Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2013

Or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to

Commission File No. 001-34037

SUPERIOR ENERGY SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 75-2379388 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1001 Louisiana Street, Suite 2900 Houston, TX | 77002 | |

| Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (713) 654-2200

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, $.001 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated | ¨ (Do not check this if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2013, the aggregate market value of the registrant’s voting stock held by non-affiliates of the registrant (based on a closing price of such shares on the New York Stock Exchange on June 28, 2013 was $4.07 billion). As of February 17, 2014, there were 158,613,126 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information called for by Items 10, 11, 12, 13 and 14 of Part III is incorporated by reference from the registrant’s definitive proxy statement to be filed pursuant to Regulation 14A.

Table of Contents

SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES

Annual Report on Form 10-K for

the Fiscal Year Ended December 31, 2013

2

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, as well as other filings made by us with the Securities and Exchange Commission (SEC), and our releases to the public, contain forward-looking statements within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Generally, the words “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements involve risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K regarding our financial position and liquidity, strategic alternatives, future capital needs, business strategies and other plans and objectives of our management for future operations and activities are forward-looking statements. These statements are based on certain assumptions and analyses made by our management in light of its experience and its perception of historical trends, current market and industry conditions, expected future developments and other factors it believes are appropriate under the circumstances. Such forward-looking statements are subject to uncertainties that could cause our actual results to differ materially from such statements. Such uncertainties include, but are not limited to: risks inherent in acquiring businesses, the effect of regulatory programs and environmental matters on our performance, including the risk that future changes in the regulation of hydraulic fracturing could reduce or eliminate demand for our pressure pumping services; risks associated with business growth outpacing the capabilities of our infrastructure and workforce; risks associated with the uncertainty of macroeconomic and business conditions worldwide; the cyclical nature and volatility of the oil and gas industry, including the level of exploration, production and development activity and the volatility of oil and gas prices; changes in competitive factors affecting our operations; political, economic and other risks and uncertainties associated with international operations; the impact that unfavorable or unusual weather conditions could have on our operations; the potential shortage of skilled workers; our dependence on certain customers; the risks inherent in long-term fixed-price contracts; and, operating hazards, including the significant possibility of accidents resulting in personal injury or death, property damage or environmental damage. These risks and other uncertainties related to our business are described in detail below in Part I, Item 1A of this Annual Report on Form 10-K. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Investors are cautioned that many of the assumptions on which our forward-looking statements are based are likely to change after our forward-looking statements are made, including for example the market prices of oil and natural gas and regulations affecting oil and gas operations, which we cannot control or anticipate. Further, we may make changes to our business plans that could or will affect our results. We undertake no obligation to update any of our forward-looking statements and we do not intend to update our forward-looking statements more frequently than quarterly, notwithstanding any changes in our assumptions, changes in our business plans, our actual experience, or other changes. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

3

Table of Contents

General

We believe we are a leading provider of specialized oilfield services and equipment. On February 7, 2012, we acquired Complete Production Services, Inc. (Complete), which significantly added to our geographic footprint in the U.S. land market area. We now offer a wider variety of products and services throughout the life cycle of an oil and gas well. The acquisition of Complete greatly expanded our ability to offer more products and services related to the completion of a well prior to full production commencing, as well as enhanced our full suite of intervention services used to carry out wellbore maintenance operations during a well’s producing phase.

We serve energy industry customers who focus on developing and producing oil and gas worldwide. Our operations are managed and organized by both business units and geomarkets, which offer products and services within the various phases of a well’s economic life cycle. We report our operating results in four segments: (1) Drilling Products and Services; (2) Onshore Completion and Workover Services; (3) Production Services; and (4) Subsea and Technical Solutions. Given our history of growth and long-term strategy of expanding geographically, we provide supplemental segment revenue information in three geographic areas: U.S. land, Gulf of Mexico and international.

For information about our operating segments and financial information by geographic area refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Part II, Item 7 of this Annual Report on Form 10-K and note 12 to our consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Complete Acquisition

Complete provided specialized completion and production services and products to oil and gas companies. At the time of the acquisition, Complete’s business was comprised of two segments: Completion and Production Services and Drilling Services. Approximately 96% of Complete’s 2011 revenue was derived from its Completion and Production Services segment, which provided intervention services (including completion, coiled tubing, workover and maintenance services), downhole and wellsite services (including wireline, production optimization, production testing and rental, fishing and pressure testing services) and fluid handling services. The majority of Complete’s operations were located in U.S. land basins, particularly in major unconventional basins in the Rocky Mountain region, Texas, Oklahoma, Louisiana, Arkansas and Pennsylvania. Complete’s products and services are reported within our Onshore Completion and Workover Services and Production Services segments.

The February 2012 acquisition of Complete resulted in several important changes to our operations, including the following:

| • | significantly increasing our presence in the U.S. land market, thereby reducing the percentage of revenue from our international and Gulf of Mexico operations; |

| • | expanding our fleet of coiled tubing units, which we believe makes us a leading provider of coiled tubing services in the U.S.; |

| • | expanding our existing wireline, rental and fishing products and services; and |

| • | expanding our operations into new product and service lines, including: |

| • | hydraulic fracturing, stimulation and cementing services through Complete’s fleet of pressure pumping equipment; |

4

Table of Contents

| • | fluid handling services, including fluid procurement, transportation, treatment, heating, pumping and disposal services, through Complete’s fleet of specialized trucks and frac tanks, fluid disposal facilities and other fluid management assets; and |

| • | well servicing through Complete’s fleet of well service rigs and swabbing units. |

Products and Services

We offer a wide variety of conventional products and services generally categorized by their typical use during the economic life of a well. A description of the products and services offered by our four segments is as follows:

| • | Drilling Products and Services – Includes downhole drilling tools and surface rentals. |

| • | Downhole drilling tools – Includes rentals of tubulars, such as primary drill pipe strings, tubing landing strings, completion tubulars and associated accessories, and manufacturing and rentals of bottom hole tools, including stabilizers, non-magnetic drill collars, and hole openers. |

| • | Surface rentals – Includes rentals of temporary onshore and offshore accommodation modules and accessories. |

| • | Onshore Completion and Workover Services – Includes pressure pumping, fluid handling and workover services. |

| • | Pressure pumping – Includes hydraulic fracturing and high pressure pumping services used to complete and stimulate production in new oil and gas wells. |

| • | Fluid management – Includes services used to obtain, move, store and dispose of fluids that are involved in the exploration, development and production of oil and gas reservoirs, including specialized trucks, fracturing tanks and other assets that transport, heat, pump and dispose of fluids. |

| • | Workover services – Includes a variety of well completion, workover and maintenance services including installations, completions, sidetracking of wells and support for perforating operations. |

| • | Production Services – Includes intervention services and specialized pressure-control tools used for pressure control and intervention operations. |

| • | Intervention services – Includes services to enhance, maintain and extend oil and gas production during the life of the well, including coiled tubing, cased hole and mechanical wireline, hydraulic workover and snubbing, production testing and optimization, and remedial pumping services (cementing and stimulation services). |

| • | Specialized pressure-control tools – Surface and downhole products used to manage and control pressure throughout the life of an oil and gas well, including blowout preventers, choke manifolds, fracturing flow back trees, and downhole valves for drilling, workover, and well intervention operations. |

| • | Subsea and Technical Solutions – Includes products and services that generally address customer-specific needs with their applications, which typically require specialized engineering, manufacturing or project planning. Most operations requiring our innovative and technical solutions are generally in offshore environments during the completion, production and decommissioning phase of an oil and gas well. These products and services include pressure control services, completion tools and services, subsea construction, end-of-life services, and marine technical services. This segment also includes oil and gas revenue related to our ownership in the Bullwinkle platform and related assets. |

| • | Pressure control services – Resolves well control and pressure control problems through firefighting, engineering and well control training. |

