| UBS U.S. Sustainable Equity Fund | ||||||||||||||||||||||||||||||||

| UBS U.S. Sustainable Equity Fund | ||||||||||||||||||||||||||||||||

| Investment objective | ||||||||||||||||||||||||||||||||

The Fund seeks to maximize total return, consisting of capital appreciation and current income. | ||||||||||||||||||||||||||||||||

| Fees and expenses | ||||||||||||||||||||||||||||||||

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" beginning on page 128 of this prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" beginning on page 101 of the Fund's statement of additional information ("SAI"). In addition to the fees and expenses described below, you may also be required to pay commissions or other fees to your broker for transactions in Class P shares. Shares of the Fund are available in classes other than Class P that have different fees and expenses. Different intermediaries and financial professionals may make available different sales charge waivers or discounts. These variations are described in Appendix A beginning on page A-1 of this prospectus. | ||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

| Portfolio turnover | ||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 102% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||

| Principal strategies | ||||||||||||||||||||||||||||||||

Principal investments To achieve its investment objective, the Fund invests in, or seeks exposure to companies based on various financial factors and fundamental sustainability factors such as environmental, social and governance performance of such companies. Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in equity securities of US companies. Investments in equity securities may include, but are not limited to, dividend-paying securities; common stock; preferred stock; equity securities of real estate investment trusts ("REITs"); shares of investment companies, including exchange-traded funds ("ETFs"); convertible securities; warrants and rights. The Fund may, but is not required to, use exchange-traded derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include futures and forward currency agreements. These derivatives may be used for risk management purposes to manage or adjust the risk profile of the Fund. Futures on currencies and forward currency agreements may also be used to hedge against a specific currency. In addition, futures on indices may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; or to obtain exposure to certain markets. The Fund may engage in active and frequent trading of portfolio securities to achieve its principal investment strategies. Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO"). Management process The Advisor's investment decisions are based upon price/value discrepancies as identified by the Advisor's fundamental valuation process. In selecting securities, the Advisor focuses on, among other things, identifying discrepancies between a security's fundamental value and its market price. In this context, the fundamental value of a given security is the Advisor's assessment of what a security is worth. The Advisor will select a security whose fundamental value it estimates to be greater than its market value at any given time. For each stock under analysis, the Advisor bases its estimates of value upon economic, industry and company analysis, as well as upon a company's management team, competitive advantage and core competencies. The Advisor then compares its assessment of a security's value against the prevailing market prices, with the aim of constructing a portfolio of stocks with attractive relative price/value characteristics. The Advisor will employ both a positive and negative screening process in selecting securities for the Fund. The positive screening process will identify securities of companies that are fundamentally attractive and that have superior valuation characteristics. In addition, the positive screening process will also include material, fundamental sustainability factors that the Advisor believes confirm the fundamental investment case and can enhance the ability to make good investment decisions. The sustainability factors are material extra-financial factors that evaluate the environmental, social and governance performance of companies that, along with more traditional financial analytics, identify companies that the Advisor believes will provide sustained, long-term value. The Advisor believes that the sustainability strategy provides the Fund with a high quality portfolio and mitigates risk. The Advisor also applies a negative screening process that will exclude from the Fund's portfolio securities with more than 5% of sales in industries such as alcohol, tobacco, defense, nuclear, GMO (Genetically Modified Organisms), gambling and pornography. The Advisor may modify this list of negative screens at any time, without prior shareholder approval or notice. | ||||||||||||||||||||||||||||||||

