UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-06637 | |||||||

|

| ||||||||

|

The UBS Funds | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

One North Wacker Drive, Chicago, IL |

|

60606-2807 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Tammie Lee, Esq. UBS Global Asset Management (Americas) Inc. 1285 Avenue of the Americas New York, NY 10019 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Copy to: Bruce Leto, Esq. Stradley Ronon Stevens & Young, LLP 2600 One Commerce Square Philadelphia, PA 19103-7098 | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

212-821-3000 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

June 30 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

June 30, 2014 |

| ||||||

Item 1. Reports to Stockholders.

UBS Fixed

Income Funds

June 30, 2014

The UBS Funds—Fixed Income

Annual Report

|

Table of contents |

|||||||

|

President's letter |

1 |

||||||

|

Market commentary |

3 | ||||||

|

Fixed Income |

|||||||

|

UBS Core Plus Bond Fund |

5 | ||||||

|

UBS Emerging Markets Debt Fund |

19 | ||||||

|

UBS Fixed Income Opportunities Fund |

31 | ||||||

|

Explanation of expense disclosure |

51 | ||||||

|

Statement of assets and liabilities |

54 | ||||||

|

Statement of operations |

58 | ||||||

|

Statement of changes in net assets |

60 | ||||||

|

Financial highlights |

62 | ||||||

|

Notes to financial statements |

68 | ||||||

|

Report of independent registered public accounting firm |

90 | ||||||

|

General information |

91 | ||||||

|

Board approval of investment advisory agreements |

92 | ||||||

|

Trustee and Officer information |

97 | ||||||

|

Federal tax information |

103 | ||||||

This page intentionally left blank.

President's letter

August 14, 2014

Dear Shareholder,

Investors cheered earlier this year as the bull market in US equities turned five years old. It has been a remarkable five years for US equity investors. In the depths of the "Great Recession," on March 9, 2009, the S&P 500 closed at 676.53, but on the same date this year, the index closed at 1,878.04, a gain of 178%. The anniversary of the equity bull market has inspired much reflection among investors, as opposing arguments have formed about the longevity of the market going forward.

Currently, both bullish and bearish investors have compelling arguments to support their positions. The case for a continuation of the bull market rests on expectations of low inflation, continued economic and corporate growth, and rising equity valuations. In this view, further equity market gains will be driven by a low inflationary environment, downward trending unemployment, continued consumer deleveraging and rising confidence, as well as increasing capital expenditures as corporations begin to focus on expansion. Conversely, the case for a market correction rests on assumptions of declining valuations, deteriorating profit margins and earnings disappointments. Those who support this view believe that a market correction could be led by rising interest rates, equity valuations that may appear to be overstretched versus historical averages and profit margins that, while currently above historical levels, may regress back toward their long-term mean. For mutual fund shareholders, however, long-term success will have less to do with how long the equity bull market runs and more with a long-term investment approach that will help achieve their desired outcomes despite the ups and downs of markets.

At UBS Global Asset Management, we are focused on managing funds that achieve our clients' objectives through sustainable investment outcomes. In addition to single-strategy, equity and fixed-income products, we have added funds that utilize innovative diversifiers intended to soften the impact of market swings. These funds diversify risk through strategies that are not bound by benchmarks, are expected often to benefit from both rising and falling security prices, and utilize cost-effective defensive investment strategies. UBS Global Asset Management was among the early leaders to evolve its product offerings with the intention of providing sustainable returns in up and down markets using these strategies. We believe that diversification is paramount to successful investment outcomes, irrespective of market conditions, and we will continue to offer clients products that aim to mitigate downside risk and provide durable returns through both up and down market cycles.

I am pleased to share that the client focus, investment discipline and strength of our firm recently garnered a prestigious accolade from Euromoney magazine. In its July 2014 issue, Euromoney named UBS "Best Global Bank," describing our firm as "a global wealth manager first and foremost, underpinned by a Swiss universal bank and a powerful asset management business...." This award is just one measure of how UBS is succeeding as a business by focusing on meeting clients' needs.

1

President's letter

Whatever the outcome of the current equity bull market, we remain focused on enabling our clients to achieve the outcomes they desire. As we continue to evolve our funds to provide sustainable performance in a variety of market conditions, we rely on our firm's client-oriented culture to guide everything we do. We embrace the responsibility of helping our clients meet their financial objectives and thank you for your continued trust in our skill and commitment to serve you.

Sincerely,

Mark E. Carver

President

The UBS Funds

Managing Director

UBS Global Asset Management (Americas) Inc.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. A prospectus or summary prospectus for the funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

2

The markets in review

Improving growth in the developed world

After three consecutive years of generally modest growth, the overall US economy contracted in the first quarter of 2014. Looking back, gross domestic product ("GDP") in the US grew at annualized rates of 4.5% and 3.5% during the third and fourth quarters of 2013, respectively. The Commerce Department then reported that first quarter 2014 GDP contracted at a 2.1% annualized rate. This was the first negative reading since the first quarter of 2011 and the downturn was partially attributed to severe winter weather in parts of the country. However, this proved to be a temporary setback for the economy, as GDP growth was 4.0% during the second quarter of 2014.1

The Federal Reserve Board (the "Fed") took a number of actions during the reporting period. In December 2013, the Fed announced that it would begin paring back its monthly asset purchases, stating "Beginning in January, the Committee will add to its holdings of agency mortgage-backed securities at a [reduced] pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a [reduced] pace of $40 billion per month rather than $45 billion per month." At its meetings in January, March, April and June 2014, the Fed said it would further taper its asset purchases, in each case paring its total purchases a total of $10 billion per month. Beginning in July, it will buy a total of $35 billion per month ($15 billion per month of agency mortgage-backed securities and $20 billion per month of longer-term Treasuries). In the Fed's official statement it stated, "Information received since the Federal Open Market Committee met in April indicates that growth in economic activity has rebounded in recent months. Labor market indicators generally showed further improvement. The unemployment rate, though lower, remains elevated. Household spending appears to be rising moderately and business fixed investment resumed its advance, while the recovery in the housing sector remained slow."

Growth outside the US generally improved. In its April 2014 World Economic Outlook Update, the International Monetary Fund ("IMF") reported that "Global activity has broadly strengthened and is expected to improve further in 2014-15, with much of the impetus coming from advanced economies." From a regional perspective, the IMF anticipates 2014 growth will be 1.2% in the Eurozone, versus a 0.5% contraction in 2013. Economic activity in Japan is expected to be relatively stable, with growth of 1.4% in 2014, compared with 1.5% in 2013. After decelerating in 2013, the IMF projects that overall growth in emerging market countries will experience an uptick to 4.9% in 2014, versus 4.7% in 2013.

1 Based on the Commerce Department's first estimate announced on July 30, 2014, after the reporting period had ended.

3

The markets in review

The fixed income market performs well

The fixed income market surprised many investors, as it posted positive results during the reporting period as a whole. During the first half of the period, US Treasury yields moved higher and negatively impacted the overall bond market (yields and bond prices move in opposite directions). This was due to a number of factors, including continued economic growth and expectations that the Fed would begin tapering its asset purchase program. However, as discussed, the US economy weakened during the first quarter of 2014, and geopolitical concerns triggered several flights to quality. All told, the yield on the 10-year Treasury fell from 3.04% to 2.53% during the first six months of 2014. The overall US bond market, as measured by the Barclays US Aggregate Index,2 gained 4.37% during the 12 month reporting period and the US taxable spread sectors (non-US Treasury fixed income securities) generated positive absolute returns. Taking on greater risk was often rewarded, as investors looked to generate incremental yield in the low interest rate environment. For example, high yield bonds, as measured by the BofA Merrill Lynch US High Yield Cash Pay Constrained Index3 rose 11.70% during the reporting period. Elsewhere, emerging markets debt, as measured by the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global),4 gained 11.05%.

2 The Barclays US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. Investors should note that indices do not reflect the deduction of fees and expenses.

3 The BofA Merrill Lynch US High Yield Cash Pay Constrained Index is an unmanaged index of publicly placed non-convertible, coupon-bearing US dollar denominated below investment grade corporate debt with a term to maturity of at least one year. The index is market capitalization weighted, so that larger bond issuers have a greater effect on the index's return. However, the representation of any single bond issuer is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees and expenses.