5

Table of Contents

| • | Completion tools and services – Provides products and services used during the completion phase of an offshore well to control sand and maximize oil and gas production, including sand control systems, well screens and filters, and surface-controlled sub surface safety valves. |

| • | Subsea construction – Includes subsea well intervention, inspection, repair and maintenance services utilizing subsea operating vessels, diving systems, remotely operated vehicles and engineering services. |

| • | End-of-life services – Provides offshore well and platform decommissioning, including plugging and abandoning wells at the end of their economic life and dismantling and removing associated infrastructure. |

| • | Marine technical services – Provides technical solutions for oil and gas offshore and marine applications including subsea and offshore Marine engineering and design, harsh environment engineering, well containment systems and project management services. |

Customers

Our customers are the major and independent oil and gas companies that are active in the geographic areas in which we operate. EOG Resources, Inc. (EOG Resources) accounted for approximately 10% and 13% of our revenues in 2013 and 2012, respectively, primarily within the Onshore Completion and Workover segment. Our inability to continue to perform services for EOG Resources or a number of our other large existing customers, if not offset by sales to new or other existing customers, could have a material adverse effect on our business and operations.

Competition

We provide products and services worldwide in highly competitive markets. Our revenues and earnings can be affected by several factors, including changes in competition, fluctuations in drilling activity, perceptions of future prices of oil and gas, government regulation, disruptions caused by weather and general economic conditions. We believe that the principal competitive factors are price, performance, product and service quality, safety, response time and breadth of products.

We believe our primary competitors include Weatherford International, Ltd., Baker Hughes Incorporated, Halliburton Company and Schlumberger N.V. We also compete with various other regional and local providers within certain geographic markets for products and services.

Potential Liabilities and Insurance

Our operations involve a high degree of operational risk and expose us to significant liabilities. An accident involving our services or equipment, or the failure of a product, could result in personal injury, loss of life, and damage to property, equipment or the environment. Litigation arising from a catastrophic occurrence, such as fire, explosion, well blowout or vessel loss, may result in substantial claims for damages.

We generally attempt to negotiate the terms of our customer contracts consistent with common industry practice whereby we attempt to take responsibility for our own personnel and property and intend for our customers, such as the well operators, to take responsibility for their own personnel, property and all liabilities related to the well and subsurface operations, in all cases regardless of either party’s negligence.

We maintain a liability insurance program that covers against certain operating hazards, including product liability, property damage and personal injury claims, as well as certain limited environmental pollution claims for damage to a third party or its property arising out of contact with pollution for which we are liable, but well control costs are not covered by this program. These policies include primary and excess umbrella liability policies with limits of $250 million per occurrence, including sudden and accidental pollution incidents. All of the insurance policies purchased by us contain specific terms, conditions, limitations and exclusions and are

6

Table of Contents

subject to either deductibles or self-insured retention amounts for which we are responsible. There can be no assurance that the nature and amount of insurance we maintain will be sufficient to fully protect us against all liabilities related to our business.

Government Regulation

Our business is significantly affected by laws and other regulations. These laws and regulations relate to, among other things:

| • | worker safety standards; |

| • | the protection of the environment; |

| • | the handling and transportation of hazardous materials; and |

| • | the mobilization of our equipment to work sites. |

Numerous permits are required for the conduct of our business and operation of our various facilities and equipment, including our underground injection wells, marine vessels, trucks and other heavy equipment. These permits can be revoked, modified or renewed by issuing authorities based on factors both within and outside our control.

We cannot predict the level of enforcement of existing laws and regulations or how such laws and regulations may be interpreted by enforcement agencies or court rulings in the future. We also cannot predict whether additional laws and regulations will be adopted, including changes in regulatory oversight, increase of federal, state or local taxes, increase of inspection costs, or the effect such changes may have on us, our businesses or our financial condition.

Environmental Matters

Our operations, and those of our customers, are subject to extensive laws, regulations and treaties relating to air and water quality, generation, storage and handling of hazardous materials, and emission and discharge of materials into the environment. We believe we are in substantial compliance with all regulations affecting our business. Historically, our expenditures in furtherance of our compliance with these laws, regulations and treaties have not been material, and we do not expect the cost of compliance to be material for 2014.

Seasonality

Seasonal weather and severe weather conditions can temporarily impair our operations and reduce demand for our products and services. Examples of seasonal events that negatively affect our operations include high seas associated with cold fronts during the winter months and hurricanes during the summer months in the Gulf of Mexico, and severe cold during winter months in the U.S. land market area.

Employees

As of December 31, 2013, we had approximately 14,500 employees. Approximately 7% of our employees are subject to union contracts, all of which are in international locations. We believe that our relationship with our employees is good.

Facilities

Our principal executive offices are located at 1001 Louisiana Street, Suite 2900, Houston, Texas, 77002. We own or lease a large number of facilities in the various areas in which we operate throughout the world.

Intellectual Property

We seek patent and trademark protections throughout the world for our technology when we deem it prudent, and we aggressively pursue protection of these rights. We believe our patents and trademarks are adequate for the conduct of our business, and that no single patent or trademark is critical to our business. In addition, we rely to a great extent on the technical expertise and know-how of our personnel to maintain our competitive position.

7

Table of Contents

Other Information

We have our principal executive offices at 1001 Louisiana Street, Suite 2900, Houston, Texas 77002. Our telephone number is (713) 654-2200. We also have a website at http://www.superiorenergy.com. Copies of the annual, quarterly and current reports we file with the SEC, and any amendments to those reports, are available on our website free of charge soon after such reports are filed with or furnished to the SEC. The information posted on our website is not incorporated into this Annual Report on Form 10-K. Alternatively, you may access these reports at the SEC’s website at http://www.sec.gov/.

We have a Code of Business Ethics and Conduct, which applies to all of our directors, officers and employees. The Code of Business Ethics and Conduct is publicly available on our website at http://www.superiorenergy.com. Any waivers granted to directors or executive officers and any material amendment to our Code of Business Ethics and Conduct will be posted promptly on our website and/or disclosed in a current report on Form 8-K.

