UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06637

The UBS Funds

(Exact name of registrant as specified in charter)

One North Wacker Drive, Chicago, IL 60606-2807

(Address of principal executive offices) (Zip code)

|

Keith A. Weller, Esq. UBS Asset Management One North Wacker Drive Chicago, IL 60606 |

| (Name and address of agent for service) |

| Copy to: |

|

Bruce G. Leto, Esq. Stradley Ronon Stevens & Young, LLP 2005 Market Street, Suite 260 Philadelphia, PA 19103-7098 |

Registrant’s telephone number, including area code: 888-793 8637

Date of fiscal year end: June 30

Date of reporting period: June 30, 2022

Item 1. Reports to Stockholders.

| (a) | Copy of the report transmitted to shareholders: |

The UBS Funds

Annual Report | June 30, 2022

|

Table of contents |

Page |

||||||

|

President's letter |

1 |

||||||

|

Market commentary |

3 |

||||||

|

UBS All China Equity Fund |

5 |

||||||

|

UBS Dynamic Alpha Fund |

12 |

||||||

|

UBS Global Allocation Fund |

25 |

||||||

|

UBS Emerging Markets Equity Opportunity Fund |

39 |

||||||

|

UBS Engage For Impact Fund |

45 |

||||||

|

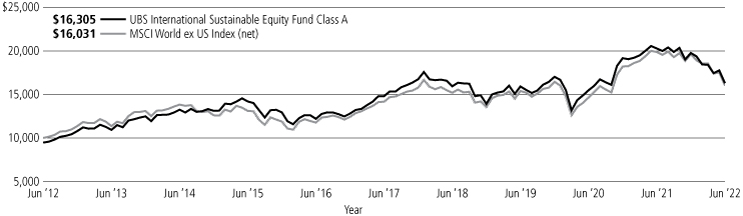

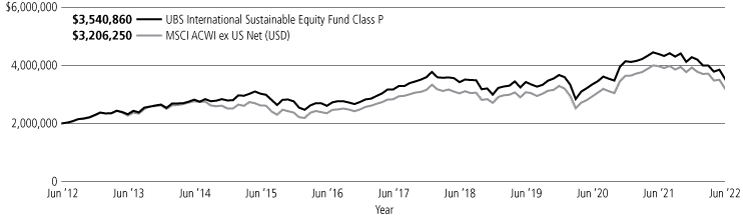

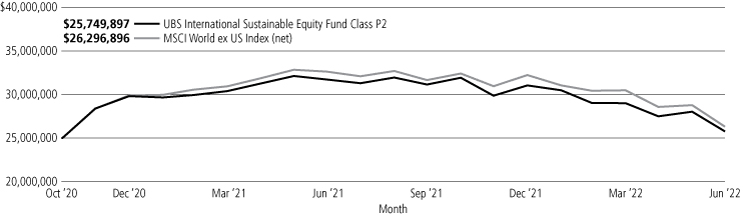

UBS International Sustainable Equity Fund |

53 |

||||||

|

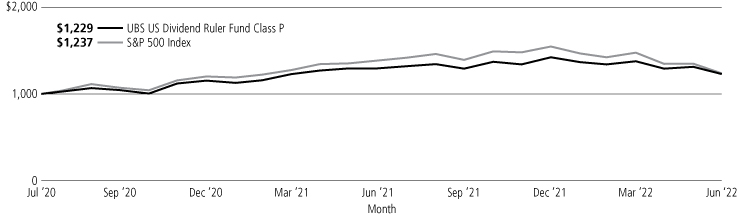

UBS US Dividend Ruler Fund |

62 |

||||||

|

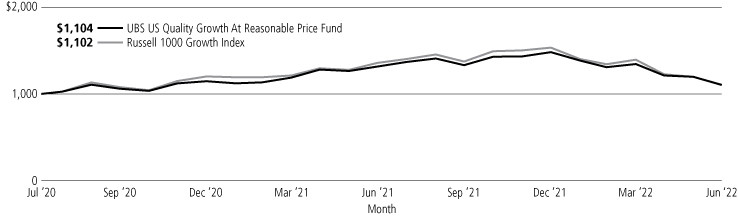

UBS US Quality Growth At Reasonable Price Fund |

69 |

||||||

|

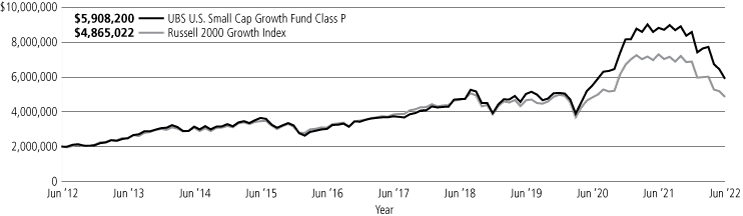

UBS U.S. Small Cap Growth Fund |

76 |

||||||

|

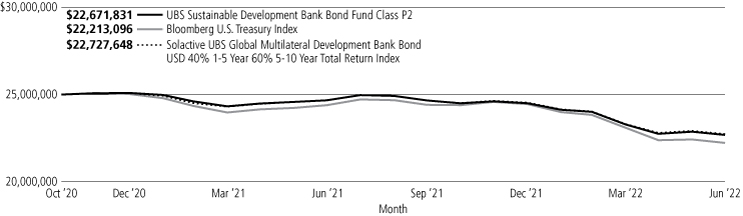

UBS Sustainable Development Bank Bond Fund |

85 |

||||||

|

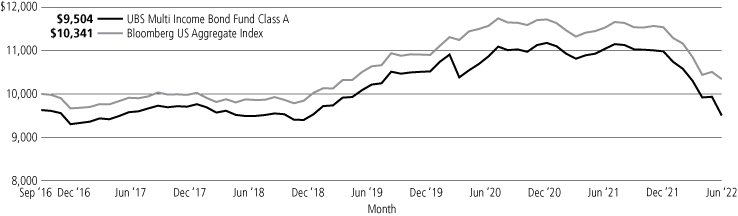

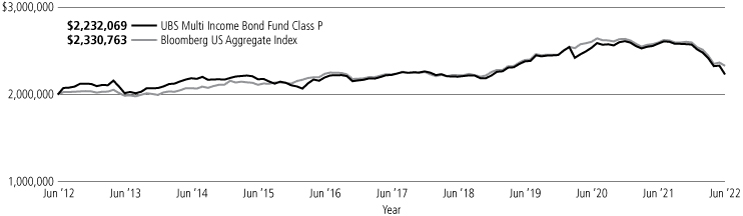

UBS Multi Income Bond Fund (formerly, UBS Total Return Bond Fund) |

91 |

||||||

|

Glossary of terms used in the Portfolio of investments |

102 |

||||||

|

Explanation of expense disclosure |

103 |

||||||

|

Statement of assets and liabilities |

106 |

||||||

|

Statement of operations |

111 |

||||||

|

Statement of changes in net assets |

115 |

||||||

|

Financial highlights |

121 |

||||||

|

Notes to financial statements |

133 |

||||||

|

Report of independent registered public accounting firm |

165 |

||||||

|

Federal tax information |

167 |

||||||

|

General information |

168 |

||||||

|

Board approval of investment advisory agreements |

169 |

||||||

|

Trustee and officer information |

175 |

||||||

This page intentionally left blank.

President's letter

August 12, 2022

Dear Shareholder,

While the global economic recovery has continued since I last wrote to you, it once again experienced unexpected challenges to growth, notably the ongoing Russian invasion of Ukraine and the knock-on effects to the economy as well as soaring inflation in the US.

Given the generally low levels of global trade with an already ailing Russian economy, the predominant channel for global economic disruption has been higher oil and natural gas prices, with flat out shortages in continental Europe.

Meanwhile, in the US, the highest consumer price index (CPI) increases since the 70s have forced the Federal Reserve's hand into an accelerated and aggressive tightening cycle (including two 0.75% hikes) which has put the federal funds target range (a key interest rate measure) 2.25% higher than where we started the year, as of this writing.

That said, while there has been the first talk of stagflation in the US in sometime, conversations around when the current tightening cycle will end have already also begun, as the market continues to revise its view and the Fed moves away from direct forward guidance.

A global decoupling is also underway, with Europe facing the most severe challenge to economic growth due to its direct dependence on Russia for natural gas, while in the US, unemployment remains low and wage growth remains strong, supporting economic growth in the face of inflation; meanwhile, China is moving from a tightening cycle to easier economic policy, with the People's Bank of China actually cutting rates and the federal government rolling back some of its restrictive fiscal policies.

And in addition to economic cycle decoupling, the Russian invasion of Ukraine, and the growing fear of energy politicization, is exacerbating the trend of deglobalization that has been underway since the beginning of the COVID-19 pandemic exposed the fragility of international supply chains. Increasing US-China tensions also continues to feed into this reversion from previous decades.

Amid the accompanying volatility and uncertainty generated by all these competing and conflicting scenarios, the need for UBS Asset Management to be 'on the ground' to provide region and country specific insights in order to offer robust, globally diversified investment solutions to our clients, amid competing and conflicting scenarios, remains as important as ever.

