UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-06637 | |||||||

|

| ||||||||

|

The UBS Funds | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

One North Wacker Drive, Chicago, IL |

|

60606-2807 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Tammie Lee, Esq. UBS Global Asset Management (Americas) Inc. 1285 Avenue of the Americas New York, NY 10019 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Copy to: Bruce Leto, Esq. Stradley Ronon Stevens & Young, LLP 2600 One Commerce Square Philadelphia, PA 19103-7098 | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

212-821-3000 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

June 30 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

June 30, 2015 |

| ||||||

Item 1. Reports to Stockholders.

UBS Asset

Allocation Funds

June 30, 2015

The UBS Funds—Asset Allocation

Annual Report

|

Table of contents |

|||||||

|

President's letter |

1 |

||||||

|

Market commentary |

3 |

||||||

|

Asset Allocation Funds |

|||||||

|

UBS Asset Growth Fund |

5 |

||||||

|

UBS Dynamic Alpha Fund |

12 | ||||||

|

UBS Global Allocation Fund |

33 | ||||||

|

UBS Multi-Asset Income Fund |

48 | ||||||

|

Explanation of expense disclosure |

62 | ||||||

|

Statement of assets and liabilities |

66 | ||||||

|

Statement of operations |

70 | ||||||

|

Statement of changes in net assets |

72 | ||||||

|

Financial highlights |

74 | ||||||

|

Notes to financial statements |

82 | ||||||

|

Report of independent registered public accounting firm |

106 | ||||||

|

General information |

107 | ||||||

|

Board approval of investment advisory agreements |

108 | ||||||

|

Trustee and Officer information |

112 | ||||||

|

Federal tax information |

119 | ||||||

This page intentionally left blank.

President's letter

August 14, 2015

Dear Shareholder,

In my last letter, I wrote about the building forward momentum of the US economy against a backdrop of economic weakness outside the United States. Since I last wrote to you, the rise of two economic themes has begun to cast a shadow on the global growth story. The first of these, the continuing Greek debt crisis, appears to be on the road to resolution after an agreement was reached in July between the Greek government and its creditors. Although the risk of Greece's exit from the eurozone is somewhat reduced, substantial political and economic challenges remain. While the news of an agreement has brought relief to global markets, it is disconcerting to consider that the future of the European project has not been in such peril since the introduction of the euro in 1999.

Turning to a development that is decidedly less settled, Chinese equity markets have seen some spectacular declines in recent months, raising questions about the durability of the world's second-largest economy. The Shanghai composite index hit a high of 5,166 on June 12, before falling 30% in just three weeks. Taken together, over $3 trillion of value has been wiped away from the Shanghai and Shenzhen exchanges in a matter of weeks. China's economy grew at its slowest pace since 1990 last year, and early indicators suggest that the economy has weakened further so far into 2015. While investor confidence in China has been understandably shaken, it remains to be seen what effect these headwinds may have outside of the country.

In this global investment landscape of debt crises and shaken confidence, partnering with a knowledgeable asset manager, such as UBS Global Asset Management, can help investors avoid potential pitfalls on the path to reaching their long-term financial goals. As we continue to review the UBS family of funds with an eye toward an ever-changing investment landscape, we remain committed to providing a diverse range of solutions that can be used to create a comprehensive investment plan. Core funds—such as UBS US Large Cap Equity Fund—are the foundation on which many investors build their portfolios. Driven by fundamental research and long-term perspective, these funds used disciplined approaches that time and experience have shown can lead to successful outcomes, despite shorter-term market fluctuations and shocks.

Furthermore, we believe that flexible investment solutions can strengthen an investment plan against market shocks and declines. In this spirit, UBS Global Asset Management provides flexibly managed funds to help create well-balanced, globally diversified portfolios. In our view, flexible funds that may be less correlated to market trends and have multiple sources of revenue are an important component of a comprehensive investment plan. Many of the funds in the UBS family—such as UBS Dynamic Alpha Fund—are designed to achieve consistent returns with less reliance on favorable market conditions. When included in a comprehensive investment plan, these funds act as ballast during volatile market conditions and may have the effect of smoothing a portfolio's performance over time. As we have seen in the first half of 2015, market shocks can take any number of forms and can originate in any corner of the world. In today's market environment, we believe it is crucial that investors diversify their holdings within the context of a carefully considered plan. When combined in the context of such a plan, UBS Global Asset Management's foundational and flexible funds can assist investors in obtaining peace of mind while looking toward the future.

1

President's letter

In my correspondence over the years, I have written at considerable length about the importance of having a sound investment plan. Creating an investment plan with a knowledgeable financial advisor is an opportunity to envision the future that you would like to have, while being cognizant of the potential challenges that lie ahead. At UBS Global Asset Management, we believe that in managing our funds we create more than investment returns: we help our clients achieve their goals. As we continue to evolve our funds to provide stable returns in a variety of market conditions, we rely on our firm's client-oriented culture to guide everything we do. With over 30 years of experience in active investment management, UBS Global Asset Management is ready to serve you with our family of funds and knowledgeable professionals as we look toward the future, a future we create together.

Sincerely,

Mark E. Carver

President

The UBS Funds

Managing Director

UBS Global Asset Management (Americas) Inc.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. A prospectus or summary prospectus for the funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

2

The markets in review

Global growth generally improves

Growth in the US fluctuated during the reporting period. The US Commerce Department reported that gross domestic product ("GDP") expanded at a 4.3% seasonally adjusted annualized rate during the third quarter of 2014. GDP growth then moderated to 2.1% during the fourth quarter and 0.6% for the first quarter of 2015, partially due to severe winter weather in parts of the country. However, the economy then improved, as the Commerce Department's initial estimate for second quarter GDP was 2.3%.1

The US Federal Reserve Board largely maintained its accommodative monetary policy during the reporting period. The central bank continued to hold the fed funds rate at a historically low range between 0% and 0.25%. (The federal funds rate or the "fed funds rate," is the rate banks charge one another for funds they borrow on an overnight basis.) However, at the Fed's meeting in October 2014, it said that it had concluded its asset purchase program, also known as quantitative easing. At its March 2015 meeting, the Fed said that it "... anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2% objective over the medium term." Finally, at the central bank's meeting that concluded in June 2015, the Fed said that it "...currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

In terms of the global economy, the International Monetary Fund's ("IMF") July 2015 World Economic Outlook Update, released after the reporting period ended, said "A setback to activity in the first quarter of 2015, mostly in North America, has resulted in a small downward revision to global growth for 2015 relative to the April 2015 World Economic Outlook. Nevertheless, the underlying drivers for a gradual acceleration in economic activity in advanced economies—easy financial conditions, more neutral fiscal policy in the euro area, lower fuel prices, and improving confidence and labor market conditions—remain intact." The IMF projects that 2015 growth in the eurozone will be 1.5%, versus 0.8% in 2014. Japan's economy is expected to expand 0.8% in 2015, an improvement from the 0.1% contraction in 2014. In contrast, the IMF sees growth in emerging market countries decelerating in 2015, with GDP of 4.2% compared to 4.6% in 2014.

US equities post superior results

While it experienced several setbacks, the US equity market generated solid results during the reporting period. Investor sentiment was challenged at times given some mixed global economic data and corporate profit figures, as well as numerous geopolitical issues. All told, the US stock market, as measured by the S&P 500 Index,2 gained 7.42% for the 12 months ended June 30, 2015. In contrast, international equities produced weak results, as they were dragged down by growth concerns, fluctuating oil prices and, most recently, the escalating crisis in Greece. International developed equities, as measured by the MSCI EAFE Index (net),3 fell 4.22% during the period. Emerging market equities, as measured by the MSCI Emerging Markets Index (net),4 declined 5.12% over the same period.

1 Based on the Commerce Department's initial estimate announced on July 30, 2015, after the reporting period had ended.

2 The S&P 500 Index is an unmanaged, weighted index composed of 500 widely held common stocks varying in composition and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees and expenses.

