0000886346DEF 14AFALSE00008863462022-01-022022-12-31iso4217:USDiso4217:USDxbrli:shares00008863462021-01-032022-01-0100008863462019-12-292021-01-020000886346kai:EquityAwardsDeductionsMemberecd:PeoMember2019-12-292021-01-020000886346kai:EquityAwardsDeductionsMemberecd:NonPeoNeoMember2019-12-292021-01-020000886346kai:EquityAwardsDeductionsMemberecd:PeoMember2021-01-032022-01-010000886346kai:EquityAwardsDeductionsMemberecd:NonPeoNeoMember2021-01-032022-01-010000886346kai:EquityAwardsDeductionsMemberecd:PeoMember2022-01-022022-12-310000886346kai:EquityAwardsDeductionsMemberecd:NonPeoNeoMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2019-12-292021-01-020000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-032022-01-010000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-022022-12-310000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2019-12-292021-01-020000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2021-01-032022-01-010000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2022-01-022022-12-310000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearVestedMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2019-12-292021-01-020000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-032022-01-010000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-022022-12-310000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsVestedMember2019-12-292021-01-020000886346kai:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsVestedMember2021-01-032022-01-010000886346kai:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsVestedMember2022-01-022022-12-310000886346kai:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2019-12-292021-01-020000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2021-01-032022-01-010000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2022-01-022022-12-310000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedInPriorYearsForfeitedMember2022-01-022022-12-310000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2019-12-292021-01-020000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2019-12-292021-01-020000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2021-01-032022-01-010000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2021-01-032022-01-010000886346ecd:PeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2022-01-022022-12-310000886346ecd:NonPeoNeoMemberkai:EquityAwardsGrantedDuringTheYearFairValueAdjustmentMember2022-01-022022-12-31000088634612022-01-022022-12-31000088634622022-01-022022-12-31000088634632022-01-022022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

_____________________________________________

| | | | | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant ☐ |

| | |

Check the appropriate box: | | |

☐ Preliminary Proxy Statement | |

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| ☐ Definitive Additional Materials | | |

| ☐ Soliciting Material Pursuant to Rule 14a-12 | | |

Kadant Inc.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | |

|

KADANT INC. One Technology Park Drive Westford, MA 01886 USA Tel: +1 978-776-2000 www.kadant.com |

March 29, 2023

Dear Stockholder:

I am pleased to invite you to attend the 2023 annual meeting of stockholders of Kadant Inc. The meeting will be held on Wednesday, May 17, 2023 at 2:30 p.m. at our corporate office located at One Technology Park Drive, Westford, Massachusetts 01886. In addition to the physical portion of the meeting at the corporate office of Kadant Inc., the 2023 annual meeting will also be held over the Internet in a virtual meeting format, via live webcast. You will be able to attend the annual meeting in person or via the webcast. Stockholders who attend via the webcast will be able to vote and submit questions by visiting https://agm.issuerdirect.com/kai and entering a control number. Further information about how to attend the annual meeting via the webcast, vote your shares online during the meeting and submit questions during the meeting is included in the attached notice of meeting and proxy statement. Details regarding the business to be conducted at the meeting are described in the enclosed notice of the meeting and proxy statement.

We make our proxy materials available over the Internet and stockholders will receive a notice describing the Internet availability of our proxy materials. The notice contains instructions for accessing our proxy materials over the Internet or requesting a paper copy of the proxy materials by mail. Our proxy materials include this proxy statement and our 2022 annual report to stockholders, containing our audited financial statements and information about our business.

Your vote is very important. Whether or not you plan to attend the meeting in person, you can ensure your shares of our common stock are voted at the meeting by submitting your instructions by telephone, the Internet, or in writing by returning your proxy card or voting form.

Thank you for your support and continued interest in Kadant.

Sincerely,

JONATHAN W. PAINTER

Chairman of the Board of Directors

| | |

|

KADANT INC. One Technology Park Drive Westford, MA 01886 USA Tel: +1 978-776-2000 www.kadant.com |

March 29, 2023

To Stockholders of

KADANT INC.

NOTICE OF ANNUAL MEETING

The 2023 annual meeting of stockholders of Kadant Inc. will be held on Wednesday, May 17, 2023, at 2:30 p.m. at our corporate office located at One Technology Park Drive, Westford, Massachusetts 01886 and online via the Internet at https://agm.issuerdirect.com/kai. The purpose of the meeting is to consider and take action upon the following matters:

1.to elect two directors for a three-year term expiring in 2026;

2.to approve, by non-binding advisory vote, our executive compensation;

3.to recommend, by non-binding advisory vote, the frequency of future executive compensation advisory votes;

4.to approve restricted stock unit grants to our non-employee directors;

5.to ratify the selection of KPMG LLP by the audit committee of our board of directors as our company’s independent registered public accounting firm for the 2023 fiscal year; and

6.to vote on such other business as may properly be brought before the meeting and any adjournment of the meeting.

The record date for the determination of the stockholders entitled to receive notice of and to vote at the meeting is March 20, 2023. Our stock transfer books will remain open.

Our bylaws require that the holders of a majority of the shares of our common stock, issued and outstanding and entitled to vote at the meeting, be present in person or represented by proxy at the meeting in order to constitute a quorum for the transaction of business. Accordingly, it is important that your shares be represented at the meeting regardless of the number of shares you may hold. Whether or not you plan to attend the meeting in person or online, please ensure that your shares of our common stock are present and voted at the meeting by submitting your instructions by telephone, the Internet, or in writing by completing, signing, dating and returning your proxy card or voting form. You may obtain directions to the location of the annual meeting of stockholders by contacting the company at (978) 776-2000.

You are entitled to participate in the 2023 annual meeting if you were a stockholder of record at the close of business on March 20, 2023, the record date, or hold a legal proxy for the meeting provided by your bank, broker or nominee as of such record date. To access, participate in, and vote your shares virtually at the 2023 annual meeting, visit https://agm.issuerdirect.com/kai and enter a control number. Stockholders of record must enter the control number found on your proxy card or the Notice of Internet Availability.

If your shares are held in “street name” through a broker, bank or other nominee, in order to participate in the annual meeting virtually, you must first obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of Kadant Inc. common stock you held as of the record date, your name and email address. You must then obtain a new control number from American Stock Transfer & Trust Company (AST), the company’s transfer agent, by presenting the legal proxy to AST. You should submit a request for a new control number to AST as follows: (1) by email to proxy@astfinancial.com; (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as “Legal Proxy” and be received by AST no later than 5:00 p.m. Eastern time on May 10, 2023.

We encourage you to test your computer and internet browser prior to the meeting. If you experience technical difficulties, please visit the help pages found at https://www.webcaster4.com/support. You may also call 1-844-399-3386 or 919-744-2718 for assistance accessing the meeting.

If you join the meeting virtually, you can submit questions in writing during the meeting through the Q&A tab on the virtual platform. We intend to answer as many questions that pertain to company matters as time allows during the meeting. Questions that are substantially similar may be grouped or not answered to ensure we are able to answer as many questions as possible.

A complete list of registered stockholders will be made available to stockholders of record at the meeting. In addition, a complete list of registered stockholders will be available to stockholders of record at least ten days prior to the annual meeting for examination by sending an email to annualmeeting@kadant.com with a request to virtually access such list.

This notice, the proxy and proxy statement are sent to you by order of our board of directors on behalf of the company.

STACY D. KRAUSE

Senior Vice President,

General Counsel and Secretary

TABLE OF CONTENTS

| | | | | |

| |

| | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Pay Versus Performance | |

| |

| |

| |

| |

| |

| |

| |

PROXY STATEMENT

We are furnishing this proxy statement in connection with the solicitation of proxies by the board of directors of Kadant Inc. (we, us, the company) for use at our 2023 annual meeting of stockholders to be held on Wednesday, May 17, 2023, at 2:30 p.m. at our corporate office located at One Technology Park Drive, Westford, Massachusetts 01886, and at any adjournment of that meeting. The mailing address of our executive office is One Technology Park Drive, Westford, Massachusetts 01886. The notice of annual meeting, this proxy statement and the enclosed proxy are being first furnished to our stockholders on or about March 29, 2023.

