Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-269296

|

GS Finance Corp. $145,000 Index-Linked Notes due 2029 guaranteed by The Goldman Sachs Group, Inc. |

The notes do not bear interest. The amount that you will be paid on your notes on the stated maturity date (January 3, 2029) is based on the lesser performing of the S&P 500® Index and the Russell 2000® Index as measured from the trade date (December 28, 2023) to and including the determination date (December 28, 2028).

If the final level of each index on the determination date is greater than its initial level (4,783.35 with respect to the S&P 500® Index and 2,058.335 with respect to the Russell 2000® Index (which in each case is an intra-day level or the closing level of such index on the trade date)), the return on your notes will be positive and will equal the participation rate of 1.05 times the index return of the lesser performing index for each $1,000 face amount of your notes.

If the final level of any index is equal to or less than its initial level, you will receive the face amount of your notes.

The amount that you will be paid on your notes at maturity is based on the performance of the index with the lowest index return. The index return for each index is the percentage increase or decrease in the final level of such index from its initial level. On the stated maturity date, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page PS-10.

The estimated value of your notes at the time the terms of your notes are set on the trade date is equal to approximately $979 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

Original issue date: |

January 3, 2024 |

Original issue price: |

100% of the face amount |

Underwriting discount: |

1% of the face amount* |

Net proceeds to the issuer: |

99% of the face amount |

* See “Supplemental Plan of Distribution; Conflicts of Interest” on page PS-20 for additional information regarding the fees comprising the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Pricing Supplement No. 12,509 dated December 28, 2023.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

Estimated Value of Your Notes The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is equal to approximately $979 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $21 per $1,000 face amount). Prior to April 28, 2024, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through April 27, 2024). On and after April 28, 2024, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models. |

About Your Prospectus

The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes a supplement to the documents listed below, does not set forth all of the terms of your notes and therefore should be read in conjunction with such documents: The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes. We refer to the notes we are offering by this pricing supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below. Please note that in this pricing supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement. The notes will be issued in book-entry form and represented by master note no. 3, dated March 22, 2021.

|

PS-2

Terms AND CONDITIONS

|

CUSIP / ISIN: 40057XGA7 / US40057XGA72

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underliers (each individually, an underlier): the S&P 500® Index (current Bloomberg symbol: “SPX Index”), or any successor underlier and the Russell 2000® Index (current Bloomberg symbol: “RTY Index”), or any successor underlier, as each may be modified, replaced or adjusted from time to time as provided herein

Face amount: $145,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: On the stated maturity date, the company will pay, for each $1,000 of the outstanding face amount, an amount in cash equal to the cash settlement amount.

Cash settlement amount:

Initial underlier level: 4,783.35 with respect to the S&P 500® Index and 2,058.335 with respect to the Russell 2000® Index. The initial underlier level of each underlier is an intra-day level or the closing level of such underlier on the trade date.

Final underlier level: with respect to an underlier, the closing level of such underlier on the determination date, subject to adjustment as provided in “—Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of an underlier” below

Upside participation rate: 105%

Underlier return: with respect to an underlier, the quotient of (i) its final underlier level minus its initial underlier level divided by (ii) its initial underlier level, expressed as a percentage

Lesser performing underlier return: the underlier return of the lesser performing underlier

Lesser performing underlier: the underlier with the lowest underlier return

Trade date: December 28, 2023

Original issue date: January 3, 2024

Determination date: December 28, 2028, unless the calculation agent determines that, with respect to any underlier, a market disruption event occurs or is continuing on that day or that day is not otherwise a trading day. In the event the originally scheduled determination date is a non-trading day with respect to any underlier, the determination date will be the first day thereafter that is a trading day for all underliers (the “first qualified trading day”) provided that no market disruption event occurs or is continuing with respect to an underlier on that day. If a market disruption event with respect to an underlier occurs or is continuing on the originally scheduled determination date or the first qualified trading day, the determination date will be the first following trading day on which the calculation agent determines that each underlier has had at least one trading day (from and including the originally scheduled determination date or the first qualified trading day, as applicable) on which no market disruption event has occurred or is continuing and the closing level of each underlier will be determined on or prior to the postponed determination date as set forth under “— Consequences of a market disruption event or a non-trading day” below. (In such case, the determination date may differ from the date on which the level of an underlier is determined for the purpose of the calculations to be performed on the determination date.) In no event, however, will the determination date be postponed to a date later than the originally scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date, either due to the occurrence of serial non-trading days or due to the occurrence of one or more market disruption events. On such last possible determination date, if a market disruption event occurs or is continuing with respect to an underlier that has not yet had such a trading day on which no market

PS-3

disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such underlier, that day will nevertheless be the determination date.