3 The MSCI EAFE Index (net) is an index of stocks designed to measure the investment returns of developed economies outside of North America. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

4 The MSCI Emerging Markets Index (net) is a market capitalization-weighted index composed of different emerging market countries in Europe, Latin America, and the Pacific Basin. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

3

The markets in review

Mixed returns in the fixed income market

The global fixed income markets experienced periods of volatility during the reporting period. This was triggered by incoming economic data, uncertainties surrounding future monetary policy and—as was the case for the equity market—unfolding geopolitical events. Against this backdrop, the yield on the 10-year Treasury fell from 2.53% to 2.35% during the reporting period and the overall US bond market, as measured by the Barclays US Aggregate Index,5 gained 1.86%. A sharp sell-off late in the reporting period pushed the returns of riskier fixed income securities into negative territory for the 12 months ended June 30, 2015. High yield bonds, as measured by the BofA Merrill Lynch US High Yield Cash Pay Constrained Index6 declined 0.52% during the reporting period. Emerging markets debt, as measured by the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global),7 fell 1.57%.

5 The Barclays US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. Investors should note that indices do not reflect the deduction of fees and expenses.

6 The BofA Merrill Lynch US High Yield Cash Pay Constrained Index is an unmanaged index of publicly placed, non-convertible, coupon-bearing US dollar denominated, below investment grade corporate debt with a term to maturity of at least one year. The index is market capitalization weighted, so that larger bond issuers have a greater effect on the index's return. However, the representation of any single bond issuer is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees and expenses.

7 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which is designed to track total returns for US dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees and expenses.

4

UBS Asset Growth Fund

Portfolio performance

For the 12 months ended June 30, 2015, Class A shares of UBS Asset Growth Fund declined 1.18% (Class A shares fell 6.58% after the deduction of the maximum sales charge), while Class P shares declined 0.96%. The Fund's benchmark, the MSCI World Free Index (net) (the "Index") gained 1.43%. (Class P shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 7; please note that these returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund produced a negative return during the reporting period and underperformed the benchmark.

During the reporting period, we used derivatives for risk management purposes and as a tool to help enhance returns across various strategies. With respect to our active currency strategy, the utilization of currency futures had a direct negative impact on Fund performance. Various equity and fixed income futures and exchange traded funds (ETFs) were used to implement our market allocation strategy. Derivatives were just one tool, among others, that we used to implement our market allocation strategy. In aggregate, these derivatives added to performance relative to the benchmark during the reporting period.

Portfolio performance summary1

What worked:

• The Fund's long directional position in certain equity markets generated positive absolute returns.

– The Fund's position in Japanese equities was the biggest contributor to performance. Japan continued to be a top performing equity market, as monetary stimulus by the Bank of Japan has had a positive effect on equity markets.

– The Fund also maintained an overweight position in European equities, which had a strong run of performance following the European Central Bank's decision to enact quantitative easing in January 2015.

What didn't work:

• The Fund's position in fixed income securities was negative for results.

– The Fund held positions in US credit, both investment grade and high yield, which negatively impacted performance. Credit spreads widened during the reporting period, creating negative price action on corporate credit.

• Certain equity positions were negative for performance.

– The Fund was hurt by a long position in emerging market equities which underperformed during the period. Volatility was high, as the Chinese stock market had a significant rally and subsequent fall.

1 For a detailed commentary on the market environment in general during the reporting period, see page 3.

5

UBS Asset Growth Fund

• Leverage detracted from the Fund's performance.

– The Fund maintains a volatility target of 15% or less annually. During the reporting period, both market volatility and Fund-realized volatility remained mostly subdued and, therefore, the Fund maintained leverage throughout the period. However, during October and December 2014, the volatility of the baseline portfolio rose to the point where the amount of leverage being applied to reach the Fund's target volatility of 15% was reduced. The Fund's leverage ranged from the maximum 175% down to 125%. Since the Fund maintained leverage throughout a period where some of its market allocations were negative, leverage detracted from performance.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2015. The views and opinions in the letter were current as of August 14, 2015. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

6

UBS Asset Growth Fund

Average annual total returns for periods ended 06/30/15 (unaudited)

|

1 year |

5 years |

Inception1 |

|||||||||||||

|

Before deducting maximum sales charge |

|||||||||||||||

|

Class A2 |

(1.18 |

)% |

10.16 |

% |

1.34 |

% |

|||||||||

|

Class C3 |

(1.94 |

) |

9.33 |

0.58 |

|||||||||||

|

Class P4 |

(0.96 |

) |

10.42 |

1.59 |

|||||||||||

|

After deducting maximum sales charge |

|||||||||||||||

|

Class A2 |

(6.58 |

)% |

8.91 |

% |

0.62 |

% |

|||||||||

|

Class C3 |

(2.92 |

) |

9.33 |

0.58 |

|||||||||||

|

MSCI World Free Index (net)5 |

1.43 |

% |

13.10 |

% |

3.39 |

% |

|||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2014 prospectuses were as follows: Class A—2.36% and 1.57%; Class C—3.13% and 2.32%; Class P—2.11% and 1.32%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short), through the period ending October 27, 2015, do not exceed 1.40% for Class A shares, 2.15% for Class C shares and 1.15% for Class P shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, UBS Global AM (Americas)'s three year recoupment rights will survive.

1 Inception date of all share classes of UBS Asset Growth Fund and the index is July 26, 2007.

2 Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees.

3 Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 distribution and service fees.

4 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but Class P shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance.

5 The MSCI World Free Index (net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

Prior to February 17, 2015, if an investor sold or exchanged shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged was deducted at the time of the transaction, except as noted otherwise in the prospectus. For sales or exchanges taking place on or after February 17, 2015 but prior to August 3, 2015, there is a reduction in the redemption holding period from 90 days to 30 days. Effective August 3, 2015, the 1.00% redemption fee imposed on sales or exchanges of any class of shares of the funds made during the holding periods specified in the prospectus will be eliminated. Please refer to the prospectus for further information.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

7

UBS Asset Growth Fund

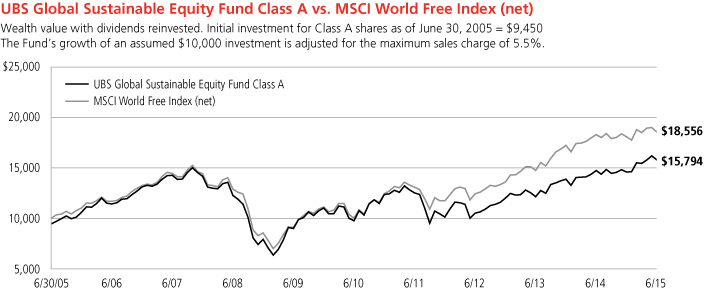

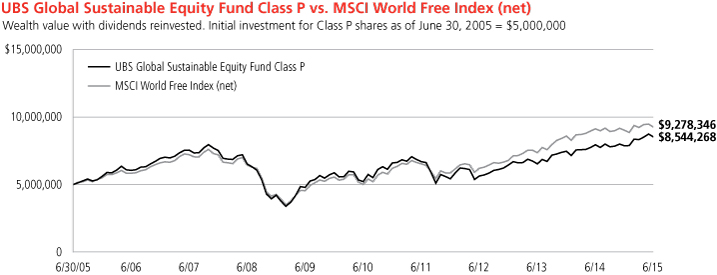

Illustration of an assumed investment of $10,000 in Class A shares (adjusted for 5.5% maximum sales charge) and $5,000,000 in Class P shares (unaudited)