8

Table of Contents

Executive Officers of Registrant

David D. Dunlap, age 52, has served as our Chief Executive Officer since April 2010 and our President since February 2011. Prior to joining us, he was employed by BJ Services Company as its Executive Vice President and Chief Operating Officer since 2007. Mr. Dunlap joined BJ Services in 1984 and held numerous positions during his tenure, including President of the International Division, Vice President for the Coastal Division of North America and U.S. Sales and Marketing Manager.

Robert S. Taylor, age 59, has served as our Chief Financial Officer since January 1996, as one of our Executive Vice Presidents since September 2004, and as our Treasurer since July 1999. He also served as one of our Vice Presidents from July 1999 to September 2004.

A. Patrick Bernard, age 56, has served as a Senior Executive Vice President since July 2006 and as one of our Executive Vice Presidents since September 2004. He served as one of our Vice Presidents from June 2003 until September 2004. From July 1999 until June 2003, Mr. Bernard served as the Chief Financial Officer of a wholly-owned subsidiary and its predecessor company.

Brian K. Moore, age 57, was appointed Senior Executive Vice President of North America Services on February 7, 2012. From March 2007 until the effectiveness of the Complete acquisition in 2012, Mr. Moore was President and Chief Operating Officer of Complete. Mr. Moore joined a predecessor company of Complete as President and Chief Executive Officer in April 2004.

Westervelt T. Ballard, Jr., age 42, was appointed Executive Vice President of International Services on February 7, 2012. Mr. Ballard previously served as Vice President of Corporate Development since joining us in June 2007. Prior to joining us, Mr. Ballard spent six years working in private equity.

L. Guy Cook, III, age 45, has served as one of our Executive Vice Presidents since September 2004. He has also served as an Executive Vice President of a wholly-owned subsidiary, and previously as a Vice President of a wholly-owned subsidiary and its predecessor company since August 2000.

William B. Masters, age 56, has served as our General Counsel and one of our Executive Vice Presidents since March 2008. He was previously a partner in the law firm Jones Walker LLP for more than 20 years.

Gregory A. Rosenstein, age 46, was appointed Executive Vice President of Corporate Development on February 7, 2012. He also is our Corporate Secretary and our main point of contact for investor relations matters, having previously served as Vice President of Investor Relations. He has been with us since March 2000.

Danny R. Young, age 58, has served as one of our Executive Vice Presidents since September 2004. Mr. Young has also served as an Executive Vice President of a wholly-owned subsidiary. From January 2002 to May 2005, he served as Vice President of Health, Safety and Environment and Corporate Services of a wholly-owned subsidiary.

9

Table of Contents

The following information should be read in conjunction with management’s discussion and analysis of financial condition and results of operations contained in Part II, Item 7 and the consolidated financial statements and related notes contained in Part II, Item 8 of this Annual Report on Form 10-K, as well as, in conjunction with the matters contained under the caption “Forward-Looking Statements” at the beginning of this Annual Report on Form 10-K.

The risks described below could materially and adversely affect our business, results of operations, financial condition and liquidity, as well as adversely affect the value of an investment in our securities. These risks are not the only risks that we face. Our business operations could also be affected by additional factors that apply to all companies operating in the U.S. and globally, as well as other risks that are not presently known to us or that we currently consider to be immaterial to our operations. These risks include:

Our business depends on conditions in the oil and gas industry, especially oil and gas prices and capital expenditures by oil and natural gas companies.

Our business depends on the level of oil and gas exploration, development and production activity by oil and gas companies worldwide. The level of exploration, development and production activity is directly affected by trends in oil and gas prices, which historically have been volatile. Oil and gas prices are subject to large fluctuations in response to relatively minor changes in supply and demand, market uncertainty and a variety of other factors beyond our control. Lower oil and natural gas prices generally lead to decreased spending by our customers. While higher oil and natural gas prices generally lead to increased spending by our customers, sustained high energy prices can be an impediment to economic growth, and can therefore negatively impact spending by our customers. Our customers also take into account the volatility of energy prices and other risk factors by requiring higher returns for individual projects if there is higher perceived risk. Any of these factors could affect the demand for oil and natural gas and could have a material effect on our results of operations.

The availability of quality drilling prospects, exploration success, relative production costs, the stage of reservoir development and political and regulatory environments are also expected to affect the demand for our services. Worldwide military, political and economic events have in the past contributed to oil and gas price volatility and are likely to do so in the future. Any prolonged reduction of oil and gas prices, as well as anticipated declines, could also result in lower levels of exploration, development and production activity. The demand for our services may be affected by numerous factors, including the following:

| • | the cost of exploring for, producing and delivering oil and natural gas; |

| • | demand for energy, which is affected by worldwide economic activity and population growth; |

| • | the ability of the Organization of Petroleum Exporting Countries (OPEC) to set and maintain production levels for oil; |

| • | the level of excess production capacity; |

| • | the discovery rate of new oil and natural gas reserves; |

| • | domestic and global political and economic uncertainty, socio-political unrest and instability or hostilities; |

| • | weather conditions and changes in weather patterns, including summer and winter temperatures that impact demand; |

| • | the availability, proximity and capacity of transportation facilities; |

| • | the level and effect of trading in commodity future markets, including trading by commodity price speculators and others; |

10

Table of Contents

| • | the nature and extent of governmental regulation (including environmental regulation) and taxation; |

| • | demand for and availability of alternative, competing sources of energy; and |

| • | technological advances affecting energy exploration, production and consumption. |

There are operating hazards inherent in the oil and natural gas industry that could expose us to substantial liabilities.

Our operations are subject to hazards inherent in the oil and gas industry that may lead to property damage, personal injury, death or the discharge of hazardous materials into the environment. Many of these events are outside of our control. Typically, we provide products and services at a well site where our personnel and equipment are located together with personnel and equipment of our customer and other service providers. From time to time, personnel are injured or equipment or property is damaged or destroyed as a result of accidents, failed equipment, faulty products or services, failure of safety measures, uncontained formation pressures or other dangers inherent in oil and gas exploration, development and production. Any of these events can be the result of human error. All of these risks expose us to a wide range of significant health, safety and environmental risks and potentially substantial litigation claims for damages. With increasing frequency, our products and services are deployed in more challenging exploration, development and production environments. From time to time, customers and third parties may seek to hold us accountable for damages and costs incurred as a result of an accident, including pollution. Our insurance policies are subject to exclusions, limitations and other conditions, and may not protect us against liability for some types of events, including events involving a well blowout, or against losses from business interruption. Moreover, we may not be able to maintain insurance at levels of risk coverage or policy limits that we deem adequate or on terms that we deem commercially reasonable. Any damages caused by our services or products that are not covered by insurance, or are in excess of policy limits or subject to substantial deductibles or retentions, could adversely affect our financial condition, results of operations and cash flows.

We may not be fully indemnified against losses incurred due to catastrophic events for which we are not responsible.

