As filed with the Securities and Exchange Commission on March 11, 2016

File No. 333-209344

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

Pre-Effective Amendment No. |

o |

|

|

|

|

Post-Effective Amendment No. 1 |

x |

|

|

|

|

|

(Check appropriate box or boxes) |

THE UBS FUNDS

(Exact Name of Registrant as Specified in Charter)

One North Wacker, Chicago, Illinois 60606

(Address of Principal Executive Offices) (Number, Street, City, State, Zip Code)

312-525-7100

(Registrant’s Area Code and Telephone Number)

Send Copies of Communications to:

|

MARK F. KEMPER |

JANA L. CRESSWELL, ESQ. |

|

UBS ASSET MANAGEMENT (AMERICAS) INC. |

STRADLEY RONON STEVENS & YOUNG LLP |

|

ONE NORTH WACKER |

2005 MARKET STREET, SUITE 2600 |

|

CHICAGO, ILLINOIS 60606 |

PHILADELPHIA, PA 19103-7018 |

Approximate Date of Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of securities being registered:

Class P shares of beneficial interest, without par value, of the UBS Total Return Bond Fund. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective immediately upon filing pursuant to Rule 485(b) under the Securities Act of 1933, as amended.

The UBS Funds

Proxy Statement/Prospectus

Fort Dearborn Income Securities, Inc.

Combined Proxy Statement/Prospectus

March 11, 2016

One North Wacker Drive

Chicago, Illinois 60606

1-800-647 1568

www.ubs.com

Dear Shareholder:

I am writing to let you know that a special meeting of the shareholders of Fort Dearborn Income Securities, Inc. ("Fort Dearborn" or the "Target Fund"), will be held on April 18, 2016 at 12:00 p.m., Central Time, at the principal executive offices of Fort Dearborn, One North Wacker Drive, 34th Floor, Chicago, Illinois 60606 (the "Meeting"). The purpose of the Meeting is to vote on a proposal to reorganize the Target Fund into Class P shares of UBS Total Return Bond Fund (the "Acquiring Fund"), a newly-organized series of The UBS Funds (the "UBS Trust").

If you are a shareholder of record of the Target Fund as of the regular close of business of the New York Stock Exchange on February 29, 2016, you have the opportunity to vote on the proposal. This package contains notice of the Meeting, information about the proposal and the materials to use when casting your vote. If the Target Fund's shareholders vote to approve the reorganization, shareholders of the Target Fund will receive Acquiring Fund shares having a total dollar value equivalent to the total dollar value of their investment in the Target Fund immediately prior to the time of the reorganization.

UBS Asset Management (Americas) Inc. ("UBS AM (Americas)"), the investment advisor to the Target Fund believes that reorganizing the Target Fund, a closed-end fund, into the Acquiring Fund, an open-end fund will provide the Target Fund shareholders with a fund with a similar investment program that will allow the shareholders to purchase and sell shares at net asset value. UBS AM (Americas) will serve as the investment advisor of the Acquiring Fund and the portfolio managers of the Target Fund will also serve as the portfolio managers of the Acquiring Fund. The proposed reorganization is not expected to result in a change in the level or quality of services shareholders of the Target Fund currently receive. The proposed reorganization has been carefully reviewed and approved by the Board of Directors of the Target Fund ("Target Fund Board" or "Target Fund Directors") and the Board of Trustees of the UBS Trust. The Target Fund Directors recommend that you vote FOR the proposed reorganization.

More information on the specific details of and reasons for the reorganization is contained in the enclosed Combined Proxy Statement/Prospectus. Please read the enclosed materials carefully and cast your vote on the Proxy Card. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

If you have any questions before you vote, please call the Target Fund's proxy solicitor toll-free at 866-741 9588. Thank you for your participation in this important initiative.

Sincerely,

Mark E. Carver

President

Fort Dearborn Income Securities, Inc.

A Proxy Card(s) covering the Target Fund is/are enclosed along with the Combined Proxy Statement/Prospectus.

VOTING IS QUICK AND EASY. YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

To secure the largest possible representation at the Meeting, please mark, sign and return your Proxy Card. If you sign, date and return the Proxy Card but give no voting instructions, your shares will be voted "FOR" the proposal indicated on the card. You may revoke your proxy at any time at or before the Meeting.

If we do not hear from you after a reasonable amount of time, you may receive a call from our proxy solicitor, Georgeson Inc., reminding you to vote.

THE TARGET FUND BOARD RECOMMENDS THAT YOU VOTE "FOR" THE PROPOSAL.

ii

Instructions for signing proxy card(s)

The following general guidelines for signing Proxy Cards may be of assistance to you and will help avoid the time and expense involved in validating your vote if you fail to sign your Proxy Card properly.

1. Individual accounts: Sign your name exactly as it appears in the registration on the Proxy Card.

2. Joint accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the Proxy Card.

3. All other accounts: The capacity of the individual signing the Proxy Card should be indicated unless it is reflected in the form of registration. For example:

|

Registration |

Valid signature |

||||||

|

Corporate Accounts |

|||||||

|

(1) ABC Corp. |

ABC Corp. John Doe, Treasurer |

||||||

| (2) ABC Corp. |

John Doe, Treasurer |

||||||

| (3) ABC Corp. c/o John Doe, Treasurer |

John Doe |

||||||

| (4) ABC Corp. Profit Sharing Plan |

John Doe, Trustee |

||||||

|

Partnership Accounts |

|||||||

| (1) The XYZ Partnership |

Jane B. Smith, Partner |

||||||

| (2) Smith and Jones, Limited Partnership |

Jane B. Smith, General Partner |

||||||

|

Trust Accounts |

|||||||

| (1) ABC Trust Account |

Jane B. Doe, Trustee |

||||||

| (2) Jane B. Doe, Trustee u/t/d 12/18/78 |

Jane B. Doe |

||||||

|

Custodial or Estate Accounts |

|||||||

|

(1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA/UTMA |

John B. Smith |

||||||

| (2) Estate of John B. Smith |

John B. Smith, Jr., Executor |

||||||

iii

This page intentionally left blank.

iv

Fort Dearborn Income Securities, Inc.

One North Wacker Drive

Chicago, Illinois 60606

1-800-647 1568

www.ubs.com

Notice of Special Meeting of Shareholders to be held on April 18, 2016

To the shareholders of Fort Dearborn Income Securities, Inc. ("Fort Dearborn" or the "Target Fund"):

NOTICE IS HEREBY GIVEN that Fort Dearborn will hold a Special Meeting of Shareholders (the "Meeting") on April 18, 2016 at 12:00 p.m., Central Time, at the principal executive offices of Fort Dearborn, One North Wacker Drive, 34th Floor, Chicago, Illinois 60606. The purpose of the Meeting is to consider and act upon the following proposals:

1. To approve an Agreement and Plan of Reorganization (the "Plan") providing for the: (i) acquisition by The UBS Funds, a Delaware statutory trust (the "UBS Trust"), on behalf of its series, UBS Total Return Bond Fund (the "Acquiring Fund") of all of the property, assets and goodwill of the Target Fund, in exchange solely for Class P shares of beneficial interest, no par value, of the Acquiring Fund; (ii) the assumption by the UBS Trust, on behalf of the Acquiring Fund, of all of the liabilities of the Target Fund; (iii) the distribution of Class P shares of the Acquiring Fund to the shareholders of the Target Fund according to their respective interests in complete liquidation of the Target Fund; and (iv) the dissolution of the Target Fund as soon as practicable after the closing (the "Proposal").

