Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-219206

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion. Dated June 29, 2018.

GS Finance Corp.

$

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

guaranteed by

The Goldman Sachs Group, Inc.

|

The notes will not bear interest. Unless your notes are automatically called on any annual call observation date, the amount that you will be paid on your notes on the stated maturity date (expected to be July 26, 2028) will be based on the performance of the GS Momentum Builder® Multi-Asset 5S ER Index as measured from the trade date (expected to be July 12, 2018) to and including the determination date (expected to be July 12, 2028). The index measures the extent to which the performance of the selected underlying assets (up to 14 ETFs and a money market position in 3-month USD LIBOR, which provide exposure to broad-based equities, fixed income, emerging markets, alternatives, commodities, inflation, and cash equivalent asset classes) outperform the sum of the return on 3-month USD LIBOR plus 0.65% per annum (accruing daily). LIBOR is being modified, see page S-28.

If the final index level (the closing level of the index on the determination date) is greater than the initial index level set on the trade date, the return on your notes will be the index return (the percentage increase or decrease in the final index level from the initial index level). Because the index measures the performance of the selected underlying assets less the sum of the return on 3-month USD LIBOR plus 0.65% per annum (accruing daily), on any day such assets must outperform the return on 3-month USD LIBOR plus 0.65% per annum for the index level to increase.

Your notes will be called if the closing level of the index on any call observation date is greater than or equal to the applicable call level (specified on page S-6), resulting in a payment on the corresponding call payment date (the tenth business day after the call observation date) equal to the face amount of your notes plus the product of $1,000 times the applicable call return (specified on page S-6).

The index rebalances on each index business day from among the 15 underlying assets. The daily weight used to rebalance each underlying asset on any index business day equals the average of the target weights for each underlying asset determined on such day and each of the prior 21 index business days. Target weights are determined by calculating for each day the combination of underlying assets with the highest return during three return look-back periods (9, 6 and 3 months), subject to a (a) limit of 5% on portfolio realized volatility over the related volatility look-back period (6, 3 and 1 months for the 9, 6 and 3 month return look-back periods, respectively) and (b) maximum weight for each underlying asset and each asset class. This results in a portfolio for each of the three return look-back periods for each day. The target weight of each underlying asset will equal the average of the weights, if any, of such underlying asset in the three portfolios. As a result of this rebalancing, the index may include as few as 3 ETFs (and the money market position) and may never include some of the underlying assets or asset classes.

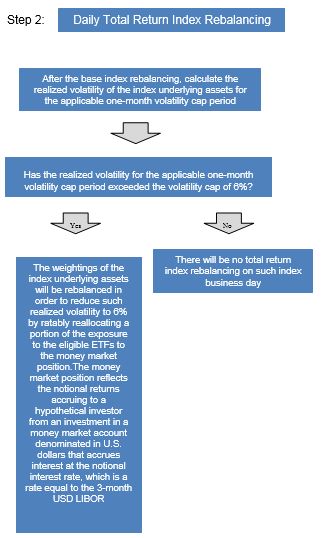

After the index is rebalanced on an index business day, the realized volatility for the prior month is calculated. Realized volatility is the degree of variation in the daily closing prices or levels of the aggregate of the underlying assets over the applicable volatility look-back period. If the realized volatility exceeds 6%, the index will be rebalanced again for that day by ratably reallocating a portion of the exposure to the ETFs in the index to the money market position sufficient to reduce the prior month realized volatility to 6%. As a result of such rebalancing, the index may not include any ETFs and may allocate its entire exposure to the money market position, the return on which will always be less than the sum of the return on 3-month USD LIBOR plus 0.65% per annum. Historically, a significant portion of the index has been in the money market position.

If your notes are not called, at maturity, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

| · |

if the index return is positive (the final index level is greater than the initial index level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the index return; or

|

| · |

if the index return is zero or negative (the final index level is equal to or less than the initial index level), $1,000.

|

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page S-18.

The estimated value of your notes at the time the terms of your notes are set on the trade date is expected to be between $870 and $930 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

|

Original issue date:

|

expected to be July 17, 2018

|

Original issue price:

|

100% of the face amount*

|

|

Underwriting discount:

|

% of the face amount*

|

Net proceeds to the issuer:

|

% of the face amount

|

* The original issue price will be % for certain investors; see “Supplemental Plan of Distribution” on page S-171.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Prospectus Supplement No. dated , 2018.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this prospectus supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

|

Estimated Value of Your Notes

The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is expected to be between $870 and $930 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $ per $1,000 face amount).

Prior to , the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through ). On and after , the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models.

|

|

About Your Prospectus

The notes are part of the Medium-Term Notes, Series E program of GS Finance Corp., and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this prospectus supplement and the accompanying documents listed below. This prospectus supplement constitutes a supplement to the documents listed below and should be read in conjunction with such documents:

The information in this prospectus supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes.

|

The following is a list of the eligible underlying assets for the index, including the related asset classes, asset class minimum and maximum weights and underlying asset minimum and maximum weights. The index is more fully described beginning on page S-47 herein.

|

ASSET

CLASS

|

ASSET

CLASS

MINIMUM

WEIGHT

|

ASSET

CLASS

MAXIMUM

WEIGHT

|

ELIGIBLE

UNDERLYING

ASSET*

|

TICKER

|

UNDERLYING

ASSET

MINIMUM

WEIGHT

|

UNDERLYING

ASSET

MAXIMUM

WEIGHT

|

|

|

Broad-Based Equities

|

0%

|

50%

|

SPDR® S&P 500® ETF Trust

|

SPY

|

0%

|

20%

|

|

|

iShares® MSCI EAFE ETF

|

EFA

|

0%

|

20%

|

||||

|

iShares® MSCI Japan ETF

|

EWJ

|

0%

|

10%

|

||||

|

Fixed Income

|

0%

|

50%

|

iShares® 20+ Year Treasury Bond ETF

|

TLT

|

0%

|

20%

|

|

|

iShares® iBoxx $ Investment Grade Corporate Bond ETF

|

LQD

|

0%

|

20%

|

||||

|

iShares® iBoxx $ High Yield Corporate Bond ETF

|

HYG

|

0%

|

20%

|

||||

|

iShares® 7-10 Year Treasury Bond ETF

|

IEF

|

0%

|

20%

|

||||

|

Emerging Markets

|

0%

|

20%

|

iShares® MSCI Emerging Markets ETF

|

EEM

|

0%

|

20%

|

|

|

Alternatives

|

0%

|

25%

|

iShares® U.S. Real Estate ETF

|

IYR

|

0%

|

20%

|

|

|

iShares® U.S. Preferred Stock ETF

|

PFF

|

0%

|

10%

|

||||

|

iShares® Nasdaq Biotechnology ETF

|

IBB

|

0%

|

10%

|

||||

|

Commodities

|

0%

|

25%

|

SPDR® S&P® Oil & Gas Exploration & Production ETF

|

XOP

|

0%

|

20%

|

|

|

SPDR® Gold Trust

|

GLD

|

0%

|

20%

|

||||

|

Inflation

|

0%

|

10%

|

iShares® TIPS Bond ETF

|

TIP

|

0%

|

10%

|

|

|

Cash Equivalent

|

0%

|

50%**

|

Money Market Position

|

N/A

|

0%

|

50%**

|

* The value of a share of an eligible ETF may reflect transaction costs and fees incurred or imposed by the investment advisor of the eligible ETF as well as the costs to the ETF to buy and sell its assets. These costs and fees are not included in the calculation of the index underlying the eligible ETF. For more fee information relating to an eligible ETF, see “The Eligible Underlying Assets” on page S-74.

