UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Commission File Number

(Exact name of registrant as specified in its charter)

GROUP SIMEC

(Translation of registrant’s name into English)

UNITED STATES

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| American Depositary Shares (each representing one Series B share) Series B Common Stock | NYSE American* |

| * | Not for trading, but only in connection with the registration of American depositary shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Series B Common Stock —

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Accelerated filer ☐ | Non-accelerated filer ☐ | |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No

Table of Contents

i

CERTAIN TERMS

Grupo Simec, S.A.B. de C.V. is a corporation (sociedad anónima bursátil de capital variable) organized under the laws of the United Mexican States (“Mexico”). Unless the context requires otherwise, when used in this annual report, the terms “we,” “our,” “the company,” “our company” and “us” refer to Grupo Simec, S.A.B. de C.V., together with its consolidated subsidiaries.

References in this annual report to “U.S. dollars” or “U.S.$” are to the lawful currency of the United States of America. References in this annual report to “pesos” or “Ps.” are to the lawful currency of Mexico. References in this annual report to “real” are to the lawful currency of Brazil. References to “tons” in this annual report refer to tons; a metric ton equals 1,000 kilograms or 2,204 pounds. We publish our financial statements in pesos.

The terms “special bar quality steel” or “SBQ steel” refer to steel that is hot rolled or cold finished into round square, or hexagonal steel bars that generally contain higher proportions of alloys than lower quality grades of steel. SBQ steel is produced with precise chemical specifications and generally is made to order following client specifications.

This annual report contains translations of certain peso amounts to U.S. dollars at specified rates solely for your convenience. These translations do not mean that the peso amounts actually represent such dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, we have translated these U.S. dollar amounts from pesos at the exchange rate of Ps. 19.3615 per U.S.$1.00, the interbank transactions rate in effect on December 31, 2022. On April 28, 2023, the interbank transactions rate for the peso was Ps. 18.1030 per U.S.$1.00.

FORWARD LOOKING STATEMENTS

This annual report contains certain statements regarding our business that may constitute “forward looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used in this annual report, the words “anticipates,” “plans,” “believes,” “estimates,” “intends,” “expects,” “projects” and similar expressions are intended to identify forward looking statements, although not all forward looking statements contain those words. These statements, including, but not limited to, our statements regarding the ongoing effects of the coronavirus (COVID-19) pandemic on both our projected customer demand and supply chain, as well as our operations and financial performance, our strategy for raw material acquisition, products and markets, production processes and facilities, sales and distribution and exports, growth and other trends in the steel industry and various markets, operations and liquidity and capital resources, are based on management’s beliefs, as well as on assumptions made by, and information currently available to, management, and involve various risks and uncertainties, some of which are beyond our control. Our actual results could differ materially from those expressed in any forward looking statement. In light of these risks and uncertainties, we cannot assure you that forward looking statements will prove to be accurate. Factors that might cause actual results to differ materially from forward looking statements include, but are not limited to, the following:

| ● | the overall global economic environment and risks associated with the COVID-19 pandemic; |

| ● | factors relating to the steel industry (including the cyclicality of the industry, finished product prices, worldwide production capacity, the high degree of competition from Mexican, U.S. and foreign producers and the price of ferrous scrap, iron ore and other raw materials); |

| ● | our inability to operate at high capacity levels; |

| ● | the costs of compliance with Mexican, Brazilian and U.S. environmental laws; |

| ● | future capital expenditures and acquisitions; |

| ● | future devaluations of the peso and the real; |

| ● | the imposition by Mexico and Brazil of foreign exchange controls and price controls; |

| ● | the influence of economic and market conditions in other countries on Mexican securities; and |

| ● | the factors discussed in Item 3.D – “Risk Factors” below. |

Forward looking statements speak only as of the date of this filing, and we undertake no obligation to publicly update or to revise any forward looking statements after the date of this annual report because of new information, future events or other factors. In light of the risks and uncertainties described above, the forward looking events and circumstances discussed in this annual report might not occur.

ii

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Reserved

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in our series B shares and ADSs involves a high degree of risk. You should consider carefully the following risks, as well as all the other information presented in this annual report, before making an investment decision. Any of the following risks, if they were to occur, could materially and adversely affect our business, results of operations, prospects and financial condition. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially and adversely affect our business, results of operations, prospects and financial condition. In either event, the market price of our series B shares and ADSs could decline significantly, and you could lose all or substantially all of your investment.

Risks Related to Our Business

Our results of operations are significantly influenced by the cyclical nature of the steel industry.

The steel industry is highly cyclical and sensitive to regional and global macroeconomic conditions. Global demand for steel as well as global production capacity levels significantly influence prices for our products, and changes in global demand or supply for steel in the future will likely impact our results of operations. Steel prices are sensitive to macroeconomic fluctuations in the global economy, and substantial price decreases during periods of economic weakness have not always been offset by price increases during periods of economic strength. The steel industry has suffered in the past, especially during downturn cycles, from substantial over-capacity relative to local demand. Currently, as a result of the increase in steel production capacity in recent years, there are signs of excess capacity in steel markets, which is impacting the profitability of the steel industry. During 2020, global steel prices decreased, a trend which accelerated due to the global COVID-19 pandemic. In 2022 and 2021, global steel prices increased after a global economic recovery. We cannot give you any assurance as to prices of steel in the future.

The U.S. economy has experienced a strong recovery from the conditions experienced at the onset of the COVID-19 pandemic, but new variants of COVID-19 and the continued abatement of the COVID-19 pandemic, labor shortages, supply chain disruptions, new or proposed legislation related to governmental spending, inflation and increases in interest rates have impacted, and will continue to impact, economic growth. Even with this economic recovery, challenges from global production overcapacity in the steel industry and ongoing uncertainties, both in the United States and in other regions of the world, remain. We are unable to predict with certainty the duration of current economic conditions or the magnitude and timing of changes in economic activity. Future economic downturns, prolonged slow growth or stagnation in the economy, a sector-specific slowdown in one of our key end-use markets, such as nonresidential construction, or changes in inflation could materially adversely affect our business, results of operations, financial condition and cash flows, especially in light of the capital-intensive nature of our business.

1

We may not be able to pass along price increases for raw materials to our customers to compensate for fluctuations in price and supply.

Prices for raw materials necessary for production of our steel products have fluctuated significantly in the past and may do so in the future. Significant increases in raw material prices could adversely affect our gross profit. During periods when prices for scrap metal, iron ore, ferroalloys, coking coal and other raw materials have increased, our industry has historically sought to maintain profit margins by passing along increased raw material costs to customers by means of price increases. For example, prices of scrap metal in 2018 increased approximately 19%, in 2019 decreased approximately 20%, in 2020 increased approximately 9%, in 2021 increased approximately 62.6% and 0.5% in 2022; while prices of ferroalloys in 2018 increased approximately 10%, in 2019 increased approximately 1%, in 2020 decreased approximately 20%, in 2021 increased approximately 32.9% and 36.4% in 2022. We may not be able to pass along these and other cost increases in the future and, therefore, our profitability may be materially and adversely affected. Even when we can successfully increase our prices, interim reductions in profit margins frequently occur due to a time lag between the increase in raw material prices and the market acceptance of higher selling prices for finished steel products. We cannot assure you that our customers will agree to pay increased prices for our steel products that compensate us for increases in our raw material costs.

