The UBS Funds

October 28, 2014

UBS U.S. Defensive Equity Fund

Summary Prospectus

Before you invest, you may want to review the fund's prospectus and statement of additional information ("SAI"), which contain more information about the fund and its risks. You can find the fund's prospectus, SAI and other information about the fund online at http://www.ubs.com/us/en/asset_management/individual_investors/mutual_fund.html. You can also get this information at no cost by calling 1-800-647 1568 or by sending an email request to ubs@fundinsite.com. The current prospectus and SAI, dated October 28, 2014, are incorporated by reference into this summary prospectus (i.e., they are legally a part of this summary prospectus).

Share Class: Ticker Symbol

|

Class A |

Class C |

Class P |

|||||||||

|

BEAAX |

BEACX |

BEAYX |

|||||||||

Investment objective

The Fund seeks to maximize total return, consisting of capital appreciation and current income, while controlling risk.

Fees and expenses

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" on page 51 of the Fund's prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" on page 117 of the Fund's statement of additional information ("SAI").

Shareholder fees (fees paid directly from your investment)

|

Class A |

Class C |

Class P |

|||||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

5.50 |

% |

None |

None |

|||||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

None1 |

1.00 |

% |

None |

|||||||||||

|

Redemption fee (as a % of amount redeemed within 90 days of purchase, if applicable) |

1.00 |

% |

1.00 |

% |

1.00 |

% |

|||||||||

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Class A |

Class C |

Class P |

|||||||||||||

|

Management fees |

1.00 |

% |

1.00 |

% |

1.00 |

% |

|||||||||

|

Distribution and/or service (12b-1) fees |

0.25 |

1.00 |

None |

||||||||||||

|

Other expenses: |

|||||||||||||||

|

Dividend expense and security loan fees for securities sold short |

0.65 |

0.65 |

0.65 |

||||||||||||

|

Other2 |

1.90 |

1.96 |

1.88 |

||||||||||||

|

Total other expenses |

2.55 |

2.61 |

2.53 |

||||||||||||

|

Total annual fund operating expenses2 |

3.80 |

4.61 |

3.53 |

||||||||||||

|

Less management fee waiver/expense reimbursements |

1.65 |

1.71 |

1.63 |

||||||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements2,3 |

2.15 |

2.90 |

1.90 |

||||||||||||

1 Purchases of $1 million or more that were not subject to a front-end sales charge are subject to a 1% CDSC if sold within one year of the purchase date.

2 "Other expenses" include "Acquired fund fees and expenses," which were less than 0.01% of average net assets of the Fund.

3 The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short), through the period ending October 27, 2015, otherwise do not exceed 1.50% for Class A shares, 2.25% for Class C shares and 1.25% for Class P shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements, to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of

the fee waiver/expense reimbursement agreement, however, the UBS Global AM (Americas)'s three year recoupment rights will survive.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

5 years |

10 years |

||||||||||||||||

|

Class A |

$ |

756 |

$ |

1,504 |

$ |

2,269 |

$ |

4,265 |

|||||||||||

|

Class C (assuming sale of all shares at end of period) |

393 |

1,238 |

2,191 |

4,604 |

|||||||||||||||

|

Class C (assuming no sale of shares) |

293 |

1,238 |

2,191 |

4,604 |

|||||||||||||||

|

Class P |

193 |

932 |

1,692 |

3,693 |

|||||||||||||||

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 60% of the average value of its portfolio.

Principal strategies

Principal investments

Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in equity and/or equity-related instruments of US companies. Equity-related instruments include securities or other instruments that derive their value from equity securities and may include such instruments as short sales of equity securities, and futures and options on equity securities. The Fund will generally invest in equity securities of large and mid capitalization companies but is permitted to invest up to 15% of its net assets in small capitalization companies. The Fund will maintain both long positions and short positions in equity securities and securities with equity-like characteristics. In addition, up to 20% of the Fund's net assets may be invested in securities of foreign companies in developed countries, including long

and short positions in foreign equity securities and securities with equity-like characteristics.