We believe our team of investment professionals around the world are well placed to help clients build genuinely diversified portfolios capable of producing results across markets and asset classes in these uncertain and trying times, and there are many unique and compelling opportunities that with the right strategies in the hands of skilled portfolio managers have the potential to deliver better investment outcomes for our clients.

1

President's letter

As always, we thank you for being a part of the UBS family of funds.

Sincerely,

Igor Lasun

President

The UBS Funds

Managing Director

UBS Asset Management (Americas) Inc.

2

The markets in review

Economic headwinds develop

While the global economy continued to expand during the reporting period as a whole, there were signs of potential weakness on the horizon. These included the ongoing challenges from COVID-19 and its variants, elevated and persistent inflation, supply chain bottlenecks, monetary policy tightening, and repercussions from the war in Ukraine. Looking back, third quarter 2021 US annualized gross domestic product ("GDP") was 2.3%. GDP then grew 6.9% over the fourth quarter of the year. The US economy then contracted 1.6% in the first quarter of 2022. This was partially attributable to rising imports and moderating business inventory buildups. Finally, the Commerce Department's initial estimate for second quarter annualized GDP—released after the reporting period ended—was -0.9%.

With US inflation hitting a 40-year high, the Federal Reserve Board (the "Fed") took a number of aggressive actions in an attempt to combat rising prices. The Fed ended its monthly asset purchases in March 2022 and then raised the federal funds rate 0.25% to a range between 0.25% and 0.50% in March 2022, its first rate hike since 2018. The central bank then raised rates 0.50% and 0.75% at its May and June meetings respectively. The latter rate hike was the largest by the Fed since 1994. The Fed also began shrinking its balance sheet, a process called "quantitative tightening." Finally, on July 27, 2022—after the reporting period ended—the Fed raised rates 0.75%, to a range between 2.25% and 2.50%. Overseas, the Bank of England raised rates for a fifth consecutive time at its June 2022 meeting, and the European Central Bank announced a plan to raise rates at its July and September 2022 meetings.

From a global perspective, in its April 2022 World Economic Outlook, the International Monetary Fund ("IMF") said, "Global economic prospects have worsened significantly since our last World Economic Outlook forecast in January [2022]. At the time, we had projected the global recovery to strengthen from the second quarter of this year after a short-lived impact of the Omicron variant. Since then, the outlook has deteriorated, largely because of Russia's invasion of Ukraine—causing a tragic humanitarian crisis in Eastern Europe—and the sanctions aimed at pressuring Russia to end hostilities." The IMF expects US GDP growth to be 3.7% in 2022, versus 5.7% in 2021. Elsewhere, the IMF expects 2022 GDP growth in the eurozone, UK and Japan will be 2.8%, 3.7% and 2.4%, respectively. For comparison purposes, GDP growth in these economies was 5.3%, 7.4% and 1.6%, respectively, in 2021.

Global equities experience a setback

Equities around the globe generated weak returns during the reporting period. The US market was dragged down by elevated inflation, expectations for aggressive Fed rate hikes and concerns whether the central bank could orchestrate a "soft landing" for the economy. Investor sentiment was also negatively impacted by the ongoing fallout from the war in Ukraine. For the 12-months ended June 30, 2022, the S&P 500 Index1 returned -10.62% and entered a bear market (a decline of 20% from a recent high). Outside the US, international developed equities, as measured by the MSCI EAFE Index (net),2 returned -17.77%. Emerging markets equities were even weaker, as the MSCI Emerging Markets Index (net)3 returned -25.28%.

1 The S&P 500 Index is an unmanaged, weighted index composed of 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees and expenses.

2 The MSCI EAFE Index (net) is an index of stocks designed to measure the investment returns of developed economies outside of North America. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

3 The MSCI Emerging Markets Index (net) is a market capitalization-weighted index composed of different emerging market countries in Europe, Latin America, and the Pacific Basin. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

3

The markets in review

The fixed income market falls sharply

The global fixed income market also performed poorly, as many central banks pivoted to tightening monetary policy to battle inflation. In the US, short- and long-term US Treasury yields moved sharply higher. For the 12 months ended June 30, 2022, the yield on the US 10-year Treasury rose from 1.45% to 2.98%. 10-year government bond yields outside the US also moved higher. (Bond yields and prices generally move in opposite directions.) For the 12-month reporting period as a whole, the overall US bond market, as measured by the Bloomberg US Aggregate Index,4 returned -10.29%. Returns of riskier fixed income securities also fell sharply. High yield bonds, as measured by the ICE BofAML US High Yield Cash Pay Constrained Index,5 returned -12.66%. Elsewhere, emerging markets debt, as measured by the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global),6 returned -19.25% during the reporting period.

4 The Bloomberg US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. Investors should note that indices do not reflect the deduction of fees and expenses.

5 The ICE BofAML US High Yield Cash Pay Constrained Index is an unmanaged index of publicly placed, non-convertible, coupon-bearing US dollar denominated, below investment grade corporate debt with a term to maturity of at least one year. The index is market capitalization weighted, so that larger bond issuers have a greater effect on the index's return. However, the representation of any single bond issuer is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees and expenses.

6 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which is designed to track total returns for US dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees and expenses.

4

UBS All China Equity Fund

Portfolio performance

For the 12 months ended June 30, 2022, the UBS All China Equity Fund (the "Fund") returned -27.86%. The Fund's benchmark, the MSCI China All Shares Index (net) (the "Index"), returned -25.48% over the same time period. (Please note that the Fund's returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund's performance was driven primarily by stock selection decisions.

Portfolio performance summary1

What worked:

• Within stock selection, Kweichow Moutai was the top contributor to Fund performance for the 12-month period.

– Moutai's share price recovered due to optimism about reopening post COVID-19 lockdowns. In addition, its first quarter 2022 results showed strong growth in revenues and profits, which were better than expected and indicated that the business remains resilient despite the broad slowdown in consumption in China. The company launched its iMoutai app in late March, reflecting its commitment to increase direct sales, which could help to improve average selling price and profit margins in the longer run. (For details, see "Portfolio highlights.")

• Several other stock selection decisions benefited performance during the reporting period.

– NetEase rose due to solid and better-than-expected first quarter 2022 results, as well as a strong pipeline of games this year. The company's highly anticipated game, Diablo Immortal, was scheduled to launch overseas in June, and the game already had 35 million preregistered users worldwide. NetEase also traded higher based on the resumption of some gaming license approvals, which served as a positive stimulus to the sector. (For details, see "Portfolio highlights.")

– China Resources Land outperformed on the back of the company's good land bank and strong management. We believe the company is likely to gain market share as the highly leveraged private companies weaken.

– The decision not to own NIO Inc., contributed positively to relative performance. We do not own the stock, as we believe competition from electric vehicle (EV) start-ups and traditional original equipment manufacturers (OEMs) will intensify.

– Shares of Anhui Gujing Distillery traded higher, possibly due to investors' expectations that the company would benefit from Shanghai's reopening and economic recovery, given the city's proximity to the company's key sales region of Anhui province.

What didn't work:

• Certain stock selection decisions made a negative contribution to Fund returns during the 12-month period.

– The Fund was underweight to Alibaba Group due to lingering regulatory concerns, weaker consumption, and tougher competition in the e-commerce space, as well as the company's lowered fiscal year 2022 guidance. We still hold Alibaba, as it is trading at an attractive valuation, and we consider it one of the best e-commerce plays in China. (For details, see "Portfolio highlights.")

– Not holding BYD Company detracted from relative performance as the stock rose on the possibility of new business opportunities. BYD also benefited from the fact that capacity and supply chain are seeing a gradual recovery.

1 For a detailed commentary on the market environment in general during the reporting period, see page 3.

5

UBS All China Equity Fund

– Ping An Bank fell due to investor concerns about the spillover effect of the continued weakness in the real estate sector. We continue to hold this stock.

– Jiangsu Hengrui Medicine underperformed during the 12-month period. Market sentiment about China's health care industry was weak due to the continued regulatory pressure. There are also uncertainties about the earnings impact from the government's centralized procurement price cuts. However, we expect the company's newly launched innovative drugs to mitigate any loss in revenue from the price cuts. We continue to hold this stock.

– Jinke Smart Services declined as its parent company, Jinke Property Group, extended the payment deadline of its onshore bond. Property sales were lackluster during the period, and consumer confidence remained weak as people adopted a wait-and-see approach. We continue to hold this stock.

Portfolio highlights

• Tencent is the leading company in China's PC/mobile internet market, and provides services such as instant messaging, online gaming, social community, news and online music. Tencent has established several powerful online service platforms and accumulated a huge number of loyal customers. With its current strong position, we expect the company to ride on the mature business models and consistently grow its business going forward. Fast-growing online games—along with newly emerging mobile games, which is one of the largest revenue-generating segments—will likely contribute most to the company going forward.