We purchase our raw materials either in the open market or from certain key suppliers. Both scrap metal and ferroalloy prices are negotiated on a monthly basis with our suppliers and are subject to market conditions. We cannot assure you that we will be able to continue to find suppliers of these raw materials in the open market, that the prices of these materials will not increase or that the quality will remain the same. In addition, if any of our key suppliers fails to deliver or we fail to renew our supply contracts, we could face limited access to some raw materials, or higher costs and delays resulting from the need to obtain our raw materials requirements from other suppliers.

The energy costs involved in our production processes are subject to fluctuations that are beyond our control and could significantly increase our costs of production.

Energy costs constitute a significant component of our costs of operations. Our energy cost was 12.6% of our manufacturing costs for 2022 compared to 10.8% for 2021, 11.1% for 2020, 14.3% for 2019 and 12.4% for 2018. Our energy costs are driven by the dependence of our production processes on adequate supplies of electricity and natural gas. A substantial increase in the cost of electricity or natural gas could have a material adverse effect on our gross profit. In addition, a disruption or curtailment in supply could have a material adverse effect on our production and sales. Prices for electricity increased approximately 14% in 2018, in 2019 increased approximately 1%, in 2020 decreased approximately 9.8%, in 2021 increased approximately 2.8% and 7.7% in 2022; and prices for natural gas increased approximately 28% in 2018 and increased approximately 1.8% in 2019, decreased approximately 18% in 2020, increased approximately 37% in 2021 and 54.3% in 2022.

We pay special rates to the Mexican federal electricity commission (Comisión Federal de Electricidad or “CFE”) for electricity. We also pay special rates to Pemex, Gas y Petroquímica Básica, (“PEMEX”), the national oil company of Mexico, for natural gas used at our facilities in Mexico. We cannot assure you that these special rates will continue to be available to us or that these rates may not increase significantly in the future, particularly in light of recent energy reforms in Mexico. In accordance with the energy reform in Mexico, the Republic’s Congress approved the Law of the Electricity Industry and the Regulation of the Law of the Electricity Industry, which regulate some articles of the Constitution of the United Mexican States and have the purpose of regulating the planning and control of the National Electric System (SEN), the Public Service of Transmission and Distribution (T&D) of electric energy and other activities of the electric industry. The Mexican State will establish and execute the policies, regulation and surveillance of the electricity industry through the Secretary of Energy (SENER), which is empowered to establish, conduct and coordinate the country’s energy policies in matters of electricity, direct the process of planning and preparation of the SEN development program, establishing the criteria for granting Clean Energy Certificates, monitoring the operation of the Wholesale Electricity Market (the Market) and the determinations of the National Center for Energy Control (CENACE), among others. The Energy Regulatory Commission (CRE) is empowered to grant qualified user generation permits, among others, to determine the consideration methodologies applicable to Exempt Generators, to issue and apply the tariff regulation to which the T&D, the operation of the Providers of Basic Services, the operation of CENACE and Related Services not included in the Market, as well as the final rates of the Basic Supply that are not determined by the Federal Executive, authorize the contract models that CENACE enters into with Market Participants, among others. In the United States of America, we have contracts in place with special rates from the electric utilities. We cannot assure you that these special rates will continue to be available to us or that these rates may not increase significantly in the future. In certain deregulated electric markets in the United States of America, we have third party electric generation contracts under a fixed price arrangement. These contracts mitigate our price risk for electric generation from the volatility in the electric markets. In addition, we purchase natural gas from various suppliers in the United States of America and Canada. These purchase prices are generally established as a function of monthly New York Mercantile Exchange settlement prices. We also contract with different natural gas transportation and storage companies to deliver the natural gas to our facilities. In addition, we enter into futures contracts to fix and reduce volatility of natural gas prices both in Mexico and the United States of America, as appropriate. As of December 31, 2022, we have not entered into derivative financial instruments in Mexico, the United States of America or Brazil. We have not always been able to pass the effect of increases in our energy costs on to our customers and we cannot assure you that we will be able to pass the effect of these increases on to our customers in the future. We also cannot assure you that we will be able to maintain futures contracts to reduce volatility in natural gas prices. Changes in the price or supply of electricity or natural gas would materially and adversely affect our business and results of operations.

2

We face significant competition from other steel producers, which may adversely affect our profitability and market share.

Competition in the steel industry is intense, which exerts a downward pressure on prices, and, due to high start-up costs, the economics of operating a steel mill on a continuous basis may encourage mill operators to establish and maintain high levels of output even in times of low demand, which further decreases prices and profit margins. The recent trend of consolidation in the global steel industry may further increase competitive pressures on independent producers of our size, particularly if large steel producers formed through consolidations, which have access to greater resources than us, adopt predatory pricing strategies that decrease prices and profit margins. If we are unable to remain competitive with these producers, our profitability and market share would likely be materially and adversely affected.

A number of our competitors in Mexico, the United States of America, Brazil and Canada have undertaken modernization and expansion plans, including the installation of production facilities and manufacturing capacity for certain products that compete with our products. As these producers become more efficient, we will face increased competition from them and may experience a loss of market share. In each of Mexico, the United States of America and Brazil, we also face competition from international steel producers. Increased international competition, especially when combined with excess production capacity, would likely force us to lower our prices or to offer increased services at a higher cost to us, which could materially reduce our profit margins.

Competition from other materials could significantly reduce demand and market prices for steel products.

In many applications, steel competes with other materials that may be used as steel substitutes, such as aluminum (particularly in the automobile industry), cement, composites, glass, plastic and wood. Additional substitutes for steel products could significantly reduce demand and market prices for steel products and thereby affect our results of operations.

A sudden slowdown in consumption in, or increase in exports from, China could have a significant impact on international steel prices, affecting our profitability.

As demand for steel has surged in China, steel production capacity in that market has also increased, and China is now the largest worldwide steel producing country, accounting for approximately half the worldwide steel production. Due to the size of the Chinese steel market, a slowdown in steel consumption in that market, could cause a sizable increase in the volume of Chinese steel offered in the international steel markets, exerting a downward pressure on sales and margins of steel companies operating in other markets and regions, including us.

The COVID-19 pandemic, as well as similar epidemics and other public health emergencies in the future, could have a material adverse effect on our business, results of operations, financial condition and cash flows.