2. To vote upon any other business that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

A copy of the form of the Plan, which more completely describes the transaction proposed, is attached as Appendix A to the enclosed Combined Proxy Statement/Prospectus. It is not anticipated that any matters other than the approval of the Proposal will be brought before the Meeting. If, however, any other business is properly brought before the Meeting, proxies will be voted in accordance with the judgment of the persons designated as proxies or otherwise as described in the enclosed Combined Proxy Statement/Prospectus.

Shareholders of record of the Target Fund at the regular close of business of the New York Stock Exchange on February 29, 2016 are entitled to notice of, and to vote at, such Meeting and any adjournment(s) or postponement(s) thereof. Each share of the Target Fund is entitled to one vote, and each fractional share held is entitled to a proportional fractional vote, with respect to the Proposal.

Under Illinois law, shareholders of the Target Fund have the right to exercise dissenters' rights and obtain a cash payment for their shares as a result of the transactions contemplated under the Plan, provided that they comply with the provisions of Sections 11.65 and 11.70 of the Illinois Business Corporation Act. A summary of the material statutory procedures to be followed by a shareholder of the Target Fund to dissent are set forth in the

1

Combined Proxy Statement/Prospectus. Also, a copy of Sections 11.65 and 11.70 of the Illinois Business Corporation Act are attached as Appendix F to the Combined Proxy Statement/Prospectus.

The Board of Directors of the Target Fund recommends that shareholders of the Target Fund vote FOR the Proposal.

By order of the Board of Directors of Fort Dearborn Income Securities, Inc.

Mark F. Kemper

Secretary of Fort Dearborn Income Securities, Inc.

March 11, 2016

Your vote is important. To secure the largest possible representation and to save the expense of further mailings, please mark your Proxy Card, sign it, and return it as soon as possible in the enclosed envelope, which requires no postage if mailed in the United States, or vote by telephone or over the Internet by following the instructions provided on the Proxy Card. Please vote your proxy regardless of the number of shares owned. You may revoke your proxy at any time at, or before, the Meeting or vote in person if you attend the Meeting, as provided in the enclosed Combined Proxy Statement/Prospectus.

2

Combined Proxy Statement/Prospectus

Dated March 11, 2016

Fort Dearborn Income Securities Inc.

One North Wacker Drive

Chicago, Illinois 60606

1-800-647 1568

www.ubs.com

The UBS Funds

One North Wacker Drive

Chicago, Illinois 60606

1-800-647 1568

www.ubs.com

This Combined Proxy Statement/Prospectus ("Proxy Statement/Prospectus") solicits proxies to be voted at a special meeting of the shareholders (the "Meeting") of Fort Dearborn Income Securities, Inc. ("Fort Dearborn" or the "Target Fund").

At the Meeting, shareholders of the Target Fund will be asked to approve an Agreement and Plan of Reorganization (the "Plan") relating to the reorganization of the Target Fund into Class P shares of UBS Total Return Bond Fund (UTBPX) (the "Acquiring Fund"), a newly-organized series of The UBS Funds (the "UBS Trust"), as described more fully in the Plan (the "Reorganization"). The Target Fund and the Acquiring Fund may be referred to herein as a "Fund" or the "Funds."

If the Reorganization is approved by the Target Fund's shareholders on the effective date of the proposed Reorganization, Target Fund shareholders will be issued Class P shares of the Acquiring Fund.

The Meeting will be held at the principal executive offices of the Target Fund, One North Wacker Drive, 34th Floor, Chicago, Illinois 60606, at 12:00 p.m., Central Time on April 18, 2016. The Board of Directors of the Target Fund ("Target Fund Board" or "Target Fund Directors") is soliciting these proxies on behalf of the Target Fund. The Target Fund Directors believe that the proposed Reorganization is in the best interests of the Target Fund and its shareholders, and that the interests of the Target Fund's shareholders will not be diluted as a result of the Reorganization. This Proxy Statement/Prospectus will first be sent to shareholders on or about March 14, 2016.

The Target Fund is a registered, closed-end management investment company whose shares trade on the New York Stock Exchange (NYSE) and the Acquiring Fund is a registered, open-end management investment company (mutual fund). If the Target Fund's shareholders vote to approve the Plan, shareholders of the Target Fund will receive Acquiring Fund shares having a total dollar value equivalent to the net asset value (NAV) of their investment in the Target Fund immediately prior to the time of the Reorganization, as determined pursuant to the Plan. The Target Fund will then be liquidated and dissolved.

This Proxy Statement/Prospectus sets forth concisely the information about the Reorganization and the Acquiring Fund that you should know before voting on the Plan with respect to the Target Fund and investing in the Acquiring Fund.

You should retain this Proxy Statement/Prospectus for future reference. Additional information about the Target Fund, the Acquiring Fund and the proposed Reorganization can be found in the following documents, which have been filed with the U.S. Securities and Exchange Commission ("SEC") and which are incorporated by reference into this Proxy Statement/Prospectus:

1. The prospectus of the UBS Trust on behalf of the UBS Total Return Bond Fund, dated March 1, 2016 (File No. File No. 811-06637; previously filed on EDGAR, Accession No. 0001609006-16-000362), which is also enclosed herewith (the "Acquiring Fund Prospectus"); and

2. A statement of additional information ("SAI") dated March 11, 2016 (File No. 333-209344), relating to this Proxy Statement/Prospectus.

You may request a free copy of the SAI relating to this Proxy Statement/Prospectus without charge by calling 1-800-647 1568 or by writing to UBS Asset Management (Americas) Inc., One North Wacker Drive, Chicago, Illinois 60606.

You may obtain copies of the Target Fund's annual or semi-annual reports without charge by contacting Fort Dearborn at 888-793 8637 or by visiting https://www.ubs.com/us/en/asset_management/financial_advisors/closed_end_funds.html.

The Acquiring Fund Prospectus, which accompanies this Proxy Statement/Prospectus, is intended to provide you with additional information about the Acquiring Fund. The Acquiring Fund is newly organized and currently has no assets or liabilities. The Acquiring Fund was created specifically in connection with the Plan for the purpose of acquiring the assets and liabilities of the Target Fund and will not commence operations until the date of the Reorganization. The Acquiring Fund does not have any annual or semiannual reports to date. You may obtain an additional copy of the Acquiring Fund Prospectus or the related SAI without charge by contacting the UBS Trust at 1-800-647 1568.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

MUTUAL FUND SHARES ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK, AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD, OR ANY OTHER U.S. GOVERNMENT AGENCY. MUTUAL FUND SHARES INVOLVE INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

2

|

Table of contents |

|||||||

| Overview |

5 |

||||||

| On what proposal am I being asked to vote? |

5 |

||||||

| What is the anticipated timing of the Reorganization? |

6 |

||||||

| Why is the Reorganization being proposed? |

6 |

||||||

| Will the portfolio management of the Target Fund change? |

6 |

||||||

| Who will bear the expenses associated with the Reorganization? |

6 |

||||||

| What are the federal income tax consequences of the Reorganization? |

6 |

||||||

| Has the Board of the Target Fund approved the proposed Reorganization? |

7 |

||||||

| How will the number of shares of the Acquiring Fund that I will receive be determined? |

7 |

||||||

| Will my fees increase after the Reorganization? |

7 |

||||||

|

Will I have to pay any front-end sales charges, contingent deferred sales charges or redemption fees in connection with the Reorganization? |

8 |

||||||

|

Are the investment objectives and strategies of the Acquiring Fund similar to the investment objectives and strategies of the Target Fund? |

8 |

||||||

| Do the fundamental investment restrictions differ between the Target Fund and the Acquiring Fund? |

9 |

||||||

|

Do the principal risks associated with investments in the Target Fund differ from the principal risks associated with investments in the the Acquiring Fund? |

