Prospectus |

Includes:

• UBS All China Equity Fund

Class: A: UACAX, P: UACPX

• UBS Dynamic Alpha Fund

Class: A:

• UBS Emerging Markets Equity Opportunity Fund

Class: A:

• UBS Engage For Impact Fund

Class: A: UEIAX, P:

• UBS Global Allocation Fund

Class: A:

• UBS International Sustainable Equity Fund

Class: A:

• UBS U.S. Small Cap Growth Fund

Class: A:

• UBS U.S. Sustainable Equity Fund

Class: A:

• UBS Municipal Bond Fund

Class: A:

• UBS Sustainable Development Bank Bond Fund

Class: A: UDBAX, P:

• UBS Total Return Bond Fund

Class: A:

This prospectus offers Class A and Class P shares in certain series of The UBS Funds (the "Trust") (each, a "Fund" and, collectively, the "Funds").

The Board of Trustees of the Trust has approved certain actions to liquidate and dissolve the UBS U.S. Sustainable Equity Fund. The liquidation is expected to be completed on or about March 1, 2021. In connection with the liquidation, the Board approved the closure of each class of the Fund to new investments, including new investors, additional purchases from existing investors and purchases for exchange from other funds. The Board also approved the closure of each class of the Fund to reinvestments of dividends and distributions. Therefore, the Fund no longer offers shares for purchase. Also in connection with the liquidation, all contingent deferred sales charges ("CDSC") assessed on redemptions that are charged on Class A shares (on purchases of $1,000,000 or more) are eliminated. The annual service fee of 0.25% of average net assets that is charged on Class A shares will not be waived.

Shareholders of the Fund on March 1, 2021 will have their accounts liquidated and the proceeds will be delivered to them. For those shareholders with taxable accounts, the liquidation will be considered a taxable transaction, and such shareholders may recognize a gain or loss for Federal income tax purposes. Shareholders should consult their tax advisers regarding the effect of the Fund's liquidation in light of their individual circumstances.

As with all mutual funds, the US Securities and Exchange Commission ("SEC") and US Commodity Futures Trading Commission ("CFTC") have not approved or disapproved any Fund's shares or determined whether this prospectus is complete or accurate. To state otherwise is a crime.

Not FDIC Insured. May lose value. No bank guarantee.

Contents

The UBS Funds

What every investor should know about the funds

|

Fund summaries |

Page |

||||||

|

• UBS All China Equity Fund |

4 |

||||||

|

• UBS Dynamic Alpha Fund |

10 |

||||||

|

• UBS Emerging Markets Equity Opportunity Fund |

17 |

||||||

|

• UBS Engage For Impact Fund |

24 |

||||||

|

• UBS Global Allocation Fund |

31 |

||||||

|

• UBS International Sustainable Equity Fund |

38 |

||||||

|

• UBS U.S. Small Cap Growth Fund |

44 |

||||||

|

• UBS U.S. Sustainable Equity Fund |

48 |

||||||

|

• UBS Municipal Bond Fund |

53 |

||||||

|

• UBS Sustainable Development Bank Bond Fund |

58 |

||||||

|

• UBS Total Return Bond Fund |

63 |

||||||

|

More information about the funds |

|||||||

|

• UBS All China Equity Fund—Investment objective, strategies, securities selection and risks |

69 |

||||||

|

• UBS Dynamic Alpha Fund—Investment objective, strategies, securities selection and risks |

76 |

||||||

|

• UBS Emerging Markets Equity Opportunity Fund—Investment objective, strategies, securities selection and risks |

85 |

||||||

|

• UBS Engage For Impact Fund—Investment objective, strategies, securities selection and risks |

92 |

||||||

|

• UBS Global Allocation Fund—Investment objective, strategies, securities selection and risks |

100 |

||||||

|

• UBS International Sustainable Equity Fund—Investment objective, strategies, securities selection and risks |

109 |

||||||

|

• UBS U.S. Small Cap Growth Fund—Investment objective, strategies, securities selection and risks |

116 |

||||||

|

• UBS U.S. Sustainable Equity Fund—Investment objective, strategies, securities selection and risks |

120 |

||||||

|

• UBS Municipal Bond Fund—Investment objective, strategies, securities selection and risks |

125 |

||||||

|

• UBS Sustainable Development Bank Bond Fund—Investment objective, strategies, securities selection and risks |

131 |

||||||

|

• UBS Total Return Bond Fund—Investment objective, strategies, securities selection and risks |

136 |

||||||

|

Your investment |

|||||||

|

Information for managing your fund account |

|||||||

|

• Managing your fund account |

142 |

||||||

|

• Flexible pricing |

142 |

||||||

|

• Buying shares |

148 |

||||||

|

• Selling shares |

151 |

||||||

|

• Exchanging shares |

152 |

||||||

|

• Pricing and valuation |

153 |

||||||

2

|

Additional information |

Page |

||||||

|

Additional important information about the funds |

|||||||

|

• Management |

155 |

||||||

|

• Disclosure of portfolio holdings |

162 |

||||||

|

• Dividends and taxes |

163 |

||||||

|

• Related prior performance information |

167 |

||||||

|

• Financial highlights |

169 |

||||||

|

• Appendix A |

A-1 |

||||||

|

• Where to learn more about the funds |

Back cover |

||||||

Please find the UBS family of funds privacy notice on page 180 of this prospectus.

Please find the UBS Asset Management business continuity planning overview on page 181 of this prospectus.

The funds are not a complete or balanced investment program.

3

Fund Summary

The Fund seeks to maximize capital appreciation.

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Different intermediaries and financial professionals may make available different sales charge waivers or discounts. These variations are described in Appendix A beginning on page A-1 of this prospectus.

|

Class A |

Class P |

||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

|

% |

|

||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

|

|

|||||||||

|

Class A |

Class P |

||||||||||

|

Management fees |

|

% |

|

% |

|||||||

|

Distribution and/or service (12b-1) fees |

|

|

|||||||||

|

Other expenses2 |

|

|

|||||||||

|

Total annual fund operating expenses |

|

|

|||||||||

|

Less management fee waiver/expense reimbursements3 |

|

|

|||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements3 |

|

|

|||||||||

1

2

3

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those

4

periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

||||||||||

|

Class A |

$ |

|

$ |

|

|||||||

|

Class P |

|

|

|||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. Because the Fund had not yet commenced operations as of the end of the last fiscal year, it does not have a portfolio turnover rate to provide.