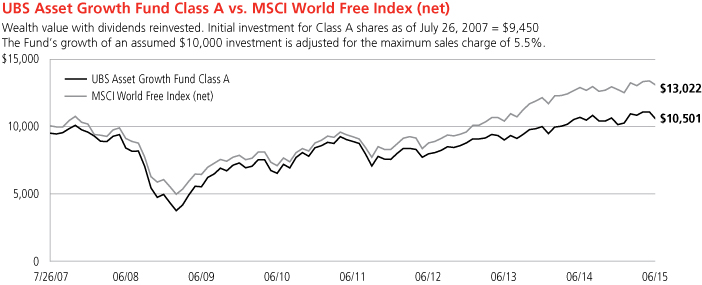

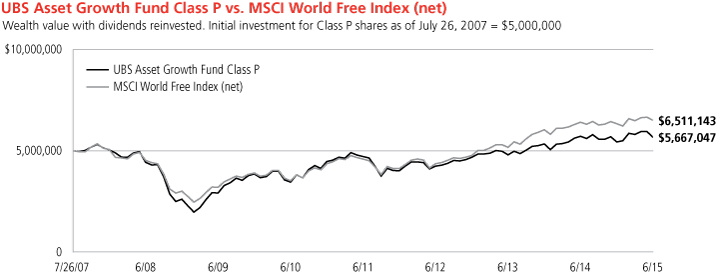

The following two graphs depict the performance of UBS Asset Growth Fund Class A and Class P shares versus the MSCI World Free Index (net) from July 26, 2007, which is the inception date of the two classes, through June 30, 2015. The performance of Class C shares will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

8

UBS Asset Growth Fund

Industry diversification (unaudited)1

As a percentage of net assets as of June 30, 2015

|

Investment companies |

|||||||

|

iShares Emerging Markets Local Currency Bond ETF |

1.70 |

% |

|||||

|

iShares iBoxx $ High Yield Corporate Bond ETF |

14.52 |

||||||

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

12.98 |

||||||

|

iShares JP Morgan USD Emerging Markets Bond ETF |

1.74 |

||||||

|

iShares MSCI Switzerland Capped ETF |

4.28 |

||||||

|

iShares TIPS Bond ETF |

11.54 |

||||||

|

SPDR Barclays Convertible Securities ETF |

3.52 |

||||||

|

Total investment companies |

50.28 |

% |

|||||

|

Short-term investment |

34.82 |

||||||

|

Investment of cash collateral from securities loaned |

18.82 |

||||||

|

Total investments |

103.92 |

% |

|||||

|

Liabilities, in excess of cash and other assets |

(3.92 |

) |

|||||

|

Net assets |

100.00 |

% |

|||||

1 Figures represent the direct investments of UBS Asset Growth Fund. Figures may be different if a breakdown of the underlying investment companies was included.

9

UBS Asset Growth Fund

Portfolio of investments

June 30, 2015

|

Shares |

Value |

||||||||||

|

Investment companies: 50.28% |

|||||||||||

|

iShares Emerging Markets Local Currency Bond ETF |

9,937 |

$ |

434,247 |

||||||||

|

iShares iBoxx $ High Yield Corporate Bond ETF1 |

41,854 |

3,716,635 |

|||||||||

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

28,714 |

3,322,784 |

|||||||||

|

iShares JP Morgan USD Emerging Markets Bond ETF1 |

4,046 |

444,736 |

|||||||||

|

iShares MSCI Switzerland Capped ETF |

33,455 |

1,095,651 |

|||||||||

|

iShares TIPS Bond ETF |

26,361 |

2,953,750 |

|||||||||

|

SPDR Barclays Convertible Securities ETF |

18,920 |

900,025 |

|||||||||

|

Total investment companies (cost $13,132,577) |

12,867,828 |

||||||||||

|

Short-term investment: 34.82% |

|||||||||||

|

Investment company: 34.82% |

|||||||||||

|

UBS Cash Management Prime Relationship Fund2 (cost $8,911,211) |

8,911,211 |

8,911,211 |

|||||||||

|

Shares |

Value |

||||||||||

|

Investment of cash collateral from securities loaned: 18.82% |

|||||||||||

|

UBS Private Money Market Fund LLC2 (cost $4,817,108) |

4,817,108 |

$ |

4,817,108 |

||||||||

|

Total investments: 103.92% (cost $26,860,896) |

26,596,147 |

||||||||||

|

Liabilities, in excess of cash and other assets: (3.92)% |

(1,002,548 |

) |

|||||||||

|

Net assets: 100.00% |

$ |

25,593,599 |

|||||||||

Notes to portfolio of investments

Aggregate cost for federal income tax purposes was $27,021,203; and net unrealized depreciation consisted of:

|

Gross unrealized appreciation |

$ |

6,973 |

|||||

|

Gross unrealized depreciation |

(432,029 |

) |

|||||

|

Net unrealized depreciation of investments |

$ |

(425,056 |

) |

||||

For a listing of defined portfolio acronyms, counterparty abbreviations and currency abbreviations that are used throughout the Portfolio of investments as well as the tables that follow, please refer to page 61. Portfolio footnotes begin on page 11.

Futures contracts

|

Expiration date |

Cost/ (proceeds) |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||

|

Index futures buy contracts: |

|||||||||||||||||||

|

E-mini S&P 500 Index, 58 contracts (USD) |

September 2015 |

$ |

6,019,370 |

$ |

5,957,760 |

$ |

(61,610 |

) |

|||||||||||

|

EURO STOXX 50 Index, 134 contracts (EUR) |

September 2015 |

5,163,374 |

5,133,037 |

(30,337 |

) |

||||||||||||||

|

FTSE 100 Index, 39 contracts (GBP) |

September 2015 |

4,091,420 |

3,979,442 |

(111,978 |

) |

||||||||||||||

|

Mini MSCI Emerging Markets Index, 94 contracts (USD) |

September 2015 |

4,496,302 |

4,509,180 |

12,878 |

|||||||||||||||

|

SPI 200 Index, 20 contracts (AUD) |

September 2015 |

2,124,614 |

2,082,028 |

(42,586 |

) |

||||||||||||||

|

TOPIX Index, 27 contracts (JPY) |

September 2015 |

3,642,568 |

3,597,132 |

(45,436 |

) |

||||||||||||||

|

Currency futures buy contracts: |

|||||||||||||||||||

|

Australian Dollar, 7 contracts (USD) |

September 2015 |

539,852 |

537,950 |

(1,902 |

) |

||||||||||||||

|

Euro, 9 contracts (USD) |

September 2015 |

1,268,791 |

1,255,050 |

(13,741 |

) |

||||||||||||||

|

Great Britain Pound, 16 contracts (USD) |

September 2015 |

1,550,828 |

1,572,500 |

21,672 |

|||||||||||||||

|

Japanese Yen, 5 contracts (USD) |

September 2015 |

507,071 |

511,406 |

4,335 |

|||||||||||||||

|

Currency futures sell contracts: |

|||||||||||||||||||

|

Swiss Franc, 6 contracts (USD) |

September 2015 |

(805,639 |

) |

(804,150 |

) |

1,489 |

|||||||||||||

|

Net unrealized depreciation on futures contracts |

$ |

(267,216 |

) |

||||||||||||||||

10

UBS Asset Growth Fund

Portfolio of investments

June 30, 2015

The following is a summary of the fair valuations according to the inputs used as of June 30, 2015 in valuing the Fund's investments:

|

Description |

Unadjusted quoted prices in active markets for identical investments (Level 1) |

Other significant observable inputs (Level 2) |

Unobservable inputs (Level 3) |

Total |

|||||||||||||||

|

Assets |

|||||||||||||||||||

|

Investment companies |

$ |

12,867,828 |

$ |

— |

$ |

— |

$ |

12,867,828 |

|||||||||||

|

Short-term investment |

— |

8,911,211 |

— |

8,911,211 |

|||||||||||||||

|

Investment of cash collateral from securities loaned |

— |

4,817,108 |

— |

4,817,108 |

|||||||||||||||

|

Futures contracts |

40,374 |

— |

— |

40,374 |

|||||||||||||||

|

Total |

$ |

12,908,202 |

$ |

13,728,319 |

$ |

— |

$ |

26,636,521 |

|||||||||||

|

Liabilities |

|||||||||||||||||||

|

Futures contracts |

$ |

(307,590 |

) |

$ |

— |

$ |

— |

$ |

(307,590 |

) |

|||||||||

At June 30, 2015, there were no transfers between Level 1 and Level 2.