• Kweichow Moutai engages in the manufacture and distribution of Moutai liquor series products. Moutai is a Chinese premium liquor brand with strong pricing power and growth visibility. The share price is attractively valued, and the company offers the potential to benefit from state-owned enterprise (SOE) reform.

• Netease is a leading online game company in China. It has a good track record for delivering blockbuster games, and has posted healthy growth for more than 10 years. We believe that Netease continues to have a strong game pipeline and will be able to deliver new revenue streams. The company is well-positioned as a leading player in China's online entertainment sectors, particularly online games and music.

• Alibaba is a large e-commerce company. We believe that e-commerce penetration will continue to grow in China, even in the midst of a retail slowdown. Thus, we consider it a more defensive part of retail sales, and we believe Alibaba has the strongest position in China's e-commerce space.

• China Merchants Bank has the leading retail banking franchise in China. This was built up over many years due to an early focus on the segment while large state-owned enterprise banks were focusing on corporates. We believe China Merchants Bank is well-positioned to benefit from China's growing wealth, which would drive demand for wealth management products and financial advice.

• The Fund did not invest in derivatives during the reporting period.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2022. The views and opinions in the letter were current as of August 12, 2022. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our website at www.ubs.com/am-us.

6

UBS All China Equity Fund

Average annual total returns for periods ended 06/30/22 (unaudited)

|

1 year |

Inception |

||||||||||

|

Class P1,3 |

(27.86 |

)% |

(28.43 |

)% |

|||||||

|

Class P22,3 |

N/A |

8.19 |

|||||||||

|

MSCI China All Shares Index (net)4 |

(25.48 |

) |

(22.60 |

) |

|||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2021 prospectuses were as follows: Class P—17.70% and 1.13% and Class P2—17.70% and 0.30%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Asset Management (Americas) Inc., the Fund's investment advisor and administrator ("UBS AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses, such as proxy-related expenses) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses), through the period ending October 28, 2022, do not exceed 1.10% for Class P shares. The Advisor has also entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and retained administration fees, and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses, such as proxy-related expenses) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses, such as proxy related expenses), through the period ending October 28, 2022, do not exceed 0.30% for Class P2 shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses to the extent such reimbursement can be made during the three fiscal years following the date on which such fee waivers and expense reimbursements were made, provided that the reimbursement of the Advisor by the Fund will not cause the Fund to exceed the lesser of any applicable expense limit that is in place for the Fund (i) at the time of the waiver or reimbursement or (ii) at the time of the recoupment. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, UBS AM (Americas)'s three year recoupment rights will survive.

1 Inception date of Class P is February 24, 2021.

2 Inception date of Class P2 is April 21, 2022.

3 Class P and Class P2 shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but Class P and Class P2 shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance.

4 The MSCI China All Shares Index (net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Net total return indices reinvest dividends after the deduction of withholding taxes,using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses. Inception return for the Index is shown as of the inception date of the oldest share class: February 24, 2021.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Total returns for periods of less than one year have not been annualized. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit www.ubs.com/us-mutualfundperformance.

7

UBS All China Equity Fund

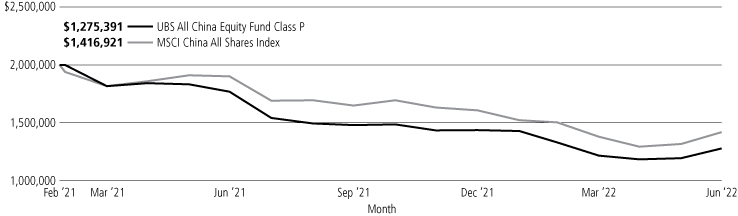

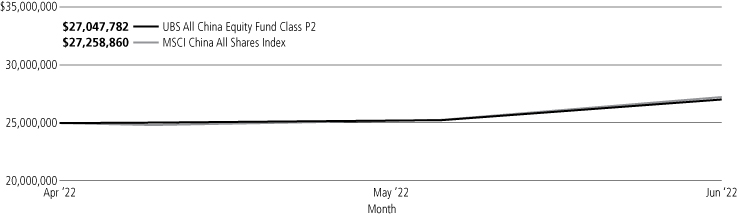

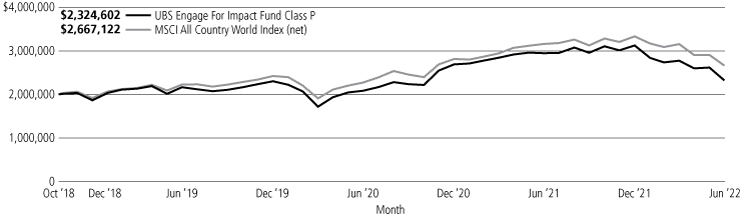

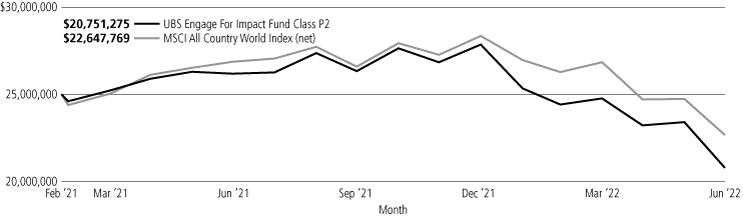

Illustration of an assumed investment of $2,000,000 in Class P shares and $25,000,000 in Class P2 shares (unaudited)

The following graphs depict the performance of UBS All China Equity Fund Class P and Class P2 shares versus the MSCI China All Shares Index from February 24, 2021, the inception date of Class P, and April 21, 2022, the inception date of Class P2, through June 30, 2022. Class P and Class P2 shares may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemptions of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or a loss upon redemption. It is important to note that UBS All China Equity Fund is a professionally managed portfolio while the Index is not available for investment and is unmanaged. The comparison is shown for illustration purposes only.

