UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________.

Commission File Number: 0-20206

PERCEPTRON, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Michigan |

|

38-2381442 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

47827 Halyard Drive

Plymouth, Michigan 48170-2461

(Address of Principal Executive Offices)

(734) 414-6100

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, $0.01 par value |

|

The NASDAQ Stock Market LLC |

|

Rights to Purchase Preferred Stock |

|

(NASDAQ Global Market) |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

☐ |

Accelerated Filer |

☒ |

Non-Accelerated Filer |

☐ |

Smaller Reporting Company |

☐ |

Emerging growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting stock held as of the registrant’s most recently completed second fiscal quarter by non-affiliates of the registrant, based upon the closing sale price of the Common Stock on December 31, 2017, as reported by the NASDAQ Global Market, was approximately $84,000,000 (assuming, but not admitting for any purpose, that all directors and executive officers of the registrant are affiliates).

The number of shares of Common Stock, $0.01 par value, issued and outstanding as of August 21, 2018, was 9,555,767.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document, to the extent specified in this report, are incorporated by reference in Part III of this report:

|

Document |

|

|

Incorporated by reference in: |

|

Proxy Statement for 2018 |

|

|

Part III, Items 10-14 |

|

Annual Meeting of Shareholders |

|

|

|

|

|

|

|

Page |

|

Part I. |

|

|

|

|

Item 1. |

|

2 |

|

|

Item 1A. |

|

6 |

|

|

Item 1B. |

|

12 |

|

|

Item 2. |

|

12 |

|

|

Item 3. |

|

12 |

|

|

Item 4. |

|

12 |

|

|

|

|

|

|

|

Part II. |

|

|

|

|

Item 5. |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

13 |

|

Item 6. |

|

16 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

17 |

|

Item 7A. |

|

28 |

|

|

Item 8. |

|

29 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

|

55 |

|

Item 9A. |

|

55 |

|

|

Item 9B. |

|

57 |

|

|

|

|

|

|

|

Part III. |

|

|

|

|

Item 10. |

|

57 |

|

|

Item 11. |

|

57 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

58 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

58 |

|

Item 14. |

|

58 |

|

|

|

|

|

|

|

Part IV. |

|

|

|

|

Item 15. |

|

59 |

|

|

|

|

65 |

General

Perceptron, Inc. (“Perceptron”, “we”, “us” or “our”) develops, produces and sells a comprehensive range of automated industrial metrology products and solutions to manufacturing organizations for dimensional gauging, dimensional inspection and 3D scanning. Products include 3D machine vision solutions, robot guidance, coordinate measuring machines, laser scanning and advanced analysis software. Our customers which include global automotive, aerospace and other manufacturing companies, rely on Perceptron's metrology solutions to assist in managing their complex manufacturing processes to improve quality, shorten product launch times and reduce costs. Headquartered in Plymouth, Michigan, Perceptron has subsidiary operations in Brazil, China, Czech Republic, France, Germany, India, Italy, Japan, Slovakia, Spain and the United Kingdom.

Our products are categorized as follows:

In-Line, Near-Line and Off-Line Measurement Solutions (“Measurement Solutions”). Sales of these products involve the development, manufacture and installation of:

|

|

• |

In-Line fixed and robot-mounted laser-based, non-contact dimensional gauging systems used in original equipment manufacturing plants and component supplier plants; |

|

|

• |

In-Line laser-based, non-contact systems that perform gauging for and intelligent guidance of industrial robots in the performance of a variety of complex automated assembly operations; |

|

|

• |

Near-Line robot-mounted laser-based, non-contact dimensional gauging systems used in original equipment manufacturing plants and component supplier plants; and |

|

|

• |

Off-Line inspection and gauging cells comprising Coordinate Measuring Machines (“CMM”) or industrial and collaborative robotic solutions integrated with laser-based non-contact scanning sensors. |

3D Scanning Solutions. Sales of these products involve the development, manufacture and marketing of laser-based sensors and software for the following applications:

|

|

• |

Laser scanning sensors and metrology software for three-dimensional measurement on CMM for the reverse engineering and automated component inspection markets; |

|

|

• |

Laser scanning sensors integrated into vehicle wheel-alignment machines installed in automotive assembly plants. |

Value Added Services. Perceptron offers the following value added services to customers:

|

|

• |

Training; |

|

|

• |

Field Service and Calibration; |

|

|

• |

Launch Support Services; |

|

|

• |

Consulting Services; and |

|

|

• |

Equipment and Software Maintenance Agreements. |

Markets

Perceptron has a long history serving the global automotive manufacturing market with advanced technology. In fiscal 2018, 2017 and 2016, automotive sales represented approximately 82%, 85% and 65% of total sales, respectively. We have product offerings encompassing numerous manufacturing processes, including complex part assembly, automotive body construction, industrial robotic guidance for complex assembly applications, gauging cells, coordinate measuring solutions and reverse engineering.

Products and Applications

Measurement Solutions

Perceptron’s In-Line and Near-Line measurement solutions are based on our scanning sensors and software developed by combining Helix® and TriCam® sensors with Vector software. Our Off-Line measurement solutions are based on a full CMM line plus measuring software. Measurement Solutions in our fiscal year 2018, 2017, and 2016 represented 91%, 90% and 90% of total sales, respectively.

In-Line and Near-Line

AutoGauge®: Our dimensional gauging systems are used in assembly and fabrication plants to contain, correct and control the quality of complex assemblies. AutoGauge® systems are placed directly in the manufacturing line or near the line to automatically measure critical dimensional characteristics of parts using non-contact, laser triangulation sensors.

2

AutoGauge®ACF: Our near-line robotic systems utilize Perceptron’s AccuSiteTM optical tracking technology to eliminate the need to correlate to a CMM by making all measurements accurate. These systems are used in assembly and manufacturing facilities to replace traditional checking fixtures. Virtually everything about AutoGauge®ACF is automatic – from high speed data collection, to real-time reporting and analysis. AutoGauge®ACF measures parts within minutes, greatly increasing inspection throughput compared to CMMs, ring gauges, manual tools and other optical metrology systems. This is a newer product that we launched during our fiscal year ending June 30, 2018.

AutoFit®: Our gap and flush systems are primarily used in automotive manufacturing plants to contain, correct and control the fit of exterior body panels. These systems automatically measure, record and display the gap and flushness of parts most visible to the automobile consumer such as gaps between front and rear doors, hoods and fenders as well as deck lids and rear quarter panels. These measurements can be conducted throughout the manufacturing process, including in the body shop during assembly of non-painted vehicles and in the final assembly area after the vehicle has been painted. AutoFit® can measure vehicles while in motion along the assembly line or in a stationary position. During our fiscal year ending June 30, 2018, we made significant advancements in the algorithms that we use to process the data gathered by our sensors which results in significantly improved information for our customers.

