EX-99.2

Exhibit 99.2

Management’s Discussion and Analysis

Index

This Management’s Discussion and Analysis (“MD&A”) is dated March 5, 2018 and should be read in conjunction with our consolidated financial

statements and the accompanying notes for the year ended December 31, 2017. Except where otherwise noted, the financial information presented in this MD&A is prepared in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (the “IASB”). We use the United States dollar as our reporting currency and, except where otherwise noted, all currency amounts are stated in United States

dollars. In this MD&A, a reference to the “Company” refers to Methanex Corporation and a reference to “Methanex”, “we”, “our” and “us” refers to the Company and its subsidiaries or any one of

them as the context requires, as well as their respective interests in joint ventures and partnerships.

As at March 5, 2018, we had 83,783,704 common shares

issued and outstanding and stock options exercisable for 1,497,296 additional common shares.

Additional information relating to Methanex, including our Annual

Information Form, is available on our website at www.methanex.com, the Canadian Securities Administrators’ SEDAR website at www.sedar.com and on the United States Securities and Exchange Commission’s EDGAR website at www.sec.gov.

OVERVIEW OF THE BUSINESS

Methanol is a clear liquid

commodity chemical that is predominantly produced from natural gas and is also produced from coal, particularly in China. Approximately 55% of all methanol demand is used to produce traditional chemical derivatives, including formaldehyde, acetic

acid and a variety of other chemicals that form the basis of a large number of chemical derivatives for which demand is influenced by levels of global economic activity. The remaining 45% of methanol demand comes from a range of energy-related

applications. These include methanol-to-olefins (“MTO”), methyl tertiary-butyl ether (“MTBE”), direct blending of methanol into gasoline (primarily

in China), di-methyl ether (“DME”), biodiesel, methanol-to-gasoline (“MTG”), industrial boilers and marine

fuel.

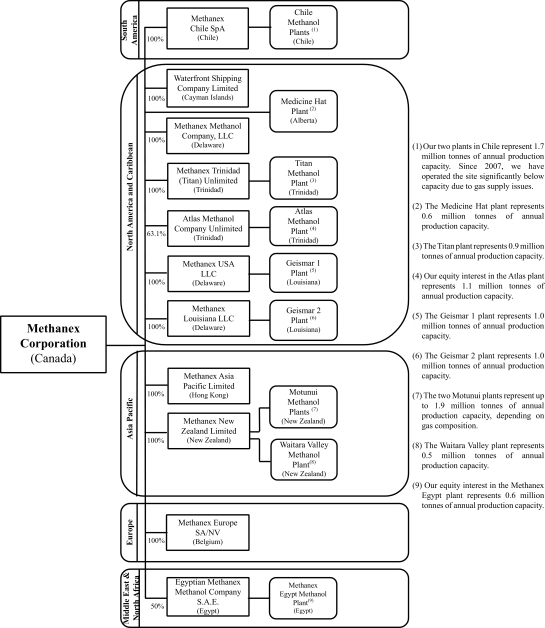

We are the world’s largest producer and supplier of methanol to the major international markets in Asia Pacific, North America, Europe and South America.

Our total annual production capacity, including Methanex interests in jointly owned plants, is currently 9.4 million tonnes and is located in New Zealand, the United States, Trinidad, Egypt, Canada and Chile. In addition to the methanol

produced at our sites, we purchase methanol produced by others under methanol offtake contracts and on the spot market. This gives us flexibility in managing our supply chain while continuing to meet customer needs and support our marketing efforts.

We have marketing rights for 100% of the production from the jointly-owned plants in Trinidad and Egypt, which provides us with an additional 1.3 million tonnes per year of methanol offtake supply when the plants are operating at full capacity.

Refer to the Production Summary section on page 11 for more information.

2017 Industry Overview & Outlook

Methanol is a global commodity and

our earnings are significantly affected by fluctuations in the price of methanol, which is directly impacted by changes in methanol supply and demand. Demand for methanol is driven primarily by levels of industrial production, energy prices and the

strength of the global economy.

6 2017 Methanex Corporation Annual Report

Demand

Demand for methanol

grew by approximately 4% or 3 million tonnes in 2017, resulting in total demand of 78 million tonnes in 2017, excluding demand from integrated coal-to-olefins

(“CTO”) facilities.

Energy-related demand, which represented approximately 45% of total demand, grew by approximately 8% in 2017. Included in that sector,

MTO represented approximately 15% of total methanol demand, and led demand growth as MTO units operated at high rates when they were not experiencing technical issues. This demand segment is anticipated to grow further as three additional MTO units

are currently under construction, with the combined capacity to consume over three million tonnes of methanol annually at full operating rates, and we expect these plants to be completed in 2018. The future operating rates and methanol consumption

from MTO facilities will depend on a number of factors, including pricing for their various final products, the degree of downstream integration of these units with other products and the impact of the olefin industry feedstock costs, including

naptha, on relative competitiveness.

Global regulations to promote the use of clean-burning fuels support long-term demand growth for a number of emerging energy

applications for methanol.

In China, stricter air quality emissions regulations are leading to a phase-out of coal-fueled

industrial boilers in favour of cleaner fuels, creating a growing market for methanol as an alternative fuel. We estimate that this growing demand segment already represents over 1.5 million tonnes of methanol demand.

Demand for other fuel applications in China remains healthy with interest from other countries growing. China’s high blend

(M85-M100) methanol vehicle pilot program staged by the Ministry of Industry and Information Technology has achieved positive results during the official review in 2017 with further expansion planned for 2018.

Blending continues to gain momentum outside of China. Several other countries are in the assessment or near-commercial stage for low-level methanol fuel blending.

Regulatory changes are playing an increasing role in encouraging new applications for methanol due to its emissions benefits as a fuel. As a result of the International

Maritime Organization’s expansion of future sulphur limits from ocean-going vessels, methanol has emerged as a promising competitive alternative. A number of projects are underway with cruise ships, ferries as well as tug boats and barges. In

China, Methanex is partnering with the Ministry of Agriculture to initiate a marine fuel pilot and working with the Ministry of Transport and relevant stakeholders to support the development of methanol marine fuel guidelines.

Demand from traditional applications for methanol grew by approximately 2% in 2017 and we estimate that traditional chemical derivatives consume approximately 55% of

methanol globally.

Supply

There were no significant new industry capacity

additions outside of China in 2017. In China, we estimate that approximately two million tonnes of new production capacity was added in 2017, excluding methanol production that is integrated with production of other downstream products and not sold

on the merchant market.

Over the next few years, the majority of large-scale capacity additions outside of China are expected to be in North America and the Middle

East. OCI N.V. and Consolidated Energy Limited (through its subsidiary G2X Energy) continue to advance their jointly owned Natgasoline project, a 1.8 million tonne plant under construction in Beaumont, Texas with methanol production expected in

2018. There are a number of other large-scale projects under discussion in the United States; however, we believe that there has been limited committed capital to date. In Iran, there are a number of plants at various stages of construction. We

expect just over four million tonnes of capacity to come onstream in Iran over the next two years; however, the start-up timing and future operating rates at these facilities will be dependent on various

factors. Caribbean Gas Chemical Limited (“CGCL”) is constructing a 1.0 million tonne plant in Trinidad with announced production towards the end of the decade. To the end of 2018, we expect approximately two million tonnes of new

capacity additions in China. Beyond 2018, we anticipate that new capacity additions in China will be modest due to increasing restrictions placed by the Chinese government on new coal-based capacity additions. We expect that production from new

capacity in China will be consumed in that country.

