Table of Contents

As filed with the Securities and Exchange Commission on February 9, 2023

Registration Statement No. 333-269296

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| THE GOLDMAN SACHS GROUP, INC. | GOLDMAN SACHS CAPITAL I | |

| (Exact name of Registrant as specified in its charter) | GOLDMAN SACHS CAPITAL II | |

| GOLDMAN SACHS CAPITAL III | ||

| Delaware | GOLDMAN SACHS CAPITAL VI | |

| (State or other jurisdiction of incorporation or organization) | GOLDMAN SACHS CAPITAL VII | |

| 13-4019460 | GS FINANCE CORP. | |

| (I.R.S. Employer Identification Number) | (Exact name of each Registrant as specified in its charter) | |

| 200 West Street | ||

| New York, NY 10282 | ||

| (212) 902-1000 | Delaware | |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

(State or other jurisdiction of incorporation or organization) | |

| 20-6109925, 20-6109972, 34-2036412 | ||

| 34-2036414, 82-6291478, 26-0785112 | ||

| (I.R.S. Employer Identification Number) | ||

| c/o The Goldman Sachs Group, Inc. | ||

| 200 West Street | ||

| New York, NY 10282 | ||

| (212) 902-1000 | ||

| (Address, including zip code, and telephone number, including area code, of each Registrant’s principal executive offices) | ||

Matthew E. Tropp

The Goldman Sachs Group, Inc.

200 West Street

New York, New York 10282

(212) 902-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Catherine M. Clarkin | William R. Massey | |

| Sullivan & Cromwell LLP | Sidley Austin LLP | |

| 125 Broad Street | 787 Seventh Avenue | |

| New York, New York 10004 | New York, New York 10019 | |

| (212) 558-4000 | (212) 839-5300 |

Approximate date of commencement of proposed sale to the public: From time to time after the effectiveness of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrants hereby amend this registration statement on the date or dates as may be necessary to delay its effective date until the Registrants file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on the date that the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Explanatory Note

The seven prospectuses contained herein relate to the following:

| • | with respect to the first prospectus, the initial offering of debt securities, warrants, purchase contracts, units, preferred stock, depositary shares and common stock (including securities convertible into common stock) of The Goldman Sachs Group, Inc. on a continuous or delayed basis; |

| • | with respect to the second prospectus, the initial offering of debt securities, warrants and units of GS Finance Corp. (including guarantees thereof by The Goldman Sachs Group, Inc.) on a continuous or delayed basis; |

| • | with respect to the third prospectus, the initial offering of guarantees by The Goldman Sachs Group, Inc. of certificates of deposit issued or to be issued at any time and from time to time in the past or in the future by Goldman Sachs Bank USA, or by any successor to Goldman Sachs Bank USA or by any other banking subsidiary of The Goldman Sachs Group, Inc., in each case whether now or hereafter formed, on a continuous or delayed basis; |

| • | with respect to the fourth prospectus, the initial offering of guarantees by The Goldman Sachs Group, Inc. of notes and deposit notes issued or to be issued at any time and from time to time in the past or in the future by Goldman Sachs Bank USA, or by any successor to Goldman Sachs Bank USA or by any other banking subsidiary of The Goldman Sachs Group, Inc., in each case whether now or hereafter formed, on a continuous or delayed basis; |

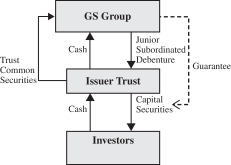

| • | with respect to the fifth prospectus, the initial offering of capital securities of the Issuer Trusts (including guarantees with respect thereto by The Goldman Sachs Group, Inc.) on a continuous or delayed basis; |

| • | with respect to the sixth prospectus, the reoffer and resale on an ongoing basis in market-making transactions by affiliates of the Registrants of 6.345% Capital Securities of Goldman Sachs Capital I Securities fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. (initially offered and sold on Registration Statement No. 333-112367) at prevailing market prices less such affiliate’s customary bid and ask spreads; |

| • | with respect to the seventh prospectus, the reoffer and resale on an ongoing basis in market-making transactions by affiliates of the Registrants of Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II (formerly known as Goldman Sachs Capital IV) fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. (initially offered and sold on Registration Statement No. 333-130074) and Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III (formerly known as Goldman Sachs Capital V) fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. (initially offered and sold on Registration Statement No. 333-130074) at prevailing market prices less such affiliate’s customary bid and ask spreads; and |

| • | with respect to the first five prospectuses, market-making transactions that may occur on a continuous or delayed basis in (1) the securities described above after they are initially offered and sold and (2) securities of one or more of the same classes that were initially registered under registration statements previously filed by the Registrants and were initially offered and sold prior to the date of the first five prospectuses (but are now registered hereunder with respect to ongoing market-making transactions). |

| • | With respect to the first, second and fifth prospectuses, the amount of securities that can be offered in initial offerings by The Goldman Sachs Group, Inc., GS Finance Corp., Goldman Sachs Capital VI and Goldman Sachs Capital VII, in the aggregate, is limited to an initial public offering price of up to $196,691,644,885. |

When the applicable prospectus is delivered to an investor or otherwise applies with respect to an initial offering described above, the investor will be informed of that fact in the confirmation of sale. If the investor is not so informed in the confirmation of sale, then the applicable prospectus is being delivered or otherwise applies with respect to a market-making transaction.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 9, 2023

|

|

$196,691,644,885 The Goldman Sachs Group, Inc.

Debt Securities Warrants Purchase Contracts Units Preferred Stock Depositary Shares Common Stock |

|

The Goldman Sachs Group, Inc. from time to time may offer to sell debt securities, warrants, purchase contracts, preferred stock, either separately or represented by depositary shares, and common stock, as well as units comprised of these securities or securities of third parties. The debt securities, warrants, purchase contracts and preferred stock may be convertible into or exercisable or exchangeable for common or preferred stock or other securities of The Goldman Sachs Group, Inc. or debt or equity securities of one or more other entities. The common stock of The Goldman Sachs Group, Inc. is listed on the New York Stock Exchange and trades under the ticker symbol “GS”.

$196,691,644,885 of securities have been registered on our registration statement, filed on Form S-3. The aggregate amount may be used by The Goldman Sachs Group, Inc., GS Finance Corp., Goldman Sachs Capital VI and Goldman Sachs Capital VII to offer securities pursuant to this prospectus or any of the other prospectuses contained in the registration statement.

The Goldman Sachs Group, Inc. may offer and sell these securities to or through one or more underwriters, dealers and agents, including the firm named below, or directly to purchasers, on a continuous or delayed basis.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in the applicable prospectus supplement to this prospectus.

These securities are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Goldman Sachs may use this prospectus in the initial sale of these securities. In addition, Goldman Sachs & Co. LLC or any other affiliate of Goldman Sachs may use this prospectus in a market-making transaction in any of these or similar securities after its initial sale. Unless Goldman Sachs or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

All descriptions of, or references to, LIBOR in this prospectus relate solely to securities initially offered and sold prior to the date hereof for which LIBOR is the base rate or referenced in the securities or the calculation of the base rate. This prospectus may be used in ongoing market-making transactions in these securities, as well as other securities initially offered and sold prior to the date hereof.