AutoGuide®: Our robot guidance systems are used by manufacturing companies for flexible automated assembly applications. These systems utilize Perceptron sensors and measurement technology to guide and control robotic assembly operations. AutoGuide® systems calculate the difference between theoretical and actual relationships of a robot to the part being assembled and communicate compensation data in six degrees of freedom to the robot. AutoGuide® supports numerous robotic assembly applications including automotive windshield insertion, roof loading, hinge mounting, door attachment and sealant application. During our fiscal year ending June 30, 2018, we reworked and optimized our robot guidance platform for the simpler requirements of de-racking, seam sealing and glue bead applications. The large field of view Helix®evo X300 sensor and one-glance dashboard eliminate the need for precision fixtures, large conveyors and station operators and part handlers. With the streamlined interface for these specific applications, station setup time can now be completed in hours, not days.

Helix®evo: Our Helix®evo sensor family takes 3D scanning to the next level, improving performance through faster measuring and increased overall system robustness. Helix®evo utilizes a green laser to measure the multitude of materials used in today’s manufacturing, such as chrome, aluminum, sheet metal and painted surfaces. Its scan acquisition provides accurate feature extraction along with the pristine scan quality required for form analysis. Helix®evo also uses a single power over ethernet cable which reduces the number of auxiliary components required and is designed for fast and accurate measurement on the plant floor.

Off-Line

Coord3®: The Coord3 CMM product line includes bridge, gantry and horizontal style machines. Bench-top CMM are used for small part inspection while very large CMM are used in aerospace, defense and heavy equipment industries. CMM can be equipped with tactile scanning probes and our TouchDMIS™ measuring software.

TouchDMISTM : TouchDMIS™ measuring software simplifies CMM measurement by incorporating a 100% touch interface with the TouchCADTM quick programming module. TouchDMIS™ is the world’s first all-touch CMM software.

3D Scanning Solutions

3D Scanning Solutions in our fiscal year 2018, 2017, and 2016 represented 3%, 7% and 6% of total sales, respectively.

WheelWorks®: WheelWorks® software and sensors offer a fast, accurate, non-contact method of measuring wheel position for use in automated or manual wheel alignment machines in automotive assembly plants. Perceptron supplies sensors and software to a number of wheel alignment equipment manufacturers in Europe, Asia and North America who in turn sell alignment systems to automotive manufacturers.

Value Added Services

Value Added Services: Value Added Services sales in our fiscal year 2018, 2017, and 2016 represented 6%, 3% and 4% of total sales, respectively. Value Added Services include training, field service, calibration, launch support services, consulting services, maintenance agreements and repairs.

Sales and Marketing

We market our in-line and near-line products directly to end-user Original Equipment Manufacturer (“OEM”) customers and through manufacturing line builders and system integrators. We market our Coord3 CMM product line through both direct sales and value added resellers.

3

Perceptron’s principal customers for measurement solution products have historically been automotive manufacturing companies that we either sell to directly or through manufacturing line builders, system integrators or assembly equipment manufacturers. These products are typically purchased for installation in connection with retooling programs undertaken by these companies. Because sales are dependent on the timing of customers’ retooling programs, sales by customer vary significantly from year to year. For our fiscal years 2018, 2017 and 2016, approximately 41%, 36% and 34%, respectively, of our “Net Sales” on our Consolidated Statements of Operations were derived from sales directly to our four largest automotive end-user customers. We also sell to manufacturing line builders, system integrators and assembly equipment manufacturers, who in turn sell to our automotive customers. For our fiscal years 2018, 2017 and 2016, approximately 7%, 11% and 8%, respectively, of our net sales were to manufacturing line builders, system integrators and original equipment manufacturers for the benefit of the same four largest automotive end-user customers in each respective year. During our fiscal years 2018, 2017 and 2016, direct sales to General Motors Company accounted for approximately 17%, 14% and 12%, respectively, and direct sales to Volkswagen Group accounted for approximately 15%, 16% and 17%, respectively, of our total net sales.

Manufacturing and Suppliers

Our manufacturing operations consist primarily of final assembly and calibration of hardware components and the development, testing and integration of our software with these hardware components. We build our products from a combination of commercially available parts and uniquely-designed and manufactured parts. The components are primarily manufactured by third parties. Individual components such as printed circuit boards are manufactured and supplied by third parties. We believe a low level of vertical integration gives us significant manufacturing and inventory flexibility and minimizes total product costs.

We purchase certain component parts and assemblies from single and multi-source suppliers. With respect to the majority of our components, we believe that alternative suppliers could be found if existing suppliers could not ship to us. Many of our components are customized for our specific manufacturing needs. Due to these specifications, various lead times would be required, based on the specific component that needed to be re-sourced. Component supply shortages in certain industries, including the electronics industry, have occurred in the past and are possible in the future due to imbalances in supply and demand. We use global purchasing sources to minimize the risk of part shortages. We have not experienced significant component supply shortages from single source suppliers in recent years. However, in fiscal 2017 some of our suppliers informed us that a few of our components were at “end-of-life” and so have been discontinued. We have launched new products that do not require these “end-of-life” components in significant quantities going forward. Significant delays or interruptions in the delivery of components, assemblies or products by suppliers, or difficulties or delays in shifting manufacturing capacity to new suppliers, could have a material adverse effect on us.

International Operations

Europe: Our European operations contributed approximately 40%, 41% and 45%, of our net sales during our fiscal years ended June 30, 2018, 2017, and 2016, respectively. Our wholly-owned subsidiary, Perceptron Europe B.V. (“Perceptron B.V.”), formed in The Netherlands, holds a 100% equity interest in Perceptron (Europe) GmbH (“Perceptron GmbH”) and Coord3 s.r.l. (“Coord3”). Perceptron GmbH is located in Munich, Germany and is the operational headquarters for our European market. We own subsidiaries that operate direct sales, application and support offices in Vélizy-Villacoublay, France, Barcelona, Spain, Birmingham, UK and Bratislava, Slovakia. Coord3 is a CMM designer and manufacturer in Bruzolo, Italy. Furthermore, we own a software development company, Next Metrology Software s.r.o. in Prague, Czech Republic. At June 30, 2018, we had 138 employees in our European operations.

Asia: Our Asian operations contributed approximately 19%, 20% and 22% of our net sales during our fiscal years ended June 30, 2018, 2017, and 2016, respectively. We own subsidiaries that operate direct sales, application and support offices in Tokyo, Japan; Shanghai and Beijing, China; and Delhi and Chennai, India to service our customers in Asia. At June 30, 2018, we had 61 employees in our Asian operations.

South America: We have a direct sales, application and support office in Sao Paulo, Brazil to service customers in South America. At June 30, 2018, we had 5 employees in our Brazilian operations.

Our foreign operations are subject to certain risks typically encountered in such operations, including fluctuations in foreign currency exchange rates and controls, expropriation and other economic and local policies of foreign governments and the laws and policies of the U.S. and local governments affecting foreign trade and investment. For information regarding net sales and identifiable assets of our non-U.S. based operations, see Note 19, of the Notes to the Consolidated Financial Statements, “Segment and Geographic Information”, contained in Item 8 of this Annual Report on Form 10-K.