The COVID-19 pandemic is continuing to impact countries, communities, supply chains and markets, though to a generally lesser extent than during 2020-2022. Responses by individuals, governments and businesses to ever-changing developments in the COVID-19 pandemic and efforts to reduce its spread, including quarantines, travel restrictions, business closures, and mandatory stay-at-home or work-from-home orders, while largely lifted during 2022, could be reinstituted in the event novel strains or new variants prove resistant to existing vaccines. We continue to be subject to risks arising out of the turbulence of the economic recovery associated with the COVID-19 pandemic, including inflationary pressures, which have generally increased the costs of our labor, raw materials, energy supplies and other production inputs, adversely impacting our results of operations and profitability. Despite our widespread vaccination efforts, we remain subject to the ongoing risk that a portion of our workforce or on-site contractors in the United States, Mexico and Brazil could suffer illness or otherwise be unable to perform their ordinary work functions due to adverse developments in the COVID-19 pandemic or other infectious disease outbreak. In addition, we have experienced, and may continue to experience, supply chain disruptions or operational issues with our vendors or logistics providers, as our suppliers and contractors face similar challenges related to the COVID-19 pandemic, including as a result of new or continued pandemic lockdowns in China. Because the prolonged COVID-19 pandemic and resulting economic volatility continues to evolve, we cannot predict the full extent to which our businesses, results of operations, financial condition or liquidity will ultimately be impacted. To the extent the COVID-19 pandemic adversely affects our businesses, it may also have the effect of exacerbating many of the other risks described in Item 3.D. “Risk Factors.”, any of which could have a material adverse effect on us.

3

Implementing our growth strategy, which may include additional acquisitions, may adversely affect our operations.

As part of our growth strategy, we may seek to expand our existing facilities, build additional plants, acquire additional steel production assets, enter into joint ventures or form strategic alliances that we expect will expand or complement our existing business. If we undertake any of these transactions, they will likely involve some or all of the following risks:

| ● | disruption of our ongoing business; |

| ● | diversion of our resources and of management’s time; |

| ● | decreased ability to maintain uniform standards, controls, procedures and policies; |

| ● | difficulty managing the operations of a larger company; |

| ● | increased likelihood of involvement in labor, commercial or regulatory disputes or litigation related to the new enterprise; |

| ● | potential liability to joint venture participants or to third parties; |

| ● | difficulty competing for acquisitions and other growth opportunities with companies having greater financial resources; and |

| ● | difficulty integrating the acquired operations and personnel into our existing business. |

We will require significant capital for acquisitions and other strategic plans, as well as for the maintenance of our facilities and compliance with environmental regulations. We may not be able to fund our capital requirements from operating cash flow and we may be required to issue additional equity or debt securities or obtain additional credit facilities, which could result in additional dilution to our shareholders. We cannot assure you that adequate equity or debt financing would be available to us on favorable terms or at all. If we are unable to fund our capital requirements, we may not be able to implement our growth strategy.

We intend to continue to pursue a growth strategy, the success of which will depend in part on our ability to acquire and integrate additional facilities. Some of these acquisitions may be outside of Mexico, the United States of America, Canada and Brazil. Acquisitions involve special risks, in addition to those described above, that could adversely affect our business, financial condition and results of operations, including the assumption of legacy liabilities and the potential loss of key employees. We cannot assure you that any acquisition we make will not materially and adversely affect us or that any such acquisition will enhance our business. We are unable to predict the likelihood of any additional acquisitions being proposed or completed in the near future or the terms of any such acquisitions.

Tariffs, anti-dumping and countervailing duty claims imposed in the future could harm our ability to export our products outside of Mexico, and changes in Mexican tariffs on steel imports could adversely affect the profitability and market share of our Mexican steel business.

International trade-related administrative proceedings, legal actions and restrictions pose a constant risk for our international operations and sales throughout the world. Countries may impose restrictive import duties and other restrictions on imports under various national trade laws. The timing and nature of the imposition of trade-related restrictions potentially affecting our exports are unpredictable. Trade restrictions on our exports could adversely affect our ability to sell products abroad and, as a result, our profit margins, financial condition and overall business could suffer.

One significant source of trade restrictions results from the imposition of “anti-dumping” and “countervailing” duties, as well as “safeguard measures.” These duties can severely limit or altogether prevent exports to relevant markets. For example, in October 2014, the United States of America International Trade Commission (USITC) determined that the U.S. steel industry was materially injured by imports of steel concrete reinforcing bars from Mexico that are sold in the United States of America at less than fair value, and from Turkey, that are subsidized by the government of Turkey. As a result of the USITC’s affirmative determinations, the U.S. Department of Commerce issued an anti-dumping duty order on imports of this product from Mexico and a countervailing duty order on imports of this product from Turkey. The U.S. government imposed tariffs of 66.7% against imports for rebar from Deacero, S.A.P.I de C.V. and us and tariffs of 20.58% for rebar imports from all other producers in Mexico, including Simec. On January 6, 2021, a preliminary dumping rate of 66.7% was imposed on our exports of rebar to the United States of America; following the U.S. Department of Commerce’s physical review carried out at our San Luis Potosí plant, arguing deficiencies and adverse facts during the information process. Such dumping rate was ratified on June 1, 2022. A preliminary dumping rate of 6.35% was imposed and will be ratified in the first half of 2023.

4

Many of our products are subject to existing duties, tariffs, anti-dumping duties and quotas that may limit the quantity of some types of goods that we import into the United States of America. Furthermore, certain of our competitors may be better positioned than us to withstand or react to border taxes, tariffs or other restrictions on global trade and as a result we may lose market share to such competitors. Due to broad uncertainty regarding the timing, content and extent of any regulatory changes in the U.S. or elsewhere, we cannot predict the impact, if any, that these changes could have to our business, financial condition and results of operations. See “Risks Related to Mexico—Developments in other countries could adversely affect the Mexican economy, our financial performance and the price of our shares.”

We and our auditors identified material weaknesses in our internal controls over financial reporting for 2020 and 2021, which resulted in our conducting a thorough review and implementing remedial measures in 2020 and 2021.

In connection with the preparation of our financial statements as of and for each of the years ended December 31, 2020 and 2021, we and our auditors identified material weaknesses (as defined under standards established by the U.S. Public Company Accounting Oversight Board) in our internal controls over financial reporting for the years 2020 and 2021. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. In 2020 and 2021, the Company made progress addressing the deficiencies. In 2022, we believe that all material weaknesses have been addressed.

For details about our internal control deficiencies and remediation, see Items 15.B. “Controls and Procedures—Management’s Annual Report on Internal Control Over Financial Reporting – Material Weaknesses,” 15.C. “Attestation Report of the Independent Registered Public Accounting Firms,” 15.D. “Changes in Internal Control over Financial Reporting,” and 8 “Financial Information-Legal Proceedings.”