2017 Methanex Corporation Annual

Report 7

Price

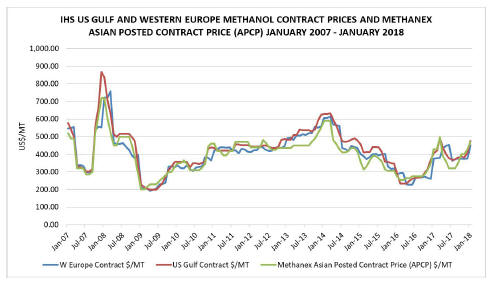

Methanex’s

average realized price in 2017 increased to $337 per tonne from $242 per tonne in 2016. Although methanol pricing was volatile in 2017, the stronger average methanol price was supported by a number of factors. Demand for methanol in traditional and

energy applications continued to grow, led by methanol-to-olefins demand in China. Higher energy prices also supported the affordability of methanol into energy

applications. Rising coal and natural gas prices increased the relative cost of production and increased the cost curve support for methanol prices. In addition, a number of planned and unplanned outages throughout the year impacted global

production, particularly towards the end of 2017 when methanol prices significantly exceeded the cost curve due to a shortage of supply. Methanol prices continued to move higher in the first quarter of 2018.

Future methanol prices will ultimately depend on the strength of the global economy, industry operating rates, global energy prices, new supply additions and the strength

of global demand.

OUR STRATEGY

Our primary

objective is to create value by maintaining and enhancing our leadership in the global production, marketing and delivery of methanol to customers. To achieve this objective we have a simple, clearly defined strategy: global leadership, low cost and

operational excellence. We also pride ourselves in being a leader in Responsible Care. Our brand differentiator “The Power of Agility®” defines our culture of flexibility,

responsiveness and creativity that allows us to capitalize on opportunities quickly as they arise, and swiftly respond to customer needs.

Global Leadership

Global leadership is a key element of our strategy. We are focused on maintaining and enhancing our position as the major producer and supplier in the global

methanol industry, improving our ability to cost-effectively deliver methanol to customers and supporting both traditional and energy-related global methanol demand growth.

We are the leading producer and supplier of methanol to the major international markets in Asia Pacific, North America, Europe and South America. Our 2017 sales volume of

10.7 million tonnes of methanol represented approximately 14% of global methanol demand. Our leadership position has enabled us to play an important role in the industry, which includes publishing Methanex reference prices that are used in each

major market as the basis of pricing for our customer contracts.

The geographically diverse locations of our production sites allow us to deliver methanol

cost-effectively to customers in all major global markets, while investments in global distribution and supply infrastructure, which include a fleet of ocean-going vessels and terminal capacity within all major international markets, enable us

to enhance value to customers by providing reliable and secure supply.

A key component of our global leadership strategy is the strength of our asset position

with over 8.5 million tonnes of operating capacity in 2017. We achieved record production in 2017 of 7.2 million tonnes, exceeding our previous record of 7.0 million tonnes set in 2016. Our Chile operations are currently operating at

less than full production capacity and provide further potential to increase production.

Another key component of our global leadership strategy is our ability to

supplement methanol production with methanol purchased from third parties to give us flexibility in our supply chain to meet customer commitments. We purchase methanol through a combination of methanol offtake contracts and spot purchases. We manage

the cost of purchased methanol by taking advantage of our global supply chain infrastructure, which allows us to purchase methanol in the most cost-effective region while still maintaining overall security of supply.

The Asia Pacific region continues to lead global methanol demand growth and we have invested in and developed our presence in this important region. We have storage

capacity in China, South Korea and Japan that allows us to cost-effectively manage supply to customers and we have offices in Hong Kong, Shanghai, Tokyo, Seoul and Beijing to enhance customer service and industry positioning in the region. This

enables us to participate in and improve our knowledge of the rapidly evolving and high growth methanol markets in China and other Asian countries. Our expanding presence in Asia Pacific has also helped us identify several opportunities to support

the development of applications for methanol in the energy-related sector.

8 2017 Methanex Corporation Annual Report

Low Cost

A low cost

structure is an important competitive advantage in a commodity industry and is a key element of our strategy. Our approach to major business decisions is guided by a drive to improve our cost structure and create value for shareholders. The most

significant components of total costs are natural gas for feedstock and distribution costs associated with delivering methanol to customers. Our cost structure per tonne continues to benefit from significant leverage on our fixed costs as production

increases.

The New Zealand, Trinidad and Egypt facilities are underpinned by natural gas purchase agreements where the natural gas price varies with methanol prices.

This pricing relationship enables these facilities to be competitive throughout the methanol price cycle. We have a fixed price contract to supply substantially all our Geismar 1 facility and forward contracts to hedge natural gas prices for

approximately 40% of the natural gas requirements of our Geismar 2 facility through 2025 with the remainder of natural gas requirements at Geismar purchased in the spot market. We have entered into fixed price contracts to supply the majority of our

natural gas requirements for our Medicine Hat facility through 2031.

Our production facilities are well located to supply global methanol markets. Still, the cost to

distribute methanol from production locations to customers is a significant component of total operating costs. These include costs for ocean shipping, in-market storage facilities and in-market distribution. We are focused on identifying initiatives to reduce these costs, including optimizing the use of our shipping fleet and taking advantage of prevailing conditions in the shipping market by

varying the type and length of term of ocean vessel contracts. 2017 was our first full year with seven vessels equipped with flex-fuel engines that can run on conventional fuel or methanol, which provides us with further flexibility in our supply

chain. We also look for opportunities to leverage our global asset position by entering into geographic product exchanges with other methanol producers to reduce distribution costs.

Operational Excellence

We maintain a focus on operational excellence in all

aspects of our business. This includes excellence in manufacturing and supply chain processes, marketing and sales, human resources, corporate governance practices and financial management.

To differentiate ourselves from competitors, we strive to be the best operator in all aspects of our business and to be the preferred supplier to customers. We believe

that reliability of supply is critical to the success of our customers’ businesses and our goal is to deliver methanol reliably and cost-effectively. We have a commitment to Responsible Care (an operating ethic and set of principles developed

by the Chemistry Industry Association of Canada) and we use it as the umbrella under which we manage issues related to employee health and safety, environmental protection, community involvement, social responsibility, sustainability, security and

emergency preparedness at each of our facilities and locations. Through the International Council of Chemical Associations, over 60 countries have adopted the Responsible Care Ethic and Principles for Sustainability. We believe a commitment to

Responsible Care helps us achieve an excellent overall environmental and safety record.

Product stewardship is a vital component of a Responsible Care culture and

guides our actions through the complete life cycle of our product. We aim for the highest safety standards to minimize risk to employees, customers and suppliers as well as to the environment and the communities in which we do business. We promote

the proper use and safe handling of methanol at all times through a variety of internal and external health, safety and environmental initiatives, and we work with industry colleagues to improve safety standards. We readily share technical and

safety expertise with key stakeholders, including customers, end-users, suppliers, logistics providers and industry associations in the methanol and methanol applications marketplace through active

participation in local and international industry associations, seminars and conferences and online education initiatives.

As a natural extension of the Responsible

Care ethic, we have a Social Responsibility policy that aligns corporate governance, employee engagement and development, community involvement and social investment strategies with our core values and corporate strategy.

Our strategy of operational excellence also includes the financial management of the Company. We operate in a highly competitive commodity industry. Accordingly, we

believe it is important to maintain financial flexibility and we have adopted a prudent approach to financial management. We have an undrawn $300 million credit facility provided by highly rated financial institutions that expires

2017 Methanex Corporation Annual

Report 9

in December 2022. As at December 31, 2017, we had a strong balance sheet and a cash balance of $375 million. We believe we are well-positioned to meet our financial commitments, pursue

our near-term growth opportunities in Chile and deliver on our commitment to return excess cash to shareholders through dividends and share repurchases.