Competition

We believe our products provide cost-efficient and complete solutions for our customers in terms of system capabilities, level of support and competitive pricing for the value provided, which we believe are the principal competitive factors in our markets. We also believe the technology within our products is more advanced than our competition.

There are a number of companies that sell similar and/or alternative technologies and methods into the same markets and regions as Perceptron. We believe there may be entities, some of which may be larger and have greater resources than our resources, that could develop technology and products which could prove to be competitive with us. We also believe that certain existing or potential customers may be capable of internally developing their own technology. See Item 1A: “Risk Factors” titled “There are a number of companies offering competitive products in our markets, or developing products to compete with our products, which could result in a reduction in our revenues through lost sales or a reduction in prices”.

4

As of June 30, 2018, we had a backlog of $47.5 million, compared to $45.0 million at June 30, 2017. Most of our backlog is subject to cancellation or delay by the customer, often with limited or no penalties. Historically, cancellations of orders once they have been booked have been very infrequent although several cancellations have occurred during the last two fiscal years. The level of our backlog at any particular time is not necessarily indicative of our future operating performance. We expect to be able to fill substantially all of the orders in our backlog by June 30, 2019.

Research and Development

During fiscal year 2018, our research and development efforts focused on developing new and improved hardware and software subsystems to support the range of our industry-proven solutions. Developments accomplishments included:

|

|

• |

The release of the Helix®evo sensor family that increases the accuracy, speed and robustness of this unique 3D scanner. |

|

|

• |

The employment of lean, single-piece flow manufacturing for the construction of Helix®evo, resulting in substantially reduced labor, reduced lead time and increased product uniformity. |

|

|

• |

The creation of a cost-reduced and mass-optimized family of Helix®evo sensor mounts that reduces the material and labor required when installing systems in our customers’ plants. |

|

|

• |

The development of a modular family of plant-floor ready 3D image processing computers that allows tight control of the cost of a delivered system. |

|

|

• |

The addition of the X0300 member of the Helix®evo family that, when combined with an advanced set of algorithms, facilitates robot guidance applications in the de-racking arena. |

|

|

• |

The completion of the AccuSite™ external tracking hardware and software suite that is being delivered to a global automotive OEM of luxury vehicles to control dimensions of closure panels for a new auto platform. |

We continue to focus on value engineering our hardware and software solutions to remove costs from all phases of our product lifecycle. We believe this investment in our products provides ongoing competitive advantages in all our markets.

As of June 30, 2018, 54 of our employees were focused primarily on research, development and engineering. For our fiscal years ended June 30, 2018, 2017 and 2016, our research, development and engineering expenses were $8.0 million, $6.8 million and $7.4 million, respectively.

Patents, Trade Secrets and Confidentiality Agreements

As of June 30, 2018, we own 18 U.S. patents that have been granted to us which relate to various products and processes manufactured, used, and/or sold. We also own 5 foreign patents that have been granted to us in Europe, China and Japan and we have 5 patent applications pending in foreign locations. The U.S. and foreign patents expire from 2018 through 2031. In addition, we hold perpetual licenses to more than 35 other U.S. patents including rights to practice 7 U.S. patents for non-forest product related applications that were assigned in conjunction with the sale of a previous business unit in 2002, and rights to practice 9 U.S. patents that were sold in conjunction with the sale of another prior business line in August 2012. The expiration dates for these licensed patents range from 2018 to 2031.

Perceptron has registered, and continues to register, various trade names and trademarks including Perceptron®, Powered by Perceptron®, AutoGauge®, AutoFit®, AutoGuide®, AutoScan®, Contour Probe®, ScanWorks®, TriCam®, WheelWorks®, Visual Fixturing®, Helix®, Intelligent Illumination®, TouchDMIS™, and Coord3™, among others, which are used in connection with the conduct of our business.

Our software products are copyrighted and generally licensed to our customers pursuant to license agreements that restrict the use of the products to the customer’s own internal purposes on designated Perceptron equipment.

We also use proprietary information and invention agreements and non-disclosure agreements with employees, consultants and other parties to protect our intellectual property.

There can be no assurance that any of the above measures will be adequate to protect our intellectual property or other proprietary rights. Effective patent, trademark, copyright and trade secret protection may be unavailable in certain foreign countries.

Employees

During our fiscal year 2016, we implemented a financial improvement plan that resulted in a reduction in global headcount of approximately 10%. The plan was implemented to re-align our fixed costs with our near-to mid-term expectations for our business. The financial improvement plan included headcount reductions and position eliminations spread across our geographic regions, departments and roles. In fiscal 2018, we announced that we were substantially complete with this plan and we started to invest in additional resources to develop new products. This investment has primarily been in the form of hiring additional full-time staff in our Engineering, Research and Development area.

5

As of June 30, 2018, we have 337 employees worldwide. All of our employees were employed on a full-time basis and 133 are located in North America. The remainder are distributed across the globe as identified above in International Operations. In Italy, we have 57 employees covered by Italy’s National Collective Bargaining Agreement for employees in the mechanical engineering industry. The agreement was signed in November 2016 and it will be valid for 3 years. None of our other employees are covered by a collective bargaining agreement. We believe our relations with our employees are good.

Available Information

Perceptron’s Internet address is www.perceptron.com. On our website, we make available, free of charge, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). These reports can be accessed through the “Investor Relations” section of our website under “SEC Filings”. The information found on our website is not part of this or any report we file with, or furnish to, the SEC.

An investment in our Common Stock involves numerous risks and uncertainties. You should carefully consider the following information about these risks. Any of the risks described below could result in a significant or material adverse effect on our future results of operations, cash flows or financial condition. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that adversely affect our business in the future. We believe that the most significant of the risks and uncertainties we face are as follows:

Our future commercial success depends upon our ability to maintain a competitive technological position in our markets, which are characterized by continual technological change.

Technology plays a key role in the systems and solutions that we produce. The ability to sell our products to customers is directly influenced by the technology used in our systems and solutions. With the rapid pace at which technology is changing, there is a possibility that our customers may require more technologically advanced systems and solutions than we may be capable of producing.

Technological developments could render our actual and proposed products or technologies as uneconomical or obsolete. There is also a possibility that we may not be able to keep pace with our competitors’ products. In that case, our competitors may make technological improvements to their products that make them more desirable than our products.

Our growth and future financial performance depend upon our ability to introduce new products and enhance existing products that include the latest technological advances and customer requirements. We may not be able to introduce new products successfully or achieve market acceptance for such products. Any failure by us to anticipate or respond adequately to changes in technology and customer preferences, or any significant delays in product development or introduction, could have a material adverse effect on our business. Accordingly, we believe that our future commercial success will depend upon our continued ability to develop and introduce new cost-effective products and maintain a competitive technological position.

Our future success is dependent upon our ability to implement our long-term growth strategy.