As is customary in our industry, our contracts generally provide that we will indemnify and hold harmless our customers from any claims arising from personal injury or death of our employees, damage to or loss of our equipment, and pollution emanating from our equipment and services. Similarly, our customers generally agree to indemnify and hold us harmless from any claims arising from personal injury or death of their employees, damage to or loss of their equipment, and pollution caused from their equipment or the well reservoir (including uncontained oil flow from a reservoir). Our indemnification arrangements may not protect us in every case. For example, from time to time we may enter into contracts with less favorable indemnities or perform work without a contract that protects us. In addition, our indemnification rights may not fully protect us if the customer is insolvent or becomes bankrupt, does not maintain adequate insurance or otherwise does not possess sufficient resources to indemnify us. In addition, our indemnification rights may be held unenforceable in some jurisdictions.

Lower capital spending by our customers could affect demand and pricing for our services which could adversely affect our results of operations.

Our business is directly affected by changes in capital expenditures by our customers, and reductions in their capital spending could reduce demand for our services and products. The rate of economic growth in the U.S. and worldwide has not reached the levels experienced since before the 2008 economic downturn. Prolonged periods of little or no economic growth will likely decrease demand for oil and gas and increase pricing pressure for our services and products. In addition, if a significant number of our customers experience a prolonged business decline or disruptions, we may incur increased exposure to credit risk and bad debts.

11

Table of Contents

Increased regulation of or limiting or banning hydraulic fracturing could reduce or eliminate demand for our pressure pumping services.

Our hydraulic fracturing services are subject to a range of applicable federal, state and local laws. Our hydraulic fracturing services are designed and operated to minimize the risk, if any, of subsurface migration of hydraulic fracturing fluids and spillage or mishandling of hydraulic fracturing fluids. However, a proven case of subsurface migration of hydraulic fracturing fluids or a case of spillage or mishandling of hydraulic fracturing fluids during these activities could potentially subject us to civil and/or criminal liability and the possibility of substantial costs, including environmental remediation, depending on the circumstances of the underground migration, spillage, or mishandling, the nature and scope of the underground migration, spillage, or mishandling, and the applicable laws and regulations.

The practice of hydraulically fracturing formations to stimulate the production of natural gas and oil remains under increased scrutiny from federal and state governmental authorities. Various federal legislative and regulatory initiatives have been undertaken which could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. For example, the U.S. Department of Interior has issued proposed regulations that would apply to hydraulic fracturing wells subject to federal oil and gas leases that would impose requirements to disclose chemicals used in the fracturing process as well as certain prior approvals to conduct hydraulic fracturing. In addition, certain states have adopted laws and regulations requiring additional disclosure regarding chemicals used in the fracturing process, but with protections for proprietary information, and other states are evaluating the adoption of legislation or regulations governing hydraulic fracturing. Possible legislation or regulation could impose further disclosure obligations or other requirements, such as restrictions on the use of certain chemicals or prohibitions on hydraulic fracturing in certain areas, which could affect our operations. The adoption of any future federal, state or local laws or implementing regulations could make it more difficult to complete oil and gas wells, adversely affecting our hydraulic fracturing business.

Adverse and unusual weather conditions may affect our operations.

Our operations may be materially affected by severe weather conditions in areas where we operate. Severe weather, such as hurricanes, high winds and seas, blizzards and extreme temperatures may cause evacuation of personnel, curtailment of services and suspension of operations, inability to deliver materials to jobsites in accordance with contract schedules, loss of or damage to equipment and facilities and reduced productivity. In addition, variations from normal weather patterns can have a significant impact on demand for oil and gas, thereby reducing demand for our services and equipment.

Any capital financing that may be necessary may not be available at economic rates.

Turmoil in the credit and financial markets could adversely affect financial institutions, inhibit lending and limit our access to funding through borrowings under our credit facility or newly created facilities in the public or private market on terms we believe to be reasonable. If future financing is not available to us when required, as a result of limited access to the credit markets or otherwise, or is not available to us on acceptable terms, we may be unable take advantage of business opportunities or respond to competitive pressures.

Failure and/or cost to retain key employees and skilled workers could adversely affect our operations.

Our performance could be adversely affected if we are unable to retain certain key employees and skilled technical personnel. Our ability to continue to expand the scope of our services and products depends in part on our ability to increase the size of our skilled labor force. The loss of the services of one or more of our key employees or the inability to employ or retain skilled technical personnel could adversely affect our operating results. The demand for skilled personnel is high and the supply is limited. We have experienced increases in labor costs in recent years and may continue to do so in the future.

12

Table of Contents

Our international operations and revenue are affected by political, economic and other uncertainties worldwide.

In 2013, we conducted business in approximately 75 countries, and we intend to expand our international operations. Our international operations are subject to a number of risks inherent in any business operating in foreign countries, including, but not limited to, the following:

| • | political, social and economic instability; |

| • | potential expropriation, seizure or nationalization of assets; |

| • | inflation; |

| • | deprivation of contract rights; |

| • | increased operating costs; |

| • | inability to collect receivables; |

| • | civil unrest and protests, strikes, acts of terrorism, war or other armed conflict; |

| • | import-export quotas; |

| • | confiscatory taxation or other adverse tax policies; |

| • | currency exchange controls; |

| • | currency exchange rate fluctuations, devaluations and conversion restrictions; |

| • | restrictions on the repatriation of funds; and |

| • | other forms of government regulation which are subject to change and are beyond our control. |

These and the other risks outlined above could cause us to curtail or terminate operations, result in the loss of personnel or assets, disrupt financial and commercial markets and generate greater political and economic instability in some of the geographic areas in which we operate. International areas where we operate that have significant risk include the Middle East, Colombia, Indonesia, Kazakhstan, Nigeria and Mexico.

Control of oil and natural gas reserves by state-owned oil companies may impact the demand for our services.

In many countries around the world where we do business, all or a significant portion of the decision making regarding procuring our services and products is controlled by state-owned oil companies. State-owned oil companies may require their contractors to meet local content requirements or other local standards, such as joint ventures, that could be difficult or undesirable for the Company to meet. The failure to meet the local content requirements and other local standards may adversely impact the Company’s operations in those countries. In addition, our ability to work with state-owned oil companies is subject to our ability to negotiate and agree upon acceptable contract terms, and to enforce those terms. In addition, many state-owned oil companies may require integrated contracts or turnkey contracts that could require the Company to provide services outside its core business. Providing services on an integrated or turnkey basis generally requires the Company to assume additional risks.

Changes in tax laws or tax rates, adverse positions taken by taxing authorities and tax audits could impact our operating results.

We have operations in numerous foreign countries. As a result, we are subject to the jurisdiction of a significant number of taxing authorities. Changes in tax laws or tax rates, the resolution of tax assessments or audits by various tax authorities could impact our operating results. In addition, we may periodically restructure our legal entity organization. If taxing authorities were to disagree with our tax positions in connection with any such

13

Table of Contents

restructurings, our effective tax rate could be impacted. The final determination of our income tax liabilities involves the interpretation of local tax laws, tax treaties and related authorities in each taxing jurisdiction, as well as the significant use of estimates and assumptions regarding future operations and results and the timing of income and expenses. We may be audited and receive tax assessments from taxing authorities that may result in assessment of additional taxes that are ultimately resolved with the authorities or through the courts. We believe these assessments may occasionally be based on erroneous and even arbitrary interpretations of local tax law. Resolution of any tax matter involves uncertainties and there are no assurances that the outcomes will be favorable.