4 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which is designed to track total returns for US dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees and expenses.

4

UBS Core Plus Bond Fund

Portfolio performance

For the 12 months ended June 30, 2014, Class A shares of UBS Core Plus Bond Fund (the "Fund") gained 5.68% (Class A shares returned 0.92% after the deduction of the maximum sales charge), while Class Y shares gained 6.08%. The Fund's benchmark, the Barclays US Aggregate Index (the "Index"), returned 4.37% over the same time period. (Class Y shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 7; please note that the Fund's returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund posted a positive return and outperformed the Index during the reporting period, largely due to sector allocation and issue selection.

The Fund used derivatives during the reporting period. Certain interest rate derivatives were utilized to facilitate specific duration and yield curve strategies. Credit derivatives (such as credit default swaps and options on credit default swaps) were used to implement specific credit-related investment strategies as part of the Fund's sector allocation and security selection. Throughout the period, the Fund engaged in foreign exchange forwards to help implement its active currency positions. Derivatives play a role in the overall portfolio construction process, but are just one of the tools we use to manage the Fund's overall risk exposure and to implement the aforementioned strategies. That said, overall, spread sector1 management was additive to performance, duration and yield curve positioning detracted from performance, and currency management produced mixed results, but on the balance was moderately negative.

Portfolio performance summary2

What worked

• Overall, sector allocation contributed to performance during the reporting period.

– We tactically adjusted the Fund's exposure to investment grade corporate bonds and commercial mortgage-backed securities ("CMBS"). For the majority of the period, we had overweight positions in these sectors, which was beneficial for performance given generally solid demand from investors seeking yield in the low interest rate environment.

• An allocation to high yield corporate bonds was beneficial. The Fund tactically had an out-of-Index exposure to high yield bonds, which benefited performance over the reporting period. High yield corporate bonds were supported by the low default environment and investor demand for income and yield oriented assets.

• Security selection was additive to performance.

– Security selection of investment grade corporate bonds and CMBS contributed to performance.

– Within the investment grade corporate bond sector we generally maintained exposure to select industrial and financial credits, which benefited performance.

1 A spread sector refers to non-government fixed income sectors, such as investment grade or high yield bonds, commercial mortgage-backed securities (CMBS), etc.

2 For a detailed commentary on the market environment in general during the reporting period, see page 3.

5

UBS Core Plus Bond Fund

What didn't work

• From a currency perspective, our positioning in the euro detracted from results.

– We traded the euro with a bias toward being short. This detracted from results, as the euro strengthened versus the US dollar over the 12 month period.

• Duration positioning in the latter half of the reporting period was negative for results. We generally maintained a short duration bias during the first half of 2014. This was not rewarded, as interest rates fell due to weaker than expected economic data and geopolitical concerns.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2014. The views and opinions in the letter were current as of August 14, 2014. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com/globalam-us.

6

UBS Core Plus Bond Fund

Average annual total returns for periods ended 06/30/14 (unaudited)

|

1 year |

5 years |

10 years |

|||||||||||||

|

Before deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

5.68 |

% |

6.14 |

% |

2.92 |

% |

|||||||||

|

Class C2 |

5.30 |

5.61 |

2.40 |

||||||||||||

|

Class Y3 |

6.08 |

6.41 |

3.18 |

||||||||||||

|

After deducting maximum sales charge |

|||||||||||||||

|

Class A1 |

0.92 |

% |

5.18 |

% |

2.45 |

% |

|||||||||

|

Class C2 |

4.55 |

5.61 |

2.40 |

||||||||||||

|

Barclays US Aggregate Index4 |

4.37 |

% |

4.85 |

% |

4.93 |

% |

|||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2013 prospectuses were as follows: Class A—1.59% and 0.65%; Class C—2.03% and 1.15%; Class Y—1.21% and 0.40%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short), through the period ending October 28, 2014, do not exceed 0.64% for Class A shares, 1.14% for Class C shares and 0.39% for Class Y shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, UBS Global AM (Americas)'s three year recoupment rights will survive.

1 Maximum sales charge for Class A shares is 4.5%. Class A shares bear ongoing 12b-1 service fees.

2 Maximum contingent deferred sales charge for Class C shares is 0.75% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 distribution and service fees.

3 The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 distribution and service fees.

4 The Barclays US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. Investors should note that indices do not reflect the deduction of fees and expenses.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

7

UBS Core Plus Bond Fund

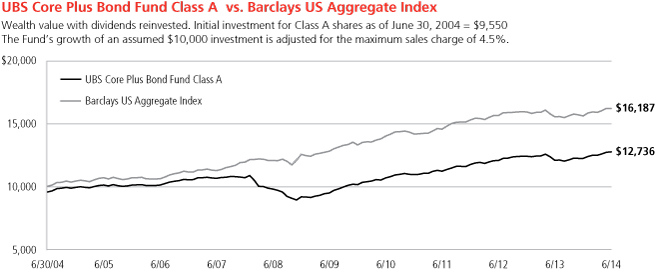

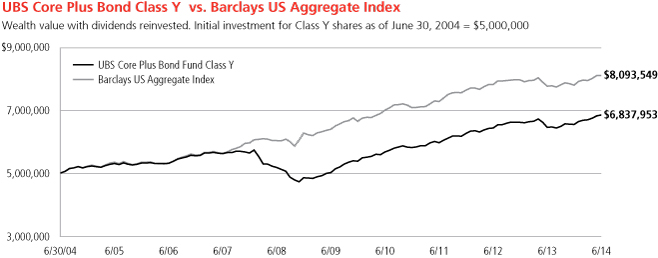

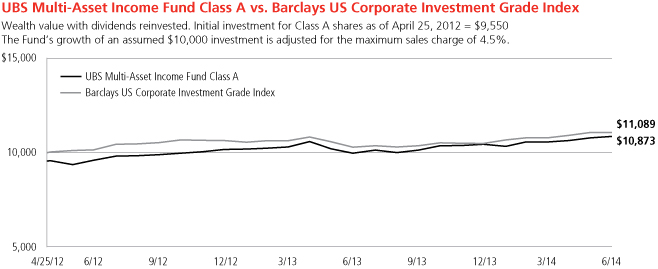

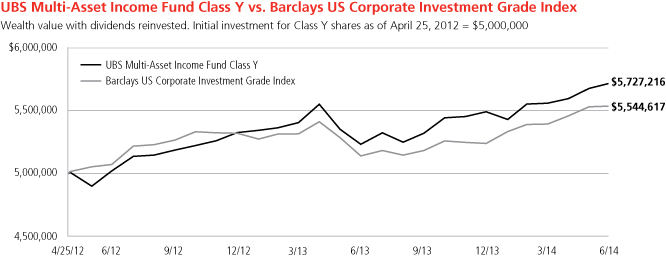

Illustration of an assumed investment of $10,000 in Class A shares (adjusted for 4.5% maximum sales charge) and $5,000,000 in Class Y shares (unaudited)

The following two graphs depict the performance of UBS Core Plus Bond Fund Class A and Class Y shares versus the Barclays US Aggregate Index over the 10 years ended June 30, 2014. The performance of Class C shares will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://globalam-us.ubs.com/corpweb/performance.do.

