| Label |

Element |

Value |

| UBS International Sustainable Equity Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

UBS International Sustainable Equity Fund

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund seeks to maximize total return, consisting of capital appreciation and current income by investing primarily in the equity securities of non-US issuers.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" beginning on page 128 of this prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" beginning on page 103 of the Fund's statement of additional information ("SAI"). In addition to the fees and expenses described below, you may also be required to pay commissions or other fees to your broker for transactions in Class P shares. Shares of the Fund are available in classes other than Class P that have different fees and expenses.

Different intermediaries and financial professionals may make available different sales charge waivers or discounts. These variations are described in Appendix A beginning on page A-1 of this prospectus.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 57% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

57.00%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the irrevocable fee waiver and expense reimbursement for all years. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Principal investments

Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in equity securities. Investments in equity securities may include, but are not limited to, dividend-paying securities, common stock and preferred stock of issuers located throughout the world; equity securities of real estate investment trusts ("REITs"); and exchange-traded funds ("ETFs"). Under normal market conditions, the Fund invests primarily (at least 65% of its total assets) in issuers organized or having their principal place of business outside the United States or doing a substantial amount of business outside the United States. Up to 35% of the Fund's assets may be invested in US equity securities. The Fund may invest in issuers from both developed and emerging markets. The Advisor, on behalf of the Fund, intends to diversify broadly among countries, but reserves the right to invest a substantial portion of the Fund's assets in one or more countries if economic and business conditions warrant such investments. The Fund may invest in stocks of companies of any size.

The Fund may, but is not required to, use exchange-traded or over-the-counter ("OTC") derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include futures, forward currency agreements and equity participation notes. All of these derivatives may be used for risk management purposes to manage or adjust the risk profile of the Fund. Futures on currencies and forward currency agreements may also be used to hedge against a specific currency. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments (except for forward currency agreements); or to obtain exposure to certain markets (except for forward currency agreements). The Fund also may use futures contracts on equity securities and indices to gain market exposure on its uninvested cash.

Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO").

Management process

The Advisor's investment decisions are based upon price/value discrepancies as identified by the Advisor's fundamental valuation process.

In selecting securities for the portion of the Fund that is managed according to the Advisor's fundamental valuation process, the Advisor focuses on, among other things, identifying discrepancies between a security's fundamental value and its market price. In this context, the fundamental value of a given security is the Advisor's assessment of what a security is worth. The Advisor will select a security whose fundamental value it estimates to be greater than its market value at any given time. For each stock under analysis, the Advisor bases its estimates of value upon country, economic, industry and company analysis, as well as upon a company's management team, competitive advantage and core competencies. The Advisor then compares its assessment of a security's value against the prevailing market prices, with the aim of constructing a portfolio of stocks across industries and countries with attractive relative price/value characteristics.

The Advisor will employ both a positive and negative screening process with regard to securities selection for the Fund. The negative screening process will exclude securities with more than 5% of sales in alcohol, tobacco, defense, nuclear, GMO (Genetically Modified Organisms), gambling and pornography from the Fund's portfolio. We believe that this negative screen reduces the global universe by about 7% by market capitalization, and we do not expect it to have a material impact on portfolio construction or strategy. The Advisor may modify the above list of negative screens at any time, without prior shareholder approval or notice.

The positive screening process will identify securities of companies that are attractive based on their fundamental and valuation profile in addition to evaluating specific sustainability factors.

These sustainability factors are material factors that help the Advisor evaluate and compare the environmental, social and governance performance of the investable universe. This information is combined with additional financial analysis and research to identify companies the Advisor believes will provide attractively valued and sustainable investment opportunities.

|

|

| Risk [Heading] |

rr_RiskHeading |

Main risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Below are some of the specific risks of investing in the Fund.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers.

Emerging market risk: There are additional risks inherent in investing in less developed countries that are applicable to the Fund. Compared to the United States and other developed countries, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Further, emerging countries may have economies based on only a few industries and securities markets that trade only a small number of securities and employ settlement procedures different from those used in the United States. Prices on these exchanges tend to be volatile and, in the past, securities in these countries have offered greater potential for gain (as well as loss) than securities of companies located in developed countries. Further, investments by foreign investors are subject to a variety of restrictions in many emerging countries. Countries such as those in which the Fund may invest may experience high rates of inflation, high interest rates, exchange rate fluctuations or currency depreciation, large amounts of external debt, balance of payments and trade difficulties and extreme poverty and unemployment.

Sustainability factor risk: The Fund's sustainability factors used in its investment process will likely make the Fund perform differently from a fund that relies solely or primarily on financial metrics. The sustainability factors may cause the Fund's industry allocation to deviate from that of funds without these considerations.

Small- and mid-capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments, and they may have more limited resources.

IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time.