We are subject to environmental laws and regulations which could reduce our business opportunities and revenue, and increase our costs and liabilities.

Our business is significantly affected by a wide range of laws and regulations in the areas in which we operate, and increasingly stringent environmental laws and regulations governing air emissions, water discharges and waste management. Generally, environmental laws have in recent years become more stringent and have sought to impose greater liability on a larger number of potentially responsible parties.

We incur, and expect to continue to incur, capital and operating costs to comply with these laws and regulations. The technical requirements of these laws and regulations are becoming increasingly complex and expensive to implement. For instance, a variety of regulatory developments, proposals or requirements have been introduced in the domestic and international regions that are focused on restricting the emission of carbon dioxide, methane and other greenhouse gases, which could impose restrictions in greenhouse gas emissions. Also, the U.S. Environmental Protection Agency (EPA) has undertaken efforts to collect information regarding greenhouse emissions, as well as adopting and implementing certain regulations to restrict emissions. The EPA has adopted rules requiring the reporting of certain onshore and offshore oil and gas production facilities and by certain large emissions sources. It is not currently feasible to predict whether, or which of, the current greenhouse gas emission proposals will be adopted, or what other actions may be taken, including subsequent EPA activity. The potential passage of climate change regulation may curtail production and demand for fossil fuels such as oil and gas in areas of the world where our customers operate and thus adversely affect future demand for our products and services, which may in turn adversely affect future results of operations.

Further, environmental laws may provide for “strict liability” for remediation costs, damages to natural resources or threats to public health and safety. Strict liability can render a party liable for damages without regard to negligence or fault on the part of the party. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances. For example, our well service and fluids businesses routinely involve the handling of significant amounts of waste materials, some of which are classified as hazardous substances. We also store, transport and use radioactive and explosive materials in certain of our operations. In addition, many of our current and former facilities are, or have been, used for industrial purposes. Accordingly, we could become subject to material liabilities relating to the containment and disposal of hazardous substances, oilfield waste and other waste materials, the use of radioactive materials, the use of underground injection wells, and to claims alleging personal injury or property damage as the result of exposures to, or releases of, hazardous substances. In addition, stricter enforcement of existing laws and regulations, new laws and regulations, the discovery of previously unknown contamination or the imposition of new or increased requirements could require us to incur costs or become the basis of new or increased liabilities that could reduce our earnings and our cash available for operations. We believe we are currently in substantial compliance with environmental laws and regulations.

We are affected by global economic factors and political events.

Our financial results depend on demand for our services and products in the U.S. and the international markets in which we operate. Declining economic conditions, or negative perceptions about economic conditions, could result in a substantial decrease in demand for our services and products. World political events could also result

14

Table of Contents

in further U.S. military actions, terrorist attacks and related unrest. Military action by the U. S. or other nations could escalate and further acts of terrorism may occur in the U.S. or elsewhere. Such acts of terrorism could lead to, among other things, a loss of our investment in the country, impairment of the safety of our employees and impairment of our ability to conduct our operations. Such developments have caused instability in the world’s financial and insurance markets in the past. In addition, these developments could lead to increased volatility in prices for oil and gas and could affect the markets for our products and services. Insurance premiums could also increase and coverages may be unavailable.

Uncertain economic conditions and instability make it particularly difficult for us to forecast demand trends. The timing and extent of any changes to currently prevailing market conditions is uncertain, and may affect demand for many of our services and products. Consequently, we may not be able to accurately predict future economic conditions or the effect of such conditions on demand for our services and products and resulting results of operations or financial condition.

We may not realize the anticipated benefits of acquisitions or divestitures.

We continually seek opportunities to increase efficiency and value through various transactions, including purchases or sales of assets or businesses. These transactions are intended to result in the offering of new services or products, the generation of income or cash, the creation of efficiencies or the reduction of risk. Whether we realize the anticipated benefits from an acquisition or any other transactions depends, in part, upon our ability to integrate the operations of the acquired business, the performance of the underlying product and service portfolio, and the performance of the management team and other personnel of the acquired operations. Accordingly, our financial results could be adversely affected from unanticipated performance issues, legacy liabilities, transaction-related charges, amortization of expenses related to intangibles, charges for impairment of long-term assets, credit guarantees, partner performance and indemnifications. While we believe that we have established appropriate and adequate procedures and processes to mitigate these risks, there is no assurance that these transactions will be successful. We also may make strategic divestitures from time to time. These transactions may result in continued financial involvement in the divested businesses, such as guarantees or other financial arrangements, following the transaction. Nonperformance by those divested businesses could affect our future financial results through additional payment obligations, higher costs or asset write-downs.

Business growth could outpace the capabilities of our infrastructure and workforce.

We cannot be certain that our infrastructure and workforce will be adequate to support our operations as we expand. Future growth also could impose significant additional demands on our resources, resulting in additional responsibilities of our senior management, including the need to recruit and integrate new senior level managers, executives and operating personnel. We cannot be certain that we will be able to recruit and retain such additional personnel. To the extent that we are unable to manage our growth effectively, or are unable to attract and retain additional qualified personnel, we may not be able to expand our operations or execute our business plan.

Our operations may be subject to cyber attacks that could have an adverse effect on our business operations.

Our operations may be subject to the risk of cyber attacks. If our systems for protecting against cybersecurity risks prove not to be sufficient, we could be adversely affected by, among other things, loss or damage of proprietary information or customer data, having our business operations interrupted, and increased costs to prevent, respond to, or mitigate cybersecurity attacks.

We may be exposed to unforeseen costs in some of our projects.

Some of our decommissioning business may be conducted under fixed-price or “turnkey” contracts. Under fixed-price contracts, we agree to perform a defined scope of work or deliver a product for a fixed price. Prices for

15

Table of Contents

these contracts are established based largely upon estimates and assumptions relating to project scope and specifications, personnel and material needs. These estimates and assumptions may prove inaccurate or conditions may change due to factors out of our control resulting in cost overruns, which we may be required to absorb and could have a material adverse effect on our business, financial condition and results of operations.

Estimates of our oil and gas reserves and potential liabilities relating to our oil and gas properties may be incorrect.

From time to time, we may engage in projects that include the acquisition of oil and gas properties. Acquisitions of these properties require an assessment of a number of factors beyond our control, including estimates of recoverable reserves, future oil and gas prices, operating costs and potential environmental and plugging and abandonment liabilities. These assessments are complex and inherently imprecise, and, with respect to estimates of oil and gas reserves, require significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each reservoir. In addition, since these properties are typically mature and could be in shallow water, our facilities and operations may be more susceptible to hurricane damage, equipment failure or mechanical problems. In connection with these assessments, we perform due diligence reviews that we believe are generally consistent with industry practices. However, our reviews may not reveal all existing or potential problems. In addition, our reviews may not permit us to become sufficiently familiar with the properties to fully assess their deficiencies and capabilities. We may not always discover structural, subsurface, environmental or other problems that may exist or arise.