8

UBS Core Plus Bond Fund

Top ten long-term fixed income holdings (unaudited)1

As of June 30, 2014

|

Percentage of net assets |

|||||||

|

US Treasury Bond, 3.375%, due 05/15/44 |

3.8 |

% |

|||||

|

US Treasury Inflation Indexed Notes (TIPS), 0.125%, due 04/15/18 |

2.6 |

||||||

|

Federal National Mortgage Association Pools, 3.500%, TBA |

2.1 |

||||||

|

Federal National Mortgage Association Pools, 4.000%, TBA |

1.9 |

||||||

|

Government National Mortgage Association Pools, 4.000%, TBA |

1.8 |

||||||

|

Government National Mortgage Association Pools, 4.500%, TBA |

1.7 |

||||||

|

Federal National Mortgage Association Pools, 3.000%, TBA |

1.6 |

||||||

|

Federal National Mortgage Association Pools, #AE9202, 4.000%, due 09/01/41 |

1.5 |

||||||

|

Federal National Mortgage Association Pools, #AT2725, 3.000%, due 05/01/43 |

1.4 |

||||||

|

Federal National Mortgage Association Pools, 5.000%, TBA |

1.3 |

||||||

|

Total |

19.7 |

% |

|||||

Industry diversification (unaudited)1

As a percentage of net assets as of June 30, 2014

|

Bonds |

|||||||

|

Corporate bonds |

|||||||

|

Banks |

5.21 |

% |

|||||

|

Beverages |

0.26 |

||||||

|

Biotechnology |

0.17 |

||||||

|

Building products |

0.08 |

||||||

|

Capital markets |

1.75 |

||||||

|

Chemicals |

0.63 |

||||||

|

Commercial services & supplies |

0.30 |

||||||

|

Communications equipment |

0.45 |

||||||

|

Consumer finance |

1.10 |

||||||

|

Diversified financial services |

0.22 |

||||||

|

Diversified telecommunication services |

0.94 |

||||||

|

Electric utilities |

0.72 |

||||||

|

Electronic equipment, instruments & components |

0.28 |

||||||

|

Energy equipment & services |

0.54 |

||||||

|

Food & staples retailing |

0.17 |

||||||

|

Food products |

0.34 |

||||||

|

Health care providers & services |

0.20 |

||||||

|

Hotels, restaurants & leisure |

0.22 |

||||||

|

Independent power and renewable electricity producers |

0.04 |

||||||

|

Insurance |

2.26 |

||||||

|

IT services |

0.30 |

||||||

|

Media |

1.44 |

||||||

|

Metals & mining |

1.77 |

||||||

|

Multi-utilities |

0.33 |

||||||

|

Oil, gas & consumable fuels |

6.97 |

||||||

|

Pharmaceuticals |

0.60 |

||||||

|

Real estate investment trust (REIT) |

0.79 |

||||||

|

Road & rail |

0.79 |

||||||

|

Semiconductors & semiconductor equipment |

0.16 |

||||||

|

Tobacco |

0.65 |

||||||

|

Trading companies & distributors |

0.35 |

||||||

|

Wireless telecommunication services |

0.60 |

||||||

|

Total corporate bonds |

30.63 |

% |

|||||

|

Asset-backed securities |

1.59 |

||||||

|

Commercial mortgage-backed securities |

9.08 |

||||||

|

Mortgage & agency debt securities |

31.97 |

||||||

|

Municipal bonds |

1.79 |

||||||

|

US government obligations |

9.05 |

||||||

|

Non-US government obligations |

1.54 |

||||||

|

Total bonds |

85.65 |

% |

|||||

|

Investment company |

|||||||

|

UBS High Yield Relationship Fund |

5.62 |

||||||

|

Short-term investments |

32.31 |

||||||

|

Options purchased |

0.29 |

||||||

|

Investment of cash collateral from securities loaned |

0.78 |

||||||

|

Total investments |

124.65 |

% |

|||||

|

Liabilities, in excess of cash and other assets |

(24.65 |

) |

|||||

|

Net assets |

100.00 |

% |

|||||

1 Figures represent the direct investments of UBS Core Plus Bond Fund. Figures might be different if a breakdown of the underlying investment companies was included.

