Prospectus Supplement Filed Pursuant to Rule 424(b)(3)

Registration No. 333-190798

Common Stock

26,499,996 Shares of Common Stock Underlying Secured Convertible Promissory Notes and Warrants

PROSPECTUS SUPPLEMENT NO. 2

DATED NOVEMBER 13, 2013

(To Prospectus Dated September 27, 2013)

This Prospectus Supplement No. 2 supplements information contained in, and should be read in conjunction with, that certain Prospectus, dated September 27, 2013, as amended and supplemented from time to time, of Adamis Pharmaceuticals Corporation, relating to the offer and sale from time to time by the selling stockholders named therein of up to 26,499,996 shares of our common stock (as amended and supplemented from time to time, the “Prospectus”). This Prospectus Supplement No. 2 is not complete without, and may not be delivered or used except in connection with, the original Prospectus, including all amendments and supplements thereto.

This Prospectus Supplement No. 2 includes the attached Quarterly Report on Form 10-Q for the quarter ended September 30, 2013, as filed by the Company with the Securities and Exchange Commission on November 13, 2013.

We may further amend or supplement the Prospectus from time to time by filing additional amendments or supplements as required. You should read the entire Prospectus and any amendments or supplements carefully before you make an investment decision.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this Prospectus Supplement No. 1 (or the Prospectus, including any supplements or amendments thereto) is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement No. 2 is November 13, 2013.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2013

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _______________________ to _______________________

Commission File Number: 0-26372

ADAMIS PHARMACEUTICALS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

82-0429727

|

|

|

(State or other jurisdiction of incorporation

or organization)

|

(I.R.S. Employer Identification Number)

|

11455 El Camino Real, Suite 310, San Diego, CA 92130

(Address of principal executive offices, including zip code)

(858) 997-2400

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “larger accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares outstanding of the issuer’s common stock, par value $0.0001 per share, as of November 4, 2013, was 104,876,409.

ADAMIS PHARMACEUTICALS, INC.

CONTENTS OF QUARTERLY REPORT ON FORM 10-Q

|

Page

|

|||

|

PART I FINANCIAL INFORMATION

|

|||

|

Item 1.

|

Financial Statements:

|

||

|

3

|

|||

|

4

|

|||

|

5

|

|||

|

7

|

|||

|

Item 2.

|

14

|

||

|

Item 3.

|

17

|

||

|

Item 4.

|

17

|

||

|

PART II OTHER INFORMATION

|

|||

|

Item 1.

|

18

|

||

|

Item 1A.

|

18

|

||

|

Item 2.

|

18

|

||

|

Item 3.

|

18

|

||

|

Item 4.

|

18

|

||

|

Item 5.

|

18

|

||

|

Item 6.

|

19

|

||

|

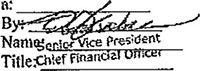

Signatures

|

|||

2

|

ADAMIS PHARMACEUTICALS CORPORATION AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

September 30, 2013

|

||||||||

|

ASSETS

|

(Unaudited)

|

March 31, 2013

|

||||||

|

CURRENT ASSETS

|

||||||||

|

Cash

|

$ | 119,579 | $ | — | ||||

|

Prepaid Expenses and Other Current Assets

|

55,100 | 64,347 | ||||||

|

Non-refundable Deposit

|

3,000,000 | — | ||||||

|

Debt Issuance Cost

|

347,986 | 286,582 | ||||||

|

Total Assets

|

$ | 3,522,665 | $ | 350,929 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts Payable

|

$ | 2,335,177 | $ | 2,431,919 | ||||

|

Accrued Other Expenses

|

562,322 | 754,709 | ||||||

|

Accrued Bonuses

|

101,436 | 101,436 | ||||||

|

Conversion Feature Derivative, at fair value

|

381,026 | 162,456 | ||||||

|

Down-round Protection Derivative, at fair value

|

730,843 | 50,545 | ||||||

|

Warrant Derivative, at fair value

|

377,126 | — | ||||||

|

Warrant Down-round Protection Derivative, at fair value

|

771,156 | — | ||||||

|

Convertible Notes Payable, net

|

561,295 | 982,997 | ||||||

|

Secured Convertible Prommisory Notes, net

|

2,456,393 | — | ||||||

|

Other Notes Payable

|

97,683 | 97,683 | ||||||

|

Notes Payable to Related Party

|

81,232 | 97,122 | ||||||

|

Total Liabilities

|

8,455,689 | 4,678,867 | ||||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Preferred Stock – Par Value $.0001; 10,000,000 Shares

|

||||||||

|

Authorized; Issued and Outstanding-None

|

— | — | ||||||

|

Common Stock – Par Value $.0001; 200,000,000 Shares Authorized;

|

||||||||

|

110,104,597 and 109,656,180 Issued, 104,876,409 and 104,427,992 Outstanding, Respectively

|

11,011 | 10,966 | ||||||

|

Additional Paid-in Capital

|

34,112,775 | 33,643,449 | ||||||

|

Accumulated Deficit

|

(39,051,581 | ) | (37,977,124 | ) | ||||

|

Treasury Stock - 5,228,188 Shares, at cost

|

(5,229 | ) | (5,229 | ) | ||||

|

Total Stockholders' (Deficit)

|

(4,933,024 | ) | (4,327,938 | ) | ||||

| $ | 3,522,665 | $ | 350,929 | |||||

|

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

|

||||||||

3

|

ADAMIS PHARMACEUTICALS CORPORATION AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

September 30, 2013

|

September 30, 2012

|

September 30, 2013

|

September 30, 2012

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||||||

|

REVENUE

|

$ | — | $ | — | $ | — | $ | — | ||||||||

|

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

|

762,078 | 429,742 | 1,277,322 | 1,047,108 | ||||||||||||

|

RESEARCH AND DEVELOPMENT

|

194,954 | 421,403 | 419,470 | 528,760 | ||||||||||||

|

Loss from Operations

|

(957,032 | ) | (851,145 | ) | (1,696,792 | ) | (1,575,868 | ) | ||||||||

|

OTHER INCOME (EXPENSE)

|

||||||||||||||||

|

Interest Expense

|

(2,777,575 | ) | (579,330 | ) | (3,182,459 | ) | (874,295 | ) | ||||||||

|

Change in Fair Value Derivative Liabilities

|

(244,198 | ) | (105,636 | ) | (203,653 | ) | (77,036 | ) | ||||||||

|

Change in Fair Value of Conversion Feature Liability

|

2,542,344 | 678,636 | 2,603,981 | (1,056,673 | ) | |||||||||||

|

Change in Fair Value of Warrants Liability

|

1,404,466 | — | 1,404,466 | — | ||||||||||||

|

Total Other Income (Expense)

|

925,037 | (6,330 | ) | 622,335 | (2,008,004 | ) | ||||||||||

|

Net (Loss)

|

$ | (31,995 | ) | $ | (857,475 | ) | (1,074,457 | ) | $ | (3,583,872 | ) | |||||

|

Basic and Diluted Gain (Loss) Per Share

|

$ | — | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.04 | ) | |||||

|

Basic and Diluted Weighted Average Shares Outstanding

|

104,875,832 | 98,293,417 | 104,659,058 | 97,743,066 | ||||||||||||

|

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

|

||||||||||||||||

4

|

ADAMIS PHARMACEUTICALS CORPORATION AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