9 |

||||||

| What are the prinicpal differences between open-end and closed-end funds? |

9 |

||||||

| How many votes am I entitled to cast? |

10 |

||||||

| How do I vote my shares? |

10 |

||||||

| What are the quorum and approval requirements for the Reorganization? |

11 |

||||||

|

What if there are not enough votes to reach a quorum or to approve the Reorganization by the scheduled Meeting date? |

11 |

||||||

| What happens if the Reorganization is not approved by the Target Fund's shareholders? |

11 |

||||||

| Comparison of the Target Fund and the Acquiring Fund |

11 |

||||||

| Comparison of fee tables |

11 |

||||||

| Comparison of investment objectives, strategies and risks |

13 |

||||||

|

Comparison of fundamental investment restrictions |

19 |

||||||

| Comparison of portfolio turnover |

25 |

||||||

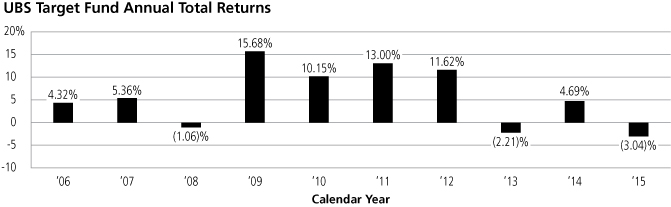

| Comparison of fund performance |

25 |

||||||

| Comparison of investment advisors and other service providers |

25 |

||||||

|

Comparison of fund shares |

27 |

||||||

|

Purchase, redemption and exchange procedures for the Acquiring Fund |

28 |

||||||

|

Comparison of dividend and distribution policies and fiscal years |

29 |

||||||

| Comparison of business structures, shareholder rights and applicable law |

30 |

||||||

| Board considerations |

31 |

||||||

| The proposed Reorganization |

32 |

||||||

| Agreement and Plan of Reorganization |

32 |

||||||

| Description of the Securities to be Issued |

33 |

||||||

| Federal income tax consequences of the Reorganization |

34 |

||||||

| Pro forma capitalization |

35 |

||||||

| Additional information about the funds |

36 |

||||||

| Financial highlights |

36 |

||||||

| Voting information |

36 |

||||||

| Solicitation of votes |

37 |

||||||

| Quorum and voting requirements |

37 |

||||||

| Effect of abstention and broker "non-votes" |

37 |

||||||

| Adjournment |

37 |

||||||

3

| Other matters |

38 |

||||||

| Future shareholder proposals |

38 |

||||||

| Record date and outstanding shares |

38 |

||||||

| You have dissenters' rights |

39 |

||||||

| Where to find additional information about the funds |

42 |

||||||

|

Appendix A—Form of Agreement and Plan of Reorganization |

A-1 |

||||||

|

Appendix B—Target Fund's financial highlights |

B-1 |

||||||

|

Appendix C—Target Fund's performance |

C-1 |

||||||

|

Appendix D—Comparison of State Laws |

D-1 |

||||||

|

Appendix E—Comparison of Governing Documents |

E-1 |

||||||

|

Appendix F—Dissenters' rights |

F-1 |

||||||

4

Overview

The following is a brief overview of the proposal to be voted upon at the Meeting of shareholders scheduled for April 18, 2016. Your vote is important. Additional information is contained elsewhere in this Proxy Statement/Prospectus, as well as the Plan, the Acquiring Fund Prospectus, and the SAI for this Proxy Statement/Prospectus, all of which are incorporated herein by reference.

Shareholders should read the entire Proxy Statement/Prospectus and the Acquiring Fund Prospectus (which is included herewith) carefully for more complete information. If you need another copy of the Proxy Statement/Prospectus, please call the Target Fund's proxy solicitor at 866-741 9588 (toll-free).

On what proposal am I being asked to vote?

As a Target Fund shareholder, you are being asked to vote on the approval of an Agreement and Plan of Reorganization. The Plan provides for the: (i) acquisition by the UBS Trust, on behalf of the Acquiring Fund, of all of the property, assets and goodwill of the Target Fund, in exchange solely for Class P shares of beneficial interest, no par value, of the Acquiring Fund; (ii) the assumption by the UBS Trust, on behalf of the Acquiring Fund, of all of the liabilities of the Target Fund; (iii) the distribution of the Class P shares of the Acquiring Fund to the shareholders of the Target Fund according to their respective interests in complete liquidation of the Target Fund; and (iv) the dissolution of the Target Fund as soon as practicable after the closing (the "Proposal").

As a result of the Reorganization (if approved by shareholders), a Target Fund shareholder will become a shareholder of the Acquiring Fund and shareholders of the Target Fund will receive Class P shares of the Acquiring Fund having a total dollar value equal to the net asset value (not market value) of the shares such shareholder held in the Target Fund immediately prior to the effectiveness of the Reorganization as determined pursuant to the Plan.

The Reorganization of the Target Fund into the Acquiring Fund is currently scheduled to take place as of the opening of business on May 9, 2016, or such other date and time as the parties may agree (the "Closing"). The Class P shares of the Acquiring Fund may be redeemed at NAV at any time, although Class P shares of the Acquiring Fund that are redeemed with in the first ninety days following the Closing of the Reorganization are subject to a redemption fee of 2.00%.

The Plan is subject to certain closing conditions and may be terminated at any time by mutual consent of the Target Fund and the UBS Trust, by the UBS Trust if any condition precedent to its obligations has not been fulfilled or waived by the UBS Trust, or by the Target Fund if any condition precedent to its obligations has not been fulfilled or waived by the Target Fund.

You should consult the Acquiring Fund Prospectus for more information about the Acquiring Fund, which has been incorporated by reference into this Proxy Statement/Prospectus. In addition, a copy of the Acquiring Fund Prospectus accompanies this Proxy Statement/Prospectus. For more information regarding shareholder approval of the Reorganization, please refer to the "The proposed Reorganization" and "Voting information" sections below. A form of the Plan is attached hereto as Appendix A to this Proxy Statement/Prospectus. For more information regarding the calculation of the number of Acquiring Fund shares to be issued, please refer to the "How will the number of shares of the Acquiring Fund that I will receive be determined?" section below.

5

What is the anticipated timing of the Reorganization?

The Meeting is scheduled to occur on April 18, 2016. If all necessary approvals are obtained, the proposed Reorganization will likely take place in the second quarter of 2016, and is currently scheduled to take place upon the opening of business on May 9, 2016.

Why is the Reorganization being proposed?

UBS Asset Management (Americas) Inc. ("UBS AM (Americas)" or the "Advisor"), the investment advisor to the Target Fund, believes that the proposed Reorganization is in the best interests of the Target Fund and its shareholders. The Acquiring Fund will provide the Target Fund shareholders with a comparably priced Fund with a similar investment program. The Target Fund over the last several years has been trading at a discount to its net asset value (NAV). The proposed Reorganization of the Target Fund into the Acquiring Fund, an open-end fund, will allow Target Fund shareholders to recognize NAV for their shares and avoid the discount that would apply if they were to sell their shares on the stock exchange. The proposed Reorganization also will allow all shareholders of the Target Fund to become shareholders of the Acquiring Fund without experiencing the adverse federal tax consequences of a sale of shares. As an open-end fund, the Acquiring Fund may provide Target Fund shareholders with the potential to achieve greater economies of scale because the Acquiring Fund will be able to increase its asset base through the continuous sale of shares. Larger funds are generally able to capitalize on economies of scale and spread fixed costs over a broader asset base, and may trade in larger quantities, therefore reducing trading costs. The proposed Reorganization has been carefully reviewed and approved by the Board of Directors of the Target Fund and the Board of Trustees of the UBS Trust. Lastly, shareholders of an open-end fund will be able to redeem their shares at NAV as opposed to trading their shares in the open market at a price that may be below the NAV, as closed-end funds commonly trade at a discount. The Target Fund Directors recommend that you vote FOR the proposed Reorganization.