Goldman Sachs & Co. LLC

Prospectus dated , 2023.

Table of Contents

The Goldman Sachs Group, Inc. is required to file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the “SEC”). Our filings with the SEC are available to the public through the SEC’s Internet site at http://www.sec.gov.

We have filed a registration statement on Form S-3 with the SEC relating to the securities covered by this prospectus. This prospectus is a part of the registration statement and does not contain all of the information in the registration statement. Whenever a reference is made in this prospectus to a contract or other document of The Goldman Sachs Group, Inc., please be aware that the reference is only a summary and that you should refer to the exhibits that are a part of the registration statement for a copy of the applicable contract or other document. You may review a copy of the registration statement through the SEC’s Internet site.

The SEC’s rules allow us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to any of the SEC filings referenced in the list below. Any information referred to in this way in this prospectus or the applicable prospectus supplement is considered part of this prospectus from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of securities by means of this prospectus is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus.

The Goldman Sachs Group, Inc. incorporates by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules):

| (1) | Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (File No. 001-14965); |

| (2) | Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2022, June 30, 2022 and September 30, 2022 (File No. 001-14965); |

| (3) | Current Reports on Form 8-K dated and filed on January 18, 2022 (which is only incorporated by reference to the extent stated therein), dated and filed on January 24, 2022, dated and filed on January 28, 2022, dated and filed on March 15, 2022, dated and filed on March 21, 2022, dated and filed on March 28, 2022, dated and filed on April 14, 2022 (which is only incorporated by reference to the extent stated therein), dated April 28, 2022 and filed on April 29, 2022, dated April 28, 2022 and filed on April 29, 2022, dated and filed on June 13, 2022, dated and filed on June 27, 2022, dated and filed on July 18, 2022 (which is only incorporated by reference to the extent stated therein), dated and filed on August 23, 2022, dated and filed on September 22, 2022, dated and filed on October 18, 2022 (which is only incorporated by reference to the extent stated therein), dated October 26, 2022 and filed on October 28, 2022 (which is only incorporated by reference to the extent stated therein), dated and filed on November 1, 2022, dated January 12, 2023 and filed on January 13, 2023, dated and filed on January 17, 2023 (which is only incorporated by reference to the extent stated therein) and dated and filed on January 27, 2023 (File No. 001-14965); |

| (4) | All documents filed by The Goldman Sachs Group, Inc. under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) on or after the date of this prospectus and before the termination of the offering of securities under this prospectus; |

| (5) | Solely with regard to the securities covered by this prospectus that were initially offered and sold under previously filed registration statements of The Goldman Sachs Group, Inc. and that from time to time may be reoffered and resold in market-making transactions under this |

2

Table of Contents

| prospectus, the information in the prospectus supplements relating to those securities that were previously filed by The Goldman Sachs Group, Inc. in connection with their initial offer and sale (except to the extent that any such information has been modified or superseded by other information included or incorporated by reference in this prospectus); and |

| (6) | The descriptions of our common stock contained in our Registration Statement filed under Section 12 of the Securities Exchange Act of 1934 and any amendment or report filed for the purpose of updating that description, and any other Registration Statement on Form 8-A relating to any securities offered by this prospectus. |

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You can request those documents from Investor Relations, 200 West Street, New York, New York 10282, telephone (212) 902-0300.

When we refer to “Goldman Sachs” or the “Firm” in this prospectus, we mean The Goldman Sachs Group, Inc., together with its consolidated subsidiaries and affiliates. References to “The Goldman Sachs Group, Inc.”, “we”, “our” or “us” refer only to The Goldman Sachs Group, Inc. and not to its consolidated subsidiaries.

3

Table of Contents

This summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus as further described above under “Available Information”. This summary does not contain all the information that you should consider before investing in the securities being offered by this prospectus. You should carefully read the entire prospectus, the documents incorporated by reference into this prospectus, the applicable prospectus supplement, if applicable, and the prospectus supplement relating to the securities that you propose to buy, especially any description of investment risks that we may include in the applicable prospectus supplement.

The Goldman Sachs Group, Inc.

The Goldman Sachs Group, Inc. is a leading global financial institution that delivers a broad range of financial services across investment banking, securities, investment management and consumer banking to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the Firm is headquartered in New York and maintains offices in all major financial centers around the world. The Firm’s principal executive offices are located at 200 West Street, New York, New York 10282, telephone (212) 902-1000. The Goldman Sachs Group, Inc. is a bank holding company and a financial holding company regulated by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”). The Firm’s U.S. depository institution subsidiary, Goldman Sachs Bank USA, is a New York State-chartered bank.

The Securities We Are Offering

We may offer any of the following securities from time to time:

| • | debt securities; |

| • | warrants; |

| • | purchase contracts; |

| • | units, comprised of one or more debt securities, warrants, purchase contracts, shares of preferred stock and depositary shares described in this prospectus, as well as debt or equity securities of third parties, in any combination; |

| • | preferred stock, either directly or represented by depositary shares; and |

| • | common stock. |

When we use the term “security” or “securities” in this prospectus, we mean any of the securities we may offer with this prospectus, unless we say otherwise. This prospectus, including the following summary, describes the general terms that may apply to the securities; the specific terms of any particular securities that we may offer will be described in the applicable prospectus supplement to this prospectus and may differ from the general terms described herein.

Debt Securities

The debt securities may be senior or subordinated in right of payment. For any particular debt securities we offer, the applicable prospectus supplement will describe the title and series of the debt securities, the aggregate principal amount and the original issue price; the ranking, whether senior or subordinated; the stated maturity; the redemption terms, if any; the rate or manner of calculating the rate and the payment dates for interest, if any; the amount or manner of calculating the amount

4

Table of Contents

payable at maturity and whether that amount may be paid by delivering cash, securities or other property; the terms on which the debt securities may be convertible into or exercisable or exchangeable for common stock or other securities of The Goldman Sachs Group, Inc. or any other entity, if any; and any other specific terms. We will issue the senior and subordinated debt securities under separate debt indentures (as described in “Description of Debt Securities We May Offer—The Senior Debt Indentures and the Subordinated Debt Indenture”), each between us and The Bank of New York Mellon, as trustee.

Warrants

We may offer two types of warrants:

| • | warrants to purchase our debt securities; and |

| • | warrants to purchase or sell, or whose cash value is determined by reference to the performance, level or value of, one or more of the following: |

| • | securities of one or more issuers, including our common or preferred stock or other securities described in this prospectus or debt or equity securities of third parties; |

| • | one or more currencies; |

| • | one or more commodities; |

| • | any other financial, economic or other measure or instrument, including the occurrence or non-occurrence of any event or circumstance; |

| • | one or more indices; and/or |

| • | one or more baskets of the items described above. |

For any particular warrants we offer, the applicable prospectus supplement will describe the underlying property; the expiration date; the exercise price or the manner of determining the exercise price; the amount and kind, or the manner of determining the amount and kind, of property to be delivered by you or us upon exercise; and any other specific terms. We may issue the warrants under the warrant indenture between us and The Bank of New York Mellon, as trustee, or under warrant agreements between us and one or more warrant agents.