Six Months Ended September 30,

|

||||||||

|

2013

|

2012

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net (Loss)

|

$ | (1,074,457 | ) | $ | (3,583,872 | ) | ||

|

Adjustments to Reconcile Net (Loss) to Net

|

||||||||

|

Cash (Used in) Operating Activities:

|

||||||||

|

Vesting of Options for Compensation

|

145,871 | 74,134 | ||||||

|

Change in Derivative Liabilities Fair Value

|

203,653 | 77,036 | ||||||

|

Change in Conversion Feature Liability Fair Value

|

(2,603,981 | ) | (1,401,056,673 | |||||

| Change in Warrant Liability Fair Value | (1,404,466 | ) | ||||||

|

Amortization of Discount on Notes Payable

|

2,534,691 | 359,142 | ||||||

|

Amortization of Debt Issuance Costs

|

444,445 | 427,506 | ||||||

|

Amortization of Stock Issued for Services

|

35,500 | — | ||||||

|

Change in Assets and Liabilities:

|

||||||||

|

(Increase) Decrease in:

|

||||||||

|

Prepaid Expenses and Other Current Assets

|

(26,253 | ) | (29,904 | ) | ||||

|

Increase (Decrease) in:

|

||||||||

|

Accounts Payable

|

(96,742 | ) | (176,709 | ) | ||||

|

Accrued Other Expenses

|

(140,443 | ) | (137,036 | ) | ||||

|

Net Cash (Used in) Operating Activities

|

(1,982,182 | ) | (1,933,030 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Payments of Non-refundable deposit | (3,000,000 | ) | — | |||||

| Net Cash (Used in) Investing Activities | (3,000,000 | ) | — | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Proceeds from Notes Payable

|

5,875,000 | 2,000,000 | ||||||

|

Payment of Notes Payable

|

(471,000 | ) | (40,000 | ) | ||||

|

Cash Paid for Debt Issuance Costs

|

(286,349 | ) | — | |||||

|

Payment of Notes Payable to Related Parties

|

(15,890 | ) | (24,400 | ) | ||||

|

Net Cash Provided by Financing Activities

|

5,101,761 | 1,935,600 | ||||||

|

Increase in Cash

|

119,579 | 2,570 | ||||||

|

Cash:

|

||||||||

|

Beginning

|

— | 7,519 | ||||||

|

Ending

|

$ | 119,579 | $ | 10,089 | ||||

|

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements

|

||||||||

5

|

ADAMIS PHARMACEUTICALS CORPORATION AND SUBSIDIARIES

|

||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||||||||||||

|

Six Months Ended September 30,

|

||||||||

|

2013

|

2012

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

||||||||

|

Cash Paid for Interest

|

$ | 208,667 | $ | 13,056 | ||||

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING AND

|

||||||||

|

INVESTING ACTIVITIES

|

||||||||

|

Common Stock issued for Exercised Warrants and/or Options

|

$ | 25 | $ | 41 | ||||

|

Common Stock issued for Debt Issuance Cost

|

$ | — | $ | 990,000 | ||||

|

Note Payable Discounts from Deriviative and Convertible Feature Liabilities, and Warrants

|

$ | 5,962,763 | $ | 539,764 | ||||

|

Additional Paid-In Capital from Notes Payable Discount

|

$ | — | $ | 172,727 | ||||

|

Accrued Interest Applied to Principal Balance

|

$ | 51,944 | $ | — | ||||

|

Notes Payable Converted to Common Stock

|

$ | 104,000 | $ | — | ||||

|

Stock Based Compensation Expense

|

$ | 145,871 | $ | 74,134 | ||||

|

Warrants Issued for Debt Costs

|

$ | 219,500 | $ | — | ||||

|

Settlement of Derivative Liability though Modification of Note

|

$ | 110,818 | $ | — | ||||

|

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

|

||||||||

6

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1: Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Articles 8 and 10 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”). Accordingly, certain information and footnote disclosures normally included in annual financial statements have been condensed or omitted. In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements reflect all adjustments (including normal recurring adjustments and the elimination of intercompany accounts) considered necessary for a fair statement of all periods presented. The results of Adamis Pharmaceuticals Corporation operations for any interim periods are not necessarily indicative of the results of operations for any other interim period or for a full fiscal year. These unaudited interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2013.

Liquidity and Capital Resources

Our cash and cash equivalents were $119,579 and $0 at September 30, 2013 and March 31, 2013, respectively.

We prepared the condensed consolidated financial statements assuming that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities during the normal course of business. In preparing these condensed consolidated financial statements, consideration was given to the Company’s future business as described below, which may preclude the Company from realizing the value of certain assets.

The Company has negative working capital, liabilities that exceed its assets and significant cash flow deficiencies. Additionally, the Company will need significant funding for future operations and the expenditures that will be required to conduct the clinical and regulatory work to develop the Company’s product candidates. Management’s plans include seeking additional funding to satisfy existing obligations, liabilities and future working capital needs, to build working capital reserves and to fund its research and development projects. There is no assurance that the Company will be successful in obtaining the necessary funding to meet its business objectives.

Basic and Diluted (Loss) per Share

The Company computes basic loss per share by dividing the loss attributable to holders of common stock for the period by the weighted average number of shares of common stock outstanding during the period. Since the effect of common stock equivalents was anti-dilutive, all such equivalents were excluded from the calculation of weighted average shares outstanding. Potential dilutive securities, which are not included in dilutive weighted averages shares for the three and six month periods ended September 30, 2013 and September 30, 2012 consist of outstanding stock options and other compensation arrangements (7,600,315 and 5,331,112, respectively), outstanding warrants (15,538,668 and 1,804,645, respectively), and potential common stock to be issued upon conversion of convertible debt (14,095,225 and 5,818,182, respectively).

Recent Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board (“FASB”) issued accounting guidance on the presentation of an unrecognized tax benefit when a net operating loss carryforward exists. Under this guidance, an unrecognized tax benefit, or a portion of an unrecognized tax benefit, should be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward. This guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. Other than a potential change in presentation within the consolidated balance sheet, this accounting guidance will not have an impact on our consolidated financial position, results of operations or cash flows.

