The UBS Funds

October 28, 2013

UBS Equity Long-Short Multi-Strategy Fund

Summary Prospectus

Before you invest, you may want to review the fund's prospectus and statement of additional information ("SAI"), which contain more information about the fund and its risks. You can find the fund's prospectus, SAI and other information about the fund online at http://www.ubs.com/us/en/asset_management/individual_investors/mutual_fund.html. You can also get this information at no cost by calling 1-800-647 1568 or by sending an email request to ubs@fundinsite.com. The current prospectus and SAI, dated October 28, 2013, are incorporated by reference into this summary prospectus (i.e., they are legally a part of this summary prospectus).

Share Class: Ticker Symbol

|

Class A |

Class C |

Class Y |

|||||||||

|

BMNAX |

BMNCX |

BMNYX |

|||||||||

Investment objective

The Fund seeks to preserve and grow capital with low correlation to the equity markets.

Fees and expenses

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a sales charge waiver or discount if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts and waivers, as well as eligibility requirements for each share class, is available from your financial advisor and in "Managing your fund account" on page 51 of the Fund's prospectus and in "Reduced sales charges, additional purchase, exchange and redemption information and other services" on page 113 of the Fund's statement of additional information ("SAI").

Shareholder fees (fees paid directly from your investment)

|

Class A |

Class C |

Class Y |

|||||||||||||

|

Maximum front-end sales charge (load) imposed on purchases (as a % of offering price) |

5.50 |

% |

None |

None |

|||||||||||

|

Maximum contingent deferred sales charge (load) (CDSC) (as a % of purchase or sales price, whichever is less) |

None1 |

1.00 |

% |

None |

|||||||||||

|

Redemption fee (as a % of amount redeemed within 90 days of purchase, if applicable) |

1.00 |

% |

1.00 |

% |

1.00 |

% |

|||||||||

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

|

Class A |

Class C |

Class Y |

|||||||||||||

|

Management fees |

1.25 |

% |

1.25 |

% |

1.25 |

% |

|||||||||

|

Distribution and/or service (12b-1) fees |

0.25 |

1.00 |

None |

||||||||||||

|

Other expenses: |

|||||||||||||||

|

Dividend expense and security loan fees for securities sold short2 |

2.40 |

2.40 |

2.40 |

||||||||||||

|

Other |

2.93 |

2.38 |

2.60 |

||||||||||||

|

Total other expenses |

5.33 |

4.78 |

5.00 |

||||||||||||

|

Acquired fund fees and expenses |

0.02 |

0.02 |

0.02 |

||||||||||||

|

Total annual fund operating expenses3 |

6.85 |

7.05 |

6.27 |

||||||||||||

|

Less management fee waiver/expense reimbursements |

2.68 |

2.13 |

2.35 |

||||||||||||

|

Total annual fund operating expenses after management fee waiver/expense reimbursements3,4 |

4.17 |

4.92 |

3.92 |

||||||||||||

1 Purchases of $1 million or more that were not subject to a front-end sales charge are subject to a 1% CDSC if sold within one year of the purchase date.

2 Due to the anticipated increase of the use of short sales, the Fund has restated the "Dividend expense and security loan fees for securities sold short" based on the anticipated expenses for the new strategy. These "Dividend expense and security loan fees for securities sold short" are based on estimates and may vary based on actual investments. The actual "Dividend expense and security loan fees for securities sold short" for the Fund's fiscal year ended June 30, 2013 were 2.18% for Class A shares, 2.25% for Class C shares and 2.31% for Class Y shares.

3 Since the "Acquired fund fees and expenses" are not directly borne by the Fund, they are not reflected in the Fund's financial statements, and therefore the amounts listed in "Total annual fund operating expenses" and "Total annual fund operating expenses after management fee waiver/expense reimbursements" will differ from those presented in the Financial highlights.