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

| ($ Millions, except as noted) |

|

2017 |

|

|

2016 |

|

| Production (thousands of tonnes) (attributable to Methanex shareholders) |

|

|

7,187 |

|

|

|

7,017 |

|

| Sales volume (thousands of tonnes) |

|

|

|

|

|

|

|

|

| Methanex-produced methanol |

|

|

7,229 |

|

|

|

6,828 |

|

| Purchased methanol |

|

|

2,289 |

|

|

|

1,892 |

|

| Commission sales |

|

|

1,151 |

|

|

|

758 |

|

| Total sales volume1 |

|

|

10,669 |

|

|

|

9,478 |

|

| Methanex average non-discounted posted price ($ per tonne)2 |

|

|

396 |

|

|

|

279 |

|

| Average realized price ($ per tonne)3 |

|

|

337 |

|

|

|

242 |

|

| Revenue |

|

|

3,061 |

|

|

|

1,998 |

|

| Adjusted revenue4 |

|

|

3,227 |

|

|

|

2,118 |

|

| Adjusted EBITDA4 |

|

|

838 |

|

|

|

287 |

|

| Cash flows from operating activities |

|

|

788 |

|

|

|

227 |

|

| Adjusted net income (loss)4 |

|

|

409 |

|

|

|

(15 |

) |

| Net income (loss) (attributable to Methanex shareholders) |

|

|

316 |

|

|

|

(13 |

) |

| Adjusted net income (loss) per common share ($ per

share)4 |

|

|

4.71 |

|

|

|

(0.17 |

) |

| Basic net income (loss) per common share ($ per share) |

|

|

3.64 |

|

|

|

(0.14 |

) |

| Diluted net income (loss) per common share ($ per share) |

|

|

3.64 |

|

|

|

(0.14 |

) |

| Common share information (millions of shares) |

|

|

|

|

|

|

|

|

| Weighted average number of common shares |

|

|

87 |

|

|

|

90 |

|

| Diluted weighted average number of common shares |

|

|

87 |

|

|

|

90 |

|

| Number of common shares outstanding, end of period |

|

|

84 |

|

|

|

90 |

|

| 1 |

Methanex-produced methanol represents our equity share of volume produced at our facilities and excludes volume marketed on a commission basis related to 36.9% of the Atlas facility and 50% of the Egypt facility that we

do not own. Methanex-produced methanol includes any volume produced in Chile using natural gas supplied from Argentina under a tolling arrangement (“Tolling Volume”). There has been no Tolling Volume produced in the periods presented.

|

| 2 |

Methanex average non-discounted posted price represents the average of our non-discounted posted prices in North America, Europe and Asia

Pacific weighted by sales volume. Current and historical pricing information is available at www.methanex.com. |

| 3 |

Average realized price is calculated as revenue, excluding commissions earned and the Egypt non-controlling interest share of revenue, but including an amount representing our

share of Atlas revenue, divided by the total sales volume of Methanex-produced and purchased methanol, but excluding Tolling Volume. |

| 4 |

The Company has used the terms Adjusted EBITDA, Adjusted net income (loss), Adjusted net income (loss) per common share, Adjusted revenue, and Operating income throughout this document. These items are non-GAAP measures that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Refer to the Supplemental Non-GAAP Measures section on page 36 for a description of each non-GAAP measure and reconciliations to the most comparable GAAP measures. |

10 2017 Methanex Corporation Annual Report

PRODUCTION SUMMARY

The following table details the annual production capacity and actual production of our facilities in 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Thousands of tonnes) |

|

Annual

production

capacity1 |

|

|

Annual

operating

capacity2 |

|

|

2017

Production |

|

|

2016

Production |

|

| New Zealand3 |

|

|

2,430 |

|

|

|

2,430 |

|

|

|

1,943 |

|

|

|

2,181 |

|

| Geismar (USA) |

|

|

2,000 |

|

|

|

2,000 |

|

|

|

1,935 |

|

|

|

2,055 |

|

| Trinidad (Methanex interest)4 |

|

|

2,000 |

|

|

|

2,000 |

|

|

|

1,768 |

|

|

|

1,605 |

|

| Egypt (50% interest) |

|

|

630 |

|

|

|

630 |

|

|

|

534 |

|

|

|

293 |

|

| Medicine Hat (Canada) |

|

|

600 |

|

|

|

600 |

|

|

|

593 |

|

|

|

488 |

|

|

Chile5 |

|

|

1,720 |

|

|

|

880 |

|

|

|

414 |

|

|

|

395 |

|

| |

|

|

9,380 |

|

|

|

8,540 |

|

|

|

7,187 |

|

|

|

7,017 |

|

| 1 |

Annual production capacity reflects, among other things, average expected plant outages, turnarounds and average age of the facility’s catalyst. As a result, the

actual production of a facility may be higher or lower than the stated annual production capacity. |

| 2 |

Annual operating capacity includes only those facilities which are currently capable of operating, but excludes any portion of an asset that is underutilized due to a

lack of natural gas feedstock over a prolonged period of time. Our current annual operating capacity is 8.5 million tonnes, including 0.9 million tonnes related to our Chile operations. The operating capacity of our production facilities

may be higher than original nameplate capacity as, over time, these figures have been adjusted to reflect ongoing operating efficiencies at these facilities. Actual production for a facility in any given year may be higher or lower than operating

capacity due to a number of factors, including natural gas composition or the age of the facility’s catalyst. |

| 3 |

The operating capacity of New Zealand is made up of the two Motunui facilities and the Waitara Valley facility (refer to the New Zealand section below).

|

| 4 |

The operating capacity of Trinidad is made up of the Titan (100% interest) and Atlas (63.1% interest) facilities (refer to the Trinidad section below).

|

| 5 |

The production capacity of our Chile I and IV facilities is 1.7 million tonnes annually assuming access to natural gas feedstock. |

New Zealand

In New Zealand, we produced 1.9 million tonnes of methanol in

2017 compared with 2.2 million tonnes in 2016. A planned turnaround and repairs at the Motunui facilities impacted production in 2017. The plants are able to produce at an annual production capacity of up to 2.4 million tonnes of methanol,

depending on natural gas composition. Our New Zealand facilities are ideally situated to supply the growing Asia Pacific market. Refer to the Risk Factors and Risk Management – New Zealand section on page 26 for more

information.

United States

The Geismar facilities produced

1.9 million tonnes of methanol in 2017 compared with 2.1 million tonnes in 2016. Lower production in 2017 compared with 2016 was a result of planned maintenance activities undertaken at both Geismar plants in the year. Refer to the Risk

Factors and Risk Management – United States section on page 26 for more information.

Trinidad

Our ownership interest in the methanol facilities in Trinidad represents 2.0 million tonnes of annual capacity. The Titan and Atlas facilities in Trinidad are well

located to supply global methanol markets and are underpinned by natural gas purchase agreements where the natural gas price varies with methanol prices. The Trinidad facilities produced a total of 1.8 million tonnes of methanol (Methanex

share) in 2017 compared with 1.6 million tonnes in 2016. Our results in 2016 reflected a turnaround performed at the Atlas facility.

During 2016 and 2017, we

continued to experience natural gas curtailments to our Trinidad facilities due to a mismatch between upstream supply to the National Gas Company of Trinidad and Tobago Limited (“NGC”) and downstream demand from NGC’s customers. We

are engaged with key stakeholders to find a solution to this issue, but expect to continue to experience gas curtailments to the Trinidad site. Refer to the Risk Factors and Risk Management – Trinidad section on page 27 for more

information.