Portfolio footnotes

1 Security, or portion thereof, was on loan at June 30, 2015.

2 The table below details the Fund's investments in funds advised by the same Advisor as the Fund. The Advisor does not earn a management fee from the affiliated UBS Relationship Fund.

|

Security description |

Value 06/30/14 |

Purchases during the year ended 06/30/15 |

Sales during the year ended 06/30/15 |

Value 06/30/15 |

Net income earned from affiliate for the year ended 06/30/15 |

||||||||||||||||||

|

UBS Cash Management Prime Relationship Fund |

$ |

7,680,934 |

$ |

47,399,640 |

$ |

46,169,363 |

$ |

8,911,211 |

$ |

8,112 |

|||||||||||||

|

UBS Private Money Market Fund LLCa |

7,801,795 |

65,294,817 |

68,279,504 |

4,817,108 |

319 |

||||||||||||||||||

|

$ |

15,482,729 |

$ |

112,694,457 |

$ |

114,448,867 |

$ |

13,728,319 |

$ |

8,431 |

||||||||||||||

a The Advisor earns a management fee from this affiliated fund. Please see the Notes to financial statements for further information.

See accompanying notes to financial statements.

11

UBS Dynamic Alpha Fund

Portfolio performance

For the 12 months ended June 30, 2015, Class A shares of UBS Dynamic Alpha Fund (the "Fund") gained 2.03% (Class A shares declined 3.56% after the deduction of the maximum sales charge), while Class P shares rose 2.29%. For purposes of comparison, the BofA Merrill Lynch US Treasury 1-5 Year Index returned 1.38% during the same time period, the MSCI World Free Index (net) gained 1.43%, and the Citigroup One-Month US Treasury Bill Index returned 0.02%. (Class P shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 14; please note that these returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund produced a positive absolute return during the reporting period. Performance was due to asset allocation and currency decisions.

During the reporting period, we used derivatives for risk management purposes and as a tool to help enhance returns across various strategies. With respect to our active currency strategy, utilizing currency forwards had a direct positive impact on Fund performance. We used a variety of equity and fixed income options, futures and swaps to implement our market allocation strategy. Derivatives were just one tool, among others, that we used to implement our market allocation strategy. These derivatives, in aggregate, contributed to performance during the reporting period.

Portfolio performance summary1

What worked:

• Overall, the Fund's positions in equities were the biggest drivers of returns during the reporting period.

– Net long positions in developed-market equities were additive for results. Strong performance was achieved from the Fund's long position in Japanese equities, which rallied on the back of monetary stimulus. A long position in European equities was also beneficial. They generated strong performance following the European Central Bank's decision to enact quantitative easing.

– The Fund's positioning within Chinese equities was beneficial to performance. The Fund took advantage of mispricing in the China A-share market and China H-share market through the use of futures.

• Certain fixed income positions added value over the reporting period.

– The Fund held a long position in Australian government bonds, which added significant value, as the Reserve Bank of Australia cut interest rates in early 2015.

– The Fund's relative value trade of long German government bonds versus French government bonds added value, as the spread between these two sovereigns widened.

• Overall, the Fund's active currency strategy added to performance.

– The Fund's short position in commodity currencies such as the New Zealand dollar and Australian dollar relative to the US dollar were the biggest contributors to currency results, as commodity prices declined during the reporting period.

– The Fund's trade of long Mexican peso versus Canadian dollar added to performance.

1 For a detailed commentary on the market environment in general during the reporting period, see page 3.

12

UBS Dynamic Alpha Fund

What didn't work:

• Certain equity positions were negative during the reporting period.

– The Fund's pair trade of long US industrials versus US consumer staples was a headwind for results. Historically, consumer staples have underperformed industrials during the growth phase of the business cycle, but this did not occur as expected during the reporting period.

– The Fund's positioning in emerging market equities was negative for performance. While there appears to be a general weakness in the broad emerging market, strong returns in December, January and February did not favor our short emerging market position.

• Overall, the Fund's fixed income positioning was slightly negative for results.

– The Fund's position in emerging market debt was the biggest detractor from performance, as concerns grew over the falling price of oil.

– The Fund was hurt by its positioning in US government bonds, particularly since the Fund was positioned for a flattening of the US yield curve, which did not occur.

• Several currency trades performed poorly.

– The Fund's trade of long Japanese yen versus the US dollar and euro detracted from performance over the reporting period, as the yen significantly depreciated due to the Bank of Japan's actions during the reporting period.

– The position of long Mexican peso versus Malaysian ringgit was negative for performance, as the peso depreciated, primarily due to falling oil prices.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2015. The views and opinions in the letter were current as of August 14, 2015. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

13

UBS Dynamic Alpha Fund

Average annual total returns for periods ended 06/30/15 (unaudited)

|

1 year |

5 years |

10 years |

|||||||||||||

|

Before deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

2.03 |

% |

5.40 |

% |

3.16 |

% |

|||||||||

|

Class C2 |

1.21 |

4.63 |

2.37 |

||||||||||||

|

Class P3 |

2.29 |

5.67 |

3.45 |

||||||||||||

|

After deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

(3.56 |

)% |

4.20 |

% |

2.58 |

% |

|||||||||

|

Class C2 |

0.23 |

4.63 |

2.37 |

||||||||||||

|

BofA Merrill Lynch US Treasury 1-5 Year Index4 |

1.38 |

% |

1.37 |

% |

3.08 |

% |

|||||||||

|

MSCI World Free Index (net)5 |

1.43 |

13.10 |

6.38 |

||||||||||||

|

Citigroup One-Month US Treasury Bill Index6 |

0.02 |

0.05 |

1.26 |

||||||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2014 prospectuses were as follows: Class A—1.42% and 1.35%; Class C—2.18% and 2.10%; Class P—1.15% and 1.10%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short), through the period ending October 27, 2015, do not exceed 1.35% for Class A shares, 2.10% for Class C shares and 1.10% for Class P shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, UBS Global AM (Americas)'s three year recoupment rights will survive.

1 Maximum sales charge for Class A shares is 5.5%. Class A shares bear ongoing 12b-1 service fees.

2 Maximum contingent deferred sales charge for Class C shares is 1% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 distribution and service fees.

3 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but Class P shares held through advisory programs may be subject to a program fee, which, if included, would have reduced performance.

4 The BofA Merrill Lynch US Treasury 1-5 Year Index is an unmanaged index designed to track US Treasury securities with maturities between 1 and 5 years. Investors should note that indices do not reflect the deduction of fees and expenses.

5 The MSCI World Free Index (net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net total return indices reinvest dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The index is constructed and managed with a view to being fully investable from the perspective of international institutional investors. Investors should note that indices do not reflect the deduction of fees and expenses.

6 The Citigroup One-Month US Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last one month Treasury Bill issue. Investors should note that indices do not reflect the deduction of fees and expenses.