Principal investments

The Advisor seeks to achieve the Fund's investment objective by investing, under normal circumstances, at least 80% of the Fund's net assets (plus borrowings for investment purposes, if any) in a portfolio of equity securities of companies economically tied to China, and in other instruments that have economic characteristics similar to such securities. For this purpose, China includes the People's Republic of China ("PRC") and Hong Kong. A security will be considered to be economically tied to China if it: (i) is issued or guaranteed by a government of China or any of its agencies, political subdivisions or instrumentalities; (ii) has its primary trading market in China; (iii) is issued by an entity organized under the laws of, derives at least 50% of its revenues from, or has at least 50% of its assets in China; (iv) is included in an index representative of China; or (v) is exposed to the economic fortunes and risks of China.

Equity securities may include common stocks; preferred stocks; equity securities of real estate investment trusts ("REITs"); shares of other investment companies, including exchange-traded funds ("ETFs"); depositary receipts; and derivative instruments related to equity securities, including equity participation notes, options and futures on individual securities and indexes. The Fund's investments may include investments in securities of companies listed on exchanges located in and outside of the PRC, including but not limited to the Hong Kong Stock Exchange, Taiwan Stock Exchange, Singapore Exchange,

the New York Stock Exchange, and London Stock Exchange. The Fund's investments also include China A-shares. China A-shares are equity securities issued by companies incorporated in mainland China and are denominated and traded in renminbi ("RMB") on the Shenzhen and Shanghai Stock Exchanges through the Shanghai-Hong Kong Stock Connect program and the Shenzhen-Hong Kong Stock Connect program (collectively, "Stock Connect").

The Fund may invest in companies of any size. The Fund is a non-diversified fund, which means that the Fund may invest more of its assets in a smaller number of issuers than a diversified investment company.

The Advisor believes that discrepancies between market price and fair value arise from market behavior and market structure, and these discrepancies provide opportunities to outperform the market. To take advantage of these opportunities, the Advisor seeks to identify upcoming industry leaders in key secular growth sectors early in the company's lifecycle and when the company's share price trades far below our estimate of the firm's fair value.

The Advisor adopts a benchmark agnostic approach (meaning that the Advisor selects companies without the benchmark by which the Fund measures performance (the MSCI China All Shares Index (net)) being determinative), and the Fund may have a wider deviation from the benchmark than other funds. This is expected to enable the Advisor to identify non-benchmark companies with stronger long-term growth potential than might otherwise be the case.

The Fund may, but is not required to, use exchange-traded or over-the-counter derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include options (including options on securities, indices, futures, forwards, and swap agreements), futures, forward currency agreements, swap agreements (including interest rate, total return and currency) and equity participation notes and equity linked notes. All of these derivatives may be used for risk management purposes to manage or adjust the risk profile of the Fund. Futures on currencies and forward currency agreements may also be used to hedge against a specific currency. Further, the Fund may acquire and sell forward foreign currency exchange contracts in order to attempt to protect against uncertainty in the level of future foreign currency exchange rates in

5

connection with the settlement of securities. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments (except for forward currency agreements); to obtain exposure to certain markets; or to establish net short positions for individual currencies (except for equity participation notes).

Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO").

Management process

The investment process for the All China strategy is driven by bottom-up proprietary research. As a starting point, the investment universe includes all investable quoted equities domiciled in China and/or of issuers generating the majority of their income in China. The investment team is expected to exclude companies exhibiting what we view as unsustainable business models, poor corporate governance practices, and negative industry dynamics. In order to form a qualitative assessment of a company, the Advisor scores companies based on a set of questions covering three areas:

1. Industry Structure and Company's Competitiveness

2. Trends & Profitability: Trends and Sustainability

3. Governance, disclosure, environmental and social practices

The Advisor further conducts extensive valuation analysis incorporating company/industry fundamentals, future operations, and cash generation. Peer comparisons and valuation bands are also studied based on historical and forward looking financials.

The Advisor seeks to construct a "best ideas," concentrated, high-conviction portfolio. The companies would be selected based on the attractiveness of their valuations, top down macro factors, and a conviction that the investment thesis is likely to be realized. Positions would be assigned weights based on the investment parameters for the strategy and the portfolio manager's conviction in the investment thesis. The Advisor aims to construct a portfolio diversified across many sectors with no single stock position being greater than 10% of the portfolio.

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective.

China risk: There are special risks associated with investments in China, Hong Kong and Taiwan, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization and exchange control regulations (including currency blockage). Inflation and rapid fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China, Hong Kong and Taiwan. In addition, investments in Taiwan and Hong Kong could be adversely affected by their respective political and economic relationship with China. China, Hong Kong and Taiwan are deemed by the investment manager to be emerging markets countries, which means an investment in these countries has more heightened risks than general foreign investing due to a lack of established legal, political, business and social frameworks in these countries to support securities markets as well as the possibility for more widespread corruption and fraud. In addition, the standards for environmental, social and corporate governance matters in China, Hong Kong and Taiwan tend to be lower than such standards in more developed economies.

Certain securities issued by companies located or operating in China, such as China A-shares, are subject to trading restrictions, quota limitations and less market liquidity. A reduction in spending on Chinese products and services or the institution of additional tariffs or other trade barriers, including as a result of heightened trade tensions between China and the United States may have an adverse impact on the Chinese economy. Additionally, the Chinese economy is highly dependent on the exportation of products and services, and could experience a significant slowdown due to a reduction in global demand for Chinese exports, contraction in spending on domestic goods by Chinese consumers, trade or political disputes with China's major trading partners, natural disasters, or public health threats.

Additionally, emerging market countries, such as China, may subject the Fund's investments to a number of tax rules, and the application of many of those rules may be uncertain. Changes in applicable Chinese tax law could reduce the after-tax profits of the Fund, directly or indirectly, including by reducing the after-tax profits of companies in China in which the Fund invests. Uncertainties

6

in Chinese tax rules could result in unexpected tax liabilities for the Fund.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers.

Emerging market risk: There are additional risks inherent in investing in less developed countries that are applicable to the Fund. Compared to the United States and other developed countries, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Further, emerging countries may have economies based on only a few industries and securities markets that trade only a small number of securities and employ settlement procedures different from those used in the United States. Prices on these exchanges tend to be volatile and, in the past, securities in these countries have offered greater potential for gain (as well as loss) than securities of companies located in developed countries. Issuers may not be subject to uniform accounting, auditing and financial reporting standards and there may be less publicly available financial and other information about such issuers, comparable to U.S. issuers. Further, investments by foreign investors are subject to a variety of restrictions in many emerging countries. Countries such as those in which the Fund may invest may experience high rates of inflation, high interest rates, exchange rate fluctuations or currency depreciation, large amounts of external debt, balance of payments and trade difficulties and extreme poverty and unemployment.