Our future success is dependent upon our ability to implement our long-term strategy, which includes growing our customer base in the automotive market and expanding into new markets. However, there are a number of uncertainties involved in our long-term strategy over which we have no or limited control, including:

|

|

• |

The quality and cost of competitive products already in existence or developed in the future |

|

|

• |

The level of interest that existing and potential new customers may have in our existing and new products and technologies |

|

|

• |

Our ability to resolve technical issues inherent in the development of new products and technologies |

|

|

• |

Our ability to identify and satisfy market needs |

|

|

• |

Our ability to identify satisfactory distribution networks |

|

|

• |

General product development and commercialization difficulties |

|

|

• |

Rapid or unexpected technological changes |

|

|

• |

General product demand and market acceptance risks |

|

|

• |

Our ability to successfully compete with alternative and similar technologies |

|

|

• |

Our ability to attract and retain the appropriate personnel to effectively represent, install and service our products |

|

|

• |

The effect of economic conditions |

Even if we are able to expand our customer base and markets, the new revenues we derive may not offset declines in revenues from our current products. We also may not be able to generate profits from these new customers or markets at the same level as we generate from our current business. There can be no assurance that we will be able to expand our customer base and markets or successfully execute our strategies in a fashion to maintain or increase our revenues and profits.

6

We are dependent on proprietary technology. If our competitors develop competing products that violate our intellectual property rights or successfully challenge those rights, our revenues and profits may be adversely affected.

Our products contain features that are protected by patents, trademarks, trade secrets, copyrights and contractual rights. Despite these protections, there is still a chance that competitors may use these protected features in their products as a result of our inability to keep our trade secrets confidential, or in violation of our intellectual property rights or following a successful challenge to those rights. The prosecution of infringement claims against third parties and the defense of legal actions challenging our intellectual property rights could be costly and require significant attention from management. Because of the small size of our management team, this could result in the diversion of management’s attention from day-to-day operations.

There also is the possibility that competitors may develop technology that performs the same functions as our products without infringing upon our exclusive rights. It is possible that competitors may reverse engineer those features of our products that are not protected by patents, trademarks and trade secrets. If a competitor is able to reverse engineer an unprotected feature successfully, the competitor may gain an understanding of how our feature works and introduce similar products to compete with our products.

Because our products are sold globally, we are at risk of competitors misappropriating our intellectual property included in those products or reverse engineering those products. As a result, we may have a more limited ability, and significantly greater costs, to enforce our intellectual property rights in those products. Constant technological improvement of those products will be particularly important to keep our products competitive in their markets.

There are a number of companies offering competitive products in our markets, or developing products to compete with our products, which could result in a reduction in our revenues through lost sales or a reduction in prices.

We are aware of a number of companies in our markets selling products using similar or alternative technologies and methods. We believe that there may be other companies, some of whom may be substantially larger and have significantly greater resources than us, which may be engaged in the development of technology and products for some of our markets that could prove to be competitive with ours. We believe that the principal competitive factor in our markets is the total capability that a product offers. In some markets, a competitive price for the level of functionality and reliability provided are the principal competitive factors. While we believe that our products compete favorably, it is possible that these competitors could capture some of our sales opportunities or force us to reduce prices in order to complete the sale.

We believe that certain existing and potential customers may be capable of internally developing their own technology. This could cause a decline in sales of our products to those customers.

A significant percentage of our revenue is derived from a small number of customers, so that the loss of any one of these customers could result in a significant reduction in our revenues and profits.

A majority of our revenue in fiscal 2018 was derived from the sale of systems and solutions to a small number of customers that consist primarily of automotive manufacturers and suppliers in North America, Western Europe and Asia.

With such a large percentage of our revenues coming from such a small and highly concentrated group of customers, we are susceptible to a substantial risk of losing revenues if these customers stop purchasing our products or reduce their purchases of our products. In addition, we have no control over whether these customers will continue to purchase our products, systems and solutions in volumes or at prices sufficient to generate profits for us.

Because a large portion of our revenues are generated from a limited number of sizeable orders, our revenues and profits may vary widely from quarter to quarter and year to year.

A large portion of our revenue is generated from a limited number of sizeable orders that are placed by a small number of customers. If the timing of these orders is delayed from one quarter to the next or from one year to the next, we may experience fluctuations in our quarterly and annual revenues and operating results. Because our order terms vary from project to project, the application of our revenue recognition accounting policies to our orders can cause the timing for the recognition of revenue from an order to vary significantly. This may cause our revenues and operating results to vary significantly from quarter to quarter and year to year.

The amount of revenues that we earn in any given quarter may vary based in part on the timing of new vehicle programs in the global automotive industry. In contrast, many of our operating expenses are fixed and will not vary from quarter to quarter. As a result, our operating results may vary significantly from quarter to quarter and from year to year.

We have operations outside the United States, increasing the possibility that our business could be adversely affected by risks of doing business in foreign countries.

We have significant operations outside of the United States.

7

Our foreign operations are subject to risks customarily encountered in such operations. For instance, we may encounter fluctuations in foreign currency exchange rates, differences in the level of protection available for our intellectual property, the impact of differences in language and local business and social customs on our ability to market and sell our products in these markets, the inability to recruit qualified personnel in a specific country or region, more stringent employment regulations and local labor conditions and difficulties in repatriating cash earned in other countries back to the United States. In addition, we may be affected by U.S. laws and policies that impact foreign trade and investment. Finally, we may be adversely affected by laws and policies imposed by foreign governments in the countries where we have business operations or sell our products.

If the suppliers and subcontractors we rely on for component parts or products delay deliveries, fail to deliver parts or products meeting our requirements or stop supplying parts or products altogether, we may not be able to deliver products to our customers in a timely fashion and our revenues and profits could be reduced.

We rely on subcontractors for certain components of our products, including outside subcontracting assembly houses to produce the circuit boards that we use in our products. As a result, we have limited control over the quality and the delivery schedules of components or products purchased from third parties. In addition, we purchase a number of component parts from single source suppliers. If our supplies of component parts or products meeting our requirements are significantly delayed or interrupted, or our subcontractors choose to terminate their supply contracts, we may not be able to deliver products to our customers in a timely fashion. This could result in a reduction in revenues and profits for these periods. The termination of or material change in the purchase terms of any single source supplier could have a similar impact on us. It is also possible, if our delay in delivering products to our customer is too long, the customer could cancel their order or potentially charge us with penalties, resulting in a permanent loss of revenue and/or profit from that sale. Although we have not experienced significant supply shortages from single source suppliers in recent years, from time to time, we have experienced significant delays in the receipt of certain components. Furthermore, some of our suppliers have informed us that a few of our components are at “end-of-life”, therefore, we may need to find an alternative supplier or change our product design. Finally, although we believe that alternative suppliers are available for the components in our products, difficulties or delays may arise if we shift manufacturing capacity to new suppliers.

Because of our significant foreign operations, our revenues and profits can vary significantly as a result of fluctuations in the value of the United States Dollar against other currencies.

Products that we sell in foreign markets are typically priced in the currency of the country where the customer is located. To the extent that the U.S. Dollar fluctuates against these currencies, the costs of our products sold in those countries’ currencies also will fluctuate. As a result, revenue and profits on the sale of our products could vary based on these fluctuations. Accordingly, we could experience unanticipated gains or losses in our profits that could have a material impact on our results of operations.