Stated maturity date: January 3, 2029, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Closing level: on any trading day, (i) with respect to the S&P 500® Index, the official closing level of such underlier or any successor underlier published by the underlier sponsor on such trading day for such underlier and (ii) with respect to the Russell 2000® Index, the closing level of such underlier or any successor underlier reported by Bloomberg Financial Services, or any successor reporting service the company may select, on such trading day for that underlier (as of the trade date, whereas the underlier sponsor publishes the official closing level of the Russell 2000® Index to six decimal places, Bloomberg Financial Services reports the closing level to fewer decimal places)

Trading day: with respect to an underlier, a day on which the respective principal securities markets for all of its underlier stocks are open for trading, the underlier sponsor is open for business and such underlier is calculated and published by the underlier sponsor

Successor underlier: with respect to an underlier, any substitute underlier approved by the calculation agent as a successor as provided under “— Discontinuance or modification of an underlier” below

Underlier sponsor: with respect to an underlier, at any time, the person or entity, including any successor sponsor, that determines and publishes such underlier as then in effect. The notes are not sponsored, endorsed, sold or promoted by any underlier sponsor or any affiliate thereof and no underlier sponsor or affiliate thereof makes any representation regarding the advisability of investing in the notes.

Underlier stocks: with respect to an underlier, at any time, the stocks that comprise such underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to an underlier:

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to such underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to such underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

PS-4

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

A market disruption event with respect to one underlier will not, by itself, constitute a market disruption event for any unaffected underlier.

Consequences of a market disruption event or a non-trading day: With respect to any underlier, if a market disruption event occurs or is continuing on a day that would otherwise be the determination date, or such day is not a trading day, then the determination date will be postponed as described under “— Determination date” above. If the determination date is postponed to the last possible date due to the occurrence of serial non-trading days, the level of each underlier will be the calculation agent’s assessment of such level, in its sole discretion, on such last possible postponed determination date. If the determination date is postponed due to a market disruption event with respect to any underlier, the final underlier level with respect to the determination date will be calculated based on (i) for any underlier that is not affected by a market disruption event on the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing level of the underlier on that date, (ii) for any underlier that is affected by a market disruption event on the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing level of the underlier on the first following trading day on which no market disruption event exists for such underlier and (iii) the calculation agent’s assessment, in its sole discretion, of the level of any underlier on the last possible postponed determination date with respect to such underlier as to which a market disruption event continues through the last possible postponed determination date. As a result, this could result in the final underlier level on the determination date of each underlier being determined on different calendar dates. For the avoidance of doubt, once the closing level for an underlier is determined for the determination date, the occurrence of a later market disruption event or non-trading day will not alter such calculation.

Discontinuance or modification of an underlier: If an underlier sponsor discontinues publication of an underlier and such underlier sponsor or anyone else publishes a substitute underlier that the calculation agent determines is comparable to such underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the cash settlement amount on the stated maturity date by reference to such successor underlier.

If the calculation agent determines that the publication of an underlier is discontinued and there is no successor underlier, the calculation agent will determine the cash settlement amount on the stated maturity date by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate such underlier.

If the calculation agent determines that (i) an underlier, the underlier stocks comprising such underlier or the method of calculating such underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of such underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in such underlier or the method of its calculation as it believes are appropriate to ensure that the levels of such underlier used to determine the cash settlement amount on the stated maturity date is equitable.

All determinations and adjustments to be made by the calculation agent with respect to an underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Overdue principal rate: the effective Federal Funds rate

PS-5

Hypothetical ExampleS

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that various hypothetical closing levels of the underliers on the determination date could have on the cash settlement amount at maturity assuming all other variables remain constant.

The examples below are based on a range of underlier levels that are entirely hypothetical; no one can predict what the closing level of any underlier will be on any day throughout the life of your notes and what the final underlier level of the lesser performing underlier will be on the determination date. The underliers have been highly volatile in the past — meaning that the underlier levels have changed substantially in relatively short periods — and their performance cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the face amount and held to the stated maturity date. If you sell your notes in a secondary market prior to the stated maturity date, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below, such as interest rates, the volatility of the underliers, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page PS-10 of this pricing supplement. The information in the examples also reflects the key terms and assumptions in the box below.

Key Terms and Assumptions |

|

Face amount |

$1,000 |

Upside participation rate |

105% |

Neither a market disruption event nor a non-trading day occurs on the originally scheduled determination date |

|

No change in or affecting any of the underlier stocks or the method by which the applicable underlier sponsor calculates any underlier |

|

Notes purchased on original issue date at the face amount and held to the stated maturity date |

|

For these reasons, the actual performance of the underliers over the life of your notes, as well as the amount payable at maturity may bear little relation to the hypothetical examples shown below or to the historical underlier levels shown elsewhere in this pricing supplement. For information about the underlier levels during recent periods, see “The Underliers — Historical Closing Levels of the Underliers” on page PS-15. Before investing in the notes, you should consult publicly available information to determine the underlier levels between the date of this pricing supplement and the date of your purchase of the notes.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the underlier stocks.