The operation of our facilities depends on good labor relations with our employees.

As of December 31, 2022, approximately 88% of our non-Mexican and 46% of our Mexican employees were members of unions. The compensation terms of our labor contracts are adjusted on an annual basis, and all other terms of the labor contracts are renegotiated every two years. In addition, collective bargaining agreements are typically negotiated on a facility-by-facility basis for our Mexican facilities. Any failure to reach an agreement on new labor contracts or to negotiate these labor contracts could result in strikes, boycotts or other labor disruptions. These potential labor disruptions could have a material and adverse effect on our business. Labor disruptions or significant negotiated wage increases could reduce our sales or increase our costs, which could in turn have a material adverse effect on our results of operations.

Operations at our Lackawanna, New York, facility depend on our continuing right to use certain property and assets of an adjoining facility and the termination of any such rights would interrupt our operations and have a material adverse effect on our results of operations and financial condition.

The operations of our Lackawanna facility depend upon certain service and utility arrangements and understandings with third parties relating to, among other things, our use of industrial water, compressed air, sanitary sewer and electrical power. We have entered into a written agreement, subject to automatic one-year renewals and terminable by either party, for the provision of compressed air to our Lackawanna facility and an option to purchase the equipment at various times and at stated prices. The water pump that services our plant is located on property owned and maintained by another third party, which also continues to furnish industrial water to us on a month-to-month basis. The electric system which services the compressed air equipment, as well as the electric system which services the property on which the compressed air equipment is located, is routed through our electric meter located at a substation on adjacent property owned by the third party providing the compressed air to our facility. In the event of a termination of any of our rights, either due to a failure to negotiate a satisfactory outcome with the third parties providing these services or for any other reason, we could be required to cease all or substantially all of our operations at the Lackawanna facility. Because we produce certain types of products in our Lackawanna facility that we do not produce in our other facilities, an interruption of production at our Lackawanna facility would result in a substantial loss of revenue and could damage our relationships with customers.

Our sales in the United States of America are concentrated and could be significantly reduced if one of our major customers reduced its purchases of our products or was unable to fulfill its financial obligations to us.

Our sales in the United States of America are concentrated among a relatively small number of customers. Any of our major customers can stop purchasing our products or significantly reduce their purchases at any time. During 2022, 2021, 2020, 2019, and 2018, sales to our ten largest customers in the United States of America accounted for approximately 72.1%, 66.6%, 68%, 65% and 68.4% of our consolidated revenues in the United States of America, respectively, and approximately 10.8%, 14.8%, 15.5%, 20.8% and 13.8% of our total consolidated revenues, respectively. A disruption in sales to one or more of our largest customers would adversely affect our cash flow and results of operations.

5

We cannot assure you that we will be able to maintain our current level of sales to our largest customers or that we will be able to sell our products to other customers on terms that are favorable to us or at all. The loss of, or substantial decrease in the amount of purchases by, or a write-off of any significant receivables from, any of our major customers would materially and adversely affect our business, results of operations, liquidity and financial condition.

Unanticipated problems with our manufacturing equipment and facilities could have an adverse impact on our business.

Our capacity to manufacture steel products depends on the suitable operation of our manufacturing equipment, including blast furnaces, electric arc furnaces, continuous casters, reheating furnaces and rolling mills. Breakdowns requiring significant time and/or resources to repair, as well as the occurrence of unexpected adverse events, such as fires, explosions or adverse meteorological conditions, could cause production interruptions that could adversely affect our results of operations.

We have not obtained insurance against all risks, and do not maintain insurance covering losses resulting from catastrophes or business interruptions (such as interruptions attributable to the COVID-19 pandemic). In the event we are not able to quickly and cost-effectively remedy problems creating any significant interruption of our manufacturing capabilities, our operations could be adversely affected. In addition, in the event any of our plants were destroyed or significantly damaged or their production capabilities otherwise significantly decreased, we would likely suffer significant losses, and capital investments necessary to repair any destroyed or damaged facilities or machinery would adversely affect our profitability, liquidity and financial condition.

If we are unable to obtain or maintain quality and environmental management certifications for our facilities, we may lose existing customers and fail to attract new customers.

Most of our automotive parts customers in Mexico and the United States of America require that we have ISO 9001, TS 16949 and ISO 14001 certifications. All of the Mexican and U.S. facilities that sell to automotive parts customers are currently certified, as required. If the foregoing certifications are canceled, approvals are withdrawn or necessary additional standards are not obtained in a timely fashion, our ability to continue to serve our targeted market, retain our customers or attract new customers may be impaired. For example, our failure to maintain these certifications could cause customers to refuse shipments, which could materially and adversely affect our revenues and results of operations. We cannot assure you that we will be able to maintain these required certifications.

In the SBQ steel market, all participants must satisfy quality audits and obtain certifications in order to obtain the status of “approved supplier.” The automotive industry has put these stringent conditions in place for the production of auto parts to assure vehicle quality and safety. We currently are an approved supplier for our automotive parts customers. Maintaining these certifications is key to preserving our market share, because they can be a barrier to entry in the SBQ steel market, and we cannot assure you that we will be able to do so.

Failure to comply with environmental laws and regulations may result in fines, penalties or other significant liabilities or prevent us from operating our facilities.

Our operations are subject to a broad range of environmental laws and regulations governing our impact on air, water, soil and groundwater and exposure to hazardous substances. The costs of complying with and the imposition of liabilities pursuant to, environmental laws and regulation can be significant. Despite our efforts to comply with environmental laws and regulations, environmental incidents or events that negatively affect the operations of our facilities may occur. In addition, we cannot assure you that we will at all times operate in compliance with environmental laws and regulations. If we fail to comply with these laws and regulations, we may be assessed fines or penalties, be required to make large expenditures to comply with such laws and regulations, or be forced to shut down non-compliant operations and face lawsuits by third parties. In addition, environmental laws and regulations are becoming increasingly stringent and it is possible that future laws and regulations may require us to undertake material environmental compliance expenditures and require modifications in our operations. Furthermore, we need to maintain existing and obtain future environmental permits in order to operate our facilities. The failure to obtain necessary permits or consents or the loss of any permits could result in significant fines or penalties or prevent us from operating our facilities. We may also be subject, from time to time, to legal proceedings brought by private parties or governmental agencies with respect to environmental matters, including matters involving alleged property damage or personal injury that could result in significant liability. Certain of our facilities in the United States of America have been the subject of administrative action by federal, state and local environmental authorities. See Item 8. “Financial Information—Legal Proceedings.”

6

Greenhouse gas policies and regulations, particularly any binding restriction on emissions of greenhouse gases such as carbon dioxide, could negatively impact our steelmaking operations.