Actual future production, cash flows, development expenditures, operating and abandonment expenses and quantities of recoverable oil and gas reserves may vary substantially from those estimated by us and any significant variance in these assumptions could materially affect the estimated quantity and value of our proved reserves. Therefore, the risk exists we may overestimate the value of economically recoverable reserves and/or underestimate the cost of plugging wells and abandoning production facilities. If costs of abandonment are materially greater or actual reserves are materially lower than our estimates, they could have an adverse effect on our financial condition, results of operations and cash flows.

Item 1B. Unresolved Staff Comments

None.

Information on properties is contained in Part I, Item 1 of this Annual Report on Form 10-K.

We are involved in various legal and other proceedings and claims that are incidental to the conduct of our business. Our management does not believe that the outcome of any ongoing proceedings, individually or collectively, would have a material adverse effect on our financial condition, results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not Applicable.

16

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock Information

Our common stock trades on the New York Stock Exchange under the symbol “SPN.” The following table sets forth the high and low sales prices per share of common stock as reported for each fiscal quarter during the periods indicated.

| High | Low | |||||||

| 2012 |

||||||||

| First Quarter |

$ | 31.88 | $ | 25.51 | ||||

| Second Quarter |

28.21 | 17.54 | ||||||

| Third Quarter |

24.45 | 18.80 | ||||||

| Fourth Quarter |

21.76 | 18.00 | ||||||

| 2013 |

||||||||

| First Quarter |

$ | 27.36 | $ | 21.10 | ||||

| Second Quarter |

29.22 | 22.89 | ||||||

| Third Quarter |

28.13 | 24.43 | ||||||

| Fourth Quarter |

28.32 | 24.28 | ||||||

As of February 17, 2014, there were 158,613,126 shares of our common stock outstanding, which were held by 136 record holders.

Dividend Information

On December 10, 2013, our Board of Directors initiated a quarterly dividend program and declared an initial quarterly dividend of $0.08 per share on the outstanding common stock. The initial dividend was paid on February 19, 2014 to all shareholders of record as of January 30, 2014.

Equity Compensation Plan Information

Information required by this item with respect to compensation plans under which our equity securities are authorized for issuance is incorporated by reference from Part III, Item 12 of this Annual Report Form 10-K.

Issuer Purchases of Equity Securities

The following table provides information about shares of our common stock repurchased and retired during each month for the three months ended December 31, 2013:

| Period |

Total Number of Shares Purchased (1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(2) |

Approximate Dollar Value of Shares that May Yet be Purchased Under the Plan or Programs |

||||||||||||

| October 1 - 31, 2013 |

663 | $ | 20.72 | — | $ | 400,000,000 | ||||||||||

| November 1 - 30, 2013 |

300 | $ | 26.76 | — | $ | 400,000,000 | ||||||||||

| December 1 - 31, 2013 |

426,883 | $ | 24.91 | 426,883 | $ | 389,364,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

427,846 | $ | 24.91 | 426,883 | $ | 389,364,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Through our stock incentive plans, 963 shares were delivered to us by our employees to satisfy their tax withholding requirements upon vesting of restricted stock. |

| (2) | On October 14, 2013, we announced that our Board of Directors authorized a $400 million share repurchase program of our common stock, which will expire on December 31, 2015. |

17

Table of Contents

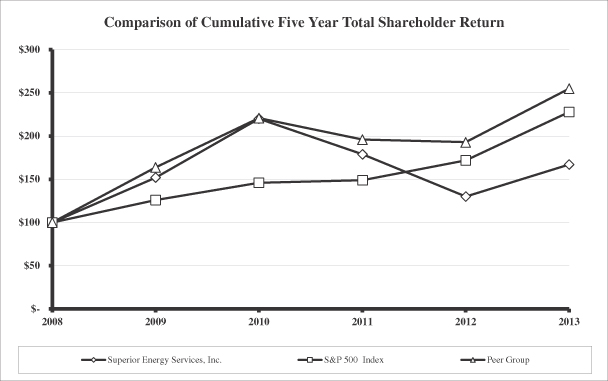

Performance Graph

The following performance graph and related information shall not be deemed “solicitating material” or “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into such filing.

The following graph compares the total stockholder return on our common stock for five years ended December 31, 2013 with the total return on the S&P 500 Stock Index and our Self-Determined Peer Group, as described below, for the same period. The information in the graph is based on the assumption of a $100 investment on January 1, 2009 at closing prices on December 31, 2008.

The comparisons in the graph are required by the SEC and are not intended to be a forecast or indicative of possible future performance of our common stock.

| Years Ended December 31, | ||||||||||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | ||||||||||||||||

| Superior Energy Services, Inc. |

$ | 152 | $ | 220 | $ | 179 | $ | 130 | $ | 167 | ||||||||||

| S&P 500 Stock Index |

$ | 126 | $ | 146 | $ | 149 | $ | 172 | $ | 228 | ||||||||||

| Peer Group |

$ | 164 | $ | 221 | $ | 196 | $ | 193 | $ | 255 | ||||||||||

NOTES:

| • | The lines represent monthly index levels derived from compounded daily returns that include all dividends. |

| • | The indexes are reweighted daily, using the market capitalization on the previous trading day. |

| • | If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. |

| • | The index level for all series was set to $100.00 on December 31, 2008. |

18

Table of Contents

Our Self-Determined Peer Group consists of 16 companies whose average stockholder return levels comprise part of the performance criteria established by the Compensation Committee of our Board of Directors under our long-term incentive compensation program: Baker Hughes, Incorporated, Basic Energy Services, Inc., Cameron International Corporation, FMC Technologies, Inc., Halliburton Company, Helix Energy Solutions Group, Inc., Helmerich & Payne Inc., Key Energy Services, Inc., Nabors Industries Ltd., National Oilwell Varco, Inc., Oceaneering International, Inc., Oil States International, Inc., Patterson-UTI Energy Inc., RPC, Inc., Schlumberger N.V and Weatherford International, Ltd.

Item 6. Selected Financial Data

We present below our selected consolidated financial data for the periods indicated. We derived the historical data from our audited consolidated financial statements.