UBS All China Equity Fund Class P vs. MSCI China All Shares Index

UBS All China Equity Fund Class P2 vs. MSCI China All Shares Index

8

UBS All China Equity Fund

Portfolio statistics and industry diversification—(unaudited)1

As a percentage of net assets as of June 30, 2022

Top ten holdings

|

Kweichow Moutai Co. Ltd., Class A |

9.9 |

% |

|||||

|

China Merchants Bank Co. Ltd., Class H |

9.1 |

||||||

|

NetEase, Inc. |

8.9 |

||||||

|

Tencent Holdings Ltd. |

8.2 |

||||||

|

Hong Kong Exchanges & Clearing Ltd. |

4.1 |

||||||

|

Ping An Bank Co. Ltd., Class A |

3.6 |

||||||

|

Ping An Insurance Group Co. of China Ltd., Class H |

3.5 |

||||||

|

Yunnan Energy New Material Co. Ltd., Class A |

3.2 |

||||||

|

Inner Mongolia Yili Industrial Group Co. Ltd., Class A |

2.9 |

||||||

|

Meituan, Class B |

2.7 |

||||||

|

Total |

56.1 |

% |

|||||

Top issuer breakdown by country or territory of origin

|

China |

90.2 |

% |

|||||

|

Hong Kong |

7.2 |

||||||

|

United States |

3.5 |

||||||

|

Total |

100.9 |

% |

|||||

|

Common stocks |

|||||||

|

Automobiles |

1.4 |

% |

|||||

|

Banks |

12.7 |

||||||

|

Beverages |

12.7 |

||||||

|

Capital markets |

4.1 |

||||||

|

Chemicals |

0.5 |

||||||

|

Construction materials |

0.7 |

||||||

|

Containers & packaging |

3.2 |

||||||

|

Diversified consumer services |

0.1 |

||||||

|

Diversified financial services |

1.1 |

||||||

|

Entertainment |

9.2 |

||||||

|

Food products |

3.9 |

||||||

|

Gas utilities |

0.1 |

||||||

|

Health care providers & services |

0.1 |

||||||

|

Household durables |

0.4 |

||||||

|

Insurance |

4.8 |

||||||

|

Interactive media & services |

8.2 |

||||||

|

Internet & direct marketing retail |

5.7 |

||||||

|

IT services |

1.2 |

||||||

|

Life sciences tools & services |

5.3 |

||||||

|

Pharmaceuticals |

6.2 |

||||||

|

Real estate management & development |

7.5 |

||||||

|

Semiconductors & semiconductor equipment |

3.8 |

||||||

|

Software |

0.0 |

† |

|||||

|

Textiles, apparel & luxury goods |

0.5 |

||||||

|

Tobacco |

1.5 |

||||||

|

Transportation infrastructure |

2.5 |

||||||

|

Total common stocks |

97.4 |

||||||

|

Short-term investments |

3.5 |

||||||

|

Total investments |

100.9 |

||||||

|

Liabilities in excess of other assets |

(0.9 |

) |

|||||

|

Net assets |

100.0 |

% |

|||||

1 The portfolio is actively managed and its composition will vary over time.

† Amount represents less than 0.05% or (0.05)%

9

UBS All China Equity Fund

Portfolio of investments

June 30, 2022

|

Number of shares |

Value |

||||||||||

|

Common stocks: 97.4% |

|||||||||||

|

China: 90.2% |

|||||||||||

|

Alibaba Group Holding Ltd.* |

5,400 |

$ |

77,007 |

||||||||

|

Anhui Conch Cement Co. Ltd., Class H |

6,500 |

28,164 |

|||||||||

|

Anhui Gujing Distillery Co. Ltd., Class B |

5,200 |

81,113 |

|||||||||

|

China Gas Holdings Ltd. |

4,200 |

6,487 |

|||||||||

|

China Jinmao Holdings Group Ltd. |

82,000 |

22,050 |

|||||||||

|

China Merchants Bank Co. Ltd., Class H |

58,500 |

391,402 |

|||||||||

|

China Resources Land Ltd. |

22,000 |

102,615 |

|||||||||

|

Chinasoft International Ltd.* |

52,000 |

53,214 |

|||||||||

|

Country Garden Services Holdings Co. Ltd. |

15,000 |

66,811 |

|||||||||

|

CSPC Pharmaceutical Group Ltd. |

96,000 |

95,305 |

|||||||||

|

Far East Horizon Ltd.1 |

56,000 |

46,959 |

|||||||||

|

Hainan Meilan International Airport Co. Ltd., Class H* |

37,000 |

108,923 |

|||||||||

|

Hangzhou Silan Microelectronics Co. Ltd., Class A |

11,100 |

86,223 |

|||||||||

|

Inner Mongolia Yili Industrial Group Co. Ltd., Class A |

21,600 |

125,677 |

|||||||||

|

JD.com, Inc., Class A |

1,509 |

48,615 |

|||||||||

|

Jiangsu Hengrui Medicine Co. Ltd., Class A |

7,500 |

41,554 |

|||||||||

|

Jinke Smart Services Group Co. Ltd., Class H |

14,800 |

38,100 |

|||||||||

|

Joinn Laboratories China Co. Ltd., Class H2 |

10,700 |

90,135 |

|||||||||

|

Kingsoft Corp. Ltd. |

3,000 |

11,699 |

|||||||||

|

Kweichow Moutai Co. Ltd., Class A |

1,400 |

427,677 |

|||||||||

|

Li Auto, Inc., ADR* |

1,590 |

60,913 |

|||||||||

|

Li Ning Co. Ltd. |

2,500 |

23,162 |

|||||||||

|

Longfor Group Holdings Ltd.2 |

20,000 |

94,434 |

|||||||||

|

LONGi Green Energy Technology Co. Ltd., Class A |

7,840 |

78,034 |

|||||||||

|

Meituan, Class B*,2 |

4,800 |

118,795 |

|||||||||

|

Midea Group Co. Ltd., Class A |

2,100 |

18,944 |

|||||||||

|

NetEase, Inc. |

21,000 |

385,648 |

|||||||||

|

Ping An Bank Co. Ltd., Class A |

70,000 |

156,641 |

|||||||||

|

Ping An Healthcare and Technology Co. Ltd.*,1,2 |

800 |

2,370 |

|||||||||

|

Ping An Insurance Group Co. of China Ltd., Class H |

22,500 |

152,976 |

|||||||||

|

Smoore International Holdings Ltd.1,2 |

21,000 |

64,765 |

|||||||||

|

Number of shares |

Value |

||||||||||

|

Common stocks—(concluded) |

|||||||||||

|

China—(concluded) |

|||||||||||

|

TAL Education Group, ADR* |

468 |

$ |

2,279 |

||||||||

|

Tencent Holdings Ltd. |

7,900 |

356,803 |

|||||||||

|

Tuya, Inc., ADR* |

400 |

1,048 |

|||||||||

|

Wanhua Chemical Group Co. Ltd., Class A |

1,400 |

20,284 |

|||||||||

|

Wuliangye Yibin Co. Ltd., Class A |

1,300 |

39,214 |

|||||||||

|

Wuxi AppTec Co. Ltd. Class H2 |

5,600 |

74,578 |

|||||||||

|

Wuxi Biologics Cayman, Inc.*,2 |

7,000 |

64,052 |

|||||||||

|

Yihai International Holding Ltd.* |

12,000 |

43,279 |

|||||||||

|

Yunnan Baiyao Group Co. Ltd., Class A |

6,020 |

54,307 |

|||||||||

|

Yunnan Energy New Material Co. Ltd., Class A |

3,700 |

138,426 |

|||||||||

|

3,900,682 |

|||||||||||

|

Hong Kong: 7.2% |

|||||||||||

|

AIA Group Ltd. |

5,200 |

56,362 |

|||||||||

|

Hong Kong Exchanges & Clearing Ltd. |

3,600 |

177,091 |

|||||||||

|

SSY Group Ltd. |

148,000 |

79,028 |

|||||||||

|

312,481 |

|||||||||||

|

Total common stocks (cost $4,546,449) |

4,213,163 |

||||||||||

|

Short-term investments: 3.5% |

|||||||||||

|

Investment companies: 3.5% |

|||||||||||

|

State Street Institutional U.S. Government Money Market Fund, 1.430%3 (cost $151,066) |

151,066 |

151,066 |

|||||||||

|

Total investments: 100.9% (cost $4,697,515) |

4,364,229 |

||||||||||

|

Liabilities in excess of other assets: (0.9)% |

(40,032 |

) |

|||||||||

|

Net assets: 100.0% |

$ |

4,324,197 |

|||||||||

For a listing of defined portfolio acronyms that are used throughout the Portfolio of investments as well as the tables that follow, please refer to the Glossary of terms used in the Portfolio of investments.

10

UBS All China Equity Fund

Portfolio of investments

June 30, 2022

Fair valuation summary

The following is a summary of the fair valuations according to the inputs used as of June 30, 2022 in valuing the Fund's investments. In the event a Fund holds investments for which fair value is measured using the NAV per share practical expedient (or its equivalent), a separate column will be added to the fair value hierarchy table; this is intended to permit reconciliation to the amounts presented in the Portfolio of investments:

|

Description |

Unadjusted quoted prices in active markets for identical investments (Level 1) |

Other significant observable inputs (Level 2) |

Unobservable inputs (Level 3) |

Total |

|||||||||||||||

|

Assets |

|||||||||||||||||||

|

Common stocks |

$ |

4,213,163 |

$ |

— |

$ |

— |

$ |

4,213,163 |

|||||||||||

|

Short-term investments |

— |

151,066 |

— |

151,066 |

|||||||||||||||

|

Total |

$ |

4,213,163 |

$ |

151,066 |

$ |

— |

$ |

4,364,229 |

|||||||||||

At June 30, 2022, there were no transfers in or out of Level 3.

Portfolio footnotes

* Non-income producing security.

1 Security, or portion thereof, was on loan at the period end.

2 Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities are considered liquid, unless noted otherwise, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Securities exempt from registration pursuant to Rule 144A, in the amount of $509,129, represented 11.8% of the Fund's net assets at period end.

3 Rates shown reflect yield at June 30, 2022.

See accompanying notes to financial statements.

11

UBS Dynamic Alpha Fund

Portfolio performance

For the 12 months ended June 30, 2022 (the "reporting period"), Class A shares of UBS Dynamic Alpha Fund (the "Fund") returned -5.92% (Class A shares returned -11.13% after the deduction of the maximum sales charge), while Class P shares returned -5.78%. For purposes of comparison, the ICE BofA Merrill Lynch US Treasury 1-5 Year Index retuned -4.61% during the same time period, the MSCI World Index (net) returned -14.34%, and the FTSE One-Month US Treasury Bill Index returned 0.15%. (Class P shares have lower expenses than other share classes of the Fund.) Returns for all share classes over various time periods are shown on page 14; please note that these returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

Overall, the Fund delivered a negative return in a challenging market environment of rapidly rising yields and falling equity markets. The Fund fell short of its cash plus goal, but managed to limit overall market declines.

The Fund posted positive performance during the first half of the reporting period, with most of our trades and directional exposures contributing to results. It was a period of reflation, reopening and optimism. Global growth accelerated, yield curves steepened during early months, and inflation expectations increased more than 1%. During this time, equites strongly outperformed bonds and our cyclicals value trades added to performance. Finally, attractively valued emerging market currencies benefited from a weaker US dollar and gradually improving global financial conditions. The Fund was exposed to all those factors.

The second half of the reporting period was less constructive and represented more of a mixed bag for the Fund. With inflation and supply issues already being a concern heading into 2022, these issues were exacerbated with repeated COVID-19 outbreaks in China, along with Russia's invasion of Ukraine, which added geopolitical risks and macroeconomic uncertainty causing equity markets to sell-off. In turn, investors turned more cautious, equity markets experienced severe headwinds, and the US dollar strengthened in anticipation of weaker near-term (global) growth.

Portfolio performance summary1

• The portfolio's strategic allocation to equities and credit detracted from performance.

– Our strategic allocation to global equities delivered negative returns over the reporting period, as global equity markets entered a bear market in 2022, driven by recession worries and higher yields.