Our steel making operations in the United States of America, Brazil and Mexico use electric arc furnaces where carbon dioxide generation is primarily linked to energy use. In the United States of America, the Environmental Protection Agency has issued rules imposing inventory and reporting obligations to which some of our facilities are subject, and has also issued rules that will affect preconstruction permits for our facilities where increases in greenhouse gas pollutants are contemplated. The U.S. Congress has debated various measures for regulating greenhouse gas emission (such as carbon dioxide) and may enact them in the future. Such laws and regulations may also result in higher costs for coking coal, natural gas and electricity generated by carbon-based systems (such as coal-fired electric generating facilities). Such future laws and regulations, whether in the form of a cap-and-trade emissions permit system, a carbon tax or other regulatory regime may have a negative effect on our operations. Climate change policy is evolving at regional, national and international levels, and political and economic events may significantly affect the scope and timing of climate change measures that are ultimately put in place. As signatories to the United Nations Framework Convention on Climate Change (the “UNFCCC”), Mexico became subject to the Paris Agreement to fight climate change, which was approved at the 21th session of the UNFCCC conference in 2015. The United States of America is also a member of the Paris Agreement.

If we are required to remediate contamination at our facilities, we may incur significant liabilities.

Certain of our U.S. facilities are currently engaged in the investigation and/or remediation of environmental contamination. Most of these investigations relate to legacy activities by prior owners. We may in the future be subject to similar investigations or required to undertake similar remediation measures at other facilities. We recognize a liability for environmental remediation when it becomes probable that such remediation will be required and the amount can be reasonably estimated. As estimated costs to remediate change, or when new liabilities become probable, we adjust the record liabilities accordingly. However, due to the numerous variables associated with the judgments and assumptions that are part of these estimates and changes in governmental regulations and environmental technologies over time, we cannot assure you that our environmental reserves will be adequate to cover such liabilities or that our environmental expenditures will not differ significantly from our estimates or materially increase in the future. Failure to comply with any legal obligations requiring remediation of contamination could result in liabilities, imposition of cleanup liens and fines, and we could incur large expenditures to bring our facilities into compliance. See Item 8. “Financial Information—Legal Proceedings.”

We could incur losses due to product liability claims.

We could experience losses from defects or alleged defects in our steel products that subject us to claims for monetary damages. For example, many of our products are used in automobiles and it is possible that a defect in a vehicle could result in product liability claims against us. In accordance with normal commercial sales, some of our products include warranties that they meet certain agreed upon manufacturing specifications. We cannot assure you that future product liability claims will not be brought against us.

We depend on our senior management and their unique knowledge of our business and of the SBQ steel industry, and we may not be able to replace key executives if they leave.

We depend on the performance of our executive officers and key employees. Our senior management has significant experience in the steel industry, and the loss of any member of senior management or our inability to attract and retain additional senior management could materially and adversely affect our business, results of operations, prospects and financial condition. We believe that the SBQ steel market is a niche market where specific industry experience is key to success. We depend on the knowledge of our business and the SBQ steel industry of our senior management team. In addition, we attribute much of the success of our growth strategy to our ability to retain most of the key senior management personnel of the companies and businesses that we have acquired. Competition for qualified personnel is significant, and we may not be able to find replacements with sufficient knowledge of, and experience in, the SBQ steel industry for our existing senior management or any of these individuals if their services are no longer available. Our business could be adversely affected if we cannot attract or retain senior management or other necessary personnel.

7

Our tax liability may increase if the tax laws and regulations in countries in which we operate change or become subject to adverse interpretations.

Taxes payable by companies in the countries in which we operate are substantial and include income tax, value-added tax, excise duties, profit taxes, payroll-related taxes, property taxes and other taxes. Tax laws and regulations in some of these countries may be subject to change, varying interpretation and inconsistent enforcement. Ineffective tax collection systems and continuing budget requirements may increase the likelihood of the imposition of onerous taxes and penalties which could have a material adverse effect on our financial condition and results of operations. In addition to the usual tax burden imposed on taxpayers, these conditions create uncertainty as to the tax implications of various business decisions. This uncertainty could expose us to significant fines and penalties and to enforcement measures despite our best efforts at compliance, and could result in a greater than expected tax burden. In addition, many of the jurisdictions in which we operate, including Mexico, have adopted transfer pricing legislation. If tax authorities impose significant additional tax liabilities as a result of transfer pricing adjustments, it could have a material adverse effect on our financial condition and results of operations. It is possible that tax authorities in the countries in which we operate will introduce additional tax raising measures. The introduction of any such provisions may affect our overall tax efficiency and may result in significant additional taxes becoming payable. Any such additional tax exposure could have a material adverse effect on our financial condition and results of operations.

If we are unable to protect our information systems against data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.

We are increasingly dependent on information technology networks and systems to process, transmit and store electronic information. In particular, we depend on our information technology infrastructure for digital marketing activities and electronic communications among us and our clients, suppliers and also among our subsidiaries and facilities. Security breaches or infrastructure flaws can create system disruptions, shutdowns or unauthorized disclosures of confidential information. If we are unable to prevent such breaches or flaws, our operations could be disrupted, or we may suffer financial damage or loss because of lost or misappropriated information.

Cyber threats are rapidly evolving and those threats and the means for obtaining access to information in digital and other storage media are becoming increasingly sophisticated. Cyber threats and cyber-attackers can be sponsored by countries or sophisticated criminal organizations or be the work of a single “hacker” or small groups of “hackers.”

Insider or employee cyber and security threats are increasingly a concern for all companies, including ours. Nevertheless, as cyber threats evolve, change and become more difficult to detect and successfully defend against, one or more cyber-attacks might defeat our or a third-party service provider’s security measures in the future and obtain the personal information of customers or employees. Employee error or other irregularities may also result in a defeat of security measures and a breach of information systems. Moreover, hardware, software or applications we use may have inherent defects of design, manufacture or operations or could be inadvertently or intentionally implemented or used in a manner that could compromise information security. A security breach and loss of information may not be discovered for a significant period of time after it occurs. While we have no knowledge of a material security breach to date, any compromise of data security could result in a violation of applicable privacy and other laws or standards, the loss of valuable business data, or a disruption of our business. A security breach involving the misappropriation, loss or other unauthorized disclosure of sensitive or confidential information could give rise to unwanted media attention, materially damage to our customer relationships and reputation, and result in fines, fees, or liabilities, which may not be covered by our insurance policies.

Risks Related to Global Economic Conditions

The COVID-19 pandemic, as well as similar epidemics and other public health emergencies in the future, could have a material adverse effect on our business, results of operations, financial condition and cash flows.