Note 2: Notes Payable

10% Secured Convertible Note

On June 11, 2012, the Company completed the closing of a private placement financing transaction with Gemini. The Company issued a 10% Senior Convertible Note in the aggregate principal amount of $500,000 (“Gemini Note II”) and 500,000 shares of common stock, and received gross proceeds of $500,000, excluding transaction costs and expenses. The maturity date was originally nine months after the date of the note, but was extended to July 11, 2013 on the original maturity date. The Gemini Note II was convertible into shares of common stock at any time at the discretion of the investor at an initial conversion price per share of $0.55, subject to adjustment for stock splits, stock dividends and other similar transactions and subject to the terms of the Gemini Note II. The conversion price was also subject to price anti-dilution adjustments (or down-round protection) providing that with the exception of certain excluded categories of issuances and transactions, if we issue equity securities or securities convertible into equity securities at an effective price per share less than the conversion price of the Gemini Note II, the conversion price of the Gemini Note II will be adjusted downward to equal the per share price of the new securities. The Company bifurcated the conversion option derivative from the debt. See Note 3. Our obligations under the Gemini Note II and the other transaction agreements were guaranteed by our principal subsidiaries, including Adamis Corporation, Adamis Laboratories, Inc. and Adamis Viral, Inc. The Gemini Note II, including accrued interest of $51,944, was exchanged for Secured Notes and Warrants as part of the Company’s June 26, 2013 private placement transaction, and is no longer outstanding.

7

Secured Convertible Promissory Notes

On June 26, 2013, the Company completed the closing of a private placement financing transaction (the “Transaction”) with a small number of accredited institutional investors. Pursuant to a Subscription Agreement (the “Purchase Agreement”) and other transaction documents, we issued Secured Convertible Promissory Notes (“Secured Notes”) and common stock purchase warrants (“Warrants”) to purchase up to 13,004,316 shares of common stock ("Warrant Shares"), and received gross cash proceeds of $5,300,000, of which $286,349 was used to pay for transaction costs, fees and expenses. The Secured Notes have an aggregate principal amount of $6,502,158, including a $613,271 principal amount note issued to Gemini Master Fund Ltd. in exchange for its previously outstanding Gemini Note II, which is no longer outstanding. The maturity date of the Secured Notes is December 26, 2013. Our obligations under the Secured Notes and the other transaction documents are guaranteed by our principal subsidiaries and, pursuant to a Security Agreement entered into with the investors, are secured by a security interest in substantially all of our assets and those of the subsidiaries. The Secured Notes are convertible into shares of common stock at any time at the discretion of the investor at an initial conversion price per share of $0.50. The conversion prices of the Secured Notes and the Warrants are subject to anti-dilution provisions providing that, with the exception of certain excluded categories of issuances and transactions, if we issue any shares of common stock or securities convertible into or exercisable for common stock, or if common stock equivalents are repriced, at an effective price per share less than the conversion price of the Secured Notes or the exercise price of the Warrants (as applicable), without the consent of a majority in interest of the investors, the conversion price of the Secured Notes and Warrants will be adjusted downward to equal the per share price of the securities issued or deemed issued in such transaction. The Company bifurcated the conversion feature derivative and down-round protection derivative from the debt, and recorded a discount totaling $3,564,483 as a result. See Note 3.

The Warrants are exercisable for a period of five years from the date of issuance. The exercise price of the Warrants is $0.715 per share, which was 110% of the closing price of the common stock on the day before the closing. The Warrants provide for proportional adjustment of the number and kind of securities purchasable upon exercise of the Warrants and the per share exercise price upon the occurrence of certain specified events, and include price anti-dilution provisions which provide for an adjustment to the per share exercise price of the Warrants and the number of shares issuable upon exercise of the Warrants, if the Company issues common stock or common stock equivalents at effective per share prices lower than the exercise price of the Warrants, on terms similar in material respects to the anti-dilution provisions relating to the Secured Notes.

Provided (i) there is an effective registration statement that covers resale of all of the Warrant Shares, or (ii) all of the Warrant Shares may be sold pursuant to Rule 144 upon cashless exercise without restrictions including without volume limitations or manner of sale requirements, each such event referred to as a Trigger Condition, the company has the option to “call” the exercise of any or all of the Warrant, referred to as a Warrant Call, from time to time by giving a Call Notice to the holder. The company’s right to exercise a Warrant Call commences five trading days after either of the Trigger Conditions has been in effect continuously for 15 trading days. A holder has the right to cancel the Warrant Call up until the date the called Warrant Shares are actually delivered to the holder, such date referred to as the Warrant Call Delivery Date, if the Trigger Condition relied upon for the Warrant Call ceases to apply. A Call Notice may not be given within 30 days of the expiration of the term of the Warrants. In addition, a Call Notice may be given not sooner than 15 trading days after the Warrant Call Delivery Date of the immediately preceding Call Notice.

We may give a Call Notice only within 10 trading days after any 20-consecutive trading day period during which the volume weighted average price ("VWAP") of our common stock is not less than 250% of the exercise price for the Warrants in effect for 10 out of such 20-consecutive trading day period. The maximum amount of Warrant Shares that may be included in a Call Notice will be reduced for the holder to the extent necessary so as to prevent the holder from exceeding the beneficial ownership limitation described in the warrants. In addition, a Call Notice may not be given after the occurrence of an event of default. Subject to the foregoing, a holder must exercise the Warrant and purchase the called Warrant Shares within 14 trading days after the Call Date, or the Warrant will be cancelled with respect to the unexercised portion of the Warrant that was subject to the Call Notice. Call Notices generally must be given to all Warrant holders.

The Warrants with the embedded call option as of September 30, 2013 were valued using the Binomial Option Pricing Model. The average fair value of a single Warrant, including the call option, was $0.0290 per share and the average value of the Warrant anti-dilution reset feature was $0.0593per share as of September 30, 2013. As a result, the Company recorded a discount to the Notes for the warrant derivative and warrant down-round protection derivative totaling $1,148,282. See Note 3.

The Secured Notes have a stated interest rate of 0% and were issued with an original issue discount of $539,395. The effective annual interest rate of the note is 199.6%.

The total discount balance related to the Secured Notes resulting from anti-dilution provisions, the conversion features and warrants and original issue discount was $6,502,158 as of June 30, 2013, and is amortized to interest expense using the effective interest method: Amortization for the three months ended September 30, 2013 was $2,456,393.

8

In conjunction with the private placement financing transaction, the Company issued warrants to a private placements agent to purchase up to 844,444 shares of common stock. The fair market value of the warrants at the time of issuance was $152,000 and was recorded as debt issuance costs. The costs are being amortized to interest expense over the life of Secured Notes. Amortization expense for the quarter ended September 30, 2013 was $76,415. See Note 6.

Convertible Notes Payable

On December 31, 2012, the Company issued a convertible promissory note in the principal amount of $600,000 and 600,000 shares of common stock to a private investor, and received gross proceeds of $600,000, excluding transaction costs and expenses. Interest on the outstanding principal balance of the note accrues at a rate of 10% per annum compounded monthly and is payable monthly commencing February 1, 2013. All unpaid principal and interest on the note was due and payable on September 30, 2013. In connection with the June 26, 2013 private placement transaction, the maturity date of the note was extended to March 26, 2014. At any time on or before the maturity date, the investor has the right to convert part or all of the principal and interest owed under the note into common stock at a conversion price equal to $0.55 per share (subject to adjustment for stock dividends, stock splits, reverse stock splits, reclassifications or other similar events affecting the number of outstanding shares of common stock). The market value of the common stock on the date issued was $0.71 per share, for a total value of $426,000. Debt issuance cost of $426,000 was recorded as a result, and is being amortized over the term of the note. The stock is restricted for six months from the date issued. Amortization of the debt issuance cost, which is included in interest expense, was $190,768 for the six month period ended September 30, 2013, and the remaining unamortized balance at September 30, 2013 was $95,814.