In addition to the physical portion of the meeting at the corporate office of Kadant Inc., the 2023 annual meeting will also be held over the Internet in a virtual meeting format, via live webcast. You will be able to attend the annual meeting in person or via the webcast. Stockholders who attend via the webcast will be able to vote and submit questions by visiting https://agm.issuerdirect.com/kai and entering a control number. Stockholders of record must enter the control number found on your proxy card or the Notice of Internet Availability.

We encourage you to test your computer and internet browser prior to the meeting. If you experience technical difficulties, please visit the help pages found at https://www.webcaster4.com/support. You may also call 1-844-399-3386 or 919-744-2718 for assistance accessing the meeting.

If you join the meeting virtually, you can submit questions in writing during the meeting through the Q&A tab on the virtual platform. We intend to answer as many questions that pertain to company matters as time allows during the meeting. Questions that are substantially similar may be grouped or not answered to ensure we are able to answer as many questions as possible.

INTERNET AVAILABILITY OF PROXY MATERIALS

Our proxy materials are available over the Internet. You will receive a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and 2022 annual report to stockholders, and submit your proxy. The Notice of Internet Availability also provides information on how to request paper copies of our proxy materials if you prefer. If you have previously requested a paper copy of the proxy materials, you will receive a paper copy of our proxy materials by mail. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise.

VOTING PROCEDURES

Purpose of Annual Meeting

Stockholders entitled to vote at the 2023 annual meeting will consider and act upon the matters outlined in the notice of meeting accompanying this proxy statement, including the election of two individuals, each to be elected for a three-year term expiring in 2026 (Proposal 1); approval of, by non-binding advisory vote, our executive compensation (Proposal 2); to recommend, by non-binding advisory vote, the frequency of future executive compensation advisory votes (Proposal 3); approval of restricted stock unit grants to our non-employee directors (Proposal 4); and ratification of the selection of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year (Proposal 5).

Voting Securities and Record Date

Only stockholders of record at the close of business on March 20, 2023, are entitled to vote at the meeting or any adjournment of the meeting. Each share is entitled to one vote. Our outstanding capital stock entitled to vote at the meeting (which excludes shares held in our treasury) as of March 20, 2023, consisted of 11,703,481 shares of our common stock, $.01 par value per share.

You are entitled to participate in the 2023 annual meeting if you were a stockholder of record at the close of business on March 20, 2023, the record date, or hold a legal proxy for the meeting provided by your bank, broker or nominee as of such record date. To access, participate in, and vote your shares virtually at the 2023 annual meeting, visit https://agm.issuerdirect.com/kai and enter a control number. Stockholders of record must enter the control number found on your proxy card or the Notice of Internet Availability.

If your shares are held in “street name” through a broker, bank or other nominee, in order to participate in the annual meeting virtually, you must first obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of Kadant Inc. common stock you held as of the record date, your name and email address. You must then obtain a new control number from American Stock Transfer & Trust Company (AST), the company’s transfer agent, by presenting the legal proxy to AST. You should submit a request for a new control number to AST as follows: (1) by email to proxy@astfinancial.com; (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, Attn: Proxy Tabulation Department,

6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as “Legal Proxy” and be received by AST no later than 5:00 p.m. Eastern time on May 10, 2023.

Quorum

The holders of a majority of the shares of our common stock that are issued and outstanding and entitled to vote at the meeting constitute a quorum for the transaction of business at the meeting. If a quorum is not present, the meeting will be adjourned until a quorum is obtained. For purposes of determining the presence or absence of a quorum, abstentions, withhold votes or do not vote instructions, and broker non-votes (where a broker or nominee does not exercise discretionary authority to vote on a proposal) will be counted as present.

Manner of Voting

Each share of common stock you hold is entitled to one vote for or against a proposal. Shares entitled to be voted at the meeting can only be voted if the stockholder of record of such shares is present at the meeting, returns a signed proxy card, or authorizes proxies to vote his or her shares by telephone or over the Internet. Shares represented by valid proxy will be voted in accordance with your instructions. If you choose to vote your shares by telephone or over the Internet, you may do so until 11:59 p.m. Eastern time on Tuesday, May 16, 2023, by following the instructions on the proxy card or the Notice of Internet Availability.

You may revoke your proxy at any time before the shares are voted at the meeting by entering new voting instructions by telephone or over the Internet before 11:59 p.m. Eastern time on Tuesday, May 16, 2023, by written notice received by our corporate secretary before the meeting, by executing and returning a new proxy bearing a later date or by voting by ballot at the meeting. Attendance at the meeting without voting by ballot will not revoke a previously submitted proxy.

You may specify your choices by marking the appropriate box on the proxy card. If your proxy card is signed and returned without specifying choices, your shares will be voted in accordance with the recommendations of our board of directors and as the individuals named as proxy holders on the proxy card deem advisable on all other matters that may properly come before the meeting. The board of directors recommends that you vote for the listed nominees for director; for approval of our executive compensation; for an annual vote on the frequency of future advisory votes on executive compensation; for approval of restricted stock unit grants to our non-employee directors; and for ratification of the selection of our independent registered public accounting firm.

If you hold your shares in “street name” through a broker, bank or other representative, generally the broker or other representative may only vote the shares that it holds for you in accordance with your instructions. However, if the broker or other representative has not timely received your instructions, it may vote on certain matters for which it has discretionary voting authority. The vote on election of directors, the advisory vote on executive compensation, the advisory vote on the frequency of future advisory votes on executive compensation and the vote on the restricted stock unit grants to our non-employee directors are non-discretionary voting matters and your broker will not be able to vote on these matters without receiving your instructions. The vote to ratify the selection of our independent registered public accounting firm is a discretionary matter and your broker has discretionary authority to vote on that proposal. Your broker or other representative will generally provide detailed voting instructions with your proxy materials. These instructions may include information on whether your shares can be voted by telephone or over the Internet and the manner in which you may revoke your votes.

Vote Required

Assuming a quorum is present at the meeting, the vote required to adopt each of the proposals is as follows:

•Election of Directors (Proposal 1). The election of directors is determined by a majority of the votes cast in person or by proxy by the stockholders entitled to vote on the election of directors in an uncontested election. Under our bylaws, a nominee will be elected to the board of directors if the votes cast “for” the nominee’s election exceed the votes cast “against” the nominee’s election. Abstentions and broker non-votes are not counted as votes “for” or “against” a nominee and will have no effect upon the outcome of the vote on the election of directors. If an uncontested incumbent nominee receives a majority of votes “against” his or her election, the director must tender his or her resignation to the board of directors. The board of directors will then decide whether to accept the resignation within 90 days following certification of the stockholder vote. We will publicly disclose the board of directors’ decision and its reasoning regarding the offered resignation.

•Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation (Proposal 3). The advisory vote on the frequency of future executive compensation advisory votes is determined by whichever of the three frequency options (one year, two years or three years) receives the highest number of votes cast by the holders of the shares present or represented by proxy at the meeting and voting on the matter. Under our bylaws,

abstentions and broker non-votes will have no effect on determining which frequency option has received the highest number of votes cast on the matter.

•All Other Matters: Advisory Vote on Executive Compensation (Proposal 2), Approval of Restricted Stock Unit Grants to our Non-employee Directors (Proposal 4) and Ratification of the Selection of Our Independent Registered Public Accounting Firm (Proposal 5). The advisory vote on our executive compensation, the approval of restricted stock unit grants to our non-employee directors and the ratification of the selection of our independent registered public accounting firm are determined by a majority of the votes cast by the holders of the shares present or represented by proxy at the meeting and voting on each matter. Under our bylaws, abstentions and broker non-votes will have no effect on the determination of whether stockholders have approved these proposals.