9

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

|

Face amount |

Value |

||||||||||

|

Bonds: 85.65% |

|||||||||||

|

Corporate bonds: 30.63% |

|||||||||||

|

Brazil: 1.81% |

|||||||||||

|

Caixa Economica Federal, 2.375%, due 11/06/171 |

$ |

150,000 |

$ |

146,250 |

|||||||

|

Petrobras Global Finance BV, 3.250%, due 03/17/17 |

150,000 |

152,931 |

|||||||||

|

Petrobras International Finance Co., 5.375%, due 01/27/212 |

120,000 |

124,380 |

|||||||||

|

Vale Overseas Ltd., 4.375%, due 01/11/222 |

85,000 |

87,270 |

|||||||||

|

6.875%, due 11/21/36 |

30,000 |

33,211 |

|||||||||

|

Total Brazil corporate bonds |

544,042 |

||||||||||

|

Canada: 1.09% |

|||||||||||

|

Barrick Gold Corp., 3.850%, due 04/01/22 |

90,000 |

89,543 |

|||||||||

|

Cenovus Energy, Inc., 3.800%, due 09/15/23 |

100,000 |

103,086 |

|||||||||

|

Goldcorp, Inc., 3.700%, due 03/15/23 |

40,000 |

39,453 |

|||||||||

|

Rogers Communications, Inc., 5.000%, due 03/15/44 |

50,000 |

52,141 |

|||||||||

|

Teck Resources Ltd., 6.250%, due 07/15/41 |

40,000 |

43,424 |

|||||||||

|

Total Canada corporate bonds |

327,647 |

||||||||||

|

Cayman Islands: 0.08% |

|||||||||||

|

XLIT Ltd., 6.375%, due 11/15/24 |

21,000 |

25,384 |

|||||||||

|

China: 0.66% |

|||||||||||

|

Sinopec Group Overseas Development 2013 Ltd., 2.500%, due 10/17/181 |

200,000 |

199,728 |

|||||||||

|

France: 0.34% |

|||||||||||

|

BNP Paribas SA, 2.700%, due 08/20/18 |

100,000 |

102,301 |

|||||||||

|

Israel: 0.50% |

|||||||||||

|

Teva Pharmaceutical Finance Co. BV, 2.400%, due 11/10/16 |

70,000 |

72,175 |

|||||||||

|

Teva Pharmaceutical Finance IV BV, 3.650%, due 11/10/21 |

75,000 |

76,966 |

|||||||||

|

Total Israel corporate bonds |

149,141 |

||||||||||

|

Mexico: 0.69% |

|||||||||||

|

America Movil SAB de CV, 5.000%, due 03/30/20 |

115,000 |

127,652 |

|||||||||

|

Petroleos Mexicanos, 4.875%, due 01/24/222 |

75,000 |

81,135 |

|||||||||

|

Total Mexico corporate bonds |

208,787 |

||||||||||

|

Face amount |

Value |

||||||||||

|

Netherlands: 0.14% |

|||||||||||

|

LYB International Finance BV, 4.875%, due 03/15/44 |

$ |

40,000 |

$ |

41,704 |

|||||||

|

Norway: 0.33% |

|||||||||||

|

Eksportfinans ASA, 3.000%, due 11/17/14 |

100,000 |

100,610 |

|||||||||

|

Spain: 0.86% |

|||||||||||

|

Santander US Debt SA Unipersonal, 3.724%, due 01/20/151 |

100,000 |

101,480 |

|||||||||

|

Telefonica Emisiones SAU, 3.192%, due 04/27/18 |

150,000 |

156,761 |

|||||||||

|

Total Spain corporate bonds |

258,241 |

||||||||||

|

United Kingdom: 1.53% |

|||||||||||

|

Barclays Bank PLC, 5.140%, due 10/14/20 |

100,000 |

109,530 |

|||||||||

|

HSBC Holdings PLC, 6.500%, due 09/15/37 |

100,000 |

123,306 |

|||||||||

|

Imperial Tobacco Finance PLC, 3.500%, due 02/11/231 |

110,000 |

108,980 |

|||||||||

|

Lloyds Bank PLC, 6.500%, due 09/14/201,2 |

100,000 |

117,377 |

|||||||||

|

Total United Kingdom corporate bonds |

459,193 |

||||||||||

|

United States: 22.60% |

|||||||||||

|

21st Century Fox America, Inc., 6.200%, due 12/15/34 |

35,000 |

42,847 |

|||||||||

|

ADT Corp., 3.500%, due 07/15/22 |

100,000 |

91,000 |

|||||||||

|

Ally Financial, Inc., 8.000%, due 03/15/20 |

10,000 |

12,150 |

|||||||||

|

Altria Group, Inc., 5.375%, due 01/31/44 |

50,000 |

54,767 |

|||||||||

|

9.950%, due 11/10/38 |

18,000 |

29,985 |

|||||||||

|

Anadarko Petroleum Corp., 5.950%, due 09/15/16 |

95,000 |

105,218 |

|||||||||

|

6.450%, due 09/15/36 |

50,000 |

63,762 |

|||||||||

|

Anheuser-Busch InBev Worldwide, Inc., 8.200%, due 01/15/39 |

50,000 |

76,509 |

|||||||||

|

Bank of America Corp., 5.625%, due 07/01/20 |

75,000 |

86,283 |

|||||||||

|

6.110%, due 01/29/37 |

100,000 |

115,364 |

|||||||||

|

6.875%, due 04/25/18 |

60,000 |

70,688 |

|||||||||

|

Berkshire Hathaway Finance Corp., 3.000%, due 05/15/22 |

35,000 |

35,192 |

|||||||||

|

Boston Properties LP, REIT, 3.800%, due 02/01/24 |

60,000 |

60,678 |

|||||||||

|

Celgene Corp., 4.000%, due 08/15/23 |

50,000 |

52,070 |

|||||||||

10

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

|

Face amount |

Value |

||||||||||

|

Bonds—(Continued) |

|||||||||||

|

Corporate bonds—(Continued) |

|||||||||||

|

United States—(Continued) |

|||||||||||

|

CF Industries, Inc., 3.450%, due 06/01/23 |

$ |

150,000 |

$ |

148,678 |

|||||||

|

CIT Group, Inc., 5.500%, due 02/15/191 |

10,000 |

10,837 |

|||||||||

|

Citigroup, Inc., 5.375%, due 08/09/20 |

40,000 |

45,838 |

|||||||||

|

5.500%, due 09/13/25 |

200,000 |

223,094 |

|||||||||

|

6.125%, due 05/15/18 |

55,000 |

63,367 |

|||||||||

|

8.500%, due 05/22/19 |

65,000 |

83,082 |

|||||||||

|

Comcast Corp., 6.300%, due 11/15/17 |

45,000 |

52,320 |

|||||||||

|

6.950%, due 08/15/37 |

25,000 |

33,701 |

|||||||||

|

Continental Resources, Inc., 4.900%, due 06/01/441 |

50,000 |

51,665 |

|||||||||

|

DIRECTV Holdings LLC, 6.000%, due 08/15/40 |

40,000 |

46,053 |

|||||||||

|

DISH DBS Corp., 7.875%, due 09/01/19 |

10,000 |

11,875 |

|||||||||

|

DPL, Inc., 7.250%, due 10/15/21 |

85,000 |

93,500 |

|||||||||

|

El Paso Pipeline Partners Operating Co., LLC, 5.000%, due 10/01/21 |

80,000 |

87,460 |

|||||||||

|

Energy Transfer Partners LP, 5.200%, due 02/01/22 |

105,000 |

116,194 |

|||||||||

|

9.000%, due 04/15/19 |

130,000 |

166,130 |

|||||||||

|

ERAC USA Finance LLC, 2.800%, due 11/01/181 |

80,000 |

82,626 |

|||||||||

|

ERP Operating LP, REIT, 4.750%, due 07/15/20 |

35,000 |

39,076 |

|||||||||

|

FirstEnergy Transmission LLC, 5.450%, due 07/15/441 |

40,000 |

40,528 |

|||||||||

|

Flextronics International Ltd., 5.000%, due 02/15/23 |

80,000 |

82,694 |

|||||||||

|

Ford Motor Credit Co. LLC, 8.125%, due 01/15/20 |

250,000 |

319,198 |

|||||||||

|

Frontier Communications Corp., 8.500%, due 04/15/20 |

10,000 |

11,800 |

|||||||||

|

General Electric Capital Corp., Series A, 6.750%, due 03/15/32 |

50,000 |

65,958 |

|||||||||

|

Glencore Funding LLC, 2.500%, due 01/15/191 |

120,000 |

119,695 |

|||||||||

|

Goldman Sachs Group, Inc., 5.750%, due 01/24/22 |

80,000 |

92,575 |

|||||||||

|

6.150%, due 04/01/18 |

100,000 |

114,682 |

|||||||||

|

Hartford Financial Services Group, Inc., 5.950%, due 10/15/36 |

80,000 |

96,507 |

|||||||||

|

Host Hotels & Resorts LP, Series D, 3.750%, due 10/15/23 |

60,000 |

59,459 |

|||||||||

|

Face amount |

Value |

||||||||||

|

International Lease Finance Corp., 7.125%, due 09/01/181 |

$ |

90,000 |

$ |

104,400 |

|||||||

|

Kinder Morgan Energy Partners LP, 3.950%, due 09/01/22 |

145,000 |

148,306 |

|||||||||

|

6.500%, due 09/01/39 |

45,000 |

53,085 |

|||||||||

|

Kroger Co., 3.850%, due 08/01/23 |

50,000 |

51,373 |

|||||||||

|

Marathon Oil Corp., 6.600%, due 10/01/37 |

30,000 |

38,663 |

|||||||||

|

Markel Corp., 3.625%, due 03/30/23 |

40,000 |

39,906 |

|||||||||

|

Marsh & McLennan Cos., Inc., 9.250%, due 04/15/19 |

65,000 |

84,844 |

|||||||||

|

Maxim Integrated Products, Inc., 3.375%, due 03/15/23 |

50,000 |

48,813 |

|||||||||

|

Mondelez International, Inc., 4.000%, due 02/01/24 |

100,000 |

103,579 |

|||||||||

|

Morgan Stanley, 4.875%, due 11/01/22 |

45,000 |

48,304 |

|||||||||

|

7.300%, due 05/13/19 |

200,000 |

244,549 |

|||||||||

|

Motorola Solutions, Inc., 3.500%, due 03/01/23 |

140,000 |

135,451 |

|||||||||

|

Mylan, Inc., 2.550%, due 03/28/19 |

30,000 |

30,220 |

|||||||||

|

Northern Trust Corp., 3.950%, due 10/30/25 |

25,000 |

25,982 |

|||||||||

|

NRG Energy, Inc., 8.250%, due 09/01/20 |

10,000 |

10,925 |

|||||||||

|

Owens Corning, 6.500%, due 12/01/16 |

21,000 |

23,420 |

|||||||||

|

Petrohawk Energy Corp., 7.250%, due 08/15/18 |

185,000 |

193,325 |

|||||||||

|

Plains Exploration & Production Co., 6.500%, due 11/15/20 |

60,000 |

66,975 |

|||||||||