Stock Connect investing risk: Investing in A-shares through Stock Connect is subject to trading, clearance, settlement, and other procedures, which could pose risks to the Fund. Trading through the Stock Connect program is subject to daily quotas that limit the maximum daily net purchases on any particular day, each of which may restrict or preclude the Fund's ability to invest in A-shares through the Stock Connect program. A primary feature of the Stock Connect program is the application of the home market's laws and rules applicable to investors in A-shares. Therefore, the Fund's investments in Stock Connect A-shares are generally subject to PRC securities regulations and listing rules, among other restrictions. The Shanghai and Shenzhen markets may be open at a time when the Stock Connect Program is not trading, with the result that prices of China A-shares may fluctuate at times when the Fund is unable to add to or exit its position.

China A-shares risk: China A-shares are subject to a number of restrictions imposed by Chinese securities regulations and listing rules. Investments by foreign investors in A-shares are subject to various restrictions, regulations and limits. The A-share market is volatile with a risk of suspension of trading in a particular security or multiple securities or government intervention. The A-shares market can have a higher propensity for trading suspensions than many other global equity markets. Trading suspensions could lead to greater market execution risk, valuation risks, liquidity risks, and costs for the Fund.

Furthermore, any changes in laws, regulations and policies of the China A-shares market or rules in relation to Stock Connect may affect China A-share prices. These risks are heightened by the developing state of the PRC's investment and banking systems in general.

Per a circular (Caishui [2014] 79), the Fund is expected to be temporarily exempt from the Chinese withholding tax ("WHT") on capital gains on trading in A-shares. There is no indication as to how long the temporary exemption will remain in effect. Accordingly, the Fund may be subject to such taxes in the future. If the Fund expects such WHT on trading in A-shares to be imposed, it reserves the right to establish a reserve for such tax, although it currently does not do so. If the Fund establishes such a reserve but is not ultimately subject to the tax, shareholders who redeemed or sold their shares while the reserve was in place will effectively bear the tax and may not benefit from the later release, if any, of the reserve. Conversely, if the Fund does not establish such a reserve but ultimately is subject to the tax, shareholders who redeemed or sold their shares prior to the tax being withheld, reserved or paid will have effectively avoided the tax, even if they benefited from the trading that precipitated the Fund's payment of it. Investors should note that such provision may be excessive or inadequate to meet actual WHT liabilities (which could include interest and penalties) on the Fund's investments. As a result, investors may be advantaged or disadvantaged depending on the final rules of the relevant PRC tax authorities.

Geographic concentration risk: The risk that if the Fund has most of its investments in a single country or region, its portfolio will be more susceptible to factors adversely affecting issuers located in that country or region than would a more geographically diverse portfolio of securities.

Liquidity risk: The risk that investments cannot be readily sold at the desired time or price, and the Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund's value or prevent the Fund from taking advantage of other investment opportunities. Liquid portfolio investments may become illiquid or

7

less liquid after purchase by the Fund due to low trading volume, adverse investor perceptions and/or other market developments. In recent years, the number and capacity of dealers that make markets in fixed income securities has decreased. Consequently, the decline in dealers engaging in market making trading activities may increase liquidity risk, which can be more pronounced in periods of market turmoil. Liquidity risk may be magnified in a rising interest rate environment or when investor redemptions from fixed income funds may be higher than normal, causing increased supply in the market due to selling activity. Liquidity risk includes the risk that the Fund will experience significant net redemptions at a time when it cannot find willing buyers for its portfolio securities or can only sell its portfolio securities at a material loss.

Small- and mid-capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments, and they may have more limited resources.

Non-diversification risk:

IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time.

Market risk: The market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses

and can result in losses to the Fund that exceed the amount originally invested.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market security. In addition, many types of swaps and other non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Investing in other funds risk: The Fund's investment performance is affected by the investment performance of the underlying funds in which the Fund may invest. Through its investment in the underlying funds, the Fund is subject to the risks of the underlying funds' investments and their expenses.

Investing in ETFs risk: The Fund's investment in ETFs may subject the Fund to additional risks than if the Fund would have invested directly in the ETF's underlying securities. These risks include the possibility that an ETF may experience a lack of liquidity that can result in greater volatility than its underlying securities; an ETF may trade at a premium or discount to its net asset value; an ETF may not replicate exactly the performance of the benchmark index it seeks to track; trading an ETF's shares may be halted if the listing exchange's officials deem such action appropriate; and a passively managed ETF would not necessarily sell a security because the issuer of the security was in financial trouble unless the security is removed from the index that the ETF seeks to track. In addition, investing in an ETF may also be more costly than if a Fund had owned the underlying securities directly. The Fund, and indirectly, shareholders of the Fund, bear a proportionate share of the ETF's expenses, which include management and advisory fees and other expenses. In addition, the Fund will pay brokerage commissions in connection with the purchase and sale of shares of the ETF.

Real estate securities and REITs risk: The risk that the Fund's performance will be affected by adverse developments in the real estate industry. Real estate values may be affected by a variety of factors, including: local, national or global economic conditions; changes in zoning or other property-related laws; environmental regulations; interest rates; tax and insurance considera-

8

tions; overbuilding; property taxes and operating expenses; or declining values in a neighborhood. Similarly, a REIT's performance depends on the types, values, locations and management of the properties it owns. In addition, a REIT may be more susceptible to adverse developments affecting a single project or market segment than a more diversified investment. Loss of status as a qualified REIT under the US federal tax laws could adversely affect the value of a particular REIT or the market for REITs as a whole.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

Investment advisor

UBS Asset Management (Americas) Inc. serves as the investment advisor to the Fund.

Portfolio manager

• Bin Shi, portfolio manager of the Fund beginning at its inception.

Purchase & sale of Fund shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Class A and P shares of the

Fund either through a financial advisor or directly from the Fund. In general, the minimum initial investment for Class A shares is $1,000 and the minimum subsequent investment is $100; and the minimum initial investment for Class P shares is $2 million ($1,000 for investors who are clients of wrap fee advisory programs (with a minimum subsequent investment of $100)).

Tax information

The dividends and distributions you receive from the Fund are taxable and generally will be taxed as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

Payments to broker-dealers and other financial intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's Web site for more information.

9

Fund Summary

The Fund seeks to maximize total return, consisting of capital appreciation and current income.

