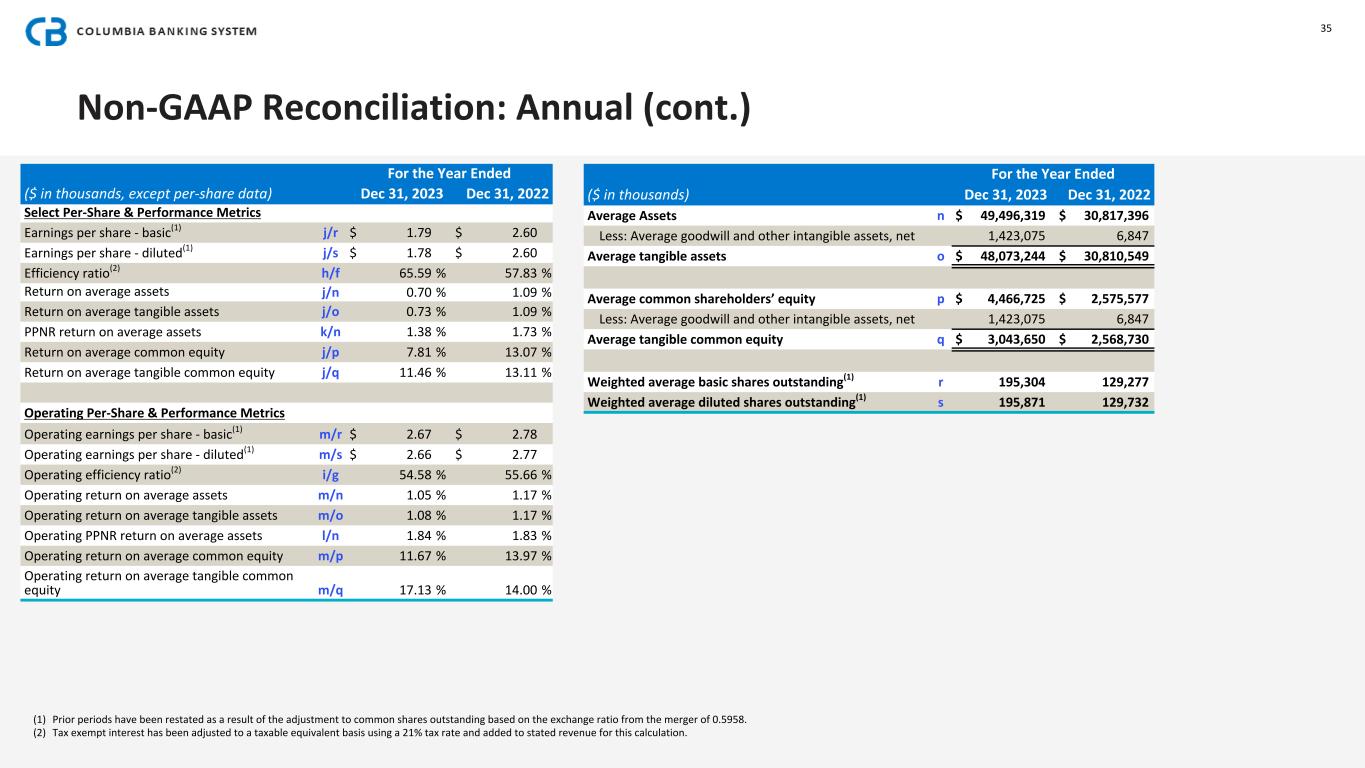

Non-GAAP Reconciliation: Annual (cont.) For the Year Ended ($ in thousands, except per-share data) Dec 31, 2023 Dec 31, 2022 Select Per-Share & Performance Metrics Earnings per share - basic(1) j/r $ 1.79 $ 2.60 Earnings per share - diluted(1) j/s $ 1.78 $ 2.60 Efficiency ratio(2) h/f 65.59 % 57.83 % Return on average assets j/n 0.70 % 1.09 % Return on average tangible assets j/o 0.73 % 1.09 % PPNR return on average assets k/n 1.38 % 1.73 % Return on average common equity j/p 7.81 % 13.07 % Return on average tangible common equity j/q 11.46 % 13.11 % Operating Per-Share & Performance Metrics Operating earnings per share - basic(1) m/r $ 2.67 $ 2.78 Operating earnings per share - diluted(1) m/s $ 2.66 $ 2.77 Operating efficiency ratio(2) i/g 54.58 % 55.66 % Operating return on average assets m/n 1.05 % 1.17 % Operating return on average tangible assets m/o 1.08 % 1.17 % Operating PPNR return on average assets l/n 1.84 % 1.83 % Operating return on average common equity m/p 11.67 % 13.97 % Operating return on average tangible common equity m/q 17.13 % 14.00 % For the Year Ended ($ in thousands) Dec 31, 2023 Dec 31, 2022 Average Assets n $ 49,496,319 $ 30,817,396 Less: Average goodwill and other intangible assets, net 1,423,075 6,847 Average tangible assets o $ 48,073,244 $ 30,810,549 Average common shareholders’ equity p $ 4,466,725 $ 2,575,577 Less: Average goodwill and other intangible