4 The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding

expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses, and dividend expense and security loan fees for securities sold short), through the period ending October 28, 2014, do not exceed 1.75% for Class A shares, 2.50% for Class C shares and 1.50% for Class Y shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund. The fee waiver/expense reimbursement agreement may be terminated by the Fund's Board of Trustees at any time and also will terminate automatically upon the expiration or termination of the Fund's advisory contract with the Advisor. Upon termination of the fee waiver/expense reimbursement agreement, however, the UBS Global AM (Americas)'s three year recoupment rights will survive.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods unless otherwise stated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The costs described in the example reflect the expenses of the Fund that would result from the contractual fee waiver and expense reimbursement agreement with the Advisor for the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 year |

3 years |

5 years |

10 years |

||||||||||||||||

|

Class A |

$ |

946 |

$ |

2,227 |

$ |

3,461 |

$ |

6,353 |

|||||||||||

|

Class C (assuming sale of all shares at end of period) |

592 |

1,875 |

3,201 |

6,286 |

|||||||||||||||

|

Class C (assuming no sale of shares) |

492 |

1,875 |

3,201 |

6,286 |

|||||||||||||||

|

Class Y |

394 |

1,646 |

2,866 |

5,782 |

|||||||||||||||

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 167% of the average value of its portfolio.

Principal strategies

Principal investments

Under normal circumstances, the Fund invests at least 80% of its net assets (plus borrowings for investment purposes, if any) in equity and/or equity-related instruments. Equity-related instruments include securities or other instruments that derive their value from equity securities and may include such instruments as short sales of equity securities, swaps on equity securities,

and futures and options on equity securities. Investments by the Fund in equity securities may include, but are not limited to, common stock and preferred stock of issuers in developed countries (including the United States) and emerging markets. The Fund's equity investments may include large, intermediate and small capitalization companies. The Fund will maintain both long positions and short positions in equity securities and securities with equity-like characteristics. The Fund also may invest in securities convertible into equity securities.

The Fund may, but is not required to, use exchange-traded or over-the-counter ("OTC") derivative instruments for risk management purposes or as part of the Fund's investment strategies. The derivatives in which the Fund may invest include options, futures, forward agreements, swap agreements (specifically, total return and currency swaps), equity participation notes and equity linked notes. All of these derivatives may be used for risk management purposes, such as hedging against a specific security or currency, or to manage or adjust the risk profile of the Fund. In addition, all of the derivative instruments listed above may be used for investment (non-hedging) purposes to earn income; to enhance returns; to replace more traditional direct investments; to obtain exposure to certain markets; or to establish net short positions for individual markets, currencies or securities.

Under certain market conditions, the Fund may invest in companies at the time of their initial public offering ("IPO"). To the extent permitted by the Investment Company Act of 1940, as amended (the "1940 Act"), the Fund may borrow money from banks to purchase investments for the Fund.

Management process

The Fund seeks to maximize total returns by allocating its assets among one or more distinct equity investment strategies (each a "Fund component" and together, the "Fund components"), which are managed by portfolio management teams at the Advisor. Each Fund component is unique in terms of the source of its investment insight, its geographic focus, or both. A Fund component will purchase securities long that it believes will outperform the market, other Fund securities or both, and sell securities short that are expected to underperform the market, other Fund securities or both. The Fund engages in its long/short strategies in order to generate returns with low correlations to equity markets.

The Advisor selects Fund components and allocates the Fund's assets among the Fund components based on each Fund component's expected contribution to the risk adjusted investment return of the Fund. Fund components are chosen by the Advisor in part because the

Fund components demonstrate a low correlation of returns versus equity markets and among each other. The Advisor intends to allocate assets among the Fund components with the goal of providing returns for the Fund that are a function of the Advisor's stock-level investment insights rather than a function of broad market movements.

In deciding the Fund's allocation to each Fund component, the Advisor utilizes analytical tools that enable the Advisor to view the entire investment portfolio of the Fund across all underlying components in order to best assess the allocation of Fund assets among these components based on alpha potential and contribution to volatility and to monitor the impact of individual stock positions, both long and short positions, on the Fund's entire portfolio.