In addition, because a significant portion of our assets are denominated in foreign currencies, we face exposure to foreign currency exchange rate fluctuations. These fluctuations have, in the past, resulted in material adverse foreign currency translations adjustments to our comprehensive net income or loss as well as had a material negative impact on our reported levels of cash and cash equivalents.

A change in our effective tax rate can have a significant adverse impact on our business.

A number of factors may adversely impact our future effective tax rates, such as the future valuation of our deferred tax assets which are predominantly in the U.S. and the valuation can vary significantly, positively or negatively, depending on future periods of taxable income or taxable losses in each tax jurisdiction in which we operate; the geographic composition of our pre-tax income and the various tax rates in those countries; changes in available tax credits, changes in tax laws and rates, and the repatriation of earnings from outside the U.S. for which we have not previously provided for U.S. taxes. A change in our effective tax rate can adversely impact our net income.

On December 22, 2017, the Tax Cuts and Jobs Act (the “Act”) was enacted by the U.S. The Act implements comprehensive tax legislation which, among other changes, imposes a tax on the untaxed foreign earnings of foreign subsidiaries of U.S. companies by deeming those earnings to be repatriated (the “Transition Tax”). The changes in the Act are broad and complex. We have estimated the impact of the Transition Tax by incorporating assumptions made based upon our current interpretation and analysis to-date of the Act and have determined that our foreign tax credits would completely offset any Transition Tax calculated, and therefore, we do not expect to make any cash payments related to the Transition Tax.

From time to time, we may make forward looking statements and provide estimates as to the impact of the Act on us. The final impacts of the Act may differ from such statements or estimates, possibly materially, as allowed under Staff Accounting Bulletin No. 118 (“SAB 118”), due to, among other things, further refinements of our calculations, changes in interpretations and assumptions we have made, guidance that may be issued and actions we may take as a result of the Act.

8

The occurrence of business system disruptions or information security breaches could adversely affect our business.

To our knowledge, we have not been subject to any material information security breaches; however, many other companies have experienced such breaches because of illegal hacking, computer viruses or acts of vandalism or terrorism. While we have implemented security measures to protect against such breaches, it is possible that our security measures may not detect or prevent such breaches. Any such compromise to our information security could result in an interruption in our operations, the unauthorized publication of our confidential business or proprietary information, the unauthorized release of customer, vendor, or employee data, the violation of privacy or other laws and the exposure to litigation, any of which could harm our business and operating results. A disruption to our management information systems could cause significant disruption to our business, including our ability to receive and ship orders, receive and process payments and timely report our financial results. Any disruption occurring with these systems may have a material adverse effect on our results of operations.

Our ability to increase sales of our CMM products depends on our ability to successfully expand our distribution channels.

With the acquisitions of Coord3 and NMS in fiscal 2015, we expanded our product lines to include the design, manufacture and sale of CMM products. We market our line of CMM products directly to end users and through distributors and resellers. Growth of our sales of this product line depends upon our ability to expand our distribution channels by identifying, developing and maintaining relationships with distributors and resellers. In addition, our distributors and resellers can potentially sell products offered by our competitors. If we are not able to successfully expand our distribution channels for our CMM products, or if our distributors or resellers do not or are not able to successfully sell our CMM products, our strategic plan to expand our revenues will be adversely affected.

We are subject to risks related to litigation.

From time to time, we are subject to lawsuits and other claims arising out of our business operations. Adverse judgments in one or more of these lawsuits could require us to pay significant damage amounts. The outcome of lawsuits is inherently uncertain and typically a loss cannot be reasonably estimated or accrued by us. Accordingly, if the outcome of a legal proceeding is adverse to us, we would have to record a charge for the matter at the time the legal proceeding is resolved and generally in the full amount at which it is resolved. In addition, the expenses related to these lawsuits may be significant. Lawsuits can have a material adverse effect on our business and operating results, particularly where we have not established an accrual or a sufficient accrual for damages, settlements or expenses. See “Item 3 – Legal Proceedings” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Litigation and Other Contingencies” below for a discussion of our policies in accounting for lawsuits and other claims.

Our revenues are highly influenced by the sale of products for use in the global automotive market, particularly by manufacturers based in the United States, China and Western Europe. These manufacturers have experienced periodic downturns in their businesses that could adversely affect their level of purchases of our products.

Due to our significant revenue from the automotive industry, our ability to sell our systems and solutions to automotive manufacturers and suppliers is affected by periodic downturns in the global automotive industry, such as what occurred in 2009-2010.

New vehicle tooling programs are the most important selling opportunity for our automotive-related sales. The number and timing of new vehicle tooling programs can be influenced by a number of economic factors. Our customers only launch a limited number of new car programs in any given year because of the time and financial resources required. From a macro perspective, we continue to assess the global economy and its likely effect on our automotive customers and markets served. We continue to view the automotive industry’s focus on introducing new vehicles more frequently to satisfy their customers’ changing requirements, as well as their continuing focus on improved quality, as positive indicators for new business. However, because of periodic economic downturns experienced by our customers, our customers could decide to reduce their number of new car programs. The automobile industry is a very cost competitive industry. Pricing pressures could adversely affect the margins we realize on the sale of our products, and ultimately, our profitability.

We may not be able to complete business opportunities and our profits could be negatively affected if we do not successfully integrate those that we do complete.

We will evaluate, from time to time, business opportunities that fit our strategic plans. There can be no assurance that we will identify any opportunities that fit our strategic plans or be able to enter into agreements with identified business opportunities on terms acceptable to us. We may incur significant development and other costs with no assurance that a business opportunity will be realized after incurring these costs.

We intend to finance any such business opportunities from available cash on hand, existing credit facilities, issuance of additional stock or additional sources of financing, as circumstances warrant. The issuance of additional equity securities to finance business opportunities could be substantially dilutive to our current stockholders. In addition, if the business opportunities do not perform as expected, we could incur charges with no future benefits. If we are not successful in generating additional profits from these items, this dilution and these additional costs could cause our Common Stock price to drop.

9

Global economic conditions may negatively impact our results of operations.

Our revenue levels are impacted by global economic conditions, as we have a significant business in many countries throughout the world. In fiscal 2018, only 40% of our sales were generated in North America and as a result, a significant decline in global economic conditions could have a material adverse impact on our results of operations.

A significant amount of our assets represent goodwill and intangible assets, and our net income would be reduced if our goodwill or intangible assets become impaired.

As of June 30, 2018, we had $8.0 million of net goodwill and $3.8 million of net intangible assets. Our acquisitions of Coord3 and NMS resulted in goodwill as the cost exceeded the fair value of the net tangible and identifiable intangible assets acquired. Goodwill is subject to an impairment analysis at least annually based on the fair value of the reporting unit. Intangible assets relate primarily to trademarks, customer relationships and software acquired and are subject to an impairment analysis whenever events or changes in circumstances exist that indicate that the carrying value of the intangible asset might not be recoverable. If we determine that any intangible assets or goodwill is impaired, we would be required to take a related charge to earnings that could have a material adverse effect on our results of operations. For example, in the third quarter of fiscal 2016, we recorded an impairment charge in the amount of $0.7 million related to previously capitalized software related to a product line that was discontinued.