The conversion feature of the note is considered beneficial to the investor due to the conversion price for the convertible note being lower than the market value of the common stock on the date the note was issued. The estimated value of the beneficial conversion feature was $174,545. The beneficial conversion feature is being amortized over the term of the note. This resulted in a charge to interest expense of $78,299 for the six month period ended September 30, 2013. At September 30, 2013, the net carrying value of the note was $561,295.

The effective annual interest rate of the note is 107% after considering the debt issuance cost and the beneficial conversion feature.

In connection with extending the maturity date of the convertible promissory note and for other considerations related to the June 26, 2013 private placement transaction, the Company issued warrants on June 26, 2013 to the December 31, 2012 note holder to purchase up to 375,000 shares of common stock. The fair market value of the warrants at the time of issuance was $67,500 and was recorded as debt issuance costs. The Company is amortizing the costs over the life of note. Amortization expense for the six months ended September 30, 2013 was $23,724. See Note 6.

On April 5, 2013, we completed the closing of a private placement financing transaction with two investors pursuant to a Securities Purchase Agreement. Pursuant to the purchase agreement, we issued 12% Convertible Debentures in the aggregate principal amount of $575,000, and received gross proceeds of $575,000, of which $67,000 was used to pay for transaction costs, fees and expenses. Interest on the debentures was payable in the amount of 12% of the principal amount, regardless of how long the debentures remain outstanding. Principal and interest was due and payable October 5, 2013. The debentures were convertible into shares of common stock at any time at the discretion of the investor at an initial conversion price per share of $0.50. In June 2013, the note holders converted a portion of the notes into 208,000 shares of common stock, and $644,000 of the net proceeds from the Secured Note and warrant private placement transaction discussed below was used to redeem and pay the outstanding amounts due under the notes including $173,000 for interest. As a result, the notes are no longer outstanding at September 30, 2013.

Other Notes Payable

On November 30, 2010, the Company entered into a note payable with a drug wholesaler related to sales returns in the amount of $132,741. The note bears interest at the prime rate, plus 2% (5.25% at September 30, 2013), and originally required monthly payments of $10,000. The note is currently due on demand. The outstanding balance on this note at September 30, 2013 and March 31, 2013 was $25,074.

On May 1, 2011, the Company entered into a non-interest bearing note payable with a drug wholesaler related to sales returns in the amount of $147,866. The note required monthly payments of $10,000 with a final payment of $7,866 due on July 15, 2012. The note is currently due on demand and now bears interest at 12% per annum. The outstanding balance on this note at September 30, 2013 and March 31, 2013 was $72,609.

9

Notes Payable to Related Party

The Company had notes payable to a related party amounting to $81,232 at September 30, 2013, and $97,122 at March 31, 2013, respectively. The notes bear interest at 10%. Accrued interest related to the notes was $76,727 at September 30, 2013 and $72,655 at March 31, 2013, respectively.

Note 3: Derivative Liabilities and Fair Value Measurements

Accounting Standards Codification ("ASC") 815 - Derivatives and Hedging provides guidance to determine what types of instruments, or embedded features in an instrument, are considered derivatives. This guidance can affect the accounting for convertible instruments that contain provisions to protect holders from a decline in the stock price, referred to as anti-dilution or down-round protection. Down-round provisions reduce the exercise price of a convertible instrument if a company either issues equity shares for a price that is lower than the exercise price of those instruments, or issues new convertible instruments that have a lower exercise price. The Company has determined that the conversion feature liability, warrant liability and related down-round provisions on the Gemini Notes II and Secured Notes should be treated as derivatives. The Company is required to report derivatives at fair value and record the fluctuations in fair value in current operations.

The Company recognizes the derivative liabilities at their respective fair values at inception and on each reporting date. The Company values its financial assets and liabilities on a recurring basis and certain nonfinancial assets and nonfinancial liabilities on a nonrecurring basis based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In order to increase consistency and comparability in fair value measurements, a fair value hierarchy that prioritizes observable and unobservable inputs is used to measure fair value into three broad levels, which are described below:

|

Level 1:

|

Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs.

|

|

|

Level 2:

|

Observable inputs other that Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in inactive markets; or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated with observable market data.

|

|

|

Level 3:

|

Unobservable inputs are used when little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs.

|

In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible as well as considers counterparty credit risk in its assessment of fair value.

The Company recognizes the derivative liabilities at their respective fair values at inception and on each reporting date. The Company utilized a binomial option pricing model (“BOPM”) to develop its assumptions for determining the fair value of the conversion and anti-dilution features of the Gemini Note II, Secured Notes and Warrants. Key assumptions at June 26, 2013 for the Gemini Note II include a volatility factor of 50.0%, a dividend yield of 0%, expected life of .04 years and a risk free interest rate of 0.02%.

The Company estimated the original fair values of the embedded conversion and anti-dilution features of the Gemini Note II dated June 11, 2012 note to be $169,455 and $23,909, respectfully. The fair value of the embedded conversion and anti-dilution features were $162,456 and $50,545 at March 31, 2013, respectively. The fair value of the conversion feature at the exchange date of June 26, 2013 of $100,819 and the fair value of the anti-dilution feature for the same date of $10,000 were settled as part of the modification of the Gemini Note II in conjunction with the June 26, 2013 private placement financing transaction. The gain on the conversion feature derivative is $61,637 and the gain on the down-round protection derivative is $40,545 for the three months ended June 30, 2013. Since the note was exchanged with the Secured Notes in June no gain or loss was recorded in the second quarter.

Key assumptions at September 30, 2013 for the embedded converison and down round protection features include a volatility factor of 88.0%, a dividend yield of 0%, expected life of .25 years and a risk free interest rate of 0.02%.

The Company estimated the fair value of the embedded conversion feature derivative of the Secured Notes to be $0.0293 per share and the down-round protection derivative for the same notes is estimated at $0.0562. The number of potential conversion shares for the Secured Notes is 13,004,316. The carrying value of the conversion feature derivative at September 30, 2013 was $381,026 and the carrying value of the down-round protection derivative for the same date was $730,843.

10

Key assumptions at September 30, 2013 for the Warrants discussed in Note 2 include a volatility factor of 137.0%, a dividend yield of 0%, expected life of 4.75 years and a risk free interest rate of 1.39%.

The Company estimated the fair value of the Warrants, including call options, to be $0.0290 per share and the down-round protection derivative for the same warrants is estimated at $0.0593. The number of Warrants issued was 13,004,316. The carrying value of the Warrants with call options at September 30, 2013 was $377,126 and the carrying value of the down-round protection derivative for the same date was $771,156.