Purchase Contracts

We may offer purchase contracts for the purchase or sale of, or whose cash value is determined by reference to the performance, level or value of, one or more of the following:

| • | securities of one or more issuers, including our common or preferred stock or other securities described in this prospectus and debt or equity securities of third parties; |

| • | one or more currencies; |

| • | one or more commodities; |

| • | any other financial, economic or other measure or instrument, including the occurrence or non-occurrence of any event or circumstance; |

| • | one or more indices; and/or |

| • | one or more baskets of the items described above. |

For any particular purchase contracts we offer, the applicable prospectus supplement will describe the underlying property; the settlement date; the purchase price or manner of determining the purchase

5

Table of Contents

price and whether it must be paid when the purchase contract is issued or at a later date; the amount and kind, or the manner of determining the amount and kind, of property to be delivered at settlement; whether the holder will pledge property to secure the performance of any obligations the holder may have under the purchase contract; and any other specific terms. We may issue purchase contracts under a debt indenture described above or a unit agreement described below.

Units

We may offer units, comprised of one or more debt securities, warrants, purchase contracts, shares of preferred stock, depositary shares and shares of common stock described in this prospectus, as well as debt or equity securities of third parties, in any combination. For any particular units we offer, the applicable prospectus supplement will describe the particular securities comprising each unit; the terms on which those securities will be separable, if any; whether the holder will pledge property to secure the performance of any obligations the holder may have under the unit; and any other specific terms of the units. We may issue the units under unit agreements between us and one or more unit agents.

Preferred Stock and Depositary Shares

We may offer our preferred stock, par value $0.01 per share, in one or more series. For any particular series we offer, the applicable prospectus supplement will describe the specific designation; the aggregate number of shares offered; the rate and periods, or manner of calculating the rate and periods, for dividends, if any; the stated value and liquidation preference amount, if any; the voting rights, if any; the terms on which the series will be convertible into or exercisable or exchangeable for our common stock, preferred stock of another series or other securities described in this prospectus, debt or equity securities of third parties or property, if any; the redemption terms, if any; and any other specific terms. We may also offer depositary shares, each of which would represent an interest in a fractional share or multiple shares of our preferred stock. We may issue the depositary shares under deposit agreements between us and one or more depositaries.

Common Stock

We may offer our common stock, par value $0.01 per share. For any offering of common stock, the applicable prospectus supplement will describe the aggregate number of shares offered and any other specific terms.

Form of Securities

We will issue the securities in book-entry form through one or more depositaries, such as The Depository Trust Company, Euroclear or Clearstream, named in the applicable prospectus supplement. Each sale of a security in book-entry form will settle in immediately available funds through the applicable depositary, unless otherwise stated. We will issue the securities only in registered form, without coupons.

Payment Currencies

Amounts payable in respect of the securities, including the original issue price, will be payable in U.S. dollars, unless the applicable prospectus supplement says otherwise.

6

Table of Contents

Listing

If any securities are to be listed or quoted on a securities exchange or quotation system, the applicable prospectus supplement will say so.

Use of Proceeds

We intend to use the net proceeds from the sales of the securities to provide additional funds for our operations and for other general corporate purposes.

Manner of Offering

The securities will be offered in connection with their initial issuance or in market-making transactions by our affiliates after initial issuance. Those offered in market-making transactions may be securities that we will not issue until after the date of this prospectus as well as securities that we have previously issued.

When we issue new securities, we may offer them for sale to or through underwriters, dealers and agents, including our affiliates, or directly to purchasers. The applicable prospectus supplement will include any required information about the firms we use and the discounts or commissions we may pay them for their services.

Our affiliates that we refer to above may include, among others, Goldman Sachs & Co. LLC (“GS&Co.”), for offers and sales in the United States, and Goldman Sachs International, Goldman Sachs (Asia) L.L.C. and Goldman Sachs (Singapore) Pte. for offers and sales outside the United States.

Conflicts of Interest

GS&Co. is an affiliate of The Goldman Sachs Group, Inc. and, as such, will have a “conflict of interest” in any offering of the securities within the meaning of Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121. Consequently, any offering of the securities will be conducted in compliance with the provisions of Rule 5121. GS&Co. will not be permitted to sell securities in any offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder.

Risks and Considerations Relating to the Securities

There are a number of risks and considerations that you should take into account prior to investing in the securities. Please read “Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements”, “Considerations Relating to Floating Rate Securities”, “Considerations Relating to Indexed Securities”, “Considerations Relating to Securities Denominated or Payable in or Linked to a Non-U.S. Dollar Currency” and “United States Taxation—Taxation of Debt Securities—Foreign Account Tax Compliance Act (“FATCA”) Withholding” for more information.

For a discussion of important business and financial risks relating to The Goldman Sachs Group, Inc., please see “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which are incorporated in this prospectus by reference (and in any of our annual or quarterly reports for a subsequent fiscal period that are so incorporated).

7

Table of Contents

RISKS RELATING TO REGULATORY RESOLUTION STRATEGIES AND

LONG-TERM DEBT REQUIREMENTS

Please note that in this section entitled “Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements”, references to “Group Inc.”, “we” and “our” refer only to The Goldman Sachs Group, Inc. and not to its consolidated subsidiaries. References to our “debt securities”, including “fixed rate debt securities”, “floating rate debt securities” and “indexed debt securities”, are explained below under “Description of Debt Securities We May Offer”.

The application of regulatory resolution strategies could increase the risk of loss for holders of our securities in the event of the resolution of Group Inc.

Your ability to recover the full amount that would otherwise be payable on our securities in a proceeding under the U.S. Bankruptcy Code may be impaired by the exercise by the FDIC of its powers under the “orderly liquidation authority” under Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”). In addition, the single point of entry strategy described below is intended to impose losses at the top-tier holding company level in the resolution of a global systemically important bank (“G-SIB”) such as Group Inc.

Title II of the Dodd-Frank Act created a resolution regime known as the “orderly liquidation authority” to which financial companies, including bank holding companies such as Group Inc., can be subjected. Under the orderly liquidation authority, the FDIC may be appointed as receiver for a financial company for purposes of liquidating the entity if, upon the recommendation of applicable regulators, the Secretary of the Treasury determines, among other things, that the entity is in severe financial distress, that the entity’s failure would have serious adverse effects on the U.S. financial system and that resolution under the orderly liquidation authority would avoid or mitigate those effects. Absent such determinations, Group Inc., as a U.S. bank holding company, would remain subject to the U.S. Bankruptcy Code.