We face various risks arising from the legal, regulatory and tax requirements imposed on our operations in the various countries in which we conduct our business operations.

We are subject to various risks relating to our compliance with existing and new laws, rules and regulations implemented in the countries in which we conduct our business operations, including anti-corruption, anti-bribery, tax, material composition of our products, such as restrictions on lead and other substances, environmental, safety and export control regulations.

We are subject to the United States Foreign Corrupt Practices Act (“FCPA”), which generally prohibits companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or keeping business or other benefits. As a result of our foreign operations, we may have contact with persons who are considered foreign officials under the FCPA, putting us at an increased risk of potential FCPA violations.

The U.S. proposed significant increases in tariffs on certain imports, which prompted retaliatory measures from major U.S. trading partners. Our earnings and sales could be affected by changes to international trade agreements in North America and elsewhere, including potential increases of import tariffs. Changes in government policies in these areas might cause a decrease in our sales, operating income and net earnings.

Our failure or inability to comply with any of these laws, rules or regulations could subject us to civil or criminal penalties, other remedial measures or financial or regulatory obligations that may adversely affect our results of operations, financial position, reputation or ability to conduct business. We may receive audit notices or other inquiries from governmental or regulatory authorities, and we may participate in voluntary disclosure programs, related to legal, regulatory or tax compliance matters. These audits, inquiries or disclosure programs or any non-compliance with applicable laws, rules or regulations could result in our incurring material expense, including investigation costs, defense costs, assessments and penalties, or other consequences that could have a materially adverse effect on our results of operations, financial position, reputation or ability to conduct business.

Failure to comply with U.S. federal, state and international laws and regulations relating to privacy or data protection, or the expansion of current or the enactment of new laws or regulations relating to privacy or data protection, could adversely affect our business and our financial condition.

A variety of U.S. federal, state and international laws and regulations govern the collection, use, retention, sharing and security of data. Laws and regulations relating to privacy and data protection are evolving and subject to potentially differing interpretations. These requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another or may conflict with other rules or our practices. As a result, our practices may not have complied or may not comply in the future with all such laws, regulations, requirements and obligations. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any federal, state or international privacy or data protection related laws, regulations, industry self-regulatory principles, industry standards or codes of conduct, regulatory guidance, orders to which we may be subject or other legal obligations relating to privacy or data protection could adversely affect our reputation and business, and may result in claims, proceedings or actions against us by governmental entities or others or other liabilities or require us to change our operations and/or cease using certain data sets. Any such claim, proceeding or action could hurt our reputation and business, force us to incur significant expenses in defense of such proceedings, distract our management, increase our costs of doing business, result in a loss of customers and suppliers and may result in the imposition of monetary penalties. We may also be contractually required to indemnify and hold harmless third parties from the costs or consequences of non-compliance with any laws, regulations or other legal obligations relating to privacy or data protection or any inadvertent or unauthorized use or disclosure of data that we store or handle as part of operating our business.

Foreign data protection, privacy and other laws and regulations are often more restrictive than those in the U.S. The European Union, for example, traditionally has imposed stricter obligations under its laws and regulations relating to privacy and data protection than the U.S., most recently adopting the General Data Protection Regulation (GDPR) throughout Europe in May 2018. Individual European Union member countries have discretion with respect to their interpretation and implementation of these laws and the penalties for breach and have their own regulators with differing attitudes towards enforcement, which results in varying privacy standards and enforcement risk from country to country.

10

We may have additional tax liabilities, which could adversely affect our results of operations.

We are subject to income taxes in the U.S. and other jurisdictions, including Germany, Italy and China. In determining our provisions for income taxes, we make judgments regarding various tax positions reported on our tax returns. As a result, there are transactions and calculations where the ultimate tax determination is uncertain. Our tax returns are regularly under audit by tax authorities. Because of these uncertain tax positions, the final determination of these tax audits could be materially different than is reflected in our financial statements and could have a material adverse effect on our provisions for income taxes, results of operations or cash flows.

We may need replacement or additional financing in the future to meet our operational needs, including working capital or capital expenditures and such financing may not be available on terms favorable to us, if at all, and may be dilutive to existing shareholders.

Our credit facilities in the U.S. and Brazil are on-demand facilities and may be cancelled by either party at any time. We may need to seek additional financing for our general corporate purposes. For example, we may need to increase our investment in research and development activities or need funds to support working capital or capital expenditure needs. Furthermore, in fiscal 2017, we terminated our German credit facility at the request of the lender, and in fiscal 2018, two of the credit lines in Brazil were closed. We may be unable to obtain any desired replacement or additional financing on terms favorable to us, if at all. If adequate funds are not available on acceptable terms, we may be unable to fund our operations, successfully develop or enhance products or respond to competitive pressures, any of which could negatively affect our business. If we raise additional funds through the issuance of equity securities, our shareholders will experience dilution of their ownership interest. If we raise additional funds by issuing debt, we may be subject to further limitations on our operations due to restrictive covenants.

We could become involved in costly litigation alleging patent infringement.

In the past, we had been informed that certain of our customers have received allegations of possible patent infringement involving processes and methods used in our products. Certain of these customers, including a customer who was a party to a patent infringement suit relating to this matter, settled such claims. We believe that the processes used in our products were independently developed without utilizing any previous patented process or technology. However, it is possible, that in the future, we or our customers could receive allegations of possible patent infringement or could be parties to patent infringement litigation relating to our products.

The defense of patent infringement litigation could be costly and require significant attention from management. Because of the small size of our management team, this could result in the diversion of management’s attention from day-to-day operations or could have a material adverse effect on our results of operations.

Our business depends on our ability to attract and retain key personnel.

Our success depends in large part upon the continued service of our executives and key employees, including those in engineering, software engineering, sales and marketing positions, as well as our ability to attract such additional employees in the future. At times and in certain geographic markets, competition for the type of highly skilled employees we require can be significant. The loss of key personnel or the inability to attract new qualified key employees could adversely affect our ability to implement our long-term growth strategy and have a material adverse effect on our business.

Because of the limited trading in our Common Stock, it may be difficult for shareholders to dispose of a large number of shares of our Common Stock in a short period of time or at then current prices.

Because of the limited number of shares of our Common Stock outstanding and the limited number of holders of our Common Stock, only a limited number of shares of our Common Stock trade on a daily basis. This limited trading in our Common Stock makes it difficult to dispose of a large number of shares in a short period of time. In addition, it is possible that the sale by a shareholder of a large number of shares of our Common Stock over an extended period would depress the price of our Common Stock.

The trading price of our stock has been volatile.

The following factors may affect the market price of our Common Stock, which can vary widely over time:

|

|

• |

announcements of new products by us |

|

|

• |

announcements of new products by our competitors |

|

|

• |

variances in our operating results |

|

|

• |

market conditions in the electronic and sensing industry and/or automotive industry |

|

|

• |

announcements by our largest customers that have a significant impact on their operations |

|

|

• |

market conditions and stock prices in general |

|

|

• |

the volume of our Common Stock traded |

11

Market volatility adversely impacts the market price of our Common Stock.