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Different intermediaries and financial professionals may make available different sales charge waivers or discounts. These variations are described in Appendix A beginning on page A-1 of this prospectus.

|

Class A |

Class P |

||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

|

% |

|

||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

|

|

|||||||||

|

Class A |

Class P |

||||||||||

|

Management fees |

|

% |

|

% |

|||||||

|

Distribution and/or service (12b-1) fees |

|

|

|||||||||

|

Other expenses |

|

|

|||||||||

|

Acquired fund fees and expenses |

|

|

|||||||||

|

Total annual fund operating expenses |

|

|

|||||||||

|

Less management fee waiver/expense reimbursements3 |

|

|

|||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements2,3 |

|

|

|||||||||

1

2

3

10

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

5 years |

10 years |

||||||||||||||||

|

Class A |

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||

|

Class P |

|

|

|

|

|||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was

Principal investments

In order to achieve the Fund's objective, the Fund employs an asset allocation strategy that seeks to achieve a total rate of return for the Fund that meets or exceeds the FTSE One-Month US Treasury Bill Index plus 2%-4% (net of fees) over a rolling five year time horizon. This active management process is intended to produce superior performance relative to the benchmark (the difference of which is "alpha"). The Advisor does not represent or guarantee that the Fund will meet this total return goal.

The Fund invests in securities and financial instruments to gain exposure to global equity, global fixed income and cash equivalent markets, including global currencies. The Fund may invest in equity and fixed income securities of issuers located within and outside the United States or in open-end investment companies including those advised by the Advisor to gain exposure to certain global equity and global fixed income markets.

Investments in fixed income securities may include, but are not limited to, debt securities of governments throughout the world (including the United States), their

agencies and instrumentalities, debt securities of corporations and supranationals, inflation protected securities, convertible bonds, mortgage-backed securities, asset-backed securities, equipment trusts and other collateralized debt securities. Investments in fixed income securities may include issuers in both developed (including the United States) and emerging markets. The Fund's fixed income investments may reflect a broad range of investment maturities, credit qualities and sectors, including high yield (lower-rated or "junk bonds") securities and convertible debt securities.

Investments in equity securities may include, but are not limited to, common stock and preferred stock of issuers in developed nations (including the United States) and emerging markets; and equity securities of real estate investment trusts ("REITs"). Equity investments may include securities of companies of any capitalization size.

In addition, the Fund attempts to generate positive returns and manage risk through asset allocation and sophisticated currency management techniques. These decisions are integrated with analysis of global market and economic conditions. The Fund may also take active positions on volatility to generate returns or to hedge the Fund's portfolio.

The Fund may, but is not required to, use exchange-traded or over-the-counter derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include options (including options on securities, indices, futures, forwards and swap agreements), futures, forward agreements, swap agreements (including interest rate, total return, and credit default swaps), credit-linked securities, equity participation notes and equity linked notes. All of these derivatives may be used for risk management purposes, such as hedging against a specific security or currency, or to manage or adjust the risk profile of the Fund. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; to obtain exposure to certain markets; or to establish net short positions for individual markets, currencies or securities. Options on indices, options on swap agreements, futures on indices, forward agreements, interest rate swaps, total return swaps, credit default swaps and credit-linked securities may also be used to adjust the Fund's portfolio duration, including to achieve a negative portfolio duration.

11

Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO"). To the extent permitted by the Investment Company Act of 1940, as amended (the "1940 Act"), the Fund may borrow money from banks to purchase investments for the Fund. The Fund may seek to implement its investment strategy through investments in exchange-traded funds ("ETFs").

Management process

The Advisor will manage the Fund's portfolio using the following investment process as described below:

The strategy invests in the full spectrum of instruments and markets globally. The Advisor believes that the Advisor is able to improve the return outcome and risk management of the Fund by employing a well diversified strategy across a broad global opportunity set. Returns are generated from asset allocation across markets, currency and security selection. The Advisor aims to employ 15-25 of the Advisor's highest conviction trade ideas into the following diversified risk buckets:

• Market Directional: Explicit view on equities, credit, and interest rates

• Relative Value Market: Capitalizing on misvaluation between two markets

• Relative Value Currency: Active decisions between two markets that are made independent from market decisions

Asset allocation decisions are primarily driven by UBS AM (Americas)'s assessment of valuation and prevailing market conditions in the United States and around the world. Using a systematic approach, the portfolio management team analyzes the asset classes and investments across equities, fixed income, and alternative asset classes (including currency), considering both fundamental valuation, economic and other market indicators. Regarding valuation, the Advisor evaluates whether asset classes and investments are attractively priced relative to fundamentals. The starting point is to assess the intrinsic value of an asset class, as determined by the fundamentals that drive an asset class' future cash flow. The intrinsic value represents a long term anchor point to which the Advisor believes the asset class will eventually revert.

Fair value estimates of asset classes and markets are an output of UBS AM (Americas)'s proprietary valuation models. Discounting the asset's future cash flow using a discount rate that appropriately reflects the inherent investment risk associated with holding the asset gives the asset's fair value. The competitive advantage of the Advisor's models lies in the quality and consistency of the inputs used and, therefore, the reliability of valuation conclusions. The discrepancy between actual

market level and fair value (the price/value discrepancy) is the primary valuation signal used in identifying investment opportunities.

Next, the Advisor assesses additional market indicators and considers the effect that other determinants of economic growth and overall market volatility will have on each asset class. While in theory price/value discrepancies may resolve themselves quickly and linearly, in practice price/value discrepancy can grow larger before it resolves. While valuation models have proven effective at identifying longer-term price/value discrepancies, in the shorter term other factors can swamp valuation considerations. Thus, the Advisor incorporates an additional discipline in our idea generation process. The Advisor refers to this additional step in its idea generation process as market behavior analysis. Adding this step helps the Advisor to understand what other market indicators might drive the market towards or away from fundamental value. The Advisor performs systematic analysis of non-valuation drivers using models measuring sentiment, momentum and flows, market stress, the stage of the economic cycle, as well as an assessment of the general macroeconomic landscape. Conversely, valuation considerations tend to dominate when an asset class is substantially above or below fair value, but the Advisor recognizes that the use of market behavior analysis during these periods is very important to helping improve the timing in and out of these asset classes with very stretched valuations.

The asset allocation process is structured around the Investment Solutions Investment Committee (the "ISIC Committee") meetings, which provides a forum for debate and the exploration of all ramifications of any investment decision, rather than aiming for a consensus to be reached. Instead, any voting member of the ISIC Committee can sponsor a trade idea, preparing a detailed investment thesis to support the view. An investment thesis has to define the investment rationale based on valuation and market behavioral influences, the time scale for it being realized, the transaction costs and the potential milestones the Advisor would expect to evaluate whether or not the view is correct. The sponsor is then responsible for convincing another member of the ISIC Committee to support the idea as co-sponsor.