** With respect to the money market position, the related asset class maximum weight and underlying asset maximum weight limitations do not apply after the first rebalancing on each index business day and, therefore, the index may allocate its entire exposure to the money market position.

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

The below is only a brief summary of the terms of your notes. You should read the detailed description thereof in “Summary Information” on page S-11 and in “Specific Terms of Your Notes” on page S-41 as well as the accompanying prospectus supplement and accompanying prospectus.

INVESTMENT THESIS

For investors who:

| · |

seek the opportunity to achieve a return at maturity based on the performance of an index that attempts to track the positive price momentum in certain eligible underlying assets by varying exposure to those eligible underlying assets, subject to limitations on volatility and a minimum and maximum weight for each underlying asset and each asset class.

|

| · |

understand that the eligible underlying assets provide exposure to broad-based equities, fixed income, emerging markets, alternatives, commodities, inflation, and cash equivalent asset classes.

|

| · |

seek to have their principal returned after a period of approximately 120 months.

|

| · |

believe the index will increase during the period from the trade date to the determination date, but are willing to accept that the term of the notes will be reduced if the notes are automatically called on a call observation date (in which case the return on the notes will be limited to the applicable call return).

|

| · |

are willing, if the notes are not automatically called, to receive only their principal back at maturity if the index return is less than or equal to zero.

|

As a result of the rebalancing among the 15 underlying assets, the index may include as few as four underlying assets (as few as three ETFs) and may not include some of the underlying assets or assets classes during the entire term of your notes. As a result of any rebalancing into the money market position to reduce the prior month realized volatility to 6%, the index may not include any ETFs and may allocate its entire exposure to the money market position, the return on which will always be less than the sum of the return on 3-month USD LIBOR plus 0.65% per annum (accruing daily). Historically, a significant portion of the index exposure has been to the money market position.

PAYOUT DESCRIPTION

Your notes will be called if the closing level of the index on any call observation date is greater than or equal to the applicable call level, resulting in a payment on the corresponding call payment date equal to the face amount of your notes plus the product of $1,000 times the applicable call return.

If your notes are not called, at maturity, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

| ● |

if the index return is positive (the final index level is greater than the initial index level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the index return; or

|

|

●

|

if the index return is zero or negative (the final index level is equal to or less than the initial index level), $1,000.

|

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

THE INDEX

The GS Momentum Builder® Multi-Asset 5S ER Index (the index) measures the extent to which the performance of the exchange-traded funds and a money market position (together with the ETFs, the underlying assets) included in the index outperform the sum of the return on the notional interest rate, which is a rate equal to 3-month USD LIBOR, plus 0.65% per annum (accruing daily). The money market position reflects the notional returns accruing to a hypothetical investor from an investment in a money market account denominated in U.S. dollars that accrues interest at the notional interest rate. The index rebalances on each index business day from among 15 underlying assets that have been categorized in the following asset classes: broad-based equities; fixed income; emerging markets; alternatives; commodities; inflation; and cash equivalent. The index attempts to track the positive price momentum in the underlying assets, subject to limitations on volatility and a minimum and maximum weight for each underlying asset and each asset class, each as described below.

Features of the index include:

| · |

daily rebalancing from among the 15 eligible underlying assets on each index business day (in this context, a base index rebalancing day) by calculating, for each day in the weight averaging period related to that base index rebalancing day, the combination of underlying assets that would have provided the highest historical return during three return look-back periods (nine months, six months and three months), subject to:

|

| o |

a limit of 5% on the degree of variation in the daily closing prices or closing level, as applicable, of the aggregate of such underlying assets over the related realized volatility look-back periods (the prior six months, three months and one month for the nine-month, six-month and three-month return look-back periods, respectively); and

|

| o |

a minimum and maximum weight for each underlying asset and each asset class; and

|

| · |

the potential for daily total return index rebalancing into the money market position, based on whether the realized volatility of the underlying assets comprising the index exceeds the volatility cap of 6% for the applicable volatility cap period (the prior one month).

|

Analyzing realized volatility over three volatility look-back periods results in three potential portfolios of underlying assets (one for each return look-back period) for each day in the applicable weight averaging period. The weight of each underlying asset for a given day in a weight averaging period (the “target weight”) will equal the average of the weights of such underlying asset in the three potential portfolios while the weight of each underlying asset for the daily base index rebalancing will equal the average of such target weights. This daily rebalancing is referred to as the base index rebalancing and the resulting portfolio of index underlying assets comprise the base index effective after the close of business on a given day. The weight averaging period for any base index rebalancing day will be the period from (but excluding) the 22nd index business day on which no index market disruption event occurs or is continuing with respect to any underlying asset prior to such day to (and including) such day.

The value of the index is calculated in U.S. dollars on each index business day by reference to the performance of the total return index value net of the sum of the return on the notional interest rate in effect at that time plus 0.65% per annum (accruing daily). Any cash dividend paid on an index ETF is deemed to be reinvested in such index ETF and subject to subsequent changes in the value of the index ETF. In addition, any interest accrued on the money market position is similarly deemed to be reinvested on a daily basis in such money market position and subject to subsequent changes in the notional interest rate. The total return index value on each index business day is calculated by reference to the weighted performance of:

| · |

the base index, which is the weighted combination of underlying assets that comprise the index at the applicable time as a result of daily base index rebalancing; and

|

| · |

any additional exposure to the money market position resulting from any daily total return index rebalancing.

|

The underlying assets that comprise the base index as the result of daily base index rebalancing may include a combination of ETFs and the money market position, or solely ETFs. A daily total return index rebalancing will occur effective after the close of business on a given day if the realized volatility of the base index exceeds the volatility cap of 6% for the volatility cap period applicable to such index business day. As a result of a daily total return index rebalancing, the index will have exposure to the money market position even if the base index has no such exposure resulting from its daily base index rebalancing.