PS-6

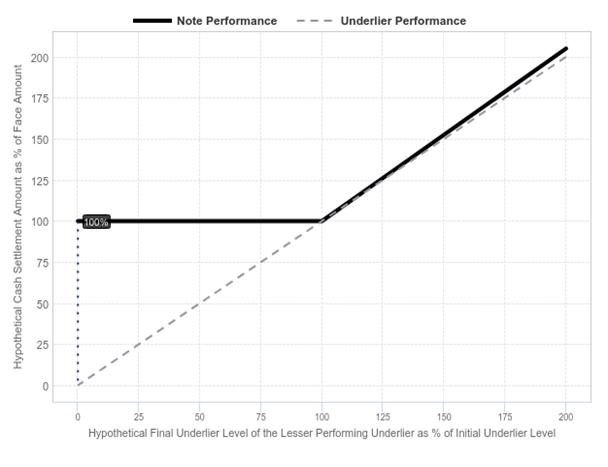

The levels in the left column of the table below represent hypothetical final underlier levels of the lesser performing underlier and are expressed as percentages of the initial underlier level of the lesser performing underlier. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level of the lesser performing underlier, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final underlier level of the lesser performing underlier and the assumptions noted above.

|

|

|

|

Hypothetical Final Underlier Level of the Lesser Performing Underlier |

Hypothetical Cash Settlement Amount at Maturity |

(as Percentage of Initial Underlier Level) |

(as Percentage of Face Amount) |

200.000% |

205.000% |

175.000% |

178.750% |

150.000% |

152.500% |

125.000% |

126.250% |

100.000% |

100.000% |

75.000% |

100.000% |

50.000% |

100.000% |

25.000% |

100.000% |

0.000% |

100.000% |

|

|

If, for example, the final underlier level of the lesser performing underlier were determined to be 20.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be 100.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would receive no return on your investment.

The following chart shows a graphical illustration of the hypothetical cash settlement amounts that we would pay on your notes on the stated maturity date, if the final underlier level of the lesser performing underlier were any of the hypothetical levels shown on the horizontal axis. The hypothetical cash settlement amounts in the chart are expressed as percentages of the face amount of your notes and the hypothetical final underlier levels of the lesser performing underlier are expressed as percentages of its initial underlier level. The chart shows that any hypothetical final underlier level of the lesser performing underlier of less than 100.000% (the section left of the 100.000% marker on the horizontal axis) would result in a hypothetical cash settlement amount of 100.000% of the face amount of your notes.

PS-7

The cash settlement amounts shown above are entirely hypothetical; they are based on market prices for the underlier stocks that may not be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical cash settlement amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical cash settlement amounts on notes held to the stated maturity date in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page PS-12.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this pricing supplement.

PS-8

We cannot predict the actual final underlier levels or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the closing levels of the underliers and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive at maturity and the rate of return on the offered notes will depend on the actual final underlier levels determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical returns are based may turn out to be inaccurate. Consequently, the amount of cash to be paid in respect of your notes on the stated maturity date may be very different from the information reflected in the examples above.

PS-9

Additional Risk Factors Specific to Your Notes |

An investment in your notes is subject to the risks described below, as well as the risks and considerations described in the accompanying prospectus, in the accompanying prospectus supplement, under “Additional Risk Factors Specific to the Securities” in the accompanying underlier supplement no. 38 and under “Additional Risk Factors Specific to the Notes” in the accompanying general terms supplement no. 8,999. You should carefully review these risks and considerations as well as the terms of the notes described herein and in the accompanying prospectus, the accompanying prospectus supplement, the accompanying underlier supplement no. 38 and the accompanying general terms supplement no. 8,999. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent to investing directly in the underlier stocks, i.e., with respect to an underlier to which your notes are linked, the stocks comprising such underlier. You should carefully consider whether the offered notes are appropriate given your particular circumstances. |

Risks Related to Structure, Valuation and Secondary Market Sales

The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes

The original issue price for your notes exceeds the estimated value of your notes as of the time the terms of your notes are set on the trade date, as determined by reference to GS&Co.’s pricing models and taking into account our credit spreads. Such estimated value on the trade date is set forth above under “Estimated Value of Your Notes”; after the trade date, the estimated value as determined by reference to these models will be affected by changes in market conditions, the creditworthiness of GS Finance Corp., as issuer, the creditworthiness of The Goldman Sachs Group, Inc., as guarantor, and other relevant factors. The price at which GS&Co. would initially buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), and the value that GS&Co. will initially use for account statements and otherwise, also exceeds the estimated value of your notes as determined by reference to these models. As agreed by GS&Co. and the distribution participants, this excess (i.e., the additional amount described under “Estimated Value of Your Notes”) will decline to zero on a straight line basis over the period from the date hereof through the applicable date set forth above under “Estimated Value of Your Notes”. Thereafter, if GS&Co. buys or sells your notes it will do so at prices that reflect the estimated value determined by reference to such pricing models at that time. The price at which GS&Co. will buy or sell your notes at any time also will reflect its then current bid and ask spread for similar sized trades of structured notes.

In estimating the value of your notes as of the time the terms of your notes are set on the trade date, as disclosed above under “Estimated Value of Your Notes”, GS&Co.’s pricing models consider certain variables, including principally our credit spreads, interest rates (forecasted, current and historical rates), volatility, price-sensitivity analysis and the time to maturity of the notes. These pricing models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold your notes in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of your notes determined by reference to our models due to, among other things, any differences in pricing models or assumptions used by others. See “The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” below.