Prior to February 17, 2015, if an investor sold or exchanged shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged was deducted at the time of the transaction, except as noted otherwise in the prospectus. For sales or exchanges taking place on or after February 17, 2015 but prior to August 3, 2015, there is a reduction in the redemption holding period from 90 days to 30 days. Effective August 3, 2015, the 1.00% redemption fee imposed on sales or exchanges of any class of shares of the funds made during the holding periods specified in the prospectus will be eliminated. Please refer to the prospectus for further information.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

14

UBS Dynamic Alpha Fund

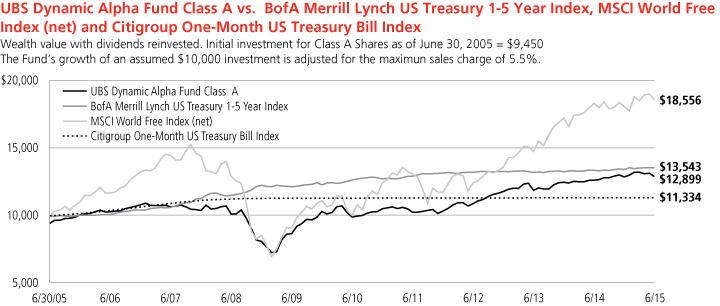

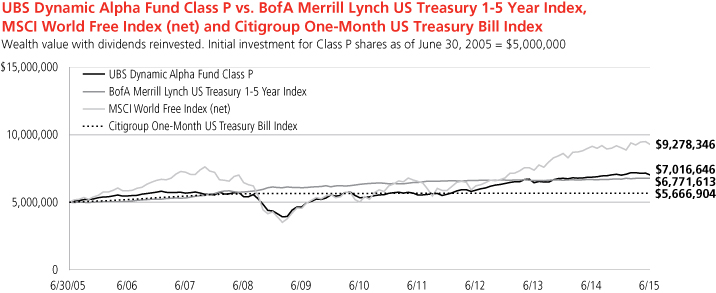

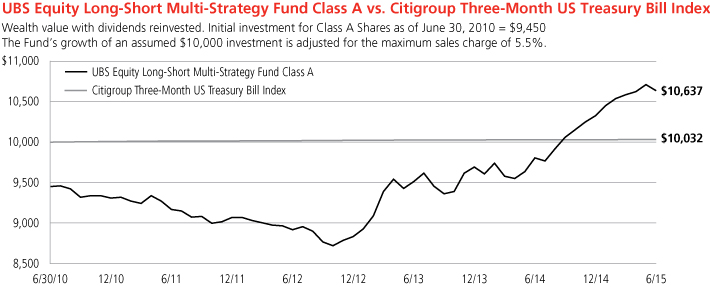

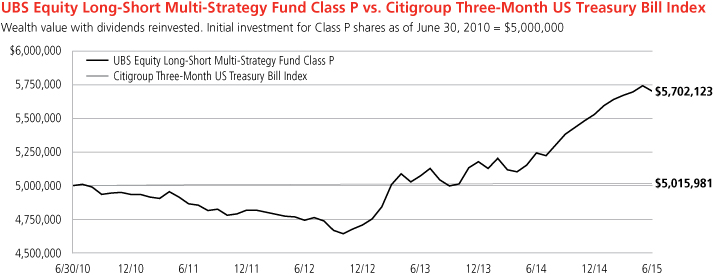

Illustration of an assumed investment of $10,000 in Class A shares (adjusted for 5.5% maximum sales charge) and $5,000,000 in Class P shares (unaudited)

The following two graphs depict the performance of UBS Dynamic Alpha Fund Class A and Class P shares versus the BofA Merrill Lynch US Treasury 1-5 Year Index, the MSCI World Free Index (net) and the Citigroup One-Month US Treasury Bill Index over the 10 years ended June 30, 2015. The performance of Class C shares will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

15

UBS Dynamic Alpha Fund

Top ten long-term fixed income holdings (unaudited)

As of June 30, 2015

|

Percentage of net assets |

|||||||

|

Government of Australia, 4.500%, due 04/15/20 |

1.9 |

% |

|||||

|

Government of Australia, 4.250%, due 07/21/17 |

1.8 |

||||||

|

Government of Australia, 4.750%, due 06/15/16 |

1.6 |

||||||

|

JPMorgan Chase & Co., 3.200%, due 01/25/23 |

0.8 |

||||||

|

Bank of America Corp., 1.875%, due 01/10/19 |

0.5 |

||||||

|

General Electric Capital Corp., Series A, 6.750%, due 03/15/32 |

0.5 |

||||||

|

Buoni Poliennali Del Tesoro, 4.500%, due 07/15/15 |

0.5 |

||||||

|

Morgan Stanley, 2.375%, due 07/23/19 |

0.5 |

||||||

|

Wachovia Corp., 5.750%, due 02/01/18 |

0.5 |

||||||

|

Goldman Sachs Group, Inc., 1.375%, due 07/26/22 |

0.5 |

||||||

|

Total |

9.1 |

% |

|||||

Country exposure by issuer, top five (unaudited)

As of June 30, 2015

|

Percentage of net assets |

|||||||

|

United States |

26.6 |

% |

|||||

|

Australia |

8.7 |

||||||

|

United Kingdom |

7.6 |

||||||

|

Netherlands |

4.8 |

||||||

|

France |

2.0 |

||||||

|

Total |

49.7 |

% |

|||||

16

UBS Dynamic Alpha Fund

Industry diversification (unaudited)