2017 Methanex Corporation Annual

Report 11

Egypt

We operate a

1.26 million tonne per year methanol facility in Egypt and have marketing rights for 100% of the production. The Egypt methanol facility is well located to supply European and Asia Pacific methanol markets. We produced 1,068,000 tonnes of

methanol (Methanex share of 534,000) at the plant during 2017, compared to 586,000 tonnes (Methanex share of 293,000) in 2016. Production in 2017 was impacted by a planned turnaround in the third quarter. Following the turnaround, the plant

restarted and ran at high rates for the remainder of the year.

The Egypt facility has experienced periodic natural gas supply restrictions since mid-2012 and gas restrictions worsened through 2014 and 2015. Gas deliveries for the year ended December 31, 2017 have improved significantly compared to the same period in 2016. We are optimistic that the

strong efforts by Egyptian governmental entities to fast-track existing and new upstream gas supply in Egypt are leading to improved gas deliveries and an improved outlook for gas deliveries in the medium term. Refer to the Risk Factors and Risk

Management – Egypt section on page 27 for more information.

Canada

The Medicine Hat facility produced 593,000 tonnes of methanol in 2017 compared to 488,000 tonnes in 2016. A mechanical issue at the Medicine Hat facility impacted

production in 2016 and early 2017. Repairs to address the issue were completed early in 2017 with the plant running at high rates for the remainder of the year. Refer to the Risk Factors and Risk Management – Canada

section on page 27 for more information.

Chile

The Chile facility

produced 414,000 tonnes of methanol in 2017 compared to 395,000 tonnes in 2016. Production increased for 2017 as compared to 2016 as a result of improved natural gas availability from Chilean suppliers. For the second consecutive year, we produced

methanol throughout the southern hemisphere winter months, which are a period of typically lower gas deliveries.

The future of our Chile operations is primarily

dependent on the level of natural gas exploration and development in southern Chile and our ability to secure a sustainable natural gas supply to our facilities on economic terms from Chile and Argentina. We are optimistic that our underutilized

1.7 million tonne Chile facilities represent a very low capital cost growth opportunity for Methanex due to significant progress in developing natural gas reserves in the area. Project work has commenced for the restart of our Chile IV plant

and, if additional gas supply can be secured, will be followed by the refurbishment of our Chile I plant in order to restore Chile to a two-plant operation at a very low capital cost. Refer to the Risk

Factors and Risk Management – Chile section on page 28 for more information.

HOW WE ANALYZE OUR BUSINESS

Our operations consist of a single operating segment – the production and sale of methanol. We review our financial results by analyzing changes in the components of

Adjusted EBITDA, mark-to-market impact of share-based compensation, depreciation and amortization, Argentina gas settlement, finance costs, finance income and other

expenses, and income taxes.

The Company has used the terms Adjusted EBITDA, Adjusted net income (loss), Adjusted net income (loss) per common share, Adjusted revenue

and Operating income throughout this document. These items are non-GAAP measures that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures

presented by other companies. Refer to the Supplemental Non-GAAP Measures section on page 36 for a description of each non-GAAP measure and reconciliations to the

most comparable GAAP measures.

12 2017 Methanex Corporation Annual Report

In addition to the methanol that we produce at our facilities, we also purchase and resell methanol produced by others

and we sell methanol on a commission basis. We analyze the results of all methanol sales together, excluding commission sales volume. The key drivers of changes in Adjusted EBITDA are average realized price, cash costs and sales volume, which are

defined and calculated as follows:

|

|

|

| PRICE |

|

The change in Adjusted EBITDA as a result of changes in average realized price

is calculated as the difference from period to period in the selling price of methanol multiplied by the current period total methanol sales volume, excluding commission sales volume and Tolling Volume, plus the difference from period to period in

commission revenue. |

| CASH COSTS |

|

The change in Adjusted EBITDA as a result of changes in cash costs is calculated as the difference from

period to period in cash costs per tonne multiplied by the current period total methanol sales volume, excluding commission sales volume and Tolling Volume in the current period. The cash costs per tonne is the weighted average of the cash cost per

tonne of Methanex-produced methanol and the cash cost per tonne of purchased methanol. The cash cost per tonne of Methanex-produced methanol includes absorbed fixed cash costs per tonne and variable cash costs per tonne. The cash cost per tonne of

purchased methanol consists principally of the cost of methanol itself. In addition, the change in Adjusted EBITDA as a result of changes in cash costs includes the changes from period to period in unabsorbed fixed production costs, consolidated

selling, general and administrative expenses and fixed storage and handling costs. |

| SALES VOLUME |

|

The change in Adjusted EBITDA as a result of changes in sales volume is calculated as the difference from

period to period in total methanol sales volume, excluding commission sales volume and Tolling Volume, multiplied by the margin per tonne for the prior period. The margin per tonne for the prior period is the weighted average margin per tonne of

Methanex-produced methanol and margin per tonne of purchased methanol. The margin per tonne for Methanex-produced methanol is calculated as the selling price per tonne of methanol less absorbed fixed cash costs per tonne and variable cash costs per

tonne. The margin per tonne for purchased methanol is calculated as the selling price per tonne of methanol less the cost of purchased methanol per tonne.

|

We own 63.1% of the Atlas methanol facility and market the remaining 36.9% of its production through a commission offtake agreement. A

contractual agreement between us and our partners establishes joint control over Atlas. As a result, we account for this investment using the equity method of accounting, which results in 63.1% of the net assets and net earnings of Atlas being

presented separately in the consolidated statements of financial position and consolidated statements of income (loss), respectively. For purposes of analyzing our business, Adjusted EBITDA, Adjusted net income (loss), Adjusted net income (loss) per

common share and Adjusted revenue include an amount representing our 63.1% equity share in Atlas. Our analysis of depreciation and amortization, finance costs, finance income and other expenses, and income taxes is consistent with the presentation

of our consolidated statements of income (loss) and excludes amounts related to Atlas.

We own 50% of the 1.26 million tonne per year Egypt methanol facility and

market the remaining 50% of its production through a commission offtake agreement. We account for this investment using consolidation accounting, which results in 100% of the revenues and expenses being included in our financial statements. We also

consolidate less then wholly-owned entities for which we have a controlling interest. Non-controlling interests are included in the Company’s consolidated financial statements and represent the non-controlling shareholders’ interests in the Egypt methanol facility and any entity where we have control. For purposes of analyzing our business, Adjusted EBITDA, Adjusted net income (loss), Adjusted net

income (loss) per common share and Adjusted revenue exclude the amounts associated with non-controlling interests.

FINANCIAL RESULTS

For the year ended December 31, 2017, we reported net income attributable to Methanex shareholders of $316 million ($3.64 income

per common share on a diluted basis), compared with net loss attributable to Methanex shareholders of $13 million ($0.14 loss per common share on a diluted basis) for the year ended December 31, 2016.

For the year ended December 31, 2017, we reported Adjusted EBITDA of $838 million and Adjusted net income of $409 million ($4.71 Adjusted net income per

common share), compared with Adjusted EBITDA of $287 million and Adjusted net loss of $15 million ($0.17 Adjusted net loss per common share) for the year ended December 31, 2016.

2017 Methanex Corporation Annual

Report 13

We calculate Adjusted EBITDA and Adjusted net income (loss) by including amounts related to our equity share of the

Atlas facility (63.1% interest) and by excluding the non-controlling interests’ share, the mark-to-market impact of

share-based compensation as a result of changes in our share price and the impact of certain items associated with specific identified events.