– Fixed income was a slight detractor overall as yields rose over the reporting period. An exception was high-yield corporate bonds, which were additive for returns due to narrowing credit spreads.

• Overall, market allocation decisions added to results.

– We maintained an equity overweight for most of the reporting period. Prior to the start of the period, we decided to assume a more neutral stance (at least from a risk [beta] point of view) as we transitioned into second quarter of 2021, as several of our key risk indicators turned more negative. First, economic momentum was peaking and markets historically struggled during such an adjustment period. Second, our behavioral sentiment indicators were softening, as the media increasingly focused on the aforementioned peak in global growth. Lastly, we were concerned that a quick rise in yields could pressure lofty equity valuations.

– Within equities, we maintained a pro-cyclical value positioning for most of the reporting period, with the rationale of further earnings upside from a reopening of the global economy. Most of the trades within this category contributed to performance, such as long Stoxx600 Banks versus Eurostoxx50, long FTSE MIB (Milano Indice di Borsa) Italy versus Stoxx50.

1 For a detailed commentary on the market environment in general during the reporting period, see page 3.

12

UBS Dynamic Alpha Fund

– Other trades that added to performance were the more defensively minded, such as the long UK versus EuroStoxx50 position and the long Topix versus MSCI World trade, which performed especially well in 2022.

– Minor detractors were the long materials trades and the US yield curve steepener trade. Materials underperformed on the back of severe COVID lockdowns in the second quarter of 2022 and an ongoing deceleration of the domestic real estate market. Meanwhile, yield curves flattened on the back of increasing growth worries and a hawkish shift of the US Federal Reserve at year end.

• Overall, active currency positions detracted from results.

– The largest contributor to performance was a short US dollar Norwegian krone trade. This position benefited from hawkish rhetoric from the Norges Bank and a procyclical growth improvement, which similarly, helped long emerging market positions, such as the Brazilian real and Mexican peso against the US dollar, which were additive to performance.

– On the downside, the Fund's short positions in developed commodity currencies, such as the Canadian dollar and New Zealand dollar against the US dollar, were the largest detractors amidst the improved global growth outlook and a rebound in commodity prices.

We used derivatives, specifically futures and forwards, for risk management purposes and as a tool to help enhance returns across various strategies. Derivatives were just one tool, among others, that we used to implement our market allocation strategy. The use of derivatives detracted from Fund Performance.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2022. The views and opinions in the letter were current as of August 12, 2022. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our website at www.ubs.com/am-us.

13

UBS Dynamic Alpha Fund

Average annual total returns for periods ended 06/30/22 (unaudited)

|

1 year |

5 years |

10 years |

|||||||||||||

|

Before deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

(5.92 |

)% |

0.83 |

% |

1.57 |

% |

|||||||||

|

Class P2 |

(5.78 |

) |

1.07 |

1.80 |

|||||||||||

|

After deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

(11.13 |

)% |

(0.30 |

)% |

0.99 |

% |

|||||||||

|

ICE BofA US Treasury 1-5 Year Index3 |

(4.61 |

) |

0.91 |

0.89 |

|||||||||||

|

MSCI World Index (net)4 |

(14.34 |

) |

7.67 |

9.51 |

|||||||||||

|

FTSE One-Month US Treasury Bill Index5 |

0.15 |

1.02 |

0.57 |

||||||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2021 prospectuses were as follows: Class A—2.32% and 1.38%; Class P—2.09% and 1.13%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Asset Management (Americas) Inc., the Fund's investment advisor and administrator ("UBS AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, dividend expense and security loan fees for securities sold short, and extraordinary expenses, such as proxy-related expenses), through the period ending October 28, 2022, do not exceed 1.35% for Class A shares and 1.10% for Class P shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses to the extent such reimbursement can be made during the three fiscal years following the date on which such fee waivers and expense reimbursements were made, provided that the reimbursement of the Advisor by the Fund will not cause the Fund to exceed the lesser of any applicable expense limit that is in place for the Fund (i) at the time of the waiver or reimbursement or (ii) at the time of the recoupment. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, UBS AM (Americas)'s three year recoupment rights will survive.

1 Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees.

2 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but Class P shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance.

3 The ICE BofA US Treasury 1-5 Year Index is an unmanaged index designed to track US Treasury securities with maturities between 1 and 5 years. Investors should note that indices do not reflect the deduction of fees and expenses.

4 The MSCI World Index (net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

5 The FTSE One-Month US Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last one month Treasury Bill issue. Investors should note that indices do not reflect the deduction of fees and expenses.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Total returns for periods of less than one year have not been annualized. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit www.ubs.com/us-mutualfundperformance.

14

UBS Dynamic Alpha Fund

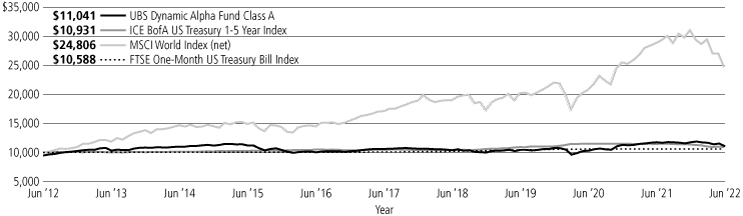

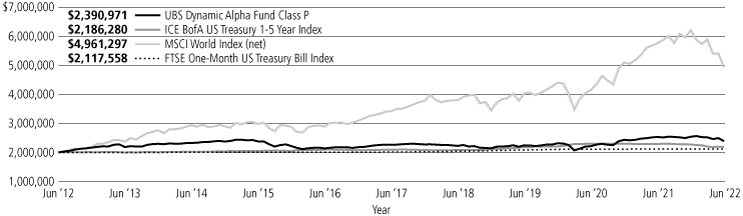

Illustration of an assumed investment of $10,000 in Class A shares (adjusted for 5.5% maximum sales charge) and $2,000,000 in Class P shares (unaudited)

The following graphs depict the performance of UBS Dynamic Alpha Fund Class A and Class P shares versus the ICE BofA US Treasury 1-5 Year Index, the MSCI World Index (net) and the FTSE One-Month US Treasury Bill Index over the 10 years ended June 30, 2022. Class P shares may be subject to a program fee, which, if included, would have reduced performance. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemptions of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or a loss upon redemption. It is important to note that UBS Dynamic Alpha Fund is a professionally managed portfolio while the Indices are not available for investment and are unmanaged. The comparison is shown for illustration purposes only.

UBS Dynamic Alpha Fund Class A vs. ICE BofAML US Treasury 1-5 Year Index, MSCI World Index (net) and FTSE One-Month US Treasury Bill Index

UBS Dynamic Alpha Fund Class P vs. ICE BofAML US Treasury 1-5 Year Index, MSCI World Index (net) and FTSE One-Month US Treasury Bill Index