If the FDIC is appointed as receiver under the orderly liquidation authority, then the orderly liquidation authority, rather than the U.S. Bankruptcy Code, would determine the powers of the receiver and the rights and obligations of creditors and other parties who have transacted with Group Inc. There are substantial differences between the rights available to creditors in the orderly liquidation authority and in the U.S. Bankruptcy Code, including the right of the FDIC under the orderly liquidation authority to disregard the strict priority of creditor claims in some circumstances (which would otherwise be respected by a bankruptcy court) and the use of an administrative claims procedure to determine creditors’ claims (as opposed to the judicial procedure utilized in bankruptcy proceedings). In certain circumstances under the orderly liquidation authority, the FDIC could elevate the priority of claims that it determines necessary to facilitate a smooth and orderly liquidation without the need to obtain creditors’ consent or prior court review. In addition, the FDIC has the right to transfer claims to a third party or “bridge” entity under the orderly liquidation authority.

The FDIC has announced that a single point of entry strategy may be a desirable strategy to resolve a large financial institution such as Group Inc. in a manner that would, among other things, impose losses on shareholders, debt holders (including, in our case, holders of our securities) and other creditors of the top-tier holding company (in our case, Group Inc.), while permitting the holding company’s subsidiaries to continue to operate. In addition, the Federal Reserve Board has adopted requirements that U.S. G-SIBs, including Group Inc., maintain minimum amounts of long-term debt and total loss-absorbing capacity to facilitate the application of the single point of entry resolution strategy. It is possible that the application of the single point of entry strategy under the orderly liquidation authority—in which Group Inc. would be the only entity to enter resolution proceedings—would result in

8

Table of Contents

greater losses to holders of our securities (including holders of our fixed rate, floating rate and indexed debt securities), than the losses that would result from the application of a bankruptcy proceeding or a different resolution strategy, such as a multiple point of entry resolution strategy for Group Inc. and certain of its material subsidiaries. Assuming Group Inc. entered resolution proceedings and that support from Group Inc. or other available resources to its subsidiaries was sufficient to enable the subsidiaries to remain solvent, losses at the subsidiary level would be transferred to Group Inc. and ultimately borne by Group Inc.’s security holders, third-party creditors of Group Inc.’s subsidiaries would receive full recoveries on their claims, and Group Inc.’s security holders (including our shareholders, holders of our debt securities and other unsecured creditors) could face significant and possibly complete losses. In that case, Group Inc.’s security holders would face losses while the third-party creditors of Group Inc.’s subsidiaries would incur no losses because the subsidiaries would continue to operate and would not enter resolution or bankruptcy proceedings. In addition, holders of our eligible LTD (defined below) and holders of our other debt securities could face losses ahead of our other similarly situated creditors in a resolution under the orderly liquidation authority if the FDIC exercised its right, described above, to disregard the priority of creditor claims.

The orderly liquidation authority also provides the FDIC with authority to cause creditors and shareholders of a financial company (such as Group Inc.) in receivership to bear losses before taxpayers are exposed to such losses, and amounts owed to the U.S. government would generally receive a statutory payment priority over the claims of private creditors, including senior creditors. In addition, under the orderly liquidation authority, claims of creditors (including holders of our securities) could be satisfied through the issuance of equity or other securities in a bridge entity to which Group Inc.’s assets are transferred. If such a securities-for-claims exchange were implemented, there can be no assurance that the value of the securities of the bridge entity would be sufficient to repay or satisfy all or any part of the creditor claims for which the securities were exchanged. While the FDIC has issued regulations to implement the orderly liquidation authority, not all aspects of how the FDIC might exercise this authority are known and additional rulemaking is possible. In addition, certain jurisdictions, including the U.K. and the E.U., have implemented, or are considering, changes to resolution regimes to provide resolution authorities with the ability to recapitalize a failing entity by writing down its unsecured debt or converting its unsecured debt into equity. Such “bail-in” powers are intended to enable the recapitalization of a failing institution by allocating losses to its shareholders and unsecured debtholders. For example, the Bank of England requires a certain amount of intercompany funding that we provide to our material U.K. subsidiaries to contain a contractual trigger to expressly permit the Bank of England to exercise such “bail-in” powers in certain circumstances. If the intercompany funding we provide to our subsidiaries is “bailed in,” Group Inc.’s claims on its subsidiaries would be subordinated to the claims of the subsidiaries’ third party creditors or written down. U.S. regulators are considering and non-U.S. authorities have adopted requirements that certain subsidiaries of large financial institutions maintain minimum amounts of total loss absorbing capacity that would pass losses up from the subsidiaries to the top-tier BHC and, ultimately, to security holders of the top-tier holding company in the event of failure.

The application of Group Inc.’s proposed resolution strategy could result in greater losses for Group Inc.’s security holders.

As required by the Dodd-Frank Act and regulations issued by the Federal Reserve Board and the FDIC, we are required to provide to the Federal Reserve Board and the FDIC a plan for our rapid and orderly resolution in the event of material financial distress affecting the firm or the failure of Group Inc. In our resolution plan, Group Inc. would be resolved under the U.S. Bankruptcy Code. The strategy described in our resolution plan is a variant of the single point of entry strategy: Group Inc. and Goldman Sachs Funding LLC (“Funding IHC”), a wholly-owned, direct subsidiary of Group Inc., would recapitalize and provide liquidity to certain major subsidiaries, including through the forgiveness of intercompany indebtedness, the extension of the maturities of intercompany indebtedness and the

9

Table of Contents

extension of additional intercompany loans. If this strategy were successful, creditors of some or all of Group Inc.’s major subsidiaries would receive full recoveries on their claims, while Group Inc.’s security holders could face significant and possibly complete losses.

To facilitate the execution of our resolution plan, we formed Funding IHC. In exchange for an unsecured subordinated funding note and equity interest, Group Inc. transferred certain intercompany receivables and substantially all of its global core liquid assets (“GCLA”) to Funding IHC, and agreed to transfer additional GCLA above prescribed thresholds.

We also put in place a Capital and Liquidity Support Agreement (“CLSA”) among Group Inc., Funding IHC and our major subsidiaries. Under the CLSA, Funding IHC has provided Group Inc. with a committed line of credit that allows Group Inc. to draw sufficient funds to meet its cash needs during the ordinary course of business. In addition, if our financial resources deteriorate so severely that resolution may be imminent, (i) the committed line of credit will automatically terminate and the unsecured subordinated funding note will automatically be forgiven, (ii) all intercompany receivables owed by the major subsidiaries to Group Inc. will be transferred to Funding IHC or their maturities will be extended to five years, (iii) Group Inc. will be obligated to transfer substantially all of its remaining intercompany receivables and GCLA (other than an amount to fund anticipated bankruptcy expenses) to Funding IHC, and (iv) Funding IHC will be obligated to provide capital and liquidity support to the major subsidiaries. Group Inc.’s and Funding IHC’s obligations under the CLSA are secured pursuant to a related security agreement. Such actions would materially and adversely affect Group Inc.’s liquidity. As a result, during a period of severe stress, Group Inc. might commence bankruptcy proceedings at an earlier time than it otherwise would if the CLSA and related security agreement had not been implemented.