The difference between the estimated value of your notes as of the time the terms of your notes are set on the trade date and the original issue price is a result of certain factors, including principally the underwriting discount and commissions, the expenses incurred in creating, documenting and marketing the notes, and an estimate of the difference between the amounts we pay to GS&Co. and the amounts GS&Co. pays to us in connection with your notes. We pay to GS&Co. amounts based on what we would pay to holders of a non-structured note with a similar maturity. In return for such payment, GS&Co. pays to us the amounts we owe under your notes.

In addition to the factors discussed above, the value and quoted price of your notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market in the notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including any

PS-10

deterioration in our creditworthiness or perceived creditworthiness or the creditworthiness or perceived creditworthiness of The Goldman Sachs Group, Inc. These changes may adversely affect the value of your notes, including the price you may receive for your notes in any market making transaction. To the extent that GS&Co. makes a market in the notes, the quoted price will reflect the estimated value determined by reference to GS&Co.’s pricing models at that time, plus or minus its then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess amount described above).

Furthermore, if you sell your notes, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission or discount will further reduce the proceeds you would receive for your notes in a secondary market sale.

There is no assurance that GS&Co. or any other party will be willing to purchase your notes at any price and, in this regard, GS&Co. is not obligated to make a market in the notes. See “Additional Risk Factors Specific to the Notes —Your Notes May Not Have an Active Trading Market” on page S-7 of the accompanying general terms supplement no. 8,999.

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor

Although the return on the notes will be based on the performance of each underlier, the payment of any amount due on the notes is subject to the credit risk of GS Finance Corp., as issuer of the notes, and the credit risk of The Goldman Sachs Group, Inc. as guarantor of the notes. The notes are our unsecured obligations. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our creditworthiness. Similarly, investors are dependent on the ability of The Goldman Sachs Group, Inc., as guarantor of the notes, to pay all amounts due on the notes, and therefore are also subject to its credit risk and to changes in the market’s view of its creditworthiness. See “Description of the Notes We May Offer — Information About Our Medium-Term Notes, Series F Program — How the Notes Rank Against Other Debt” on page S-5 of the accompanying prospectus supplement and “Description of Debt Securities We May Offer — Guarantee by The Goldman Sachs Group, Inc.” on page 68 of the accompanying prospectus.

The Amount Payable on Your Notes Is Not Linked to the Levels of the Underliers at Any Time Other than the Determination Date

The final underlier level of each underlier will be based on the closing level of such underlier on the determination date (subject to adjustment as described elsewhere in this pricing supplement). Therefore, if the closing level of one underlier dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly less than it would have been had the cash settlement amount been linked to the closing level of the underlier prior to such drop. Although the actual closing levels of the underliers on the stated maturity date or at other times during the life of your notes may be higher than the closing levels of the underliers on the determination date, you will not benefit from the closing levels of the underliers at any time other than on the determination date.

Also, the market price of your notes prior to the stated maturity date may be significantly lower than the purchase price you pay for your notes. Consequently, if you sell your notes before the stated maturity date, you may receive far less than the amount of your investment in the notes.

The Cash Settlement Amount Will Be Based Solely on the Lesser Performing Underlier

The cash settlement amount will be based on the lesser performing underlier without regard to the performance of the other underlier. As a result, you would receive no return on your initial investment if the lesser performing underlier return is zero or negative, even if there is an increase in the level of the other underlier. This could be the case even if the other underlier increased by an amount greater than the decrease in the lesser performing underlier.

Your Notes Do Not Bear Interest

You will not receive any interest payments on your notes. As a result, even if the cash settlement amount payable for your notes on the stated maturity date exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a non-indexed debt security of comparable maturity that bears interest at a prevailing market rate.

PS-11

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

When we refer to the market value of your notes, we mean the value that you could receive for your notes if you chose to sell them in the open market before the stated maturity date. A number of factors, many of which are beyond our control, will influence the market value of your notes, including:

Without limiting the foregoing, the market value of your notes may be negatively impacted by increasing interest rates. Such adverse impact of increasing interest rates could be significantly enhanced in notes with longer-dated maturities, the market values of which are generally more sensitive to increasing interest rates.

These factors may influence the market value of your notes if you sell your notes before maturity, including the price you may receive for your notes in any market making transaction. If you sell your notes prior to maturity, you may receive less than the face amount of your notes. You cannot predict the future performance of the underliers based on their historical performance.

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected

The cash settlement amount will not be adjusted based on the issue price you pay for the notes. If you purchase notes at a price that differs from the face amount of the notes, then the return on your investment in such notes held to the stated maturity date will differ from, and may be substantially less than, the return on notes purchased at face amount. If you purchase your notes at a premium to face amount and hold them to the stated maturity date, the return on your investment in the notes will be lower than it would have been had you purchased the notes at face amount or a discount to face amount.

You Have No Shareholder Rights or Rights to Receive Any Underlier Stock

Investing in your notes will not make you a holder of any of the underlier stocks. Neither you nor any other holder or owner of your notes will have any rights with respect to the underlier stocks, including any voting rights, any right to receive dividends or other distributions, any rights to make a claim against the underlier stocks or any other rights of a holder of the underlier stocks. Your notes will be paid in cash and you will have no right to receive delivery of any underlier stocks.