Bottom up selection across active equity and fixed income markets can be utilized as part of the asset allocation process at the asset class level. With respect to specific equity securities for inclusion in the Fund's equity asset classes, the Advisor may utilize fundamental valuation, quantitative and growth-oriented strategies. The Advisor's bottom up fixed income security selection strategy combines judgments about the absolute value of the fixed income universe and the relative value of issuer sectors, maturity intervals, security durations,

12

credit qualities and coupon segments, as well as specific circumstances facing the issuers of fixed income securities.

The Advisor uses both fundamental valuation and market behavior analysis to make the two-pronged determination of risk budget and risk allocation. The Advisor works closely with the Risk Management team, members of which attend the ISIC Committee meetings, to determine the appropriate amount of risk capital to allocate to the underlying trade ideas given the strategy's risk budget and objectives, prevailing investment opportunities, and other strategy exposures. To assist in this process the Risk Management team performs scenario and correlation analysis to better understand the risk and diversification of the overall strategy, and attempts to ensure that unintended factor exposures are identified, managed and monitored.

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective.

Asset allocation risk: The risk that the Fund may allocate assets to an asset category that performs poorly relative to other asset categories.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Investments in foreign government bonds involve special risks because the Fund may have limited legal recourse in the event of default. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers.

Credit risk: The risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to or guarantor of a derivative contract, is unable or unwilling to meet its financial obligations. This risk is likely greater for lower quality investments than for investments that are higher quality.

Liquidity risk: The risk that investments cannot be readily sold at the desired time or price, and the Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund's value or prevent the Fund from taking advantage of other investment opportunities. Liquid portfolio investments may become illiquid or less liquid after purchase by the Fund due to low trading

volume, adverse investor perceptions and/or other market developments. In recent years, the number and capacity of dealers that make markets in fixed income securities has decreased. Consequently, the decline in dealers engaging in market making trading activities may increase liquidity risk, which can be more pronounced in periods of market turmoil. Liquidity risk may be magnified in a rising interest rate environment or when investor redemptions from fixed income funds may be higher than normal, causing increased supply in the market due to selling activity. Liquidity risk includes the risk that the Fund will experience significant net redemptions at a time when it cannot find willing buyers for its portfolio securities or can only sell its portfolio securities at a material loss.

Interest rate risk: An increase in prevailing interest rates typically causes the value of fixed income securities to fall. Changes in interest rates will likely affect the value of longer-duration fixed income securities more than shorter-duration securities and higher quality securities more than lower quality securities. When interest rates are falling, some fixed income securities provide that the issuer may repay them earlier than the maturity date, and if this occurs the Fund may have to reinvest these repayments at lower interest rates. The Fund may face a heightened level of interest rate risk due to certain changes in monetary policy, such as certain types of interest rate changes by the Federal Reserve.

Mortgage- and asset-backed securities risk: The Fund may invest in mortgage- and asset-backed securities that are subject to prepayment or call risk, which is the risk that the borrower's payments may be received earlier or later than expected due to changes in prepayment rates on underlying loans. Faster prepayments often happen when interest rates are falling. As a result, the Fund may reinvest these early payments at lower interest rates, thereby reducing the Fund's income. Conversely, when interest rates rise, prepayments may happen more slowly, causing the security to lengthen in duration. Longer duration securities tend to be more volatile. Securities may be prepaid at a price less than the original purchase value. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of mortgage-backed securities and could result in losses to the Fund.

High yield bond risk: The risk that the issuer of bonds with ratings of Ba1 or lower by Moody's Investors Service, Inc. ("Moody's") or BB+ or lower by Standard & Poor's Financial Services LLC ("S&P") or Fitch Ratings, Inc. ("Fitch"), comparably rated by another nationally recognized statistical rating organization, or, if unrated, are determined to be of comparable quality by the Advisor will default or otherwise be unable to honor a financial obligation (also known as lower-rated or "junk bonds"). These securities are considered to be predominately speculative with respect to an issuer's capacity to pay

13

interest and repay principal in accordance with the terms of the obligations. Lower-quality bonds are more likely to be subject to an issuer's default or downgrade than investment grade (higher quality) bonds.

Small- and mid-capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments, and they may have more limited resources.

Emerging market risk: There are additional risks inherent in investing in less developed countries that are applicable to the Fund. Compared to the United States and other developed countries, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Further, emerging countries may have economies based on only a few industries and securities markets that trade only a small number of securities and employ settlement procedures different from those used in the United States. Prices on these exchanges tend to be volatile and, in the past, securities in these countries have offered greater potential for gain (as well as loss) than securities of companies located in developed countries. Issuers may not be subject to uniform accounting, auditing and financial reporting standards and there may be less publicly available financial and other information about such issuers, comparable to U.S. issuers. Further, investments by foreign investors are subject to a variety of restrictions in many emerging countries. Countries such as those in which the Fund may invest may experience high rates of inflation, high interest rates, exchange rate fluctuations or currency depreciation, large amounts of external debt, balance of payments and trade difficulties and extreme poverty and unemployment.

US Government securities risk: There are different types of US government securities with different levels of credit risk, including risk of default, depending on the nature of the particular government support for that security. For example, a US government-sponsored entity, although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are therefore riskier than those that are.

IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market

in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time.

Market risk: The risk that the market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Leverage risk associated with borrowing: The Fund may borrow money from banks to purchase investments for the Fund, which is a form of leverage. If the Fund borrows money to purchase securities and the Fund's investments decrease in value, the Fund's losses will be greater than if the Fund did not borrow money for investment purposes. In addition, if the return on an investment purchased with borrowed funds is not sufficient to cover the cost of borrowing, then the net income of the Fund would be less than if borrowing were not used.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market securities. Derivatives relating to fixed income markets are especially susceptible to interest rate risk and credit risk. In addition, many types of swaps and other non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Investing in other funds risk: The Fund's investment performance is affected by the investment performance of the underlying funds in which the Fund may invest. Through its investment in the underlying funds, the Fund is subject to the risks of the underlying funds'

14

investments and subject to the underlying funds' expenses.