Multiple Stockholders per Household

When more than one stockholder share the same address, we will deliver only one notice describing the Internet availability of our proxy materials to that address, unless we have been instructed to the contrary by the stockholders. Similarly, beneficial owners with the same address who hold their shares in street name through a broker, bank or other representative may have elected to receive only one copy of the notice at that address. We will promptly send a separate copy of the notice, our annual report or proxy statement to you if you request one by writing or calling us at Kadant Inc., One Technology Park Drive, Westford, Massachusetts 01886 (telephone: 978-776-2000). If you are receiving multiple copies and would like to receive only one copy for your household in the future, you should contact your broker, bank or other representative if you hold shares in street name, or contact our transfer agent, American Stock Transfer & Trust Company, Shareholder Services Department, 6201 15th Avenue, Brooklyn, New York 11219 (telephone: 718-921-8124 or 800-937-5449) if you hold shares in your own name.

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors is divided into three classes of directors serving staggered three-year terms, with each class being as nearly equal in number as possible. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires. We have two directors whose terms expire at the 2023 annual meeting.

Our board of directors has nominated John M. Albertine and Thomas C. Leonard for election as directors for the three-year term expiring at the 2026 annual meeting of stockholders. Dr. Albertine and Mr. Leonard are each currently a member of our board of directors. If either nominee becomes unable to serve as a director, the proxy holders may vote the proxy for the election of a substitute nominee to be designated by our board of directors. We do not expect that either nominee will be unable to serve. Directors serve until the expiration of their terms and until their successors have been elected and qualified or until their earlier resignation, death or removal in accordance with our bylaws.

Information regarding the names, ages, principal occupations and employment during the past five years of each of our directors is provided below. We have also included information about each director’s specific experience, qualifications, attributes or skills that led the board of directors to conclude that he or she should serve as a director. Unless we have specifically noted below, no corporation or organization referred to below is a subsidiary or affiliate of ours. There are no family relationships among any of our directors and executive officers. Information on the stock ownership of our directors is provided in this proxy statement under the heading “Stock Ownership.” Information regarding the compensation of our directors is provided in this proxy statement under the heading “Director Compensation.”

Nominees for Director for the Three-Year Term That Will Expire in 2026

| | | | | |

| John M. Albertine | Dr. Albertine, 78, has been a member of our board of directors since June 2001, is the chairman of our compensation committee and is one of the board’s designated “audit committee financial experts.” Dr. Albertine has been the founder, chairman and chief executive officer of Albertine Enterprises, Inc., a Washington, D.C.-based public policy consulting firm, since 1990. He also has served since 2005 as a founding partner of JJ&B, LLC, a Washington, D.C.-based investment banking firm that provides finance, corporate strategy and economic analysis to clients. Dr. Albertine has been a member of the board of directors of Tecogen, Inc., a publicly traded manufacturer of cogeneration, chiller and heat pump systems, since 2022. Dr. Albertine has been the chairman of the Crest Foundation, Center for Research in Environmental and Sustainable Technologies, since 2021. Crest is a non-profit environmental and social governance initiative dedicated to people and planet well-being. Dr. Albertine has served on the boards of 15 publicly traded companies in his business career. From 2008 to 2018, Dr. Albertine served as a director of Intersections Inc., a publicly traded global provider of consumer and corporate identity risk management services, and served as chairman of its risk committee. Dr. Albertine also served for 10 years ending in 2013 as a trustee and six years as vice chairman of the Virginia Retirement System, a public pension fund. Dr. Albertine also served as a member of Virginia Governor Tim Kaine's Board of Economic Advisors for the State of Virginia for two terms ending in 2014. Dr. Albertine holds a Ph.D. in economics from the University of Virginia. We believe Dr. Albertine’s qualifications to serve on our board of directors include his knowledge of the economy, capital markets and diverse businesses, his service as a director on numerous other public company boards and as chairman of the board of two of those public companies and his chairmanship of a non-profit foundation devoted to environment and people well-being, and his education as an economist. |

| |

| Thomas C. Leonard | Mr. Leonard, 68, has been a member of our board of directors since June 2005, is the chairman of our audit committee and is one of the board’s designated “audit committee financial experts.” Mr. Leonard is a director of Dynasil Corporation of America (Dynasil), a publicly-traded company that develops and manufactures detection and analysis technology, precision instruments and optical components for homeland security, medical and industrial markets, and previously served as its chief financial officer and chief accounting officer from 2013 to 2016. He began serving as the chair of Dynasil's audit committee in 2019. From 2008 to 2012, Mr. Leonard was the senior vice president-finance, treasurer and chief financial officer of Pennichuck Corporation, a publicly-traded water utility holding company. From 2006 to 2008, he was a vice president of CRA International, a consulting firm, where he specialized in forensic accounting. He was previously a managing director specializing in forensic accounting and dispute resolution at Huron Consulting Group LLC, a publicly-traded management consulting firm, from 2002 to 2006. Previously, Mr. Leonard was a senior partner at Arthur Andersen LLP, an independent public accounting firm, from 1987 through 2002 and served as partner-in-charge of its New England assurance and business advisory practice. Mr. Leonard is a certified public accountant. We believe Mr. Leonard’s qualifications to serve on our board of directors include his expertise in finance and accounting and experience as a public company chief financial officer. |

Our directors listed below are not up for election this year and each will continue in office for the remainder of his or her specified term of office or until his or her earlier resignation, death or removal in accordance with our bylaws.

| | | | | |

| Erin L. Russell | Term Expires May 2024 Ms. Russell, 49, has been a member of our board of directors since January 2019, is the chair of our risk oversight and sustainability committee and is one of the board’s designated “audit committee financial experts.” Ms. Russell currently serves as a director and member of the audit committee of eHealth, Inc., a publicly-traded provider of health insurance enrollment solutions through its proprietary marketplace. Ms. Russell previously served as a director, member of the compensation committee and the chair of the audit committee of Tivity Health, Inc., a publicly traded provider of fitness, healthy life changing, and digital engagement solutions, from March 2020 to June 2022, when Tivity Health, Inc. ceased being publicly traded. She was a principal of Vestar Capital Partners, L.P. (Vestar), a private equity firm specializing in management buyouts, recapitalizations and growth equity investments, from August 2001 until April 2017. While at Vestar, Ms. Russell served on the boards of directors of a number of companies, including most recently as a director of DeVilbiss Healthcare LLC from 2012 until 2015 and as a director and a member of the audit committee of 21st Century Oncology Inc. from 2008 until 2016, including as the chair of the audit committee until 2014, both private healthcare companies. She also served as a director of DynaVox Inc., a communications device manufacturer, from 2004 until 2014, including serving as the chair of its audit committee until its initial public offering in 2010. Ms. Russell is also a member of the school advisory board of St. Thomas Aquinas Catholic School of Fairfield, Connecticut, where she has served since 2018, and has served on the advisory boards of McIntire School of Commerce since 2016 and the Jefferson Scholars Foundation at the University of Virginia since 2008. We believe Ms. Russell’s qualifications to serve on our board of directors include her financial, operating, mergers and acquisitions, and management experience gained through working with a variety of private equity portfolio companies, her knowledge and experience gained through service on the boards of other companies, and her high level of financial literacy and experience with capital and credit markets gained through her investment experience. |

| |

| Rebecca Martinez O'Mara | Term Expires May 2024 Rebecca Martinez O'Mara, 57, has been a member of our board of directors since May 2022 and is the chair of our nominating and corporate governance committee. Ms. O’Mara served as President of Industrial Services for Stanley Black & Decker, Inc., a Fortune 500 manufacturer of industrial tools and household hardware, from 2020 to 2022. She was previously Vice President of Services and Solutions at Grundfos Holdings A / S, a global pump manufacturer, from 2017 to 2019. From 2013 to 2017, she was Vice President of Marketing, Customer Service and Aftermarket, at Sullair, LLC, a global industrial air compressor manufacturer. From 2007 to 2012, Ms. O’Mara was Program Director at Fiat Industrial SpA, a global heavy equipment manufacturer. Prior to her role at Fiat, Ms. O’Mara was Director of Global Business Development - Remanufacturing for Caterpillar Inc., a Fortune 100 construction equipment manufacturer from 2003 to 2007. She started her career at AT&T (formerly Ameritech) where she spent over 10 years in various positions including marketing, operations, and public policy. Ms. O'Mara is a member of the Latino Corporate Directors Association and is also a Chicago United Business Leaders of Color Honoree. We believe Ms. O'Mara's qualifications to serve on our board of directors include executive operational experience as a profit and loss leader at numerous industrial companies, including roles in business development, strategy, financial and organizational management, mergers and acquisitions, and scaling businesses with Industry 4.0 solutions. She also has experience managing environmental, corporate social responsibility, and sustainability challenges. |