The Fund may, but is not required to, use exchange-traded or over-the-counter ("OTC") derivative instruments for risk management purposes or as part of the Fund's investment strategies. Generally, derivatives are financial contracts whose value depends upon, or is derived from, the value of an underlying asset, reference rate, or index, and may relate to stocks, bonds, interest rates, currencies or currency exchange rates, and related indexes. The derivatives in which the Fund may invest include futures, options and forward currency agreements. These derivatives may be used for risk management purposes to manage or adjust the risk profile of the Fund. Futures on currencies and forward currency agreements may also be used to hedge against a specific currency. Options may also be used to generate cash flow or enhance returns. In addition, futures on indices may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; or to obtain exposure to certain markets.

The Fund may also invest in exchange-traded funds ("ETFs") and similarly structured pooled investments in order to provide exposure to the equity markets while maintaining liquidity. The Fund may also engage in short sales of ETFs and similarly structured pooled investments in order to reduce exposure to certain sectors of the equity markets.

Management process

The Advisor's investment style is singularly focused on investment fundamentals. The Advisor believes that investment fundamentals determine and describe future cash flows that define fundamental investment value. The Advisor tries to identify and exploit periodic discrepancies between market prices and fundamental value. These price/value discrepancies are used as the building blocks for portfolio construction.

In constructing the Fund's portfolio, the Advisor primarily uses fundamental analysis and, to a lesser extent, quantitative analysis to identify securities that are underpriced and overpriced relative to their fundamental value. In general, the Advisor buys securities "long" for the Fund's portfolio that it believes are underpriced and will outperform, and sells securities "short" that it believes are overpriced and will underperform. The Fund anticipates that it will normally maintain long positions in equity securities and securities with equity-like characteristics equal to 120% to 140% of the value of its net assets, short positions in equity securities and securities with equity-like characteristics equal to 20% to 40% of the value of its net assets and cash positions equal to 0% to 10% of the value of its net assets. The

Fund's ability to fully implement its investment strategy may be affected by (i) regulatory restrictions prohibiting short sales of certain securities that may be imposed from time to time or (ii) the Advisor's written procedures designed to address potential conflicts that exist where the Advisor manages both long-only and long/short accounts and/or funds.

In addition, the Advisor seeks to manage the Fund's equity risk by utilizing an options-based strategy designed to reduce systematic market risk in the Fund's portfolio in extreme down markets. The Advisor regularly purchases and sells exchange-traded and OTC put and call options on securities and indices in order to limit the Fund's downside equity risk in extreme down markets. This strategy may often result in the Fund purchasing an index put option in combination with writing an index put option or a covered call option. The Advisor combines purchased and written options in this manner in order to customize the type and level of extreme market downside protection and to reduce the cost of such downside protection. This options overlay strategy, while expected to be beneficial in providing downside equity protection in extreme down markets, may also limit the Fund's returns in normal or rising markets. In addition, the strategy is not intended to provide downside protection from normal or modest market declines, and is not a total market hedge. The Advisor believes that this defensive options-based overlay strategy provides the Fund with reduced downside equity risk in extreme down markets in an efficient and price-sensitive manner, while enabling the Fund to participate, in part, in rising equity markets. However, under certain market conditions, the Advisor may, in its own discretion, not hedge equity market risk or employ the options-based strategy.

In employing these investment strategies for the Fund, the Advisor seeks to achieve equity-like returns or better with less than equity-like risk or volatility over a full market cycle. The Advisor does not represent or guarantee that the Fund will meet this goal.

Main risks

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Below are some of the specific risks of investing in the Fund.

Market risk: The market value of the Fund's investments may fluctuate, sometimes rapidly or unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

Short sales risk: There are certain unique risks associated with the use of short sales strategies. When selling a security short, the Advisor will sell a security it does not own at the then-current market price and then borrow the security to deliver to the buyer. The Fund is then obligated to buy the security on a later date so it can return the security to the lender. Short sales therefore involve the risk that the Fund will incur a loss by subsequently buying a security at a higher price than the price at which the Fund previously sold the security short. This would occur if the securities lender required the Fund to deliver the securities the Fund had borrowed at the commencement of the short sale and the Fund was unable to either purchase the security at a favorable price or to borrow the security from another securities lender. If this occurs at a time when other short sellers of the security also want to close out their positions, a "short squeeze" can occur. A short squeeze occurs when demand is greater than supply for the security sold short. Moreover, because the Fund's loss on a short sale arises from increases in the value of the security sold short, such loss, like the price of the security sold short, is theoretically unlimited. By contrast, the Fund's loss on a long position arises from decreases in the value of the security and therefore is limited by the fact that a security's value cannot drop below zero. It is possible that the Fund's securities held long will decline in value at the same time that the value of the securities sold short increases, thereby increasing the potential for loss.