Will the portfolio management of the Target Fund change?

No. UBS AM (Americas) will serve as the investment advisor of the Acquiring Fund and the same portfolio managers that currently manage the Target Fund will be the portfolio managers of the Acquiring Fund.

Who will bear the expenses associated with the Reorganization?

The costs of the solicitation related to the Reorganization, including any costs directly associated with preparing, filing, printing, and distributing to the shareholders of the Target Fund all materials relating to this Proxy Statement/Prospectus and soliciting shareholder votes, as well as the conversion costs associated with the Reorganization will be borne by the Target Fund. The Target Fund is estimated to pay approximately $375,000 in connection with the Reorganization. In addition to solicitations through the mail, proxies may be solicited by officers, employees, and agents of the Target Fund, UBS AM (Americas) and its affiliates, or, if necessary, a communications firm retained for this purpose.

What are the federal income tax consequences of the Reorganization?

The Reorganization is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes and will not take place unless the Target Fund and the Acquiring Fund receive a satisfactory opinion of counsel to the effect that the Reorganization will be tax-free, as described in more detail in the section entitled "Federal income tax consequences of the Reorganization" (although there can be no assurance that the Internal Revenue Service will agree with such opinion). Accordingly, no gain or loss is expected to be

6

recognized by the Target Fund or its shareholders as a direct result of its Reorganization. In addition, the tax basis and holding period of a shareholder's Target Fund shares are expected to carry over to the Acquiring Fund shares the shareholder receives in its Reorganization.

For more detailed information about the tax consequences of the Reorganization please refer to the "Federal income tax consequences of the Reorganization" section below.

Has the Board of the Target Fund approved the proposed Reorganization?

The Target Fund Board has approved the Reorganization and the Plan and recommends that you vote to approve the Plan. The UBS Trustees believe that the proposed Reorganization is in the best interests of the Target Fund and its shareholders, and that the interests of the Target Fund's shareholders will not be diluted as a result of the Reorganization.

As described in more detail below, UBS AM (Americas) and the Target Fund Board have engaged in discussions regarding how to pursue the best interests of the Target Fund and its shareholders. UBS AM (Americas) proposed that the UBS Board approve the Reorganization, in light of a number of factors, including the elimination of the discount at which the Target Fund's shares have historically traded and the similarity in the Target Fund's and corresponding Acquiring Fund's investment objectives and strategies. For information regarding the specific factors that were considered by the Target Fund Directors, please refer to the section below entitled "Board considerations."

How will the number of shares of the Acquiring Fund that I will receive be determined?

As a Target Fund shareholder, you will receive your pro rata share of Class P shares of the Acquiring Fund received by the Target Fund in the Reorganization. The number of shares that the Target Fund's shareholders will receive will be based on the relative net asset values ("NAVs") of the Target Fund and the Acquiring Fund as of the regular close of business of the New York Stock Exchange ("NYSE") on the business day immediately preceding the Closing (the "Closing Date"). The Target Fund's assets will be valued pursuant to the Funds' valuation procedures. The total value of your holdings should not change as a result of the Reorganization.

Will my fees increase after the Reorganization?

As a result of the proposed Reorganization, shareholders of the Target Fund can expect a higher investment management fee and higher total fund operating expenses; however, after any applicable expense waivers and reimbursements, shareholders of the Target Fund can expect to experience lower total fund operating expenses as a percentage of average daily net assets as shareholders in the Acquiring Fund after the Reorganization. As a result, while the Acquiring Fund's fee waiver/expense reimbursement agreement is in effect, shareholders of the Target Fund can expect to pay lower total fund operating expenses after the Reorganization. The Target Fund, for the 2015 fiscal year, paid UBS AM (Americas) an investment management fee at the rate of 0.47% which is slightly lower than the rate of 0.50% to be paid by the Acquiring Fund to UBS AM (Americas) under the Acquiring Fund's investment advisory agreement. However, due to a contractual fee waiver and expense limitation agreement with respect to the Acquiring Fund, the total annual operating expenses of the Acquiring Fund will be limited to 0.50% of the Acquiring Fund's average annual net assets through October 27, 2017, which is lower than the total annual operating expenses of 0.75% experienced by the Target Fund for the 2015 fiscal year.

7

For more details, please see "Comparison of fee tables" and "Comparison of investment advisors and other service providers" below.

Will I have to pay any front-end sales charges, contingent deferred sales charges or redemption fees in connection with the Reorganization?

No. You will not have to pay any front-end sales charges, contingent deferred sales charges ("CDSCs") or redemption/exchange fees in connection with the Reorganization, which means that the aggregate value of Acquiring Fund shares issued to you in the Reorganization will be equal to the aggregate net asset value of the Target Fund shares you own immediately prior to a Reorganization. You may be subject to a redemption fee when selling the Acquiring Fund shares if you sell such shares within 90 days of the effective date of the Reorganization.

Are the investment objectives and strategies of the Acquiring Fund similar to the investment objectives and strategies of the Target Fund?

The Funds have generally similar investment objectives and strategies. The Target Fund's primary objective is to provide its shareholders with: (1) a stable stream of current income consistent with external interest rate conditions, and (2) a total return over time that is above what they could receive by investing individually in the investment grade and long-term maturity sectors of the bond market. The Target Fund's secondary objective is capital appreciation. The Acquiring Fund has a similar investment objective of maximizing total return, consisting of capital appreciation and current income. The principal investment strategies of the Acquiring Fund are similar to the principal investment strategies of the Target Fund. The Acquiring Fund, like the Target Fund, will invest across a number of fixed income markets. The Acquiring Fund, however, may provide a more balanced allocation across the fixed income markets. For example, the Target Fund currently invests over 70% of its assets in corporate debt, while the Acquiring Fund may invest to a lesser extent in corporate debt, which would be more in line with the benchmark for both Funds. Like the Target Fund, the Acquiring Fund may invest in foreign obligations denominated in US dollars and in foreign currencies. While the Target Fund hedges all of its foreign currency exposure back to the US dollar, the Acquiring Fund is permitted to maintain foreign currency exposure up to 25% of its net assets in order to diversify its sources of potential risk and return.

UBS AM (Americas) expects that the Acquiring Fund will retain a significant majority of the portfolio holdings of the Target Fund when the Reorganization is affected. A portion of the Target Fund's portfolio assets may be sold in connection with the Reorganization as distinct from normal portfolio turnover. Such repositioning of the Target Fund's portfolio assets may occur before the closing of the Reorganization to align the Target Fund's portfolio to the investment policies of the Acquiring Fund and to acquire cash or cash equivalent positions in anticipation of potential shareholder redemptions following such Reorganization. These sales may result in the realization of capital gains, which to the extent not offset by available capital loss carryovers, would be distributed to shareholders. The amount of any capital gains that may be realized and distributed to the shareholders will depend upon a variety of factors, including the Target Fund's net unrealized appreciation in the value of its portfolio assets at that time and any repositioning of the Target Fund before the Reorganization. It is not anticipated that such sales of a portion of the portfolio assets prior to the closing of the Reorganization would result in any material amounts of capital gains to be distributed to shareholders. Once the Proposal is approved by shareholders, but prior to the Reorganization, the Target Fund will commence such repositioning of the portfolio and may incur additional transaction costs. The amount of the Target Fund's portfolio assets that may be sold in connection with the Reorganization and the related portfolio transaction costs that may be incurred will depend upon a variety of factors, including market conditions. It is estimated that the Target Fund may sell approximately 20% of its portfolio assets. The Target Fund may need to maintain a larger cash or cash equivalent balance and engage in further disposition of assets in preparation

8

for the Reorganization depending on prevailing market conditions, bond market liquidity and shareholder ownership/concentration dynamics.

