| UBS DYNAMIC ALPHA FUND | |||||||||||||||||||||||||||||||||||||||||||||

| UBS DYNAMIC ALPHA FUND | |||||||||||||||||||||||||||||||||||||||||||||

| Investment objective | |||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to maximize total return, consisting of capital appreciation and current income. | |||||||||||||||||||||||||||||||||||||||||||||

| Fees and expenses | |||||||||||||||||||||||||||||||||||||||||||||

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" on page 71 of the Fund's prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" on page 99 of the Fund's statement of additional information ("SAI"). | |||||||||||||||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

| Portfolio turnover | |||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 50% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||

| Principal strategies | |||||||||||||||||||||||||||||||||||||||||||||

Principal investments In order to achieve the Fund's objective, the Fund employs an asset allocation strategy that seeks to achieve a total rate of return for the Fund that meets or exceeds the Citigroup One-Month US Treasury Bill Index plus 2%-4% (net of fees) over a rolling five year time horizon. The Advisor does not represent or guarantee that the Fund will meet this total return goal. The Fund invests in securities and financial instruments to gain exposure to global equity, global fixed income and cash equivalent markets, including global currencies. The Fund may invest in equity and fixed income securities of issuers located within and outside the United States or in open-end investment companies advised by the Advisor, to gain exposure to certain global equity and global fixed income markets. The Fund is a non-diversified fund. Investments in fixed income securities may include, but are not limited to, debt securities of governments throughout the world (including the United States), their agencies and instrumentalities, debt securities of corporations and supranationals, inflation protected securities, convertible bonds, mortgage-backed securities, asset-backed securities, equipment trusts and other collateralized debt securities. Investments in fixed income securities may include issuers in both developed (including the United States) and emerging markets. The Fund's fixed income investments may reflect a broad range of investment maturities, credit qualities and sectors, including high yield (lower-rated or "junk bonds") securities and convertible debt securities. Investments in equity securities may include, but are not limited to, common stock and preferred stock of issuers in developed nations (including the United States) and emerging markets. Equity investments may include securities of companies of any capitalization size. In addition, the Fund attempts to generate positive returns and manage risk through asset allocation and sophisticated currency management techniques. These decisions are integrated with analysis of global market and economic conditions. The Fund may also take active positions on volatility to generate returns or to hedge the Fund's portfolio. The Fund may, but is not required to, use exchange-traded or over-the-counter derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include options (including options on securities, indices, futures, forwards and swap agreements), futures, forward agreements, swap agreements (including interest rate, total return, and credit default swaps), credit-linked securities, equity participation notes and equity linked notes. All of these derivatives may be used for risk management purposes, such as hedging against a specific security or currency, or to manage or adjust the risk profile of the Fund. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; to obtain exposure to certain markets; or to establish net short positions for individual markets, currencies or securities. Options on indices, options on swap agreements, futures on indices, forward agreements, interest rate swaps, total return swaps, credit default swaps and credit-linked securities may also be used to adjust the Fund's portfolio duration, including to achieve a negative portfolio duration. Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO"). To the extent permitted by the Investment Company Act of 1940, as amended (the "1940 Act"), the Fund may borrow money from banks to purchase investments for the Fund. Management process The Advisor will manage the Fund's portfolio using the following investment process as described below: The strategy invests in the full spectrum of instruments and markets globally. The Advisor believes that the Advisor is able to improve the return outcome and risk management of the Fund by employing a well diversified strategy across a broad global opportunity set. Returns are generated from asset allocation across markets, currency and security selection. The Advisor aims to employ 15-25 of the Advisor's highest conviction trade ideas into the following diversified risk buckets: • Market Directional: Explicit view on equities, credit, and interest rates • Relative Value Market: Capitalizing on misvaluation between two markets • Relative Value