As a percentage of net assets as of June 30, 2015

|

Bonds |

|||||||

|

Corporate bonds |

|||||||

|

Aerospace & defense |

0.10 |

% |

|||||

|

Airlines |

0.23 |

||||||

|

Auto components |

0.05 |

||||||

|

Automobiles |

0.14 |

||||||

|

Banks |

11.66 |

||||||

|

Beverages |

1.41 |

||||||

|

Biotechnology |

0.20 |

||||||

|

Capital markets |

2.20 |

||||||

|

Chemicals |

0.77 |

||||||

|

Commercial services & supplies |

0.53 |

||||||

|

Communications equipment |

0.26 |

||||||

|

Construction & engineering |

0.54 |

||||||

|

Consumer finance |

1.59 |

||||||

|

Diversified financial services |

2.48 |

||||||

|

Diversified telecommunication services |

2.67 |

||||||

|

Electric utilities |

3.09 |

||||||

|

Energy equipment & services |

0.57 |

||||||

|

Food & staples retailing |

0.25 |

||||||

|

Food products |

0.98 |

||||||

|

Gas utilities |

1.01 |

||||||

|

Health care equipment & supplies |

0.48 |

||||||

|

Health care providers & services |

0.52 |

||||||

|

Hotels, restaurants & leisure |

0.12 |

||||||

|

Household durables |

0.10 |

||||||

|

Independent power and renewable electricity producers |

0.27 |

||||||

|

Industrial conglomerates |

0.34 |

||||||

|

Insurance |

5.98 |

||||||

|

Internet & catalog retail |

0.29 |

||||||

|

Internet software & services |

0.14 |

||||||

|

IT services |

0.17 |

||||||

|

Life sciences tools & services |

0.10 |

||||||

|

Machinery |

0.18 |

||||||

|

Marine |

0.24 |

||||||

|

Media |

2.09 |

||||||

|

Metals & mining |

0.97 |

||||||

|

Multi-utilities |

0.75 |

||||||

|

Oil, gas & consumable fuels |

7.17 |

||||||

|

Pharmaceuticals |

1.28 |

||||||

|

Real estate investment trust (REIT) |

0.29 |

||||||

|

Real estate management & development |

0.10 |

||||||

|

Road & rail |

0.66 |

||||||

|

Software |

0.30 |

||||||

|

Specialty retail |

0.29 |

||||||

|

Textiles, apparel & luxury goods |

0.07 |

||||||

|

Thrifts & mortgage finance |

0.15 |

||||||

|

Tobacco |

1.27 |

||||||

|

Transportation infrastructure |

0.89 |

||||||

|

Water utilities |

0.56 |

||||||

|

Wireless telecommunication services |

0.92 |

||||||

|

Total corporate bonds |

57.42 |

% |

|||||

|

Collateralized debt obligation |

0.00 |

%1 |

|||||

|

Mortgage & agency debt security |

0.01 |

||||||

|

Non-US government obligations |

5.77 |

||||||

|

Supranational bonds |

0.42 |

||||||

|

Total bonds |

63.62 |

% |

|||||

|

Short-term investments |

23.35 |

||||||

|

Options purchased |

0.87 |

||||||

|

Investment of cash collateral from securities loaned |

0.48 |

||||||

|

Total investments |

88.32 |

% |

|||||

|

Cash and other assets, less liabilities |

11.68 |

||||||

|

Net assets |

100.00 |

% |

|||||

1 Amount represents less than 0.005%.

17

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2015

|

Face amount |

Value |

||||||||||

|

Bonds: 63.62% |

|||||||||||

|

Corporate bonds: 57.42% |

|||||||||||

|

Australia: 3.39% |

|||||||||||

|

Adani Abbot Point Terminal Pty Ltd., 5.750%, due 11/01/18 |

AUD |

1,025,000 |

$ |

808,145 |

|||||||

|

APT Pipelines Ltd., 4.200%, due 03/23/251 |

$ |

910,000 |

889,955 |

||||||||

|

Aurizon Network Pty Ltd., 2.000%, due 09/18/24 |

EUR |

500,000 |

543,913 |

||||||||

|

Australia & New Zealand Banking Group Ltd., 4.500%, due 03/19/242 |

$ |

250,000 |

251,391 |

||||||||

|

Australia Pacific Airports Melbourne Pty Ltd., 1.750%, due 10/15/24 |

EUR |

450,000 |

497,044 |

||||||||

|

BHP Billiton Finance USA Ltd., 5.000%, due 09/30/43 |

$ |

290,000 |

301,030 |

||||||||

|

Commonwealth Bank of Australia, 1.125%, due 03/13/17 |

370,000 |

370,278 |

|||||||||

|

2.250%, due 03/16/171 |

630,000 |

643,538 |

|||||||||

|

2.250%, due 03/16/172 |

250,000 |

255,373 |

|||||||||

|

National Australia Bank Ltd., 2.000%, due 11/12/243 |

EUR |

550,000 |

607,391 |

||||||||

|

2.750%, due 03/09/17 |

$ |

650,000 |

668,327 |

||||||||

|

Origin Energy Finance Ltd., 2.500%, due 10/23/202 |

EUR |

775,000 |

892,041 |

||||||||

|

5.450%, due 10/14/212 |

$ |

345,000 |

372,490 |

||||||||

|

QBE Insurance Group Ltd., 2.400%, due 05/01/182 |

405,000 |

407,242 |

|||||||||

|

6.750%, due 12/02/443 |

795,000 |

834,750 |

|||||||||

|

Santos Finance Ltd., 8.250%, due 09/22/703 |

EUR |

380,000 |

458,594 |

||||||||

|

Scentre Group Trust 1, 1.500%, due 07/16/20 |

250,000 |

283,036 |

|||||||||

|

SGSP Australia Assets Pty Ltd., 2.000%, due 06/30/22 |

350,000 |

396,486 |

|||||||||

|

Suncorp-Metway Ltd., 1.700%, due 03/28/172 |

$ |

440,000 |

443,371 |

||||||||

|

Telstra Corp. Ltd., 4.800%, due 10/12/211 |

200,000 |

223,924 |

|||||||||

|

4.800%, due 10/12/212 |

350,000 |

391,866 |

|||||||||

|

Transurban Finance Co. Pty Ltd., 1.875%, due 09/16/24 |

EUR |

300,000 |

329,310 |

||||||||

|

2.500%, due 10/08/20 |

210,000 |

248,013 |

|||||||||

|

Total Australia corporate bonds |

11,117,508 |

||||||||||

|

Belgium: 0.35% |

|||||||||||

|

AG Insurance SA, 3.500%, due 06/30/473 |

900,000 |

897,438 |

|||||||||

|

Elia System Operator SA, 3.250%, due 04/04/282 |

200,000 |

253,411 |

|||||||||

|

Total Belgium corporate bonds |

1,150,849 |

||||||||||

|

Face amount |

Value |

||||||||||

|

Bermuda: 0.17% |

|||||||||||

|

Bacardi Ltd., 2.750%, due 07/03/232 |

EUR |

470,000 |

$ |

558,371 |

|||||||

|

Brazil: 0.56% |

|||||||||||

|

BRF SA, 2.750%, due 06/03/221 |

210,000 |

227,973 |

|||||||||

|

Petrobras Global Finance BV, 3.250%, due 04/01/192 |

610,000 |

644,053 |

|||||||||

|

3.875%, due 01/27/16 |

$ |

