UBS Municipal Bond Fund

Summary Prospectus | October 28, 2016

Before you invest, you may want to review the fund's prospectus and statement of additional information ("SAI"), which contain more information about the fund and its risks. You can find the fund's prospectus, SAI and other information about the fund online at http://www.ubs.com/us/en/asset_management/individual_investors/mutual_fund.html. You can also get this information at no cost by calling 1-800-647 1568 or by sending an email request to ubs@fundinsite.com. The current prospectus and SAI, dated October 28, 2016, are incorporated by reference into this summary prospectus (i.e., they are legally a part of this summary prospectus).

Share Class: Ticker Symbol

| Class A |

Class C |

Class P |

|||||||||

|

UMBAX |

UMBCX |

UMBPX |

|||||||||

Investment objective

The Fund seeks to provide total return consisting of capital appreciation and current income exempt from federal income tax.

Fees and expenses

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $100,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" on page 71 of the Fund's prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" on page 99 of the Fund's statement of additional information ("SAI").

Shareholder fees (fees paid directly from your investment)

|

Class A |

Class C |

Class P |

|||||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

2.25 |

% |

None |

None |

|||||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

None1 |

0.75 |

% |

None |

|||||||||||

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Class A |

Class C |

Class P |

|||||||||||||

|

Management fees |

0.40 |

% |

0.40 |

% |

0.40 |

% |

|||||||||

|

Distribution and/or service (12b-1) fees |

0.25 |

0.75 |

None |

||||||||||||

|

Other expenses2 |

0.50 |

0.50 |

0.49 |

||||||||||||

|

Total annual fund operating expenses |

1.15 |

1.65 |

0.89 |

||||||||||||

|

Less management fee waiver/expense reimbursements |

0.50 |

0.50 |

0.49 |

||||||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements3 |

0.65 |

1.15 |

0.40 |

||||||||||||

1 Purchases of $500,000 or more that were not subject to a front-end sales charge are subject to a 0.75% CDSC if sold within one year of the purchase date.

2 "Other expenses" include "Acquired fund fees and expenses," which were less than 0.01% of the average net assets of the Fund.

3 The Trust, with respect to the Fund, and UBS Asset Management (Americas) Inc., the Fund's investment advisor ("UBS AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses), through the period ending October 27, 2017, do not exceed 0.65% for Class A shares, 1.15% for Class C shares and 0.40% for Class P shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses to the extent such reimbursement can be made during the three years following the period during which such fee waivers and expense reimbursements were made, provided that the reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, the UBS AM (Americas)'s three year recoupment rights will survive.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

5 years |

10 years |

||||||||||||||||

|

Class A |

$ |

290 |

$ |

534 |

$ |

796 |

$ |

1,547 |

|||||||||||

|

Class C (assuming sale of all shares at end of period) |

192 |

471 |

850 |

1,913 |

|||||||||||||||

|

Class C (assuming no sale of shares) |

117 |

471 |

850 |

1,913 |

|||||||||||||||

|

Class P |

41 |

235 |

445 |

1,051 |

|||||||||||||||

Portfolio turnover

The Fund pays transaction costs, such as mark-ups, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 100% of the average value of its portfolio.

Principal strategies

Principal investments

Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in municipal bonds and other investments with similar economic characteristics, the interest on which is exempt from regular federal income tax. The Fund primarily invests in securities that, at the time of purchase, are rated investment grade by an independent rating agency (or if unrated are deemed to be of comparable quality by the Advisor), but may invest up to 10% in securities rated below investment grade (also known as "junk bonds"). The Fund may also, to a lesser extent, invest in US Treasury securities and other securities of the US government, its agencies and government-sponsored enterprises. The Fund is a non-diversified fund.

The Fund's weighted average portfolio duration will normally range between 3 and 10 years, but the Fund generally targets a duration of between 4.5 and 7 years. The Fund may invest in bonds of any maturity or duration.

The Fund may invest in insured and uninsured municipal securities. The Fund's investments may include, but are not limited to, general obligation and revenue bonds, tax-exempt commercial paper, short-term municipal notes, tender option bonds (including inverse floaters), floating and variable rate obligations, and other municipal securities that pay income exempt from federal income tax. The Fund does not intend to invest substantially in securities whose interest is subject to the federal alternative minimum tax.