|

6.875%, due 02/15/23 |

60,000 |

70,200 |

|||||||||

|

PPL Capital Funding, Inc., 3.950%, due 03/15/24 |

30,000 |

31,161 |

|||||||||

|

Principal Financial Group, Inc., 8.875%, due 05/15/19 |

90,000 |

116,196 |

|||||||||

|

Prudential Financial, Inc., 5.200%, due 03/15/443 |

95,000 |

96,900 |

|||||||||

|

6.625%, due 12/01/37 |

145,000 |

186,573 |

|||||||||

|

Regions Financial Corp., 2.000%, due 05/15/18 |

70,000 |

69,754 |

|||||||||

|

Ryder System, Inc., 2.350%, due 02/26/19 |

75,000 |

75,617 |

|||||||||

|

2.550%, due 06/01/19 |

80,000 |

80,984 |

|||||||||

|

Sempra Energy, 9.800%, due 02/15/19 |

75,000 |

99,671 |

|||||||||

|

Southern Copper Corp., 3.500%, due 11/08/22 |

50,000 |

48,688 |

|||||||||

|

Southwestern Electric Power Co., 3.550%, due 02/15/22 |

50,000 |

51,289 |

|||||||||

11

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

|

Face amount |

Value |

||||||||||

|

Bonds—(Continued) |

|||||||||||

|

Corporate bonds—(Concluded) |

|||||||||||

|

United States—(Concluded) |

|||||||||||

|

TCI Communications, Inc., 7.875%, due 02/15/26 |

$ |

50,000 |

$ |

69,992 |

|||||||

|

Tenet Healthcare Corp., 6.000%, due 10/01/20 |

10,000 |

10,850 |

|||||||||

|

Time Warner Cable, Inc., 6.550%, due 05/01/37 |

35,000 |

43,550 |

|||||||||

|

Time Warner Entertainment Co. LP, 8.375%, due 03/15/23 |

120,000 |

162,292 |

|||||||||

|

Time Warner, Inc., 6.100%, due 07/15/40 |

35,000 |

41,084 |

|||||||||

|

Transocean, Inc., 3.800%, due 10/15/22 |

65,000 |

64,332 |

|||||||||

|

6.800%, due 03/15/38 |

85,000 |

96,947 |

|||||||||

|

Valero Energy Corp., 6.625%, due 06/15/37 |

110,000 |

136,679 |

|||||||||

|

Ventas Realty LP, 3.750%, due 05/01/24 |

50,000 |

49,932 |

|||||||||

|

Ventas Realty LP/Ventas Capital Corp., 2.700%, due 04/01/20 |

80,000 |

79,620 |

|||||||||

|

Verizon Communications, Inc., 1.981%, due 09/14/183 |

50,000 |

52,753 |

|||||||||

|

6.400%, due 09/15/33 |

50,000 |

61,247 |

|||||||||

|

Williams Cos., Inc., 3.700%, due 01/15/232 |

90,000 |

86,574 |

|||||||||

|

Williams Partners LP, 4.300%, due 03/04/24 |

50,000 |

52,145 |

|||||||||

|

Wyndham Worldwide Corp., 5.625%, due 03/01/21 |

60,000 |

67,624 |

|||||||||

|

Xerox Corp., 3.800%, due 05/15/24 |

90,000 |

89,513 |

|||||||||

|

Total United States corporate bonds |

6,799,392 |

||||||||||

|

Total corporate bonds (cost $8,892,252) |

9,216,170 |

||||||||||

|

Asset-backed securities: 1.59% |

|||||||||||

|

United States: 1.59% |

|||||||||||

|

AmeriCredit Automobile Receivables Trust, Series 2014-1, Class D, 2.540%, due 06/08/20 |

125,000 |

125,657 |

|||||||||

|

Capital Auto Receivables Asset Trust, Series 2013-3, Class B, 2.320%, due 07/20/18 |

150,000 |

152,942 |

|||||||||

|

Ford Credit Auto Owner Trust, Series 2014-A, Class C, 1.900%, due 09/15/19 |

175,000 |

176,110 |

|||||||||

|

Renaissance Home Equity Loan Trust, Series 2006-4, Class AF1, 5.545%, due 01/25/374 |

39,597 |

24,224 |

|||||||||

|

Total asset-backed securities (cost $486,522) |

478,933 |

||||||||||

|

Face amount |

Value |

||||||||||

|

Commercial mortgage-backed securities: 9.08% |

|||||||||||

|

United States: 9.08% |

|||||||||||

|

Boca Hotel Portfolio Trust, Series 2013-BOCA, Class D, 3.202%, due 08/15/261,3 |

$ |

150,000 |

$ |

150,429 |

|||||||

|

CG-CCRE Commercial Mortgage Trust, Series 2014-FL1, Class C, 1.902%, due 06/15/311,3,5 |

225,000 |

225,000 |

|||||||||

|

Commercial Mortage Loan Trust, Series 2008-LS1, Class A4B, 6.213%, due 12/10/493 |

250,000 |

275,426 |

|||||||||

|

Commercial Mortgage Pass Through Certificates, Series 2013-GAM, Class B, 3.531%, due 02/10/281,3 |

200,000 |

197,388 |

|||||||||

|

Series 2013-LC13, Class C, 5.217%, due 08/10/461,3 |

200,000 |

217,500 |

|||||||||

|

FDIC Structured Sale Guaranteed Notes, Series 2010-C1, Class A, 2.980%, due 12/06/201 |

126,599 |

131,474 |

|||||||||

|

Greenwich Capital Commercial Funding Corp., Series 2007-GG11, Class A4, 5.736%, due 12/10/49 |

88,000 |

97,830 |

|||||||||

|

Hilton USA Trust, Series 2013-HLT, Class DFX, 4.407%, due 11/05/301 |

100,000 |

103,551 |

|||||||||

|

JP Morgan Chase Commercial Mortgage Securities Corp., Series 2007-LD11, Class A4, 5.991%, due 06/15/493 |

275,000 |

302,409 |

|||||||||

|

Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C7, Class B, 3.769%, due 02/15/46 |

50,000 |

50,264 |

|||||||||

|

Series 2013-C10, Class C, 4.218%, due 07/15/463 |

100,000 |

99,769 |

|||||||||

|

Series 2014-C14, Class C, 4.996%, due 02/15/473 |

125,000 |

131,705 |

|||||||||

|

Morgan Stanley Re-REMIC Trust, Series 2009-GG10, Class A4B, 5.997%, due 08/12/451,3 |

175,000 |

191,787 |

|||||||||

|

Wachovia Bank Commercial Mortgage Trust, Series 2007-C34, Class AM, 5.818%, due 05/15/463 |

125,000 |

138,545 |

|||||||||

|

Series 2007-C32, Class A3, 5.933%, due 06/15/493 |

175,000 |

191,494 |

|||||||||

|

WF-RBS Commercial Mortgage Trust, Series 2013-C12, Class B, 3.863%, due 03/15/483 |

225,000 |

228,208 |

|||||||||

|

Total commercial mortgage-backed securities (cost $2,745,390) |

2,732,779 |

||||||||||

12

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

|

Face amount |

Value |

||||||||||

|

Bonds—(Concluded) |

|||||||||||

|

Mortgage & agency debt securities: 31.97% |

|||||||||||

|

United States: 31.97% |

|||||||||||

|

Federal Home Loan Mortgage Corp. Gold Pools,6 3.500%, TBA |

$ |

125,000 |

$ |

128,486 |

|||||||

| 4.000%, TBA |

125,000 |

132,422 |

|||||||||

| 4.500%, TBA |

100,000 |

108,228 |

|||||||||

|

#A96140, 4.000%, due 01/01/41 |

103,875 |

110,193 |

|||||||||

|

#FG A96792, 4.500%, due 02/01/41 |

54,381 |

59,084 |

|||||||||

|

#G08451, 4.500%, due 06/01/41 |

137,357 |

148,769 |

|||||||||

|

#C63008, 6.000%, due 01/01/32 |

58,480 |

65,662 |

|||||||||

|

#G01717, 6.500%, due 11/01/29 |

52,303 |

59,518 |

|||||||||

|

Federal National Mortgage Association Pools,6 2.500%, TBA |

375,000 |

380,918 |

|||||||||

| 3.000%, TBA |

700,000 |

701,695 |

|||||||||

| 3.500%, TBA |

875,000 |

909,082 |

|||||||||

| 4.000%, TBA |

550,000 |

583,749 |

|||||||||

| 4.500%, TBA |

250,000 |

270,742 |

|||||||||

| 5.000%, TBA |

350,000 |

388,664 |

|||||||||

|

#AP1589, 3.000%, due 08/01/27 |

84,055 |

87,420 |

|||||||||

|

#AT2725, 3.000%, due 05/01/43 |

435,502 |

430,733 |

|||||||||

|

#AP6056, 3.000%, due 07/01/43 |

71,441 |

70,659 |

|||||||||

|

#AS0302, 3.000%, due 08/01/43 |

25,585 |

25,305 |

|||||||||

|

#AU3735, 3.000%, due 08/01/43 |

97,938 |

96,866 |

|||||||||

|

#AV1735, 3.000%, due 11/01/43 |

74,642 |

73,824 |

|||||||||

|

#AP3098, 3.500%, due 10/01/42 |

102,536 |

105,743 |

|||||||||

|

#AQ0600, 3.500%, due 10/01/42 |

112,865 |

116,500 |

|||||||||

|

#AH4568, 4.000%, due 03/01/41 |

107,389 |

114,129 |

|||||||||

|

#AE9202, 4.000%, due 09/01/41 |

413,552 |

439,894 |

|||||||||

|

#AE0106, 4.500%, due 06/01/40 |

1,271 |

1,377 |

|||||||||

|

#AI6578, 4.500%, due 07/01/41 |

298,785 |

323,717 |

|||||||||

|

#AS1587, 4.500%, due 01/01/44 |

49,902 |

54,089 |

|||||||||

|

#890209, 5.000%, due 05/01/40 |

191,276 |

212,940 |

|||||||||

|

#AD9114, 5.000%, due 07/01/40 |

238,801 |

266,358 |

|||||||||

|

#AJ1422, 5.000%, due 09/01/41 |

187,030 |

208,391 |

|||||||||

|

#688066, 5.500%, due 03/01/33 |

108,801 |

123,530 |

|||||||||

|

#688314, 5.500%, due 03/01/33 |

117,535 |

133,493 |

|||||||||

|

#802481, 5.500%, due 11/01/34 |

209,218 |

236,280 |

|||||||||

|

#408267, 6.000%, due 03/01/28 |

13,764 |

15,676 |

|||||||||

|

#323715, 6.000%, due 05/01/29 |

9,047 |

10,315 |

|||||||||

|

#676733, 6.000%, due 01/01/33 |

77,326 |

87,604 |

|||||||||

|

#831730, 6.500%, due 09/01/36 |

91,534 |

103,209 |

|||||||||

|

First Horizon Asset Securities, Inc., Series 2004-FL1, Class 1A1, 0.422%, due 02/25/353 |