| |

| | | | | |

Jonathan W. Painter | Term Expires May 2025 Mr. Painter, 64, has been the chairman of our board of directors since July 2020 and has been a member of our board of directors since January 2010. He previously served as the executive chairman of our board of directors from July 2019 to July 2020, our chief executive officer from January 2010 to June 2019 and served as our president from September 2009 to March 2019. He also served as our chief operating officer from September 2009 to January 2010. Prior to becoming our president, Mr. Painter was an executive vice president from 1997 to September 2009, and from 2007 to September 2009 had supervisory responsibility for our stock-preparation and fiber-based products businesses. He also served as president of our composites building products business from 2001 until its sale in 2005. Mr. Painter was our treasurer and the treasurer of Thermo Electron Corporation, now named Thermo Fisher Scientific Inc. (Thermo), a manufacturer of high-tech instrumentation, from 1994 to 1997. Prior to 1994, Mr. Painter held various managerial positions with our company and Thermo. Mr. Painter also serves as director, the chairman of the board and member of the audit and compensation committees of Graham Corporation, a publicly-traded designer and manufacturer of critical equipment for the defense, space, energy and chemical industries. We believe Mr. Painter’s qualifications to serve on our board of directors include his diverse experience in operations, finance, law, acquisitions and corporate strategy, as well as his experience as our former president and chief executive officer. |

| |

| Jeffrey L. Powell | Term Expires May 2025 Mr. Powell, 64, has served as our chief executive officer and a member of our board of directors since July 2019 and as our president since April 2019. He previously served as an executive vice president and co-chief operating officer from March 2018 to March 2019, with supervisory responsibility for our stock-preparation, wood processing, and fiber-based products businesses. Prior to March 2018, he had served as an executive vice president with responsibility for such businesses since March 2013. From September 2009 to March 2013, he served as our senior vice president with responsibility for such businesses. From January 2008 to September 2009, Mr. Powell was vice president, new ventures, with principal responsibility for acquisition-related activities. Prior to joining us, Mr. Powell was the chairman and chief executive officer of Castion Corporation, a manufacturer of systems for industrial wastewater treatment, from April 2003 through December 2007. Prior to Castion, Mr. Powell held various management positions at Thermo, including chief executive officer and president of one of its publicly traded subsidiaries. From 2007 to 2015, Mr. Powell served on the board of directors of TerraTherm, a private thermal technology solutions company, including on its compensation committee. We believe Mr. Powell’s qualifications to serve on our board of directors include his diverse experience in acquisitions, corporate strategy, and operations, as well as his role as our president and chief executive officer. |

| |

Effective as of January 1, 2023, Dr. William P. Tully, 82, a member of our board of directors since December 2010, resigned from our board of directors. In March 2023, our board of directors reduced the size of the board from seven to six members.

Board Skills and Experience

The following matrix provides information regarding the members of our board of directors, including certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors which our board of directors believes are relevant to our business. The matrix does not encompass all of the knowledge, skills, experience or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of our board of directors.

| | | | | | | | | | | | | | | | | | | | |

Knowledge, Skills and Experience | Albertine | Leonard | O'Mara | Painter | Powell | Russell |

Public Company Board Experience | x | x | | x | x | x |

Financial Acumen and Expertise | x | x | x | x | x | x |

Risk Management | x | x | x | x | x | x |

Regulatory and Industry | | | | x | x | |

Executive Experience | x | x | x | x | x | x |

Operations | | | x | x | x | |

Strategic Leadership, Planning & Oversight | x | | x | x | x | x |

Mergers and Acquisitions | x | | x | x | x | x |

Academic/Education | x | | | | | |

Sustainable Business Practices and Social Responsibility | x | | x | | x | |

Corporate Finance and Capital Markets | x | x | x | x | x | x |

Recommendation

Our board of directors believes that the election of Dr. Albertine and Mr. Leonard as directors is in the best interests of our company and our stockholders and recommends a vote FOR their election.

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are asking that our stockholders cast an advisory, non-binding vote on the executive compensation of our named executive officers, commonly referred to as “say-on-pay.” This proposal is required by Section 14A of the Securities Exchange Act of 1934, as amended (the Exchange Act). In 2017, our board of directors recommended, our stockholders agreed, and our board of directors thereafter concluded, that our stockholders cast an advisory vote once every year on the executive compensation of our named executive officers. We believe it is appropriate to seek the views of our stockholders on the design and effectiveness of our executive compensation program, as described in this proxy statement.

Our compensation philosophy is described in the Compensation Discussion and Analysis contained in this proxy statement. Our goal is to attract and retain a talented leadership group and we seek to accomplish this goal with a compensation program that rewards performance and is aligned with our stockholders’ long-term interests. Our program emphasizes compensation linked to objective performance measures, which we believe are linked in turn to the creation of stockholder value. Highlights of our compensation program include the following:

•Cash compensation in the form of base salary and an annual performance-based cash incentive opportunity (bonus). We use objective financial measures based on earnings per share growth and return on average stockholders’ equity to determine our executives’ annual performance-based bonus and there is no individual performance component.

•Equity compensation to reward performance and retain key personnel. We annually award performance-based restricted stock units that use objective financial measures based on adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA). All performance-based awards are subject to additional time-based vesting periods once the performance goals have been met. We also may use equity compensation in other forms that are intended to promote retention of our key personnel, and for this purpose have used time-based restricted stock units.

•All of our named executive officers are employees-at-will. All of our current named executive officers are employees-at-will and do not have an employment agreement or severance agreement other than an agreement that provides benefits upon termination of employment following a change in control, except for Mr. Fredrik H. Westerhout. In May 2022, we entered into an employment agreement with Mr. Westerhout, who serves as our vice president and resides in The Netherlands, which contains terms and conditions more typical of European executives. See "Compensation Discussion and Analysis - Other Elements of Compensation and Compensation Policies", "Executive Compensation - Pension Benefits" and “Executive Compensation - Potential Payments Upon Termination or Change in Control” for more information on the change in control agreements and the employment agreement with Mr. Westerhout.

We believe that our executive compensation program provides compensation opportunities that reflect our company’s performance and align the pay of our executives with the long-term interests of our stockholders. Our recent