The capital and credit markets are subject to volatility and disruption. During such a period, the volatility and disruption could reach unprecedented levels, which would exert downward pressures on stock prices, including the market price of our Common Stock.

The Board of Directors has the right to issue up to 1,000,000 shares of preferred stock without further action by shareholders. The issuance of those shares could cause the market price of our Common Stock to drop significantly and could be used to prevent or frustrate shareholders’ attempts to replace or remove current management.

Although no preferred stock currently is outstanding, we are authorized to issue up to 1,000,000 shares of preferred stock. Preferred stock may be issued in one or more series, the terms of which may be determined at the time of issuance by the Board of Directors, without further action by shareholders, and may include voting rights (including the right to vote as a series on particular matters), the dividends payable thereon, liquidation payments, preferences as to dividends and liquidation, conversion rights and redemption rights. In the event that preferred stock is issued, the rights of the common stockholders may be adversely affected. This could result in a reduction in the value of our Common Stock.

The preferred stock could be issued to discourage, delay or prevent a change in control. This may be beneficial to our management or Board of Directors in a hostile tender offer or other takeover attempt and may have an adverse impact on shareholders who may want to participate in the tender offer or who favor the takeover attempt.

Our rights plan could be used to discourage hostile tender offers.

We maintain a rights plan. Under the plan, if any person acquires 20% or more of our outstanding Common Stock, our shareholders, other than the acquirer, will have the right to purchase shares of our Common Stock at half their market price. The rights plan discourages potential acquirers from initiating tender offers for our Common Stock without the approval of the Board of Directors. This may be beneficial to our management or Board of Directors in a hostile tender offer or other takeover attempt and may have an adverse impact on shareholders who may want to participate in the tender offer or who favor the takeover attempt.

Not applicable.

Our principal domestic facility consists of a 70,000 square foot building located in Plymouth, Michigan, owned by us. In addition, we own a 3,100 square meter facility in Bruzolo, Italy. We lease a 1,576 square meter facility in Munich, Germany and we lease office space in Sao Paulo, Brazil; Tokyo, Japan; Prague, Czech Republic; Shanghai, China; and Chennai and New Delhi, India. We plan to move our German facility during fiscal 2019. We believe our current and expected facilities will be sufficient to accommodate our requirements through fiscal 2019.

See Note 14, of the Notes to the Consolidated Financial Statements, “Commitments and Contingencies”, contained in Item 8 of this Annual Report on Form 10-K.

Not applicable.

12

|

ITEM 5: |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Perceptron’s Common Stock is traded on The NASDAQ Stock Market’s Global Market under the symbol “PRCP”. The following table shows the reported high and low sales prices of Perceptron’s Common Stock for fiscal 2018 and 2017:

|

|

|

Prices |

|

|||||

|

Fiscal 2018 |

|

High |

|

|

Low |

|

||

|

Quarter through September 30, 2017 |

|

$ |

7.99 |

|

|

$ |

6.80 |

|

|

Quarter through December 31, 2017 |

|

$ |

10.71 |

|

|

$ |

7.26 |

|

|

Quarter through March 31, 2018 |

|

$ |

10.81 |

|

|

$ |

8.20 |

|

|

Quarter through June 30, 2018 |

|

$ |

10.60 |

|

|

$ |

8.51 |

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2017 |

|

High |

|

|

Low |

|

||

|

Quarter through September 30, 2016 |

|

$ |

7.00 |

|

|

$ |

4.60 |

|

|

Quarter through December 31, 2016 |

|

$ |

6.97 |

|

|

$ |

5.59 |

|

|

Quarter through March 31, 2017 |

|

$ |

8.87 |

|

|

$ |

5.96 |

|

|

Quarter through June 30, 2017 |

|

$ |

8.95 |

|

|

$ |

7.18 |

|

In fiscal 2015, the Board of Directors elected to not pay a dividend and to end our dividend program for the foreseeable future; as a result, no dividend was paid in fiscal 2018. Based upon a review of our capital allocations, we believe it is better to invest in our growth and diversification strategy rather than a dividend strategy.

Under the terms of our Loan Agreement with Chemical Bank, we are not permitted to pay dividends. See “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

The approximate number of shareholders of record on August 21, 2018, was 106.

The information pertaining to the securities we have authorized for issuance under equity plans is hereby incorporated by reference to Item 12, "Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters – Equity Compensation Plan Information”. For more information about our equity compensation plans, see Note 17, of the Notes to the Consolidated Financial Statements, “Stock Based Compensation”, contained in Item 8 of this Annual Report on Form 10-K.

STOCK PRICE PERFORMANCE GRAPH

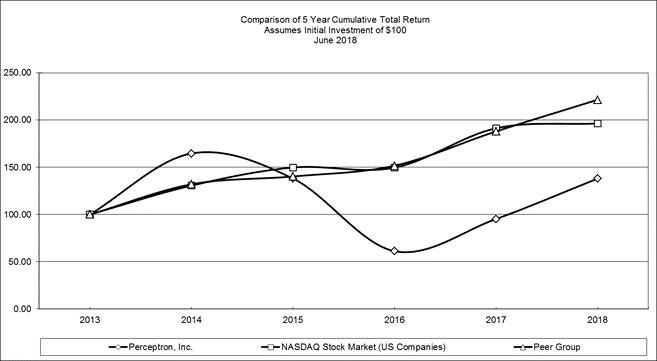

The following graph compares the cumulative 5-year total return attained by shareholders on our Common Stock relative to the cumulative total returns of The Nasdaq Stock Market (U.S.) Index (the “Nasdaq U.S. Index”) and a peer group of companies consisting of all U.S. exchange traded companies with standard industrial classification codes 3823 (Industrial Instruments for Measurement, Display, and Control of Process Variables; and Related Products), 3827 (Optical Instruments and Lenses) and 3829 (Measuring and Controlling Devices) (the “Peer Group Index”). The returns of each company in the Peer Group Index have been weighted according to their respective stock market capitalization. The graph assumes that the value of the investment in our Common Stock, the Peer Group Index and the Nasdaq U.S. Index was $100 on June 30, 2013 and that all dividends were reinvested.

13

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Perceptron, Inc., the Nasdaq U.S. Index,

and a Peer Group Index

|

* |

$100 invested on June 30, 2013 in stock or index, including reinvestment of dividends. Fiscal year ending June 30. |

|

CUMULATIVE TOTAL RETURN |

|

||||||||||||||||||||||

|

|

6/30/2013 |

|

|

6/30/2014 |

|

|

6/30/2015 |

|

|

6/30/2016 |

|

|

6/30/2017 |

|

|

6/30/2018 |

|

||||||

|

Perceptron, Inc. |

|

100.00 |

|

|

|

164.65 |

|

|

|

138.19 |

|

|

|

61.24 |

|

|

|

95.27 |

|

|

|

138.06 |

|

|

Nasdaq U.S. Index |

|

100.00 |

|

|

|

130.62 |

|

|

|

149.82 |

|

|

|

149.63 |

|

|

|

191.33 |

|

|

|

196.38 |

|

|

Peer Group Index |

|

100.00 |

|

|

|

132.03 |

|

|

|

140.31 |

|

|

|

151.72 |

|

|

|

188.03 |

|

|

|

221.48 |

|

The graph displayed above is presented in accordance with applicable legal requirements. Shareholders are cautioned against drawing any conclusions from the data contained in the graph, as past results are not necessarily indicative of future performance. The graph in no way reflects our forecast of future financial performance.