Investing in ETFs risk: The Fund's investment in ETFs may subject the Fund to additional risks than if the Fund would have invested directly in the ETF's underlying securities. These risks include the possibility that an ETF may experience a lack of liquidity that can result in greater volatility than its underlying securities; an ETF may trade at a premium or discount to its net asset value; an ETF may not replicate exactly the performance of the benchmark index it seeks to track; trading an ETF's shares may be halted if the listing exchange's officials deem such action appropriate; and a passively managed ETF would not necessarily sell a security because the issuer of the security was in financial trouble unless the security is removed from the index that the ETF seeks to track. In addition, investing in an ETF may also be more costly than if a Fund had owned the underlying securities directly. The Fund, and indirectly, shareholders of the Fund, bear a proportionate share of the ETF's expenses, which include management and advisory fees and other expenses. In addition, the Fund will pay brokerage commissions in connection with the purchase and sale of shares of the ETF.

Real estate securities and REITs risk: The risk that the Fund's performance will be affected by adverse developments in the real estate industry. Real estate values may be affected by a variety of factors, including: local, national or global economic conditions; changes in zoning or other property-related laws; environmental regulations; interest rates; tax and insurance considerations; overbuilding; property taxes and operating expenses; or declining values in a neighborhood. Similarly, a REIT's performance depends on the types, values, locations and management of the properties it owns. In addition, a REIT may be more susceptible to adverse developments affecting a single project or market segment than a more diversified investment. Loss of status as a qualified REIT under the US federal tax laws could adversely affect the value of a particular REIT or the market for REITs as a whole.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

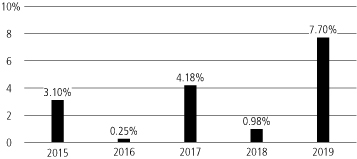

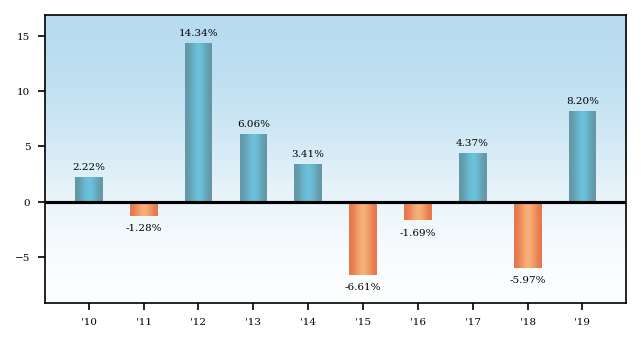

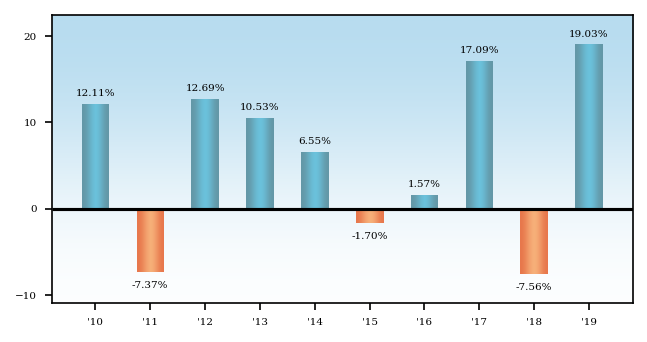

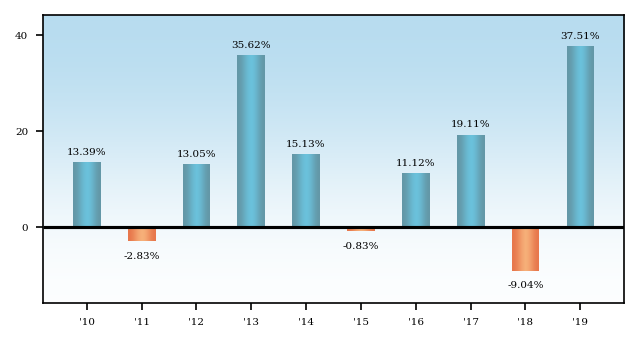

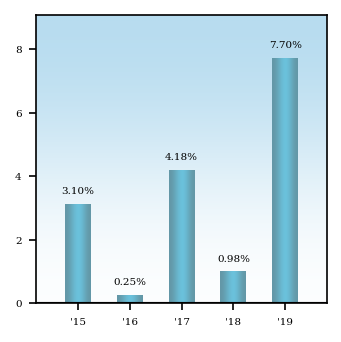

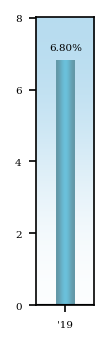

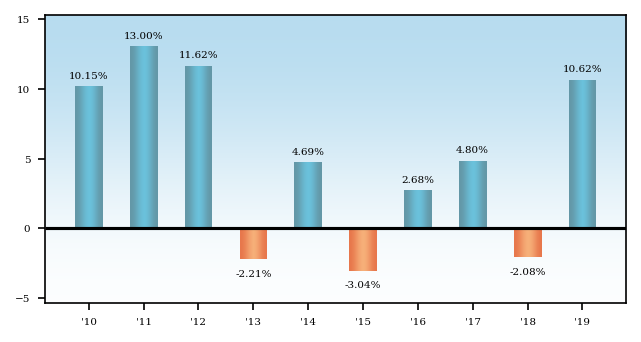

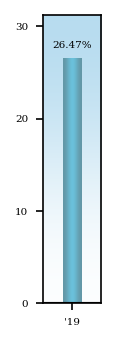

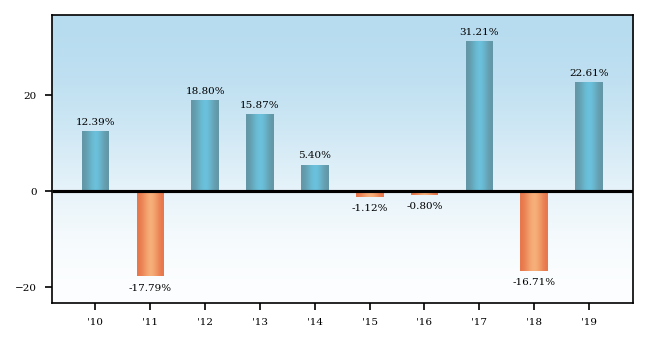

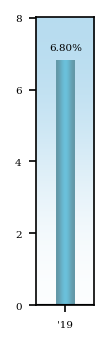

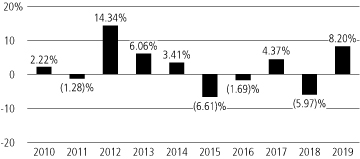

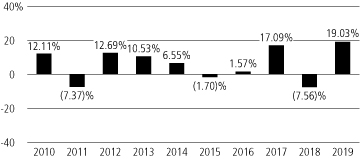

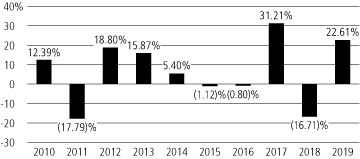

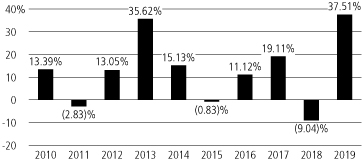

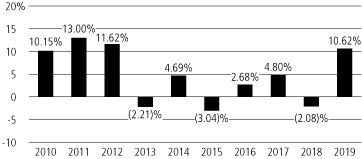

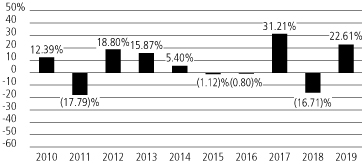

Risk/return bar chart and table

The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table.