15

UBS Dynamic Alpha Fund

Portfolio statistics and industry diversification—(unaudited)1,2

As a percentage of net assets as of June 30, 2022

Top ten holdings

|

U.S. Treasury Bills, 0.533% due 07/14/22 |

12.4 |

% |

|||||

|

U.S. Treasury Bills, 1.620% due 12/01/22 |

10.9 |

||||||

|

U.S. Treasury Notes, 0.250% due 05/31/25 |

3.5 |

||||||

|

Bundesobligation, 0.010% due 04/11/25 |

3.4 |

||||||

|

U.S. Treasury Notes, 0.375% due 04/30/25 |

1.9 |

||||||

|

Canadian Government Bond, 1.500% due 09/01/24 |

1.9 |

||||||

|

Ireland Government Bond, 1.000% due 05/15/26 |

1.9 |

||||||

|

Japan Government Ten Year Bond, 0.400% due 03/20/25 |

1.7 |

||||||

|

New Zealand Government Inflation Linked Bond, 3.000% due 09/20/30 |

1.6 |

||||||

|

Canadian Government Bond, 1.000% due 09/01/22 |

1.4 |

||||||

|

Total |

40.6 |

% |

|||||

Top five issuer breakdown by country or territory of origin

|

United States |

50.6 |

% |

|||||

|

United Kingdom |

5.4 |

||||||

|

Germany |

4.4 |

||||||

|

Canada |

4.0 |

||||||

|

France |

4.0 |

||||||

|

Total |

68.4 |

% |

|||||

|

Corporate bonds |

|||||||

|

Advertising |

0.1 |

% |

|||||

|

Aerospace & defense |

0.1 |

||||||

|

Agriculture |

0.6 |

||||||

|

Airlines |

0.2 |

||||||

|

Apparel |

0.0 |

† |

|||||

|

Auto manufacturers |

1.4 |

||||||

|

Auto parts & equipment |

0.2 |

||||||

|

Banks |

8.0 |

||||||

|

Biotechnology |

0.1 |

||||||

|

Chemicals |

0.7 |

||||||

|

Commercial services |

0.2 |

||||||

|

Computers |

0.3 |

||||||

|

Diversified financial services |

1.2 |

||||||

|

Electric |

2.6 |

||||||

|

Engineering & construction |

0.5 |

||||||

|

Entertainment |

0.2 |

||||||

|

Gas |

0.8 |

||||||

|

Healthcare-products |

0.2 |

||||||

|

Insurance |

2.6 |

||||||

|

Machinery-diversified |

0.1 |

||||||

|

Media |

0.3 |

||||||

|

Miscellaneous manufacturers |

0.2 |

||||||

|

Oil & gas |

0.9 |

||||||

|

Pharmaceuticals |

0.2 |

||||||

|

Pipelines |

0.5 |

||||||

|

Real estate |

0.2 |

||||||

|

Real estate investment trusts |

0.6 |

||||||

|

Retail |

0.1 |

||||||

|

Semiconductors |

0.2 |

||||||

|

Software |

0.1 |

||||||

|

Sovereign |

0.4 |

||||||

|

Supranationals |

0.4 |

||||||

|

Telecommunications |

0.3 |

||||||

|

Transportation |

0.3 |

||||||

|

Water |

0.4 |

||||||

|

Total corporate bonds |

25.2 |

||||||

|

Mortgage-backed securities |

0.0 |

† |

|||||

|

Non-U.S. government agency obligations |

23.1 |

||||||

|

U.S. Treasury obligations |

30.9 |

||||||

|

Exchange traded funds |

6.9 |

||||||

|

Short-term investments |

3.1 |

||||||

|

Investment of cash collateral from securities loaned |

0.6 |

||||||

|

Total investments |

89.8 |

||||||

|

Other assets in excess of liabilities |

10.2 |

||||||

|

Net assets |

100.0 |

% |

|||||

† Amount represents less than 0.05% or (0.05)%.

1 The portfolio is actively managed and its composition will vary over time.

2 Figures represent the breakdown of direct investments of UBS Dynamic Alpha Fund. Figures would be different if a breakdown of the underlying investment companies and exchange traded funds was included.

16

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2022

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds: 25.2% |

|||||||||||

|

Australia: 0.9% |

|||||||||||

|

APA Infrastructure Ltd. 4.200%, due 03/23/252 |

15,000 |

$ |

14,874 |

||||||||

|

Aurizon Network Pty Ltd. 4.000%, due 06/21/242 |

AUD |

30,000 |

20,461 |

||||||||

|

Ausgrid Finance Pty Ltd. 3.750%, due 10/30/242 |

AUD |

30,000 |

20,312 |

||||||||

|

Commonwealth Bank of Australia (fixed, converts to FRN on 10/03/24), 1.936%, due 10/03/292,3 |

EUR |

100,000 |

100,687 |

||||||||

|

Westpac Banking Corp. 2.000%, due 01/13/23 |

30,000 |

29,849 |

|||||||||

|

(fixed, converts to FRN on 09/21/27), 5.000%, due 09/21/273,4 |

80,000 |

69,943 |

|||||||||

|

256,126 |

|||||||||||

|

Belgium: 0.4% |

|||||||||||

|

Resa SA 1.000%, due 07/22/262 |

EUR |

100,000 |

99,676 |

||||||||

|

Bermuda: 0.1% |

|||||||||||

|

XLIT Ltd. 5.250%, due 12/15/43 |

20,000 |

21,305 |

|||||||||

|

Canada: 0.4% |

|||||||||||

|

Bank of Nova Scotia 3.450%, due 04/11/25 |

30,000 |

29,604 |

|||||||||

|

Canadian Pacific Railway Co. 1.350%, due 12/02/24 |

60,000 |

56,442 |

|||||||||

|

TELUS Corp. 3.750%, due 01/17/25 |

CAD |

15,000 |

11,459 |

||||||||

|

97,505 |

|||||||||||

|

Cayman Islands: 0.7% |

|||||||||||

|

Amber Circle Funding Ltd. 3.250%, due 12/04/222 |

200,000 |

199,960 |

|||||||||

|

China: 0.1% |

|||||||||||

|

NXP BV/NXP Funding LLC/NXP USA, Inc. 2.700%, due 05/01/25 |

5,000 |

4,750 |

|||||||||

|

3.150%, due 05/01/27 |

15,000 |

13,920 |

|||||||||

|

18,670 |

|||||||||||

|

France: 2.6% |

|||||||||||

|

AXA SA (fixed, converts to FRN on 05/28/29), 3.250%, due 05/28/492,3 |

EUR |

100,000 |

96,602 |

||||||||

|

Credit Agricole SA 1.250%, due 04/14/262 |

EUR |

100,000 |

99,904 |

||||||||

|

Electricite de France SA 5.625%, due 01/22/24 |

100,000 |

91,550 |

|||||||||

|

SCOR SE (fixed, converts to FRN on 03/13/29), 5.250%, due 03/13/292,3,4 |

200,000 |

161,250 |

|||||||||

|

Terega SA 2.200%, due 08/05/252 |

EUR |

100,000 |

103,704 |

||||||||

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds—(continued) |

|||||||||||

|

France—(concluded) |

|||||||||||

|

TotalEnergies SE (fixed, converts to FRN on 02/26/25), 2.625%, due 02/26/252,3,4 |

EUR |

100,000 |

$ |

97,459 |

|||||||

|

Unibail-Rodamco-Westfield SE (fixed, converts to FRN on 04/25/26), 2.875%, due 01/25/262,3,4 |

EUR |

100,000 |

72,441 |

||||||||

|

722,910 |

|||||||||||

|

Germany: 0.9% |

|||||||||||

|

ADLER Group SA 1.500%, due 07/26/242,5 |

EUR |

100,000 |

60,385 |

||||||||

|

Volkswagen International Finance N.V. 1.125%, due 10/02/232 |

EUR |

100,000 |

103,716 |

||||||||

|

Series NC6, (fixed, converts to FRN on 06/27/24), 3.375%, due 06/27/242,3,4 |

EUR |

100,000 |

96,586 |

||||||||

|

260,687 |

|||||||||||

|

Guernsey: 0.3% |

|||||||||||

|

Globalworth Real Estate Investments Ltd. 3.000%, due 03/29/252 |

EUR |

100,000 |

91,748 |

||||||||

|

Ireland: 1.0% |

|||||||||||

|

AerCap Ireland Capital DAC/AerCap Global Aviation Trust 1.650%, due 10/29/24 |

300,000 |

276,999 |

|||||||||

|

Japan: 0.1% |

|||||||||||

|

Mitsubishi UFJ Financial Group, Inc. 2.665%, due 07/25/22 |

25,000 |

25,005 |

|||||||||

|

Mexico: 0.9% |

|||||||||||

|

Mexico City Airport Trust 5.500%, due 07/31/472 |

200,000 |

136,100 |

|||||||||

|

Petroleos Mexicanos 3.750%, due 02/21/242 |

EUR |

100,000 |

101,049 |

||||||||

|

237,149 |

|||||||||||

|

Poland: 0.3% |

|||||||||||

|

Tauron Polska Energia SA 2.375%, due 07/05/272 |

EUR |

100,000 |

86,901 |

||||||||

|

Spain: 1.6% |

|||||||||||

|

Banco Santander SA 3.250%, due 04/04/262 |

EUR |

100,000 |

102,419 |

||||||||

|

4.000%, due 01/19/232 |

AUD |

200,000 |

138,270 |

||||||||

|

Iberdrola International BV (fixed, converts to FRN on 03/26/24), 2.625%, due 12/26/232,3,4 |

EUR |

100,000 |

101,128 |

||||||||

|

Redexis Gas Finance BV 1.875%, due 04/27/272 |

EUR |

100,000 |

96,203 |

||||||||

|

438,020 |

|||||||||||

|

Supranationals: 0.8% |

|||||||||||

|

Corp. Andina de Fomento 4.500%, due 06/05/252 |

AUD |

35,000 |

23,770 |

||||||||

17

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2022

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds—(continued) |

|||||||||||

|

Supranationals—(concluded) |

|||||||||||

|

European Financial Stability Facility 0.500%, due 07/11/252 |

EUR |

100,000 |

$ |

102,267 |

|||||||

|

European Investment Bank 2.000%, due 12/15/22 |

100,000 |

99,723 |

|||||||||

|

225,760 |

|||||||||||

|

Switzerland: 0.4% |

|||||||||||

|

Argentum Netherlands BV for Swiss Life AG (fixed, converts to FRN on 06/16/25), 4.375%, due 06/16/252,3,4 |