For the purpose of the index:

| · |

an “eligible underlying asset” is one of the ETFs or the money market position that is eligible for inclusion in the index on an index business day;

|

| · |

an “eligible ETF” is one of the ETFs that is eligible for inclusion in the index on an index business day (when we refer to an “ETF” we mean an exchange-traded fund, which for purposes of this prospectus supplement includes the following exchange traded products: SPDR® S&P 500® ETF Trust and SPDR® Gold Trust);

|

| · |

an “index underlying asset” is an eligible underlying asset with a non-zero weighting on any index business day;

|

| · |

an “index ETF” is an ETF that is an eligible ETF with a non-zero weighting on any index business day; and

|

| · |

an “index business day” is a day on which the New York Stock Exchange is open for its regular trading session.

|

TERMS

|

Issuer

|

GS Finance Corp.

|

|

Guarantor

|

The Goldman Sachs Group, Inc.

|

|

Index

|

GS Momentum Builder® Multi-Asset 5S ER Index

|

|

Face Amount

|

$ in the aggregate; each note will have a face amount of $1,000

|

|

Trade Date

|

Expected to be July 12, 2018

|

|

Settlement Date (to be set on the trade date)

|

Expected to be July 17, 2018

|

|

Determination Date (to be set on the trade date)

|

Expected to be July 12, 2028

|

|

Stated Maturity Date (to be set on the trade date)

|

Expected to be July 26, 2028

|

|

Initial Index Level

|

To be determined on the trade date

|

|

Final Index Level

|

The closing level of the index on the determination date

|

|

Closing Level of the Index

|

With respect to any trading day, the official closing level of the index or any successor index published by the index sponsor on such trading day

|

|

Index Return

|

The quotient of (i) the final index level minus the initial index level divided by (ii) the initial index level, expressed as a percentage

|

|

Automatic Call Feature

|

If, as measured on any call observation date, the closing level of the index is greater than or equal to the applicable call level, your notes will be automatically called; if your notes are automatically called on any call observation date, on the corresponding call payment date you will receive an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the applicable call return.

|

|

Cash Settlement Amount

|

If your notes are not called, for each $1,000 face amount of notes, we will pay you on the stated maturity date an amount in cash equal to:

· if the index return is positive (the final index level is greater than the initial index level), the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the index return; or

· if the index return is zero or negative (the final index level is equal to or less than the initial index level), $1,000.

|

|

Call Observation Date

|

Call Level (Expressed as a

Percentage of the Initial Index Level)

|

Call Return

|

|

|

July 12, 2019

|

102%

|

10%

|

|

|

July 13, 2020

|

104%

|

20%

|

|

|

July 12, 2021

|

106%

|

30%

|

|

|

July 12, 2022

|

108%

|

40%

|

|

|

July 12, 2023

|

110%

|

50%

|

|

|

July 12, 2024

|

112%

|

60%

|

|

|

July 14, 2025

|

114%

|

70%

|

|

|

July 13, 2026

|

116%

|

80%

|

|

|

July 12, 2027

|

118%

|

90%

|

|

Call Observation Dates (to be set on the trade date)

|

Expected to be the dates specified as such in the table below.

|

|

Call Payment Dates

|

Expected to be the tenth business day after each call observation date

|

|

Call Level

|

With respect to any call observation date, the applicable call level specified in the table set forth under “Call Observation Dates” above; as shown in such table, the call level increases the longer the notes are outstanding

|

|

Call Return

|

With respect to any call payment date, the applicable call return specified in the table set forth under “Call Observation Dates” above; as shown in such table, the call return increases the longer the notes are outstanding

|

|

CUSIP/ISIN

|

40055QKF8 / US40055QKF80

|

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

HYPOTHETICAL EXAMPLES

The following examples are provided for purposes of illustration only. These examples should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that various hypothetical closing levels of the index on a call observation date could have on the related call payment date assuming all other variables remain constant. While there are nine potential call payment dates with respect to your notes, the examples below only illustrate the amount you will receive, if any, on the first and second call payment date. These examples assume a $1,000 face amount of a note and an initial index level of 110. The actual performance of the index over the life of your notes, particularly on each of the call observation dates, may bear little relation to the hypothetical examples shown below or on page S-14 or to the historical levels of the index shown elsewhere in this prospectus supplement. You should also refer to the historical index performance information and hypothetical performance data beginning on page S-59 of this prospectus supplement.

If, for example, your notes are automatically called on the first call observation date (i.e., on the first call observation date the closing level of the index is greater than or equal to 102% of the initial index level), the cash settlement amount that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call return times $1,000. Therefore, for example, if the closing level of the index on the first call observation date were determined to be 120% of the initial index level, your notes would be automatically called and the cash settlement amount that we would deliver on your notes on the corresponding call payment date would be 110% of the face amount of your notes or $1,100 for each $1,000 face amount of your notes. Even if the closing level of the index on a call observation date exceeds the applicable call level, causing the notes to be automatically called, the cash settlement amount on the call payment date will be limited due to the applicable call return.

If, for example, the notes are not automatically called on the first call observation date and are called on the second call observation date (i.e., on the first call observation date the closing level of the index is less than 102% of the initial index level and on the second call observation date the closing level of the index is greater than or equal to 104% of the initial index level), the cash settlement amount that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call return times $1,000. Therefore, for example, if the closing level of the index on the second call observation date were determined to be 140% of the initial index level, your notes would be automatically called and the cash settlement amount that we would deliver on your notes on the corresponding call payment date would be 120% of the face amount of your notes or $1,200 for each $1,000 face amount of your notes. Even if the closing level of the index on a call observation date exceeds the applicable call level, causing the notes to be automatically called, the cash settlement amount on the call payment date will be limited due to the applicable call return.

The following table is provided for purposes of illustration only. It should not be taken as an indication or prediction of future investment results and is intended merely to illustrate the impact that various hypothetical closing levels of the index on the determination date could have on the cash settlement amount assuming all other variables remain constant. The actual performance of the index over the life of your notes, particularly on the determination date, as well as the amount payable on the stated maturity date, may bear little relation to the hypothetical examples shown below or on page S-14 or to the historical levels of the index shown elsewhere in this prospectus supplement. You should also refer to the historical index performance information and hypothetical performance data beginning on page S-59 of this prospectus supplement.

The Notes Have Not Been Automatically Called

|

Hypothetical Final Index

Level (as a Percentage of

the Initial Index Level)

|

Hypothetical Cash

Settlement Amount (as a

Percentage of Face

Amount)