short-term U.S. Treasury securities. The MSCI World Index (net) shows how the Fund's performance compares to an index that is designed to measure the equity market performance of developed markets. The FTSE One-Month US Treasury Bill Index shows how the Fund's performance compares to public obligations of the US Treasury with maturities of one month.

Total return January 1 -

15

|

Class (inception date) |

1 year |

5 years |

10 years |

||||||||||||

|

Class A ( Return before taxes |

|

% |

( |

)% |

|

% |

|||||||||

|

Class P ( Return before taxes |

|

( |

) |

|

|||||||||||

|

Return after taxes on distributions |

|

( |

) |

|

|||||||||||

|

Return after taxes on distributions and sale of fund shares |

|

( |

) |

|

|||||||||||

|

ICE BofA U.S. Treasury 1-5 Year Index |

|

|

|

||||||||||||

|

MSCI World Index (net) |

|

|

|

||||||||||||

|

FTSE One-Month US Treasury Bill Index |

|

|

|

||||||||||||

Investment advisor

UBS Asset Management (Americas) Inc. serves as the investment advisor to the Fund.

Portfolio managers

• Alan Zlatar, portfolio manager of the Fund since 2018.

• Alain Bützberger, portfolio manager of the Fund since January 2020.

Purchase & sale of Fund shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Class A or P shares of

the Fund either through a financial advisor or directly from the Fund. In general, the minimum initial investment for Class A shares is $1,000, and the minimum subsequent investment is $100; and the minimum investment for Class P shares is $2 million ($1,000 for investors who are clients of wrap fee advisory programs (with a minimum subsequent investment of $100)).

Tax information

The dividends and distributions you receive from the Fund are taxable and generally will be taxed as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions may be taxed as ordinary income when withdrawn from the tax-advantaged account.

Payments to broker-dealers and other financial intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's Web site for more information.

16

Fund Summary

The Fund seeks to maximize capital appreciation.

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

Different intermediaries and financial professionals may make available different sales charge waivers or discounts. These variations are described in Appendix A beginning on page A-1 of this prospectus.

|

Class A |

Class P |

||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

|

% |

|

||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

|

|

|||||||||

|

Class A |

Class P |

||||||||||

|

Management fees |

|

% |

|

% |

|||||||

|

Distribution and/or service (12b-1) fees |

|

|

|||||||||

|

Other expenses2 |

|

|

|||||||||

|

Total annual fund operating expenses |

|

|

|||||||||

|

Less management fee waiver/expense reimbursements3,4 |

|

|

|||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements3,4 |

|

|

|||||||||

1

2

3

4

17

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

5 years |

10 years |

||||||||||||||||

|

Class A |

$ |

|

$ |

|

$ |

|

$ |

|

|||||||||||

|

Class P |

|

|

|

|

|||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was

Principal investments

Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in equity securities that are tied economically to emerging market countries. Investments in equity securities may include, but are not limited to, common stock; shares of collective trusts, investment companies, including exchange-traded funds ("ETFs"); preferred stock; securities convertible into common stock, rights, warrants and options; sponsored or unsponsored depository receipts and depository shares, including American Depositary Receipts, European Depositary Receipts and Global Depositary Receipts; equity securities of real estate investment trusts ("REITs"); securities sold in private placements; and new issues, including initial and secondary public offerings.

Securities tied economically to emerging market countries include securities on which the return is derived from issuers in emerging market countries, such as equity swap contracts and equity swap index contracts. The Fund intends to invest primarily in a portfolio of equity securities of issuers located in at least three emerging

market countries, which may be located in Asia, Europe, Latin America, Africa and/or the Middle East.

The Fund may invest in stocks of companies of any size. The Fund will generally hold the stocks of between 20 to 40 issuers. The Fund may invest up to +/- 15% of its benchmark's weighting (the MSCI Emerging Markets Index) in any one country or sector.

The Fund may, but is not required to, use exchange-traded or over-the-counter derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include options (including options on securities, indices, futures, forwards, and swap agreements) futures, forward currency agreements, swap agreements (including interest rate, total return and currency) and equity participation notes and equity linked notes. All of these derivatives may be used for risk management purposes to manage or adjust the risk profile of the Fund. Futures on currencies and forward currency agreements may also be used to hedge against a specific currency. Further, the Fund may acquire and sell forward foreign currency exchange contracts in order to attempt to protect against uncertainty in the level of future foreign currency exchange rates in connection with the settlement of securities. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments (except for forward currency agreements); to obtain exposure to certain markets; or to establish net short positions for individual currencies (except for equity participation notes).

The Advisor considers a number of factors to determine whether an investment is tied to a particular country, including whether the investment is issued or guaranteed by a particular government or any of its agencies, political subdivisions, or instrumentalities; the investment has its primary trading market in a particular country; the issuer is organized under the laws of, derives at least 50% of its revenues from, or has at least 50% of its assets in a particular country; the investment is included in an index representative of a particular country or region; and the investment is exposed to the economic fortunes and risks of a particular country. The Fund considers a country's market to be an "emerging market" if it is defined as an emerging or developing economy by any of the International Bank for Reconstruction and Development (i.e., the World Bank), the International Finance Corporation or the United

18

Nations or its authorities. Additionally, the Fund, for purposes of its investments, may consider a country included in JP Morgan, MSCI or FTSE emerging markets indices to be an emerging market country. The countries included in this definition will change over time. The Fund's investments may include investments in China A-shares (shares of companies based in mainland China that trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange).

The Fund may invest in securities issued by companies in any market capitalization range, including small capitalization companies.

Management process

The Advisor employs a high alpha long opportunistic strategy, also known as the "UBS-HALO" strategy. The UBS-HALO strategy is a long-term investing approach focused on taking opportunities that seek to produce superior performance relative to the benchmark (the difference of which is "alpha"). The Advisor follows a price to intrinsic value approach. The price to intrinsic value investment philosophy means the Advisor pays great attention to investment fundamentals and expected cash flows when assessing investments.