If our proposed resolution strategy were successful, Group Inc.’s security holders could face losses while the third-party creditors of Group Inc.’s major subsidiaries would incur no losses because those subsidiaries would continue to operate and not enter resolution or bankruptcy proceedings. As part of the strategy, Group Inc. could also seek to elevate the priority of its guarantee obligations relating to its major subsidiaries’ derivatives contracts or transfer them to another entity so that cross-default and early termination rights would be stayed under the International Swaps and Derivatives Association Universal Resolution Stay Protocol or International Swaps and Derivatives Association 2018 U.S. Resolution Stay Protocol, as applicable, which would result in holders of our eligible LTD (defined below) and holders of our other debt securities incurring losses ahead of the beneficiaries of those guarantee obligations. It is also possible that holders of our eligible LTD and holders of our other debt securities could incur losses ahead of other similarly situated creditors of our major subsidiaries. If Group Inc.’s preferred resolution strategy were not successful, Group Inc.’s financial condition would be adversely impacted and Group Inc.’s security holders, including holders of our debt securities, may as a consequence be in a worse position than if the strategy had not been implemented. In all cases, any payments to holders of our debt securities are dependent on our ability to make such payments and are therefore subject to our credit risk.

Senior debt securities issued on or after January 1, 2017 under the 2008 indenture will provide only limited acceleration and enforcement rights.

On December 15, 2016, the Federal Reserve Board adopted rules (the “TLAC Rules”) that require the eight U.S. G-SIBs, including Group Inc., among other things, to maintain minimum amounts of long-term debt—i.e., debt having a maturity greater than one year from issuance—satisfying certain eligibility criteria (“eligible LTD”) commencing January 1, 2019. The TLAC Rules disqualify from eligible LTD, among other instruments, senior debt securities issued on or after December 31, 2016 that permit acceleration for reasons other than insolvency or payment default. As a result of the TLAC Rules, we have modified the 2008 indenture under which our senior debt securities may be issued to provide that,

10

Table of Contents

for any such debt securities issued on or after January 1, 2017, the only events of default will be payment defaults that continue for a 30-day grace period and insolvency events as specified herein, unless the applicable prospectus supplement says otherwise. Any other default under or breach of the indenture or any such securities will not give rise to an event of default, whether after notice, the passage of time or otherwise. As a consequence, if any such other default or breach occurs, neither the trustee nor the holders of any such securities issued on or after January 1, 2017 will be entitled to accelerate the maturity of any securities — that is, they will not be entitled to declare the principal of any securities to be immediately due and payable because of such other default or breach (other than any securities whose terms specify otherwise, as described in the applicable prospectus supplement). These other defaults and breaches would include, among others, any breach of the covenants described below under “— Mergers and Similar Transactions”. In addition, if any such other default or breach occurs, neither the trustee nor the holders of any such securities will be entitled to enforce or seek any remedy under the 2008 indenture or the securities, except as described below under “— Default, Remedies and Waiver of Default” in respect of certain covenant breaches.

The limitations on events of default, acceleration rights and other remedies described in the prior paragraph do not apply with regard to any securities issued under the 1999 indenture or to any securities issued prior to January 1, 2017 under the 2008 indenture. Therefore, if certain defaults or breaches occur, holders of securities issued before January 1, 2017 may be able to accelerate their securities so that such securities become immediately due and payable while you, as a holder of securities issued on or after January 1, 2017, may not be able to do so. In such an event, our obligation to repay the accelerated securities in full could adversely affect our ability to make timely payments on your securities thereafter. These limitations on your rights and remedies could adversely affect the market value of your securities, especially during times of financial stress for us or our industry.

Please see “Description of Debt Securities We May Offer — Default, Remedies and Waiver of Default” below for an explanation of the terms “1999 indenture”, “2008 indenture”, “event of default” and “covenant breach”, as well as for information regarding acceleration rights and remedies.

Subordinated debt securities issued under the subordinated debt indenture provide even more limited acceleration and enforcement rights.

For any subordinated debt securities issued under the subordinated debt indenture, unless the applicable prospectus supplement says otherwise, events of default, acceleration rights and other remedies will also be limited as described below in “Description of Debt Securities We May Offer — Subordination Provisions”. These limitations are greater than those described in the prior paragraph with regard to senior debt securities. For example, the maturity of the subordinated debt securities would be accelerated only upon insolvency events as specified herein, unless the applicable prospectus supplement says otherwise. There will be no right of acceleration of the payment of principal of the subordinated debt securities upon a default in the payment of principal, interest or any other amount (including upon redemption) on the subordinated debt securities. Therefore, if certain payment defaults occur, holders of senior debt securities may be able to accelerate their securities so that such securities become immediately due and payable while you, as a holder of subordinated debt securities, may not be able to do so. In such an event, our obligation to repay the accelerated securities in full could adversely affect our ability to make timely payments on your securities thereafter.

11

Table of Contents

Holders of our senior debt securities issued on or after January 1, 2017 under the 2008 indenture and holders of our subordinated debt securities issued after July 7, 2017 under the subordinated debt indenture could be at greater risk for being structurally subordinated if Group Inc. sells or transfers its assets substantially as an entirety to one or more of its subsidiaries.

With respect to any securities issued on or after January 1, 2017 under the 2008 indenture and any securities issued after July 7, 2017 under the subordinated debt indenture, we may sell or transfer our assets substantially as an entirety, in one or more transactions, to one or more entities, provided that the assets of Group, Inc. and its direct or indirect subsidiaries in which it owns a majority of the combined voting power, taken together, are not sold or transferred substantially as an entirety to one or more entities that are not such subsidiaries. If we sell or transfer our assets substantially as an entirety to our subsidiaries, third-party creditors of our subsidiaries would have additional assets from which to recover on their claims while holders of our securities issued on or after January 1, 2017 under the 2008 indenture and any securities issued after July 7, 2017 under the subordinated debt indenture would be structurally subordinated to creditors of our subsidiaries with respect to such assets.

Please see “Description of Debt Securities We May Offer — Mergers and Similar Transactions” below for more information.

12

Table of Contents

Table of Contents

DESCRIPTION OF DEBT SECURITIES WE MAY OFFER

Please note that in this section entitled “Description of Debt Securities We May Offer”, references to “The Goldman Sachs Group, Inc.”, “we”, “our” and “us” refer only to The Goldman Sachs Group, Inc. and not to its consolidated subsidiaries. Also, in this section, references to “holders” mean those who own debt securities registered in their own names, on the books that we or the trustee maintain for this purpose, and not those who own beneficial interests in debt securities registered in street name or in debt securities issued in book-entry form through one or more depositaries. Owners of beneficial interests in the debt securities should read the section below entitled “Legal Ownership and Book-Entry Issuance”.