|

|

175.00%

|

175.00%

|

|

150.00%

|

150.00%

|

|

125.00%

|

125.00%

|

|

110.00%

|

110.00%

|

|

100.00%

|

100.00%

|

|

90.00%

|

100.00%

|

|

75.00%

|

100.00%

|

|

50.00%

|

100.00%

|

|

25.00%

|

100.00%

|

|

0.00%

|

100.00%

|

|

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

|

||

|

DAILY REBALANCING

|

||

|

|

|

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

Historical Information and Hypothetical Data

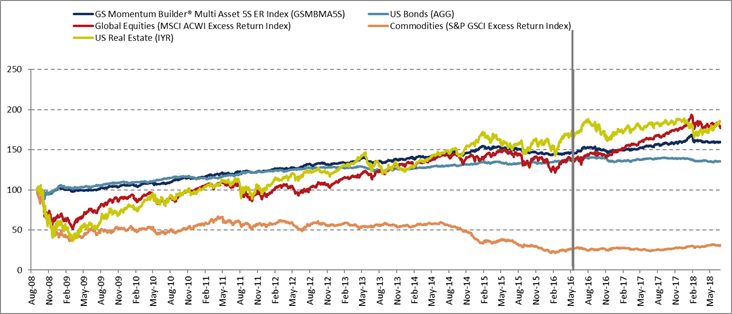

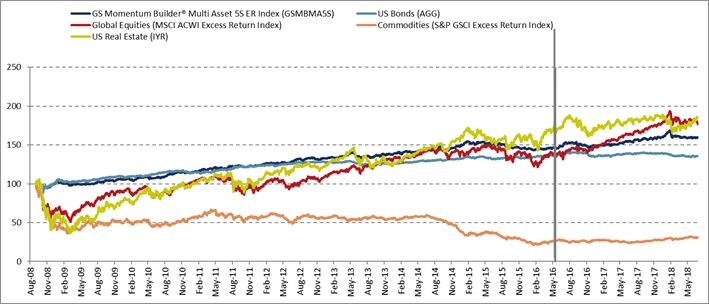

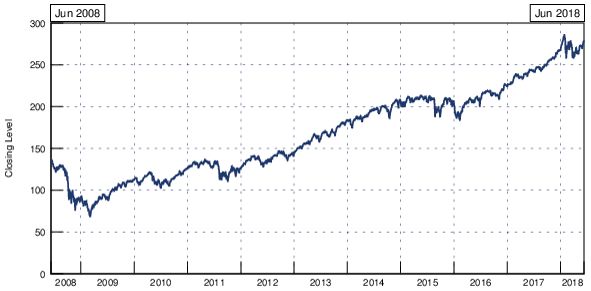

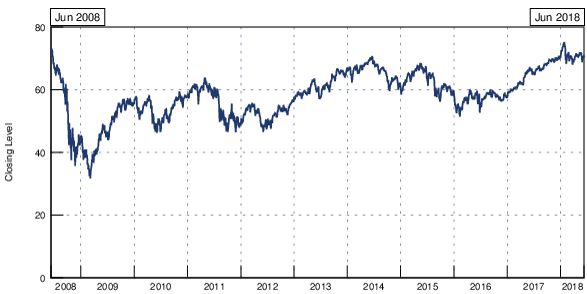

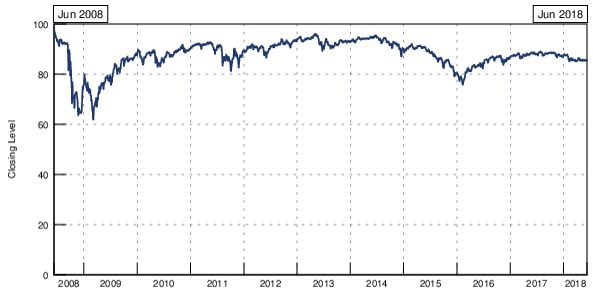

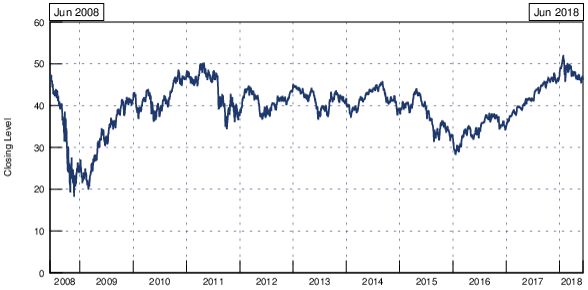

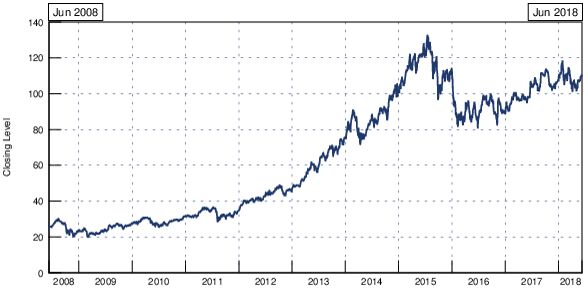

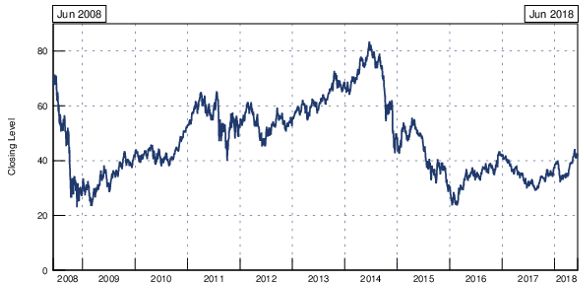

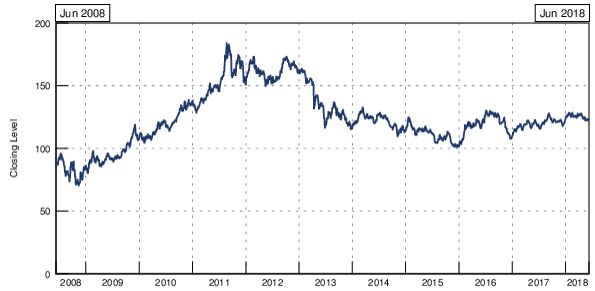

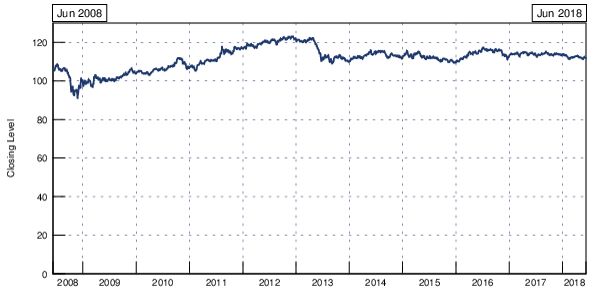

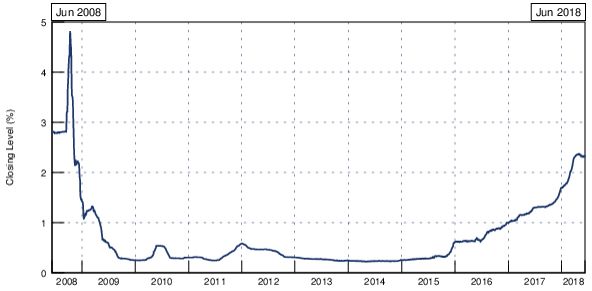

The following chart and table provide a comparison between the index (using historical information and hypothetical data, as explained below) and certain asset classes (in each case, represented by a benchmark ETF or a benchmark index, which are distinct from the asset classes in which the 15 underlying assets have been categorized for purposes of this index) from August 29, 2008 to June 27, 2018. Benchmark ETF data and benchmark index data is based on the historical levels of the benchmark ETFs and benchmark indices, respectively. The historical index information from May 16, 2016 (the index launch date) to June 27, 2018 reflects the actual performance of the index. (In the chart, this historical index information can be found to the right of the vertical solid line marker.) The hypothetical index data from August 29, 2008 to May 15, 2016 is based on the historical levels of the eligible underlying assets, using the same methodology that is used to calculate the index. Please note that the hypothetical index data is presented from August 29, 2008 to minimize assumptions about the level of the iShares® U.S. Preferred Stock ETF prior to November 29, 2007, which is the first date on which such ETF had a continuously published level. As a result, the following chart and table do not reflect the entirety of the global financial crisis, which had a severe and negative effect on certain of the benchmark ETFs, benchmark indices and eligible underlying assets and would have had a severe and negative effect on the index. Please also note that the benchmark ETFs and benchmark indices that are used to represent asset classes for purposes of the following table and chart may not be eligible underlying assets for purposes of the index and in some cases differ from the eligible underlying assets that are used to represent asset classes with the same or similar titles for purposes of the index. You should not take the historical index information, hypothetical index data or historical benchmark ETF and benchmark index data as an indication of the future performance of the index.