Currency: Active decisions between two markets that are made independent from market decisions Asset allocation decisions are primarily driven by UBS AM (Americas)'s assessment of valuation and prevailing market conditions in the United States and around the world. Using a systematic approach, the portfolio management team analyzes the asset classes and investments across equities, fixed income, and alternative asset classes (including currency), considering both fundamental valuation, economic and other market indicators. Regarding valuation, the Advisor evaluates whether asset classes and investments are attractively priced relative to fundamentals. The starting point is to assess the intrinsic value of an asset class, as determined by the fundamentals that drive an asset class' future cash flow. The intrinsic value represents a long term anchor point to which the Advisor believes the asset class will eventually revert. Fair value estimates of asset classes and markets are an output of UBS AM (Americas)'s proprietary valuation models. Discounting the asset's future cash flow using a discount rate that appropriately reflects the inherent investment risk associated with holding the asset gives the asset's fair value. The competitive advantage of the Advisor's models lies in the quality and consistency of the inputs used and, therefore, the reliability of valuation conclusions. The discrepancy between actual market level and fair value (the price/value discrepancy) is the primary valuation signal used in identifying investment opportunities. Next, the Advisor assesses additional market indicators and considers the effect that other determinants of economic growth and overall market volatility will have on each asset class. While in theory price/value discrepancies may resolve themselves quickly and linearly, in practice price/value discrepancy can grow larger before it resolves. While valuation models have proven effective at identifying longer-term price/value discrepancies, in the shorter term other factors can swamp valuation considerations. Thus, the Advisor incorporates an additional discipline in our idea generation process. The Advisor refers to this additional step in its idea generation process as market behavior analysis. Adding this step helps the Advisor to understand what other market indicators might drive the market towards or away from fundamental value. The Advisor performs systematic analysis of non-valuation drivers using models measuring sentiment, momentum and flows, market stress, the stage of the economic cycle, as well as an assessment of the general macroeconomic landscape. Conversely, valuation considerations tend to dominate when an asset class is substantially above or below fair value, but the Advisor recognizes that the use of market behavior analysis during these periods is very important to helping improve the timing in and out of these asset classes with very stretched valuations. The asset allocation process is structured around the Multi Asset Investment Committee (the "MAIC Committee") meetings, which provides a forum for debate and the exploration of all ramifications of any investment decision, rather than aiming for a consensus to be reached. Instead, any voting member of the MAIC Committee can sponsor a trade idea, preparing a detailed investment thesis to support the view. An investment thesis has to define the investment rationale based on valuation and market behavioral influences, the time scale for it being realized, the transaction costs and the potential milestones the Advisor would expect to evaluate whether or not the view is correct. The sponsor is then responsible for convincing another member of the MAIC Committee to support the idea as co-sponsor. Bottom up selection across active equity and fixed income markets can be utilized as part of the asset allocation process at the asset class level. With respect to specific equity securities for inclusion in the Fund's equity asset classes, the Advisor may utilize fundamental valuation, quantitative and growth-oriented strategies. The Advisor's bottom up fixed income security selection strategy combines judgments about the absolute value of the fixed income universe and the relative value of issuer sectors, maturity intervals, security durations, credit qualities and coupon segments, as well as specific circumstances facing the issuers of fixed income securities. The Advisor uses both fundamental valuation and market behavior analysis to make the two-pronged determination of risk budget and risk allocation. The Advisor works closely with the Risk Management team, members of which attend the MAIC Committee meetings, to determine the appropriate amount of risk capital to allocate to the underlying trade ideas given the strategy's risk budget and objectives, prevailing investment opportunities, and other strategy exposures. To assist in this process the Risk Management team performs scenario and correlation analysis to better understand the risk and diversification of the overall strategy, and ensures that unintended factor exposures are identified, managed and monitored. | |||||||||||||||||||||||||||||||||||||||||||||