In 2017, we recorded a

non-cash charge of $37 million to net income from the revaluation of a net deferred tax asset as a result of tax reform in the United States. In 2016, we recorded a gain of $32.5 million

($21 million after-tax) after reaching a settlement with Petrobras Energía S.A. (“Petrobras”) of Argentina to terminate Petrobras’ natural gas delivery obligations pursuant to a

long-term natural gas supply agreement in Chile (the “Argentina gas settlement”).

A reconciliation from net income (loss) attributable to Methanex

shareholders to Adjusted net income (loss) and the calculation of Adjusted diluted net income (loss) per common share is as follows:

|

|

|

|

|

|

|

|

|

| ($ Millions, except number of shares and per share amounts) |

|

2017 |

|

|

2016 |

|

| Net income (loss) attributable to Methanex shareholders |

|

$ |

316 |

|

|

$ |

(13 |

) |

| U.S. tax reform charge |

|

|

37 |

|

|

|

– |

|

| Mark-to-market impact of

share-based compensation, net of tax |

|

|

56 |

|

|

|

19 |

|

| Argentina gas settlement, net of tax |

|

|

– |

|

|

|

(21 |

) |

| Adjusted net income (loss) |

|

$ |

409 |

|

|

$ |

(15 |

) |

| Diluted weighted average shares outstanding (millions) |

|

|

87 |

|

|

|

90 |

|

| Adjusted net income (loss) per common share |

|

$ |

4.71 |

|

|

$ |

(0.17 |

) |

|

| A summary of our consolidated statements of income (loss) for 2017 and 2016 is as follows:

|

|

| ($ Millions) |

|

2017 |

|

|

2016 |

|

| Consolidated statements of income: |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

3,061 |

|

|

$ |

1,998 |

|

| Cost of sales and operating expenses |

|

|

(2,352 |

) |

|

|

(1,774 |

) |

| Mark-to-market impact of

share-based compensation |

|

|

68 |

|

|

|

22 |

|

| Adjusted EBITDA (attributable to associate) |

|

|

148 |

|

|

|

63 |

|

| Amounts excluded from Adjusted EBITDA attributable to non-controlling interests |

|

|

(87 |

) |

|

|

(22 |

) |

| Adjusted EBITDA (attributable to Methanex shareholders) |

|

|

838 |

|

|

|

287 |

|

| U.S. tax reform charge |

|

|

(37 |

) |

|

|

– |

|

| Mark-to-market impact of

share-based compensation |

|

|

(68 |

) |

|

|

(22 |

) |

| Argentina gas settlement |

|

|

– |

|

|

|

33 |

|

| Depreciation and amortization |

|

|

(232 |

) |

|

|

(228 |

) |

| Finance costs |

|

|

(95 |

) |

|

|

(90 |

) |

| Finance income and other expenses |

|

|

13 |

|

|

|

4 |

|

| Income tax recovery (expense) |

|

|

(59 |

) |

|

|

9 |

|

| Earnings of associate adjustment1 |

|

|

(72 |

) |

|

|

(43 |

) |

| Non-controlling interests

adjustment1 |

|

|

28 |

|

|

|

37 |

|

| Net income (loss) attributable to Methanex shareholders |

|

$ |

316 |

|

|

$ |

(13 |

) |

| Net income (loss) |

|

$ |

375 |

|

|

$ |

(28 |

) |

| 1 |

These adjustments represent depreciation and amortization, finance costs, finance income and other expenses and income taxes associated with our 63.1% interest in the Atlas methanol facility and the non-controlling interests. |

Revenue

There are many factors that impact our global and regional revenue levels. The methanol business is a global commodity industry affected by supply and demand

fundamentals. Due to the diversity of the end products in which methanol is used, demand for methanol largely depends upon levels of industrial production, energy prices and changes in general economic conditions, which can vary across the major

international methanol markets. Revenue increased to $3.1 billion in 2017 from $2.0 billion in 2016. The higher revenue reflects an increase in our average realized price and higher sales volume in 2017.

14 2017 Methanex Corporation Annual Report

We publish regional non-discounted reference prices for each major methanol

market and these posted prices are reviewed and revised monthly or quarterly based on industry fundamentals and market conditions. Most of our customer contracts use published Methanex reference prices as a basis for pricing, and we offer discounts

to customers based on various factors. Our average non-discounted published reference price in 2017 was $396 per tonne compared with $279 per tonne in 2016. Our average realized price in 2017 increased to

$337 per tonne from $242 per tonne in 2016.

Distribution of Revenue

The

geographic distribution of revenue by customer location for 2017 was similar to 2016. Details are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ Millions, except where noted) |

|

2017 |

|

|

2016 |

|

| China |

|

$ |

802 |

|

|

|

26 |

% |

|

$ |

518 |

|

|

|

26 |

% |

| Europe |

|

|

609 |

|

|

|

20 |

% |

|

|

404 |

|

|

|

20 |

% |

| United States |

|

|

570 |

|

|

|

19 |

% |

|

|

359 |

|

|

|

18 |

% |

| South Korea |

|

|

348 |

|

|

|

11 |

% |

|

|

258 |

|

|

|

13 |

% |

| South America |

|

|

279 |

|

|

|

9 |

% |

|

|

179 |

|

|

|

9 |

% |

| Canada |

|

|

168 |

|

|

|

6 |

% |

|

|

110 |

|

|

|

6 |

% |

| Other Asia |

|

|

285 |

|

|

|

9 |

% |

|

|

170 |

|

|

|

8 |

% |

| |

|

$ |

3,061 |

|

|

|

100 |

% |

|

$ |

1,998 |

|

|

|

100 |

% |

Adjusted EBITDA (Attributable to Methanex Shareholders)

2017 Adjusted EBITDA was $838 million compared with 2016 Adjusted EBITDA of $287 million, an increase of $551 million. The key drivers of change in our

Adjusted EBITDA are average realized price, sales volume and cash costs as described below (refer to the How We Analyze Our Business section on page 12 for more information).

|

|

|

|

|

| ($ Millions) |

|

2017 vs. 2016 |

|

| Average realized price |

|

$ |

910 |

|

| Sales volume |

|

|

43 |

|

| Total cash costs |

|

|

(402 |

) |

| Increase in Adjusted EBITDA |

|

$ |

551 |

|

Average Realized Price

Our average realized price for the year ended December 31, 2017 increased to $337 per tonne from $242 per tonne for 2016, and this increased Adjusted EBITDA by

$910 million (refer to the Financial Results – Revenue section on page 14 for more information).

Sales Volume

Methanol sales volume, excluding commission sales volume, for the year ended December 31, 2017 increased by 798,000 tonnes to 9.5 million tonnes

from 8.7 million tonnes in 2016, and this increased Adjusted EBITDA by $43 million. Including commission sales volume from the Atlas and Egypt facilities, our total methanol sales volume was 10.7 million tonnes in 2017 compared with

9.5 million tonnes in 2016.

Total Cash Costs

The primary drivers of change in our total cash costs are changes in the cost of Methanex-produced methanol and changes in the cost of methanol we purchase from others

(“purchased methanol”). We supplement our production with methanol produced by others through methanol offtake contracts and purchases on the spot market to meet customer needs and support our marketing efforts within the major global

markets.

We have adopted the first-in, first-out method of accounting for inventories

and it generally takes between 30 and 60 days to sell the methanol we produce or purchase. Accordingly, the changes in Adjusted EBITDA as a result of changes in Methanex-produced and purchased methanol costs primarily depend on changes in methanol

pricing and the timing of inventory flows.