The data presented below should be read together with, and are qualified in their entirety by reference to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Part II, Item 7 of this Annual Report on Form 10-K and our consolidated financial statements included in Part I, Items 7 and 8, respectively, in this Annual Report on Form 10-K. The financial data is in thousands, except per share amounts.

|

|

Years Ended December 31, | |||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Revenues |

$ | 4,611,824 | $ | 4,568,068 | $ | 1,964,332 | $ | 1,563,043 | $ | 1,320,641 | ||||||||||

| Income (loss) from operations |

30,789 | 706,522 | 296,389 | 173,852 | (81,396 | ) | ||||||||||||||

| Net income (loss) from continuing operations |

(111,418 | ) | 383,142 | 159,389 | 86,146 | (120,540 | ) | |||||||||||||

| Income (loss) from discontinued operations, net of tax |

— | (17,207 | ) | (16,835 | ) | (4,329 | ) | 18,217 | ||||||||||||

| Net income (loss) |

(111,418 | ) | 365,935 | 142,554 | 81,817 | (102,323 | ) | |||||||||||||

| Net income (loss) from continuing operations per share: |

||||||||||||||||||||

| Basic |

(0.70 | ) | 2.57 | 2.00 | 1.09 | (1.54 | ) | |||||||||||||

| Diluted |

(0.70 | ) | 2.54 | 1.97 | 1.08 | (1.54 | ) | |||||||||||||

| Net income (loss) from discontinued operations per share: |

||||||||||||||||||||

| Basic |

— | (0.12 | ) | (0.21 | ) | (0.05 | ) | 0.23 | ||||||||||||

| Diluted |

— | (0.12 | ) | (0.21 | ) | (0.05 | ) | 0.23 | ||||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

(0.70 | ) | 2.45 | 1.79 | 1.04 | (1.31 | ) | |||||||||||||

| Diluted |

(0.70 | ) | 2.42 | 1.76 | 1.03 | (1.31 | ) | |||||||||||||

| Cash dividends per share |

0.08 | — | — | — | — | |||||||||||||||

| Total assets* |

7,411,307 | 7,802,886 | 4,048,145 | 2,907,533 | 2,516,665 | |||||||||||||||

| Long-term debt, net, net of current portion* |

1,646,535 | 1,814,500 | 1,685,087 | 681,635 | 848,665 | |||||||||||||||

| Decommissioning liabilities, less current portion |

56,197 | 93,053 | 108,220 | 100,787 | — | |||||||||||||||

| Stockholders’ equity |

4,131,444 | 4,231,079 | 1,453,599 | 1,280,551 | 1,178,045 | |||||||||||||||

| * | Total assets and long-term debt, net include amounts related to discontinued operations for years 2009 through 2011. |

19

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our consolidated financial statements and applicable notes to our consolidated financial statements and other information included elsewhere in this Annual Report on Form 10-K, including risk factors disclosed in Part I, Item 1A. The following information contains forward-looking statements, which are subject to risks and uncertainties. Should one or more of these risks or uncertainties materialize, our actual results may differ from those expressed or implied by the forward-looking statements. See “Forward-Looking Statements” at the beginning of this Annual Report on Form 10-K.

Executive Summary

We believe we are a leading provider of specialized oilfield services and equipment. We offer a wide variety of products and services throughout the life cycle of an oil and gas well. The acquisition of Complete Production Services, Inc. (Complete) in February 2012 greatly expanded our ability to offer more products and services related to the completion of a well prior to full production commencing, as well as enhancing our full suite of intervention services used to carry out wellbore maintenance operations during a well’s producing phase.

We serve energy industry customers who focus on developing and producing oil and gas worldwide. Our operations are managed and organized by both business units and geomarkets offering products and services within various phases of a well’s economic life cycle, including end of life services. Business unit and geomarket leaders report to executive vice presidents, and we report our operating results in four segments: (1) Drilling Products and Services; (2) Onshore Completion and Workover Services; (3) Production Services; and (4) Subsea and Technical Solutions. Given our history of growth and long-term strategy of expanding geographically, we provide supplemental segment revenue information in three geographic areas: U.S. land, Gulf of Mexico and international.

The fourth quarter of 2013 continued to present us with challenges primarily relating to the execution of our strategies within our Subsea and Technical Solutions segment. We also took actions based on negative outlooks in Venezuela and Mexico. As a result of these circumstances, we recorded $419.4 million of pre-tax charges for reduction in value of assets during the quarter. The charges were as follows:

| • | We incurred pre-tax charges of $91.0 million relating to reduction in value of goodwill and $328.4 million relating to the reduction in value of certain assets. The entire reduction in value of goodwill and $280.5 million of the reduction in value of assets are within the Subsea and Technical Solutions segment, relating primarily to our Asia Pacific-based subsea construction business and the Marine Technical Services business. During the fourth quarter, our management began a strategic review and analysis of our subsea construction business and has determined to pursue strategic alternatives for that business. Also included in the charges for reduction in value of assets was approximately $28.7 million related to the write down of assets in Venezuela and the diminished value of assets located in Mexico. Based on actions taken by Petroleos de Venezuela SA, the Venezuelan state oil company, including the seizure of certain of our assets in 2013, we have decided to exit this non-core market. The charge for our assets in Mexico relates to the decline of activity in the northern part of that country. The remaining charges relate to assets across our Drilling Products and Services, Onshore Completion and Workover Services and Production Services segments that are either obsolete or no longer used or useful in our businesses. |

| • | We incurred a pre-tax charge of $23.6 million relating to an ongoing specialized platform decommissioning project in the Gulf of Mexico. The charge for the specialized platform decommissioning project is attributable to increases in the estimated total cost of that project. Our specialized wreck removal and platform decommissioning projects in the Gulf of Mexico are long term contracts that are accounted for using the percentage-of-completion method, which necessarily involve difficult estimates due to the nature and duration of these projects and contingencies unknown to us at the time we enter into the contract. We expect to complete this project by mid-2014. While we will retain the expertise to manage a large specialized platform decommissioning project, we will |

20

Table of Contents

| discontinue participating in the routine end of life decommissioning business and owning derrick barges. We have no other similar projects that are ongoing at this time. This will not, however, affect our Gulf of Mexico plug and abandonment business, which has been a core service since our founding. |

| • | We incurred a pre-tax charge of $5.6 million primarily relating to cost saving initiatives in certain of our U.S. land market areas due to changed market conditions. These charges relate primarily to severance costs and lease costs for facilities where we no longer operate. As a result of these restructuring efforts, we expect to realize annualized savings of approximately $20 million to $30 million, beginning in the second quarter of 2014. |

For further discussion about these pre-tax charges, see note 4 to our consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Overview of our business segments

The Drilling Products and Services segment is capital intensive with higher operating margins relative to our other segments as a result of relatively low operating expenses. The largest fixed cost is depreciation as there is little labor associated with our drilling products and services businesses. The financial performance is primarily a function of changes in volume rather than pricing. In 2013, approximately 34% of segment revenue was derived from U.S. land market areas (down from 44% in 2012), while approximately 38% of segment revenue was from the Gulf of Mexico market area (up from 31% in 2012) and approximately 28% of segment revenue was from international market areas (up from 25% in 2012). Premium drill pipe accounted for more than 40% of this segment’s revenue in 2013, while bottom hole assemblies and accommodations each accounted for more than 20% of this segment’s revenue in 2013.