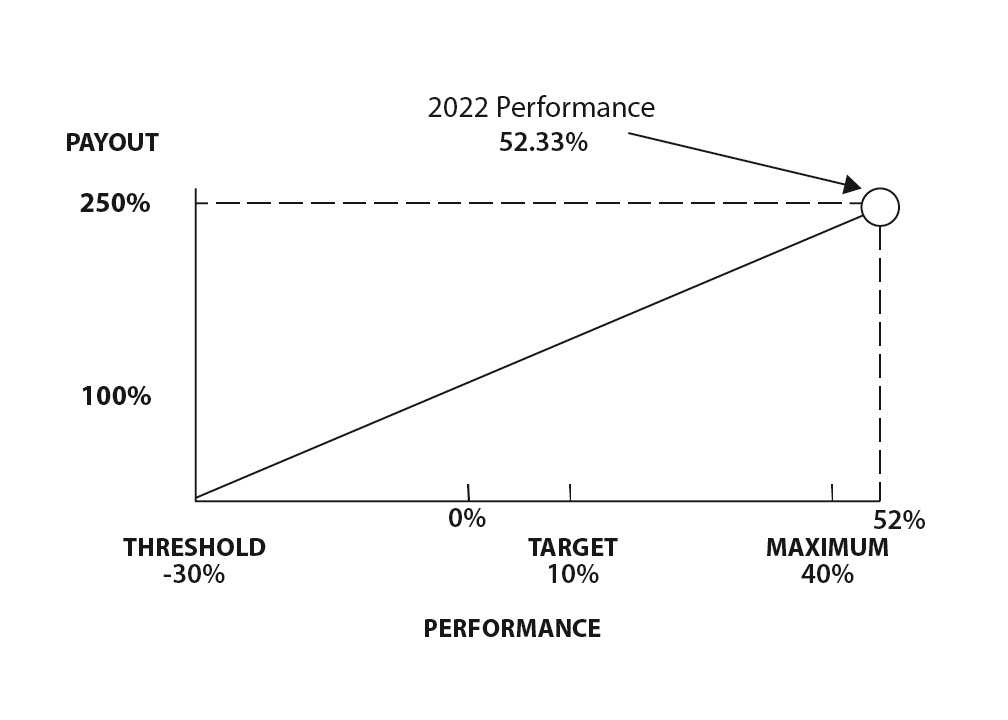

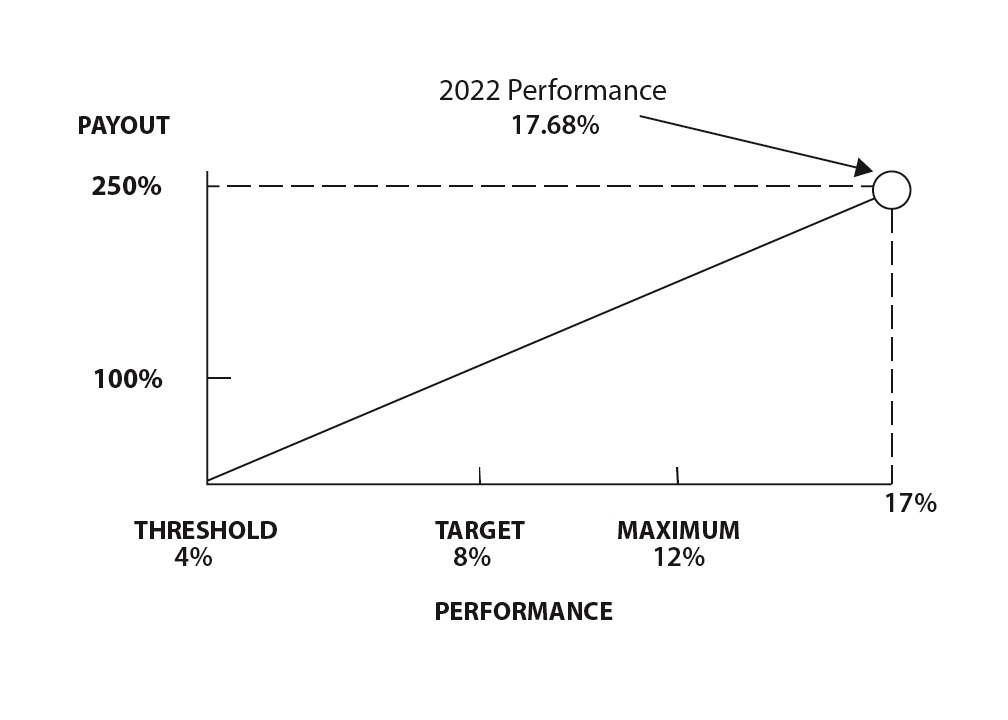

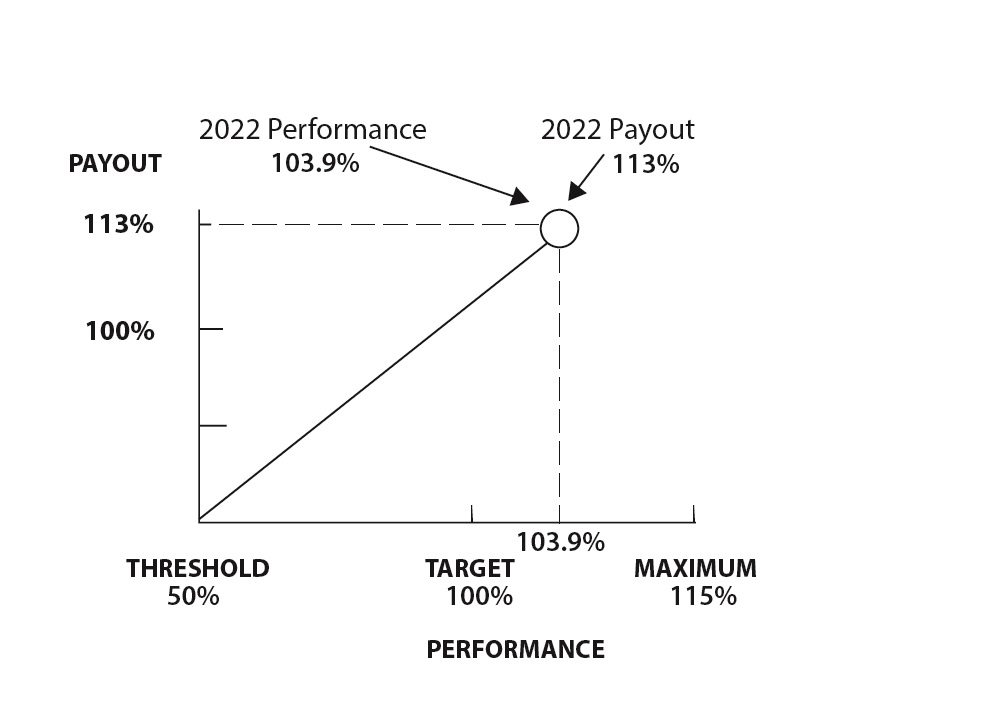

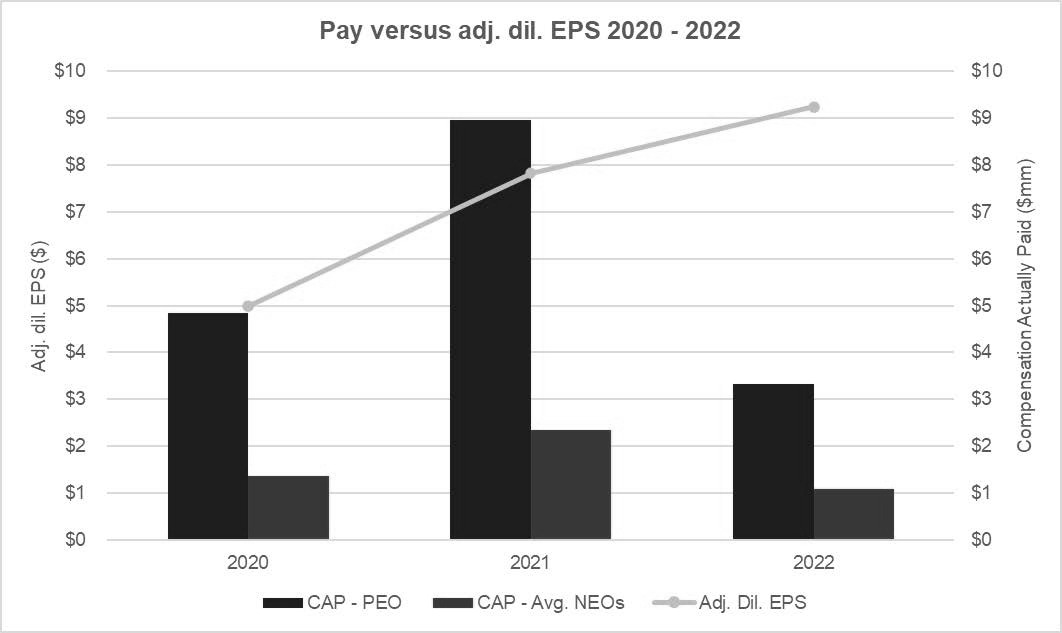

financial performance has yielded strong returns, and fiscal 2022 was a record-setting year across many key metrics with full year increases in revenue, bookings, net income, diluted earnings per share (diluted EPS), adjusted diluted earnings per share (adjusted diluted EPS), adjusted EBITDA and adjusted EBITDA margin as compared to the prior fiscal year. For fiscal 2022, our corporate performance measures used in our incentive plans resulted in our named executive officers earning above target performance-based cash bonus awards at the maximum potential level and earning above target under our performance-based equity award program.