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price

At our sole option, we may decide to sell an additional aggregate face amount of the notes subsequent to the date of this pricing supplement. The issue price of the notes in the subsequent sale may differ substantially (higher or lower) from the issue price you paid as provided on the cover of this pricing supplement.

PS-12

Risks Related to Tax

Your Notes Will Be Treated as Debt Instruments Subject to Special Rules Governing Contingent Payment Debt Instruments for U.S. Federal Income Tax Purposes

The notes will be treated as debt instruments subject to special rules governing contingent payment debt instruments for U.S. federal income tax purposes. If you are a U.S. individual or taxable entity, you generally will be required to pay taxes on ordinary income from the notes over their term based on the comparable yield for the notes, even though you will not receive any payments from us until maturity. This comparable yield is determined solely to calculate the amount on which you will be taxed prior to maturity and is neither a prediction nor a guarantee of what the actual yield will be. In addition, any gain you may recognize on the sale, exchange or maturity of the notes will be taxed as ordinary interest income. If you are a secondary purchaser of the notes, the tax consequences to you may be different. Please see “Supplemental Discussion of U.S. Federal Income Tax Consequences” below for a more detailed discussion. Please also consult your tax advisor concerning the U.S. federal income tax and any other applicable tax consequences to you of owning your notes in your particular circumstances.

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to Payments on Your Notes, Including as a Result of the Failure of the Bank or Broker Through Which You Hold the Notes to Provide Information to Tax Authorities

Please see the discussion under “United States Taxation — Taxation of Debt Securities — Foreign Account Tax Compliance Act (FATCA) Withholding” in the accompanying prospectus for a description of the applicability of FATCA to payments made on your notes.

PS-13

The Underliers |

S&P 500® Index

The S&P 500® Index includes a representative sample of 500 companies in leading industries of the U.S. economy and is intended to provide a performance benchmark for the large-cap U.S. equity markets. For more details about the S&P 500® Index, the underlier sponsor and license agreement between the underlier sponsor and the issuer, see “The Underliers — S&P 500® Index” on page S-116 of the accompanying underlier supplement no. 38.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC, and has been licensed for use by GS Finance Corp. (“Goldman”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and these trademarks have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by Goldman. Goldman’s notes are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, Standard & Poor’s Financial Services LLC or any of their respective affiliates and neither S&P Dow Jones Indices LLC, Dow Jones, Standard & Poor’s Financial Services LLC or any of their respective affiliates make any representation regarding the advisability of investing in such notes.

Russell 2000® Index

The Russell 2000® Index measures the composite price performance of stocks of 2,000 companies incorporated in the U.S., its territories and certain “benefit-driven incorporation countries.” The Russell 2000® Index is designed to track the performance of the small capitalization segment of the U.S. equity market. For more details about the Russell 2000® Index, the underlier sponsor and license agreement between the underlier sponsor and the issuer, see “The Underliers — Russell 2000® Index” on page S-79 of the accompanying underlier supplement no. 38.

The Russell 2000® Index is a trademark of FTSE Russell (“Russell”) and has been licensed for use by GS Finance Corp. The notes are not sponsored, endorsed, sold or promoted by Russell, and Russell makes no representation regarding the advisability of investing in the notes.