Options-based strategy risk: The Fund regularly purchases and sells exchange-traded and OTC put and call options in order to attempt to limit the Fund's downside risk in extreme down markets. The purchase and sale of exchange-traded and over-the-counter put and call options involves costs, which the Fund will incur on a regular basis, and, therefore, these costs may limit the Fund's returns in normal or rising markets. In addition, there is no guarantee that the Advisor's options-based strategy will provide the expected protection in extreme down markets.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. It is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk and counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations). In addition, non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are differ-

ent from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested.

Limited capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers.

Unseasoned company risk: The Fund may invest in relatively new or unseasoned companies that are in their early stages of development. Securities of unseasoned companies present greater risks than securities of larger, more established companies. The companies may have greater risks because they (i) may be dependent on a small number of products or services; (ii) may lack substantial capital reserves; and (iii) do not have proven track records.

Performance

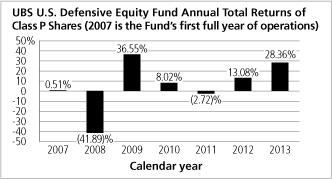

Risk/return bar chart and table

The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. Index reflects no deduction for fees, expenses or taxes. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. On or about January 28, 2013, the Fund's investment strategies, including its 80% policy, changed. The performance information below is attributable to the

Fund's performance before the strategy change. Updated performance for the Fund is available at http://globalam-us.ubs.com/corpweb/performance.do.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class P shares' after-tax returns shown.

Total return

Total return January 1 - September 30, 2014: 6.61%

Best quarter during calendar years shown—2Q 2009: 23.05%

Worst quarter during calendar years shown—4Q 2008: (27.94)%

Average annual total returns (figures reflect sales charges)

(for the periods ended December 31, 2013)

|

Class (inception date) |

1 year |

5 years |

Life of class |

||||||||||||

|

Class A (9/26/06) |

|||||||||||||||

|

Return before taxes |

20.97 |

% |

14.18 |

% |

2.85 |

% |

|||||||||

|

Class C (9/26/06) |

|||||||||||||||

|

Return before taxes |

25.98 |

14.61 |

2.87 |

||||||||||||

|

Class P (9/26/06) |

|||||||||||||||

|

Return before taxes |

28.36 |

15.80 |

3.90 |

||||||||||||

|

Return after taxes on distributions |

28.36 |

15.77 |

3.57 |

||||||||||||

|

Return after taxes on distributions and sale of fund shares |

16.05 |

12.79 |

2.99 |

||||||||||||

|

Russell 1000 Index |

33.11 |

18.59 |

7.18 |

||||||||||||

Investment advisor

UBS Global Asset Management (Americas) Inc. serves as the investment advisor to the Fund.

Portfolio managers

• Thomas Digenan, portfolio manager of the Fund since its inception.

• Ian McIntosh, portfolio manager of the Fund since 2012.

Purchase & sale of fund shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. In general, the minimum initial investment is $1,000 and the minimum subsequent investment is $100.

Tax information

The dividends and distributions you receive from the Fund are taxable and generally will be taxed as ordinary income, capital gains, or some combination of both, unless you are investing through a tax deferred arrangement, such as a 401(k) plan or an individual

retirement account, in which case your distributions generally will be taxed when withdrawn from the tax-deferred account.

Payments to broker/dealers and other financial intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's Web site for more information.

This page intentionally left blank.

This page intentionally left blank.

©UBS 2014. All rights reserved.

The UBS Funds

Investment Company Act File No. 811-6637

UBS Global Asset Management (Americas) Inc.

is a subsidiary of UBS AG.

S1501