|

Performance Since August 2008

|

|

As of 6/27/2018

|

GS Momentum

Builder® Multi

Asset 5S ER

Index (GSMBMA5S)

|

US Bonds

(AGG)

|

Global Equities

(MSCI ACWI

Excess Return

Index)

|

Commodities

(S&P GSCI

Excess Return

Index)

|

US Real Estate

(IYR)

|

|

Effective Performance (1 Month)

|

0.89%

|

0.18%

|

-2.16%

|

-0.21%

|

3.96%

|

|

Effective Performance (6 Month)

|

-0.97%

|

-2.47%

|

-1.81%

|

9.29%

|

-0.24%

|

|

Annualized* Performance (since August 2008)

|

4.90%

|

3.16%

|

5.97%

|

-11.16%

|

6.46%

|

|

Annualized* Realized Volatility (since August 2008)**

|

5.12%

|

4.99%

|

16.99%

|

22.82%

|

31.75%

|

|

Return over Risk (since August 2008)***

|

0.96

|

0.63

|

0.35

|

-0.49

|

0.20

|

|

Maximum Peak-to-Trough Drawdown****

|

-7.53%

|

-12.96%

|

-48.43%

|

-78.65%

|

-65.74%

|

| * |

Calculated on a per annum percentage basis.

|

| ** |

Calculated on the same basis as realized volatility used in calculating the index.

|

| *** |

Calculated by dividing the annualized performance by the annualized realized volatility since August 29, 2008.

|

| **** |

The largest percentage decline experienced in the relevant measure from a previously occurring maximum level.

|

Transaction Summary

Autocallable GS Momentum Builder® Multi-Asset 5S ER Index-Linked Notes due

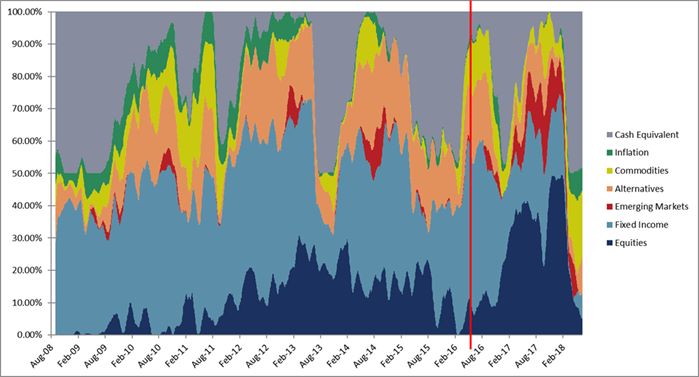

The following chart, which is based on historical information and hypothetical data, sets forth the daily allocation on each index business day between each asset class from August 29, 2008 to June 12, 2018. The historical index information from May 16, 2016 (the index launch date) to May 14, 2018 reflects the actual performance of the index. (In the chart, this historical information can be found to the right of the vertical solid line marker.) The hypothetical index data from August 29, 2008 to May 15, 2016 is based on the historical levels of the eligible underlying assets, using the same methodology that is used to calculate the index. You should not take the historical index information or hypothetical index data as an indication of the future performance of the index.

RISKS

Please read the section entitled “Additional Risk Factors Specific to Your Notes” beginning on page S-18 of this prospectus supplement as well as the risks and considerations described in the accompanying prospectus dated July 10, 2017 and the accompanying prospectus supplement dated July 10, 2017.

|

We refer to the notes we are offering by this prospectus supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below and under “Specific Terms of Your Notes” on page S-41. Please note that in this prospectus supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. Also, references to the “accompanying prospectus” mean the accompanying prospectus, dated July 10, 2017, and references to the “accompanying prospectus supplement” mean the accompanying prospectus supplement, dated July 10, 2017, for Medium-Term Notes, Series E, in each case of GS Finance Corp. and The Goldman Sachs Group, Inc. References to the “indenture” in this prospectus supplement mean the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement.

|

Key Terms

Issuer: GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Index: GS Momentum Builder® Multi-Asset 5S ER Index (Bloomberg symbol, “GSMBMA5S Index”), as published by the index sponsor (including any index calculation agent acting on the index sponsor’s behalf); see “The Index” on page S-47. Additional information about the index, including the index methodology, which may be amended from time to time, is available at the following website: solactive.com/indexing-en/indices/complex/. We are not incorporating by reference the website or any material it includes in this prospectus supplement

Index calculation agent: Solactive AG

Index sponsor: Goldman Sachs & Co. LLC (“GS&Co.”)

Specified currency: U.S. dollars (“$”)

Face amount: each note will have a face amount of $1,000; $ in the aggregate for all the offered notes; the aggregate face amount of the offered notes may be increased if the issuer, at its sole option, decides to sell an additional amount of the offered notes on a date subsequent to the date of this prospectus supplement

Denominations: $1,000 and integral multiples of $1,000 in excess thereof

Purchase at amount other than face amount: the amount we will pay you on a call payment date or the stated maturity date for your notes will not be adjusted based on the issue price you pay for your notes, so if you acquire notes at a premium (or discount) to face amount and hold them to a call payment date or the stated maturity date, it could affect your investment in a number of ways. The return on your investment in such notes will be lower (or higher) than it would have been had you purchased the notes at face amount. See “Additional Risk Factors Specific to Your Notes — If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected” on page S-20 of this prospectus supplement

Supplemental discussion of U.S. federal income tax consequences: the notes will be treated as debt instruments subject to the special rules governing contingent payment debt instruments for U.S. federal income tax purposes. Under this treatment, it is the opinion of Sidley Austin llp that if you are a U.S. individual or taxable entity, you generally should be required to pay taxes on ordinary income from the notes over their term based on the comparable yield for the notes. In addition, any gain you may recognize on the sale, exchange, redemption or maturity of the notes will be taxed as ordinary interest income.

Cash settlement amount (on any call payment date): if your notes are automatically called on a call observation date because the closing level of the index is greater than or equal to the applicable call level, for each $1,000 face amount of your notes, on the related call payment date, we will pay you an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of $1,000 times the applicable call return.

Cash settlement amount (on the stated maturity date): if your notes are not automatically called, for each $1,000 face amount of notes, we will pay you on the stated maturity date an amount in cash equal to:

| · |

if the index return is positive, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the index return; or

|

| · |

if the index return is zero or negative, $1,000.

|

Automatic call feature: if, as measured on any call observation date, the closing level of the index is greater than or equal to the applicable call level, your notes will be automatically called; if your notes are automatically called on any call observation date, on the corresponding call payment date, you will receive an amount in cash equal to the sum of (i) $1,000 plus (ii) the product of $1,000 times the applicable call return

Call level: with respect to any call observation date, the applicable call level specified in the table set forth under “Call observation dates” below; as shown in such table, the call level increases the longer the notes are outstanding

Call return: with respect to any call payment date, the applicable call return specified in the table set forth under “Call observation dates” below; as shown in such table, the call return increases the longer the notes are outstanding

Call payment dates (to be set on the trade date): the call payment dates are expected to be the tenth business day after each call observation date, subject to adjustment as described under “Specific Terms of Your Notes — Call Payment Dates” on page S-42