For a detailed comparison of each Target and Acquiring Fund's investment objectives and strategies and a discussion of certain differences, see the section below entitled "Comparison of investment objectives, strategies and risks."

Do the fundamental investment restrictions differ between the Target Fund and the Acquiring Fund?

Most of the fundamental investment restrictions of the Target Fund and the Acquiring Fund are similar to one another, and include investment policies required by the Investment Company Act of 1940, as amended (the "1940 Act"). The Funds do have slightly different investment restrictions with respect to concentrating in a single industry, but neither Fund's restriction permits concentration in a single industry. The diversification of investments restrictions of the two Funds also differ in that the Target Fund's investment restriction applies the 5% and 10% provisions of the restriction with respect to holdings of a single issuer to 100% of its assets, while the Acquiring Fund's restriction only applies the 5% and 10% provisions of the restriction to 75% of its assets. The lending restrictions between the two Funds differ in that the Acquiring Fund's policy permits the lending of the Fund's portfolio securities, which is a practice in which the Target Fund does not engage. The borrowing restrictions of the two Funds also differ in that the Target Fund is permitted to engage in more borrowing activity than the Acquiring Fund. However, because the Target Fund has not used borrowing as part of its investment practices, it is not expected to have an effect on the management of the portfolio. In addition to the 1940 required investment restrictions, the Target Fund also is subject to some additional investment restrictions that do not apply to the Acquiring Fund. For example, the Target Fund has an investment restriction that does not permit investment in open-end investment companies. The Acquiring Fund does not have this restriction and is permitted to invest in other open-end investment companies within the limits of the 1940 Act. If the Reorganization is approved, UBS AM (Americas) does not expect that the differences between the Funds' investments restrictions will materially affect the way in which the portfolio of the Acquiring Fund is managed compared the Target Fund.

For more information about the Funds' fundamental investment restrictions, see the section below entitled "Comparison of fundamental and non-fundamental investment restrictions."

Do the principal risks associated with investments in the Target Fund differ from the principal risks associated with investments in the Acquiring Fund?

The principal risks of the Target Fund are similar to those of the Acquiring Fund. However, the Target Fund, but not the Acquiring Fund, is subject to the principal risks of investing is collateralized loan obligations (CLOs) and the risk of differences of market price and net asset value of shares. The Acquiring Fund is subject to securities lending risk, which is not a risk of the Target Fund. For a detailed comparison of each Fund's principal risks, see the section below entitled "Comparison of investment objectives, strategies and risks."

What are the principal differences between open-end and closed-end funds?

In evaluating the Reorganization, shareholders of the Target Fund should consider the important distinctions between closed-end and open-end investment companies and how those distinctions bear upon management of the two Funds and the relative risks associated with an investment in the Funds. The Acquiring Fund is an open-end fund that engages in a continuous offering of its shares. In addition, the Acquiring Fund must stand ready to redeem its shares at the instruction of shareholders. The Acquiring Fund's size will fluctuate

9

both because of sales and redemptions of its shares as well as market appreciation and depreciation in fund assets. By contrast, the Target Fund is a closed-end fund that does not sell its shares on a continuous basis and generally may not redeem its shares upon shareholder request. As a consequence, the number of outstanding shares of the Target Fund will generally remain constant (absent an issuer tender offer, an open-market repurchase program or shares issued pursuant to a dividend reinvestment plan). Accordingly, the size of the Target Fund is generally affected only by the market appreciation and depreciation of its assets. This distinction has a direct bearing on the management of the Funds and on expenses to which the Funds are subject.

As an open-end fund, the Acquiring Fund must be managed in anticipation of possible redemptions, which generally must be honored within seven days after a redemption request is received by the Fund in good order. Payments to shareholders that redeem their shares generally must be paid in cash, the source of which typically is cash-on-hand or cash raised by the sale of portfolio securities. Conversely, unless the Target Fund has announced a tender offer of its shares, the Target Fund need not be managed in anticipation of possible redemptions. As such, the Acquiring Fund may hold more liquid assets, such as a larger cash position, than the Target Fund in order to be managed in anticipation of possible redemptions. The Acquiring Fund, as an open-end fund, has the potential for growth in size through sales of additional shares, with the flexibility in management and the potential per share cost savings that may arise from increased size. In contrast, an investment in the Target Fund does not present the same potential growth because it may not engage in a continuous offering of its shares. However, unlike the Target Fund, the Acquiring Fund's net assets may decrease due to shareholder redemptions. In order to achieve growth through sales, the Target Fund would be required to engage in an additional underwritten public offering or a rights offering, both of which are expensive and time consuming. The inability of the Target Fund to quickly and relatively inexpensively raise additional capital in a public offering can be a significant impediment to the Target Fund's operation, if, as a result of market depreciation, the value of its assets were to significantly decline. In such an instance, fixed costs would be spread over fewer assets, thus causing its expense ratio to increase.

Apart from flexibility of management, there are other distinctions between the two structures of the Funds. Open-end funds, such as Acquiring Fund, provide investors with liquidity by generally allowing shareholders to purchase, sell (redeem) and exchange their shares at NAV each business day the mutual fund is open (subject to certain limitations, as provided in the applicable prospectus). In contrast, the Target Fund lists its shares on the NYSE and holders of Target Fund shares must trade their shares on the open market and will typically receive the prevailing market price at that time, which may be equal to, greater than or less than the per share NAV of the Target Fund shares at the time of the trade.

How many votes am I entitled to cast?

As a shareholder of the Target Fund, you are entitled to one vote for each whole share, and a proportionate fractional vote for each fractional share, that you own of the Target Fund on the record date. The record date is February 29, 2016 (the "Record Date"). Completion of the Reorganization is conditioned on the approval of the Reorganization by the Target Fund's shareholders.

How do I vote my shares?

You can vote your shares in person at the Meeting or by completing and signing the enclosed Proxy Card and mailing it in the enclosed postage-paid envelope. If you need any assistance, or have any questions regarding the Proposal or how to vote your shares, please call 866-741 9588.

10

What are the quorum and approval requirements for the Reorganization?

A majority of the shares outstanding and entitled to vote on the Record Date, present in person or by proxy, shall constitute a quorum for the purpose of voting on the Proposal.

Approval of the Reorganization requires the affirmative vote (i) of 67% or more of the voting securities present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Target Fund are present or represented by proxy, or (ii) of more than 50% of the outstanding voting securities of the Target Fund, whichever is less (a "1940 Act Majority").

What if there are not enough votes to reach a quorum or to approve the Reorganization by the scheduled Meeting date?

If there are not sufficient votes to approve the Proposal or to achieve a quorum by the time of the Meeting, the Meeting may be postponed or adjourned from time to time to permit further solicitation of proxy votes. To facilitate the receipt of a sufficient number of votes, we may need to take additional action. Georgeson Inc., a proxy solicitation firm, or other persons who are affiliated with UBS AM (Americas) or their affiliates, may contact you by mail or telephone. Therefore, we encourage shareholders to vote as soon as they review the enclosed proxy materials to avoid additional mailings or telephone calls.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

What happens if the Reorganization is not approved by the Target Fund's shareholders?

If the shareholders of the Target Fund do not approve the Reorganization, the Target Fund Board will consider other alternatives including liquidation of the Target Fund. The Target Fund liquidation could be a taxable event for shareholders of the Target Fund.