The Fund may, but is not required to, use exchange traded or over-the-counter ("OTC") derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, index or other market factor and may relate to stocks, bonds, interest rates, credit, currencies or currency exchange rates, commodities and related indexes. The derivatives in which the Fund may invest include interest rate and credit instruments such as options (including, options on futures and swap agreements), futures, swap agreements (including, interest rate, total return, and credit default swaps), credit-linked securities and structured investments. All of these derivatives may be used for risk management purposes, such as hedging against a specific security, or to manage or adjust the risk profile of the Fund. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; to obtain exposure to certain markets; to establish net short positions for individual sectors, markets or securities; or to adjust the Fund's portfolio duration.

Management process

The Advisor adheres to a disciplined top-down and bottom-up investment process that seeks to leverage information advantage by using a proprietary credit research framework while focusing on three key decisions: duration, sector allocation and security selection. The investment process begins with an in-depth analysis of top-down inputs to determine the correct duration positioning of the portfolio. These inputs originate from the Advisor's proprietary research on the structure of the yield curve and its relationship to the US Treasury market. The Advisor's sector allocation analysis determines the attractiveness of various segments of the municipal market with a focus on two main themes—bond security (e.g., state vs. local general obligation bonds) and essential services (e.g., water and sewer systems or electric utilities). Security selection represents the final level of decision-making in the Advisor's investment process. The Advisor uses rigorous credit/structure analysis and relative pricing to select securities that the Advisor believes demonstrate superior risk/return characteristics. The Advisor then seeks to select individual securities

that will provide the portfolio the desired sector and duration exposures at the lowest cost.

Main risks

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Below are some of the specific risks of investing in the Fund.

Interest rate risk: An increase in prevailing interest rates typically causes the value of fixed income securities to fall. Changes in interest rates will likely affect the value of longer-duration fixed income securities more than shorter-duration securities and higher quality securities more than lower quality securities. When interest rates are falling, some fixed income securities provide that the issuer may repay them earlier than the maturity date, and if this occurs the Fund may have to reinvest these repayments at lower interest rates. The risks associated with rising interest rates may be more pronounced in the near future due to the current period of historically low rates.

Credit risk: The risk that the Fund could lose money if the issuer or guarantor of a fixed income security, or the counterparty to or guarantor of a derivative contract, is unable or unwilling to meet its financial obligations. This risk is likely greater for lower quality investments than for investments that are higher quality.

Prepayment or call risk: The risk that issuers will prepay fixed rate obligations when interest rates fall, forcing the Fund to reinvest in obligations with lower interest rates than the original obligations. When interest rates are rising, slower prepayments may extend the duration of the securities and may reduce their value.

Political risk: The Fund's investments may be significantly affected by political changes, including legislative proposals that may make municipal bonds less attractive in comparison to taxable bonds or other types of investments.

Related securities concentration risk: Because the Fund may invest more than 25% of its net assets in municipal bonds that are issued to finance similar projects, economic, business, or political developments or changes that affect one municipal bond also may affect other municipal bonds in the same sector.

Tax liability risk: Tax liability risk is the risk of noncompliant conduct by a municipal bond issuer, resulting in distributions by the Fund being taxable to shareholders as ordinary income.

US Government securities risk: There are different types of US government securities with different levels of credit risk, including risk of default, depending on the nature of the particular government support for that security. For example, a US government-sponsored entity, although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the US Treasury and are therefore riskier than those that are.

Liquidity risk: The risk that investments cannot be readily sold at the desired time or price, and the Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund's value or prevent the Fund from taking advantage of other investment opportunities. Liquid portfolio investments may become illiquid or less liquid after purchase by the Fund due to low trading volume, adverse investor perceptions and/or other market developments. In recent years, the number and capacity of dealers that make markets in fixed income securities has decreased. Consequently, the decline in dealers engaging in market making trading activities may increase liquidity risk, which can be more pronounced in periods of market turmoil. Liquidity risk may be magnified in a rising interest rate environment or when investor redemptions from fixed income funds may be higher than normal, causing increased supply in the market due to selling activity. Liquidity risk includes the risk that the Fund will experience significant net redemptions at a time when it cannot find willing buyers for its portfolio securities or can only sell its portfolio securities at a material loss.