2017 Methanex Corporation Annual

Report 15

In a rising price environment, our margins at a given price are higher than in a stable price environment as a result

of methanol purchases and production versus sales. Generally, the opposite applies when methanol prices are decreasing.

The changes in Adjusted EBITDA due to changes

in total cash costs for 2017 compared with 2016 were due to the following:

|

|

|

|

|

| ($ Millions) |

|

2017 vs. 2016 |

|

| Methanex-produced methanol costs |

|

$ |

(154 |

) |

| Proportion of Methanex-produced methanol sales |

|

|

(13 |

) |

| Purchased methanol costs |

|

|

(238 |

) |

| Other, net |

|

|

3 |

|

| Decrease in Adjusted EBITDA due to changes in total cash

costs |

|

$ |

(402 |

) |

Methanex-Produced Methanol Costs

Natural gas is the primary feedstock at our methanol facilities and is the most significant component of Methanex-produced methanol costs. We purchase natural gas for

more than half of our production under natural gas purchase agreements where the unique terms of each contract include a base price and a variable price component linked to the price of methanol to reduce our commodity price risk exposure. The

variable price component of each gas contract is adjusted by a formula related to methanol prices above a certain level. Methanex-produced methanol costs were higher in 2017 compared with 2016 by $154 million, primarily due to the impact of

changes in realized methanol prices on the variable portion of our natural gas costs and changes in the mix of production sold from inventory. For additional information regarding our natural gas supply agreements, refer to the Liquidity and

Capital Resources – Summary of Contractual Obligations and Commercial Commitments section on page 22.

Proportion of

Methanex-produced methanol sales

The cost of purchased methanol is directly linked to the selling price for methanol at the time of purchase and the cost

of purchased methanol is generally higher than the cost of Methanex-produced methanol. Accordingly, an increase in the proportion of Methanex-produced methanol sales results in a decrease in our overall cost structure for a given period. The

proportion of Methanex-produced methanol sales decreased in 2017 due to total sales volume increasing more than production volume and this decreased Adjusted EBITDA by $13 million for 2017 compared with 2016.

Purchased Methanol Costs

A key element of our

corporate strategy is global leadership and, as such, we have built a leading market position in each of the major global markets where methanol is sold. We supplement our production with purchased methanol through methanol offtake contracts and on

the spot market to meet customer needs and support our marketing efforts within the major global markets. In structuring purchase agreements, we look for opportunities that provide synergies with our existing supply chain that allow us to purchase

methanol in the most cost effective region. The cost of purchased methanol consists principally of the cost of the methanol itself, which is directly related to the price of methanol at the time of purchase. As a result of changes in methanol prices

in 2017 and the timing of inventory flows and purchases, the cost of purchased methanol per tonne increased and this decreased Adjusted EBITDA by $238 million compared with 2016.

Other, Net

Our investment in global

distribution and supply infrastructure includes a dedicated fleet of ocean-going vessels. We utilize these vessels to enhance value to customers by providing reliable and secure supply and to optimize supply chain costs overall, including through

third-party backhaul arrangements when available. Logistics costs can also vary from period to period depending on the levels of production from each of our production facilities and the resulting impact on our supply chain. Other, net relates to

logistics costs, selling, general and administrative expenses and other operational charges.

16 2017 Methanex Corporation Annual Report

Mark-to-Market Impact of Share-Based

Compensation

We grant share-based awards as an element of compensation. Share-based awards granted include stock options, share appreciation rights, tandem share

appreciation rights, deferred share units, restricted share units and performance share units. For all share-based awards, share-based compensation is recognized over the related vesting period for the proportion of the service that has been

rendered at each reporting date. Share-based compensation includes an amount related to the grant-date value and a mark-to-market impact as a result of subsequent

changes in the Company’s share price. The grant-date value amount is included in Adjusted EBITDA and Adjusted net income (loss). The mark-to-market impact of

share-based compensation as a result of changes in our share price is excluded from Adjusted EBITDA and Adjusted net income (loss) and analyzed separately.

|

|

|

|

|

|

|

|

|

| ($ Millions, except share price) |

|

2017 |

|

|

2016 |

|

| Methanex Corporation share price1 |

|

$ |

60.55 |

|

|

$ |

43.80 |

|

| Grant-date fair value expense included in Adjusted EBITDA and Adjusted net income (loss) |

|

|

11 |

|

|

|

11 |

|

|

Mark-to-market impact due to change in share

price |

|

|

68 |

|

|

|

22 |

|

| Total share-based compensation expense, before tax |

|

$ |

79 |

|

|

$ |

33 |

|

| 1 |

U.S. dollar share price of Methanex Corporation as quoted on the NASDAQ Global Select Market on the last trading day of the respective period. |

For stock options, the cost is measured based on an estimate of the fair value at the date of grant using the Black-Scholes option pricing model, and this grant-date fair

value is recognized as compensation expense over the related vesting period with no subsequent re-measurement in fair value. Accordingly, share-based compensation expense associated with stock options will not

vary significantly from period to period.

Share appreciation rights (“SARs”) are units that grant the holder the right to receive a cash payment upon

exercise for the difference between the market price of the Company’s common shares and the exercise price that is determined at the date of grant. Tandem share appreciation rights (“TSARs”) give the holder the choice between

exercising a regular stock option or a SAR. The fair values of SARs and TSARs are re-measured each quarter using the Black-Scholes option pricing model, which considers the market value of the Company’s

common shares on the last trading day of each quarter.

Deferred, restricted and performance share units are grants of notional common shares that are redeemable for

cash based on the market value of the Company’s common shares and are non-dilutive to shareholders. Performance share units have an additional feature where the ultimate number of units that vest will be

determined by the Company’s total shareholder return in relation to a predetermined target over the period to vesting. The number of performance share units that will ultimately vest will be in the range of 25% to 150% based on the

weighted-average closing share price for the 90 calendar days on the NASDAQ Global Select Market immediately preceding the year end date that the performance share units vest. For deferred, restricted and performance share units, the value is

initially measured at the grant date and subsequently re-measured based on the market value of the Company’s common shares on the last trading day of each quarter. The price of the Company’s common

shares as quoted on the NASDAQ Global Select Market increased from $43.80 per share at December 31, 2016 to $60.55 per share at December 31, 2017. As a result of the increase in the share price and the resulting impact on the fair value of

the outstanding units, we recorded a $68 million mark-to-market expense related to share-based compensation during 2017.

Depreciation and Amortization

Depreciation and amortization was

$232 million for the year ended December 31, 2017 compared with $228 million for the year ended December, 31 2016. The increase in depreciation and amortization in 2017 compared with 2016 is primarily the result of higher sales volume

of Methanex-produced methanol.

U.S. Tax Reform

In 2017, we recorded a non-cash charge of $37 million to net income related to the revaluation of a net deferred tax asset as a result of tax reform in the United States (refer to the Financial Results – Income Taxes

section on page 18 for more information).

Argentina Gas Settlement

In

2016, we recorded a gain of $32.5 million ($21 million after-tax) after reaching a settlement with Petrobras to terminate Petrobras’ natural gas delivery obligations pursuant to a long-term

natural gas supply agreement in Chile. The Company received the settlement amount in 2016.

2017 Methanex Corporation Annual

Report 17

Finance Costs

Finance costs

are primarily comprised of interest on borrowings and finance lease obligations and were $95 million for the year ended December 31, 2017 compared to $90 million for the year ended December 31, 2016. The increase in finance costs

for the year ended December 31, 2017 compared to the same period in 2016 is primarily due to interest incurred relating to new ocean going vessels treated as finance leases put in use part way through 2016.