Comparison of the Target Fund and the Acquiring Fund

Comparison of fee tables

The tables below allow a shareholder to compare the sales charges, management fees and expense ratios of the Target Fund and the Acquiring Fund and to analyze the estimated expenses that the Acquiring Fund expects to bear following the Reorganization. Annual Fund Operating Expenses are paid by each Fund. They include management fees, administrative costs and shareholder servicing fees, including pricing and custody services. For the Acquiring Fund, Annual Fund Operating Expenses (and related Example Expenses) also are presented on a pro forma combined basis.

The Annual Fund Operating Expenses shown in the table below are based on expenses for the twelve-month period ended September 30, 2015 for the Target Fund. The numbers provided in the following expense tables and examples for the Acquiring Fund are estimates because this Fund has not commenced operations as of the date of this Proxy Statement/Prospectus. As such, the rate at which expenses are accrued during the fiscal year may not be constant and, at any particular point, may be greater or less than the stated average percentage.

11

Fort Dearborn Income Securities, Inc. shares

UBS Total Return Bond Fund—Class P shares

| Shareholder Fees (fees paid directly from your investment) | |||||||||||

|

Fort Dearborn Income Securities, Inc. (Target Fund) |

UBS Total Return Bond Fund (Acquiring Fund) and Pro Forma Combined |

||||||||||

|

Shares |

Class P |

||||||||||

|

Maximum Sales Charge (Load) imposed on purchases (as a percentage of offering price) |

None |

None |

|||||||||

|

Maximum Deferred Sales Charge (Load) |

None |

None |

|||||||||

|

Redemption Fee (as a percentage of amount redeemed or exchanged within 90 days of the Reorganization) |

None |

2.00 |

%1 |

||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||

|

Fort Dearborn Income Securities, Inc. (Target Fund) |

UBS Total Return Bond Fund (Acquiring Fund) and Pro Forma Combined |

||||||||||

|

Management Fee2 |

0.47 |

% |

0.50 |

% |

|||||||

|

Distribution and/or Service (12b-1) Fees |

None |

None |

|||||||||

|

Other Expenses3 |

0.28 |

% |

0.31 |

% |

|||||||

|

Total Annual Fund Operating Expenses |

0.75 |

% |

0.81 |

%4 |

|||||||

|

Fee Waiver/Expense Reimbursement |

None |

(0.31 |

)%5 |

||||||||

|

Total Annual Fund Operating Expenses after Fee Waiver/Expense Reimbursement |

0.75 |

% |

0.50 |

%4 |

|||||||

1 Details regarding redemption fees can be found in the "Purchase, redemption and exchange procedures for the Acquiring Fund" section of this Proxy Statement/Prospectus.

2 Details regarding the Target and Acquiring Funds' management fee schedules can be found in the "Comparison of investment advisors and other service providers" section of this Proxy Statement/Prospectus.

3 The costs incurred in connection with the Reorganization will be borne by the Target Fund. These Reorganization expenses have not been reflected in the tables above.

4 To the extent that there may be significant redemptions from the Acquiring Fund as a result of the Reorganization, it may increase the Acquiring Fund's Annual Fund Operating Expenses (before waivers), but Annual Fund Operating Expenses after Fee Waiver/Expense Reimbursement would remain at 0.50%, pursuant to the expense limitation agreement noted below.

5 The UBS Trust, with respect to the Acquiring Fund, and UBS AM (Americas) have entered into a written agreement pursuant to which UBS AM (Americas) has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses) to the extent necessary so that the Acquiring Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses), through the period ending October 27, 2017, do not exceed 0.50% for Class P shares. Pursuant to the written agreement, UBS AM (Americas) is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of UBS AM (Americas) by the Acquiring Fund will not cause the Acquiring Fund to exceed any applicable expense limit that is in place for the Acquiring Fund. The fee waiver/expense reimbursement agreement may be terminated by the Acquiring Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Acquiring Fund's advisory contract with UBS AM (Americas). Upon termination of the fee waiver/expense reimbursement agreement, however, UBS AM (Americas)'s three year recoupment rights will survive.

12

Expense example

The following Examples are intended to help you compare the cost of investing in shares of the Target Fund with the cost of investing in the Acquiring Fund currently and on a pro forma basis, and allow you to compare these costs with the cost of investing in other mutual funds.

The Examples assume that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. It assumes a 5% return each year and no change in expenses. Because the Examples are hypothetical and for comparison only, your actual costs may be higher or lower. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Fort Dearborn Income Securities, Inc. (Target Fund) |

|||||||||||||||||||

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Target Fund shares1 |

$ |

77 |

$ |

240 |

$ |

417 |

$ |

930 |

|||||||||||

|

UBS Total Return Bond Fund (Acquiring Fund) and Pro Forma Combined |

|||||||||||||||||||

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||||||||||

|

Class P shares1 |

$ |

51 |

$ |

228 |

$ |

419 |

$ |

973 |

|||||||||||

1 To the extent that there may be significant redemptions from the Acquiring Fund as a result of the Reorganization, it may increase the Acquiring Fund's Annual Fund Operating Expenses (before waivers), but Annual Fund Operating Expenses after Fee Waiver/Expense Reimbursement would remain at 0.50%, pursuant to the expense limitation agreement noted above.

The projected post-Reorganization pro forma combined Annual Fund Operating Expenses and Expense Example presented above is based on numerous material assumptions, including that the current contractual agreement will remain in place for one year. Although these projections represent good faith estimates, there can be no assurance that any particular level of expenses or expense savings will be achieved because expenses depend on a variety of factors, such as the future level of the Acquiring Fund's assets. Those factors are beyond the control of the Acquiring Fund and UBS AM (Americas) Inc. The information in the previous tables should not be considered a representation of past or future expenses. Actual expenses may be greater or less than those shown and may change.

If the Reorganization is approved, the resulting combined Fund will retain the Acquiring Fund's expense structure.

Comparison of investment objectives, strategies and risks

The following summarizes the investment objectives, strategies and risks of the Target Fund and the Acquiring Fund. Further information about the Acquiring Fund's investment objectives, strategies and risks are contained in the Acquiring Fund Prospectus and Acquiring Fund SAI, which are on file with the SEC. The Acquiring Fund Prospectus also is included with this Proxy Statement/Prospectus and incorporated herein by reference.

Investment Objective

The Target Fund's primary investment objective is to provide its shareholders with: (1) a stable stream of current income consistent with external interest rate conditions, and (2) a total return over time that is above what they could receive by investing individually in the investment grade and long-term maturity sectors of the bond market. The Target Fund's secondary objective is capital appreciation. The Acquiring Fund has a

13

similar investment objective of maximizing total return, consisting of capital appreciation and current income. The investment objectives of both Funds are fundamental, meaning they cannot be changed without shareholder approval.

Investment Strategies

The principal investment strategies of the Acquiring Fund are similar to the principal investment strategies of the Target Fund. The Acquiring Fund, like the Target Fund, will maintain a portfolio of predominately investment grade securities. The Target Fund invests at least 75% of its total assets in non-convertible fixed income securities, which at the time of purchase are considered investment grade by being rated in the four highest grades as determined by Moody's Investors Service, Inc. ("Moody's"), Standard & Poor's Financial Services LLC ("S&P") or Fitch Ratings, Inc. ("Fitch"), or if not rated, are considered by the Advisor to be of comparable investment quality. The Acquiring Fund has a similar policy that, under normal circumstances, the Fund will invest at least 75% of its net assets in securities that, at the time of purchase, are rated investment grade by an independent rating agency (or if unrated are deemed to be of comparable quality by the Advisor). However, the Target Fund's 75% policy is fundamental, meaning it may not be changed without shareholder approval. The Acquiring Fund's 75% policy is non-fundamental, which means it may be changed by its Board of Trustees, without approval by shareholders. The Acquiring Fund also has a policy that under normal circumstances, the Acquiring Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in bonds and/or investments that provide exposure to bond markets. The Acquiring Fund will provide at least 60 days notice to shareholders before changing the 80% policy. Furthermore, both the Acquiring Fund and the Target Fund utilize the same Barclays US Aggregate Bond Index.