The Advisor tries to identify and exploit periodic discrepancies between market prices and fundamental value.

These price/value discrepancies are used as the building blocks for portfolio construction.

In selecting individual securities for investment, the Advisor considers, among others:

• A company's potential cash generation

• Earnings outlook

• Expected sustainable return on investments

• Expected sustainable growth rates

• Stock prices versus a company's asset or franchise values

The Fund is classified by UBS AM (Americas) as an "ESG-integrated" fund. The Fund's investment process integrates material sustainability and/or environmental, social and governance ("ESG") considerations into the research process. ESG integration is driven by taking into account material ESG risks which could impact investment returns, rather than being driven by specific ethical principles or norms. The analysis of material sustainability/ESG considerations can include many different aspects, including, for example, the carbon footprint, employee health and well-being, supply chain management, fair customer treatment and governance processes of a company. The Fund's portfolio managers

may still invest in securities with a higher ESG risk profile where the portfolio managers believe the potential compensation outweighs the risks identified.

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers.

Emerging market risk: There are additional risks inherent in investing in less developed countries that are applicable to the Fund. Compared to the United States and other developed countries, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Further, emerging countries may have economies based on only a few industries and securities markets that trade only a small number of securities and employ settlement procedures different from those used in the United States. Prices on these exchanges tend to be volatile and, in the past, securities in these countries have offered greater potential for gain (as well as loss) than securities of companies located in developed countries. Issuers may not be subject to uniform accounting, auditing and financial reporting standards and there may be less publicly available financial and other information about such issuers, comparable to U.S. issuers. Further, investments by foreign investors are subject to a variety of restrictions in many emerging countries. Countries such as those in which the Fund may invest may experience high rates of inflation, high interest rates, exchange rate fluctuations or currency depreciation, large amounts of external debt, balance of payments and trade difficulties and extreme poverty and unemployment.

Focus risk: To the extent the Fund's investment strategy leads to sizable allocations to a particular market, sector or industry, the Fund may be more sensitive to any single economic, business, political, regulatory, or other event that occurs in that market, sector or industry. As a result, there may be more fluctuation in the price of the Fund's shares.

19

China risk: There are special risks associated with investments in China, Hong Kong and Taiwan, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization and exchange control regulations (including currency blockage). Inflation and rapid fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China, Hong Kong and Taiwan. In addition, investments in Taiwan and Hong Kong could be adversely affected by their respective political and economic relationship with China. China, Hong Kong and Taiwan are deemed by the investment manager to be emerging markets countries, which means an investment in these countries has more heightened risks than general foreign investing due to a lack of established legal, political, business and social frameworks in these countries to support securities markets as well as the possibility for more widespread corruption and fraud. In addition, the standards for environmental, social and corporate governance matters in China, Hong Kong and Taiwan tend to be lower than such standards in more developed economies.

Certain securities issued by companies located or operating in China, such as China A-shares, are subject to trading restrictions, quota limitations and less market liquidity. A reduction in spending on Chinese products and services or the institution of additional tariffs or other trade barriers, including as a result of heightened trade tensions between China and the United States may have an adverse impact on the Chinese economy. Additionally, the Chinese economy is highly dependent on the exportation of products and services, and could experience a significant slowdown due to a reduction in global demand for Chinese exports, contraction in spending on domestic goods by Chinese consumers, trade or political disputes with China's major trading partners, natural disasters, or public health threats.

Additionally, emerging market countries, such as China, may subject the Fund's investments to a number of tax rules, and the application of many of those rules may be uncertain. Changes in applicable Chinese tax law could reduce the after-tax profits of the Fund, directly or indirectly, including by reducing the after-tax profits of companies in China in which the Fund invests. Uncertainties in Chinese tax rules could result in unexpected tax liabilities for the Fund.

Geographic concentration risk: The risk that if the Fund has most of its investments in a single country or region, its portfolio will be more susceptible to factors adversely affecting issuers located in that country or region than would a more geographically diverse portfolio of securities.

Stock Connect investing risk: Investing in A-shares through Stock Connect is subject to trading, clearance,

settlement, and other procedures, which could pose risks to the Fund. Trading through the Stock Connect program is subject to daily quotas that limit the maximum daily net purchases on any particular day, each of which may restrict or preclude the Fund's ability to invest in A-shares through the Stock Connect program. A primary feature of the Stock Connect program is the application of the home market's laws and rules applicable to investors in A-shares. Therefore, the Fund's investments in Stock Connect A-shares are generally subject to PRC securities regulations and listing rules, among other restrictions. The Shanghai and Shenzhen markets may be open at a time when the Stock Connect Program is not trading, with the result that prices of China A-shares may fluctuate at times when the Fund is unable to add to or exit its position.

China A-shares risk: China A-shares are subject to a number of restrictions imposed by Chinese securities regulations and listing rules. Investments by foreign investors in A-shares are subject to various restrictions, regulations and limits. The A-share market is volatile with a risk of suspension of trading in a particular security or multiple securities or government intervention. The A-shares market can have a higher propensity for trading suspensions than many other global equity markets. Trading suspensions could lead to greater market execution risk, valuation risks, liquidity risks, and costs for the Fund.

Furthermore, any changes in laws, regulations and policies of the China A-shares market or rules in relation to Stock Connect may affect China A-share prices. These risks are heightened by the developing state of the PRC's investment and banking systems in general.

Per a circular (Caishui [2014] 79), the Fund is expected to be temporarily exempt from the Chinese withholding tax ("WHT") on capital gains on trading in A-shares. There is no indication as to how long the temporary exemption will remain in effect. Accordingly, the Fund may be subject to such taxes in the future. If the Fund expects such WHT on trading in A-shares to be imposed, it reserves the right to establish a reserve for such tax, although it currently does not do so. If the Fund establishes such a reserve but is not ultimately subject to the tax, shareholders who redeemed or sold their shares while the reserve was in place will effectively bear the tax and may not benefit from the later release, if any, of the reserve. Conversely, if the Fund does not establish such a reserve but ultimately is subject to the tax, shareholders who redeemed or sold their shares prior to the tax being withheld, reserved or paid will have effectively avoided the tax, even if they benefited from the trading that precipitated the Fund's payment of it. Investors should note that such provision may be excessive or inadequate to meet actual WHT liabilities (which could include interest and penalties) on the Fund's investments. As a result, investors may be advantaged

20

or disadvantaged depending on the final rules of the relevant PRC tax authorities.