PS-14

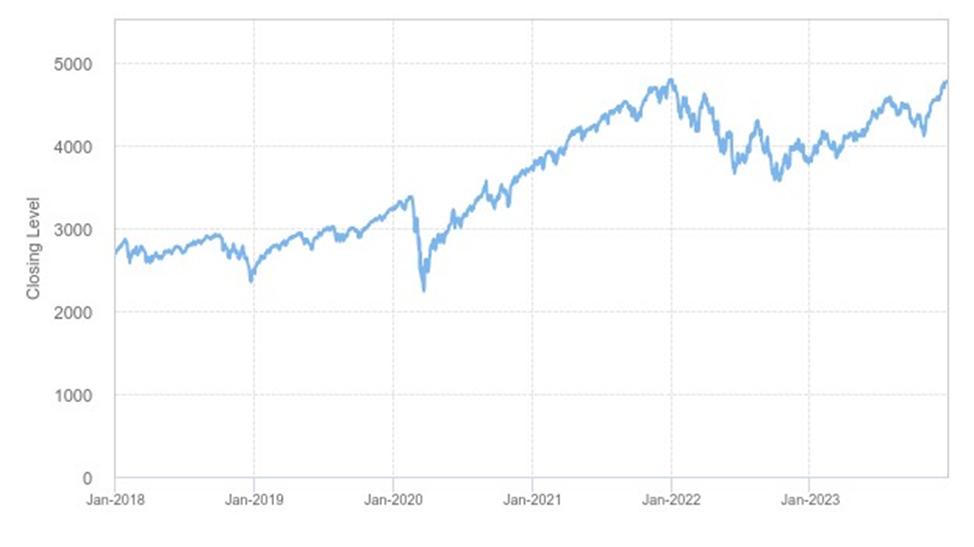

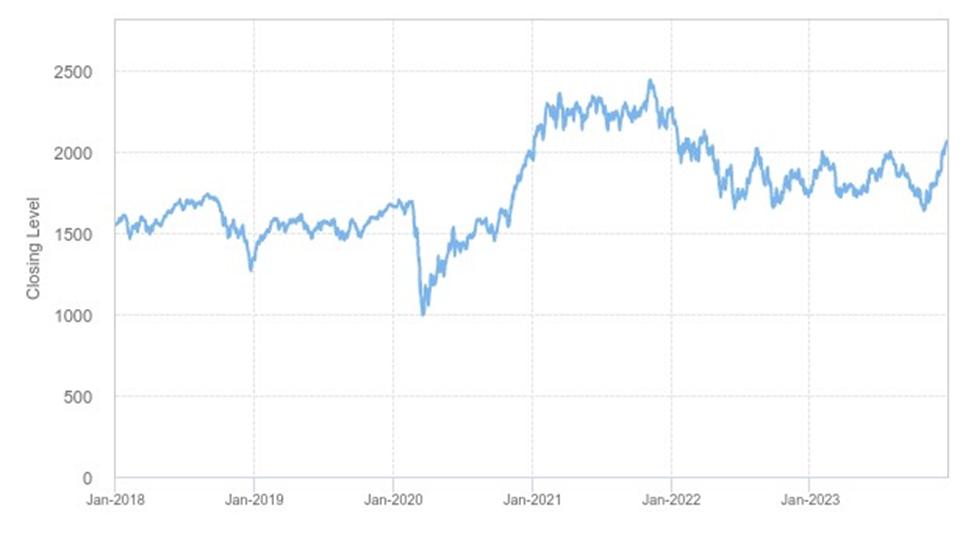

Historical Closing Levels of the Underliers

The closing levels of the underliers have fluctuated in the past and may, in the future, experience significant fluctuations. In particular, the underliers have recently experienced extreme and unusual volatility. Any historical upward or downward trend in the closing level of any underlier during the period shown below is not an indication that such underlier is more or less likely to increase or decrease at any time during the life of your notes.

You should not take the historical closing levels of an underlier as an indication of the future performance of an underlier, including because of the recent volatility described above. We cannot give you any assurance that the future performance of any underlier or the underlier stocks will result in you receiving the outstanding face amount of your notes on the stated maturity date.

Neither we nor any of our affiliates make any representation to you as to the performance of the underliers. Before investing in the offered notes, you should consult publicly available information to determine the relevant underlier levels between the date of this pricing supplement and the date of your purchase of the offered notes and, given the recent volatility described above, you should pay particular attention to recent levels of the underliers. The actual performance of an underlier over the life of the offered notes, as well as the cash settlement amount at maturity may bear little relation to the historical levels shown below.

The graphs below show the daily historical closing levels of each underlier from January 1, 2018 through December 28, 2023. As a result, the following graphs do not reflect the global financial crisis which began in 2008, which had a materially negative impact on the price of most equity securities and, as a result, the level of most equity indices. We obtained the levels in the graphs below from Bloomberg Financial Services, without independent verification. Although the official closing levels of the Russell 2000® Index are published to six decimal places by the underlier sponsor, Bloomberg Financial Services reports the levels of the Russell 2000® Index to fewer decimal places.

Historical Performance of the S&P 500® Index

PS-15

Historical Performance of the Russell 2000® Index

PS-16

SUPPLEMENTAL DISCUSSION OF U.S. FEDERAL INCOME TAX CONSEQUENCES

The following section supplements the discussion of U.S. federal income taxation in the accompanying prospectus.

The following section is the opinion of Sidley Austin llp, counsel to GS Finance Corp. and The Goldman Sachs Group, Inc. It applies to you only if you hold your notes as a capital asset for tax purposes. This section does not apply to you if you are a member of a class of holders subject to special rules, such as:

This section is based on the U.S. Internal Revenue Code of 1986, as amended, its legislative history, existing and proposed regulations under the Internal Revenue Code, published rulings and court decisions, all as currently in effect. These laws are subject to change, possibly on a retroactive basis.

You should consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the notes, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.

United States Holders

This subsection describes the tax consequences to a United States holder. You are a United States holder if you are a beneficial owner of notes and you are:

If you are not a United States holder, this section does not apply to you and you should refer to “— Non-United States Holders” below.

Your notes will be treated as debt instruments subject to special rules governing contingent payment debt instruments for U.S. federal income tax purposes. Under those rules, the amount of interest you are required to take into account for each accrual period will be determined by constructing a projected payment schedule for your notes and applying rules similar to those for accruing original issue discount on a hypothetical noncontingent debt instrument with that projected payment schedule. This method is applied by first determining the yield at which we would issue a noncontingent fixed rate debt instrument with terms and conditions similar to your notes (the “comparable yield”) and then determining as of the issue date a payment schedule that would produce the comparable yield. These rules will generally have the effect of requiring you to include amounts in income in respect of your notes, even though you will not receive any payments from us until maturity.

We have determined that the comparable yield for the notes is equal to 5.02% per annum, compounded semi-annually with a projected payment at maturity of $1,286.05 based on an investment of $1,000.