The ongoing global pandemic resulting from the spread of COVID-19 has had a significant effect on economies, businesses and individuals around the world. Efforts by governments around the world, including in the U.S., Brazil and Mexico, to contain COVID-19 have involved, among other things, border closings and other significant travel restrictions; mandatory stay-at-home and work-from-home orders; mandatory business closures; public gathering limitations; and prolonged quarantines. These efforts and other governmental, business and individual responses to the COVID-19 pandemic have led to significant disruptions to commerce, supply chains, credit losses, lower consumer demand for goods and services and general uncertainty regarding the near-term and long-term effects of COVID-19 on the domestic and international economy and on public health. Global steel production has been and will continue to be affected by volatility in the market due to the COVID-19 pandemic and uncertainty remains around the potential emergence of new and more contagious variants of the virus and the effectiveness of vaccine programs. These developments and other consequences of the COVID-19 outbreak have and could continue to materially adversely affect our results of operations, financial condition and cash flows. In addition, the COVID-19 pandemic or other public health emergencies could negatively affect our internal controls over financial reporting as a portion of our workforce may be required to work from home in the future and, therefore, new processes, procedures, and controls may be required to respond to changes in our business environment. The effects of the COVID-19 pandemic may also have the effect of exacerbating many of the other risks described in this Item 3.D. “Risk Factors.”

8

Global economic conditions which have been impacted by the Russian invasion of Ukraine and the failure of Silicon Valley Bank, have in the past, and may continue to, significantly impact our business.

The corresponding reduction in demand across the economy in general and in the automotive, construction and manufacturing sectors due to the global pandemic has reduced demand for steel products in North America and globally. These economic conditions significantly impacted, and will continue to significantly impact, our business and results of operations. Although the reasons mentioned before, demand, production levels and prices in certain segments and markets have recovered and stabilized to a certain degree in 2022. On February 24, 2022, Russia invaded Ukraine, which, due to geopolitical reasons, increased the uncertainty and could delay the global economic recovery. An increase in price of certain commodities has been the major impact of this fact.

In March 2023, Silicon Valley Bank, or SVB, was closed by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation, or FDIC, as receiver. In the same month, each of Signature Bank and Silvergate Capital Corp. were swept into receivership. In the same month, each of Signature Bank and Silvergate Capital Corp. were also placed in receivership. Although we did not have any cash balances on deposit with these banks and are not a borrower or party to any agreement with these banks, investor concerns regarding the U.S. or international financial systems could result in less favorable commercial financing terms, including higher interest rates or costs and tighter financial and operating covenants, or systemic limitations on access to credit and liquidity sources potentially making it more difficult to acquire financing. If global macroeconomic conditions deteriorate, the outlook for steel producers would be adversely affected. It is difficult to predict the duration or severity of a new global economic downturn, or to what extent it will affect us.

An unsustainable recovery and persistently weak economic conditions in our key markets could depress demand for our products and adversely affect our business and results of operations. We sell our products to the automotive and construction-related industries, both of which reported substantially lower customer demand during and after the latest global recession and have recently exhibited reduced demand for steel products due to the ongoing financial recession. Our operating levels in recent years declined compared to pre-recession levels. In 2020, 2021 and 2022 we experienced a decrease in our sales to the automotive industry.

Moreover, if the global economic downturn continues for a prolonged period, or a new global financial crisis occurs, we may face increased risk of insolvency and other credit related issues of our customers and suppliers, as we faced with our customers and suppliers particularly in industries that were hard hit by the latest recession, such as automotive, construction and appliance. Also, there is the possibility that our suppliers face similar risks. The decrease in available credit may increase the risk default of our clients and that our suppliers might delay the raw materials delivery. The impact of global economic conditions on these industries may have a significant effect on our results of operations.

Finally, if global economic conditions continue to deteriorate, we may be required to undertake asset impairments, as we have been required to undertake in the past.

Because a significant portion of our sales are to the automotive industry, a decrease in automotive manufacturing could reduce our cash flows and adversely affect our results of operations.

Sales of our products to the automotive market (either directly to automotive assemblers and manufacturers or indirectly through distributors, component suppliers, and steel service centers) accounted for approximately 20% of our net sales of our SBQ steel products in 2022. Demand for our products is affected by, among other things, the relative strength or weakness of the North American automotive industry. Any reduction in vehicles manufactured in North America, the principal market for our SBQ steel products, has had and will continue to have an adverse effect on our results of operations. Developments affecting the North American automotive industry may adversely affect us.

Our customers in the automotive industry continually seek to obtain price reductions from us, which may adversely affect our results of operations.

A challenge that we and other suppliers of intermediary products used in the manufacture of automobiles face is continued price reduction pressure from our customers in the automobile manufacturing business. Downward pricing pressure has been a characteristic of the automotive industry in recent years and it is migrating to all our vehicular markets. Virtually all automobile manufacturers have aggressive price reduction initiatives that they impose upon their suppliers, and such actions are expected to continue in the future. In the face of lower prices to customers, we must continue to reduce our operating costs in order to maintain profitability. We have taken and continue to take steps to reduce our operating costs to offset customer price reductions; however, price reductions are adversely affecting our profit margins and are expected to do so in the future. If we are unable to offset customer price reductions through improved operating efficiencies, new manufacturing processes, sourcing alternatives, technology enhancements and other cost reduction initiatives, or if we are unable to avoid price reductions from our customers, our results of operations could be adversely affected.

9

Sales may fall as a result of fluctuations in industry inventory levels.

Inventory levels of steel products held by companies that purchase our products can vary significantly from period to period. These fluctuations can temporarily affect the demand for our products, as customers draw from existing inventory during periods of low investment in construction and the other industry sectors that purchase our products and accumulate inventory during periods of high investment and, as a result, these companies may not purchase additional steel products or maintain their current purchasing volume. Accordingly, we may not be able to increase or maintain our current levels of sales volumes or prices.

Risks Related to Mexico

Adverse economic conditions in Mexico may adversely affect our financial performance.

A substantial portion of our operations are conducted in Mexico and our business is affected by the performance of the Mexican economy. The Mexican economy, as measured by gross domestic product, was growing 2% in 2018, contracted by 0.1% in 2019, contracted by 8.5% in 2020 and grew by 5% in 2021 and 3% in 2022 (according to figures of the Instituto Nacional de Estadística y Geografía (INEGI)). Mexico has historically experienced prolonged periods of economic crises, caused by internal and external factors over which we have no control. Those periods have been characterized by exchange rate instability, high inflation, high domestic interest rates, changes in oil prices, economic contraction, a reduction of international capital flows, balance of payment deficits, a reduction of liquidity in the banking sector and high unemployment rates. Decreases in the growth rate of the Mexican economy, or periods of negative growth, or increases in inflation may result in lower demand for our products. The Mexican government recently cut spending in response to a downward trend in international crude oil prices, and it may further cut spending in the future. These cuts could adversely affect the Mexican economy and, consequently, our business, financial condition, operating results and prospects. We cannot assure you that economic conditions in Mexico will not worsen, or that those conditions will not have an adverse effect on our financial performance.

Political, social and other developments in Mexico could adversely affect our business.