The Fund components utilize fundamental valuation, quantitative research or a combination of both to construct a portfolio. The investment decisions for certain Fund components are based on price/value discrepancies as identified by the Advisor's fundamental valuation process. In selecting securities utilizing the fundamental valuation process, the Advisor bases its estimates of value upon economic, industry and company analysis, as well as upon a company's management team, competitive advantage and core competencies. The investment decisions for other Fund components are based on investment opportunities generated by quantitative research techniques that systematically exploit market anomalies to provide consistent excess returns for the Fund.

The Fund's expected net equity market exposure (long market value—short market value) will typically range from 10% to 50%; however, in response to market conditions the Fund may adjust its net equity market exposure. The Fund's net equity market exposure may range from -25% to +75% and at the same time will comply with all leverage restrictions required by Section 18 of the 1940 Act and subsequent determinations of the SEC and any other regulatory limitations. The Fund may hold a substantial portion of its total assets in cash when the Fund maintains a net short equity market position. By taking both long and short positions, the Fund seeks to provide some protection in down markets when compared to a fund that takes only long positions.

Main risks

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other govern-

ment agency. Below are some of the specific risks of investing in the Fund.

Management risk: The risk that the investment strategies, techniques and risk analyses employed by the Advisor may not produce the desired results.

Short sales risk: There are certain unique risks associated with the use of short sales strategies. When selling a security short, the Advisor will sell a security it does not own at the then-current market price and then borrow the security to deliver to the buyer. The Fund is then obligated to buy the security on a later date so it can return the security to the lender. Short sales therefore involve the risk that the Fund will incur a loss by subsequently buying a security at a higher price than the price at which the Fund previously sold the security short. This would occur if the securities lender required the Fund to deliver the securities the Fund had borrowed at the commencement of the short sale and the Fund was unable to either purchase the security at a favorable price or to borrow the security from another securities lender. If this occurs at a time when other short sellers of the security also want to close out their positions, a "short squeeze" can occur. A short squeeze occurs when demand is greater than supply for the security sold short. Moreover, because a Fund's loss on a short sale arises from increases in the value of the security sold short, such loss, like the price of the security sold short, is theoretically unlimited. By contrast, a Fund's loss on a long position arises from decreases in the value of the security and therefore is limited by the fact that a security's value cannot drop below zero. It is possible that the Fund's securities held long will decline in value at the same time that the value of the securities sold short increases, thereby increasing the potential for loss.

Foreign investing risk: The value of the Fund's investments in foreign securities may fall due to adverse political, social and economic developments abroad and due to decreases in foreign currency values relative to the US dollar. Also, foreign securities are sometimes less liquid and more difficult to sell and to value than securities of US issuers. These risks are greater for investments in emerging market issuers. In addition, investments in emerging market issuers may decline in value because of unfavorable foreign government actions, greater risks of political instability or the absence of accurate information about emerging market issuers.

Multi-strategy risk: The risk that the Fund may allocate assets to a Fund component that underperforms other strategy types.

Market risk: The risk that the market value of the Fund's investments may fluctuate, sometimes rapidly or

unpredictably, as the stock and bond markets fluctuate. Market risk may affect a single issuer, industry, or sector of the economy, or it may affect the market as a whole.

Derivatives risk: The value of "derivatives"—so called because their value "derives" from the value of an underlying asset, reference rate or index—may rise or fall more rapidly than other investments. When using derivatives for non-hedging purposes, it is possible for the Fund to lose more than the amount it invested in the derivative. The risks of investing in derivative instruments also include market risk, management risk and counterparty risk (which is the risk that a counterparty to a derivative contract is unable or unwilling to meet its financial obligations). In addition, many types of swaps and other non-exchange traded derivatives may be subject to liquidity risk, credit risk and mispricing or valuation complexity. These derivatives risks are different from, and may be greater than, the risks associated with investing directly in securities and other instruments.

Leverage risk associated with financial instruments: The use of financial instruments to increase potential returns, including derivatives used for investment (non-hedging) purposes, may cause the Fund to be more volatile than if it had not been leveraged. The use of leverage may also accelerate the velocity of losses and can result in losses to the Fund that exceed the amount originally invested.