Finance Income and Other Expenses

Finance income and other expenses was a gain

of $13 million for the year ended December 31, 2017 compared to a gain of $4 million for the year ended December 31, 2016. The change in finance income and other expenses in 2017 compared with 2016 is primarily related to the

impact of changes in foreign exchange rates.

Income Taxes

A summary of

our income taxes for 2017 compared with 2016 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ Millions, except where noted) |

|

2017 |

|

|

2016 |

|

| |

|

Net Income |

|

|

Adjusted Net

Income |

|

|

Net Loss |

|

|

Adjusted Net

Loss |

|

| Amount before income tax |

|

$ |

471 |

|

|

$ |

524 |

|

|

$ |

(37 |

) |

|

$ |

(26 |

) |

| U.S. tax reform charge |

|

|

(37 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Income tax recovery (expense) |

|

|

(59 |

) |

|

|

(115 |

) |

|

|

9 |

|

|

|

11 |

|

| Amount after income tax |

|

$ |

375 |

|

|

$ |

409 |

|

|

$ |

(28 |

) |

|

$ |

(15 |

) |

| Effective tax rate |

|

|

20 |

% |

|

|

22 |

% |

|

|

25 |

% |

|

|

44 |

% |

We earn the majority of our income in New Zealand, Trinidad, the United States, Egypt, Canada and Chile. In Trinidad and Chile, the

statutory tax rate is 35%. The statutory rates in Canada and New Zealand are 27% and 28%, respectively. The United States statutory tax rate applicable to Methanex was 36% in 2017 and is 23% starting in 2018 and the Egypt statutory tax rate is

22.5%. As the Atlas entity is accounted for using the equity method, any income taxes related to Atlas are included in earnings of associate and therefore excluded from total income taxes but included in the calculation of Adjusted net income.

In December 2017, the United States passed the Tax Cuts and Jobs Act of 2017 (“U.S. tax reform” or “the Act”) which reduced the US federal corporate

tax rate from 35% to 21% effective from January 1, 2018. The Act includes a number of other provisions related to corporate taxation that will impact Methanex. The decrease in the corporate tax rate and these other provisions will impact taxes

payable on our income earned in the United States going forward. Up to December 31, 2017, Methanex had claimed certain interest deductions in the United States on debt instruments. There are provisions in the Act that going forward will reduce

the value of these interest deductions. The impact of the passing of the U.S. tax reform recorded in the fourth quarter of 2017 is a non-cash tax charge recorded to net income of $37 million and to other

comprehensive income of $9 million associated with the revaluation of net deferred tax assets. These charges have resulted in a total decrease of $46 million to net deferred tax assets and reflect our initial estimate and may be refined in

the future as additional guidance emerges.

The effective tax rate related to Adjusted net income was 22% for the year ended December 31, 2017 compared with 44%

on an Adjusted net loss for the year ended December 31, 2016. Adjusted net income (loss) represents the amount that is attributable to Methanex shareholders and excludes the

mark-to-market impact of share-based compensation and the impact of certain items associated with specific identified events. The effective tax rate differs from period

to period depending on the source of earnings and the impact of foreign exchange fluctuations against the United States dollar on our tax balances. In periods with low income levels, the distribution of income and loss between jurisdictions can

result in income tax rates that are not indicative of the longer term corporate tax rate. In addition, the effective tax rate is impacted by changes in tax legislation in the jurisdictions in which we operate.

For additional information regarding income taxes, refer to note 15 of our 2017 consolidated financial statements.

18 2017 Methanex Corporation Annual Report

LIQUIDITY AND CAPITAL RESOURCES

A summary of our consolidated statements of cash flows is as follows:

|

|

|

|

|

|

|

|

|

| ($ Millions) |

|

2017 |

|

|

2016 |

|

| Cash flows from / (used in) operating activities: |

|

|

|

|

|

|

|

|

| Cash flows from operating activities before changes in non-cash

working capital |

|

$ |

837 |

|

|

$ |

314 |

|

| Changes in non-cash working

capital |

|

|

(49 |

) |

|

|

(87 |

) |

|

|

|

788 |

|

|

|

227 |

|

| Cash flows from / (used in) financing activities: |

|

|

|

|

|

|

|

|

| Dividend payments |

|

|

(101 |

) |

|

|

(99 |

) |

| Interest paid |

|

|

(86 |

) |

|

|

(83 |

) |

| Repayment of long-term debt |

|

|

(57 |

) |

|

|

(48 |

) |

| Payments for the repurchase of shares |

|

|

(286 |

) |

|

|

– |

|

| Net proceeds on issue of long-term debt |

|

|

– |

|

|

|

66 |

|

| Other |

|

|

(1 |

) |

|

|

(6 |

) |

|

|

|

(531 |

) |

|

|

(170 |

) |

| Cash flows from / (used in) investing activities: |

|

|

|

|

|

|

|

|

| Property, plant and equipment |

|

|

(103 |

) |

|

|

(100 |

) |

| Changes in non-cash working

capital relating to investing activities |

|

|

(3 |

) |

|

|

12 |

|

| |

|

|

(106 |

) |

|

|

(88 |

) |

| Increase (decrease) in cash and cash equivalents |

|

|

151 |

|

|

|

(31 |

) |

| Cash and cash equivalents, end of year |

|

$ |

375 |

|

|

$ |

224 |

|

Cash Flow Highlights

Cash Flows from Operating Activities

Cash flows

from operating activities for the year ended December 31, 2017 were $788 million compared with $227 million for the year ended December 31, 2016. The increase in cash flows from operating activities is primarily due to higher net

income resulting from a higher realized methanol price. The following table provides a summary of these items for 2017 and 2016:

|

|

|

|

|

|

|

|

|

| ($ Millions) |

|

2017 |

|

|

2016 |

|

| Net income (loss) |

|

$ |

375 |

|

|

$ |

(28 |

) |

| Deduct earnings of associate |

|

|

(76 |

) |

|

|

(20 |

) |

| Add dividends received from associate |

|

|

85 |

|

|

|

47 |

|

| Add (deduct) non-cash items: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

232 |

|

|

|

228 |

|

| Income tax expense (recovery) |

|

|

96 |

|

|

|

(9 |

) |

| Share-based compensation expense |

|

|

79 |

|

|

|

33 |

|

| Finance costs |

|

|

95 |

|

|

|

90 |

|

| Other |

|

|

(49 |

) |

|

|

(27 |

) |

| Cash flows from operating activities before changes in non-cash

working capital |

|

|

837 |

|

|

|

314 |

|

| Changes in non-cash working capital: |

|

|

|

|

|

|

|

|

| Trade and other receivables |

|

|

(49 |

) |

|

|

(14 |

) |

| Inventories |

|

|

(20 |

) |

|

|

(28 |

) |

| Prepaid expenses |

|

|

(6 |

) |

|

|

(1 |

) |

| Accounts payable and accrued liabilities, including long-term

payables |

|

|

26 |

|

|

|

(44 |

) |

| |

|

|

(49 |

) |

|

|

(87 |

) |

| Cash flows from operating activities |

|

$ |

788 |

|

|

$ |

227 |

|

For a discussion of the changes in net income (loss), depreciation and amortization, share-based compensation recovery and finance costs,

refer to the Financial Results section on page 13.

2017 Methanex Corporation Annual

Report 19

Changes in non-cash working capital decreased cash flows from operating

activities by $49 million for the year ended December 31, 2017, compared with a decrease of $87 million for the year ended December 31, 2016. Trade and other receivables increased in 2017 and this decreased cash flows from

operating activities by $49 million, primarily due to the impact of trade receivables related to higher sales in 2017 compared to 2016. Inventories increased primarily due to the impact of higher methanol prices which decreased cash flows from

operating activities by $20 million.