Debt Securities May Be Senior or Subordinated

We may issue senior or subordinated debt securities. Neither the senior debt securities nor the subordinated debt securities will be secured by any property or assets of The Goldman Sachs Group, Inc. or its subsidiaries. Thus, by owning a debt security, you are one of our unsecured creditors.

The senior debt securities will constitute part of our senior debt, will be issued under one of our senior debt indentures (as described in “— The Senior Debt Indentures and the Subordinated Debt Indenture” below) and will rank equally with all of our other unsecured and unsubordinated debt.

The subordinated debt securities will constitute part of our subordinated debt, will be issued under our subordinated debt indenture described below and will be subordinate in right of payment to all of our “senior debt”, as defined in the subordinated debt indenture. The prospectus supplement for any series of subordinated debt securities or the information incorporated in this prospectus by reference will indicate the approximate amount of senior debt outstanding as of the end of our most recent fiscal year.

None of the indentures limit our ability to incur additional senior debt.

When we refer to “debt securities” in this prospectus, we mean both the senior debt securities and the subordinated debt securities.

The Senior Debt Indentures and the Subordinated Debt Indenture

The senior debt securities are governed by documents called the “senior debt indentures” (the Indenture dated as of May 19, 1999, as amended or supplemented from time to time, between us and The Bank of New York Mellon (formerly known as The Bank of New York), as trustee, which we refer to as the “1999 indenture”, and the Senior Debt Indenture dated as of July 16, 2008, as amended or supplemented from time to time, between us and The Bank of New York Mellon, as trustee, as amended by the Fourth Supplemental Indenture to the 2008 indenture dated as of December 31, 2016 (which, together, we refer to as the “2008 indenture”), and the subordinated debt securities are governed by the “subordinated debt indenture” (the Subordinated Debt Indenture dated as of February 20, 2004 between us and The Bank of New York Mellon, as trustee, and together with the senior debt indentures, the “debt indentures”). The debt indentures are substantially identical, except for our covenant described below under “— Restriction on Liens”, which is included only in the two senior debt indentures; the provisions relating to subordination, which are included only in the subordinated debt indenture; certain provisions described below under “— Modification of the Debt Indentures and Waiver of Covenants”, which vary substantially between the two senior debt indentures; and the provisions relating to events of default and rights and remedies available upon any default or breach, which vary substantially between the two senior debt indentures and between them and the subordinated debt indenture.

14

Table of Contents

Whether securities have been issued before or after January 1, 2017 under the 2008 indenture or July 7, 2017 under the subordinated debt indenture will be determined by us by reference to the time of the original issuance of the series of which such securities are a part. For this purpose, “series” means securities with the same CUSIP number. Unless otherwise provided in your prospectus supplement, all securities issued under the 2008 indenture on or after January 1, 2017 will be subject to the provisions of the fourth supplemental indenture to the 2008 indenture dated December 31, 2016, and all securities issued under the subordinated debt indenture after July 7, 2017 will be subject to the provisions of the tenth supplemental indenture to the subordinated debt indenture, dated July 7, 2017.

The trustee under each debt indenture has two main roles:

| • | First, the trustee can enforce your rights against us if we default. There are some limitations on the extent to which the trustee acts on your behalf, which we describe below under “— Default, Remedies and Waiver of Default”. |

| • | Second, the trustee performs administrative duties for us, such as sending you interest payments and notices. |

See “— Our Relationship With the Trustee” below for more information about the trustee.

When we refer to the “indenture”, the “debt indenture” or the “trustee” with respect to any debt securities, we mean the debt indenture under which those debt securities are issued and the trustee under that debt indenture.

We May Issue Many Debt Securities or Series of Debt Securities

We may issue many distinct debt securities or series of debt securities under any of our three debt indentures. This section summarizes terms of the debt securities that apply generally to all debt securities and series of debt securities. The provisions of each debt indenture allow us not only to issue debt securities with terms different from those of debt securities previously issued under that debt indenture, but also to “reopen” previously issued debt securities and issue additional debt securities as the same series, with the same CUSIP number, stated maturity, interest payment dates, if any, and other terms, except for the date of issuance and issue price. We will describe the specific terms of your debt securities in the applicable prospectus supplement accompanying this prospectus. Those terms may vary from the terms described here.

As you read this section, please remember that the specific terms of your debt security as described in your prospectus supplement will supplement and, if applicable, may modify or replace the general terms described in this section. If there are any differences between your prospectus supplement and this prospectus, your prospectus supplement will control. Thus, the statements we make in this section may not apply to your debt security.

When we refer to “debt securities” or a “series of debt securities”, we mean, respectively, debt securities or a series of debt securities issued under the applicable debt indenture. When we refer to your prospectus supplement, we mean the prospectus supplement describing the specific terms of the debt security you purchase. The terms used in your prospectus supplement will have the meanings described in this prospectus, unless otherwise specified.

Amounts That We May Issue

None of the debt indentures limits the aggregate amount of debt securities that we may issue or the number of series or the aggregate amount of any particular series of debt securities. We may issue debt securities and other securities at any time without your consent and without notifying you.

15

Table of Contents

The debt indentures and the debt securities do not limit our ability to incur other indebtedness or to issue other securities. Also, we are not subject to financial or similar restrictions by the terms of the debt securities, except as described below under “— Restriction on Liens”.

Principal Amount, Stated Maturity and Maturity

Unless otherwise stated, the principal amount of a debt security means the principal amount payable at its stated maturity, unless such amount is not determinable, in which case the principal amount of a debt security is its face amount. Any debt securities owned by us or any of our affiliates are not deemed to be outstanding.

The term “stated maturity” with respect to any debt security means the day on which the principal amount of your debt security is scheduled to become due. The principal of your debt security may become due sooner, by reason of redemption or acceleration after a default or otherwise in accordance with the terms of your debt security. The day on which the principal of your debt security actually becomes due, whether at the stated maturity or otherwise, is called the “maturity” of the principal. You will receive the principal amount of your debt security at maturity (plus accrued and unpaid interest, if any), unless your prospectus supplement specifies another amount.

We also use the terms “stated maturity” and “maturity” to refer to the days when other payments become due. For example, we may refer to a regular interest payment date when an installment of interest is scheduled to become due as the “stated maturity” of that installment. When we refer to the “stated maturity” or the “maturity” of a debt security without specifying a particular payment, we mean the stated maturity or maturity, as the case may be, of the principal.