45,346 |

40,955 |

|||||||||

|

Government National Mortgage Association Pools, 3.000%, TBA |

250,000 |

252,344 |

|||||||||

| 3.500%, TBA |

350,000 |

364,574 |

|||||||||

| 4.000%, TBA |

675,000 |

722,000 |

|||||||||

| 4.500%, TBA |

475,000 |

518,659 |

|||||||||

|

#G2 AB2784, 3.500%, due 08/20/42 |

89,088 |

92,979 |

|||||||||

|

Face amount |

Value |

||||||||||

|

#G2 779425, 4.000%, due 06/20/42 |

$ |

101,451 |

$ |

108,749 |

|||||||

|

#G2 2687, 6.000%, due 12/20/28 |

17,608 |

19,839 |

|||||||||

|

#G2 2794, 6.000%, due 08/20/29 |

53,191 |

59,763 |

|||||||||

|

#G2 4245, 6.000%, due 09/20/38 |

50,117 |

57,017 |

|||||||||

|

Total mortgage & agency debt securities (cost $9,442,948) |

9,622,143 |

||||||||||

|

Municipal bonds: 1.79% |

|||||||||||

|

Chicago Transit Authority, Series 2008-A, 6.899%, due 12/01/40 |

50,000 |

62,047 |

|||||||||

|

Los Angeles Unified School District, 6.758%, due 07/01/34 |

110,000 |

147,414 |

|||||||||

|

State of California, GO Bonds, 7.300%, due 10/01/39 |

90,000 |

126,750 |

|||||||||

|

State of Illinois, GO Bonds, 5.877%, due 03/01/19 |

180,000 |

201,326 |

|||||||||

|

Total municipal bonds (cost $458,780) |

537,537 |

||||||||||

|

US government obligations: 9.05% |

|||||||||||

|

US Treasury Bonds, 3.375%, due 05/15/44 |

1,150,000 |

1,157,727 |

|||||||||

|

3.625%, due 02/15/442 |

60,000 |

63,319 |

|||||||||

|

US Treasury Inflation Indexed Bonds (TIPS), 1.375%, due 02/15/447 |

150,000 |

167,818 |

|||||||||

|

US Treasury Inflation Indexed Notes (TIPS), 0.125%, due 04/15/187 |

725,000 |

768,052 |

|||||||||

|

0.625%, due 01/15/247 |

300,000 |

315,858 |

|||||||||

|

US Treasury Note, 1.625%, due 04/30/19 |

250,000 |

250,469 |

|||||||||

|

Total US government obligations (cost $2,684,051) |

2,723,243 |

||||||||||

|

Non-US government obligations: 1.54% |

|||||||||||

|

Brazil: 0.69% |

|||||||||||

|

Banco Nacional de Desenvolvimento Economico e Social, 3.375%, due 09/26/161 |

200,000 |

206,750 |

|||||||||

|

Greece: 0.48% |

|||||||||||

|

Hellenic Republic, 2.000%, due 02/24/314,8 |

EUR |

150,000 |

143,875 |

||||||||

|

Turkey: 0.37% |

|||||||||||

|

Republic of Turkey, 6.750%, due 04/03/18 |

$ |

100,000 |

112,750 |

||||||||

|

Total Non-US government obligations (cost $455,353) |

463,375 |

||||||||||

|

Total bonds (cost $25,165,296) |

25,774,180 |

||||||||||

13

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

|

Shares |

Value |

||||||||||

|

Investment company: 5.62% |

|||||||||||

|

UBS High Yield Relationship Fund*9 (cost $1,550,630) |

48,228 |

$ |

1,690,858 |

||||||||

|

Short-term investments: 32.31% |

|||||||||||

|

Investment company: 25.67% |

|||||||||||

|

UBS Cash Management Prime Relationship Fund9 (cost $7,725,321) |

7,725,321 |

7,725,321 |

|||||||||

|

Face amount |

|||||||||||

|

US government obligation: 6.64% |

|||||||||||

|

US Treasury Bill, 0.091%, due 05/28/1510 (cost $1,998,345) |

$ |

2,000,000 |

1,998,300 |

||||||||

|

Total short-term investments (cost $9,723,666) |

9,723,621 |

||||||||||

|

Number of contracts |

|||||||||||

|

Options purchased: 0.29% |

|||||||||||

|

Call options: 0.22% |

|||||||||||

|

2 Year Euro-Dollar Midcurve, strike @ USD 97.88, expires September 2014 |

59 |

64,900 |

|||||||||

|

Number of contracts |

Value |

||||||||||

|

Put options: 0.07% |

|||||||||||

|

2 Year Euro-Dollar Midcurve, strike @ USD 97.88, expires September 2014 |

59 |

$ |

4,425 |

||||||||

|

3 Year Euro-Dollar Midcurve, strike @ USD 97.75, expires June 2016 |

26 |

11,862 |

|||||||||

|

30 Year US Treasury Bonds, strike @ USD 135.00, expires August 2014 |

7 |

4,594 |

|||||||||

|

90 Day Euro-Dollar Time Deposit, strike @ USD 99.25, expires March 2015 |

49 |

1,225 |

|||||||||

|

22,106 |

|||||||||||

|

Total options purchased (cost $171,076) |

87,006 |

||||||||||

|

Shares |

|||||||||||

|

Investment of cash collateral from securities loaned: 0.78% |

|||||||||||

|

UBS Private Money Market Fund LLC9 (cost $236,033) |

236,033 |

236,033 |

|||||||||

|

Total investments: 124.65% (cost $36,846,701) |

37,511,698 |

||||||||||

|

Liabilities, in excess of cash and other assets: (24.65%) |

(7,419,634 |

) |

|||||||||

|

Net assets: 100.00% |

$ |

30,092,064 |

|||||||||

Notes to portfolio of investments

Aggregate cost for federal income tax purposes was $36,805,446; and net unrealized appreciation consisted of:

|

Gross unrealized appreciation |

$ |

911,349 |

|||||

|

Gross unrealized depreciation |

(205,097 |

) |

|||||

|

Net unrealized appreciation of investments |

$ |

706,252 |

|||||

For a listing of defined portfolio acronyms, counterparty abbreviations and currency abbreviations that are used throughout the Portfolio of investments as well as the tables that follow, please refer to page 50. Portfolio footnotes begin on page 17.