Both the Acquiring Fund and Target Fund may invest across a number of fixed income markets. Each Fund's investments in fixed income securities may include, but are not limited to, securities of the US government, its agencies and government-sponsored enterprises, securities guaranteed by the US government, corporate debt securities of US and non-US issuers, including convertible securities, obligations of non-US governments or their subdivisions, agencies and government-sponsored enterprises, obligations of international agencies or supranational entities, mortgage-backed (including commercial and residential mortgage-backed securities), asset-backed securities, and other securitized and structured debt securities. The Acquiring Fund, however, may provide a more balanced allocation across the fixed income markets. For example, the Target Fund currently invests over 70% of its assets in corporate debt securities, while the Acquiring Fund may invest to a lesser extent in corporate debt. Each of the Target Fund and Acquiring Fund also may invest up to 25% of its assets in high yield securities. While the Acquiring Fund, like the Target Fund, is permitted to invest in collateralized loan obligations (CLOs), such investments are expected to be utilized to a lesser extent in the Acquiring Fund than the Target Fund.

Both the Acquiring Fund and Target Fund may invest in foreign obligations (including emerging markets securities) denominated in US dollars and in foreign currencies. While the Target Fund hedges all of its foreign currency exposure back to the US dollar, the Acquiring Fund is permitted to maintain foreign currency exposure up to 25% of its net assets.

With respect to the derivative instruments in which the Target Fund and Acquiring Fund may invest as a principal strategy, each Fund is permitted invest in options, futures, forward agreements, swap agreements (specifically, interest rate, total return, currency and credit default swaps), credit-linked securities and structured investments for risk management purposes or for investment (non-hedging) purposes. All of these derivatives may be used by both Funds for risk management purposes, such as hedging against a specific security or currency, or to manage or adjust the risk profile of the Fund. In addition, all of the derivative instruments

14

listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; to obtain exposure to certain markets; or to establish net short positions for individual sectors, markets, or securities. The Target Fund may use all of the derivatives listed above to adjust the Target Fund's portfolio duration, and the Acquiring Fund may use options, futures, swap agreements, credit-linked securities and structured investments to adjust the Acquiring Fund's duration. In addition, the Acquiring Fund may use derivatives to establish net short positions for currencies.

The Acquiring Fund, unlike the Target Fund, may engage in securities lending for the purpose of generating revenue for the Fund.

Investment Risks—Acquiring Fund and Target Fund

The following principal risks of investments in the Target Fund and the Acquiring Fund are similar, although the precise identification and description of those risks may differ. Below is a description of the risks of investing in the Target and Acquiring Funds. The discussion below presents the risks as disclosed in the Acquiring Fund Prospectus.

Neither the Target Fund nor the Acquiring Fund can guarantee that it will achieve its investment objective. If the value of a Fund's investments goes down, you may lose money.

Interest rate risk—The risk that changing interest rates may adversely affect the value of an investment. An increase in prevailing interest rates typically causes the value of fixed income securities to fall, while a decline in prevailing interest rates may cause the market value of fixed income securities to rise. Changes in interest rates will affect the value of longer-term fixed income securities more than shorter-term securities and higher quality securities more than lower quality securities. Interest rate changes can be sudden and unpredictable, and are influenced by a number of factors including government policy, inflation expectations and supply and demand. A substantial increase in interest rates may have an adverse impact on the liquidity and valuation of a security, especially those with longer maturities. Changes in government monetary policy, including changes in tax policy or changes in a central bank's implementation of specific policy goals, may have a substantial impact on interest rates. There can be no guarantee that any particular government or central bank policy will be continued, discontinued or changed nor that any such policy will have the desired effect on interest rates. The risks associated with rising interest rates may be more pronounced in the near future due to the current period of historically low rates.

Credit and high yield bond risk—The risk that an issuer may default or otherwise be unable to honor a financial obligation. Bonds with ratings of BB (S&P or Fitch) or Ba (Moody's) or below may have increased risks of default (also known as lower-rated or "junk bonds"). These securities are considered to be predominately speculative with respect to an issuer's capacity to pay interest and repay principal in accordance with the terms of the obligations. Lower-rated bonds are more likely to be subject to an issuer's default or downgrade than investment grade (higher-rated) bonds.

US Government securities risk—Credit risk is the risk that the issuer will not make principal or interest payments when they are due. There are different types of US government securities with different relative levels of credit risk depending on the nature of the particular government support for that security. US government securities may be supported by (i) the full faith and credit of the United States; (ii) the ability of the issuer to borrow from the US Treasury; (iii) the credit of the issuing agency, instrumentality or government-sponsored entity; (iv) pools of assets (e.g., mortgage-backed securities); or (v) the United States in some other way. In some cases, there is even the risk of default. For example, for asset backed securities there is the risk those assets will decrease in value below the face value of the security. Similarly, for certain

15

agency-issued securities there is no guarantee the US government will support the agency if it is unable to meet its obligations. Further, the US government and its agencies and instrumentalities do not guarantee the market value of their securities; consequently, the value of such securities will fluctuate.

Illiquidity risk—The risk that a Fund may have difficulty or may not be able to sell its investments. Illiquidity may result from political, economic or issuer specific events; changes in a specific market's size or structure, including the number of participants; or overall market disruptions. When there is no willing buyer and investments cannot be readily sold at the desired time or price, a Fund may have to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund's value or prevent the Fund from being able to take advantage of other investment opportunities. Liquid portfolio investments may become illiquid or less liquid after purchase by the Fund due to low trading volume, adverse investor perceptions and/or other market developments. Illiquidity risk includes the risk that the Fund will experience significant net redemptions at a time when it cannot find willing buyers for its portfolio securities or can only sell its portfolio securities at a material loss. Illiquidity risk can be more pronounced in periods of market turmoil.

Mortgage- and asset-backed securities risk—The Fund may invest in mortgage- and asset-backed securities that are subject to prepayment or call risk, which is the risk that the borrower's payments may be received earlier or later than expected due to changes in prepayment rates on underlying loans. Faster prepayments often happen when interest rates are falling. As a result, the Fund may reinvest these early payments at lower interest rates, thereby reducing the Fund's income. Conversely, when interest rates rise, prepayments may happen more slowly, causing the security to lengthen in duration. Longer duration securities tend to be more volatile. Securities may be prepaid at a price less than the original purchase value. An unexpectedly high rate of defaults on mortgages held by a mortgage pool may adversely affect the value of mortgage-backed securities and could result in losses to the Fund.

Market risk—The risk that the market value of a Fund's investments will fluctuate as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole.

Foreign investing risk—The risk that prices of a Fund's investments in foreign securities may go down because of unfavorable foreign government actions, political instability or the absence of accurate information about foreign issuers. In addition, political, diplomatic, or regional conflicts, terrorism or war, social and economic instability, and internal or external policies or economic sanctions limiting or restricting foreign investment, the movement of assets or other economic activity may affect the value and liquidity of foreign securities. Also, a decline in the value of foreign currencies relative to the US dollar will reduce the value of securities denominated in those currencies. Also, foreign securities are sometimes less liquid and harder to sell and to value than securities of US issuers. Each of these risks is more severe for securities of issuers in emerging market countries.