14

The Peer Group consists of the following companies:

|

• Abaxis, Inc. (ABAX) |

• Attune RTD, Inc (AURT) |

|

• Camtek, Ltd (CAMT) |

• Cemtrex Inc. (CETX) |

|

• Cognex Corp. (CGNX) |

• Clearsign Combustion Corp. (CLIR) |

|

• Cubic Corporation (CUB) |

• CyberOptics Corp. (CYBE) |

|

• Danaher Corp. (DHR) |

• Electro-Sensors, Inc. (ELSE), |

|

• Esterline Technologies Corp. (ESL) |

• EcoLogix Resource Group, Inc. (EXRG) |

|

• Faro Technologies Inc. (FARO) |

• Flexpoint Sensor Systems, Inc. (FLXT) |

|

• Fortive Corporation (FTV) |

• Geospace Technologies Corporation (GEOS) |

|

• Hickok, Inc. (HICKA) |

• Hurco Companies Inc. (HURC) |

|

• INFICON Holding AG (IFCN.SW) |

• II-VI Inc. (IIVI) |

|

• International Isotopes, Inc. (INIS) |

• Integral Vision, Inc. (INVI) |

|

• Image Sensing Systems, Inc. (ISNS) |

• Keysight Technologies, Inc. (KEYS) |

|

• KLA–Tencor Corp. (KLAC) |

• Know Labs, Inc. (KNWN) |

|

• Lifeline Biotechnologies, Inc. (LLBO) |

• Maclos Capital Inc. (LMSMF) |

|

• Midwest Energy Emissions Corp. (MEEC) |

• Mikros Systems Corp (MKRS) |

|

• MKS Instruments, Inc. (MKSI) |

• Mechanical Technology, Incorporated (MKTY) |

|

• Mesa Laboratories Inc. (MLAB) |

• MTS Systems Corporation (MTSC) |

|

• Nanometrics Incorporated (NANO) |

• National Energy Services, Inc. (NESV) |

|

• Nova Measuring Instruments Ltd. (NVMI) |

• OPT-Sciences Corporation (OPST) |

|

• Optex Systems Holdings, Inc. (OPXS) |

• Orbotech Ltd. (ORBK) |

|

• Rockwell Automation Inc. (ROK) |

• Roper Technologies Inc. (ROP) |

|

• Rudolph Technologies Inc. (RTEC) |

• Senseonics Holdings, Inc. (SENS) |

|

• Signal Advance, Inc. (SIGL) |

• Schmitt Industries, Inc. (SMIT) |

|

• Sierra Monitor Corp. (SRMC) |

• Sensata Technologies Holding NV (ST) |

|

• ProPhotonix Limited (STKR) |

• SheerVision, Inc. (SVSO) |

|

• Sypris Solutions Inc. (SYPR) |

• Thermo Fisher Scientific, Inc. (TMO) |

|

• Trimble Navigation Limited (TRMB) |

• US Nuclear Corp (UCLE) |

|

• Universal Dectection Technology (UNDT) |

|

The following companies that were included in the Peer Group used in preparing the Stock Price Performance Graph contained in the Company’s 2017 Form 10-K were excluded from the Peer Group used in preparing the graph displayed above:

|

• AmbiCom Holdings, Inc. ((ABHI) – Revoked |

• CDEX Inc. (CDEX) – Revoked |

|

• Elbit Vision Systems Ltd. (EVSNF) – Acquired |

• Landauer Inc. (LDR) – Acquired |

|

• Secure Point Technologies Inc. (IMSCQ) - Bankruptcy |

• Smart Energy Solutions, Inc. (SMGY) – Reporting under a difference SIC code |

|

• Visualant, Inc. (VSUL) – Now known as Know Labs, Inc. (KNWN) and is included under its new name |

• Winland Electronics, Inc. (WELX) - Reporting under a different SIC code |

15

ITEM 6:SELECTED FINANCIAL DATA

The selected Statement of Operations and Balance Sheet data presented below are derived from our Consolidated Financial Statements and should be read in conjunction with our Consolidated Financial Statements and notes thereto and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this Annual Report on Form 10-K.

|

|

|

Fiscal Years Ended June 30, |

|

|||||||||||||||||

|

Statement of Operations Data |

|

2018 |

|

2017 |

|

2016 (1) |

|

2015 (2) |

|

2014 |

|

|||||||||

|

|

(In Thousands, Except Per Share Amounts) |

|

||||||||||||||||||

|

Net Sales |

|

$ |

84,693 |

|

|

$ |

77,947 |

|

|

$ |

69,135 |

|

|

$ |

74,405 |

|

|

$ |

59,612 |

|

|

Gross Profit |

|

|

32,000 |

|

|

|

27,769 |

|

|

|

21,139 |

|

|

|

28,271 |

|

|

|

24,849 |

|

|

Operating Income (Loss) |

|

|

4,948 |

|

|

|

1,819 |

|

|

|

(9,384 |

) |

|

|

(37 |

) |

|

|

2,942 |

|

|

Income (Loss) Before Income Taxes |

|

|

4,489 |

|

|

|

1,262 |

|

|

|

(9,217 |

) |

|

|

(835 |

) |

|

|

3,002 |

|

|

Net Income (Loss) |

|

|

3,716 |

|

|

|

(168 |

) |

|

|

(22,113 |

) |

|

|

(461 |

) |

|

|

2,427 |

|

|

Income (Loss) Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.39 |

|

|

$ |

(0.02 |

) |

|

$ |

(2.36 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.27 |

|

|

Diluted |

|

$ |

0.39 |

|

|

$ |

(0.02 |

) |

|

$ |

(2.36 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.26 |

|

|

Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

9,469 |

|

|

|

9,382 |

|

|

|

9,360 |

|

|

|

9,252 |

|

|

|

8,983 |

|

|

Diluted |

|

|

9,579 |

|

|

|

9,382 |

|

|

|

9,360 |

|

|

|

9,252 |

|

|

|

9,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, |

|

|||||||||||||||||

|

Balance Sheet Data |

|

2018 |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

|||||||||

|

|

(In Thousands, Except Per Share Amounts) |

|

||||||||||||||||||

|

Working Capital |

|

$ |

28,168 |

|

|

$ |

22,483 |

|

|

$ |

21,326 |

|

|

$ |

32,978 |

|

|

$ |

46,454 |

|

|

Total Assets |

|

|

74,204 |

|

|

|

70,615 |

|

|

|

67,922 |

|

|