Forward foreign currency contracts

|

Counterparty |

Contracts to deliver |

In exchange for |

Maturity date |

Unrealized depreciation |

|||||||||||||||

|

CIBC |

JPY |

30,136,669 |

USD |

295,000 |

09/11/14 |

$ |

(2,640 |

) |

|||||||||||

|

GSI |

CHF |

139,363 |

USD |

155,000 |

09/11/14 |

(2,249 |

) |

||||||||||||

|

JPMCB |

CHF |

240,000 |

USD |

268,133 |

09/11/14 |

(2,670 |

) |

||||||||||||

|

JPMCB |

EUR |

640,000 |

USD |

872,068 |

09/11/14 |

(4,521 |

) |

||||||||||||

|

JPMCB |

JPY |

57,700,000 |

USD |

562,715 |

09/11/14 |

(7,150 |

) |

||||||||||||

|

MSCI |

EUR |

340,000 |

USD |

460,608 |

09/11/14 |

(5,080 |

) |

||||||||||||

|

Net unrealized depreciation on forward foreign currency contracts |

$ |

(24,310 |

) |

||||||||||||||||

14

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

Futures contracts

|

Expiration date |

Cost/ (proceeds) |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||

|

US Treasury futures buy contracts: |

|||||||||||||||||||

|

US Long Bond, 1 contract (USD) |

September 2014 |

$ |

138,220 |

$ |

137,187 |

$ |

(1,033 |

) |

|||||||||||

|

US Ultra Bond, 7 contracts (USD) |

September 2014 |

1,055,116 |

1,049,562 |

(5,554 |

) |

||||||||||||||

|

US Treasury futures sell contracts: |

|||||||||||||||||||

|

5 Year US Treasury Notes, 47 contracts (USD) |

September 2014 |

(5,618,278 |

) |

(5,614,664 |

) |

3,614 |

|||||||||||||

|

10 Year US Treasury Notes, 6 contracts (USD) |

September 2014 |

(752,406 |

) |

(751,031 |

) |

1,375 |

|||||||||||||

|

Interest rate futures buy contracts: |

|||||||||||||||||||

|

3 Month EURIBOR, 10 contracts (EUR) |

March 2015 |

3,399,546 |

3,417,601 |

18,055 |

|||||||||||||||

|

Australian Government 10 Year Bond, 5 contracts (AUD) |

September 2014 |

556,297 |

567,997 |

11,700 |

|||||||||||||||

|

Net unrealized appreciation on futures contracts |

$ |

28,157 |

|||||||||||||||||

Interest rate swap agreements

|

Counterparty |

Notional amount |

Termination date |

Payments made by the Fund11 |

Payments received by the Fund11 |

Upfront payments |

Value |

Unrealized depreciation |

||||||||||||||||||||||||

|

MLI |

USD |

965,000 |

08/15/39 |

3.219 |

% |

3 month USD LIBOR |

$ |

— |

$ |

(5,304 |

) |

$ |

(5,304 |

) |

|||||||||||||||||

Credit default swaps on corporate issues—buy protection12

|

Counterparty |

Referenced obligation13 |

Notional amount |

Termination date |

Payments made by the Fund11 |

Upfront payments made |

Value |

Unrealized depreciation |

||||||||||||||||||||||||

|

MSC |

Deutsche Bank AG bond, 5.125%, due 08/31/17 |

EUR |

140,000 |

06/20/17 |

1.000 |

% |

$ |

(4,270 |

) |

$ |

(2,826 |

) |

$ |

(7,096 |

) |

||||||||||||||||

Credit default swaps on credit indices—sell protection14

|

Counterparty |

Referenced index13 |

Notional amount |

Termination date |

Payments received by the Fund11 |

Upfront payments (made)/ received |

Value |

Unrealized appreciation/ (depreciation) |

Credit spread15 |

|||||||||||||||||||||||||||

|

CSI |

CMBX.NA.BBB. Series 6 Index |

USD |

350,000 |

05/11/63 |

3.000 |

% |

$ |

14,151 |

$ |

6,577 |

$ |

20,728 |

2.750 |

% |

|||||||||||||||||||||

|

MLI |

CMBX.NA.A. Series 6 Index |

USD |

300,000 |

05/11/63 |

2.000 |

(827 |

) |

6,372 |

5,545 |

1.740 |

|||||||||||||||||||||||||

|

MLI |

CMBX.NA.BB. Series 6 Index |

USD |

300,000 |

05/11/63 |

5.000 |

(9,368 |

) |

7,385 |

(1,983 |

) |

4.670 |

||||||||||||||||||||||||

|

MSC |

CMBX.NA.A. Series 6 Index |

USD |

350,000 |

05/11/63 |

2.000 |

4,480 |

7,434 |

11,914 |

1.740 |

||||||||||||||||||||||||||

|

$ |

8,436 |

$ |

27,768 |

$ |

36,204 |

||||||||||||||||||||||||||||||

15

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

Centrally cleared interest rate swap agreements

|

Notional amount |

Termination date |

Payments made by the Fund11 |

Payments received by the Fund11 |

Value |

Unrealized appreciation |

||||||||||||||||||

|

AUD |

570,000 |

10/18/23 |

6 month BBSW |

4.535 |

% |

$ |

30,935 |

$ |

30,935 |

||||||||||||||

Options written

|

Expiration date |

Premiums received |

Value |

|||||||||||||

|

Call options |

|||||||||||||||

|

3 Year Euro-Dollar Midcurve, 26 contracts, strike @ USD 98.75 |

June 2016 |

$ |

21,034 |

$ |

(21,125 |

) |

|||||||||

|

4 Year Euro-Dollar Midcurve, 59 contracts, strike @ USD 96.38 |

September 2014 |

41,094 |

(81,125 |

) |

|||||||||||

|

30 Year US Treasury Bonds, 7 contracts, strike @ USD 140.00 |

August 2014 |

5,457 |

(3,500 |

) |

|||||||||||

|

Put options |

|||||||||||||||

|

3 Year Euro-Dollar Midcurve, 26 contracts, strike @ USD 96.75 |

June 2016 |

21,034 |

(3,900 |

) |

|||||||||||

|

4 Year Euro-Dollar Midcurve, 59 contracts, strike @ USD 96.38 |

September 2014 |

37,331 |

(2,950 |

) |

|||||||||||

|

30 Year US Treasury Bonds, 7 contracts, strike @ USD 130.00 |

August 2014 |

3,050 |

(547 |

) |

|||||||||||

|

90 Day Euro-Dollar Time Deposit, 49 contracts, strike @ USD 98.25 |

March 2015 |

12,691 |

(306 |

) |

|||||||||||

|

Options written on credit default swaps on credit indices16 |

|||||||||||||||

|

If option exercised payment from the counterparty will be made upon the occurrence of a failure to pay, obligation acceleration, repudiation or restructuring of the referenced obligation specified in the CDX.NA.HY Series 22 Index and the Fund receives quarterly fixed rate of 5.000% per annum. Underlying credit default swap terminating 06/20/19. European style. Counterparty: JPMCB, Notional Amount USD 330,000 |

September 2014 |

3,267 |

(2,734 |

) |

|||||||||||

|

If option exercised payment from the counterparty will be made upon the occurrence of a failure to pay, obligation acceleration, repudiation or restructuring of the referenced obligation specified in the CDX.NA.HY Series 22 Index and the Fund receives quarterly fixed rate of 5.000% per annum. Underlying credit default swap terminating 06/20/19. European style. Counterparty: MLI, Notional Amount USD 2,000,000 |

September 2014 |

8,910 |

(7,356 |

) |

|||||||||||

|

Total options written |

$ |

153,868 |

$ |

(123,543 |

) |

||||||||||

Written options activity for the year ended June 30, 2014 was as follows:

|

Number of contracts |

Premiums received |

||||||||||

|

Options outstanding at June 30, 2013 |

61 |

$ |

22,607 |

||||||||

|

Options written |

326 |

139,936 |

|||||||||

|

Options terminated in closing purchase transactions |

(154 |

) |

(20,852 |

) |

|||||||

|

Options expired prior to exercise |

— |

— |

|||||||||

|

Options outstanding at June 30, 2014 |

233 |

$ |

141,691 |

||||||||

16

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

Written swaptions activity for the year ended June 30, 2014 was as follows:

|

Premiums received |

|||||||

|

Swaptions outstanding at June 30, 2013 |

$ |

— |

|||||

|

Swaptions written |

66,677 |

||||||

|

Swaptions terminated in closing purchase transactions |

(54,500 |

) |

|||||

|

Swaptions expired prior to exercise |

— |

||||||

|

Swaptions outstanding at June 30, 2014 |

$ |

12,177 |

|||||

The following is a summary of the fair valuations according to the inputs used as of June 30, 2014 in valuing the Fund's investments:

|

Description |

Unadjusted quoted prices in active markets for identical investments (Level 1) |

Other significant observable inputs (Level 2) |

Unobservable inputs (Level 3) |

Total |

|||||||||||||||

|

Assets |

|||||||||||||||||||

|

Corporate bonds |

$ |

— |

$ |

9,216,170 |

$ |

— |

$ |

9,216,170 |

|||||||||||

|

Asset-backed securities |

— |

478,933 |

— |

478,933 |

|||||||||||||||

|

Commercial mortgage-backed securities |

— |

2,732,779 |

— |

2,732,779 |

|||||||||||||||

|

Mortgage & agency debt securities |

— |

9,622,143 |

— |

9,622,143 |

|||||||||||||||

|

Municipal bonds |

— |

537,537 |

— |

537,537 |

|||||||||||||||

|

US government obligations |

— |

2,723,243 |

— |

2,723,243 |

|||||||||||||||

|

Non-US government obligations |

— |

463,375 |

— |

463,375 |

|||||||||||||||

|

Investment company |

— |

1,690,858 |

— |

1,690,858 |

|||||||||||||||

|

Short-term investments |

— |

9,723,621 |

— |

9,723,621 |

|||||||||||||||

|

Options purchased |

87,006 |

— |

— |

87,006 |

|||||||||||||||

|

Investment of cash collateral from securities loaned |

— |

236,033 |

— |

236,033 |

|||||||||||||||

|

Futures contracts |

34,744 |

— |

— |

34,744 |

|||||||||||||||

|

Swap agreements |

— |

58,703 |

— |

58,703 |

|||||||||||||||

|

Total |

$ |

121,750 |

$ |

37,483,395 |

$ |

— |

$ |

37,605,145 |

|||||||||||

|

Liabilities |

|||||||||||||||||||

|

Forward foreign currency contracts |

$ |

— |

$ |

(24,310 |

) |

$ |

— |

$ |

(24,310 |

) |

|||||||||

|

Futures contracts |

(6,587 |

) |

— |

— |

(6,587 |

) |

|||||||||||||

|

Swap agreements |

— |

(8,130 |

) |

— |

(8,130 |

) |

|||||||||||||

|

Options written |

(113,453 |

) |

(10,090 |

) |

— |

(123,543 |

) |

||||||||||||

|

Total |

$ |

(120,040 |

) |

$ |

(42,530 |

) |

$ |

— |

$ |

(162,570 |

) |

||||||||

At June 30, 2014, there were no transfers between Level 1 and Level 2.

Portfolio footnotes

* Non-income producing security.

1 Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities are considered liquid, unless noted otherwise, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2014, the value of these securities amounted to $2,507,445 or 8.33% of net assets.

2 Security, or portion thereof, was on loan at June 30, 2014.

3 Variable or floating rate security—The interest rate shown is the current rate as of June 30, 2014 and changes periodically.

17

UBS Core Plus Bond Fund

Portfolio of investments

June 30, 2014

4 Step bond—Coupon rate increases in increments to maturity. Rate disclosed is as of June 30, 2014. Maturity date disclosed is the ultimate maturity date.

5 Security is being fair valued by a valuation committee under the direction of the Board of Trustees. At June 30, 2014, the value of this security amounted to $225,000 or 0.75% of net assets.

6 On September 7, 2008, the Federal Housing Finance Agency placed the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association into conservatorship, and the US Treasury guaranteed the debt issued by those organizations.

7 Debt security whose principal and/or interest payments are adjusted for inflation, unlike debt securities that make fixed principal and interest payments. The interest rate paid by the securities is fixed, while the principal value rises or falls based on changes in an index. Thus, if inflation occurs, the principal and interest payments on the securities are adjusted accordingly to protect investors from inflationary loss. During a deflationary period, the principal and interest payments decrease, although the securities' principal amounts will not drop below their face amounts at maturity. In exchange for the inflation protection, the securities generally pay lower interest rates than typical government securities from the issuer's country. Only if inflation occurs will securities offer a higher real yield than a conventional government security of the same maturity.

8 Security exempt from registration pursuant to Regulation S under the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. At June 30, 2014, the value of this security amounted to $143,875 or 0.48% of net assets.

9 The table below details the Fund's investments in funds advised by the same Advisor as the Fund. The Advisor does not earn a management fee from the affiliated UBS Relationship Funds.

|

Security description |

Value 06/30/13 |

Purchases during the year ended 06/30/14 |

Sales during the year ended 06/30/14 |

Net realized gain (loss) during the year ended 06/30/14 |

Change in net unrealized appreciation/ (depreciation) during the year ended 06/30/14 |

Value 06/30/14 |

Net income earned from affiliate for the year ended 06/30/14 |

||||||||||||||||||||||||

|

UBS Cash Management Prime Relationship Fund |

$ |

4,494,940 |

$ |

25,091,076 |

$ |

21,860,695 |

$ |

— |

$ |

— |

$ |

7,725,321 |

$ |

4,135 |

|||||||||||||||||

|

UBS Private Money Market Fund LLCa |

800,921 |

4,190,264 |

4,755,152 |

— |

— |

236,033 |

21 |

||||||||||||||||||||||||

|

UBS High Yield Relationship Fund |

1,851,702 |

450,000 |

800,000 |

50,629 |

138,527 |

1,690,858 |

— |

||||||||||||||||||||||||

|

UBS Opportunistic Emerging Markets Debt Relationship Fund |

342,988 |

— |

346,464 |

(22,006 |

) |

25,482 |

— |

— |

|||||||||||||||||||||||

|

$ |

7,490,551 |

$ |

29,731,340 |

$ |

27,762,311 |

$ |

28,623 |

$ |

164,009 |

$ |

9,652,212 |

$ |

4,156 |

||||||||||||||||||

a The Advisor does earn a management fee from this affiliated fund. Please see the Notes to financial statements for further information.

10 Rate shown is the discount rate at date of purchase.

11 Payments made or received are based on the notional amount.

12 If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap agreement less the recovery value of the referenced obligation.

13 Payments to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the referenced index/obligation.

14 If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap agreement less the recovery value of the underlying securities comprising the referenced index.

15 Credit spreads, represented in absolute terms, utilized in determining the market value as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other credit event occurring for the credit derivative. The credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as "Defaulted" indicates a credit event has occurred for the referenced entity. Credit spreads are unaudited.

16 Illiquid investment as of June 30, 2014.

See accompanying notes to financial statements.

18

UBS Emerging Markets Debt Fund

Portfolio performance

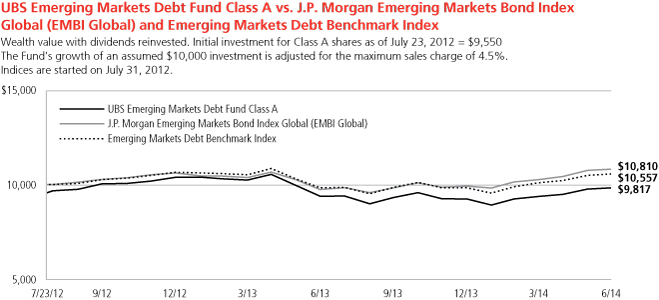

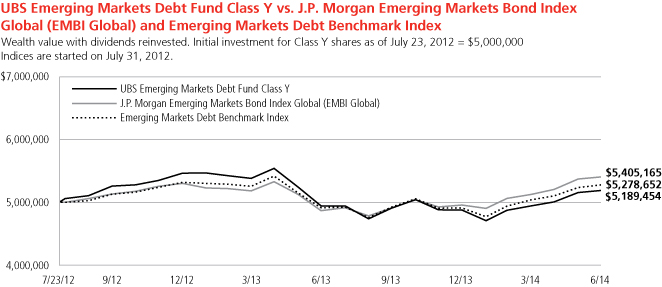

For the 12 months ended June 30, 2014, Class A shares of UBS Emerging Markets Debt Fund (the "Fund") returned 4.65% (Class A shares declined 0.09% after the deduction of the maximum sales charge), while Class Y shares returned 5.01%. For comparison purposes, the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) gained 11.05%, and the Emerging Markets Debt Benchmark Index (the "Index") returned 7.46% over the same time period. (Class Y shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 21; please note that the Fund's returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

Comments below relate to the Fund's positioning and performance relative to the Index, which represents investments in both US dollar-denominated and local currency debt.

The emerging markets debt asset class was weak during the first half of the reporting period, but then rallied sharply and generated strong results for the 12-months ended June 30, 2014. The asset class was initially weak due to concerns about decelerating global growth, geopolitical issues and rising US interest rates. However, the asset class moved sharply higher over the last five months of the reporting period as investor demand was largely robust, US interest rates declined and China's economy appeared to stabilize. Over the 12 month period, US dollar denominated emerging markets debt substantially outperformed local currency denominated emerging markets debt. While the Fund generated a positive absolute return, it underperformed the Index, partially due to its overweight to emerging markets local currencies.