The table below provides a reconciliation of beginning and ending balances for the liabilities measured at fair value using significant unobservable inputs (Level 3)

| Convertible | Warrant | |||||||||||||||||||

|

Down-round

|

Feature

|

Warrant

|

Down-round

|

|||||||||||||||||

|

Protection Derivative

|

Derivative

|

Derivative

|

Protection Derivative

|

Total

|

||||||||||||||||

|

Balance, March 31, 2013

|

$

|

(50,545

|

)

|

$

|

(162,456

|

)

|

$

|

—

|

$ |

—

|

$

|

(213,001

|

)

|

|||||||

|

Net Change in Fair Value

|

40,545

|

61,637

|

—

|

—

|

102,182

|

|||||||||||||||

|

Settlement Through Modification of Gemini Note II

|

10,000

|

100,819

|

—

|

—

|

110,819

|

|||||||||||||||

|

Fair Value at Issuance of Secured Notes

|

(641,113

|

)

|

(2,923,370

|

)

|

(1,781,592

|

)

|

(616,688

|

)

|

(5,962,763

|

)

|

||||||||||

|

Balance at June 30, 2013

|

(641,113

|

) |

(2,923,370

|

) |

(1,781,592

|

) |

(616,688

|

) |

(5,962,763

|

) | ||||||||||

| Net Change in Fair Value | (89,730 | ) | 2,542,344 | 1,404,466 | (154,468 | ) | 3,702,612 | |||||||||||||

|

Balance at September 30, 2013

|

$

|

(730,843

|

)

|

$

|

(381,026

|

)

|

$

|

(377,126

|

)

|

$

|

(771,156

|

)

|

$

|

(2,260,151

|

)

|

|||||

The derivative liabilities are considered Level 3 liabilities on the fair value hierarchy as the determination of fair values includes various assumptions about future activities and stock price and historical volatility inputs.

The following table describes the valuation techniques used to calculate fair values for assets in Level 3. There were no changes in the valuation techniques during the quarter ended September 30, 2013.

|

Fair Value at

|

Valuation

|

||||||||||

|

9/30/2013

|

Technique

|

Unobservable Input

|

Range

|

||||||||

|

Conversion Feature Derivative and Down-round Protection Derivative (combined)

|

|||||||||||

|

$

|

1,111,869

|

Binomial Option Pricing Model

|

Probability of common stock issuance at prices less than conversion prices stated in agreements

|

80

|

%

|

||||||

|

Warrant Derivative and Warrant Down-round Protection Derivative (combined)

|

$

|

1,148,282

|

Binomial Option Pricing Model

|

Probability of common stock issuance at prices less than exercise prices stated in agreements

|

80

|

%

|

|||||

Significant unobservable inputs for the derivative liabilities include the estimated probability of the occurrence of a down‐round financing during the term over which the related debt and warrants are convertible or exercisable and the estimated magnitude of the down‐round. These estimates which are unobservable in the market were utilized to value the anti-dilution features of the convertible debt and warrants as of September 30, 2013.

Note 4: License Agreement

On August 1, 2013, we entered into an agreement to initially license and, with an additional closing payment fully acquire from 3M Company and 3M Innovative Properties Company (“3M”), certain intellectual property and assets relating to 3M’s Taper Dry Powder Inhaler (DPI) technology under development for the treatment of asthma and chronic obstructive pulmonary disease (“COPD”). The intellectual property includes patents, patent applications and other intellectual property relating to the Taper assets.

Pursuant to the terms of the agreement, we made an initial non-refundable payment to 3M of $3 million and obtained an exclusive worldwide license to the assets and intellectual property in all indications in the dry powder inhalation field. Upon a subsequent closing payment by Adamis of an additional $7 million before December 31, 2013, and satisfaction of other customary closing conditions, ownership of the assets and intellectual property will be transferred to the Company, with the Company granting back to 3M a license to the intellectual property assets outside of the dry powder inhalation field.

Under the agreement, if we have not made the closing payment and the closing has not occurred by December 15, 2013, then 3M may in its discretion elect to accept payment of the closing payment by delivery of a number of shares of our common stock equal to $14,000,000 divided by the average of the closing prices of the common stock for the 30 trading days preceding the business day before the closing date.

11

If the closing does not occur by December 31, 2013, then the exclusive license converts to a non-exclusive license, and 3M can license, transfer, assign or otherwise enter into any transaction involving the assets with any third party. If after December 31, 2013, 3M sells or enters into an agreement with a third party to sell or exclusively license in any territory any of the assets, then 3M may terminate the agreement with us. If before June 30, 2014, 3M has not entered into such an agreement with a third party and the Company tenders the closing payment in cash plus a premium of $1,000,000, and the other closing conditions are satisfied or waived, then the assets will be transferred to the Company with the same effect as if the closing had occurred before December 31, 2013. If the closing does not occur by June 30, 2014, 3M may terminate the agreement. The agreement includes other customary provisions including representations and warranties, warranty disclaimers and indemnification provisions.

Note 5: Common Stock

On May 30, 2013, the Company issued common stock upon exercise of an employee stock option. The employee utilized a cashless conversion of 94,442 options with a strike price of $0.19 and received 68,054 shares of common stock.

On June 21, 2013, the Company issued common stock upon exercise of an investor warrant. The investor utilized a cashless conversion of 210,600 warrants with a strike price of $0.20 and received 145,800 shares of common stock.

On June 26, 2013, the Company issued 208,000 shares of common stock in conversion of $104,000 of principal of the notes issued on April 5, 2013.

On July 3, 2013, the Company issued common stock upon exercise of an investor warrant. The investor utilized a cashless conversion of 50,000 warrants with a strike price of $0.30 and received 26,563 shares of common stock.

Note 6: Stock Option Plans, Shares Reserved and Warrants

On May 30, 2013, the Company issued common stock upon exercise of an employee stock option. The employee utilized a cashless conversion of 94,442 options, discussed in Note 5.

On June 21, 2013, the Company issued common stock upon exercise of an investor warrant. The investor utilized a cashless conversion of 210,600 warrants, discussed in Note 5.

Effective June 26, 2013, the Company issued warrants to purchase up to 13,004,316 shares of common stock to the holders of the Secured Notes. The warrants have a five-year term. The exercise price of the warrants is $0.715 per share. The warrants were valued using a binomial option pricing model. The calculated fair value of the warrants was $1,781,592. See Note 3.

Effective June 26, 2013, the Company issued warrants to purchase up to 844,444 shares of common stock to the private placements agents involved in the June 26, 2013 private placement transaction. The warrants were valued using the Black-Scholes option pricing model; the expected volatility was approximately 32% and the risk-free interest rate was approximately 1%, which resulted in a calculated fair value of $152,000.

Effective June 26, 2013, the Company issued a warrant to purchase 375,000 shares of common stock to the holder of the Company’s convertible promissory note dated December 31, 2012, in connection with the June 26, 2013 private placement transaction. The warrant has a five-year term. The exercise price of the warrant is $0.715 per share. The warrant was valued using the Black-Scholes option pricing model; the expected volatility was approximately 32% and the risk-free interest rate was approximately 1%, which resulted in a calculated fair value of $67,500.