The Onshore Completion and Workover Services segment consists primarily of services used in the completion and workover of oil and gas wells on land. These services include pressure pumping, well service rigs and fluid management services. Virtually all of this segment’s revenue is derived in the U.S. land market areas by businesses acquired in the Complete acquisition in February 2012. Demand for these services in the U.S. land market area can change quickly and is primarily dependent on the number of land wells drilled and completed. Given the cyclical nature of activity drivers in the U.S. land market areas coupled with the high labor intensity of these services, operating margins can fluctuate widely depending on supply and demand at a given point in the cycle. In an effort to lessen some of the volatility, we try to contract our pressure pumping horsepower that is used for horizontal well fracturing. In addition, the volumes of produced water that we permanently dispose of for our customers typically generate stable revenue streams as they are primarily a by-product of ongoing oil and gas production from existing and mature wells. Pressure pumping is the largest service offering in this segment, representing more than 40% of this segment’s revenue in 2013, while well service rigs and fluid management each account for more than 20% of this segment’s revenue in 2013.

The Production Services segment consists of intervention services primarily used to maintain and extend oil and gas production during the life of a producing well, and specialized pressure-control tools used to manage and control pressure throughout the life of a well. The services provided are labor intensive and margins can fluctuate based on how much customers spend on enhancing existing oil and gas production from mature wells. In 2013, approximately 61% of segment revenue was derived from the U.S. land market area (down from 69% in 2012), while approximately 15% of segment revenue was from the Gulf of Mexico market area (up from 11% in 2012) and approximately 24% of this segment’s revenue was from international market areas (up from 20% in 2012). Coiled tubing is the largest service offering in this segment, accounting for more than 25% of segment revenue in 2013.

The Subsea and Technical Solutions segment consists of products and services that generally address customer-specific needs and include offerings such as pressure control services, completion tools and services, subsea construction, end-of-life services, production handling arrangements, the production and sale of oil and gas, and marine technical services. In 2013, revenue derived from the U.S. land market area was approximately 10% of

21

Table of Contents

segment revenue (essentially unchanged from 2012), while approximately 54% of segment revenue was from the Gulf of Mexico market area (up from 46% in 2012) and approximately 36% of segment revenue was from international market areas (down from 44% in 2012). Given the project-specific nature associated with several of the service offerings in this segment and the seasonality associated with shallow water Gulf of Mexico activity, revenue and operating margins in this segment can have significant variations from quarter to quarter. Well control and associated services represent the largest service offering in this segment, accounting for approximately 25% of this segment’s revenue in 2013.

Market drivers and conditions

The oil and gas industry remains highly cyclical and seasonal. Activity levels are driven primarily by traditional energy industry activity indicators, which include current and expected commodity prices, drilling rig counts, well counts, well completions and workover activity, geological characteristics of producing wells which determine the number and intensity of services required per well, oil and gas production levels, and customers’ spending allocated for drilling and production work, which is reflected in our customers’ operating expenses or capital expenditures.

Historical market indicators are listed below:

| 2013 | % Change |

2012 | % Change |

2011 | ||||||||||||||||

| Worldwide Rig Count (1) |

||||||||||||||||||||

| U.S. (land and offshore) |

1,761 | -8 | % | 1,919 | 0 | % | 1,879 | |||||||||||||

| International (2) |

1,296 | 5 | % | 1,234 | 6 | % | 1,167 | |||||||||||||

| Commodity Prices (average) |

||||||||||||||||||||

| Crude Oil (West Texas Intermediate) |

$ | 97.98 | 4 | % | $ | 94.22 | -1 | % | $ | 95.47 | ||||||||||

| Natural Gas (Henry Hub) |

$ | 3.73 | 36 | % | $ | 2.75 | -33 | % | $ | 4.09 | ||||||||||

| (1) | Estimate of drilling activity as measured by average active drilling rigs based on Baker Hughes Incorporated rig count information. |

| (2) | Excludes Canadian Rig Count. |

The following table compares our revenues generated from major geographic regions for the years ended December 31, 2013 and 2012 (in thousands). We attribute revenue to countries based on the location where services are performed or the destination of the rental or sale of products.

| Revenue | ||||||||||||||||||||

| 2013 | % | 2012 | % | Change | ||||||||||||||||

| U.S. Land |

$ | 2,847,427 | 62 | % | $ | 3,043,599 | 67 | % | $ | (196,172 | ) | |||||||||

| Gulf of Mexico |

912,849 | 20 | % | 725,929 | 16 | % | 186,920 | |||||||||||||

| International |

851,548 | 18 | % | 798,540 | 17 | % | 53,008 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 4,611,824 | 100 | % | $ | 4,568,068 | 100 | % | $ | 43,756 | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

In 2013, our U.S. land revenue decreased 6% to $2,847.4 million as a result of the decline in general market conditions in the U.S land market area, including competitive pressures and resulting lower pricing and utilization. Production Services segment revenue from the U.S. land market area declined by 15%, primarily as a result of the decline in market demand for coiled tubing, wireline, hydraulic workover and snubbing, and remedial pumping services. Drilling Products and Services segment’s revenue derived from the U.S. land market area decreased approximately 16% primarily due to decreased demand for premium drill pipe and accommodations. Onshore Completion and Workover Services Segment derives virtually all of its revenue from the U.S. land market area. This segment’s revenue was essentially unchanged from 2012. U.S. land market area

22

Table of Contents

revenue from our Subsea and Technical Solutions segment increased 9%, primarily as a result of increased demand for environmental services and sand control and stimulation services.

Our Gulf of Mexico revenue increased 26% to $912.9 million primarily as a result of a demand for our drilling products and services and completion tools in the deepwater. The Drilling Products and Services segment, which has significant deepwater Gulf of Mexico exposure, experienced a 30% increase in revenue in this market, with downhole drilling tools, such as bottom hole assemblies and premium drill pipe, experiencing the most growth. The Subsea and Technical Solutions segment revenue from the Gulf of Mexico increased 23%, and the Production Services segment revenue from the Gulf of Mexico grew 24% in 2013.

Our international revenue increased 7% to $851.5 million primarily as a result of acquisitions in Latin America and continued expansion of our drilling products and services. Production Services segment revenue from international market areas increased 15%, primarily due to our acquisitions of a wireline and well testing company and a cementing company in Latin America. The Drilling Products and Services segment experienced a 23% increase in revenue from international market areas due to increases in most of our product lines within the segment. These increases were partially offset by a 12% decrease in revenue from our Subsea and Technical Solutions segment from international market areas, primarily as a result of decreases in well control and subsea construction work.

Industry Outlook

Based on current expectations of activity indicators for oilfield services (commodity prices and drilling rig counts), we believe overall activity in U.S. land market areas will be flat or slightly higher in 2014 than in 2013 with rig count increases anticipated in basins more focused on drilling and producing oil than natural gas. In the Gulf of Mexico market area, year-over-year activity levels should increase, albeit at a slower pace of growth than 2013. Demand and activity levels in international market areas should grow at a slightly faster pace than 2013.