| Main risks | |||||||||||||||||||||||||||||||||||||||||||||

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Below are some of the specific risks of investing in the Fund. Interest rate risk: An increase in prevailing interest rates typically causes the value of fixed income securities to fall. Changes in interest rates will likely affect the value of longer-duration fixed income securities more than shorter-duration securities and higher quality securities more than lower quality securities. When interest rates are falling, some fixed income securities provide that the issuer may repay them earlier than the maturity date, and if this occurs the Fund may have to reinvest these repayments at lower interest rates. The risks associated with rising interest rates may be more pronounced in the near future due to the current period of historically low rates. Credit risk: The risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to or guarantor of a derivative contract, is unable or unwilling to meet its financial obligations. This risk is likely greater for lower quality investments than for investments that are higher quality. High yield bond risk: The risk that the issuer of bonds with ratings of BB (Standard & Poor's Financial Services LLC ("S&P") or Fitch Ratings, Inc. ("Fitch")) or Ba (Moody's Investors Service, Inc. ("Moody's")) or below, or deemed of equivalent quality, will default or otherwise be unable to honor a financial obligation (also known as lower-rated or "junk bonds"). These securities are considered to be predominately speculative with respect to an issuer's capacity to pay interest and repay principal in accordance with the terms of the obligations. Lower-quality bonds are more likely to be subject to an issuer's default or downgrade than investment grade (higher quality) bonds. US Government securities risk: There are different types of US government securities with different levels of credit risk, including risk of default, depending on the nature of the particular government support for that security. For example, a US government-sponsored entity, although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are therefore riskier than those that are. Liquidity risk: The risk that investments cannot be readily sold at the desired time or price, and the Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund's value or prevent the Fund from taking advantage of other investment opportunities. Liquid portfolio investments may become illiquid or less liquid after purchase by the Fund due to low trading volume, adverse investor perceptions and/or other market developments. In recent years, the number and capacity of dealers that make markets in fixed income securities has decreased. Consequently, the decline in dealers engaging in market making trading activities may increase liquidity risk, which can be more pronounced in periods of market turmoil. Liquidity risk may be magnified in a rising interest rate environment or when investor redemptions from fixed income funds may be higher than normal, causing increased supply in the market due to selling activity. Liquidity risk includes the risk that the Fund will experience significant net redemptions at a time when it cannot find willing buyers for its portfolio securities or can only sell its portfolio securities at a material loss. Mortgage- and asset-backed securities risk: The Fund may invest in mortgage- and asset-backed securities that are subject to prepayment or call risk, which is the risk that the borrower's payments may be received earlier or later than expected due to changes in prepayment rates on underlying loans. Faster prepayments often happen when interest rates are falling. As a result, the Fund may reinvest these early payments at lower interest rates, thereby reducing the Fund's income. Conversely, when interest rates rise, prepayments may happen more slowly, causing the security to lengthen in duration. Longer duration securities tend to be more volatile. Securities may be prepaid at a price less than the original purchase value. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of mortgage-backed securities and could result in losses to the Fund. Market risk: The risk that the market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole. Small- and mid-capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources. IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time. Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Investments in foreign government bonds involve special risks because the Fund may have limited legal recourse in the event of default. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers. In addition, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Asset allocation risk: The risk that the Fund may allocate assets to an asset category that performs poorly relative to other asset categories. Non-diversification risk: The Fund is a non-diversified investment company, which means that the Fund may invest more of its assets in a smaller number of issuers than a diversified investment company. As a non-diversified fund, the Fund's share price may be more volatile and the Fund has a greater potential to realize losses upon the occurrence of adverse events affecting a particular issuer. Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market securities. Derivatives relating to fixed income markets are especially susceptible to interest rate risk and credit risk. In addition, many types of swaps and other non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments. Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested. Leverage risk associated with borrowing: The Fund may borrow money from banks to purchase investments for the Fund, which is a form of leverage. If the Fund borrows money to purchase securities and the Fund's investments decrease in value, the Fund's losses will be greater than if the Fund did not borrow money for investment purposes. In addition, if the return on an investment purchased with borrowed funds is not sufficient to cover the cost of borrowing, then the net income of the Fund would be less than if borrowing were not used. Investing in other funds risk: The Fund's investment performance is affected by the investment performance of the underlying funds in which the Fund may invest. Through its investment in the underlying funds, the Fund is subject to the risks of the underlying funds' investments and subject to the underlying funds' expenses. Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results. | |||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||