No options expired or were cancelled during the three months ended September 30, 2013. During the six months ended September 30, 2013, approximately 5,600 options were cancelled. The options had an exercise price of $0.19. During the three months ended September 30, 2013, 100,000 of investor warrants expired. The warrants had an exercise price of $0.30. During the six months ended September 30, 2013, 225,000 of investor warrants expired. The warrants had an exercise price of $0.30.

On July 15, 2013, the Company issued a stock option to a new employee under the Company’s equity incentive plan to purchase up to 150,000 shares of common stock. The option has a ten-year term. The exercise price of the option is $0.51 per share. The option was valued using a Black Scholes model. The calculated fair value of the options was $73,500.

12

The Company recorded $145,871 of share based compensation expense during the six months ended September 30, 2013. The following summarizes outstanding stock options at September 30, 2013:

|

Number of

Stock Options

|

Weighted

Average

Remaining

Contractual Life

|

Weighted Average

Exercise Price

|

Number of

Stock Options

Vested

|

|||||||

|

Non-Plan Stock Options

|

100,714

|

.10 Years

|

$

|

41.27

|

100,714

|

|||||

|

2009 Equity Incentive Plan

|

6,773,582

|

5.44 Years

|

$

|

0.34

|

5,398,706

|

|||||

The following summarizes warrants outstanding at September 30, 2013:

|

Warrant

Shares

|

Exercise Price

Per Share

|

Date Issued

|

Expiration Date

|

||||||||

|

Biosyn Warrants

|

4,105

|

$

|

57.97 - $173.92

|

October 22, 2004

|

January 4, 2014

|

||||||

|

Old Adamis Warrants

|

1,000,000

|

$

|

0.50

|

November 15, 2007

|

November 15, 2015

|

||||||

|

Consultant Warrants

|

10,800

|

$

|

0.20

|

January 29, 2010

|

January 29, 2015

|

||||||

|

2013 Private Placement

|

14,223,763

|

0.715

|

June 26, 2013

|

June 25, 2018

|

|||||||

|

Consultant Warrants

|

300,000

|

$

|

0.22

|

July 11, 2011

|

July 11, 2016

|

||||||

|

Total Warrants

|

15,538,668

|

||||||||||

At September 30, 2013, the Company has reserved shares of common stock for issuance upon exercise of outstanding options and warrants, and options and other awards that may be granted in the future under the 2009 Equity Incentive Plan, as follows:

|

Warrants

|

15,538,668

|

|||

|

Non-Plan Stock Options

|

100,714

|

|||

|

2009 Equity Incentive Plan

|

23,239,344

|

|||

|

Total Shares Reserved

|

38,878,726

|

Note 7: Legal Matters

Information regarding certain legal proceedings to which the Company is a party can be found in the description of legal proceedings contained in the Company’s most recent Annual Report on Form 10-K for the year ended March 31, 2013 previously filed with the Securities and Exchange Commission, and is incorporated herein by reference. There have not been any material developments with respect to such proceedings during the quarter to which this Report on Form 10-Q relates.

Note 8: Subsequent Events

As the Company has previously on a Report on Form 8-K filed with the Securities and Exchange Commission, effective October 30, 2013, the investors in the private placement financing Transaction described in Note 2 above, pursuant to action taken by a majority in interest of such investors, amended the transaction documents in certain respects, in the event that the Company completes a registered underwritten public offering or a registered direct public offering resulting in at least $10 million of gross proceeds to the Company (a “Qualified Offering”) before December 26, 2013. The investors waived the right of first refusal provisions relating to the investors’ right to purchase shares in such a Qualified Offering. The investors also waived the price anti-dilution provisions of the transaction documents with respect to such a Qualified Offering, including any adjustment to the Conversion Price of the Secured Notes which could otherwise result from such Qualified Offering, if such Qualified Offering is completed on or before December 26, 2013, and the right of any investor to convert the Secured Notes in connection with or after such a Qualified Offering if the price to the public of common stock sold in such Qualified Offering is at or below $0.59 per share; however, this waiver did not constitute a waiver of any adjustment to the Exercise Price of the Warrants resulting from the closing of a Qualified Offering on or before December 26, 2013. Finally, the investors agreement that any election by an investor to accelerate or to convert an investor’s Secured Note in connection with a Qualified Offering before December 26, 2013, must be given three trading days, rather than two trading days, prior to the anticipated closing of such a Qualified Offering.

13

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Information Relating to Forward-Looking Statements

This Quarterly Report on Form 10-Q includes “forward-looking” statements. These forward-looking statements are not historical facts, but are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. These forward-looking statements include statements about our strategies, objectives and our future achievement. To the extent statements in this Quarterly Report involve, without limitation, our expectations for growth, estimates of future revenue, our sources and uses of cash, our liquidity needs, our current or planned clinical trials or research and development activities, product development timelines, our future products, regulatory matters, expense, profits, cash flow balance sheet items or any other guidance on future periods, these statements are forward-looking statements. These statements are often, but not always, made through the use of word or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” and “would. “ These forward-looking statements are not guarantees of future performance and concern matters that could subsequently differ materially from those described in the forward-looking statements. Actual events or results may differ materially from those discussed in this Quarterly Report on Form 10-Q. Except as may be required by applicable law, we undertake no obligation to update any forward-looking statements or to reflect events or circumstances arising after the date of this Report. Important factors that could cause actual results to differ materially from those in these forward-looking statements are in the section entitled “Risk Factors” in the most recent Annual Report on Form 10- K, as amended, filed with the Securities and Exchange Commission, and the other risks and uncertainties described elsewhere in this report as well as other risks identified from time to time in our filings with the Securities and Exchange Commission, press releases and other communications. In addition, the statements contained throughout this Quarterly Report concerning future events or developments or our future activities, including concerning, among other matters, current or planned clinical trials, anticipated research and development activities, anticipated dates for commencement of clinical trials, anticipated completion dates of clinical trials, anticipated meetings with the FDA or other regulatory authorities concerning our product candidates, anticipated dates for submissions to obtain required regulatory marketing approvals, anticipated dates for commercial introduction of products, and other statements concerning our future operations and activities, are forward-looking statements that in each instance assume that we are able to obtain sufficient funding in the near term and thereafter to support such activities and continue our operations and planned activities in a timely manner. There can be no assurance that this will be the case. Also, such statements assume that there are no significant unexpected developments or events that delay or prevent such activities from occurring. Failure to timely obtain sufficient funding, or unexpected developments or events, could delay the occurrence of such events or prevent the events described in any such statements from occurring.

Unless the context otherwise requires, the terms “we,” “our,” and “the Company” refer to Adamis Pharmaceuticals Corporation, a Delaware corporation, and its subsidiaries. Savvy and C31G® are our trademarks, among others. We also refer to trademarks of other corporations and organizations in this document.