We Are a Holding Company

Because our assets consist principally of interests in the subsidiaries through which we conduct our businesses, our right to participate as an equity holder in any distribution of assets of any of our subsidiaries upon the subsidiary’s liquidation or otherwise, and thus the ability of our security holders to benefit from the distribution, is junior to creditors of the subsidiary, except to the extent that any claims we may have as a creditor of the subsidiary are recognized. Many of our subsidiaries, including our broker-dealer, bank and insurance subsidiaries, are subject to laws that restrict dividend payments or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to us. Restrictions or regulatory action of that kind could impede access to funds that we need to make payments on our obligations, including debt obligations. Because some of our subsidiaries, including from time to time some of our principal operating subsidiaries, are partnerships in which we are a general partner or the sole limited partner, we may be liable for their obligations. We also guarantee many of the obligations of our subsidiaries. Any liability we may have for our subsidiaries’ obligations could reduce our assets that are available to satisfy our direct creditors, including investors in our securities.

This Section Is Only a Summary

The debt indentures and their associated documents contain the full legal text of the matters described in this section and in your prospectus supplement. We have filed copies of the debt indentures with the SEC as exhibits to our registration statement, of which this prospectus is a part. See “Available Information” above for information on how to obtain copies of them.

This section and your prospectus supplement summarize all the material terms of the debt indentures, where applicable, and your debt security. They do not, however, describe every aspect of the debt indentures and your debt security. For example, in this section and your prospectus

16

Table of Contents

supplement, we use terms that have been given special meaning in the debt indentures, but we describe the meaning for only the more important of those terms. Your prospectus supplement will have a more detailed description of the specific terms of your debt security.

Governing Law

The debt indentures are, and the debt securities will be, governed by New York law.

Currency of Debt Securities

Amounts that become due and payable on your debt security in cash will be payable in a currency, composite currency, basket of currencies or currency unit or units specified in your prospectus supplement. We refer to this currency, composite currency, basket of currencies or currency unit or units as a “specified currency”. The specified currency for your debt security will be U.S. dollars, unless your prospectus supplement states otherwise. Some debt securities may have different specified currencies for principal and interest. You will have to pay for your debt securities by delivering the requisite amount of the specified currency for the principal to GS&Co. or another firm that we name in your prospectus supplement, unless other arrangements have been made between you and us or you and GS&Co. We will make payments on your debt securities in the specified currency, except as described below in “— Payment Mechanics for Debt Securities”. See “Considerations Relating to Securities Denominated or Payable in or Linked to a Non-U.S. Dollar Currency” below for more information about risks of investing in debt securities of this kind.

Form of Debt Securities

We will issue each debt security in global — i.e., book-entry — form only, unless we specify otherwise in the applicable prospectus supplement. Debt securities in book-entry form will be represented by a global security registered in the name of a depositary, which will be the holder of all the debt securities represented by the global security. Those who own beneficial interests in a global debt security will do so through participants in the depositary’s securities clearing system, and the rights of these indirect owners will be governed solely by the applicable procedures of the depositary and its participants. We describe book-entry securities below under “Legal Ownership and Book-Entry Issuance”.

In addition, we will generally issue each debt security in registered form, without coupons.

Types of Debt Securities

We may issue any of the three types of senior debt securities or subordinated debt securities described below. A debt security may have elements of each of the three types of debt securities described below. For example, a debt security may bear interest at a fixed rate for some periods and at a floating rate in others. Similarly, a debt security may provide for a payment of principal at maturity linked to an index and also bear interest at a fixed or floating rate.

Fixed Rate Debt Securities

A debt security of this type will bear interest at a fixed rate described in the applicable prospectus supplement. This type includes zero coupon debt securities, which bear no interest and are instead issued at a price lower than the principal amount. See “— Original Issue Discount Debt Securities” below for more information about zero coupon and other original issue discount debt securities.

Each fixed rate debt security, except any zero coupon debt security, will bear interest from its original issue date or from the most recent date to which interest on the debt security has been paid or

17

Table of Contents

made available for payment. Interest will accrue on the principal of a fixed rate debt security at the fixed rate per annum stated in the applicable prospectus supplement, until the principal is paid or made available for payment or the debt security is converted or exchanged. Interest due on each interest payment date and at maturity will be calculated as described below under “— Calculations of Interest on Debt Securities”. We will pay interest on each interest payment date and at maturity as described below under “— Payment Mechanics for Debt Securities”.

If your debt security is a zero coupon debt security, the applicable prospectus supplement may specify the original issue discount and the information necessary to determine the accreted value. The accreted value will be (1) as of any date prior to the stated maturity, an amount equal to the sum of (A) the original issue price of your debt security and (B) the portion of the excess of the principal amount of your debt security over the original issue price that shall have been accreted from the original issue price on a daily basis and compounded annually on a date specified in the applicable prospectus supplement, up to and including the stated maturity, at a rate that will be specified in the applicable prospectus supplement from the original issue date, computed on the basis of the day count fraction set forth in your prospectus supplement; and (2) as of any date on or after the stated maturity, the principal amount of your debt security.

Floating Rate Debt Securities

A debt security of this type will bear interest at rates that are determined by reference to an interest rate formula. In some cases, the rates may also be adjusted by adding or subtracting a spread or multiplying by a spread multiplier and may be subject to a minimum rate or a maximum rate. The various interest rate formulas and these other features are described below in “— Calculations of Interest on Debt Securities — Floating Rate Debt Securities”. If your debt security is a floating rate debt security, the formula and any adjustments that apply to the interest rate will be specified in your prospectus supplement.

Interest due on each interest payment date and at maturity will be calculated as described below under “— Calculations of Interest on Debt Securities”. We will pay interest on each interest payment date and at maturity as described below under “— Payment Mechanics for Debt Securities”.

Indexed Debt Securities

A debt security of this type provides that the principal amount payable at its maturity, and/or the amount of interest payable on an interest payment date, will be determined by reference to:

| • | securities of one or more issuers; |

| • | one or more currencies; |

| • | one or more commodities; |

| • | any other financial, economic or other measure or instrument, including the occurrence or non-occurrence of any event or circumstance; |

| • | one or more indices; and/or |

| • | one or more baskets of the items described above. |

An indexed debt security may provide either for cash settlement or for physical settlement by delivery of the underlying security or another property of the type listed above. An indexed debt security may also provide that the form of settlement may be determined at our option or at the holder’s option. Some indexed debt securities may be convertible, exercisable or exchangeable, at our option or the holder’s option, into or for securities of The Goldman Sachs Group, Inc. or an issuer other than The Goldman Sachs Group, Inc.

18

Table of Contents

An indexed debt security may bear interest at a fixed or floating rate, if specified in your prospectus supplement. Unless otherwise indicated in your prospectus supplement, indexed debt securities that bear interest at a fixed rate will bear interest as described above under “— Fixed Rate Debt Securities” and indexed debt securities that bear interest at a floating rate will bear interest as described above under “— Floating Rate Debt Securities”.

If you purchase an indexed debt security, your prospectus supplement will include information about the relevant index or indices, about how amounts that are to become payable will be determined by reference to the price or value of that index or indices and about the terms on which the security may be settled physically or in cash. Your prospectus supplement will also identify the calculation agent that will calculate the amounts payable with respect to the indexed debt security and will have sole discretion in doing so. The calculation agent may be GS&Co. or another of our affiliates. See “Considerations Relating to Indexed Securities” for more information about risks of investing in debt securities of this type.