Our board of directors is asking stockholders to approve a non-binding advisory vote on the following resolution:

RESOLVED, that the compensation paid to our named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (SEC), including the compensation discussion and analysis, the compensation tables and any related material disclosed in this proxy statement, is hereby approved.

As an advisory vote, this proposal is not binding upon the board of directors. The outcome of this advisory vote will not overrule any decision by our company or our board of directors (or any of its committees), create or imply any change to the fiduciary duties of our company or our board of directors (or any of its committees), or create or imply any additional fiduciary duties for our company or our board of directors (or any of its committees). However, our compensation committee, which is responsible for designing and administering our executive compensation program, and our board of directors value the opinions expressed by our stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for named executive officers.

Recommendation

Our board of directors recommends a vote FOR Proposal 2. Proxies solicited by our board of directors will be voted FOR the proposal unless stockholders otherwise specify to the contrary on their proxy.

PROPOSAL 3

ADVISORY VOTE ON THE FREQUENCY OF FUTURE EXECUTIVE COMPENSATION ADVISORY VOTES

We are also asking that our stockholders provide an advisory vote on how frequently we should seek future "say-on-pay" advisory votes on the compensation of our named executive officers, as required by Section 14A of the Exchange Act. By voting on this Proposal 3, stockholders may indicate whether they would prefer an advisory vote on named executive officer compensation once every one, two or three years.

In 2011 and 2017, our board of directors recommended, and our stockholders approved by non-binding advisory vote, that our executive compensation be submitted to our stockholders for an advisory vote annually. Our board of directors continues to believe that an annual advisory vote on executive compensation is the most appropriate alternative for our company, and our board of directors recommends that you vote for a one-year frequency for future advisory votes on executive compensation.

In considering its recommendation, our board of directors considered that an annual advisory vote on executive compensation will allow our stockholders to provide us with their direct and immediate input on our compensation philosophy, policies and practices as disclosed in our proxy statement each year.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years or abstain from voting when you vote on Proposal 3.

Recommendation

Our board of directors believes that an annual advisory vote on executive compensation is in the best interests of our company and stockholders and recommends you vote FOR the frequency option of ONE YEAR. Proxies solicited by our board of directors will be voted FOR the frequency option of ONE YEAR unless stockholders otherwise specify to the contrary on their proxy.

PROPOSAL 4

APPROVAL OF RESTRICTED STOCK UNIT GRANTS TO OUR NON-EMPLOYEE DIRECTORS

Our board of directors has approved a grant, subject to stockholder approval, of such number of restricted stock units (RSUs) determined by dividing $170,000 by the grant date fair value per share of our common stock based on the closing price on the day of the grant, which would be the date of our 2023 annual meeting, calculated in accordance with Accounting Standards Codification Topic 718, Compensation-Stock Compensation (ASC Topic 718), to our non-employee directors (Dr. Albertine, Mr. Leonard, Ms. O'Mara, Mr. Painter and Ms. Russell). If approved, the grant would be made under our 2006 amended and restated equity incentive plan, as amended (2006 equity incentive plan). We are asking that our stockholders cast a vote on the equity grants to our non-employee directors. Although we are not required to seek stockholder approval of these specific RSUs or other RSU awards, our board of directors decided to provide our stockholders with the opportunity to approve the proposed grants for this year. If this proposal is not approved by our stockholders at the 2023 annual meeting, these specific RSU awards will not occur. Our compensation committee will then consider the award of an appropriate amount of RSUs to our non-employee directors taking into consideration the outcome of the stockholder vote.

Our compensation philosophy with respect to non-employee directors is to structure a compensation program that is reasonable as compared to the non-employee director compensation of our compensation peer group of companies, as described in “Compensation Discussion and Analysis—Determining Compensation—Compensation Peer Group,” rewards performance and is aligned with our stockholders’ long-term interests. Our compensation committee is responsible for reviewing non-employee director compensation and recommending our non-employee director compensation pay for approval by our board of directors. Our compensation philosophy has been to weight total compensation for non-employee directors more heavily toward equity compensation as opposed to cash compensation, which may cause our director pay to exceed the median of total compensation for our peer group in years where our stock performance is strong. In 2017, in connection with the approval of the amendment and restatement of the 2006 equity incentive plan, we adopted a cap on total annual non-employee director compensation of $750,000 (based on the grant date fair value of equity awards for financial reporting purposes and cash payable to any non-employee director in any fiscal year), which was approved by our stockholders at our 2017 annual meeting. The total compensation of our non-employee directors for 2022 is reported under “Director Compensation,” was approximately $240,000 (excluding committee and chair retainers), based on a stock price of $180.57, other than for Ms. O'Mara, for whom the stock price was $178.49, and was above the median and slightly above the 75th percentile of our compensation peer group.

In the first quarter of 2022, our compensation committee engaged Willis Towers Watson to benchmark our director compensation against our compensation peer group, in particular for the purpose of reevaluating the equity award component of non-employee director compensation. Based on this review, our compensation committee concluded that the cash component of our non-employee director compensation fell below the 25th percentile of our compensation peer group and should therefore be adjusted to better align with the 25th percentile of our compensation peer group, while the equity component was above the median and at approximately the 70th percentile of our compensation peer group, resulting in total compensation above median of the peer group between the 60th and 70th percentile of our compensation peer group. Our committee also considered our recent financial performance and our one- and three-year total shareholder return (TSR) performance compared to the Russell 3000 Index and our compensation peer group. While our one-year TSR was negative, due in large part to stock market volatility caused by macroeconomic conditions, our three-year TSR remained strong. Our one-year TSR was -23% for 2022 and our three-year TSR was 19% through the end of 2022.

Given our strong financial performance in 2022 (as described in “Compensation Discussion and Analysis—Executive Summary—2022 Financial Performance Highlights”) and our one- and three- year TSR performance, our compensation committee believed that it would be reasonable to grant equity awards around the 75th percentile of our peer compensation data, with the cash compensation generally aligned with the 25th percentile. The compensation committee did not recommend an increase in the value of the equity to be awarded to non-employee directors or to committee and board chair fees. Our compensation committee recommended that for 2023, the equity award for non-employee directors be equal to such number of RSUs determined by dividing $170,000 by the grant date fair value per share of our common stock based on the closing price on the day of the grant, which would be the date of our 2023 annual meeting, calculated in accordance with ASC Topic 718. In 2022, the equity award for non-employee directors was also based on a value of $170,000. For purposes of illustration only, if the grant date fair value per share of our common stock based on the closing price on the date of our 2023 annual meeting calculated in accordance with ASC Topic 718 is $190, the award will consist of 894 RSUs to each non-employee director. By contrast, if the grant date fair value per share of our common stock based on the closing price on the date of our 2023 annual meeting calculated in accordance with ASC Topic 718 is $200, the award will consist of 850 RSUs to each non-employee director, and if the grant date fair value per share of our common stock based on the closing price on the date of our 2023 annual meeting calculated in accordance with ASC Topic 718 is $210, the award will consist of 809 RSUs to each

non-employee director. Our board of directors approved the award of RSUs, with the underlying number of RSUs to be determined by dividing $170,000 by the grant date fair value per share of our common stock based on the closing price on the day of grant, which would be the date of our 2023 annual meeting, calculated in accordance with ASC Topic 718, for each of our non-employee directors, subject to stockholder approval. Our board of directors decided that stockholders should have an opportunity to vote on the awards at the 2023 annual meeting.