General

Company Overview

We are an emerging pharmaceutical company combining specialty pharmaceuticals and biotechnology to provide innovative medicines for patients and physicians. Within our group of specialty pharmaceutical products, we are currently developing four innovative products in the allergy and respiratory markets, including a dry powder inhaler technology that we recently exclusively licensed and have rights to acquire from 3M Company. Our goal is to create low cost therapeutic alternatives to existing treatments. Consistent across all specialty pharmaceuticals product lines, Adamis intends to pursue section 505(b)(2) regulatory approval filings with the FDA whenever possible in order to reduce the time needed to get to market and to save on costs, compared to full NDA filings for new drug products. Within our group of biotechnology products, we are focused on the development of therapeutic vaccine product candidates and cancer drugs for patients with unmet medical needs in the multi-billion dollar global cancer market.

Our general business strategy is to generate revenue through launch of our allergy and respiratory products in development, in order to generate cash flow to help fund expansion of our allergy and respiratory business, as well as support our future cancer and vaccine product development efforts. To achieve our goals and support our overall strategy, we will need to raise a substantial amount of funding and make substantial investments in equipment, new product development and working capital.

Recent Developments

On August 1, 2013, we entered into an agreement to exclusively license and, upon final payment before December 31, 2013 or, in certain circumstances June 30, 2014, acquire assets relating to 3M Company’s patented Taper dry powder inhaler, or DPI, platform technology under development for the treatment of asthma and chronic obstructive pulmonary disease, or COPD. The Taper DPI technology was being developed by 3M to compete with other dry powder inhalers such as GlaxoSmithKline’s Advair Diskus®. We intend to utilize the Taper DPI assets initially to develop a pre-metered inhaler device for the treatment of asthma and COPD, to deliver the same active ingredients as GlaxoSmithKline’s Advair Diskus®. Upon completion of product development and clinical trials and if required regulatory approvals are obtained, we intend to commercially market the inhaler product to compete for a share of the Advair market with a branded generic version utilizing the acquired technology. The design of the inhaler uses proprietary 3M technology to store active pharmaceutical ingredient on a microstructured carrier tape. Under the agreement, we have agreed with 3M to work in good faith to negotiate and enter into a supply agreement before the closing providing for the supply of the drug delivery tape to be used with the product. Pursuant to the agreement, we made an initial payment of $3 million to 3M and acquired an exclusive license to the DPI assets, and upon a final payment to 3M of $7 million before December 31, 2013 or, in certain circumstances $8 million before June 30, 2014, and satisfaction of other customary closing conditions, the DPI assets will be transferred to us. If we do not make the final payment before the required dates, 3M may terminate the license and the agreement.

14

Going Concern and Management Plan

Our independent registered public accounting firm has included a “going concern” explanatory paragraph in its report on our financial statements for the years ended March 31, 2013 and 2012 indicating that we have incurred recurring losses from operations and have limited working capital to pursue our business alternatives, and that these factors raise substantial doubt about our ability to continue as a going concern. As of September 30, 2013, we had approximately $119,000 in cash and equivalents, an accumulated deficit of approximately $39.1 million and substantial liabilities and obligations. We have limited cash reserves, liabilities that exceed our assets and significant cash flow deficiencies. Additionally, we will need significant funding in the short term to continue operations and for the future operations and the expenditures that will be required to conduct the clinical and regulatory work to develop our product candidates.

Continued operations are dependent on our ability to complete other equity or debt funding transactions. Such capital formation activities may not be available or may not be available on reasonable terms. If we do not obtain additional equity or debt funding in the near future, our cash resources will rapidly be depleted and we will be required to materially reduce or suspend operations, which would likely have a material adverse effect on our business, stock price and our relationships with third parties with whom we have business relationships, at least until additional funding is obtained.

The above conditions raise substantial doubt about our ability to continue as a going concern. The financial statements included elsewhere herein were prepared under the assumption that we would continue our operations as a going concern, which contemplates the realization of assets and the satisfaction of liabilities during the normal course of business. In preparing these financial statements, consideration was given to our future business as described elsewhere herein, which may preclude us from realizing the value of certain assets. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. This basis of accounting contemplates the recovery of our assets and the satisfaction of liabilities in the normal course of business. Without additional funds from debt or equity financing, sales of assets, sales or out-licenses of intellectual property or technologies, or from a business combination or a similar transaction, we will soon exhaust our resources and will be unable to continue operations. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in us.

Our management intends to address any shortfall of working capital by attempting to secure additional funding through equity or debt financings, sales or out-licensing of intellectual property assets, seeking partnerships with other pharmaceutical companies or third parties to co-develop and fund research and development efforts, or similar transactions. However, there can be no assurance that we will be able to obtain any sources of funding. If we are unsuccessful in securing funding from any of these sources, we will defer, reduce or eliminate certain planned expenditures. There is no assurance that any of the above options will be implemented on a timely basis or that we will be able to obtain additional financing on acceptable terms, if at all. If adequate funds are not available on acceptable terms, we could be required to delay development or commercialization of some or all of our products, to license to third parties the rights to commercialize certain products that we would otherwise seek to develop or commercialize internally, or to reduce resources devoted to product development. In addition, one or more licensors of patents and intellectual property rights that we have in-licensed could seek to terminate our license agreements, if our lack of funding made us unable to comply with the provisions of those agreements. If we did not have sufficient funds to continue operations, we could be required to seek bankruptcy protection or other alternatives that could result in our stockholders losing some or all of their investment in us. Any failure to dispel any continuing doubts about our ability to continue as a going concern could adversely affect our ability to enter into collaborative relationships with business partners, make it more difficult to obtain required financing on favorable terms or at all, negatively affect the market price of our common stock and could otherwise have a material adverse effect on our business, financial condition and results of operations.

15

Results of Operations

Six Months Ended September 30, 2013 and 2012

Revenues. Adamis had no revenues during the six month periods ending September 30, 2013 and 2012, respectively.

Research and Development Expenses. Our research and development costs are expensed as incurred. Non-refundable advance payments for goods and services to be used in future research and development activities are recorded as an asset and are expensed when the research and development activities are performed. Research and development costs were approximately $419,000 and $529,000 for the six months ending September 30, 2013 and 2012, respectively.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the six months ending September 30, 2013 and 2012 were approximately $1,278,000 and $1,047,000, respectively. Selling, general and administrative expenses consist primarily of legal fees, accounting and audit fees, professional/consulting fees and employee salaries.

Other Income (Expense). Interest expense for the six month period ending September 30, 2013 and 2012 was approximately $(3,182,000) and approximately $(874,000), respectively. Interest consists primarily of interest expense in connection with various notes outstanding at September 30, 2013, and the amortization of debt issuance costs as well as the amortization of the discounts on the notes for the six months ended September 30, 2013. The increase in interest expense for the six month period ended September 30, 2013, in comparison to the same period for fiscal 2013 was due to the new notes payable entered into during the first quarter of fiscal 2014. The change in fair value of the derivative liability for the period is approximately $(204,000) and the change in the fair value of the conversion feature is approximately $2,604,000. The change in fair value of warrants liability is approximately $1,404,000. The June 26, 2013 notes contain full ratchet anti-dilution provisions and the corresponding changes in fair value are recorded in Other Income (Expense).