Original Issue Discount Debt Securities

A fixed rate debt security, a floating rate debt security or an indexed debt security may be an original issue discount debt security. A debt security of this type is issued at a price lower than its principal amount and may provide that, upon redemption or acceleration of its maturity, an amount less than its principal amount may be payable. An original issue discount debt security may be a zero coupon debt security. A debt security issued at a discount to its principal may, for U.S. federal income tax purposes, be considered an original issue discount debt security, regardless of the amount payable upon redemption or acceleration of maturity. See “United States Taxation — Taxation of Debt Securities — United States Holders — Original Issue Discount” below for a brief description of the U.S. federal income tax consequences of owning an original issue discount debt security.

Information in Your Prospectus Supplement

Your prospectus supplement will describe the specific terms of your debt security, which will include some or all of the following:

| • | whether it is a senior debt security or a subordinated debt security and, if it is a senior debt security, under which senior debt indenture it will be issued; |

| • | the aggregate principal amount of your debt security or the debt securities of the same series, as applicable; |

| • | the stated maturity; |

| • | the specified currency or currencies for principal and interest and, if the specified currency is not U.S. dollars, certain other terms relating to your debt security; |

| • | the issue price at which we originally issue your debt security, expressed as a percentage of the principal amount, and the original issue date; |

| • | whether your debt security is a fixed rate debt security, a floating rate debt security or an indexed debt security or any combination thereof; |

| • | if your debt security is a fixed rate debt security, a rate per annum at which your debt security will bear interest, if any, the applicable business day convention, the day count convention for computing interest payable for an interest period and the interest payment dates; |

| • | if your debt security is a floating rate debt security, the interest rate basis; any applicable index currency or index maturity, spread or spread multiplier or initial base rate, maximum rate or minimum rate; the interest reset, determination, calculation and payment dates; the day count convention used to calculate interest payments for any period; the business day convention; and the calculation agent; |

19

Table of Contents

| • | if your debt security is an indexed debt security, the principal amount, if any, we will pay you at maturity, the amount of interest, if any, we will pay you on an interest payment date or the formula we will use to calculate these amounts, if any, and the terms on which your debt security will be exchangeable for or payable in cash, securities or other property; |

| • | if your debt security may be converted into or exercised or exchanged for common stock or preferred stock or other securities of The Goldman Sachs Group, Inc. or debt or equity securities of one or more third parties, the terms on which conversion, exercise or exchange may occur, including whether conversion, exercise or exchange is mandatory, at the option of the holder or at our option, the period during which conversion, exercise or exchange may occur, the initial conversion, exercise or exchange price or rate and the circumstances or manner in which the amount of common stock or preferred stock or other securities issuable upon conversion, exercise or exchange may be adjusted; |

| • | if your debt security is also an original issue discount debt security, the yield to maturity; |

| • | if applicable, the circumstances under which your debt security may be redeemed at our option or repaid at the holder’s option before the stated maturity, including any redemption commencement date, repayment date(s), redemption price(s) and redemption period(s); |

| • | the authorized denominations, if other than $1,000 and integral multiples of $1,000 in excess thereof; |

| • | the depositary for your debt security, if other than DTC, and any circumstances under which the holder may request securities in non-global form, if we choose not to issue your debt security in book-entry form only; |

| • | if applicable, the circumstances under which we will pay additional amounts on any debt securities held by a person who is not a United States person for tax purposes and under which we can redeem the debt securities if we have to pay additional amounts; |

| • | the names and duties of any co-trustees, depositaries, authenticating agents, paying agents, transfer agents or registrars for your debt security, as applicable; and |

| • | any other terms of your debt security, which could be different from those described in this prospectus. |

Market-Making Transactions. If you purchase your debt security — or any of our other securities we describe in this prospectus — in a market-making transaction, you will receive information about the issue price you pay and your trade and settlement dates in a separate confirmation of sale. A market-making transaction is one in which GS&Co. or another of our affiliates resells a security that it has previously acquired from another holder. A market-making transaction in a particular security occurs after the original issuance and sale of the security. See “Plan of Distribution” below.

Calculations of Interest on Debt Securities

Interest Rates and Interest. Fixed rate debt securities will have the interest rate stated in the applicable prospectus supplement.

For each floating rate debt security, the calculation agent will determine, on the corresponding interest calculation or interest determination date, as described below or in the applicable prospectus supplement, the interest rate that takes effect on each interest reset date. Upon the request of the holder of any floating rate debt security, the calculation agent will provide for that debt security the interest rate then in effect — and, if determined, the interest rate that will become effective on the next interest reset date. The calculation agent’s determination of any interest rate, and its calculation of the amount of interest for any interest period, will be final and binding in the absence of manifest error. In

20

Table of Contents

determining the base rate that applies to a floating rate debt security issued prior to July 1, 2020 during a particular interest period, the calculation agent may obtain rate quotes from various banks or dealers active in the relevant market, as described below or in the applicable prospectus supplement. Those reference banks and dealers may include the calculation agent itself and its affiliates, as well as any underwriter, dealer or agent participating in the distribution of the relevant floating rate debt securities and its affiliates, and they may include affiliates of The Goldman Sachs Group, Inc.

The references below to provisions of the 2006 ISDA Definitions refer to the referenced provisions as published by the International Swaps and Derivatives Association, without regard to any subsequent amendments or supplements (the “2006 ISDA Definitions”).

The calculation agent (in the case of floating rate debt securities) or the paying agent, which may be the indenture trustee (in the case of fixed rate debt securities) will calculate the amount of interest that has accrued during each interest period — i.e., the period from and including the original issue date, or the last date to which interest has been paid (which may be an interest payment date, depending on the business day convention that applies to your debt securities), to but excluding the next date to which interest will be paid (which may be an interest payment date, depending on the business day convention that applies to your debt securities, as described under “— Business Day Conventions” below). For each interest period, the agent will calculate the amount of accrued interest by multiplying the principal amount or face amount of the debt security, as applicable, by an accrued interest factor for the interest period. The accrued interest factor will be determined by multiplying the per annum fixed rate or floating rate, as applicable, by a factor resulting from the day count convention specified below or in your prospectus supplement, which may include the following:

| • | If “1/1 (ISDA)” or “1/1” is specified, the factor will be equal to 1, as described in Section 4.16(a) of the 2006 ISDA Definitions. |

| • | If “Actual/Actual”, “Actual/Actual (ISDA)”, “Act/Act” or “Act/Act (ISDA)” is specified, the factor will be equal to the actual number of days in the interest period divided by 365 (or, if any portion of that interest period falls in a leap year, the sum of (1) the actual number of days in that portion of the interest period falling in a leap year divided by 366 and (2) the actual number of days in that portion of the interest period falling in a non-leap year divided by 365), as described in Section 4.16(b) of the 2006 ISDA Definitions. |