Our compensation committee intends to continue to weight total compensation for non-employee directors more heavily toward equity compensation as opposed to cash compensation, consistent with its belief that such a compensation program aligns director pay with the long-term interests of our stockholders. Our compensation committee’s philosophy is to target average cash compensation of our non-employee directors at approximately the 25th percentile of our compensation peer group and to target equity compensation, assuming strong annual performance, at above the median closer to the 75th percentile, based on the approximate value of the award. In determining the appropriate size of the RSU awards to non-employee directors each year, our compensation committee will consider, among other factors, our financial performance and recent TSR performance relative to the Russell 3000 Index and our compensation peer group.

If the stockholders approve this proposal, the non-employee director RSU awards will be granted on the date of the 2023 annual meeting. Fifty percent of the RSUs will vest on June 1, 2023 and the remainder of the RSUs will vest in two equal installments on the last day of each of our third and fourth quarters of 2023. Each RSU entitles the director to one share of common stock. The proposed RSU awards will be made under our stockholder-approved 2006 equity incentive plan pursuant to the terms of the plan. The vesting of all such RSU awards will accelerate in the event of a change in control of our company. Any RSU award, to the extent not previously vested, is forfeited if the individual is no longer a member of the board of directors on the applicable vesting date. Each of Dr. Albertine, Mr. Leonard, Ms. O'Mara. Mr. Painter and Ms. Russell will receive the RSUs upon stockholder approval of this proposal and has an interest in the approval of this proposal.

Recommendation

Our board of directors believes the grant of the RSU awards to our non-employee directors is in the best interests of our company and stockholders and recommends a vote FOR Proposal 4. Proxies solicited by our board of directors will be voted FOR the proposal unless stockholders otherwise specify to the contrary on their proxy.

PROPOSAL 5

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected KPMG LLP as our company’s independent registered public accounting firm for the 2023 fiscal year. KPMG LLP was appointed as our company’s independent registered public accounting firm in August 2012, and has audited our consolidated financial statements since our 2012 fiscal year. Although we are not required to seek stockholder ratification of this selection, our board of directors decided to provide our stockholders with the opportunity to do so. If this proposal is not approved by our stockholders at the 2023 annual meeting, our audit committee will reconsider the selection of KPMG LLP. Even if the selection of KPMG LLP is ratified, our audit committee in its discretion may select a different independent registered public accounting firm at any time during the year.

Representatives of KPMG LLP are expected to be present at the 2023 annual meeting of stockholders. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders.

Recommendation

Our board of directors believes that the ratification of the selection of KPMG LLP as our company’s independent registered public accounting firm for the 2023 fiscal year is in the best interests of our company and stockholders and recommends you vote FOR ratification. Proxies solicited by our board of directors will be voted FOR the proposal unless stockholders otherwise specify to the contrary on their proxy.

CORPORATE GOVERNANCE

Our board of directors believes that good corporate governance is important to ensure that our company is managed for the long-term benefit of stockholders. Current copies of our corporate governance guidelines, code of business conduct and ethics, and charters for our audit, compensation, nominating and corporate governance, and risk oversight and sustainability committees are available on our website, www.kadant.com, in the Investors section under the caption “Corporate Governance.” We may also use our website in the future to make certain disclosures required by the rules of The New York Stock Exchange (NYSE), on which our common stock is listed.

Director Independence

Our board of directors has determined that each of the following directors qualifies as an “independent director,” as defined in the listing requirements of the NYSE: Dr. Albertine, Mr. Leonard, Ms. O'Mara and Ms. Russell. Its findings included an affirmative determination that none of our outside directors has a material relationship with our company. Neither Mr. Painter, who serves as the chairman of the board of directors, nor Mr. Powell, who serves as our current president and chief executive officer, qualify as an “independent director” under the NYSE rules. Our board of directors has established guidelines to assist it in determining whether a director has a material relationship with our company. Under these guidelines, a director is not considered to have a material relationship with our company if the director is independent and the director:

•receives, or has a family member that receives, less than $120,000 in direct compensation from our company for services rendered, excluding director and committee fees or deferred compensation for prior service;

•is an executive officer of another company that does business with our company, unless the annual sales to, or purchases from, our company account for more than the greater of $1 million or 2% of the annual consolidated gross revenues of the company of which the director is an executive officer;

•is an executive officer of another company that is indebted to our company, or to which our company is indebted, unless the total amount of either company’s indebtedness to the other is more than 1% of the total consolidated assets of the company of which the director is an executive officer; or

•is an officer, director or trustee of a charitable organization, unless our company’s discretionary charitable contributions to the organization are more than the greater of $1 million or 2% of the organization’s total annual charitable receipts. For this purpose, the automatic matching of employee charitable contributions, if any, is not included in the amount of our company’s contributions.

Ownership of a significant amount of our company’s stock, by itself, does not constitute a material relationship.

For relationships not covered by these guidelines, the determination of whether a material relationship exists is made by the other members of our board of directors who are independent.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation committee, a nominating and corporate governance committee, and a risk oversight and sustainability committee. Each committee operates under a charter that has been approved by our board of directors. Current copies of the committee charters are posted on our website, www.kadant.com.

Our board of directors has determined that all of the members of each committee also meet the independence guidelines applicable to each committee set forth in the listing requirements of the NYSE, including the enhanced NYSE and the SEC independence requirements for members of the audit and compensation committees.

The audit committee is responsible for the selection of our company’s independent registered public accounting firm and assists our board of directors in its oversight of the integrity of our financial statements, our independent registered public accounting firm’s performance, qualifications and independence, the performance of our internal audit function and, in conjunction with our risk oversight and sustainability committee, our compliance with legal and regulatory requirements. The audit committee meets regularly with management and our independent registered public accounting firm to discuss the annual audit of our financial statements, the quarterly reviews of our financial statements and our quarterly and annual earnings disclosures. The audit committee also reviews the experience and qualifications of the lead partner and other senior members of the independent auditor, including compliance with applicable rotation requirements, and considers whether there should be rotation of the firm itself. The current members of the audit committee are Mr. Leonard (chairman), Dr. Albertine, and Ms. Russell and their committee report is included in this proxy statement under the heading “Audit Committee Report.” Each of Dr. Albertine, Mr. Leonard and Ms. Russell has been designated by our board of directors as an “audit committee financial expert” (as defined in applicable SEC regulations).

The compensation committee reviews the performance and determines the compensation of the chief executive officer and other officers of our company, administers executive compensation, incentive compensation and incentive programs

and policies, and reviews and assesses management succession planning. The current members of the compensation committee are Dr. Albertine (chairman), Mr. Leonard and Ms. O'Mara. See “Compensation Discussion and Analysis” below for information regarding the compensation committee’s processes and procedures for the consideration and determination of executive compensation.

The nominating and corporate governance committee identifies and recommends to our board of directors qualified candidates for nomination as directors, develops and monitors our company’s corporate governance principles and evaluates the performance of our board and the individual directors. The current members of the nominating and corporate governance committee are Ms. O'Mara (chair), Dr. Albertine and Ms. Russell.

The risk oversight and sustainability committee assists our board of directors in fulfilling its oversight responsibilities with respect to management’s identification, prevention, evaluation, management and monitoring of our company’s critical enterprise risks, including major strategic, operational and reputational risks inherent in our business, including with respect to privacy and cybersecurity, legal, regulatory, and sustainability and compliance therewith. The current members of the risk oversight and sustainability committee are Ms. Russell (chair), Dr. Albertine, Mr. Leonard and Ms. O'Mara.

Attendance at Meetings

In 2022, our board of directors met six times and acted by unanimous written consent once, the audit committee met eight times, the risk oversight and sustainability committee met four times, the compensation committee met five times and acted by unanimous written consent three times, and the nominating and corporate governance committee met two times. Each director attended over 75% of all meetings of our board of directors and committees on which he or she served that were held during 2022. Our directors are encouraged to attend the annual meeting of stockholders, to the extent practicable. All of our directors attended our 2022 annual meeting of stockholders.

Board Self-Evaluation and Individual Director Evaluation

Our board of directors conducts an annual self-evaluation of the board’s performance as a whole and a peer evaluation of each of the individual directors. As part of this process, directors are asked to assess the independence from management of each individual director, and each director was deemed independent taking his or her tenure on the board into consideration. Our board of directors believes such evaluations are valuable tools in assessing the board’s effectiveness in performing its oversight of management and fulfilling its responsibilities. The results of the evaluations are collected by the chair of the nominating and corporate governance committee and communicated to the board of directors.