Call observation dates (to be set on the trade date): expected to be the dates specified as such in the table below, commencing July 2019 and ending July 2027, subject to adjustment as described under “Specific Terms of Your Notes — Call Observation Dates” on page S-43

|

Call Observation Date

|

Call Level (Expressed as a

Percentage of the Initial Index Level)

|

Call Return

|

|

July 12, 2019

|

102%

|

10%

|

|

July 13, 2020

|

104%

|

20%

|

|

July 12, 2021

|

106%

|

30%

|

|

July 12, 2022

|

108%

|

40%

|

|

July 12, 2023

|

110%

|

50%

|

|

July 12, 2024

|

112%

|

60%

|

|

July 14, 2025

|

114%

|

70%

|

|

July 13, 2026

|

116%

|

80%

|

|

July 12, 2027

|

118%

|

90%

|

Initial index level (to be set on the trade date):

Final index level: the closing level of the index on the determination date, except in the limited circumstances described under “Specific Terms of Your Notes — Payment of Principal on Stated Maturity Date — Consequences of a Non-Trading Day” on page S-43 and subject to adjustment as provided under “Specific Terms of Your Notes — Payment of Principal on Stated Maturity Date — Discontinuance or Modification of the Index” on page S-43

Closing level of the index: the official closing level of the index or any successor index published by the index sponsor (including any index calculation agent acting on the index sponsor’s behalf) on any trading day for the index

Index return: the quotient of (i) the final index level minus the initial index level divided by (ii) the initial index level, expressed as a positive or negative percentage

Trade date: expected to be July 12, 2018

Original issue date (settlement date) (to be set on the trade date): expected to be July 17, 2018

Stated maturity date (to be set on the trade date): expected to be July 26, 2028, subject to postponement as described under “Specific Terms of Your Notes — Stated Maturity Date” on page S-42

Determination date (to be set on the trade date): expected to be July 12, 2028, subject to adjustment as described under “Specific Terms of Your Notes — Determination Date” on page S-42

No listing: the notes will not be listed on any securities exchange or interdealer market quotation system

No interest: the offered notes will not bear interest

Note calculation agent: GS&Co.

Business day: as described under “Specific Terms of Your Notes — Special Calculation Provisions — Business Day” on page S-44

Trading day: as described under “Specific Terms of Your Notes — Special Calculation Provisions — Trading Day” on page S-44

CUSIP no.: 40055QKF8

ISIN no.: US40055QKF80

FDIC: the notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that the various hypothetical closing levels of the index on a call observation date and on the determination date could have on the cash settlement amount on a call payment date or on the stated maturity date, as the case may be, assuming all other variables remain constant.

The examples below are based on a range of index levels that are entirely hypothetical; no one can predict what the index level will be on any day throughout the life of your notes, and no one can predict what the closing level of the index will be on any call observation date or what the final index level will be on the determination date. The index has been highly volatile in the past — meaning that the index level has changed considerably in relatively short periods — and its performance cannot be predicted for any future period.

The information in the following examples assumes that the offered notes are purchased on the original issue date at the face amount and held to a call payment date or the stated maturity date, as the case may be. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below such as the volatility of the index, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page S-18 of this prospectus supplement. The information in the examples also reflects the key terms and assumptions in the box below.

|

Key Terms and Assumptions

|

|

|

Face amount

|

$1,000

|

|

Initial index level

|

110

|

|

No non-trading day occurs on any originally scheduled call observation date or the originally scheduled determination date

No change in or affecting any of the eligible underlying assets or the method by which the index sponsor calculates the index

|

|

|

Notes purchased on original issue date and held to a call payment date or the stated maturity date

|

|

Moreover, we have not yet set the initial index level that will serve as the baseline for determining if the notes will be called and the amount that we will pay on your notes on the call payment date or at maturity. We will not do so until the trade date. As a result, the initial index level may differ substantially from the index level prior to the trade date. For these reasons, the actual performance of the index over the life of your notes, particularly on each call observation date and the determination date, as well as the amount payable at maturity, may bear little relation to the hypothetical examples shown below or to the historical index performance information or hypothetical performance data shown elsewhere in this prospectus supplement. For information about the historical index performance levels and hypothetical performance data of the index during recent periods, see “The Index —Daily Closing Levels of the Index” on page S-59. Before investing in the offered notes, you should consult publicly available information to determine the level of the index between the date of this prospectus supplement and the date of your purchase of the offered notes.

Any rate of return you may earn on an investment in the notes may be lower than that which you could earn on a comparable investment in the index underlying assets.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the index ETFs.

Hypothetical Cash Settlement Amount on a Call Payment Date

The following examples reflect hypothetical cash settlement amounts that you could receive on the applicable call payment dates. While there are nine potential call payment dates with respect to your notes, the examples below only illustrate the amount you will receive, if any, on the first and second call payment date.

If, for example, your notes are automatically called on the first call observation date (i.e., on the first call observation date the closing level of the index is greater than or equal to 102% of the initial index level), the cash settlement amount that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call return times $1,000. Therefore, for example, if the closing level of the index on the first call observation date were determined to be 120% of the initial index level, your notes would be automatically called and the cash settlement amount that we would deliver on your notes on the corresponding call payment date would be 110% of the face amount of your notes or $1,100 for each $1,000 face amount of your notes. Even if the closing level of the index on a call observation date exceeds the applicable call level, causing the notes to be automatically called, the cash settlement amount on the call payment date will be limited due to the applicable call return.

If, for example, the notes are not automatically called on the first call observation date and are called on the second call observation date (i.e., on the first call observation date the closing level of the index is less than 102% of the initial index level and on the second call observation date the closing level of the index is greater than or equal to 104% of the initial index level), the cash settlement amount that we would deliver for each $1,000 face amount of your notes on the applicable call payment date would be the sum of $1,000 plus the product of the applicable call return times $1,000. Therefore, for example, if the closing level of the index on the second call observation date were determined to be 140% of the initial index level, your notes would be automatically called and the cash settlement amount that we would deliver on your notes on the corresponding call payment date would be 120% of the face amount of your notes or $1,200 for each $1,000 face amount of your notes. Even if the closing level of the index on a call observation date exceeds the applicable call level, causing the notes to be automatically called, the cash settlement amount on the call payment date will be limited due to the applicable call return.

Hypothetical Cash Settlement Amount at Maturity

If the notes are not automatically called on any call observation date (i.e., on each call observation date the closing level of the index is less than the applicable call level), the cash settlement amount we would deliver for each $1,000 face amount of your notes on the stated maturity date will depend on the performance of the index on the determination date, as shown in the table below. The table below shows the hypothetical cash settlement amounts that we would deliver on the stated maturity date in exchange for each $1,000 face amount of the notes if the final index level (expressed as a percentage of the initial index level) were any of the hypothetical levels shown in the left column.

The levels in the left column of the table below represent hypothetical final index levels and are expressed as percentages of the initial index level. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final index level (expressed as a percentage of the initial index level), and are expressed as percentages of the face amount of a note (rounded to the nearest one-hundredth of a percent). Thus, a hypothetical cash settlement amount of 100.00% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.00% of the face amount of a note, based on the corresponding hypothetical final index level (expressed as a percentage of the initial index level) and the assumptions noted above.