Three Months Ended September 30, 2013 and 2012

Revenues. Adamis had no revenues during the three month periods ending September 30, 2013 and 2012, respectively.

Research and Development Expenses. Our research and development costs are expensed as incurred. Non-refundable advance payments for goods and services to be used in future research and development activities are recorded as an asset and are expensed when the research and development activities are performed. Research and development costs were approximately $195,000 and $421,000 for the three months ending September 30, 2013 and 2012, respectively.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the three months ending September 30, 2013 and 2012 were approximately $762,000 and $430,000, respectively. Selling, general and administrative expenses consist primarily of legal fees, accounting and audit fees, professional/consulting fees and employee salaries.

Other Income (Expense). Interest expense for the three month period ending June 30, 2013 and 2012 was approximately $(2,778,000) and approximately $(579,000), respectively. Interest consists primarily of interest expense in connection with various notes outstanding at September 30, 2013, and the amortization of debt issuance costs as well as the amortization of the discounts on the notes for the three months ended September 30, 2013. The increase in interest expense for the three month period ended September 30, 2013, in comparison to the same period for fiscal 2013 was due to the new notes payable entered into during the first quarter of fiscal 2014. The change in fair value of the derivative liability for the period is approximately $(244,000) and the change in the fair value of the conversion feature is approximately $2,542,000. The change in fair value of warrants liability is approximately $1,404,000. The June 26, 2013 notes contain full ratchet anti-dilution provisions and the corresponding changes in fair value are recorded in Other Income (Expense).

Financial Position

Total assets, all of which are classified as current, were approximately $3,523,000 at September 30, 2013, an increase of approximately $3,172,000 from March 31, 2013. Liabilities, all of which are classified as current, exceed current assets by approximately $4,930,000 at September 30, 2013.

The most significant change in assets results from the payment of a $3,000,000 non-refundable deposit to initially license and acquire certain intellectual property and assets from 3M Company and 3M Innovative Properties Company. See Note 4 to the condensed consolidated financial statements.

The most significant change in liabilities results in the amortization of note payable discounts recorded in conjunction with the Secured Convertible Promissory Notes issued with the June 26, 2013 private placement transaction. Amortization of these discounts was approximately $2,456,000.

Liquidity and Capital Resources

We have incurred net loss of approximately $1.1 million and $3.6 million for the six months ended September 30, 2013 and 2012, respectively. Since inception, and through September 30, 2013, we have an accumulated deficit of approximately $39.1 million. We have financed our operations principally through debt financing and through private issuances of common stock. We expect to finance future cash needs primarily through proceeds from equity or debt financings, loans, out-licensing transactions, and/or collaborative agreements with corporate partners.

Net cash used in operating activities for the six months ended September 30, 2013 and 2012, was approximately $(2.0) million and $(1.9) million, respectively. We expect net cash used in operating activities to increase going forward as we engage in additional product research and development and other business activities, assuming that we are able to obtain sufficient funding.

Net cash used in investing activities for the six months ended September 30, 2013 and 2012 was $3,000,000 and $0, respectively. Results for the six months ended September 30, 2013 represents the payment of the non-refundable deposit described in Note 4 to the condensed consolidated financial statements.

16

Net cash provided by financing activities was approximately $5.1 million and $1.9 million for the six months ended September 30, 2013 and 2012. Results for the six months ended September 30, 2013, were affected primarily by $5.3 million of proceeds received from the a private placement completed in June 2013 and the reduction of a promissory note from a related party.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based on our unaudited condensed consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these unaudited condensed consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We evaluate our estimates on an ongoing basis. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ materially from these estimates under different assumptions or conditions.

The Company’s critical accounting policies and estimates previously disclosed in our Annual Report on Form 10-K for the year ended March 31, 2013 have not significantly changed, and no additional policies have been adopted during the three months ended September 30, 2013.

Recent Accounting Pronouncements

See financial statements.

Off Balance Sheet Arrangements

At September 30, 2013, Adamis did not have any off balance sheet arrangements.

ITEM 3. Quantitative and Qualitative Disclosure of Market Risk

Not required.

ITEM 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness of our disclosure controls and procedures as of September 30, 2013. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (“Exchange Act”), means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on the evaluation of our disclosure controls and procedures as of September 30, 2013, our principal executive officer and principal financial officer concluded that, as of such date, the Company’s disclosure controls and procedures were not effective at the reasonable assurance level, for the reasons set forth in the Company’s Annual Report on Form 10-K for the year ended March 31, 2013, under the heading “Item 9A Controls and Procedures” relating to disclosure controls and procedures and internal controls over financial reporting.

Changes in Internal Controls

No change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) occurred during the quarter ended September 30, 2013, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

17

PART II OTHER INFORMATION

ITEM 1. Legal Proceedings

Information regarding certain legal proceedings to which the Company is a party can be found in the description of legal proceedings contained in the Company’s most recent Annual Report on Form 10-K for the year ended March 31, 2013, and is incorporated herein by reference. There have not been any material developments with respect to such proceedings during the quarter to which this Report on Form 10-Q relates.

The litigation described in our previous filings could divert management time and attention from the Company, could involve significant amounts of legal fees and other fees and expenses. An adverse outcome in any such litigation could have a material adverse effect on Adamis. In addition to the matters described in our previous filings and above, we may become involved in or subject to, routine litigation, claims, disputes, proceedings and investigations in the ordinary course of business, which in our opinion will not have a material adverse effect on our financial condition, cash flows or results of operations.

Item 1A. Risk Factors

As a smaller reporting company, Adamis is not required under the rules of the Securities and Exchange Commission, or SEC, to provide information under this Item. Risks and uncertainties relating to the amount of cash and cash equivalents at September 30, 2013, and uncertainties concerning the need for additional funding, are discussed above under the headings, “Going Concern and Management Plan” and “Liquidity and Capital Resources” in the Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this Form 10-Q, and are incorporated herein by this reference. Other material risks and uncertainties associated with Adamis’ business have been previously disclosed in our most recent annual report on Form 10-K filed with the Securities and Exchange Commission, included under the heading “Risk Factors,” and those disclosures are incorporated herein by reference.

ITEM 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the second quarter of fiscal 2014, we issued the securities described below without registration under the Securities Act of 1933, as amended.

On July 3, 2013, the Company issued common stock upon exercise of an investor warrant. The investor utilized a cashless conversion of 50,000 warrants with a strike price of $0.30 and received 26,563 shares of common stock.

All issuances were issued in private placement transactions to a limited number of shareholders in reliance on Section 4(2) of the Securities Act of 1933, as amended, and/or Regulation D promulgated under the Securities Act. Each person or entity to whom securities were issued represented that the securities were being acquired for investment purposes, for the person’s or entity’s own account, not as nominee or agent, and not with a view to the resale or distribution of any part thereof in violation of the Securities Act.