Board Leadership Structure

Our board of directors separated the roles of chief executive officer and chairman of the board in 2010 and believes this leadership structure continues to be appropriate.

Our chief executive officer is responsible for setting our strategic direction and the day-to-day leadership and performance of our company. Our chairman of the board of directors provides guidance to the chief executive officer and sets the agenda for board meetings and presides over meetings of the full board of directors.

In addition, because our chairman of the board of directors and our chief executive officer are also directors and are not independent under the NYSE rules, we also schedule regular executive sessions of our non-employee and independent directors without management present.

The presiding director at these sessions is rotated among the chair of the committees of our board of directors, all of whom are independent directors. Our board of directors recognizes that different leadership structures may be appropriate in the future, depending on our company’s circumstances, and will periodically review its leadership structure as situations change, our company evolves, and best practices develop.

Board Role in Risk Oversight

Our board of directors administers its risk oversight function directly and through its audit committee and risk oversight and sustainability committee. In general, management is responsible for the day-to-day management of the risks our company faces, while the board of directors, acting as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

Our board of directors formed the risk oversight and sustainability committee to assist it in fulfilling its oversight responsibilities with respect to management’s identification, prevention, evaluation, management and monitoring of our company’s critical enterprise risks, including major strategic, operational and reputational risks inherent in our business, including with respect to privacy and cybersecurity, legal, regulatory, and sustainability and compliance therewith. The risk oversight and sustainability committee meets regularly with our chief executive officer and senior management to discuss risk

management-related and other matters, including briefings regarding our cybersecurity risks and readiness from our Head of Global IT at least twice a year. We continually invest in protecting, monitoring, alerting and mitigating cybersecurity risks, including through our robust information security training and compliance programs and regular employee training. We have never experienced a cybersecurity incident which had a material effect on our business and operations, and we have not had any material cybersecurity incidents in the past three years.

The board of directors and the audit committee regularly discuss with management and our independent registered public accounting firm our major risk exposures, their potential financial impact on our company, and the steps we take to manage these risks. The audit committee assists the board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and, in coordination with the risk oversight and sustainability committee, compliance with legal and regulatory requirements. In addition, the audit committee discusses policies with respect to risk assessment and risk management with management, our internal auditors and the independent registered accounting firm.

Board Tenure

Our board of directors recognizes that its current members have served on the board of directors for various tenures, with the shortest tenure being one year, but with several other directors serving for 10 years or more. Our board of directors believes that the board represents a balance of experience in the industries served by our company and in the financial and business communities, which provides effective guidance and oversight to management. Our board of directors also recognizes the desire to keep our board of directors “refreshed” and has adopted a policy limiting director tenure to age 75 for members, other than certain grandfathered members of the board, which include Messrs. Albertine, Leonard and Painter. Directors (other than the grandfathered members) will not be nominated for election after reaching age 75. In addition, our nominating and corporate governance committee assesses the continuing independence of long-tenured directors from management as part of its determination on whether to nominate an incumbent director for re-election.

Nomination of Directors

The nominating and corporate governance committee of our board of directors identifies and evaluates director candidates and recommends to our board of directors qualified candidates for nomination as directors for election at our annual meeting of stockholders or to fill vacancies on our board of directors. The process followed by the committee in fulfilling its responsibilities includes requests to board members and others for recommendations, meetings to evaluate biographical information, experience and other background material relating to potential candidates, and interviews of selected candidates.

In considering candidates, the committee applies the criteria for selection of directors adopted by our board of directors, which is set forth as an appendix to our company’s corporate governance guidelines. These criteria include the following assessments of the candidate’s:

•integrity;

•business acumen, experience and judgment;

•knowledge of our company’s business and industry;

•ability to understand the interests of various constituencies of our company and to act in the interests of all of our stockholders;

•potential conflicts of interest; and

•contribution to diversity on our board of directors.

Our criteria specify that the value of diversity on the board of directors should be considered by the committee in the director identification and nomination process. While we do not have a formal policy on board diversity, our nominating and corporate governance committee and board of directors have affirmed their commitment to actively seeking women and racially and ethnically diverse candidates for the pool from which director candidates are selected. The committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The committee believes that the backgrounds and qualifications of our company’s directors, considered as a group, should provide a significant breadth of experience, knowledge and abilities to assist our board of directors in fulfilling its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sex, sexual orientation, gender identity or expression, disability or any other basis prohibited by law.

After completing its evaluation of potential nominees, the nominating and corporate governance committee makes a recommendation to our board of directors as to the persons who should be nominated for election to our board of directors, and our board of directors determines the nominees after considering the recommendation and report of the committee.

The nominating and corporate governance committee will consider candidates recommended by individual stockholders, if their names and credentials are provided to the committee on a timely basis for consideration prior to the annual meeting. Stockholders who wish to recommend an individual to the nominating and corporate governance committee for consideration as a potential candidate for director should submit the individual’s name, together with appropriate supporting

documentation, to the committee at the following address: Nominating and Corporate Governance Committee, c/o Corporate Secretary, Kadant Inc., One Technology Park Drive, Westford, Massachusetts 01886. A submission will be considered timely if it is made during the timeframes disclosed in this proxy statement under “Stockholder Proposals.” The submission must be accompanied by a statement as to whether the stockholder or group of stockholders making the recommendation has owned more than 5% of our common stock for at least a year prior to the date the recommendation is made. Submissions meeting these requirements will be considered by the nominating and corporate governance committee using the same process and applying substantially the same criteria it follows for candidates submitted by others. If our board of directors determines to nominate and recommend for election a stockholder-recommended candidate, then the candidate’s name will be included in our company’s proxy card for the next annual meeting of stockholders.

Stockholders also have the right under our company’s bylaws to directly nominate candidates for director, without any action or recommendation on the part of the nominating and corporate governance committee or our board of directors, by following the procedures described in this proxy statement under “Stockholder Proposals.” Except as otherwise required by law, candidates nominated by stockholders in accordance with these bylaw procedures will not be included in our company’s proxy card for the next annual meeting of stockholders.

Communications with Directors

Stockholders and other interested parties who wish to send written communications on any topic to our board of directors, or the presiding director of executive sessions of the non-employee and independent directors, may do so by addressing such communications to our Board of Directors, c/o Corporate Secretary, Kadant Inc., One Technology Park Drive, Westford, Massachusetts 01886. The independent members of our board of directors have approved a process directing the corporate secretary to monitor communications and to forward communications, such as those relating to corporate governance, long-term strategy and their oversight responsibilities, to our board of directors and to forward communications that relate to ordinary business affairs, personal grievances or other similar matters to management for response, if any.

Code of Business Conduct and Ethics

Our company’s code of business conduct and ethics is applicable to all our employees, officers and directors. A current copy of our code of business conduct and ethics is posted on our website, www.kadant.com. We intend to satisfy disclosure requirements of the SEC and NYSE regarding amendments to, or waivers of, our code of business conduct and ethics by providing information on our website.

Compensation Committee Interlocks and Insider Participation

During fiscal 2022, our compensation committee was comprised solely of the following independent directors: Dr. Albertine, Mr. Leonard and Dr. Tully. None of our officers, former officers or employees serves on our compensation committee. During fiscal 2022, none of our executive officers served on the board of directors or compensation committee of another company in which any of our directors also served as a director or executive officer.

Certain Relationships and Related Party Transactions

We review relationships and transactions between our company and our directors, nominees for director, executive officers and their immediate family members to determine whether these individuals have a direct or indirect material interest in a transaction, based on the facts and circumstances. Such transactions are referred to the disinterested members of the audit committee of our board of directors to review and approve or ratify the transaction. Directors and executive officers are canvassed in writing to determine whether such related party transactions exist or are under consideration, and are required under our code of business conduct and ethics to disclose to us potential conflicts of interest with our company.