PS-17

Based on this comparable yield, if you are an initial holder that holds a note until maturity and you pay your taxes on a calendar year basis, we have determined that you would be required to report the following amounts as ordinary income, not taking into account any positive or negative adjustments you may be required to take into account based on the actual payments on the notes, from the note each year:

Accrual Period |

|

Interest Deemed to Accrue During Accrual Period (per $1,000 note) |

|

Total Interest Deemed to Have Accrued from Original Issue Date (per $1,000 note) as of End of Accrual Period |

January 3, 2024 through December 31, 2024 |

|

$51.26 |

|

$51.26 |

January 1, 2025 through December 31, 2025 |

|

$54.19 |

|

$105.45 |

January 1, 2026 through December 31, 2026 |

|

$56.98 |

|

$162.43 |

January 1, 2027 through December 31, 2027 |

|

$59.92 |

|

$222.35 |

January 1, 2028 through December 31, 2028 |

|

$63.18 |

|

$285.53 |

January 1, 2029 through January 3, 2029 |

|

$0.52 |

|

$286.05 |

You are required to use the comparable yield and projected payment schedule that we compute in determining your interest accruals in respect of your notes, unless you timely disclose and justify on your U.S. federal income tax return the use of a different comparable yield and projected payment schedule.

The comparable yield and projected payment schedule are not provided to you for any purpose other than the determination of your interest accruals in respect of your notes, and we make no representation regarding the amount of contingent payments with respect to your notes.

If you purchase your notes at a price other than their adjusted issue price determined for tax purposes, you must determine the extent to which the difference between the price you paid for your notes and their adjusted issue price is attributable to a change in expectations as to the projected payment schedule, a change in interest rates, or both, and reasonably allocate the difference accordingly. The adjusted issue price of your notes will equal your notes’ original issue price plus any interest deemed to be accrued on your notes (under the rules governing contingent payment debt instruments) as of the time you purchase your notes. The original issue price of your notes will be the first price at which a substantial amount of the notes is sold to persons other than bond houses, brokers or similar persons or organizations acting in the capacity of underwriters, placement agents or wholesalers. Therefore, you may be required to make the adjustments described above even if you purchase your notes in the initial offering if you purchase your notes at a price other than the issue price.

If the adjusted issue price of your notes is greater than the price you paid for your notes, you must make positive adjustments increasing (i) the amount of interest that you would otherwise accrue and include in income each year, and (ii) the amount of ordinary income (or decreasing the amount of ordinary loss) recognized upon maturity by the amounts allocated under the previous paragraph to each of interest and the projected payment schedule; if the adjusted issue price of your notes is less than the price you paid for your notes, you must make negative adjustments, decreasing (i) the amount of interest that you must include in income each year, and (ii) the amount of ordinary income (or increasing the amount of ordinary loss) recognized upon maturity by the amounts allocated under the previous paragraph to each of interest and the projected payment schedule. Adjustments allocated to the interest amount are not made until the date the daily portion of interest accrues.

Because any Form 1099-OID that you receive will not reflect the effects of positive or negative adjustments resulting from your purchase of notes at a price other than the adjusted issue price determined for tax purposes, you are urged to consult with your tax advisor as to whether and how adjustments should be made to the amounts reported on any Form 1099-OID.

You will recognize gain or loss upon the sale, exchange or maturity of your notes in an amount equal to the difference, if any, between the cash amount you receive at such time and your adjusted basis in your notes. In

PS-18

general, your adjusted basis in your notes will equal the amount you paid for your notes, increased by the amount of interest you previously accrued with respect to your notes (in accordance with the comparable yield and the projected payment schedule for your notes) and increased or decreased by the amount of any positive or negative adjustment, respectively, that you are required to make if you purchase your notes at a price other than the adjusted issue price determined for tax purposes.

In addition, any gain you recognize upon the sale, exchange or maturity of your notes will be ordinary interest income. Any loss you recognize at such time will be ordinary loss to the extent of interest you included as income in the current or previous taxable years in respect of your notes, and thereafter, capital loss. If you are a noncorporate holder, you would generally be able to use such ordinary loss to offset your income only in the taxable year in which you recognize the ordinary loss and would generally not be able to carry such ordinary loss forward or back to offset income in other taxable years.

Non-United States Holders

If you are a non-United States holder, please see the discussion under “United States Taxation — Taxation of Debt Securities — Non-United States Holders” in the accompanying prospectus for a description of the tax consequences relevant to you. You are a non-United States holder if you are the beneficial owner of the notes and are, for U.S. federal income tax purposes:

a nonresident alien individual;

a foreign corporation; or

an estate or trust that in either case is not subject to U.S. federal income tax on a net income basis on income or gain from the notes.