assets, net 1,423,075 6,847 Average tangible common equity q $ 3,043,650 $ 2,568,730 Weighted average basic shares outstanding(1) r 195,304 129,277 Weighted average diluted shares outstanding(1) s 195,871 129,732 (1) Prior periods have been restated as a result of the adjustment to common shares outstanding based on the exchange ratio from the merger of 0.5958. (2) Tax exempt interest has been adjusted to a taxable equivalent basis using a 21% tax rate and added to stated revenue for this calculation. 35

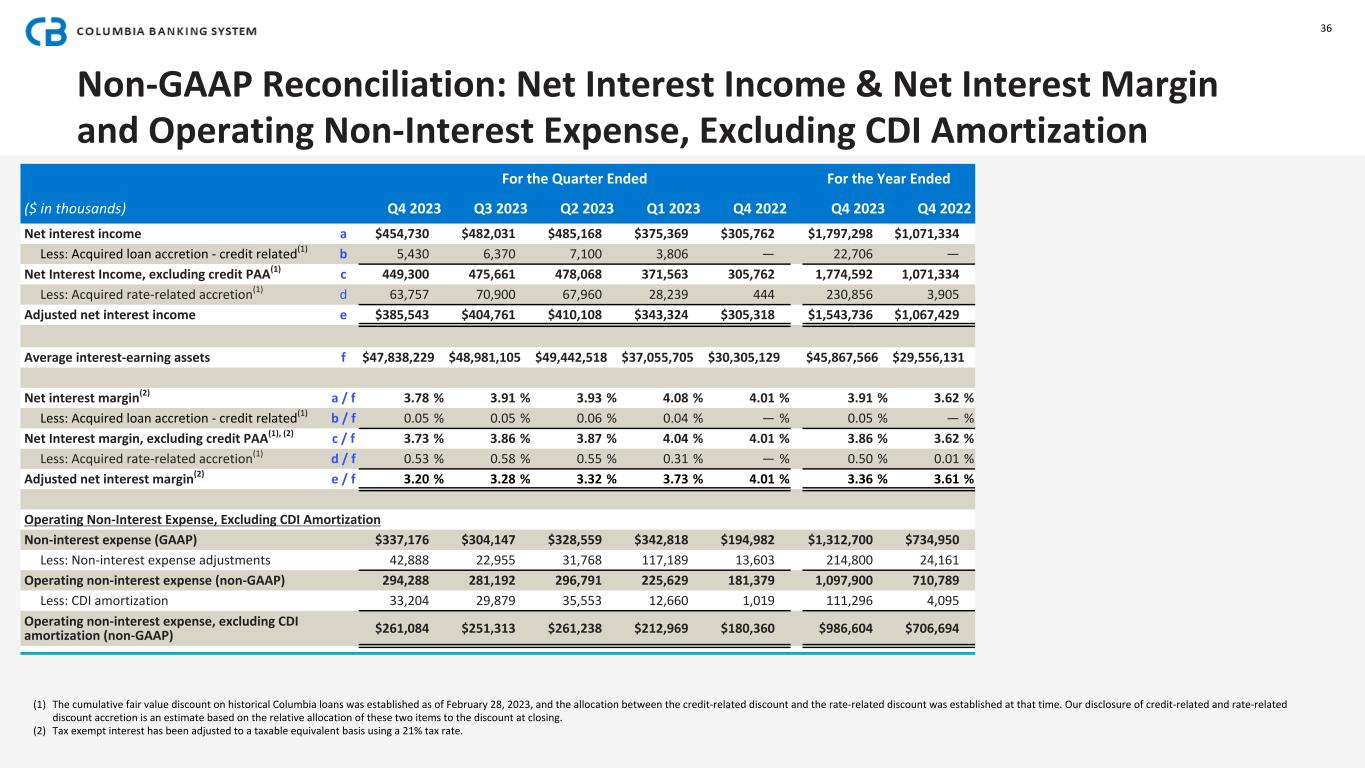

Non-GAAP Reconciliation: Net Interest Income & Net Interest Margin and Operating Non-Interest Expense, Excluding CDI Amortization (1) The cumulative fair value discount on historical Columbia loans was established as of February 28, 2023, and the allocation between the credit-related discount and the rate-related discount was established at that time. Our disclosure of credit-related and rate-related discount accretion is an estimate based on the relative allocation of these two items to the discount at closing. (2) Tax exempt interest has been adjusted to a taxable equivalent basis using a 21% tax rate. 36 For the Quarter Ended For the Year Ended ($ in thousands) Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q4 2023 Q4 2022 Net interest income a $454,730 $482,031 $485,168 $375,369 $305,762 $1,797,298 $1,071,334 Less: Acquired loan accretion - credit related(1) b 5,430 