The Notes Have Not Been Automatically Called

|

Hypothetical Final Index

Level (as Percentage of

Initial Index Level)

|

Hypothetical Cash

Settlement Amount (as

Percentage of Face

Amount)

|

|

175.00%

|

175.00%

|

|

150.00%

|

150.00%

|

|

125.00%

|

125.00%

|

|

110.00%

|

110.00%

|

|

100.00%

|

100.00%

|

|

90.00%

|

100.00%

|

|

75.00%

|

100.00%

|

|

50.00%

|

100.00%

|

|

25.00%

|

100.00%

|

|

0.00%

|

100.00%

|

If, for example, the notes have not been automatically called on a call observation date and the final index level were determined to be 25.00% of the initial index level, the cash settlement amount that we would deliver on your notes at maturity would be 100.00% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date and held them to the stated maturity date, you would receive no return on your investment.

The following chart also shows a graphical illustration of the hypothetical cash settlement amounts (expressed as a percentage of the face amount of your notes) that we would pay on your notes on the stated maturity date, if the final index level (expressed as a percentage of the initial index level) were any of the hypothetical levels shown on the horizontal axis. The chart shows that any hypothetical final index level (expressed as a percentage of the initial index level) of less than 100.00% (the section left of the 100.00% marker on the horizontal axis) would result in a hypothetical cash settlement amount of 100.00% of the face amount of your notes.

The cash settlement amounts shown above are entirely hypothetical; they are based on closing levels of the index that may not be achieved on a call observation date or the determination date, as the case may be, and on assumptions that may prove to be erroneous. The actual market value of your notes on a call payment date, the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to a call payment date or the stated maturity date, as the case may be, in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page S-20.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of a zero coupon bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this prospectus supplement.

|

We cannot predict the actual closing levels of the index on each of the call observation dates or final index level on the determination date or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the index level and the market value of your notes at any time prior to the stated maturity date. The actual cash settlement amount that you will receive and the rate of return on the offered notes will depend on whether or not the notes are called, the actual initial index level, which we will set on the trade date, and the actual closing level of the index on each call observation date and the actual final index level on the determination date, each as determined by the note calculation agent as described above. Moreover, the assumptions on which the hypothetical examples are based may turn out to be inaccurate. Consequently, the cash settlement amount to be paid in respect of your notes on a call payment date or the stated maturity date, as the case may be, may be very different from the information reflected in the examples above.

|

|

An investment in your notes is subject to the risks described below, as well as the risks and considerations described in the accompanying prospectus and in the accompanying prospectus supplement. You should carefully review these risks and considerations as well as the terms of the notes described herein and in the accompanying prospectus and the accompanying prospectus supplement. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent to investing directly in any eligible underlying asset or the assets held by any eligible ETF or in notes that bear interest at the notional interest rate. You should carefully consider whether the offered notes are suited to your particular circumstances.

Although we have classified the risks described below into three categories (general risks, risks related to the index and risks related to the eligible ETFs), the order in which these categories are presented is not intended to signify any decreasing (or increasing) significance of these risks. You should read all of the risks described below and in the accompanying prospectus supplement and the accompanying prospectus.

|

General Risks

The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes

The original issue price for your notes exceeds the estimated value of your notes as of the time the terms of your notes are set on the trade date, as determined by reference to GS&Co.’s pricing models and taking into account our credit spreads. Such estimated value on the trade date is set forth above under “Estimated Value of Your Notes”; after the trade date, the estimated value as determined by reference to these models will be affected by changes in market conditions, the creditworthiness of GS Finance Corp., as issuer, the creditworthiness of The Goldman Sachs Group, Inc., as guarantor, and other relevant factors. The price at which GS&Co. would initially buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), and the value that GS&Co. will initially use for account statements and otherwise, also exceeds the estimated value of your notes as determined by reference to these models. As agreed by GS&Co. and the distribution participants, this excess (i.e., the additional amount described under “Estimated Value of Your Notes”) will decline to zero on a straight line basis over the period from the date hereof through the applicable date set forth above under “Estimated Value of Your Notes”. Thereafter, if GS&Co. buys or sells your notes it will do so at prices that reflect the estimated value determined by reference to such pricing models at that time. The price at which GS&Co. will buy or sell your notes at any time also will reflect its then current bid and ask spread for similar sized trades of structured notes.

In estimating the value of your notes as of the time the terms of your notes are set on the trade date, as disclosed above under “Estimated Value of Your Notes”, GS&Co.’s pricing models consider certain variables, including principally our credit spreads, interest rates (forecasted, current and historical rates), volatility, price-sensitivity analysis and the time to maturity of the notes. These pricing models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold your notes in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of your notes determined by reference to our models due to, among other things, any differences in pricing models or assumptions used by others. See “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” below.

The difference between the estimated value of your notes as of the time the terms of your notes are set on the trade date and the original issue price is a result of certain factors, including principally the underwriting discount and commissions, the expenses incurred in creating, documenting and marketing the notes, and an estimate of the difference between the amounts we pay to GS&Co. and the amounts GS&Co. pays to us in connection with your notes. We pay to GS&Co. amounts based on what we would pay to holders of a non-structured note with a similar maturity. In return for such payment, GS&Co. pays to us the amounts we owe under your notes.

In addition to the factors discussed above, the value and quoted price of your notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market in the notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including any deterioration in our creditworthiness or perceived creditworthiness or the creditworthiness or perceived creditworthiness of The Goldman Sachs Group, Inc. These changes may adversely affect the value of your notes, including the price you may receive for your notes in any market making transaction. To the extent that GS&Co. makes a market in the notes, the quoted price will reflect the estimated value determined by reference to GS&Co.’s pricing models at that time, plus or minus its then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess amount described above).

Furthermore, if you sell your notes, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission or discount will further reduce the proceeds you would receive for your notes in a secondary market sale.

There is no assurance that GS&Co. or any other party will be willing to purchase your notes at any price and, in this regard, GS&Co. is not obligated to make a market in the notes. See “— Your Notes May Not Have an Active Trading Market” below.

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor

Although the return on the notes will be based on the performance of the index, the payment of any amount due on the notes is subject to the credit risk of GS Finance Corp., as issuer of the notes, and the credit risk of The Goldman Sachs Group, Inc., as guarantor of the notes. The notes are our unsecured obligations. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our creditworthiness. Similarly, investors are dependent on the ability of The Goldman Sachs Group, Inc., as guarantor of the notes, to pay all amounts due on the notes, and therefore are also subject to its credit risk and to changes in the market’s view of its creditworthiness. See “Description of the Notes We May Offer — Information About Our Medium-Term Notes, Series E Program — How the Notes Rank Against Other Debt” on page S-4 of the accompanying prospectus supplement and “Description of Debt Securities We May Offer — Guarantee by The Goldman Sachs Group, Inc.” on page 42 of the accompanying prospectus.

You May Receive Only the Face Amount of Your Notes at Maturity

If the index return is zero or negative on the determination date, the return on your notes will be limited to the face amount.

Even if the amount paid on your notes at maturity exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a note with the same stated maturity that bears interest at the prevailing market rate.

Your Notes Will Not Bear Interest

You will not receive any interest payments on your notes. As a result, even if the cash settlement amount payable for your notes on the stated maturity date exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a non-indexed debt security of comparable maturity that bears interest at a prevailing market rate.