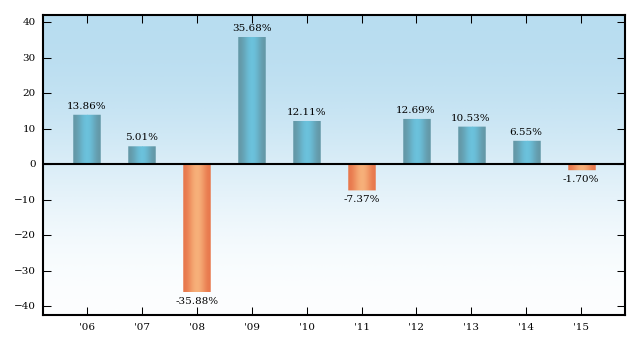

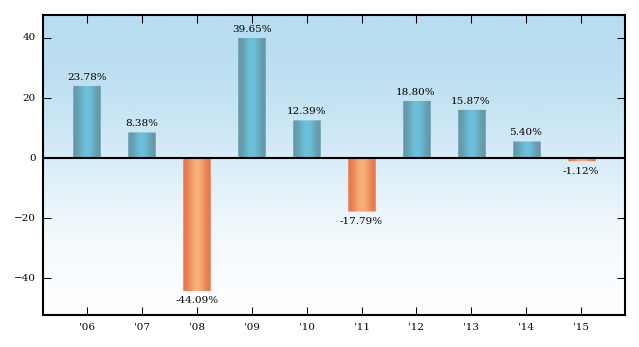

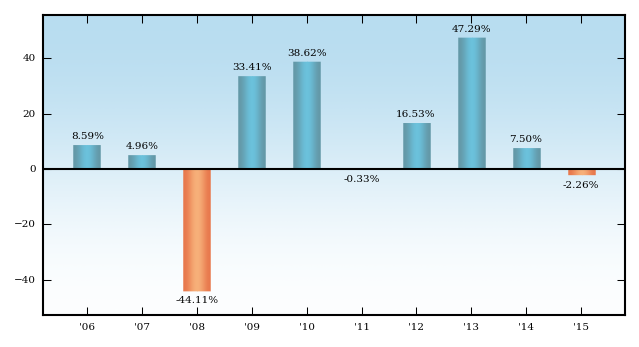

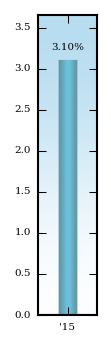

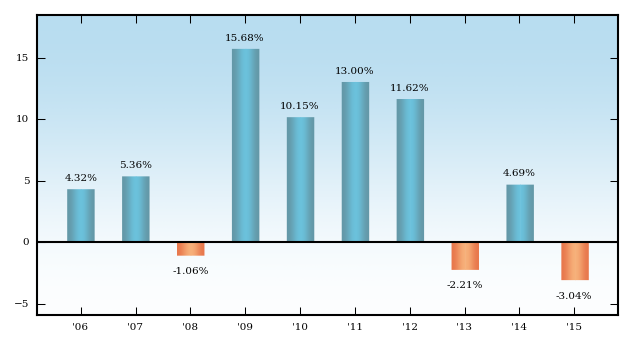

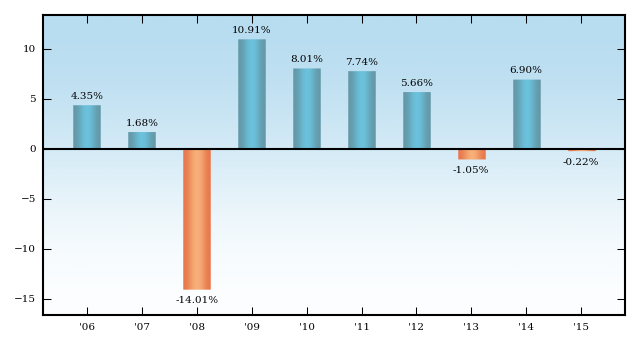

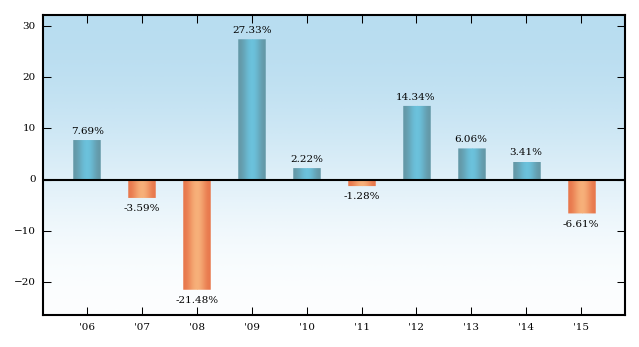

Risk/return bar chart and table The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. The MSCI World Free Index (net) shows how the Fund's performance compares to an index that is designed to measure the equity market performance of developed markets. The Citigroup One-Month US Treasury Bill Index shows how the Fund's performance compares to public obligations of the U.S. Treasury with maturities of one month. Indices reflect no deduction for fees, expenses or taxes, except for the MSCI World Free Index (net) which reflects no deduction for fees and expenses. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at www.ubs.com/us-mutualfundperformance. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class P shares' after-tax returns shown. | |||||||||||||||||||||||||||||||||||||||||||||

| Total return (Class P) | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

Total return January 1 - September 30, 2016: (1.69)% | |||||||||||||||||||||||||||||||||||||||||||||

| Average annual total returns (figures reflect sales charges) (for the periods ended December 31, 2015) | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||