6,370 7,100 3,806 — 22,706 — Net Interest Income, excluding credit PAA(1) c 449,300 475,661 478,068 371,563 305,762 1,774,592 1,071,334 Less: Acquired rate-related accretion(1) d 63,757 70,900 67,960 28,239 444 230,856 3,905 Adjusted net interest income e $385,543 $404,761 $410,108 $343,324 $305,318 $1,543,736 $1,067,429 Average interest-earning assets f $47,838,229 $48,981,105 $49,442,518 $37,055,705 $30,305,129 $45,867,566 $29,556,131 Net interest margin(2) a / f 3.78 % 3.91 % 3.93 % 4.08 % 4.01 % 3.91 % 3.62 % Less: Acquired loan accretion - credit related(1) b / f 0.05 % 0.05 % 0.06 % 0.04 % — % 0.05 % — % Net Interest margin, excluding credit PAA(1), (2) c / f 3.73 % 3.86 % 3.87 % 4.04 % 4.01 % 3.86 % 3.62 % Less: Acquired rate-related accretion(1) d / f 0.53 % 0.58 % 0.55 % 0.31 % — % 0.50 % 0.01 % Adjusted net interest margin(2) e / f 3.20 % 3.28 % 3.32 % 3.73 % 4.01 % 3.36 % 3.61 % Operating Non-Interest Expense, Excluding CDI Amortization Non-interest expense (GAAP) $337,176 $304,147 $328,559 $342,818 $194,982 $1,312,700 $734,950 Less: Non-interest expense adjustments 42,888 22,955 31,768 117,189 13,603 214,800 24,161 Operating non-interest expense (non-GAAP) 294,288 281,192 296,791 225,629 181,379 1,097,900 710,789 Less: CDI amortization 33,204 29,879 35,553 12,660 1,019 111,296 4,095 Operating non-interest expense, excluding CDI amortization (non-GAAP) $261,084 $251,313 $261,238 $212,969 $180,360 $986,604 $706,694