440,000 |

441,892 |

||||||||

|

Vale SA, 5.625%, due 09/11/42 |

640,000 |

538,739 |

|||||||||

|

Total Brazil corporate bonds |

1,852,657 |

||||||||||

|

Canada: 1.90% |

|||||||||||

|

Bank of Montreal, 6.020%, due 05/02/18 |

CAD |

470,000 |

424,445 |

||||||||

|

Bank of Nova Scotia, 4.100%, due 06/08/17 |

695,000 |

586,499 |

|||||||||

|

Canadian Imperial Bank of Commerce, 1.350%, due 07/18/16 |

$ |

445,000 |

447,587 |

||||||||

|

3.400%, due 01/14/16 |

CAD |

515,000 |

417,570 |

||||||||

|

Canadian Natural Resources Ltd., 3.900%, due 02/01/25 |

$ |

320,000 |

316,179 |

||||||||

|

Hydro One, Inc., 5.360%, due 05/20/36 |

CAD |

335,000 |

325,521 |

||||||||

|

Nexen Energy ULC, 6.400%, due 05/15/37 |

$ |

500,000 |

596,518 |

||||||||

|

Royal Bank of Canada, 2.980%, due 05/07/19 |

CAD |

475,000 |

400,430 |

||||||||

|

Suncor Energy, Inc., 6.500%, due 06/15/38 |

$ |

515,000 |

627,480 |

||||||||

|

Talisman Energy, Inc., 3.750%, due 02/01/21 |

480,000 |

475,189 |

|||||||||

|

TELUS Corp., 3.750%, due 01/17/25 |

CAD |

165,000 |

135,535 |

||||||||

|

Thomson Reuters Corp., 1.300%, due 02/23/17 |

$ |

480,000 |

478,883 |

||||||||

|

Toronto-Dominion Bank, 3.367%, due 11/02/203 |

CAD |

660,000 |

531,826 |

||||||||

|

Yamana Gold, Inc., 4.950%, due 07/15/24 |

$ |

470,000 |

452,719 |

||||||||

|

Total Canada corporate bonds |

6,216,381 |

||||||||||

|

Cayman Islands: 0.82% |

|||||||||||

|

Hutchison Whampoa International 09 Ltd., 7.625%, due 04/09/191 |

300,000 |

355,038 |

|||||||||

|

7.625%, due 04/09/192 |

125,000 |

147,933 |

|||||||||

|

Noble Holding International Ltd., 5.950%, due 04/01/25 |

245,000 |

241,564 |

|||||||||

18

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2015

|

Face amount |

Value |

||||||||||

|

Bonds—(Continued) |

|||||||||||

|

Corporate bonds—(Continued) |

|||||||||||

|

Cayman Islands—(Concluded) |

|||||||||||

|

Principal Financial Global Funding II LLC, 4.500%, due 01/26/17 |

EUR |

650,000 |

$ |

769,530 |

|||||||

|

Tencent Holdings Ltd., 3.375%, due 05/02/191 |

$ |

450,000 |

461,340 |

||||||||

|

Thames Water Utilities Cayman Finance Ltd., 5.375%, due 07/21/253 |

GBP |

190,000 |

316,447 |

||||||||

|

Yorkshire Water Services Bradford Finance Ltd., 6.000%, due 04/24/253 |

230,000 |

385,798 |

|||||||||

|

Total Cayman Islands corporate bonds |

2,677,650 |

||||||||||

|

China: 0.44% |

|||||||||||

|

AIA Group Ltd., 1.750%, due 03/13/182 |

$ |

760,000 |

752,536 |

||||||||

|

2.250%, due 03/11/191 |

275,000 |

272,993 |

|||||||||

|

Bank of China Ltd., 5.000%, due 11/13/241 |

200,000 |

203,933 |

|||||||||

|

Bao-trans Enterprises Ltd., 1.625%, due 02/23/182 |

EUR |

200,000 |

224,271 |

||||||||

|

Total China corporate bonds |

1,453,733 |

||||||||||

|

Czech Republic: 0.20% |

|||||||||||

|

NET4GAS sro, 2.500%, due 07/28/21 |

560,000 |

644,606 |

|||||||||

|

Denmark: 0.24% |

|||||||||||

|

AP Moeller - Maersk A/S, 3.375%, due 08/28/192 |

650,000 |

798,401 |

|||||||||

|

Finland: 0.69% |

|||||||||||

|

Elenia Finance Oyj, 2.875%, due 12/17/20 |

550,000 |

652,760 |

|||||||||

|

Pohjola Bank Oyj, 1.125%, due 06/17/19 |

100,000 |

113,395 |

|||||||||

|

1.750%, due 08/29/18 |

300,000 |

346,864 |

|||||||||

|

Sampo Oyj, 1.500%, due 09/16/21 |

250,000 |

279,966 |

|||||||||

|

Teollisuuden Voima Oyj, 2.500%, due 03/17/21 |

425,000 |

474,383 |

|||||||||

|

4.625%, due 02/04/192 |

335,000 |

408,408 |

|||||||||

|

Total Finland corporate bonds |

2,275,776 |

||||||||||

|

France: 2.01% |

|||||||||||

|

Arkema SA, 1.500%, due 01/20/25 |

200,000 |

212,110 |

|||||||||

|

Face amount |

Value |

||||||||||

|

AXA SA, 6.667%, due 07/06/163,4 |

GBP |

285,000 |

$ |

455,307 |

|||||||

|

BNP Paribas SA, 2.700%, due 08/20/18 |

$ |

500,000 |

511,667 |

||||||||

|

2.875%, due 03/20/263 |

EUR |

350,000 |

394,668 |

||||||||

|

Christian Dior SE, 1.375%, due 06/19/19 |

200,000 |

226,052 |

|||||||||

|

CNP Assurances, 4.250%, due 06/05/453 |

100,000 |

113,113 |

|||||||||

|

Credit Logement SA, 1.136%, due 09/16/152,3,4 |

200,000 |

184,619 |

|||||||||

|

Electricite de France SA, 4.125%, due 01/22/223,4 |

300,000 |

342,816 |

|||||||||

|

5.625%, due 01/22/241,3,4 |

$ |

280,000 |

284,760 |

||||||||

|

6.950%, due 01/26/391 |

200,000 |

259,477 |

|||||||||

|

GDF Suez, 4.750%, due 07/10/213,4 |

EUR |

600,000 |

725,399 |

||||||||

|

Infra Foch SAS, 1.250%, due 10/16/20 |

200,000 |

221,996 |

|||||||||

|

Orange SA, 5.875%, due 02/07/223,4 |

GBP |

300,000 |

480,803 |

||||||||

|

Societe Des Autoroutes Paris-Rhin-Rhone, 2.250%, due 01/16/20 |

EUR |

600,000 |

706,354 |

||||||||

|

Total Capital International SA, 1.550%, due 06/28/17 |

$ |

1,190,000 |

1,201,037 |

||||||||

|

TOTAL SA, 2.625%, due 02/26/253,4 |

EUR |

265,000 |

274,528 |

||||||||

|

Total France corporate bonds |

6,594,706 |

||||||||||

|

Germany: 0.25% |

|||||||||||

|

Allianz SE, 4.750%, due 10/24/233,4 |

200,000 |

239,869 |

|||||||||

|

Merck KGaA, 3.375%, due 12/12/743 |

265,000 |

291,222 |

|||||||||

|

RWE AG, 2.750%, due 04/21/753 |

270,000 |

281,124 |

|||||||||

|

Total Germany corporate bonds |

812,215 |

||||||||||

|

Guernsey: 0.13% |

|||||||||||

|

Credit Suisse Group Guernsey I Ltd., 7.875%, due 02/24/412,3 |

$ |

415,000 |

433,904 |

||||||||

|

India: 0.16% |

|||||||||||

|

Reliance Industries Ltd., 4.125%, due 01/28/251 |

525,000 |

512,339 |

|||||||||

|

Ireland: 0.60% |

|||||||||||

|

Aquarius + Investments PLC for Swiss Reinsurance Co., Ltd., 6.375%, due 09/01/243 |