Political, social and other developments in Mexico may adversely affect our business. Social unrest, such as strikes, suspension of labor, demonstrations, acts of violence and terrorism in the Mexican states in which we operate could disrupt our financial performance. Additionally, the Mexican government has exercised, and continues to exercise, significant influence over the economy. Accordingly, Mexican federal governmental actions and policies concerning the economy, the regulatory framework, the social or political context, and state-owned and stated controlled entities or industries could have a significant impact on private sector companies and on market conditions, prices and returns of Mexican securities. In the past, governmental actions have involved, among other measures, increases in interest rates, changes in tax policies, price controls, currency devaluations, capital controls and limits on imports.

The Mexican government has exercised, and continues to exercise, significant influence over the Mexican economy.

The Mexican federal government has exercised, and continues to exercise, significant influence over the Mexican economy. Accordingly, Mexican federal governmental actions and policies concerning the economy, state-owned enterprises and state controlled, funded or influenced financial institutions could have a significant impact on private sector entities in general and on us in particular, and on market conditions, prices and returns on securities of Mexican companies. The Mexican federal government occasionally makes significant changes in policies and regulations, and may do so again in the future. Actions to control inflation and other regulations and policies have involved, among other measures, increases in interest rates, changes in tax policies, price controls, currency devaluations, capital controls and limits on imports. Tax legislation in Mexico is subject to continuous change and we cannot assure you whether the Mexican government may maintain existing political, social, economic or other policies, or whether changes may have a material adverse effect on our financial performance.

Violence in Mexico may adversely impact the Mexican economy and have a negative effect on our financial performance.

Mexican drug related violence and other organized crime have escalated significantly since 2006, when the Mexican federal government began increasing the use of the army and police to fight drug trafficking. Drug cartels have carried out attacks largely directed at competing drug cartels and law enforcement agents; however, they also target companies and their employees, including companies’ industrial properties, including through extortion, theft from trucks or industrial sites, kidnapping and other forms of crime and violence. This increase in violence and criminal activity has led to increased costs for companies in the form of stolen products and added security and insurance. Corruption and links between criminal organizations and authorities also create conditions that affect our business operations, as well as extortion and other acts of intimidation, which may have the effect of limiting the level of action taken by federal and local governments in response to such criminal activity. We cannot assure you that the levels of violent crime in Mexico, over which we have no control, will not have an adverse effect on the country’s economy and, as a result, on our financial performance.

10

Depreciation of the Mexican peso relative to the U.S. dollar could adversely affect our financial performance.

The peso historically has been subject to significant depreciation against the U.S. dollar. Depreciation of the Mexican peso relative to the U.S. dollar decreases a portion of our revenues in U.S. dollar terms, as well as increases the cost of a portion of the raw materials we require for production and any debt obligations denominated in U.S. dollars, and thereby may negatively affect our results of operations.

The Mexican Central Bank may from time to time participate in the foreign exchange market to minimize volatility and support an orderly market. The Mexican Central Bank and the Mexican government have also promoted market-based mechanisms for stabilizing foreign exchange rates and providing liquidity to the exchange market, such as using over-the-counter derivatives contracts and publicly-traded futures contracts on the Chicago Mercantile Exchange. However, the Peso is currently subject to significant fluctuations against the U.S. dollar and may be subject to such fluctuations in the future. In 2019, the exchange rate registered a low of Ps. 18.76 to U.S.$1.00 and a high of Ps. 20.12 to U.S.$1.00. In 2020, the exchange rate registered a low of Ps. 18.57 to U.S.$1.00 and a high of Ps. 24.86 to U.S.$1.00. In 2021, the exchange rate registered a low of Ps.19.58 to U.S. $1.00 and a high of Ps. 21.82. In 2022, the exchange rate registered a low of Ps.19.14 to U.S. $1.00 and a high of Ps. 21.38.

A severe depreciation of the Mexican peso may also result in disruption of the international foreign exchange markets and may limit our ability to transfer and to convert Mexican pesos into U.S. dollars and other currencies. While the Mexican government does not currently restrict, and since 1982 has not restricted the right or ability of Mexican or foreign persons or entities to convert Mexican pesos into U.S. dollars or to transfer other currencies out of Mexico, the Mexican government could impose restrictive exchange rate policies in the future.

Currency fluctuations or restrictions on transfer of funds outside Mexico may have an adverse effect on our financial performance, and could adversely affect the U.S. dollar value of the price of our Series B shares and the ADSs.

Changes in the reference rate set by the Mexican Central Bank may negatively affect our business and operations. The Mexican Central Bank has increased the reference rate during the last two years. On March 1, 2023, reference rate was increased to 11.25%. Future changes by the Mexican Central Bank of the reference rate or by U.S. Federal Reserve of the target range for the federal funds rate in the United States of America may negatively impact the Mexican economy or the value of securities issued by Mexican companies including as a result of any precipitous unwinding of investments in emerging markets, depreciations and increased volatility in the value of their currency and higher interest rates.

High inflation rates in Mexico may affect demand for our products and result in cost increases.

Mexico has historically experienced high annual rates of inflation. However, the Mexican economy has been in a non-inflationary environment given the low inflation rates of recent years. The annual rate of inflation, as measured by changes in the Mexican national consumer price index (Índice Nacional de Precios al Consumidor) published by the INEGI was 4.8% for 2018, 2.8% for 2019, 3.2% for 2020, 7.4% for 2021 and 7.8% for 2022. High inflation rates could adversely affect our business and results of operations by reducing consumer purchasing power, thereby adversely affecting demand for our products, increasing certain costs beyond levels that we could pass on to consumers, and by decreasing the benefit to us of revenues earned if the inflation rate exceeds the growth in our pricing levels.

Developments in other countries could adversely affect the Mexican economy, our financial performance and the price of our shares.

The Mexican economy and the market value of Mexican companies may be, to varying degrees, affected by economic and market conditions globally, in other emerging market countries and major trading partners, in particular the United States of America. Although economic conditions in other countries may differ significantly from economic conditions in Mexico, investors’ reactions to adverse developments in other countries may have an adverse effect on the market value of securities of Mexican issuers or of Mexican assets.

In addition, in recent years economic conditions in Mexico have become increasingly correlated with economic conditions in the United States of America and Canada as a result of the Tratado entre Mexico, Estados Unidos y Canada (TMEC) or the United States of America, Mexico and Canada Agreement (USMCA) which entered into effect on July 1, 2020; increased economic activity between the three countries, and the remittance of funds from Mexican immigrants working in the United States of America to Mexican residents. Adverse economic conditions in the US, changes to the TMEC and other related events could have an adverse effect on the Mexican economy. We cannot assure that events in other countries, the United States of America or another event could negatively impact our financial situation.