In addition, the Treasury Department has issued regulations under which amounts paid or deemed paid on certain financial instruments (“871(m) financial instruments”) that are treated as attributable to U.S.-source dividends could be treated, in whole or in part depending on the circumstances, as a “dividend equivalent” payment that is subject to tax at a rate of 30% (or a lower rate under an applicable treaty), which in the case of amounts you receive upon the sale, exchange or maturity of your notes, could be collected via withholding. If these regulations were to apply to the notes, we may be required to withhold such taxes if any U.S.-source dividends are paid on the stocks included in the underliers during the term of the notes. We could also require you to make certifications (e.g., an applicable Internal Revenue Service Form W-8) prior to the maturity of the notes in order to avoid or minimize withholding obligations, and we could withhold accordingly (subject to your potential right to claim a refund from the Internal Revenue Service) if such certifications were not received or were not satisfactory. If withholding was required, we would not be required to pay any additional amounts with respect to amounts so withheld. These regulations generally will apply to 871(m) financial instruments (or a combination of financial instruments treated as having been entered into in connection with each other) issued (or significantly modified and treated as retired and reissued) on or after January 1, 2025, but will also apply to certain 871(m) financial instruments (or a combination of financial instruments treated as having been entered into in connection with each other) that have a delta (as defined in the applicable Treasury regulations) of one and are issued (or significantly modified and treated as retired and reissued) on or after January 1, 2017. In addition, these regulations will not apply to financial instruments that reference a “qualified index” (as defined in the regulations). We have determined that, as of the issue date of your notes, your notes will not be subject to withholding under these rules. In certain limited circumstances, however, you should be aware that it is possible for non-United States holders to be liable for tax under these rules with respect to a combination of transactions treated as having been entered into in connection with each other even when no withholding is required. You should consult your tax advisor concerning these regulations, subsequent official guidance and regarding any other possible alternative characterizations of your notes for U.S. federal income tax purposes.

Foreign Account Tax Compliance Act (FATCA) Withholding

Pursuant to Treasury regulations, Foreign Account Tax Compliance Act (FATCA) withholding (as described in “United States Taxation—Taxation of Debt Securities—Foreign Account Tax Compliance Act (FATCA) Withholding” in the accompanying prospectus) will generally apply to obligations that are issued on or after July 1, 2014; therefore, the notes will generally be subject to the FATCA withholding rules.

PS-19

Supplemental plan of distribution; conflicts of interest

See “Supplemental Plan of Distribution” on page S-51 of the accompanying general terms supplement no. 8,999 and “Plan of Distribution — Conflicts of Interest” on page 127 of the accompanying prospectus; GS Finance Corp. estimates that its share of the total offering expenses, excluding underwriting discounts and commissions, will be approximately $20,000.

GS Finance Corp. will sell to GS&Co., and GS&Co. will purchase from GS Finance Corp., the aggregate face amount of the offered notes specified on the front cover of this pricing supplement. GS&Co. proposes initially to offer the notes to the public at the original issue price set forth on the cover page of this pricing supplement, and to certain securities dealers at such price less a concession not in excess of 1% of the face amount. GS&Co. will pay a fee of 0.5% from the concession to Axio Financial LLC in connection with its marketing efforts related to the offered notes.

GS&Co. is an affiliate of GS Finance Corp. and The Goldman Sachs Group, Inc. and, as such, will have a “conflict of interest” in this offering of notes within the meaning of Financial Industry Regulatory Authority, Inc. (FINRA) Rule 5121. Consequently, this offering of notes will be conducted in compliance with the provisions of FINRA Rule 5121. GS&Co. will not be permitted to sell notes in this offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder. We have been advised that GS&Co. will also pay a fee to iCapital Markets LLC, a broker-dealer in which an affiliate of GS Finance Corp. holds an indirect minority equity interest, for services it is providing in connection with this offering.

We will deliver the notes against payment therefor in New York, New York on January 3, 2024. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on any date prior to two business days before delivery will be required to specify alternative settlement arrangements to prevent a failed settlement.

We have been advised by GS&Co. that it intends to make a market in the notes. However, neither GS&Co. nor any of our other affiliates that makes a market is obligated to do so and any of them may stop doing so at any time without notice. No assurance can be given as to the liquidity or trading market for the notes.

The notes will not be listed on any securities exchange or interdealer quotation system.

PS-20

VALIDITY OF THE NOTES AND GUARANTEE

In the opinion of Sidley Austin llp, as counsel to GS Finance Corp. and The Goldman Sachs Group, Inc., when the notes offered by this pricing supplement have been executed and issued by GS Finance Corp., such notes have been authenticated by the trustee pursuant to the indenture, and such notes have been delivered against payment as contemplated herein, (a) such notes will be valid and binding obligations of GS Finance Corp., enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above and (b) the guarantee with respect to such notes will be a valid and binding obligation of The Goldman Sachs Group, Inc., enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors' rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of the date hereof and is limited to the laws of the State of New York and the General Corporation Law of the State of Delaware as in effect on the date hereof. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated January 18, 2023, which has been filed as Exhibit 5.6 to the registration statement on Form S-3 filed with the Securities and Exchange Commission by GS Finance Corp. and The Goldman Sachs Group, Inc. on January 18, 2023.

PS-21

We have not authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this pricing supplement, the accompanying general terms supplement no. 8,999, the accompanying underlier supplement no. 38, the accompanying prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This pricing supplement, the accompanying general terms supplement no. 8,999, the accompanying underlier supplement no. 38, the accompanying prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this pricing supplement, the accompanying general terms supplement no. 8,999, the accompanying underlier supplement no. 38, the accompanying prospectus supplement and the accompanying prospectus is current only as of the respective dates of such documents.

$145,000

GS Finance Corp.

Index-Linked Notes due 2029

guaranteed by

The Goldman Sachs

Group, Inc.

Goldman Sachs & Co. LLC