| Main risks | ||||||||||||||||||||||||||||||||

All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Below are some of the specific risks of investing in the Fund. Focused investment risk: The risk that investing in a select group of securities could subject the Fund to greater risk of loss and could be considerably more volatile than the Fund's primary benchmark or other mutual funds that are diversified across a greater number of securities. Portfolio turnover risk: High portfolio turnover from frequent trading will increase the Fund's transaction costs and may increase the portion of the Fund's capital gains that are realized for tax purposes in any given year. The Fund does not restrict the frequency of trading in order to limit expenses or the tax effect that its distributions may have on shareholders. Sustainability factor risk: The Fund's sustainability factors used in its investment process will likely make the Fund perform differently from a fund that relies solely or primarily on financial metrics. The sustainability factors may cause the Fund's industry allocation to deviate from that of funds without these considerations. Small- and mid-capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments, and they may have more limited resources. IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time. Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. Market risk: The market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole. Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested. Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market securities. In addition, non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments. Investing in ETFs risk: The Fund's investment in ETFs may subject the Fund to additional risks than if the Fund would have invested directly in the ETF's underlying securities. These risks include the possibility that an ETF may experience a lack of liquidity that can result in greater volatility than its underlying securities; an ETF may trade at a premium or discount to its net asset value; an ETF may not replicate exactly the performance of the benchmark index it seeks to track; trading an ETF's shares may be halted if the listing exchange's officials deem such action appropriate; and a passively managed ETF would not necessarily sell a security because the issuer of the security was in financial trouble unless the security is removed from the index that the ETF seeks to track. In addition, investing in an ETF may also be more costly than if a Fund had owned the underlying securities directly. The Fund, and indirectly, shareholders of the Fund, bear a proportionate share of the ETF's expenses, which include management and advisory fees and other expenses. In addition, the Fund will pay brokerage commissions in connection with the purchase and sale of shares of the ETF. Real estate securities and REITs risk: The risk that the Fund's performance will be affected by adverse developments in the real estate industry. Real estate values may be affected by a variety of factors, including: local, national or global economic conditions; changes in zoning or other property-related laws; environmental regulations; interest rates; tax and insurance considerations; overbuilding; property taxes and operating expenses; or declining values in a neighborhood. Similarly, a REIT's performance depends on the types, values, locations and management of the properties it owns. In addition, a REIT may be more susceptible to adverse developments affecting a single project or market segment than a more diversified investment. Loss of status as a qualified REIT under the US federal tax laws could adversely affect the value of a particular REIT or the market for REITs as a whole. Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results. | ||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||

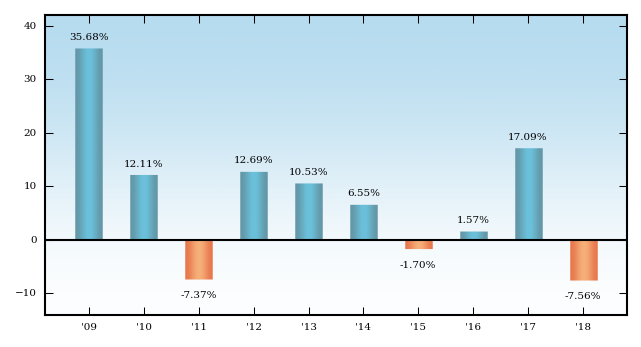

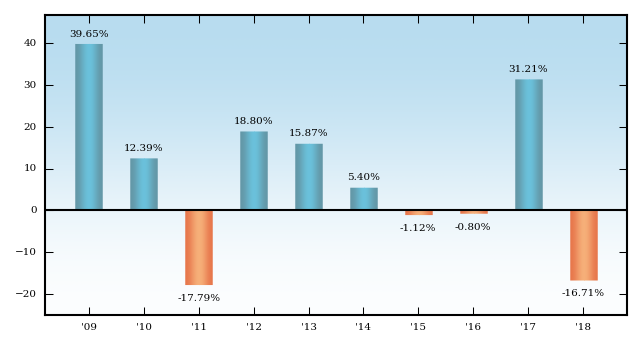

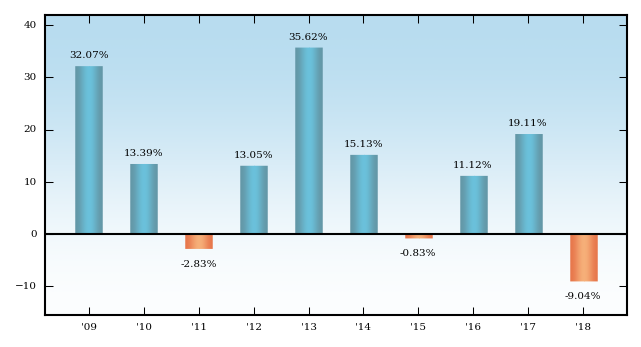

Risk/return bar chart and table The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. An index reflects no deduction for fees, expenses or taxes. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. In October 2017, the Fund's investment strategies changed. The performance below for periods prior to that date is attributable to the Fund's performance before the strategy change. Updated performance for the Fund is available at www.ubs.com/us-mutualfundperformance. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class P shares' after-tax returns shown. | ||||||||||||||||||||||||||||||||

| Total return (Class P) | ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

Total return January 1 - September 30, 2019: 22.68% | ||||||||||||||||||||||||||||||||

| Average annual total returns (figures reflect sales charges) (for the periods ended December 31, 2018) | ||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||