EUR |

100,000 |

101,809 |

||||||||

|

United Kingdom: 4.0% |

|||||||||||

|

AstraZeneca PLC 3.500%, due 08/17/23 |

30,000 |

30,085 |

|||||||||

|

Aviva PLC (fixed, converts to FRN on 09/29/22), 6.125%, due 09/29/223,4 |

GBP |

30,000 |

36,519 |

||||||||

|

Barclays PLC (fixed, converts to FRN on 10/06/22), 2.375%, due 10/06/232,3 |

GBP |

100,000 |

121,378 |

||||||||

|

BAT Capital Corp. 3.557%, due 08/15/27 |

25,000 |

22,871 |

|||||||||

|

BAT International Finance PLC 0.875%, due 10/13/232 |

EUR |

100,000 |

103,480 |

||||||||

|

Lloyds Banking Group PLC 2.250%, due 10/16/242 |

GBP |

100,000 |

116,894 |

||||||||

|

Natwest Group PLC (fixed, converts to FRN on 06/25/23), 4.519%, due 06/25/243 |

200,000 |

199,486 |

|||||||||

|

Phoenix Group Holdings PLC 4.125%, due 07/20/222 |

GBP |

150,000 |

182,630 |

||||||||

|

Reynolds American, Inc. 4.450%, due 06/12/25 |

25,000 |

24,850 |

|||||||||

|

Virgin Money UK PLC (fixed, converts to FRN on 04/24/25), 3.375%, due 04/24/262,3 |

GBP |

100,000 |

115,688 |

||||||||

|

WPP Finance 2010 3.750%, due 09/19/24 |

25,000 |

24,415 |

|||||||||

|

Yorkshire Water Finance PLC (fixed, converts to FRN on 03/22/23), 3.750%, due 03/22/462,3 |

GBP |

100,000 |

121,702 |

||||||||

|

1,099,998 |

|||||||||||

|

United States: 9.7% |

|||||||||||

|

3M Co. 2.650%, due 04/15/25 |

20,000 |

19,613 |

|||||||||

|

Air Products and Chemicals, Inc. 2.050%, due 05/15/30 |

20,000 |

17,287 |

|||||||||

|

Albemarle Corp. 5.450%, due 12/01/44 |

30,000 |

29,359 |

|||||||||

|

Altria Group, Inc. 4.400%, due 02/14/26 |

13,000 |

12,770 |

|||||||||

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds—(continued) |

|||||||||||

|

United States—(continued) |

|||||||||||

|

American Airlines Pass-Through Trust, Series 2014-1, Class B, 4.375%, due 10/01/22 |

31,614 |

$ |

31,576 |

||||||||

|

Apache Corp. 4.250%, due 01/15/44 |

60,000 |

43,745 |

|||||||||

|

Apple, Inc. 1.800%, due 09/11/24 |

30,000 |

29,063 |

|||||||||

|

Aptiv PLC/Aptiv Corp. 2.396%, due 02/18/25 |

50,000 |

47,750 |

|||||||||

|

AT&T, Inc. 4.350%, due 03/01/29 |

60,000 |

59,078 |

|||||||||

|

Bank of America Corp. (fixed, converts to FRN on 12/20/22), 3.004%, due 12/20/233 |

90,000 |

89,705 |

|||||||||

|

3.875%, due 08/01/25 |

80,000 |

79,653 |

|||||||||

|

Baxter International, Inc. 2.600%, due 08/15/26 |

30,000 |

28,069 |

|||||||||

|

Boeing Co. 2.196%, due 02/04/26 |

20,000 |

18,027 |

|||||||||

|

Broadcom, Inc. 3.150%, due 11/15/25 |

35,000 |

33,706 |

|||||||||

|

Chevron Phillips Chemical Co. LLC/Chevron Phillips Chemical Co. LP 3.300%, due 05/01/236 |

120,000 |

119,743 |

|||||||||

|

5.125%, due 04/01/256 |

25,000 |

25,761 |

|||||||||

|

Citigroup, Inc. 3.875%, due 10/25/23 |

130,000 |

131,332 |

|||||||||

|

4.600%, due 03/09/265 |

20,000 |

20,025 |

|||||||||

|

Comcast Corp. 3.950%, due 10/15/25 |

35,000 |

35,138 |

|||||||||

|

Costco Wholesale Corp. 1.600%, due 04/20/30 |

10,000 |

8,435 |

|||||||||

|

CVS Health Corp. 2.625%, due 08/15/245 |

25,000 |

24,441 |

|||||||||

|

Dell International LLC/EMC Corp. 5.300%, due 10/01/29 |

60,000 |

59,150 |

|||||||||

|

EnLink Midstream Partners LP 4.400%, due 04/01/24 |

10,000 |

9,762 |

|||||||||

|

Enterprise Products Operating LLC 3.900%, due 02/15/245 |

20,000 |

19,975 |

|||||||||

|

EQT Corp. 3.900%, due 10/01/27 |

20,000 |

18,612 |

|||||||||

|

Eversource Energy 2.900%, due 03/01/27 |

80,000 |

75,098 |

|||||||||

|

Exelon Corp. 3.400%, due 04/15/26 |

15,000 |

14,554 |

|||||||||

|

Ford Motor Credit Co. LLC 3.021%, due 03/06/24 |

EUR |

100,000 |

100,407 |

||||||||

|

General Electric Co. 6.750%, due 03/15/32 |

6,000 |

6,712 |

|||||||||

|

General Motors Financial Co., Inc. 4.350%, due 04/09/25 |

90,000 |

88,891 |

|||||||||

18

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2022

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds—(continued) |

|||||||||||

|

United States—(continued) |

|||||||||||

|

Georgia Power Co., Series A, 2.100%, due 07/30/23 |

25,000 |

$ |

24,639 |

||||||||

|

Gilead Sciences, Inc. 2.500%, due 09/01/23 |

20,000 |

19,786 |

|||||||||

|

Goldman Sachs Group, Inc. 1.625%, due 07/27/262 |

EUR |

30,000 |

29,574 |

||||||||

|

3.375%, due 03/27/252 |

EUR |

25,000 |

26,569 |

||||||||

|

3.500%, due 04/01/25 |

80,000 |

78,420 |

|||||||||

|

Illinois Tool Works, Inc. 2.650%, due 11/15/26 |

45,000 |

43,036 |

|||||||||

|

John Deere Capital Corp. 2.125%, due 03/07/255 |

20,000 |

19,311 |

|||||||||

|

JPMorgan Chase & Co. 3.200%, due 01/25/23 |

220,000 |

220,308 |

|||||||||

|

3.625%, due 12/01/27 |

60,000 |

57,601 |

|||||||||

|

Kinder Morgan, Inc. 5.625%, due 11/15/236 |

35,000 |

35,636 |

|||||||||

|

Liberty Mutual Group, Inc. 4.569%, due 02/01/296 |

25,000 |

24,581 |

|||||||||

|

Lincoln National Corp. 3.800%, due 03/01/28 |

70,000 |

66,815 |

|||||||||

|

Magallanes, Inc. 3.755%, due 03/15/276 |

50,000 |

46,900 |

|||||||||

|

Mastercard, Inc. 2.000%, due 03/03/25 |

20,000 |

19,246 |

|||||||||

|

Morgan Stanley 4.000%, due 07/23/25 |

85,000 |

84,928 |

|||||||||

|

4.350%, due 09/08/26 |

20,000 |

19,793 |

|||||||||

|

MPLX LP 4.250%, due 12/01/27 |

30,000 |

28,949 |

|||||||||

|

National Rural Utilities Cooperative Finance Corp. 3.700%, due 03/15/29 |

15,000 |

14,378 |

|||||||||

|

NIKE, Inc. 2.400%, due 03/27/25 |

10,000 |

9,738 |

|||||||||

|

Oncor Electric Delivery Co. LLC 3.700%, due 11/15/28 |

25,000 |

24,325 |

|||||||||

|

Oracle Corp. 2.500%, due 04/01/25 |

20,000 |

19,002 |

|||||||||

|

Paramount Global 4.750%, due 05/15/25 |

33,000 |

33,306 |

|||||||||

|

Quanta Services, Inc. 0.950%, due 10/01/24 |

50,000 |

46,243 |

|||||||||

|

Raytheon Technologies Corp. 3.950%, due 08/16/25 |

25,000 |

25,052 |

|||||||||

|

Southern California Edison Co., Series E, 3.700%, due 08/01/25 |

20,000 |

19,672 |

|||||||||

|

Southern Co. 3.250%, due 07/01/26 |

35,000 |

33,492 |

|||||||||

|

Swiss Re Treasury U.S. Corp. 4.250%, due 12/06/426 |

30,000 |

27,742 |

|||||||||

|

Face amount1 |

Value |

||||||||||

|

Corporate bonds—(concluded) |

|||||||||||

|

United States—(concluded) |

|||||||||||

|

Target Corp. 1.950%, due 01/15/275 |

15,000 |

$ |

13,914 |

||||||||

|

Thermo Fisher Scientific, Inc. 1.215%, due 10/18/24 |

20,000 |

18,948 |

|||||||||

|

TWDC Enterprises 18 Corp. 1.850%, due 07/30/26 |

10,000 |

9,235 |

|||||||||

|

United Airlines Pass-Through Trust, Series 2016-1, Class B, 3.650%, due 01/07/26 |