11

Moreover, the financial recession originated by the effects to stop the COVID-19 pandemic, the recent confrontation between the United States of America and China, the negative effect on the worldwide markets due to the recent Russian invasion of Ukraine and the recent changes in credit conditions, may also affect the global and Mexican economies. We cannot assure you that events in other emerging market countries, in the United States of America or elsewhere will not adversely affect our financial performance.

We could be adversely affected by violations of the Mexican Federal Anticorruption Law in Public Contracting, the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws.

The Mexican Federal Anticorruption Law (Ley Federal de Anticorrupción en Contrataciones Públicas), the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws generally prohibit companies and their intermediaries from making improper payments to government officials and other persons for the purpose of obtaining or retaining business. There can be no assurance that our internal control policies and procedures will protect us from reckless or criminal acts committed by our employees or agents. Violations of these laws, or allegations of such violations, could disrupt our business and could have an adverse effect on our business, financial condition and results of operations.

Our financial statements are prepared in accordance with IFRS and therefore are not directly comparable to financial statements of other companies prepared under U.S. GAAP or other accounting principles.

All Mexican companies listed on the Mexican Stock Exchange must prepare their financial statements in accordance with IFRS which differs in certain significant respects from U.S. GAAP. Items on the financial statements of a company prepared in accordance with IFRS may not reflect its financial position or results of operations in the way they would be reflected had such financial statements been prepared in accordance with U.S. GAAP. Accordingly, Mexican financial statements and reported earnings are likely to differ from those of companies in other countries in this and other respects.

Mexico has different corporate disclosure and accounting standards than those in the United States of America and other countries.

A principal objective of the securities laws of the United States of America, Mexico and other countries is to promote full and fair disclosure of all material corporate information, including accounting information. However, there may be different or less publicly available information about issuers of securities in Mexico than is regularly made available by public companies in countries with more highly developed capital markets, including the United States of America. The disclosure standards imposed by the Mexican Stock Exchange may be different than those imposed by securities exchanges in other countries or regions such as the United States of America. As a foreign private issuer, we are not subject to U.S. proxy rules and are exempt from certain reports under the U.S. Securities Exchange Act of 1934 (the “Exchange Act”), as we are not required to file annual, quarterly and current reports and financial statements with the SEC as frequently or as promptly as U.S. domestic reporting companies whose securities are registered under the Exchange Act. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting company.

Risks Related to Brazil

Brazilian political and economic conditions, and the Brazilian government’s economic and other policies, may negatively affect our business, operations and financial condition.

The Brazilian economy has been characterized by frequent and occasionally extensive intervention by the Brazilian government and unstable economic cycles. The Brazilian government has often changed monetary, taxation, credit, tariff and other policies to influence the course of Brazil’s economy. The Brazilian government’s actions to control inflation and implement other policies have at times involved wage and price controls, blocking access to bank accounts, imposing capital controls and limiting imports into Brazil.

Our results of operations and financial condition may be adversely affected by factors such as:

| ● | fluctuations in exchange rates; |

| ● | exchange control policies; |

| ● | interest rates; |

12

| ● | inflation; |

| ● | tax policies; |

| ● | expansion or contraction of the Brazilian economy, as measured by rates of growth in gross domestic product (“GDP”); |

| ● | changes in labor regulation; |

| ● | energy shortages; |

| ● | social and political instability; |

| ● | liquidity of domestic capital and lending markets; and |

| ● | other political, diplomatic, social and economic developments in or affecting Brazil. |

Risks Related to Ownership of our ADRs

We are a foreign private issuer under the rules and regulations of the SEC and are therefore exempt from a number of rules under the Exchange Act and are permitted to file less information with the SEC than a domestic U.S. reporting company, which reduces the level and amount of disclosure that you receive.

We are a foreign private issuer under the rules and regulations of the SEC and are therefore exempt from a number of rules under the Exchange Act and are permitted to file less information with the SEC than a domestic U.S. reporting company, which reduces the level and amount of disclosure that you receive.

As a foreign private issuer whose ADRs are listed on the NYSE American, we are permitted to follow certain home country corporate governance practices instead of certain requirements of the NYSE American. Among other things, as a foreign private issuer we may also follow home country practice with regard to, the composition of the board of directors, director nomination procedure, compensation of officers and quorum at shareholders’ meetings. See Item 10.B “Memorandum and Articles of Association.

The market price of our ADRs has been, and may continue to be, highly volatile, and such volatility could cause the market price of our ADRs to decrease and could cause you to lose some or all of your investment in our ADRs.

The stock market in general and the market prices of the ADRs on NYSE American, in particular, are or will be subject to fluctuation, and changes in these prices may be unrelated to our operating performance. During the first quarter of 2023, the market price of our ADRs fluctuated from a high of $36.96 per ADR to a low of $30.75 per ADR, and the price of our ADRs continues to fluctuate. We anticipate that the market prices of our securities will continue to be subject to wide fluctuations. The market price of our securities may be subject to a number of factors, including:

| ● | announcements of new products by us or others; | |

|

● |

announcements by us of significant acquisitions, strategic partnerships, in-licensing, joint ventures or capital commitments; | |

| ● | the developments of the businesses and projects of our various subsidiaries; | |

| ● | expiration or terminations of licenses, research contracts or other collaboration agreements; | |

| ● | public concern as to the safety of the products we sell; | |

| ● | the volatility of market prices for shares of companies with whom we compete; |

13

| ● | developments concerning intellectual property rights or regulatory approvals; | |

| ● | variations in our and our competitors’ results of operations; | |

| ● | changes in revenues, gross profits and earnings announced by us; | |

| ● | changes in estimates or recommendations by securities analysts, if the ADSs are covered by analysts; | |

| ● | fluctuations in the share price of our publicly traded subsidiaries; | |

| ● | changes in government regulations or patent decisions; and | |

| ● | general market conditions and other factors, including factors unrelated to our operating performance. |

These factors may materially and adversely affect the market price of our securities and result in substantial losses by our investors.

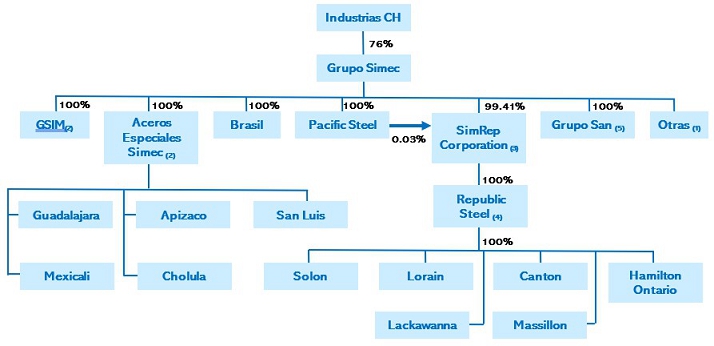

Our controlling shareholder, Industrias CH, S.A.B. de C.V. (“Industrias CH”), is able to exert significant influence on our business and policies and its interests may differ from those of other shareholders.