Market risk: The market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market securities. In addition, non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Investing in ETFs risk: The Fund's investment in ETFs may subject the Fund to additional risks than if the Fund would have invested directly in the ETF's underlying securities. These risks include the possibility that an ETF may experience a lack of liquidity that can result in greater volatility than its underlying securities; an ETF may trade at a premium or discount to its net asset value; an ETF may not replicate exactly the performance of the benchmark index it seeks to track; trading an ETF's shares may be halted if the listing exchange's officials deem such action appropriate; and a passively managed ETF would not necessarily sell a security because the issuer of the security was in financial trouble unless the security is removed from the index that the ETF seeks to track. In addition, investing in an ETF may also be more costly than if a Fund had owned the underlying securities directly. The Fund, and indirectly, shareholders of the Fund, bear a proportionate share of the ETF's expenses, which include management and advisory fees and other expenses. In addition, the Fund will pay brokerage commissions in connection with the purchase and sale of shares of the ETF.

Real estate securities and REITs risk: The risk that the Fund's performance will be affected by adverse developments in the real estate industry. Real estate values may be affected by a variety of factors, including: local, national or global economic conditions; changes in zoning or other property-related laws; environmental regulations; interest rates; tax and insurance considerations; overbuilding; property taxes and operating expenses; or declining values in a neighborhood. Similarly, a REIT's performance depends on the types, values, locations and management of the properties it owns. In addition, a REIT may be more susceptible to adverse developments affecting a single project or market segment than a more diversified investment. Loss of status as a qualified REIT under the US federal tax laws could adversely affect the value of a particular REIT or the market for REITs as a whole.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

You may lose money by investing in the Fund.

|

|

| RIsk Not Insured [Text] |

rr_RiskNotInsured |

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

Risk/return bar chart and table

The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. Indicies reflect no deduction for fees and expenses. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. In October 2013, the Fund's investment strategies changed. The performance below for periods prior to that date is attributable to the Fund's performance before the strategy change. Updated performance for the Fund is available at www.ubs.com/us-mutualfundperformance.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class P shares' after-tax returns shown.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.ubs.com/us-mutualfundperformance

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

|

|

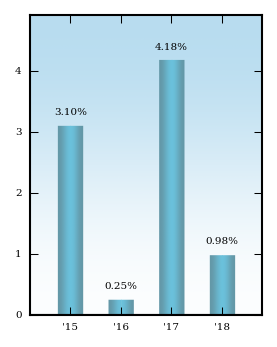

| Bar Chart [Heading] |

rr_BarChartHeading |

Total return (Class P)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Total return January 1 - September 30, 2019: 11.17%

Best quarter during calendar years shown—2Q 2009: 29.94%

Worst quarter during calendar years shown—3Q 2011: (23.88)%

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Total return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2019

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

11.17%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

29.94%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(23.88%)

|

|

| Performance Table Market Index Changed |

rr_PerformanceTableMarketIndexChanged |

Effective October 28, 2019, the MSCI ACWI ex-US Index replaced MSCI World ex USA Index (net) as the Fund's primary benchmark because it more closely aligns with the Fund's investment strategy.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

Indicies reflect no deduction for fees and expenses.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns for other classes will vary from the Class P shares' after-tax returns shown.

|

|

| Average Annual Return, Caption |

rr_AverageAnnualReturnCaption |

Average annual total returns (figures reflect sales charges) (for the periods ended December 31, 2018)

|

|

| UBS International Sustainable Equity Fund | MSCI ACWI ex-US Index |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(14.20%)

|

[1] |

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

0.68%

|

[1] |

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.57%

|

[1] |

| UBS International Sustainable Equity Fund | MSCI World ex USA Index (net) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(14.09%)

|

[1] |

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

0.34%

|

[1] |

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.24%

|

[1] |

| UBS International Sustainable Equity Fund | CLASS A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.50%

|

|

| Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

[2] |

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.48%

|

[3] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.53%

|

|

| Less management fee waiver/expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.28%

|

[4] |

| Total annual fund operating expenses after management fee waiver/expense reimbursements |

rr_NetExpensesOverAssets |

1.25%

|

[4] |

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

Purchases of $1 million or more that were not subject to a front-end sales charge are subject to a 1% CDSC if sold within one year of the purchase date.

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 670

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

925

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,199

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,978

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(21.48%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

1.06%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.35%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 1997

|

|

| UBS International Sustainable Equity Fund | CLASS P |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.80%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses |

rr_OtherExpensesOverAssets |

0.46%

|

[3] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.26%

|

|

| Less management fee waiver/expense reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

0.26%

|

[4] |

| Total annual fund operating expenses after management fee waiver/expense reimbursements |

rr_NetExpensesOverAssets |

1.00%

|

[4] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 102

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

318

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

552

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,225

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

39.65%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

12.39%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(17.79%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

18.80%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

15.87%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

5.40%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(1.12%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

(0.80%)

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

31.21%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(16.71%)

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(16.71%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

2.47%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

7.21%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 31, 1993

|

|

| UBS International Sustainable Equity Fund | CLASS P | After Taxes on Distributions |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(16.98%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

2.17%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

6.66%

|

|

| UBS International Sustainable Equity Fund | CLASS P | After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

(9.49%)

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

2.01%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

5.87%

|

|

|

|