Cash Flows from Financing Activities

During 2017, we increased our regular quarterly dividend to $0.30 per common share from $0.275 per common share. Total dividend payments in 2017 were $101 million

compared with $99 million in 2016 and total interest payments in 2017 were $86 million compared with $83 million in 2016. In October 2017, we completed a 10% normal course issuer bid initiated in March 2017, repurchasing the maximum

6,152,358 common shares for approximately $286 million. In 2017, we repaid $57 million of other limited recourse debt compared to $48 million of other limited recourse debt repayments in 2016.

Cash Flows from Investing Activities

During

2017, we incurred capital expenditures relating to our consolidated operations of $103 million primarily related to sustaining projects in New Zealand, Geismar, Egypt and Trinidad and project work for the restart of our Chile IV plant. The

restart of the Chile IV plant is targeted for the third quarter of 2018 and the project is budgeted for $55 million.

Liquidity and Capitalization

Our objectives in managing liquidity and capital are to provide financial capacity and flexibility to meet our strategic objectives, to provide an adequate return to

shareholders commensurate with the level of risk and to return excess cash through a combination of dividends and share repurchases.

The following table provides

information on our liquidity and capitalization position as at December 31, 2017 and December 31, 2016:

|

|

|

|

|

|

|

|

|

| ($ Millions, except where noted) |

|

2017 |

|

|

2016 |

|

| Liquidity: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

375 |

|

|

$ |

224 |

|

| Undrawn credit facilities |

|

|

300 |

|

|

|

300 |

|

| Total liquidity |

|

$ |

675 |

|

|

$ |

524 |

|

| Capitalization: |

|

|

|

|

|

|

|

|

| Unsecured notes |

|

$ |

1,188 |

|

|

$ |

1,186 |

|

| Limited recourse debt facilities, including current

portion |

|

|

314 |

|

|

|

370 |

|

| Total debt |

|

|

1,502 |

|

|

|

1,556 |

|

| Non-controlling interests |

|

|

244 |

|

|

|

209 |

|

| Shareholders’ equity |

|

|

1,501 |

|

|

|

1,597 |

|

| Total capitalization |

|

$ |

3,247 |

|

|

$ |

3,362 |

|

| Total debt to capitalization1 |

|

|

46 |

% |

|

|

46 |

% |

| Net debt to capitalization2 |

|

|

39 |

% |

|

|

42 |

% |

| 1 |

Defined as total debt (including 100% of Egypt limited recourse debt facilities) divided by total capitalization. |

| 2 |

Defined as total debt (including 100% of Egypt limited recourse debt facilities) less cash and cash equivalents divided by total capitalization less cash and cash equivalents. |

We manage our liquidity and capital structure and make adjustments to it in light of changes to economic conditions, the underlying risks inherent in our operations and

the capital requirements to maintain and grow our business. The strategies we have employed include the issue or repayment of general corporate debt, the issue of project debt, the payment of dividends and the repurchase of shares.

We are not subject to any statutory capital requirements and have no commitments to sell or otherwise issue common shares except pursuant to outstanding employee stock

options and TSARs.

20 2017 Methanex Corporation Annual Report

We operate in a highly competitive commodity industry and believe that it is appropriate to maintain a strong balance

sheet and retain financial flexibility. As at December 31, 2017, we had a cash balance of $375 million, access to a $300 million undrawn credit facility and no significant debt maturities until 2019 other than normal course

obligations for principal repayments related to our limited recourse debt facilities. We invest our cash only in highly rated instruments that have maturities of three months or less to ensure preservation of capital and appropriate liquidity.

We have covenant and default provisions under our long-term debt obligations and we also have certain covenants that could restrict access to the credit facility. The

covenants governing the unsecured notes, which are specified in an indenture, apply to the Company and its subsidiaries, excluding the Egypt entity, and include restrictions on liens, sale and lease-back transactions, a merger or consolidation with

another corporation or sale of all or substantially all of our assets. The indenture also contains customary default provisions. The significant covenants and default provisions under the credit facility include:

| |

a) |

the obligation to maintain an EBITDA to interest coverage ratio of greater than 2:1 calculated on a four-quarter trailing basis and a debt to capitalization ratio of less than or equal to 55%, both ratios calculated in

accordance with definitions in the credit agreement that include adjustments related to the limited recourse subsidiaries; |

| |

b) |

a default if payment is accelerated by a creditor on any indebtedness of $50 million or more of the Company and its subsidiaries, except for the limited recourse subsidiaries; and |

| |

c) |

a default if a default occurs that permits a creditor to demand repayment on any other indebtedness of $50 million or more of the Company and its subsidiaries, except for the limited recourse subsidiaries.

|

The Egypt limited recourse debt facilities have covenants and default provisions that apply only to the Egypt entity, including restrictions on the

incurrence of additional indebtedness and requirement to fulfill certain conditions before the payment of cash or other shareholder distributions. Certain conditions had not been met, resulting in a restriction on shareholder distributions from the

Egypt entity to December 31, 2017. Under amended terms reached in 2017, shareholder distributions are permitted if the average gas deliveries over the prior 12 months are greater than 70% of gas requirements. The first $100 million of

shareholder distributions must be matched with $100 million of principal repayments on the Egypt limited recourse debt facilities. As at December 31, 2017, the Egypt cash balance on a 100% ownership basis was $131 million. The Egypt

entity continues to be able to fully utilize its funds for operating, capital and financing needs, including the repayment of the Egypt limited recourse debt facilities and over the last 12 months has received all gas requirements.

As at December 31, 2017, management believes the Company was in compliance with all significant terms and default provisions related to its long-term debt

obligations.

In 2017, we reached agreement with Empresa Nacional del Petróleo (“ENAP”) for additional gas supply in Chile and remain optimistic that

our underutilized 1.7 million tonne Chile facilities represent a very low capital cost growth opportunity for Methanex due to the significant progress in developing natural gas reserves in the area. Project work has commenced for the restart of

our Chile IV plant and remains targeted for the third quarter of 2018 and is budgeted for $55 million. If additional gas supply can be secured in Chile, the Chile IV project will be followed by the refurbishment of our Chile I plant in order to

restore Chile to a two-plant operation at a very low capital cost. Our planned capital maintenance expenditure program directed towards maintenance, turnarounds and catalyst changes for existing operations is

currently estimated to be in the range of $90 to $135 million to the end of 2018, dependent on the timing of turnarounds.

In January 2018, we announced a 10%

increase in the quarterly dividend to $0.33 per share from $0.30 per share for the dividend payable March 31, 2018. We also announced in March 2018 that our Board of Directors has approved a new 10% share repurchase program, through a normal

course issuer bid.

We believe we are well positioned to meet our financial commitments, pursue our near-term growth opportunities in Chile and deliver on our

commitment to return excess cash to shareholders through dividends and share repurchases.

2017 Methanex Corporation Annual

Report 21

Summary of Contractual Obligations and Commercial Commitments

A summary of the amount and estimated timing of cash flows related to our contractual obligations and minimum commercial commitments as at December 31, 2017 is as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ Millions) |

|

2018 |

|

|

2019-2020 |

|

|

2021-2022 |

|

|

After 2022 |

|

|

|

|

|

Total |

|

| Long-term debt repayments |

|

$ |

57 |

|

|

$ |

472 |

|

|

$ |

391 |

|

|

$ |

600 |

|

|

|

|

|

|

$ |

1,520 |

|

| Long-term debt interest obligations |

|

|