High yield bond risk: The risk that the issuer of municipal bonds with ratings of BB (Standard & Poor's Financial Services LLC ("S&P") or Fitch Ratings, Inc. ("Fitch")) or Ba (Moody's Investors Service, Inc. ("Moody's")) or below, or deemed of equivalent quality, will default or otherwise be unable to honor a financial obligation (also known as lower-rated or "junk bonds"). These securities are considered to be predominately speculative with respect to an issuer's capacity to pay interest and repay principal in accordance with the terms of the obligations. Lower-rated municipal bonds are more likely to be subject to an issuer's default or downgrade than investment grade (higher quality) municipal bonds.

Non-diversification risk: The Fund is a non-diversified investment company, which means that the Fund may invest more of its assets in a smaller number of issuers than a diversified investment company. As a non-diversified fund, the Fund's share price may be more volatile and the Fund has a greater potential to realize losses upon the occurrence of adverse events affecting a particular issuer.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk, counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations) and the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index or overall market securities. Derivatives relating to fixed income markets are especially susceptible to interest rate risk and credit risk. In addition, many types of swaps and other non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

Market risk: The risk that the market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Performance

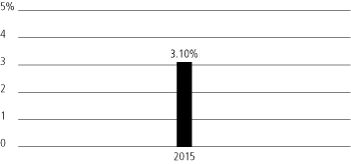

Risk/return bar chart and table

The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing the Fund's performance for the year 2015 and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. The Bloomberg Barclays Municipal Bond Index shows how the Fund's performance compares to an index that is designed to measure the fixed income market performance of the tax-exempt bond market. The Bloomberg Barclays Municipal Managed Money Intermediate (1-17) Index compares the Fund's performance to an index that measures the performance of municipal securities issued by state and local municipalities whose interest is exempt from both federal income tax and the federal alternative minimum tax.

Indices reflect no deduction for fees, expenses or taxes. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at www.ubs.com/us-mutualfundperformance.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class P shares' after-tax returns shown.

Total return ( Class P)

Total return January 1 - September 30, 2016: 3.83%

Best quarter during calendar year shown—4Q 2015: 1.95%

Worst quarter during calendar year shown—2Q 2015: (0.67)%

Average annual total returns (figures reflect sales charges) (for the periods ended December 31, 2015)

|

Class (inception date) |

1 year |

Life of class |

|||||||||

|

Class A (11/10/2014) Return before taxes |

0.64 |

% |

1.32 |

% |

|||||||

|

Class C (11/10/2014) Return before taxes |

1.60 |

2.80 |

|||||||||

|

Class P (11/10/2014) Return before taxes |

3.10 |

3.52 |

|||||||||

|

Return after taxes on distributions |

3.10 |

3.52 |

|||||||||

|

Return after taxes on distributions and sale of fund shares |

2.61 |

3.13 |

|||||||||

|

Bloomberg Barclays Municipal Bond Index |

3.30 |

3.74 |

|||||||||

|

Bloomberg Barclays Municipal Managed Money Intermediate (1-17) Index |

3.40 |

3.69 |

|||||||||

Investment advisor

UBS Asset Management (Americas) Inc. serves as the investment advisor to the Fund.

Portfolio manager

• Elbridge Gerry, portfolio manager of the Fund since its inception.

• Kevin McIntyre, portfolio manager of the Fund since October 2015.

Purchase & sale of Fund shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. In general, the minimum initial investment is $1,000 and the minimum subsequent investment is $100.

Tax information

The distributions you receive from the Fund primarily will be exempt from regular federal income tax. A portion of these distributions, however, may be subject to the federal alternative minimum tax and state and local taxes. The Fund may also make distributions that are taxable to you as ordinary income or capital gains.

Payments to broker/dealers and other financial intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's Web site for more information.

This page intentionally left blank.

This page intentionally left blank.

©UBS 2016. All rights reserved.

The UBS Funds

Investment Company Act File No. 811-6637

UBS Asset Management (Americas) Inc.

is a subsidiary of UBS AG.

S1573

www.ubs.com/globalam-us