200,000 |

207,166 |

|||||||||

19

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2015

|

Face amount |

Value |

||||||||||

|

Bonds—(Continued) |

|||||||||||

|

Corporate bonds—(Continued) |

|||||||||||

|

Ireland—(Concluded) |

|||||||||||

|

Cloverie PLC for Zurich Insurance Co., Ltd., 1.750%, due 09/16/24 |

EUR |

130,000 |

$ |

142,609 |

|||||||

|

FGA Capital Ireland PLC, 2.625%, due 04/17/19 |

435,000 |

500,721 |

|||||||||

|

Perrigo Co. PLC, 4.000%, due 11/15/23 |

$ |

200,000 |

202,683 |

||||||||

|

PGH Capital Ltd., 5.750%, due 07/07/21 |

GBP |

280,000 |

466,421 |

||||||||

|

XL Group PLC, 4.450%, due 03/31/25 |

$ |

275,000 |

272,595 |

||||||||

|

5.250%, due 12/15/43 |

185,000 |

191,019 |

|||||||||

|

Total Ireland corporate bonds |

1,983,214 |

||||||||||

|

Israel: 0.38% |

|||||||||||

|

Delek & Avner Tamar Bond Ltd., 3.839%, due 12/30/181 |

1,020,000 |

1,034,025 |

|||||||||

|

Teva Pharmaceutical Finance IV BV, 3.650%, due 11/10/21 |

200,000 |

203,350 |

|||||||||

|

Total Israel corporate bonds |

1,237,375 |

||||||||||

|

Italy: 1.17% |

|||||||||||

|

2i Rete Gas SpA, 1.125%, due 01/02/20 |

EUR |

200,000 |

220,427 |

||||||||

|

Assicurazioni Generali SpA, 2.875%, due 01/14/20 |

120,000 |

142,246 |

|||||||||

|

Ei Towers SpA, 3.875%, due 04/26/18 |

400,000 |

477,022 |

|||||||||

|

Intesa Sanpaolo SpA, 3.625%, due 08/12/151 |

$ |

235,000 |

235,682 |

||||||||

|

3.875%, due 01/16/18 |

320,000 |

330,347 |

|||||||||

|

4.375%, due 10/15/192 |

EUR |

400,000 |

496,444 |

||||||||

|

Snam SpA, 3.875%, due 03/19/182 |

660,000 |

797,155 |

|||||||||

|

Terna Rete Elettrica Nazionale SpA, 4.125%, due 02/17/17 |

365,000 |

430,791 |

|||||||||

|

UniCredit SpA, 3.250%, due 01/14/21 |

EUR |

295,000 |

349,392 |

||||||||

|

6.375%, due 05/02/232,3 |

$ |

340,000 |

355,529 |

||||||||

|

Total Italy corporate bonds |

3,835,035 |

||||||||||

|

Japan: 0.23% |

|||||||||||

|

Bank of Tokyo-Mitsubishi UFJ Ltd., 2.350%, due 09/08/191 |

380,000 |

379,518 |

|||||||||

|

2.350%, due 09/08/192 |

200,000 |

199,746 |

|||||||||

|

Nippon Telegraph & Telephone Corp., 1.400%, due 07/18/17 |

190,000 |

190,229 |

|||||||||

|

Total Japan corporate bonds |

769,493 |

||||||||||

|

Face amount |

Value |

||||||||||

|

Jersey, Channel Islands: 0.83% |

|||||||||||

|

AA Bond Co., Ltd., 4.720%, due 07/31/182 |

GBP |

275,000 |

$ |

457,978 |

|||||||

|

Gatwick Funding Ltd., 5.250%, due 01/23/242 |

250,000 |

442,327 |

|||||||||

|

Heathrow Funding Ltd., 1.500%, due 02/11/30 |

EUR |

425,000 |

412,981 |

||||||||

|

4.600%, due 02/15/182 |

590,000 |

726,184 |

|||||||||

|

HSBC Capital Funding LP, 5.130%, due 03/29/163,4 |

170,000 |

192,829 |

|||||||||

|

QBE Capital Funding III Ltd., 7.250%, due 05/24/412,3 |

$ |

430,000 |

475,586 |

||||||||

|

Total Jersey, Channel Islands corporate bonds |

2,707,885 |

||||||||||

|

Luxembourg: 0.15% |

|||||||||||

|

Belfius Financing Co., 1.267%, due 02/09/173 |

GBP |

325,000 |

505,550 |

||||||||

|

Mexico: 0.45% |

|||||||||||

|

America Movil SAB de CV, 5.000%, due 03/30/20 |

$ |

735,000 |

813,608 |

||||||||

|

5.125%, due 09/06/733 |

EUR |

145,000 |

170,949 |

||||||||

|

Coca-Cola Femsa SAB de CV, 2.375%, due 11/26/18 |

$ |

490,000 |

497,742 |

||||||||

|

Total Mexico corporate bonds |

1,482,299 |

||||||||||

|

Netherlands: 4.85% |

|||||||||||

|

ABN AMRO Bank NV, 4.875%, due 01/16/192 |

GBP |

350,000 |

605,451 |

||||||||

|

6.250%, due 09/13/223 |

$ |

370,000 |

396,825 |

||||||||

|

Achmea BV, 2.500%, due 11/19/20 |

EUR |

960,000 |

1,127,172 |

||||||||

|

4.250%, due 02/04/253,4 |

350,000 |

375,294 |

|||||||||

|

Allianz Finance II BV, 4.375%, due 02/17/173,4 |

435,000 |

501,934 |

|||||||||

|

BAT Netherlands Finance BV, 2.375%, due 01/19/232 |

550,000 |

645,397 |

|||||||||

|

Bharti Airtel International Netherlands BV, 3.375%, due 05/20/211 |

100,000 |

116,641 |

|||||||||

|

4.000%, due 12/10/18 |

650,000 |

773,567 |

|||||||||

|

Coca-Cola HBC Finance BV, 2.375%, due 06/18/202 |

560,000 |

649,693 |

|||||||||

|

5.500%, due 09/17/15 |

$ |

355,000 |

357,010 |

||||||||

|

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, 1.700%, due 03/19/18 |

830,000 |

832,050 |

|||||||||

|

2.500%, due 05/26/263 |

EUR |

745,000 |

823,811 |

||||||||

|

5.500%, due 06/29/203,4 |

850,000 |

954,730 |

|||||||||

|

Deutsche Annington Finance BV, 4.000%, due 12/17/213,4 |

300,000 |

332,725 |

|||||||||

20

UBS Dynamic Alpha Fund

Portfolio of investments

June 30, 2015

|

Face amount |

Value |

||||||||||

|

Bonds—(Continued) |

|||||||||||

|

Corporate bonds—(Continued) |

|||||||||||

|

Netherlands—(Concluded) |

|||||||||||

|

Deutsche Telekom International Finance BV, 6.500%, due 04/08/22 |

GBP |

170,000 |

$ |

324,632 |

|||||||

|

E.ON International Finance BV, 6.650%, due 04/30/381 |

$ |

145,000 |

174,458 |

||||||||

|

EDP Finance BV, 2.000%, due 04/22/25 |

EUR |

255,000 |

256,512 |

||||||||

|

4.625%, due 06/13/16 |

405,000 |

466,423 |

|||||||||

|

Heineken NV, 2.125%, due 08/04/202 |

645,000 |

757,898 |

|||||||||

|

Koninklijke KPN NV, 6.500%, due 01/15/16 |

257,000 |

296,049 |

|||||||||

|

LYB International Finance BV, 5.250%, due 07/15/43 |

$ |

285,000 |

290,332 |

||||||||

|

Nomura Europe Finance NV, 1.500%, due 05/12/21 |

EUR |

300,000 |

328,530 |

||||||||

|

Redexis Gas Finance BV, 1.875%, due 04/27/27 |

650,000 |

642,531 |

|||||||||

|

2.750%, due 04/08/21 |

450,000 |

531,369 |

|||||||||

|

REN Finance BV, 2.500%, due 02/12/25 |

300,000 |

317,272 |

|||||||||

|

4.750%, due 10/16/20 |

345,000 |

436,504 |

|||||||||

|

Repsol International Finance BV, 4.250%, due 02/12/162 |

200,000 |

228,278 |

|||||||||

|

4.375%, due 02/20/182 |

200,000 |

243,463 |

|||||||||

|

Shell International Finance BV, 4.375%, due 05/11/45 |

$ |

825,000 |

814,334 |

||||||||

|

Siemens Financieringsmaatschappij NV, 5.125%, due 02/20/17 |

EUR |

335,000 |

403,464 |

||||||||

|

6.125%, due 09/14/663 |

GBP |

225,000 |

367,672 |

||||||||

|

Swiss Reinsurance Co. via ELM BV, 2.600%, due 09/01/253,4 |

EUR |

230,000 |

234,726 |

||||||||

|

TenneT Holding BV, 6.655%, due 06/01/173,4 |

250,000 |

304,145 |

|||||||||

|

Total Netherlands corporate bonds |

15,910,892 |

||||||||||

|

Norway: 0.62% |

|||||||||||

|

DNB Bank ASA, 3.200%, due 04/03/171 |

$ |

450,000 |

464,143 |

||||||||

|

SpareBank 1 SR-Bank ASA, 2.125%, due 04/14/21 |

EUR |

650,000 |

757,751 |

||||||||

|

Statoil ASA, 3.125%, due 08/17/17 |

$ |

430,000 |

446,743 |

||||||||

|

4.800%, due 11/08/43 |

355,000 |

375,862 |

|||||||||

|

Total Norway corporate bonds |

2,044,499 |

||||||||||

|

Face amount |

Value |

||||||||||

|

Portugal: 0.07% |

|||||||||||

|

Caixa Geral de Depositos SA, 3.750%, due 01/18/18 |

EUR |

200,000 |

$ |

241,714 |

|||||||

|

Qatar: 0.06% |

|||||||||||

|

Qtel International Finance Ltd., 3.875%, due 01/31/281 |

$ |

200,000 |

189,042 |

||||||||

|

Singapore: 0.08% |

|||||||||||

|

United Overseas Bank Ltd., 3.750%, due 09/19/243 |

250,000 |

254,405 |

|||||||||

|

South Korea: 0.10% |

|||||||||||

|

GS Caltex Corp., 5.500%, due 04/24/172 |

300,000 |

318,070 |

|||||||||

|

Spain: 1.38% |

|||||||||||

|

Aigues de Barcelona Finance SAU, 1.944%, due 09/15/21 |

EUR |

430,000 |

483,735 |

||||||||

|

Banco de Sabadell SA, 3.375%, due 01/23/18 |

100,000 |

120,196 |

|||||||||

|

BBVA Senior Finance SAU, 3.250%, due 03/21/16 |

200,000 |

227,472 |

|||||||||

|

BBVA US Senior SAU, 4.664%, due 10/09/15 |

$ |

460,000 |

464,407 |

||||||||

|

Canal de Isabel II Gestion SA, 1.680%, due 02/26/25 |

EUR |

300,000 |

305,551 |

||||||||

|

Santander Consumer Finance SA, 0.900%, due 02/18/202 |

900,000 |

983,779 |

|||||||||

|

Santander International Debt SAU, 1.375%, due 03/25/17 |

800,000 |

903,453 |

|||||||||

|

Telefonica Emisiones SAU, 4.710%, due 01/20/202 |

800,000 |

1,028,293 |

|||||||||

|

Total Spain corporate bonds |

4,516,886 |

||||||||||

|

Sweden: 0.73% |

|||||||||||

|

PGE Sweden AB, 1.625%, due 06/09/19 |

200,000 |

226,017 |

|||||||||

|

Svenska Handelsbanken AB, 5.125%, due 03/30/201 |

$ |

475,000 |

536,509 |

||||||||

|

5.125%, due 03/30/202 |

115,000 |

129,892 |

|||||||||

|

5.250%, due 03/01/213,4 |