Leverage risk associated with borrowing: The Fund may borrow money from banks to purchase investments for the Fund, which is a form of leverage. If the Fund borrows money to purchase securities and the Fund's investments decrease in value, the Fund's losses will be greater than if the Fund did not borrow money for investment purposes. In addition, if the return on an investment purchased with borrowed funds is not sufficient to cover the cost of borrowing, then the net income of the Fund would be less than if borrowing were not used.

Limited capitalization risk: The risk that securities of smaller capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. This can have a disproportionate effect on the market price of smaller capitalization companies and affect the Fund's ability to purchase or sell these securities. In general, smaller capitalization companies are more vulnerable than larger companies to adverse business or economic developments and they may have more limited resources.

IPOs risk: The purchase of shares issued in IPOs may expose the Fund to the risks associated with issuers that have no operating history as public companies, as well as to the risks associated with the sectors of the market

in which the issuer operates. The market for IPO shares may be volatile, and share prices of newly-public companies may fluctuate significantly over a short period of time.

Performance

Risk/return bar chart and table

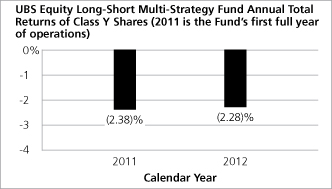

The performance information that follows shows the Fund's performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by showing the Fund's performance from year to year and by showing how the Fund's average annual total returns compare with those of a broad measure of market performance. Index reflects no deduction for fees, expenses or taxes. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. On September 5, 2012 the Fund's investment strategy changed. The performance information below, prior to that date, is attributable to the Fund's previous investment strategy. Updated performance for the Fund is available at http://globalam-us.ubs.com/corpweb/performance.do.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns for other classes will vary from the Class Y shares' after-tax returns shown.

Total return

Total return January 1 - September 30, 2013: 6.16%

Best quarter during calendar years shown—4Q 2012: 0.86%

Worst quarter during calendar years shown—3Q 2012: (1.58)%

Average annual total returns (figures reflect sales charges)

(for the periods ended December 31, 2012)

| Class (inception date) |

1 year |

Life of class |

|||||||||

|

Class A (6/30/10) |

|||||||||||

|

Return before taxes |

(7.98 |

)% |

(4.83 |

)% |

|||||||

|

Class C (6/30/10) |

|||||||||||

|

Return before taxes |

(4.34 |

) |

(3.38 |

) |

|||||||

|

Class Y (6/30/10) |

|||||||||||

|

Return before taxes |

(2.28 |

) |

(2.38 |

) |

|||||||

|

Return after taxes on distributions |

(2.28 |

) |

(2.38 |

) |

|||||||

|

Return after taxes on distributions and sale of fund shares |

(1.49 |

) |

(2.01 |

) |

|||||||

|

Citigroup Three-Month US Treasury Bill Index |

0.07 |

0.09 |

|||||||||

Investment advisor

UBS Global Asset Management (Americas) Inc. serves as the investment advisor to the Fund.

Portfolio managers

• John Leonard, portfolio manager of the Fund since 2012.

• Ian Paczek, portfolio manager of the Fund since its inception.

• Ian McIntosh, portfolio manager of the Fund since 2012.

• Scott Bondurant, portfolio manager of the Fund since its inception.

Purchase & sale of fund shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. In general, the minimum initial investment is $1,000 and the minimum subsequent investment is $100.

Tax information

The dividends and distributions you receive from the Fund are taxable and generally will be taxed as ordinary income, capital gains, or some combination of both, unless you are investing through a tax deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions generally will be taxed when withdrawn from the tax-deferred account.

Payments to broker/dealers and other financial intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's Web site for more information.

This page intentionally left blank.

This page intentionally left blank.

©UBS 2013. All rights reserved.

The UBS Funds

Investment Company Act File No. 811-6637

UBS Global Asset Management (Americas) Inc.

is a subsidiary of UBS AG.

S1391