32,870 |

29,909 |

|||||||||

|

Verizon Communications, Inc. 3.376%, due 02/15/25 |

25,000 |

24,814 |

|||||||||

|

Virginia Electric and Power Co., Series A, 3.800%, due 04/01/28 |

20,000 |

19,549 |

|||||||||

|

Visa, Inc. 1.900%, due 04/15/27 |

25,000 |

23,060 |

|||||||||

|

Williams Cos., Inc. 4.300%, due 03/04/24 |

35,000 |

35,151 |

|||||||||

|

Xcel Energy, Inc. 4.800%, due 09/15/41 |

80,000 |

75,372 |

|||||||||

|

2,646,431 |

|||||||||||

|

Total corporate bonds (cost $7,598,984) |

6,906,659 |

||||||||||

|

Mortgage-backed securities: 0.0%† |

|||||||||||

|

Cayman Islands: 0.0%† |

|||||||||||

|

LNR CDO IV Ltd., Series 2006-1A, Class FFX, 7.592%, due 05/28/436,7,8 |

8,000,000 |

0 |

|||||||||

|

United States: 0.0%† |

|||||||||||

|

Structured Adjustable Rate Mortgage Loan Trust, Series 2005-7, Class B11, 2.971%, due 04/25/359 |

61,626 |

1 |

|||||||||

|

Total mortgage-backed securities (cost $8,099,709) |

1 |

||||||||||

|

Non-U.S. government agency obligations: 23.1% |

|||||||||||

|

Australia: 2.8% |

|||||||||||

|

Australia Government Bond 2.250%, due 05/21/282 |

AUD |

420,000 |

271,551 |

||||||||

|

2.750%, due 11/21/272 |

AUD |

200,000 |

133,578 |

||||||||

|

5.750%, due 07/15/222 |

AUD |

540,000 |

373,264 |

||||||||

|

778,393 |

|||||||||||

|

Canada: 3.7% |

|||||||||||

|

Canada Housing Trust No. 1 2.350%, due 09/15/236 |

CAD |

120,000 |

92,367 |

||||||||

|

Canadian Government Bond 1.000%, due 09/01/22 |

CAD |

500,000 |

387,865 |

||||||||

|

1.500%, due 09/01/24 |

CAD |

690,000 |

518,288 |

||||||||

|

998,520 |

|||||||||||

19

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2022

|

Face amount1 |

Value |

||||||||||

|

Non-U.S. government agency obligations—(continued) |

|||||||||||

|

China: 0.4% |

|||||||||||

|

China Development Bank 1.250%, due 01/21/232 |

GBP |

100,000 |

$ |

120,688 |

|||||||

|

Colombia: 0.1% |

|||||||||||

|

Colombia Government International Bond 8.125%, due 05/21/24 |

30,000 |

31,112 |

|||||||||

|

France: 1.4% |

|||||||||||

|

Caisse d'Amortissement de la Dette Sociale 1.375%, due 11/25/242 |

EUR |

100,000 |

105,139 |

||||||||

|

French Republic Government Bond OAT 0.010%, due 03/25/252 |

EUR |

260,000 |

264,861 |

||||||||

|

370,000 |

|||||||||||

|

Germany: 3.4% |

|||||||||||

|

Bundesobligation 0.010%, due 04/11/252 |

EUR |

910,000 |

932,822 |

||||||||

|

Ireland: 1.9% |

|||||||||||

|

Ireland Government Bond 1.000%, due 05/15/262 |

EUR |

490,000 |

510,016 |

||||||||

|

Japan: 3.8% |

|||||||||||

|

Japan Bank for International Cooperation 0.625%, due 05/22/23 |

200,000 |

195,961 |

|||||||||

|

Japan Government Ten Year Bond 0.400%, due 03/20/25 |

JPY |

63,000,000 |

470,076 |

||||||||

|

Japanese Government CPI Linked Bond 0.100%, due 03/10/26 |

JPY |

48,587,660 |

375,115 |

||||||||

|

1,041,152 |

|||||||||||

|

Mexico: 0.1% |

|||||||||||

|

Mexico Government International Bond 8.000%, due 09/24/22 |

30,000 |

30,362 |

|||||||||

|

New Zealand: 2.6% |

|||||||||||

|

New Zealand Government Bond 0.500%, due 05/15/26 |

NZD |

500,000 |

277,257 |

||||||||

|

New Zealand Government Inflation Linked Bond 3.000%, due 09/20/302 |

NZD |

545,146 |

434,594 |

||||||||

|

711,851 |

|||||||||||

|

Poland: 0.3% |

|||||||||||

|

Republic of Poland Government International Bond 0.010%, due 02/10/252 |

EUR |

90,000 |

88,704 |

||||||||

|

Romania: 0.4% |

|||||||||||

|

Romanian Government International Bond 2.750%, due 02/26/262 |

EUR |

100,000 |

98,429 |

||||||||

|

Spain: 0.7% |

|||||||||||

|

Spain Government Bond 1.600%, due 04/30/252,6 |

EUR |

180,000 |

190,123 |

||||||||

|

Face amount1 |

Value |

||||||||||

|

Non-U.S. government agency obligations—(concluded) |

|||||||||||

|

Supranationals: 0.1% |

|||||||||||

|

European Union 3.000%, due 09/04/262 |

EUR |

30,000 |

$ |

33,413 |

|||||||

|

United Kingdom: 1.4% |

|||||||||||

|

Bank of England Euro Note 0.500%, due 04/28/232 |

40,000 |

39,253 |

|||||||||

|

United Kingdom Gilt 0.500%, due 07/22/222 |

GBP |

290,000 |

352,925 |

||||||||

|

392,178 |

|||||||||||

|

Total non-U.S. government agency obligations (cost $7,110,404) |

6,327,763 |

||||||||||

|

U.S. Treasury obligations: 30.9% |

|||||||||||

|

United States: 30.9% |

|||||||||||

|

U.S. Treasury Bills 0.533%, due 07/14/2210 |

3,400,000 |

3,399,355 |

|||||||||

|

1.620%, due 12/01/2210 |

3,000,000 |

2,979,791 |

|||||||||

|

U.S. Treasury Notes 0.250%, due 05/31/25 |

1,030,000 |

950,457 |

|||||||||

|

0.375%, due 04/30/25 |

560,000 |

519,728 |

|||||||||

|

1.375%, due 09/30/23 |

320,000 |

313,788 |

|||||||||

|

1.500%, due 02/28/23 |

210,000 |

208,261 |

|||||||||

|

2.750%, due 11/15/23 |

100,000 |

99,699 |

|||||||||

|

Total U.S. Treasury obligations (cost $8,605,861) |

8,471,079 |

||||||||||

|

Number of shares |

|||||||||||

|

Exchange traded funds: 6.9% |

|||||||||||

|

United States: 6.9% |

|||||||||||

|

iShares MSCI USA Value Factor ETF5 |

8,035 |

727,328 |

|||||||||

|

iShares MSCI International Value Factor ETF |

52,125 |

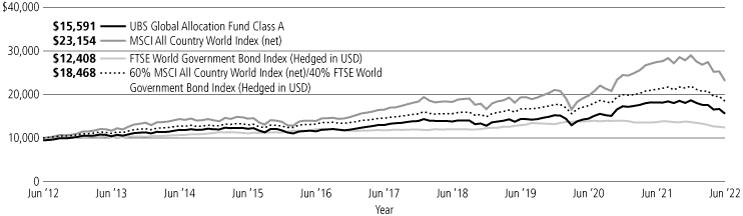

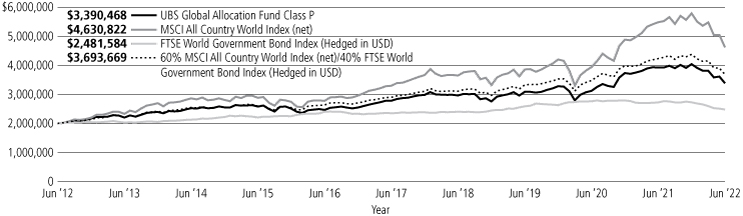

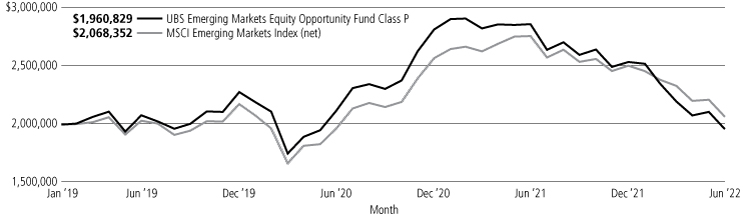

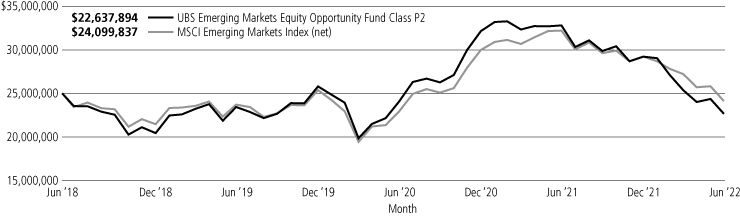

1,156,132 |