Emerging market risk—The risk that investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers. Further, emerging countries may have economies based on only a few industries and securities markets that trade only a small number of securities and employ settlement procedures different from those used in the United States. Prices on these exchanges tend to be volatile and, in the past, securities in these countries have offered greater potential for gain (as well as loss) than securities of companies located in developed countries. Further, investments by foreign investors are subject to a variety of restrictions in many emerging countries. Countries such as those in which the Fund may invest may experience high rates of inflation, high interest rates, exchange rate fluctuations or currency depreciation,

16

large amounts of external debt, balance of payments and trade difficulties and extreme poverty and unemployment.

Derivatives risk—Derivatives involve risks different from, and possibly greater than, the risks associated with investing directly in securities and other instruments. Derivatives require investment techniques and risk analyses different from those of other investments. If the Advisor incorrectly forecasts the value of securities, currencies, interest rates, or other economic factors in using derivatives, a Fund might have been in a better position if the Fund had not entered into the derivatives. While some strategies involving derivatives can protect against the risk of loss, the use of derivatives can also reduce the opportunity for gain or even result in losses by offsetting favorable price movements in other Fund investments. Derivatives also involve the risk of mispricing or improper valuation, the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate, index, or overall securities markets, and counterparty and credit risk (the risk that the other party to a swap agreement or other derivative will not fulfill its contractual obligations, whether because of bankruptcy or other default). With respect to futures and certain swaps, there is a risk of loss by a Fund of the initial and variation margin deposits in the event of bankruptcy of a futures commission merchant ("FCM") with which the Fund has an open position in a futures or swaps contract. The assets of the Fund may not be fully protected in the event of the bankruptcy of the FCM or central counterparty. The Fund is also subject to the risk that the FCM could use the Fund's assets to satisfy its own financial obligations or the payment obligations of another customer to the central counterparty. Gains or losses involving some options, futures, and other derivatives may be substantial (for example, for some derivatives, it is possible for the Fund to lose more than the amount the Fund invested in the derivatives). Some derivatives tend to be more volatile than other investments, resulting in larger gains or losses in response to market changes.

Derivatives are subject to a number of other risks, including liquidity risk (the possible lack of a secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close out the derivatives) and interest rate risk (some derivatives are more sensitive to interest rate changes and market price fluctuations). A Fund's use of derivatives may cause the Fund to realize higher amounts of short-term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Finally, the regulation of swaps and other derivatives is a rapidly changing area of law and it is not possible to predict fully the effects of current or future regulation. It is possible that developments in government regulation of various types of derivatives could affect the character, timing and amount of the Fund's taxable income or gains; may limit or prevent the Fund from using or limit the Fund's use of these instruments effectively as a part of its investment strategy; and could adversely affect the Fund's ability to achieve its investment objective. A Fund's use of derivatives may be limited by the requirements for taxation of the Fund as a regulated investment company. New requirements, even if not directly applicable to the Fund, may increase the cost of the Fund's investments and cost of doing business.

Leverage risk associated with financial instruments—Certain derivatives that a Fund may use may create leverage. Derivatives that involve leverage can result in losses to the Fund that exceed the amount originally invested in the derivatives.

Management risk—The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results. The Advisor may be incorrect in its assessment of the value of securities or assessment of market or interest rate trends, which can result in losses to a Fund.

Portfolio turnover risk—High portfolio turnover from frequent trading will increase a Fund's transaction costs and may increase the portion of the Fund's capital gains that are realized for tax purposes in any given year. This, in turn, may increase the Fund's taxable distributions in that year. Frequent trading also may

17

increase the portion of the Fund's realized capital gains that is considered "short-term" for tax purposes. Shareholders will pay higher taxes on distributions that represent short-term capital gains than they would pay on distributions that represent long-term capital gains. The Fund does not restrict the frequency of trading in order to limit expenses or the tax effect that its distributions may have on shareholders.

Investment Risk—Acquiring Fund only

The Acquiring Fund, but not the Target Fund, may engage in securities lending and, therefore, is subject to securities lending risk as described below.

Securities lending risk—Securities lending involves the lending of portfolio securities owned by the Fund to qualified broker-dealers and financial institutions who provide collateral to the Fund in connection with these loans. Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, the Fund may lose money and there may be a delay in recovering the loaned securities. The Fund also could lose money if it does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral.

Investment Risks—Target Fund only

The Target Fund, but not the Acquiring Fund, is subject to the principal risks of collateralized loan obligations (CLOs) risk and the risk of differences of market price and net asset value of shares as described below. Collateralized loan obligations (CLO) risk is a principal risk of the Target Fund because CLOs are considered a principal investment for the Target Fund. Although the Acquiring Fund is permitted to invest in CLOs it is not expected to be a principal investment of the Fund. The Target Fund also is subject to risk regarding difference between the Fund's market price and net asset value of shares. The Acquiring Fund, as an open-end fund, is not subject to this risk. Descriptions of these risks are found below.

Collateralized Loan Obligations (CLOs) risk—A CLO is a trust typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. CLOs may charge management fees and administrative expenses. In addition to the normal risks associated with debt securities (e.g. interest rate risk, credit risk and default risk), CLOs carry additional risks including, but not limited to: (i) the possibility that distributions will not be adequate to make interest or other payments; (ii) the collateral may decline in value or quality or go into default; (iii) the Fund may invest in tranches of a CLO that are subordinate to other classes; and (iv) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer, difficulty in valuing the security or unexpected investment results.

Market price and net asset value of shares—Shares of closed-end management investment companies frequently trade at a discount from their net asset values. Whether an investor will realize gains or losses upon the sale of shares does not depend directly upon the changes in the Fund's net asset value but rather upon whether the market price of the shares at the time of sales is above or below the investor's purchase price for the shares. This market price risk is separate and distinct from the risk that the Fund's net asset value may decrease. Accordingly, the shares are designed primarily for long-term investors. Investors in shares should not view the Fund as a vehicle for trading purposes. The market price of the Fund's shares will fluctuate with interest rate changes, as well as with price changes of the Fund's portfolio securities and market supply/demand dynamics (for example, if enough investors decide to sell their shares of the Fund because they have decided to rotate their investments into a different sector or to get out of the market

18

overall, it could depress the price of the Fund's shares regardless of whether the value of its underlying portfolio is increasing or not).

Comparison of fundamental investment restrictions

As required by the 1940 Act each Fund has adopted certain fundamental investment restrictions including policies regarding borrowing money, issuing senior securities, engaging in the business of underwriting, concentrating investments in a particular industry or group of industries, purchasing and selling real estate, making loans, diversifying investments and investing in commodities. In addition, the Target Fund is subject to a few other fundamental investment restrictions. Fundamental investment restrictions may not be changed without the affirmative vote of the lesser of (i) 67% or more of the shares of a Fund present at a shareholders meeting if holders of more than 50% of the outstanding shares of the Fund are present in person or by proxy or (ii) more than 50% of the outstanding shares of a Fund. The chart below describes the fundamental restrictions of the Target Fund and the Acquiring Fund and provides a comparison of the Funds' restrictions.

|

Subject |

Target Fund Fundamental Restrictions |

Acquiring Fund Fundamental Restrictions |

Comparison of Restrictions |

||||||||||||

|

Concentrating |

The Target Fund may not invest in the securities of issuers conducting their principal business activities in the same industry, if immediately after such investment the value of its investments in such industry would exceed 25% of the Target Fund's total assets. (As to utility companies, the gas, electric, water and telephone businesses will be considered separate industries.) |