The Cash Settlement Amount You Will Receive on a Call Payment Date or on the Stated Maturity Date is Not Linked to the Closing Level of the Index at Any Time Other Than on the Applicable Call Observation Date or the Determination Date, as the Case May Be

The cash settlement amount you will receive on a call payment date, if any, will be paid only if the closing level of the index on the applicable call observation date is greater than or equal to the applicable call level. Therefore, the closing level of the index on dates other than the call observation dates will have no effect on any cash settlement amount paid in respect of your notes on the call payment date. In addition, the cash settlement amount you will receive on the stated maturity date (if the notes were not previously called) will be based on the closing level of the index on the determination date and, therefore, the closing level of the index on dates other than the determination date will have no effect on any cash settlement amount paid in respect of your notes on the stated maturity date. Therefore, for example, if the closing level of the index dropped precipitously on the determination date, the cash settlement amount for the notes may be significantly less than it otherwise would have been had the cash settlement amount been linked to the closing level of the index prior to such drop. Although the actual closing level of the index on the applicable call payment dates, the stated maturity date or at other times during the life of the notes may be higher than the closing level of the index on the call observation dates or the final index level on the determination date, you will not benefit from the closing level of the index at any time other than on the call observation dates or on the determination date.

The Cash Settlement Amount You Will Receive on a Call Payment Date Will Be Limited

Regardless of the closing level of the index on each of the call observation dates, the cash settlement amount you may receive on a call payment date is limited. Even if the closing level of the index on a call observation date exceeds the applicable call level, causing the notes to be automatically called, the cash settlement amount on the call payment date will be limited due to the applicable call return. If your notes are automatically called on a call observation date, the maximum payment you will receive for each $1,000 face amount of your notes will depend on the applicable call return.

Your Notes Are Subject to Automatic Redemption

We will automatically call and redeem all, but not part, of your notes on a call payment date, if, as measured on any call observation date, the closing level of the index is greater than or equal to the applicable call level. Therefore, the term for your notes may be reduced and you will not receive any further payments on the notes since your notes will no longer be outstanding. You may not be able to reinvest the proceeds from an investment in the notes at a comparable return for a similar level of risk in the event the notes are called prior to maturity.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

When we refer to the market value of your notes, we mean the value that you could receive for your notes if you chose to sell them in the open market before the stated maturity date. A number of factors, many of which are beyond our control, will influence the market value of your notes, including:

| · |

the level of the index, including the initial index level;

|

| · |

the volatility — i.e., the frequency and magnitude of changes — in the level of the index (even though the index attempts to limit volatility with daily rebalancing), the eligible underlying assets and the assets that comprise the eligible ETFs;

|

| · |

the market prices of the eligible ETFs;

|

| · |

3-month USD LIBOR;

|

| · |

economic, financial, regulatory, political, military and other events that affect markets generally and the assets held by the eligible ETFs, and which may affect the closing levels of the index;

|

| · |

other interest rates and yield rates in the market;

|

| · |

the time remaining until your notes mature; and

|

| · |

our creditworthiness and the creditworthiness of The Goldman Sachs Group, Inc., whether actual or perceived, including actual or anticipated upgrades or downgrades in our credit ratings or the credit ratings of The Goldman Sachs Group, Inc., or changes in other credit measures.

|

These factors, and many other factors, will influence the price you will receive if you sell your notes before maturity, including the price you may receive for your notes in any market making transaction. If you sell your notes before maturity, you may receive less than the face amount of your notes.

You cannot predict the future performance of the index based on its historical performance or on any hypothetical performance data. The actual performance of the index over the life of the notes, as well as the cash settlement amount payable on the stated maturity date, may bear little or no relation to the historical index performance information, hypothetical performance data or hypothetical return examples shown elsewhere in this prospectus supplement.

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected

The cash settlement amount you will be paid for your notes on a call payment date or the stated maturity date will not be adjusted based on the issue price you pay for the notes. If you purchase notes at a price that differs from the face amount of the notes, then the return on your investment in such notes held to a call payment date or the stated maturity date will differ from, and may be substantially less than, the return on notes purchased at face amount. If you purchase your notes at a premium to face amount and hold them to a call payment date or the stated maturity date, the return on your investment in the notes will be lower than it would have been had you purchased the notes at face amount or a discount to face amount.

Anticipated Hedging Activities by Goldman Sachs or Our Distributors May Negatively Impact Investors in the Notes and Cause Our Interests and Those of Our Clients and Counterparties to be Contrary to Those of Investors in the Notes

Goldman Sachs expects to hedge our obligations under the notes by purchasing listed or over-the-counter options, futures and/or other instruments linked to the index and the eligible underlying assets. Goldman Sachs also expects to adjust the hedge by, among other things, purchasing or selling any of the foregoing, and perhaps other instruments linked to the index, the eligible underlying assets, 3-month USD LIBOR or assets held by the eligible ETFs, at any time and from time to time, and to unwind the hedge by selling any of the foregoing on or before the determination date for your notes. Alternatively, Goldman Sachs may hedge all or part of our obligations under the notes with unaffiliated distributors of the notes which we expect will undertake similar market activity. Goldman Sachs may also enter into, adjust and unwind hedging transactions relating to other index-linked notes whose returns are linked to the index, the eligible underlying assets, 3-month USD LIBOR or assets held by the eligible ETFs.

In addition to entering into such transactions itself, or distributors entering into such transactions, Goldman Sachs may structure such transactions for its clients or counterparties, or otherwise advise or assist clients or counterparties in entering into such transactions. These activities may be undertaken to achieve a variety of objectives, including: permitting other purchasers of the notes or other securities to hedge their investment in whole or in part; facilitating transactions for other clients or counterparties that may have business objectives or investment strategies that are inconsistent with or contrary to those of investors in the notes; hedging the exposure of Goldman Sachs to the notes including any interest in the notes that it reacquires or retains as part of the offering process, through its market-making activities or otherwise; enabling Goldman Sachs to comply with its internal risk limits or otherwise manage firmwide, business unit or product risk; and/or enabling Goldman Sachs to take directional views as to relevant markets on behalf of itself or its clients or counterparties that are inconsistent with or contrary to the views and objectives of the investors in the notes.

Any of these hedging or other activities may adversely affect the levels of the index — directly or indirectly by affecting the price of the eligible underlying assets — and therefore the market value of your notes and the amount we will pay on your notes, if any, at maturity. In addition, you should expect that these transactions will cause Goldman Sachs or its clients, counterparties or distributors to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the notes. Neither Goldman Sachs nor any distributor will have any obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the notes, and may receive substantial returns on hedging or other activities while the value of your notes declines. In addition, if the distributor from which you purchase notes is to conduct hedging activities in connection with the notes, that distributor may otherwise profit in connection with such hedging activities and such profit, if any, will be in addition to the compensation that the distributor receives for the sale of the notes to you. You should be aware that the potential to earn fees in connection with hedging activities may create a further incentive for the distributor to sell the notes to you in addition to the compensation they would receive for the sale of the notes.

Goldman Sachs’ Trading and Investment Activities for its Own Account or for its Clients, Could Negatively Impact Investors in the Notes